WE

LOOK AT Inhorgenta Munich report

Can gold re-test its all-time highs? Influencer marketing trends that are dominating Africa retailing’s next global hot spot

BYL DIAMONDS -SAJN - COVER ARTWORK - PRINT READY FINAL - 25 MARCH V2.pdf 1 2024/03/25 20:10:06

SA jewellerynews

APRIL 2024

DATES: Sunday, 8th September & Monday, 9th September 2024

VENUE: The Wanderers Club, 21 North Street, Illovo, Johannesburg

BOOKINGS: elsad@jewellery.org.za or lornal@jewellery.org.za

Africa’s Premier Jewellery and Watch Showcase OFFICE: 011 484 5528 | Lorna Lloyd: 082 456 5558 | Elsa da Silva: 082 214 0028 | jewellex@jewellery.org.za BOOK NOW! STAND SALES OPEN

CREATIVE AND GIFTED DESIGNER IS PUTTING A SPECIAL SHINE IN THE

Koketso started Ditsala because of a need to leave a legacy and to promote South Africa’s rich heritage. “I’ve noticed that young Africans are following trends set by the Americans, forgetting that our heritage is so full of colour, style, and class,” Koketso says, “I am setting an African

young, gifted, and creative African woman from Soshanguve in Pretoria.

Koketso’s foray into the world of gemstones and minerals was not a straightforward one.

After she matriculated from Prestige College Private School in 2006, she initially pursued PC Engineering. It was after completing this course that she had the opportunity to be enrolled in a MQA learnership through the Atteridgeville Jewellery Project.

After completing this learnership, the Atteridgeville Jewellery Project recommended Koketso to the Umjindi Jewellery Project to study the CAD (Rhinoceros) advanced course where Evert Van Eangelan trained her. After completing three (3) short courses, Koketso was declared to be competent with the Assessment College and this was funded by the MQA.

In 2015 she was selected as one of the twenty-five (25) jewellery students who were selected and were funded through a MQA scholarship to study further in Italy. In 2017, Koketso obtained a European Master Diploma in Goldsmith, Gemstone Setting and Design.

“I always wanted to be a designer from an early age, making beaded jewellery when I was in primary school. In high school I fell in love with the character of Parson from Isidingo, who was a jewellery designer. That is when I started researching on Jewellery Design with the help of my art teacher. After completing my matric year, I wanted to further my studies at university but unfortunately my mother could not afford the fees. That is when the MQA came along.”

Koketso has been featured in a number of local publications and on television. In 2022 Koki was awarded the FIASA Accessory Designer of the Year at the Fashion Industry Awards. She has also dressed and worked with quite a number of popular South African celebrities and is currently working on manufacturing jewellery items for the Shaka Ilembe series.

Asked about her future plans, Koki has this to say:

“I want to further my studies to study Youth Development, I am very passionate about developing the youth. There is so much talent in South Africa, and we have so much to offer the world. Our country is rich with precious metals and gemstones that we mine, but we cannot afford to work with them. This is why with the right mentorship programmes and guidance our youth will be able conquer the world.”

Koketso’s message to the young aspiring jewellery designers is, be yourself and tell your story through your work.

Koketso is currently managing Ditsala Designs while also mentoring up-and-coming jewellers on a part time basis at The Platinum Incubator in Rustenburg.

For more information on jewellery related learning programmes, please contact the MQA:

@Mining Qualifications Authority @MQA_SA @mqa_sa Mining Qualifications Authority

547 2600

011

www.mqa.org.za info@mqa.org.za

The Science of Colored Stone Identification and Origin.

GIA research and reports are the benchmark of colored stone analysis. Those who buy, sell, or curate the world’s most important gems rely on GIA's expertise, precision, objectivity, and integrity.

©2024 Gemological Institute of America, Inc. (GIA). All trademarks are registered trademarks owned by GIA. GIA is a nonprofit 501(c)(3) organization. All rights reserved. Learn More. GIA.edu/ColoredStones

Website: www.ungarbros.co.za

Simplicity is the Ultimate Sophistication

contents

8. NEWS

• Jewellex Africa 2024 dates and venue announced

• USA sanctions Zimbabwean president for diamond-smuggling

• WFDB concludes successful Presidents’ Meeting in Shanghai

• Watches and Wonders set to open doors

• Firestone unearths its largest diamond ever at Lesotho mine

• Sotheby’s to offer over 250 jewels from iconic designers

14. METAL MATTERS

“In the current climate, can gold re-test its all-time highs?” asks leading independent precious metals research consultancy Metals Focus

16. AFRICA AND MIDDLE EAST

RETAILING’S NEXT GLOBAL HOT SPOTS

The Global Retail Development Index focuses on the top 35-40 emerging economies and evaluates their relative attractiveness to retailers

SA JEWELLERY NEWS - APRIL 2024 4

CONTENTS

39 25

18. INHORGENTA MUNICH 2024 REPORT

SA Jewellery News freelance reviewer Martin Foster reports on leading EU watch, clock and equipment fair Inhorgenta Munich

22. DOMINANT INFLUENCER MARKETING TRENDS

Hustle Media Influence has achieved a significant milestone by garnering 2,9 million content views across various campaigns and industries since its conception

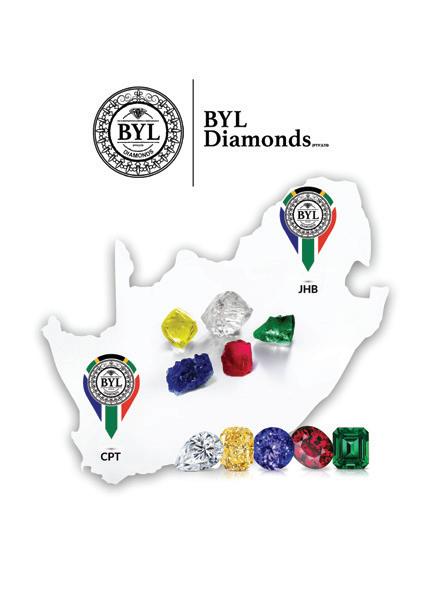

25. COVER FEATURE

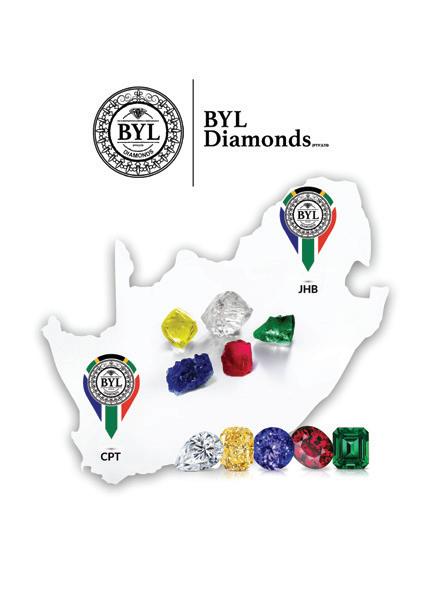

BYL Diamonds has cemented its reputation as one of South Africa’s leading diamond and jewellery manufacturers and wholesale suppliers

26. SPECTACULAR JEWELLERY FROM THE 2024 RED CARPET

The A-listers’ red carpet at this year’s award ceremonies dazzled with diamonds and glittering gemstones

33. EDUCATIONAL INSERT

Coloured stones unearthed: Gems recovered from sedimentary rocks

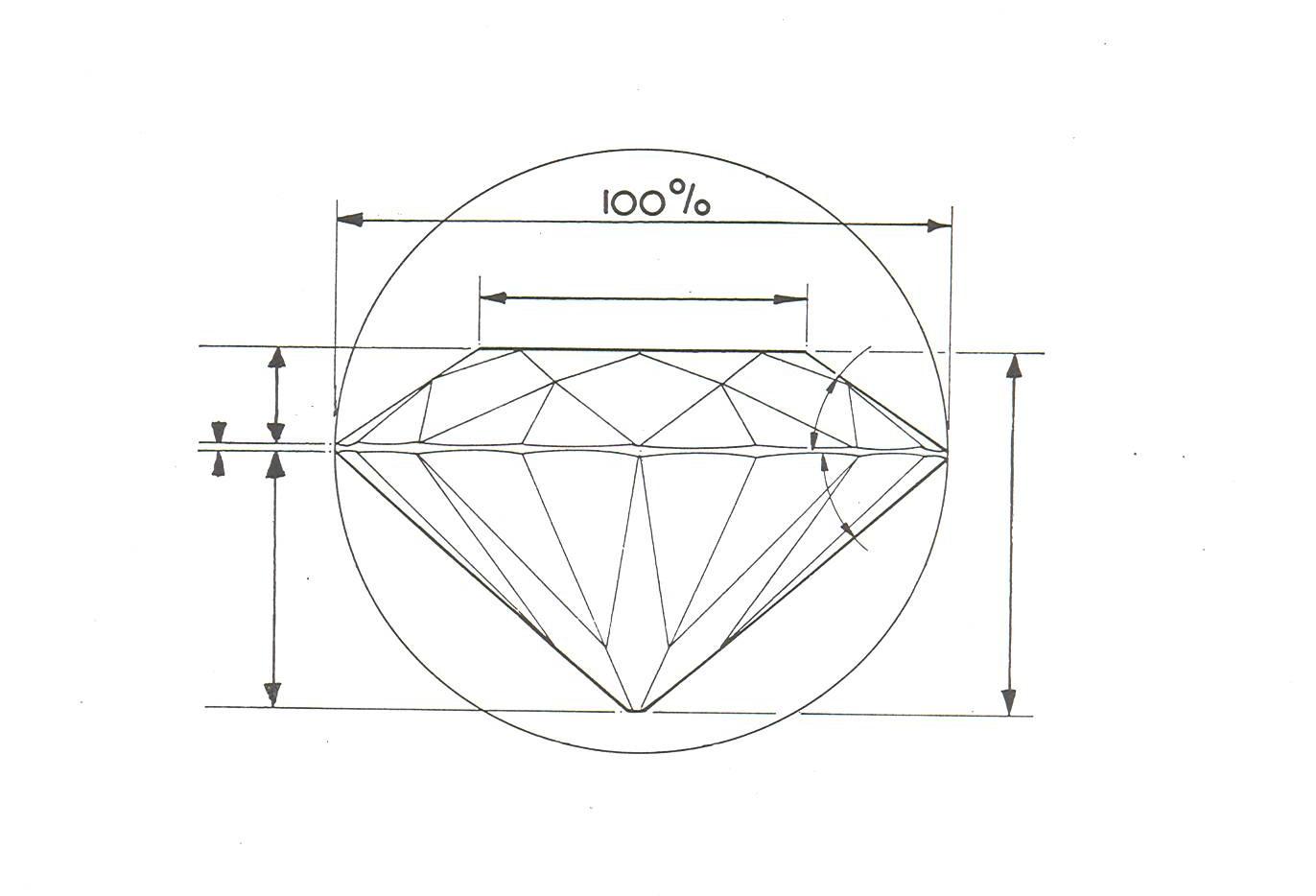

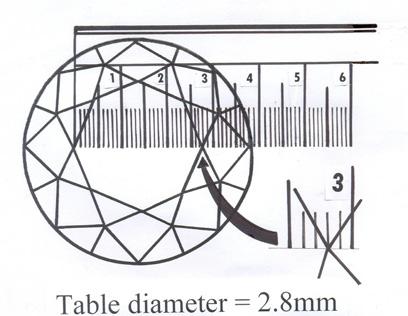

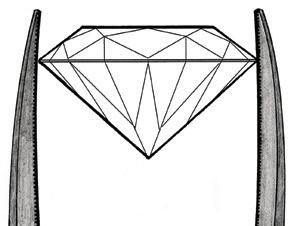

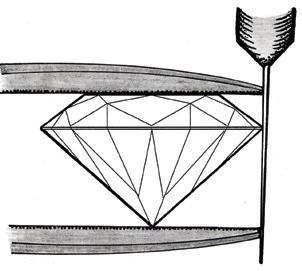

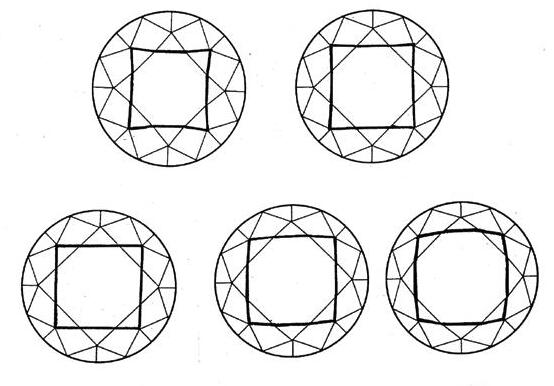

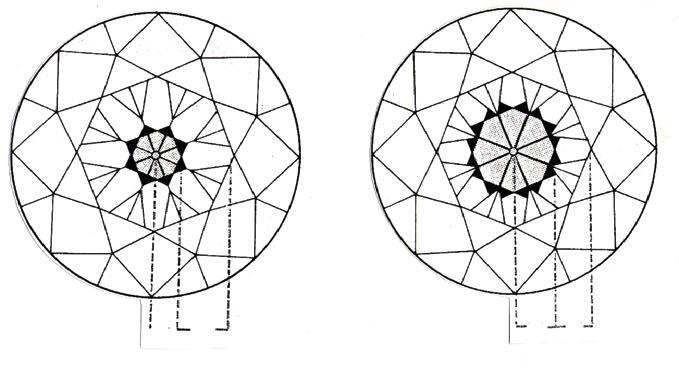

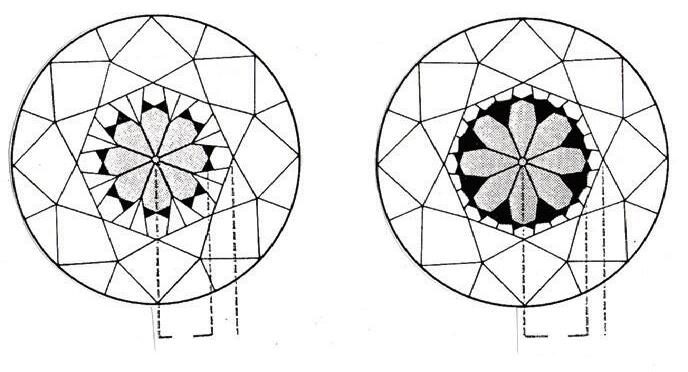

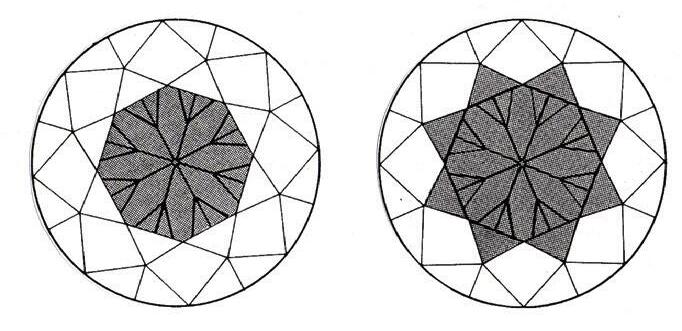

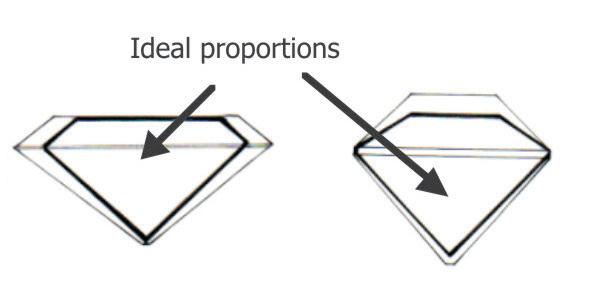

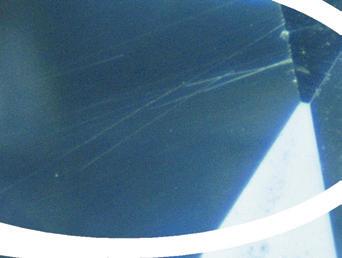

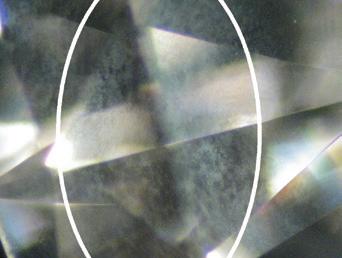

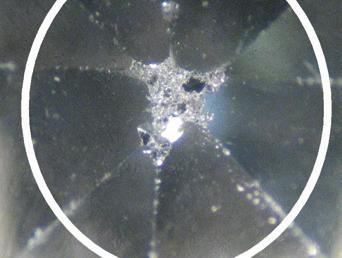

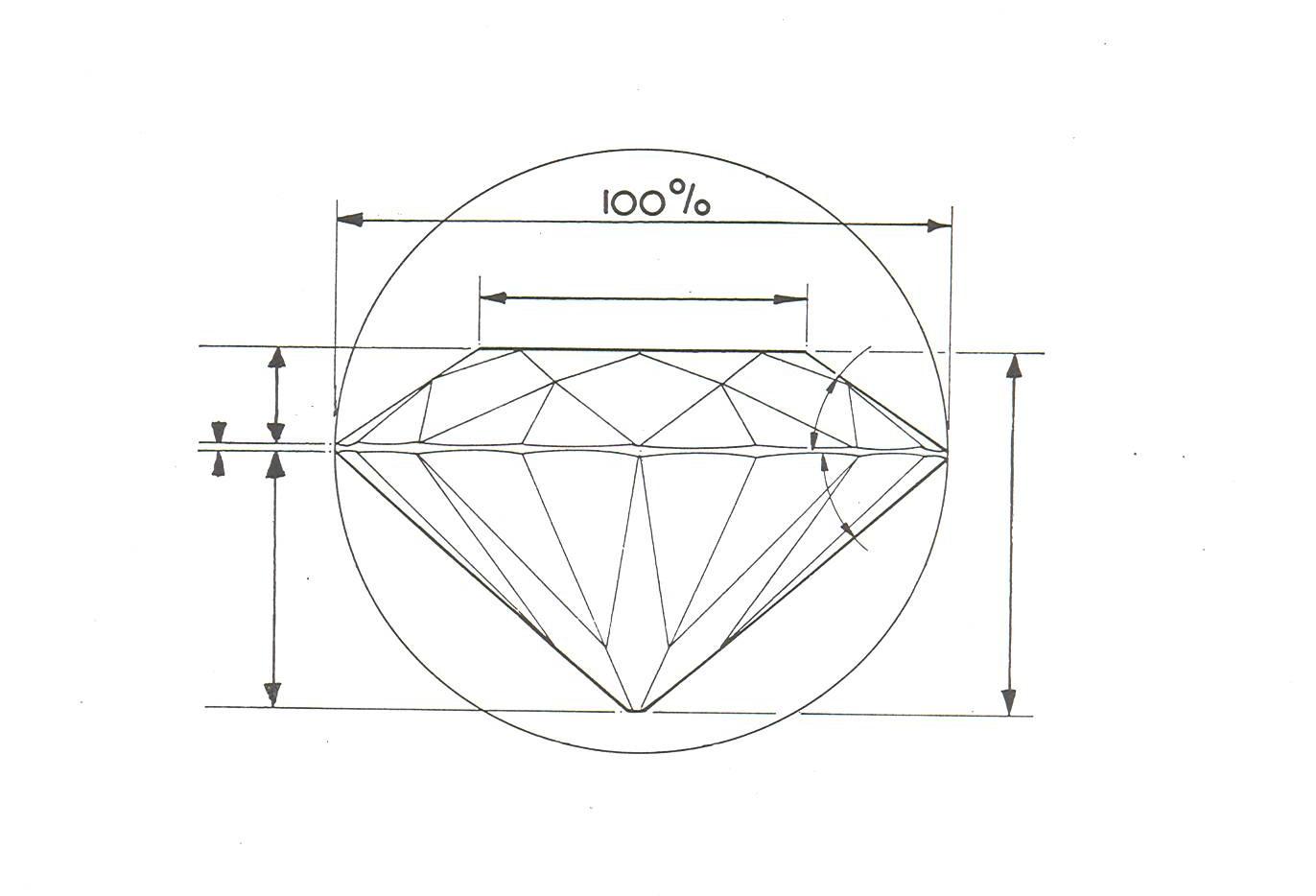

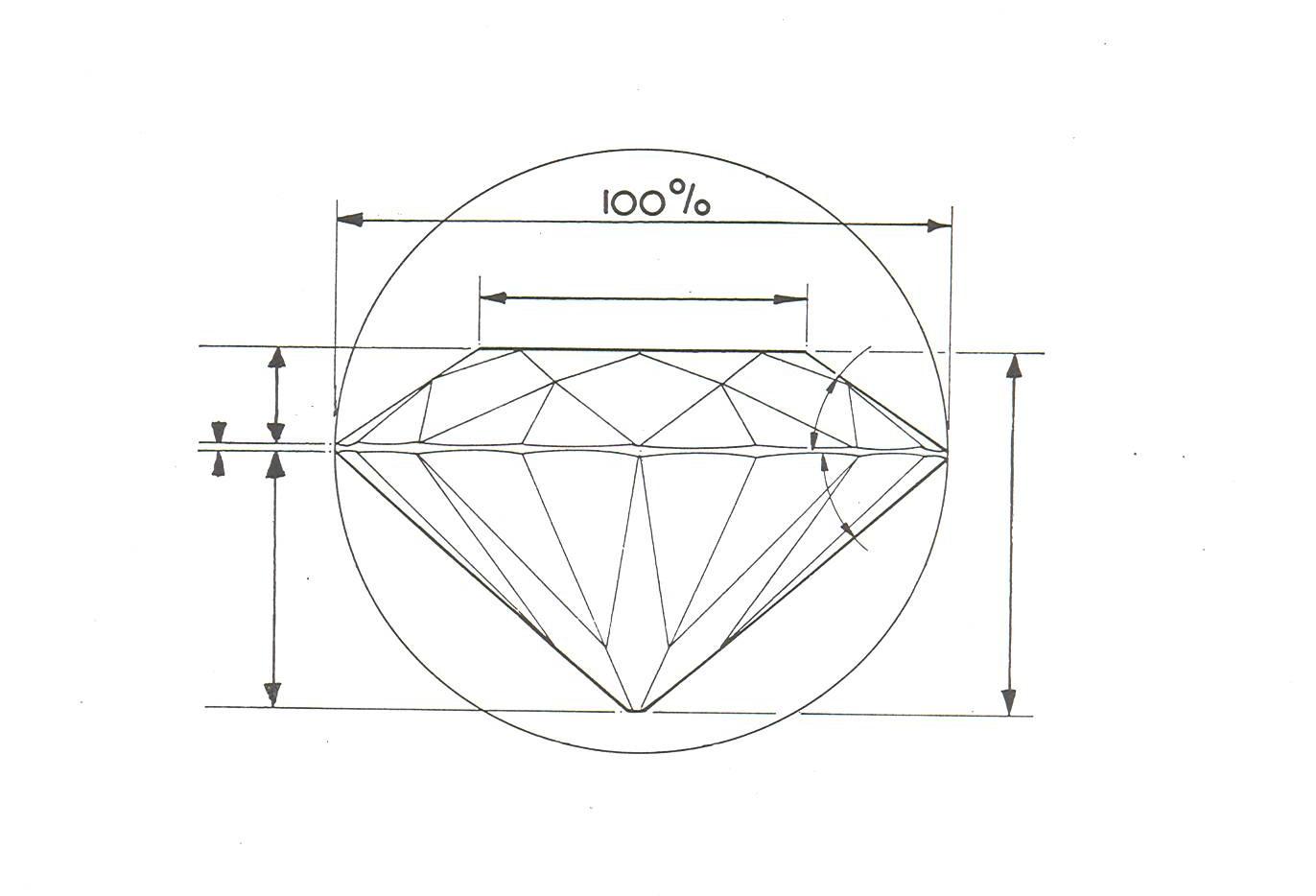

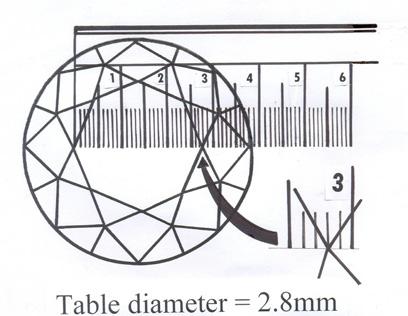

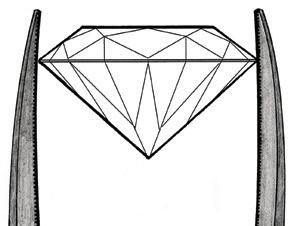

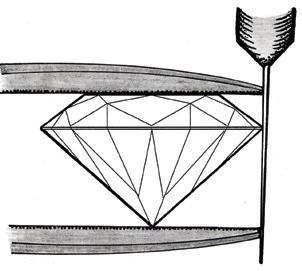

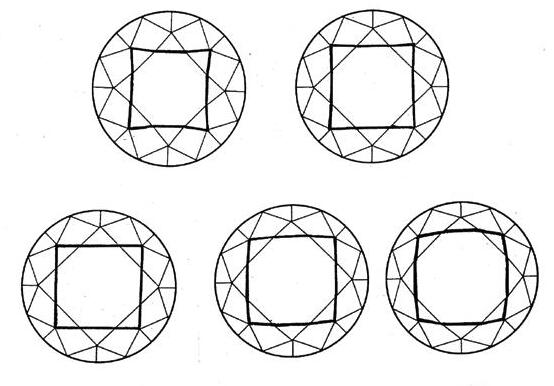

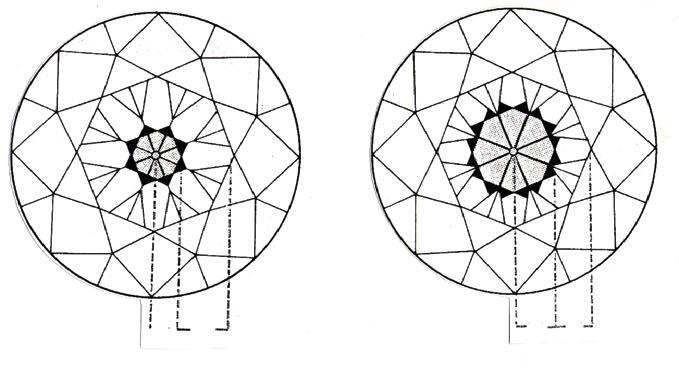

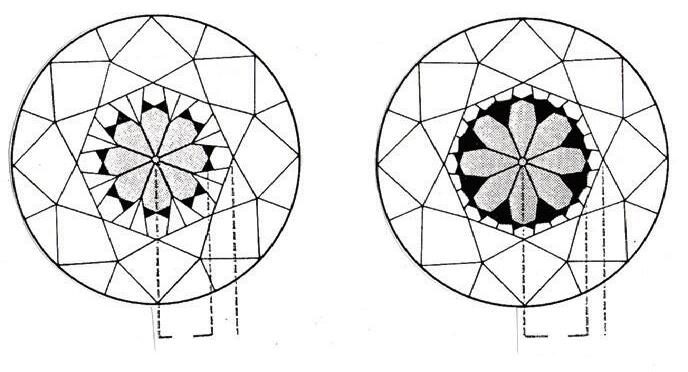

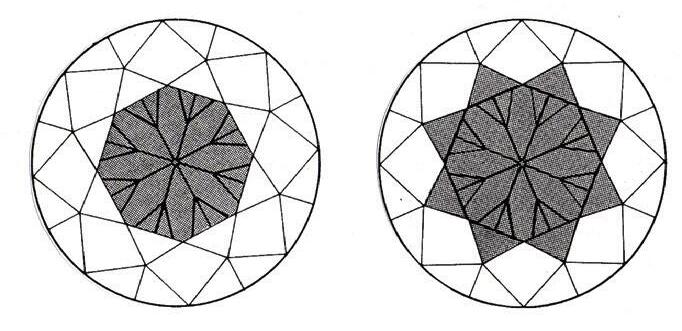

38. EVALUATING THE CUT OF A DIAMOND

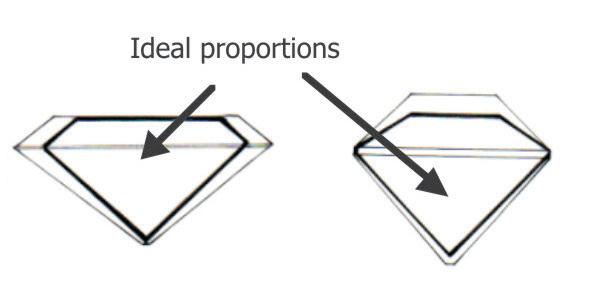

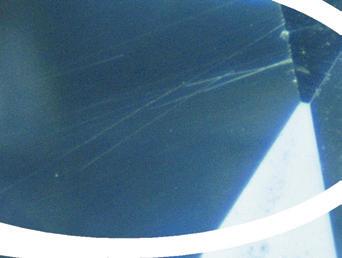

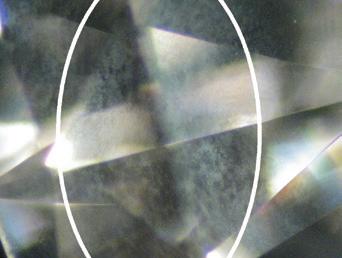

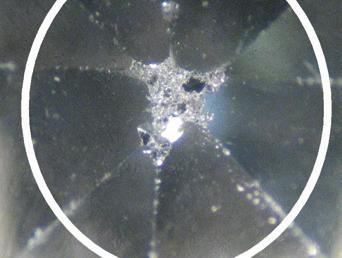

For many years, diamond-cutters have argued about which set of proportions provides the best sparkle

44. BORN IN AFRICA

A comprehensive directory featuring information and contact details of all members of the Jewellery Manufacturing Association of South Africa

SA JEWELLERY NEWS - APRIL 2024 5 18

CONTENTS

The views expressed in this publication are not necessarily those of the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, its members, the publisher or its agents. While every effort has been made to ensure the accuracy of its contents, neither the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, the editor nor the publisher can be held responsible for any omissions or errors; or for any misfortune, injury or damages which may arise therefrom. The same applies to all advertising. SA Jewellery News© 2024. All rights reserved. No part of this magazine may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage retrieval system, without prior written permission from the publishers. ISSN 1817-5333.

Official Journal of the Jewellery Council of South Africa and the Diamond Dealers’ Club of South Africa.

www.ddcsa.co.za

www.jewellery.org.za

Suite 313 – Third Floor, 5 Sturdee Avenue, Johannesburg, South Africa Office: +27 11 268 6980 Cell: +27 64 954 1204 / +27 82 707 8676 info@afrasiandiamonds.co.za www.afrasiandiamonds.co.za Where the sparkle never fades

I AM A MEMBER OF THE LOCAL JEWELLERY manufacturers’ WhatsApp group and was surprised to see that there are quite a few local jewellers who make breastmilk jewellery after a manufacturer posted that one of his clients requested such a piece.

Called DNA jewellery, earrings, rings, bracelets and necklaces can include sentimental DNA items such as breastmilk, umbilical cord, a loved one’s ashes, hair, pet fur, beloved pet ashes and small flowers. It made me realise once again that jewellery can be extremely personal and tell a story that has meaning and purpose. Jewellery can say a lot about a person: their personality, their style and even their values. For many people, their choice in jewellery has more meaning and depth than a simple matter of fashion and can also be a conversation-starter and a way to connect at a time of disconnection.

The sentimental value of jewellery often goes beyond its monetary worth. It can carry a unique narrative and become a treasure that holds immeasurable sentimental value.

Next time you are designing a piece, or planning to buy a piece of jewellery, take a moment to think of its significance in your client’s or your own life.

We hope you enjoy this issue. It looks at Africa and the Middle East being retailing’s next global hot spots and asks whether gold can re-test its all-time highs. SAJN freelance reviewer Martin Foster reports on leading EU watch, clock and equipment fair Inhorgenta Munich, while also looking at influencer marketing trends that are currently dominating. The A-listers’ red carpet at this year’s award ceremonies dazzled with diamonds and glittering gemstones and we feature some of the most striking pieces. We are also pleased to report that the venue and dates for this year’s Jewellex Africa have been announced.

Happy reading!

7 SA JEWELLERY NEWS - APRIL 2024

Editor: Adri Viviers Tel: +27 (0)11 883-4627 Cell: 084-261-1805 E-mail: adri@isikhova.co.za Managing Director: Imraan Mahomed E-mail: imraanm@isikhova.co.za Operations Director: Thuli Majola Tel: +27 (0)11 883-4627 E-mail: thuli@isikhova.co.za Advertising Sales: Tel: +27 (0)11 883-4627 Cell: 083-450-6052 Copy Editor: Anne Phillips Design and layout: Joanne Brook E-mail: joanne@isikhova.co.za Distribution: Ruth Dlamini SA Jewellery News is published by: Isikhova Media (Pty) Ltd Website: www.isikhova.co.za

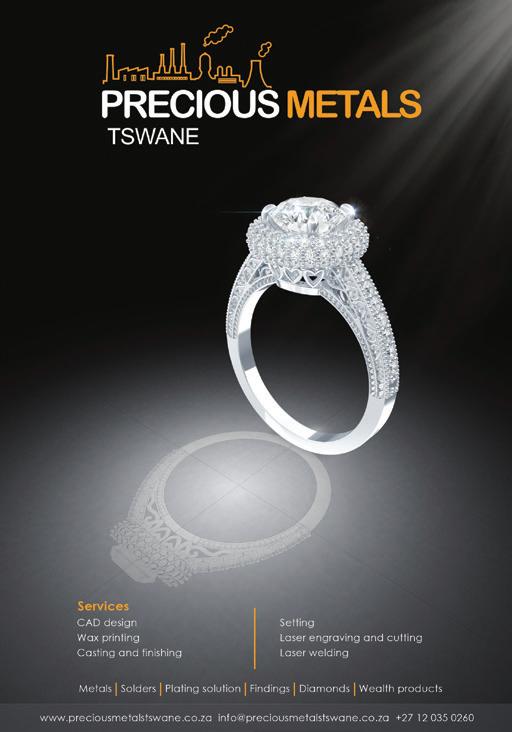

note ON THE COVER BYLDIAMONDS-SAJN COVERARTWORK PRINTREADY 25MARCH 2024/03/25 20:10:06 SA jewellerynews APRIL2024 WELOOKAT InhorgentaMunichreport Cangoldre-testitsall-timehighs? Influencermarketingtrendsthataredominating Africaretailing’snextglobalhotspot With offices in Cape Town and Johannesburg, BYL Diamonds has cemented its reputation as one of South Africa’s leading diamond and jewellery manufacturers and wholesale suppliers. Through associates with mines in SA and state-of-the-art polishing factories abroad, BYL Diamonds has secured access to some of the world’s most impressive loose cut diamonds and gemstones, in a galaxy of shapes, sizes, colours and clarities. In addition to being a leading supplier of loose

and

it is renowned for the quality

its

DIAMONDS ARTWORK READY MARCH 2024/03/25 20:10:06 SA jewellerynews APRIL 2024 WE LOOK AT Inhorgenta Munich report Can gold re-test its all-time highs? Influencer marketing trends that are dominating Africa retailing’s next global hot spot

Adri Viviers

Editor's

diamonds

gemstones,

of

ever-changing jewellery range, with each piece made up using the finest diamonds and gemstones carefully chosen for each individual item. For more information on its range of diamonds, gemstones and jewellery collections, contact BYL Diamonds on tel: (021) 419-2000, e-mail: orders@byldiamonds.com or visit: www.byldiamonds.com.

Sotheby’s to offer over 250 jewels from iconic designers

Sotheby’s will showcase more than 250 iconic jewels from a single collector, including the largest collection of René Boivin pieces ever to come to auction.

The jewellery, which was amassed over half a century, will feature at a sale called

“Iconic Jewels: Her Sense of Style”, said Sotheby’s. It will take place across two auctions, one during Sotheby’s Magnificent Jewels sales in Geneva on 14 May and the other online from 2-16 May.

The entire collection is expected to fetch US$5,4 million-US$8,3 million. It includes the most iconic pieces and influential trends from prestigious houses such as Cartier, Van Cleef & Arpels, Bvlgari, Boucheron, Chaumet and David Webb.

Within the offering is a group of nearly 30 lots designed by French jeweller René Boivin, a record number for the designer at auction, Sotheby’s noted.

The top item at the sale is a pair of Bvlgari earrings containing two fancy yellow diamonds each weighing just under 10ct. The set, which previously belonged to the Baroness di Portanova, is estimated to fetch up to US$678 673.

“When you come across a jewellery collection as consistently stunning and substantial as this one, it’s a heart-stopping moment – the kind you know you’ll never forget,” said Marie-Cécile Cisamolo, a jewellery specialist at Sotheby’s Geneva. “It’s truly one of a kind and one of the most important private jewellery collections I’ve ever seen.” – Rapaport

NEWS

(Left): A necklace and earring set by Monture Cartier will also go up for auction. The jewels are estimated at US$169 668-US$226 224.

(Left): A rare Serpenti bracelet watch named Theodorus, which is accompanied by an original drawing from the Bvlgari archives dated 1968, carries a presale price of US$226 224-US$452 449.

(Above): Sotheby’s will sell this diamond and emerald Cartier Panthère leopard bangle dated 1969 for US$282 780-US$395 892.

Watches and Wonders set to open doors

Watches and Wonders, the luxury watch industry’s pre-eminent annual event, will take place from 9-15 April 2024 in Geneva’s Halles de Palexpo and will feature an enhanced programme. From 13-15 April, the event will be open to the public, offering one whole day more than its 2023 edition – a decision that was made to put more emphasis on improving visitors’ experience.

A total of 55 watch brands have confirmed

their participation in the upcoming Geneva trade show, with prestigious contenders such as Rolex, Patek Philippe, Parmigiani Fleurier and IWC making their return to showcase their latest horological offerings. In addition, the trade show will welcome six new brands which are taking part for the first time.

The Watches and Wonders Geneva event has effectively supplanted Baselworld as the world’s top watch fair.

Firestone unearths its largest diamond ever at Lesotho mine

Firestone Diamonds recently unearthed a 215ct rough diamond from its Liqhobong mine in Lesotho, marking the largest highquality stone ever discovered at the site.

The company has announced that it will offer the diamond through a competitive bidding tender. Prior to that, it will hold viewings in Antwerp and Dubai. Firestone

owns 75% of Liqhobong, with the Lesotho government holding the remainder.

Liqhobong is located 2 600 m above sea level in the highlands of Lesotho and began production in 2017.

UK-based Firestone reported fourthquarter revenue last year of US$12,6 million, down almost 40% on the previous quarter.

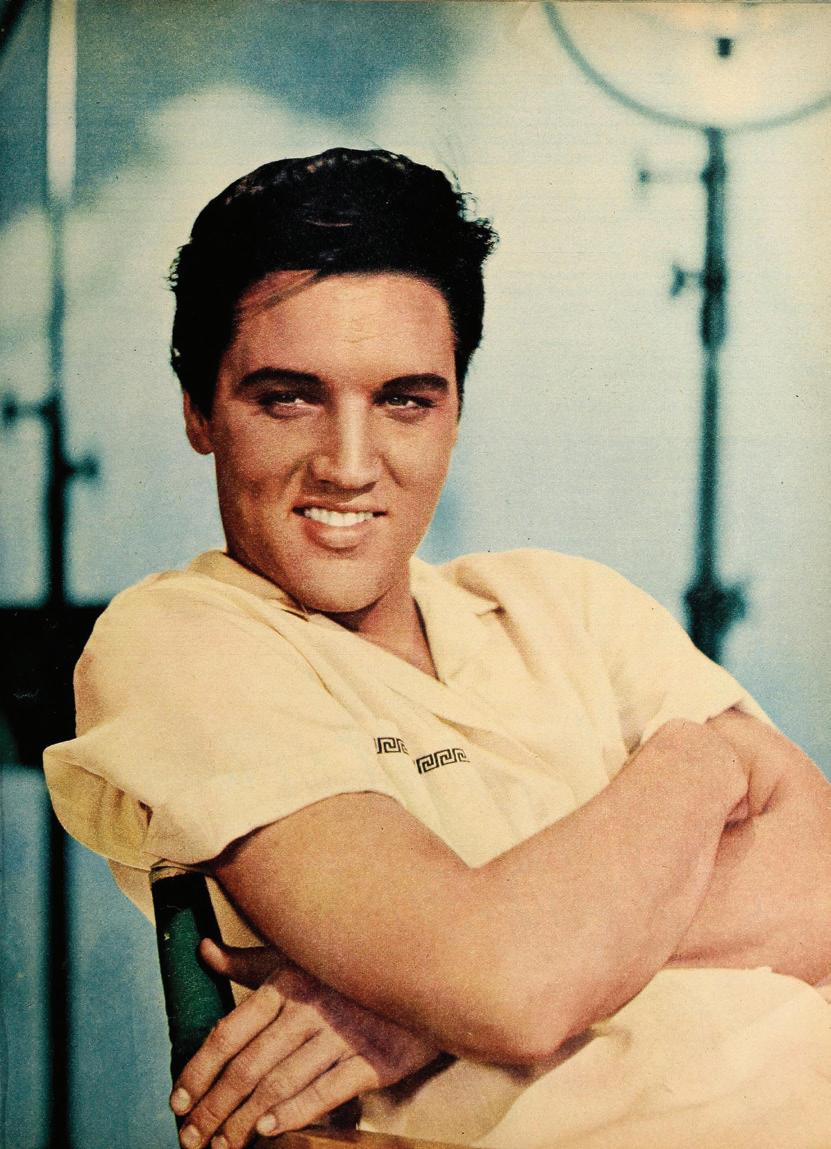

Book about Hollywood jeweller William Ruser published

The story of the life and stellar jewellery career of William Ruser is brought to life in a newly published book, William Ruser: The Jeweler Who Charmed Hollywood, written by GIA Research Librarian Judy Colbert and coauthor Peggy Tsiamis. Ruser is remembered for his whimsical figural jewellery with freshwater pearls.

“Ruser had a very specific look in his unique and special designs. Like all great designers, there are certain elements within

his pieces that make his work recognisable,” said the late estate jeweller Michael Kazanjian.

Ruser came from humble beginnings to become the go-to jeweller for the leading movie stars and socialites of the 1940s through the 1960s. His celebrity clientele included Elizabeth Taylor, Frank Sinatra, Barbara Stanwyck, Robert Wagner and Joan Crawford, among many others.

The 125-page paperback book includes more than 100 images.

Premium platinum with the best commercial terms for South African jewellers

SA JEWELLERY NEWS - APRIL 2024 NEWS SEZ: +27 (0) 12 000 4440 | CPT: +27 (0) 21 510 0770 info@MetCon.co.za | MetCon.co.za Scan the QR code to learn more A Platinum Partnership Featured jewellery designed by Kim Nel of Van Deijl Jewellers

Jewellex Africa 2024 dates and venue announced

Jewellex Africa, the continent’s leading jewellery trade show, is set to return to the Wanderers Club in Illovo, Johannesburg on 8-9 September.

Organised by the Jewellery Council of South Africa (JCSA), Jewellex Africa boasts a rich history of connecting industry professionals, buyers and jewellery enthusiasts. This year’s edition once again promises to be exceptional, offering a captivating experience for all.

“Due to demand, we’ve expanded the show to accommodate a larger selection of exhibitors and look forward to working with the industry to make Jewellex Africa a remarkable success once more,” says Lorna Lloyd, JCSA CEO.

Prospective exhibitors are invited to contact Elsa da Silva for more information on tel: (011) 484-5528 or 082-214-0028 or e-mail: elsad@jewellery.org.za.

WFDB concludes successful Presidents’ Meeting in Shanghai

The World Federation of Diamond Bourses (WFDB) concluded its annual Presidents’ Meeting for 2024, held in Shanghai, China. The three-day meeting explored the most pressing issues facing the world diamond industry – the G7 restrictions, laboratory-grown diamonds and the lacklustre Chinese market – with expert panels, speeches and discussions.

The Presidents’ Meeting was held at the new Shangrila Hotel in Pudong and was hosted by Shanghai Diamond Exchange President Lin Qiang. It was attended by bourse presidents from around the world, as well as by important Chinese guests, including Shanghai Vice-Mayor Hua Yuan and Zhu Zhisong, Party Secretary of Pudong. A delegation representing the Ministry of Mines of Angola and Endiama also attended, as well as one from Namibia.

panels and discussions was the necessity of collaboration among organisations in dealing with the challenges affecting the industry and the key role of the WFDB under President Yoram Dvash in leading industry-wide initiatives. One such example is the recent letter to the G7 in response to the diamond import restrictions, organised by the WFDB and signed by the World Diamond Council, the Gem & Jewellery Export Promotion Council and the International Diamond Manufacturers’ Association, which is galvanising industry-wide support.

In addition, WFDB leaders met personally with Chinese government officials and large private companies to promote the importance of investing in large-scale marketing campaigns in the Chinese market, to supplement and balance such campaigns in the USA. This message was met with agreement on the Chinese side.

Among the expert speakers at the meeting were Ye Zhibin, Chairperson of the China Gem & Jewelry Association; Kent Wong, MD of Chow Tai Fook; Ahmed Bin Sulayem, Chairperson of the Kimberley Process and Chairperson of the Dubai Diamond Exchange and the Dubai Gold & Commodities Exchange; Feriel Zerouki, Chairperson of the World Diamond Council; Marcus Lung, AD of De Beers; David Block, CEO of Sarine; Sissi Xu, CEO of the Natural Diamond Council in China; Mahiar Borhanjoo, Chairperson of Uni Diamonds and industry analyst Avi Krawitz.

USA sanctions Zimbabwean president for diamond-smuggling

The USA has sanctioned Zimbabwean President Emmerson Mnangagwa for corruption in connection with gold- and diamond-smuggling, as well as human rights abuses.

The Treasury Department’s Office of Foreign Assets Control (OFAC) has accused Mnangagwa of “providing a protective shield” to gold- and diamond-smuggling

An important conclusion of the various networks that operate in Zimbabwe, it said. He is also accused of directing Zimbabwean officials to “facilitate the sale of gold and diamonds in illicit markets” and taking “bribes in exchange for his services”.

The USA has restricted Mnangagwa from being a leader or official of entity, including any government entity, that has “engaged in, or whose members have engaged in, serious human rights abuses”, OFAC explained.

“[This restriction applies] to a foreign person who is a current or former government official, or a person acting for or on behalf of such an official, who is responsible for or complicit in, or has directly or indirectly engaged in corruption, including the misappropriation of state assets, the expropriation of private assets for personal

gain, corruption related to government contracts or the extraction of natural resources, or bribery,” OFAC stated.

OFAC issued the new sanctions after American President Joe Biden signed an executive order which terminated Zimbabwe’s national emergency and revoked sanctions on the entire country, so as not to target its citizens.

“The USA remains deeply concerned about democratic backsliding, human rights abuses and government corruption in Zimbabwe,” said Wally Adeyemo, Deputy Secretary of the treasury. “The changes we’re making today are intended to make clear what’s always been true: that our sanctions aren’t intended to target the people of Zimbabwe. Today we’re refocusing our sanctions on clear and specific targets.” – Rapaport

SA JEWELLERY NEWS - APRIL 2024 10 NEWS

Jewellery Council of SA update

AN IMPORTANT ROLE WHICH THE JEWELLERY Council plays is to support members’ business well-being to facilitate growth. Part of this is to help them operate legitimately by applying for permits and licences, paying taxes and following the laws.

A huge challenge being experienced by members is that VAT claims to SARS have either not been paid or are being paid six months to a year after claims were lodged.

The council has stepped in by requesting members who are not receiving their Import VAT and/or Notional VAT claims from SARS to contact the council for assistance. For small companies, keeping Jeweller’s Permit/Licence registers up to date, having second-hand goods registers in order and paying VAT and income tax, as well as PAYE, UIF and SDL, on time every month is becoming unrealistic to keep their doors open. In return, it is a legitimate expectation to expect VAT claims to be settled. This has been communicated to SARS, which has indicated its willingness to assist.

The council has been successful, in some cases, in assisting members with their VAT claims and we continue to assist those who have not yet received their refunds.

accommodation, hosted buyer badges, use of the buyer lounge and attendance at the fair reception and networking event.

Jewellex Africa 2024 has been launched and the show will be taking place on 8-9 September, once again at the Wanderers Club. Due to the amazing response, we have increased the space to include both the downstairs and upstairs exhibition rooms. Stand sales are open and interested parties are invited to contact the council.

We recently invited Gauteng companies which would like to explore exporting to the USA to participate in stakeholder engagements with the USAID African Trade and Investment SA programme to share information about tools, initiatives and activities available to take advantage of the American market. These engagements are ongoing and enquiries can be made at the council.

Competition (DTIC) for travel, accommodation and stand costs. The aim of these shows is to facilitate export markets.

In past years, we were able to accommodate 20 companies. However, due to increased costs and exchange rates, we are now only able to take 10 companies. Unfortunately, our application for DTIC funding to the Hong Kong International Jewellery Show was rejected due to its financial constraints, but we have applied for assistance for the JCK Las Vegas and New York Now shows later this year.

The Mining Qualification Authority (MQA) requested the council’s support in encouraging jewellery experts to assist with developing skills programmes for the jewellery industry. A list of the programmes which the MQA is planning to develop or has already started developing was circulated to attend these sessions. Members are welcome to contact the council, should they wish to get involved.

We encourage you to participate in and make use of the opportunities offered by the Jewellery Council to get the most out of the relationship.

On a positive note, potential SA jewellery-buyers who are members of the Jewellery Council have been invited to attend the Jewellery and Gem Shows in Bangkok and Hong Kong. The council has been able to negotiate buyer incentives such as complimentary hotel

One of the important projects which the council embarks on each year is co-ordinating and project-managing the participation of SA manufacturing jewellers to exhibit at international jewellery shows. Financial support is provided by the Department of Trade, Industry and

Enquiries about the council, its activities and how to become part of a responsible jewellery community can be made by visiting our website at: www.jewellery.org.za, contacting us on tel: (011) 484-5528 or emailing us at: admin@jewellery.org.za.

Lorna Lloyd Chief Executive Officer

SA JEWELLERY NEWS - APRIL 2024 13 FROM THE JCSA’S OFFICE

Can gold re-test its all-time highs?

The gold price has seen notable volatility in recent months, reflecting several factors, including the strength of the USA economy, cooling inflation, the USA interest outlook and heightened geopolitical risk, writes Metals Focus

AFTER A DROP IN EARLY OCTOBER 2023

to US$1 809, gold quickly rebounded as the conflict in the Middle East emerged and later as rate cuts expectations for 2024 strengthened in the aftermath of the US Federal Reserve (Fed) December meeting. As a result, gold jumped to an all-time high of US$2 135 on 4 December. Since then, however, the price has failed to hold above US$2 100, spending much of the start to 2024 in the US$2 000-US$2 080 range.

With the American economy maintaining a decent growth momentum and the labour market still broadly healthy, we believe there is scope for a hawkish re-pricing of interest rate expectations, which in turn could prevent gold from attempting a new peak in the near term and also open up

the possibility of a modest price correction. Looking first at interest rate expectations, over the past two years the markets have often taken a more dovish position compared with the Fed. From pricing in fewer rate hikes than the central bank in 2022 to expecting rates to peak earlier than Fed forecasts in 2023, the market has typically been more optimistic. However, on both occasions, there were times when these expectations eventually aligned with the Fed as the USA economy consistently fared better, compared with widespread views of an imminent recession. As such, these episodes saw gold correct, with the price falling from around US$2 000 to near US$1 600 on three occasions in 2022 and towards US$1 800 in 2023.

With American inflation easing considerably from its 2022 peak, a similar dynamic has emerged since late 2023. With some signs of cooling in the USA labour market late last year and a slightly dovish tone emerging from the Fed, financial markets quickly adopted a more optimistic stance about rate cuts in 2024.

METAL MATTERS

SA JEWELLERY NEWS - APRIL 2024 14

At best, uncertainties will underpin safe haven demand for gold and help ensure that any price corrections are modest.

As such, even though the Fed outlined the possibility of just three rate cuts (totalling 75 basis points) this year, Fed fund futures have been pricing almost double, or 150 basis points of rate cuts in recent months. Importantly, even though the Fed has signalled that rate cuts might not occur very soon, financial conditions have eased notably and, in turn, supported gold prices. For instance, the Goldman Sachs USA financial conditions index is now at its lowest since August 2022, having realised its 2023 peak in November.

That said, more recently some of the optimism about the rate cut cycle has been tempered by a strong set of economic data from the USA. For instance, the latest monthly employment report showed that American payrolls jumped by 353 000 in January, which was far higher than expected. This was accompanied by a healthy growth in wages and a drop in the unemployment rate.

With the upward revision to the December data, 2023 marked the second consecutive year of USA unemployment at under 4%, making it the best such period in five decades. The January Federal Open Market Committee meeting also saw the Fed reiterate its stance of three rate cuts for this year. All of this has helped prevent gold from moving higher so far

this year, as the timing of the first-rate cut has now been pushed back from March to May, effectively implying five rate cuts this year, compared with market expectations of six at the beginning of 2024. With a USA recession almost ruled out and the probability of a soft landing much higher than last year, the Fed is unlikely to resort to aggressive loosening of monetary policy in 2024 unless there is a material deterioration in economic momentum.

This leaves the potential for further repricing of current expectations to align more closely with Fed forecasts of three rate cuts in 2024. This, we believe, can push gold below the long-held US$2 000 level in the short term.

While the USA economic backdrop poses a downside risk to gold, there are other uncertainties that have prevented financial markets from aligning with the Fed’s outlook.

Of these, continued tensions in the Middle East have kept concerns about a wider regional escalation high. The risk this poses to oil prices and global shipping costs also means that inflation and global growth concerns could re-emerge if more entities in the Middle East are involved in the conflict. More recently, the USA banking sector troubles also came back in focus after New York Community Bancorp reported a surprise loss of US$252 million in the last quarter compared with a US$172 million profit in the fourth quarter of 2022. This led to a wider sell-off in shares of other regional banks as worries about a repeat of the 2023 crisis emerged.

An index of USA regional banks, called the KBW Regional Banking Index, has declined by 13% since then. While we have little reason to believe that this can result in contagion, these worries are unlikely to disappear entirely in the near term. On balance, we believe that even as uncertainties abound, gold may not be able to re-test its all-time highs in the near future. At best, uncertainties will underpin safe haven demand for gold and help ensure that any price corrections are modest. That said, notwithstanding the risk of a short-term price fall, as we outline in our latest Five-Year Gold Forecast, with the increasing likelihood of rate cuts later this year, this will set the stage for a more sustainable price rally.

About Metals Focus

Metals Focus is a leading, independent precious metal research consultancy. With a team spread across nine countries, it is dedicated to providing world-class statistics, analysis and forecasts to the global precious metal market. Its highly experienced precious metal team consists of analysts and consultants who possess a deep understanding of the market.

SA JEWELLERY NEWS - APRIL 2024 15 METAL MATTERS

Africa and Middle East retailing’s next big global hot spots

ENTERING A NEW MARKET OR DECIDING to expand as a retailer is a move that carries with it very high stakes and very real risks. Success can never be guaranteed. Given the high stakes, the smart retailer would make their decisions based on objective data and informed insights.

“This is why we created the biennial Global Retail Development Index [GRDI] in 2002. The latest edition of the report paints a very rosy future for Africa and the Middle East,” says Prashaen Reddy, Partner at Kearney, a leading global management consulting firm with deep-rooted expertise in strategic transformation.

This year’s GRDI shines a spotlight on the Middle East and Africa (MEA) as retailing’s next big global “hot spot”. Their youth-driven urban populations, a projected doubling of disposable income by 2040 and favourable government policies are just some of the factors that give MEA countries such high potential for retail sector growth.

“Since its inception, the countries ranked on the GRDI have tracked closely as the top destinations for retailers. This shortlisting ensures that the analysis focuses on the most successful emerging markets of today and those that therefore offer the highest potential down the road,” says Debashish Mukherjee, Partner at Kearney Middle East & Africa –Consumer & Retail Practice Lead.

Globally, the GRDI identified six key trends that had the most significant impact on developing nations:

• Macro-economic uncertainty: The hopedfor “new normal” is not all that normal and global economic uncertainty remained high across large developing economies,

The Global Retail Development Index (GRDI) focuses on the top 35-40 emerging economies and evaluates their relative attractiveness to retailers based on an in-depth examination of economic health and stability, government policy, competitive activity, penetration of e-commerce, consumer behaviours and demographic, social and cultural considerations

which weighed on GDP growth and purchasing power.

• Inflationary pressure on consumers is forcing them to trade down: Even though luxury and premium products have an established consumer base at the economic top of MEA nations, shoppers in these emerging markets (including Saudi Arabia, Egypt and Turkey) are increasingly opting for less expensive, local and private-label items as substitutes for pricier imported and branded products.

• The ongoing journey of e-commerce growth continues: Globally, e-commerce is expected to grow at twice the rate of bricks-and-mortar retail with a compound annual growth rate of ~10-12% until 2027. In emerging markets, most of this growth is the result of growing access to digital marketplaces which continue to take root

SA JEWELLERY NEWS - APRIL 2024 16 MARKET TRENDS

and rapidly change consumer behaviour, especially younger consumers living in cities.

• Omnichannels continue to define retailers’ strategy: While omnichannels are considered table stakes in most developed economies, in many developing nations an omnichannel approach is still in its nascent or early evolutionary stage. However, store-based retailers in developing markets are continuing to invest in developing omnichannel capabilities, particularly in terms of fulfilment and customer services, including in-store pickup, curb-side pick-up, etc.

• The increasing rise in e-payments and buy now, pay later (BNPL) options: Customers in emerging markets are moving quickly to new payment options. Shoppers in the Asia-Pacific region are rapidly adopting digital wallets, while MEA customers have eagerly embraced the adoption of BNPL.

• The rise of retail artificial intelligence (AI): Retailers in MEA are increasingly turning to emerging technologies to leapfrog traditional market evolution and create new, vibrant, experiential marketing approaches designed to attract, entertain, educate and better service consumers. The use of AI-generated virtual avatars and live streaming by some of China’s largest retailers are examples of the innovations being introduced.

“Across the globe – especially in emerging economies – retail markets continue to face strong headwinds, particularly in terms of macro-economic factors such as inflation and currency fluctuation, political conflicts, the impact of changing demographics and, of course, environmental factors from superstorms to droughts,” says Mukherjee.

“Of course, each of these challenges also offers opportunities. To leverage them, global retailers need to carefully match their strategic ambitions and investments against the balance of their portfolios – and that requires careful thinking and data-based decision-making.”

A copy of the report can be downloaded from: https://www.kearney.com/industry/ consumer-retail/global-retail-developmentindex.

– The GRDI was released during a media briefing on 20 February 2024.

The Middle East and Africa’s (MEA) youth-driven urban populations, a projected doubling of disposable income by 2040 and favourable government policies are just some of the factors that give MEA countries such high potential for retail sector growth.

SA JEWELLERY NEWS - APRIL 2024 17

MARKET TRENDS

Inhorgenta demonstrates PR potential for upper and mid-range brands

International reviewer of the Horological Journal in the UK and SA Jewellery News freelance reviewer Martin Foster reports on Inhorgenta Munich, the leading EU watch, clock and equipment fair

INHORGENTA MUNICH HAS BEEN A SHOWCASE FOR the industry and a platform for the trade since 1974. For its 2024 50th anniversary, it presented itself from 16-19 February as more modern, diverse and prestigious. It certainly occupies an interesting place in the established calendar of the annual international watch and clock trade fairs.

It opened this year under its new motto, “Bold and Confident”, in Munich where there is ample, well-serviced exhibition space, spread over six halls at Messe München.

Exhibitors from across the globe presented their latest creations, located in a beautiful city with plentiful, good-quality accommodation that opens for four days about a month before the Watches & Wonders April events in Geneva, Switzerland.

It is interesting to note that the late Baselworld had its “terminal” exhibitor issues, but it was certainly by far the best for footfall visitors and the press. Inhorgenta has these same excellent qualities for visitors and the press, together with spacious halls inviting the watch industry to come together and hopefully ending the acrimony of the Baselworld events.

Inhorgenta today is already the EU’s largest watch, jewellery and equipment fair with state-of-the-art security facilities and infrastructure. With around

INTERNATIONAL FAIR

SA JEWELLERY NEWS - APRIL 2024 18

25 000 trade visitors from 90 countries (+5% on 2023), the Inhorgenta trade fair is a significant information platform for the sector and is now surely poised to grow.

“With a new spirit and a high-quality ambience, Europe’s leading industry platform for jewellery, watches and equipment has set the course for a successful future,” says Stefan Rummel, CEO of Messe München. With 870 exhibitors from 37 countries, Inhorgenta has grown by 9% compared with the previous year. Half of the exhibitors are from abroad, giving Inhorgenta Munich 2024 its international standing.

With six exhibition halls, there is a lot to discover. At the “Timepieces” Hall A1 – which is entirely dedicated to watches – national and international exhibitors showcase watches of all kinds and watchmaking schools provide information about career opportunities. The Salon Suisse and the Watch Boutique are also located here. Familiar brands include MühleGlashütte, Ebel, Junghans, Tutima Glashütte, Michel Herbelin, Citizen, Casio, Garmin and Porsche Design.

A major highlight of this year’s fair was the Inhorgenta Awards ceremony on 17 February, at the Showpalast in Munich.

The 1970s-style gala event was hosted by TV personalities Rebecca Mir and Christian Düren. On this evening, the winners of nine categories were chosen in front of 500 guests. A jury of industry experts nominated three finalists in each category. Among the members of the selection committee were

Director of Special Projects Fabergé Sarah Fabergé, Wempe’s Manager Anja Heiden and Swisswatches Magazine founder and CEO Zurab Zazashvili.

One of the categories was “Watch Design of the Year”, with its three finalists: Garmin, a brand specialising in smart and tool watches (MARQ Golfer Carbon Edition), the 2023 revival of Löbner (Rocketman Edition 50) and Porsche Design (Chronograph 1 Utility Limited Edition).

There was also the newly-introduced “Luxury Watch of the Year” category for mechanical wristwatches with a retail price of €5 000 or more.

The three nominees were Swiss watch manufacturer Baume & Mercier (Riviera Baumatic Perpetual Calendar 50th Anniversary Edition (M0A10742)), founded in 1830, Dresden-based Maison Lang & Heyne (Anton Manufaktur Edition) and Tutima Glashütte (Tempostopp).

In terms of fashion, big, bold statements are still dominating both watches and jewellery. Yellow gold is still hovering in the wings waiting for its revival and the titanium honeymoon is still in full swing as designers find clever blends of colours and finish which would have been impossible “rule-breakers” a few decades ago.

The functions of a trade fair are, broadly speaking, to promote and sell an industry and its products. We read varying reports of the prosperity of the watch industry, but trade fairs such as Inhorgenta are where agents and wealthy patrons can make assessments and decisions in line with their needs – and in these times of changing political alliances, developing fractures and war-talk, the wealthy end of town still dominates the

SA JEWELLERY NEWS - APRIL 2024 19 INTERNATIONAL FAIR

setting of new and auction-house pricing.

Thus Inhorgenta is quietly repositioning itself away from a “German” fair into a broader EU event which will provide a competitive backdrop in Europe for the Watches and Wonders Fair in Geneva about a month later.

However, one of the difficulties is the parochial perception of the German exhibitors themselves that they are participating in a “German” fair and their economic outlook is blinkered by the performance of the German economy. There is improvement over previous years, but some are slow to capitalise on the broader pan-European platform presented by Inhorgenta.

Another emerging feature of the world’s watch fairs certainly has its origins in the Covid-19 disruption to established practice.

As we have observed, the purpose of a trade fair is to promote an industry and its products. But this was disrupted by Coronavirus restrictions, with limitations on the travel and large gatherings which are key features of trade fairs.

Today these restrictions have been largely put aside, but with the four years of the virus’s dominance, a new level of skilled staff have emerged into leading roles in the fair administration. However, they are

without the historical experience of those they replace. The upshot of this is that the PR of the fairs endlessly features significant people when it should feature significant timepieces.

A visit online to the Inhorgenta fair reviews/ reports features pages and pages of people, with very few high-resolution images of the watches we want to see. The readers of these pages are here to update on the latest

watches, without the least interest in those who run the companies that make or promote them. With no disrespect, warn of this issue and hope for greater awareness of it.

Readers can find more about the 2024 Inhorgenta Munich fair at: https://inhorgenta. com/en/.

The next Inhorgenta Fair takes place from 21-24 February 2025 at the New Munich Trade Fair Centre.

Inhorgenta today is already the EU’s largest watch, jewellery and equipment fair with state-of-the-art security facilities and infrastructure. With around 25 000 trade visitors from 90 countries (+5% on 2023), the Inhorgenta trade fair is a significant information platform for the sector and is now surely poised to grow.

SA JEWELLERY NEWS - APRIL 2024 20 INTERNATIONAL FAIR

Dominant influencer marketing trends

In 2023, Hustle Media Influence, a division of Hustle Media, achieved a significant milestone by garnering 2,9 million content views across various campaigns and industries since its conception. That is a substantial number of eyeballs on campaign content

GARNERING 2,9 MILLION CONTENT VIEWS across various campaigns and industries is an impressive milestone. The key to this success lies in Hustle Media Influence’s understanding of crucial influencer marketing trends and its ability to apply them to its campaigns. Influencer marketing is a dynamic field that requires staying abreast of the latest trends, understanding their impact on brands and content creators and seamlessly incorporating them into campaigns. The landscape of influencer marketing is ever-

evolving and there is no sign of it slowing down anytime soon.

As we navigate this dynamic industry, we must recognise that influencer marketing is always in motion. Currently, it is gearing up for significant changes that have the potential to shake things up for both brands and creators.

The following influencer marketing trends are poised to dominate this year:

Authenticity is non-negotiable Authenticity has always been paramount in

influencer marketing and in 2024, it remains a critical factor. Audiences increasingly seek genuine connections with influencers and brands they can identify with. Audience fatigue has set in from seeing highly polished content that does not align with their own lives. Campaigns that emphasise authenticity, transparency and real-life experiences will capture the hearts of consumers. Brands will collaborate with influencers who align with their values, fostering trust among their audiences.

SA JEWELLERY NEWS - APRIL 2024 22 BUSINESS MANAGEMENT

Sustainability takes centre-stage

With global environmental concerns gaining prominence, influencers will play a pivotal role in promoting sustainability. Brands will partner with influencers who advocate ecofriendly practices, showcasing products and services that align with a more sustainable lifestyle. Expect to see influencers promoting eco-conscious brands and encouraging their followers to make environmentally responsible choices. Audiences gravitate towards brands that care.

Hyper-local and niche influencer campaigns will offer better targeting

While mega-influencers will always have their place, the focus shifts towards microinfluencers with niche audiences. These influencers often have a more engaged and loyal following, providing a targeted reach for brands. Collaborations with micro-influencers bring authenticity and relatability to campaigns, making them a powerful force in 2024. Savvy brands are poised to significantly ramp up their use of highly targeted, hyperlocal campaigns, focusing on niche or nano-

influencers. By capitalising on geotargeted influencer campaigns, brands can connect with specific communities through local influencers who deeply understand regional preferences and trends.

Video dominance continues

This one is no surprise. Video content has been ruling the digital landscape for some time and its dominance is set to continue. Shortform videos, reels and live streams will be the preferred mediums for influencer marketing. Brands will collaborate with influencers who can create captivating video content that

resonates with their audiences, offering an immersive and shareable experience. Video content quality is a key vetting factor for Hustle Media when we select content creators for the brands with which we work.

Ephemeral content for fear of missing out (FOMO)

Ephemeral content, such as stories, will continue to leverage FOMO. Brands will collaborate with influencers to create timesensitive and exclusive content, driving urgency and engagement among their followers. Stories, as campaign teasers, are a great way of creating excitement before the campaign officially rolls out.

Brands will shift towards long-term influencer collaborations

Brands increasingly favour long-term collaborations with the same influencers over one-off campaigns with various ones. Authenticity drives this shift and trust develops when an influencer consistently endorses a brand. The longer-term approach transforms sporadic promotions into an engaging narrative, making the brand’s presence in the influencer’s content feel more genuine and less like random advertising. Regular, consistent endorsements from a trusted influencer can significantly enhance brand loyalty and credibility, as opposed to fleeting appearances by multiple, changing faces.

Paid advertising will be key for broad reach Brands and influencers will benefit from the paid amplification of the content created by influencers. Using the fine-tuned targeting available on platforms like Facebook Ads or through advertising tools for other social media platforms, brands can push out highquality influencer content to the people who care about seeing it without relying on social media algorithms, because we all know that these are fickle.

Influencer marketing is a dynamic field that requires staying abreast of the latest trends, understanding their impact on brands and content creators and seamlessly incorporating them into campaigns.

SA JEWELLERY NEWS - APRIL 2024 23 BUSINESS MANAGEMENT

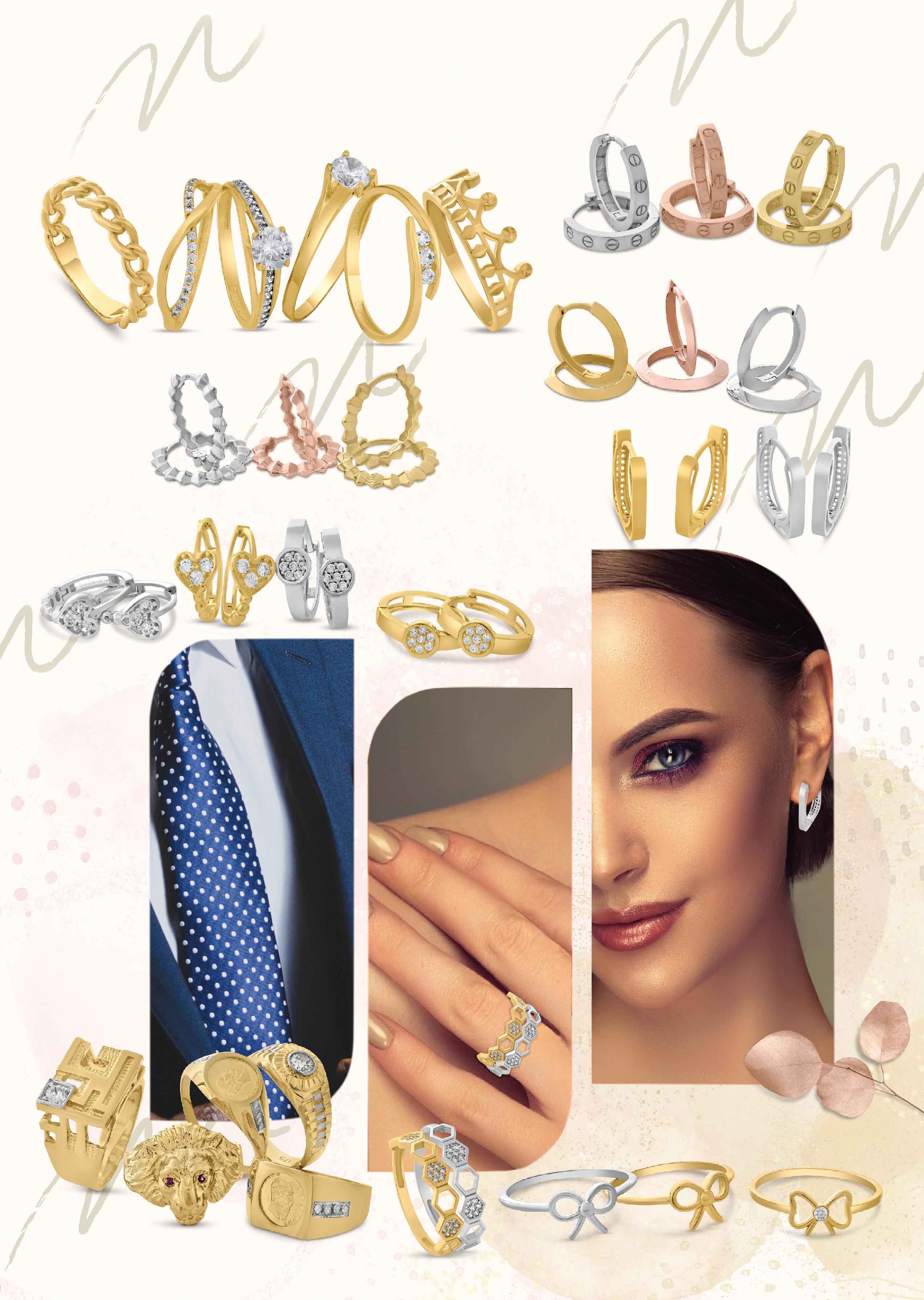

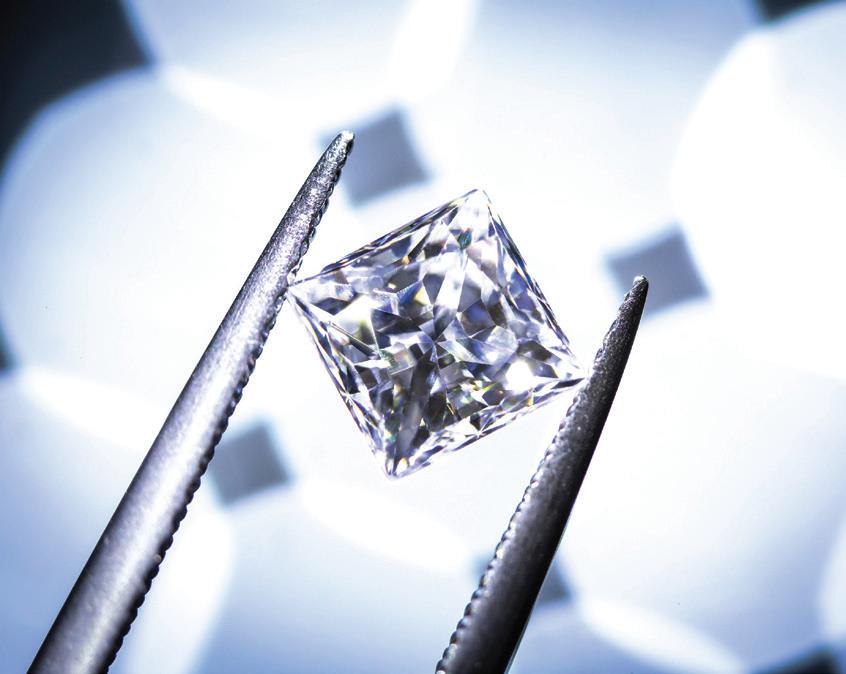

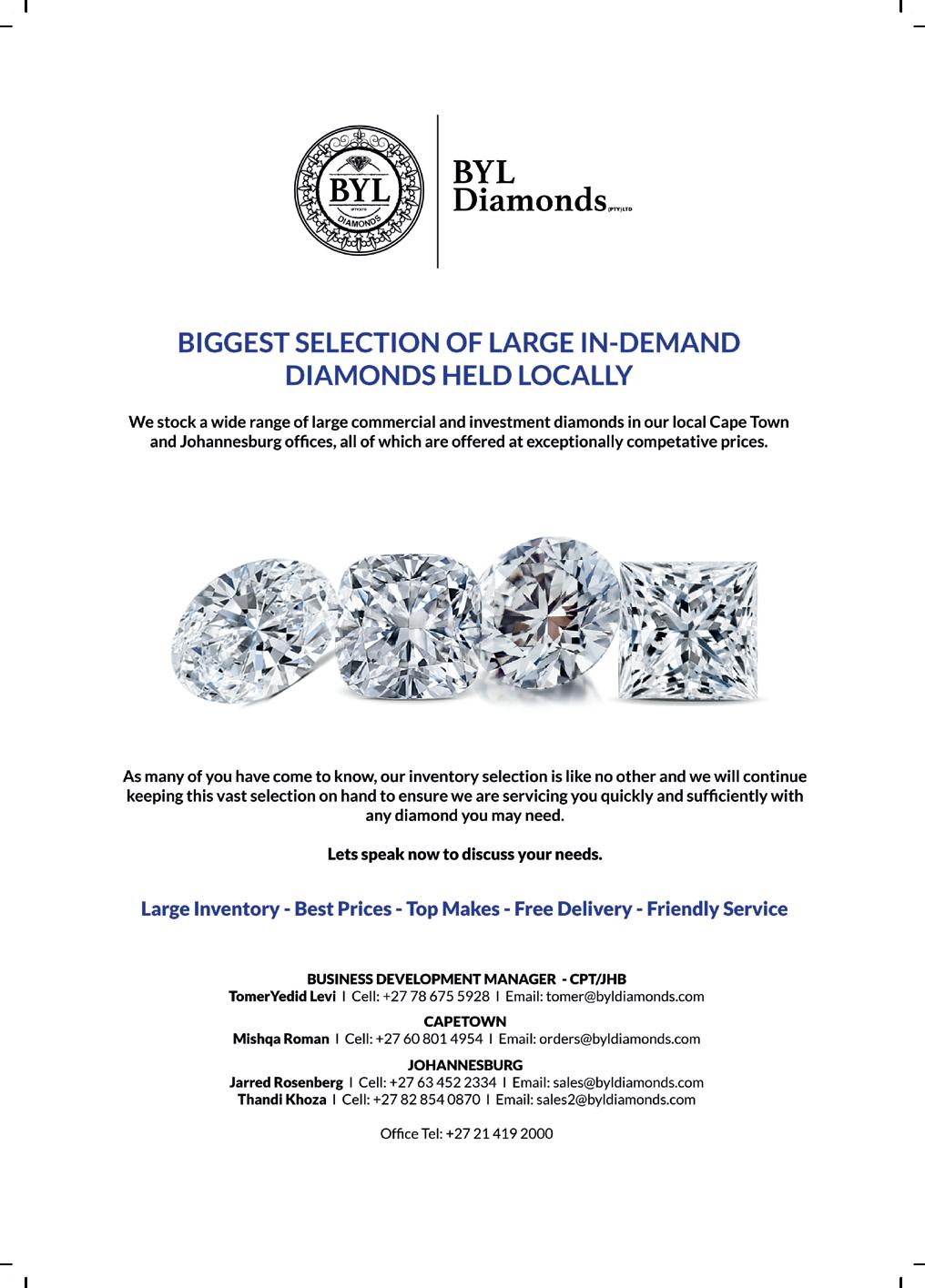

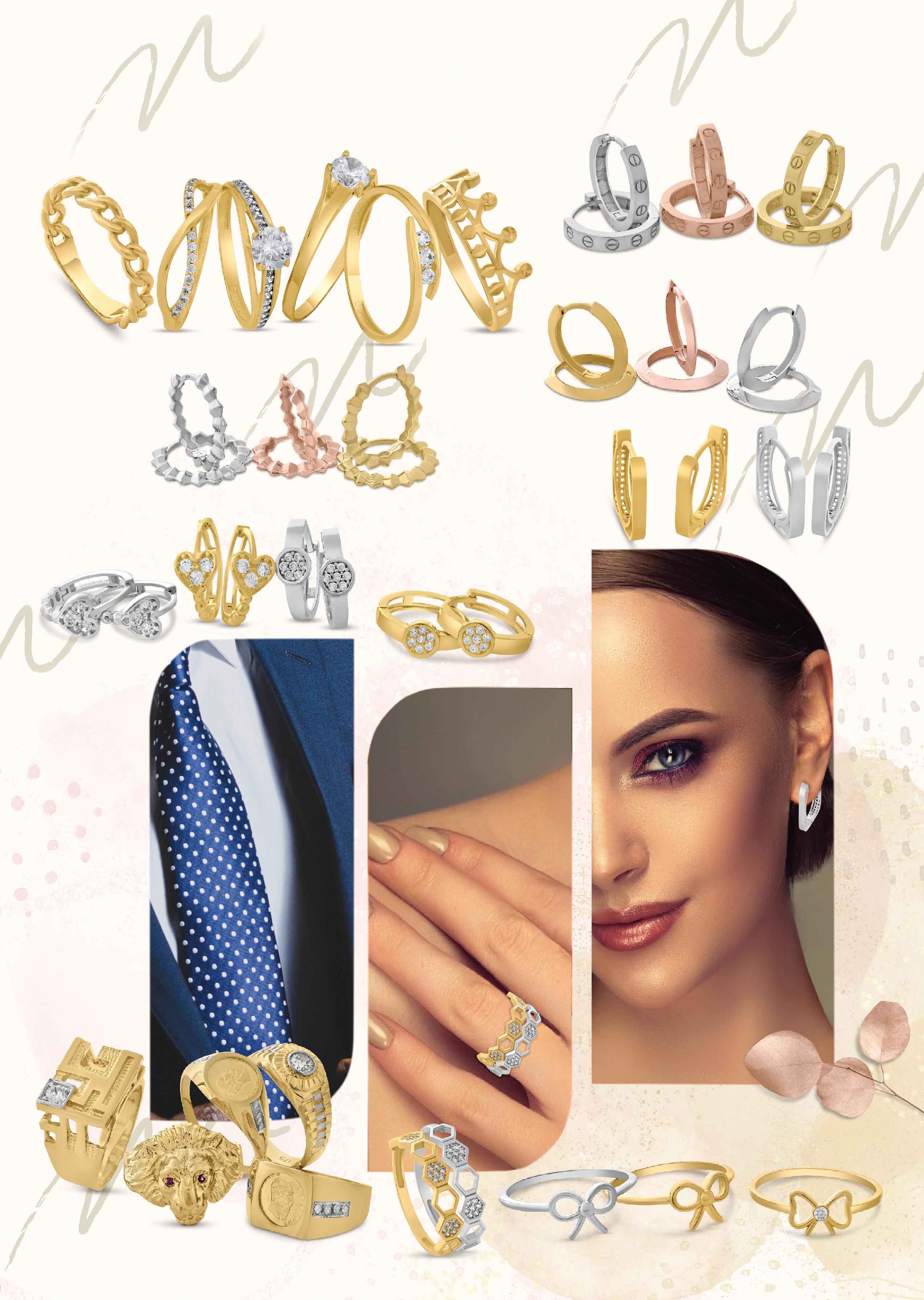

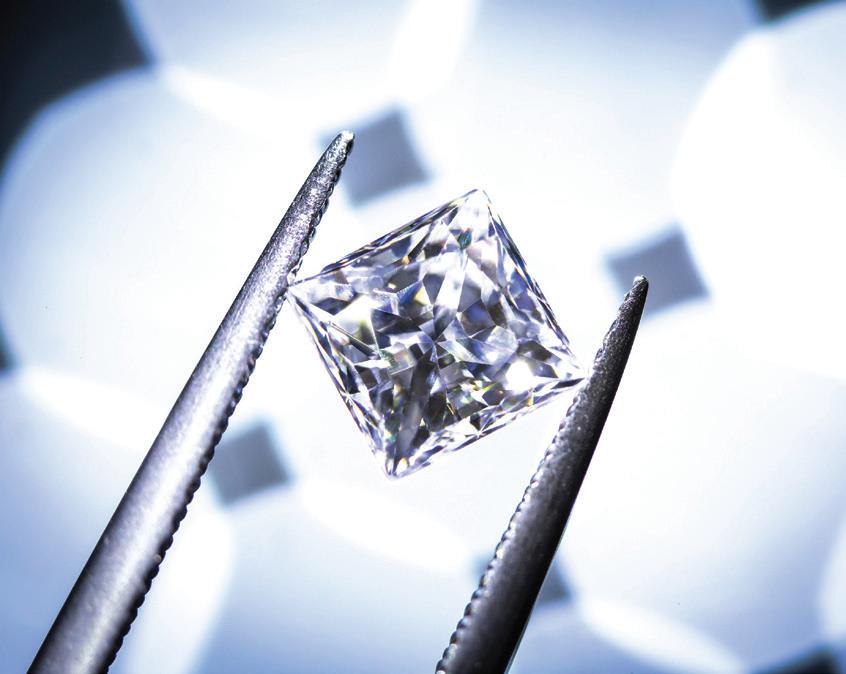

Defined by quality and choice

With offices in Cape Town and Johannesburg, BYL Diamonds has cemented its reputation as one of South Africa’s leading diamond and jewellery manufacturers and wholesale suppliers and has now also expanded to the UK

THROUGH ASSOCIATES WITH MINES IN SA and state-of-the-art polishing factories abroad, BYL Diamonds has secured access to some of the world’s most impressive loose cut diamonds and gemstones in a galaxy of shapes, sizes, colours and clarities. Its diamond collection includes a wide range of loose diamonds, mostly certified by the Gemological Institute of America, calibrated round and fancy shape diamonds, as well as investment stones. “It’s always been our aim to offer our clientele the largest selection of the most sought-after commercial and investment diamonds at very competitive prices,” says Omri Yedid Levi, CEO of BYL Diamonds, “and provide access to any diamond a client might need.”

BYL Diamonds’ inventory consists of certified diamonds, fancy colour diamonds, calibrated round diamonds, exclusive fancy shape pairs, gemstones and investment stones.

In addition to being a leading supplier of loose diamonds and gemstones, it is renowned for the quality of its ever-changing jewellery range, with each piece made up using the finest

diamonds and gemstones carefully chosen for each individual item. Its portfolio offers eye-catching pieces, set in a range of metals including platinum, white gold, yellow gold and rose gold. Its jewellery collection consists of designer diamond jewellery, certified gemstone jewellery, platinum diamond jewellery and tanzanite jewellery, as well as its BYL Collection, which offers clients uniquely designed diamond jewellery at very competitive prices.

“Loyal customers are an essential part of our business’s success,” says Levi. “We believe that exceptional businesses need exceptional partners, which is why we constantly strive to innovate and move forward, together with our valued clients.”

Why should clients deal with BYL Diamonds? “Our experts in diamonds are always available to give advice and assist in finding the ideal diamond for a client’s needs. Their satisfaction is our priority,” says Levi. “We also have the largest selection of loose diamonds held locally, including large investment stones, allowing us to fulfil any request clients may have.”

BYL Diamonds’ loose diamond inventory is viewable on its new live inventory feed, providing clients with first-hand exclusive access to diamond availability, discounts, specifications, its unique videos and copies of certificates. Its extensive inventory of jewellery and loose diamonds can also easily be viewed

Business Development Manager –Cape Town/Johannesburg

Tomer Yedid Levi

Tel: 078-675-5928

E-mail: tomer@byldiamonds.com

Cape Town

Mishqa Roman

Tel: 060-801-4954

E-mail: orders@byldiamonds.com

Johannesburg

Jarred Rosenberg

Tel: 063-542-2334

E-mail:sales@byldiamonds.com or Thandi Khoza

Tel: 082-854-0870

E-mail: sales2@byldiamonds.com

Office tel: (021) 419-2000

Website: www.byldiamonds.com

on its website: www.byldiamonds.com.

“We exclusively carry diamonds which are eye-clean and comprise only top makes, ensuring that clients receive the finest quality at the most competitive prices. We guarantee peace of mind when buying from us. Clients can have complete confidence that all our diamonds are natural and come with accurate certifications,” says Levi.

“Our main goal is to provide our clients with the best-quality products at the most competitive prices. We view our clients as long-term partners and consider their success our own.”

SA JEWELLERY NEWS - APRIL 2024 25

COVER FEATURE

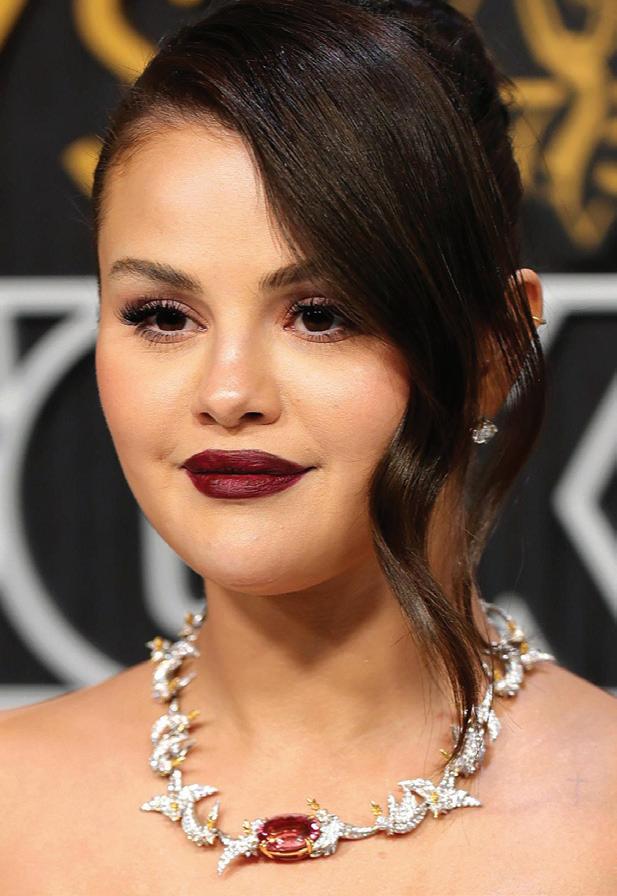

Spectacular jewellery from the 2024 red carpet

The A-listers’ red carpet at the 66th annual Grammys, the 30th Screen Actors Guild Awards, the 81st Golden Globe Awards, the 51st Daytime Emmy Awards and the 96th Academy Awards dazzled with diamonds and glittering gemstones

SA JEWELLERY NEWS - APRIL 2024 AWARD SEASON JEWELLERY 26

(Above): Ayo Edebiri wearing Boucheron at the Golden Globes

(Above): Carey Mulligan at the 2024 SAG Awards wearing Armani Prive and Fred Leighton jewellery

(Above): Chris Perfetti attended the SAG Awards wearing an Anabela Chan brooch

(Left): Jennifer Lopez in Boucheron at the Golden Globes

(Left): Anne Hathaway wearing Bvlgari jewels at the SAG Awards

(Above): Fantasia Barrino wearing Messika diamonds at the Grammys Getty Images Getty Images Getty Images Getty Images Getty Images

27

JEWELLERY SA JEWELLERY NEWS - APRIL 2024

AWARD SEASON

(Above): Victoria Mone t wearing Bvlgari jewels at the Grammys

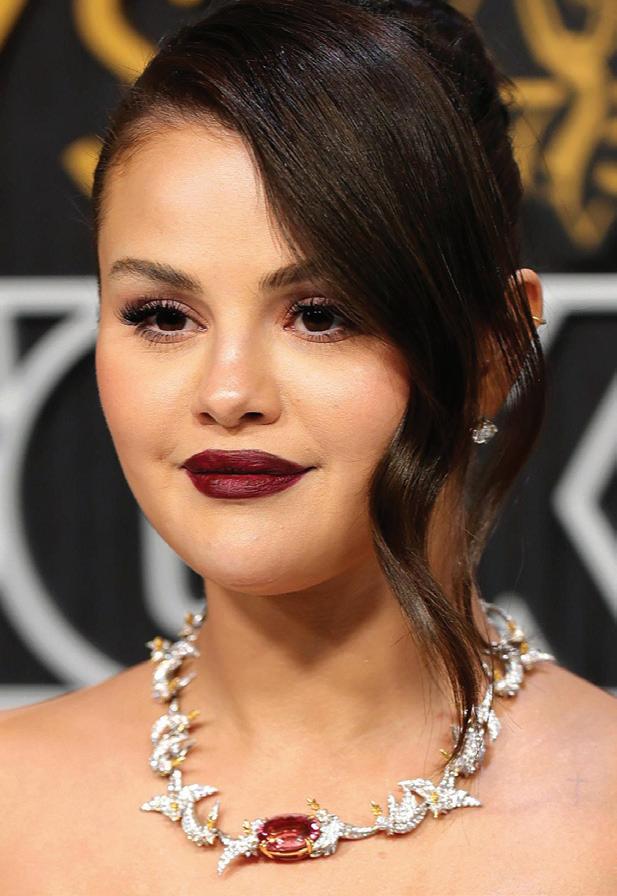

(Right): Selena Gomez wearing Tiffany at the Primetime Emmy Awards

(Above): Quinta Brunson at the SAG Awards 2024 wearing jewels by Yvan Tufenkjian

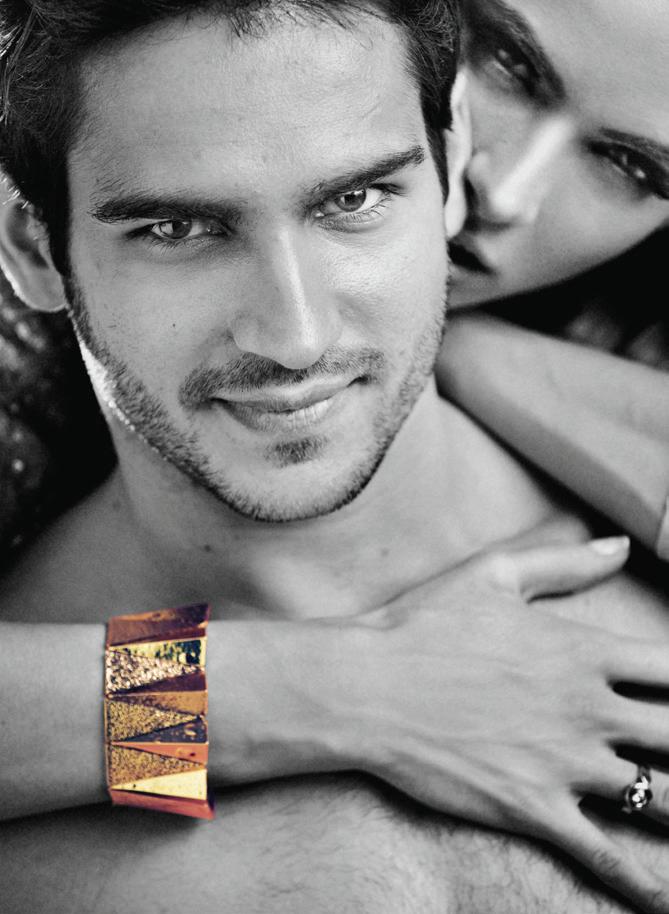

(Above): Trevor Noah chose Tiffany & Co to host the 2024 Grammy Awards

(Above): Taylor Swift wearing De Beers at the Golden Globes

(Above): Jenna Ortega wearing Dior at the Primetime Emmy Awards

(Above): Florence Pugh wearing Tiffany & Co at the Golden Globes Getty Images Getty Images Getty Images Getty Images Getty Images

(Right): Oprah Winfrey wearing Chopard at the Golden Globes Getty Images Getty Images Getty Images

savvy

together

za

883 4627 TO ADVERTISE Scan for our latest issue

BE ON-TREND

thinkers smart doers

people jza@isikhova.co.

011

What our jewellery offers tourists

When it comes to purchasing diamonds and jewellery, South Africa offers tourists a unique experience all round

BUYING DIAMONDS AND JEWELLERY FROM

SA is a rewarding choice for tourists for various reasons, including: Buying from a country of source: Buying diamonds directly from the source can offer tourists a sense of authenticity and connection to the origins of their purchase, making their experience much more memorable.

Commitment to ethics and integrity:

Most SA jewellery stores are members of the Jewellery Council of SA, where adherence to a strict code of ethics and conduct is expected. This code requires businesses to conduct themselves with integrity, ensuring that all clients, including tourists, receive the highest standards of service.

Diverse selection: Tourists are greeted with a vast array of options when shopping for diamonds and jewellery in SA. From classic round cuts to intricate fancy shapes, each piece is meticulously crafted to perfection, offering an abundance of choices to suit every preference and style.

VAT exemption for tourists: SA extends

a VAT exemption to tourists, making it an attractive destination for purchasing highvalue items such as diamonds and jewellery. The local jewellery trade is well versed in helping tourists reclaim the value-added tax, which is 15% on their purchases, ensuring a seamless and rewarding shopping experience.

Transparency through certification: To instil confidence in its customers, the SA jewellery industry places great emphasis on providing tourists with internationally recognised, independent laboratory certificates for all loose diamonds and gemstone

purchases. This commitment to transparency ensures that tourists can make informed decisions with complete peace of mind.

Fair pricing and ethical sourcing: The SA jewellery industry is dedicated to offering tourists fair pricing for their purchases, while upholding ethical sourcing practices. From responsibly mined diamonds to ethically sourced gemstones, every product is curated with sustainability and social responsibility in mind.

Buying diamonds and jewellery from SA not only offers tourists a diverse selection and exceptional service, but also ensures transparency, ethical sourcing and value for money. With its unwavering commitment to excellence, the SA jewellery industry continues to delight tourists from around the globe, making each purchase a memorable and fulfilling experience.

SA JEWELLERY NEWS - APRIL 2024 29 WORLD-CLASS JEWELLERY

Design to deliver high quality trade services

Price List 2024 | All prices excluding 15% VAT

CAD DESIGNS

R 450.00 | R 575.00 | R 700.00

Design Changes - R 100.00

WAX PRINTING

R 0.65/mm3

GOLD CASTINGS

925 | 9ct | 14ct | 18ct | 22ct

Casting Fee Per Flask -

Small R160.00 | Medium R 320.00 | Large R 500 |

Sprue-up Fee R 50.00

PLATINUM CASTINGS

PtAu | PtCu

R 75.00/g

FINISHING SERVICES

925 | 9ct | 14ct | 18ct | 22ct

Semi-Finishing Fee - R 70.00/g

PtAu | PtCu

Semi-Finishing Fee - R 100.00/g

925 | 9ct | 14ct | 18ct | 22ct

Full Finishing Fee - R 160.00/g | 200.00/g | R 215.00/g | 230.00/g | 250.00/g

PtAu | PtCu

Finishing Fee - R 250.00/g

SETTING SERVICES

From R 35.00/stone | Removal of Stones R 15.00/stone

info@piccolo-jewellery.co.za | 083 396 6178

educational insert

Monthly

Gems Recovered from Sedimentary Rocks

ARTICLE

UNEARTHED

James E. Shigley, Roy Bassoo and Aaron C. Palke SPONSORED BY FEATURE

COLOURED STONES

Locating Alluvial Gem Deposits

Finding an alluvial gem deposit is no small task, and such occurrences are often just the result of a serendipitous discovery by an individual spotting a gem crystal fragment lying loose in the dirt along a path or exposed in a rock outcrop. Such an event often results in many local people swarming the area and digging up the ground hoping to “strike it rich.” Historic examples include the gold rushes in California in 1848 (Kelley, 1954; Eifler, 2016; Mountford and Tuffnell, 2018; Baumgardner, 2020), in Australia in 1851 (Mudd, 2007), and more recently the extensive alluvial gem deposits found in the Ilakaka region of Madagascar in the mid-1990s (figure 10; see Guerin and Moreau, 2000).

Alluvial gem deposit formation is due collectively to geological, geomorphological, and sedimentological processes. Ideally, one tries to first establish whether the geological conditions in the area would allow for the formation of certain gemstones in original host rocks (such as the presence of pegmatites which can host beryl, tourmaline, and topaz). The geomorphology of a prospective secondary location must also be conducive to collecting and storing gem crystals over geologic time through “structural traps” such as valleys, scours, dike margins, fractures, large changes in elevation, and river splays onto a floodplain. Rivers and streams must have enough water velocity and volume to move gemstone-bearing sediments into structural traps where the reduced velocity causes the gem crystals

to settle out. Similarly, they settle out along the inner bends of river meanders where the water velocity is also reduced. Geologic time is also another important consideration. Alluvial sediments are constantly in flux, so the most productive alluvial deposits are those that have had enough time to remove fine clays and sands and those that have also been buried to protect them from further erosion.

Mining Alluvial Gem Deposits

As described above, alluvial deposits of gems and other valuable heavy minerals vary widely in their geologic occurrence, extent, and accessibility. The host sediments can also vary in their degree of compaction from unconsolidated to more cemented sedimentary rocks. In some cases, the gemstones themselves are not contained within any sediments, but they lie loose along the bottoms of bodies of water. All these factors influence the mining techniques and types of equipment used for mineral recovery (Griffith, 2013). Both placer gems and industrial minerals are often recovered by artisanal miners (both men and women) working in the informal sector. Alluvial deposits are prospective because they typically have higher quality gem crystals, since over time inferior stones tend to be mostly destroyed by comminution, the geologic process where large particles are reduced to a smaller size. In addition, the deposits

ISSUE 12

ISSUE 13

Figure 10. Artisanal miners removing alluvial sediments to reach a deeply buried gravel layer containing gem fragments near Ilakaka in Madagascar. Photo courtesy of Toby Smith.

are often easier to mine with simple hand tools because the sediments are exposed near the surface, they are only partly consolidated, and the loose gems can often be recovered by washing and/or panning (figure 11).

Artisanal miners usually target alluvial gem deposits that are typically impractical in economic terms for mining companies. A few placer deposits are exploited on a larger scale by companies using more modern mining equipment and techniques (figure 12). Among these are diamond deposits on the Atlantic continental shelf and beaches of South Africa and Namibia, the ruby deposits near Montepuez in Mozambique, and the deposits of volcanic sapphire in sediments near Chanthanaburi in Thailand.

Summary

Sedimentary rocks host important deposits of numerous gem minerals that either formed or have been found in these

rocks. This edition of Colored Stones Unearthed summarizes the characteristic features of sedimentary rocks and describes the sedimentary geological environments where gem minerals can become concentrated. Although often limited in lateral extent, surface exposures of secondary gem deposits can often be worked with simple tools, so they are exploited by artisanal miners in many parts of the world. A final comment is necessary. The previous two installments of this column covered gems found in igneous and in metamorphic rocks. The present entry on gems in sedimentary rocks completes the main categories of rocks exposed at the earth’s surface as would be discussed in any geology textbook. The three installments present these subjects as separate rock categories, when geological field observations sometimes produce a less clear picture. Since the environments of mineral formation among these three rock types lack distinct and accepted boundary conditions of temperature, pressure, time, and chemical composition, some surface rocks display evidence of having formed under conditions along the borders between rock categories. As mentioned earlier, for example, sediments being heated and compacted by burial undergo the process of diagenesis, whose conditions with even deeper burial can evolve into metamorphism. Therefore, mineral and gem formation can sometimes take place more along a continuum of geological conditions than might be inferred by the organization of the installments of this series.

AN INTRODUCTION TO GEMSTONES ISSUE 13

Figure 11. Artisanal miners washing sediments along the Njuga River to recover fancy sapphires and other gem fragments in 2016 near Amani Makoro, a few kilometers from Songea in southern Tanzania. Photo by Wim Vertriest.

Figure 12. Mining of eluvial gem-bearing sediments from very weathered lava flows with mechanical equipment including a mechanical excavator, a rotating trammel cage to separate large rock pieces from the sediments, and a long sluice box to wash the sediments. This photo was taken in November 2020 at Khao Ploy Waen, an eroded volcano where sapphire is mined near Chanthaburi in eastern Thailand. Photo by Wim Vertriest.

REFERENCES

Ardekani S.J., Mackizadeh M.A., Ayati F. (2020) Mineralogy and formation conditions of turquoise in Ali Abad copper porphyry deposit. Journal of Economic Geology, Vol. 12, No. 1, pp. 93–109.

Baumgardner F. (2020) Golden Dreams: True Stories of Adventure in the California Gold Rush. Author Solutions, Bloomington, Indiana, 218 pp.

Birkeland P.W. (1999) Soils and Geomorphology, 3rd ed. Oxford University Press, New York.

Bluck B.J., Ward J.D., De Wit M.C.J. (2005) Diamond mega-placers: Southern Africa and the Kaapvaal craton in a global context. Geological Society of London Special Paper, Vol. 248, pp. 213–245.

Boyd R., Nordgulen O., Thomas B., Bingen B. (2010) The geology and geochemistry of the East African orogen in northeastern Mozambique. South African Journal of Geology, Vol. 113, No. 1, pp. 87–129, http://dx.doi.org/10.2113/gssajg.113.1.87

Cabri L.I., Oberthur T., Keays R.R. (2022) Origin and depositional history of platinum-group minerals in placers – A critical review of facts and fiction. Ore Geology Reviews, Vol. 144, article no. 104733, http://dx.doi.org/10.1016/j.oregeorev.2022.104733

Cook R.B. (2001) Connoisseur’s choice: Malachite - Shaba Region, Democratic Republic of Congo. Rocks and Minerals, Vol. 76, No. 5, pp. 326–330, http://dx.doi.org/10.1080/00357520109603236

Corbett I., Burrell B. (2001) The earliest Pleistocene (?) Orange River fan-delta: An example of successful exploration delivery aided by applied Quaternary research in diamond placer sedimentology and palaeontology. Quaternary International, Vol. 82, No. 1, pp. 63–73, http://dx.doi.org/10.1016/S10406182(01)00009-X

De Putter T., Mees F., Decree S., Dewaele S. (2010) Malachite, an indicator of major Pliocene copper remobilization in a karstic environment (Katanga, Democratic Republic of Congo). Ore Geology Reviews, Vol. 38, No. 1/2, pp. 90–100.

Dill H.G. (2018) Gems and placers – A genetic relationship par excellence. Minerals, Vol. 8, No. 10, article no. 470.

Dissanayake C.B., Rupasinghe M.S. (1993) A prospectors’ guide map to the gem deposits of Sri Lanka. G&G, Vol. 29, No. 3, pp. 173–181, http://dx.doi.org/10.5741/GEMS.29.3.173

Eifler M.A. (2016) The California Gold Rush - The Stampede that Changed the World. Routledge Publishers, Milton Park, United Kingdom, 234 pp.

El Desouky H.A., Muchez P., Boyce A.J., Schneider J., Cailteux J.L.M., Dewaele S., von Quadt A. (2010) Genesis of sedimenthosted stratiform copper-cobalt mineralization at Luiswishi and Kamoto, Katanga Copperbelt (Democratic Republic of Congo). Mineralium Deposita, Vol. 45, No. 8, pp. 735–763, http://dx.doi.org/10.1007/s00126-010-0298-3

Farrar B. (2009) Three centuries of diamonds: Preserving a tradition in Brazil. Rock and Gem, Vol. 39, No. 3, pp. 37–40.

Garnett R.H.T., Bassett N.C. (2005) Placer deposits. Economic Geology, Vol. 100, pp. 813–843.

Griffith S.V. (2013) Alluvial Prospecting and Mining. Elsevier Publishers, Amsterdam, Netherlands, 256 pp.

Grimaldi D.A. (2003) Amber: Window to the Past. Harry N. Abrams Publishers, New York, 216 pp.

Guerin C., Moreau S. (2000) Ilakaka (Madagascar): La ruée vers le saphir. Les Cahiers d'Outre-Mer, Vol. 53, No. 211, pp. 253–272, http://dx.doi.org/10.3406/caoum.2000.3769

Gunatilaka A. (2007) Role of basin-wide landslides in the formation of extensive alluvial gemstone deposits in Sri Lanka. Earth Surface Processes and Landforms, Vol. 32, No. 12, pp. 1863–1873, http://dx.doi.org/10.1002/esp.1498

Gurney J.J., Levinson A.A., Smith H.S. (1991) Marine mining of diamonds off the west coast of southern Africa. G&G, Vol. 27, No. 4, pp. 206–219, http://dx.doi.org/10.5741/GEMS.27.4.206

Hsu T., Lucas A., Pardieu V. (2015) Splendor in the outback: A visit

to Australia’s opal fields. G&G, Vol. 51, No. 4, pp. 418–427, http://dx.doi.org/10.5741/GEMS.51.4.418

Hsu T., Lucas A., Kane R.E., McClure S.F., Renfro N.D. (2017) Big Sky country sapphire: Visiting Montana's alluvial deposits. G&G, Vol. 53, No. 2, pp. 215–227, http://dx.doi.org/10.5741/GEMS.53.2.215

Ibrahim E., Lema L., Barnabe P., Lacroix P., Pirard E. (2020) Small-scale surface mining of gold placers: Detection, mapping, and temporal analysis through the use of free satellite imagery. International Journal of Applied Earth Observation and Geoinformation, Vol. 93, article no. 102194, http://dx.doi.org/10.1016/j.jag.2020.102194

Jacob J., Grobbelaar, G. (2019) Onshore and nearshore diamond mining on the south-western coast of Namibia: Recent activities and future exploration techniques. Journal of Gemmology, Vol. 36, No. 6, pp. 524–532.

Jacob R.J., Bluck B.J., Ward J.D. (1999) Tertiary-age diamondiferous fluvial deposits of the Lower Orange River Valley, Southwestern Africa. Economic Geology, Vol. 94, No. 5, pp. 749–758.

Joshi K.B., Banerji U.S., Dubey C.P., Oliveira E.P. (2021) Heavy minerals in provenance studies: An overview. Arabian Journal of Geosciences, Vol. 14, No. 14, article no. 1330, http://dx.doi.org/10.1007/s12517-021-07687-y

Kampunzu A.B., Cailteux J.L.H., Kamona A.F., Intiomale M.M., Melcher F. (2009) Sediment-hosted Zn–Pb–Cu deposits in the Central African Copperbelt. Ore Geology Reviews, Vol. 35, No. 3/4, pp. 263–297, http://dx.doi.org/10.1016/j.oregeorev.2009.02.003

Kasiński J.R., Kramarska R. (2008) Sedimentary environment of amber-bearing association along the Polish-Russian Baltic coastline. In J. Rascher et al., Eds., Bitterfeld Amber versus Baltic Amber - Hypotheses, Facts, Questions. Excursion Guide and Publications of the German Society for Geosciences, Vol. 236, pp. 46–57.

Kelley R.L. (1954) Forgotten giant: The hydraulic gold mining industry in California. Pacific Historical Review, Vol. 23, No. 4, pp. 343–356, http://dx.doi.org/10.2307/3634653

Leelawatanasuk T., Wathanakul P., Paramita S., Sutthirat C., Sriprasert B., Bupparenoo P. (2013) The characteristics of amber from Indonesia. Australian Gemmologist, Vol. 25, No. 4, pp. 142–145.

Liesegang M., Milke R. (2014) Australian sedimentary opal-A and its associated minerals: Implications for natural silica sphere formation. American Mineralogist, Vol. 99, No. 7, pp. 1488–1499, http://dx.doi.org/10.2138/am.2014.4791

Maree B.D. (1987) The deposition and distribution of alluvial diamonds in South Africa. South African Journal of Geology, Vol. 90, No. 4, pp. 428–447.

Marquez-Zavalia M.F., Craig J.R. (2022) Stalactitic rhodochrosite from the 25 de Mayo and Nueve veins, Capillitas, Catamarca, Argentina: Physical and chemical variations. Journal of Geosciences, Vol. 67, No. 3, pp. 223–241, http://dx.doi.org/10.3190/jgeosci.354

Moore J.M., Moore A.E. (2004) The roles of primary kimberlitic and secondary Dwyka glacial sources in the development of alluvial and marine diamond deposits in Southern Africa. Journal of African Earth Sciences, Vol. 38, No. 2, pp. 115–134, http://dx.doi.org/10.1016/j.jafrearsci.2003.11.001

Mountford B., Tuffnell S., Eds. (2018) A Global History of Gold Rushes. University of California Press, Oakland, California, 336 pp.

Mudd G.M. (2007) Gold mining in Australia: Linking historical trends and environmental and resource sustainability. Environmental Science and Policy, Vol. 10, No. 7/8, pp. 629–644, http://dx.doi.org/10.1016/j.envsci.2007.04.006

Nakashole A.N., Hodgson D.M., Chapman R.J., Morgan D.J., Jacob R.J. (2018) Long-term controls on continental-scale bedrock river terrace deposition from integrated clast and heavy mineral assemblage analysis: An example from the lower Orange River, Namibia. Sedimentary Geology, Vol. 364, pp. 103–120,

ISSUE 13 522 COLORED STONES UNEARTHED GEMS & GEMOLOGY WINTER 2023

http://dx.doi.org/10.1016/j.sedgeo.2017.12.010

Nikiforova Z.S. (2021) Criteria for determining the genesis of placers and their different sources based on the morphological features of placer gold. Minerals, Vol. 11, No. 4, article no. 381, http://dx.doi.org/10.3390/min11040381

Ovissi M., Yazdi M., Ghorbani M. (2017) The Persian turquoise mining at [the] Neyshabur mine in historical times. Geography, Vol. 14, No. 51, pp. 87–99.

Palke A.C., Shigley J.E. (2022) Colored Stones Unearthed: Gems formed in magmatic rocks. G&G, Vol. 58, No. 4, pp. 494–506.

Palke A.C., Renfro N.D., Hapeman J.R., Berg R.B. (2023) Gemological characterization of Montana sapphire from the secondary deposits at Rock Creek, Missouri River, and Dry Cottonwood Creek. G&G, Vol. 59, No. 1, pp. 2–45, http://dx.doi.org/10.5741/GEMS.59.1.2

Papineau D. (2020) Chemically oscillating reactions in the formation of botryoidal malachite. American Mineralogist, Vol. 105, No. 4, pp. 447–454, http://dx.doi.org/10.2138/am-2020-7029

Patyk-Kara N.G. (2002) Placers in the system of sedimentogenesis. Lithology and Mineral Resources, Vol. 37, No. 5, pp. 429–441.

Penny D. (Ed) (2010) Biodiversity of Fossils in Amber from Major World Deposits. Siri Scientific Press, Rochdale, United Kingdom, 304 pp.

Phillips D., Harris J.W., de Wit M.C.J., Matchan E.L. (2018) Provenance history of detrital diamond deposits, west coast of Namaqualand, South Africa. Mineralogy and Petrology, Vol. 112, Supp. 1, pp. 259–273, http://dx.doi.org/10.1007/s00710-0180568-9

Rakontondrazafy A.F.M., Giuliani G., Ohnenstetter D., Fallick A.E., Rakotosamizanany S., Andriamamonjy A., Ralantoarison T., Razanatseheno M., Offant Y., Garnier V., Maluski H., Dunaigre C., Schwarz D., Ratrimo V. (2008) Gem corundum deposits of Madagascar: A review. Ore Geology Reviews, Vol. 34, No. 1/2, pp. 134–154.

Rey P.F. (2013) Opalisation of the Great Artesian Basin (central Australia): An Australian story with a Martian twist. Australian Journal of Earth Sciences, Vol. 60, No. 3, pp. 291–314, http://dx.doi.org/10.1080/08120099.2013.784219

Ross A. (2010) Amber: The Natural Time Capsule. Firefly Books Publishers, Richmond Hill, Canada, 112 pp.

Sachanbiński M., Kuleba M., Natkaniec-Nowak L. (2023) Chrysoprase – History and present. Mineralogia, Vol. 54, No. 1, pp. 1–10, http://dx.doi.org/10.2478/mipo-2023-0001

Sadowski E-M., Schmidt A.R., Seyfullah L.J., Kunzmann L. (2017) Conifers of the “Baltic amber forest” and their palaeoecological significance. Stapfia, Vol. 106, pp. 1–73.

Shigley J.E., Laurs B.M., Renfro N.D. (2009) Chrysoprase and prase opal from Haneti, central Tanzania. G&G, Vol. 45, No. 4, pp. 271–279, http://dx.doi.org/10.5741/GEMS.45.4.271

Shirdam B., Shen A.H., Yang M.X., Moktari Z., Fazliani H. (2021) Persian turquoise: The ancient treasure of Neyshabur. G&G, Vol. 57, No. 3, pp. 240–257, http://dx.doi.org/10.5741/GEMS.57.3.240

Stanaway K.J. (2012) Ten placer deposit models from five sedimentary environments. Applied Earth Science, Vol. 121, No. 1, pp. 43–51, http://dx.doi.org/10.1179/1743275812Y.0000000020

Standke H. (2008) Bitterfeld amber equal to Baltic amber? - A geological space-time consideration and genetic conclusions. In J. Rascher et al., Eds., Bitterfeld Amber versus Baltic AmberHypotheses, Facts, Questions. Excursion Guide and Publications of the German Society for Geosciences, Vol. 236, pp. 11–33.

Sun T.T., Kleišmantas A., Nyunt T.T., Minrui Z., Krishnaswamy M., Ying L.H. (2015) Burmese amber from Hti Lin. Journal of Gemmology, Vol. 34, No. 7, pp. 606–615.

Sutherland D.G. (1982) The transport and sorting of diamonds by fluvial and marine processes. Economic Geology, Vol. 77, No. 7, pp. 1613–1620, http://dx.doi.org/10.2113/gsecongeo.77.7.1613

Svisero D.P., Shigley J.E., Weldon R. (2017) Brazilian diamonds: A historical and recent perspective. G&G, Vol. 53, No. 1, pp. 2–33, http://dx.doi.org/10.5741/GEMS.53.1.2

Torvela T., Lambert-Smith J.S., Chapman R.J., Eds. (2022) Recent Advances in Understanding Gold Deposits – from Orogeny to Alluvium. Geological Society of London Special Publication, Vol. 516, 440 pp.

Vertriest W., Saeseaw S. (2019) A decade of ruby from Mozambique: A review. G&G, Vol. 55, No. 2, pp. 162–183, http://dx.doi.org/10.5741/GEMS.55.2.162

Weitschat W., Wichard W. (2010) Baltic amber. In D. Penny, Ed., Biodiversity of Fossils in Amber from the Major World Deposits, Siri Scientific Press, Rochdale, United Kingdom, pp. 81–116.

Wilson M.G.C., Henry G., Marshall T.R. (2006) A review of the alluvial diamond industry and the gravels of the North West Province, South Africa. South African Journal of Geology, Vol. 109, No. 3, pp. 301–314, http://dx.doi.org/10.2113/gssajg.109.3.301

Wolfe A.P., Tappert R., Muehlenbachs K., Boudreau M., McKellar R.C., Basinger J.F., Garrett A. (2009) A new proposal concerning the botanical origin of Baltic amber. Proceedings of the Royal Society B, Vol. 276, No. 1672, pp. 3403–3412, http://dx.doi.org/10.1098/rspb.2009.0806

Zhang Z., Jiang X., Wang Y., Kong F., Shen A.H. (2020) Fluorescence characteristics of blue amber from the Dominican Republic, Mexico, and Myanmar. G&G, Vol. 56, No. 4, pp. 484–496, http://dx.doi.org/10.5741/GEMS.56.4.484

Zwaan J.C., Buter E., Mertz-Kraus R., Kane R.E. (2015) Alluvial sapphires from Montana: Inclusions, geochemistry, and indications of a metasomatic origin. G&G, Vol. 51, No. 4, pp. 370–391, http://dx.doi.org/10.5741/GEMS.51.4.370

ISSUE 13 COLORED STONES UNEARTHED GEMS & GEMOLOGY WINTER 2023 523

gia.edu/gems-gemology For online access to all issues of GEMS & GEMOLOGY from 1934 to the present, visit: