jewellerynews

Why gold

There was a time when value in the industry was measured only in purity, and weight, but today provenance and ethical background play an important part in value. Which is why we are always evolving how we source our metal. Our commitment to responsible business practices and sourcing, allow us to not only preserve our business, but our people, product

• PlatAfrica pieces available for purchase

• 70th anniversary of first modern diving watch

• Free Jewellex365 exhibitor subscription for JCSA members

• A bigger and brighter JGT Dubai

• Jewellery and gem fairs return to Hong Kong

• GIA launches digital Diamond Dossier

Piccolo Fine Designer Jewellery was established in 2008 by Johann Claassens and his wife Suvette, who were joined by Director Christian Oldewage in 2020. The company offers a full range of jewellery services to the trade, including high-quality CAD designs, 3D wax models, casting and stone-setting, as well as semi- and total finishes.

Gold is one of the precious metals that has stood the test of time in terms of its value. The amount of gold purchased globally each year has trebled since the early '70s. Although South Africa is no longer the world’s largest gold producer, its gold mining sector remains a significant contributor to the country's GDP.

Forget about the greenback. Gold is the ultimate safe-haven asset, writes Arkadiusz Sieron, PhD, exclusively for SAJN. “People aren't very grateful and they forget the good that happened to them. Whenever gold experiences a weaker period, journalists ask: ‘Is gold still a safe haven?’ or even shoot first, judging that ‘gold has lost its safe-haven appeal’.”

There is growing interest in developing methods to deduce the geographic origin of diamonds. For now and the foreseeable future, the only definitive method to establish diamond origin depends on preserving and retaining origin information from the time of mining.

Africa has the potential to become an exemplary world leader by challenging conventions and embracing responsible, tech-based industrial initiatives. Industrialisation creates jobs and drives social, political and economic development, helping to transform and improve the lives of ordinary people.

The Cultured Pearl Association of America has announced the winners of its 13th Annual International Pearl Design Competition. The association is a non-profit founded in 1957 and comprises manufacturers, wholesalers, dealers and suppliers of cultured pearls. Its goals are to improve retail marketability of pearls and cultivate demand among consumers.

February is the month of love and, as pink gemstones symbolise it, SAJN takes a closer look at the numerous different types of gemstones which occur in one or more shades of that colour.

views expressed in this publication are not necessarily those of the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, its members, the publisher or its agents. While every effort has been made to ensure the accuracy of its contents, neither the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, the editor nor the publisher can be held responsible for any omissions or errors; or for any misfortune, injury or damages which may arise therefrom. The same applies to all advertising.

Jewellery

2023. All rights reserved.

part

this magazine may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage retrieval system, without prior written permission from the publishers. ISSN 1817-5333.

Publishing Director/Editor-In-Chief:

Jason Aarons

Cell: 074-400-6677

E-mail: jason@isikhova.co.za

Editor: Adri Viviers

Tel: +27 (0)11 883-4627

Cell: 084-261-1805

E-mail: adri@isikhova.co.za

Managing Director: Imraan Mahomed

E-mail: imraanm@isikhova.co.za

Director Brand Strategy: Jenny Justus

Cell: 083-450-6052

E-mail: jenny@isikhova.co.za

Creative Director: Joanne Brook

E-mail: joanne@isikhova.co.za

Operations Director: Thuli Majola

Tel: +27 (0)11 883-4627

E-mail: thuli@isikhova.co.za

Advertising Sales:

Tel: +27 (0)11 883-4627

Cell: 083-450-6052

Copy Editor: Anne Phillips

Design Intern: Zian Cornelissen

Distribution: Ruth Dlamini

SA Jewellery News is published by: Isikhova Media (Pty) Ltd,

Physical: 10th Floor, Metal Box, 25 Owl Street, Milpark, Johannesburg, South Africa.

Website: www.isikhova.co.za

Welcome to the first issue of SAJN for 2023. A new year is a time full of hope –new experiences and new beginnings. However, new beginnings are actually always all around us, whether it is the start of a new year, moving to a new home, watching kids move out or starting a new job. Some new beginnings are exciting, while others are more stressful and entail letting go of parts of your life. The past three years have certainly taught me that life is filled with twists and turns which we cannot always predict.

I cannot help but be a tad afraid of change because the unknown is always a little frightening. That fear has often held me back. Indeed, without our realising it, fear may be stunting our growth – both personally and professionally.

Allowing ourselves to grow and evolve over time is a necessary part of life and a requirement of the journey we are on. The past years have changed us. They

have also changed our industry and the way we do business. They have forced us to take chances and push ourselves beyond our comfort zones – and many of us were surprised at what we discovered there.

We at SAJN hope that all your new beginnings this year will be happy and longlasting. Remember, embarking on anything is already one-third of the work done.

May we all face 2023 head-on, never turning away from new opportunities or shirking our responsibilities. May we also strive to keep learning new things because education and experience are essential if we are to grow into better-rounded people this year who have the confidence to take risks, to rise and sometimes to fall, but always to get up again and continue.

Happy reading!

Piccolo Fine Designer Jewellery is a caster, manufacturer and designer of high-quality, elegant jewellery serving both the trade and private clients. Established in 2008 by Johann Claassens and his wife Suvette, it is a business built on passion and dedication. Piccolo does it all – or anything and everything in between, from CAD designs using the latest technology to 3D wax models for which it has a number of machines that it updates regularly. Piccolo casts in platinum and all kinds of gold alloys – especially high palladium, white gold alloys and silver. It also does semi-finishes (finishing

“At the beginning of last year, we started ramping up our activities in the USA,” Sarine CEO David Block told Rapaport News. “Due to that, the discussions with regard to this [deal] ramped up along with our involvement in the US market. This [deal] should be quite a significant jump in the scope of our business in the USA.”

Israeli-based Sarine has signed a nonbinding memorandum of understanding to purchase the stake for an all-cash consideration, it announced in a recent statement. The parties plan to reach a final agreement in a few months' time once due diligence is complete, Block said. The companies have not disclosed

Building on the success of its maiden edition, Jewellery, Gem & Technology Dubai (JGT Dubai) is returning to the Dubai World Trade Centre from 12-14 February with more

the sale price or the size of the share.

GCAL will continue to offer its customers the same products and services as before the deal and its executives will remain in charge, Sarine said.

However, while currently operating out of a single location in New York, GCAL will be able to implement Sarine’s e-Grading – an automated grading service using artificial intelligence – to develop the lab’s capabilities across the US and globally. The companies will begin integrating their technology and services even before the deal closes, Block explained. Sarine will continue to offer its services independently outside the USA.

world-class exhibitors, product introductions and the second annual JWA Dubai Awards presentation ceremony and panel discussion. Designed around the theme “The Centre of Business” and positioned as “the B2B fair to expand international business into new markets”, JGT Dubai is seeing solid demand for booth space from international suppliers angling for a strong start to the buying season. The second edition aims to present the latest offerings of about 400 major suppliers from more than 20 countries and regions, representing at least a 30% increase in exhibitor numbers compared with the 2022 inaugural show. The sourcing event is also adding a new hall to meet firm demand for booth locations, effectively expanding the show’s gross exhibi -

Stepping into a world-class exhibition, the HKTDC Hong Kong International Jewellery Show presents the glamour of the jewellery industry’s sparkling elites. The fair is recognised as a preeminent annual marketplace for masterpieces, timeless classics and visionary creations.

In addition, the line-up of industry

seminars, jewellery parades and networking sessions delivers exceptional insight.

The physical fair is scheduled to take place from 1-5 March 2023 at the Hong Kong Convention and Exhibition Centre and the Click2Match online exhibition will take place until 12 March. The HKTDC Hong Kong Internation -

Founded in 2001 by Don Palmieri, familyowned GCAL is known for providing diamond certificates carrying a guarantee, rather than just reports that act as a description of grades. In 2021 it launched 8X, a cut-grading standard that it claims is more exacting than the industry’s triple Ex score.

“Sarine’s technologies will allow us to continue to abide by [our] key code of ethics while still expanding our services to meet the growing demand by consumers seeking confidence that their acquired products and services meet all norms of quality and sustainability,” said GCAL chief operating officer Angelo Palmieri. – Rapaport

tion space by 40% to about 15 000 m².

JGT Dubai is a joint venture of two of the industry’s leading events groups: Informa Markets Jewellery – organiser of the world’s biggest fine jewellery marketplace, Jewellery & Gem WORLD Hong Kong (JGW), which is making a full return to Hong Kong next year – and the Italian Exhibition Group SpA, organiser of Vicenzaoro, one of the most influential jewellery shows worldwide and the top European trade fair in the sector. Their combined resources, global reach and local knowledge are further enhanced by the support of the Dubai Multi-Commodities Centre, JGT Dubai’s official partner and the Dubai Gold & Jewellery Group, the fair’s industry partner.

al Jewellery Show for online sourcing (hktdc. com Sourcing) will commence on 1 February and close on 31 March 2023.

The 2022 physical fair welcomed 33 120 visitors from around the world and hosted 291 exhibitors from four different countries and regions.

Following the announcement on 10 October 2022 that Al Cook will succeed Bruce Cleaver as CEO of the De Beers Group in early 2023, the group advises that Cook will formally take over the role of CEO on 20 February, with Cleaver moving into the role of Co-Chair on the same date.

Together with its joint venture partners, the De Beers Group employs more than 20 000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in South Africa, Botswana, Canada and Namibia.

Jewellery Council of SA (JCSA) members can now sign up to activate their free exhibition subscription on the Jewellex365 online B2B platform until the end of August this year.

Launched by the JCSA in June this year, the Jewellex365 Online B2B platform has been developed in line with the global digitalisation of jewellery business platforms. “It’s a natural and much-needed online resource and an integral part of how we do business and collaborate,” says Lorna Lloyd, JCSA’s CEO. “The JCSA had no hesitation in investing in this platform and its development – based on research and excellent feedback – and the clear need to keep our industry moving forward.”

Jewellex365 offers a fantastic opportunity for sellers and buyers to connect

directly with each other and is marketed to the industry via the JCSA’s website, social media and e-mail.

Sellers will be able to continuously upload and display new products and services throughout the year, which will encourage an ongoing flow of potential buyers.

Both exhibitors and buyers are vetted upon registration.

Members and non-members are invited to apply. Non-member pricing can be viewed at: https://jewellex365.co.za/pricing/.

For further information, contact Kirsten Lenton on e-mail: kirstenl@jewellery.org.za.

Annually, Anglo American Platinum, Platinum Guild International India and Metal Concentrators host the PlatAfrica jewellery design and manufacture competition. It celebrates and supports the South African platinum industry by giving student, apprentice and professional jewellers the opportunity to work, experiment, innovate and develop their technical expertise with the metal. PlatAfrica highlights the strength and beauty of platinum, while revealing the glowing jeweller talent of SA.

This year, Blancpain celebrates the 70th anniversary of the first modern diving watch – the Fifty Fathoms, launched in 1953.

Created by a diver to meet the needs of underwater exploration, it was chosen by diving pioneers and elite marine corps around the world as a professional timekeeping instrument. With its water-resistance, robust doubled-sealed crown, self-winding movement, contrasting dark dial with luminescent indications, unidirectional rotating bezel and anti-magnetic protection, the Fifty Fathoms has become an indispensable instrument for divers on their underwater missions.

These key signature elements that established the Fifty Fathoms as the archetypal diver’s watch

Every year an original theme is chosen for the competition, producing one-of-a-kind, statement pieces of jewellery. Many of those pieces are melted down in order to re-use the precious metal.

The PlatAfrica Pop-Up Store, which is exclusively online, gives the public an opportunity to invest in the resource of platinum and in the South African jewellery industry. To view or shop for pieces from the PlatAfrica 2022 Hope collection, visit: https:// plat.africa/.

continue to define the identity of such timepieces for the entire watch industry. Bearing witness to the past, while simultaneously looking firmly to the future, contemporary Fifty Fathoms models incorporate modern movements renowned for their robustness and reliability. They feature numerous technical innovations derived from Blancpain’s long-standing experience in the field of diving, with its risks and necessities.

The Fifty Fathoms has played an essential role in the development of scuba-diving and the discovery of the marine world. It has enabled Blancpain to forge close links with the ocean community that have been consistently strengthened over the past 70 years. The watch is the catalyst for Blancpain’s commitment to the preservation of the world's oceans.

The start of 2023 marks a significant milestone in the digital transformation of the global diamond industry – the launch of the fully digital GIA Diamond Dossier, the most widely available diamond grading report in the world.

“The launch of the digital GIA Diamond Dossier report starts the conversion of all GIA’s laboratory reports to a modern digital format,” said Tom Moses, GIA Executive VicePresident and Chief Laboratory and Research Officer. “This important change improves data security, offers efficiencies across the supply chain and reduces our reliance on paper.”

The first digital GIA Diamond Dossier report was issued at the GIA laboratory in Ramat Gan, Israel, on 2 January this year. More than 33 million printed GIA Diamond Dossier reports were issued since the introduction of the service in 1998.

“In 2025, when all GIA reports are digital, retailers and consumers will find greater convenience and a more immersive experience,” said Pritesh Patel, GIA’s chief Operating Officer. “Eliminating printed reports is an important advancement, reducing the impact of using, shipping and storing the nearly 40 tons of paper and plastic that go

Rising star Holger Rune has joined hands with Swiss luxury watch brand Rolex.

Rune, a Danish professional tennis-player, was ranked as high as No 10 in singles by the Association of Tennis Professionals (ATP), which he first achieved on 7 November 2022, making him the highest-ranked Danish singles male tennis player in the ATP rankings. Rune has won three ATP tour singles titles, including a Masters 1000 title at the 2022 Paris Masters and produced his best grand slam performance at the 2022 French Open

into printed GIA reports each year.”

The secure digital GIA Diamond Dossier is available in the reimagined GIA App or on computers, tablets and phones through the robust and secure online GIA Report Check Service and the GIA advanced application programming interface for commercial users. The digital report service includes a Report Access Card with the report number, a QR code linking to the digital report and 4Cs information to embed into receipts, invoices and e-commerce sites.

The new GIA App is widely available for Apple and Android devices. The Android app for China is in development and will be available at a later date.

The GIA Match iDTM inscription matching service is expected to be available in the first half of 2023, accessible exclusively through the reimagined GIA App.

Helpful videos, a guide with answers to frequently asked questions and information about the GIA App, including download links, are available at GIA.edu/digital-dossier. GIA laboratory clients can contact their client service representative or e-mail: labservices@gia.edu.

The GIA Diamond Dossier is available for D-to-Z diamonds from 0,15-1,99ct without colour treatments. Printed GIA Diamond Dossier reports issued before January 2023 remain valid.

by reaching the quarter-finals in his main draw debut at the tournament.

On 15 January, the 19-year-old took to social media to reveal that he had joined the Rolex family ahead of the 2023 Australian Open. The details of the endorsement deal, however, have yet to be made public.

Piccolo Fine Designer Jewellery was stablished in 2008 by Johann Claassens and his wife Suvette, who were joined by Director Christian Oldewage in 2020. The company offers a full range of jewellery services to the trade, including high-quality CAD designs, 3D wax models, casting and stone-setting, as well as semi- and total finishes.

WITH A CLIENT BASE OF MANUFACTURERS, designers, makers, retailers and private clients, Piccolo Fine Designer Jewellery fiercely upholds its standards of excellence and attention to detail.

The company comprises a small, but hardworking and passionate team. Johann does all the custom designs using modern computeraided design (CAD) programs. Suvette, who holds a BTech and taught jewellery design and manufacturing for five years, does all Piccolo’s benchwork and finishing. Christian also does design work and helps when Johann’s workload is too demanding. In addition, Christian does all the technical work, such as 3D wax printing up to and including metal preparation and casting.

Each of the team members has a very fine eye for detail and between them, they have more than 28 years of industry experience.

“We strive to provide the highest quality and exemplary service,” says Johann. “Drawn from a variety of backgrounds and skills (which we’re constantly developing through modern technology), we pride ourselves on the challenge of guiding our clients and giving them exactly what they want. Over the past 10 years, we've done a lot of research and development of platinum castings because of the huge demand for it. Most people in our industry source it out to casting houses and struggle to find someone who can do it well. We're very proud of the work we do and have complete confidence in the platinum castings which we supply to more than 50 jewellers all over the country.

“We have a very close working relationship with Cape Precious Metals,” adds Johann. “Piccolo sources all its precious metals only from them, as we know that

they operate within a socially responsible and sustainable business framework backed up by internationally recognised accreditation.”

Piccolo’s services to the trade include: Design: Supplying high-quality CAD designs for jewellers using the latest technology is one of Piccolo’s core services. “We help jewellers transform a client’s idea from a picture or pencil sketch to a CAD drawing, ready to be printed in wax,” explains Johann. An added benefit for jewellers is that the Piccolo team know what to look for and design in such a way that the rest of the steps, such as casting and setting, will not only be performed easily,

but will result in a good product. Paying Piccolo for a design they need instead of spending thousands of rands on programs also helps jewellers keep their costs down. “Our turnaround time is also quite fast, which means jeweller’s clients don’t have to wait long,” adds Johann.

Wax printing: Piccolo uses the CAD drawings it receives from jewellers or that it has designed for them to print top-quality, 100% wax models which are ready to cast. It has a number of machines that are updated regularly in order to do so. An added benefit for jewellers is that no matter how many times

a wax model needs to be printed, clients only pay once. “The stress that comes with wax models becomes our concern, not the client’s, which means they have one less thing to worry about,” says Johann.

Casting: Piccolo uses 3D wax models to make moulds. High-quality investment powders are used for the moulds in the wax casting process. After many years, the company knows which investment powder works best for different alloys. Piccolo casts in platinum and palladium, as well as all kinds of gold alloys. “This means that jewellers don’t have the costs of all the different elements needed to cast,” says Oldewage.

Finishing: With more than 25 years of experience between the team, Piccolo finishes castings for other jewellers offering exceptional quality. Castings that have been finished then only need setting, which a jeweller can do with Piccolo or use their setter of choice. “There’s a big ‘loss’ on metal when it comes to finishing, which is expensive and can only be recovered through expensive refining. When Piccolo does the finishing for jewellers, they don’t have to worry about those losses and costs, as they only pay for the metal they get when the piece is done,” says Suvette.

Setting: Piccolo can also handle the setting of jewellery. Its stone-setter has more than 15 years of experience in this field.

“In today’s economic conditions, one must try to save in every possible way, especially in our industry, where the raw material – and every process that goes with it – is outrageously expensive,” explains Johann. “Then one needs a number of different people with knowledge of each of these processes, which again costs money. By having work done by us, jewellers can save a large portion of their overhead costs, since they only pay for what we do for them, whether it’s just one piece a month or 100, as we’re set up for this type of work.

lyn, Pretoria has been using Piccolo Fine Designer Jewellery for all its CAD and casting work for many years. “I used to do everything by hand,” says Luhani Wegerle of 9-5. “One can only imagine how using them for those services has helped my business. Their service and products are exceptional.”

Natasha Gray of Simply Gray Designs in Centurion, who uses Piccolo for casting, finishing and setting, agrees. “I’ve used them for more than five years now and can honestly say that they’re my favourite people in the trade with whom to work. Their communication and work are incomparable,” she says. “I also contact Johann regularly for advice or help in other areas of my business and he’s always happy to assist.”

Another happy client is Sandra Oberholzer of Jewellery Matrix in Pretoria East, who has been making use of Piccolo’s services since 2015. “Initially, Piccolo did my design work for me and currently do my printing and casting work. They really make the entire process much easier. I use them for all metals. Overall, they deliver an excellent experience time and time again,” she says.

“We strive to make jewellers’ work less stressful not only from a financial point of view, but also by easing their production pressures, as they don’t have to do all the work themselves. This allows them more time with their clients so that it’s a happy and comfortable experience for all.”

9-to-5 Manufacturing Jewellers in Brook-

“We can do it all, or anything and everything in between,” says Johann. “We’re very proud of the work we do and have complete confidence in our offerings to jewellers across the country, so we encourage the industry to give our services a try. We also offer incredible specials specifically for the trade on a regular basis.”

We pride ourselves on the challenge of guiding our clients and giving them exactly what they want.

Gold is one of the precious metals that has stood the test of time in terms of its value. The amount of gold purchased globally each year has trebled since the early 1970s. Although no longer the world’s largest gold producer, South Africa’s gold mining sector remains a significant contributor to its GDP.

THE MINING INDUSTRY CONTRIBUTES

about 7% to SA’s gross domestic product – approximately R350 billion – and employs over 450 000 people.

Gold mining in SA is centred mainly on the Witwatersrand Reef, as well as the Barberton Greenstone Belt, both in the interior of the country.

The elliptical basin stretches over an area of over 400 km through the Free State, North West and Gauteng provinces and features operational depths which reach up to 4 km. The discovery of gold in the late 19th century led to a gold rush that spawned the development of Johannesburg and was instrumental in the growth of the country’s economy during the 20th century.

SAJN takes a closer look at SA’s largest gold mines.

Mponeng Gold Mine in Gauteng is the deepest operating mine in the world (reaching a depth of 4 km below ground level, the trip from the surface to the bottom of the mine takes over an hour) and was the last underground operation by AngloGold Ashanti in SA.

Harmony Gold, SA’s biggest gold

producer, became the owner and operator of the Mponeng underground mine by acquiring AngloGold Ashanti’s remaining South African assets in October 2020.

Harmony Gold produced 175 095 ounces of gold by processing 683 000 tons of Mponeng underground ore during the first nine months of its operatorship from October 2020 to June 2021. The company expects to produce up to 250 000 ounces of gold a year from Mponeng over an estimated remaining mine life of eight years.

South Deep Gold Mine is a bulk mechanised mining operation located in the Witwatersrand Basin near Westonaria, 50 km south-west of Johannesburg. The mine has been built to extract one of the largest known gold deposits in the world and boasts a mineral reserve of 32,19 million ounces. This is equivalent to almost 80 470 gold bullion bars.

The current life-of-mine is estimated to be 80 years, so not only will South Deep be a valuable asset to the Gold Fields Group for decades to come, but it is likely to be the last gold mine in SA, with most other mines having run out of reserves by then.

Kloof is an intermediate- to ultra-deep-level gold mine in the West Wits Line of the Witwatersrand Basin, near the towns of Randfontein and Westonaria, approximately 60 km west of Johannesburg.

It was one of the three original assets acquired by Sibanye when Gold Fields International completed its unbundling transaction in February 2013. Mining operations have been carried out on the West Rand since the late 19th century and at Kloof in its current form since 2000, when several existing mining operations were amalgamated.

At 31 December 2021, Kloof had combined surface and underground gold mineral reserves of 3,8 million ounces and mineral resources of 31 million ounces.

Kusasalethu is a mature, deep-level mine 90 km west of Johannesburg, near the GautengNorth West provincial border. The current life-of-mine is estimated at three years.

Mine infrastructure comprises twin vertical and twin sub-vertical shaft systems. Conventional mining methods are used in a sequential grid layout, with mining depths reaching 3 388 m below surface, where

the vertical crater retreat is the primary ore body exploited. Ore mined is treated at the Kusasalethu plant.

The mine is owned by Harmony Gold and is the amalgamation of the Deelkraal and Elandsrand mines, bought from AngloGold in 2001 for R1 billion in cash.

Driefontein is a large, mature, shallow to ultra-deep-level gold mining and processing operation located in the far West Rand gold field of the Witwatersrand Basin, near Carletonville in Gauteng, 70 km west of Johannesburg.

At 31 December 2021, Driefontein had total gold mineral reserves of 3,0 million ounces and gold mineral resources of 10,9 million ounces.

Driefontein was one of the assets acquired by Sibanye-Stillwater when Gold Fields unbundled its South African operations in February 2013. Mining operations have been carried out at Driefontein since the 1930s.

The Tshepong operations, owned by Harmony Gold, constitute an integrated mining complex in the Free State, near the town of Welkom, 250 km from Johannesburg. The deeplevel workings include the Tshepong and Phakisa underground sections. The proximity of these two mines has allowed for the integration of operations, facilitating the use of excess hoisting capacity and under-used infrastructure at Tshepong section and freeing up Phakisa’s constrained infrastructure.

Conventional undercut mining methods are used at the mature Tshepong section; Phakisa uses the newer conventional undercut and open-cut mining method. The principal goldbearing ore body exploited by both sections is the Basal Reef, with the B Reef mined as a high-grade secondary one.

Doornkop Gold Mine, operated by Harmony Gold, is a mature, deep-level, single-shaft operation some 30 km west of Johannesburg on the northern rim of the Witwatersrand Basin. Its remaining life-of-mine is currently 14 years. The operation focuses on narrow-reef conventional mining of the South Reef goldbearing conglomerate reef. Mining reaches depths of 2 219 m. Ore is processed at the Doornkop plant, which uses the carbon-inpulp process.

Moab Khotsong, also operated by Harmony Gold, is a deep-level mine near the towns of Orkney and Klerksdorp, some 180 km south-west of Johannesburg. The mine, which began producing in 2003, was acquired from AngloGold Ashanti in March 2018.

Mining is based on a scattered mining method, together with an integrated backfill support system which incorporates bracket pillars. The geology at Moab Khotsong is structurally complex, with large fault-loss areas between the three mining areas (top mine (Great Noligwa), middle mine and lower mine (growth project and Zaaiplaats project in execution phase)). The mine exploits the Vaal Reef as its primary ore body.

in the Pilbara region of Western Australia has renewed interest and helped increase the country’s consistent gold output.

3. Russia

Russia was once again the third-largest producer of gold. The country’s output has been rising over the past few years. According to Fitch Solutions, Russia is reportedly planning to raise its gold output in a bid to become the world’s largest gold producer by 2029.

4. USA

American gold production has been dropping over the past few years. Most gold in the country was produced at more than 40 lode mines, several large placer mines in Alaska and a number of smaller placer mines in western USA. The top 26 operations in the country were responsible for 98% of American gold output.

5. Canada

Historically, countries like SA were known to house some of the world’s largest gold reserves, but these have been surpassed by nations like China, Russia, Australia and the USA over the years.

According to the latest list released by Investing News Network (updated in 2022), the world’s top gold-producing countries are:

Once again, China is the largest producer of gold in the world. The country has held its top position for more than a decade. According to the World Gold Council, China is also the world’s leading consumer of gold jewellery.

Gold production in Australia had another highperforming year. Recent exploration activity

Gold production in Canada was on par, allowing the nation to maintain its status as the fifth-largest producer of the yellow metal. Ontario and Quebec are the largest goldproducing provinces in the country; together, they represent more than 70% of Canada’s gold output.

6. Ghana

In 2021, Ghana took the position of sixthlargest gold-producing country. It is also Africa’s largest gold producer, having overtaken SA in recent years. Industry heavyweights AngloGold Ashanti and Gold Fields have mining operations in Ghana, which has cheaper production costs than SA.

7. Mexico, SA and Uzbekistan

Mexico is a notable gold producer, tying with SA and Uzbekistan for the seventh spot. SA has been one of the world’s top gold producers for decades, but between 1980 and 2018, gold output fell by 85%.

8. Indonesia, Peru and Sudan

Indonesia, Peru and Sudan are tied for eighth place on the list of largest producers of gold.

PEOPLE ARE NOT VERY GRATEFUL AND THEY forget the good that happened to them. Whenever gold experiences a weaker period, journalists ask: “Is gold still a safe haven?” or even shoot first, judging that “gold has lost its safe-haven appeal.”

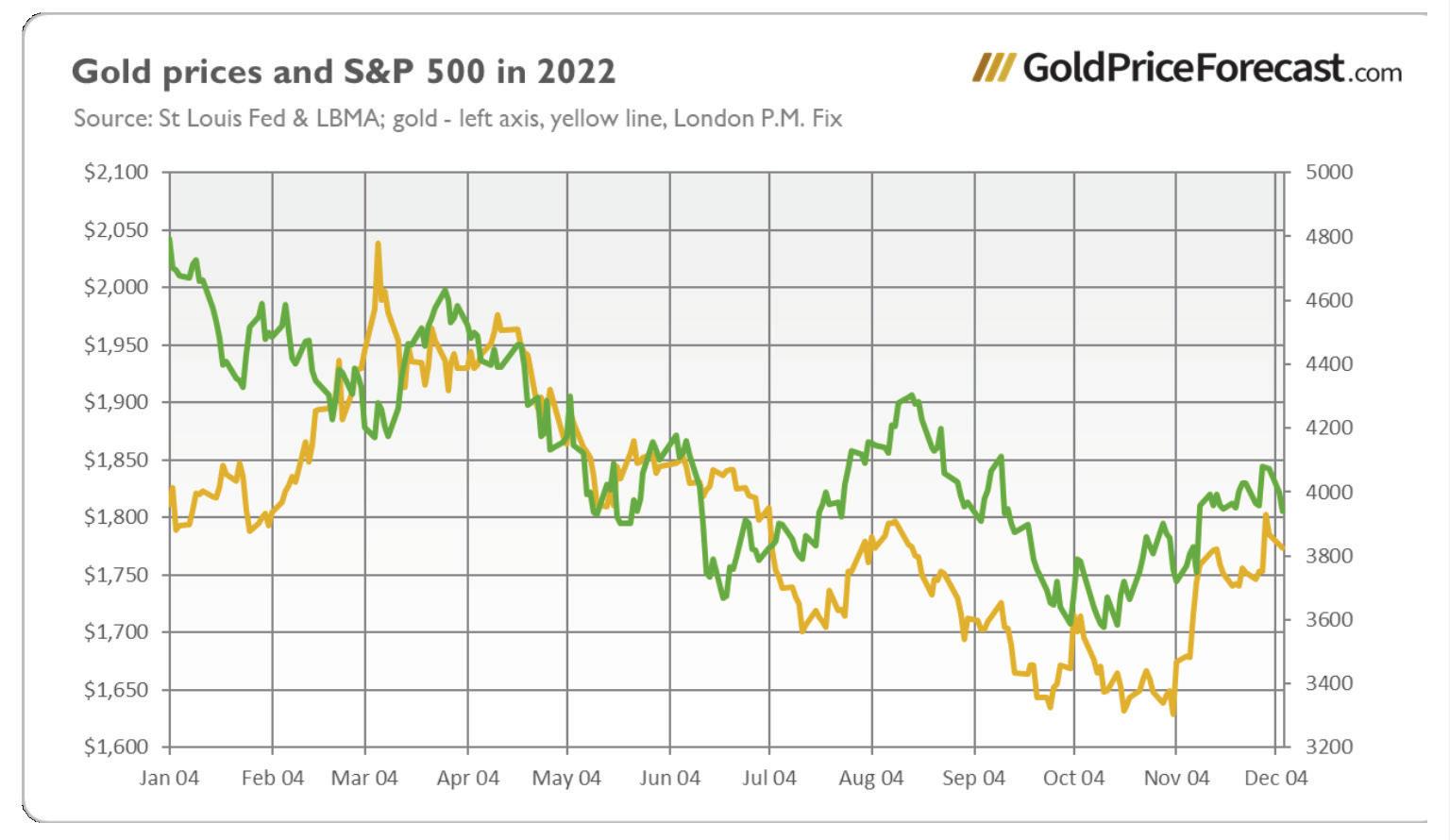

I would say that what has lost its lustre is journalism, but not the yellow metal. Of course, 2022 was not the best year for gold or silver prices. The former has lost about 1,8% of its value since the end of 2021, while the latter has lost about 4.4%. But, hey! Let us talk about the fantastic rate of return provided by equities. The S&P 500 plunged about 17,8% last year, from about 4800 to below 4000, or 10 times more than the price of gold. For the sake of good manners, I do not mention cryptocurrencies.

Hence, the gold price did not rally in 2022, as some people hoped, but it still outperformed most major assets. This is the very essence of a safe haven. After all, it is an asset that is uncorrelated or negatively correlated with other assets in times of market stress. Last year, gold was actually positively correlated with equities because of the Fed’s tightening cycle, but it still performed much better.

Safe havens active during crises 2022 was a tough year. However, we have so far avoided a recession. The economic

crisis is still ahead of us. I am writing about this because safe-haven assets are not supposed to perform well all the time. Gold protects investors during crises, but not necessarily during normal times. Indeed, as the chart below shows, the greatest rallies in gold prices happened during the Great Stagflation, the Great Recession and the Great Coronavirus Crisis (in 2020, gold grew more than 30%).

Another misconception about gold being a safe haven is that it should protect against crashes in particular asset markets. However, such a view is too limited, as gold is an insurance against broader systemic tail risks. This means that gold will not rally simply because the stock market has dropped. It

Forget about the greenback. Gold is the ultimate safe-haven asset, writes Arkadiusz Sieron, PhD, exclusively for SAJN.

protects investors against systemic risks related to the current, inherently unstable monetary system based on fractional reserve banking (this is why so many crypto institutions are collapsing right now) and fiat currencies.

Gold remains a safe-haven asset. However, that does not mean that it will always protect investors against any losses or that it will always rise whenever the stock market plunges. No, gold offers protection against a serious financial crisis or a collapse of the monetary system. Interestingly, gold’s role was acknowledged even by the central banks. In 2019, De Nederlandsche Bank (DNB), which is the central bank of the Netherlands, released a note in which it wrote as follows: Shares, bonds and other securities are not without risk and prices can go down. But a bar of gold retains its value, even in times of crisis. That is why central banks, including DNB, have traditionally held considerable amounts of gold.

Gold is the perfect piggy bank – it is the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank's balance sheet and creates a sense of security. If the central banks, which do not like the yellow metal that competes with their fiat currencies, admit that gold is the ultimate safe haven, then it must be true!

About Arkadiusz Sieron

Sieron received his PhD in economics in 2016 (his doctoral thesis was about Cantillon effects) and has been an assistant professor at the Institute of Economic Sciences at the University of Wrocław, Poland, since 2017. He is a board member of the Polish Mises Institute of Economic Education, author of several dozen scientific publications (including in such periodicals as the Journal of Risk Research, Prague Economic Papers, Quarterly Journal of Austrian Economics and Research in Economics) and a regular contributor to GoldPriceForecast.com and SilverPriceForecast.com. His two books, Money, Inflation and Business Cycles and Monetary Policy after the Great Recession, are both published by Routledge. Sieron is also a certified investment advisor, a long-time precious metals market enthusiast and a free market advocate who believes in the power of peaceful and voluntary co-operation of people.

Hence the gold price did not rally in 2022, as some people hoped, but it still outperformed most major assets. This is the very essence of a safe haven.

M. Smith, Karen V. Smit, and Steven B. Shirey

M. Smith, Karen V. Smit, and Steven B. Shirey

There is growing interest in developing methods to deduce the geographic origin of diamonds. Most approaches have focused on trace elements within diamonds, which can be sensitive recorders of geological conditions during the growth of minerals. Gem-quality diamonds have ultra-low concentrations of trace elements, making them extremely challenging to analyze quantitatively. Nonetheless, high-quality trace element data from multiple studies reveal complex and variable patterns, but with striking similarities and overlap between worldwide deposits. Diamond properties such as trace element or isotopic characteristics vary as a function of geological conditions that are not necessarily distinct and resolvable between diamonds of different geographic origin. We conclude that there has been no study by any method demonstrating unique and measurable characteristics that would allow for independent provenance determination of a random individual diamond. For now and the foreseeable future, the only definitive method to establish diamond origin depends on preserving and retaining origin information from the time of mining.

Some famous diamonds, such as the Hope, the Cullinan, and the 404.2 ct “4 de Fevereiro” diamond in figure 1, have highprofile histories that include their geographic provenance. Other diamonds with a known origin can occasionally be sourced in the marketplace or directly from miners. But for the majority of diamonds, this information is not preserved, instead becoming obscured as they move through the supply chain. To some extent, diamond provenance has not been seen as a valuable piece of information and is not presented as a relevant pricing factor the way it sometimes is for some other gemstones. Rough diamonds are typically bought and sold in lots or parcels based on physical characteristics, including color, clarity, size, and morphology. In assembling these parcels, it is common practice to mix diamonds of similar character from different mines. Faceted diamonds are sold mainly on the basis of the 4Cs (color, cut, clarity, and carat weight) and may be mixed further.

Beyond the historical or scientific interest in provenance, several recent developments have put diamond origin at the forefront of conversations in the industry and among consumers. Initially, this was driven by a need to track conflict diamonds and prevent their entrance into the trade. Now, with mounting global sustainability efforts across all industries, consumers are interested in knowing the origin and impact of the goods they purchase. These social pressures have prompted direct efforts, by both privately and publicly funded research groups, to search for distinct geographic signatures among diamonds (e.g., Watling et al., 1995; McNeill et al., 2009; Dalpé et al., 2010; Rege et al., 2010; Coney et al., 2012; Melton et al., 2012; Brill et al., 2020; McManus et al., 2020).

A common goal has been to develop a database of measurable characteristics to compare diamonds from different sources. Trace element characteristics, in conjunction with other observations, have proven useful for origin determination of other gem materials (see box A). Similarly, trace element analysis using mass spectrometry has been regarded as the most promising approach for diamonds (Watling et al., 1995; McNeill et al ., 2009; Dalpé et al ., 2010; Rege et al ., 2010; Coney et al ., 2012; Melton et al ., 2012; Brill et al ., 2020). One study has also used laser-induced breakdown spectroscopy (LIBS) for this application (McManus et al ., 2020). This article will discuss these methods and the challenges they face. The reality at the moment is that there is no scientifically robust method to determine the geographic origin of any given diamond (Dalpé et al ., 2010; Cartier et al ., 2018; Krebs et al ., 2019). All current, reliable, and available means of establishing provenance depend on retaining countryof-origin and/or mine-of-origin information, rather than determining this analytically.

One of the significant concepts emerging from the past century of diamond research is that there are many different ways diamonds can form, with the pertinent variables being the host rock type, the composition of the diamond-forming fluid or melt, and the depth of formation (lithospheric or sublithospheric) (Shirey et al., 2013). There are distinct varieties of diamond that arise in nature, and, crucially, these varieties do not appear to have unique geographic distributions overall.

In general, diamonds form as carbon-bearing fluids flow through rocks in the mantle and the carbon crystallizes due to chemical reactions or changes in pressure or temperature. Studying the interior of diamonds with cathodoluminescence has revealed that many diamonds exhibit multiple concentric growth layers, resulting from multiple fluid pulses and episodes of growth (figure 2; Shirey et al., 2013). The layers can have

Methodologies for geographic origin determination of rubies, emeralds, and other gem materials cannot readily be applied to diamonds. This is due to fundamental differences between diamonds and other gem materials. Diamonds form in the mantle, much deeper than most other gemstones. Except for some mantle-derived olivine/peridot, most other gemstones form in the earth’s crust at relatively shallow depths.

Minerals in the crust are the product of multiple melting and differentiation processes that over time have created the crust. These processes concentrate certain elements (known as incompatible elements), which tend to partition into magma as rocks melt. Consequently, crustal rocks have relatively high concentrations of these otherwise rare incompatible elements. When gemstones form within crustal rocks, they naturally inherit higher concentrations of incompatible elements. Furthermore, the crust has great diversity in chemical composition, in contrast to the mantle’s more uniform composition. Because of the chemical diversity of different geological environments in the crust, gemstones formed in different crustal environments often have markedly different trace element compositions. For example, rubies can exhibit differences in certain trace elements (magnesium, titanium, vanadium, iron, and gallium) based on their formation in igneous (basaltic and lamprophyric), metamorphic (granulitic and metalimestone), and metasomatic (skarn and pegmatitic) environments (Palke et al., 2019b).

In some cases, it is possible to relate specific compositional features in these gemstones to the compositions of known and exposed crustal rocks in the different geologic settings. Determining trace element concentrations within crustal gemstones allows constraints to be placed on the geological setting they formed in, potentially allowing their geographic origin to be inferred. However, distinguishing crustal gemstones that are from the same kind of geological setting but from different geographic locations remains challenging.

Multiple layers of evidence, including geochemical and inclusion characteristics, often must be combined in order to better assess a gemstone’s origin.

This challenge is even more pronounced for diamonds. Diamonds formed in the same kinds of geological settings are found spread across many different geographic locations. The majority of diamonds form in the thick and ancient portions of the continental lithospheric mantle. There are three main host rock types – peridotite, eclogite, and websterite – that are composed primarily of different proportions of only four minerals: olivine, orthopyroxene, clinopyroxene, and garnet. Compared to crustal rocks, the rocks of the mantle have limited mineralogical and chemical variability. Furthermore, the covalently bonded diamond lattice is extremely compact and regular, composed of only one major element, and cannot easily accommodate the addition of substitutional and interstitial impurity elements. Only a few elements, such as hydrogen, boron, nitrogen, silicon, and nickel, fit into the diamond lattice. Other trace elements in diamond are thought to be present as nano-inclusions of fluid rather than occupying discrete crystal lattice sites (Melton et al., 2012; Krebs et al., 2019). Consequently, as a diamond grows, it incorporates extremely low levels of trace elements compared to other minerals. Nitrogen, however, is a notable exception.

Nitrogen is the most common impurity in natural diamond. It can substitute for carbon in the diamond lattice, typically at concentrations of tens to hundreds of parts per million (ppm). Diamond has a median nitrogen value of 160 ppm, with 99% being <1400 ppm (Stachel, 2014). It can occur as isolated nitrogen atoms (C centers), as aggregated pairs (A centers), or as groups of four atoms plus a vacancy (B centers) (Breeding and Shigley, 2009). Unfortunately, the nitrogen concentration and its degree of aggregation overlap completely among diamonds from around the world and cannot be used to determine geographic origin.

distinct carbon isotope compositions (δ13C), nitrogen concentrations, nitrogen isotope compositions (δ15N) (Stachel et al., 2022b), and perhaps other characteristics as well, such as trace element contents. Diamond trace element and isotopic composition are controlled by the elements present in the parental carbon-bearing fluid, varying with the extent of interaction between the fluid and surrounding host rock minerals (Weiss et al., 2015).

The products of diamond formation in the earth’s mantle are surprisingly similar across many different localities. Categorizing diamonds based on their mineral inclusions provides much of the basis for our understanding of different geological varieties of diamond. The major geological varieties defined by inclusion mineralogy are shown in table 1. These represent diamonds from the lithospheric mantle, formed at approximately 150–200 km, and exclude the rarer (<2%)

sublithospheric or “superdeep” varieties of diamonds (Smith et al., 2017; Stachel et al., 2022a).

Diamonds we see at the earth’s surface have been carried up in magmas that form kimberlites (or, less commonly, lamproites). The magma rips up pieces of diamond-hosting mantle rocks hundreds of kilometers below the surface. During this journey, mantle rocks break apart and release diamonds into the magma, forming so-called xenocrysts (crystals foreign to the magma). Individual kimberlite deposits at the surface often contain multiple populations of diamonds mixed together, which could have originally crystallized in completely independent and episodic diamond-forming events within different host rocks. The spatial and temporal scale of diamond-forming events at depths in the mantle is not well understood because it is never exposed. Multiple eruption phases of a kimberlite may sample different portions of the lithosphere. Compiling a complete picture of diamond characteristics from any given deposit means taking into account multiple dissimilar populations. Depending on the nature of the deposit, it could be difficult to judge whether a sample suite of diamonds is truly representative of that deposit. The situation may be more complex for alluvial deposits, which may contain diamonds eroded from multiple primary known or unknown kimberlite/lamproite sources.

The known geological varieties of diamond, including the major categories outlined in table 1, are not geographically restricted. Diamond properties are a function of geology, not geography, and the geological controls for the most common varieties of diamond result in broad, overlapping similarities between many geographic settings. For example, the most well-studied diamonds, found in most deposits around the

world, formed within harzburgite (a type of peridotite) host rocks, at comparable pressure and temperature conditions, from carbon-bearing fluids of similar composition (Shirey et al., 2013). These are the kinds of diamonds that contain rare vibrant purple Cr-pyrope garnets. The diamond exploration strategy is to search for these garnets and other indicator minerals released by fragmentation of diamond-hosting rocks and dispersed in surficial sediments. The success of the strategy is underpinned by the fact that the predominant diamond formation processes are often similar from one deposit to the next worldwide. Searching for kimberlitic indicator minerals with the same composition as those from existing mines is an effective technique for finding new diamond-bearing kimberlites (Kjarsgaard et al., 2019).

Each diamond deposit encompasses a range of diamond morphologies, surface textures, colors, and other characteristics. Some localities have more visually distinctive rough diamonds than others, which is noticeable upon examining parcels of diamonds from that locality. For example, the Ellendale mine in Australia produced a large proportion of resorbed, smooth-surfaced dodecahedral (or tetrahexahedral) yellow diamonds (Hall and Smith, 1984; Jaques et al., 1986). The Marange alluvial deposit in Zimbabwe has diamonds with a nontransparent coating and radiation damage (Smit et al., 2018), while the Victor mine in Canada has produced a high proportion of well-formed, near-colorless octahedral crystals with few mineral inclusions (“The real value of Victor Project,” 2007).

Of course, these are not the only examples of particular features associated with certain diamond localities. An unusual example is the porous, micro-polycrystalline diamond variety known as carbonado. Although not of gem quality, it is interesting because it is only recovered from placer deposits in Brazil and the Central African Republic (Heaney et al., 2005). As another example, the Cullinan mine in South Africa is known as a chief source of boron-bearing, type IIb diamonds (King et al., 1998). A random type IIb diamond circulating in the marketplace has a reasonable probability of being from Cullinan. The Argyle mine in Australia, which closed in 2020, was a leading producer of pink (and many brown) diamonds. Argyle’s pink diamonds generally have highly aggregated nitrogen (more B centers than A) and a color that is associated with slightly more diffuse pink graining compared to pink diamonds from most other localities, which tend to have less aggregated nitrogen and a pink color associated with sharply defined glide planes (Gaillou et al., 2012). Argyle was also an almost exclusive source of rare blue to violet diamonds whose color is related to hydrogen (Eaton-Magaña et al., 2018). The distinctive characteristics described here are helpful observations in terms of inferring the origin of some specific diamonds or representative and unmixed parcels, but they are certainly not definitive. Experienced professionals can reach an educated guess about the origin of diamond parcels, or even an individual diamond, but this judgment is highly subjective and cannot be easily verified. For the majority of polished or rough diamonds, there are no distinct characteristics that reveal the geographic origin.

Carbon and Nitrogen Characteristics. Carbon and nitrogen might seem to be a good way to fingerprint diamonds, given their high abundances and isotopic variations in this material. Such analyses could be performed on most

diamonds. However, nitrogen abundance variations (measured by infrared absorbance spectroscopy or even imaged with luminescence-based techniques) reveal that the nitrogen content can vary greatly between the growth zones of each diamond (figure 2), not to mention on the scale of millions of diamonds in a single mine.

This variation in nitrogen content is due to the influx of different fluid pulses during diamond growth, each of which may have had a different nitrogen content. Diamonds with an internal tenfold difference in nitrogen content have been documented through secondary ion mass spectrometry (SIMS), a technique that can obtain spatially resolved measurements (see the measurement locations superimposed in figure 2) (Stachel et al., 2022b). These differences are averaged when using bulk analytical techniques such as infrared spectroscopy. Nitrogen abundance variability (within the limited range of possible concentrations) is so pervasive and occurs on such a small scale that nitrogen content alone is not a useful tool to distinguish diamonds from different geological environments.

Both carbon and nitrogen have two stable isotopes (12C, 13C and 14N, 15N), with the lighter atomic mass isotope of each element (12C and 14N) comprising ~99% of the isotopic composition of the respective element. Similar to nitrogen content, the entire global range of both δ13C and δ15N (the part per thousand variation of the 13C/12C and 15N/14N ratios, with respect to a standard) may be represented within one deposit (figures 3 and 4). The main mantle range of δ13C is centered around –5‰, and the global δ13C distributions of diamonds that form in the two main host rocks – peridotite and eclogite – have modes that overlap with this mantle range (figure 4). Consequently, the stable isotope composition of a diamond lends insight into the host rock and fluids from which the crystal formed, but it is not a geographically distinct feature. Even if it were moderately helpful for origin determination, the time-consuming and expensive nature of stable isotope analysis, as well as the formation of ablation pits, makes it unsuitable for routine application to faceted diamonds.

Trace Element Characteristics. Like any mineral, diamond contains minute amounts of elements other than those stated in its mineral formula (see box B). These so-called trace elements may provide a rich geochemical record of the conditions of mineral growth, potentially revealing differences between different deposits. Trace elements can be present at concentrations from many parts per million (ppm) down to parts per billion (ppb), parts per trillion (ppt), or less, so there are enormous ranges of possible concentrations in natural materials.

In transparent, gem-quality diamond, the concentrations of trace elements are extremely low, often in the ppt range, making them especially difficult to measure compared to other minerals. The first pioneering measurements of trace elements in gem-quality diamond were made by instrumental neutron activation analysis (INAA) (Fesq et al., 1973; Bibby, 1982), but the amount and quality of data were limited. It is worth noting that the neutron bombardment of INAA severely damages the appearance of the whole diamond being analyzed.

Later studies have employed laser ablation – inductively coupled plasma–mass spectrometry (LA-ICP-MS), a widely used tool for measuring elemental compositions of many geological materials, including gemstones (Liu et al., 2013). Laser ablation involves vaporizing a small amount of the sample material by blasting a tiny crater into it with a laser. The liberated sample particles are ionized in a plasma to form a beam of atomic and small polyatomic ions, which are then continuously separated by mass/charge in a mass spectrometer (figure 5A). This technique has been applied to many gemstones (see review in Groat et al., 2019), including blue sapphire (Palke et al., 2019a), ruby (Palke et al., 2019b), and emerald, all of which contain abundant trace elements that are relatively straightforward to measure.

When it comes to transparent, gem-quality diamond, however, the ultra-low concentration of most trace elements is problematic. The low bulk concentration of trace elements means that high-quality data cannot be obtained by routine

Most of the rocks and minerals around us are made up of a relatively small selection of elements, including oxygen (O), silicon (Si), aluminum (Al), calcium (Ca), iron (Fe), magnesium (Mg), sodium (Na), and potassium (K), the most abundant elements in the earth’s crust. Just consider the mineral formulas of some common rockforming minerals: quartz (SiO2), olivine ([Mg,Fe]2SiO4), potassium feldspar (KAlSi3O8), or what is regarded as the most abundant mineral at great depth within the earth, bridgmanite ([Mg,Fe]SiO3). Many elements on the periodic table do not make an appearance as major defining components of minerals and are present only in trace quantities. In geology, the term trace element generally refers to those elements making up less than about 0.1% by weight (1000 ppm) of a mineral, rock, magma, or other system (Shaw, 2006). In a mineral, elements given in the mineral formula are essential structural constituents (Hanson and Langmuir, 1978) that impart distinct properties and make up the majority of the material. These are called major elements. The terms major and trace elements can therefore refer to

“online” LA-ICP-MS analysis of gem-quality diamond because most elements fall near or below the limit of detection (McNeill et al., 2009). Increasing the laser energy to ablate more diamond in an effort to overcome the low concentration carries the risk of uncontrolled fractionation at the ablation site during sampling and increased diamond destruction. For these reasons, applying routine LA-ICP-MS techniques to gem-quality diamonds yields data that are generally not quantitative and whose uncertainties are difficult to evaluate (McNeill et al., 2009), making them of limited use for investigating diamond paragenesis and potential geographic variability. For example, in a study of 400 monocrystalline (nonfibrous) diamonds analyzed by LA-ICP-MS (Rege et al., 2010), the trace element patterns exhibited strong similarities regardless of geographic locality or geological paragenesis. Early attempts such as this struggled to accurately characterize detection limits or demonstrate that the data produced were significantly different from instrumental background.

Aside from carbon, most elements do not incorporate easily into the diamond crystal lattice as it grows, which is one of the reasons high-clarity diamond crystals have such low trace element concentrations. A few trace elements such as hydrogen, boron, nitrogen, silicon, and nickel (also common in laboratory-

different elements depending on the material in question. Diamond is rather special, being composed solely of one major element, carbon. Other examples are gold, silver, and copper, all of which occur in their native form. In diamond, carbon is the only major element, whereas all other elements in this mineral are only present in trace quantities, often expressed in parts per million (ppm), billion (ppb), trillion (ppt), and so on, by weight.

The concentrations and relative abundances of trace elements can provide information about the way minerals formed. Trace element analysis of diamond has primarily focused on unraveling the geological settings and elements involved in diamond formation, but a secondary goal has been the forensic/gemological application of trying to distinguish geographic origin. The trace elements typically discussed in the context of diamonds include Cs, Rb, Ba, Th, U, Pb, Ta, Nb, La, Ce, Pr, Sr, Nd, Sm, Hf, Zr, Eu, Ti, Gd, Tb, Dy, Y, Ho, Er, Yb, and Lu, as well as the lighter elements H, B, N, O, Na, Mg, Al, Si, Cl, K, Ca, Fe, and Ni.

Figure 5. Simplified schematic of analytical methods. A: Conventional “online” LA-ICP-MS. A gas stream carries the ablated sample directly into the plasma torch, where it is ionized and accelerated as a beam. In the mass spectrometer, ions are separated based on mass/charge and their abundance can be quantified. B: “Offline” laser ablation combined with solution-based ICP-MS. Ablation takes place in a sealed vessel over an extended time, allowing a larger amount of ablated material to accumulate. Dissolving the ablated sample in acid allows it to be analyzed as a solution. C: The laserinduced breakdown spectroscopy (LIBS) technique. The laser striking the diamond creates a plasma, the emitted light of which can be separated into different wavelengths by a diffraction grating inside a spectrometer. The light spectrum can contain information about the elements and chemical bonding within the sample.

grown diamonds) may be incorporated as defects in the diamond lattice. But the majority of trace elements of geological interest, when they do occur in gem diamond, are thought to be hosted as fluid nano-inclusions that are simply too small and sparse to see (Melton et al., 2012; Krebs et al., 2019, 2020).

In contrast to the ultra-low trace element concentrations in gem-quality diamond, a particular growth habit called fibrou s diamond has diamond trace element concentrations that are at least two to four orders of magnitude greater (Weiss et al., 2008). Fibrous diamond has a cloudy appearance due to abundant sub-micrometer-sized high-density fluid (HDF) inclusions (Navon et al., 1988) and is generally not considered gem-quality because of the diminished clarity. However, the abundance of HDF inclusions in fibrous diamond causes the bulk trace element contents to be high enough to analyze using LA-ICP-MS. Most trace element studies of diamond have focused on fibrous diamond (Tomlinson et al., 2005, 2009; Zedgenizov et al., 2007b; Rege et al., 2010; Smith et al., 2012; Weiss et al., 2013; Klein-BenDavid et al., 2014). Even though these analyses are based on micro-inclusions hosted in diamond and not the diamond itself, there is evidence that similar trace element characteristics exist at lower concentrations in gem-quality diamond that do not contain visible inclusions (Jablon and Navon, 2016; Krebs et al., 2019). This suggests that fibrous diamonds and their HDF inclusions are broadly informative of non fibrous, gem-quality diamonds and provide an additional basis for discussing the prospect of origin determination (see the section “Fibrous Diamonds Bolster Our Insight into Trace Elements”).

This specialized method for measuring trace elements in diamond involves a pre-concentration step that allows a larger sample to be collected in a controlled fashion. It was developed by McNeill, Pearson, and colleagues at Durham University specifically for analyzing diamond (McNeill et al., 2009). The diamond is placed in an enclosed vessel with a window through which the laser can pass. Ablation takes place within this sealed vessel, allowing the ablated material to accumulate over the course of minutes or even hours. Compared to the direct uninterrupted ablation-to-analysis of LA-ICP-MS, this offline sampling technique means a much larger amount of diamond, and therefore a larger sample of trace elements, can be ablated in a controlled way. The accumulated sample is then taken up in acid and analyzed by conventional solution-based ICP-MS. Analyzing solutions greatly simplifies standardization, circumventing the need for a diamond standard. Appropriate solution standards with elemental concentrations similar to that expected in diamond can easily be prepared. Weighing the diamond before and after ablation gives the mass of

diamond ablated, providing a way to recast results as elemental concentrations within the diamond. Offline ablation allows much higher volumes of analyte to be pre-concentrated before measurement rather than having the ablated material swept directly into a gas stream for analysis, as in LA-ICP-MS, effectively boosting what is known in analytical work as the signal-to-noise ratio by several orders of magnitude.

To measure a signal, having a strong signal and having low background noise are equally important. An example of low signal-to-noise ratio occurs when the noise from city lights prohibits the signal of distant stars from being seen by curious stargazers. In rural areas, background light is so low that even faint signals from stars can be seen.

In analytical work, scientists must pay special attention to the relative contributions of signal and noise. The limit of detection (LOD) provides a threshold level where weak signals cannot be confidently distinguished from background noise. One definition of the LOD is 3× the standard deviation of the blank/ background (Currie, 1968). However, we want to know how much of the element there is, not just that it can be detected. For the exceptionally low trace element contents of most gemquality diamonds, which may be only marginally above the background noise, McNeill et al. (2009) argued that a more stringent limit is needed: the limit of quantification (LOQ). This is defined as 7 to 10× the standard deviation of the blank/ background (Currie, 1968), and it is a better cutoff to ensure that the signal seen above the background can be used to calculate element concentration. Data must exceed the LOQ (the minimum accurate quantifiable value) to be considered truly quantitative. A number of studies have reported conventional online laser ablation results from gem-quality diamonds but with such low signal-to-noise ratios that LOQ criteria could not be met (Rege et al., 2005, 2010; Coney et al., 2012; Brill et al., 2020). If measurements do not exceed the LOQ, they may carry qualitative meaning, but large uncertainties will obscure comparison between samples, restricting their utility.

Offline laser ablation with ICP-MS enables quantitative trace element data for gem-quality diamond. However, the technique is not without drawbacks. The amount of diamond that must be ablated is large compared to the typical ablation crater involved in conventional LA-ICP-MS of other materials. For example, analyses of most colored gem materials using LA-ICP-MS would involve a spot size of 50–100 μm, meaning that an analysis can be performed on the girdle of a valuable ruby, sapphire, or emerald and would not be visible to the unaided eye.

To be continued in the March issue

Africa has the potential to become an exemplary world leader by challenging conventions and embracing responsible, tech-based industrial initiatives.

A THRIVING MANUFACTURING SECTOR IS a positive indicator for emerging market countries on the African continent. Industrialisation creates jobs and drives social, political and economic developments, helping to transform and improve the lives of ordinary people. With its young workforce and a keen

desire for a seat at the global trade table, resource-rich Africa is abundant in opportunities. While the projected trajectory for growth in the manufacturing sector has been challenged by the recent pandemic, experts foresee US$666,4 billion in earnings by 2030.

The effort made by the continent’s leaders to band together and position themselves as allied trade partners capable of competing with other global players is an exciting and positive step. The African Continental Free Trade Area, launched in 2018, encompasses

most of Africa and seeks to eliminate tariffs on goods and services (subject to certain conditions) to liberate the market and remove barriers to capital, investment and labour. Manufacturing lights the way to a united Africa that enables business and infrastructural development, while reducing poverty and uplifting the lives of citizens.

Africa’s unique position, history and biodiversity have encouraged innovation and a distinctly African approach to solving the continent’s most pertinent issues, namely its vulnerability to the inherent threat of climate change. As a result, leaders are open and keen to adopt advanced manufacturing

methodologies and forge partnerships with investors whose initiatives will protect the continent against exploitation and further environmental damage.

With its significant exposure to the effects of climate change, Africa cannot afford to put itself at risk by following the traditional pathway to industrialisation. While this is a challenge, it presents unique opportunities. By developing a manufacturing sector that integrates sustainability best practices to meet targets for the reduction of CO2 emissions, Africa could take advantage of the international market’s demand for green goods and services while simultaneously building a resilient economy that is not solely reliant on volatile commodities.

Aggressive adoption of low-carbon technologies and a transition to renewable energy sources will help position Africa as a competitive and attractive trade and manufacturing partner. A demonstrated commitment to decarbonisation and net zero emissions will draw in the necessary investment that promotes green growth across the continent. Africa stands to gain an ecosystem that builds strong relationships between responsible energy providers and manufacturers, rapidly accelerating muchneeded cross-border development.

Furthermore, an Africa dedicated to decarbonisation could lead to the creation of approximately 3,8 million net new jobs, with just under 6 million new jobs expected to emerge from green businesses by 2050, primarily in electric vehicle-charging infrastructure, wind and solar industries, as well as cross-laminated timber.

Businesses that take advantage of green initiatives could leverage niche markets in the production of goods that displace existing carbon-intensive products. With an emphasis on green transportation, plant-based proteins and components used in renewable

energy technologies, Africa could spearhead revolutionary sectors that address the evolving B2B and B2C demands for environmentally friendly manufacturing practices.

At a time when the global supply chain is swiftly becoming digitised and both the private and public sectors are attempting to minimise their carbon footprint, Africa finds itself in an exciting and potentially lucrative position, where manufacturing is concerned. The continent could soon become an exemplary world leader by challenging conventions and embracing responsible, tech-based industrial initiatives.

The Manufacturing Indaba 2023 is set to present concise and incisive thought leadership that looks to the future while embracing all industry stakeholders. The symposium has been meticulously curated to feature riveting and inclusive content unlike any other industrial event. What is more, the platform is set to assemble a wide canvas of delegates from speakers to business-owners, investors, political figureheads and sectoral experts. Participants can expect to learn innovative ways of seizing current opportunities and spotlighting future ones, thus inspiring the next generation to become part of moving the manufacturing transition forward.

The Manufacturing Indaba 2023 is set to present concise and incisive thought leadership that looks to the future while embracing all industry stakeholders. The symposium has been meticulously curated to feature riveting and inclusive content unlike any other industrial event.

The ancient Greeks were some of the first to establish the concept of prayer beads. Greek monks used strings of beads, called komboloi, to keep track of their prayers, much like a modern-day rosary. Though technically considered jewellery, for centuries, only men used komboloi and they were not really worn. After a while, komboloi lost their religious meaning, but kept their place in Greek culture as worry beads. Similar to a stress ball, worry beads can be fiddled with to relieve stress and pass the time.

The number one silver-producing country in the world is Mexico. It produced 5 600 metric tons in 2021.

Alfred Hitchcock used jewellery in any number of movies to turn the plot. Jewels were often props that expressed a character’s status or a visual way to represent an important scene. In several films, jewellery was a clue used to solve a murder.

In 1989, Harry Winston’s son Ronald Wilson wanted to pay tribute to the anniversary of The Wizard of Oz. After two months of placing 4 600 rubies on the slippers, the House of Harry Winston débuted its own rendition of the iconic shoe. The pair features 1 350ct of rubies and 50ct of diamonds

It was once believed that smoke from amber that had been ignited could be used to fend off evil spirits, dangers and enchantments. Amber was also used as a gem for the grieving and to honour the dead because it so perfectly preserved life as can be seen by the insect and plant matter often captured within it.

Flashy jewellery always remains an integral part of hip-hop fashion. Although many changes occur in the hip-hop style, the base of the jewellery always remains the same. These items are mostly made up of platinum and gold. Everything symbolises the rappers’ success.

1970s jewellery, especially the kind that was made with the chic hippie in mind, was designed and created in the same spirit. Items were bold and vibrant, with men and women wearing an array of colours and styles across the board. Statement jewellery was a major trend at the time, with large attention-grabbing rings and necklaces taking centre stage. This period also took advantage of coloured diamonds and other naturally coloured gemstones

For her coronation, Queen Elizabeth II wore a gorgeous Jaeger-LeCoultre Calibre 101 timepiece. At the time, this watch was known for having the smallest mechanical movement in the world.

It is a taboo to give a Chinese person a clock since it has the same pronunciation, in both Mandarin and Cantonese, as “attend a funeral”. The clock can also imply that the person is running out of time and that you are waiting to attend their funeral.

In the film adaptation of Harry Potter and the Order of the Phoenix, Evanna Lynch, who portrays Luna, personally crafted the beaded radish earrings that she wore in the film.

Accoding to McKinsey & Co, between now and 2025, the jewellery and watch industries are expected to rebound from the COVID-19 pandemic and grow globally at 3-4% per year (fine jewellery) and 1-3% per year (watches).

The very first watch to leave the earth's atmosphere was the Sturmanskie, worn by Yuri Gagarin. The astronaut ventured into space on 12 April 1961 from the Baikonur Cosmodrome (now known as Kazakhstan). This Soviet brand was gifted to Gagarin and his fellow pilots after graduating from the Chkalov Air Force Pilot School in Orenberg.

The word "amethyst" comes from the Greek word "amethystos" which translates as "sober." Many Greeks and Romans believed that the stone could guard against drunkenness. However, they would drink wine from chalices carved out of amethyst and likely get drunk anyway!

The Cultured Pearl Association of America (CPAA) has announced the winners of its 13th Annual International Pearl Design Competition (IPDC). The association is a non-profit founded in 1957 and comprises manufacturers, wholesalers, dealers and suppliers of cultured pearls. Its goals are to improve retail marketability of pearls and cultivate demand among consumers.

AT THE END OF LAST YEAR, JUDGES inspected International Division entrants – all sketches or CAD renderings – at a private location in Manhattan, USA. Judges included Jean François Bibet, Workshop and Production Director at Cartier, Patricia Faber, co-owner of the Aaron Faber Gallery, Lenore Fedow, associate editor of National Jeweler, Maria Tsangaropoulos, supervisor of instruction at GIA’s New York City campus, Michael

Coan, assistant professor for the jewellery design department at the Fashion Institute of Technology and Kathy Zaltas, owner of Zaltas Gallery.

Seven winners were chosen across six categories, with one individual earning two awards and a pair of co-winners in another category.

President’s Trophy

This top prize is given to the piece deemed the most beautiful and original design concept that is well made, celebrates pearls and leaves a lasting impression of them as must-have gems.

Winner: Kentsugi bracelet by Shikha Pathak for the C Krishniah Chetty Group of Jewellers of India, made in 18ct yellow gold with 8-20 mm white, pinkish and champagne-coloured South Sea cultured pearls, mother-of-pearl with gold inlay and

round and baguette-cut diamonds.

Lustre Award

These winning pieces represent the evolution of best-selling pearl jewellery designs bearing covetable and marketable concepts with wide appeal for the marketplace. New for 2022: these pieces had to retail for US$3 000 or less.