Human beings have been fascinated by the future for thousands of years.

A desire for the ability to eliminate uncertainty about what fate has in store is probably as old as humanity itself. Wizards, clairvoyants and oracles – foreseeing the future has been surrounded by a web of countless stories since ancient times, and fairground fortune tellers do a roaring trade even today.

Of course, the trouble with predictions was that they didn’t always turn out well. The Delphic Oracle occasionally sent its petitioners to their doom, and Cassandra with her gift of foretelling the future was tormented by the fact that no-one wanted to believe her, despite always being right.

++ Armin Juncker Chief Executive Verband Deutscher Großbäckereien e.V. and Treasurer and thus a member of the Executive Board of the AIBI (International Association of Plant Bakers)

The best way to find this out is to actively shape the future oneself: in dialogue with others, based on the most up-to-date information and prepared at all times to adapt in whatever way may be necessary.

The saying “Be a player, not just a spectator!” urges us to lend a hand in shaping the baking sector’s future ourselves as entrepreneurs (m/f). The fact that the legislator and customer also have their say in this matter is only natural. Constant dialogue is important, not only to be able to pull together in compliance with constantly regulatory amendments or changes in customer requests, but also to represent one’s own interests in the best possible way. For this, it is especially important to have (fore)knowledge of the latest trends and innovations to enable a proactive response.

We best fit ourselves for the future not by complaining about it or mere crystal ball gazing, but by obtaining concrete, practical information! Presentations to the specialist public will include not only the market’s latest innovations from A to Z. The iba trade fair is also an ideal environment in which to establish and deepen contacts. Ultimately, the whole sector benefits from close interaction and a strong, stable network as it journeys into the future.

The iba trade fair is also an interesting “melting pot” in terms of internationality, thanks to its many exhibitors and visitors from other countries!

The iba, held this year in Munich from 15th to 20th September, offers a chance to experience the sector’s future at first hand.

Around the world, more food is proofed, baked, cooked, cooled and frozen on our conveyor belts. Ask for Ashworth.

Optimized mixing process

06 Diane: Main principle: durable

14 Henk Hoppenbrouwers: The trend towards bigger capacitiese

22 Bakery landscape: The 50 biggest chain bakeries

Hans-Jochen Holthausen: “We must go with our products to where the customer buys”

PUBLISHING COMPANY

f2m food multimedia gmbh Ehrenbergstr. 33

22767 Hamburg, Germany

+49 40 39 90 12 27 www.foodmultimedia.de

PUBLISHER

Hildegard M. Keil

+49 40 380 94 82 keil@foodmultimedia.de

EDITOR-IN-CHIEF

Bastian Borchfeld

+49 40 39 90 12 28 borchfeld@foodmultimedia.de

EDITORIAL STAFF

Helga Baumfalk

+49 40 39 60 30 61 baumfalk@foodmultimedia.de

Silke Liebig-Braunholz

+49 (0)40 386 167 92 liebig-braunholz@foodmultimedia.de

ADVERTISING DEPT.

International sales director

Dirk Dixon

+44 14 35 87 20 09 dixon@foodmultimedia.de

Advertisement administration

Wilfried Krause

+49 40 38 61 67 94 krause@foodmultimedia.de

DISTRIBUTION

+49 40 39 90 12 27 vertrieb@foodmultimedia.de

TRANSLATION

Skript Fachübersetzungen Gerd Röser info@skript-translations.de

TYPESETTING

LANDMAGD in der Heide Linda Langhagen; design@landmagd.de

PRINTED BY

Kitzinger: All-in-one: a new tray washing plant for Schäfer’s

Dr. Schär Deutschland GmbH: Retrofit – via a picker cell

Leinebergland Druck GmbH & Co. KG Industriestr. 2a, 31061 Alfeld (Leine), Germany

BAKING+BISCUIT INTERNATIONAL is published six times a year. Single copies may be purchased for EUR 15.– per copy. Subscription rates are EUR 75.– for one year. Students (with valid certification of student status) will pay EUR 40.– (all rates including postage and handling, but without VAT).

Cancellation of subscription must be presented three month prior to the end of the subscription period in writing to the publishing company. Address subscriptions to the above stated distribution department. No claims will be accepted for not received or lost copies due to reasons being outside the responsibility of the publishing company. This magazine, including all articles and illustrations, is copyright protected. Any utilization beyond the tight limit set by the copyright act is subject to the publisher’s approval.

Online dispute resolution in accordance with Article 14 Para. 1 of the ODR-VO (European Online Dispute Resolution Regulation): The European Commission provides a platform for Online Dispute Resolution (OS), which you can find at http://ec.europa.eu/consumers/odr

Valid advertising price list: 2018 cover

To meet growing consumer demand, Mondelēz International inaugurated its newest “Factory of the Future” in the Kingdom of Bahrain. The company invested $90 million in the stateof-the-art biscuit manufacturing plant that produces iconic Power Brands, including Oreo cookies and Barni soft cakes, for local consumers and serves as a hub for exports to the Gulf region, the Levant and Africa, reducing delivery costs and improving product freshness. The 250,000 square meter manufacturing facility is about the size of 30 soccer fields with production capacity of nearly 45,000 tons per year. This new plant is located alongside Mondelēz International’s existing manufacturing site, which has been producing Kraft cheese and Tang powdered beverages since 2008. +++

Extremely fast, dust-free and homogeneously mixed – these are the key factors in industrial dough production. The highspeed mixer DymoMix from Rödermark’s dough experts from “Zeppelin plant engineering” meets these requirements with flying colours and with low energy consumption. At the Anuga FoodTec 2018, the leading international trade fair for food and beverage technology, the DymoMix was awarded the International FoodTec Award in silver. At the Anuga FoodTec 2018 trade fair in Cologne on March 20, 2018, the “Deutsche Landwirtschafts-Gesellschaft (DLG)” honoured 17 laureates in total out of approx. 100 registered companies

Diosna: Oevermann is Dr. Eisser’s successor

for technical innovations and further developments that make food technology particularly future-proof, sustainable and efficient. The international jury of experts awarded the Zeppelin Group one of twelve silver medals and thus the award for product optimizations which allow a significant improvement of the function or the process. +++

There will be a change in the management of the machine builder Diosna on 1st May. Henrik Oevermann (40), who has worked in the company since 2011 and currently occupies the post of Commercial Manager and Bakery Technology Area Manager, will succeed Dr. Wolfgang Eisser (65). Dr. Eisser is retiring after 20 years in the company’s management, although he will remain employed for a further two years in an advisory capacity on the Supervisory Board of the French parent company Linxis. +++

The Middleby Corporation announced the acquisition of Ve.Ma.C. The company is a leading designer and manufacturer of handling, automation and robotics solutions for protein food processing lines. The company is based in Castelnuovo Rangone, Italy and has approximately $15 million USD in annual revenues. “This acquisition extends our capabilities related to automation and robotics, providing for further opportunities to integrate our existing food processing equipment offerings. We can now provide more comprehensive end to end solutions for our customers with reduced labor, increased capacity and greater operating efficiency,” said Selim Bassoul, CEO of The Middleby Corporation. “We are very excited about Ve.Ma.C. as a key addition to our portfolio as we continue to evolve our platform of fully automated solutions.” +++

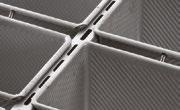

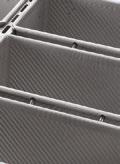

Diane has developed a dimensionally stable peelboard whose surface consists of hard-wearing polymer. If needed, there is a peelboard suitable for every industrial line.

+Proofing boards have existed in the USA and also in Europe for a long time, but the processes were very much aimed at the artisan sector (wooden boards, plastic boards, cloths). However, requirements relating to stability and hygiene have become ever higher with the growth of industrialization in the area of proofing. Thus there is a rising demand in Europe for new boards, although the old “simple” boards still exist. Incidentally, the term “peelboard” originates from the English-speaking world.

The demand for peelboards is accelerating compared to the demand for baking trays. One reason for this is the trend towards baking on hearth or stone plates, even on a large scale. Cloths or fabric coverings are also in decline for hygiene reasons. The most important reason, however, is the opportunity to automate proofing processes by using loading and unloading systems for proofing carriers. The dimensional stability of the proofing carriers is a decisive precondition for this, and it is a requirement that is a matter of course for Diane.

So that explains the increased emergence of peelboards, which is why Diane, already well-known as one of Europe’s most modern producers of trays and pans, is now launching two newly-developed peelboards. They will be offered under the Blue Board ® name. There is one shallow version with a double-sided worksurface and an aluminum frame, and one “high” version with stainless steel frames for fully automated plants.

American peelboards were initially simple wooden boards, cheap, with a tendency to deform, and not very hygienic. After that, plastic boards came into use, although these did not withstand the mechanical and temperature-related requirements in bakeries for very long. Nowadays, peelboards made by Diane consist of a frame, a dimensionally-stabilizing interior, and surfaces usable on one or both sides. If the boards are transported on roller conveyors, as a rule they are flat and both sides are usable. Recesses for stoppers or carriers are often necessary in factories that have automated transport from loading to the oven transfer point, which is why they have only one usable surface. There are certainly quality differences in the workmanship of the various components.

According to the company’s founder Roger Messio, Diane’s new board is the only one whose surfaces are cut from a special material. A material that completely prevents dough pieces adhering by means of different particle sizes and without a silicone or Teflon coating. “In addition,”, according to Messio, “our fabrication processes are designed to adapt the basic dimensions, the height and the fabrication of the boards precisely to any line and its requirements.”

The special surface material consists of acrylonitrile-butadiene-styrene copolymers (ABS), a plastic that combines mechanical stability and chemical resistance, and is often used for housings and other moldings, as well as for Lego bricks. Their stability can be marveled at in any child’s playroom.

As a rule, for shallow boards that are more likely to be moved by hand, the frames are made from a peripheral aluminum strip. Depending on the design of the line and/or loader, the

choice for automated handling is stainless steel frames, which allow enough space underneath for stoppers or carriers.

In the case of the higher frames, an aluminum trough shaped according to requirements is first of all recessed into the finished frame. Into that goes an aluminum honeycomb structure which ensures that a 600 x 800 mm tray, despite its stability, weighs no more than 5.9 kg. After that, the surface material is glued on with a special adhesive that is commonly used in aircraft construction and can be exposed to a very wide range of temperatures without embrittling. Thus ABS withstands temperatures from -35°C up to +50°C.

With particularly large trays, internal bracing ensures additional rigidity so they do not warp or distort. In the case of shallow trays, ABS is glued onto both sides of the honeycomb structure.

Such peelboards are usually brushed off and are then clean. Anyone who wants to use water to clean them or even to immerse them in a cleaning solution can also obtain watertight peelboards. In such cases, the frame and the lower trough are glued together. This stops any penetration of water. The frames can either be provided with codes for automatic recognition, or the peelboards are passed over an induction loop on the line that reads out a hidden internal code.

According to Messio, the request to develop particularly stable peelboards that are guaranteed to be flat came from customers and machine builders. Industrial plants in Switzerland, Germany Poland and Turkey are already running the Diane peelboards. +++

Follow us on our digital channels.

Sancassiano is specialized in mixers, kneaders and automatic mixing systems. The new EG Smart elevator has a small footprint, independent lifting and tilting movements, up to dedicated programmable cycles.

In a small footprint, independent lifting up to dedicated programmable cycles

LIFTING POST INCLINATION FROM 90° TO 60°

MULTIPLE TILTING HEIGHTS

AVAILABLE AS OPTION

- Eliminate intermediate dough transfer (conveyors,...)

- Respect dough quality features

- Optimize the floor space

+The costumer can order the new Sancassiano EG Smart elevator in different configurations. The lifting post inclination from 90° to 60° to eliminate intermediate dough transfers.

Features

+ Adapting the dough transfer to your product quality requirements and characteristics

+ In a small footprint, independent lifting and tilting movements, up to dedicated programmable cycles

+ Multiple tilting heights available as option

MULTIPLE TILTING ANGLES

MULTIPLE TILTING HEIGHTS AVAILABLE AS OPTION

SCRAPER MOVING WITH THE BOWL FOR:

- Easier sanitation

OPTIONAL CONSTRUCTION ON WHEELS AND OPTIONAL MULTIPLE TILTING HEIGHTS

- Reduced cross contamination

+ Multiple tilting angles

REVERSE TILTING SIDE FOR WASHING OR BAD DOUGH REJECT AVAILABLE AS OPTION

+ Reverse tilting side for washing or bad dough reject available as option

+ Scraper moving with the bowl for: easier sanitation, reduced cross contamination, fully programmable scraping and not-scraping sequences

Programmable parameters in multiple steps:

+ Tilting height (option)

+ Tilting angle

+ Tilting direction (option)

+ Scraping system on/off

+ Bowl rotation on/off

+ Lifting and descending speed

+ Tilting speed

Parameters can be combined to program the most suitable sequences for the product. There is also a optional construction on wheels and optional multiple tilting heights to feed multiple lines. The Elevator on wheels, with optional multiple tilting heights and hold-to-run command for:

+ Use of one elevator for multiple lines

+ Reduce the floor space with hold to run command (no programmable cycle in this case)

REVERSE TILTING SIDE FOR WASHING OR BAD DOUGH REJECT AVAILABLE AS OPTION

- Fully programmable scraping and not-scraping sequences

BOWL

Sancassiano

90° From ©

Technical data and photos are supplied for information only and they do not bind San Cassiano on the eventual modifications which could be made. Each dough has different characteristics which affect and determine the maximum batch size that each mixer can handle. Sancassiano declines any machines can mix. Sancassiano technical staff is fully available to assist with mixing tests in order to collect the necessary mixing data and properly

The costumer can also choose between front and side bowl tilting to optimize floor space to increase the operator efficiency. +++

In a small footprint, independent lifting and tilting movements, up to dedicated programmable cycles

You can order the elevator in different configurations

The Ditsch GmbH pretzel bakery has invested in a new DymoMix system at its Oranienbaum site. Processing tolerance of the wheat doughs has already improved. The next scheduled step is to increase dough yield.

+For Matthias Hartung, Oranienbaum Works Manager, and Matthias Grollmisch, Engineering Manager, Brezelbäckerei Ditsch GmbH, this is the first line from the systems engineering supplier Zeppelin Systems GmbH. The DymoMix system, together with a Codos mixer, has been operating to produce wheat doughs continuously in 3-shift operation for around seven months. The two experts were convinced firstly by the line’s very small footprint to produce doughs continuously on a few square meters, and secondly the dough quality was also improved. Matthias Grollmisch says “The DymoMix wetting system makes doughs for bread rolls and sticks more uniform and easier to process by machine.” Matthias Hartung adds “The system also saves around 40% of the mixing and kneading time, and the dough develops faster.” Work is currently underway to increase the dough yield. The DymoMix wetting system developed by Zeppelin, which operates as a pre-mixer in Oranienbaum, successfully achieved this. The system wets powdered raw materials such as flour, sugar and baking agent with water, forming a homogeneous dough instantly. Wetting with water takes place through a specially developed nozzle integrated into the rotating shaft of the DymoMix.

So much energy is input by the impact of the water on the dry materials and an initial mixing by metal rods fixed to the shaft below that not only is the flour wetted, but also a gluten network is initiated. Matthias Grollmisch, Head of Engineering, assumes the dough from the DymoMix is already almost fully kneaded, and that the process generally leads to faster dough development.

The DymoMix is also positioned directly above a Codos mixer. This allows raw materials to move continuously into the mixing compartment underneath, where the dough is fully kneaded to the required consistency. The temperature of the raw materials and dough is constantly measured during the entire process steps. Dough temperature is controllable via the temperature of the added water and the cooling jacket installed on the mixer. Describing the line’s special features, Works Manager Matthias Hartung says “Zeppelin individually readapted our plate heat exchanger.” Cooling medium is circulated via a control unit mounted on the Codos, which regulates the double jacket to the required set-point temperature. Another special feature is that due to the structural arrangements, the flour storage tank stands alongside the line, exactly like the small components line.

Questions to Matthias Grollmisch, Engineering Manager, Ditsch GmbH pretzel bakery, Oranienbaum works

+ Borchfeld: Why did you decide in favor of a continuous line?

+ Grollmisch: The robust mechanical engineering and the dough qualities for our special applications demonstrated in test runs gave us confidence in the design concept of Zeppelin’s continuous mixer.

+ Borchfeld: What were the preconditions, or what was the line required to be capable of?

+ Grollmisch: Continuous dough production with our specific requirements regarding consistency, processability and dough temperature were the basic requirement for the purchase decision.

+ Borchfeld: In your view, what are the line’s special features?

+ Grollmisch: The compact construction and small footprint requirement, together with the combination of a DymoMix with a Codos and the associated opportunities for absorption of water into the dough.

+ Borchfeld: What distinguishes the line from other machines?

+ Grollmisch: The main difference is the amount of water absorption that is possible with the same consistency/ processability.

+ Borchfeld: Where and how does post-kneading take place?

+ Grollmisch: What comes out of the entire system is a

fully-kneaded dough, so post-kneading is unnecessary.

+ Borchfeld: What is the situation regarding dough heating?

+ Grollmisch: We defined the dough temperature with Zeppelin in the run-up. Dough heating is counteracted by adding ice-water and by active mixer jacket cooling.

+ Borchfeld: What kind of doughs currently run through the line?

+ Grollmisch: Exclusively doughs for lye products.

+ Borchfeld: How long was needed for installation and commissioning?

+ Grollmisch: Approximately three months.

+ Borchfeld: What is the line’s hourly capacity?

+ Grollmisch: Around 3,200 kg of dough.

+ Borchfeld: How many employees work in Oranienbaum?

+ Grollmisch: 395 (as on 27.2.2018)

+ Borchfeld: Do they work three shifts?

+ Grollmisch: Yes, and also partly into the weekend.

+ Borchfeld: Which products do the staff manufacture?

+ Grollmisch : We produce lye baked products in various shapes, e.g. pretzels, bread rolls, sticks, knots, plaits, pizzas and croissants. The lye pretzels, for example, range from 50 g to 1,800 g. Among convenience products, we offer pre-proofed dough pieces and fully-baked products, each frozen.

+ Borchfeld: How many lines are now operating?

+ Grollmisch: We currently have 8 lines operating in Oranienbaum.

+ Borchfeld: Many thanks for the interview. +++

Generally speaking, Zeppelin integrates control of the metering and dough production into a higher-level process control system. The required machine parameters (e.g. rotation speeds, temperatures, pressures etc.) together with the recipe parameters for the respective operating modes are transferred from the process control system to the mixer via the interface. Starting and stopping the line can either be manually at the control panel, or by signal exchange from the downstream lines, or centrally from the process control system. At Ditsch, the fully kneaded dough is carried on a conveyor belt to further processing steps.

For cleaning, the DymoMix is disconnected from the Codos, swiveled out, and the protective tube removed. The latter goes into a washroom, while the DymoMix tools are cleaned manually in situ. The inlet pipe is removed from the Codos and also goes into the washroom, where it is afterwards cleaned internally by four ceiling-mounted directed-jet cleaners. Upstream of the directed-jet cleaners there are three disk valves that distribute the water to the cleaners by alternately switching, thus increasing the cleaning effect. In general, installing the new system enabled the mixing process at Ditsch GmbH to be optimized. +++

For more than 30 years, American Pan has led the way in baking tin and tray innovation; from energy-saving designs to industry-leading coatings.

We don’t believe in “one size fits all.” By engineering trays, applying proprietary coatings and providing economic refurbishment programs to fit your exact product and facility needs, we help you save money, increase quality, and outpace the competition.

The machines produced by the Tromp Group in the Netherlands, part of the Markel Food Group, include pizza plants for the whole world. Sales Director Henk Hoppenbrouwers is regarded as an industry insider. In this interview, the expert explains how the pizza market is developing.

Borchfeld: M r. Hoppenbrouwers, what trends do you see in the pizza market?

+ Hoppenbrouwers: Each country and every region has its own preferences. Tastes differ greatly. We in the Netherlands like a rather sweet pizza with pineapple or vegetables. The Chinese, on the other hand, prefer pizza with lots of cheese, some sauce and a lot of poultry meat. As I said, every country has its own individual flavor preferences.

+ Borchfeld: You just mentioned China. Is it a market for pizza?

+ Hoppenbrouwers: Asia’s pizza market is still small, but it is growing, and we have already sold plants into the region. There is a difference in the product range we offer there, however, because many Asian households have no oven at all, so the consumer has no possible way of baking his pizza at home either. Pizzas are therefore 100% fully baked, then offered for sale either frozen or chilled. Customers can then reheat the pizzas, e.g. in a microwave.

+ Borchfeld: It seems to be a really specialized market.

+ Hoppenbrouwers: That’s true, and the market is changing rapidly. But in the Tromp Group we support our customers to enable them to respond to market changes. We provide specialist knowledge not only on the spot but also in our Technology Centre here in the Netherlands. Together with customers, we develop baked products to suit the home market. We also help our customers with product adaptation and development.

+ Borchfeld: So are there any general trends in the pizza market?

+ Hoppenbrouwers: To begin with, Europe’s frozen pizza market has an annual growth rate of 8 to 10%. I observe a trend towards smaller pizzas and pizza snacks at the same time. There is a growing market in North America for fresh and chilled pizzas, for example those sold in supermarkets. We have also installed a plant to manufacture gluten-free pizza. Here again we observe a trend. On the other hand, a different shape is something that doesn’t seem to go down too well with consumers. Rectangular pizzas, for example, are not very popular with customers. 90% of consumers think of a pizza as having a round shape. A general trend is the “De-Luxe Pizza”, richly topped with various kinds of cheese and meat.

+ Borchfeld: What do pizza producers want from the mechanical engineers?

+ Hoppenbrouwers: Pizza manufacturing plants are becoming bigger and wider, and thus more efficient. For example,

we have installed output capacities of up to 12,000 pizzas/hour. What I observe is an annual increase in hourly output capacity. The majority of customers also want complete turnkey plants with good control and monitoring. These plants should allow a quick product change and should also be easy to clean. That’s why we offer the corresponding interchangeable modules, e.g. strewers, that can be wet-cleaned. Robots can also be used, e.g. to distribute tomato sauce onto pizza crusts with pin-point accuracy. Customers also want to be able to produce a variety of baked goods on a single line, to avoid plant downtimes and to make them more flexible. There is a general increase in what clients require from mechanical engineers.

+ Borchfeld: The Tromp Group manufactures a wide variety of plants e.g. laminating lines, pie and cake lines as well as wafer plants. How important to you are pizza production lines?

+ Hoppenbrouwers: Pizza lines are clearly part of Tromp Group's growth strategy. Tromp Group earns around 30% of its revenues from pizza production plants, and demand is high. We also profit through synergies within the Group. For example, we can offer continuous mixers from our sister company Reading Bakery Systems in the USA. There is also a transfer of know-how. From our pie-making plants we know about the pressing process to manufacture pizza crusts. At the same time, however, we can also offer our customers a process to punch pizza crusts from a dough sheet.

+ Borchfeld: In terms of the end product, do the various processes yield different pizzas?

+ Hoppenbrouwers: I think it’s a question of manufacturing philosophy. What we observe is that the press process is more likely to be used by premium suppliers, since pressing dough to form a pizza crust takes time because the dough ball needs

++ Pizza lines are part of Tromp Group's growth strategy

to be pressed at least twice to achieve the required shape and stability. On the other hand, punching the pizza crust from a dough sheet is quicker. Only a single operation is needed. However, it creates a corresponding amount of scrap dough that has to be recycled back into the process. I don’t imagine that the end customer will be able to detect any big difference in the finished product. Perhaps in the bite. As I said, we offer our customers both processes.

+ Borchfeld: One more quick look at the iba. What can visitors to the trade fair expect?

+ Hoppenbrouwers: In Munich we will present, among other things, innovations in the pizza and healthy snacks segments.

+ Borchfeld: Mr. Hoppenbrouwers, many thanks for the interview. +++

Handmade amaranth bread, 100% ryebread with honey, bread made with Spirulina (blue algae) and pumpkin seeds, and two types of gluten-free bread – the British online giant Ocado recently also introduced bread from the Gradz Bakery, a bakery founded in London in 2015 and specializing in sourdough breads according to old recipes. Products made by Gails Bakery, a mix of a delivery and branch bakery famous for its artisan breads, have been available for some years, as have the organic breads made by Celtic Bakers. Ocado’s range of bread and baked goods lists an impressive total of 821 products, from bread, brioche and croissants to donuts and cakes. Ocado’s retail sales in 2017 were GBP 1,317m., and thus 12.4% above the previous year. Ocado earned another GBP 116m. through system solutions for other retailers. 263,000 orders/week were delivered in 2017, with a growing customer network densification, more Sunday deliveries and more highly perfected order-handling technology. +++

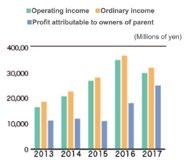

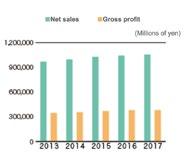

The Japanese food and bakery group Yamazaki Baking Co. increased its revenues by 1.1% last year to JPY 1.05 trillion, equivalent to USD 9.96bn. On the other hand, there is less satisfaction with the trend in operative profit, which fell 14% to JPY 30.087bn., equivalent to USD 292.9m. Obviously the reason for this was a weak trend in retail profits. Yamazaki is a diversified conglomerate that not only manufactures bread, noodles and rice-based dishes, but also operates its own convenience stores, often with their own baking station. The Group’s revenues purely from bread rose by 2.5% in 2017 to the equivalent of JPY 96.493bn., equivalent to USD 915m.

Growing demand by Japanese consumers for premium products and small packs, e.g. containing only three slices of bread, is regarded as the reason for this pleasing development. On the other hand, sweet buns, i.e. sweet bread rolls, which are Yamazaki’s main product, achieved revenues of JPY 359.571bn. in 2017, equivalent to USD 3.41bn., corresponding to a rise of “only” 0.9%. Market researchers attribute a 23% share of the Japanese baked products market to Yamazaki. +++

As reported in the Netherlands newspaper De Tijd, the Dutch retail group Sligro is selling its Emté brand supermarkets, a meat-processing factory in Enschede, Emté’s headquarters in Veghel and the distribution centers in Kapelle and Putten to a consortium of the two retail groups Jumbo and Coop. According to De Tijd, Emté’s most recent sales figure was EUR 828m. The purchase price is said to have been EUR 410m. The deal affects around 6,200 employees, equivalent to around 2,700 full-time jobs. Two-thirds of the Emté markets are scheduled for integration into Jumbo, and one third into Coop. There are currently 130 supermarkets in the Netherlands operating under the Emté name, 34 of them managed by independent traders. Jumbo operates around 580 markets in the Netherlands, and 390 pick-up points where customers can collect the goods they ordered, and Jumbo supermarkets also offer home delivery. Jumbo and its outlets generated revenues of EUR 7.01bn. in 2017. Coop operates a total of 263 supermarkets, 143 of which are managed by independent traders. Coop’s sales in 2017 were EUR 1.18bn. +++

In clear contrast to Switzerland, online sales of foods and near-food products are gaining importance in the Netherlands. According to the Thuiswinkel Market Monitor, consumers there bought 52% more in the food/near-food category in the period from early October to mid-December 2017 than in the comparable period in the previous year. The reason for this is said to be the growing popularity of online supermarkets. Sales through online supermarkets in 2017 reached around EUR 1.1bn. www.Thuiswinkel.org observes the online retail trend in that country jointly with the local GfK (Consumer, Marketing and Sales Research Association) and PostNL. According to GfK, sales in Dutch supermarkets in 2017 rose by a total of 3.2% to EUR 35.58bn. The value of the average checkout bill rose by 6.3% to EUR 23.91, although the number of checkout bills issued fell by 2.9% at the same time. +++

-Dough Make-Up

-Proofing

-Seeders, Toppers, Pan Shakers & Water Splitters

-Depositing, Portioning, Filling and Pumping

-Ovens (Tunnel, Conveyorized, Serpentine, Tray, Rack and Deck)

-Cooling

-Pan & Product Handling Systems

-Packaging & Distribution

A Bakery in the German speaking area (DACH Region) invested in a new generation Rademaker Laminator, Croissant line and Pastry line. The Laminator is designed according Rademaker’s Sigma hygienic design guidelines.

The new Sigma® Laminator is designed according to the Rademaker Sigma® design guidelines. These guidelines are directly derived from various high-end requirements for hygiene and clean ability such as the GMA standard and Ehedg recommendations. With excellent machine surface finishing, tilted surfaces, rounded frames, FDA approved materials, minimized hinges and bolts and numerous other items, the line is living up to the highest industrial expectations. Total elimination of recesses, cavities and dead corners is achieved. An open design enables easy cleaning without lowering the operator’s safety.

Accessibility for cleaning and inspection is achieved by opening covers on both sides of the machine, belt lifters, retractable belt tensioners and knife transfers. Belt lifters enable good accessibility resulting in fast and thorough drying after wet cleaning processes. Accumulation of dirt and dust is reduced due to the application of standoffs and pollution with dough parts is prevented by using wider conveyor belts. New standard feature is also the application of life-time lubricated bearings in the product zone. Needless to say that also this new Rademaker line is fully designed and approved for wet cleaning.

An open design with best possible visibility of the process has been the focus for the system design. Rounded edges and

fully opening covers on both sides of each unit are applied throughout the system. The best possible accessibility of the process is achieved by optimizing the space between the working stations and application of horizontal conveyor belts. Also smaller units are designed with open housing. Lightweight safety covers with extra handles enable ergonomic operation. Overall safety is guaranteed by the application of safety locks.

The new Sigma ® Laminator is designed with wider rollers (+50 mm) and belts (+100 mm). Apart from a higher output this is resulting in improved dough support, reduced risk for micro-damage and stress in the outer dough edges. Final result is even less thickness variation and improved consistency of the layers than before.

The overall set-up of the Sigma ® Laminator is designed for high production efficiency. Operation is made as easy as possible. This is enabled by easy to remove tools, reduced change parts, exchangeable scrapers and bins and various options to minimize required cleaning efforts and increase uptime. Furthermore, the system is equipped with automatic settings allowing for a “one button” action bringing the total machine in the cleaning or drying status. After the cleaning the operator will be warned if belts are not tensioned properly.

Accessibility of the system is strongly improved in order to allow for easy service and maintenance. The service and maintenance requirements are reduced by optimal material selection. This results in minimal wear and increased lifetime of all sensitive items, in combination with a minimized variance of spare parts. Lifetime lubricated bearings in the product zone and clear, comprehensive lubrication locations for bearings outside product zone are resulting in minimal downtime. Parts that require regular maintenance are located in easily accessible places outside the production zone. All conveyor belts are equipped with quick belt release mechanisms to reduce. Downtime during cleaning and to keep maintenance to a minimum. Cleaning and maintenance require less time and production can go on without interruption. Data gathered by the plc can be used to improve maintenance (fe. motor loadings, running stops, stop causes).

Process control by means of intensive data handling and communication is becoming increasingly more important in industrial production processes. The control platform enables OMAC based data exchange with neighboring (third party) equipment as well as LMS, MES or ERP systems.

Furthermore, advanced data processing enables on-line monitoring and optimization of equipment efficiency. The smart use of the combination of process and recipe information allows easy and fast start-up and reduction of flour usage. The existing cascade system and automatic belt speed adaptation (DDIC/Dough loop) is adapted to fit the increased hygiene level. The advanced control system features fully automatic speed adjustment and enables the different sections to operate independently. While the last dough part of the production run is processed towards the end of the line, the

beginning of the line is ready for cleaning or for the production of another product. The operator will be advised when the next recipe can be started on the machine. Finally, the number of sensors is reduced to guarantee for the optimal control with minimal risk for downtime due to malfunction.

When the ingredients are mixed, a kneaded dough batch generated. The dough batches are deposited into the a Chunker before it is processed by Rademaker’s Low Stress Sheeting (LSS) System. The Chunker cuts the dough batch into process able dough chunks. After the dough sheet is created by the LSS, it undergoes a thickness reduction by the Quick Reductor. Rademaker’s Fat pump then processes butter blocks into a consistent butter layer. The fat layer is applied on top of the dough sheet, after with the fat is folded into the dough sheet.

After reducing the dough sheet thickness further, it enters two lapping lamination sections. After several reduction stations, the dough sheet is cut into dough slaps. By means of the cutting and stacking lamination method, the required number of dough-fat layers is created. The cutting and stacking method is applied because of the system’s high output capacity. The system achieves an output of 2.000kg laminated pastry per hour. Also with this lamination method, the less as possible tension that is build up in the dough during the production process, is released. So, an optimum relaxed dough is achieved at a high output.

After reducing this final laminated dough sheet, it undergoes a cooling and resting period in Rademaker’s Cooling and Resting system. Cooling the dough sheet is done because it makes sure that the integrity of the layers remains intact and it creates an even better consistency of fat and dough. This

eventually results in a significant improvement for the further processing steps. Because of the resting period, the best possible taste and shape/volume is realized, resulting from a combination of dough relaxation and controlled yeast activity. This eventually results in the development of mono sugars and CO 2. Because, according to the bakery, the Cooling and Resting system masters this process, they choose to integrate the Rademaker system into their production process. Because the system realizes an optimum airflow, energy usage is kept to a minimum. Rademaker applies a unique concept with this system, based on indirect, active air coolant. The system is designed according the GMA hygienic design standards, this way the system is living up to the highest possible industry standards.

Behind the laminator there are two dough make-up sections; a croissant line and a pastry make-up line, both from Rademaker. Depending on the product, the required make-up section is selected. During the visit, Apple pockets were produced. The croissant line was by-passed by an upper conveyor belt, transporting the cooled and relax dough sheet towards the pastry make-up section. First, a decoration roller creates the decorational cut into the dough sheet. Then the required dough lanes are created, a total of seven rows. When a different decoration is required, the bakery can quickly change the decoration roller for another one. Then the apple filling is applied onto the dough by a Rademaker depositor. During processing, the apple filling is cooled. A folding set then folds the filling into the dough lanes, creating a filled dough pocket. The last and final step in this make-up process is product cutting. Now the dough products are transported towards the proofing system. Before the products are transported towards the freezer, the proofed products are sprayed by Rademaker’s egg yolk sprayer. A recirculation system makes sure that no egg yolk is lost.

The pastry line can be changed for a wide range of different filled and folded products. It only requires a tool- and operator program change, after that the production run can be started. The baker specifically chooses for the systems of Rademaker because of the quick change-over times. Rademaker’s cascade system enables that the production line can switch towards another production run, while the production line continues to keep running. When the last part of the existing production run enters the last section, the other sections can be changed towards another product run, this significantly reduces change-over time, making the system an efficient solution.

As said, with this flexible production system, it is also possible to produce croissants, both filled and unfilled, with open or closed ends. When the dough sheet comes out of the Cooling and Resting system, the dough sheet is cut into the required dough lanes. Out of these lanes, the dough triangles are cut and lined up for the next process step. When filled croissants need to be produced, the Rademaker depositor is set to work. It applies the type of filling that is required and deposits it onto the dough triangles. When unfilled croissants are produced, the depositor is bypassed. After depositing, the dough triangles are transferred toward the vacuum roller where they are rolled into croissants. After this shaping process, the croissants are transferred towards the proofing system. After proofing, the croissants can be topped and/or sprayed with egg yolk. The last production step before packaging, is transferring the croissants towards the freezer.

This European based bakery deliberately chose Rademaker`s technology because it was able to meet the conceptual demands placed on production technology, the high availability of the systems, and Rademaker`s wide-ranging support program to assist its customers. +++

AMF Bakery Systems’ Spiral Conveyor incorporates the most sanitary design elements, including a patent-pending monopiece cage bar, for efficient cleaning and maintenance. Equipped with plastic modular belting using the Intralox DirectDrive™ System, the Spiral Conveyor eliminates product movement on the belt to minimize potential jams. This custom-configured solution is suitable for a variety of product applications including intermediate dough proofing, product proofing, cooling, and freezing.

Your bakery is our world.

VISIT

In its latest issue (brot+backwaren 2/18), the journal’s editor took an entirely new look at the bakery landscape in the German Federal Republic. With meticulous care and diligence, she created a map of Germany illustrating the 54 biggest bakery branch networks.

+A map was prepared for each of these businesses, showing the postcode areas in which the company is represented by branches. Another map in which these points were each grouped into a kind of catchment area shows that there are no longer many places in Germany beyond the reach of these 54 chain stores. Moreover, the fact that there are also local chain stores, possibly strong ones, is also not excluded. Altogether, the map of Germany with its major chain store systems in the German baking industry shows 9,645 locations, and that probably corresponds to nearer a third than a quarter of the total number of bakery chains in Germany. Economic pressure in the last few years has convinced many businesses to systematically close unprofitable locations instead of propping them up any longer.

The portraits of the individual chains are at least as exciting as the overview shown in the general map, which shows clearly that many passed the stage of expanding around their own back door long ago, and even a 100-km radius is no longer the be-all and end-all for many. On the other hand, in the maps for Landbäckerei Stinges & Söhne GmbH in Bruges with 107 branches, and Bäcker Görtz GmbH in Ludwigshafen with 155 branches, it is quite clear how much the expansion policy entails logistics requirements and a sales region that is as self-contained as possible. The picture is also similar for Bäckerei Heitzmann GmbH & Co KG in Bad Krotzingen-Biengen, which has developed its existing branch network of 110 locations extending from Lörrach and Freiburg to Offenburg into a compact region, or Beck in Tennenlohe, which attaches importance to its branches being in a coherent distribution area with only the city of Regensburg as an additional exclave. Junge Die Bäckerei in Lübeck pursues a different but nonetheless clearly recognizable concept with branches in Hamburg, along the entire Baltic coastline, in the vacation areas around Lake Müritz, and recently in Berlin as well.

A counterexample is Bäckerei Wilhelm Middelberg GmbH in Bad Iburg, whose Westphalian origin is still as clearly visible as ever, but whose network of branches now extends to selected points as far south as Leverkusen, Cologne or Kerpen. Hofmeister Brot GmbH in Landau is similar, and scatters its 146 branches from Saarbrücken in the west and Rastatt in the south to the gates of Rüsselsheim in

the north and Heilbronn in the east, or Landbäckerei Ihle, whose 258 branches cover a big area.

The private bakery with the biggest catchment area is undoubtedly Meisterbäckerei Steinecke GmbH & Co KG in the Mariental municipality in Lower Saxony, whose network of 648 branches now extends from Nienburg on the river Weser to the Polish border and from Brandenburg in the northeast down to the southern tip of Saxony-Anhalt.

In a separate map, brot+backwaren shows the locations of the four bakeries that are now striving for a national spread through locations in urban centers: Kamps Backstuben, Heberer, BackWerk and Back-Factory.

The editor also generously allows an individual map for the Edeka Group’s five businesses, namely K&U as a subsidiary of Edeka South-West with 805 branches, the Edeka HannoverMinden subsidiary Schäfers with 739 locations, Backstube Wünsche, a subsidiary of Edeka South Bavaria with 276

branches, Büsch GmbH represented 183 times on the Ruhr and Rhine, and Edeka North’s subsidiary, Dallmeyers Backhus, with 103 branches. Incidentally, the biggest distribution area belongs not to K&U but to Schäfers, whose catchment zone extends from the Polish border into the Münsterland region

and from Bremen to Erfurt. But with 805 to 739 branches, there’s not much difference between them anyway. Thus the two of them are also probably among the five baked goods producers in Germany who between them earn more revenue than the 9,387 businesses each with annual sales of less than EUR 1 million (in this connection, see BackMarkt 4/2018: Germany’s baked products market in 2016: 5>9,387).

It must be said at the outset that these statistics suffer from a system error. They compare apples with pears. The figure that is counted is for sales reported by businesses for VAT, regardless of whether the sales are at end consumer prices, as in a bakery’s branch outlet, or sales at ex-factory prices as in the case of industrial companies. It would be necessary to add in the wholesale and retail margins to arrive at a comparable end consumer price. Drinks and merchandise in bakery branches also push up sales inconsiderably.

A second distortion, at least of the average figures, is because they count all the businesses that report sales, even if the latter are below EUR 100,000/year. They are as many as 1,920 of these companies listed in the “annual sales below EUR 1 million” category. Even many of the 2,773 businesses that declared annual sales between EUR 100,000 and 250,000/year to the tax authority and earned average annual sales of just about EUR 171,000 can hardly rank as full-time businesses.

Disregarding the imbalance inherent in the way the system collects sales figures, sales in the whole sector as a 2015/2016 year-on-year comparison rose by 1.9% to EUR 20.13 billion. The inflation rate in Germany in 2016 was just under half of one percent, so it is entirely correct to talk of real growth in the sector. The only question is: growth for whom?

It was not in the group comprising the five big businesses with annual sales of more than EUR 250,000 per company. Their total sales fell from EUR 3,002.71 million (2015) to EUR 2,934.15 million (2016). However, Lieken AG suffered the majority of this shortfall.

The 38 companies counted in both 2015 and 2016, and consisting of medium-sized industrial businesses and large chain stores whose annual sales amounted to between EUR 50 and 250 million, represented 17.55% of the

Anyone who doesn’t subscribe to the brot+backwaren journal can download the issue from their web site at www.brotund backwaren.de. After purchase, payment by PayPal and waiver of the revocation option, there are two different downloads, a “short” version of 60 MB and a “large” one of 250 MB with which the maps can also be enlarged without becoming blurred. +++

market in 2015, whereas in 2016 the figure was only 17.41%. In absolute terms, however, their combined sales correspond to EUR 38.03 million, equivalent to a 1.1% increase and thus still lay above the inflation rate of half a percent.

Businesses with individual sales volumes of EUR 1 to 10 million gained a quarter of a percent more market share in 2016. In absolute terms, their combined sales turned out 2.8% higher than in 2015. However, they had to share the upturn with 40 new entrants to the category, so an increase of EUR 4,000 per company per year was all that remained in the end.

The improvements in 2016 were “creamed off” by baking business in the center ground with annual sales of between EUR 10 and 50 million. Their number rose by 11 to 255 companies, their combined market share by 1.26% to 25.34% and their average sales by slightly more than EUR 0.5 million to EUR 20 million/company per year. In percentage terms, however, that’s only a 2.6% increase.

The 9,387 baking businesses that each had whole-year sales below EUR 1 million in 2016 still had a market share of 14.54% in 2016. Their number decreased by 413 from 2015 to 2016. Of these, 362 closed their doors permanently, while, 51 successfully jumped into the next-higher sales category.

Smooth-running: The experience, knowledge and skill of the baker’s trade shows in every step of each process performed by our IMPRESSA croissant systems. Effortless punching and turning, precise coiling along with fully automated bending of filled or unfilled croissants. The entire spectrum of coiled pastries – perfection and volume production combined. Find out more www.fritsch-group.com

We look forward to welcoming you to our booth.

Perfection is when it all comes together.

Germany’s biggest baker earned a 2.7% increase in revenues in 2017. Hans-Jochen Holthausen , Managing Partner of the family business, explains how and why.

Keil: Mr. Holthausen, a brief look back on 2017 – how did Harry-Brot fare?

+ Holthausen: We grew in all categories, and will close the year with revenues of EUR 978m. Personally, I was delighted with the growth of around 4% in brand business because it shows that brands also have potential.

+ Keil: Where were these potentials for Harry to be found in 2017?

+ Holthausen: They lay mainly in sliced sandwich bread and mixed bread. Baked products for baking-off also sold very well. Movement in the self-service area is achievable again and again with new product innovations.

+ Keil: Market growth, or joy for one and grief for another?

+ Holthausen: The total market is no longer growing, but our sales have risen from EUR 300m to 900m in the past ten years. That answers the question. However, one thing must be clearly understood, namely that the concentration in the past few years and decades was not a zero-sum game. Sales have disappeared. Let me illustrate that with an example. When Rugenberger Mühle declared insolvency in 1995, the turnover recorded there was DM 220m. One year later, when we totaled the revenues of all the other suppliers, we were only able to

trace DM 160m of it, and the remainder was nowhere to be found.

+ Keil: What is the reason for these vanishing turnovers?

+ Holthausen: There are various causes. Not for nothing is it said that competition stimulates business. Moreover, there are niche products that only this company (Rugenberger) produced and which disappeared from the market with its insolvency. Rugenberger had some real cult products in its range, like their gugelhupf cakes or small toast slices for canapés at Christmas and New Year. These don’t exist in Germany any longer. One or other artisan baker will certainly have sold a couple more bread rolls as a result of the Rugenberger insolvency, but you won’t find the DM 60 million again there either. The same phenomenon re-emerged after the disappearance of Löwenbäcker and Müller-Brot.

+ Keil: Isn’t it possible that some exports also fell by the wayside at the same time? Didn’t the market also become very much more European, if not more global, in the same period?

+ Holthausen: That may certainly explain part of the vanished sales. Another possibility is the shift from shelf to prebake, i.e. baking stations, as well as to central warehousing business.

+ Keil: Going back to Harry-Brot and the year 2017. What did it look like at the baking stations?

+ Holthausen: Slight growth occurred there last year.

+ Keil: Does that mean baking stations have reached their limit?

+ Holthausen: I don’t think so, but growth is greatly dependent on two factors, product innovations and operator quality.

+ Keil: As a supplier, you have little influence over operator quality.

+ Holthausen: The retail has an interest in optimizing their fresh product range, and thereby to bring more frequentation into the markets. Baking stations still offer considerable potential in this respect. Aldi is currently providing clear impetus with its new concepts.

+ Keil: Innovations enliven business – but do they achieve that on a permanent basis, or do they just create small “additional turnovers” again and again?

+ Holthausen: Take high-protein bread. Many people thought it was a passing fad that would die spontaneously. Five years ago, we really entertained this topic only at the request of customers. Today it is one of our permanent success items, we supply double digit millions of packs of it every year, and it is enjoying sustained growth.

+ Keil: What does the situation look like with other trendy fashions like ancient cereal varieties, chia seed etc.?

+ Holthausen: Consumers are open-minded about such things. Chia seed has been talked about for around four years, is enjoying growing popularity, and significant amounts of it are used and sold, either in sandwich bread or in mixed bread. Customers feel good when they buy bread with chia seed. Spelt is another trend product in sliced bread, and anything that sells off the shelf also sells in the prebake area. With topics like emmer wheat or einkorn etc., we naturally hit the limits of communication and distribution sooner or later.

+ Keil: And sooner or later the batch sizes baked with them will probably also become too small and therefore inefficient for industrial processors.

+ Holthausen: In the frozen range, goods go into a deep-freeze warehouse and the required amounts are distributed from there. Large batches are needed in the freshly-baked area to guarantee quality. If I want to market smaller batches, I need deep-freeze in the middle. Our business in Harry is quality and freshness in big batches, and as a result cost leadership as

well. Business with small batches is the reserve of the corner baker who nowadays, like a restaurant chef, creates enthusiasm by what he writes on the menu. He is unbeatable and will remain so, because he knows his clientele personally and bakes what they want.

+ Keil: Is the sales ratio of off-the-shelf goods relative to baking station stable, or is there still a trend from the shelf to the baking station?

+ Holthausen: As I said already, at Harry we had growth in both areas in the past year. The baking station-shelf relation is stable for us at present, but pre-bake as a proportion of the total market is growing. Overall, however, consumption is not rising.

+ Keil: Efforts are currently ongoing at a European level to reduce the salt content of bread. There is an initiative by various retail groups in Austria to reduce the sugar content in own-brand products. Others don’t want any glyphosate in cereals etc. Do you feel patronized by such campaigns?

+ Holthausen: Healthy nutrition should be taken seriously, but it should be enjoyable and should also taste good, otherwise people will move away to other products and the aim will be missed. Self-commitment on the part of the retail is currently beginning in Austria, and everyone has the right to operate his businesses as he sees fit. I don’t feel constrained. We follow our customers’ wishes in the private brand business. We have a free hand in the brand name business, and we do work proactively in these matters instead of waiting until a customer asks. It’s no accident that Harry enjoys the trust and confidence of customers and end consumers.

+ Keil: The retail everywhere is currently involved in expanding its business from the shelf via the baking station and into catering. Do you sense that as a supplier?

+ Holthausen: That’s actually an old topic, but it is gaining momentum. I consider the growth potentials in the catering direction to be very high. Whether any independent retailer will earn money from it still remains to be seen, because a good product range is very service-intensive and highly raw materials intensive, and end consumers remain very price-conscious. But there are exciting design concepts with fresh dishes and fresh baked products. It’s an ongoing trend and offers high growth potential. We must ensure we are there with our frozen products.

+ Keil: More out-of-house consumption means less eating at home – what will suffer as a result of that, prebake or the shelf?

36. - 43. KW

Weizenbrot mit Roter Beete, 500g

Artikelnummer: 4421

Weizenbrot unter Zugabe von Roter Beete gebacken. Aromatisch in der Krume, erdig-würzig in der Kruste. Schöne Färbung im Krumen-Krusten-Verlauf. Gute Frischhaltung.

44. - 52. KW

Weizenmischbrot mit 50 % Weizenmehl, 600g

Artikelnummer: 4422

+ Holthausen: Prebake stations are more likely to profit due to the snack elements, while the self-service area will tend to fall. At the same time, however, it must be remembered that modern products such as baguettes or slices of bread topped like a pizza and sold as self-service products are also a part of bread consumption. These markets show that with good concepts, it is entirely possible to counteract the potential attrition. However, we must be there with our products wherever the customer buys, and that can also be the delivery service or a business that carries out further refinement.

+ Keil: The retail is fighting over the out-of-house market –does that threaten concepts like Back-Factory? What more has Back-Factory to offer as a USP (Unique Selling Proposition) if there is a retailer with a snack stand alongside?

Kräftiges Roggenmischbrot nach „bayrischer Art“ mit Kümmel gebacken. Würzig-aromatische Krume mit deftig-herzhafter Kruste. und Frischhaltung.

+ Holthausen: In the first place, Back-Factory also operates proactively, and as far as the USP is concerned it offers a broad product range, operator quality, quick purchasing, atmosphere and last but not least location, location, location. We take the format wherever there is a large customer footfall. But when a retailer who also offers good snacks opens across the road, we naturally feel it. Anyone who does their shopping there will possibly also buy a snack there.

Sehr kräftig ausgebackenes Brot mit langer Teigführung. Dadurch sehr aromatisch-würzig im Geschmack mit rustikaler Porung in der Krume.

+ Keil: How many Back-Factory locations are there today?

+ Holthausen: We have reached the “round” hundred. We open bigger formats and systematically close smaller ones to keep the outlet quality high. Back-Factory records growth in every respect.

+ Keil: Is there any thought of upgrading Back-Factories into convenience shops?

+ Holthausen: We certainly do already have convenience elements in them. But we don’t want to earn our money by selling chewing gum. On the other hand, I can entirely imagine elements like sliced fruit in our outlets. The question is when or with which product offer will we reach our credibility limits. On the other hand, ten or twenty years ago no-one would have believed that some day Aldi would offer apartments.

+ Keil: Mr. Holthausen, thank you for the interview. +++

The Harry industrial bakery signed a contract with Frank Kleiner (46) as Managing Director for Sales and Marketing, effective as of April 1. Hans-Jochen Holthausen is delighted with the succession plan for the business area for which he was responsible for more than 25 years, and says “Harry has always brought in the best to have the greatest success.” According to the company, graduate business economist Frank Kleiner enjoys a very good reputation in the baked products market and in food retail. He was Lieken AG’s board member responsible for food retail sales until 2013. After that, as Overall Managing Director for Europe and Asia/Pacific, he trimmed the international baked goods group Aryzta AG for growth. The decision to appoint Kleiner was taken with farsightedness: Holthausen agrees with Harry’s managing directors and shareholders that “Frank Kleiner represents continuity in the fresh produce service, potentials in the frozen food market and the company’s further international development.” Hans-Jochen Holthausen (62) will continue to back the company unreservedly as a Managing Partner. +++

The Rademaker approach includes a close co-operation with the end user. We deploy decades of experience to develop the best possible process solutions. The customers’ boundary conditions with regard to ingredients and actual production environment are the basis for all tests run in the Rademaker Technology Centre. Our consistent focus on the customers’ requirements results in specific solutions aimed at the ultimate success of our customers in the market.

Self-proclaimed diet gurus are fond of preaching abstinence. Cereal products, especially wheats, have been a popular bogeyman in this respect for some time. However, only individuals diagnosed as having celiac disease need avoid them completely.

+Persons who do not have celiac disease but suffer digestion problems as a reaction to conventional wheats, and have therefore been forced to avoid wheat flour products up to now, recently benefited from product innovations spurred on by nutritional medicine, e.g. 2ab wheat. This not only features a particularly low FODMAP content (Fermentable Oligo-, Di- and Monosaccharides And Polyols), which is the decisive factor leading to the good tolerability of 2ab products, but also shows that the “one size fits it all” principle – or more accurately “one product for all” – is no longer up-to-date. Arising from this consideration, medical nutritionists like Prof. Dr. med. Christian Sina in Lübeck develop and research science-driven concepts for personalized nutrition, with very promising results.

Lying behind this is the knowledge that the same foods lead to very different metabolic responses in different individuals, as measured by changes in their blood sugar level. Whereas a single cookie will push one consumer’s blood sugar value up to levels high enough to suspect diabetes, another person’s response stays considerably lower. If both eat one banana, the blood sugar response may be similar or different, even in totally the opposite direction. Put simply: each responds to each foodstuff with an individual change in their levels of blood sugar, and thus in their entire metabolism. Prof. Sina says: “That’s why food traffic lights aimed broad-brush fashion at sugar content are not very sensible. They lull consumers into a false sense of security. In the worst case, entirely the opposite effect is attained.”

How is it possible to determine each person’s nutrition type?

Prof. Sina and his colleagues recently founded the startup company Perfood to answer this question. The Perfood program’s core element, named “MillionFriends”, is a 14-day continuous blood sugar level measurement by a chip applied to the skin. In parallel, food is eaten according to a defined plan, and an app-based dietary reporting system is maintained to clearly record triggers and blood sugar responses. The scientists also determine the intestinal flora and specific metabolic products occurring in the test person’s blood, and these together with the blood sugar data are the basis for a selflearning algorithm that will, in the future, also allow predictive statements about “tops” and “flops” in that person’s own diet.

It is now scientifically proven that the composition of the so-called intestinal microbiome, i.e. our intestinal flora, is not only the factor that decides how food is metabolized by the body. The bacterial flora even have a large influence on the hormone balance and immune system. Prof. Sina says:

“Hormones and metabolic products produced in the intestine are at least as important as insulin in regulating the blood sugar level.” In addition, the test persons describe their lifestyle and eating habits in a questionnaire, because the frequency of food intake and the time of day chosen by the person for this have an effect on their metabolism, just like their sleeping pattern, occupational stress, other ailments, medication etc.

According to Prof. Sina, from the wealth of information collected in this way it is possible to derive individual nutritional recommendations that a person can stick to even on a long-term basis, since they require only an adjustment of the

Cereal products, especially wheat and thus also bread, have been demonized as “fattening foods” right across all the public media for many years, and not a few nutritional advisers recommend a breadfree diet. Nonsense is hard to fight against, above all when it can be sold as lucratively as these guidebooks. Bakeries are also well-advised to pass on the information presented here to their customers. If you want to include this article in your customer newspaper, request the Word document at keil@foodmultimedia.de. We will provide you with the manuscript free of charge, and all we ask is that you please acknowledge the source

Every person has his/her optimum individual metabolic pattern that changes only insignificantly during their lifetime. But there are similarities that enable three basic types to be defined. If consumers know their nutritional types, food suppliers such as bakers can signpost and publicize the suitability of their products for different nutritional types. Anyone who thinks that’s all a future dream is advised to take a look at the list of companies who are members of foodRegio (The North German Food Processing Industry Network). It contains many foodstuff providers, who presumably are there not without hope of applications and benefits. Become a part of the network and let the Lübeck experts classify your product range or individual products into three nutritional types.

An example of the dissimilar effects of identical test meals in different individuals. Whereas Person 7 (subject 7) reacts to white bread with high glucose values, the blood sugar level stays at its initial value for Person 4 and 6. In the case of the “oat flakes” test meal, Person 4 in particular responds with a rise in their glucose concentration. Uses of this diagram is permissible only with the consent of Perfood GmbH

individual’s meal plan, not a complete change. Prof. Sina says: “When viewed in the long run, complete lifestyle changes or broad-brush diets simply don’t work because they go against an individual’s life rhythms and habits. Sooner or later, around 95% of all the test persons break off conventional diets or good intentions.” On the other hand, investigation of the individual’s metabolic pattern allows the construction of a nutritional plan that matches the person and his or her habits, life and preferences. Prof. Sina: “After the analysis, we can tell an individual exactly what he personally would do better to reduce, what he can continue to eat and what he should perhaps introduce into his diet plan. Just imagine, you’re standing in a main rail station and are hungry. On the right there’s a cheese sandwich and on the left an apple pie. In this situation, no diet plan will tell you whether you should now reach left or right and for what reason. In this case, a knowledge of your own metabolic type can help you make a decision that is right for you personally.” Prof. Sina is certain that exchanging five to ten percent of their foods will

Analysis of the Perfood data entries showed that the reaction of 25 – 30 of every 100 test persons to eating white bread is a significant rise in their blood sugar value, whereas the blood sugar in this group increases only moderately when rye bread is eaten. On the other hand, more than half of the test persons showed exactly the opposite results. Their blood sugar value shot up after eating rye bread, but hardly at all with wheat bread. Approx. 10% of Perfood’s customers show an almost equal response to the two types of bread. Even though with this number of cases the result may not yet be representative of the whole population of the Federal Republic of Germany, one thing is certain: the same recommendation does not hold true for everyone!

already make a diet right for an individual’s type – a diet with long-lasting effectiveness that can be kept up over a prolonged period. “It is also permissible to deviate from it occasionally, because guests are there or you have a craving for a curry sausage. Knowing about their own nutritional type gives individuals the freedom to actively decide.” However, even tailor-made nutrition does not invalidate a few basic rules. An adequate supply of micronutrients and a sufficient amount of movement must both be ensured. Food intake should also not exceed the individual’s calorie requirements.

How exactly is that calculated? There’s also a personalized solution for that in Lübeck. Over a period of time, from their collected data such as weight, blood sugar level, nutritional report etc., a self-learning algorithm develops exactly the correct number of calories for each person for normal everyday life or even for special situations.

Research in Lübeck now clearly shows that examining a person’s individual nutritional type can help not only with classical diseases of civilization such as obesity, diabetes mellitus and an elevated cholesterol level, but with increasing knowledge will also play an important role in the future in relation to digestive problems such as irritable bowel syndrome or wheat sensitivity. Prof. Sina says: “In fact, we usually eat complex meals, not just single nutrients. That’s exactly why it will be very helpful when we can tell each person individually the things to which he or she should pay attention when putting it all together. The direction is the important thing in this respect, without turning it into a dogma. Eating should continue to be enjoyable.”

Prof. Dr. Christian Sina is the Director of the Institute for Nutritional Medicine at Schleswig-Holstein University Clinic, Lübeck Campus, Germany, and co-founder of Perfood GmbH, a startup company for personalized nutritional concepts and food innovations. +++

Reading Bakery Systems, a member of the Markel Food Group, offers a full line of mixer models and sizes to mix a wide variety of products successfully. The redesigned MX Continuous Mixer is the most versatile mixer and is well suited for a wide range of products.

The Exact Mixing MX Continuous Mixer is the most versatile mixer from Reading Bakery Systems. The mixer is well suited for a wide range of products including cookies, snacks, pastries, croissants, pizza, flatbreads, batters, icings, pastes and more. It is also an ideal first stage mixer for processes that require creme up or pre-blend stages. When the mixer is used with the exclusive Hydrobond Technology from Reading, the continuous process is more efficient and allows for the use of a smaller mixer, which means lower equipment costs and a smaller footprint.

The MX Mixer can also be combined with an optional 2nd stage developer (referred to as the HDX mixing system) to produce higher development doughs for buns (hamburger and hot dog) and sandwich bread.

+ The mixing shaft can be configured with interchangeable mixing elements to mix a wide variety of dough/products

+ Dual clam-shell design for easy sanitation and maintenance

+ Optimizes food safety by ensuring dough is never exposed to the environment

+ Precise and uninterrupted ingredient delivery to the mixer

+ Reduced energy, labor costs, and smaller production footprint

+ Wide range of mixer sizes

+ High efficiency wall and shaft cooling available

+ Dough automatically produced into usable sizes

+ Fully automated operation ensures operators are not exposed to moving parts

+ All access points are interlocked with the control system

+ Only FDA approved materials are used in the product zone

+ Clamshell mixing chamber provides easy access for sanitation and maintenance

+ Quick disconnect, sanitary connections for easy cleaning of liquid ingredient lines

+ All mixing components are clean in place

+ Touchscreen interfaces provided

+ Automated, recipe based controls for all ingredient handling and mixing functions

+ Local, two handed controls for opening main mixing chamber

+ Emergency stop buttons provided around the mixing system for operator safety

+ Monitoring and display of parameter trends throughout the process allows operators real time understanding of the continuous mixing process

+ Process parameters and operating history stored in memory

+ Automatic, manual, and maintenance operation modes

The ability to accurately and consistently meter ingredients into a continuous mixer is critical to the quality and consistency of the product at the mixer discharge.

+ Gravimetric, Loss-in-Weight technology provides precise, uninterrupted dry ingredient metering

+ Mass flow-meters connected to the closed loop control system ensure that the liquid ingredients are accurately delivered in coordination with the dry ingredients

+ Automated dough temperature control

+ Throughput can be automatically adjusted in conjunction with downstream demand or stoppage

This mixing system will be displayed at iba Hall B1. Stand 234. +++

DirectDrive System spirals function the way spiral systems should function; with reduced belt tension, with improved product orientation, with increased load capability. This system eliminates overdrive and makes operation of your mission critical equipment reliably smooth, without interruption.

Technology like this isn’t a luxury. It’s a necessity.

Improved efficiency

Reliable performance

Reduced total cost of ownership

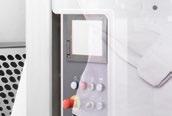

A new plant made by Kitzinger has been washing trays and peelboards in Schäfer’s Berlin factory since February 2018. Performance, durability and flexibility were decisive aspects for the bakery, but above all the plant was required to make do with little space.

+The requirements catalogue with which Schäfer’s combed the market for suitable candidates was definitely challenging. The machine had to be able to clean 1,100 to 1,300 trays/hour. And any number of different trays, because altogether nearly 20,000 of them in 12 different formats* rotate in the company. It had to be able to cope equally well with other items needing to be washed: cake rings, crates, baskets, molds/pans, dollies and especially PlanB peelboards. “Not entirely straightforward,” according to Works Manager Thomas Drews. “Since in contrast to trays, these boards do not dry nearly so well because they are made of plastic and thus do not absorb heat.” However, the biggest obstacle that had to be overcome was the limited space. “Our existing building had no more than 16 meters of length available for the plant.” There were not many machine constructors who could fit this kind of cleaning performance into the really short size of the available space. The company finally decided in favor of Kitzinger Maschinenbau GmbH in Flensburg.

Schäfer’s new investment is a tray washing plant of the contino type. It is 13.80 m long, and is thus a whole 2 m shorter than the length specifications. But it’s not an “off-the-peg” machine. Here are a few of its special features:

+ Adjustment of the machine to differently sized trays or boards takes place via two levers. The first lever can be used to vary the machine’s belt width to accommodate the items to be washed. The second level allows the height of the spray-heads to be adjusted so the jet of water can act in an optimum way on the respective item being washed. No motor is needed for this.

+ The nozzle arms can be dismantled without tools.