The pandemic broke out like a perfect storm that took lives, permeated our most human emotions and sowed such uncertainty that several companies from different industries found themselves adrift.

However, even though the storm has not passed, today's panorama is different. Some markets more than others have been able to give the rudder at the right time and catch the tailwind, taking advantage of the scenarios derived from this and other global situations.

This is the case of the auto parts industry in Mexico, which according to the national association (INA) itself could recover pre-pandemic levels by the end of this year. It expects to close with a production of US$105,121 million, higher than the US$97,228 million of 2019, in addition to generating 870,000 jobs, the second highest figure in the history of the indicator.

In a conversation with the president of the association, Francisco González, several factors explain the fourth position reached by the Latin American country as a world producer of auto parts: from the national human talent, which is still trying to make it more specialized, to free trade agreements trade like the T-MEC with nearshoring trend, as well as the semiconductor crisis itself.

The shortage of chips and the growing demand from different industries after the relaxation of restrictive measures due to COVID-19, conditioned among others by trade relations between China and the United States, reflected the thin threads on which the supply chain hangs today in day. However, that same delay in the sale of cars from Asia propelled the aftermarket due to the usage of parts from used cars from this side of the world.

However, as the Brand Manager of Automechanika and Messe Frankfurt VP, Michael Johannes, stated, it is necessary to think more about solutions for new challenges, and Automechanika Frankfurt realized this. The president of the INA verified it traveling to the fair and encountering innovations around electromobility and digitization.

These latest issues project lessons from this time of pandemic, with sustainability as the driving force of a new era in which the future of electric cars, with their respective auto parts and charging stations, is increasingly. Here is a new challenge transformed into an opportunity to light new horizons in the industry.

Federico Duarte Editor

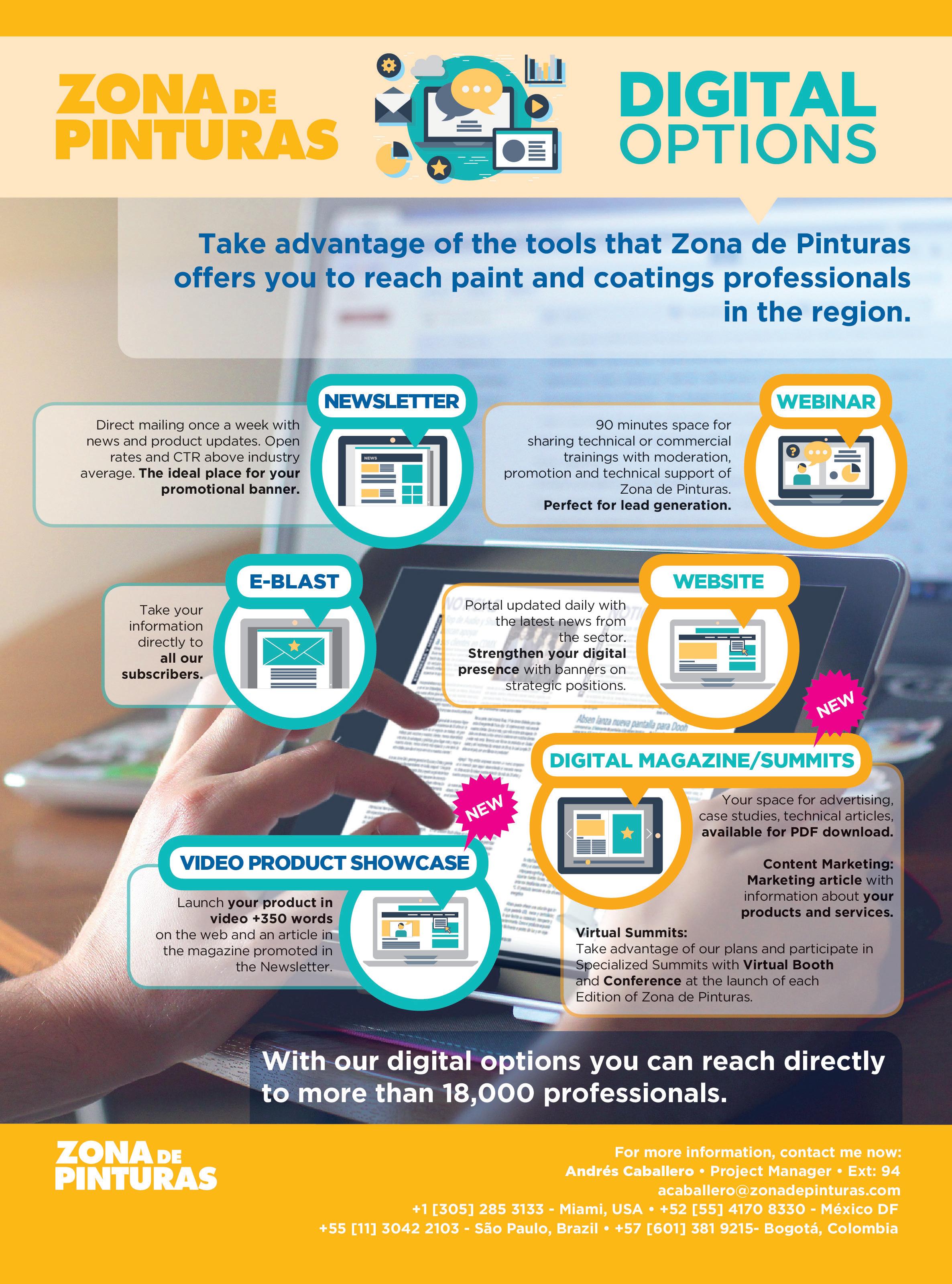

Es una publicación periódica propiedad de Latin Press, Inc.

Producida y distribuida para Latin Press, Inc. por Latin Press Colombia y Latin Press USA

Max Jaramillo / Manuela Jaramillo

EDITOR IN-CHIEF

Duván Chaverra dchaverra@aftermarketinternational.com

EDITOR Federico Duarte fduarte@aftermarketinternational.com

PROJECT MANAGER Andrés Caballero acaballero@aftermarketinternational.com

PUBLISHER Brad Glazer bglazer@aftermar ketinternational.com

ACCOUNT MANAGERS

MÉXICO

Verónica Marín vmarin@aftermarketinternational.com

COLOMBIA Fabio Giraldo fgiraldo@aftermarketinternational.com

DATABASE MANAGER Maria Eugenia Rave mrave@aftermarketinternational.com

PRODUCTION MANAGER Fabio Franco ffranco@aftermarketinternational.com

LAYOUT AND DESIGN

Jhonnatan Martínez jmartinez@aftermarketinternational.com

FRONT PAGE Nastasic - Canva

OFFICE PHONES:

Latin Press USA Miami, USATel +1 [305] 285 3133

Latin Press México Ciudad de México Tel +52 [55] 4170 8330

Latin Press Colombia Bogotá, Colombia Tel +57 [601] 381 9215

São Paulo, Brasil Tel +55 [11] 3042 2103

The opinions expressed by the authors of the articles in this journal do not commit the publishing house.

Por Aftermarket International

Por Aftermarket International

Three Venezuelan businessmen tell what it has been like to build a brand and make themselves known in the US aftermarket.

The auto parts industry is a chain that requires the synergy of different components to be activated. The semiconductor crisis showed this by affecting the availability of new cars, something that was especially evident in the Latin American market.

The in-depth knowledge of this market is a plus with which professionals from

this region have arrived to provide greater dynamism to the machinery of the industry in the United States.

However, the work to promote a brand, carve out a space in marketing positions and project unforeseen horizons is synthesized in stories of strength, perseverance and a lot of dedication. Here are some of them.

In February of this year, Gabriel Garrido celebrated 30 years in the heavy vehicle industry. His origins go back to the city of Valencia, in Venezuela, where he started working in a wholesale company called Suspenco, in which he remained until 1999.

On August 26, 1997, he founded his own company called RDV Venezuela, which recently celebrated 25 years as a truck parts wholesaler in Venezuela. However, on November 2, 2002, he created in Miami the company initially called Master Parts, which functioned as the purchasing office for RDV Venezuela in the US until 2008.

That year, on July 28, 2008 (the dates are fixed in his memory and are important to him, as they represent the beginning or end of a stage), he moved with his wife and three children to Miami.

There he rented his first warehouse and started in the market with the name of Master Parts. However, a California law firm called him indicating that he could not use that brand that he had already been using, so they gave him time to change it.

The acronym MP was already part of the logo printed on the distribution boxes, so I kept thinking of a name that would be in

tune with them. Once, when boarding a plane on the way to China, a Colombian client who had received his name in Spanish called him, alluding to the “más partes”.

This made Gabriel communicate with some of his partners, asking them what it could mean if he added an 's' to the 'más' and left the base complement of 'parts', which resulted in 'Mass Parts'. The 'mass' itself,

A business of several generations

Precisely, next December marks the tenth anniversary of the establishment in Miami of Braico Group, a venture by another Venezuelan in the 1960s. His son-in-law, José Luis Bruno, is the current CEO of the company.

For more than half a century, the company has been purely dedicated to the auto parts market. Although it has an inventory of around 3,000 items, it manages two large product lines: the segment of transmission belts and conveyor belts for the automotive and industrial market, from the Japanese brand Bando, as well as professional tools through Jonnesway brand.

“Physically we work at the level of distributors and wholesalers; we do not serve the public directly,” explains José Luis, who asserts that although the company maintains operations in Venezuela, it has expanded to new borders: the Caribbean, South Florida, as well as parts of Central and South America. These markets, in his opinion, have been quite affected by the pandemic, despite finding some signs of recovery.

"The business format that is used in many Latin American countries, including Venezuela, is very different from the business format that exists today in the United States," says José Luis, who points out that they have had to open

up to online sales and develop specialized stores for their products.

It is part of the new times to which this family-type company has had to adapt, which always stands out as an effort of more than 50 years. He is currently supported by his brother, Gabriel, and his son, Luis Alberto.

"We are facing great changes, going through difficult times, at the level of everything we have experienced in recent years," says José Luis, pointing to the global problem of supply chains.

"Production is not in line with demand and we are seeing delays in dispatching orders, which I have honestly never seen in 22 years," he points out as one of the factors that does not allow for a better sales position.

“Hardly today you get a new vehicle. Easier, the new engines tend to have smaller belts, because there are fewer components, and we are moving towards the world of electrification”, he comments on a trend that, in his opinion, remains to be seen if it materializes during the next 10 to 15 years.

It is an era that Luis Alberto, who would be the third generation in charge of the company, may have to assume. "Some times that I find hard to believe, but obviously the big companies are investing heavily in that," he notes.

More than 25 years ago, Milagros Méndez also came from Venezuela to the United States. She came to practice her law career. However, a friend of her, a mechanical engineer, called from Venezuela to ask her for help with some poorly prepared orders from her supplier in the United States.

“But I know absolutely nothing about this; Talk to me about the law, but not about spare parts,” Milagros replied. "Don't worry; I will teach you step by step”, he told her on the other side of the line.

Thus, Milagros learned where to get sensors, which was the best factory, how to test them. With each indication, she delved deeper into the aftermarket world, becoming passionate until she could not sleep, and finding boxes from suppliers that flooded his house, and that she took out through two or three containers per week to Venezuela.

At one point, she had to acquire a 1,000-square-foot warehouse in El Doral and hire a lady to help her pack when large orders arrived, already from an even larger distributor in Venezuela. Over time, this distribution would be extended not only to sensors, but also to water pumps, gasoline, modules and coils.

During an AAPEX fair, an important client from Mexico asked her to distribute his product, for which he inquired about her brand. Ramco Automotive (located in booth A3867 of this version), registered since the beginning of the last decade, was born in her mind at the beginning of this century

a few months after the death of her father: Ramiro Méndez. The first letters of her name became the basis for it, to which was added the 'co' suggested by a friend, "because that's going to be something big."

Ten years ago, her old friend, Clarisa Gianelli, also traveled from Venezuela to Miami looking for better opportunities. She found Milagros with only the client from Mexico and the distribution in Venezuela, where she had just lost an important producto lot because of a partner who disappeared.

Immediately, Clarisa, who had knowledge in the logistics area from her experience in a printing company in Venezuela, began to compile a wide list of distributors not only in Latin America and the Caribbean, but even in Europe. Thus, the company took a second wind of expansion, to the point of opening up to the United States market thanks to The National Performance Warehouse Companies (NPW), which highlighted the quality of its product.

In this country they have 25 employees, most of them women, whose presence they want to reaffirm in "a closed world of men", as Clarissa affirms, who maintains that within the United States it is the only company with its own brand, certified by Miami-Dade SBE & LDB, led by Latin women. For this goal, they have had the valuable support of Tammy Tecklenburg with her company Dott, which, in the words of Milagros, has been "a reliable voice in navigating the industry and fundamental to our recent success."

By Federico Duarte Garcés Editor de Aftermarket International

By Federico Duarte Garcés Editor de Aftermarket International

In an exclusive interview, the president of the INA gave us his impressions on what the last INA PAACE fair left, as well as the impact of the T-MEC together with nearshoring and the generation of talent to surpass Germany and be the fourth world producer of auto parts.

Since January of this year, Francisco González assumed the executive presidency of the National Auto Parts Industry of Mexico (INA), with which he represents the interests of more than 900 companies in the country. For more than 20 years he has promoted Mexican industries by serving, among others, as CEO of Bancomext and ProMéxico.

This year he was at the head of the twenty-fourth INA PAACE Automechanika Mexico. This served as a reunion of the different members of an industry that, as stated at the opening, is the main generator of net foreign exchange for the country, in addition to producing around 900,000 jobs per year (according to the INA, during the first semester of 2022, the auto parts sector employed more than 850,000 people).

Francisco González Presidente de INAIn conversation with AFTERMARKET INTERNATIONAL after the event, he revealed that the event satisfied 99% of the participants. Among them were companies throughout Mexico, apart from the presence of 16 countries with some 70 stands on the exhibition floor, which had around 10,000 daily visitors.

"So, although it is a fair that is starting again after Covid, we are still the

largest fair in Latin America regarding aftermarket and refractions," he told us in an exclusive interview.

Among the most outstanding technologies during the fair, he highlighted the electrification part, “but in three senses: in the first electric sense; electric cars from all over the market that exist around it; the combustion part, which obviously includes combustion, and of course the electrification part; and plug-ins, which are starting to have a very important success”.

Among the most outstanding technologies during the fair, he highlighted the electrification part, “but in three senses: in the first electric sense; electric cars from all over the market that exist around it; the combustion part, which obviously includes combustion, and of course the electrification part; and plug-ins, which are starting to have a very important success”.

Among these, he highlighted the use of green hydrogen, “but specifically the important part of sustainability of cars; we are seeing that nothing else matters, that it does not contaminate at the time of use, but in manufacturing”.

Precisely, during the fair, an understanding and collaboration agreement was signed between the INA and the Association for Manufacturing Technology to disseminate the best training and technology practices of the manufacturing industry in Latin America and globally.

“This association has a very important impact because

they have state-of-the-art technologies; it means that it is advanced technology, which increases productivity”, remarked Francisco González.

“The issue that it also includes is the part of sustainability, because what we are strongly promoting are production technologies 4.0, which have to do precisely with the efficiency in the lines,” he stressed about an association that offers courses and conferences that they provide information on the latest technologies to those on the production lines.

they reminded him, could refer to mass, volume (outside of being the abbreviation for the state of Massachusetts). Gabriel called his lawyer to check the availability of the name in the system, and immediately went to register it.

In this way, Mass Parts began its path in the US market, in a 1,000-square-foot warehouse, which now reaches 25,000 square feet. In the beginning it had emerged to supply his company in Venezuela and grow in Central America. However, today 60% of its total sales correspond to the United States and 40% to Latin America, with sales not only in Florida; also in Texas, Alabama, Georgia, among other American states.

“There we are growing; It is not easy due to the extension of the United States market, a country that is logistically

very complicated, but we are here to continue growing and being successful”, says Gabriel about the Mass Parts business as a distributor of spare parts and accessories for trucks.

“We have been committed to offering our clients highquality products at competitive prices since 2010,” he adds, referring to the year in which he created his third company in Bogotá, under the name of RDV Colombia. Both this and RDV Venezuela are managed by his brother, Leonardo Garrido.

About 20 employees work there, the same number as the Miami-based company that, despite global situations and local challenges, maintains the perspective of continuing to expand and have more events to celebrate, such as its 50th birthday next December.

Among the topics that brought together the most important leaders in the industry was also the circular economy, the increasing penetration of electric vehicles, as well as the development of talent in Mexico.

“We have an important production, if it can be said like that, of engineers in Mexico; of also technicians, of different trades and capacities, precisely because the industry is absorbing them”, González commented in relation to one of the four factors that explains the position obtained this year by the Latin American country as the fourth largest producer of auto parts in the world (in 2021 manufactured automotive components worth 94,778 million dollars) and the main supplier of the United States.

Francisco pointed out that a next factor is that the level of complexity of the automotive industry in Mexico is great; “complexity in a good way, not as something very difficult, but very structured”.

“The auto parts production plant in Mexico, the companies established here, produce practically all the defense automobile, with tires, glass and others; there is a synergy and knowledge of the different materials and necessary processes”, he indicates, and points to materials such as textiles, plastic, rubber, as well as steel, aluminum and manganese in terms of metalworking.

The third factor, which in his opinion is the most important, is the free trade agreements that Mexico is part of; especially the Treaty between Mexico, the United States and Canada, the so-called T-MEC. According to him, this increased the need for auto parts from 62.5% to 75%.

Recently, in a panel on the automotive revolution, the general director of the INA, Alberto Bustamante, detailed this aspect by pointing out that with the rules of origin of the T-MEC a new regional content value (VCR) was reached by passing 62.5%. to 75% for light vehicles, and from 60% to 70% for heavy vehicles.

The INA has forecast for this year, with information from IHS Markit, that while Mexico's imports of auto parts from the United States and Canada would be 34.8 billion dollars in 2022, Mexican exports to those countries would reach US$79.5 billion this year.

Finally, Francisco González raised as a fourth point the delay in the sale of cars from Asia due to the semiconductor crisis. "Then the cars that one had, the old cars, well, you have to keep them fit, and you must have the corresponding auto parts."

"All this has driven the auto parts market to grow, reaching fourth place, surpassing precisely Germany, and keeping us looking for third place at some point," he asserted.

In one of his weekly columns in a Mexican newspaper, the president of the INA referred to the phenomenon of nearshoring (a model for the transfer of production processes to a country close to its target market) as the great opportunity for the auto parts sector in Mexico.

When asked about this trend, increased by events of the global situation such as the pandemic and the conflict between Russia and Ukraine, he stated that “nearshoring is precisely taking advantage of the synergy of the T-MEC”.

“This synergy that can bring us great advantages, because instead of producing in another country, it is required to have the integration of North America. Obviously, the part of the politics between China and the United States plays an important role. We know that it can have clear advantages to be able to have this growth of greater investment in Mexico”, he assured.

Immediately afterwards, González recalled the blockage in the Suez Canal of the cargo ship Ever Given, which froze nearly US$10,000 million of daily trade. "Having your production nearby helps you avoid problems like this," he said.

When asked about what he foresees in the industry for the end of this 2022, the president of the INA pointed to a very clear growth in production, of the order of nearly US$103,000 million, which would mean surpassing last year's record.

"We hope for a successful end of the year, and obviously arming ourselves for the next expo, which we believe will be very strong," he said, noting that many companies absent this year due to certain complexities of COVID-19 will be able to attend. "It is a fact that we are going to have more leading companies," he stressed.

Finally, when asked about what must happen so that Mexico continues to climb positions as a world producer of auto parts and approach the podium currently

occupied by China (US$470,000 million), the United States (US$228,000 million) and Japan (US$172,000 million), he stated that the key continues to be the development of talent.

“There is quite a lot, but more is being required, and more specialized in the part

of new electrification technologies. We need people who handle electricity in the car, who handle fluids in the car, and that specialization is developing in Mexico. So having a significant base of developed talent, I think we can get to the next levels, along with the entire industry in North America,” he concluded.

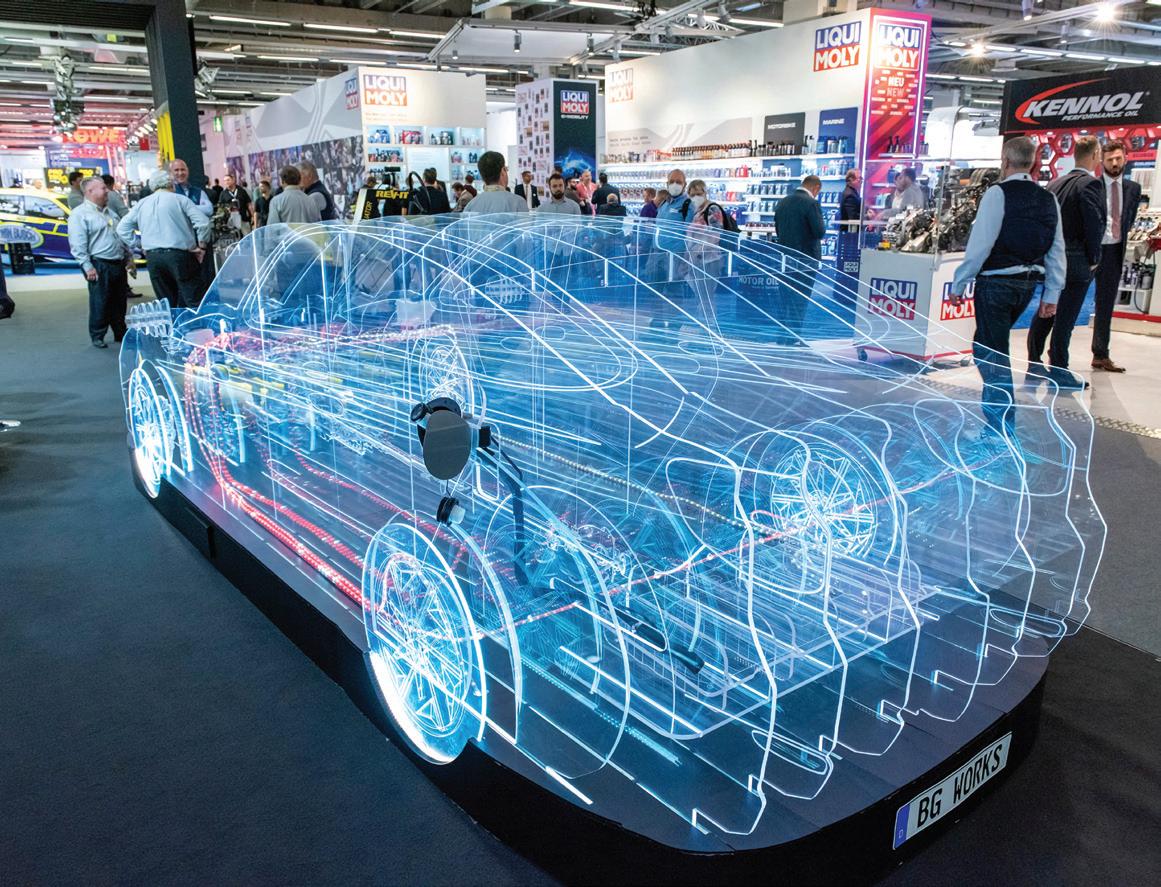

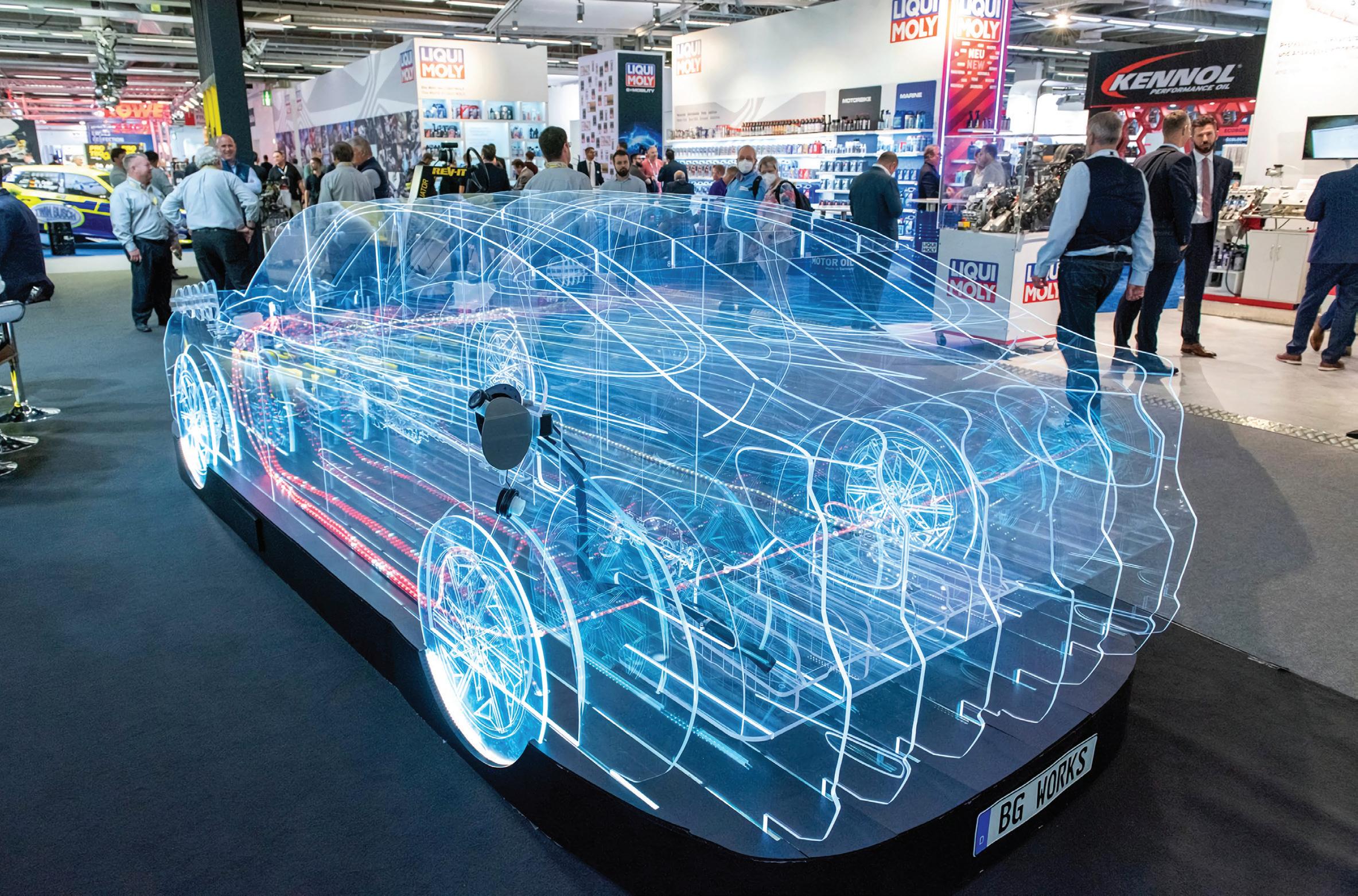

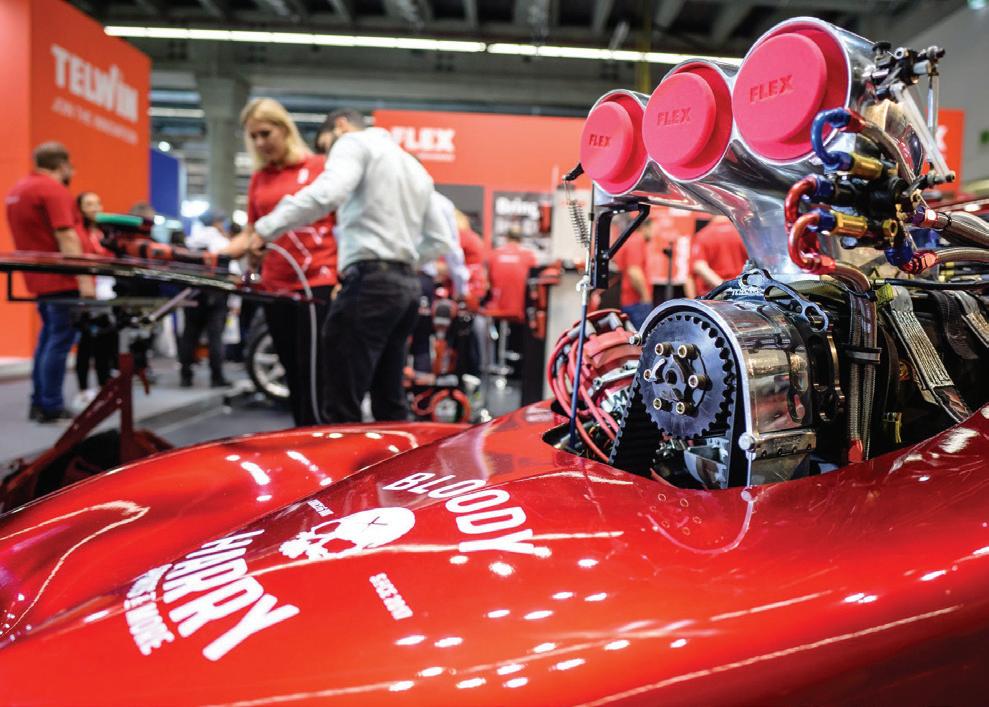

Visitors showed great interest in the new 'Innovation4Mobility' showcase, which covered topics such as battery technology, alternative powertrains, hydrogen, solar technology, e-commerce and connected vehicles.

For five days, 2,804 companies from 70 countries exhibited their products and services on 19 floor levels and in the open-air exhibition area of Automechanika Frankfurt.

The expo also had a space to celebrate pioneering innovations in the industry chosen by a jury of 14 members, including for the first time experts from the US, South Africa, Turkey, the UK and Australia (see box 1).

“Automechanika made two things very clear: firstly, even in an increasingly digital world, it all comes down to people; talking to someone in person, visiting a booth, walking through showrooms, even shaking hands – none of these things can be replaced.

Second, the transformation of the industry has continued to accelerate. Fields such as digital workshop services and alternative drive systems, for example, are more important than ever.

As a forum for promising fields like these, Automechanika will be even more important in the future, because expertise is absolutely essential if workshops and dealers are to continue to play an important role,” said Peter Wagner, Managing Director of Continental Aftermarket & Services at the end of the world fair, whose last face-to-face version had been in 2018.

Hence the expectation expressed a few days ago by the Brand Manager of Automechanika and Messe Frankfurt VP, Michael Johannes, who in a conversation with AFTERMARKET INTERNATIONAL (see box 2) expressed his optimism about the reunion of the industry at the Frankfurt fairground.

“I must admit that we have never had so much content from the show and never before have we had so many applications for the Innovation award, which shows us that Automechanika Frankfurt, which is the leading platform for the automotive aftermarket, certainly needs our customers and they are very happy”, he expressed, aware of the high expectations surrounding the return to face-to-face attendance at this event.

Already the versions of Ho Chi Minh, Istanbul and Mexico had

set the bar high. However, the 92% level of satisfaction that the surveys reported in the end reflected the good feelings of the 78,000 visitors from 175 countries as they passed through the exhibition space of the German city.

The fair reflected the topics on which the industry has set its sights in recent years: the increase in digitization, remanufacturing, alternative propulsion systems and electromobility.

The winners of the Innovation Awards were chosen from a total of 133 candidates. The products and solutions presen ted were evaluated by an international panel of 14 experts. They examined various criteria, including degree of innova tion, cost-effectiveness, ease of use, functionality, relevance to the aftermarket, safety and quality, as well as contribu tions to environmental protection and sustainability.

As Messe Frankfurt Senior Vice President Stephan Kurzawski said at the award ceremony: “Innovations are the focus of Automechanika. Over the next few days, more than 2,800 exhibitors will present their latest products and services, many of which are world firsts. In recent years, new smart products and solutions have been developed at an astoni shing rate. This once again highlights the wealth of innova tion on offer in the international automotive aftermarket.”

This year's award-winning products revealed a clear focus on digitization, new mobility and sustainability. The winners included smart solutions for workshops and automotive te chnology, including an app that allows you to quickly and reliably find and order spare parts, compatible online sys tems for damage diagnosis, and a Bluetooth color scanner

that can identify colors and use a datable to supply the co rrect paint-matching formula in seconds.

Prize winners included a fast charging station with a maxi mum power output of 240 kW and a system to reduce bra king torque.

The German company GelKoh GmbH participated in the trade fair for the first time this year. It obtained both the Innovation Award in the Workshop and Service Solutions category and the Green Award, to honor the most ecologi cally sustainable innovation among the products presented, thanks to 'LiBa Rescue', a recovery system for electric cars that helps conserve resources.

GelKoh GmbH Technical Director Markus Kohten said: “The trade fair was very good for us. We were able to meet many of our clients here, including major corporations like insu rers, car dealers, recovery companies, even people from the fire brigade – 90% of our target groups, in other words. We are very particular about the trade shows we participate in, and we are already considering participating in the next Automechanika.”

For the first time, more than 350 events were offered, including introductions to new market members and free workshops for automotive professionals.

“In these turbulent times, the industry needs new knowledge and new ideas. After all, the goal is to ensure that everyone can enjoy safer, more sustainable and environmentally friendly mobility in the future”, explained Messe Frankfurt CEO Detlef Braun.

Michael Johannes highlighted the transfer of knowledge as one of the main themes of Automechanika Frankfurt. Hence, he stand out the importance of the conferences, debates and presentations given as part of the Automechanika Academy program.

“We have so many workshops and you have the best professionals showing the trainees or participants how things can be solved,” he said. “The industry is moving so fast, it is changing so fast (…) You have to learn, you have to go with the challenges, with the disruption, with the digitalization of the industry”.

Automechanika Academy focused on four stages: Future Workshop 4.0, Bodywork & Paintwork and Classic Cars, Car Wash & Care and Detailing and Innovation4Mobility. The latter brought together experts and speakers talking on alternative propulsion systems, electric mobility, digitization, e-commerce, solar technology, connected vehicles, hydrogen, battery technology, among others.

In turn, the organization was surprised by the number of young visitors who attended the trade show to learn more about the training and career opportunities offered in the automotive aftermarket.

This year marked the first time that the newly established association Talents4AA, a non-profit organization that aims to attract talented specialists and newcomers to the automotive aftermarket, appeared at Automechanika Frankfurt.

His appearance was a great success: the association significantly increased its membership list during the five-day event.

Talents4AA General Secretary Stéphane Freitas said: “The trade show was an excellent networking opportunity and the association received excellent feedback from its industry members.”

“ADI, Bilstein Group, Continental, Misfat Group, NRF and SKF are some of the companies that officially joined the Talents4AA initiative during Automechanika Frankfurt. I am sure that we will welcome many more new members after the fair ends”, added Freitas.

On the effects of the pandemic, the war in Ukraine, climate change, the energy and supply chain crisis in the auto parts industry

Of course we have a lot of problems in the world and you mention them: it's not just the pandemic, it's not just the war between Russia and Ukraine; it is also the inflation in the different countries and the deflation of the currencies, as well as important problems in the supply chain. Therefore, there are many challenges not only for the automotive af termarket.

That said, many companies try to develop new products. There is also a lot of digital business, and I think if you come to Automechanika Frankfurt you will find a lot of new solu tions to the different problems, the different challenges that we have, and this is exactly what the industry needs.

About the industry in Germany

I think that, in general, the German auto parts market is doing well. At least the figures from the markets are showing us that companies are making money.

In the aftermarket, of course, we said that there are many challenges and there will be winners and losers, and compa nies that cannot adapt to certain standards to be innovative. Surely there will be more difficulties in the future to measure up to the speed of the market.

The automotive aftermarket industry is a global operating industry and over the past few months and last year we have learned how important it is to be a part of the global market due to production in different countries, develop ment in different countries, needs in different countries.

They have to adapt to the situation and I always said that coun tries like Mexico, or even South America, can adapt to the cha llenges of the industry and the automotive aftermarket.

But I especially think that when we talk about Automechanika Frankfurt, we are not referring to an event purely for Europe to show its products to Europe. Automechanika Frankfurt has always been the leading trade fair for doing business with different regions of the world, different countries.

In the words of the Brand Manager of Automechanika and Messe Frankfurt VP

Hence a lot more business has been done in the past be tween, say, South America and South Africa, or Brazil and China, and these meetings and this business have been done in Frankfurt. So when we talk about Automechanika Frankfurt, it is really important that companies understand that they are not only serving the German or European market.

In Frankfurt the whole world is gathering, with about 70 countries exhibiting and we don't know how many coun tries will come as a visiting nation. In 2018 we had 181 countries; human beings who came from 181 countries to Frankfurt.

If you have a new product, if you develop something, then it is certainly necessary to show your product. It is better to come to Frankfurt for five days and show your product than to try to travel around the world for five months and try to explain and sell it.

About the commitment to sustainability For companies that are involved in the aftermarket industry for their products, it becomes really vital that they go green at a certain point.

This is a political will (Green Deal), but it is also a kind of mentality these days that we have to understand that we have to do something for our planet; otherwise we will all suffer.

So it's not just a trendy theme or catchphrase for us; it is really important how we, as Automechanika Frankfurt, show ourselves as part of the market as a neutral platform. We are doing many things to become carbon neutral.

We are doing a lot to make our shows sustainable, as our cus tomers are doing the same in the automotive aftermarket; it is not only their products but also the companies that, at least here in Europe, are trying to be more and more sustainable.

From November 22-24, 2022, the international automotive industry will meet once again at the Dubai World Trade Center to explore new business opportunities and scale new heights.

According to the organizers, after a hugely successful edition in 2021, Automechanika Dubai is ready for a much bigger show in 2022.

Despite the challenges of COVID-19, Automechanika Dubai 2021 brought together 20,574 visitors from 129 countries, with 578 exhibitors from 47 countries and 12 official pavilions. The exhibitor survey indicated that 95% of exhibitors will return for this year's version.

This will be a space for representatives from different countries to reconnect and engage in serious business talks, sign new deals, explore new partnerships and stay up-to-date on the latest market trends.

Sub-Saharan Africa's auto parts

market is poised for a decade of growth, according to a report commissioned by Messe Frankfurt, organizer of Automechanika Dubai.

It advises industry players to monitor emerging opportunities on the continent and move fast to seize first-mover advantage.

The report points to Africa's growing population as the engine of growth. The continent is expected to be home to 2.4 billion people by 2050 and Africa's working-age population, a key driver of economic growth, is expected to grow exponentially, surpassing China's by that year and three times that of European Union.

“In the automotive context, this means a huge demand for the transport of people and goods, especially around the ever-growing urban centers of the continent,” the document states.

The study predicts that Africa's current vehicle fleet of around 50 million

units will grow substantially over the next decade, with the vehicle fleet in key markets more than doubling to 2040, when most of the growth continues to come from of imported vehicles.

“Used vehicles depend on the US and Europe in West Africa and Japan in East Africa, which means that the type of vehicles and their characteristics are likely to change. Furthermore, its source may also change as fleets in other emerging regions grow,” the report adds.

Automechanika Dubai Show Director Mahmut Gazi Bilikozen said that Dubai has long been the supply hub for Africa, “and for the automotive aftermarket, Automechanika Dubai is seen as the hub of origin for new products, services and trade associations”.

“The dedicated AfricaConnections section of the show, which connects African buyers with global suppliers, is a front-line business enabler to take advantage of these emerging opportunities,” he said.

The 17th Automechanika Shanghai will move to the Shenzhen World Convention & Exhibition Center from December 20 to 23, 2022 as a special arrangement.

The relocation gives attendees more flexibility in their planning and will allow the show to meet industry expectations for in-person trade and business meetings.

The facility offers state-of-the-art infrastructure that can accommodate the show's expected 3,500 exhibitors from 21 countries and regions.

General Manager of Messe Frankfurt, Fiona Chiew, said: “As organizers of such an influential show, our top priorities are protecting the well-being of the participants and stimulating market activity.

Therefore, holding this year's fair in Shenzhen is an interim solution while the Shanghai market continues to evolve."

“It is a good alternative for Automechanika Shanghai thanks to the city's position in the automotive industry

and the venue's integrated exhibition facilities,” added.

On the other hand, the general manager of China National Machinery Industry International, Li Zhang, assured: "In addition to speaking with various organizations and support partners, we understand that many exhibitors and buyers are eager to reconnect."

“The determining factors for the relocation of this year's fair are the feedback from our customers and the market information that we have carefully examined. I would like to thank all of our stakeholders for supporting the movement and look forward to welcoming everyone to the fair in Shenzhen,” said Zhang.

Shenzhen is a technology hub contributing to the Greater Bay Area's automobile manufacturing cluster. As one of China's leading trade complexes in the region, the Shenzhen World Convention & Exhibition Center will play host to Automechanika Shanghai – Shenzhen Edition.

Latin America. The meeting between U.S. Secretary of State Antony Blinken and Mexican President Andrés Manuel López Obrador left an invitation to the Latin American country to join the U.S. plan to promote electromobility.

After the closed-door meeting, the Mexican president highlighted on social networks: "Productive and friendly meeting with the Secretary of State, Antony Blinken and the Secretary of Commerce of the United States, Gina Raimondo."

However, it was the Mexican Foreign Secretary, Marcelo Ebrard Casaubón, who gave details of what was discussed in this meeting. According to Ebrard, the US Secretary of State invited Mexico to participate in the development of its infrastructure program to produce semiconductors or chips linked to electromobility.

"The invitation was made to Mexico to the new investment package that the United States has just announced in

semi-conductors, electromobility," said Foreign Minister Ebrard.

Faced with this, López Obrador informed Blinken about the Sonora Renewable Energy Plan to establish in that entity the national exploitation of lithium and clean energy.

Although there was some expectation for some statement regarding the differences caused by the call for consultations by the United States and Canada regarding Mexico's energy policy within the framework of the Free Trade Agreement between Mexico, the United States and Canada (T-MEC), the foreign minister said that there was hardly any space for that issue.

According to the National Auto Parts Industry of Mexico (INA), in the last 23 years, the USMCA has attracted a foreign direct investment of 83,883 million dollars for the automotive sector, of which US$48,347 million belong to the auto parts industry. This has led to the creation of 875,000 direct jobs.

Mexico is the main supplier of auto parts to the U.S., with 36% of that country's total imports coming from Mexico. This equates to $80 billion at the end of 2022, according to the INA.

"With the USMCA and other factors, the so-called nearshoring has been detonated, which further encourages the arrival of new investments, mostly from Asia," the institute says.

Internacional. Annual sales increased by 11.1% over the previous year, while domestic sales in equal stores increased by 8.4%.

AutoZone has reported net sales of $5300 million for its fourth quarter (16 weeks) ended August 27, 2022, an increase of 8.9% over the fourth quarter of fiscal 2021 (16 weeks). Domestic same-store sales, or sales of stores opened for at least one year, increased 6.2% in the quarter.

"Our results are a testament to our AutoZoners' continued commitment to providing exceptional customer service every

day. Our retail business performed well this quarter, ending with positive same-store sales in addition to last year's strong performance," said the company's President and Chief Executive Officer, Bill Rhodes.

The executive added: "The growth of our commercial business continued to be exceptionally strong at 22%. The investments we have made in both inventory availability and technology are improving our competitive positioning. We are optimistic about our growth prospects ahead of our new fiscal year."

For the quarter, gross profit, as a percentage of sales, was 51.5%, a decrease of 73 basis points compared to the previous year.

The decrease in gross margin was driven by accelerated growth in AutoZone's commercial business and a non-cash LIFO charge of 28 basis points driven primarily by increased freight costs.

Operating expenses, as a percentage of sales, were 30.9% versus 31.0% last year.

Operating profit increased 5.7% to $1.1 trillion. Net income for the quarter increased 3.1% from the same period last year to $810 million, while diluted earnings per share increased 13.4% to $40.51 from $35.72 in the quarter of the prior year.

For the fiscal year ended August 27, 2022, sales were $16.3 billion, an increase of 11.1% over the previous year, while domestic sales in equal stores increased 8.4%.

Latin America. Latin America. According to projections by the Ministry of Finance and Public Credit (SHCP), this subsector will maintain its positive trend during the second half of the year, registering fewer closing days in automotive plants in the country due to the shortage of semiconductors.

The U.S. Department of Commerce projected 6.9 percent year-over-year growth in both Mexico's auto parts production and exports by the end of this year. This would mean 83,900 million dollars on account of shipments abroad.

According to the National Auto Parts Industry (INA), Mexican exports of auto parts went from US$81 billion in 2019 to US$64.8

billion in 2020 and US$78.5 billion in 2021.

Key to this was the entry into force as of July 1, 2020 of the Agreement between Mexico, the United States and Canada (T-MEC). It requires that 75% of the contents of a vehicle (70% in the case of heavy trucks) be produced in North America, and that the basic parts of the cars come from the United States, Canada or Mexico.

At the same time, the nearshoring phenomenon resulted in the arrival of foreign investments that seek to take advantage of the conditions of the USMCA to bring production processes closer to their customers in North America.

The USMCA was the first of the six points

Internacional. The deal closed on September 12 and the location was renamed Johnny's Auto Parts. It is the second Johnny's Auto Parts branded store in South Florida.

NPW, now at its new facility in Miami, Florida, has announced its second acquisition and expansion in South Florida in 2022 with the addition of Hi Tech Auto Parts.

Johnny's Auto Parts is known for having large inventory, free delivery, and machine shop services. It will expand its capacity to better serve installers in the North Miami area.

NPW Chief Operating Officer and Executive Vice President Chris Pacey said, "We are pleased to have Hi Tech under the NPW umbrella."

"We have the original Johnny's Auto Parts, the largest volume independent parts store in the Southeast, and to create, maintain and expand this wellknown brand we chose to expand that name. So, we called this location Johnny's Auto Parts #2," he said.

"We look forward to working with the great people Hi Tech has brought and expanding the business," Pacey said.

that the president of the INA, Francisco González, raised at the press conference about the situation and perspective of the automotive sector held today in conjunction with the Mexican Association of the Automotive Industry (AMIA), the National Association of Producers of Buses, Trucks and Tractors (ANPACT) and the Mexican Association of Automotive Distributors (AMDA).

According to the Commerce Department, assembly plants prefer suppliers located nearby to minimize inventory volumes and facilitate on-time deliveries.

Component-related auto parts for Tier 2 suppliers represent the most exported items from the United States.

For its part, MACS is a leader in providing training in best practices and subject matter expertise on mobile air conditioning and climate control for individuals and service workshops.

MACS members have access to the latest changes in the mobile air conditioning industry and technological advancements that companies like CYTK are innovating, helping mobile air conditioning technicians provide their customers with best-in-class service and experience.

"Auto repair technicians (including mobile repair technicians) are experiencing an ever-changing landscape in vehicle technology, combined with a population of obsolete vehicles," states CYTK founder and CEO Bryan Levenson.

International. The two partners will provide natural language processing and machine learning technology to help mobile technicians.

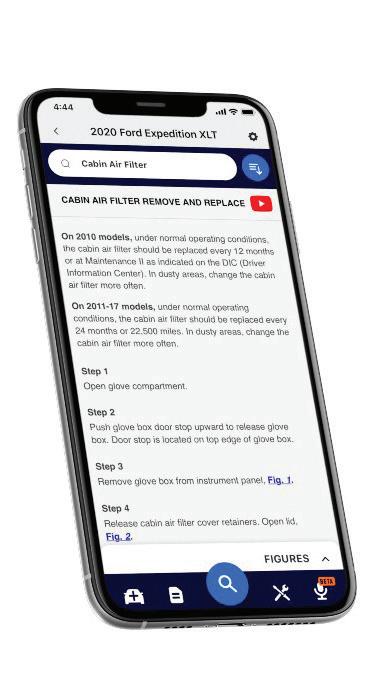

CYTK has announced a strategic partnership with The Mobile Air Climate Systems Association (MACS). Automotive technicians refer to CYTK.io as a comprehensive, frictionless mobile repair search app available on a smartphone (iOS or Android).

CYTK provides comprehensive mechanical repair content, allowing technicians to access a wide range of information about automotive parts and repairs through keyword search, touch, or voice (hands-free) on their smartphone. In this way, they can stay next to the vehicle or in the place where the customer is.

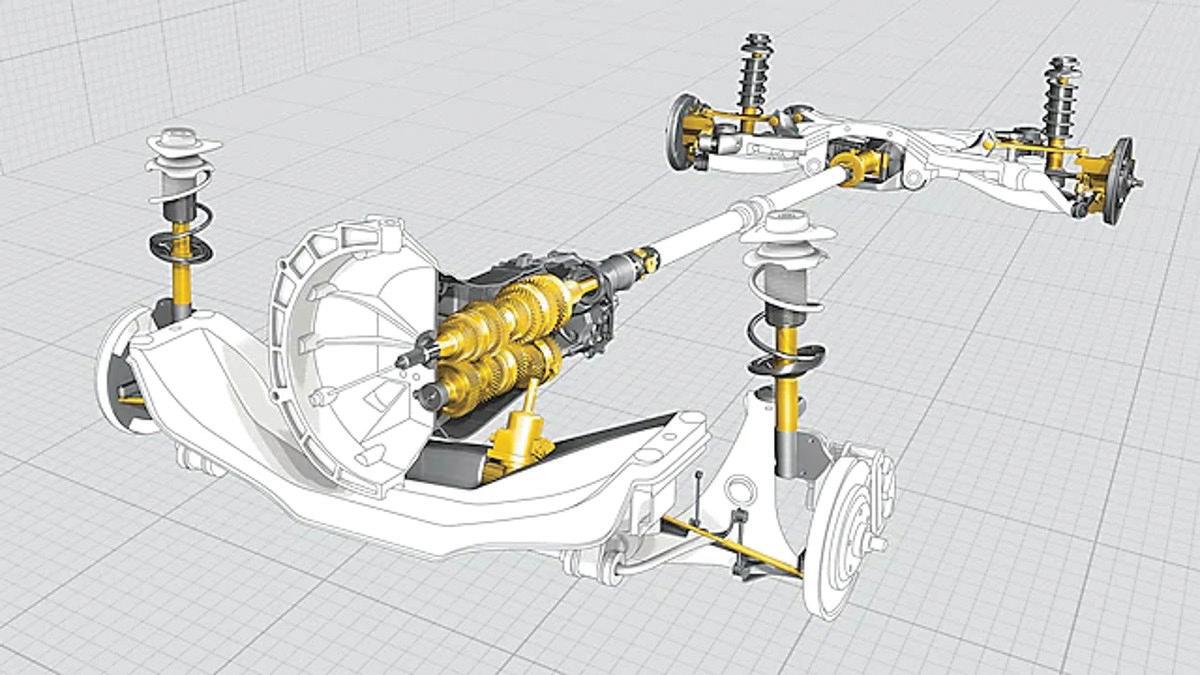

Latin America. The Global Technology and Business Center (GTBC) brings together more than 4,000 employees at its headquarters in Naucalpan de Juárez, State of Mexico.

Ford's campus, which is made up of corporate offices, is positioned as one of the largest centers of engineering in Latin America and top-notch amenities. It is a commitment to Mexican talent to lead the efforts of transformation and global modernization in the business model of the US multinational.

"Ford de Mexico is one of the three global centers in charge of carrying out these efforts, positioning itself as a strategic region for the operation of the company, thanks to the quality, ingenuity, commitment and dedication of Mexicans," she said in a statement.

According to the company, the new facilities can accommodate up to 9,000 employees in a hybrid work scheme, which would allow the brand's operations to expand in the country.

Ford's arrival in the State of Mexico also represents a window

"Automotive technicians need MACS training and best practice standards combined with CYTK.io innovation to meet the demands of new vehicle specifications and training manuals," adds Levenson, who argues that CYTK empowers new and experienced automotive technicians with advanced machine learning technologies and natural language understanding to provide easy access (updated in real time) to automotive repair information, whether in the bay or at the customer's home.

MACS President and CoO Peter Coll said: "The Mobile Air Climate Systems Association (MACS) is delighted to partner with CYTK to bring the next generation of car repair information to our members."

"As the repair industry continues to move toward mobile data solutions, industry leader CYTK gives our members the data they need, where they need it," Coll said.

of job opportunities for new talent. In 2021, Ford de Mexico as a global operations center hired nearly 500 new employees; 2.5 times more than the amount that was projected at the beginning of the year.

"With the start of operations in this new town and on its way to the future, today more than ever it continues in search of new talent," says the statement of the multinational, with a presence in the Central American country for 97 years; the first shipowner to do so.

Latinoamérica. The EcoStruxure for eMobility platform offers comprehensive solutions to cover the entire electromobility value chain.

According to Schneider Electric, an automation and efficient energy management company, the prices of electric vehicles are in constant decline worldwide. The company estimates that by 2025 they will reach amounts similar to conventional cars.

According to the same company's estimates, 30% of global passenger vehicle sales will be fully electric by 2030.

Hence, it introduces comprehensive solutions to cover the entire value chain of electromobility, especially that which will be needed in commercial buildings and homes. For this, according to the company, the main thing is that these infrastructures are prepared for a correct charging of electric vehicles.

One such solution is EVlink ProAC, a charging device that the company describes as "reliable, sustainable and connected." It ensures that it is quick and easy to install, operate and maintain, as well as minimize costs and downtime.

It also highlights EcoStruxure EV

Charging Expert, an electric vehicle charging management system that, according to the multinational, dynamically distributes the available energy, in real time, to avoid peak hours and integrate renewable energy. It ensures that you can also ensure access to advanced analytics services.

On the other hand, there is EcoStruxure EV Advisor, a cloud-based operations software that allows remote and easy monitoring of the commissioning, monitoring and control of the electric vehicle charging infrastructure in real time.

The company emphasizes its interest in providing an efficient, environmentally friendly, high-performance system that generates significant savings for all users.

The sale of hybrid and electric vehicles continues to show a growth scenario in Colombia by reaching the highest level since the first records were kept. A report by the National Association of Industrialists (ANDI) and the National Federation of Merchants (Fenalco) revealed that vehicle sales showed an increase.

As of August 2022, according to the National Traffic Registry (RUNT), in August

2022 in the case of electric vehicles, the growth was 272.1% with 2,426 units sold, if contrasted with the eighth month of 2021. It even exceeds what was sold in the consolidated of all last year.

"After the growth of electric cars, the reduction in sales costs and the help of the Government in improving the amounts of import, thinking about an eco-friendly transport, electric mobility must focus on optimizing everything related to the system and infrastructure of loads and energy management," says the director of Mobility for South America at Schneider Electric, Ursula de la Mata.

In a statement, the company points out that in Colombia there are 119 electrolineras available, "a greater amount than countries like Peru where there are only 47, an aspect that despite being relevant, does not cover the demand they currently have."

"We must bear in mind that drivers charge their electric vehicles when they stop, they do not stop to charge," says the director of Mobility, so they promote a charging system that allows people to do so from the comfort of home, workplace, buildings, among other places where they usually park.

International. UL Solutions ' autonomous driving safety assessment experts audited the Great Wall Motor development process and confirmed compliance with the requirements set by the recently published standard.

UL Solutions, an applied safety science company, has announced that Chinese automaker Great Wall Motor Co. Ltd. is the first to obtain the ISO 21448:2022 process certificate, Road Vehicles: Safety of Intended Functionality (SOTIF) issued by UL Solutions.

UL Solutions' autonomous driving safety assessment experts audited the Great Wall Motor development process and confirmed compliance with the requirements set out by the newly published standard.

The certification requirements aim to raise the benchmark for achieving functional safety in the automotive industry, including a functional safety process and management system, as well as a quality management system.

ISO 21448:2022 goes beyond traditional functional safety standards

to cover the functionality of Advanced Driver Assistance Systems (ADAS) and automated driving.

The standard presents a methodology for addressing potential safety issues related to automated driving.

UL Solutions and Great Wall Motor began working together two years ago to apply the methodologies and processes of the ISO 21448:2022 standard to automated driving systems, which at the time were in a preliminary state.

"With the development of autonomous driving technologies, the safety requirements for smart, connected vehicles are becoming more complex and diverse," said Jody Nelson, general manager of UL Solutions' Functional Industrial Safety division.

"The ISO 21448:2022 process certificate reflects Great Wall Motor's investment and focus on the safety of automated driving. We are honored that Great Wall Motor has trusted UL Solutions to help navigate these changes, helping to bring innovative vehicles to market safely."

Stout has worked in various operational roles at Midwest Automotive Designs over the past ten years.

REV Group announced the promotion of Brian Stout to Vice President and General Manager of Midwest Automotive Designs, LLC, effective immediately.

Stout has served as chief operating officer for the past three years. He will report to Mike Lanciotti, president of REV's Recreation Segment.

Based in Elkhart, Indiana, Midwest Automotive Designs introduced the Sprinter luxury pickup in 2001 and is now one of the most respected names in Sprinter Van custom conversions. According to REV Groupo, it is known for its quality, performance and safety engineering.

Since joining Midwest Automotive Designs in 2012, Stout has overseen four plant relocations. At the same time, it has ensured minimal downtime and a rapid increase in production at the new facility.

REV Group indicates that, as chief operating officer, Stout has helped increase production from five pickups per week to a maximum of 40 pickups per week.

"Brian has been an integral part of Midwest's growth, helping to increase production levels and identifying opportunities to improve efficiency and effectiveness," said Rev Recreation Segment President Mike Lanciotti.

"His tremendous impact on the success of the business made him the ideal candidate to take on the leadership role," Lanciotti added.

Stout holds an Associate Degree in Business Administration from Southwestern Michigan College and is a Six Sigma Green Belt.

The application enables technicians to use machine learning and natural language understanding to perform their jobs with a higher degree of accuracy by accessing manufacturer information about the vehicle they are preparing for service. The information is available on a smartphone app on iOS or Android devices.

So far CYTK has over 30 subscribers, and another 30 or so are signing up weekly for a 30-day free trial.

The target market is dealership technicians, especially those in operations with quick oil change services and light repairs. Technicians at used car lots, franchise service centers like Pep Boys, and independent stores are also potential customers.

The MTX line offers long life and premium performance as an Absorbed Glass Fiber Battery (AGM) or Enhanced Flood Battery (EFB) and a 36-month free replacement warranty.

Interstate Batteries' MTX AGM is an absorbed fiberglass mesh battery that uses a revolutionary design that, instead of allowing liquid to flow freely into a battery cell, suspends the electrolyte in fiberglass meshes. This design contains more lead in the car battery, giving it the longest life possible, while the battery itself is spill-proof and vibration-resistant.

On the other hand, the Interstate Batteries MTX EFB is designed like normal flooded batteries with critical differences that allow an EFB battery to last longer than a normal battery between recharges. The Interstate EFB Battery is only suitable as an OE replacement for vehicles that require an EFB Battery.

Lubricants can play a critical role in production efficiency and are often an integral component of products.

Whether you want to reduce the costs of maintaining a production line with the latest technology and long-lasting lubricants and greases, or if you are looking to improve the efficiency of vehicles or components with innovative initial fill lubricants, the wide range of products are designed to please your needs.

It has fast and efficient lifting thanks to the double-acting manual pump. The low closed height of only 180mm makes it suitable for vehicles with low clearance, the flexible upper support beam can be extended up to 1610mm.

The unique height-adjustable support arm system: designed to fit all current lifts and pits (order separately), additionally, it has two-hand lowering with deadman's release, automatic safety locking device and overload valve for optimal security.

It is noteworthy that it is supplied with 3 sets of extensions (10/45/90 mm) and a rubber cushion for the protection of the car body.

The electric motors mounted on the spare parts for Bosch gasoline pumps are manufactured with superior quality materials, guarantee and safety certificate.

Among its main characteristics are: maximum durability and superior efficiency, guarantee of safety in the vehicle and less noise and less variation in the electric current.

It is also noteworthy that each pump is subjected to the following tests to meet the Original Equipment requirements: volumetric flow, efficiency (electric current curve) and vibrations.

With an extensive range composed of more than 60 references and in continuous growth, these thermostats have been designed following the specifications of the original manufacturers.

These thermostats are integrated that adjust the cooling flow to the radiator, deciding when and how heat is added. The vast majority of this range is of the map-controlled type and features an electric actuator.

TRICO Asian Fit is designed to meet the specific needs of vehicles manufactured in Asia, while improving conventional wipers.

With TRICO Asian Fit, the blades will work and look the same as when you left the parking lot without needing to visit the dealership to replace them.

Among the main features are: Made for Toyota, Nissan, Infiniti, Mazda, Subaru, Mitsubishi, Honda, Hyundai, Kia and more, exactly matches the hybrid style and performance of the original wipers, has low profile to improve wind resistance, polymer housing protects the blade from the elements and is designed for all weather conditions.

Element3 brake pads are the pinnacle of automotive brake pads. With enhanced hybrid HD technology and professional grade formulations.

They ensure cleanliness and corrosion protection, for stable lubrication and temperature resistance. Even simple mineral engine oils, which no longer come close to the requirements of today's engines, have up to 15% additives. Modern oils, such as fully synthetic motor oils, have up to 30%.

Oil additives clean the engine from the inside, minimize friction and wear, reduce oil consumption and protect against corrosion. They are suitable for both petrol and diesel engines and help recreate the original performance of your vehicle's engine.

Element3 pads offer: Unparalleled performance and reliability, excellent coverage for domestic and imported applications, and improved wear and durability of the pads.

The following features are obtained from the application: Quiet operation and superior braking power, premium multilayer fittings and stainless steel fittings for maximum noise damping, state-of-the-art coverage, compliance with all environmental regulations on copper and hardware included, where applicable.