National Trends

National Population Growth & Decline Snapshot

According to the U.S. Census Bureau, U.S. population increased by .35% between 2019 and 2020. Kentucky’s population increased by .15% over the same time period.

Between 2019 and 2020, some states saw significant increases in population numbers that contributed to overall national growth. The top fastest-growing states during this period were Arizona and Idaho. Other states saw a population decline. 16 U.S. states law population loss in 2020, such as California, Connecticut, Hawaii, West Virginia, and Illinois.

Fastest Growing States 20221

The U.S. is Still Recovering from the 2008 Housing Crisis Housing issues are at the forefront of community development. Improving land use and zoning to increase an equitable and sustainable housing supply is front of mind for planners.

After the Great Recession, the number of home builders declined significantly, and housing production was unable to meet buyer demand. This deficit of housing in the United States continues to exist because of persistent supply-side headwinds for builders, creating a critical housing affordability challenge for renters and homebuyers. Yet despite these challenges, residential construction is set to evolve and expand throughout the decade ahead.2

State and Region

Lexington-Fayette

The New Decade Brings Systemic Change

2022 is an inflection point for planners and the communities we serve. With historically high levels of federal support, tools, and key reforms in hand, the reinvention of communities will be the focus driving much of what planners do.5

Covid-19 Pandemic

The pandemic created many changes that impact planning—from accelerating changes in brick-and-mortar office and retail to the ways we engage the public. Over the course of the pandemic, supply chain issues and inflation impact everything from groceries to the price of a new home, while parks and public land are seeing some of their highest usage in modern times.6

Social Justice & Racial Equity

In response to social justice issues, the American Institute of Certified Planners (AICP) revised their Code of Ethics and Professional Condict in November 2021 to “more fully account for the planners’ role in social justice and racial equity, while accepting our responsibility to eliminate historic patterns of inequity tied to planning decisions.”7

In February of 2022, Mayor Gorton made permanent the city’s Racial Justice and Equality Commission, the purpose of which is to assemble diverse community members to listen, discuss and create empowering solutions that dismantle systemic racism in Fayette County.8

Climate Change Planning plays a significant role in both climate change mitigation and adaptation. Two of the largest contributors of greenhouse gases — transportation and buildings — are influenced by planning decisions and policies. When planning leads the way on local climate action, communities reduce cost, create jobs, and keep communities strong.9

Lexington-Fayette Metropolitan Statistical Area

Fayette County is the primary county within the Lexington–Fayette, KY Metropolitan Statistical Area, which comprises five of the six adjacent counties, excluding Madison County. The 2020 U.S. Census MSA population is 516,811 which is an increase of 9.47% from the 2010 Census. For reference, the population of Louisville-Jefferson Co. is 633,045.

2010-2020 Regional Population Growth Comparison

Lexington-Fayette County 9.05% (13.55% in 2000-2010)

Lexington-Fayette MSA 9.47% (15.62% in 2000-2010)

Louisville-Jefferson County 5.98% (7.83% in 2000-2010)

Louisville-Jefferson MSA 5.34% (3.39% in 2000-2010)

Lexington-Fayette County

A Boundary and a Merger

In 1958, Lexington created the nation’s first Urban Service Boundary. The American Planning Association designated the Urban Service Boundary as a “National Planning Landmark” in 1991, an award for projects that are “historically significant, initiated a new direction in planning or impacted American planning, cities or regions over a broad range of time or space.” Throughout the years, this boundary has seen many evolutions; it has been expanded, it has been contracted, and it has been maintained in it’s current configuration for over 20 years.

In 1972 the voters of Lexington and Fayette County approved consolidation of a merged city-county government which created the Lexington-Fayette Urban County Government (LFUCG).

2020 Population 322,570 285 mi2 Total area of Lexington-Fayette Co.

Rural Service Area Urban Service Area

Rural Land Management 200 square miles are included in the Rural Service Area. In 1999, the first Rural Service Area Land Management Plan was adopted as an element of the 1996 Comprehensive Plan. The groundbreaking document was the first extensive effort dedicated to the planning and management of land uses in the Rural Service Area.12

Many specific aspects and elements contribute to the importance of the Rural Service Area, including the agricultural economy, tourism, long-term preservation, sustainability, the rural landscape, and cultural heritage. The Rural Service area also includes major employment centers like the Bluegrass Airport, Keeneland, Bluegrass Stockyards, and the Kentucky Horse Park.

Compact Growth

Kentucky Urban Areas Snapshot

Note the developed urban area patterns across KY. Urban Area11

Purchase of Development Rights

Roughly ¼ of the Rural Service Area is protected by the Purchase of Development Rights (PDR) program, Kentucky’s first Agricultural Conservation Easement program facilitated by a local government. Through PDR the city purchases farm owners’ development rights (their right to ever develop the farm commercially), thereby preserving it as farmland forever.

The program protects farmland for food security and conservation of environmentally sensitive lands. Eventually the city hopes to conserve 50,000 acres, or almost 40% of the Rural Service Area. These protections have largely contributed to the city’s identity and its relatively fiscally responsible development patterns.13

85 squares miles are included in the Urban Service Boundary. Approximately 97 percent of Fayette County’s population resides within the USB, equating to 5.75 people per acre within the USB.

the

Plan (EAMP)

acres

the

In

to planning for land use, community design, and infrastructure elements, the EAMP projected housing for a total population of 30,822.10

Intentional Growth

1996 Expansion Areas In 1996,

Expansion Area Master

added ~5,300

to

Urban Service Area.

addition

Expansion Area 1 614 acres Expansion Area 2A, B, C 4,213 acres Expansion Area 3 502 acres

Having an Urban Service Bounday means Lexington’s urban development must generally take place within ~30% of the city’s land. The boundary has kept development patterns relatively compact and has minimized many of the typical sprawling suburban developments that have been occurring throughout other cities in Kentucky and the United States.

County & State Comparison

Fayette County is Kentucky’s second most populous county behind only Jefferson County. Its population growth continues to rank among the fastest growing counties in Kentucky, particularly among large counties with populations over 100,000 people.

In 2019, Fayette County makes up more than seven percent of the state population and almost 15 percent of the state’s growth since 2000.1

200 mi2 Rural Service Area 70% of Total Area 85 mi2 Urban Service Area 30% of Total Area FAYETTE SCOTT JESSAMINE CLARK Lexington Nicholasville Versailles Georgetown Paris

EXP3 EXP2A EXP2B EXP2C EXP1 References Unless otherwise noted, all text and data from: Lexington Sustainable Growth Study Existing Conditions and Growth Trends Report, July 13, 2021. Stantec Consulting Services, et al. or the U.S. Census Bureau. 1. https://worldpopulationreview.com/state-rankings/fastest-growing-states 2. https://eyeonhousing.org/2020/01/a-decade-of-home-building-the-long-recovery-of-the-2010s/ 3. U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUSTNSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUSTNSA, March 14, 2022. 4. A start is defined as excavation (ground breaking) for the footings or foundation of a residential structure. For a multifamily structure, all units are counted as started when the structure is started. (NAHB) 5. https://www.planning.org/policy/priorities/ 6. https://www.tpl.org/parks-and-the-pandemic 7. https://www.planning.org/ethics/ethicscode/ 8. https://www.lexingtonky.gov/boards/commission-racial-justice-and-equality 9. https://planning.org/policy/priorities/2022/climate/ 10. Expansion Area Master Plan, https://drive.google.com/open?id=1dSXQ47o-tkSME3QN4RvJybTf3fixKRDR 11. U.S. Census Urban Areas represents the 2010 Census urban areas in the United States. An urban area comprises a densely settled core of census tracts and/or census blocks that meet minimum population density requirements. (ESRI) 3,4 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 U.S. Census Population 1900-2020 Lexingon-Fayette Co. Population %±

Data Snapshot

This table highlights general data points, but taken together these data combine to create a snapshot of Lexington’s livability and quality of life. How has Lexington changed since the previous 2018 Comprehensive Plan? And how does our data compare to regional and national trends?

For more information on Lexington’s diverse population, see the “Equity in Planning” data board.

Population & Household Trends

What does the 2020 Census Data Reveal?

The Division of Planning relies on population and household projections provided by the Kentucky State Data Center (KSDC), which is the state’s lead agency in the U.S. Census Bureau’s State Data Center Program and Kentucky’s official clearinghouse for Census data. Current projection data is based on 2010 Census Data. The KSCD will update their projections when more detailed information is released by the U.S. Census Bureau later this year.

Here’s what we know so far.

2020 U.S. Census Lexington population:

322,570

2019 American Community Survey (ACS)

total household estimate: 129,784

It is notable that the 2020 total population and the total household estimate provided in the 2019 American Community Survey (ACS) are more than 10,000 lower than KSDC’s 2020 projection for both metrics.

Population and Household Trendlines.

Conservative and Full trendlines project 20-year population in Fayette County to grow between 29,750 and 41,200 households by 2040 respectively.

Population growth in Fayette County and the surrounding region was stronger in the period between 2000 and 2010 than it has been in the past decade. Growth trends from the first part of the century are reflected in the KSDC projections in Table 9.1.

While many factors may have contributed to the recent slower growth, including lingering effects of the housing downturn or the increasing challenge of acquiring land and developing new housing inside the USB, this recent trend is apparent throughout the region and the state. As depicted in Table 9.2, the compound annual population growth in Fayette County since 2010 is consistent with the region and Madison and Jessamine counties. Only Scott County has a higher growth rate, and even it has lowered significantly from the first decade of the millennium.

Conservative and Full Trendlines

The conservative trendline is based on the past ten years of population estimates from the American Community Survey (2010 – 2019), while the full trendline reflects the projected forecast of the Kentucky State Data Center based on population estimates from the 2010 Census and the 2015 American Community Survey.

Household data comparisons.

The composition of households represents the fundamental building block of residential development and includes all residents living outside group quarter arrangements, such as nursing homes, school dormitories, and prisons. Fayette County has a slightly lower average household size than the region and state, but its average family size is close to regional and state averages. The proportion of households in families in notably lower in Fayette County than surrounding counties, as well as the proportion of households that include minors under 18 years of age and adults over 60 years of age.

This reflects Fayette County’s role as a regional metropolitan center, which tend to have a larger contingent of younger, working-aged adult households. The presence of the University of Kentucky and Transylvania University also contribute to the consistent influx of younger householders who come to Lexington for school and stay for career opportunities. Adjacent counties with a higher proportion of families and minors partially reflect their role as bedroom communities for Lexington.

12. Rural Land Management Plan, https://drive.google.com/file/d/1aTiTv6wG1tND-_uIaM4ll8uFvOlKWUeD/view

13. https://www.lexingtonky.gov/departments/purchase-development-rights

14. 2017 Fayette County Housing Demand Study, https://drive.google.com/file/d/11rszNUmkgvJiglXRb6Xb9BfjoBkNf1Zv/view

15. America’s Rental housing 2022, Joint Center for Housing Studies of Harvard University. https://www.jchs.harvard.edu/sites/default/files/reports/files/ Harvard_JCHS_Americas_Rental_Housing_2022.pdf

16. https://www.lbar.com/news-events/market-data/

17. https://www.lbar.com/news/2022/02/25/main/real-estate-activity-starts-the-year-off-strong/)

Demographics

295,803 314,488 322,570 333,580 354,318 375,637 397,513 419,813 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 2010 Census 2015 Estimate 2020 Actual (U.S. Census) 2020 Projection 2025 Projection 2030 Projection 2035 Projection 2040 Projection Fayette County Total Population 282,999 301,520 308,140 320,356 340,832 361,882 383,485 405,506 123,043 131,750 129,784 141,235 150,978 161,356 171,789 182,417 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 2010 Census 2015 Estimate 2019 ACS Estimate 2020 Projection 2025 Projection 2030 Projection 2035 Projection 2040 Projection Fayette County Household Information Population in Households Total Households 31.1% 28.4% 56.3% 3.02 2.37 34.0% 30.5% 62.3% 3.01 2.46 39.3% 31.1% 65.1% 3.06 2.49 Hshlds. With 60+ Hshds. with Minors % Families Avg. Family Size Avg. Household Size Lexington, Regional and State Households Fayette County 7 County Region Kentucky

Housing Snapshot

Existing Housing Stock

Table 5.1 presents an overview of the total number of housing units in Fayette County and the surrounding counties as reported in the United States Census’ 2019 ACS. Vacant units include both those for sale or rent as well as “Other Vacant”, which include houses not considered available, either due to condition or status. The Census reports 5,832 “Other Vacant” units in Fayette County in 2019, reducing the total available housing stock to less than 136,000 total units in the county.

Housing Unit Type Regional Comparison

As seen in Table 5.4, single-unit detached homes comprise the majority of housing units in Fayette County, but its share is notably lower than surrounding counties.

60% of housing units in Lexington are 1-unit, detached Lexington is seeing a transition from a primarily single-family market to a mixed market of single family and multi-family units. While the increase in multi-family housing is significant, the category is dominated by higher-density developments with 5 or more units per structure, with a much smaller range of two to four-unit structures.

Housing Occupancy and Cost

Fayette County Median Monthly:

Rent $869

Owner Costs w/ Mortgage $1,345

While a majority of Fayette County’s units are owner-occupied, the ownership rate is the lowest in the region, which correlates to the higher rate of larger multi-family apartment developments and the large contingent of student and young working adults living in Lexington.

Figure 5.10 shows the percentage of households who pay more than 35 percent of income to cover housing costs. This metric represents a maximum threshold for a household’s ability to affordably pay for housing.

Affordable Housing

Approximately 18,000 households in Fayette County are severely cost burdened, meaning that they pay greater than 50% of their income from housing.

Roughly 15,000 low-income households need housing assistance in Lexington today. 9,000 low-income households currently receive assistance or are otherwise accommodated within the private market.

This leaves approximately 6,000 households most of whom cannot find decent housing on the open market.

Market Based Housing Affordability

The 2017 Fayette County Housing Demand Study14 set the maximum affordability threshold for low-to-moderate income households at 80 percent of the area median household income. That equates to a home price of $185,000. This is approximately 20 percent below the median sales price for all homes recently sold in Fayette County ($230,000).

LBAR Real Estate Activity January 2022

The total real estate sales volume across the 30-county region that makes up LBAR, hit a new monthly high of over $257 million.

With demand still accelerating in the region, median prices climbed to new highs. For the first time on record, the median home price in January exceeded the $200,000 threshold, closing at $225,000, up 15% over last year when the median was $195,000. Single-family home prices increased 14% to $228,000 while townhouse/condo prices rose 21%, reaching $168,750.

The supply of housing inventory rose to 1.7 months in January, a 13% increase over last year when it was 1.5 months, and up 21% from December. The January supply was the highest since May 2020 when supply stood at 2.1 months.16,17

Lexington Housing Unit Types 1-unit, detached 1-unit, attached 2 units 3 or 4 units 5 to 9 units 10 to 19 units 20 or more units Mobile home Boat, RV, van, etc. $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 Fayette Scott Jessamine Clark Woodford Bourbon Total LBAR Region Median Price January 2021 vs January 2022 Median Price 2021 Median price 2022 54% 46% Fayette County Occupied Housing Units Owner-occupied Units Renter-occupied Units 15

Industrial Analysis

Market Summary

The regional industrial market continues to grow with strong overall fundamentals. Leasing activity continues to be limited in recent years due to a tight vacancy rate and a lack of new industrial inventory in the market.

Regional Comparison

There is approximately 60.4 million square feet of industrial inventory in Fayette County and the six surrounding counties as of Q1 2021. Fayette County has received a larger share of new industrial development over the past 20 years. There has been 5.6 million square feet of new industrial delivered in Fayette County compared to 2.5 million square feet in surrounding counties.

Trendline Analysis

Trendlines project 20-year demand between 1.3 million square feet and 5.6 million square feet of new industrial space. Based on the current metrics of Lexington’s industrial market and the opportunities for growth moving forward, it is feasible for Lexington to target the moderate growth scenario.

Office Analysis

Market Summary

The regional office market remains healthy compared to other regions across the nation that are still experiencing the fallout of the Covid-19 pandemic. Demand for office space in the region has primarily been for small-scale spaces. Office space is well spread throughout Fayette County.

Regional Comparison

There is approximately 22.4 million square feet of office inventory in Fayette County and the six surrounding counties as of Q1 2021. Lexington has historically been considered a smaller office market compared to larger-scale metro areas such as Louisville, Cincinnati, and Nashville, however its size has allowed it to weather recent economic shifts. The region currently has a vacancy rate of 7% while Louisville and Cincinnati both have vacancy rates above 15% across their metros.

Trendline Analysis

Trendlines project 20-year demand between 2.5 million square feet and 4.6 million square feet of new office space. This translates between 123,000 square feet to 231,000 square feet on an annual basis. Based on the current metrics of Lexington’s office market and the relative slow growth of office-centric economic sectors, it is feasible for Lexington to target the conservative growth scenario.

Retail Analysis

Market Summary

Many new developments are smaller infill retail or mixed-use retail projects rather than large-scale power centers. Retail demand is in growing residential neighborhoods where this is the need for daily shopping and services such as grocery, pharmacy, food & beverage, and medical. The Summit at Fritz farm is the largest new mixed-use retail project in the region and features approximately 300,000 square feet of leasable space.

Regional Comparison

There is approximately 36.7 million square feet of retail inventory in Fayette County and the six surrounding counties as of Q1 2021. The retail asset class has had strong historical performance in the region over the past several decades, even with shifting retail trends and the rise of e-commerce.

Trendline Analysis

Trendlines project 20-year demand between 2.2 million square feet and 5.0 million square feet of new retail space in Fayette County. This translates between 110,000 square feet to 250,000 square feet on an annual basis. It is recommended that Fayette County target a conservative growth scenario due to slower local population growth rates, rising e-commerce spending, construction of smaller-scale brickand-mortar retail, and lower retail requirements per capita.

Fiscal Profile

Different types of land use and development patterns produce different amounts of revenue.

Revenue

Two of LFUCG’s annual revenue sources which are directly influenced by land use are Ad Valorem taxes (property taxes) and Licenses and Permits (Occupational License Fees). Offices produce the most revenue per acre for LFUCG, mostly from the occupational license fee. Single family residential and agricultural uses generate the lease amount of direct revenue, however their presence supports the revenue generated in other areas.

LFUCG Revenue Sources

Expenditures

Most of LFUCG’s expenses can be assumed to apply evenly across the county and are not directly tied to the type of development. Others, such are water, sewer, roads, and stormwater systems are dependent on development patterns.

Some types of development cost cities more than they generate in revenue. That doesn’t mean that all development patterns should generate more than they cost, however there must be an appropriate balance for city finances to be sustainable.

Figure 7.5 illustrates where in Fayette County generates revenues that exceeds the average per acre costs and by how much. Areas in green illustrate the essential sources of land use-based revenue generation for LFUCG. Revenue

1. LFUCG GIS

Consulting Services, et al. or the U.S. Census Bureau.

2. https://www.lexingtonky.gov/greenways

3. Lexington Area MPO 2018 Bicycle and Pedestrian Plan, https://lexareampo.org/studiesplans/connectlex/

4. https://www.lexingtonky.gov/about-parks-and-recreation-master-plan

5. https://www.lexingtonky.gov/news/12-13-2021/lexington-joins-10-minute-walk-campaign-advance-access-parks-and-green-spaces

6. Imagine Lexington 2018 Comphrensive Plan, https://imaginelexington.com/

7. 2015 Comprehensive Urban Tree Canopy Analysis Report, https://www.lexingtonky.gov/lexingtons-tree-canopy

8. Tree Equity Score, by American Forests, https://www.americanforests.org/tools-research-reports-and-guides/tree-equity-score/

9. Census of Agriculture, https://www.nass.usda.gov/AgCensus/

10. Rural Land Management Plan, https://drive.google.com/file/d/1aTiTv6wG1tND-_uIaM4ll8uFvOlKWUeD/view

Related to Average Per Acre Cost Fayette Co. Industrial Annual Inventory and Vacancy Rate 20 Year Industrial Growth Trendline for Fayette Co. (Cumulative SF) 20 Year Office Growth Trendline for Fayette Co. (Cumulative SF) Fayette Co. Office Annual Inventory and Vacancy Rate Fayette Co. Retail Annual Inventory and Vacancy Rate Per Acre Revenue Value by Land Use Type 20 Year Retail Growth Trendline for Fayette Co. (Cumulative SF) Combined Property Tax and Occupational License Fee Revenue References Unless otherwise noted, all text and data from: Lexington Sustainable Growth Study Existing Conditions and Growth Trends Report, July 13, 2021. Stantec

Zoning, Land Use & Vacant Land

Zoning Summary

LFUCG has 36 zoning classes, eleven of which are for residential uses, eight business zoning classes and the balance a mixture of expansion area residential, commercial, office, industrial and agricultural and farmland.

Residentially zoned property dominates the USB. Residential property constitutes 89% of all parcels and 59% of land area. The count of residentially zoned parcels within the USB is approximately 85,326. The predominate zoning class for residential is R-1C followed by R-3.

Existing Zoning within the USB by Major Use Category, 2020

Summary of Existing Residential Zoning Acreages within the USB, 2020

Average Parcel Size of Existing Residential Uses within the USB, 2020

Land Use Summary

The information from a land use description perspective is less granular for residential but more granular from a commercial/office/industrial perspective.

Existing Land by Use Description, Acreage & Percent of Total

The land use descriptions that comprise the USB are 52% pure residential uses although residential is permitted in other parcel types. The areas designated as HOA/Retention Basin/Open Space/Greenway or Other were not used in any analysis to accommodate future demands in housing or other services.

Existing Industrial with a Land Use Parcel Size Range, 2020 There are a large number of very small parcels and a small number of very large parcels. The decline in the number of parcels with an increasing parcels size is steady.

A note about surface parking...

According to a preliminary LFUCG study, there are roughly 3,470 acres of commercial surface parking within the USB, which accounts for approximately 6% of the land area.1

Vacant Land Summary

The amount of vacant land within the USB is approximately 6,312 acres all of which has an assigned zoning classification. This total includes both vacant land at 5,200 acres and land in transistion at 1,112 acres. The “In Transition” acreage includes areas where development proposals are currently in process with LFUCG, recently approved, or under construction.1

Vacant Land by Zoning Classification

The figure below illustrates the location of the vacant land, including lands in transition, within the USB by zoning class.

Community Facilities

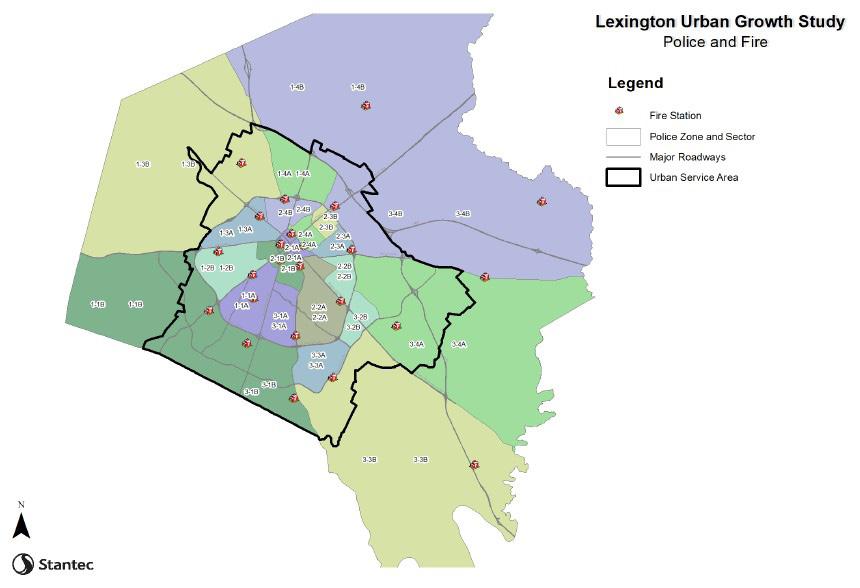

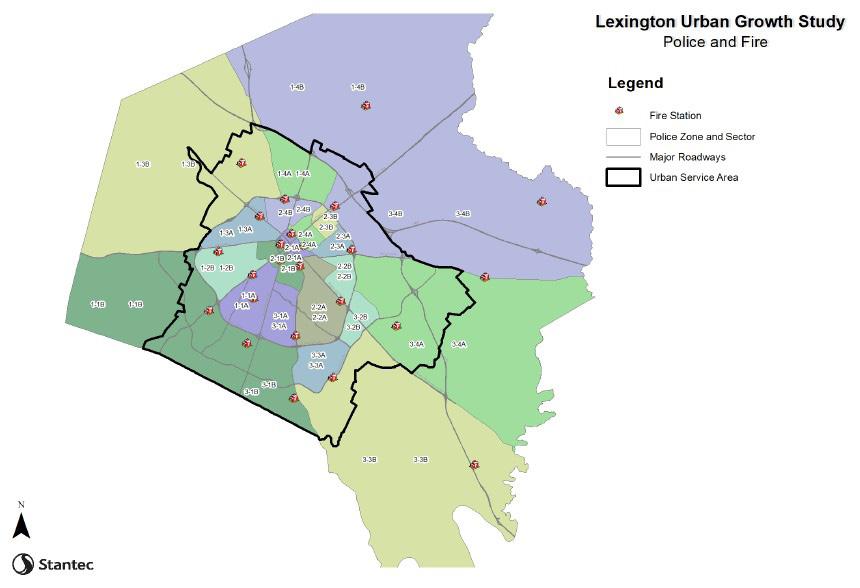

Public Safety Lexington currently has 24 fire stations, 20 of which are located inside the USB.

The Lexington Police Department divides the County into three sectors: East, and Central, and West. Sector boundaries were last drawn in the 1990’s based on census tracts and are set to be reevaluated when data from the 2020 Census becomes available. As Lexington grows, LFUCG will have to expand police, fire, and EMS services and facilities, and growth scenarios should reserve space for new police and fire stations.

Fayette County Public Schools (FCPS)

FCPS serves over 42,000 students with 37 elementary schools, twelve middle schools, six high schools, and three technical centers. FCPS determines the timing and location of new schools according to the regulatory guidelines of the Kentucky Department of Education. Growth scenarios should reserve sufficient space for new schools needed to serve areas with new and growing populations.

LFUCG Community Centers Lexington operates seven Community Centers which are primarily located on the northwest to northeast side of downtown with the exception of the Gainesway Community Center on the south side of town.1

LFUCG Greenways

The City maintains over 500 acres of greenways, which serve as stormwater management, water quality, environmental conservation and recreation areas.1,2

Community Facilities Legend Community Center Library Public School Park Greenway Future Greenway Existing and Funded Bike Infrastructure & Shared Use Trails

Environment & Conservation

Emphasizing the Role of Land Use

Patterns in Our Sustainable Future

Land use patterns are a powerful determinate of communities that are sustainable, healthy, prosperous, and desirable.

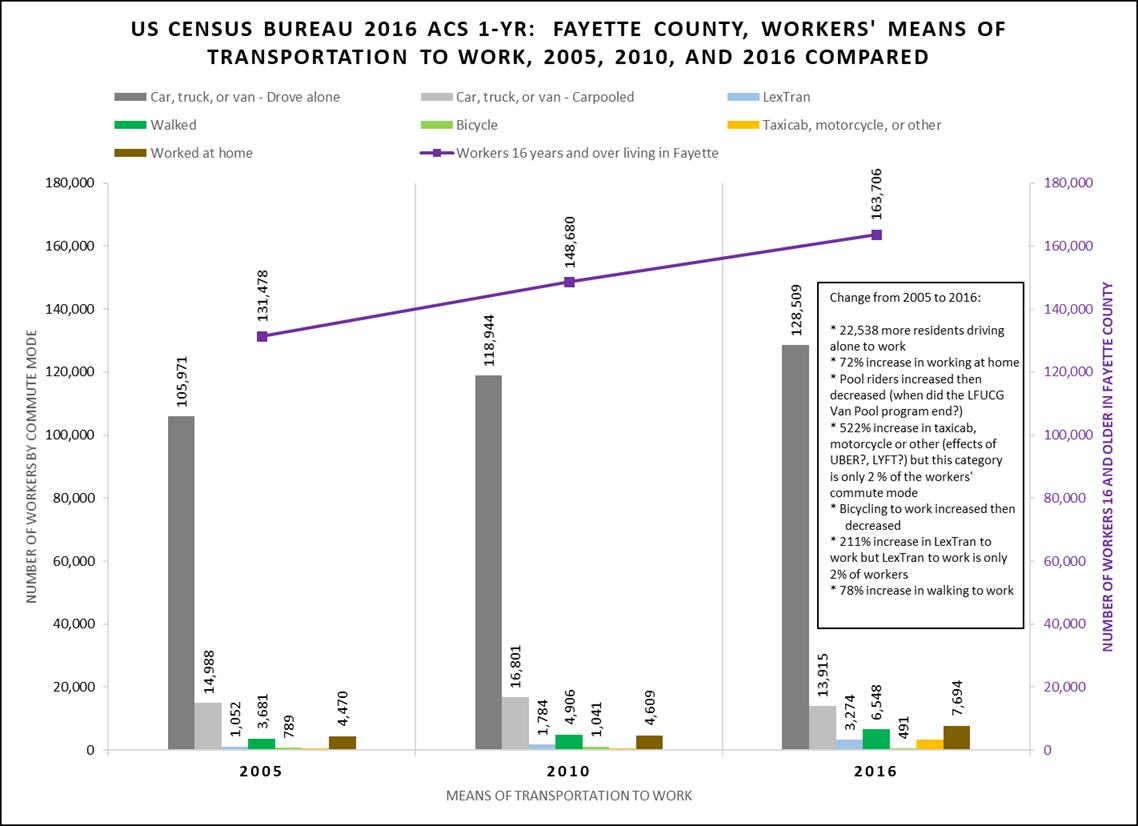

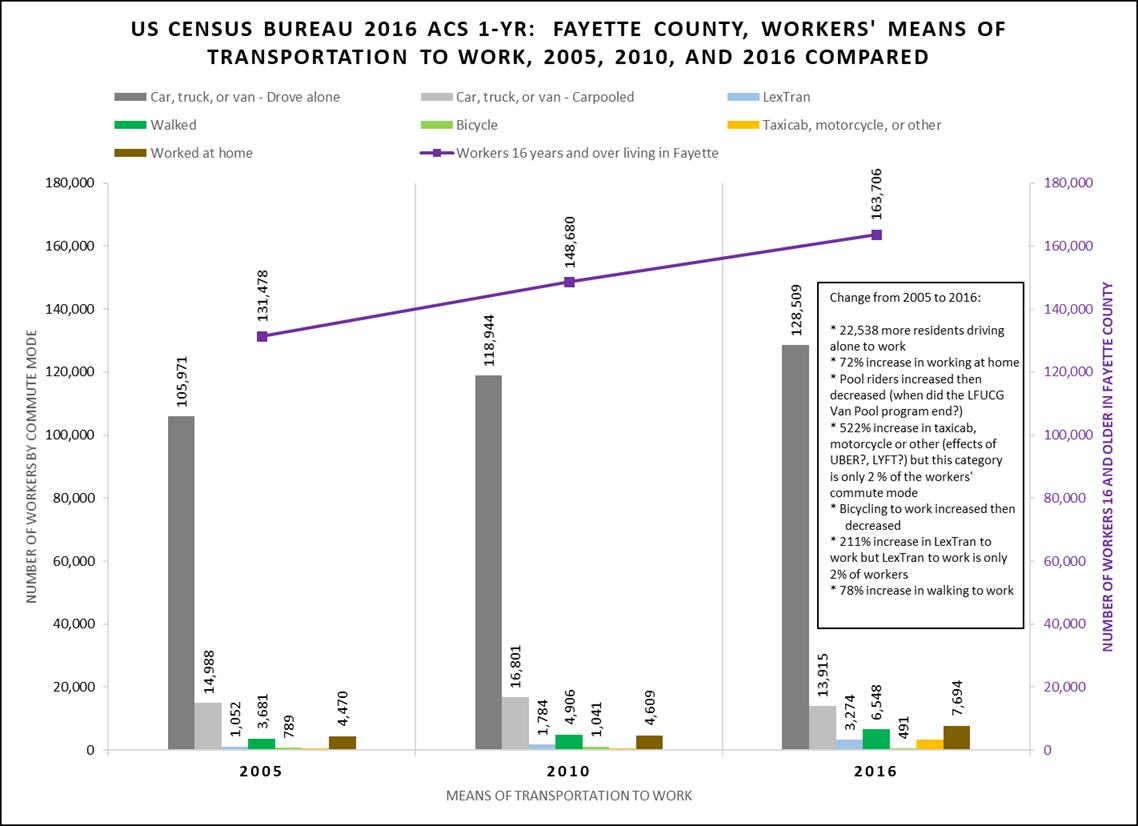

Lexington, like many similarly sized cities, has followed an auto-centric land use pattern for decades. This has resulted in disconnected land uses that often require a car to access. Auto-dependence results in a greater number vehicle miles traveled per day which contributes to higher levels of CO2 and atmospheric pollutants. Low density, vehicle-oriented development also contributes to higher levels of impervious surfaces and contributes to urban sprawl.

There are technological improvements to mitigate this issue, such as green building and electric vehicles, however density and transit-oriented development are much more powerful and sustainable tools to combat environmental challenges, in large part because they also impact a community’s psychology, culture, and ethics.3,6

Trees are important public infrastructure to any community, adding to the quality of life of both humans and the environment each day in a multitude of ways.

The 2015 Urban Tree Canopy Analysis by Davey Resource Group found that tree canopy covers 25% of the Urban Service Area. This was estimated to provide $50 million in environmental, economic, and social benefits each year.7

In 2021, the Division of Environmental Services contracted for a new Tree Canopy Analysis to be completed in the summer of 2022, which will provide an updated look at how Lexington’s tree canopy is changing and provide a foundation for priority setting when it comes to urban tree management in the urban area.

Trees also act as both an indicator and a tool for equity in a community. In 2020, American Forests began analyzing canopy cover data and aerial footage in the United States, including Lexington. Analyzing this imagery and data at the Census Block Group level, researchers then calculated a Tree Equity Score for each group based on canopy cover percentage, population density, race, income, age, health, and more. These scores are indicative of gaps in canopy cover that often coincide with income and race.8

Shared Use Trails and Bike Facilities

Lexington maintains over 140 miles of designated bicycle facilities with an additional 10.7 miles funded and in progress. The Legacy Trail, Town Branch Commons, and Town Branch Trail will provide a continuous 20 mile facility linking various neighborhoods to services and destinations including Masterson Station Park and the Kentucky Horse Park. 1,3

Parks Lexington maintains just over 5,300 acres in 101 parks and golf courses across the county. Four of these parks are located entirely outside the USB. The 2018 Parks and Rec Master Plan calls for additional parks and open spaces to be reserved or provided during new development.

The 2018 Parks and Recreation Master Plan reports that 63% of households area underserved by small neighborhood parks.4

Lexington signed on to the 10-Minute Walk Campaign, joining cities across the country who are pledging to make sure 100% of their residents live within a 10-minute walk of a park or green space by 2050. This underscores Lexington’s commitment to expand safe and equitable access to parks and green spaces.5

Map

Preserving Our Soils, the Foundation of Our Ecosystems and Agriculture

There are 22 soil series identified in Fayette County. Most of the soils, particularly those within our rural areas range from moderately to highly productive.9

Within the Rural Service Area there are 73,998 acres of prime farmland and 38,150 acres of soils of statewide significance.

The benefits of maintaining healthy, fertile soils extend into multiple realms, especially in Lexington, where the productive soils within our rural areas provide local food security for Lexington and lay the foundation for the agritourism industry. Healthy soils also provide benefits to overall ecosystem health by:

Easements

Conservation

The volume of healthy soil is depleting worldwide due to urban development. In Fayette County, approximately 30% of the prime farmland and 30% of the soils of statewide significance have been lost to development since pre-settlement.

As of 2022, over 30,000 acres of Fayette County’s agricultural land is protected by the City’s PDR program.

Protecting Our Network of Greenspaces, Streams, and Water Bodies

Fayette County’s greenspace network extends throughout both the urban and rural service areas. This network consists of greenways, trails, nature areas, streams, water bodies, tree stands, and vegetated open spaces.

Providing connections to greenways, tree stands, and stream corridors increases the linear ecological network, providing wildlife corridors and habitat for a biologically diverse ecosystem. Development within or adjacent to these greenways should not overtly impact their processes.

To provide guidance on the planning and management of the greenspace network, the City has maintained a multitude of plans and resources such as the Greenway Master Plan, Greenspace Plan, Urban Forestry Management Plan, Rural Land Management Plan, and the Stormwater Manual.

provided by LFUCG Division of Planning1

& Soil within the Rural Service Area E HERE G O S M d G S M ¯

of Water Bodies,

In tandem with the ecological contributions of the greenspace network is the significant value they hold with Lexington’s residents and visitors and how they contribute to social and physical welfare. and Greenspaces within Fayette County Legend Park Water Network & Water Bodies Greenway Urban Service Area

Network

Streams, Parks,

Recognizing Trees as Ecological, Economic, & Social Infrastructure