MAGAZINE

FOR OWNERS AND MANAGERS OF BNBS, INNS, BOUTIQUE HOTELS & HOLIDAY LETS

RENTAL - A GUIDE GET STARTED IN HOLIDAY

THE GREAT HOUSE

AIRBNB SUPERHOST

FOR OWNERS AND MANAGERS OF BNBS, INNS, BOUTIQUE HOTELS & HOLIDAY LETS

RENTAL - A GUIDE GET STARTED IN HOLIDAY

THE GREAT HOUSE

AIRBNB SUPERHOST

This special issue of Luxury BnB brings you the full eBook "How to get started in Holiday Rental".

This full guide, written during lockdown, has been previousl serialised last year. It's a step by step guide to starting a holiday let business, from buying to marketing.

We've taken the difficult step to going online only from June 2023. We'll still be producing great targetted content on our website luxurybnbmag.com but as an online edition only.

Publisher Luxury BnB Magazine

PUBLISHING DIRECTOR

Dominic Johnson dominic@miramedia.co.uk

01892 711 144

EDITOR

Bill Lumley | Words editor@luxurybnbmag.com

DESIGN

Tracy Poulsen | Design tracy@miramedia.co.uk

CONTRIBUTORS

Karen Thorne karenjthorne@yahoo.co.uk

Yvonne Halling yvonne@yvonnehalling.com

Bethnal & Bec relax@bethnalandbec.com

Lisa Holloway looholloway@gmail.com

advised to keep copies of all materials submitted. The opinions and views expressed in Luxury BnB are not necessarily those of Miramedia. Being subject to the Advertising Standards Authority guidelines in place at the time of going to press, all data submitted by advertisers and contained in their advertising copy is accepted by Miramedia in good faith.

Miramedia owns the copyright to all content, including that of any contributors, unless agreed otherwise in writing prior to publication.

Yvonne Halling is the award-winning founder of Bed and Breakfast Coach.com and creator of the B&B Money Maker Business Transformation program.

In 2001, Yvonne opened her B&B in the Champagne region of France, running her B&B for 17 years. She now offers owners and managers in the B&B industry helpful training and masterclasses.

Join Yvonne's Facebook group at: http://bit.ly/BandBgroup

You can email Yvonne at yvonne@ yvonnehalling.com

Face Book

Yvonne Halling

Twitter: @yvonne3030

LinkedIn: @ bedandbreakfastcoach bedandbreakfastcoach. com

w READ ONLINE & SHARE >>

Read this and other columns at ... luxurybnbmag.com/ author/yvonneyvonnehalling-com/

Make your social media presence and branding consistent with your website, so everywhere we find you online, we know it’s you. This builds trust, so that when you post content, people trust it’s you and will share for you, especially when asked.

Everyone knows at least 10 people in real life and at least 100 people online. If you get 10 of your online friends to share your content, you’re potentially reaching 1000 people, and those 1000 people also know 100 people online and if you’re content is interesting enough, they’ll share it too.

And so potentially, with one piece of educational, engaging and entertaining content, you could be reaching 10,000 people, most of whom you don’t know!

Think about that!

So when you say…. I don’t have time to post on social media, think about the opportunities you’re missing.

Next, once you’ve established yourself as trustworthy, do more asking…

Ask your booked in guests to come and say Hi on your favourite platform, and then make sure you say hi back with a little reassuring message that you’re looking forward to meeting them (even if you don’t welcome them in person).

Be consistent with your posting, just once a week with a carefully crafted piece of local information that will be interesting for your potential guests. A strong call to action will do it. Then follow that post, to make sure you’re responding to all the messages, to push your post up the algorithms. Social platforms live and die

by your activity, and consequently reward you for it, so do more of it

Use the platforms that your ideal potential guests use the most. You need a presence on all the platforms, but you don’t need to be spending time on ALL of them. Focus on where you get the most engagement from the people you want to welcome.

And finally, if you really want to ramp up your likes, followers and fans, start doing video! I know I sound like a broken record, but nothing beats video for engagement and building trust. And trust is everything online.

And remember this, all that social media activity, followers, fans and likes are USELESS until you’ve got a good, sound strategy to get those lovely people legally onto your mailing list. Your mailing list is where the real magic happens in the long term, not on those platforms where you can be kicked off at the drop of their corporate hats!

01288 353999

GUESTHOUSEINSURANCE.CO.UK

PROTECT YOUR B&B, GUEST HOUSE OR SMALL HOTEL FROM UNEXPECTED LOSSES.

COMPREHENSIVE COVERS & TERMS AVAILABLE

✓ Buildings & Contents

✓ Business Interruption Cover

✓ Public & Employers Liability

✓ Business Legal Expenses Cover

• Low Excess For Claims.

• FULL Theft & Accidental Damage By Guests.

• NO Security Conditions

CREDIT: bnbfact.com

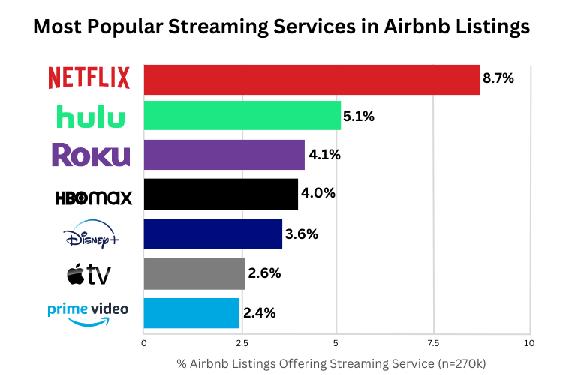

BNB FACTS ANALYZED 270K US LISTINGS SOURCED BETWEEN DECEMBER 2022 AND MARCH 2023. DATA WAS SOURCED FROM INSIDE AIRBNB, AN ACTIVIST PROJECT WITH THE OBJECTIVE TO PROVIDE DATA THAT QUANTIFIES THE IMPACT OF SHORT-TERM RENTALS ON HOUSING AND RESIDENTIAL COMMUNITIES. THE FOLLOWING GRAPH SHOWS THE PROPORTION OF LISTINGS THAT OFFERED A STREAMING SERVICE AS AN AMENITY.

Can Airbnb hosts increase their price by including a streaming service

A previous analysis demonstrated price is primarily determined by the number of rooms, the overall quality, and location of a listing. For many amenities, including them will not allow a host to charge more for their listing and this is true for streaming services. Hosts will not be able to charge more for their listing by including a streaming service.

Will including a streaming services increase occupancy on Airbnb

Adding a streaming service is unlikely to make a difference to the occupancy rate directly. Guests are not making decisions on which Airbnb to choose based on whether a streaming service is included. Factors such as price and location are far more important to guests when choosing an Airbnb.

We catch up with Sheila HarveyLarmar to find out how they make sure their hospitality business is as green as possible. Discover their efforts for sourcing plastic free packaging options and how you can start implementing more eco-friendly practices for your own business.

By Juliet Horner

By Juliet Horner

otential guests are more switched on than ever regarding environmental responsibility, but not just for their own lifestyles.

More and more, people are checking the environmental policies of the places they escape to for well-earned holidays.

But despite how popular environmental responsibility is becoming, it can be quite difficult to know where to start, especially if it concerns your business.

How can you implement more ethical and environmentally friendly practices?

We approached The Great House B&B to discover what they do to help the environment and how they earned the title ‘Plastic Free Champions’ as part of an initiative organised by Surfers Against Sewage, a grassroots movement that has grown into one of the UK’s most active environmental charities.

Sheila Harvey-Larmar and her husband Bruce own and run the Grade II listed accommodation in Exmoor and their business ethos was built with the environment in mind. “From the very first day we have been constantly working to improve our eco credentials.

“It’s all about what you’re doing to reduce what would normally be used in the business, making conscious decisions and a conscious effort," said Sheila.

URLs thegreathouse.co.uk sas.org.uk

delphiseco.com

uk.whogivesacrap.org

SOCIAL MEDIA

FB: The Great House B&B Exmoor IN: @the_great_house_exmoor

w READ ONLINE & SHARE >> luxurybnbmag.com/plastic-freechamps-oct21

One of the main areas that Sheila and Bruce focus on is the packaging on the products they use.

“It’s not always just the product itself,” explained Sheila, “but what the product is contained in.

“For example, refilling glass bottles with water from a large holding tank because glass is recyclable.

“So in terms of our shower gel and hand gel, we look for bottles that are made from either glass or recycled plastic. But as well as being made from recycled materials, it’s also important that the packaging is still 100% recyclable at the end of its life cycle.”

When choosing to use packaging that is recyclable or eco-friendly, it’s important to do your research.

“Packaging is one of the reasons why we don’t put biscuits in the rooms,” said Sheila.

“I’ve been through every major manufacturer of individually wrapped biscuits and not one of them does recyclable packaging!

“They don’t do it, so I don’t supply it and I don’t have time to make my own shortbread because we’re just a husband and wife team.”

She added: “It’s the same with cleaning products. It’s difficult because you have to assess the quality of the product itself as well as the packaging.”

Whilst researching cleaning products, Sheila and Bruce have often had to email the companies to get the information they want because it’s not on the websites.

After searching high and low for the right cleaning products to compliment their values, Sheila and Bruce recently started using Delphis Eco products.

Delphis Eco uses recycled/recyclable packaging and their products don’t contain harmful chemicals.

Sheila also explained that they use washing powder instead of liquids for laundry.

“That way, we aren’t using harmful microplastics and the washing powder comes in a cardboard box which is easily recycled.”

‘Plastic Free Champions’ is an initiative organised by Surfers Against Sewage, a grassroots movement that has grown into one of the UK’s most active environmental charities.

The SAS Plastic Free Communities movement has seen various sized businesses rising to the challenge of removing avoidable single-use plastics.

This initiative focuses on things like plastic bottles, disposable coffee cups, food packaging, straws, balloons and bathroom plastics. Independent businesses such as The Great House B&B are driving the change that’s needed to stem the plastic tide at the source.

Almost seven hundred businesses have now achieved the Plastic Free Champion award, with hundreds more working towards it.

sas.org.uk

Interestingly, one element that Sheila and Bruce compromise on, is the packaging of their tea and coffee.

“We have a local supplier just seven miles away and none of their packaging is recyclable, however we counter that against the ‘food miles’,” explained Sheila.

Food miles are a unit of measurement of the fuel used to transport products from the producer to the consumer.

For example, products produced in Scotland but used in Exmoor would result in a greater number of food miles than products produced in Exmoor and used in Exmoor. The greater the number of ‘food miles’, the greater the harm to the environment as the products are transported over longer distances.

“So having non-recyclable packaging is a fair compromise when you produce much smaller amounts of CO2 emissions with

regards to the food miles because they are very close to us,” said Sheila, “it’s a bit of a balancing act, that one is.”

Sheila and Bruce are currently researching tea and coffee suppliers within Exmoor that do use recyclable packaging as their quest to source locally and help the environment continues.

“Literally everything on our breakfast menu, apart from the baked beans that come in a can, is sourced within Exmoor.

“There’s a farm in the village that supplies eggs, and other local farms that supply sausages and bacon. The mushrooms and tomatoes are from Exmoor-based companies too.”

For businesses who wish to reduce their impact upon the environment by reducing their food miles, it’s important that you do your research and speak to the local suppliers that are available.

“Talk to your suppliers,” said

Sheila, “and put pressure on them to supply what you want.

“For example, we approached the company that do our coffee beans and said, ‘Can you supply us with beans and if we bring our own containers, can we put them straight in there?’ and they said no because of health and safety issues. And yet the farm we use, dealing with raw meat, said yes.

“So now they will lose us as customers because we are going to go somewhere else and it might force them to rethink.”

She added: “It’s putting pressure on those local suppliers to provide services like this to help the environment.

“Even small things like changing the milk bottles from plastic to glass.”

It’s a lot easier these days to find eco-friendly solutions for small, everyday products and tasks and Sheila strongly encourages hospitality businesses to apply pressure

These days, green tourism is all about travelling responsibly and making conscious choices that benefit or reduce your impact on the environment.

As a business owner, green tourism for you may mean implementing your own Environmental Policy.

For example, The Great House B&B have outlined their policy on their website, explaining their commitments to sourcing locally, recycling, reducing their use of plastics and other environmentally friendly practices.

Green Tourism is all about being environmentally responsible, something that potential guests are looking for more and more when scouting for places to stay.

Despite all your efforts as a business owner to be more environmentally friendly, reducing your carbon footprint and improving your eco credentials also lies, partly, in the hands of your guests.

So how can you encourage them to be more environmentally responsible during their stay?

“This is interesting, because I think a lot of people pick us because of our environmentally friendly ethos,” said Sheila.

“But having said that, we had someone not long ago who gave us a low review. Apparently for the price they paid, they wanted more ‘luxury’ which to them, meant shower caps, tissues and biscuits; all the things we don’t do because of our policy.

“A 50p shower cap was their idea of luxury, yet we have silver cutlery in the dining room, bone china, hand painted murals… I think it’s just a certain type of person that get’s what we’re doing.”

Sheila and Bruce direct their guests to the Environmental Policy page on their website which states not only what they try to do at The Great House B&B to reduce their environmental impact, but also what the guests can do to help.

“All our practices are largely well received,” said Sheila, “maybe they don’t think about it as much as we do, but they are glad that we have thought about it and that we are taking these actions.”

Perhaps in a unique and surprising twist, guests aren’t expected to separate their waste into different bins. Instead, Sheila and Bruce go through all the bins to ensure everything is separated correctly.

“We’ve got recyclable bags in the bins that we reuse,” said Sheila, “we don’t just throw them out everyday as you would with standard bin bags. We reuse them if they are dry.

“We tell the guests not to worry about what’s in the bin and to just chuck everything in there.

“We then go through the bins and literally pick out everything that

we can recycle.”

She added: “I think a lot of people don’t always know what can be recycled. Like olive pots - I think most people won’t know they are recyclable, but they are because we go down to our local recycling centre and do it.

“We literally go through everything and recycle everything that we possibly can.”

If you don’t know what the next step is in your eco-friendly journey as a business, write a list of all the possible changes you could make and start small.

“Just changing one thing at a time is a great place to start and an easy thing to do,” said Sheila.

Taking it one step at a time will make it more manageable; you don’t need to overwhelm yourself by changing everything at once.

1. Focus on one small change at a time.

2. Low energy light bulbs are an easy swap. Phase them in as the old ones blow out.

3. Use glasses in bathrooms instead of plastic, disposable cups.

4. Build relationships with local suppliers. They appreciate your business more than big chains and are more open to suggestions and ideas.

5. Bulk buy biodegradable carrier bags online.

6. If you don’t have time to bake your own biscuits and can’t find individually wrapped biscuits in recyclable packaging, bulk buy good quality oat cookies and decant them into glass jars.

7. Ditch laundry liquid that comes in plastic bottles and opt for powder in cardboard boxes.

8. Lobby local shops to install a milk refill station in partnership with local dairy farms. You can reuse your glass bottles and will no longer need plastic cartons.

9. Individual loo rolls wrapped in paper look extravagant but the company ‘Who Gives A Crap” only use recycled paper and 50% of their profits go towards building toilets in developing countries.

10. Why not try keeping your own hens? You’ll get fresh eggs to use in the kitchen and guests will love them!

Karen Thorne has ran Hopton House B&B in Shropshire for over 16 years and the Bed and Breakfast Academy for over 14 years.

Through the B&B Academy, Karen trains aspiring B&B owners in how to set up, buy, run and market their own B&Bs.

Karen runs monthly online courses and has recently launched a B&B Marketing membership for existing B&B owners, so she can help them to organically and authentically market their own B&Bs.

Read Karen's blog to discover more about toilet paper origami, how marrying a plumber has been very handy, and more about life as a B&B owner: bandbacademy. co.uk/blog

The hospitality industry is ever-evolving and bed and breakfast businesses are no exception.

As a bed and breakfast, it’s unlikely you’ll have the big budgets of chain hotels to embrace all of these trends. But just incorporating one or 2 small changes a season can help enhance the customer experience.

The first trend is an increase in online presence. In order to succeed, bed and breakfasts must have an online presence to draw in customers and showcase your products and services. Having a quality website, being active on social media, and optimising your online presence with SEO will continue to be essential for B&Bs moving forward.

Tip - with all the different social media platforms out there it’s easy to get overwhelmed. Choose one platform such as Instagram and learn to do it well. Post consistently and be yourself.

The second trend is the embrace of technology. Technology can be used to streamline the customer experience, and it can also help B&Bs save time and money. From automated check-in systems to online booking platforms, technology can make running a B&B easier and more efficient.

Tip - many of the booking platforms such as Freetobook & Eviivo have different features suitable to automate systems for small B&Bs. Take a fresh look around the platform you use and see if there’s one new feature you could adopt.

The third trend is personalisation. Customers want to feel special and unique, and B&Bs can provide this by crafting experiences

tailored to the individual. Adding an extra special touch to a room, customising the amenities offered, or providing personalised recommendations for local restaurants and attractions can help set a B&B apart from the competition.

Tip - Review your website, social media and in room information to see if what you supply is really helping the guest make the most of their stay. Posting videos taken on your phone on social media is a great way of giving your guests mini glimpses of the experience they’ll have whilst staying with you.

Personalisation can also be as simple as leaving a handwritten note welcoming repeat guests back or leaving a card if guests have told you in advance that they’re there for a celebration.

The fourth trend is sustainability. With more and more customers looking for eco-friendly options, B&Bs that embrace sustainability will gain an advantage. From using renewable energy sources to offering organic food and drinks.

Sustainable design is also becoming increasingly popular in UK B&Bs. This could mean using materials that are sustainably sourced or using low-energy lighting Sustainable design can help B&Bs reduce their environmental impact while also creating a more comfortable and inviting atmosphere for guests.

Tip - Identify small changes that you can make, such as installing smart light bulbs. Then highlight what you are doing to make your business more sustainable in your marketing materials.

Finally, The fifth trend is about design. One design trend that is becoming increasingly

Neil Fraser is a professional photographer of interiors, architecture and design.

His passion for high quality imagery has taken him all over the world. His work has featured in a number of magazines, reports, brochures and various marketing materials.

Can't afford a professional photographer?

Neil has a wealth of knowledge concerning holiday home photography.

Neil will be contributing to the next few magazines to provide insight and experience to help you with your own holiday home photography skills.

FB: Neil Fraser Interiors Photography

IN: @neilfraserinteriorsphotos www.nfp.photo

w READ ONLINE & SHARE >> luxurybnbmag.com/ hospitality_photos

Neil has put together a handy guide on preparing your property to get the most out of a photoshoot. Discover what should tidy away and remove in Part 1 of his 'Photoshoot Preparation' article.

The main reason for hospitality businesses to have a photoshoot is, obviously, promotional marketing. As well as showing the property to potential customers, you are also trying to sell a lifestyle.

I often see websites with photos that fulfil the former perfectly. They show the rooms as best they can but the images are, ultimately, a bit bland. Properties will not have been fully prepped beforehand; add to that bad lighting and wonky angles and the photos are not exactly going to make the property look inviting.

There are a few important things to consider before you pick up a camera or book a professional photographer:

During my time as an interiors photographer, I have been constantly surprised by the state of some properties when I arrive.

More often than you’d think, the owner won’t have tidied up at all, meaning that I have to clean and clear things away before I can start. This, of course, affects how many photos I can take.

General things to look out for throughout the property are:

• Light bulbs. Replace any bulbs that are not working. An easy way to add a bit of sparkle to your photographs is to turn the lights on. If some bulbs are not working, it can make the place look scrappy and uncared for.

• Open all the blinds and curtains. You want as much light flooding in as possible. Be aware, however, that crooked blinds never look good and curtains need to hang nicely.

• Electric cables. Big knots of electrical cables and leads under any tables or by the TV may not be noticeable to you because you’re used to them, but they really stand out in photographs and make the place look scruffy.

• Pets. Loveable as they are, not everyone wants to – or can – spend time with Tiddles or Spot. Tidy away pet toys and food

Kitchens

You might have cleaned, but you also need to tidy away the cleaning products. No one wants to be reminded of washing up and house work when they are looking to book a relaxing holiday.

• Move the sponges, cloths and washing up liquid out of sight.

• Put tea towels and oven gloves away in a drawer.

• Clear unneeded clutter from the counters: this includes baskets with sachets of tea and coffee.

• Remove general clutter such as fridge magnets.

• Sweep and clean the floor.

Bedrooms

As well as the basics of making sure the bedroom is clean and tidy, there are a few things that I recommend excluding.

• Kettles and drinks stations should generally be removed.

• Again, clear up electrical cables, especially under bedside tables.

• Check that the bedside lamps are working.

• Remove bathrobes from the back of doors.

paring a bathroom. They can be a big selling point but a dirty or messy bathroom is a big turn off.

• Hide away shower products: they never look good, especially if they are half empty.

• Cleaning products should be put away in a cupboard. A bottle of toilet cleaner or a toilet brush on the floor next to the loo is not attractive.

• Towels, as a general rule, shouldn’t be put out.

• Toilet roll should either be new and unused or not there at all.

• Give the mirror a good clean. Smears really show up in photos.

• Most importantly, toilet seats should always be down for obvious reasons.

Now what needs to be removed when preparing for a photoshoot. I’ve described

The outside of your property may not always be the easiest to clean up, but just a bit of tidying and creative hiding is what is needed here.

• Move any vehicles you can away from the building and off the drive. Prospective guests want to see a photo of the property, not your car.

• General garden mess. Put away kids toys, bags of garden waste, garden tools.

• Tidy up and wipe down any garden furniture.

• Hide the bins. Nothing brings down an exterior photo like a bin. It’s not something people need to be reminded of.

• Sweep the patio.

There are a few important rules when pre-

some common oversights and highlighted the items that you don’t want to include in your marketing photos.

Next issue, I will look at what you can add to make your setting look more professional and how you can create atmosphere for an upcoming photoshoot.

Introducing Insignia’s Eco Shower. Increase your booking potential with Insignia’s stylish, eco-friendly and zero electrics shower, an amenity that will make your guests come back for more.

Provide your guests with Insignia’s amazing top quality, non-electric shower without the expenses of spending a great deal! We are committed to innovation, providing cleaner technology lessening considerable impact on our environment and hygiene.

Insignia’s Eco Showers are easy to install, low maintenance and come with Insignia’s leak free tray design, a system that prevents major leaks and water damage. Not only does this save money on your water bill, it also reduces energy required to re-process it. Please visit our holiday rental partners website page for more information https://www.insigniashowers.com/holiday-rental-partners. For 30% off RRP discount for all holiday rental, B&B and hotel owners, contact us by calling 01908317512 or email our holiday rental expert at alex@insigniashowers.com

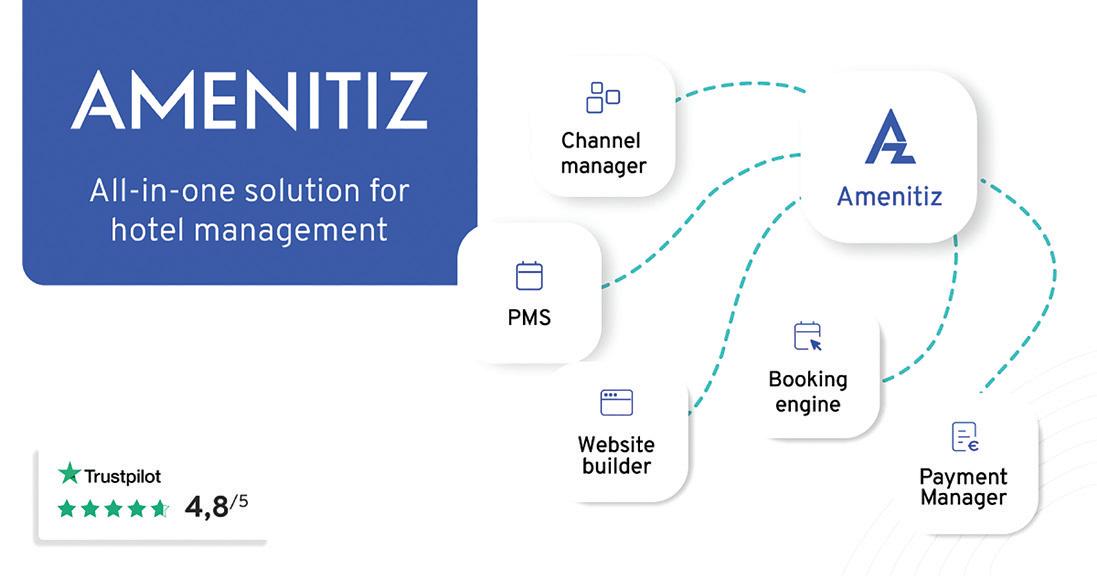

When hoteliers contact us, it's often an emergency. They have generally tried everything to make their hotel a real success... in vain. A lot of effort made for few results obtained, such as: Direct bookings low, High commission fees on Booking / Airbnb, Poor online visibility and Hours wasted performing tasks with low added value. It is impossible to work in these conditions. At Amenitiz, we help independent hoteliers develop their businesses with our allin-one solution. Thus, our customers benefit from: A new modern website optimised for SEO, A PMS which allows them to simplify their daily life, A Channel Manager to centralize all reservations and avoid overbooking, An integrated booking system to increase direct bookings and A secure payment system. As for all these independent hoteliers, we will be able to offer you the solutions adapted to your needs. www.amenitiz.com

Look no further than Alliance Online. We have recently received an influx of new restaurant supplies that will turn your B&B into the talk of the town. Let’s go through some of our new products we have stocked for 2023. From Cra’ster, the Fare trolley range is the innovative next chapter for operational efficiency in luxury hospitality. From Dalebrook, the minimalistic and modern Trafalgar tabletop range delivers a fashionable beauty in the form of the natural matte twexture that produces an exquisite contemporary finish designed to complement any B&B dining aesthetic. Another magnificent range of products suited to a modern BB would be the GenWare Black Vintage Steel range.

Offering a unique way to present and cook foods whilst remaining uncompromising on quality. To find out more please contact our head office on 01270 252333 or hello@allianceonline.co.uk to find your closest branch or visit allianceonline.co.uk.

Vogue Contract Beds are a bed and mattress manufacturer based in Leicestershire and are part of the Vogue Beds Group. Formed in 1990 with over 30 years of providing contract mattresses for companies in the UK hospitality market. Vogue Contract Beds manufacture all their own mattresses and have one of the most versatile ranges of contract mattresses on offer across the UK. Suppling contract mattresses to student accomodation as well as many of the UK’s most prestigious hotels and unique boutique hotels from Natural Pocket & Luxury hotel contract beds range. Vogue Contract Beds provide economical contract mattress solutions that suit the needs of our clients and partners from our Academic Collection. To view the range, visit www.voguecontractbeds.co.uk | Tel: 01455841257 | sales@voguebeds.co.uk

Welcome to scooms: Discover our luxurious, responsibly made and wonderfully comfortable collection of Hungarian goose down duvets & pillows and Egyptian cotton bedding & towels. Made with the finest natural materials, each product in our range is free from single-use plastics, chemical nasties and plastic packaging. Multi-award winning, with amazing five-star customer reviews, our family-owned collection has been designed without any compromise on quality or ethics. We're sure your guests will love it!

Visit our collection at scooms.com or get in touch with Jonathan for trade sales on 07703 314997, jonathan@ scooms.com.

Versatile, supportive and super-comfortable are a few words to describe the Hotel Mattress range at Mattressman. Going above and beyond to provide your guests with a rejuvenating night’s sleep, the Hotel Mattresses include fantastic features that will contribute to a sumptuous stay at your establishment. They incorporate body-moulding pocket springs with a support tension that’s suitable for every sleeping position, high-quality hypoallergenic fillings and breathable cotton covers too. The Hotel Mattresses are in congruence with Source 5 fire regulations and are available in all standard sizes: even adaptable zip and link options to transform a twin room into two singles. Our trade team can provide expert, impartial advice on what mattresses are best suited to your establishment, so don’t hesitate to get in contact with us today on 0800 5677 625 or tradesales@mattressman.co.uk. To view the range, visit mattressman.co.uk/contract

There are so many online travel agents to choose from these days. There's Expedia, Booking.com, Pitch Up, Unique Stays, Cool Stays… to name a few. But one of the major ‘top dogs’ is Airbnb.

As of June 2021, Airbnb had more than 5.6 million listings across more than 220 countries and regions worldwide, proving Airbnb is a popular platform for business owners (or as Airbnb calls them, Hosts). If you don’t currently host with Airbnb and want to look into this, head to airbnb.co.uk/host/ homes to find out how to get your business online and ready for bookings.

But for those of you who already use Airbnb, how do you get that pesky little Superhost badge and why should you try to gain this accolade?

Here at Luxury BnB, we want your business to be the best it can be, so we’ve put together this handy guide on how to become an Airbnb Superhost along with the help of Daisy Park Shepherds Huts, who gained their Superhost status only 4 months after they first started hosting.

Airbnb describe their Superhosts as people who ‘go above and beyond in their hosting duties’ and say they are a ‘shining example of how a Host should be’. Superhosts can be identified by a little pink and orange badge that appears on the listing and the Host’s profile.

Each year, Airbnb carries out four assessment periods, at the end of which you could gain your ‘Superhost’ badge. According to Airbnb, each quarterly assessment begins on the following dates:

• January 1

• April 1

• July 1

• October 1

Janice Kitto, owner of Daisy

Park Shepherds Huts, first welcomed guests at the end of June 2021 and the nearest Superhost assessment was July 1. Janice said: “Obviously we wouldn’t have qualified [in July] because we had only just started trading. We had to wait for the October assessment so we had time to fulfill all the requirements.”

To become a Superhost, you do not do anything. Janice Kitto,

owner of Daisy Park Shepherds Huts said: “It’s all done automatically so you don’t need to apply or fill in any forms.”

After each assessment, Airbnb will notify you of your status, but don't worry if your Superhost badge doesn't appear straight away. It can take up to one week for it to appear on your listing. Remember, Airbnb has a lot of businesses to assess!

So, now you know what you need to do to become an Airbnb Superhost, but WHY should you strive to fulfill all the criteria outlined above?

This might be a good time to point out that prospective guests, scrolling through Airbnb for their next getaway, can filter their searches for Superhosts.

The Superhost badge shows them that you are the best of the best in hospitality.

According to AirDNA, a provider of data and analytics for the short term rental industry, Airbnb Superhosts earn 60% more revenue per available day. They also experience an 81% higher occupancy rate as well as a 5% improvement in traffic on their listing.

Janice Kitto, owner of Daisy Park Shepherds Huts, said: “It’s one more thing that makes people more likely to book you.

“It gives them a bit more confidence when they can see you’re a Superhost, because they know you can be trusted.”

SOURCES & HELPFUL LINKS: news.airbnb.com/about-us airbnb.co.uk/host/homes airbnb.co.uk/help/article/828/about-superhosts airbnb.co.uk/help/article/829/how-to-become-a-superhost airbnb.co.uk/help/article/1320/extenuating-circumstances-policy airdna.co/blog/airbnb_superhost_status

1. Strive to reply to all enquiries within 24 hours

2. First impressions matter for good reviews (e.g. clean, tidy, easy check-in etc.)

3. Provide a welcome pack for your guests (e.g. Bottle of prosecco, chocolates, local information, etc.)

4. Greet your guests in person and welcome them to your property. Try to avoid remote check ins if you can.

5. Once you gain your Superhost badge, share it on all of your social media accounts

URLs daisyparkhuts.co.uk

SOCIAL MEDIA

Insta: @daisyparkhuts

FB: Daisy Park Huts

To gain your status as a Superhost, you must be a primary Host with an account ‘in good standing’ who has met the criteria set out by Airbnb. The criteria set out below is what you will be judged on. You must fulfill all of these requirements to become a Superhost.

Completed at least 10 stays or 100 nights across 3 reservations

• This is one of the reasons Janice Kitto from Daisy Park Shepherds Huts could not qualify as a Superhost in July, straight after opening in June.

• She said: “We had to wait until the October assessment period so that we could get the correct number of nights or number of completed stays to qualify.”

• Janice said: “You need an average of 4.8 stars for your overall feedback, which is based on the reviews left by people who have stayed with you over the last year."

• Airbnb states this is based on the date the guest left a review, not the date they checked out.

• “Your response rate is calculated on how quickly you respond to enquiries from potential guests and things like that,” explained Janice, “and I think it’s got to be within 24 hours. The quicker the better.”

Maintained a 1% cancellation or lower

• This means no more than 1 cancellation per 100 reservations.

• Janice said: “As an Airbnb Host, I must not cancel someone's holiday from my end more than once for every 100 stays.”

• However, Airbnb is lenient with this requirement. For the Hosts who fall under their Extenuating Circumstances Policy, so make sure to check the policy if you are struggling to fulfill this section of the superhost criteria

hospitality businesses comes from Google.

So it’s critical your business is visible and found easily on Google. Search engine optimisation (SEO) improves your ability to rank in the results page when someone makes an online search, for example “3 night break in Devon”.

It’s at this point that a potential guest chooses to click through to one of the results listed by Google. It’s also at this point that first impressions count. Your website and content need to stand-out if you want to capture and keep the attention of your potential guests. This is your opportunity to make an impact and speak directly to your customer in a highly engaging way that leads them to click the book button.

This can be achieved by creating an effective landing page.

YOUR website is one of your most important assets as a hospitality business. But let’s face it, there are many terrible websites out there that just don’t make the impact they should, doing a disservice to the fantastic properties across the UK.

BROWSING or ‘surfing’ the internet, usually on a search engine like Google is the first place that people go when looking for their next getaway or place to stay. In fact, with our unique benchmarking data we find that 50-70% of website traffic for

A landing page is quite simply a page for new visitors to land on your website. A landing page isn’t usually listed in your website navigation menu, but it can if you want to lead other users on your website to this information.

Ultimately, a landing page has one purpose - to convert a website visitor to complete an action. Whether this is to get contact details or to get a booking sale.

Landing pages are perfect to promote an offer, a package, or an event you have. People mostly find a landing page through Google Search but it can also be shared via email, social media, paid advertising, or other digital channels to ultimately

drive people directly to your website. So how do you create a winning landing page for your website?

7 key ingredients for a successful landing page I’m no baking expert, but I know that you need all the right ingredients to make a good loaf of bread. Without the yeast you’ll have flat bread, without the flour, well it’s not really bread, is it? And without the water, you will end up with a very dry mixture which also isn’t bread. When it comes to creating an effective landing page, the same principle applies to add the right ingredients, so you don’t end up with a flat or dry online experience, but one that is attractive and highly engaging. By using these seven simple steps you can create a high converting landing page that encourages your online visitors to click the ‘book now’ button:

1. Use a fantastic leading image: Images can speak directly to emotions. They convey what words cannot in an instant and will help draw your reader in with an emotional pull. However, it is important you use great quality photography and something that is related to your offer or package. Be clear, not abstract.

2. Add an attractive offer title: Your offer title should capture and summarise your offer in one line. It should be engaging; you can do this by using positive words that explain how your

guest might feel or the outcome of this package. For example, “Springtime Spa Break for Two” or “5 Night Cornish Cottage Retreat”.

3. Write value-added emotive copy: When you market your offer or package, use words and phrases that arouse an emotional response. Expressions like "heavenly haven", "space for peace" or "revitalising getaway" create a positive emotional connection with your audience. If you don’t tell guests how they feel when they visit, how will they possibly know?

4. Show a clear price: Present your prices clearly. When it comes to budgeting and choosing a holiday, your guests don’t want to be doing maths and adding

up extra hidden costs. Make it easy and show everything in one round number, including how many nights and people it applies to. Save cross-selling for your booking engine, at this stage, you just want to show one price and lead guests to book.

5. Benefits over features: It’s amazing how many properties market themselves solely on their features, appealing only to the rational parts of our brain. A swimming pool, free parking, or an interactive TV. These are all great, but what is the actual benefit to the customer of these features? When I stay here, how does it make me feel? Appeal to people on a deeper emotional level by letting them know the benefits of a stay, such as “escape the daily grind of life” or “feel more relaxed and invigorated”.

6. One clear call to action: Keep it simple. Don’t overwhelm your reader with too many options, as this has risk of putting them off. Direct them to make one action – book now. You can repeat this call-to-action button at the top of your landing page, in the middle and the end too. The main rule here is to use one clear call to action.

7. Promote, promote, promote: Now you’ve completed your awesome landing page you need to direct your users to it. Share your package or experience through all your marketing channels to drive people directly to your website and convert new guests.

1 YEAR = £15

Appealing to your guests’ emotional desires will give you an impactful and engaging presence online, helping you attract new visitors and convert new bookings directly through your website.

2 YEARS = £25

The Luxury BnB E-Book for those looking to set up their own hospitality business.

By Abbey Warne and Dominic Johnson

By Abbey Warne and Dominic Johnson

If you are looking to set up your own rental property but are not sure how to get started then look no further, because we have got you covered with our brand new ebook, which will provide you with everything you need to know to get started!

This chapter (1a) will introduce you to the different types of holiday rental properties, outcomes and objectives that you may need to consider, how to choose the right location, the different types and sizes of properties available, the skills required and any legal implications which may arise.

w READ ONLINE & SHARE >>

luxurybnbmag.com/lbnb_ebook1a

There are a variety of different rental properties on the market that may spark your interest, and this section will give an outline of what each property offers in terms of services, facilities, sizes and rooms. This will help you to decide which one suits you and your guests the most.

The different types of properties available:

BED AND BREAKFAST (B&B)

• A relatively small lodging establishment offering overnight accommodation and

breakfast.

• It is often a private home which typically has between 4 and 11 rooms, with 6 being the average.

• Guests will pay for the room and breakfast the following morning.

HOTEL

• An establishment providing accommodation, meals and other services for travellers and guests.

• They vary in size, but are larger than B&Bs.

• Can often have conference/meeting rooms for hire, restaurants and entertainment services.

GUEST HOUSE

• A private house offering accommodation to paying guests.

• The owner usually lives in a completely separate area within the property.

• It can be an ‘annex’ or another, smaller house on the grounds of the owner's private home.

INN

• A pub that also offers accommodation.

• Provides food, drink, and accommodation.

• Usually has a pub and restaurant, licensed bar.

HOLIDAY COTTAGE/LET

• Private renting.

• The owners live off-site.

• Have the whole property to yourself.

It can be quite tricky when deciding on a particular location and how flexible you want to be with this, so this section outlines a few brief points to consider, in order to help you pick out that perfect spot which your guests will no doubt love.

• You might have a particular area in mind or a vague county.

• You might need to tweak the location or pick a property that is more marketable.

• Have a look around and check there is a rental market to see what works and what doesn’t.

Locations may include:

• A rural destination such as somewhere in the countryside

• By the seaside, near a beach and other attractions

• A particular tourist hotspot or people travelling on business - you can charge more if you are closer rather than further away.

Helpful URL:

www.hermesthemes.com/how-to-start-run-bed-breakfast

This section will provide you with an insight into the different desires / outcomes and objectives you should consider when it comes to rental properties in a Q&A format, and will introduce you to the difference between Holiday Rentals and Single Longer Term Lets.

Questions:

Holiday rental vs single tenant?

“A friend of mine wants to get into holiday rental in Devon - 3 hours drive from her home. Due to her current commitments she has purchased a property and has started a long term rental. The aim is to move to holiday rental in a few years when she has more time.”

You would have put your heart and soul into this property and how do you feel about letting strangers into your house / bed week on week?

“One of the downsides of holiday rental I’m afraid is that people do mess up your house.”

• Consider how available to guests you want it to be

• You do get to use the house when not rented out

• Higher yields but generally irregular

• Less control over who the guests are and how they behave.

• Must be fully furnished and equipped

• Management of the property is generally more

• Some tax incentives - you can claim tax relief against any loans (repayment part only).

• Can be shut down due to a pandemic!

• Higher start up costs and possible ramp to get to revenue

• No access to the house, it’s someone's home

• Single regular payment.

• More control: credit checks, interview and references

• Can rent out unfurnished

• Less work to manage the property

• You are generally more connected to a tenant and their problems.

• Since lead times are longer, you can generally market whilst renovating and so will start receiving revenue at an earlier stage.

Thinking about the type and size of property is an important part of the process when you are looking to run your own, so this section will outline the different kinds of properties and their key features.

The different types of rental properties available (information from Roofstock and Mashvisor):

• These homes are aimed at more high-end renters.

• Include new, up-to-date appliances and technologies.

• Expensive to invest in.

• They tend to have less frequent guests due to higher prices.

• In locations which attract frequent visitors such as the seaside or countryside.

• Can be seasonal.

• Can be seen on websites such as Airbnb.

• Run by a ‘Home Owners Association.’

• Privately owned.

• Part of larger complex - apartments, villas etc.

• Consider HOA fees you will have to pay.

Helpful URLs: learn.roofstock.com/blog/types-of-rental-properties mashvisor.com/blog/types-of-rental-properties-investing

LEGAL IMPLICATIONS (PARKING PERMITS, EXTENSIONS, BUILDING WORK) (LEGAL EXPERT)

There are legal implications to consider when you want to run your own rental property, so you can make sure that you don’t run into any troubles down the line.

• There are less likely to be issues if there are other holiday let properties nearby.

• Very local so a good source of this information is the local holiday let agencies.

There are various skills required when running your own rental property, but fear not, because this section will cover the different skills you need and how you can achieve them in a few simple ways. These include ‘front-end’ and ‘back-end’ skills which will be covered in this section.

Don’t forget that running a holiday let is like running any other type of business!

The steps you should take to meet the skills required:

• You need to know you can cover all the bases.

• Take a look at your team and match up the skills you have with what you’ll need.

• Then make a list of what you have now, would be willing to learn and what you’ll need to buy in.

Examples of front-end and back-end skills:

• Maintenance

• Marketing

• Accounting

• Website Design

• Social Media

• Interior Design

• Garden Design

• Meet and Greet

• Cooking

• Cleaning

This brings chapter 1a of our e-book to a close, and we hope this has given you a better idea of the type of property you are looking for, the location, the skills that owning it may require, as well as any legal implications involved.

Make sure that you keep a look out for the next part of the ebook (chapter 1b) which will introduce you to more complicated stuff, but don’t worry, we will guide you through it step-by-step.

The sections in chapter 1b include insurance advice, tax implications and more, so make sure you keep your eyes peeled for our next issue, because you don’t want to miss out.

In this chapter (1b) we will cover insurance, tax implications, business rates, research and profit tips. Getting these sorted might initially seem like quite a daunting and complex process, but don’t worry - we’ve got you covered with expert advice to help give you a head start.

INFORMATION FROM GARY HODGSON AT HODGSON INSURANCE Insurance cover for your B&B, guest house or holiday home is a vital cog in the safe running of your business and for peace of mind should the worse happen. Here we give you some of our knowledge and tips when searching for insurance:

1) START WITH THE RIGHT POLICY

• Make sure your business is insured on a specialist guest house package policy.

• We see quite often customers have taken out a standard home policy via an online comparison site, and believe the public liability cover will cover them for taking in guests because they put down they’re B&B owners.

• A standard home insurance policy will not give you the correct liability cover to safeguard you against guests staying.

• Don’t try and obtain a public liability policy for guests separate to your main home insurance, thinking you’ll keep prices down.

• Always look for a single package policy that will include the correct liabilities and combine other main covers like buildings and contents.

2) WHERE TO OBTAIN THE RIGHT POLICY?

• We would always recommend speaking to an insurance broker.

• A broker should have access to a panel of specialist guest house schemes.

3) MAIN COVERS TO INCLUDE

• BUILDINGS: If you own the property then include the buildings, this must represent the full rebuilding cost of the property, should for example, it completely burn down.

• CONTENTS: Most guest houses are owner occupied, if that’s the case make sure the policy includes not just business contents, but also includes cover for your personal contents. Some policies include this altogether, but some insurers it can be included as an optional extra

• PORTABLE CONTENTS: In addition if you wish to include portable contents outside the home like jewellery, mobile phones etc, then again this an optional extra that only a few insurance companies provide.

• PUBLIC LIABILITY: A specialist B&B or guest house policy will automatically include Public Liability cover for your guests should they get injured or maybe food poisoned whilst staying. The limits will generally be £2 or £5 million.

• EMPLOYERS LIABILITY: If you intend on employing staff, even temporary staff, then you legally have to include Employers Liability cover. This will protect you should an employee injury themselves whilst working for you. Not always automatically included, so if you have staff make sure this is included. Employers Liability cover limits should always be £10 million.

• BUSINESS INTERRUPTION: If, for example, a burst water pipe causing flooding in bedrooms, you may not be able to rent those rooms out for a number of weeks or months.Business interruption covers you for loss of income due to an insured peril like escape of water or a fire. A vital part of a business insurance policy, some smaller B&B policies may not offer this cover or only offer as extra.

Other not so vital covers will either be included or you can pay extra for, but the above are main areas you must look at.

What are the rules if the property is sold without VAT?

• Advantage of VAT - Maximum rule.

• Need to charge 20% more

INFORMATION FROM MATT BRYANT AT OCL Accountants

When running a guest house, B&B or any other kind of hospitality business, there are many important factors to consider, and one of the most important things to think about is tax, particularly VAT.

• Many small businesses are unsure whether or not they actually need to register for VAT.

• If your earnings from the property are over £85k then you must be VAT registered.

• To check the current threshold you can either ask your accountant or go to https://www.gov.uk/vat-registration

From your effective date of registration, you must:

• Charge the right amount of VAT

• Pay any VAT due to HMRC

• Submit VAT Returns

• Keep VAT records and a VAT account

Most VAT registered businesses that earn over £85,000 must also follow the rules for ‘Making Tax Digital for VAT'. Your accountant should be able to assist with VAT, from finding out whether you have to register, deciding on a suitable VAT scheme and preparing the VAT returns.

INFORMATION FROM MATT BRYANT AT OCL ACCOUNTANTS

In running a bed and breakfast you will need comprehensive insurance to protect you, your customers, and your reputation.You are responsible for the welfare of your customers, suppliers, and any staff you employ.

• It’s important that your insurance includes public liability and employers' liability insurance in case somebody falls ill or is injured as a result of being on your premises.

• This is on top of the normal building cover in case of theft, accidental damage, fire or storm damage, and you also require cover for all your fixtures, fittings, and contents.

• Not to mention your guests’ belongings too.

• Additionally, you should have product liability cover as a safeguard against potential food poisoning, business interruption in case you are unable to trade for a period of time, an example of this is Covid-19, and financial cover for any money held on your premises.

The level of cover will need to be reviewed regularly as your business grows to ensure you have the correct level of cover.

• You can claim back the VAT on purchases - this can be a huge cost saving of 20% on all purchases.

• Many agents or OTAs charge VAT and so you can claim this back - e.g. one of the agents I use charge me 22% + VAT = 26.4%.

• So if you plan to use these providers extensively this needs to be considered.

• Google and Facebook do not charge VAT on their ad spend in the UK.

• You need to charge VAT on all rental income.

• Since the majority of your guests (assuming this is the case) will not claim back VAT (individuals not businesses) then your fees will be increased by 20%.

• You will need to do a VAT return every month but this is very simple with most accounting bookkeeping systems.

Can I register for VAT if my revenue is below £85k? Yes, it is still possible to register yourself for VAT even if your revenue is below £85k.

If you have a new build you might be able to recoup the VAT even if you are not registered - this is the case when people buy new homes. You can also claim back up.

The £85k is related to the property and not your business. So if you own 10 properties charging less than < £85k rev per year, you do not need to be VAT registered.

There is a flat rate scheme where you charge 20% but only need to send the government less than 20% (for hotels it's normally 8.5%). At the moment this is all changed due to covid - check the government website for further information: https://www. gov.uk/vat-flat-rate-scheme/how-much-you-pay

Every B&B owner operates differently, you may just let bedrooms to holiday guests, but if you allow guests access to the kitchen cooking facilities, you maybe take in DSS/council referrals or you have a self-catering annexe this can completely change the type of policy you need to be on. Make sure you give your broker a full description on how you intend to run your business.

There isn’t a standard guest house policy. Every policy has very different policy terms, conditions and claim excess’s. Make sure you always check the finer points of any quote. An insurance broker worth their weight should help and point out any significant policy conditions or exclusions.

It’s impossible to say what you will pay for your insurance as all guest houses have different requirements, sums insured and different postcodes. An example cost of a recent guest house policy we’ve set up…

• A 5 bed guest house in Gwynedd LL30, with buildings insured for £462,000 and contents at £85,000.

• Annual Premium: £628 with optional Legal Expenses £36.

• The policy had just a £150 claim excess, no security conditions and full theft by guests cover included.

All policies will have a standard policy excess - this is the amount you will need to pay towards any claims costs. A standard excess should range from £100-£250. We don’t recommend going any higher than this unless you’re getting a significant saving by doing so. Look closely in policy conditions as sometimes higher excess’s can be added for example a flood risk area, flat roof excess’s, subsidence and similar.

Most guest house policies will include theft caused by violent or forcible entry only. Some, more comprehensive policies, include full theft by guests, whether it’s a break in or if a guest just walks away with a tv. Check you’re happy with the level of theft cover.

Some policies have no security conditions which makes it easier not having to worry if you have the correct locks, especially a hospitality business where guests are coming in and out all the time. Many policies do however have minimum security requirements, if so then make sure you can adhere to them.

Yes, we’re possibly being biased but we’d always recommend using an independent insurance broker, possibly a broker who specialises in hospitality trades. A broker should help find the correct policy for your needs, will be able to make any changes during the year, help with claims advice and be able to search the market again at renewal time. Also brokers don’t all have access to the same providers and schemes, so it’s recommended to try 2 to 3 brokers so you get a good spread of quotations.

The buildings should represent the full rebuilding cost of the property including debris removal, architect and associated fees. If you have a mortgage they’ll often insist on you insuring for a certain amount. A free website you can login to and get an estimate of the rebuild is the BCIS website here: https://calculator.bcis.co.uk/ A more accurate way is paying for a chartered building surveyor, but will often be £500+ for this type of report.

This section will take you through the research you need to do step-by-step prior to setting up your holiday rental property.

• With your place in mind - location, room size, types of guest.

• Start by searching for properties closest to your new place in the overall proposition.

• Find out where they market their properties and who to.

• Find their booking form and create a spreadsheet of total possible income.

• It can be quite tricky to find this information and you’ll need to have a good poke around.

• Where possible, under estimate.

• Many holiday lets say a property is not available when the owners are using it.

• Sometimes it's hard to get a full year's bookings.

• Profile at least 3 properties where possible. The purpose of this is more about seeing where the busy times are and also get a rough idea of revenue.

• Create a rough price plan.

• At this stage look at all the possible outgoing and estimate the costs.

• You can then divide this by 12 to get a monthly outgoing.

• Compare this month on month to your estimated pricing to get a break-even point.

• Compare this to the above and see if it is realistic and you are comfortable with the risk.

• Consider again your personal situation and work out if you can afford the risk.

• Where possible, overestimate the outgoing line and underestimate the income.

Holiday rental in the UK is often peaky and so you’ll need to manage cash throughout the year. Is this to be considered?

• If you are entering the holiday let market to finance a house you want to use, you might need to make compromises here.

• What is often perfect for a holiday home is often not workable for a house you live in.

• For example, storage. You need very little storage space for a holiday let.

INFORMATION FROM CATAX AND 123 GRANTS

2020 will always be known as the year of staycations, with many families avoiding holidays abroad in favor of staying in the UK. Although the Bed & Breakfast industry in some areas of the country has enjoyed a market boost, others have faced significant cash flow challenges due to the ever-changing COVID-19 restrictions. Here, Clare Mckee from specialist tax relief firm, Catax, explains how a cash-injection in the form of capital allowances can be a lifeline for many businesses, and what to consider if you’re looking to buy a B&B property.

What are capital allowances?

“Capital allowances are a type of tax relief that offsets the hidden expenditure in commercial property, including B&Bs. This comprises elements such as air conditioning, heating and lighting – essentially everything that would remain in the building if you tipped it upside down! It can be claimed by anyone that owns their commercial building and is a UK taxpayer. However, if you let out a residential building, it must qualify as a furnished holiday lettings business to be eligible - it has to be available for holiday letting for at least 210 days of the year and let out for 105 days or more. Contrary to misconceptions, claiming for capital allowances will not impact the value of the property or capital gains tax.”

Do capital allowances have to be claimed on recent property purchases, or can it be processed for older sales too?

“Capital allowances can be claimed at any time, as long as you still own the building. We routinely process applications for expenditure that incurred 10 years ago or even longer! However, we would highly encourage owners to make a claim when they purchase the property or at the earliest opportunity, in order to benefit from the tax relief available. Should the building be sold at a later date then the balance of the claim can be retained or passed to the new owner. In addition to purchases, capital allowances can also be applied for on property refurbishments and extensions or new builds.”

What if the property was built by the owner many years ago and they have no records of the build costs, how can it be identified which costs can be claimed on capital allowances?

“It is not essential to provide records/invoices relating to the construction expenditure. Accounts and tax computations from the period of construction can often provide the necessary information, together with a conversation with the accountant that acted at the time. The land registry is often able to provide evidence of the price paid for land and this provides a basis from which to calculate the construction costs.”

If a B&B business doesn’t have sufficient taxable profits to benefit from capital allowances, could they still be eligible?

“Yes, it is definitely worthwhile to still identify qualifying capital allowances, especially if you expect your business to make taxable profits in the near future. Sometimes, capital allowances do not equate to an instant return, however they can be used to offset capital gains tax liabilities, passed to new owners and more. Ultimately, each set of circumstances is different, and I’d recommend carrying out an appraisal and seeking expert advice.”

“Most accountants provide some form of capital allowances advice. However, as capital allowances claims are extremely complex, they are ideally suited to being dealt with on a standalone basis separately to other tax matters. Capital allowances specialists possess a specific skill set with a more detailed and up-to-date understanding of what is included in capital allowances than most advisors who deal with this area of taxation less frequently. This ensures that property owners get the largest cash injection possible; for example, at Catax, our average client benefit for a Capital Allowances claim is £53,000.”

“The first stage of the process is to collect all the information for the Capital Allowances claim, including information on the property purchase, as well as details of any refurbishment expenditure. A specialist will then assess your claim and undertake any technical analysis. Generally, a surveyor will then conduct a site survey of your building to see if there’s anything further that could be included within the claim. It is then up to the capital allowances specialist to maximise the value of your claim and produce a report, which is submitted by the HMRC via your accountant. Once the claim is processed and completed, you will receive your refund!”

To find out more information about Catax and its Capital Allowances service, contact Clare Mckee, Catax hospitality specialist clare.mckee@catax.com or call Clare on 0121 293 1197 | www.catax.com.

Make sure you read our essential guide to short-stay holiday let tax here - https://www.luxurybbmag.co.uk/airbnb-shortstay-holiday-let-tax-the-definitive-guide/

It is estimated that over half of all hospitality businesses in the UK haven't claimed their capital allowance entitlement, which could be worth hundreds of thousands of pounds. It is important to get your accountant’s early involvement to look at analysing historic expenditure to compile robust capital allowance claims. By identifying qualifying assets within the building which attract tax relief. In some cases, more than half the project expenditure will attract capital allowances, including professional fees.

Where there has been constructed or undertaken the construction of a new building or an extension to an existing building you are able to analyse the costs incurred and to fully comprehend the construction processes involved and the documentation used to capture the costs, and hence maximise the level of allowances available. Early involvement in the construction planning phase can offer opportunities to proactively manage the tax relief process and often increase the level of allowances available.

A client may purchase an existing building, either for use in their business or as a commercial investment. In these cases, in order to claim capital allowances, the purchase price must be split down into the components of the building and the land. The changes to the rules for claiming capital allowances on second-hand plant and machinery fixtures, brought in by the Finance Act 2012, have a significant impact on property buyers. Whilst property sellers will not suffer directly from the new rules, there will be consequences for all businesses incurring expenditure on fixtures within commercial property and we offer a consultancy service to advise both buyers and sellers on the impact of these changes to them and the allowances within their properties. Timely advice can ensure that allowances remain available to purchasers and subsequent owners, which could otherwise be lost.

Expenditure incurred on an existing building can be analysed in a similar way to the cost of a new building or extension, by a detailed review of actual invoiced costs. The value of relief available in connection with refurbishments, alterations or fit-out works is generally enhanced by capturing the cost of all incidental expenditure. Whilst the cost of the works may be capitalised, some costs may be capitalised repairs and attract 100% tax relief in the current year.

When you decide you want to sell your B&B you will have tax to pay.

• There are several factors which will impact your Capital Gains Tax position on the sale of a B&B, it is most certainly not a “work it out yourself” guide.

• It is advisable to get advice from your accountant before your sale. There are potentially several tax reliefs available. Some of the current reliefs available in 2020 which can help reduce (or eliminate) Capital Gains Tax are:

• Principal Private Residence Relief

• Letting Relief

• Annual exemption

• Entrepreneurs’ Relief

Relief everybody gets

Every person is entitled to a CGT exemption. For the tax year 2020/21 the exemption is £12,300.

Business rates generally apply to bed and breakfast establishments unless;

a) The business does not intend to offer short-stay accommodation to more than six people simultaneously.

b) You occupy part of the property as your only or main home, and letting out the rooms is subsidiary to the use of the rest of the house as your home.

• Business rates apply to a self-catering establishment unless you offer short-term lets for fewer than 140 days a year.

• Only the part of the property used for business purposes is subject to business rates.

• Your local authority will calculate the business rates for your property based on its 'rateable value'.

You will need to pay business rates if you are providing serviced or self-catering accommodation, unless you qualify for Small Business Rate Relief, OR for bed and breakfast if:

• You do not intend to offer short stay accommodation to more than six people simultaneously, and;

• You (the owner) occupy part of the property as your only or main home, and;

• Letting out the rooms is subsidiary to the use of the rest of the house as your home (‘subsidiary’ is based on factors such as the length of your season, the scale of modifications undertaken for guests and the proportion of the house you occupy).

• For example, if you only let only two of six bedrooms in your property as a bed and breakfast, business rates are unlikely to apply. However, if you let four of your six bedrooms, you will probably have to pay business rates. Your local authority will be able to advise you.

Note: If you must pay business rates, but use your property for business and domestic purposes, it is only the part you use for business purposes that is subject to business rates.

• The domestic accommodation is liable to council tax.

• Where parts of a house have a shared use, such as a kitchen or dining room, the Valuation Officer will visit the property and assess the amount to be paid.

• Small Business Rate Relief is available to businesses. For up to date information please visit: https://www. gov.uk/apply-for-business-rate-relief/small-businessrate-relief

• Currently as of 2020 where the rateable value of the property is less than £15,000, businesses with a rateable value of up to £12,000 receive 100% relief.

• While businesses with a rateable value between £12,000 and £15,000 receive tapered relief.

If you have a second property, you'll keep getting any existing relief on your main property for 12 months. You can still get Small Business Rate relief on your main property after this if both of the following apply:

• None of your properties have a rateable value above £2,899

• The total rateable value of all your properties is less than £20,000 (£28,000 in London)

Note: If your property has a rateable value of more than £15,000 but less than £51,000 your bill will be calculated using the small business multiplier, which is lower than the standard multiplier.

• If you need to pay business rates, your property will have a 'rateable value' based on the rental value of your property.

• These values are set by an independent Government Agency, the Valuation Office Agency (VOA).

Note: Due to the impact of COVID-19, the Government has announced that the planned business rate revaluation will no longer take place in 2021.

• You can obtain details of the rateable value of your property from your local Valuation Office or the business rates department of your local authority.

• The VOA website allows you to access entries in local rating lists.

• You can make an appeal against the 2017 valuation of your property at any time during the life of the valuation (i.e. until April 1, 2022).

• You are advised to appeal as soon as possible as you will have to pay your rates in full until a decision has been reached and, for most appeals, there are limits on how far any resulting change in value will be backdated.

• Appeals are made in the form of a 'proposal' to the local Valuation Officer or online through the VOA website.

• If an agreement is not reached within three months of receipt of your proposal, it will be automatically referred to the local Valuation Tribunal, which will hear the case and give a decision.

Every business is different and will have their own targets and profit margins, but it is important to maximise these. Below are some tips to consider:

• Systemise Everything

• Know Your Key Drivers and Monitor Them

• Focus on a few key metrics. Eg. Gross profit margin. Bed Occupancy

• Review Your Prices

• Look at your price points.

• Work your margins.

• Maximise Efficiency, Automate.

• Use systems to monitor effectiveness.

• Justify Costs

• Look at all your costs, Are they necessary?

Extra things to consider:

• Hen parties, dog walking, water sports - who are your audience and what do you think to that?

• Cancellation policies, bedrooms, kitchen equipment etc.

• Look at the other properties and copy their terms.

• Many ask for 30% up front to secure the booking, balance within 60 days.

• Then the damage deposit needs to cover the insurance (payment you pay with any claim). Mine is £500.

Identifying the competition (nearby businesses)

• It is useful to select similar size properties close to yours and also properties close by.

• Consider what size of property is selling.

FINAL things to consider in terms of profit:

• Area

• Revenue

Setup estimate & cash flow forecast (for year 1)

• You need to be realistic about when you will launch which will dictate the first year’s earnings.

• Maybe your place is a summer place and so launching in October will leave a low year 1 revenue.

This brings Chapter 1B to a close, and we hope you now feel more confident when it comes to the more complex areas in setting up a holiday rental property.

It is definitely worth it in the end though, especially when you see guests enjoying themselves and the great reviews come rolling in, which is why it is good to cover all the ground you can at the very beginning, so you don’t run into issues later on down the line.

Keep a look out for Chapter 2 which will tell you everything you need to know about business plans, legal entity and finance - don’t miss it!

WHAT DO PEOPLE LOOK FOR?

Figure out:

• Who your ideal guest is (demographics)

• What your advantages are

• How you differ from your competition

• Which rooms and services got the best and worst feedback

• What your weaknesses are

• What your vision is

A VERY SIMPLE PLAN USED TO SECURE A MORTAGE.

Introduction

I wish to purchase a property in [X location]. My idea is to initially rent out the property as a short-term holiday let

Details of the property:

I plan to pay [£X] for the property. The property is in an excellent location and order. There is no work required on the property and it is currenrtly operating as a short-term holiday rental propoerty.

Existing Revenue Figures:

The figures below are actual figures (using public information):

This section will introduce you to Legal Entity, and will explain what Partnerships and Limited Companies are, and the benefits of each.

INFORMATION FROM MATT BRYANT AT OCL Accountants

Deciding on whether you trade as a Partnership or Limited Company will depend on a range of different factors, including:

• Tax considerations

• Legal requirements

Identifying the pros and cons so that you have a good grasp of the difference between a Partnership and Limited Company, is an essential part of the process of business planning.

Why making the right choice matters:

• Making the right choice can ensure optimum efficiency.

• It provides key protections and makes it simpler for your business to grow.

• It can be useful to discuss this with an accountant before you make the choice.

Partnership vs. Limited Company

What is a Limited Company?

Running costs

Cleaner / Advertise: £100 per booking = £2k/year

Maintenance: £50 per month

Services: £100 per month

Total: £3,800 / year

Release: £12,995.71

Conclusion

Finance of purchase

Savings: £ N

Business loan on property: £ N