For the Year Ended 31 July 2023

Charity Number:

For the Year Ended 31 July 2023

Charity Number:

President and visitor

The Right Rev’d Dr John Inge

The Lord Bishop of Worcester

The primary object of the College, as stated in the Royal Charter, is: “to carry on at Malvern or elsewhere a School for Boys and Girls or for children of either sex in which they may receive a sound religious, classical, mathematical, scientific and general education in conformity with the principles and doctrines of the Church of England.”

Status and administration

Malvern College is incorporated under Royal Charter originally granted in 1929, together with a Supplemental Charter granted in 1992. It is registered with the Charity Commission in England and Wales under charity registration number 527578.

Nominated Councillors: the following may each nominate one Councillor for a five-year term:

» The Lord Lieutenant for each of the Counties of Gloucestershire, Herefordshire and Worcestershire;

» The Vice-Chancellors of each of the Universities of Oxford, Cambridge and Birmingham;

» Each of the Boards of the Admiralty, the Army and the Royal Air Force; and

» The Headmaster or Headmistress and Assistant Masters and Mistresses.

Elected Councillors: The Governors of the Corporation elect ten Councillors. The two longest-serving retire on rotation each year and can be re-elected.

Co-opted Councillors: The Council may appoint between six and ten Councillors for a five-year term.

The above is a summary. Full details of the Constitution are specified in the Bye-Laws in The Royal Charter.

Officers & key management personnel:

Headmaster – A K Metcalfe Esq

Chief Operating Officer & Clerk to the Council – R A M Breare Esq

Senior Deputy Head –Mrs S G Angus

Deputy COO & Group Director of Finance – Mrs N R Roberts

Headmaster, The Downs Malvern –A Nuttall Esq

Registered address and principal office:

Malvern College College Road

Malvern

Worcestershire

WR14 3DF

Independent Auditor:

Crowe U.K. LLP

4th Floor, St James House

St James Square

Cheltenham

Gloucestershire

GL50 3PR

Bankers:

Lloyds Banking Group PLC

48 Belle Vue Terrace

Malvern

Worcestershire

WR14 4QG

Lawyers:

Veale Wasbrough Vizards

Narrow Quay House

Narrow Quay

Bristol

BS1 4QA

1.

6.

7.

8.

10.

11.

12.

13.

We instil and nurture within our pupils emotional and cultural intelligence; to develop core skills, qualities and intellectual curiosity; and to facilitate the attainment of the qualifications our pupils need.

So that they become happy, balanced and successful individuals who achieve personal fulfilment, determined and able to make a positive contribution to the world they go out into.

We are one family, in four countries:

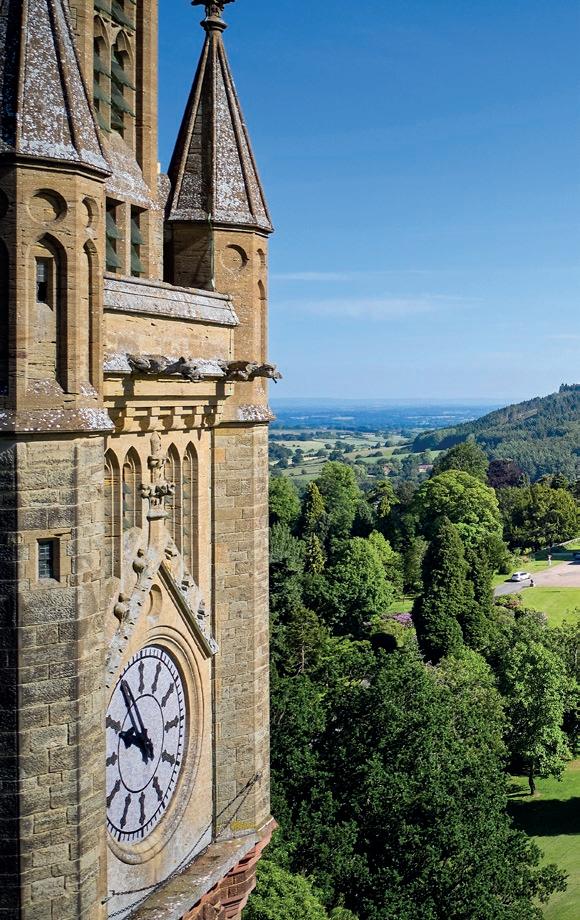

» Malvern College is at the heart of our family, based in Great Malvern, UK.

» Our UK prep school, The Downs Malvern is based close by.

» The family includes franchise international schools in China (Chengdu and Qingdao), Japan (Tokyo opened September 2023), Hong Kong, Egypt, and Switzerland (closed September 2023)

A global community of more than 4,400 pupils, 1,750 staff, and more than 10,000 alumni.

The Malvern College Family of Schools is made up of 8 different legal entities:

1. Malvern College

2. Malvern College Enterprises Ltd

3. Malvern College International Ltd

Malvern College Group accounts (consolidated)

4. College Guardians Ltd

5. Abberley Hall Ltd (CLOSED 30 June 2023)

6. The Downs, Malvern College Prep School Ltd (merged with the College from 1st November 2022)

Educating 990 pupils Employing 570 staff

Malvern College’s UK family (not consolidated)

Malvern College’s International family (not consolidated)

The above 5 entities plus:

1. The Malvernian Society Ltd

2. Abberley Hall Enterprises Ltd

Franchise international schools operating in:

1. China (2), Japan (1) & Hong Kong (1)

2. Egypt (1)

3. Switzerland (1)

Educating 3,433 pupils Employing 1,178 staff

More than 4,400 pupils Taught by over 1,740 staff On 8 campuses

2022-23 Year in Numbers

Pupils: 4,424

» Malvern College: 641

» Prep Schools: 350

» International schools: 3,433

Alumni, past staff and past parents: 11,973

* On the database

Contribution from trading subsidiaries (Enterprises, College Guardians and International): £2.2m

Total Operating Costs: £34m

Malvern College:

» Boys: 336

» Girls: 305

» Boarders: 66%

» Day: 34%

College Guardians care for: 1,287 pupils

Malvern College’s UK family

Donations received from Malvernian Society: £0.25m

Gross fee income: £31m

Staff: 1,745

» Malvern College & Preps: 567

» International Schools: 1,178

* Headcount and approximate due to change in year

Meals catered: 1,001,599

Malvern College:

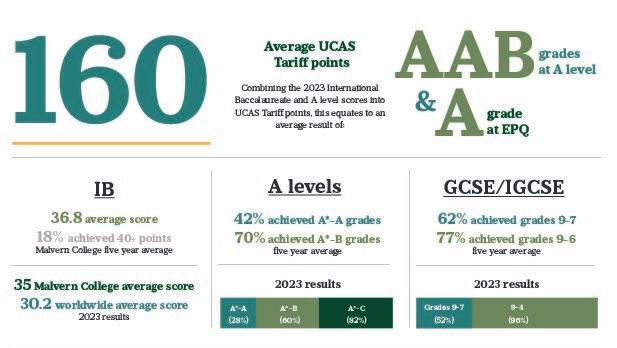

IB Results: 35 average A-levels: 60% A*-B

Total concessions: £4.5m

Pupils with means-tested financial assistance: 70

Bednight lets in the holidays: 7,780

The energy, enthusiasm and diligence of The College community throughout the 2022-23 year has been exceptional; and I would like to extend my thanks and congratulations to the staff, parents, alumni and, particularly, the pupils that make this possible.

There has been much to celebrate with another year of strong A-Level, IB and GCSE results. Pupil recruitment continues to be among the highest in the College’s 159year history; The Downs Malvern Prep School officially become part of the Corporation of Malvern College; and our international schools are going from strength to strength, with Malvern College Tokyo opening in September 2023 albeit Malvern College Switzerland closed in July 2023.

2022-23 has been a year of consolidation post-pandemic, with a focus on excellence and efficiency across our educational and operational teams. This has been vital to mitigate the impact of persistent cost inflation across the UK, and to ensure resilience in the event of the possible loss of charitable tax benefits, most notably the threat of VAT being added to school fees, potentially as soon as April 2025. Despite these pressures, The College and

The Downs together delivered a robust EBITDA of £0.9m for the 2022-23 year, supplemented by £2.2m of contribution from our international schools and other commercial activities.

The merger of The Downs and The College has been a positive step forward, allowing the two schools to act fully as ‘one school, two sites’. Under the leadership of Andy Nuttall, as Headmaster since March 2022, The Downs has gone from strength to strength with year-on-year growth in pupil numbers and a myriad of improvements to the educational offer, culminating in the complete refurbishment of the Music School in Autumn 2023.

Sadly, in July 2023 at the end of the Summer Term, Abberley Hall prep school closed its doors for the last time despite the extensive educational and financial support of The College over the last 4 years.

Following the announcement of closure in January 2023, the Abberley Hall team demonstrated an extraordinary level of professionalism through to the very last moment, providing the pupils with the support needed to transition smoothly to their next schools.

Overseas, our international school profile grew steadily from 3,000 to over 3,400 pupils over the last year, delivering exceptional academic results with pupils going on to leading universities around the world, and particularly here in the UK. The Malvern College Family of Schools will continue to expand with the recent opening of Malvern College Tokyo with a number of interesting opportunities currently under review. Our international operations bring a Malvern College education to pupils around the world and are increasingly important in enabling us to both invest in the UK estate and build our bursary endowment fund over the long-term; and demonstrate the soft power of British independent education around the world.

The generosity of parent and alumni donors has historically been a vital pillar of support for the College. 2022-23 saw our first ever ‘Green Giving Day’ raising more than £100,000 for sustainability projects from more than 300 donors and earning an award for best fundraising initiative from the Institute of Development Professionals in Education. The College community is truly grateful for all the support received over the years and welcomes interest in supporting our future projects.

Looking ahead, the independent education sector faces significant economic and political uncertainty, particularly here in the UK. It will be a time of change but, as ever, also a time of opportunity and it is with this in mind that the Council, management and the wider teams have been engaged in extensive long-term planning over the course of the last year. We are in the final stages of our new ‘Development Plan’, preparing our vision, strategies and estate masterplans for the next decade. The final plans were reviewed and approved by Council in December 2023 before being shared with the wider community and at our Annual General Meeting in March 2024. A new 6th Form Centre in the Memorial Library and a new College café and co-working space in the much-loved Grub will be the first of the estate projects, both opening in 2024, alongside a long-term investment into enhancing existing boarding and teaching facilities over the coming years.

Over the coming year, Council’s focus is to ensure that the College has a clear vision for the future, a roadmap to get there and the resources to see the journey through. After a period of streamlining our governance and structures, we are well positioned for future growth.

Robin Black Chair, Malvern College Council

For a Head, September is the best month of the year. With the start of the new academic year come the sights, smells and sounds of a great institution gearing itself up again:

freshly painted and vigorously cleaned boarding houses; Chapel pews rammed with pupils and staff, excited about seeing each other again, and with the enthusiastic excitement, and a little trepidation, for the opportunities to come; parents slightly nervously dropping off their dearly beloved, but themselves excited about living vicariously through an education system that is (probably!) far more engaging and enjoyable than the one they experienced.

In September, a new post of Director of Innovation and Collaboration started work supporting pupils leading societies and activities within the super-curriculum at Malvern College in the UK, whilst also chairing a committee of representatives from the Malvern College International Schools looking to develop initiatives and opportunities for pupils to optimise the value of being part of a global education group. Alongside this,

the Malvern Award was launched as a way to reward and encourage pupils who engage in the full holistic education that Malvern offers, with Gold, Silver and Bronze awards to recognise the different levels that pupils achieve over their time at the College.

The academic year 2022-23 also marked 30 years since Malvern became a co-educational school, when in 1992, Ellerslie, a neighbouring girls school, formally joined the College. To mark this momentous occasion there have been a number of special events including OMs Lara Vafiadis and Rose Harvey talking to current pupils about their recent feats in rowing single-handedly across the Atlantic and being the first British woman home in the 2022 London Marathon respectively; and a very well attended Ellerslie Old Girls dinner in May 2023 with over 160 guests from all across the world.

Amongst other things, a focus on parental engagement was a key objective for the year, and so with a new performing arts events guide that underlined both the number of opportunities, and the different ways that parents could attend (in person, live-streamed, or accessing a set of recordings) parents enjoyed a wide range of performances and concerts, with highlights probably being the House Singing Competition, the Christmas Concert and College Carols, the school Musical, Les Misérables, and summer’s concerto evening for our elite musicians.

The highlights of the Spring Term sports programme included a fantastic Rugby 7s season with a number of trophies for the boys’ 1st VII, matched by some excellent netball from the girls with an exciting win in a live-streamed charity match against a very talented local rival school. Sporting excellence continued into the Summer Term with the boys’ 1st XI cricket team reaching the national T20 finals at Arundel Castle for the fourth year in a row.

Over the full year, with The Downs Malvern formally becoming part of the Malvern College Corporation, there has been an ever-increasing collaboration with the focus being ‘one school on two sites’. From operations to sports, and academic departments to pastoral care, there has been a particular focus on ensuring coherence, efficiency and for those pupils who

make the transition from Year 8 at The Downs to FY at the College (the vast majority), a smooth and stress free transition, allowing them to enjoy and take the maximum benefit from their final year at Prep School when they are at their most curious and excited about exploring their own intellectual horizons.

Given the positive trajectory that The Downs is on, and particularly in its relationship to the College, it was very disappointing that we had to announce the closure of Abberley Hall prep school, which had joined the Malvern family in 2019. Winning the national Tatler Award for Best Prep School was a wonderful accolade in the autumn of 2022, but even with this accolade and the fantastic work the team were doing to make it such a good school, market forces and stubbornly low pupil numbers, as well as the high costs of running a very large and heritage site, simply made the business model unsustainable.

The academic year ended on a high with a fantastic final week of celebration with Speech Day, Prize Giving and a wonderful Leaver’s Ball, but immediately were cleared away to allow the College to continue to serve as a base for a holistic education to a wider audience as a stream of summer activity weeks, sports festivals and international schools visited and made optimal use of the excellent facilities, just as the NSSO (National Schools Symphony Orchestra) had filled the buildings with music during the Easter holidays.

As ever, during the summer holidays we received the year’s public exam groups. Given the widely reported return to 2019 grades, it was no surprise that results did indeed return to pre-pandemic levels. As a key marker of continued academic success, 75% of our leaving cohort went on to their first choice universities, which included a full range of nationally and internationally ranked universities within the UK, Europe and North America.

So, a year with many successes to celebrate, but more importantly, one with many individual stories of personal growth and development as pupils and staff have learned new skills and important life values, so that as they leave they take the confidence and the competencies gained at the Downs and the College to make a positive difference to the world they go out into.

Keith Metcalfe Headmaster

1. To carry on at Malvern in the County of Worcester or elsewhere a School for Boys and Girls or for children of either sex in which they may receive a sound religious classical mathematical scientific and general education in conformity with the principles and doctrines of the Church of England.

2. To create and administer and to assist in the creation and administration of scholarships exhibitions and prizes for the encouragement of study and learning and to act as trustees of any endowment legacy bequest or gift for educational purposes.

1. To enhance the Malvern College Family of Schools’ national and international reputation.

2. To secure long term financial sustainability.

5-Year Goals * alongside development funds for the College

1 Family of Schools with 6,800 pupils

1. Facilitate the attainment of the qualifications pupils need.

2. Instil and nurture emotional and cultural intelligence.

3. Develop core skills, qualities and intellectual curiosity.

£6m Surplus EBITDA £5m increase in the Society endowment fund*

8 International schools (+1 partner, +3 countries, +3 schools, +2,000 pupils)

1 Consolidated charity for UK schools (+ 60 pupils)

Unashamedly an academic school, but determinedly not a hothouse.

1.1. Strong and varied core-curriculum:

» FY (Year 9): focused on engagement and experience; developing core and transferable skills with highlights including cross-curricular projects, CCAs and FY passport

» GCSE (Years 10-11): breadth of choice and experiences

» IB and A level (Years 12-13): catering to the individual; delivering choice and a variety of subjects and skills

» excellent exam results and first-class preparation for university applications in UK, North America and Europe

1.2. Pupil-led super-curriculum:

» encourages pupils to develop in the areas that interest and inspire them; challenging them to think and create their own intellectual pathway

» provides opportunity for pupil leadership, ownership, innovation and collaboration; developing pupils’ transferable academic skills: research, logistics, marketing etc

» preparing them for university or degree apprenticeships, and future careers

Intentional holistic education; encouraging creative and sporting endeavour; promoting individual and collaborative participation to:

2.1. provide opportunities for skill development and intellectual engagement at all levels (from elite to purely participatory) across art, drama, design technology, music, sport, CCF and outdoor pursuits

2.2. provide opportunities for responsibility, service and leadership (e.g. through D of E, CCF, Service, school partnerships and expeditions)

And through these:

» promote and instil an understanding of physical and mental health, and well-being

» intentionally promote the development of core values (Malvern Qualities) such as resilience, collaboration, ambition and open-mindedness

» develop positive transferable skills that give pupils the confidence to lead and to serve

» develop a sense of self and responsibility towards others, ensuring emotional and cultural intelligence are developed alongside intellectual intelligence.

The underpinnings of happy and healthy young people. A secure and supportive environment where:

3.1. Houses are a familial ‘home from home’, forming ideal settings where communities support each other

3.2. each pupil is known and supported, confident to discover their strengths and plot their individual pathway

3.3. well-being is a core focus with safeguarding at the centre

3.4. opportunities for responsibility, service and leadership, and the development of the Malvern Qualities, equip pupils to seek opportunities and overcome life’s challenges

3.5. pupils are encouraged to reflect on the value of diversity, inclusivity and equality

3.6. parental and alumni engagement promotes life-long relationships with and support for the College

Staff planning reflects the value of diversity, inclusivity and equality

To achieve financial sustainability across the group at an overall surplus level, generating substantial non-fee income from fundraising, franchising and other commercial activities that can be invested in transformational bursaries and campus developments.

Goals: (i) £7m MCFS EBITDA, (ii) College

Concessions at 14.5% of gross fees, (iii) £3.5m surplus from commercial activities, (iv) £1m net contribution from development

a. fee inflation to remain at or below CPI, and absolute fees to be line with the median for direct peers

b. greater means-tested concessions, focused on securing families in the local and domestic market

c. leverage economies of scale across the family of schools to generate purchasing efficiencies

d. investment in forward-looking 10+ year campus masterplans that (i) deliver a transformational education experience (ii) approach carbon neutral and (iii) maximise commercial income

e. renewed focus on fund-raising and investment management as an important income stream

f. expansion of overseas franchise opportunities and diversification of partners and locations/continents

g. investment of 25% of MCIL net-income into an endowment fund for transformational bursaries when cash-flow allows

h. develop further the College’s commercial activities with a focus on expansion of Summer Programmes

i. ensure Net Debt is kept within the range of £10-15m.

To create a fit-for-growth operations capability that adds value across the family of schools by providing services that are tailored to individual needs and identities

a. structure and resource our operations teams to meet the needs of both the College and the wider family of schools, driving efficiencies through the sharing and application of best practice

b. support and develop staff through good management and appraisals, clarity of communication and ongoing professional development

c. invest in payroll, HR and admissions systems that can work across schools and which enable efficiencies and improved decision making

d. ensure our digital infrastructure (virtual and real) keeps pace with fast-changing technologies and needs, whilst maintaining the highest levels of cyber security and protection

e. Staff planning reflects the value of diversity, inclusivity and equality.

To attract, retain and satisfy the needs of customers who can afford to pay for a ‘Malvern’ education. To exploit the advantages of a growing family of schools and to develop further our links with parents and alumni

a. continue to modernise, improve and develop the Marketing, Communications and Admissions strategy and tactical activities, both at the College and at the associated family of schools

b. enhance customer awareness and understanding of the concept of a Malvern Education and the unique journey pupils follow at Malvern and its associated schools

c. development of a global brand which supports the strategic objective for growth and positions Malvern College as a leading global provider of education which attracts pupils who will benefit from a Malvern education and top quality academic and operational staff.

Monitor, develop and improve governance, leadership and performance management across the College and Malvern Family to ensure coherence and consistency of excellence across all entities within the corporation

a. develop a sustainable long-term strategic plan alongside a review of our corporate governance in general and the Royal Charter in particular

b. provide the resources required to enable the Schools to meet their educational, financial, legal and charitable objectives

c. ensure that the various Committees, Boards and Trustee memberships of all entities within the ‘Trust’ are structured and led optimally to develop effective Governance and oversight

d. Appropriate measures and oversight are in place to ensure diversity, inclusivity and equality.

To seek out and develop further growth internationally, both with existing partners and, where appropriate, with new educational partners, ensuring a greater spread of schools globally, and where possible, in first tier cities.

The short-term plans that were enacted in the year to achieve these objectives were:

» To develop balanced and meaningful enrichment & stretch opportunities for all year groups and increase participation.

» To build upon the departmental appraisal process by following up findings and setting specific targets for both the department and the individuals within it.

» To further develop a range of pupil-led societies that engage all pupils through a broader range of choices and effective communication.

» To operate throughout the year with tight control on costs and a thorough and successful pupil recruitment strategy.

» To review bursary levels and other public benefit contributions by the College continually.

» To develop the marketing and admission function and enhance marketing communications.

» To provide the resources required to enable the College to meet its educational, financial, legal and charitable objectives.

The strategies, objectives and plans are reviewed and updated by the College Senior Leadership Team to ensure that the objectives are being achieved. The fundraising activities are undertaken by the College Development Office in conjunction with the Malvernian Society. The College Management Board and Council reviews the progress of fundraising and future strategies and targets.

The College Council and Management Board formally reviews the 10-year plan annually.

The specific objectives for the coming year include:

» Widen profile of IB cohort and increase IB numbers to achieve greater balance between IB and A level numbers. Adapt (I)GCSE curriculum to provide greater flexibility through a 9 GCSE +1 option model.

» Development of clear strategies for ICT in Teaching & Learning, and Academic Literacy.

» Embed Director of Collaboration and Innovation role within MC’s Super-Curriculum leadership, and begin to develop the role and initiatives across MCFS.

» Appointment of Mental Health Lead and develop strategy, including embedding integrated counselling model.

» Develop and support leadership and management skills of line managers.

» Introduction of online systems to improve efficiency in operations.

» To facilitate greater sharing and application of best practice across the family of schools to build personal and team excellence.

» To improve the bursary application process by introducing bursary management software.

» To continue with the boarding house refurbishment plan.

» To continue to explore opportunities to extend our international schools programme.

Future plans are focused on the strategic development of the family, whilst capital expenditure plans focus on improving the College experience, the continuation of the Boarding House refurbishment programme and improved environmental sustainability. The strategic aims and goals for the medium term are to provide excellent education, secure the College’s long-term financial strength and to enhance our national and international reputation.

The greatest risks currently facing the College are:

1. Political pledges/threats of loss of charitable tax benefits, including VAT on fees.

2. Inflation (especially electricity and gas prices) and associated increases in Bank of England base rates together with an unstable economic climate.

3. Further increases in employer contributions to the Teacher Pension Scheme (TPS).

4. Geopolitical tensions and subsequent impact on International Schools and on wider inflation.

5. Future ‘Green’ investments that will be needed to keep up with statutory requirements.

Please see page 38 for details of the mitigations and controls in place to address these risks.

Our goal is to reach Carbon Net Zero at the latest by 2050. Malvern College enjoys an exceptionally beautiful heritage estate, first founded in 1865, but the predominantly Victorian buildings are in need of significant upgrades to bring them closer to modern energy efficiency standards.

Addressing environmental sustainability at the College is driven by multiple imperatives:

1. Playing our part to address climate change

2. Providing an appropriate ‘environmental role model’ to pupils

3. Reducing The College’s energy consumption costs (and exposure to fluctuations)

Biodiversity: Approximately 210 acres of the 235 acre estate is green.1,700 specimen trees and 80 new trees, along with 1,000 hedge whips, have been planted. The area known as ‘9 Acre’ has been largely returned to meadow, with 4 acres of wildflowers. Across the College there are 3 sedum roof coverings.

Facilities: Daylight and motion sensitive LED lighting programme has been implemented. 70% of our 97 boilers are SEDBUK rated ‘C’ or above. Electric car charging points are in place, 51 bikes have been purchased in the Cycle-to-work-Scheme, and these along with our day pupil transport scheme and significant on-site accommodation for staff, notably reduces road transport.

Waste: All waste is streamed into three recycling stations and 100% of cementitious, arboricultural and land waste is reused on campus. Central catering production waste is turned into fertiliser pellets and cooking oil is recycled. We have removed waste by introducing re-usable water bottles across campus and providing recycling bins across all facilities. In 2022-23 we introduced ‘Chef’s Eye’, a technology to better track and so mitigate food waste in our catering offer.

Energy: 100% of electricity used at The College and The Downs is now from renewable sources.

Pupil engagement: A pupil ‘Environmental Action Group’ meets regularly to identify potential for waste reduction and to identify other potential initiatives for both pupils and staff to undertake.

During the 2022-23 year, we engaged CBG Mechanical & Electrical Consultants to review our energy consumption, with the Sports Centre/CUP, main building and 7/Ellerslie clearly identified as the largest demand.

(please see above right illustration)

During the 2022-23 year, we engaged CBG Mechanical & Electrical Consultants to review the most cost-effective means of reducing our carbon footprint.

Our priority projects are:

1. To re-commission the Combined Heat and Power (CHP) unit in the sports centre and introduce a new CHP unit in Main Building to replace an obsolete system, and over the long-term provide electricity to drive a Ground Source Heat Pump project.

2. To ensure that all House refurbishments (one per annum) include sustainability measures: replacement of windows, LED lighting, insulation, two-pipe heating systems and boiler upgrades where appropriate.

3. To move our £6m+ endowment investment portfolio into a ‘Climate Active’ fund, where investments are aligned to the spirit, and content, of the 2016 Paris Agreement under the United Nations Framework Convention on Climate Change.

4. To ensure that our purchasing policy reflects sustainability at its core.

(please see below right illustration)

The College Council confirms that they have complied with the duty in Section 17 of the Charities Act 2011 to have due regard to the public benefit guidance published by the Charity Commission. The significant activities undertaken to carry out our aims for the Public Benefit and our achievements measured against those aims include the following projects and programmes.

The College Council is acutely conscious that the College must remain accessible to children irrespective of parental means. It is determined to ensure that the funds it has available are directed to cases of the greatest need.

Bursaries are reviewed periodically based on a returned and completed bursary application form. The Bursary Committee comprising the Headmaster of the College, the Headmaster of the Downs, Chief Operating Officer, Director of Marketing & Admissions, Head of Admissions and the Director of Finance considers all bursary applications on a case-by-case basis. Information about fee assistance through bursaries is provided on the College website and is contained within the College scholarship literature.

The College and the Downs also offers fee concessions for academic, sporting, musical and artistic excellence in the form of Scholarships and Exhibitions; as well as to children whose parents are in the Armed Forces, to families with two or more children at the College, to former pupils of The Downs Malvern and Abberley Hall, to children of College employees and to children of Old Malvernians, Old Ellerslie Girls, Old Hillstonians, Old Downians and Old Abberlians. The College Council reviews the levels of these concessions annually and further details are provided on the College website.

During the year the College and The Downs, awarded £4.0m of scholarships, bursaries and other awards; with approximately 106 pupils representing 12% of the total school roll being in receipt of some means-tested bursarial support. It is the College’s long-term goal to move as much of the Concessions investment as possible into means-tested financial support.

£4,500,000

£4,000,000

£3,500,000

£3,000,000

£2,500,000

£2,000,000

£1,500,000

£1,000,000

£500,000

£0

Malvern College recognises its place in the local community and is always looking to do more to contribute to the area, for example by improving educational provision for all local students and working in partnership with local state schools. The pupils’ School Council and individual Houses have charitable fund-raising high on their lists of priorities for the year and all pupils are expected to do some form of service, whether that is internally within the school, or externally, supporting charities and events in the local area.

Malvern College has a number of partnerships with local maintained schools. These include The Wyche and Malvern Parish Primary Schools, as well as The Chase and Dyson Perrins Secondary Schools. Several staff are Governors at local schools, enabling sharing of good practice and expertise on a collaborative and mutual basis. Local schools and other community activities use the College’s facilities for their events at either a reduced cost or free-of-charge, for example the running track for The Chase and Dyson Perrins’ school sports days, our theatre for local primary school productions (with technical support and assistance provided) and a local performing arts school, the swimming pool for swimming lessons for a number of primary schools, performance spaces for music concerts such as those run by the Malvern Civic Society, NADFAS exhibitions.

One particular thriving initiative has been our Magic of Science event with chemistry demonstrations by Nick Barker, the University of Warwick’s Outreach representative. These days have been run for several years and have strengthened our links with Malvern Parish School, Welland Primary School, Hanley Swan Primary School, the Wells Primary School, the Wyche Primary School, Hollymount Primary School, Our Lady Queen of Peace Primary School and Callow End Primary School. The event is always oversubscribed reflecting the level of interest generated by these scientific outreach days.

For the past 4 years we have been working to support MRATHS. We continue to host a display showing the various technologies developed at Malvern College during WWII and within Malvern since the war and MRATHS have continued to use our lecture theatre and science centre for their meetings. MRATHS scientific experts gave a highly informative demonstration lecture on infra-red at the Physics Olympics event which local state schools were invited to and which our own pupils attended.

Malvern Priory is our parish church, and we have strong links with them through the chaplaincy at the College. The vicar is a regular visitor to college and preaches termly in chapel. We support the young people at the Priory by offering opportunities for confirmation preparation with our own pupils. We are regular performers at and supporters of their lunchbox concert series.

During Lent term 2024 the Priory is closed for major works to be undertaken and the main Sunday congregation are using the College chapel for worship.

During the last academic year pupils raised over £15,000 for charitable causes including supporting MIND, British Red Cross, the OSCAR Foundation, the Salaam Baalak Trust, the Doddie Wier Foundation, James’s Place and the HOKISA Aids Orphanage in South Africa. This year, pupils have raised money through cake sales, wearing home clothes to school, car washing, and attending the CVS Ball where significant fundraising takes place during the event, and a Lower Sixth ‘Hunted’ on the Malvern Hills. In the Houses there have been a wide range of fundraising events including:

School House undertook challenges to raise money for charities. 24-hour table tennis marathon and a swim equivalent of the channel raising £1355 for Alzheimer UK.

House One ran their annual Intra-house charity football competition to raise money for ‘Stand by Me’ charity supporting orphans in Nepal.

House Three supported Shelter with a January sleep out.

House Five raised over £5000 for Sporting Wellness with their annual ‘Iron Five’ (8-10 pupil iron man distance teams) and five a side football competition with House Two.

Other community activities supported by Malvern College:

Malvern College is also pleased to host, support and assist with a wide range of local community events including:

A presentation to Year 12 Parents from Malvern College, Hanley Castle HS, The Chase HS and Prince Henry’s HS Evesham about post-18 options and trends in applications to UK universities and degree apprenticeships (20th June 2023). The CEO of UCAS and a director of PWC spoke to a highly appreciative audience.

On a wider scale, pupil-led groups include an Environmental Action group, actively promoting sustainability, an Amnesty International Group as well as a Black Student Union, both supporting and promoting equality, diversity and inclusion within and outside of the Malvern community.

“Malvern College educates over 640 pupils from the UK and internationally, and employs around 430 members of staff, which puts it amongst the larger employers in the area. Recent research has shown that the College contributes around £22 million to the local economy through employment and through spending in its supply chain.

There has been increasing engagement with the local community and the school’s premises have been used by a wide variety of local groups such as Colwall Cricket Club youth section. We have also hosted a Science morning for the local Primary school and are seeking to develop greater opportunities with Colwall Primary as well as with Colwall Community Church Youth project. The school has also raised funds for various charities across the year including The Born Free Foundation (Eco-Week), St Michael’s hospice (Christmas Carol Concert), Teams4U – (Christmas boxes and clothes collection for their Romania mission). Ledbury and Malvern Food Banks (Harvest donations), Macmillan Cancer Research Coffee morning, Comic Relief and Children in Need. The Friends of The Downs also made a donation to the Disaster Emergency Committee.

In April 2023, Malvern College’s Mean Pay Gap was 22.3%, an increase of 5.26% (was 17.04%) and the Median Pay Gap was 25.39%, a decrease of 7.16% (was 32.55%). The Pay Quartiles were:

In summary:

» Variance from 2022 was anticipated as this is the first year it has been calculated through our new payroll system. Additionally, the data now includes The Downs Malvern, which had previously not been included in this report.

» In line with cultural and national trends, there are more women who work in the lower paid, part time roles.

» All vacancies are advertised internally and externally and are open to both men and women. Where appropriate, gender-neutral job titles are used to reduce certain roles being unconsciously biased towards a gender. We provide equal pay for equal roles, regardless of gender.

The Trustees collectively form the College Council which meets once per term and remains the ultimate decision-making body of the College.

The Malvern College Corporation is the legal entity that owns the land, buildings and other assets of the College. The business and affairs of the Malvern College Corporation are managed and administered by a group of Trustees, known as the Council, who are responsible for all governance. The Corporation is a Royal Charter company.

Robin, an OM and son of an OM, qualified as a chartered accountant with KPMG, and has over 35 years of private equity and banking experience. He has been the CFO and subsequently a NED and Chair of a number of quoted and unquoted companies in the fund management, media and leisure sectors. He is also a trustee of the Sports Council Trust Company.

Sue grew up in the College as her father was Housemaster and subsequently Second Master. She was educated at Ellerslie School before it merged with the College. Following an MA in Educational Management and 10 years in Commerce, she joined the independent school sector initially as a School Bursar and then on the academic side in a range of prep, GSA and HMC environments. Sue joined the Independent Schools Inspectorate in 2011 and is now a Lead Inspector and educational consultant.

An international commercial banker, Carey worked for Standard Chartered Bank for 34 years in various countries including Hong Kong, Sri Lanka, Botswana and South Africa. He is currently an Independent NonExecutive Director in the City of London. He has been a Magistrate since 2007 and is the father of an OM.

An OM, Timothy is the nephew, brother and father of OMs. After Cambridge he read for the Bar and is head of chambers at 4-5 Gray’s Inn Square, where he practises. He has been in silk for more than 25 years. He is a bencher of Gray’s Inn, a deputy High Court Judge, a judge of the Court of Appeal of the Falklands, a Recorder of the Crown Court and an Election Commissioner. Although he achieved no distinction in the game at school he regularly plays rackets and follows Malvern rackets closely.

» Management Board (Chair)

» Malvern College School Board

» Nominations Committee (Chair)

» Remuneration Committee (Chair)

» Malvern College International Ltd Board

» Management Board

» Malvern College School Board (Chair)

» Nominations Committee

» Remuneration Committee

» Malvern College International Ltd Board

» Malvern College Enterprises Ltd Board

» College Guardians Ltd Board

» Management Board

» Abberley Hall (Chair) closed 30 June 2023

» The Downs Malvern (Chair)

» Malvern College International Ltd Board (Chair)

» Nominations Committee

» Remuneration Committee

» Audit Risk & Compliance Committee

» Malvernian Society (Chair)

» Foundation & Property Committee (Chair)

» Management Board

» Malvern College School Board

» Nominations Committee

A qualified accountant, Tom has 30 years of experience in financial services holding board positions at FTSE 100 companies, including 10 years at the Prudential Group as Head of Audit for Prudential UK & Europe, Head of Audit for M&G Investments and Chief Risk Officer for Prudential UK & Europe. He was previously Head of Audit of Willis Group, Head of Compliance & Risk of Charles Schwab and Group Compliance Officer of HBOS Clerical Medical.

Andy Collins is currently Second Master at Dauntsey’s school in Wiltshire, following his role as Assistant Head Pastoral and Designated Safeguarding Lead at Millfield School. Andy was educated at King Edward’s School, Bath and with a first degree in History, took a Diploma of Social Anthropology at Lincoln College, Oxford, where he held a Major Stanley Scholarship and was awarded two Blues, before spending seven years as a professional rugby player. Andy joined the College Council in 2022.

Charles is an OM and the grandson of an OM. Following 23 years in wealth management with Albert E Sharp, Gerrard and Barclays, in 2017 he founded a public affairs consultancy, Facultas Associates. He serves or has served as a Trustee of: AGBIS, the Conservative Agents Superannuation Fund, the English-Speaking Union and the City of Birmingham Symphony Orchestra (and sings in the CBSO Chorus). He is a Fellow of the BritishAmerican Project, an elected member of the Board of the Conservative Party 2007-2011, chairman of the CCHQ Finance & Audit Committee 20092015 and was appointed an OBE for voluntary political service.

Roger joined the College in 1994 from The Manchester Grammar School and became Housemaster of No7, Director of PE & Sports and Head of Football. He was Coach to Southern England’s Under 19 ISFA and Chairman of Hereford & Worcester Schools Athletic Association. An ISI team inspector, he was Headmaster of Heathfield School for 10 years, a governor of Gosfield School, formed the partnership to create the Heathfield International School, Bangkok and was ISA National Ambassador for Sport.

» Audit Risk & Compliance Committee (Chair)

» Safeguarding Committee (Chair)

» Malvern College School Board

» Foundation & Property Committee

» Malvernian Society Trustee

» Malvern College School Board

» Safeguarding Committee

» Abberley Hall

Christine is the Director of Alumni Relations at the University of Oxford. Before arriving at Oxford, she amassed more than 30 years of experience in alumni relations at Harvard University. Most recently, she worked at Harvard Business School where she oversaw the School’s alumni outreach and fundraising activities. Educated at Connecticut College in the US, Christine graduated with a BA in Asian Studies.

An OM and son of an OM, Paul graduated from Pembroke College, Cambridge in Classics, Archaeology and Anthropology. Paul has worked in the City since 1979 at various banks but principally at SG Warburg (later UBS Warburg). He has been the Chief Executive of Hoare Govett (owned variously by ABN Amro, RBS and now Jefferies) and since 2006 has been its Chair.

Louise has spent 30 years as an educator, living and working in Europe, the USA and Asia. A former Head of a bilingual school in Switzerland, she now has her own company offering leadership development and coaching. Originally trained as a teacher at Cambridge University, she has an MBA and has worked as a consultant developing leaders in larger organisations. Louise is married to an OM and is the parent of three OMs.

An OM, Dominic is one of Britain’s best-known historians. After studying at Oxford, St Andrews and Cambridge, he became a lecturer in history at Sheffield before pursuing a career as a freelance writer. He is the author of a series of bestselling books on Britain from the 1950s to the 1980s, has written and presented numerous documentaries for the BBC and presents the podcast, The Rest is Politics. He has been a Senior Fellow at Oxford’s Rothermere American Institute and is now Visiting Professor at King’s College London. He is also a regular columnist for the Daily Mail and BBC History Magazine, and writes book reviews for the Sunday Times.

An OM, Ben read history at Trinity College, Cambridge before qualifying as a solicitor in 2002. Having worked with law firms and in the City of London and Milan, he currently practises corporate and commercial law, specialising in the oil and gas sector.

Andrew was Headmaster of St Peter’s School, York and Warden of St Edward’s School, Oxford. On his retirement from teaching, he became a director of the leadership development and recruitment company, Aspirance and also has a private development coaching practice. In addition, he is the educational adviser for the Sons and Friends of Clergy and a member of the advisory council for the Winston Churchill Memorial Trust.

Catherine is the Director of Education for the College of Social Sciences and a Professor of Public Management and Leadership in the Institute of Local Government Studies at the University of Birmingham. She has a background as a policy maker and practitioner in public service and as such has a particular research interest in developing research which can deliver change within the public sector. Her research-informed areas of interest include developing the public service workforce, leadership and the integration of health and social care.

After reading law at University College London, Stuart has been a commercial property lawyer for nearly 40 years, initially in the City of London and for many years as a partner and now a consultant in two large Bristol law firms. His son and two daughters were educated at Malvern College, his youngest daughter also at The Downs Malvern where Stuart has been a Governor since 2011. He joined the College Council in March 2022 and is also a member of its Foundation and Property Committee.

An OM, Kaspar is a founder of KKA Partners, a Berlin-based private equity firm that invests in leading companies in Germany, Austria and Switzerland – the so-called “Mittelstand”. He started his career as a M&A banker at Citigroup in London and New York, gained his MBA in the US, and undergraduate degree in Scotland and California. He sits on the board of the HBS Alumni Association of Germany.

Neil is not a Trustee but serves on the Audit, Risk & Compliance Committee. Neil is a Vice Chairman of Deloitte Consulting and leads the firm’s relationship with several FTSE 100 organisations. A Chartered Accountant, he specializes in technology enabled finance transformation projects that embrace organisational, process and people related change. Neil’s industry experience is centred around travel, hospitality and services. Outside Deloitte, Neil is also a Governor of Birmingham City University.

From November 2022 The Downs Malvern fully merged into the Corporation of Malvern College. The Downs Malvern Board continues to have oversight of matters academic, pastoral and safeguarding. The Board meets once per term and reports through to the Corporation of Malvern College Management Board and Council. Bringing the governance of The College and The Downs closer together is already allowing for greater agility and collaboration.

» Audit Risk & Compliance Committee

A Council Management Board, made up of up to 6 trustees provides executive, strategic and financial oversight.

There are separate Council sub-committees for: (i) Audit, Risk & Compliance (ARC); (ii) Foundation & Property (F&P); (iii) Nominations; (iv) Remuneration. The ARC, F&P and Nominations Committees meet termly, and the Remuneration Committee meets once per year.

There are separate boards accountable to the trustees as follows:

1. The Malvern College, The Downs Malvern and formerly the Abberley Hall (now closed) School Boards primarily focus on education, pastoral and safeguarding matters.

2. There are company boards for Malvern College International Limited, Malvern College Enterprises Limited and College Guardians Limited.

3. There is an independent and separate board of trustees for The Malvernian Society.

The formal line of contact from individual Council members to the College Head is normally via the Chair of Council or the Chair of the Malvern College Board, and to The Downs Malvern Head is normally via its Board Chair. The Chief Operating Officer (COO) and Clerk to Council is the Council members’ first point of contact for all matters relating to the governance of the College and each prep school, and for any queries about Council business.

A committee of Council, the Management Board, comprising up to 6 Trustees, the Headmaster, the Chief Operating Officer, the Senior Deputy Head, the Finance Director, the Director of Malvern College International and the Headmasters of The Downs Malvern (TDM) and Abberley Hall (AH) now closed, meets at least once per month in term time. All major developments and decisions are presented to the College Council having first been deliberated by the Management Board.

The Malvern College Board meets once per term, focusing on the DfE’s Independent School Standards (ISSR) and the Boarding Schools: National Minimum Standards (NMS) relating to academic, pastoral and safeguarding matters.

The Malvern Executive Team (MET), chaired by the Headmaster, meets every two weeks to review matters that affect all entities in the family, and wider strategic direction, drawing on other expertise throughout the College and Prep Schools as required. The Malvern College Senior Leadership Team (SLT, formally Senior Management Team), chaired by the Headmaster, meets most weeks. The Headmaster, who has overall day to day responsibility for the management of the College, consults with the SLT before making recommendations to the Management Board and ultimately to the College Council.

The Audit, Risk and Compliance Committee meets at least three times per year and consists of two members of Council and an independent member appointed by Council. This Committee scrutinises the College’s Annual Report and Financial Statements, its financial procedures and internal controls, and compliance (e.g. H&S and data protection). The Committee oversees the relationship of the College with its external auditors, formally reporting to the College Council. This Committee also reviews the Risk Register and management’s procedures for review of the Register.

The remuneration of the Key Management Personnel is discussed in detail each year by the Remuneration Committee, with awareness of industry standards, and is approved by the full College Council.

The appointment of Council members and membership of the Committees are both identified and reviewed by the Nominations Committee.

The Foundation and Property Committee meets three times per year to review investments and property holdings of both the College and the Malvernian Society.

When a Trustee vacancy arises, the criteria of skills required, availability and eligibility, as dictated by the Royal Charter, are identified and reviewed by the Nominations Committee. The College’s elected Trustees are appointed following the recommendations of both the Nominations Committee and the full Council. Trustees are appointed to serve typically for up to a 5-year term and typically retire after a maximum of three terms.

Induction for New Trustees is co-ordinated by the Clerk to the Council. All new Trustees receive an induction pack comprising Charity Commission Trustee information, DfE publications, Malvern College Annual Report and Accounts and extensive College information. Training is undertaken through the completion of on-line safeguarding training and attendance at College-organised Trustee training events as well as through attendance at Council meetings and by interaction with fellow Trustees. A record of training is maintained for each Trustee.

As the College is a not for profit organisation which aims to follow charity sector best practice, the Trustees, via the Audit, Risk & Compliance Committee have familiarised themselves with the updated version of the Charity Gover nance Code (the “Code”) published in December 2021. The Committee considers that the College’s governance framework does align with many but not all aspects of the Code. A review of the Code was conducted in 2022 and no changes to the College’s governance and standards were deemed necessary.

Keith was educated at Monmouth School and Downing College, Cambridge, where he read Geography, and came to Malvern College from Harrow School where he served as the Deputy Head Master. As well as overseeing the day-to-day running of a school, he has held a number of positions in his career including: Housemaster, departmental head, ISI school inspector, coach of various sports, and Master in charge of the Duke of Edinburgh’s Award programme.

After working for four years in the City of London in domestic and corporate banking during the late 1980s, Sarah went to Cambridge University to read Economics at Lucy Cavendish College. After graduation, she took her PGCE in Glasgow. Having been Head of Economics at Eltham College from 1994-1998, as well as being involved in school expeditions to Iceland, Norway and Nepal, Sarah then moved as Housemistress to Trinity School in Teignmouth, Devon, where she became Head of Sixth Form. She arrived at Malvern College ten years later as Housemistress of the newly-built Ellerslie House and was appointed Deputy Head (Pastoral) in 2011. In 2017 Sarah was appointed Senior Deputy Head.

Rob graduated from St Catherine’s College, Oxford and has built a wealth of experience through his early career at Procter & Gamble and WPP, before moving to Kenya as Commercial Director (Bursar) of Pembroke House School and subsequently as Chief Operating Officer at Ol Pejeta Conservancy. Prior to joining Malvern College, Rob spent five years on the Senior Leadership Team of Nord Anglia Education working with international schools across Europe and the Middle East. Rob is enjoying returning to boarding school life having had some happy memories from his own experiences in a British boarding school in his formative years.

Lewis Faulkner studied Biological Sciences at Lady Margaret Hall, Oxford before completing his PGCE at New College, Oxford. His first teaching post was at Sale Grammar School where he helped to introduce the Duke of Edinburgh Award Scheme. He then taught at St Edward’s Oxford for nearly fourteen years where he was Head of Biology and then Housemaster of a boys’ boarding house for seven years and, latterly, Senior Housemaster. He also has an MA in Education at Oxford Brookes University.

Stephen Holroyd studied Economics and Economic History at Leeds University before completing his PGCE at Warwick University. He joined Malvern in 1990 and during his time at the College he has taken on a variety of roles parallel to his Economics teaching including Deputy Housemaster, Stage Manager, in charge of Duke of Edinburgh’s Gold Award, Head of Boys’ Hockey, Sixth Form tutor, IB Workshop Leader, Senior Examiner and author. His most recent roles have been Head of Economics, Politics and Business, and IB Diploma Coordinator. He is also an ISI School Inspector and has held several Prep School Governing roles.

Penny Bijl Head of Learning Enhancement / Designated Safeguarding Lead

Penny trained originally as a teacher of English (1986) with undergraduate degrees from Reading and Cambridge. She then gained an M.Phil in Psychology of Education, also from Cambridge, in 1987 and took her MA in 1990. After completing management training with the NHS, she worked as a Contracts and Planning Manager at Kidderminster NHS Trust for 3 years. She then returned to teaching, initially in the state sector, and joined Malvern College in 2004 in the Learning Enhancement department, subsequently also teaching English to IB, GCSE and in the FY for several years and TOK for two years.

Natalie Roberts Director of Finance

Natalie graduated from the University of York with a degree in Philosophy, Politics and Economics. After beginning her career at KPMG where she qualified as a chartered accountant, Natalie has since worked in variety of finance roles in the not-for-profit and local government sectors. These include the Grammar School at Leeds and, latterly, Westminster City Council where her focus was on commercial, capital and strategic projects.

Kate Tripp Director of Human Resources

Kate joined Malvern College in 2011 as Head of Human Resources and became Director of Human Resources in 2019. She is a Fellow of the CIPD, has a degree in Applied Social Studies from Sheffield Hallam University and an MA in Human Resources Management from Oxford Brookes University. Prior to joining Malvern, Kate was Head of Organisational Development for a Housing Association and prior to that held a variety of Human Resources roles in the charity and banking sectors.

Andy joined The Downs Malvern in May 2022. Before taking over the Headship at The Downs, he was Deputy Head at Windlesham House School in Sussex. Andy graduated from Imperial College London with a degree in Zoology, completed his PGCE at Bath University and also holds an MEd in Educational Leadership and Management from Buckingham University. Before joining Windlesham House, Andy taught at Cheam School and spent four years at The Banda School in Nairobi, where he met his wife Polly. Andy’s leisure time is focused on the outdoors: he is a keen cross country runner, enjoys fly fishing, looking after the family’s chickens and quail and gardening with his two young children, to list a few of his interests.

All fundraising activities for the College are carried out by highly professional College staff with assistance from the Malvernian Society, alongside the parents and pupils with the running of specific fundraising events. The College does not use external professional fundraisers or have any commercial participators. All fundraising activities report in to the Chief Operating Officer, are monitored by the Headmaster, and are overseen by the members of the College Council.

No complaints relating to fundraising activities have been received by the College during the financial period. However, the College has in place procedures that would be followed in the event of a complaint being received with the initial response being the responsibility of the Chief Operating Officer. Any continuing issues would then be passed to the College Council to determine what further action might be required.

The College does not currently subscribe to any specific fundraising standards or schemes for fundraising regulation but considers that it has set appropriate standards for the operation and management of its fundraising activities. In particular, the College considers that its processes and controls ensure that vulnerable people and other members

of the public are protected from any unreasonable intrusion of their privacy and that no fundraising activities would be unreasonably persistent or place undue pressure on a person to give money or property.

The Council, as Trustees of the Charity, has examined the principal areas of the College’s operations and considered the major risks faced in each of the risk areas by reviewing the Risk Register prepared by the College’s SLT. It is the opinion of the Council that the College has established resources and reviewed systems which, under normal operating conditions, should allow these risks to be mitigated to an acceptable level in its day-to-day operations.

Risks are recorded on the College’s Risk Register. The Council formally reviews the Risk Register on an annual basis. Changes to the College’s risk profile are monitored and controlled on an operational basis by the College’s SMT, the Operations Management Team and the Health and Safety Committee. These bodies report specific identified risks and the strategies for managing those risks to the Audit, Risk & Compliance Committee, the College Management Board and Council.

The key controls used by the College include:

» Formal agendas and papers for all Committee, Management Board and Council meetings, with detailed minutes taken for each;

» Clear and detailed terms of reference for each Committee;

» Comprehensive strategic planning, budgeting and management accounting;

» Established organisational structures and lines of reporting; and

» Trustees who have designated responsibility for child protection and health and safety.

The Trustees believe that the College’s financial resources and contingency planning is sufficient to ensure the ability of the College to continue as a going concern for the foreseeable future, being at least twelve months from the date of approval of these financial statements.

Malvern College Enterprises Limited is one of the College’s wholly owned trading subsidiaries and carries out non-charitable trading activities for the College. The results of MCEL are consolidated within the overall College results. Further details of MCEL’s activities and performance are given in the Financial Review and Note 5 and Note 26 of the Financial Statements.

In September 2021, the guardianship business was devolved from MCEL and was incorporated as College Guardians Limited. It has the same board of Directors as MCEL and is a wholly owned trading subsidiary of Malvern College. Further details of CG’s activities and performance are given in the Financial Review and Note 5 and Note 26 of the Financial Statements.

Malvern College International Limited (MCIL) is one of the College’s wholly owned trading subsidiaries and carries out the trading activities of the International Schools. Further details of MCIL’s activities and performance are given in the Financial Review and Note 5 and Note 26 of the Financial Statements.

The Downs Malvern (TDM) is the trading name of The Downs, Malvern College Prep School. The merger of TDM into the Malvern College entity took place on 1st November 2022. For the 2022-23 financial year the results of The Downs Malvern are consolidated within the overall College results for the 9 months period from 1 November 2022 to 31 July 2023.

Abberley Hall is the trading name of Abberley Hall Limited (AH), a prep school located in North Worcestershire, educating approximately 160 children aged between 2 and 13. As at 31 July 2023, the College had provided AH with £3.7m of grant and loan funds for working capital and investment support with an undertaking to provide additional funds of £1.3m, i.e. a total of £5m, with a first fixed charge over the freehold properties of the school and surrounding estate.

The compounded effect of the economic climate and challenging prep school market negatively affected its cash flow position. Malvern College made the difficult decision that it would not provide further funding post the 2022-23 academic year. The Governors explored an extensive range of options including approaching private school groups and direct funding from a group of parents. An announcement of potential closure was made at the beginning of the Lent term 2023 and a consultation process was undertaken with staff. An Abberley Hall Parent Group was formed who went to great efforts to fundraise for the School, in an effort to keep the school open, however given the extent financial and operational investments required, a longterm arrangement was sadly unsuccessful. As a result, the School closed at the end of the summer term.

The results of AH for the year to 31 July 2023 are consolidated into the 2023 results of Malvern College because, whilst the school is a separate charity, the College has control of the Board of Governors. Further details of AH’s activities and performance are given in the Financial Review and Note 5 and Note 26 of the Financial Statements.

Giving back, looking forward

The Malvernian Society Limited is a company limited by guarantee, which promotes the work of, and education at Malvern College, assists in fund raising and in cases of need, assists pupils in providing bursarial and/or scholarship support. In the year to 31 July 2023, the Malvernian Society generated net income of c.£0.2m and held net assets of £16.8m. The results of The Malvernian Society Limited are not consolidated with the results of Malvern College because the Society is a separate charity with an independent Board of Directors. The College receives annual grants towards the cost of scholarships, exhibitions, bursaries alongside ad hoc grants for specific projects from The Malvernian Society. See Note 26 of the Financial Statements for further details.

In August 2021, the employees of the Malvernian Society were TUPED across to Malvern College in order to bring the fundraising and development office functions under the oversight of the Chief Operating Officer but remain accountable to the Trustees of the Society.

Council members do not receive any remuneration in the performance of their duties but are related parties of the College. See Note 9 of the Financial Statements for details of applicable transactions during the year.

Our latest ISI Inspection rated Malvern College as excellent for both pupils’ academic achievement and for the quality of pupils’ personal development.

Safeguarding arrangements under the new governance structure have rolled out over the course of 2022/23. The Council has delegated oversight for Safeguarding and Child Protection to the Malvern College Board (the “Board”). One member of the Board is responsible for the oversight of safeguarding arrangements, Mr Andy Collins, Safeguarding Governor, and he regularly updates the Council on its work. The Safeguarding and Child Protection subcommittee has been meeting termly in 2022/23 to review the relevant policies, plans, and procedures in place. It is attended by the safeguarding Board member for each of Malvern College, The Downs Malvern, MCIL, MCEL and College Guardians. Pupil Mental Health concerns have continued to be at the top of the list of safeguarding concerns.

In response to the rising pressure on our counselling service (and the increasing difficulty in getting referrals to CAMHS accepted), 2022/23 saw the integrated counselling model successfully established. Our full-time counsellor is fully occupied supporting pupils but has also provided a peer support and advice space for House Assistants who carry a lot of pastoral responsibility. She is able to advise all staff on, for example, recognising and responding to selfharm, and is a valued member of the Pastoral Team, supporting CAMHS and psychiatric referrals.

There has been continued focus on pupil wellbeing this year, with the embedding of the integrated counselling model and the introduction of regular wellbeing screening questionnaires for all pupils. These questionnaires have been designed by our College Counsellor and have been adapted from the YP CORE questionnaire which is used as a screening tool by professionals. The results are seen by the College Counsellor, Lucy Davies, and relevant information is acted upon by Lucy and the pastoral and safeguarding teams.

Listening to pupil voice is a core part of our pastoral care. We carry out a regular pastoral survey for pupils and the Pupil Thrive group meets regularly to discuss issues with senior staff. Pupil feedback has encouraged us to replace weekly Sixth Form Life Skills lessons with a termly Sixth Form Life Skills Day. This has been discussed and planned during 2022-23 and will be implemented during the next academic year. We continue to embed the Life skills programme into the curriculum, and we have benefited from many good guest speakers and workshops. This has been complemented by evening Life Skills talks and webinars for parents, so that they are kept informed of the Life Skills programme and so parents feel appropriately equipped to discuss these topics with their children.

There has been continued emphasis on continuing professional development for pastoral staff. We held a very useful ‘sharing good practice’ exchange with pastoral staff at Repton. They spent a day with us, and we spent a day visiting their boarding houses, touring their campus and discussing pastoral issues with their Housems and other pastoral staff. There are now regular training lunches for Deputy Housems and House Assistants with different themes, case studies and guest speakers. Housems attended a risk assessment training day (which doesn’t sound inspiring but was actually very useful!) and Housems also attended a bespoke Level 3 Safeguarding day. We have encouraged more integration with The Downs Malvern; Houseparents from The Downs attended College Housem meetings and we organised visits and sharing good practice, such as the CPOMS software system for recording and sharing pastoral and safeguarding information.

A major project for the pastoral team was the introduction of a new school uniform for September 2023. During 2022-23 we went through the final stages of consultation with parents, pupils and staff with the design of the new uniform. The new school uniform was three years in the making and from initial sketches and fabric samples to the final collection available today, collaboration with our community was at the centre of the project.

Pupils’ commitment their community itself in their for one another.

Early ideas came from pupil A-level Design and Technology textiles projects, and from fashion designer Milly Wall (OM. No. 3). Ideas were refined through extensive consultation with pupil groups, staff input, and Parents’ Forum. Whilst developing the new uniform we focused on a modern uniform that offers quality, comfort, individuality, choice and environmental credentials. We appointed Schoolblazer Ltd as our new uniform provider and the new uniform items are now available to purchase via their website. It brings together our heritage and ambition, whilst also appropriately reflecting wider societal changes.

2023 was the first year since 2019 where pupils sat public examinations without any special measures being applied to either the nature of the final examinations or what the pupils were expected to have learned. In previous years we have had the experience of CAGs (Centre Assessed Grades), TAGs (Teacher Assessed Grades), reductions in syllabus content and changes to the format of the final examinations. This year saw a return to the pre-pandemic exams regime and a much-publicised tightening of standards from the exam boards. This was, for all of cohorts, their first experience of sitting formal public examinations. As a result, comparisons to 2020, 2021, and 2022 are largely meaningless and so we are looking at 2019 as being our benchmark.

The IB cohort achieved an average score of 35 points which is above the global average of 30.2 points. It is also above the UK National Average score of 34.67, which given that the IB is only done by highly academic independent and maintained school is a useful marker for us to judge ourselves against. Maybe more impressively this equates to an average UCAS Tariff of 203 points which is the equivalent of A*A*A*C or A*A*AA.

That average score of 35 points compares to our 5-year rolling average of 36.79 so does represent a dip when compared to previous years.

Despite the reports in the press, our A-Level pupils have achieved a better set of grades to those from 2019, the last pre-pandemic set of results that we have. Considering that this is a cohort who have never done public exams before, the results are better than we had feared they might be. There has been a dip when compared to the five-year rolling average, but given that the previous 3 years had had either Centre Assessed Grades, Teacher Assessed Grades or slimmed down syllabus contents this was a good set of grades, especially when many of our most academic pupils take the IB Programme.

29% achieved A*/A grades

61% achieved A*– B grades

82% achieved A*– C grades

Overall, the GCSE results were down this year and represented, on the face of it, a relatively weak set of grades. 52% of the grades were between 9 and 7 which represents the old A*/A grades. This compares against our 5-year rolling average of 62%, though the inflationary impact of CAGS and TAGS must be factored into this.

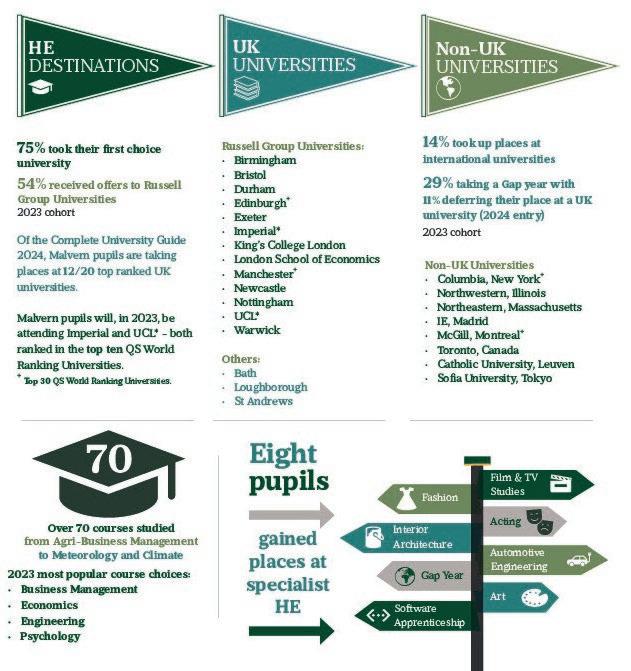

Despite what was widely regarded as being a difficult year for pupils doing IB and A-Levels the outcomes in terms of their university destinations remained very positive. 75% of pupils got into their first choice with 54% going to Russell Group Universities. Malvern has sent pupils off to 10 of the UK’s top 12 Universities including Imperial, LSE, Durham, Edinburgh, and St. Andrews.

An increasing number of pupils are applying to overseas universities with 14% doing so this year. Malvern pupils have gained places at a wide range of top-ranked European and North American universities including McGill, Columbia, and Northwestern.

The 2023 cohort are going off to study 70 different courses at university with the most popular choices being Business Management, Economics, Engineering and Psychology.

19% of pupils have chosen to take a gap year.

Malvern

took

at 5 out of the top 10

universities

QS World Rankings, 2022 Cohort

Beyond the core curriculum, we encourage pupils to broaden their intellectual horizons as well as their independence, collaborative research and engagement, through the pupil led super-curriculum that allows our pupils to individualise their own curriculum. Academic competitions, intellectual pursuits and pupil-led societies all provide opportunities for pupils to stretch themselves and challenge each other. There have been a number of achievements across the whole spectrum of subject areas:

In national level Olympiads across the Sciences and Maths there have been significant numbers being awarded medals and commendations for example in the Senior Maths Challenge Malvern pupils were awarded 7 Gold, and one pupil qualified for the British Maths Olympiad. Across the three science Olympiads and Challenges pupils were awarded 18 gold awards, with well over 100 awards in total.

As well as societies that link directly to the academic curriculum (e.g. Psychology, Economics and History societies), a range of societies that have a broader focus or look forward to future careers (e.g. Politics and Foreign affairs, Women in STEM and Med Soc) thrive. Pupil run groups that focus on wider society, human rights, responsibilities and identities including Black Students Union, LGBTQ+, Amnesty International and Empower Her Voice give pupils further platforms and opportunities to respond to and explore current affairs, issues and events.

The Aston Society (junior school academic society) finished the year with a “conference” in the Lewis Lecture Theatre and Foyer. Sixty Year 9 to 11 pupils had been researching individual projects and presented them as talks, a podcast, or academic posters. A variety of topics – from dementia in pets to random numbers, Raphael’s tapestries to social media research and extraction of essential oils captivated their audience.

The Wheeler-Bennett Society (upper school crosscurricular academic society) gives an excellent opportunity for our Upper Sixth pupils to research and present on an outstanding range of topic and it is a extremely popular society amongst all out senior pupils. All talks see our Lewis Lecture Theatre full of pupils listening keenly and enjoying the question-and-answer sessions that follow on from each talk. Of course, all pupil organised and run. Recent talks have been:

» Provably unprovableGödel’s incompleteness theorem

» Apophis - the asteroid that will NOT hit earth (or at least not any time soon)

» From Lab to Market: Revolutionising the ivory trade

» Is the fate of human society predetermined?