LONG-TERM EFFORTS DRIVE SUSTAINABILITY

Taylor Farms Increases Productivity by 50%

Extruders Tackle New Food Formulations

Frozen Pea Producer Reduces Downtime

Taylor Farms Increases Productivity by 50%

Extruders Tackle New Food Formulations

Frozen Pea Producer Reduces Downtime

Proud to partner with Riverbend Ranch along with the outstanding design, engineering, processing, subcontractor, and supplier teams to deliver “Project Angus.” Winner of ENR’s “Best of the Best” award for Top Manufacturing Facility and a finalist for PMMI’s Manufacturing Innovation Project of the Year.

Register today for free sessions conducted at our new Technology Center.

Upcoming half-day programs focus on cold cuts, chicken, pork and new food. Content includes demonstrations on specific pieces of equipment. Each informative session will focus on ways to improve operational performance in terms of productivity, yield, quality and cost effectiveness.

To see the remaining 2024 schedule and find out how you can register, scan the QR code below.

sales.northamerica@gea.com

06 From the Editor No Finish Line When it Comes to Sustainability

09 In the News Contaminant Regulations Pose Challenges for Processors

Testing Shows High Levels of Lead in Cassava-Based Pu s

Size of Pet Treats Can Impact Food Safety for Animals

20 Packaging Technology

Keurig’s Plant-Based, Compostable Pod Concept

Nesquik’s New 100% Recyclable Shrink-Sleeve Labels

Chip Company’s Recyclable Paper Bag is a First for the Format

52 Plant Floor Products

67 Tech Perspective Common Pitfalls of Anaerobic Digestion

Long-Term E orts Drive Sustainability

With continually increasing demand for transparency, it’s not enough to set meaningful environmental goals; the programs need to be in place to make those goals achievable.

17 OpX Intel: Business Continuity Planning

Supply chain, regulatory issues, cybersecurity, sta ng, and your assets should figure prominently in risk management plans.

34 Manufacturing Innovation: Taylor Farms

After a devastating fire at its flagship plant, Taylor Farms emerged stronger, more e cient, and increased productivity by 50%.

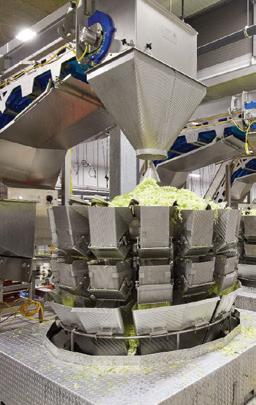

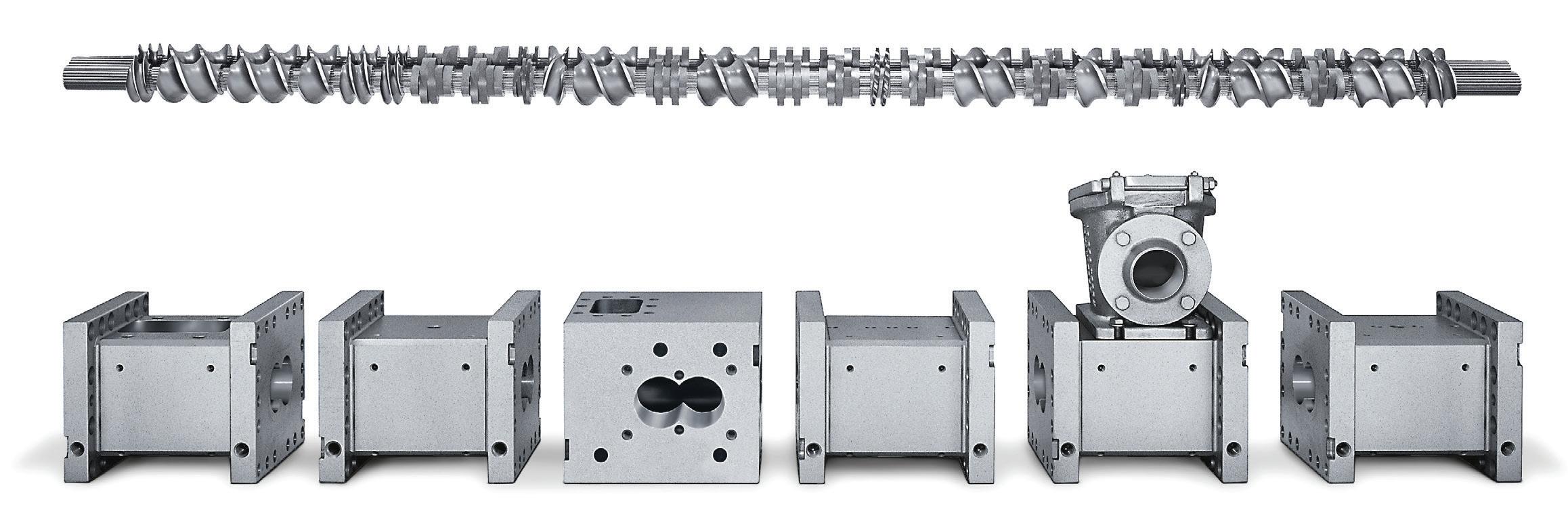

46 Tech Today: Extrusion Technologies

Extruders today feature improved controls, throughput, and flexibility, and are being used to handle novel ingredients for manufacturers.

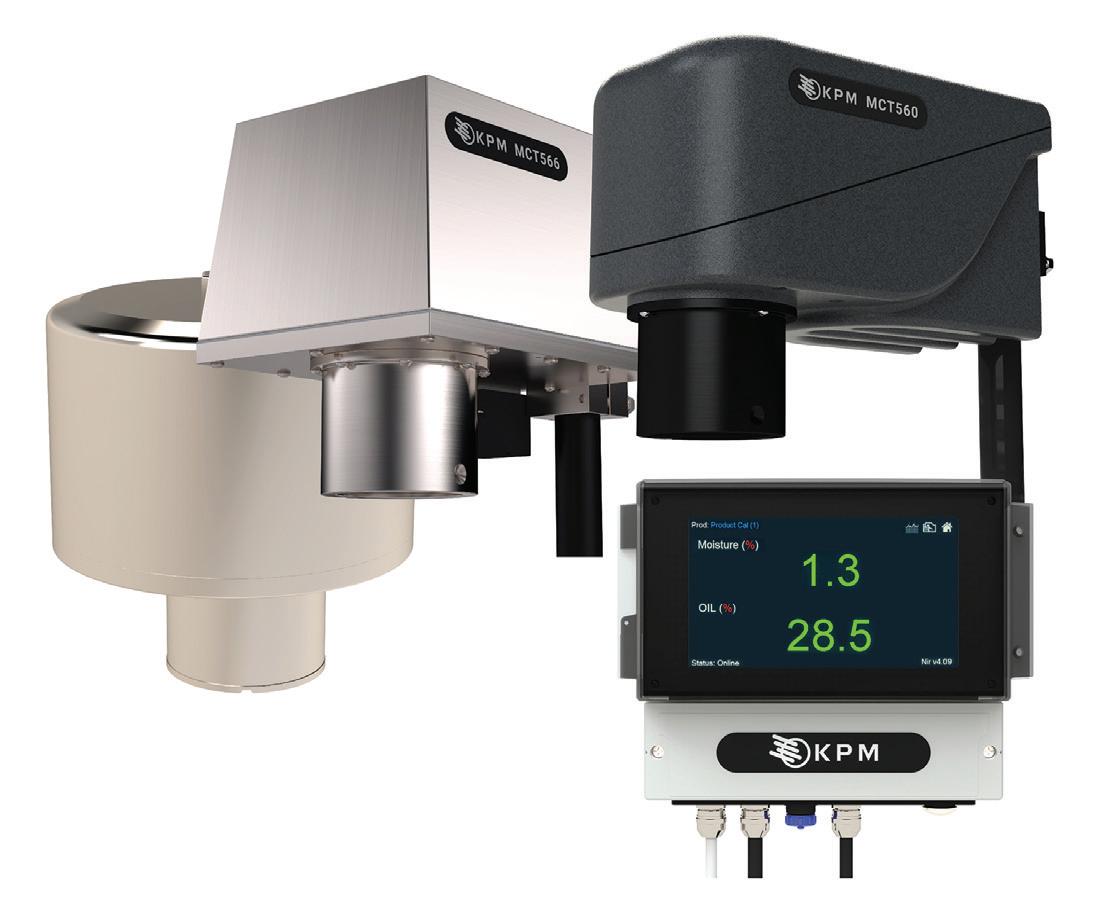

50 Case Study: Foodhills

Frozen-pea producer Foodhills solved significant processing interruptions with a new IQF tunnel freezer.

60 Case Study: Via Oliveto

High-volume bakery Via Oliveto quadrupled its flatbread output after adding a fully automated baking line.

62 Case Study: G&S Foods

Snack manufacturer G&S Foods upgraded its conveyors and seasoning equipment to handle exponential growth.

EDITOR-IN-CHIEF AARON HAND ahand@pmmimediagroup.com

SENIOR EDITOR MICHAEL COSTA mcosta@pmmimediagroup.com

CONTRIBUTING EDITORS

STEPHEN PERRY, STEPHEN SCHLEGEL

ART DIRECTOR KATHY TRAVIS

CREATIVE DIRECTOR DAVID BACHO

VICE PRESIDENT, SALES JOHN SCHREI jschrei@pmmimediagroup.com • 248/613-8672

PUBLISHER PATRICK YOUNG pyoung@pmmimediagroup.com • 610/251-2579

ACCOUNT EXECUTIVE BRIAN J. GRONOWSKI bgronowski@pmmimediagroup.com 440/564-5920

@ProFoodWorld

@ ProFoodWorld CONNECT WITH US

www.linkedin.com/ showcase/profoodworld

SENIOR MANAGER, PRINT OPERATIONS LARA KRIEGER lkrieger@pmmimediagroup.com

FINANCIAL SERVICES MANAGER JANET FABIANO jfabiano@pmmimediagroup.com

PMMI MEDIA GROUP

PRESIDENT DAVID NEWCORN

VICE PRESIDENT, DIGITAL ELIZABETH KACHORIS

SENIOR DIRECTOR, MEDIA OPERATIONS KELLY GREEBY

DIRECTOR, DIGITAL MEDIA JEN KREPELKA

DIRECTOR OF CONTENT KIM OVERSTREET

SENIOR DIRECTOR, EVENTS TREY SMITH

FOUNDING PARTNER AND EXECUTIVE VICE PRESIDENT, INDUSTRY OUTREACH, PMMI JOSEPH ANGEL

PMMI Media Group 401 N. Michigan Ave., Suite 1700, Chicago, IL 60611 Web: www.pmmimediagroup.com

PMMI, The Association for Packaging and Processing Technologies 12930 Worldgate Drive, Suite 200, Herndon, VA 20170 Phone: 571/612-3200 • Fax: 703/243-8556 • Web: www.pmmi.org

MICHAEL COSTA | CONTRIBUTING EDITOR

Eco-friendly programs should be ongoing, transparent, and achievable for a company to make a lasting impact on the planet.

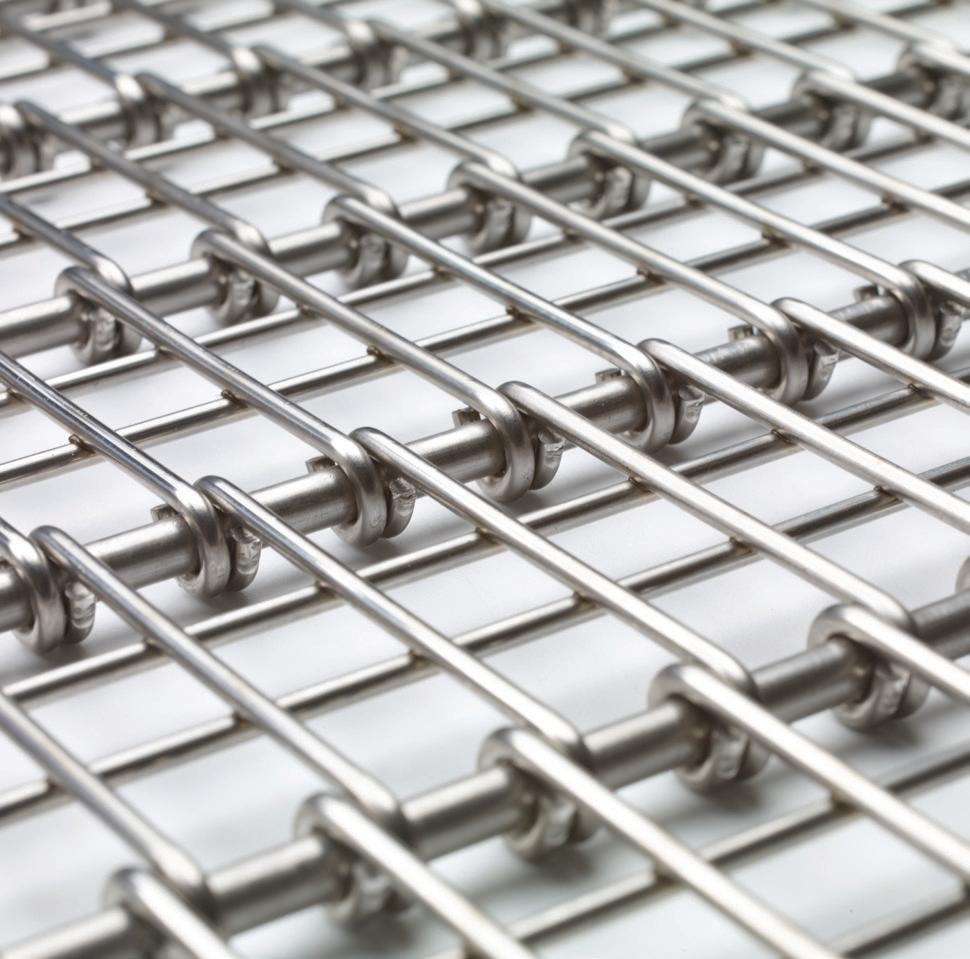

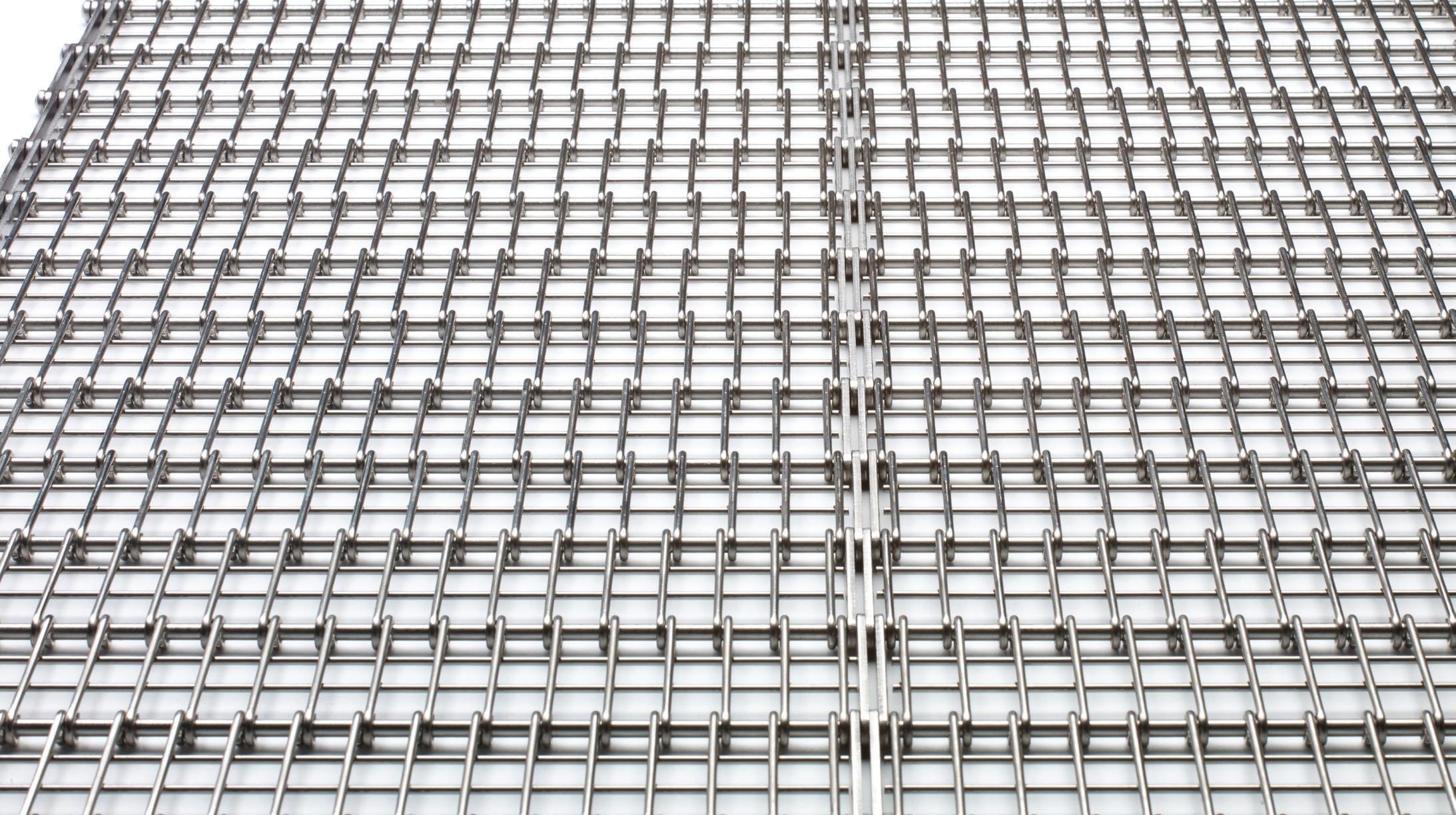

We hear a lot about greenwashing in food manufacturing—and industries outside of processing—where sustainable initiatives are announced, but the reality is that practice might not be fully happening. Or, sometimes those goals can be set out of reach, making it unrealistic to complete within a given timeframe, if ever.

Either way, when a company announces its environmental goals, the announcement alone can create an eco-friendly halo in the eyes of the public, positioning that business as striving to do something positive for the planet. Those halos are not always earned.

The four finalists in ProFood World ’s annual Sustainability Excellence in Manufacturing Awards (SEMA)—Bob’s Red Mill, Conagra, SunOpta, and Virginia Poultry Growers Cooperative—have earned their halos through deep, company-wide commitments to meet and exceed their sustainability goals, while realizing additional cost and operational benefits along the way. They also have fostered company cultures that routinely encourage employees to think and act with the earth in mind.

Turn to P. 26 for more about our four SEMA finalists and see if their ideas might transfer to your operation, helping to propel your sustainability initiatives forward, and perhaps impact your bottom line too.

On the subject of SEMA, be sure to join us at PACK EXPO International in Chicago on Nov. 5, at 4 p.m. on the Processing Innovation Stage, where we’ll announce this year’s SEMA winner, as well as our Manufacturing Innovation Award (MIA) winner. Speaking of, turn to P. 34 to read the inspiring comeback story of Taylor Farms, one of our MIA finalists this year. See you there!

EDITORIAL ADVISORY BOARD

CHRISTINE BENSE CHIEF SUPPLY CHAIN OFFICER Turkey Hill

GREG FLICKINGER CHIEF OPERATING OFFICER Nobell Foods

JOHN HILKER SENIOR VP, OPERATIONS Kite Hill

VINCE NASTI VP, OPERATIONS Nation Pizza & Foods

JIM PRUNESTI VP, ENGINEERING Conagra Brands

LISA RATHBURN VP, ENGINEERING T. Marzetti

SCOTT SPENCER CEO Quality Harvest Foods

TONY VANDENOEVER CONSULTANT, FOOD MANUFACTURING ENGINEERING Waterfall Ventures

DIANE WOLF FORMER VP, ENGINEERING AND OPERATIONS Kraft Foods

BROOKE WYNN SENIOR DIRECTOR, SUSTAINABILITY Smithfield Foods

mcosta@pmmimediagroup.com

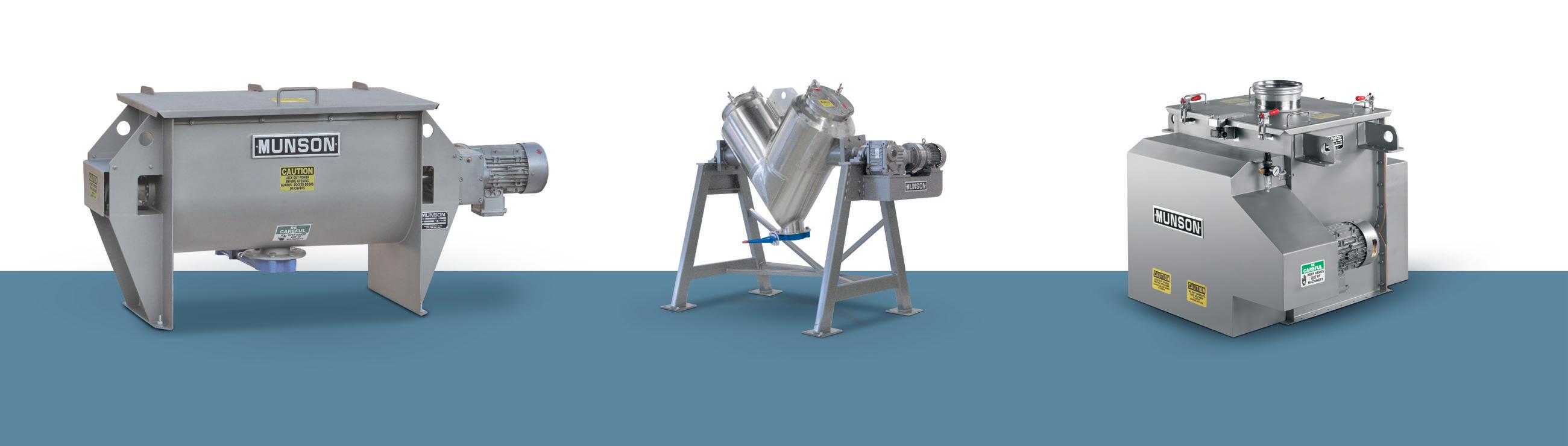

RIBBON/PADDLE/PLOW BLENDERS HANDLE POWDERS TO PASTES

Agitators forced through stationary materials impart shear needed to reduce agglomerates and blend pastes and slurries. Basic industrial units to state-of-the-art sanitary designs with heating/cooling jackets, liquid spray additions, and high-speed choppers/intensifiers. Capacities from 1 to 1,150 cu ft (.03 to 32 m3).

SANITIZE ULTRA-FAST, THOROUGHLY

Smooth internal surfaces free of baffles, shafts and bearings allow unobstructed material flow, plus complete discharge through a gate valve for rapid cleaning or sanitizing of the easy-access interior. Uniform blends are typically achieved in as little as 15 minutes with equal efficiency at fill volumes from 100% to 25% of capacity. Ideal for dry and granular materials.

n 100% Uniform blending and/or liquid additions in one to 2–1/2 minutes

n Total discharge with no segregation

n Ultra-gentle tumbling action (versus blades forced through batch)

n Ultra-low energy usage

n Equal efficiency from 100% to 15% of capacity

n No internal shaft or seals contacting material unlike other rotary mixers

FLUIDIZED BED MIXERS BLEND ULTRA-FAST, GENTLY

MUNSON® Fluidized Bed Mixers feature two shafts with paddles that counter-rotate at high speeds to fluidize material, achieving homogeneous blends in 10 seconds to 2 minutes. Low shear forces minimize friction with little or no degradation and insignificant heat generation. Drop-bottom gates provide rapid discharge. Capacities from 0.21 to 283 cu ft (6 L to 8 m3).

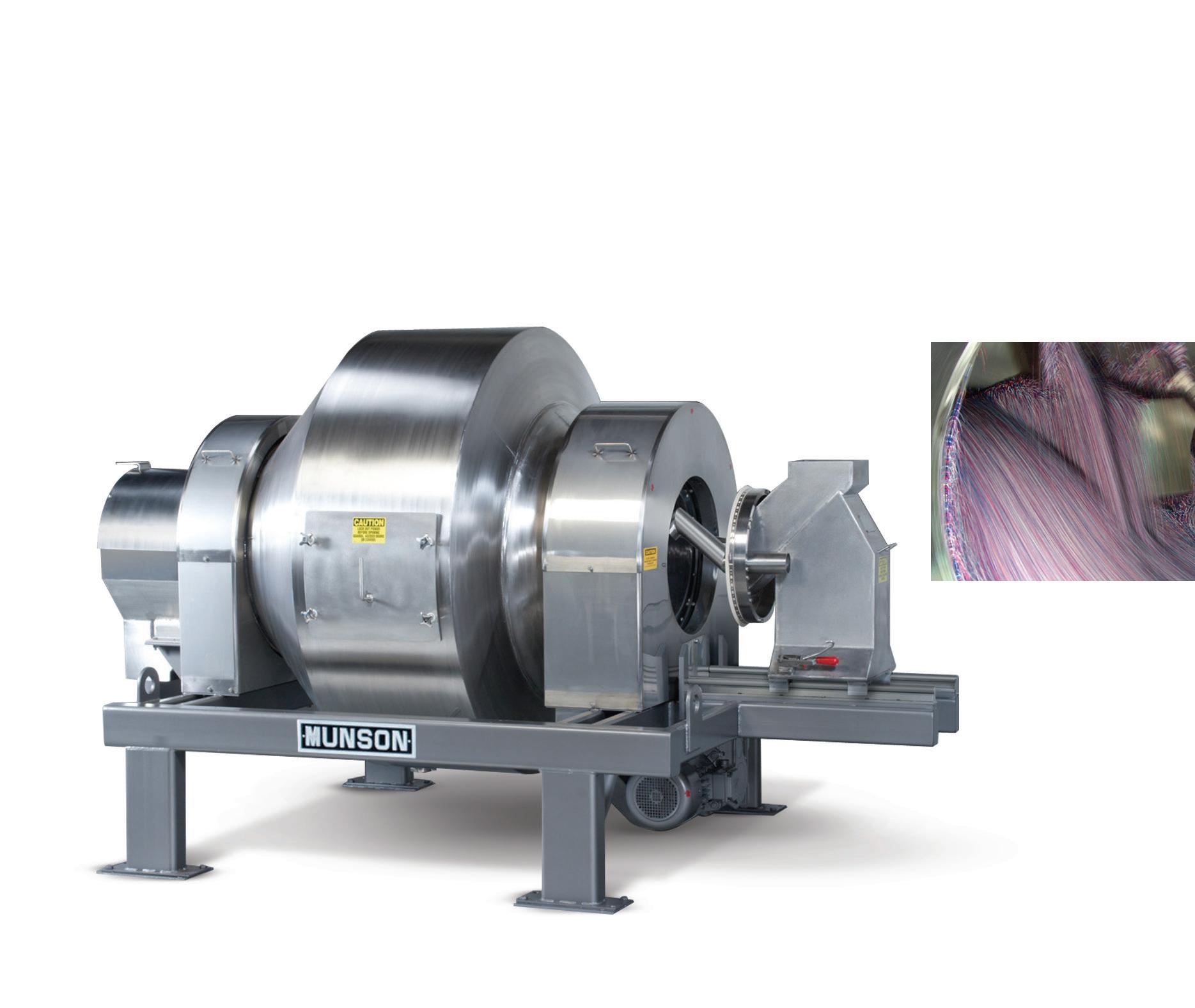

LUMP BREAKERS REDUCE AGGLOMERATES, FRIABLE MATERIALS

Remove lumps and agglomerates from bulk foods. Dual rotors with three-point, singlepiece breaking heads rotate with minimum clearance inside a curved, perforated bedscreen. On-size material exits through bedscreen apertures from 1/32 to 2–1/2 in. (0.8 to 63.5 mm) in diameter. Fits tight spaces between upstream and downstream process equipment.

PIN MILLS REDUCE FRIABLE SOLIDS IN CONTROLLED SIZE RANGES

Coarse to fine grinding of friable powders, flakes and granules into controlled particle sizes at high rates per HP/kW. High-speed rotation of the inner disc creates centrifugal force that accelerates bulk material entering the central inlet of the opposing stationary disc through five intermeshing rows of pins. Desired tight particle size distribution obtained by controlling the rotor speed.

MICHAEL COSTA | SENIOR EDITOR

WHILE THE FDA INTENDS to fi nalize acceptable lead levels for fruit juices and baby food by next year, everything else— including snacks—doesn’t yet have a threshold for lead set by the government.

As a result, states like California have taken the initiative to set their own limits on contaminants in food and food packaging, which may not apply to other states. This creates another layer of confusion for food manufacturers that have nationwide distribution for their products, while the potential cost of reformulating their food and beverages to comply with individual states adds an additional fi nancial hurdle.

At this year’s SNX show, Martin Hahn, partner at Hogan Lovells and SNAC International general counsel, guided a session about government regulation in food labeling, ingredients, traceability, and contaminants. You can read our story about Hahn’s labeling observations and advice to food manufacturers in our June issue. Regarding contaminants, Hahn detailed the following proposed and upcoming regulations that can impact manufacturers.

While there are no current federal guidelines for PFAS in bottled water, the International Bottled Water Association recommends limits of 5 ppt for one PFAS detected, and 10 ppt for two or more PFAS found.

The mayonnaise maker plans to increase production by double digits for squeeze bottle condiments, responding to a Brazilian market that has grown by 30% since last year, according to Nielsen.

The greenfield project will be located in Seymour, Ind., and feature automation and robotics to enhance production e ciencies. The plant is scheduled to open in 2027.

Acquisition of the former Cargill plant in Nashville will add 50 million lb of dry sausage production capacity for Smithfield per year.

The Tualatin, Ore., facility—which produces soup, broth, and plantbased beverages—is being shuttered as part of a $230 million supply chain optimization plan by Campbell.

Federal guidelines and independent state rules that are often not aligned can create significant hurdles for the industry to maintain consistent compliance for contaminants.

The FDA draft guidance for lead in baby food was issued in January 2023, and is expected to be finalized in 2025. The proposal would limit lead in baby food to 10 parts per billion (ppb) in multi-ingredient baby food, 20 ppb for single ingredient root vegetable baby food, and 20 ppb for dry baby cereals. The proposal would limit lead in apple juice to 10 ppb, and all other fruit juices to 20 ppb.

“I realize that your products are not intended for children under two for the most part,” says Hahn. “Some of you do have snacks for that particular category, but what we’re seeing with lead is those numbers are kind of becoming established. Even though our [snack] products are not specifically covered by this guidance on baby foods, if you start seeing products that have more than 20 ppb of lead, that’s going to be a potential concern. Not with the FDA, but class-action lawyers going out and testing products and then saying, ‘Oh, look how high these lead levels are. We’ll bring a challenge under Prop 65.’”

Hahn added that “these levels matter, even though your products are not made for children under two. We are seeing a great deal of criticism coming from the NGOs (non-government organizations) and I am concerned about the class-action liability.”

Another area of concern for Hahn is states like California passing their own ingredient bans of additives in food that are currently approved by the FDA. He noted that as of January, 2025, California will ban FDA-approved additives Red 3, propylparaben, bromated vegetable oil, and potassium bromate. Hahn notes this sets a precedent for other states to create their own rules rather than every-

one following the FDA’s lead.

“It makes it really hard to function as a manufacturer of products that are distributed throughout the U.S. when you have states starting to ban ingredients that FDA has continued to say, can lawfully be added to the food supply,” Hahn says.

Per- and polyfluoroalkyl substances (PFAS) in food packaging have also come under the regulatory microscope, according to Hahn. While the FDA had negotiated a phased approach with the industry to eliminate these substances by 2026, several states have imposed immediate bans, leaving manufacturers scrambling to comply. The lack of a sell-through period for existing stock exacerbates the situation, forcing companies to adapt quickly or face penalties.

Hahn says currently, 12 states have passed laws banning food packaging that contain intentionally added PFAS. California and New York were the first to adopt their own rules in 2023, and most other states put their regulations into effect this year. Each state law is similar, but slightly different, creating additional challenges for manufacturers.

“We as an industry can deal with these issues regardless of whether there actually is a safety issue with PFAS, but you have to have time,” Hahn explains. “FDA was giving the industry time to do this in a very systematic way, yet the states come in, ban an ingredient that is still approved for use by FDA, and that phase-out period have not gone through yet.”

The issue of packaging waste and recycling is another significant concern, according to Hahn, because states are increasingly holding manufacturers accountable for the end-of-life management of their packaging materials. California’s redefinition of what qualifies as recycled material, for example, has far-reaching implications. Even if a type of plastic is accepted for recycling in all jurisdictions within the state, it may no longer be labeled as recycled if it is not widely recycled. This shift in terminology and the associated responsibilities place additional burdens on manufacturers to ensure their packaging meets these new criteria.

The EPA’s recent establishment of ppt levels for PFAS in drinking water —tap, not bottled—further underscores the tightening regulatory environment.

This past April, according to the EPA, the agency issued the first-ever national, legally enforceable drinking water standard to protect communities from exposure to PFAS. The final rule aims to reduce PFAS exposure for approximately 100 million people, prevent thousands of deaths, and reduce tens of thousands of serious illnesses. EPA concurrently announced a further $1 billion to help states and territories implement PFAS testing and treatment at public water systems and to help owners of private wells address PFAS contamination.

The thresholds set for PFAS chemicals in drinking water by the EPA include:

• PFOA = 4 ppt

• PFOS = 4 ppt

• PFHxS = 10 ppt

• PFNA = 10 ppt

• Gen X Chemicals = 10 ppt

While there are no current federal guidelines for PFAS in bottled water, the International Bottled Water Association recommends limits of 5 ppt for one PFAS detected, and 10 ppt for two or more PFAS found. The FDA is responsible for regulating bottled water, while the EPA oversees tap water.

“I’m not confident the data on PFAS is strong enough to justify these levels,” Hahn says. “I can assure you, if you have very low levels of PFOA or PFOS in your food products and they’re detectable, NGOs and Consumer Reports will go out there and test your products and say, ‘Oh my goodness, we found 3.5 parts per trillion of PFOA in a soft drink.’ Well, that’s not a safety issue, but it doesn’t really matter because we have these very low levels that are being established by EPA.”

Hahn adds that trace amounts of these substances—or others like bisphenols, phthalates, and microplastics—in food products can trigger significant concerns in the public, driven by consumer advocacy groups and media reports. This in turn, makes the job of a processor even more difficult while trying to navigate this shifting landscape.

“I am pro trying to make certain our food is safe, but we’re coming up with these numbers that have detections where we can’t even put our arms around them,” says Hahn. “Just because [contaminants] have been detected, many times that doesn’t mean it’s a safety issue. But when they are found, we see the NGOs just driving this entire issue even further.”

MICHAEL COSTA | SENIOR EDITOR

IN OUR FEBRUARY ISSUE, we reported that lead levels in cinnamon added to applesauce pouches were high enough to sicken nearly 70 kids under the age of 6 that consumed the products. The FDA traced the cinnamon and corresponding lead back to the cinnamon supplier in Ecuador and has indicated there may have been an attempt at food fraud by adding lead to cinnamon to increase its overall weight for sale in the marketplace.

No such schemes were at the root of recent testing by Consumer Reports (CR) of six snack puff products aimed at toddlers. Four of the products use organic cassava root as the main ingredient, and that’s likely where the lead levels originated in those items, according to CR.

It was noted in CR’s story that lead in soil can occur naturally or be a byproduct of pollution. Either way, root vegetables like cassava that are possibly grown in high-lead environments, can absorb the heavy metal, retaining it to the final product. Processing contaminated root vegetables into flour can also potentially concentrate the lead content compared to eating the vegetables raw or fresh.

CR tested three brands of snack puffs—six products total—for lead content. Since there are no federal guidelines for lead content in food (yet), CR used California’s maximum allowable dose level (MADL) scale, in order to assess comparative levels of lead

per serving. This wasn’t to assess whether a product exceeds California’s or any other entity’s lead limits, according to CR, it’s just to indicate which products contain higher levels of lead.

Here is what CR found:

• Lesser Evil - Lil’ Puffs Intergalactic Voyage Veggie Blend: 112% of MADL

• Lesser Evil - Lil’ Puffs Sweet Potato Apple Asteroid: 60% of MADL

• Serenity Kids - Grain-Free Puffs, Tomato & Herbs, Bone Broth: 53% MADL

• Serenity Kids - Grain Free Puffs, Carrot & Beet: 17% of MADL

• Once Upon a Farm - Organic Fruit & Veggie Puffs, Apple, Sweet Potato & Coconut: 6% of MADL

• Once Upon a Farm - Organic Fruit & Veggie Puffs, Mango, Carrot & Coconut: 3% of MADL

CR highlighted Lesser Evil’s Lil’ Puffs Intergalactic Voyager Veggie Blend as having more lead per serving than any of the 80 baby foods CR has tested since 2017. While the first four products on the list use organic cassava flour as their main ingredient, the Once Upon a Farm puffs use organic sorghum flour as their main ingredient.

CR reached out to all three brands about the test results. Lesser Evil and Serenity Kids responded that they regularly test their raw ingredients and finished products for heavy metals, and they stand behind the safety of their foods. They also mentioned that while they work with their suppliers for safe raw ingredients, they acknowledge that heavy metals are a part of today’s food system due to many years of soil and water contamination and pollution in our environment.

Once Upon a Farm replied that they use sorghum as the main ingredient in their puffs, since it is less likely to carry heavy

metals than rice or cassava. Emily Luna, baby brand manager at Once Upon a Farm, told CR that reducing heavy metals in foods is dependent on sourcing strategies. When the company needs ingredients like carrots or sweet potatoes that can potentially have high heavy metal content, the brand aims to source “ingredients from areas worldwide that have reduced risk.”

Having multiple ingredient sources is good advice for food processors looking to avoid high heavy metal content in their products. Easier said than done though, since there’s no guarantee that any

Cassava root in its raw state. Processors are advised to use multiple suppliers and test for contaminants, rather than simply choosing the vendor with the lowest price.

supplier will deliver contaminant-free ingredients. However, having multiple options can allow a manufacturer to test and compare the same ingredients side-by-side and choose the safest one, rather than simply picking the vendor with the lowest price.

CR queried the FDA about mandating lead limits in baby food, and the agency responded it will finalize that along with lead in fruit juices in 2025. The FDA is still deciding how to regulate heavy metals in snack foods though, but in the meantime, it has the authority to penalize manufacturers selling products with high lead levels.

Eriez offers a wide range of magnetic separators to get metal out

AARON HAND | EDITOR-IN-CHIEF

LAST YEAR, PET OWNERS IN THE U.S. spent $64.4 billion on pet food and treats, which is a large piece of the $147 billion spent on pets overall, according to the American Pet Products Association. It’s within this context that Maria Cattai de Godoy, associate professor of companion animal and comparative nutrition in the University of Illinois’ Department of Animal Sciences, spoke of pet treat safety at this year’s Petfood Essentials conference.

The pet treat safety roadmap is an extremely convoluted and arduous one, Godoy says, considering formulation and ingredients, facility design and processing methods, packaging, storage and distribution, and safe use and handling—all in the face of Food Safety Modernization Act (FSMA) requirements around hazard analysis, preventive controls, verification procedures, and more.

Although Godoy makes a careful distinction between food safety and quality, there is an important overlap between the two. The pet can change

s

Maria Cattai de Godoy, associate professor of companion animal and comparative nutrition in the Department of Animal Sciences at the University of Illinois.

the equation by consuming something whole that is not intended to be consumed whole.

Godoy then detailed the In Vitro Dry Matter Disappearance (DMD) testing done for pet food clients at the University of Illinois. It’s a rapid method used to analyze treat samples. It doesn’t use animals for testing, but it provides a good correlation with digestibility. “We’re trying to mimic what happens in the stomach and small intestine of an animal,” Godoy says.

Although Godoy’s clients might argue against it, she always urges them to test the whole treat in the largest size offered. It might not be the way it’s intended to be eaten, but it doesn’t mean an animal won’t do it anyway. “There will always be that one animal that will try and succeed. That one will come and blow your brand,” she says, emphasizing the importance of this kind of testing to help prove which products are safe to eat before a pet treat is processed in quantity and sent out to the public.

BY

Ideal for pie filling, fruit preserves, nut butters, cottage cheese, soups, & more!

Innovative fabrication process to provide structure, reducing the risk of catastrophic failure!

Industrial Magnetics, Inc.’s Liquid line Magnetic T-Traps remove unwanted ferrous and work-hardened stainless contaminants from processing lines.

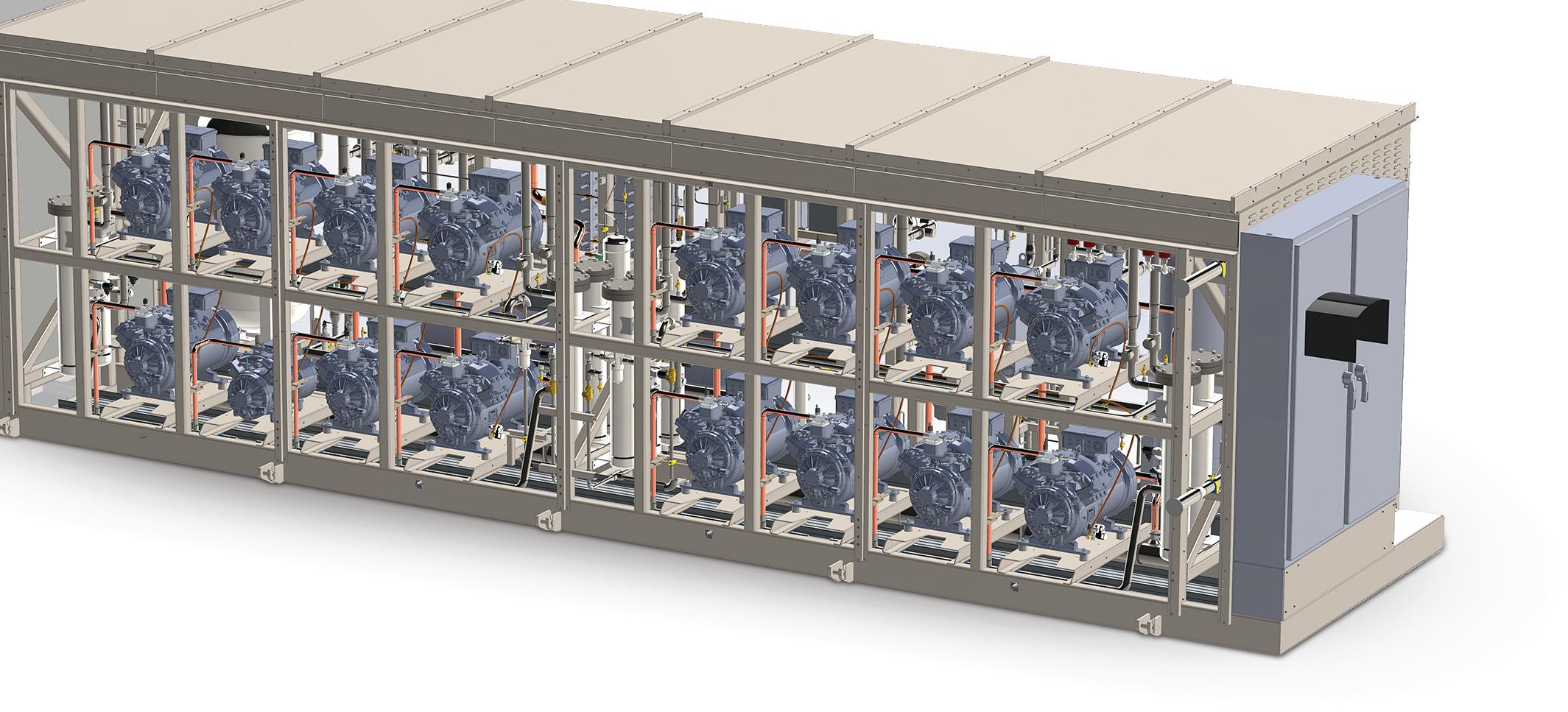

For over 50 years, we’ve pioneered the design and production of industrial refrigeration products, systems and controls. Today, we’re leading the way with CO2 natural refrigerant packaged systems that are safe, environmentally responsible, and provide energy efficiency opportunities for your cooling applications.

Packaged Systems

• Transcritical CO2 condensing units from 10–85 tons

• Transcritical CO2 industrial chillers from 50–500 tons

• Transcritical CO2 industrial racks from 50–400 tons

STEPHEN SCHLEGEL

CO-FOUNDER AND MANAGING DIRECTOR, FSO INSTITUTE

CONTRIBUTORS: Dan Sileo, Chief Manufacturing Coach, FSO Institute; James Couch, Manufacturing Coach, FSO institute

Supply chain, regulatory issues, cybersecurity, staffing, and your assets should all figure prominently in your plans for risk management.

MANUFACTURING OPERATIONS tend to run smoothly until they don’t. And when they don’t, it’s critical for manufacturing leaders to be prepared when a crisis occurs. A risk to your operations can occur at any time, so it’s imperative to plan far in advance and work with your leadership team to assess your company’s key vulnerabilities.

During its recent monthly virtual meeting, FSO Institute’s Manufacturing Health Roundtable shared some of its thoughts on the most significant features when beginning business continuity planning (BCP), especially for small to midsize consumer packaged goods (CPG) companies. The conversation was facilitated by FSO Institute coaches Dan Sileo and James Couch, resulting in the following most significant aspects of a robust BCP program.

FSO INSTITUTE: Dan, what effect do supply chain issues have on BCP?

SILEO: Many scenarios could impact your supply chain, such as extreme weather, fire, labor strikes, working with single-source suppliers, and warehouse management or transportation issues.

For a successful BCP, consider your warehouse management systems (WMS) and lot traceability workaround and their impact on shippers. An effective manual workaround can continue to satisfy customer needs while primarily maintaining lot traceability and, secondarily, first-in first-out (FIFO) production. Work must be performed in the background, such as a daily file download, so the staff will have the information they need if the WMS goes down.

Strong BCP programs are in place at most large CPG companies, but a BCP can be even more critical

for smaller organizations without the resources to withstand unexpected crises.

The recent COVID-19 outbreak negatively impacted many CPGs, underscoring the need for supplier diversification and solid contingency plans. During the outbreak, small companies without a BCP went out of business.

FSO INSTITUTE: People seem to play a critical role in solving BCP challenges. Can you expand on that?

SILEO: Unexpected staffing issues can plague all types of manufacturing companies. They can include internal emergencies or union actions, for example. The goal is keeping the facility operational by including everyone from plant leaders to plant floor workers and getting sister facilities and/or co-manufacturers to help, should an emergency occur.

Sometimes, a facility could face life or death situations. For example, an internal emergency could involve the death of, or serious injury to, a staff member, the possibility of a poisonous chemical release, or a production stoppage of critical products that sustain life.

In some cases, the facility may require a prolonged shutdown. So, in today’s challenging labor environment, part of your BCP should be how to retain employees during a shutdown.

Detailed communication plans for all the above staffing challenges, at both the plant and corporate level, are essential.

Smaller firms should network with and learn from larger companies and develop a template for their own BCPs. Prioritization of emergency actions to take is critical, particularly for smaller firms with limited resources.

FSO INSTITUTE: James, while people play an important role in managing the challenges of BCP, equipment and other machinery assets are critical too. Can you elaborate on the role of equipment assets?

COUCH: It is vital to conduct a risk assessment that prioritizes your facility’s most critical machinery assets, key components, lead times, and customer requirements. You also need to focus on your maintenance strategy programs and how your entire facility supports all operations. This includes reliability-centered maintenance (RCM), preventive maintenance optimization (PMO), predictive maintenance (PdM), or runto-failure (RTF) protocols.

FSO INSTITUTE: Increasingly, cybersecurity has become a front-and-center issue facing manufacturing of all types. What are your top-of-mind thoughts on cybersecurity?

In this part of your BCP, you should develop an engaged, multidisciplinary team consisting of the plant manager, engineering, maintenance, operations, environmental health and safety (EHS), and other departments. But don’t forget to include operators—they are your first line of defense.

Software platforms are readily available to help you conduct an equipment risk assessment, so it is not necessary to purchase custom solutions. Consider Internet of Things (IoT) platforms or edge devices to gather data. You can also see if your vendors will store critical parts on your behalf or think about partnering with vendors to develop win-win solutions that will result in speed of responsiveness.

FSO INSTITUTE: Where there’s manufacturing, there’s regulatory compliance to be considered. How do regulatory issues affect BCP?

COUCH: Don’t overlook regulatory issues in your BCP. From EHS and Occupational Safety and Health Administration (OSHA) regulations to the Food Safety Modernization Act (FSMA), proper training can mitigate many of the regulatory issues impacting your facility by creating buy-in, ownership, and advocacy (BOA) among the plant workforce to create both a people- and product-safe environment.

EHS and OSHA focus on both policy and action plans. FSMA is also focused on policy and then action, particularly the control of cleaning, allergens, and pathogens. In food safety matters, a recall process must be followed, and facilities must investigate and resolve problems.

SILEO AND COUCH: A cyberattack can shut down production and often involves a company being asked for a ransom for its operations to continue. In fact, the plant floor is as much a target as the business side of your organization. Small companies can be devastated by an attack.

Therefore, every CPG needs a clear communication plan, should a cyberattack occur. All staff should have clear roles and full knowledge of their responsibilities in this emergency. The problem is not just IT’s responsibility; operational technology (OT) must also be engaged.

Many times, a company might not immediately know it is under attack. For example, IT awareness may be seen in 30 days, but it might take months for OT to become aware. In fact, the elements of a cyberattack can lay dormant in your system, gathering intelligence for an extended period, before a later assault.

PMMI’s OpX Leadership Network has produced more than 20 manufacturing process-improvement documents for CPGs and OEMs. The FSO Institute has facilitated the adoption and implementation of these documents, especially for food and beverage manufacturers. This series of articles shows how CPGs are using OpX and FSO documents to improve their overall manufacturing health and collaboration with OEMs and other suppliers. Learn more at opxleadershipnetwork.org and fsoinstitute.com

ROSS Ribbon Blenders meet the toughest requirements for quality materials and heavy-duty construction. Standard features include thick stainless steel troughs, low-maintenance gearmotors, BISSC-certified design and much more.

Need a Ribbon Blender customized for your process? ROSS offers MANY options. Complete control systems, spray nozzles for coating, pressure feed vessels and vacuum operation, to name a few.

Used in a wide range of food applications, from granola and drink blends to soups, spices and plant-based proteins, we can customize a ROSS Ribbon Blender for your application.

Sizes from ½ cu. ft. to 1000 cu. ft. A variety of standard models are in stock for faster delivery. Available worldwide.

mixers.com/ribbon-blenders

MATT REYNOLDS | CHIEF EDITOR, PACKAGING WORLD

The new pods eliminate the plastic packaging associated with traditional Keurig beverage pods.

KEURIG DR PEPPER (KDP) introduced a new single-serve coffee packaging concept called K-Rounds plastic-free pods. K-Rounds pods contain roasted coffee beans that are ground, pressed, and wrapped in a proprietary, protective plant-based coating (primary packaging) preserving the coffee’s flavor and aroma while eliminating the need for plastic or aluminum packaging. A corresponding brewing device called the Keurig Alta brewer is required to brew K-Rounds.

It’s notable that the plant-based coating doesn’t dissolve into the liquid coffee—it stays intact during the brewing process. So after the K-Rounds are brewed, consumers can dispose the remaining pod shell, composed of a food-safe, plant-based material that the company expects will be certified as backyard compostable (certification pending).

KDP is acutely aware that coffee, perhaps uniquely among food and beverages, is sacred to consumers. Its aroma and flavor are ritualized such that coffee requires significant barrier layers in packaging to lock in flavor, aroma, and freshness for any stint on a shelf.

Phil Drapeau, senior vice president, Future Coffee Systems at KDP says the compostable plant-based coating indeed brings some aroma and flavor protection properties to the table. However, it is likely that the coating’s barrier properties are insufficient— on their own, at least—to provide the extended shelf life that retailers and consumers would prefer. That means that secondary packaging will have to carry some of the barrier load.

“The immediate packaging element for the coffee, that plant-based coating, it does have flavor and aroma protection,” Drapeau says. “The secondary packaging will also have some barrier protection within it. We’re working through the dynamics of the secondary packaging materials, exactly how much barrier protection that provides, and then how we package that up in terms of the product counts; the numbers of the pods per secondary pack.”

Drapeau was very clear that KDP “certainly doesn’t want to go down a secondary packaging path that is not easily recyclable for consumers. And it has to be something that the municipalities want to recycle, too.” Beyond that, he’s also looking into the broader secondary packaging protections that any product— coffee, durable goods, or otherwise—needs for manufacturing, shipping, and the supply chain.

In a traditional coffee pod or K-Cup, a barrier exists exclusively on the primary packaging. In K-Rounds, some of that barrier is moving to the secondary package. The primary and secondary packaging will each have barrier duties, and the secondary packaging still must be easily recyclable. How that’s achieved, and whether the new K-Rounds system is in fact more sustainable than the legacy PP pods, is for an eventual Life Cycle Assessment (LCA) to decide.

“A full LCA is going to have to look at everything, from the full manufacturing process, even the start of life in terms of the coffee itself, its grinding, etc.,” says Drapeau. “We’re a little ways off from LCA. It’s clearly on our radar screen, and we know how important that’s going to be to take a holistic look. The focus started with end of life [of the packaging], to meet consumers’ needs, and then working our way back from there.”

As part of the intellectual property portfolio that KDP owns via the larger brewer and coffee round system project, KDP acquired a perpetual license to know-how and technology invented by Delica Switzerland for its CoffeeB system in Europe, including the proprietary plant-based coating and application processes. KDP’s partnership with Delica grants Keurig exclusive rights to use and build upon these technologies for consumers across the U.S., Canada, and Mexico.

“There are four components of the plant-based primary packaging coating, and they all meet the FDA standards for food safety,” Drapeau says. “The

primary component in this sealant is alginate, which is typically derived from seaweed. [This project was] accelerated thanks to our partnership with Delica.”

Drapeau adds that KDP fully expects K-Round to be certified compostable, and “the certification that we’re going to be working through is TÜV. We have a lot of respect for the approach that they take and what they do,” Drapeau says. “We fully expect the certification, it’s just a matter of the final pods going through that testing. But everything that we know, from what co ee has done in our preliminary testing and onward, this is going to be [certified by TÜV as] completely compostable.”

As with any compostable product, the remaining sealant could be disposed of in the trash, too, though less than ideal for landfill.

Each K-Round is printed with a gold-colored “brewstyle code” so consumers can easily identify among

The plant-based coating on the K-Rounds doesn’t dissolve into the co ee—it stays intact during the brewing process. So, after the K-Rounds are brewed, consumers need to dispose of the remaining spent coating, which is expected to be certified compostable. The Keurig Alta brewer (inset), is required to brew the K-Rounds.

di erent varieties, like espresso (single or double) or dark vs. light roast co ee. This final approach here is also still in the works.

“We’re still looking at a couple of di erent technologies to get the brew-style codes etched on to the pods themselves. There are technologies that do actual etching, and then there certainly are foodsafe inks that can be printed on the K-Rounds,” Drapeau says. “We’re looking at a couple of different technologies, but we have to match that with the brewer [Keurig Alto brewing device] itself, because the brewer has to be able to read that brew-style code.”

Keurig is an omnichannel brand that’s in 45 million homes across the U.S. and Canada. That means there’s a wide variety of consumer use preferences, from four-counts to counts in the hundreds, that must travel di erent supply chain channels. Beta testing

the K-Rounds’ packaging with retailers, both brick and mortar and online, will be varied and complex.

“But that’s also why we’re so excited to get into our beta testing,” Drapeau says. “[Pack counts and sizes] are the things that the beta testing is really going to help us understand as we open up the variety of beverages, from essentially drip coffee in multiple sizes to, now, single-shot espresso, double-shot espresso, drip co ee, or cold co ee that truly comes out cold like at a co ee shop. Understanding how consumers behave and what they drink and the varieties they choose, and then how that manifests in terms of usage patterns over 30, 60, 90 days, that all becomes really, really important to us. And that’s why the beta testing is going to be so critical as we make the final decisions around pack counts and sizes and barrier protections and inks, and all those things.”

ANNE MARIE MOHAN | SENIOR EDITOR, PACKAGING WORLD

NESTLÉ HAS TRANSITIONED the full-body shrink-sleeve label for its Nesquik ready-todrink portfolio of flavored dairy beverages to a recyclable, yet still light-blocking, material. According to the company, the label is the first of its kind on-shelf and was engineered to address the recycling challenges associated with heavier-weight shrinksleeve material, while providing product protection comparable to the label it replaces.

Traditionally, during the recycling process, shrinksleeve labels sink to the bottom along with PET bottles in a float sink tank. This results in contamination of the rPET. Additionally, PETG label residue can cause clumping.

“With the former label, consumers could recycle Nesquik ready-to-drink bottles only after removing and disposing of the label sleeve, as communicated by the How2Recycle label included on the bottle sleeve,” explains Chastity McLeod, VP of sustainability, Nestlé North America. “We’re transitioning to the recyclable label sleeve to help make it easier for the consumer to recycle the bottle and help increase the bottle’s ability to be sorted accurately at recycling facilities. With the new shrink sleeve, the entire Nesquik ready-to-drink bottle will be recyclable, meaning consumers can put the entire package— including cap, bottle, and shrink sleeve—into their recycling bin without needing to remove the sleeve.”

Before the transition, Nestlé was using a white

In addition to all Nesquik flavors, Nestlé’s Coffee mate and natural bliss creamers, and Nestlé Sensations flavored milk will convert to the new recyclable shrink-sleeve labels this year.

PHOTOS COURTESY OF NESTLÉ

PETG material with light-blocking properties—an essential feature as Nesquik’s milk-based beverage has attributes such as taste, color, and vitamin level that are susceptible to light. Finding a replacement that was both recyclable and provided the same light-blocking functionality involved multiple tests across all seven Nesquik flavors.

“This included light-transmittance tests across more than 20 candidate materials, product shelf-life studies, and the completion of plastics recyclability tests to ensure the new shrink sleeve and inks would remain compatible with the U.S. recycling system,” the company explains. McLeod adds Nestlé’s testing was in accordance with the Association of Plastic Recyclers’ (APR) industry standards for material recycling facilities (MRFs) in the U.S. and completed by an independent third-party laboratory.

Following this extensive R&D process, Nestlé selected crystallized PET, along with new washable inks. “Whether or not the sleeve comes off during the recycling process depends on what type of separation process a specific facility leverages,” McLeod explains. “If the sleeve remains on the bottle, then the inks are washed off so the sleeve material can be reincorporated with the plastic supply stream. The quality of the recycled plastic is not impacted, as the sleeve was designed so that it can be reincorporated with the plastic supply stream.”

The project was not complete though until Nestlé conducted factory trials to ensure the new sleeve would run effectively on its factory production lines. This included making adjustments to optimize both the shrink sleeve and existing equipment throughout the process. The team also trialed multiple different iterations of shrink-sleeve artwork and ink combinations to make sure the new sleeve maintained Nesquik’s authentic look and feel.

With the transition of all seven Nesquik varieties, Nestlé estimates that 4,500 metric tons of PET plastic will now be easier for consumers to recycle each year. Packaging for some Coffee mate and natural bliss creamer products will also use the new label, and Nestlé Sensations flavored milk products are expected to convert to the new sleeve in early fall.

CASEY FLANAGAN | DIGITAL EDITOR, PMMI MEDIA GROUP

SNACK BRAND THE BRITISH CRISP CO. has released the first-ever recyclable paper chip bag.

Developed in partnership with packaging supplier Evopak, the chip bags use Aquapak’s Hydropol polymer as a plastic alternative, making them curbside recyclable, according to the company.

“Brits consume over eight billion packets of crisps each year, the majority of which are not recyclable and end up in landfill or incinerators—that’s a lot of waste and a huge environmental problem,” says Tom Lock, CEO at The British Crisp Co. “In partnership with Evopak and using exciting new polymer technology, we have created the first fully recyclable crisp packet.”

The Hydropol polymer behind these paper chip bags can be recycled, re-pulped, and composted, and can even break down in anaerobic environments.

The British Crisp Co. and Evopak add a thin layer of vacuum deposited aluminum to ensure product freshness, but it doesn’t impact the recyclability of the chip bags. Consumers can add the bags to their curbside recycling bins alongside other recyclable paper items.

“We have developed a unique paper which has the potential to revolutionize packaging as we know it, thanks to the unique properties of Hydropol,” says Daniel McAlister, Evopak Director of Business Operations. “The paper can be used in a range of applications from snacks and confectionary, to pet care, dry foods, and cereals, and costs the same as existing materials.”

On-Pack Recycling Labels (OPRL), a U.K. evidence-based recycling labeling organization, has certified the packs as recyclable in standard paper recycling mills. This allows The British Crisp Co. to include a green “Recycle” logo and “I’m Paper, Recycle Me” label, notifying consumers that its packs can be added to curbside bins, unlike regular chip bags.

Hydropol is non-toxic, marine-safe, and does not break down into microplastics if disposed of improperly. It dissolves and subsequently biodegrades without leaving a trace if accidentally released into the natural environment.

The Hydropol polymer behind these paper chip bags can be recycled, re-pulped, and composted, and can even break down in anaerobic environments.

The base plastic behind Hydropol is currently in use for applications including dishwasher tablets, ingestible pill casings, and soluble stitches. Hydropol expands on the base plastic’s current uses with its resistance to low temperature solubility and high barrier properties. The material is already in use in products including heat sealable paper mailer bags, dry pet food bags, and various blown film products.

“Today’s launch marks a significant milestone for Aquapak and our Hydropol technology, which can be commercialized at scale. This is a huge opportunity for brands and producers who now have a viable, functional, and recyclable alternative that enables full-fiber recovery in a standard paper recycling process,” says Mark Lapping, Aquapak CEO.

The British Chip Co. says it plans to launch the new bags in coming months across shops, pubs, hotels, and coffee shops across the U.K. The launch will begin with the brand’s three most popular chip flavors: sea salt, salt and vinegar, and cheese and onion.

Say goodbye to film contracts & boost your bottom line. Choose your film supplier with flexible, US-built & supported VFFS baggers for pumpable foods.

AARON HAND | EDITOR-IN-CHIEF

With continually increasing demand for transparency, it’s not enough to set meaningful environmental goals; the programs need to be in place to make those goals achievable.

SUSTAINABILITY HAS LONG BEEN an important part of food and beverage manufacturing, but those e orts have been growing and evolving throughout the years. More than ever, brand owners are finding the need for transparency. Whether or not they were themselves guilty of greenwashing in the past, they know that consumers demand more and more transparency these days. They can’t just talk the talk—they’ve got to walk the walk.

The industry is making strides toward more sustainable practices, driven by consumer demand, regulatory pressures, and the recognition that sustainability is good for both the environment and business.

Each year, ProFood World recognizes projects and programs undertaken by food and beverage operations. As usual, we saw a wide range of endeavors among the entries. But what the winners of this year’s Sustainability Excellence in Manufacturing Awards show us most of all is that they are creating cultural shifts among their workforces. They have embarked on ongoing programs that will drive them closer to di cult but attainable goals, and the e orts will continue for years to come.

All entries were judged by a team of food industry peers. The winners will be honored at a special session at PACK EXPO International on Nov. 5. Come join us to fi nd out which award fi nalists will walk away with the top prize.

Pallet Recovery Goes Straight to the Bottom Line at Bob’s Red Mill

Like many food operations, Bob’s Red Mill (BRM) goes through its share of pallets. And, as is also common, the company was typically using newly purchased pallets and pallets arriving with raw materials only once before sending them to a third party for disposal.

The company’s Pallet Recovery Operations (PRO) changes that paradigm, creating a system and infrastructure to organize and facilitate the reutilization of leftover pallets that are still in good enough condition to serve other purposes. “The team observed many usable pallets were being discarded. We knew significant savings were achievable with the right strategy, says Kyle Geber, QA material handler for Bob’s Red Mill.

With the new program, pallets are organized at production lines according to quality, then relegated to the appropriate section in the facility to be picked up for reuse within the plant. “Once we have accumulated a surplus or as needed, we then send a trailer of these PRO pallets next door to supplement our warehouse location,” Geber says. “We have been able to supply our warehouse and distribution center, alongside their own internal program, with solely recovered pallets from our headquarters.”

After about a five-month process R&D phase, Bob’s Red Mill launched a test/pilot project in late November 2022, monitoring the results through February 2023. The company o cially launched a facility-wide program on Feb. 21, 2023, at its headquarters in Milwaukie, Ore., then launched a secondary program with its distribution center at the start of June 2023.

With a dedicated team focused on pallet recovery, BRM has been able to achieve projected savings despite the price of new pallets decreasing. The e ect on BRM’s pallet spend has been consider-

able, with the spend on new pallets reduced by 43% (normalized by production volume-spend per cases shipped). Included in the program savings is an agreement with the brand’s pallet vendor, United Pacific Forest Products (UPFP), which is able to buy back any PRO pallets that BRM cannot use internally, at a premium purchase price.

Since implementing the PRO program, BRM has seen savings of more than $520,000, resulting in a more than eightfold payback when considering labor costs and no capital costs required. “Our rate of new pallets ordered per cases shipped decreased 20%,” Geber notes. “With our continuous improvement mindset, we expect savings to accelerate in years to come.”

Since the pallets BRM sources from its distributor are made to order, the slowing of that demand has not only impacted the food company’s bottom line, it has also had a direct e ect on lumber harvesting in its region, Geber adds. BRM estimates 3,984 trees saved per year. About 45 truckloads of pallet shipments avoided each year equals an estimated 19,026 gallons of diesel fuel saved each year as well. PRO has also had a significant impact on the total recycling diversion rate at Bob’s Red Mill, which increased to 93.4% diversion from landfill for 2023.

The program was not without its challenges, Geber notes. “There were unsuccessful attempts to reuse pallets in the past,” he says. “The lack of success was directly tied to a lack of structure and clarity surrounding the importance of reuse and the possible cost savings.”

Other challenges faced in the implementation of PRO included minimal space, widespread interdepartmental training obstacles, allocated labor resources, and fire safety regulation parameters (with the storage of wooden pallets indoors). “We were able to overcome these challenges through constant communication and continuous improve-

Instead of using pallets just once before sending them to a third party for disposal, Bob’s Red Mill now has a program in place to reuse those still in good enough condition to serve other purposes.

ment practices,” Geber says. “The success of the program has truly been a company-wide e ort. From the support of executives and procurement to forklift drivers and production leadership, display of the Bob’s Red Mill core values of Respect, Accountability, Determination, and Teamwork shined through beautifully.”

As the company’s first all-encompassing sustainability initiative on the production floor, Geber sees PRO as a program everyone can get behind. “It serves as the beginning of a shift in workplace culture and, in its wake, we have begun to launch several other projects with much more enthusiasm,” he says. “We have shared the benefits of this program and encouraged ecological mindfulness with our employee-owners through word of mouth, infographics, and our monthly newsletter. Being an employee-owned company, the savings and revenue we’ve generated through PRO have contributed to an increase in our monthly profit-sharing payouts.”

To meet its 2030 goals for greenhouse gas (GHG) emissions, Conagra Brands is aiming for a 24% reduction over its baseline emissions compared to its fiscal 2020 baseline. To help reach those goals, Conagra created its Sustainability Capital Allowance capital spend program in June 2023 with a dedicated mini-

mum capital expense budget of $9 million per year to fund energy e ciency projects focused on reducing Scope 1 and Scope 2 emissions. With a five-year or better internal rate of return (IRR) per project, the program sets a directional target of nearly $2 million in savings and approximately 10,700 metric tons (MT) of CO2e emission reductions per fiscal year over the next six years.

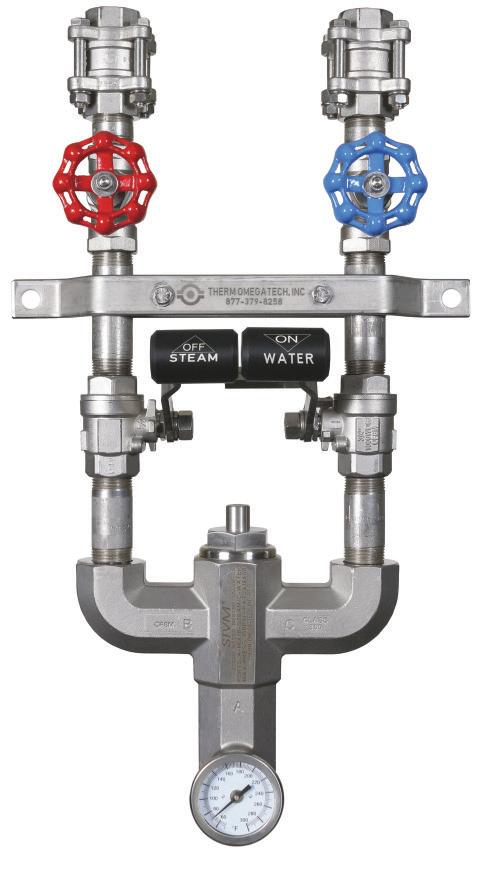

Conagra’s Scope 1 emissions are GHG emissions from sources that Conagra owns or controls directly. Scope 2 emissions are indirect GHG emissions associated with Conagra’s purchase of electricity, steam, heat, or cooling. With these scopes in mind, the focus of Conagra’s Sustainability Capital Allowance is to identify and fund thermal, boiler combustion, ammonia refrigeration, and air compressor systems e ciency and optimization projects, and to fund improvements to Conagra’s operation/maintenance practices. Under this program, Conagra has also approved solar and biogas microturbine projects at its plant in Irapuato, Mexico.

The Sustainability Capital Allowance funding pool is in addition to standard site capital funds, to provide an alternative resource to Conagra’s sites to undertake GHG emission reduction projects that Conagra expects will have significant sustainability as well as operational benefits. With dedicated capital funds available for all of Conagra’s owned or operated manufacturing sites and warehouses/distribution centers, the Sustainability Capital Allowance program builds on Conagra’s findings from a previous internal energy audit and applies sustainability-focused capital criteria.

“Internally, this program has created positive collaboration, innovation, and motivation from individuals because now there is a budget solely dedicated to energy e ciency projects,” says Christine Daugherty, vice president of sustainability at Conagra. “Projects that were previously identified but not approved under existing site capital policies have been brought to the top of the list and approved under the Sustainability Capital Allowance, as an example, our Irapuato, Mexico, biogas microturbines and solar panel projects.”

The Sustainability Capital Allowance provides a path for emission-reducing projects to be improved, Daugherty notes. While still requiring a modified internal rate of return (MIRR) for energy savings projects, the new program broadens the approval criteria to include consideration of emissions-reduction impacts as part of the capital approval process.

“During the first year of this program, we learned that due to the variability of utility costs, many identified projects were estimated to come in just under our MIRR requirement,” Daugherty says. “So, those projects are now being reviewed and approved for

Use the power of Linde technology to improve your product. The Linde CRYOLINE® PB plate belt tunnel freezer features a specially designed belt that creates a flat surface to quickly crust freeze even difficult-to-handle products, reducing moisture loss and improving yield.

Linde experts will help you make the most of this technology. We will evaluate your process requirements, guide you through selection and installation, and provide ongoing support.

Enter a new realm of performance. Learn more at lindeus.com/food

Making our world more productive

funding under the Sustainability Capital Allowance taking into account the potential impact to Conagra’s overall sustainability emissions goal. By doing this, we have the potential to realize other benefits that our standard capital approval process did not anticipate, including potential additional cost savings. A great example of this is a condensate return project completed at our facility in Imlay City [Mich.] that not only achieved its energy savings but has qualified for a utility rebate that improved the investment payback period from four to two years.”

Projects are submitted for funding under the Sustainability Capital Allowance on a monthly basis. As of April 2024, Conagra had committed to 12 energy-e ciency projects representing an approximate $5 million commitment with an expected impact of more than $1 million in energy savings and potential for an estimated 6,240 MT CO2e of combined Scope 1 and Scope 2 emissions reduction per year.

From those 12 approved projects, Conagra has also identified potential environmental impactful per year savings of:

6 million gallons of water

5,868,419 kWh of electricity

32,316 million BTU of gas

“In addition to the expected more than $1 million of utility savings per year, these first 12 projects under the Sustainability Capital Allowance program are estimated to yield additional savings in the form of one-time utility rebates,” Daugherty says. “The combined fiscal 2024 project list is expected to receive more than $300,000 in rebates during fiscal 2025 from RTO or utility companies.”

To support the Sustainability Capital Allowance program, Conagra has created a project list database that is shared across the business. “Plants are able to share best practices and take ideas from other sites to be implemented at their own sites,” Daugherty notes. “As we move forward on this journey, there is an opportunity to allocate additional project management support to encourage more submissions to take full advantage of the dedicated funds.”

When SunOpta set a target to attain Zero Waste to Landfill at its manufacturing facilities, its Modesto, Calif., location embraced the challenge. This meant

Dedicated waste and cardboard bins are placed strategically on the factory floor in SunOpta’s Modesto facility.

the team needed to achieve SunOpta’s definition of zero waste by diverting 90% of waste from landfill, which is no easy task.

“Waste is inevitable in the manufacturing process, but with a focus on continuously improving opera-

tions and enhancing operational resource management, we were able to achieve our goal at the Modesto facility,” says Levi Pomerantz, continuous improvement manager for SunOpta. “By prioritizing the optimization of solid waste management through e cient resource allocation, SunOpta has successfully reduced its environmental footprint.”

SunOpta oversees several waste streams at its Modesto location, striving to find the most preferred solution based on the Waste Management Hierarchy from the Environmental Protection Agency (EPA), Pomerantz notes. To start work on its zero waste goals, SunOpta’s Modesto plant began an assessment of its waste streams and volumes in July 2022. Looking at the various waste streams, the team worked to identify reuse or recycle solutions for each type, creating relationships with recycling/reuse organizations.

Designed with economy, efficiency and hygiene in mind, the IQ cryogenic freezer offers continuous high throughput on a broad range of foods with easy clean up. Ten-foot modular sections make it field expandable with a minimal capital investment. A SMART remote monitoring system allows for trouble shooting from afar.

Increase your IQ and profits . . . visit airproducts.com/IQ or call 833-NEED-GAS (833-633-3427) tell me more airproducts.com/IQ

“Our aim is to employ the optimal management practices for each waste stream, prioritizing alternatives to landfilling or combustion wherever feasible,” he says. “In pursuit of this goal, we collaborate with several recycling and waste collection companies.”

In cases where there were no other reasonable options for recycle or reuse, the plant contracted for a waste-to-energy solution. The Modesto facility achieved its Zero Waste to Landfill verifi cation from a third-party contractor before the end of November.

In 2023, the Modesto facility recycled slightly more than 50% of its total waste, amounting to 2,860 tons. The remaining amount was responsibly managed through a burn-to-energy facility, which

e ectively converted waste into electrical energy, benefiting the local utility grid. In all, about 5,709 tons of solid waste were diverted from landfills.

The environmental stewardship doesn’t end there, Pomerantz says, noting that all wood pallets are recycled and refurbished as part of the company’s sustainable practices. The Modesto facility also found a way to leverage the byproducts of its soy extraction process, with about 2,849 tons of discharge sold to a local agriculture company for repurposing as animal feed.

“This strategic approach not only minimizes waste but also contributes to revenue streams, aligning with our dual objectives of environmental responsibility and economic e ciency,” Pomerantz says.

Hear more from our 2023 Sustainability Excellence in Manufacturing Award winners at a special session during PACK EXPO International, and find out who’s taking home the top prize. Join us Tuesday, Nov. 5, at 4 p.m. on the Processing Innovation Stage at PACK EXPO International. After the SEMA presentations, hear about our Manufacturing Innovation Award finalists as well, then stay for our reception.

For more information or to register for the show, visit packexpointernational.com.

ProFood World want to hear about your current sustainability projects. The submission deadline and eligibility requirements for the next Sustainability Excellence in Manufacturing Awards will be announced this fall at pfwgo.to/sema.

With many of the program’s requirements already part of its practices, the Modesto facility was able to achieve Zero Waste to Landfill in just four months. Additionally, the program was integrated into existing operations without incurring any additional costs. “By optimizing resource utilization and implementing innovative waste management practices, we have successfully mitigated environmental impact without compromising our bottom line,” Pomerantz says.

Note: Six of SunOpta’s seven manufacturing plants have achieved zero waste to landfill.

As the post-COVID food industry grapples with a shrinking labor force and feeding a growing population, facility operators are turning to automation to improve efficiency, cut waste, and streamline production.

“With the rise in online delivery demand coupled with labor and space shortages in our market, we are seeing an increased demand for intelligent and space-saving automation,” says Mark Livesay, vice president of Automated Warehousing, Business Development Division, ESI Group USA. “Dependence on automation is increasing at a rate that is difficult to comprehend. Traditional methods of manufacturing, storing, and assembling customer-specific orders simply cannot keep up with demand. The market is focused on providing more product options, to an increasing number of customers, delivered as soon as humanly (or automatedly) possible, at the lowest feasible cost.”

based on supply and demand data, minimizing overages and shortages.

• Collaborative robots adjust to spatial conditions to complete programmed tasks, such as picking a variety of products to complete an order.

There are many types of technologies and software currently on the market. Choosing among them should be driven by current operations and future goals, identifying weaknesses and opportunities in current operations, and understanding the gap between where you are today and where you need to be tomorrow. Automation types run the gamut from simple to elaborate. They include:

• Fixed automation is the simplest and most common, such as conveying systems that move units from one place to another for the entirety of its lifespan.

• Flexible automation are robots capable of switching from moving one type or size of goods to another.

• Integrated automation relies on process software, such as programmable logic controllers, to adjust production

No matter which type of automation you ultimately select, there are obvious benefits. For example, reduced complexity and difficulty of tasks, and increased performance. “Automation systems can increase productivity by any amount necessary to meet the business’ demands and goals,” says Livesay. “Consider that a simple automated storage and retrieval system (AS/RS) can double or triple order assembly.”

In addition to improving productivity, an AS/RS can double or triple the storage capacity of an existing facility to reduce reliance on additional storage facilities — ultimately eliminating costs to transport product between locations.

Automation is also making a positive impact on safety, enabling better monitoring and control throughout the processing chain. This is especially critical as food safety and cleanliness requirements are becoming more stringent.

Where Livesay sees automation making the most difference is in accurate and on-time order deliveries.

70% of survey respondents rank productivity as the greatest benefit of automation

“Automation is online so that every article, movement, transaction or fault is recorded and accessible for traceability and analysis,” he says. “This visibility allows managers to analyze and enact effective change faster and helps avoid the reputational cost of poor performance and unreliable service.”

He adds, however, to weigh these benefits against the reality that automation places a high demand on energy to power its capabilities. “These two elements must be

considered when installing automation,” he says. “Fortunately, emerging technologies are making automation more energy efficient.”

In addition to energy efficiency, automation is smarter, faster, and more streamlined to allow facility operators to achieve their current and future objectives. “Every plant and distribution center has unique conditions and goals that drive its path to a more efficient and productive future.”

For one pet food producer, the decision to install automation came down to finances. “When comparing the project costs versus the transportation and logistics costs, the company realized it would see a return on its investment in just five years, explains Mark Livesay, vice president of Automated Warehousing, Business Development Division, ESI Group USA. “Storing the product onsite and allowing automated retrieval when it’s needed for shipping eliminates the need for offsite storage. Thus, costs associated with loading, trucking, logistics, and offsite storage are eliminated.”

The company chose to install Automated Guided Vehicles (AGVs), an Automated Storage & Retrieval System (AS/RS), elevators, and a monorail. ESI will construct a stand-alone structure to house the AS/ RS, a connector bridge, and penthouse – which spans approximately 95 feet between the AS/RS warehouse and the existing plant.

monorail for transport back to the elevator, lowered to the plant floor, and transferred by AGVs to the shipping dock.

Livesay explains that product will be manufactured and packaged in the existing facility. An AGV will bring the product to a conveyor that takes the palletized product up 35 feet via elevator through the roof. Product is then placed onto the monorail, which transports the pallets through the penthouse and bridge to the AS/RS where it is stored until shipment. The AS/RS has a capacity of 51,000 pallet positions.

When it is time to ship the palletized product, it is automatically retrieved from the AS/RS and loaded onto the

Livesay says the new AS/RS structure will take two years to complete. Some key takeaways are the 813 DeWaal auger cast piles supporting the AS/RS structural mat slab and bridge, and 219 helical piles supporting the structural mat slab for the new equipment in the existing warehouse and the penthouse support columns.

He says: “Once the rack-supported building is completed, the equipment will be installed and tested before turning over the project. This client drove a new level of safety protocols, allowing ESI the opportunity to raise the bar for future projects.”

Virginia Poultry Growers Cooperative (VPGC), based in Hinton, Va., is an independent coop that processes poultry for about 200 turkey growers throughout the Shenandoah Valley region. One critical component of VPGC’s turkey processing plant, the food processing washdown and sanitation system, was experiencing frequent pump failures, costing $40,000 to $50,000 a year in maintenance.

“My major pain point with our old high-pressure pump system was reliability,” says Phil Miller, engineering manager at VPGC. “The pumps would last anywhere from maybe six months to a year, and we’d have to replace them.”

The fix, however, provided not only more reliable performance but a more e cient product as well, reducing energy consumption by about 50%. A Grundfos multi-pump Hydro HP system, designed specifically for high-pressure water demands in food and beverage plants, was installed under the guidance of Grundfos and solutions provider Carotek. Along with a CU352 controller, the pump system accommodates both low-flow and high-flow demands, with variable-frequency drives to help provide the system pressure needed while using the minimum amount of horsepower for energy e ciency.

The two 150 hp pitot tube pumps used previously supplied 300 gpm at 1,000 psi, deemed unnecessary. The new solution includes two 15 hp jockey pumps for low flows. They deliver 400 gpm at 680 psi, and are controlled and monitored by the CU352 controller.

At VPGC, there are times requiring only low flows of less than 60 gpm, such as during first shift pro-

duction. The CU352 controls all eight pumps on the system, saving energy by running a jockey pump during lower demand periods and larger pumps at higher peak periods when more water is needed.

Sanitation time remains una ected despite the 320 psi less pressure of the jockey pumps. “While reducing pressure, maintaining operational e ectiveness, especially in sanitation processes, remained paramount,” says Tommy Pierce, senior sales engineer for Grundfos.

The implementation of the new pump system had several positive environmental impacts for VPGC. The savings from reduced energy consumption are calculated at $52,445 a year. The system’s improved e ciency also results in a reduction of CO2 emissions, and the use of lower water pressure helps to conserve water. There is an assumption for lower chemical usage as well.

Based on the energy savings alone, ROI of the pump system is expected to be 3.8 years. The additional savings on wear/part replacement over a fiveyear period bring that ROI closer to 2.2 years.

“Overall, this installation positively impacted the environment by improving energy e ciency, reducing resource consumption, lowering possible chemical usage, and enabling financial support for further operational e orts,” Miller says.

The team has learned some lessons along the way, including better understanding the need for a larger-flow jockey pump for smoother hydraulic hand-o and better pressure control. They also found that bleeding a small amount of water back to the supply tank during low-flow periods aids in cooling jockey pumps. Programming a lower pressure set point during low-flow demand periods enhances energy savings by reducing friction losses in the piping system.

Tommy Pierce from Grundfos (orange vest) discusses the new Hydro HP high-pressure pump system with VPGC’s Phil Miller (middle) and Carotek’s Steve Floyd.

MICHAEL COSTA | SENIOR EDITOR

After a devastating fire at its flagship plant, Taylor Farms faced the challenge of reconstructing its processing facility. Through resilience, teamwork, and strategic innovation, the company emerged stronger, more e cient, and more productive than ever.

N APRIL 2022, TAYLOR FARMS’ FLAGSHIP FACILITY

in Salinas, Calif., su ered a devastating fire where their main foodservice leafy green production facility was located. The fire started between the walls of the decades-old structure, and the blaze eventually made its way to the roof, collapsing it in flames and destroying the 60,000-sq-ft of processing space. The larger building structure surrounding that production area remained mostly intact.

In the immediate aftermath, the company decided to rebuild the facility on the same real estate . CEO Bruce Taylor also set the bar high with a one-year deadline to finish that project. Meanwhile, customer deliveries of triple-washed lettuce, romaine, cabbage, baby spinach, baby spring mix, and green leaf

would go on as scheduled, leveraging the company’s network of plants and distribution to pick up the slack, relying on a seasonal facility in Yuma, Ariz., and other local facilities near Salinas, California for processing and shipping.

Right on schedule, Taylor Farms reopened in April 2023, but along the way the company and design/ build partner Dennis Group encountered obstacles of every kind, from supply chain issues for materials and components to catastrophic weather events like an atmospheric river that turned the construction site into a mud pit, and flooded Salinas as well.

“This factory was our first factory in California. This was our first home for Taylor Farms, and it was like family coming together after losing their first

house,” says John Krbechek, VP of engineering at Taylor Farms Foodservice Division. “Failure [to rebuild] was not an option.”

Today, Taylor Farms has a state-of-the-art processing plant with a weekly production volume of 15 million lb of fresh-cut produce. It’s one of the highest capacity plants of its kind in the industry, and because of this phoenix-like rise from the ashes, Taylor Farms has earned a Manufacturing Innovation Award from ProFood World. Here, we’ll detail how Taylor Farms used the blank slate of reconstruction as an opportunity to increase e ciencies in processing, sustainability, sanitation, and much more.

The strategic triage enacted after the fire by Taylor Farms began with making sure customers received their produce orders without interruption, while detailed plans were created to rebuild the Salinas plant on a one-year timeline.

Taylor Farms has 22 production locations across North America, and depending on the location, produces a combination of fresh vegetables and fresh

One year after burning down, Taylor Farms opened its rebuilt processing facility as a state-of-the-art plant with increased e ciencies in every part of the building.

food items for restaurants, schools, grocery and convenience stores. The Salinas plant that burned down was dedicated to the foodservice market segment, so production remained in the seasonal sister facility for an extended term in Yuma, while a logistical system to service customers was created to receive raw produce and finished produce from six other coolers. Every year between April and November, leafy greens are grown and processed in Salinas. Then from November to April, production equipment is trucked from Salinas to Yuma to continue processing, since that’s when leafy greens are grown and harvested in that region.

Serendipitously, because the Salinas fire happened in April, all the equipment necessary to continue processing greens in Yuma was still there, about to be sent back to Salinas. So, Taylor Farms kept operations going in Yuma, sending raw vege-

Taylor Farms reconfigured its production to feature 15 dual-wash processing lines, resulting in a 50% increase in productivity compared to the previous setup.

Overhead monorails in the drying area were converted to round tubing to prevent excess water from pooling above.

tables now being harvested in Salinas to Yuma for processing, then back to Salinas to be shipped to clients.

With those immediate production problems solved, Krbechek and Jeffrey Lewandoski, senior partner at Dennis Group, turned their attention to rebuilding the Salinas plant and using the opportunity to upgrade and modernize the facility from the ground up.

“It was pretty devastating when we were looking [into the ruins] and it was still smoldering. We had big evaporative coils that were just melted into a pool of aluminum,” says Krbechek. “The surrounding building structure survived the fire but the infrastructure, electrical, refrigeration, water, and all the utilities had to be redone, rerouted, or reconfigured.”

Starting from scratch meant Taylor Farms could build a new plant envelope up to the very latest hygienic standards, and those high standards would apply to

everything inside that envelope. “The whole facility is a food-safe, sanitary washdown space, including walls, ceilings, floors, and drains—there are no points that can’t be cleaned,” says Lewandoski. “Nothing is tight to the walls that you can’t clean behind. We have two-inch standoffs on all piping, conduit, racks, and everything is washdown ready, from the lights to the doors to the frames, everything can get wet, soaked, and sanitized,” he says, adding that they used either stainless steel or galvanized steel for materials because those don’t rust, which can be a hazard in a food plant.