48

www.globaltrailermag.com ISSN 1839-5201

01

9 771836 520000

INNOVATION

BUSINESS

WABCO Telematics Updates JOST Delivers Blue Brake Pads Innovative Tipper Trailer Designs Haldex’s Scalable Brake System

Tonar Executive Interview Market Report: South Africa Port Developments in Rotterdam Global OEM Ranking List

Visualization coming into Reality Modular and Digital design

CIMC Vehicle’s modular and digital design beyond the existing design language allows customers to be unprecedentedly autonomous. Customers can be free to choose the configuration and appearance according to their needs and preferences.

www.cimcvehiclesgroup.com

COVER STORY FUTURE DRIVEN

32

The dire economic state of Russia is influencing how prominent OEMs in the region conduct business. Tonar, despite tremulous market conditions, is committed to manufacturing flexibility and equipment reliability without compromise.

IN THIS ISSUE Twan Heetkamp – the Dutch entrepreneur who sold his trailer rental company to TIP Trailer Services in 2016 – saw his second generation of emission-free cooling trailers hit the road earlier this year.

“WE CAN SEE THAT MORE AND MORE MINING COMPANIES IN THE WORLD NEED LONG DISTANCE ROAD TRANSPORT … TONAR RECENTLY COMPLETED A PROJECT IN SIBERIA WHERE A ROAD TRAIN IS USED TO TRANSPORT 130 TONNES OF DIAMOND ORE ALONG A 178-KILOMETRE ROUTE ONE WAY.”

56 SPECIAL REPORT

Tonar

BUSINESS 24 MARKET REPORT

Despite decades of political and investment volatility, South Africa has the potential to emerge as a dynamic and diverse player in the global economy.

37 BRAKING SYSTEMS

In a close dialogue with a commercial vehicle manufacturer, Haldex has been selected to commence the concept phase of an autonomous vehicle braking solution.

38 TELEMATICS

WABCO is driving technological advancements that will continue to enable smarter operations across the commercial road transport ecosystem, including continuous innovation in trailer telematics, IoT and cloud-based solutions.

42 EVENT PREVIEW

The sixth NUFAM will see visitors from abroad experience everything from next generation rigid bodies and semi-trailers to the latest trends in telematics and load restraint technologies.

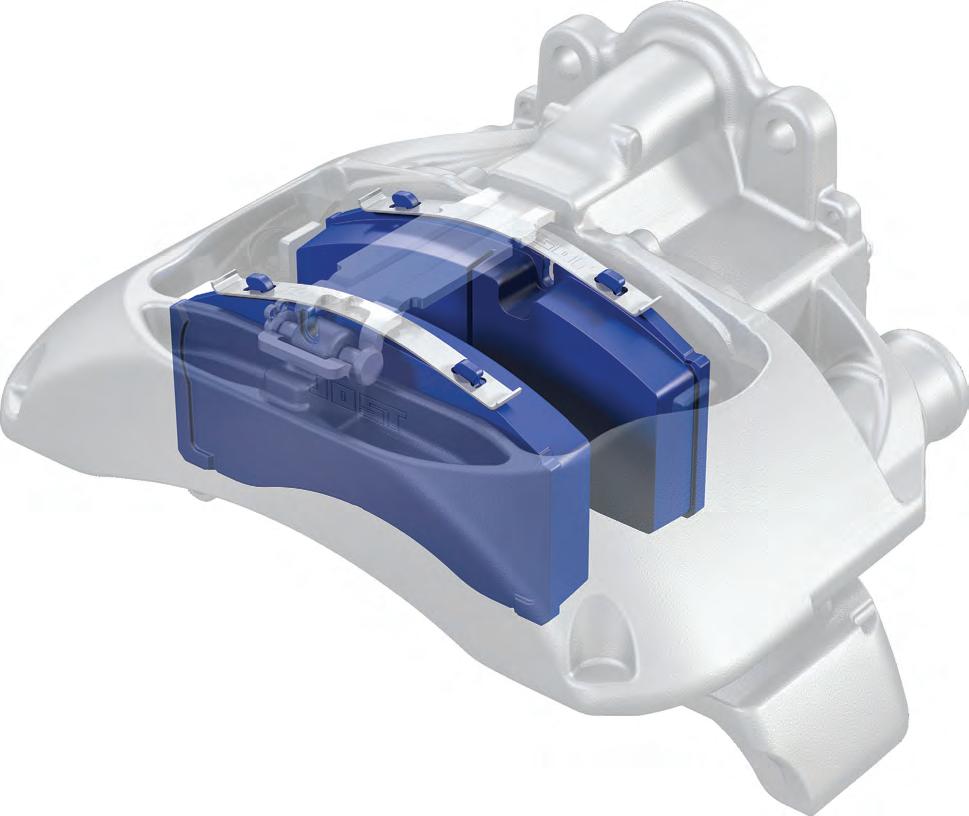

46 JOST

Equipment specialist, JOST, is releasing a new brake pad range that is optimised for longevity and improved efficiency.

48 FLEET FOCUS

In some terminals, like Rotterdam, DFDS operates workshops to maintain trailers and is set to benefit from port-side upgrades.

20

52 TRAILER DESIGN

Transparency on productivity is critical when reviewing the state of trailer manufacturing on a global scale. The numbers, according to Global Trailer, are just one part of this dynamic story.

Denis Krivtsov

FEATURES 28 KÄSSBOHRER

Kässbohrer has has expanded its construction product range to include steel halfpipe and aluminium box style tippers.

32 GORICA

The growing demand for bigger and safer tipping semi-trailers in the Middle East and Africa is a trend that GORICA is on top of.

REGULARS

60 EVENTS

04 EDITOR’S NOTE

62 MEGATRENDS

06 NEWS

55 PREVIEW

34 SCHMITZ CARGOBULL

Schmitz Cargobull brings to market a suite of tipper innovations that embrace low tare weight builds, optimised liners for improved unloading and the latest in remote control functionality.

30

EDITOR’S NOTE

PUBLISHER

John Murphy john.murphy@primecreative.com.au

MANAGING EDITOR

Luke Applebee luke.applebee@primecreative.com.au

DESIGN PRODUCTION COORDINATOR Michelle Weston michelle.weston@primecreative.com.au

ETERNAL CONSUMPTION ENGINE

ART DIRECTOR Blake Storey

DESIGN Kerry Pert, Madeline McCarty

INTERNATIONAL SALES

TO DEFY THE LAWS OF TRADITION is a crusade only of the brave. Those words, courtesy of eclectic American bassist, Les Claypool, are a constant reminder that change is inevitable, and while it may sometimes seem like a daunting task to venture beyond our comfort zones, it is often a necessary endeavour in the interests of seeking betterment. If we reflect on the ‘behind the scenes’ of our global OEM ranking list – which debuted in 2016 and has since become an annual fixture of the September edition of Global Trailer – it is evident that there has been a journey of trial and tribulation – and most importantly a professional commitment from the editorial team to continuously improve the industry resource. Of course, our attempt to rank trailer manufacturers by total production numbers is ambitious in scope and should be treated as a guide in the interests of moving toward greater transparency. Through further engagement with the commercial vehicle industry, we aim to build on what has been established and ultimately produce content that is relevant and of use. Over the past three years there has been tremendous change. Trailer manufacturing on a global scale appears to be in a state of flux where a select

4 / G L O B A L TR A I L E R / I SS U E 4 8

few – predominantly multinational corporations split by region – are now competing with more complex networks of small- and medium-sized businesses leveraging their strengths in innovation and production capabilities. Read our current global OEM ranking list (see page 56) to see where the numbers land. What’s more fascinating for myself is how trends in transport and logistics, particularly freight demand and a government’s approach to improving a country’s economy, parallel with the key decisions that manufacturers and suppliers consider on a daily basis to remain profitable and competitive in an ever-changing industry. In the case of the South African Government it founded a committee in 1994 with the purpose of holding the nation accountable for improving its socio-economic situation. Dubbed a ‘Fragile Five’ country by economists, South Africa is considered an emerging market economy that is too dependent on unreliable foreign investment to finance its growth ambitions (see our market report on page 24). New developments in mining, however, could make all the difference.

Ashley Blachford ashley.blachford@primecreative.com.au

CLIENT SUCCESS MANAGER

Justine Nardone justine.nardone@primecreative.com.au

CONTRIBUTORS Tim de Jong

HEAD OFFICE

Prime Creative Pty Ltd 11-15 Buckhurst Street South Melbourne VIC 3205 Australia p: +61 3 9690 8766 f: +61 3 9682 0044 enquiries@primecreative.com.au www.globaltrailermag.com

SUBSCRIPTIONS

+61 3 9690 8766 subscriptions@primecreative.com.au Global Trailer is available by subscription from the publisher. The rights of refusal are reserved by the publisher.

ARTICLES

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

COPYRIGHT

Global Trailer is owned by Prime Creative Media and published by John Murphy. All material in Global Trailer is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in Global Trailer are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

Follow us on twitter @Globaltrailer

“On roads across the globe: JOST keeps us rolling!”

Trusting the market leader.

Truck and trailer manufacturers around the globe trust in JOST’s comprehensive range of components. Customer-orientated solutions, innovative products and a worldwide supply of spare parts make JOST the number 1. www.jost-world.com

NEWS INTERNATIONAL ASIA CHINA The leaders of China and Colombia signed an electronic commerce cooperation agreement in July. China’s ministry of commerce and Colombia’s ministry of trade, industry and tourism signed a memorandum of understanding in Beijing on 31 July under the joint witness of Chinese President, Xi Jinping, Colombian President, Duque, Vice Minister of Commerce and Deputy China International Trade Representative, Yu Jianhua, and Minister of Trade, Industry and Tourism of Colombia, Restrepo. As per the agreement, China and Colombia will reportedly share experience in management and policy development, promote publicprivate dialogue, conduct joint research and personnel training, encourage enterprises to conduct e-commerce exchanges and cooperation and promote the trade of high-quality specialty products in their respective countries through e-commerce. “In recent years, the friendly relations between China and Colombia have developed rapidly, the cooperation in various fields has continued to be deepened, and bilateral trade volume has continued to grow,” China’s ministry of commerce said in a statement. “The signing of the memorandum will further enhance the level of trade facilitation and cooperation between the two countries and inject new vitality into bilateral economic and trade relations.” HONG KONG CIMC Vehicles is the first semi-trailer manufacturer to be listed on the main board of the Stock Exchange of Hong 6 / G L O B A L TR A I L E R / I SS U E 4 8

Kong (HKEX), effective July 11. The OEM has reported that CIMC Vehicles is the fourth independent listed platform established by CIMC, following CIMC (A+H shares), CIMC ENRIC (H share), and CIMCTianda (H share). As announced by CIMC, at 9m on July 11, the H shares (stock code: 1839) of CIMC Vehicles opens for trading on the HKEX at the final offer price of 6.38 HKD/share and at 500 shares/lot. It is also noted in CIMC’s announcement that, after global offering, CIMC will directly or indirectly own 53.82 per cent of the total capital stock issued by CIMC Vehicles through itself and its whollyowned subsidiaries. The head of CIMC’s Office of the Secretary to the Chairman noted that the successful listing of CIMC Vehicles is good for both CIMC and CIMC Vehicles. “The listing of CIMC Vehicles is good for the future development of CIMC’s vehicle business, the expansion of its financing space, the improvement of its international standardised management and the increases of its independent brand premium. The financial statements of CIMC Vehicles will still be consolidated into that of CIMC after CIMC Vehicles listing, the development of CIMC Vehicles will add value to CIMC, and bring better revenues for shareholders including CIMC.” TAIWAN Taiwan-based heavy haulage company, Chi Deh Crane Engineering, has expanded its fleet with a Goldhofer FTV 550 blade transport device to bolster its wind turbine component transport capabilities. Chi Deh has used Goldhofer

equipment since 2000 and the fleet includes a mechanically steered PST/ SL self-propelled vehicles, modular THP/SL heavy-duty systems and electronically steered PST/SL-E selfpropelled vehicles. In addition to the FTV 550, other additions include 16 axle lines of electronically steered PST/ SL-E and three SPZ-GP flatbed semitrailers with pendular axles. Chi Deh’s investment in the FTV 550 reportedly enables it to deliver the latest generation blades to remote locations with ease. DUBAI Logistics company, Aramex, confirms e-commerce has spurred volume growth while business transformation accelerates. For the second quarter and first half ended 30 June 2019, Aramex revenues grew four per cent to AED 1.279 million (€314,253,07). Aramex said in a statement that revenues would have grown by seven per cent excluding the impact from currency fluctuations, mainly in the South African Rand and Australian Dollar, as well as the company’s strategic restructuring of its operations in India through exiting the Domestic Express market. Net profit for Q2 2019 rose by one per cent to reach AED 123 million (€30.2 million), compared to AED 122 million (€29.9 million) in Q2 2018. “Strong demand from e-commerce continues to spur growth in volumes we handled over the second quarter,” said Aramex CEO, Bashar Obeid. “Our Domestic Express registered outstanding performance and International Express also enjoyed double digit growth,” he said. “This is a testament to our strong brand, efficient services and

NEWS

MIDDLE EAST increasingly competitive positioning. “However, lower yields, mainly on the cross-border International Express business and changes in fulfillment models, moderated our top line figures and profitability. FreightForwarding business performance came below expectations as it was affected by the regional economic uncertainty, however, today our efforts continue to be focused on commercial restructuring, which will enable us to grow that business line over the long term. “Our Integrated Logistics and Supply Chain Management business had another great quarter, as a result of our efforts to capitalise on the growing demand for those services, especially from regional retailers wanting to tap omni-channel sales. “We remain firmly committed to our strategic business transformation, which includes digital, commercial and operational upgrades to cater to the shifting operating environment and to retain and grow market share across different business lines. While such major changes pushed operating expenses for the period, over the long term, we are very positive that our transformation will help us improve our margins and help us further diversify our revenue mix.” “Volumes growth was very encouraging in the second quarter, with Domestic Express volumes surging 42 per cent in core markets, especially in the GCC and Levant region,” said Aramex Chief Operating Officer, Iyad Kamal. “The solid growth was owed to higher demand from e-commerce, the upgrade of our services and expansion of operations in some of our core markets, including Saudi Arabia, UAE and Egypt,” he said.

Aramex courier.

“Overall, Express volumes expanded by 20 per cent, thanks to winning new international e-tailers and receiving increased orders from existing ones. Also, in Q2 2019, we accelerated our digital transformation efforts. “Today Aramex is leaner and more operationally efficient than ever before. We are implementing technologies that will help reduce transit times and improve delivery accuracy, which will ultimately help us win more new business and enhance operating efficiencies.” IRAN International Road Transport Union (IRU) Secretary General, Umberto de Pretto, met with the President of the Islamic Republic of Iran Customs Administration (IRICA) and Deputy Minister of Economic Affairs and Finance, Mahdi Mirashrafi, this month in Geneva to discuss strengthening TIR in Iran, the region and beyond. IRU said that promoting TIR in Iran offers the opportunity to facilitate and secure transport, transit and trade not only in the

Economic Cooperation Organisation (ECO) region, but also along the International North-South Transport corridor (INSTC), the Chabahar Agreement corridor, the Belt and Road initiative corridors, the Islamabad-Tehran-Istanbul corridor (ITI), the Ashgabat Agreement corridor as well as all other trade routes passing through the country. “Over the past five years, IRU has been working closely with IRICA and IRU’s member, the Iran Chamber of Commerce, Industries, Mines and Agriculture (ICCIMA), to promote the benefits of TIR in Iran and the wider region, and today our relationship remains exemplary,” de Pretto said following the meeting. IRICA is at the forefront of promoting the digital and intermodal versions of the TIR system in the region. The first digital eTIR project between Iran and Turkey as well as the first intermodal TIR operation from Slovenia to Iran involving road, sea and rail transports have all taken place successfully. Iran also initiated a second digital TIR corridor to Azerbaijan in June. “Iran has the potential to serve as the engine of digital TIR in the region,” said de Pretto. “The eTIR pilot project with Turkey and now the digital TIR route with Azerbaijan which is due to be extended along the International North-South Transport corridor are clear examples of this fact.” With IRICA’s commitment to make eTIR fully operational with Turkey including to all TIR customs offices and all TIR transport operators, and its readiness to extend digital TIR to other neighbouring countries, Iran remains a strategic partner and is expected to be a game changer in the region. W W W. G LO B A LT R A I L E R M AG . C O M / G L O B A L T R A I L E R / 7

EUROPE AUSTRIA Kuehne + Nagel Austria has acquired Jöbstl, a medium-sized logistics enterprise headquartered in Wundschuh near Graz, to bolster its overland network. With the integration of the Jöbstl Group, Kuehne + Nagel is expanding its overland network and simultaneously strengthening the region as the gateway to Eastern Europe. In future, particularly those customers requiring European groupage services can benefit from the transport operations offered by the Jöbstl Group. “By adding the Jöbstl Group portfolio to ours, we are able to offer more services to the customers in the region, as well as further develop our overland network strategically”, said Kuehne + Nagel Senior Vice President Europe, Uwe Hött. “With over 130 overland branch offices throughout Europe, Kuehne + Nagel is already connecting all markets in the region. “By integrating the Jöbstl network, transport operations and in particular connections to neighbouring countries will be further strengthened while increasing frequency of depatures and shortening leadtimes. Expecially medium-sized companies will benefit from our expanded portfolio of offerings,” he said. Kuehne + Nagel Austria General Manager, Franz Braunsberger, said the family-owned company, Jöbstl stands for reliability, flexibility and customer service with a personal touch – values that are also extremely important to Kuehne + Nagel. Jöbstl Managing Director and shareholder of the Jöbstl Group, Christoph Jöbstl, has welcomed the acquisition. 8 / G L O B A L TR A I L E R / I SS U E 4 8

“We are pleased to join the Kuehne + Nagel Group and become a part of a global logistics network,” he said. Together we will be able to offer our customers an even wider range of services. At the same time, combinining our networks, we can build synergies and create room for growth that will benefit both our customers and employees.” The acquisition is subject to approval by the responsible antitrust authorities. As part of the acquisition, 100 per cent of SLM Spedition und Logistik GmbH, Vienna, shares will be transferred to Kuehne + Nagel. The parties have agreed not to disclose the purchase price of the transaction. FINLAND Tyre manufacturer, Nokian Heavy Tyres, has acquired heavy equipment wheel company, Levypyörä Oy. With its two business lines, wheels and steel structures, Levypyörä serves OEMs and aftermarket customers in forestry, agriculture and earthmoving applications. Annual net sales of Levypyörä is reported to be approximately €18 million. “With the acquisition, Nokian Heavy Tyres can offer innovative new solutions to its existing customers and increase wheel volume as well as further improve its service level,” said Nokian Heavy Tyres Managing Director, Manu Salmi. “Levypyörä has already been a trusted partner of ours for many years,” he said. “The acquisition provides additional growth opportunities and offers a fullservice solution for our key OE and AM customers.” “Being a part of a leading specialty tire manufacturer gives us a great opportunity to further grow and

develop Levypyörä products and services globally and strengthen our current customer and supplier relationships,” said Levypyörä Managing Director, Lars Ojansuu. Levypyörä was founded 64 years ago and it employs approximately 100 people in Nastola, Finland. Levypyörä was a part of Weckman Steel corporation. FINLAND Alexanders Removals and Storage took delivery of an Ekeri side-opening 18 tonne rigid vehicle in 2017 which, according to the London-based company, has greatly improved loading flexibility and requires no maintenance or repairs. The rigid-sided body is equipped with 6 doors, which open along the body length on the kerbside and lock centrally. While for secure loading, the Ekeri-designed lashing strap system runs along each side of the floor and both walls. Alexanders provide a comprehensive removals and storage service for domestic and commercial customers throughout the UK and Europe and rely on vehicles which enable fast, secure and flexible loading. “The Ekeri body has more than proved itself and despite a demanding operation, has neither deteriorated nor required any looking after – useful factors when it comes to keeping downtime low and ensuring a good return on investment,” said Alexanders General Manager, Richard Lear. The Ekeri vehicle is designed to allow access to any point along the load bed, from the near-side or rear. This saves handling time and avoids having to manoeuvre items around oneanother or to off-load through the rear to reach a given part of the load.

NEWS

EUROPE

Nokian Heavy Tyres Managing Director, Manu Salmi.

Manufactured by Ekeri in Finland, the GRP-skinned body is also equipped with side and rear ramps for easy access. “If required, we can load 20 pallets or 5 of our large storage boxes through the sides and rear,” said Lear. “And as there are no posts in the way, we have unrestricted access with a loading length of 8150mm and a height of 2740mm.” Formed in 2002 by husband and wife team Alex and Sam Pope, Alexanders’ diverse range of services includes tailored removals planning, individual packing, dismantling office equipment, schools, home cleaning, IT services, antiques care, insurance cover and secure self-storage and containerised storage. In addition, the company provides a wide range of removals and related services for schools, airlines and private businesses and in recognition of their professionalism, the company recently won Domestic Mover of the Year 2019 and were awarded Certificate of Excellence for the Commercial Mover of the Year 2019 by the industry association – British

Association of Removers. “Overall, the Ekeri body is perfect for mixed loads and multi-drop/collections where a certain degree of security is required,” said Lear. “Add to that, its hard-wearing, low maintenance components and we have efficiency and reliability rolled into one. Good for us and good for our customers too.” GERMANY Equipment specialist, SAF-Holland, reported a group sales record of €695.5 million (+8.6 per cent) as part of its half-year financial results. “Outside of the Americas region, the market environment for heavy trucks and trailers was challenging,” said SAF-Holland CEO, Alexander Geis. “Despite this, our performance in the first half of 2019 has been satisfactory overall. “Based on the expected industryspecific conditions, we are confident that we will meet the market expectations for the full year. The consistent implementation of the group-wide operational excellence programs and our ability to promptly and flexibly respond to fluctuations

in demand are also essential prerequisites for reaching our targets.” Group sales in the first half of 2019 reached €695.5 million, or 8.6 per cent higher than the level of €640.3 million generated in the first half of the prior year. The additional contribution to sales from the companies acquired since January 2018 amounted to €34.5 million. Organic sales growth, which stemmed exclusively from the Americas region, contributed €4.2 million (net). Positive currency effects resulting primarily from the appreciation of the US dollar against the Euro amounted to €16.4 million (previous year EUR -36.2 million). Adjusted Group earnings before interest and taxes (EBIT) in the first half of 2019 improved year-on-year by 13.2 per cent, reaching €49.9 million (previous year EUR 44.1 million). The sharp rise in earnings achieved in the Americas region was able to compensate for the lower earnings contributions from the other regions. The adjusted EBIT margin for the first half-year of 2019 equalled 7.2 per cent (previous year 6.9 per cent). The adjusted result for the period before minority interests amounted to €33.0 million (previous year €28.2 million) and was impacted by a significantly better net finance result and a higher tax rate. Based on the approximately 45.4 million ordinary shares issued, adjusted basic earnings per share amounted to €0.73 (previous year €0.62), and adjusted diluted earnings per share amounted to €0.61 (previous year €0.53). Additions to property, plant and equipment and intangible assets amounted to €24.2 million in the first half of 2019 (previous year €15.2 W W W. G LO B A LT R A I L E R M AG . C O M / G L O B A L T R A I L E R / 9

ASIA

AUSTRALIA

EUROPE

USA

GROUPED. FOR SUCCESS.

Combining decades of experience gathered in Asia, Australia, Europe and the US, global manufacturing powerhouse Fuwa has forged the strongest network of truck and trailer component specialists in the world. Merging local expertise with world-leading manufacturing prowess and an irrevocable commitment to innovation, our entire range of axles, suspension systems, landing legs, couplings, king pins, fifth wheels and ball races have been designed for one goal only -- to guarantee your success.

GROUP COMPANIES

Join the Group. Join the Revolution.

SINGAPORE

CHINA

fuwa.cn

fuwa.cn

FUWA ENGINEERING FUWA HEAVY INDUSTRIES p: +65 68631806 p: +86 750 5966333

AUSTRALIA

FUWA K-HITCH p: +61 3 9369 0000

khitch.com.au

EUROPE

VALX International p: +31 (0)88 405 8800

valx.eu

AMERICA

AXN Heavy Duty p: +1 502 749 3200

axnheavyduty.com

NEWS

EUROPE million) and included capitalised development costs of €2.4 million (previous year €1.8 million). Investments came to €8.0 million in the EMEA region (previous year €6.2 million), €11.2 million in the Americas region (previous year €8.2 million), €4.7 million in the China region (previous year €0.6 million) and €0.4 million in the APAC region (previous year €0.3 million). Key areas of investment included the construction of the Chinese Greenfield plant, rationalisation and expansion investments in the US and a new office building in Germany. At €27.6 million, cash flow from operating activities in the first six months of 2019 was significantly above the previous year’s level of EUR -30.9 million. This improvement stemmed, above all, from a sharply lower increase in net working capital - despite a further expansion of sales. Net of the cash flow from investing activities in property, plant and equipment and intangible assets amounting to €24.2 million, the operating free cash flow improved substantially to EUR +3.4 million (previous year EUR -46.1 million). “We will continue to diligently manage our net working capital in the second half of the year in order to achieve sustained positive free cash flows,” said SAF-Holland Chief Financial Officer, Dr Matthias Heiden. GERMANY Logistics on-demand service provider, Uber Freight, is launching in Germany, following its successful expansion in the Netherlands. The introduction of Uber Freight follows a recent call for action by the German industry to address logistical bottlenecks and severe

driver shortages in the road transport sector. “In an increasingly demanding sector, Uber Freight has the power to unlock efficiencies that drive the entire German industry forward,” said Uber Freight Head of European Expansion, Daniel Buczkowski. “With a global network and proven technology at scale, we look forward to seamlessly connect carriers with shipper’s loads, creating an environment in which everyone can benefit,” he said. German shippers and carriers, according to Uber, have many of the same pain points as their European counterparts and can benefit from the technology Uber Freight has developed. “The German trucking market is experiencing a severe shortage of drivers,” Uber said in a statement. “The World Bank estimates that around 40 per cent of German truck drivers will retire in the next 10 years, creating a shortfall of 150,000 drivers. Moreover, of the time drivers are on the road, 21 per cent of the total miles traveled are empty. Inefficiency of this scale results in shippers struggling to find available drivers to move their goods.” Uber said small- to medium-sized carriers in Germany make up more than 90 per cent of the carrier pool and Uber Freight’s on-demand marketplace will enable carriers of all sizes to participate in the market, and with that increase efficiency as well as reduce wasted miles and fuel. GERMANY German OEM, Kässbohrer, has expanded its cold chain transportation range with the launch of its Flower Carrier, K.SRI F.

Kässbohrer’s K.SRI F is equipped with cutting-edge technology and offers the best features for flower transportation. K.SRI F is offered with the inner height of 2,700mm, an internal width of 2,500mm, integrated load security rail, protected rear door and 1,100mm fifth wheel height with 385/65 22.5 tyres as a standard offering the maximum volume for the transportation of delicate goods. K.SRI F’s chassis, made of high strength steel is KTL coated for 10 years of no rust perforation guarantee assuring performance for the life time of the vehicle. Kässbohrer Flower Carrier is compliant with EN 12642 Code XL to provide safer transportation of the delicate goods, FRC for perishable good transportation and Pharma Certificate for pharmaceutical material transportation. To assure the continuity of cold chain operations Flower Carrier features an insulated door as well as buffers all around for maximum isolation. Flower Carrier is provided with an insulated robust rear door that is equipped with full rear rubber buffer across rear width and hinge protection rubber buffers fitted vertically full height of the rear frame increasing the robustness of the vehicle, prevents damages to the box during operations and extends the life time of the vehicle. Kässbohrer’s high-tech Flower Carrier’s steel rear frame mounted 85mm thickness insulated rear door is protected with 250mm aluminium kick strip fitted at the bases to prevent damages during operations enabling cold chain operation sustainability. As standard, reliably secured aluminium hinges are customsW W W. G LO B A LT R A I L E R M AG . C O M / G L O B A L T R A I L E R / 1 1

EUROPE compliant to prevent cargo theft. K.SRI F can be equipped with stainless steel housing door locks consisting of two parts, one part on the left-hand door and one part on the right-hand door, to make it resistant to attempted burglaries as an option. IRELAND Northern Irish OEM, SDC Trailers, has launched a new hydraulically powered tipping skeletal trailer for use with 40’ containers to transport and tip bulk materials. The new trailer is reported to offer a high-volume payload, providing the operator with efficient loading / offloading and increased flexibility to maximise deliveries. Designed for 44-tonne operation, SDC’s high quality finish is guaranteed with premium components including BPW axles, automatic twist locks, JOST landing legs, HYVA tipping gear and Aspock lighting. SDC said in a statement that it carried out extensive research during the design and development process of the skel tipper and has incorporated advanced safety features including rear stabilising legs to optimise stability and a warning lamp fitted as standard to alert anyone nearby when the tipper is being raised. The exact trailer specification can be tailored to the customer’s requirements according to SDC. The trailer tipping ram can be powered from the PTO on the truck or an on-board electric / diesel power pack. “I am delighted to announce the new 40’ addition to our tipping skeletal range, increasing our solutions for the container and bulk materials industry,” said SDC CEO, Enda Cushnahan. “Enhancing flexibility and efficiency, the 40’ tipping skeletal is not only 12 / G L O B A L TR A I L E R / I SS U E 4 8

cost effective for the operator, it also delivers environmental savings through reduced carbon emissions. “Our engineers have designed and manufactured 150,000 trailers over the last 40 years and this latest innovation is testament to our continued dedication, to provide safe and practical semi-trailer solutions,” he said. SDC’s range of tipping skeletal trailers provide a highly robust and durable option for use with various containers. The manufacturer offers four different design configurations across the range; a sliding skeletal used for tipping 20’ containers, a flexible sliding design for tipping both 20’ and 30’ containers and a rigid option for 30’ use only. The launch of SDC’s new 40’ tipping skeletal completes the range, with a solution for efficient, high volume deliveries. The trailer is now in full production at SDC’s ISO accredited manufacturing facilities in the UK and Ireland. ITALY Italian logistics company, Fercam, has taken delivery of 80 Krone Profi Liners with special equipment for railway transportation. Trailer manufacturer, Krone, said that innovative solutions, quality, intermodality and reliability were key to Fercam specifies Krone for intermodal reliability.

Fercam’s decision to invest in Krone’s trailing equipment. Johann Friedrich Harder, head of Fercam’s Bolzano branch and responsible for the company’s fleet, said Fercam’s vehicles must guarantee its customers a safe and reliable service. Harder told Krone that as Fercam carries out around 20 per cent of all transport with intermodal systems, the business pays particular attention the intermodal qualities of its trailers when investing in new equipment. Important features include body strength, flexible use and exemplary load restraint. The new Krone semi-trailers, which were delivered by the Italian Krone partner RealTrailer srl., are used by Fercam on all European routes. Fercam has 93 branches throughout Europe, 63 of them in Italy, 24 in Europe through its own subsidiaries and a further six in Turkey, Tunisia, Morocco, Serbia and Albania. Due to its 93 branches throughout the continent and in North Africa, the company can offer virtually any route, most of them even intermodal (rail/ road or road/sea transport). The South Tyrolean Fercam AG with headquarters in Bolzano (founded in 1949) is one of the leading transport and logistics companies in Italy with its 3,350 own loading units and more

NEWS

EUROPE than 1,200,000m² of storage space. The company’s services include international full load transports by road and rail as well as worldwide sea and air freight transports, national general cargo transports and numerous logistics services. Since the beginning of 2019, Fercam has also been represented in the Far East, namely in Hong Kong, China and Japan, with three of its own local facilities. The company currently has 2,100 employees and almost 4,000 external employees, who generated sales of 811 million euros in 2018.

operators could familiarise themselves with Dearman’s clean, quiet operation and its ease of use,” Dearman said in a statement. “TIP has seen its trailer leasing customers increasingly look to adopt cleaner and more efficient solutions for tractor units at the front of their vehicles and the new partnership with Dearman means TIP’s customers will be able to match their cleaner propulsion investments with a clean refrigeration solution.” TIP Vice President Benelux, Rogier Laan, said its customers frequently ponder the question of how to deal with issues such as sustainability and the type of trailers they should use. “We therefore see it as our 9376

THE NETHERLANDS UK-based ‘clean cold’ technology

company, Dearman, and TIP Netherlands (NL) have partnered to deploy Dearman’s liquid nitrogen powered transport refrigeration units in trailers leased by TIP to leading fleet operators. Reducing the environmental impact of a logistics network is an integral part of environmentally conscientious fleet operators seeking low-carbon and clean-air transport solutions according to Dearman. “Following successful trials in NL and Italy with a global top three multibrand foods company, TIP showcased Dearman’s zero emissions transport refrigeration technology at its recent Customer Innovation Platform so that

Uniquely effective The S.KO COOL COMPLETE with EXECUTIVE package is our top of the range reefer semitrailer, and includes our exclusive S.CU transport refrigeration unit. Refrigerate more costeffectively with our outstanding insulation system. Our services and TrailerConnect® telematics system are included to ensure lower maintenance costs and an impressive resale value. More Information: www.cargobull.com

EUROPE responsibility to be the best industry partner for these topics and we support innovative solutions that contribute in making our industry more sustainable,” he said. “We therefore keep a close eye on technical developments within our industry and we test these developments regularly, including this revolutionary solution from Dearman.” Dearman Chief Commercial Officer, Khaled Simmons, said that TIP’s support for clean technology innovation is a major step to enable fleet operators to meet the increasing evironmental demand upon them from regulators, food producers and retailers. “The license to operate diesel-powered refrigeration is closing in and it will take leadership from innovative leasing companies like TIP to support the transition to clean alternatives,” he said. SCOTLAND Aberdeenshire-based Lunar Freezing has become the first company in Scotland to take delivery of Carrier Transicold’s new Vector HE 19 MT (High Efficiency, Multi-Temperature) trailer refrigeration unit. Carrier Transicold is a part of Carrier, a leading global provider of innovative heating, ventilating and air conditioning (HVAC), refrigeration, fire, security and building automation technologies. Mounted to a 13.6-metre Gray & Adams trailer built at the company’s plant in nearby Fraserburgh, the trailer will transport fresh fish landed in Peterhead to Germany, Holland and throughout the UK. “We’ve had many years of fantastic service from Carrier Transicold and the chance to be the first in Scotland to introduce their next-generation system was one we didn’t want to miss,” said 14 / G L O B A L TR A I L E R / I SS U E 4 8

Lunar Freezing Engineering Manager, Jim Bruce. “The new Vector HE 19 is lighter, quieter, offers improved pull-down capacity and has the most efficient cooling system of any trailer we’ve had in the fleet. This brings real benefits for our business, and we fully expect it will become the standard unit for us moving forward.” The new Vector HE 19 system utilises Carrier Transicold’s all-electric E-Drive technology, which combined with a new multi-speed engine design, delivers up to 30 per cent in fuel savings when compared to the existing Vector 1950 unit. These figures have been independently verified against the European Committee for Standardisation (CEN) and the Association Technic Energy Environment (ATEE) partial load fuel burn standards. At the same time, the oil drain interval for the unit’s engine is doubled when compared to its predecessor. The Vector HE 19 units use of a fully hermetic scroll compressor and economiser helps to deliver a 40 per cent increase in refrigeration capacity during pull-down, while reducing the chance of refrigerant escape by 50 per cent. The system is also 19 per cent more efficient when plugged into the electrical grid on standby, meaning Lunar Freezing will see reduced diesel, maintenance and electricity bills. “We have enjoyed a strong relationship with Lunar Freezing since 2001, supplying both trailers and a rigid truck body for their busy fleet,” said Gray & Adams Sales Manager, Stewart Massie. “Most recently, they have worked with us on a project to trial and test a new rear buffer arrangement, which has proven so successful that it has been incorporated into this new trailer.

Being based so close to our factory, they are a great fleet to work with on research and development projects.” Lunar Freezing operates a fleet of 10 Carrier-cooled trailers, each averaging around 100,000 kilometres a year and on the road up to seven days per week. Founded in 1990, the company offers fishing, processing, cold storage, and transportation of fish products across the UK and into Belgium, France, Holland and Germany. SLOVAKIA AND CZECH REPUBLIC Deutsche Post DHL Group is strengthening its cooperation with Austrian Post in Slovakia and Czech Republic to create profitable growth in the booming cross-border e-commerce business. The companies will collaborate in last-mile parcel delivery in Slovakia and Czech Republic. Under the agreement, In Time s.r.o., a subsidiary of Austrian Post, will deliver parcels sent by DHL customers to Slovakia, while Deutsche Post DHL Group’s Czech subsidiary, PPL CZ s.r.o. will deliver parcels sent by Austrian Post customers to Czech Republic. Both relationships are expected to begin in September 2019. “After the collaboration with Austrian Post in Austria both parties decided to further use each other’s delivery network as described in Slovakia and Czech Republic,” said Petr Horak, Managing Director PPL CZ s.r.o. & DHL Parcel Slovensko. “With e-commerce on the rise and growing parcel volumes high quality and best-in-class customer experience in last-mile-delivery becomes increasingly a key differentiator and with this cooperation we will lay the right foundation for this,” he said.

NEWS

NORTH AMERICA US Wabash National has reported financial results for the quarter ended June 30 2019, citing net sales growth and strong operating performance. Net sales for Q2 2019 increased two percent to $626 million USD (€564.5 million) from $613 million USD (€552.8 million) in the prior year quarter, as growth was led by the Company’s Final Mile and Diversified Products Group Segments. Operating income was $47.5 million USD (€42.8 million) in the second quarter of 2019 and the company achieved a consolidated operating margin of 7.6 per cent during the

second quarter of 2019, which represents an improvement of 10 basis points from the second quarter of 2018, highlighting the success of both short and long-term initiatives targeting margin expansion. “I am very pleased with our operating performance during the second quarter,” said Wabash President and CEO, Brent Yeagy. “We delivered revenue of $626 million [USD] which is an all-time record for Wabash National and we generated our strongest operating margins in two years, driven by the Wabash Management System. “The strength of our free cash generation allowed us the flexibility

not only to pay our regular quarterly dividend and make progress on debtreduction, but also to repurchase shares during the quarter,” he said. Net income for the second quarter 2019 was $31.0 million USD (€27.9 million). Operating EBITDA, a non-GAAP measure that excludes the effects of certain items, for the second quarter 2019 was $61.0 million USD, or 9.7 per cent of net sales. Headquartered in Lafayette, Indiana, Wabash National Corporation is a diversified industrial manufacturer and a leading producer of semi-trailers, truck bodies and liquid transportation systems. Established in 1985, the

TRUST IN US

Versatile, safe and reliable: No matter what you have to move, you are ahead with vehicles of the TII Group. tii-group.com

NORTH AMERICA Company manufactures a diverse range of products including: dry freight and refrigerated trailers, platform trailers, bulk tank trailers, dry and refrigerated truck bodies, truck-mounted tanks, intermodal equipment, structural composite panels and products, trailer aerodynamic solutions, and specialty food grade and pharmaceutical equipment. US Meritor will supply one of the industry’s lightest air disc brakes to German trailer manufacturer, Schmitz Cargobull, in 2021. “Entering into an agreement with a highly respected OEM like Schmitz Cargobull reinforces our goal to diversify the business and positions Meritor for growth in Europe,” said Meritor Vice President Truck – Europe, Tony Nicol. “The new brake offers significant cost and weight savings while also maintaining the performance our customers expect,” he said. Roland Klement, Member of the Board and Chief Research and Development Officer for Schmitz Cargobull said: “We’re pleased to be working with a global supplier that has proven braking solutions with consistent quality and dedicated customer service and is aligned with our goals”. Meritor’s braking solution for the OEM is designed to meet trailer fleet expectations for efficiency, safety and performance. Components focused on weight and performance were developed at Meritor’s braking centre of excellence in Cwmbran, UK. Meritor designed the brake based on delivering TCO benefits for customers while also retaining key aspects of 16 / G L O B A L TR A I L E R / I SS U E 4 8

current technologies. Its adjuster mechanism is based on Meritor’s proven ELSA brake design and includes a new patent pending friction pad design. In other news, Meritor completed its €156.2 million acquisition of AxleTech from global investment firm The Carlyle Group in July. The previously announced transaction is reported to enhance Meritor’s growth platform with the addition of a complementary product portfolio, including a full line of independent suspensions, axles, braking solutions and drivetrain components. AxleTech will operate within Meritor’s Aftermarket, Industrial & Trailer segment. “The addition of AxleTech advances our growth strategy while further diversifying our portfolio in strategic, adjacent markets,” said Meritor CEO and President, Jay Craig. “We are delighted to welcome AxleTech to the Meritor team with a shared focus on driving superior performance, efficiency and reliability for our global customers with a wider array of products and solutions. “We look forward to realising the benefits of the transaction as we continue executing on our priorities to enhance value for our shareholders, customers and employees,” he said. US The American Trucking Associations’ (ATA) advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 1.1 per cent in June after falling four per cent in May. The index in June was 115.2 (2015=100) compared with 116.5 in May. “Tonnage continues to show

resilience as it posted the twentysixth year-over-year increase despite falling for the second straight month sequentially,” said ATA Chief Economist, Bob Costello. “The yearover-year gain was the smallest over the past two years, but the level of freight remains quite high. Tonnage is outperforming other trucking metrics as heavy freight sectors, like tank truck, are witnessing better freight levels than sectors like dry van, which has a lower average weight per load.” May’s reading was revised up compared with ATA’s June release. Compared with June 2018, the seasonally adjusted index increased 1.5 per cent, the smallest year-overyear gain since April 2017. The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 117.6 in June, 3.3 per cent below May level (121.7). In calculating the index, 100 represents 2015. Trucking is reported to serve as a barometer of the US economy, representing 70.2 per cent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.77 billion tonnes of freight in 2017. Motor carriers collected $700.1 billion USD (€628.3 billion), or 79.3 per cent of total revenue earned by all transport modes. ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the

NEWS

NORTH AMERICA fifth day of each month. The report includes month-to-month and yearover-year results, relevant economic comparisons and key financial indicators. US CIMC Intermodal Equipment (CIMC IE) celebrated the opening of a new facility in South Gate, California, in the US last month. The ribbon cutting ceremony and open house event was reported to be attended by more than 50 key customers, suppliers and Board members. The site expansion, according to

CIMC IE, added over 50,00 square feet (4,645 square metres) under roof and another 50,000 plus square feet of additional parking space to accommodate the OEM’s growing North American intermodal business. The new building houses offices for purchasing, human relations, finance and accounting, logistics, sales support and key executives. Additionally, CIMC IE has added, with this expansion, a new educational training centre, parts PDC and chassis showroom with a central product gallery. “CIMC is unique in having an indoor showroom that offers visitors a clean

INTELLIGENT TRAILER PROGRAM

RAISE YOUR TRAILER’S IQ AND YOUR RETURN ON INVESTMENT

WABCO’s Intelligent Trailer Program offers a range of more than 40 innovative trailer functions that increase operational effectiveness, safety and driver comfort. Discover how the Intelligent Trailer Program can help you to decrease the operational cost of your trailers, while increasing efficiency and safety. For further information visit:

go.wabco-auto.com/trailersolutions

and uncluttered area in which to view new container chassis,” said CIMC IE CEO, Frank Sonzala. The additional space has reportedly allowed CIMC IE to improve and re-organise the legacy facility in South Gate to update and enlarge all offices, employee facilities and operations. A modern, fully-outfitted IT department was added along with a technical centre training room and new production support offices. The CIMC IE parts department doubled in size and re-designed production lines can now produce a hundred 53’ chassis and a hundred marine and various other stock chassis per shift.

SOUTH AMERICA CHILE Bulk haulage company, Tambo, services the copper mining industry in Chile with Meiller tippers. The Tambo fleet has reportedly grown over the years since its founding in 1988. The family enterprise led by Camilo González Pendola comprises 120 trucks and 90 diggers. About 80 of those vehicles are fitted with Meiller superstructures. “Camilo González Pendola puts his faith in two powerful 4-axle vehicles, the classic rear tipper H436 and 50-tons P450 which, with a nominal volume of 20 and 22m³, can be relied upon to perform under even the harshest operating conditions,” Meiller said in a statement. “Heavyweights such as the P450 are a rare sight in Germany, as trucks weighing 50 tonnes are generally not permitted to use public roads.” New business models have for some time now been transforming the haulage sector in Chile, according to Meiller, with major construction companies no longer investing in their own equipment and preferring to lease vehicles. Tambo has taken advantage of these changes in recent years. The company relies on its own vehicles and drivers to transport soil, concrete and rubble. One new core business is the leasing of equipment, including the option of trained drivers should this be requested. The demands Tambo makes of its personnel are indeed high, with professionalism a prerequisite and regular training measures broadening the know-how of employees. This means that drivers with the necessary knowledge are available, along with mechanics who 18 / G L O B A L TR A I L E R / I SS U E 4 8

Meiller tippers take the strain on South American roads.

can remedy problems relating to vehicle superstructures on site, thus drastically reducing downtime. It is with more than a little pride that Camilo González Pendola describes his fleet as the most modern in all Chile. Vehicles are replaced every three years, with earth moving equipment being renewed every five to six years. When it comes to tippers, Camilo González Pendola’s exclusive preference is for robust tippers from Meiller. “Quality has paid off in the shortest possible time, proving the superiority of this equipment to that of other manufacturers,” said Pendola. “In addition to the excellent workmanship of these vehicles, the service provided with regard to wear and spare parts is far superior to that of other competitors.” Transport companies can only exploit specific time windows for accessing the mines, Meiller stated. The repair of vehicles on the mine site is prohibited, and a breakdown can easily mean that the tipper is out of service for two days. This does not apply to Meiller tippers. “On the one hand, we’ve experienced a lot fewer technical problems since we’ve been using Meiller vehicles and, where a small

repair is necessary, waiting times until the spare part is delivered are also practically negligible,” said Pendola. As the company now also has a secondary line of business in the sale of used vehicles after a certain period of use, resale value is also an important issue, as Pendola explains: “After three years of use, Meiller tippers are in a significantly better condition than tippers from other manufacturers. Practically no investment in maintenance is required prior to sale, and repairs are also unnecessary. That’s not the case with other vehicles.” After years of trials and testing under practical conditions, Pendola is convinced of the quality of Meiller vehicles. He has already been at the IAA in Germany and visited the plant in Munich and Slany in the Czech Republic to see where his vehicles come from and how they are manufactured, an experience that impressed him greatly. Chile is one of the most prosperous countries in South America due to the resource, copper, according to Meiller. “This is primarily extracted in the El Teniente mine in Rancagua, the world’s largest subterranean copper mine. Estimates suggest that 100 megatonnes of fine copper lie underground in this location. A network of 3,000 kilometres of drifts has been developed to access this valuable major export, and around a half a million tons of fine copper are produced from the ore mined each year. However, ore, rock and soil first need to be transported to the surface, and this calls for a haulage company with vehicles designed to do the heaviest of work and continuous operation.”

NEWS

OCEANIA THAILAND South East Asia is expected to be the largest segment of the global market for beverages according to transport and logistics company, Linfox. Growth and disruption is reported to be hallmarks of the South East Asian beverage market in the years to follow as new players seek to tap into that growth. Despite growth in South East Asia’a markets, Linfox claims that getting the goods to market will be a challenge due to poor infrastructure and administrative systems not built for the scale required. Other challenges include skills shortage and evolving regulatory frameworks which vary from country to country in the region. Linfox has had a presence in South East Asia for 25 years. In 2018, Linfox International Group (LIG) and Thailand brewer, Boon Rawd Brewery, formed a joint venture for the exclusive provision of logistics services to Boon Rawd’s beverages business in Thailand. This joint venture led to the formation of

get

BevChain Logistics Thailand. Wang Noi in Bangkok is BevChain Logistics Thailand’s main distribution centre (DC), three regional DCs (Khon Kaen, Surat Thani and Chiang Mai) and other smaller DCs in key areas. More than 800 employees and contractors operate 15 warehouses and DCs as well as nine factories, bolstered by a company and contractor fleet. Linfox said that safety has been a priority from the beginning at BevChain Logistics Thailand. The business has built a proactive safety culture by training staff on personal protective equipment, load restraint, forklift driving, manual handling techniques, incident investigation and toolbox communications. The first ‘Stop For Safety’ program was held in April in the lead up to the Songkran peak – Thailand’s New Year celebration. “This was an opportunity for the senior leadership team to engage with people face-to-face and reinforce the message about safe driving and warehouse practices,”

things

KARLSRUHE TRADE FAIR CENTRE

said BevChain Logistics Thailand Managing Director, Matt Sheridan. “The team put in a fantastic performance - more than 10 million cases were delivered and over five million cases passed through the warehouses each week.” BevChain Logistics Thailand has invested in newly designed highcapacity trailers to improve safety and boost efficiency across the factory shuttle network. “In just six months, we have made great progress towards competing in the local market and providing a safe and high-quality service,“ said Sheridan. “By consolidating volume and services for existing and new customers we can lower costs and provide much more value across the supply chain, while helping them grow in their home markets and reach emerging markets of Cambodia, Laos, Myanmar and Vietnam.” BevChain Logistics Thailand, is on track to become a leader in back-of-factory services through to consolidation and delivery.

! g n i v mo nufam.de

26 – 29 Sept. 2019

A S PA R K O F

HOPE 20 / G L O B A L TR A I L E R / I SS U E 4 8

COVER STORY

THE DIRE ECONOMIC STATE OF RUSSIA IS INFLUENCING HOW PROMINENT OEMS IN THE REGION CONDUCT BUSINESS. TONAR, DESPITE TREMULOUS MARKET CONDITIONS, IS COMMITTED TO MANUFACTURING FLEXIBILITY AND EQUIPMENT RELIABILITY WITHOUT COMPROMISE.

T

onar is one of the biggest trailer builders in Russia but 2019 is not looking as optimistic as 2018 according to General Manager, Denis Krivtsov. He explains that the Russian economy is stagnating, with less than one per cent of growth year-on-year. While infrastructure projects such as the Crimean Bridge have been completed, there is nothing currently in the country’s engineering pipeline that compares. Expected works such as highspeed rail from Moscow to Kazan and a bridge to Sakhalin seem to be in a holding pattern until the Government allocates funding. “There are also number of local factors influencing the Russian market,” he says. “The energy export ban to Ukraine via Russia has caused a collapse in the coal mining sector – coal transportation reduced consequently and the suppression of the forest trade with China has put a stop to the sales of timber trailers which were booming over the past few years.” So far, Krivtsov confirms that commercial vehicles dropped by about five per cent this year. In January-April 2019 the Russian new trailer and semi-trailer market increased by 5.1 per cent on the same period as 2018 and amounted to 9.23 thousand units, according to Russian Automotive Market Research. For the reporting period Tonar sales grew by 56.9 per cent and amounted to 0.91 thousand units. That five per cent growth in the Russian trailer market, according to Krivtsov, is a statistical anomaly. “People buy more new trailers instead of used ones from Europe, their import was banned in April 2019,” he says. “If the import of new and used trailers are combined then the trailer market is also technically decreasing. “Tipping semi-trailers suffered the most, as usual. Curtainsiders and container chassis are growing, though. The winners, though, are those Russian companies that replace imported trailers – Tonar is one of them.” Despite collapsing market conditions, Tonar is well placed with the production of around 1,500 trailers. If these conditions remain the same, Krivtsov expects to see a total production run of around 3,000 trailers by the end of the year. “We produced 170 curtainsiders in April 2019, which is our best result so far,” he says.

In addition to manufacturing a diverse range of trailing equipment, one of Tonar’s specialities is producing tipping semi-trailers. “When most of the companies around the world were developing light vehicles, Tonar – since its foundation – has been developing more and more heavy trailers as there were no real weight control on the roads and the market demanded the transportation of larger volumes,” Krivtsov says – explaining that the in the past few years this situation is changing and more road freight operators are opting for legal transportation. “Most of our recent developments aim to reduce trailers weight and increasing legal payload capacity. It is a challenging task, when you consider tough road conditions and careless road freight operators running the risk of overloading. In more recent times, Tonar has developed a full range of light tippers for different materials made of aluminium and SSAB’s Hardox steel, with three- and four-axle variants. In combination with 6x4 or 4x2 prime movers they perfectly match Russian road regulation to assure maximum payload.” Beyond Russia, Tonar exports trailers to ‘hard working’ countries such as Western Africa and the Middle East – countries, according to Krivtsov, that understand what a real overload is. “Standard European equipment simply does not work in these areas long-term,” he says. “Tonar fully utilises its experience with developing trailing equipment that is specified for

W W W. G LO B A LT R A I L E R M AG . C O M / G L O B A L T R A I L E R / 2 1

COVER STORY

rigorous use under difficult conditions.” Krivtsov also compares the European and Russian markets. “The economy of united Europe is huge and quite stable, so the main players are focused on mass production of their main models, like curtainsiders and reefers for example,” he says. “Specialisation helps to increase productivity and efficiency a lot, making them unreachable for others. It’s the opposite in Russia. Everybody is trying to increase their product range in multiple directions to remain competitive. Specialisation for Russian OEMs is generally too risky.” One of the greatest challenges for road transport operators in Russia is that there is a massive concentration of the population (approx. 150 million) in the west but the main natural resources are found in the east. “Rail is, of course, playing a major role in the transportation of resources, including chemicals and metals, over long distances across the country – its turnover is almost 10 times that of road transport,” Krivtsov says. “At the same time, though, road transport can cart more cargo by weight tenfold. “For fresh food and consumer goods road transport is probably the only option regardless of distance.” More and more industrial goods are being transported via curtainsiders from the east to the west of Russia, Krivtsov says, whereas fresh food is being sent the other way. “So, for curtainsiders and reefers it is becoming more difficult for these vehicle operators to efficiently manage return loads.” In Russia, the more you transport, the

22 / G L O B A L TR A I L E R / I SS U E 4 8

more you earn. Tonar builds road train combinations to satisfy the operational requirements of ambitious businesses looking to maximise their payload gains. Krivtsov says that public roads can limit road transport possibilities due to regulations however, on private roads, operators generally have more freedom, and a good engineer can see them rise above their competitors. “We can see that more and more mining companies in the world need long distance road transport,” he says. “Tonar recently completed a project in Siberia where a road train is used to transport 130 tonnes of diamond ore along a 178-kilometre route one way. There are many long uphills with a maximum gradient of 14 per cent, and there are steep declines where the proper use of a retarder is required. Ambient temperatures in this zone can reach -60°C.” This Tonar road train combination, specifically developed for the mine project, comprises a 6x6 prime mover with Cummins QSK19 engine, Allison 6000 series transmission, B-double trailers with 130-tonne payload on Tonar 25-tonne axles and IPH hydraulics. Tonar manufactures in-house under a 50,000-square-metre roof and does everything from cutting steel to trailer assembly and painting. Krivtsov says the OEM even produces its own axles. “We have a strong and dedicated engineering group of 50 people, which enables us to bring new products to market with relatively short lead times. “Tonar has invested considerably in robotic and automatic production. Generally, robots that operate in a serial production line are configured to produce the same trailer model over and over. Tonar has so many different models in its range that we often see completely different trailers on the same production line. All suppliers of robot equipment were quite sceptical about our chances to automate at the production level with so many models, but we surprised them all. I’m really proud of our production flexibility.” In addition to bringing innovative trailers to market, Tonar is equally committed to ensuring its customers receive the best value when it comes to the Total Cost of Ownership (TCO). “TCO is more than just mathematics,” Krivtsov says. “It encompasses the customer experience as a whole. “I started at the company 15 years ago as a purchasing manager. To build a good trailer you need world-class components and at that time you can only import them. Most of the suppliers back then didn’t have any representatives in Russia and we travelled a lot all over the world. It was a good chance to compare different sales approaches and cultures in different countries. www.tonar.info

trailer axles

Challenging themes are our motivation:

WE DEVELOP INNOVATIONS! gigant – Trenkamp & Gehle GmbH | Germany

www.gigant-group.com

T H E N AT I O N A L

DREAM DESPITE DECADES OF POLITICAL AND INVESTMENT VOLATILITY, SOUTH AFRICA HAS THE POTENTIAL TO EMERGE AS A DYNAMIC AND DIVERSE PLAYER IN THE GLOBAL ECONOMY.

T

he Republic of South Africa held a cabinet meeting in August at the Union Buildings in Pretoria. The Government outlined its National Economic Development and Labour Council (NEDLAC) commitments.

24 / G L O B A L TR A I L E R / I SS U E 4 8

As part of the country’s democratic transition 25 years ago, NEDLAC was founded to alleviate social development and economic growth issues. The nation is characterised by severe inequality in incomes, skills, economic power and ownership, which has exacerbated society issues over time. It is the aim of NEDLAC to improve South Africa’s policies on public finance, labour market, trade and industry and development.

MARKET REPORT

DEVE LOPM E NT Specifically, NEDLAC has identified three defining challenges: sustainable economic growth, to facilitate wealth creation as a means of financing social programs and attracting investment; greater social equity, both at the workplace and in communities, to ensure that large-scale inequalities are adequately addressed and that society provides at least for all the basic needs of its people; and increased participation, by all major stakeholders in economic decision-making at all levels to foster cooperation in the production of wealth and its equitable distribution. Virgil Seafield, Overall Convenor – Government, reported in the NEDLAC annual report 2016-17 that the organisation has been faced with a broader challenge in developing cooperative approaches to addressing socio-economic challenges “in the context of a discourse that is highly polarised and ideological”. He explained even though effective national tripartite engagement has been weakened by an increase in community-based conflict, inter union rivalry and intra union divisions along with challenges within the business constituency, NEDLAC at the time emerged as a champion of social dialogue in the policy formulation arena. “Over the last year the organisation facilitated ground breaking agreements on the labour relations front,” he said. “Central to the agreement on a National Minimum Wage is not the level of the agreed wage but an honest and sincere attempt by all social partners to engage on the issue of growing inequality and

Headquartered in Rosslyn, Pretoria, Afrit manufactures a diverse selection of trailers including its latest product is the T6 Sliding Curtain.

addressing, in a constructive manner, the levels of poverty in our country. The agreements reached on labour stability for government are not only about the detail but how this would contribute towards creating an investor friendly economic environment.” Overall Convenor – Labour, Bheki Ntshalintshali, however, was more critical of South Africa’s economic status in 2017 calling it a “junk state” as a result of slow post–Global Financial Crisis recovery and falling into a recession that year. Despite the unemployment crisis, reaching 37 per cent, equating to 9.3 million unemployed people, Ntshalintshali was adamant that NEDLAC stood up again under the leadership of then Deputy President Ramaphosa to tackle wage inequality and that positive indicators boosted confidence for NEDLAC’s cause. Currently, high levels of unemployment and low economic growth is a concern for the Cabinet. Quarterly Labour Force Survey results for Q2 2019 released by Statistics South Africa show that the official unemployment rate increased 1.4 percentage points to 29 per cent compared with Q1 2019. The Cabinet also remains committed to addressing structural challenges that continue to affect the performance of South Africa’s economy and its ability to respond to developmental challenges. A rapid response agreement signed by all NEDLAC parties commits to meet the stakeholders on a monthly basis to track the 77 Job Summit commitments to be chaired by President, Cyril Ramaphosa, as of September 2019. The Government said in a statement that the commitments by all stakeholders – which include government, labour, business, civilsociety organisations – target programs to create jobs, mechanisms to unblock barriers to effect implementation, as well as agreements on job retention and ways to prevent job

W W W. G LO B A LT R A I L E R M AG . C O M / G L O B A L T R A I L E R / 2 5

losses. Also included in the commitments are specific sector targeting initiatives to grow the economy. South Africa’s Cabinet also reported its participation in the 18th African Growth and Opportunity Act (AGOA) Forum which was held in Côte d’Ivoire. AGOA is reported to be a unilateral US trade preference program that provides duty-free quota-free treatment for over 6,400 tariff lines from 40 AGOA-eligible sub-Saharan African countries, including South Africa, into the US market. “South Africa’s constructive and positive discussions with the US Trade Representative provides potential access to the US market and American investment in our economy, which are important ways of addressing job creation and the elimination of poverty,” the Cabinet said. Following a visit to South Africa in June, the International Monetary Fund (IMF) was optimistic that South Africa’s subdued economic growth could be reignited if the pace of structural reform implementation is accelerated. It reported that robust actions are needed to reduce fiscal deficit and reverse the increase in public debt. The IMF claim that the South African Government also has a renewed opportunity to press ahead with policies to further strengthen governance, encourage competition, increase labour market flexibility and reduce the cost of doing business. “A focus on policy actions to remove long-standing structural constraints to growth and accelerate job creation is a must,” the IMF said in a statement. “Acting decisively on tackling structural impediments to growth would help complement the authorities’ efforts to conduct sound macroeconomic policies, thus restoring policy certainty and boosting investor confidence. An improved business environment resulting from reform implementation would attract much-needed private investment, and, in turn, lead to a virtuous cycle of growth, job creation, and social inclusion.” Minerals Council South Africa confirms that the country’s Bushveld Complex, found in the northern provinces, hosts approximately 80 per cent of platinum group metals– bearing ore – more than half of the world’s platinum, chromium, vanadium and refractory minerals. The mining industry directly contributes more than 300 billion ZAR (€17.5 billion) to South Africa’s Gross Domestic Product (GDP), and is said to be the economic anchor of many communities around the country, employing more than 450,000 people, according to a report published by management consulting company, McKinsey & Company. Putting the shine back into South African mining: A path to competitiveness and growth, released February 2019, highlights that global trends, including the transition to clean energy and a shift to China’s economic focus away from infrastructure developments to new technologies, could dampen demand for South African commodities in the years ahead. In the medium and long term,

26 / G L O B A L TR A I L E R / I SS U E 4 8

however, opportunities to rekindle growth and job-creation including localising the value chain from mining operations, expanding downstream processing for key commodities and unlocking the potential of the country’s rich ore bodies could accelerate growth in South Africa’s broader economy. To restore competitiveness and growth in South African mining, McKinsey & Company recommend: unleashing a productivity revolution through the smart use of new technology and improving employee motivation, the work environment and other organisational health elements; redefine the socioeconomic role of mines as catalysts of broader development in the communities in which they operate; embrace disruption in global energy markets to realise new sources of potential mining growth; and GRW, based in Worcester, develops and produces state-of-the-art road transport equipment including this tipping silo tanker.

ensure conditions are in place to unlock South Africa’s high-potential mining assets, including its rich, untapped reserves of iron ore and manganese, and niche opportunities in other minerals such as vanadium and industrial metals. Key to driving positive change in the country, especially for mining operators, is quality road transport investment. Equipment specialist, SAF-Holland, has a relatively small footprint in the South African market with a distribution facility and sales office based in Johannesburg and

MARKET REPORT

an additional sales office based in Durban according to Business Development Manager South Africa, Russell Vandrau. “We have long-term goals to assemble original equipment in the next five-to-ten years in South Africa,” he said. “At present, SAF-Holland only distributes products, currently without any production capability or production facilities in South Africa.” On trailer trends, Vandrau explained that Performance-Based Standards (PBS) or an equivalent high productivity scheme is still a new concept in the country. “PBS trailers are proving effective in reducing the number of vehicles on the road while increasing overall payload; we expect to see a positive trend in new PBS trailers over the next few years,” he said – adding that South Africa is rich in minerals and therefore the most popular freight tasks are that of transporting ore from the mines to processing facilities or to harbours for export. “The most popular trailer builds are that of tandem / tandem interlink tippers. The tandem / tandem interlink is a vehicle configuration that is native to South Africa.” Generally, the South African trailer market has been quite volatile over the last few years, according to Vandrau, with the 2017 growth of 21 per cent levelling out to a slight negative growth in 2018. “This is mainly due to abrupt change in political leadership and investor uncertainty,” he said. “This year looks far more positive at this stage with an 11.8 per cent increase in new trailer registrations compared to the same period in 2018. SAF-Holland South Africa is a fairly new player in the trailer market in South Africa. We are however extremely positive about our future and our market share growth in the South and Southern African regions.” Despite SAF-Holland’s decade-long active presence in the South African market, Vandrau is seeing growth in business due to the innovative solutions that the equipment specialist is able to offer. With a market share of more than 50 per cent, GRW is the leading trailer tank manufacturer in South Africa according to Sales Executive, Günther Heyman.