The recent 53 rd Institute of Quarrying Southern Africa (IQSA) conference and exhibition marked my 10 th attendance at this annual industry event which has become a staple on my calendar every year.

Judging from some of the presentations and discussions with exhibitors at this year’s event, it was apparent that the quarrying industry is at an inflection point, where environmental, social and governance (ESG), as well as digital technologies, are starting to take preference.

Amid growing pressure on mining companies to improve their ESG performance, it is encouraging to see a pipeline of new ESG policies among some construction material suppliers. A case in point is Raumix Aggregates, which used IQSA 2024 to outline its ESG initiatives and reinforce its unwavering commitment to improving its ESG performance.

There was a time when the industry’s stance on ESG issues was a public relations tactic. However, in today’s rapidly changing business climate, attention to ESG issues is becoming critical to long-term competitive success.

new concept, initially there was a degree of resistance. However, we are starting to see some senior and experienced engineers getting to understand that technology can deliver what they could previously only dream about.

The industry is increasingly making use of innovative and cutting-edge technologies to run more efficient operations, to manage risk, to improve health and safety, reduce the cost of maintenance and extraction, as well as bringing about a skills uplift.

With several other industries already embracing the digital revolution, the quarrying sector has recognised the potential of digital and technological innovations that could transform and invigorate the industry and is starting to move quickly to catch up. The economic environment presently forces businesses to ‘adapt or die’. The rate at which changes need to happen in a business is faster than it has ever been. Thankfully, technology is not only available but also affordable for enabling digital transformation.

MUNESU SHOKO

Publishing Editor Email: munesu@quarryingafrica.com

LinkedIn:

Munesu Shoko

Quarrying Africa

There is a common understanding that ESG represents one of the mining industry’s most significant opportunities for long-term value creation, building trust and sustainable growth. Miners are making significant strides to engage with their stakeholders and start to ‘bake’ ESG into the core of their strategies. To meet their ESG commitments, mining companies are getting serious about decarbonisation, while they are also working hard to overcome the trust deficit.

Another key talking point from this year’s event was the growing appetite for new technologies, particularly the digitalisation of work processes in quarrying. As with any

As the industry adapts to the changing operational environment, quarry owners are increasingly looking to digital technologies not only to enhance productivity and efficiency, but also to take people out of harm’s way. The importance of good health and safety management at operations cannot be restated enough as the industry presses ahead with its goal for zero harm.

IQSA 2024 once again demonstrated how companies are strongly showing their commitment to continually evaluating their operating practices in order to work towards a workplace with no illnesses, injuries or deaths. Like most industrial work, mining involves a degree of risk – and getting as close as possible to eliminating that risk and protecting workers always has to be a key initiative.

TIPPING BEYOND BORDERS

SENSORS

MEETING EVOLVING DRILLING NEEDS ‘LEAVING MONEY ON THE TABLE’

Publishing Editor: Munesu Shoko

Sub Editor: Glynnis Koch

Business Development Manager: Elmarie Stonell

Admin: Linda T. Chisi

Design: Kudzo Mzire Maputire

Web Manager: Thina Bhebhe

Quarrying Africa is the information hub for the sub-Saharan African quarrying sector. It is a valued reference tool positioned as a must-read for the broader spectrum of the aggregates value chain, from quarry operators and aggregate retailers, to concrete and cement producers, mining contractors, aggregate haulage companies and the supply chain at large.

Quarrying Africa, published by DueNorth Media Africa, makes constant effort to ensure that content is accurate before publication. The views expressed in the articles reflect the source(s) opinions and are not necessarily the views of the publisher and editor.

The opinions, beliefs and viewpoints expressed by the various thought leaders and contributors do not necessarily reflect the opinions, beliefs and viewpoints of the Quarrying Africa team.

Quarrying Africa prides itself on the educational content published via www.quarryingafrica.com and in Quarrying Africa magazine in print. We believe knowledge is power, which is why we strive to cover topics that affect the quarrying value chain at large.

Printed by:

Email: munesu@quarryingafrica.com

Cell: +27 (0)73 052 4335

Having made its local debut some two years ago, the Liebherr TA 230 has proven itself in some of the toughest operating environments in southern Africa.

Following the official local launch of the Liebherr TA 230 Litronic articulated dump truck (ADT) in June 2022, which marked Liebherr-Africa’s debut in the highly contested ADT market in southern Africa, several units are now hard at work in South Africa and Zimbabwe, where the ADT has proven its mettle in some of the toughest mining applications. By Munesu Shoko.

Having made its local debut some two years ago, the Liebherr TA 230 has proven itself in some of the toughest operating environments in southern Africa. With several units already operating in the field, clocking about 35 000 – 45 000 market hours in the process, Tendayi Kudumba, GM: Earthmoving Technology at Liebherr-Africa, expects the sales of the Liebherr TA 230 to pick up steam on the back of increased enquiries in the region.

“The ADT market in southern Africa is very competitive, but we are very happy with the sales performance and enquiries of the TA 230 to date. Several customers have shown immense interest in the machine, and we expect to put more units into the market soon,” says Kudumba.

With five units in its fleet, Orca Group, a prominent mining contractor operating in Zimbabwe, runs the biggest fleet of Liebherr TA 230 machines in southern Africa to date. In fact, the company was the recipient of the first ever TA 230 in the region, which was handed over during the official launch at the Liebherr-Africa headquarters in Springs, Gauteng, South Africa, in June 2022. The company initially took delivery of three units, before expanding the fleet with two more machines. The five machines have been deployed in a taxing application at Bindura-based Freda Rebecca Gold Mine, hauling ore from the underground tunnels to the overland crushers. Lavell Ruthman, head of sales, Earthmoving Technology at Liebherr-Africa, tells Quarrying Africa that the machines have

45 000

The several units already operating in the field have already clocked about 35 000 – 45 000 market hours

5

With five units, Orca Group runs the biggest fleet of Liebherr TA 230 machines in southern Africa to date

Having made its local debut some two years ago, the Liebherr TA 230 has proven itself in some of the toughest operating environments in southern Africa

With five units in its fleet, a prominent mining contractor operating in Zimbabwe, Orca Group, runs the biggest fleet of Liebherr TA 230 machines in southern Africa to date

Two of the first batch of five units to be delivered in southern Africa are hard at work in the Palaborwa area in South Africa

Another TA 230 operating in South Africa has been deployed in a chrome application in Limpopo

already clocked between 6 000 and 7 000 hours in this challenging application, travelling 15 km out of the pit fully loaded in extremely hot conditions.

Two of the first batch of five units to be delivered in southern Africa are hard at work in the Palaborwa area in South Africa. Running at this particular site for over a year now, the two Liebherr TA 230 units have already passed the 6 000-hour mark.

“Despite the heavy and abrasive nature of magnetite, the two machines have proven their mettle in this tough

Several customers have shown immense interest in the machine, and Liebherr-Africa expects to put more units into the market soon.

application, meeting the requirements of the customer in terms of uptime, efficiency and productivity,” says Ruthman. “The machine’s 28 000 kg payload with a dump body capacity of 18,1 m³ also fits the bill for the customer’s production requirements. The 6-cylinder Liebherr engine with a 12-litre displacement, producing 265 kW of power, has been praised on site for delivering enough power when needed.”

Another TA 230 operating in South Africa has been deployed in a chrome application in Limpopo. Delivered in late 2023, the machine has so far performed beyond expectations in what is known to be an abrasive application. The feedback from the customer, confirms Ruthman, has been very positive, with prospects of delivering more units in the near future.

Several customers who have purchased the TA 230 to date have expressed satisfaction with Liebherr’s new machine concept, which has been developed especially for challenging off-road applications. Modern designs in the front-end area create maximum ground clearance for greater off-road performance.

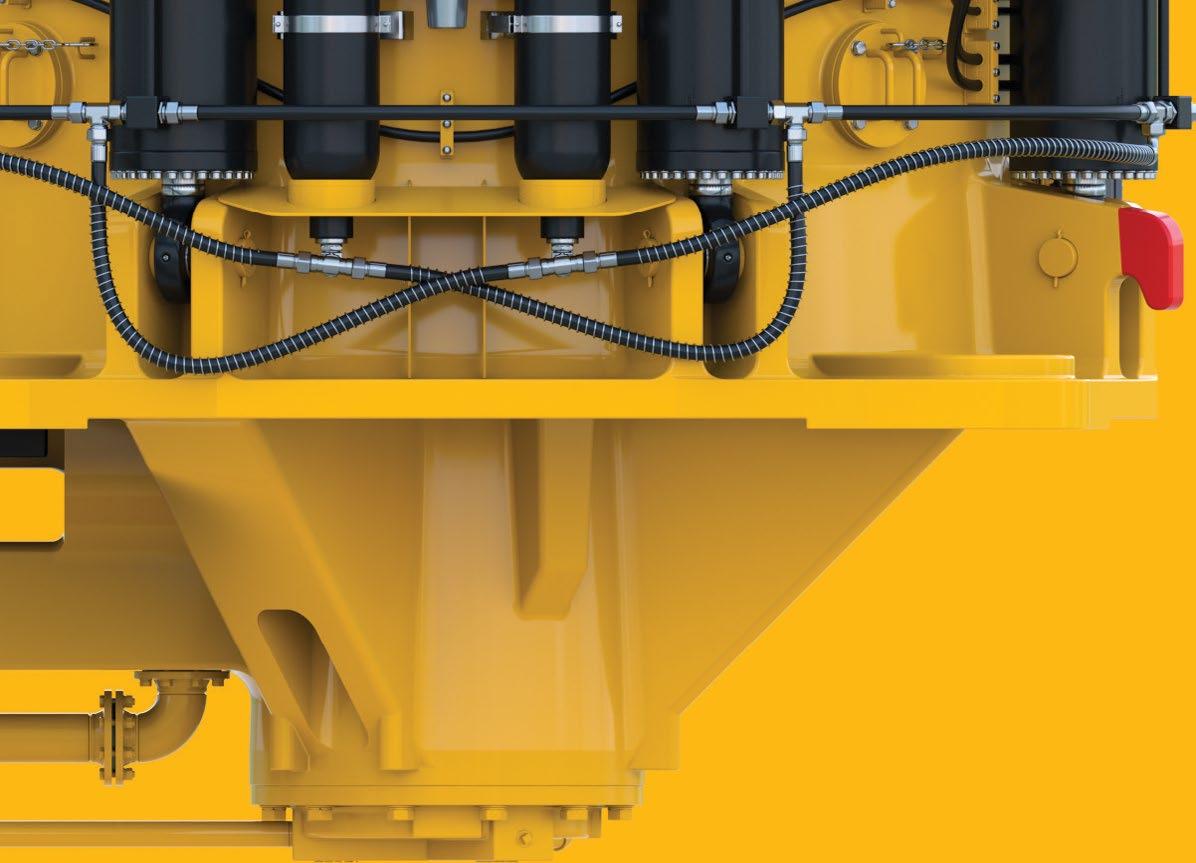

The newly designed articulated swivel joint creates sound off-road capability; it allows independent movement of the front and rear ends, thus ensuring maximum manoeuvrability. The positive-locking swivel joint with tapered roller bearing is perfect for the shear stresses associated with tough underfoot conditions, while it also withstands maximum loads and provides optimal force distribution.

The front and rear axles of the machine are secured using sturdy A-rods at the articulated swivel joint and at the rear end. On front, the truck uses hydro-pneumatic suspension for maximum comfort, which is key to the smooth driving. The shock absorbers at the articulated swivel joint and the position of the separate and oscillating A-rods of the rear axles at the rear end, provide maximum ground clearance.

Powered by a 265-kW 6-cylinder Liebherr engine with a 12-litre displacement, the TA 230 Litronic is driven by an automatic 8-speed powershift transmission which ensures optimal force distribution. The machine impresses with great driving performance and massive pulling force, even in the most difficult ground conditions and on challenging gradients.

“A combination of balanced weight distribution, permanent 6 x 6 all-wheel drive, solid, flexible mounting and large bank angle as well as the machine’s high ground clearance, enable the TA 230 Litronic to deliver unparalleled performance on uneven terrain,” says Kudumba.

The actively controlled inter-axle differential locks mean that the Liebherr TA 230 has automatic traction control. As soon as one axle experiences wheelspin, it is decelerated, and the traction is intelligently redistributed to the other axles. In addition to maximum forward drive, this reduces the power requirement and therefore translates into lower fuel consumption.

Efficiency is further enhanced by the smart gear selection, which enables the machine to adjust

automatically to its current speed and load to ensure optimum torque and fuel consumption at all times. The machine therefore automatically reduces its fuel consumption per tonne of transported material. With productivity in mind, the optimised trough ensures that more material can be moved in a short time. The front of the trough – designed for the effective transport of a 28-t payload – is straight and the sills are low so that loading with a wheel loader, for example, is easily possible across the entire length of the truck.

A standard Liebherr weighing system shows the current payload during loading on the display in the operator’s cab, helping eliminate guesswork in loadout processes. An optional loading light on both sides at the back of the operator’s cab shows the loading level outdoors.

In order to accelerate the release of the material during unloading, the inner edges of the new trough are tapered. The two tipping cylinders at the side give the TA 230 Litronic high tipping pressure. The load can be tipped against the slope easily and quickly.

“During transportation, the long chute at the end of the trough ensures minimal material loss. The trough volume can be increased with the optional tailgate. Thanks to the large opening width, tipping of large and bulky transported material is easily possible. Even with the tailgate the overall width of the TA 230 Litronic is still below three metres, which allows the machine to be easily and quickly transported on a lowbed truck,” concludes Ruthman. a

The appointment of Maretha Gerber as President and CEO marks a new beginning at Daimler Truck Southern Africa (DTSA). In a one-on-one with Quarrying Africa, Gerber – who makes history by becoming the first female to hold this position at DTSA – says she will build on the strong foundations of the market-leading brand to further drive growth and customer satisfaction. By Munesu Shoko

At a press conference attended by Quarrying Africa recently, DTSA announced that Gerber, who has been with the company for over 20 years, will take the reins as President and CEO, effective April 01, 2024. She takes over from Michael Dietz, who is up for a new challenge as President and CEO of Regional Centre Middle East and Africa at Daimler Truck.

Gerber brings a wealth of experience, which puts her in good stead to drive the marketleading brand to even greater heights. Equipped with a degree in marketing, she has held several positions within the Daimler organisation, including previously Daimler Chrysler and Mercedes-Benz South Africa.

She has fulfilled various functions across sales,

marketing and the dealer network before taking up a dealer principal role in the Mercedes-Benz Own Retail dealer network. In 2018, she moved back to the DTSA headquarters as head of Mercedes-Benz Trucks and subsequently Vice President Sales and Marketing for MercedesBenz and FUSO Trucks, a position she held before taking up the new role in April.

“We are delighted to welcome Maretha Gerber as the new President and Group CEO for DTSA and the second female on the Daimler Truck Overseas ExCom team. With her vast experience and excellent client rapport, we cannot think of anyone better for this position,” says Andreas von Wallfeld, head of Daimler Truck Overseas. “Likewise, with his extensive knowledge and broad experience, we are pleased to have won Michael for the Regional

Maretha Gerber makes history by becoming the first female to be appointed President & CEO at DTSA 20

Maretha Gerber has been with the company for over 20 years, which puts her in good stead to drive the marketleading brand to even greater heights

She takes over from Michael Dietz, who is up for a new challenge as President and CEO of Regional Centre Middle East and Africa at Daimler Truck

Gerber brings a wealth of experience, which puts her in good stead to drive the market-leading brand to even greater heights

She seeks to build on the strong foundations of the market-leading brand to further drive growth and customer satisfaction

Centre Middle East and Africa. We wish both Maretha and Michael all the best in their new roles.”

Following a record-breaking year in 2023, DTSA maintained its market-leading position in the extra heavy commercial vehicle market. Gerber says she will build on the strong foundations laid by her predecessor and the DTSA team at large. Her leadership will seek to create a “strong force” amongst DTSA employees, building on the strengths of the team. She also aims to build additional strong collaboration between DTSA, its dealers and, more importantly, its customers.

“I am truly honoured to be afforded the opportunity to lead DTSA. I am excited to work with the experienced leadership team and talented employees at DTSA and to lead the group of companies to new heights,” she says. “Together with our dealers and general distributors, we look forward to contributing to further growth and success and to build a brighter future for all stakeholders.”

Commenting on the record-breaking year in 2023, Gerber tells Quarrying Africa that several drivers were key to the growth of the commercial vehicle market. Firstly, the rail infrastructure challenges had a major impact on the growth of the trucking market, with the majority of South Africa’s freight now moved by road.

“Another major driver behind last year’s growth was the fact that most of our loyal customers had delayed their replacement cycles and it was time for them to replace as they could not ‘sweat their assets’ any longer. About 70% of our sales last year were from loyal customers who were either replacing or expanding their fleets to meet their business requirements,” says Gerber.

In recent years, the neighbouring African markets – including Zimbabwe, Zambia, Mozambique and Malawi – have seen steady growth. As part of her growth plans, Gerber wants to further grow DTSA’s sales volumes into these markets and higher up into Africa.

“Our focus this year is to increase our volumes into Africa. These markets have in recent years seen yearon-year growth. We believe there is opportunity for sustainable growth in Africa in years to come,” she says.

While the growth in construction activity is not at the levels experienced during the so-called ‘boom days’ in the run up to the 2010 Soccer World Cup, Gerber says the industry has definitely come out of a prolonged downturn.

“We see a lot more enquiries for our Arocs vehicles in particular,” she says. “We are not at the levels experienced during the boom days, but the sentiment in the market is much more positive, particularly in some of our export markets. That said, we need more investment in construction in South Africa.”

Apart from the Mercedes-Benz Arocs range, Gerber says the FUSO FJ range is doing phenomenally well in the construction market. The truck, she adds, has built a strong reputation for reliability and fuel-efficiency, and has taken the company to the next level within the construction market.

Commenting on the outlook of the market in 2024, Gerber says she believes that truck sales will normalise this year following the record growth last year. “I am of the view that the market will come to its normal levels this year, especially given that most of the big replacement cycles happened last year. However, I believe it will still stay strong, given the continued rail infrastructure challenges in the country,” concludes Gerber. a

BELL 4X4 ADTS ARE THE IDEAL HAUL TRUCK, OFFERING THE TIGHTEST TURNING CIRCLE AND LONGEST TYRE LIFE.

FINLAY MOBILE CRUSHERS, SCREENERS AND CONVEYORS ARE DESIGNED TO PRODUCE THE BEST SIZE AND SHAPE OF PRODUCT REQUIRED.

KOBELCO EXCAVATORS PROVIDE THE BENCHMARK IN HYDRAULIC AND FUEL EFFICIENCY WITH PROVEN DURABILITY AND RESALE VALUE.

JCB WHEEL LOADERS ARE GAINING TRACTION INTHE QUARRY INDUSTRY WITH THEIR SIMPLE YET EFFICIENT DESIGN AND PERFORMANCE.

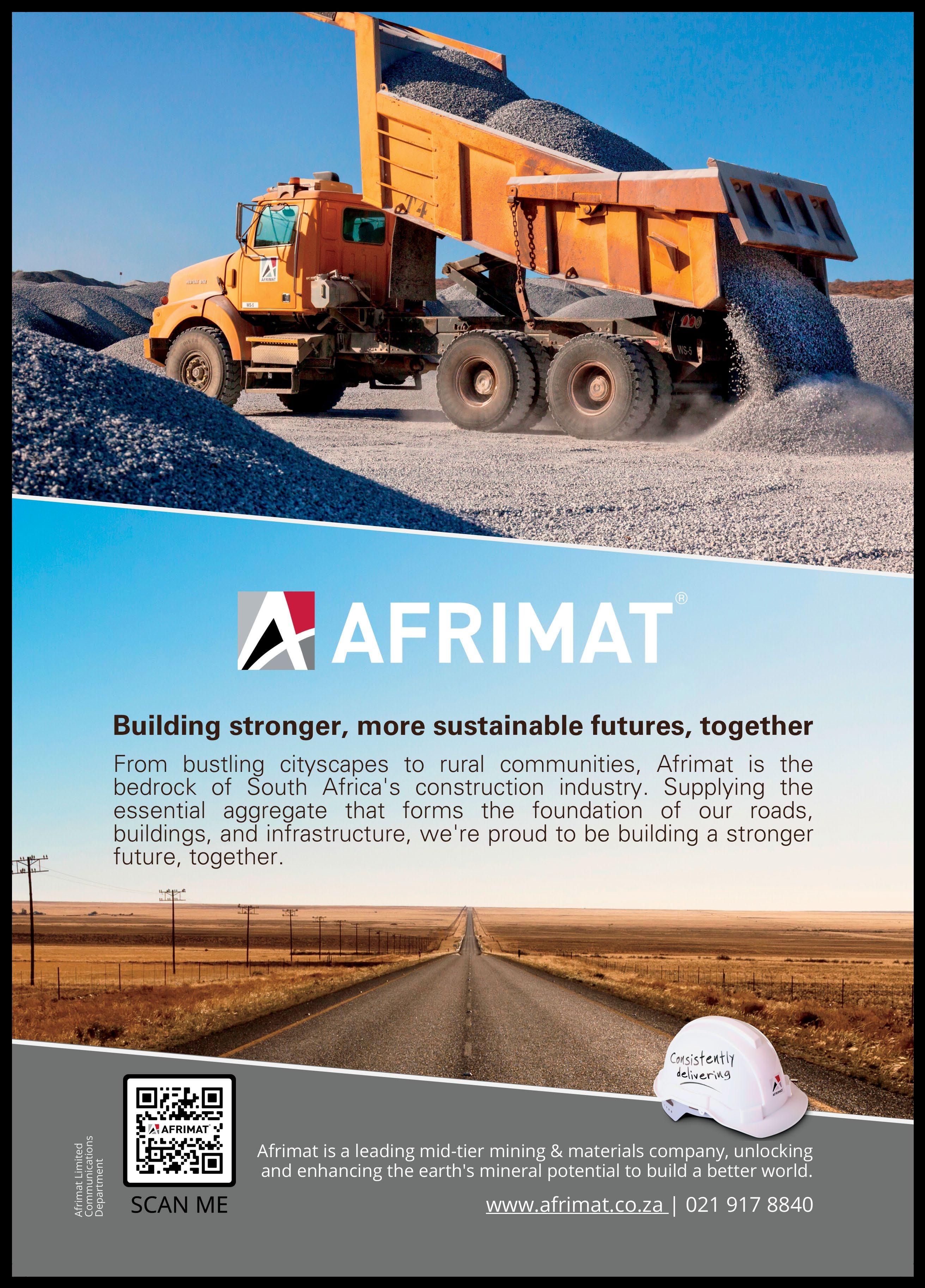

With the existing old primary plant at its Cape Lime Langvlei operation proving uneconomical to run, Afrimat invested in a two-phased plant upgrade entailing the installation of a completely new primary plant. The project has contributed greatly to the sustainability of Langvlei through the addition of scale and reduction of operational costs as a result of better efficiencies and higher output.

By Munesu ShokoThe history of Cape Lime, now a subsidiary of Afrimat since the 2016 acquisition, dates back as far as 1943 when the first vertical shaft kiln was commissioned by Cape Lime Company Ltd on the farm Langvlei near Robertson in Cape Town.

The operation’s main business is producing bagged hydrated lime through a calcining, hydrating and milling process. Aggregates

and agricultural lime add further value to the business as the run-of-mine fragmentation results in a finer yield of product, enabling the Afrimat commercial team to have a diversified product split and customer base.

To provide context, lime is used across industries for various purposes such as to neutralise and cleanse drinking water and in sugar production. It also serves as a calcium supplement in vitamins and some foods. In road

When Afrimat took over in 2016, the management team realised that the structural integrity of the primary processing plant was problematic, and an audit by external engineers highlighted and confirmed these concerns

The old AgLime plant produced at approximately 10 tph, while the upgraded Phase 1 AgLime plant can now produce at approximately 30 tph, representing a 200% increase in production capacity

Phase 2 of the project entailed the construction of an entirely new primary plant which feeds both the kilns on site with run-of-kiln feed, and the aglime plant with feedstock.

Afrimat has invested in a two-phased plant upgrade entailing the installation of a completely new primary plant at its Cape Lime Langvlei operation

Phase 1 entailed the installation of four conveyors of different sizes (designed by Afrimat engineering), a Techroq VSI crusher and a Union High Frequency screen with Afrimat-engineered bins and transfer points

Phase 2 scope comprised newly built conveyors, bins, screen structures, transfer points, as well as refurbishing a 6 x 16 double-deck screen for primary screening and refurbishing a 5 x 12 triple-deck screen for secondary screening

Following the two-phase plant upgrade, kiln feed availability has increased, and the operation does not need to run a double shift anymore to ensure stock availability for the kilns

construction, lime is used in asphalt, below the asphalt and during construction. Buildings are also constructed using at least one type of lime product, while it is also deployed to produce paper. In addition, it is used for food security (agricultural lime).

The operation also supplies crusher run to civil contracts within its vicinity, which are few and far between. The last project the Langvlei team supplied was in 2021 when a contractor built the Ashton bridge and rehabilitated the R60 between Ashton and Montagu. The operation also supplies local readymix companies, brick and block manufacturers, as well as local hardware stores with aggregates.

The Langvlei operation has produced high-quality pressure-hydrated dolomitic lime since 1943, and much of the original infrastructure has remained intact. A few upgrades took place in the early days when Cape Lime managed the business (after a management buyout

Following the two-phase plant upgrade, kiln feed availability has increased, and the operation does not need to run a double shift anymore to ensure stock availability for the kilns.

from Trans Hex), including improvements to the hydrator and the milling section.

When Afrimat took over in 2016, the management team realised that the structural integrity of the primary processing plant was problematic, and an audit by external engineers highlighted and confirmed these concerns. The first round of safety improvements was rolled out, including upgrades and improvements to catwalks, walkways, platforms and some structures and chutes. This was always going to be an interim solution that would require the team to still investigate a long-term, sustainable solution.

Due to its old age, the primary plant could not be economically upgraded to meet the growing demand and the broadening range of materials. The management team at Afrimat therefore decided that the best remedy to the situation was to build an entirely new primary plant. Stephan Becker, Manager at Cape Lime Langvlei, championed the project, with support from Afrimat’s Engineering Department and project lead, Robert Hurn.

“There were effectively two phases to the primary plant upgrade at Langvlei,” explains Andrew Wray, MD Afrimat Industrial Minerals. “Phase 1 entailed the construction of a dedicated Aglime plant to meet the growing need for agricultural lime in the Western Cape; and Phase 2 was for the construction of an entirely new primary plant which feeds both the kilns on site with run-of-kiln feed, and the aglime plant with feedstock. We also geared the primary plant to produce a range of aggregate sizes, including G-materials.”

Phase 1 of the project, explains Becker, was planned, designed, manufactured and erected in two months and commissioned for production by the end of April 2022, just in time for the AgLime season. This phase comprised the installation of four conveyors of different sizes (designed by Afrimat engineering), a Techroq vertical shaft impact (VSI) crusher and a Union High Frequency screen with Afrimat-engineered bins and transfer points. The old AgLime plant produced at approximately 10 tonnes per hour (tph), while the upgraded Phase 1 AgLime plant can now produce at approximately 30 tph, representing a 200% increase in production capacity, confirms Becker.

“We took a different approach on the building process and actually built the plant from the backend to the front. This allowed us to still produce with the old plant to ensure that we met aggregate demand,” says Becker.

Upon completion of Phase 1, the engineering team began the construction of Phase 2, the primary crushing and screening plant. This part of the plant was designed to tie into the old layout that made use of the existing jaw crusher (Osborn 25x36), a cone crusher (Osborn 36-7s) and the original T7 Oremaster VSI.

The scope also entailed newly built conveyors, bins, screen structures, transfer points, as well as refurbishing a 6 x 16 double-deck screen for primary screening and refurbishing a 5 x 12 triple-deck screen for secondary

screening. The team also built a new motor control centre (MCC) substation and central control room (CCR) and located them approximately in the centre of the layout so that the operator has prereferral views of the process.

All in all, the plant consists of 10 newly built conveyors of various sizes (Afrimat engineering design), a 6 x 16 double-deck primary screen and a 5 x 12 triple-deck secondary screen. The screens were salvaged from two different Afrimat yards. The double-deck screen came from the Langvlei operation’s salvage yard, while the triple-deck screen was salvaged from the Glen Douglas yard in Gauteng. Both the screens were refurbished by a service provider in Blackheath, Cape Town. “Part of the project’s cost-saving initiatives was to repurpose available machines within Afrimat,” explains Becker.

All chutes, transfer points, screen structures and product bins were also designed by Afrimat engineering. One of the major talking points is the innovative chute designs that enable the production team to manually dictate what products can be produced, how much gets produced, and how much of the product stream can be sent to the agricultural lime plant for further processing to achieve the stringent specification: 100% passing 1,7 mm and 50% passing 250 microns.

“We can say, with confidence, that we achieved 90% of what we set out to achieve and it was done within 125 days from start to completion,” says Becker.

Following the two-phase plant upgrade, kiln feed availability has increased, and the operation does not need to run a double shift anymore to ensure stock availability for the kilns. Kiln feed sizing has also been improved significantly, ensuring an optimised calcining

process, thus improving oxide quality and ensuring less wear and tear on refractory linings, as well as reducing consumption of burning fuel.

“Some of the key benefits of the upgrade include improved aggregate product quality (shape and size); production flexibility (which improves production to sales yields); improved production capacity of agricultural lime; enhanced safety; as well as improved key performance indicators such as overall plant performance, plant availability, plant utilisation and planned maintenance percentages,” explains Becker. In addition, the upgrades have ensured better employee morale and reduced production costs.

Executing both phases was not without challenges. Time constraints and the Western Cape winter weather presented a fair share of contests. This was exacerbated by logistical challenges to transport the components. To provide context, all structures, bins, transfer chutes were manufactured in Gauteng, and had to be transported to Robertson, Western Cape.

The project team also encountered some challenges with regards to electrical reticulation as they did not know where old cables were running underground. As a result, there were some damages incurred during the trenching stage to fit new plant cables.

“The Afrimat project team and project manager are very competent, making a project like this, where second hand equipment is repurposed and erected with new structures, a pleasure to be part of. Proper planning, project scope drafting, communications between the project team, client and suppliers were well managed, ensuring a successful result,” concludes Becker. a

Loutjie

Loadtech has appointed Loutjie Van der Merwe as Loadrite divisional manager. In a oneon-one with Quarrying Africa, he discusses his blueprint to further position Loadrite as a top choice in the market, some emerging trends in load weighing and how the new L5000 SmartWeigh system changes the game in weighing operations. By Munesu Shoko.

To entrench the Loadrite offering as a market leader in the payload management systems market, Loadtech, the authorised Loadrite distributor in sub-Saharan Africa, has assigned Loutjie van der Merwe to lead the brand, effective March 1, 2024.

His role entails overseeing and managing all aspects of the Loadrite brand, including developing and implementing branding strategies, managing brand messaging and positioning, ensuring brand

consistency across all marketing channels, as well as monitoring and analysing brand performance.

“I will work closely with other departments such as marketing, sales and product development to ensure that the brand accurately reflects the company’s values, goals and target audience,” says Van der Merwe. “Additionally, I will be responsible for monitoring market trends, competitor activities, and consumer feedback, to continuously refine and improve the brand’s image and reputation.”

Ultimately, his goal as a divisional manager is to

With its WiFi readiness and touchscreen interface, the new L5000 SmartWeigh system from Loadrite will revolutionise the industry by providing more convenience, accuracy and efficiency in weighing operations

With its WiFi readiness and touchscreen interface, the new L5000 SmartWeigh system from Loadrite revolutionises provides more convenience, accuracy and efficiency in weighing operations.

Loutjie van der Merwe has been appointed the Loadrite divisional manager at Loadtech, effective March 1, 2024

Van der Merwe notes increasing demand for advanced technology integration such as cloud connectivity to enable real-time data monitoring and analysis

In addition, there is a growing emphasis on accuracy and precision in load weighing systems to ensure compliance with industry standards and regulations

Additionally, there is a trend towards the development of more user-friendly interfaces and mobile applications for easier operation and data management

build a strong and recognisable brand that resonates with consumers and drives business growth.

Van der Merwe brings a wealth of experience. As a student at the University of Pretoria, he joined the campus radio station, Tuks FM 107.2, as marketing executive in 2003. He went on to fulfil various functions, including marketing manager, sales executive, business manager and eventually station manager from 20062013.

3, 2024

Loutjie van der Merwe’s appointment as Loadrite divisional manager at Loadtech is effective March 1, 2024

The L5000 SmartWeigh system is poised to streamline weighing processes, improve productivity and provide valuable insights for better decisionmaking in various industries.

At the end of 2013, he was appointed general manager for the online division of IT giant, Pinnacle Africa, before joining South Africa’s leading commercial trailer manufacturer, AFRIT, as head of marketing, a year later. After eight fruitful years at AFRIT, he had the urge to learn and experience something new, so in 2023 he joined Trail-Link, a South African manufacturer of electrical coils and suzis, as brand and sales representative.

“I feel that all the contacts and relationships I have built over the past 20 years will certainly stand me in good stead to take the Loadrite brand and its exposure to the next level, and I look forward to being the brand custodian connected to this journey,” he says.

Commenting on some of his immediate objectives in the new role, Van der Merwe tells Quarrying Africa that

Commenting on some of the trends observed in the market, Van der Merwe notes increasing demand for advanced technology integration such as cloud connectivity to enable real-time data monitoring and analysis. In addition, there is also a growing emphasis on accuracy and precision in load weighing systems to ensure compliance with industry standards and regulations.

“Additionally, there is a trend towards the development of more user-friendly interfaces and mobile applications for easier operation and data management. Overall, the market is moving towards more efficient, reliable and technologically advanced load weighing systems to meet the changing needs of industries,” he says.

crafting a clear and compelling brand positioning and messaging strategy that differentiates Loadrite from competitors and resonates with the target audience is principal.

In addition, he aims to develop a multi-channel marketing plan to effectively communicate the brand messaging and reach the target audience through various touchpoints. He will also monitor the key performance indicators (KPIs) to track the impact and success of branding initiatives and make data-driven decisions to optimise future strategies.

“I also aim to build strong relationships with internal stakeholders, such as marketing, sales and product development teams, to align brand objectives and collaborate effectively,” he says. “In addition, it will be important to stay up-to-date with industry trends, consumer insights and competitor activities to identify opportunities for brand growth and innovation.”

Another key objective for Van der Merwe is to implement feedback mechanisms to gather insights from customers and stakeholders in order to continuously refine and improve the brand experience. These objectives, he says, will help him establish a solid foundation for the brand and set a clear direction for future growth and success.

To further entrench the Loadrite offering as a market leader in the industry, Loadtech, in partnership with its principal, Loadrite, will ideally focus on enhancing product features and capabilities to meet evolving customer needs.

“Additionally, we will invest in marketing strategies to increase brand visibility and awareness to help position Loadrite as a top choice in the market. It is also important to build strong relationships with customers and provide excellent customer service to solidify Loadrite’s reputation as a leader in the industry,” he says.

In line with these trends, Van der Merwe believes that the new L5000 SmartWeigh system from Loadrite, with its WiFi readiness and touchscreen interface, will revolutionise the industry by providing more convenience, accuracy and efficiency in weighing operations.

The system’s wireless connectivity enables seamless data transfer and real-time monitoring. The touchscreen interface offers intuitive and userfriendly navigation, enhancing ease of use for operators.

Overall, the L5000 SmartWeigh system is poised to streamline weighing processes, improve productivity and provide valuable insights for better decision-making in various industries. Its cutting-edge features, he adds, have the potential to change the way weighing systems are used and perceived, making Loadrite a frontrunner in the market.

“This year, our goals for the L5000 SmartWeigh system launch include increasing market adoption, establishing the product as a leading solution in the industry and showcasing its value through customers’ successes and testimonials. We aim to drive revenue growth, expand our customer base and solidify our position as a trusted provider of innovative weighing technology. Additionally, we hope to receive positive feedback, gather insights for future product enhancements and continue to innovate and improve our offerings based on customer needs and market trends,” concludes Van der Merwe. a

In July this year, AfriSam turns 90, a remarkable milestone in business longevity. Over the nine decades, the leading construction materials supplier has seen good times and has also survived extremely turbulent periods. For a business that operates in such a cyclical environment, organisational resilience, innovation and adaptability have been key to its longevity. By

Munesu ShokoAs an industry leader in building and construction materials, AfriSam’s business model has always been dedicated to customer satisfaction, a philosophy that has been at the core of the company’s success for the past 90 years.

The company’s story began in 1934 with the launch of Anglovaal Portland Cement Company Ltd, a small building materials supplier. After several name changes, mergers, company expansions, technological innovations and the addition of a slagment business to the portfolio, the AfriSam brand was born in 2008.

Over the years, AfriSam has cemented itself as a leading construction materials supplier in southern Africa, with operations in South Africa, Lesotho and Eswatini. With a workforce of about 1 300

people (including permanent, contract and learner employees), the company operates two fully integrated cement plants in South Africa, a milling plant with blending and packing facilities, five blending plants (three in South Africa, one each in Lesotho and Eswatini), a slag grinding plant, 19 readymix plants and 12 aggregate quarries.

Across these operations, the company has the capacity to produce 4,5-million tonnes (t) of cement, 800 000 t of slagment, over 5-million t of aggregates and 1,5-million m³ of readymix concrete per annum.

Reflecting on the past 90 years, Glenn Johnson, Executive: Construction Materials, Operations, says AfriSam’s journey is a true reflection of the road that South Africa has travelled during the past century. “Our history as a company interrelates

With a workforce of about 1 300 people (including permanent, contract and learner employees), AfriSam operates two fully integrated cement plants in South Africa

The Gautrain was a milestone project for us. To provide context, we supplied 200 000 t of cement to the Gautrain Rapid Rail Link Project South Section and nearly 439 000 t of 73 mm ballast. On average, some 300 t of crushed material was used daily on this project.

with key periods of structural change in the country. Our transition over the years pretty much mirrors what the country has gone through over the past 90 years,” he says.

While AfriSam’s 90-year milestone is a legacy of successful creation of concrete possibilities, the road has not been without speed bumps. Surviving some of the of the worst financial disasters of the 20 th Century – the Great Depression and the Great Recession of 2008 in particular – has provided the blueprint to weather recent economic storms.

Amit Dawneerangen, Executive: Construction Materials, Sales & Product Technical, says the lack of infrastructure spending in the past decade has been one of the key challenges of recent times. In fact, adds Johnson, the construction sector in South Africa has contracted approximately 40% since 2010, yet the construction industry has the ability to be the single

4,5-million tpa

Across its operations, AfriSam has the capacity to produce 4,5-million tonnes of cement per annum

“Our history as a company interrelates with key periods of structural change in the country. Our transition over the years pretty much mirrors what the country has gone through over the past 90 years.

AfriSam’s story began in 1934 with the launch of Anglovaal Portland Cement Company Ltd, a small building materials supplier

Over the years, AfriSam has cemented itself as a leading construction materials supplier in southern Africa, with operations in South Africa, Lesotho and Eswatini

On the project front, the company has supplied its quality construction materials to some of the flagship projects in the country

In the early 2000s, AfriSam was instrumental in the construction of the Nelson Mandela Bridge in Johannesburg, the largest cable-stayed bridge in South Africa

The construction industry has the ability to be the single largest source of employment across all sectors.

largest source of employment across all sectors.

Furthermore, the influx of imported cement in South Africa has been ‘a thorn in the side’ of local cement producers. To provide context, South Africa has an installed capacity of 21-million tonnes per year (tpy). Due to the lack of meaningful infrastructure investment, the industry currently produces in the region of 12-million tpy. Yet, there are about a million tonnes of imports coming into the market annually, mainly in the coastal areas of the country, leaving the industry battling with about 9-million tpy of extra capacity.

In addition, says Dawneerangen, the demise of the socalled “Big Five” construction contractors post the 2010 infrastructure boom was a big shock to the system. This had a significant effect on the order book and the AfriSam business at large. Suddenly, says Dawneerangen, the customer profile shifted from large companies to medium sized and smaller emerging contractors.

“We have had to adjust accordingly to be able to serve this group of customers. For example, we had to create new procedures for credit facilities that speak directly to emerging contractors. In the process, we had to streamline our processes and become more flexible for us to be able to trade with these enterprises,” explains Dawneerangen.

The same view is shared by Johnson, who says the requirements of small companies are different to those of the large contractors, and this has called for a greater degree of adjustment and flexibility on AfriSam’s part.

“We have streamlined the business to be more agile and flexible. In fact, we have eliminated the traditional layers of reporting structures to ensure efficiency and the ability to operate in the new business environment,” explains Johnson.

Skills shortage has been one of the recent key challenges facing AfriSam and the construction fraternity in general. According to Johnson, the brain drain has left a big skills hole that is hard for the industry to fill. As a result, companies such as AfriSam have had to invest significantly in their own skills development programmes.

From around 2017, government’s reduced infrastructure budget contributed to depressed market conditions.

AfriSam, however, managed to tighten its belts and maintained its aggregates and readymix concrete footprint. When it looked like conditions could not get any worse, the Covid-19 pandemic struck, and AfriSam had to go into a rationalisation mode to survive the tough market conditions. Consequently, the company had to reduce its Construction Materials (CM) division’s capacity by almost 50%. Only nine out of the company’s 17 aggregate quarries, and 17 out of the 40 readymix plants were kept operational at the time. Through a Section 189 process, the company had to reduce its CM staff complement by half.

However, a Covid-19 recovery plan demonstrated the company’s adaptability. The experienced management team, with the support of the board, was able to navigate this difficult process independently.

Despite these challenges, AfriSam has recorded some major successes during its 90-year journey. On the project front, the company has supplied its quality construction materials to some of the flagship projects in the country.

In the early 2000s, AfriSam was instrumental in the construction of the Nelson Mandela Bridge in Johannesburg, the largest cable-stayed bridge in South Africa. To fill the deep piles underpinning the bridge, AfriSam designed a special self-compacting concrete with extended workability. The concrete was then pumped into the 47-m high pylons from the bottom upwards, a process which had never been attempted before in South Africa.

The run-up to the 2010 Soccer World Cup, says Johnson, was inarguably the most positive business period for AfriSam in recent times. One of the projects of note was the Gautrain, an 80-km high-speed commuter rail system in Gauteng which links Johannesburg, Pretoria, Kempton Park and O. R. Tambo International Airport.

“The Gautrain was a milestone project for us. To provide context, we supplied 200 000 t of cement to the Gautrain Rapid Rail Link Project South Section and nearly 439 000 t of 73 mm ballast. On average,

some 300 t of crushed material was used daily on this project,” explains Dawneerangen.

In addition, Johnson says the Gauteng Freeway Improvement Project (GFIP) was another important project, where AfriSam supplied material for the upgrade of 185 km of Gauteng roads. This was complemented by other big projects such as stadia and bridges.

Elsewhere, AfriSam was a key supplier to the Durban Harbour project between 2007 and 2008. The project entailed widening of the harbour by approximately 150 m and increasing the depth from minus 12 to minus 19 m. AfriSam established two readymix concrete batching plants on site that produced 300 m³ of concrete in an eight-hour shift. In total, AfriSam supplied a total of 124 000 m³ of concrete to the project.

The Leonardo, a mixed-use high-rise development in Sandton which, on completion, was the tallest building in Africa at 234 m, before being surpassed by the 264-m Great Mosque of Algiers Tower in Algeria in April 2019, is yet another notable project in the history of AfriSam. The “key-wall” columns constitute a special feature of the Leonardo. To control the plumb, state-of-the-art specialised GPS technology was used. Hi-tech sonic vibrators were successfully used in the columns for optimum compaction. To counteract friction stresses, aggregate size was reduced to 13,5 mm and 9,5 mm.

The historic 100-year-old Grain Silo complex, a thriving grain storage hub in Cape Town, was repurposed to house the Zeitz Museum of Contemporary Art Africa (MOCAA). AfriSam supplied all the new concrete requirements for this project. The main mix for the silos, including the sleeves, was a prescribed mix of 30 MPa with a 9 mm stone. The mix was developed over a period of testing to ensure that it would have the correct consistency. Aggregates were an important factor in the final mix design as the surface finish had to meet the stringent specifications of the architect but also had to comply with

the workability requirements.

Another milestone project for AfriSam is the Ingula Storage Scheme, Eskom’s third pumped storage scheme with an output of 1 332 MW, which is mostly used during peak-demand periods. The station became fully operational at the end of 2015. Here, AfriSam supplied in excess of 230 000 t of cement from the project’s commencement in 2010. Supply also included 98 000 t of sub-base and 55 000 t of overburden. Approximately 14 000 t of aggregate were supplied for readymix, pipes and manholes.

Other significant projects in the supply history of the company include the Michelangelo Towers, the Sandton Convention Centre, O.R. Tambo Airport Central Terminal Building, the Glen Shopping Centre, BRT Cape Town, Vodacom Head office, Lakeside Mall, Allandale Bridge, Newtown Junction and the Group Five Housing Project in Soshanguve, amongst others.

Commenting on some key trends in the construction materials market, Dawneerangen highlights the greater focus on sustainability. Having embarked on its sustainability journey some three decades ago, AfriSam has over the years introduced a number of initiatives to reduce its carbon footprint. Chief among them is the use of extenders to reduce clinker content in its cement. In 2009, AfriSam was the first cement maker to introduce a CO2 rating system, indicating the carbon footprint of each of its cement products relative to Ordinary Portland Cement (OPC). The company has also become the world’s first construction materials supplier to Carbon Footprint all its production operations, including cement, aggregates and readymix concrete operations.

AfriSam was also the first cement company to publish an environmental policy, having done so in 1994. In 2012, the company became the first cement company to pledge support to Eskom’s R49-million campaign to demonstrate its commitment to the global agenda for energy efficiency. Owing to a number of initiatives, AfriSam has reduced its carbon emissions by 33% since 1990 – making it a leader in decarbonisation efforts in the South African cement sector.

On the readymix concrete side of the business, the company uses supplementary cementitious materials such as slagment and fly ash to reduce the amount of cement in its concrete. “In some mixes, we use up to 70% supplementary cementitious materials, depending on the application,” says Dawneerangen. “Our readymix plants also have strict re-use and recycling processes, and must recycle most of their grey water generated on-site. Some of the plants are now using 100% recycled water as mixing water for concrete at their operations.”

Finally, Johnson says for the company to survive the next 90 years, it has to become more agile, more resourceful and entrepreneurial than ever before. “Being a corporate does not guarantee success anymore. To be relevant in the future, I believe we will have to transform our corporate mindset into operating more entrepreneurially and independently of a traditional corporate structure. Adaptability and resourcefulness will be the order of the day,” concludes Johnson. a

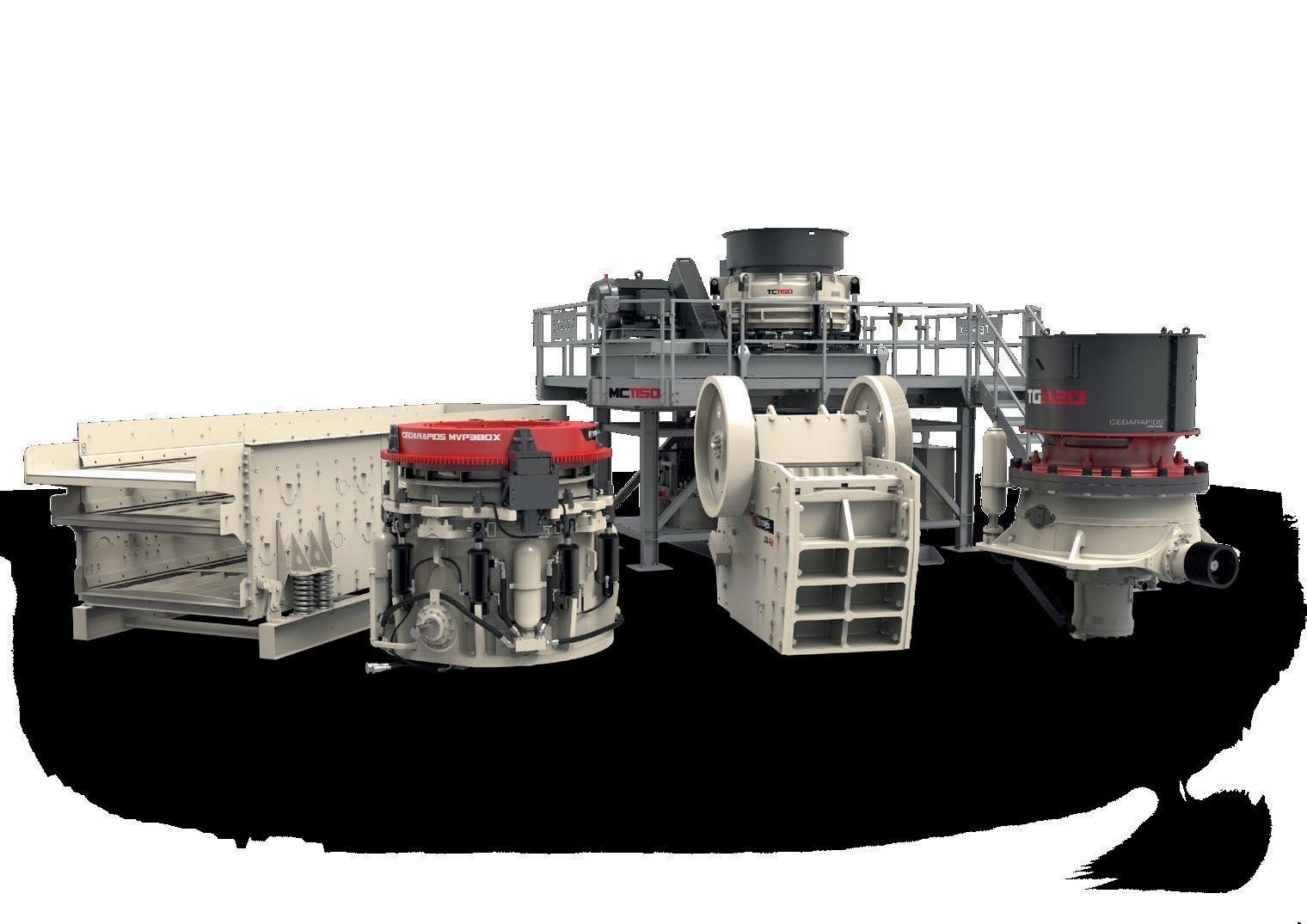

A Trio TC51 cone crusher with conveyer and cone surge hopper for processing material.

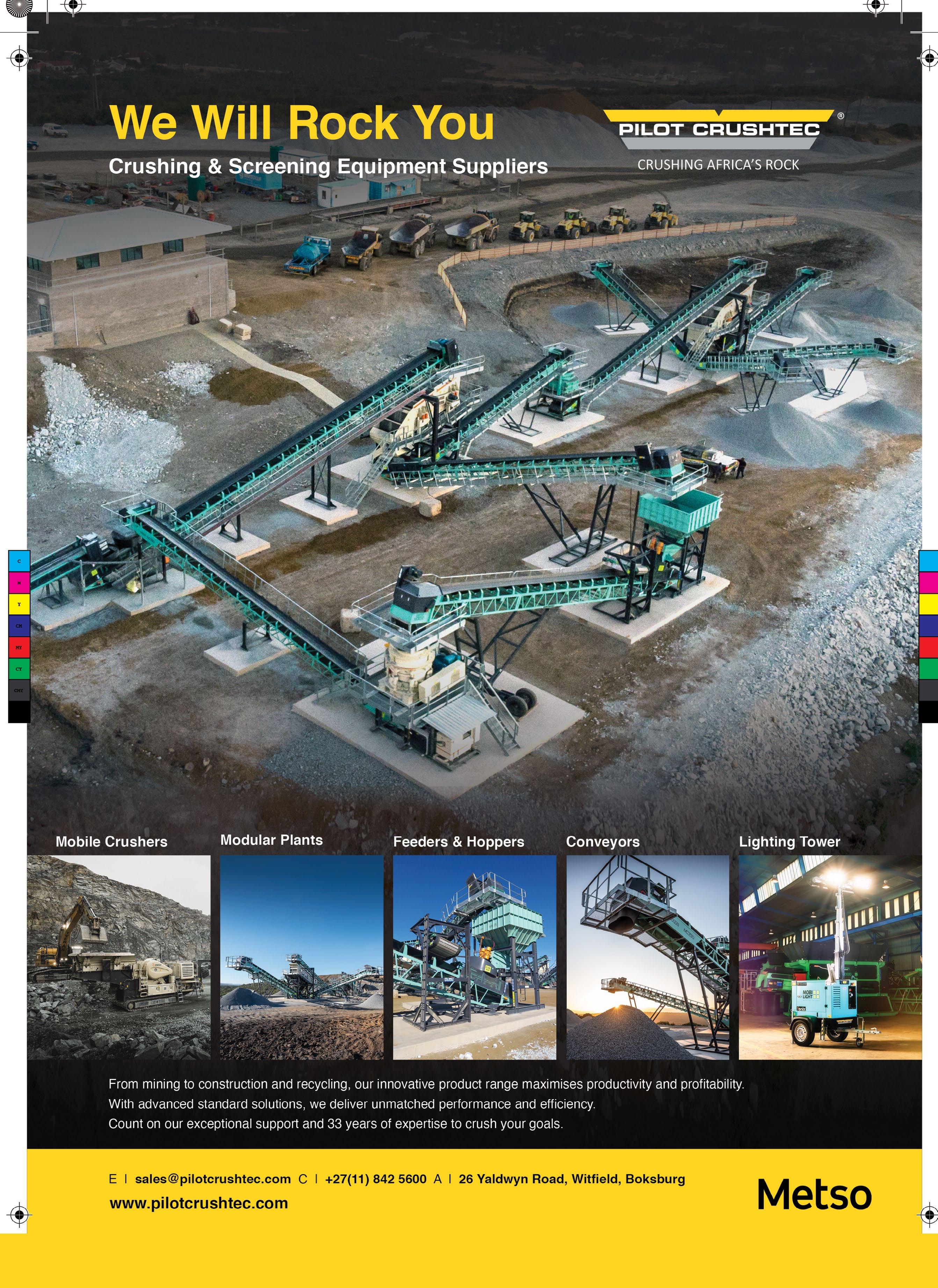

In response to the growing demand for solutions that enable crushing contractors to easily move on and between production sites, Weir Minerals Africa is reintroducing its Weir Modular Wheeled Plant (WMWP) concept in Africa. Tiisetso Masekwameng, GM – Crushing & Screening Products, unpacks the solution and its benefits. By Munesu Shoko.

Given the nomadic nature of their operations, crushing and screening contractors place high value on mobility and transportability of their plants.

Bearing that in mind, Weir Minerals Africa’s WMWP concept takes both these parameters to a whole new level.

In an exclusive interview with Quarrying Africa, Masekwameng explains that wheeled plants have always formed part of the Trio crushing and screening offering and make use of Weir Minerals’ Trio crushers, screens and material handling solutions. However, the solution has been completely redesigned to suit new market dynamics.

“Our wheeled plants have been used across the world in sand and aggregates by clients who require

the flexibility of a mobile plant without the complexity needed for additional maintenance obligations of components such as diesel engines and associated tracks on the mobile unit itself. We have found this concept to be a good solution for crushing and screening contractors who want to be able to move their equipment from site to site at short notice,” she explains.

Commenting on targeted applications, Masekwameng says the wheeled plants concept is primarily intended for the construction market, as well as the mining sector, particularly where clients require short-term solutions to help boost production rates during commodity upswings, without constructing a new static plant over a longer lead time. Weir Minerals Africa will use the

tph

Machines used for Weir Minerals’ wheeled plants are in the 50 to 350 tph range

The modular wheeled plants are available in various configurations using simple mobile conveyors to configure a plant for the customer’s requirements.

Weir Minerals Africa is reintroducing its redesigned Weir Modular Wheeled Plant (WMWP) concept in Africa

The WMWP concept takes both mobility and transportability of crushing and screening plants to a whole new level

The solution is targeted for contractors looking for solutions that allow them to easily relocate their plants to infrastructure development hotspots

Wheeled plants eliminate the complexity of having a diesel engine and tracks which require additional maintenance over and above the crushers and screens themselves

upcoming Electra Mining exhibition in September this year to showcase one of the first units.

“Many of our clients in the construction market are looking for solutions that allow them to easily relocate their plants to infrastructure development hotspots. Once they get to site, they want to mobilise quickly and start operating immediately,” says Masekwameng.

This, she adds, means that clients do not always have the time to go through a design and delivery period associated

“Our wheeled plants have been used across the world in sand and aggregates by clients who require the flexibility of a mobile plant without the complexity needed for additional maintenance obligations of components such as diesel engines and associated tracks on the mobile unit itself.

The mobile plant offers a flexibility without the need for maintenance or components like diesel engines and tracks.

with a more permanent, fixed plant which can take months to complete. A solution that can be easily transported and erected on site immediately wins the day in such a scenario. This is particularly true for markets outside of South Africa where commercial quarries are generally few and far between, with borrow pit type of operations more prevalent.

Weir Minerals’ wheeled plants are available in various configurations, starting from primary crushing solutions comprising a hopper, a vibrating grizzly feeder and a jaw crusher, to secondary crushing and stations which consist of a vibrating screen and a cone crusher. To combine these solutions, one can use simple mobile conveyors to configure a plant that is capable of producing aggregates for various end-use requirements.

“More importantly, we utilise equipment that is within the dimensions and weights that can be accommodated on a multi-axle trailer,” she emphasises. “With that comes the limitation of the amount of mass that can be accommodated per axle, in addition to legal road limits on width and height. The machines that we use for our wheeled plants are in the 50 to 350 tonnes per hour (tph) range. Once you go bigger than that, the equipment gets too heavy, and the solution becomes more like a fixed plant.”

Commenting on some key features of the system, Masekwameng makes special mention of the unique hydraulic and mechanical deployment system which requires minimal truck-mounted cranage during site installation. Its purposefully designed hydraulic leg system raises the plant from wheels, levels it and installs main supporting legs without any cranes being required.

When in operation, the plant is supported by structural support legs with the operational load removed from wheels/axles and hydraulic lifts for working safety and structural stability, as well as having reduced noise and vibration. All connections are done with structural pins and bolted connections, resulting in seamless integration of all components. The unique positioning bogey system makes final site-placing of modular wheeled units and conveyors simple and efficient.

The modular primary jaw crushing units are fed directly with excavator or front-end loaders with optional hopper extension for direct dump truck feed. The jaw wheeled units include an integrated overband magnet system for removal of tramp metal. A surge hopper unit with an integrated belt feeder could be added in circuit to ensure proper choke feeding of cone crushers for optimal crushing quality and performance.

According to Masekwameng, one of the major benefits of wheeled plants is that they eliminate the complexity of having a diesel engine

as part of the unit as well as tracks which require additional maintenance over and above the crushers and screens themselves.

“With wheeled plants, our customers can focus their maintenance attention on equipment that is core to their operation –crushers and screens – as the availability of these machines is what earns them money. Wheeled plants can also be transported on the highway depending on the size and road regulations within the client’s jurisdiction. That means customers only need to hook the plant on to the back of a truck and off they go,” she says.

By their nature, wheeled plants are portable crushing and screening solutions with minimal civil requirements, which translates into both time-savings and reduced operational costs for customers.

These solutions can be transported on road with standard horse kingpin connection (South African road transport requirements) or containerised (subject to main equipment size) for shipping to remote sites where sea freight is more economical.

In addition, these plants are designed with safety in mind and ease of maintenance as the highest priority. Various crushing and screening wheeled plant modules seamlessly integrate together with the Weir Modular Conveyor System (WMCS), all powered from a central wheeled generator/master control wheeled unit, with cable racking and routing allowance already provided for.

“WMWP combines all the features and benefits of the robust Trio and Enduron range of equipment in an easy to deploy and relocate, complete crushing and screening solution,” says Masekwameng.

Masekwameng says, given that the sand and aggregates required for infrastructure development are generally high-volume, low-value products, it is difficult for contractors to factor in transportation costs for these materials and still turn a profit when crushing projects are far away from construction sites.

“As such, it becomes important for them to move around to where there is construction development. In our view, demand for solutions that can be easily transported and quickly mobilised is going to increase as the world turns to infrastructure development as a tool to foster economic recovery and development,” concludes Masekwameng. a

Different quarries need different cone crushers. Weir Minerals is the only global manufacturer that offers both. TRIO® live and xed shaft cone crushers are made for modern quarries with advanced hydraulics, wear resistant materials and the latest technology. You get what’s right for your circuit. No unnecessary redesigns needed. Plus, with a lifelong commitment from the Weir Minerals global network, we’ve got you covered. Visit info.global.weir/trio

In the quest for optimal operations, mines, quarries and their contracting counterparts are placing value on innovative solutions in crushing and screening technology. In an exclusive interview with Quarrying Africa, Astec Industries’ Casper Booyse and Ricardo Isaacs unpack some of the emerging trends in this market. By Munesu Shoko.

As part of the OneASTEC business model, Astec Industries Africa Middle East (AME) introduced the Astec range of mobile crushers and screens to the local market some two years ago. Speaking to Quarrying Africa , Casper Booyse, regional sales manager at Astec Industries AME, says there has been a gradual uptake of the range thus far, given the competitive nature of this market, particularly in southern Africa.

The company has already delivered two units in South Africa – a GT205 mobile screen and a GT125 mobile jaw crusher. The Astec GT205, a three-deck mobile screen, was successfully commissioned last year for Astec’s long-standing KwaZulu-Natalbased customer, Lizarox, where it has proven to be up to the task. The GT125 mobile jaw crusher has been deployed in a coal application in Mpumalanga.

In the Middle East, Astec Industries AME has delivered two more units – a GT125 mobile jaw crusher and a GT205 mobile screen. Ricardo Isaacs, regional sales manager at Astec AME, says the two machines were sold through Astec’s Saudi Arabia-based dealer, Al Rashed & Sons, and are hard at work at a project in Jeddah.

Commenting on some of the key trends observed during the past two years, Booyse says the mobile crushing and screening market in southern Africa is driven by two capacity ranges – the 200-250 tonnes per hour (tph) and the 400 tph-plus tonnage requirements.

As part of the OneASTEC business model, Astec Industries AME introduced the Astec range of mobile crushers and screens to the local market some two years ago

The company has already delivered two units in South Africa – a GT205 mobile screen and a GT125 mobile jaw crusher

In the past year, Astec Industries has observed an apparent shift towards the use of bigger crushing and screening machines

Another trend of note is the growing demand for dual powered or hybrid mobile crushing and screening solutions

With its GT range, Astec Industries AME is currently focused on the 200-250 tph market segment, targeting quarrying, mining, rental, demolition and recycling sectors

The 400 tph-plus tonnage requirements are mainly for the larger mining projects where high production volumes are the order of the day

The 200-250 tph is driven by contract crushing projects, mainly the borrow pit type ones for road projects. The 400 tphplus tonnage requirements are mainly for the larger mining projects where high production volumes are the order of the day.

Our extensive regional footprint is supported by a large parts stockholding worth millions of rands. Some of the major components, such as the jaw for the GT125 mobile jaw crusher, are built at our Johannesburg facility, which means parts are locally available.

“The 200-250 tph is driven by contract crushing projects, mainly the borrow pit type ones for road projects. The 400 tph-plus tonnage requirements are mainly for the larger mining projects where high production volumes are the order of the day,” explains Booyse.

With its GT (Global Track) range, which is manufactured at Astec’s Omagh, Northern Ireland facility, Astec Industries AME is currently focused on the 200-250 tph market segment, targeting quarrying, mining, rental, demolition and recycling sectors.

The available models in this range include the GT125 jaw crusher, the FT200 cone crusher, the GT440 horizontal shaft impactor (HSI) crusher, the GT165 scalping screen and the GT205 finishing screen. All the crushers are predominantly suited for the 200 tph market, while the screens play in the 300-400 tph market.

“The GT125 is a robust crusher that has proven its capabilities, especially in the United States. A major talking point is the class-leading 38 mm stroke as well as the 25% greater capacity than most of the competitor

models in this size class. The dynamically balanced, large flywheels reduce peak horsepower requirements and allow the machine to operate with a smaller 225-hp Cat C7 engine without sacrificing performance,” explains Isaacs.

The FT200 comes with Astec’s patented tramp metal removal system which protects the crusher from uncrushable material in the crushing chamber. The GT440 HSI is able to track and crush simultaneously, making it the ideal solution for reclaimed asphalt pavement (RAP) applications in road maintenance.

The GT205 comes as either a two-deck or three-deck screen with hydraulic angle adjustments. Astec also offers what it believes to be a unique proposition in mobile screening, a multi-frequency screen, which is basically a conventional screen at the top deck and a high frequency screen at the bottom deck.

The high frequency version screen, explains Isaacs, benefits from the high speeds of 3 800 to 4 200 revolutions per minute (rpm), whereas the conventional

screen runs at 800-900 rpm. The multi-frequency screen is ideally suited for removing clay and reducing the unwanted 75-micron material in the final product.

In the past year, says Booyse, there has been an apparent shift towards the use of bigger crushing and screening machines. This is largely because of the high tonnage requirements in the mining sector where contractors are looking for 350-400 tph mobile solutions.

While Astec AME currently has a specific focus on its GT range, the company can, however, offer the larger FT (Fast Track) range. Manufactured in the United States, the FT range is currently offered as special orders in Africa and Middle East.

However, in future, this range will also be manufactured in Northern Ireland to allow Astec to cater for the bigger machine requirements in the international market. In fact, in June last year, Astec Industries announced plans for a US$5-million factory expansion at its Omagh location in Northern Ireland to better serve growing market demands in the mobile crushing and screening industry. The announcement came a year after the original facility was built to support the increased demand for mobile crushing and screening solutions.

screened oversize material back to the cone crusher. The larger FT300 CC will be launched sometime this year, confirms Booyse.

“The requirement for crusher/screen combinations on one chassis is taking root in the market. This eliminates the need to invest in two machines, thus reducing capital expenditure for customers.

In addition, running one machine instead of two reduces operating costs from a fuel consumption, maintenance and site establishment perspective,” explains Booyse.

Another trend of note is the growing demand for dual powered or hybrid mobile crushing and screening solutions. The main driver behind this trend is the need to improve fuel efficiency and reduce CO 2 emissions.

Hybrid solutions are fitted with an electric-drive system, meaning they can be connected directly to the mains or be powered by an onboard diesel generator –the latter being the case when there is no access to the electricity grid.

On all its HSI crushers, Astec provides a hybrid option. “We have invested in research and development to fast-track the upgrading of other product groups in our crushing and screening range to hybrid variants. At this stage, we have dual power solutions only in our HSI range,” says Booyse.

In June last year, Astec Industries announced plans for a US$5-million factory expansion at its Omagh location in Northern Ireland to better serve growing market demands in the mobile crushing and screening industry

Customers in the region also place significant value on aftermarket support, which informs their buying decisions.

One of the emerging trends in the mobiles market is the requirement for cone crusher/screen combinations, essentially a cone crusher and a screen on one tracked chassis. Basically, the machines feature a detachable screen which is placed just before the crushing chamber, or alternatively, post the crushing chamber.

To cater for this market requirement, Astec offers its Closed Circuit (CC) model, the FT200 CC, which features a detachable screen and return conveyor which guides

This is an area in which Astec has invested significantly. The AME region is supported from the Johannesburg manufacturing facility. However, the company has recently appointed highly qualified dealers across the region to provide sales and service support to customers. Astec has a total of 12 dealer partners in Africa and Middle East, with some of them responsible for several countries in their territories.

One example is Unatrac, which is part of the Cairoheadquartered Mantrac Group, offering sales and support services for all of the equipment in Astec Industries’ Material Solutions division in Nigeria, Ghana, Sierra Leone, Liberia, Kenya, Tanzania, Uganda, Egypt, Iraq and the Ural and Volga regions in Russia. Meanwhile, French company Aramine is the official

dealer of Astec Material Solutions products in several strategic countries in West Africa (Mauritania, Mali, Senegal, Guinea, Ivory Coast, Burkina Faso, Benin, Togo and Niger) and the Maghreb (Algeria, Tunisia and Morocco).

In southern Africa, Astec AME has a direct-to-market approach in South Africa and has dealers in strategic countries such as Namibia, Zimbabwe and Zambia, among others. The company has recently appointed Elite Crushers & Hydraulics as its dedicated agent in

This follows hard on the heels of the recent appointment of Zinpro RDC SARL in the Democratic Republic of Congo (DRC).

“This extensive regional footprint is supported by a large parts stockholding worth millions of rands. Some of the major components, such as the jaw for the GT125 mobile jaw crusher, are built at our Johannesburg facility, which means parts are locally available. This is complemented by 24/7 parts personnel across the region,” concludes Isaacs. a

The Teichmann Group has deployed the Terex WC1150S and the WJ3042i on a crushing project in Namibia.

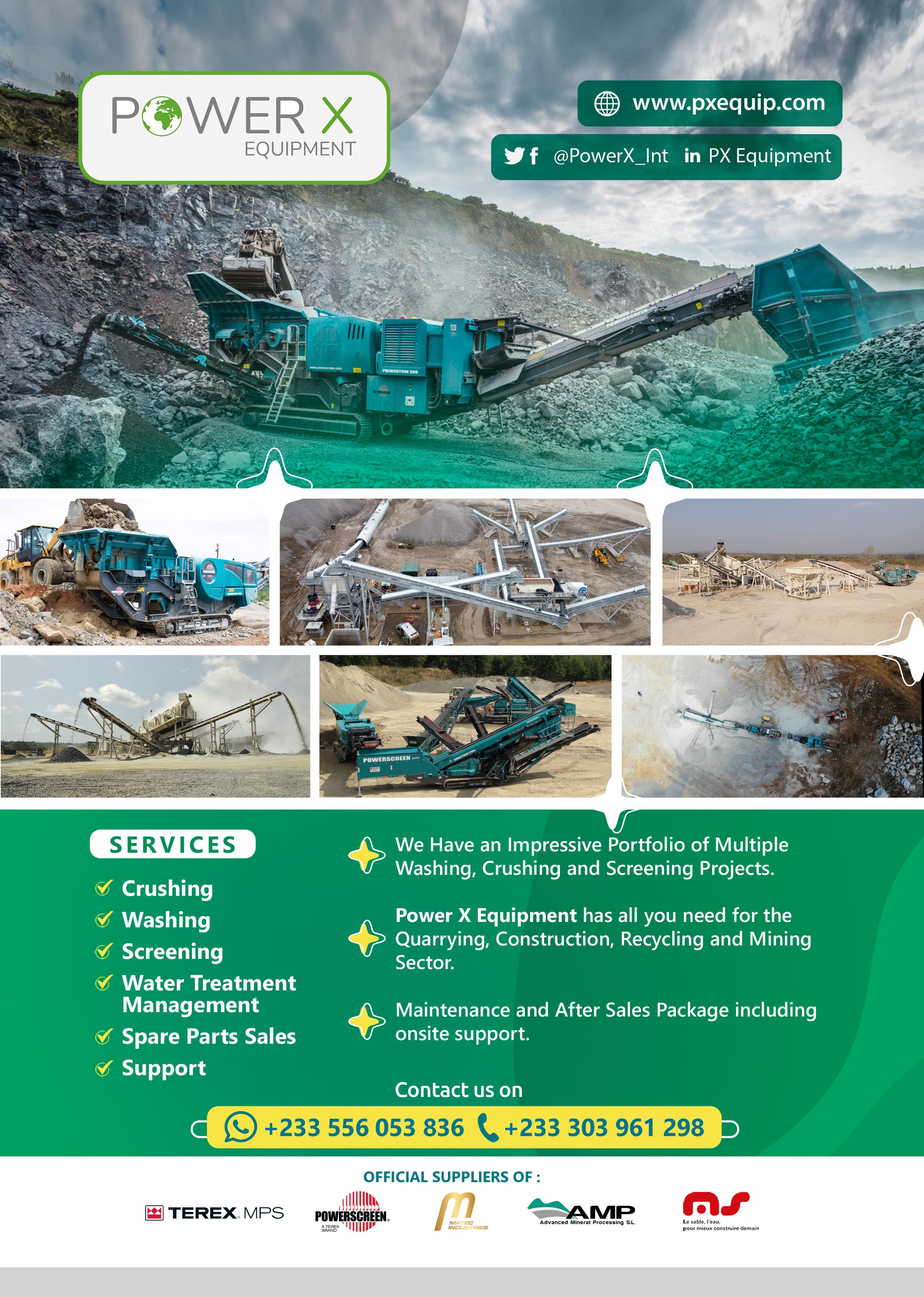

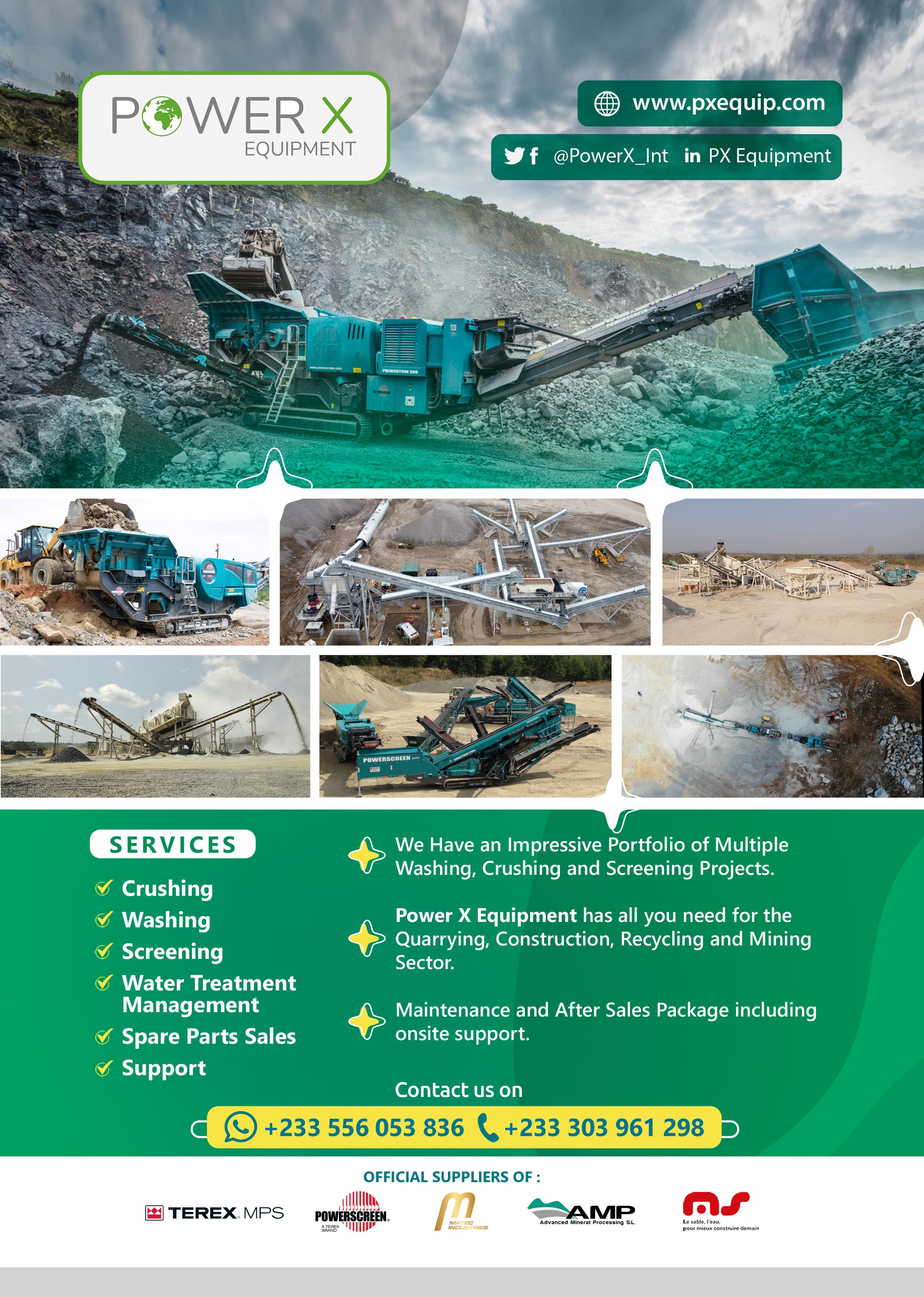

Following the official African launch last year, the Terex MPS WC1150S wheeled cone crusher and the updated WJ3042i wheeled jaw crusher have become a popular choice for contractors. A case in point is The Teichmann Group, which has deployed these models with great success on a crushing project in Namibia, producing sub-base and road stone products. By Munesu Shoko.

As part of its product expansion programme, Terex Mineral Processing Systems (Terex MPS) introduced the WC1150S cone crusher, a completely new addition to its wheeled crushing range last year. In addition, the company also unveiled the WJ3042i, an updated version of the WJ1175 wheeled jaw crusher.

The two crushers are available as standalone plants or as a multi-plant system with product conveyors for a complete crushing and screening plant. They are both suited to mining and quarrying environments.

The WC1150S and the WJ3042i can be easily set up for aggregates such as concrete and road stone, as well as

base materials.

Several units of these models are already hard at work at various sites across Africa. One of the first companies to take delivery of the WC1150S and the WJ3042i in Africa was The Teichmann Group. Delivered last year, the two machines are part of a plant deployed at a crushing project in Namibia, making sub-base and road stone material for a major road project in the country.

Established in 1995, The Teichmann Group is a dynamic group of companies boasting substantial expertise and experience in a wide range of construction services, mining and agricultural solutions. Its strategic geographical reach extends across Southern, Central and West Africa.

At the heart of the WC1150S is the 225-kW Terex TC1150 cone crusher with a modern, automated control system 3

The Teichmann Group now has three of the WJ3042i and WC1150S crushing plants operating at different sites in Africa

At the heart of the WC1150S is the 225-kW Terex TC1150 cone crusher and a 6’ x 20’ triple-deck screen.

Following their official launch in Africa in 2023, the Terex MPS WC1150S wheeled cone crusher and the updated WJ3042i wheeled jaw crusher have become a popular choice for contractors

One of the first companies to take delivery of the WC1150S and the WJ3042i in Africa was The Teichmann Group

The wheeled plant concept has offered Teichmann Group greater flexibility because of its ease of movement on and between job sites

For this particular deal, PX Equipment was able to deliver the new units, set them up and get product on the floor for The Teichmann Group in a very short time frame

“Our civil engineering companies specialise in construction projects of all sizes. We have experienced teams of qualified engineers and managers who are hands-on and prioritise safety. We offer cost-effective solutions and utilise innovative construction methods, technical expertise and value engineering to deliver successful projects,” says Gary Teichmann, Executive Chairman of The Teichmann Group.

Willem du Plooy, regional business development manager – Africa at Terex MPS, tells Quarrying Africa that the wheeled plant concept has offered The Teichmann Group greater flexibility because of its ease

“The application is a high-wear, tough granite rock, but the plant has performed exceptionally well, producing in-spec quality road products for the contractor. The Teichmann Group now has three of the WJ3042i and WC1150S crushing plants operating at different sites in Africa.

Willem du Plooy, regional business development manager – Africa at Terex MPS

of movement on and between job sites. Setup times are minimised, efficiency is increased and jobs are completed with ease.

In addition, says Du Plooy, the client was impressed by the short delivery time of the plant, especially given the urgent nature of the job. With its 225 kW Terex TC1150 cone crusher with a modern, automated control system, the WC1150S is providing optimal capacity and highquality products to The Teichmann Group.

“As the Terex MPS dealer network continues to grow throughout Africa, the majority of Terex MPS units are now available in stock. In fact, our dealers have already standardised on the WJ3042i and WC1150S. For this particular deal, PX Equipment was able to deliver the new units, set them up and get product on the floor for The Teichmann Group in a very short time frame,” says Du Plooy.

The Teichmann Group’s plant was originally set up with a vertical shaft impact (VSI) crusher in the circuit, but with the WC1150S’s special crushing action, which

provides high reduction and good product cubicity for the production of high-quality aggregate and sub-base materials, the client realised that there was no need for a VSI. Removing the VSI in the circuit resulted in a significant reduction in operating costs, especially given that a VSI by its very nature is an energy-hungry machine.

“The application is a high-wear, tough granite rock, but the plant has performed exceptionally well, producing in-spec quality road products for the contractor. The Teichmann Group now has three of the WJ3042i and WC1150S crushing plants operating at different sites in Africa,” says Du Plooy.

Du Plooy says the new crusher models are gaining quick traction in the market. More units are being commissioned in Africa, he says, proving that the new WJ3042i and WC1150S are quickly becoming the principal choice for contractors.

At the heart of the plant is the 225-kW Terex TC1150 cone crusher and a 6’ x 20’ triple-deck screen. A level sensor over the cone crusher regulates the feed to ensure the chamber is continually choke-fed, thus ensuring maximum production and liner life, as well as optimal product shape. The large onboard triple-deck screen allows for the production of sized products from a single plant.

Equipped with the Terex MPS JW42 jaw crusher and heavy-duty vibrating grizzly feeder, the Terex MPS WJ3042i delivers optimum production across various applications. The compact size, quick setup times, easy transport and simple maintenance make the Terex MPS WJ3042i ideal for quarrying, mining, demolition and recycling. The machine excels in tight spaces and can be effortlessly transported to different project sites, allowing clients to benefit from quick setup times to minimise downtime and maximise efficiency.

“With our ever-growing dealer network, Terex MPS is now able to support its customers in all of Africa, with main hubs and satellite offices in most parts of the continent. Aftermarket support is a key focus of our growth strategy in Africa and we have really fared well in that aspect as we continue to train and support new dealers in Africa,” he says.

Reiterating commitment to its dealers, last year Terex MPS hosted its first Africa Dealer Conference at its Terex MPS India facility, with distributors from Southern, Central, West and North Africa present, as well as those from the Islands of Africa. Following the success of the Africa Dealer Conference in 2023, the 2024 edition will be hosted in South Africa and possibly in Morocco in 2025.

The WC1150S cone-screen plant is a high-performance, medium-sized wheeled crushing and screening system.

“The WJ3042i’s chassis has been redesigned and upgraded to provide better overall access and the Terex MPS JW42 jaw crusher onboard has a new mounting system to reduce the stresses to the chassis while crushing,” says Du Plooy. In addition, the field kit with conveyors and surge bin has been redesigned to accommodate three possible standard layouts for the WJ3042i and WC1150S. The same field kit allows clients to set the plant up for direct all-in feed into the cone crusher or feed the screen directly, ensuring easy layout change as required for different crushing sites. All plants and conveyors are designed to fit in standard containers for easy transport. The entire system, complete with conveyors, can be transported in nine containers. Once on site, each assembled plant can be transported in a one-piece tow, while hydraulic screen lift and hydraulic support legs reduce the cranage and tools required for plant set-up and relocation.

Apart from the WJ3042i and WC1150S, Terex MPS offers the WC1000LS and WC1300 cone crusher models with fourdeck screens and the WV2000 wheeled VSI crusher with a four-deck screen. The wheeled range is complemented by the company’s United States-built portable plants, ranging from wheeled jaws, cones and impact crushers to a wide range of wheeled screening units.

“Terex MPS offers three different types of cone crushers in its range – the MVP series screw bowl, the TC series floating bowl and the TG series floating shaft cone crusher – all available in different sizes on a wheeled portable chassis to suit different customer preferences,” concludes Du Plooy. a

Cutaway of lowprofile ERC primary crusher showing the apron feeder.