INDUSTRY NEWS ENERGY CIRCULAR ECONOMY THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING www.aluminiumtoday.com January/February—Vol.36 No.1 ALUMINIUM INTERNATIONAL TODAY JANUARY/FEBRUARY 2023 VOL.36 NO1 INDUSTRY 4.0

C e r t if ie d l o w c a r b o n NEW PRODUCT INNOVATION A new line of innovative products (6 alloys divided into three levels) with a certified carbon footprint of less than 4 t CO2 /t Al, cradle-to-gate. Aludium Eco 3.0 (less than 3 tons CO2 /t Al) Aludium Eco 2.0 (less than 2 tons CO2 /t Al) Aludium Eco 4.0 (less than 4 tons CO2 /t Al) • Aludium ECO’s carbon footprint is almost half that of the average of European manufacturers. • Aludium ECO emissions follow standard ISO 14067-1:2018. • 7 years of development and €90 million of investment. The green boost your value chain needs. For further information: aludium.com 5754 8011 3004 3105 5251 3005 AVAILABLE SPECIFICATIONS

Volume 36 No. 1 – January/February 2023

Editorial

Editor: Nadine Bloxsome

Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Editorial Assistant: Zahra Awan Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales

Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com Tel: +44 (0)1737 855117

Advertisement Production Production Executive: Martin Lawrence

Managing Director: Tony Crinion CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034 email subscriptions@quartzltd.com

Annual subscription: UK £257, all other countries £278. For two year subscription: UK £485, all other countries £501. Airmail prices on request. Single copies £47

COVER

ALUMINIUM INTERNATIONAL TODAY is published six times a year by Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK. Tel: +44 (0) 1737 855000 Fax: +44 (0) 1737 855034

Email: aluminium@quartzltd.com

Aluminium International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437.

Printed in the UK by: Pensord, Tram Road, Pontlanfraith, Blackwood, Gwent, NP12 2YA, UK

CONTENTS 1 www.aluminiumtoday.com Aluminium International Today January/February 2023 2 LEADER 2 NEWS

Cover picture courtesy of GRANCO CLARK

ISSN1475-455X

© Quartz Business Media Ltd 2023

SEARCH FOR ALUMINIUM INTERNATIONAL TODAY 7 48 14 38 37 INDUSTRY NEWS ENERGY CIRCULAR ECONOMY THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING www.aluminiumtoday.com January/February—Vol.36 No.1 ALUMINIUM INTERNATIONAL TODAY JANUARY/FEBRUARY 2023 VOL.36 NO1 INDUSTRY 4.0 41 ENERGY 7 The energy crisis PRIMARY PRODUCTION 17 EGA: From small regional smelter to global giant TRANSPORT & HANDLING 37 Qatalum contract on tapping vehicles awarded to HMR USA FOCUS 41 Focus on US Aluminium in 2023 and beyond EVENT REVIEW 48 AFSA 2022 COMPANY PROFILE: MQP 44 Grain refiner specialist advances sustainable manufacturing STOCKHOLDING 46 What’s next for our industry? PACKAGING 38 Metal packaging takes hold THE ALUMINA CHRONICLES 21 Aluminium Industry in Brazil CIRCULAR ECONOMY 12 Aluminium’s infinite recyclability is the key to a circular economy 14 McKinsey’s sustainable materials hub INDUSTRY 4.0 29 PSI Metals and Seresco partnership 31 The Properzi Reality

Supporters of Aluminium International Today

MEETING THE DEMAND

January always feels as though it gets off to a slow start and then all of a sudden you’re hurtling towards Spring and the world feels like it bursts back to life.

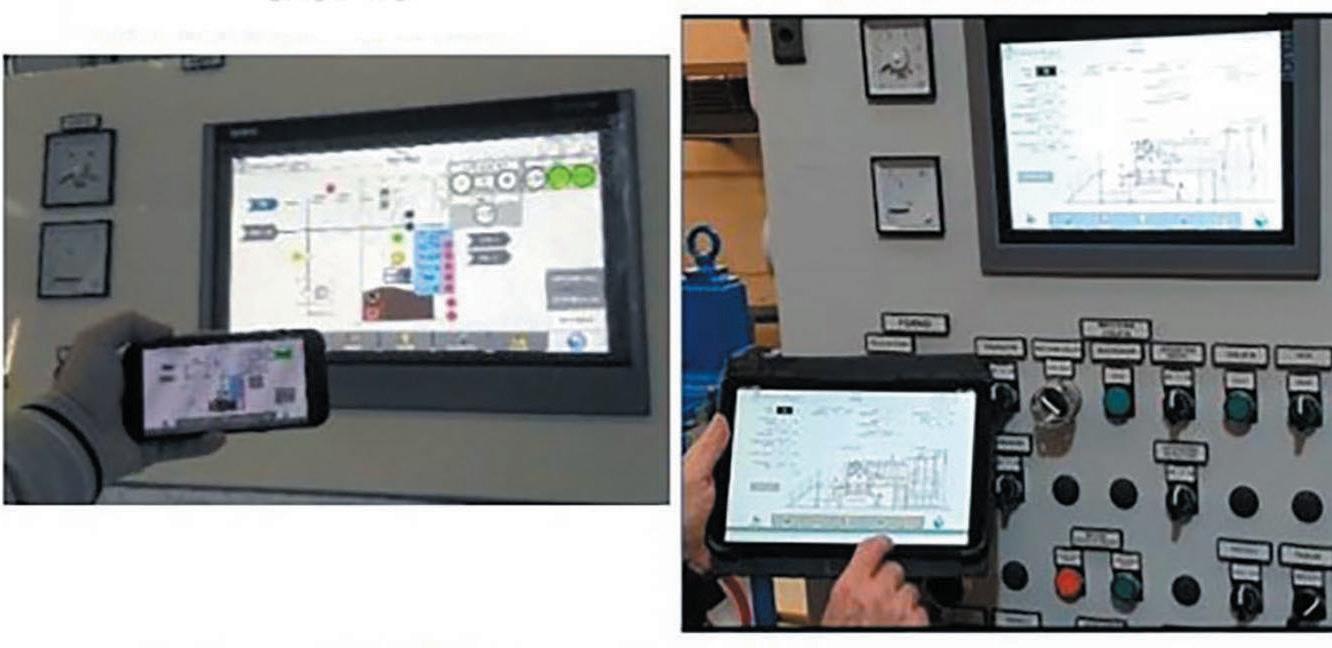

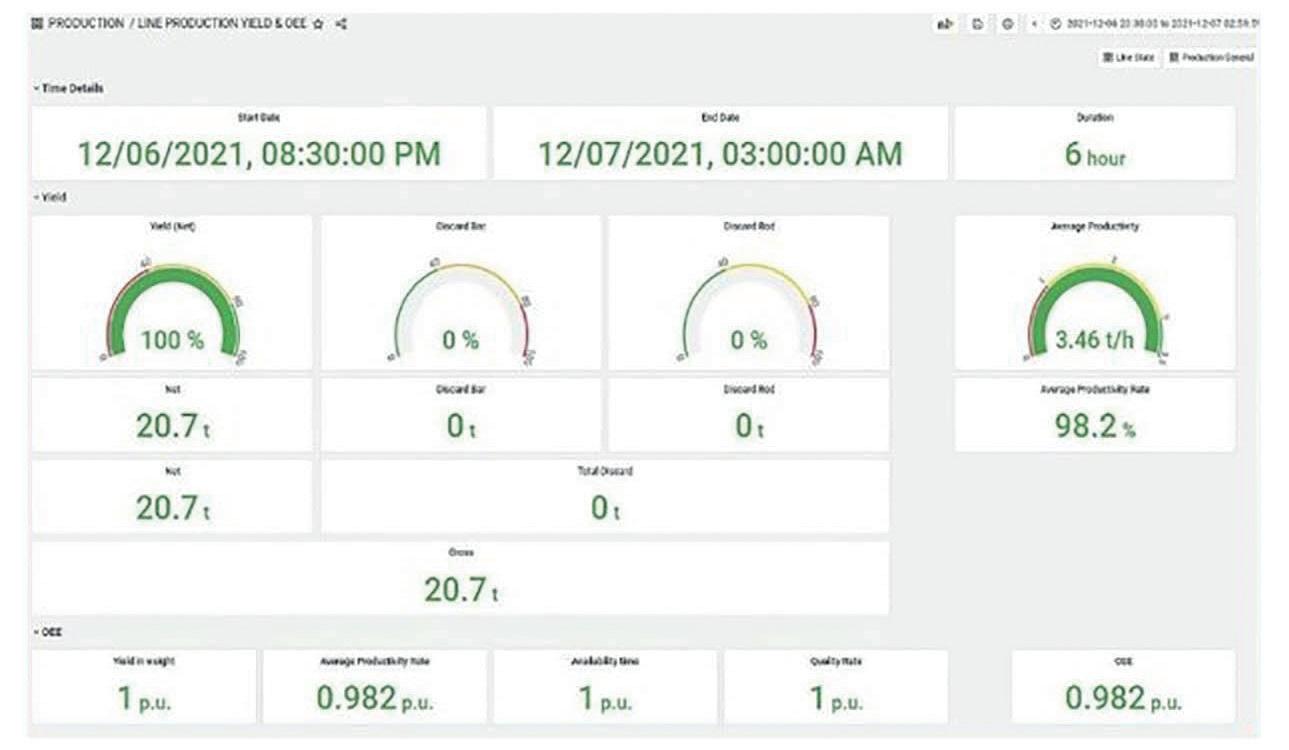

This year already feels like the industry is raring to go, despite uncertainties and hurdles that we will all be facing together.

The news pages in this issue are already starting to fill up with project, investment and Joint Venture announcements, which all point to developments and innovation across the sector.

Each of these will have a goal in mind, which inevitably revolves around meeting the projected demand for aluminium growth. This will be a key theme at the upcoming Future Aluminium Forum, which will finally take place in Québec, after it was originally planned to be held there in 2020.

And it’s not just about meeting this demand, but it is about meeting it with low carbon aluminium products and processes that help to grow and deliver a sustainable supply chain.

The Future Aluminium Forum in particular, will focus on the technologies that are being introduced to not only help streamline processes and put us on a pathway to achieving higher volumes of aluminium production, but also ensuring this aluminium is sustainably produced for current and emerging applications and then of course recycled back into the system.

Find out more about how you can hear from experts in the field and meet with producers at a dedicated forum to discuss the future of aluminium production by visiting: www.futurealuminiumforum. com

nadinebloxsome@quartzltd.com

Hydro invests in green transition

The investments at the Norwegian primary aluminium plants will help Hydro take a leading role in climate efficient aluminium solutions through continued industrial development and initiatives driving the green transition. The primary aluminium plants will have an extended lifespan and the products are turned towards low-carbon aluminum for a growing market.

“We are upgrading the plants, investing in the development of the plants, and implementing new technology such as recycling, carbon capture and green hydrogen with the goal of becoming the world’s first supplier of zero-car-

bon aluminium. We recently entered into an agreement with Mercedes Benz for a technology collaboration, and to supply our aluminium products to support their investment in making lighter, more climate friendly electric cars,” says Ola Sæter, Head of Primary Production at Hydro.

In addition to investment projects, Hydro is working on developing the skills of the work force. During the period of a weaker market for certain aluminium products, Hydro Husnes and Hydro Karmøy are doing a comprehensive skills upgrade. This involves a management develop-

ment program, industrial vocational school, training in the prevention of CO2 emissions, training on various types of vehicles and training in new work tasks.

Record-breaking production

Aluminium Bahrain (Alba) has set a new historic production record of 1,600,111 metric tonnes (MT) in 2022 - an increase of 38,889 MT versus 1,561,222 MT in 2021 (+2.5% Year-on-Year), as announced by the Company on 03 January 2023.

Commenting on this milestone, Alba’s Chief Executive Officer, Ali Al Baqali stated:

“This all-time production record translates our motto ‘opportunities don’t happen, we create them by doing the best we can with what we have’. We also look forward to set new highs in the future driven by our in-house production creep.

I take the opportunity to express

my gratitude to the Management team, our employees and contractors’ personnel for making our

Future Aluminium Forum returns

With global aluminium demand projected to increase by almost 40 per cent by 2030, the aluminium sector will need to produce an additional 33.3 Mt to meet demand growth in all industrial sectors.

This will only be possible through the inception of streamlined technologies, digital manufacturing and sustainable solutions across the supply chain.

Originally launched in 2018, the Future Aluminium Forum has focused on the challenges of implementing digitalisation and technologies associated with Industry 4.0 such as Digital Twins, the Industrial Internet of Things,

Artificial Intelligence and Machine Learning.

On May 10-12 2023, the Forum will return in a live format to

Québec City, a region where the aluminium industry has existed for more than a century and is now seeing rapid change and collaboration between manufacturers, processors, suppliers and OEMs.

With a dynamic industrial cluster and several research centres occupying a special place at the heart of this aluminium sector, Québec City is perfectly positioned to play host to the next Forum and welcome discussions and presentations about what the future of aluminium production looks like.

COMMENT 2

January/february 2023 Aluminium International Today

TOP STORIES

2022 objectives a reality by challenging themselves to do more safely and responsibly.”

Constellium to supply Daher

Constellium have announced that it has entered into a multi-year contract with Daher to supply a wide range of flat-rolled aluminium products, particularly for the TBM and Kodiak aircraft. With this new agreement, Constellium expands its customer portfolio for business and regional jets and becomes the strategic aluminium supplier for Daher.

Under this new contract, Constellium and Daher will cooperate on joint supply chain initiatives and product development. Con-

stellium will support TBM and Kodiak aircraft development as their production rate is increasing and will collaborate with Daher on the design of new solutions to further lightweight aircraft along with respective sustainability commitments.

“We are very proud and enthusiastic to become the strategic aluminium supplier of Daher; this contract is the basis of future developments between our teams,” explains Lionel Thomas, Global Aerospace Sales Director of Con-

stellium’s Aerospace and Transportation business unit.

“Choosing Constellium as our strategic aluminium supplier for the needs of our own aircraft and aerostructures programs is a major step for us, and will build foundations for further partnership to develop sustainable and optimised aircraft and solutions,” said Paul-Marie Dubreuil, VP Procurement, Daher.

Daher is supplied by Constellium’s facility in Issoire (France).

Aluminium beverage can recycling rate remains high

The latest report by Metal Packaging Europe and European Aluminium shows that the overall recycling rate for aluminium beverage cans in the European Union, United Kingdom, Switzerland, Norway and Iceland remained high in 2020 at 73% (72.8%). With a 3% points drop compared to 2019 and a growth of 9% cans consumed, the total amount of aluminium recycled from cans reached a record level of 510,000 tonnes, an increase of more than 20,000 tonnes since the previous year. This represents a total Greenhouse Gas (GHG) emissions saving of 4,2 million tonnes of CO2eq (equivalent to the amount of GHG emissions produced by a European town of nearly half a million inhabitants like Toulouse or Gdansk1.)

Can manufacturers (members of Metal Packaging Europe) and their aluminium suppliers (members of European Aluminium) welcomed the new result and stressed that despite the introduction of the new EU recycling reporting rules and the spectacular growth in cans consumed, the total tonnage of recycled aluminium cans has increased. Most EU Member States now report at the point of entrance of a recycling facility, instead of the collection phase. This has resulted in a recycling drop for

most packaging materials.

“We are fully supportive of the new EU recycling reporting rules as these measure ‘real’ recycling and we are pleased to notice that this has resulted in only a very minor and likely only temporary drop in the can recycling rate. The aluminium beverage can already meets the highest recyclability performance grade of 95% as proposed in the new draft for a Packaging & Packaging Waste Regulation’’ said Léonie Knox-Peebles, CEO of Metal Packaging Europe. As aluminium beverage cans are fully circular and can be recycled endlessly without losing the aluminium’s inherent properties, we are confident that even in a growing market we will be able to meet our 100% beverage can recycling ambition by 2030”.

“With more and more countries turning to Deposit Return Systems

(DRS) we will be able to recycle more cans via a can-to-can remelting solution, generating maximum environmental benefits and we are calling upon those countries with classic EPR systems to invest more into the collection and sorting of the whole aluminium packaging fraction in order to fully close the material loop’’ Maarten Labberton, Director Packaging Group at European Aluminium, commented. “Although we are surprised by the unfounded high reuse targets in the new EU proposal, we welcome the obligation to collect 90% or more of metal and plastic beverage containers for recycling, preferably via DRS. A Deposit Return System should be balanced, which means that it should be run by an independent operator, have variable deposit fees and no cross subsidies between the materials concerned.’’

IAI Welcomes MYTILINEOS as New Member

MYTILINEOS is one of the key players in the Metallurgy sector and one of Greece’s healthiest growing industrial companies, having operated for almost 60 years. It is the largest vertically integrated bauxite, alumina and aluminium producer in the European Union.

ASI certifies Cevher Jant A.S. against Performance Standard

Aluminium Stewardship Initiative (ASI) has announced that Cevher Jant A.Ş. (CEVHER) has been certified against the Performance Standard (V2) 2017 at its automobile wheel production facilities in Izmir, Turkey. CEVHER is a co-design partner with automotive OEMs, and brings the in-house capacity to design, develop, manufacture, and validate the wheels produced.

New funding partner for UK aerosol recycling initiative

Trivium Packaging has committed to funding the UK Aerosol Recycling Initiative launched by Alupro, the aluminium packaging recycling organisation.

Designed to increase awareness and uptake of aerosol recycling across the UK, the initiative follows a three-phase approach educating consumers around best practice, establishing a baseline recycling rate and developing a roadmap for achieving higher rates for aerosol recycling.

ASI and IPAF Workshop

Aluminium Stewardship Initiative (ASI) and Indigenous Peoples Advisory Forum (IPAF) held a one day workshop at the 10th International Conference and Exhibition on Bauxite, Alumina and Aluminium (IBAAS – JNARDDC 2022) in Raipur. The theme of the IBAAS 2022 conference was ‘Sustainability Challenges of Bauxite, Alumina & Aluminium Industry’.

The workshop provided an opportunity to explain ASI, the work of IPAF, the revised ASI Standards, certification process and the issues that aluminium companies in India face.

3 NEWS IN BRIEF January/February 2023 NEWS Aluminium International Today

5

www.aluminiumtoday.com

Alba: Solar investment

Aluminium Bahrain B.S.C. (Alba) has announced that it has awarded its Solar Farm Project towards Advanced United Systems (AUS) to install Solar Photovoltaic (PV) Panels over 37,000 m2 with a capacity of more than 6 Megawatts (MW).

The Solar Farm Project will consist of around 11,300 solar panels to be fixed on the rooftop of Alba car parks and some of its buildings to include the Spent Pot Lining Treatment (SPL) Plant. The Solar Farm Project will generate in the range of 10,539 MWHr per year and ap-

proximately 7,591,760 kilograms of carbon emissions would be reduced per year -- corresponding to a total reduction of 189,794,000 kilograms of carbon emissions over 25-year span.

Commenting on the importance of the Solar Panel Farm to Alba, Alba’s Chairman of the Board Shaikh Daij bin Salman bin Daij Al Khalifa stated:

“Sustainability is entrenched in our Vision, Mission, and Values; this Project is fully aligned with our Environmental, Social and Governance

(ESG) ambitions and our pledge to realise HRH the Crown Prince and Prime Minister’s objectives of Net Zero Emissions by 2060 as made during the 26th Climate Change Conference of the Parties (COP26). I trust that upon the completion of installing the solar panels, will see more environmentally responsible projects across the Kingdom to scale up the local clean energy generation and transition to a net-zero economy.”

EGA purchases Clean Air Certificates

Emirates Global Aluminium has purchased Clean Energy Certificates for 1.1 million megawatt hours of electricity supplied by Emirates Water and Electricity Company (EWEC), supporting EGA’s production of CelestiAL solar aluminium.

The certificates track the use of solar power from Noor Abu Dhabi, one of the world’s largest single-site solar power plants. Noor Abu Dhabi is located at Sweihan, and has 3.2 million solar panels generating approximately one gigawatt of electricity.

The transaction is the largest ac-

quisition to date of Clean Energy Certificates that track the use of solar power in Abu Dhabi, and will certify EGA’s production of around 80,000 tonnes of CelestiAL. The volume of CelestiAL EGA produces each year depends on solar power imports from the electricity grid.

The generation of the electricity required for aluminium production accounts for approximately 60 per cent of the global aluminium industry’s greenhouse gas emissions. The use of solar power by EGA significantly reduces these emissions in line with the UAE’s Net Zero by

2050 Strategic Initiative.

Abdulnasser Bin Kalban, Chief Executive Officer of Emirates Global Aluminium, said: “This agreement provides EGA with a new source of certified solar power for the production of our CelestiAL solar aluminium. I thank EWEC for their partnership, and for their leadership in the development of solar power in Abu Dhabi. The launch of CelestiAL solar aluminium last year was a landmark for EGA and our industry. CelestiAL and other low carbon metal is key to our sustainable future – both for our company and our world.”

£10M for CirConAl Project

Constellium has announced that it is leading a new consortium of automakers and suppliers to develop lower carbon, lower cost aluminium extrusion alloys.

Sponsored by a grant from the UK’s Advanced Propulsion Centre (APC), the £10 million CirConAl (Circular and Constant Aluminium) project aims to maximise the use of post-consumer scrap in a new generation of high-strength alloys that emit less than two tons of CO2 per ton of aluminium produced. CirConAl is part of joint government and industry support for projects to build an end-to-end supply chain for zero-emissions vehicles in the UK.

By designing, developing, prototyping, and testing aluminium automotive components at scale, the project is expected to demon-

strate that high-strength alloys with high recycled content can meet or exceed OEM requirements, such as strength, crushability, durability, and other performance criteria. Together, the partners would also develop scrap sorting technologies to ensure that valuable metal is recy-

cled into new automotive solutions rather than downcycled, preserving its value and contributing to a circular economy.

“Low carbon solutions require collaboration across the supply chain and Constellium is proud to lead the CirConAl project in partnership with the APC, automakers, and suppliers as the industry works toward carbon neutrality,” said Philippe Hoffmann, President of Constellium’s Automotive Structures & Industry Business Unit. “Taking advantage of Constellium’s high-strength HSA6® aluminium extrusion alloys, as well as new scrap sorting and blending technologies, we expect this next generation of alloys to provide automakers with ultra-low embodied CO2 material to drastically reduce the carbon footprint of their products.”

2023 DIARY

March 19th - 23rd TMS

The TMS Annual Meeting & Exhibition brings together more than 4,000 engineers, scientists, business leaders, and other professionals in the minerals, metals, and materials fields for a comprehensive, cross-disciplinary exchange of technical knowledge. Held in California, USA www.tms.org/ AnnualMeeting/TMS2023

30th March - 1st April METEF

Expo of customised technology for the aluminium, foundry castings & innovative metals industry. New opportunities for the downstream sector generated by the synergies between Metef and MECSPE. Held in Bologna, Italy www.metef.com/en/

MAY 10th - 12th Future Aluminium Forum

The Forum will return in a live format to Québec City, a region where the aluminium industry has existed for more than a century and is now seeing rapid change and collaboration between manufacturers, processors, suppliers and OEMs. Held in Québec City, Canada www. futurealuminiumforum. com/

16h - 18th

CRU: World Aluminium Conference 2023

The Conference will allow attendees to make valuable connections with industry peers and build their professional network in a business social environment. www.events.crugroup. com/aluminium

For a full listing visit www.aluminiumtoday.com/ events

Aluminium International Today

4

January/February 2023 NEWS

ST. LOUIS, MISSOURI, USA 800 325 7075 | www.gillespiepowers.com | 314 423 9460 ✓SINGLE CHAMBER / MULTI CHAMBER FURNACES ✓SCRAP DECOATING SYSTEMS ✓TILTING ROTARY MELTING FURNACES ✓SCRAP CHARGING MACHINES ✓LAUNDER SYSTEMS ✓CASTING / HOLDING FURNACES ✓HOMOGENIZING OVENS ✓COOLERS ✓SOW PRE-HEATERS ✓REPAIR & ALTERATIONS

GLAMAMaschinenbauGmbH Headquarters: Hornstraße19 D-45964Gladbeck/Germany Fon:+49(0)204397380 Fax:+49(0)2043973850 email:info@glama.de glama.de Costeffectiveheavyduty mobileequipment foraluminiumindustries... always thedurable solution GLAMAUSAInc. 60HelwigSt.,Berea,Ohio44017 Fon:+18774526266 Email:sales@glama-us.com

The energy crisis

Challenges and chances for the European aluminium industry

Interview with Emilio Braghi – Executive Vice President, Novelis Inc. & President, Novelis Europe – on the current energy situation for the European aluminium industry and the company´s approach to navigating through the storm.

Mr Braghi, how do you assess the current energy crisis? How is Novelis affected?

Novelis, as one of the world’s largest aluminium recyclers, is less dependent on electricity than primary aluminium producers, who consume a lot of power in the electrolysis process. By leveraging recycling, we contribute to reduce our energy needs. Recycling saves 95% of energy and up to around the same amount of carbon emissions compared

to primary aluminium production. However, to recycle and further process aluminium, we do need a stable supply of natural gas and electricity at affordable prices and therefore we are also impacted by the energy price escalation.

The high levels of energy prices coming with this extreme volatility is clearly something which is not sustainable for the European industry in the long-term, so we need to find a solution. I believe

that the energy market will rebalance, and it’ll probably take 18 to 24 months to see prices stabilising at a more normal level. But it’s very important for the aluminium industry in Europe and in general for the overall European manufacturing industry to get back into a situation where energy prices are more affordable and enable the industry to remain competitive with other regions, also to prevent relocations.

Is this a real threat to the industry´s future in Europe – and to the company you are heading?

There definitely is a threat for the industries in Europe as the cost increases for operations are substantial. We already see the impacts in the market – for the aluminium industry and other energy intensive sectors. The true extent of the damage will depend on how long energy prices will remain at these exceptionally high levels and volatility

and if government programs can help secure the financial sustainability and international competitiveness of European companies.

Don´t forget the market dynamics following this energy crisis, which came on top of the production backlogs and supply chain challenges following Covid. Macroeconomic and geopolitical risks remain elevated, and we will need to navigate a challenging couple of quarters ahead as inflationary impacts intensify.

Although the macro-economic environment is uncertain, we believe long-term demand for sustainable, lightweight and infinitely recyclable aluminium products will persist. As such, we remain committed to our transformational capital investment strategy, investing in new rolling and recycling capacity and capabilities to grow with our customers, and we will continue to progress these activities in a disciplined, paced manner.

ENERGY 7 Aluminium International Today January/February 2023

Emilio Braghi, Executive Vice President, Novelis Inc. and President, Novelis Europe

You mentioned government programs. Which EU programs are you referring to and to what extent is the aluminium sector benefitting from these?

Within Europe, there are differences from country to country in terms of the support received by the industry. French producers for example benefit from an industry price for electricity, which was in place already before the energy crisis, and measures to reduce the price of gas and electricity. Spain and Portugal have also implemented very early support programs with approval of the European

The European Union has been working on a price capping mechanism applying to all Member states. Do you support this proposed Market Correction Mechanism? I highly support the launch of such initiatives – even more than that, I think they´re indispensable. The idea of limiting excessive European gas prices when they are unrelated to global price spikes is an effective way to secure international competitiveness. The price level of EUR 275/MWh initially proposed was a signal in the wrong direction. With EUR 180/ MWh we have now come to a level which is avoiding extreme peaks –however, it is still a multiple of the pre-crisis prices and does not ensure the competitiveness of the European industry in my opinion.

So how should a Governmental protection shield look like? Programs with the power to effectively protect the industry will need to restore costs to a level that enables the industry to run sustainable businesses in Europe – taking into account the competition in other regions of the world and still making our region attractive for exporters of natural gas. They should not impact hedging contracts or be linked to the requirement to demonstrate a negative EBITDA. And of course, they should be in place for a long enough duration to enable plannability and predictability.

Commission.

To avoid distortions of the competition within Europe, a Europe-wide solution would be preferrable, including a cap on the price of gas which enables the industry to run sustainable businesses in Europe, decoupling the electricity price from the price of gas, and the acceleration of investments in renewable energy.

Given that there is currently no EUwide cap on the price of gas at a level the industry needs, we welcome the measures taken at national level such as the protective shield that Germany is

putting in place for tackling both the gas price and the electricity price. However, it is important to note that we are talking about a gas price cap at 7ct/kWh, and an electricity price cap at 13ct/kWh. Both price caps still are at a multiple of the pre-crisis levels and only apply to 70% of the consumption.

In addition, various restrictions, conditions and upper limits apply which may dilute the effect of the price caps. The situation will thus remain extremely challenging for the industry, also in Germany.

So, are your sustainability projects slipping more and more into the focus of cost saving instead of a strong purpose?

No, definitely not. Novelis is driven by its strong purpose of shaping a sustainable world together. We made environmental and social sustainability the core of our business strategy and daily actions already 11 years ago. It might seem that the news on the current geopolitical situation and its impact on the markets is taking precedence over the political

Which measures are you taking within your company to mitigate the risks the energy crisis brings?

We are currently reviewing all appropriate measures to minimise the impact of the energy crisis on our business and discussing with our customers and suppliers how to manage the situation going forward.

We are in general saving electricity and gas in our processes wherever possible, aiming to accelerate the achievement of our set goal: 10% reduction of energy intensity by 2026. As we know that every continuous improvement project is based on accurate measuring before developing and implementing sustainable improvement action, we started to focus on detailed tracking of energy consumption per machine center.

In addition, we have filed two projects in Europe to build onsite solar parks close to our plants – reducing the amount of energy we are taking out of the national grid and with that of course further increasing our independency from the energy market.

debate on the need for carbon neutrality – but the need for decarbonizing our operations and our daily life is in no way diminished.

Our Novelis sustainability strategy is clear, we hold on to our ambitious carbon footprint reduction targets. We aim at a reduction of 30% by 2026 and being carbon neutral by 2050.

Moreover, we’re pushing hard on circularity. It’s not only about carbon footprint reduction – our offering and concept on aluminium is really to bring

the material back into the production loop at the end of the products life, again and again.

The difference that the current situation of energy crisis brings to our sustainability journey – and I tend to be optimistic on that side – is a chance to accelerate the transition to renewable energy in Europe, combined with an increased focus on the need to reduce energy consumption –for which our core business of recycling aluminium contributes dramatically.

Aluminium International Today January/February 2023 ENERGY 8

Novelis recycles more than 80 billion used beverage cans annually and runs the largest and technologically most advanced aluminium recycling plant in the world where up to 400,000 tonnes of aluminium scrap can be processed every year.

Novelis PAE Centr’Alp BP 24 38341 Voreppe Cedex, France Tel +33 4 76 57 87 00 Fax +33 4 76 56 65 39 pae.marketing@novelis.adityabirla.com www.novelispae.com ALPUR® G3-2R degassing unit Meet us at GIFA 2023 Germany

You already talked about your focus on recycling and projects to increase onsite renewable energy generation – any other energy saving project you can tell us about?

We pursue a holistic approach to increase energy efficiency in our plants –in general and even more in the current situation. Heat recovery is one of the topics we are looking into rolling out more broadly, which means finding

And what does the future hold for Novelis?

Aluminium is the ideal material for circularity. We are a committed business partner to our customers, who are increasingly demanding sustainable aluminium products. To meet this growing demand, Novelis has begun

ways to reuse the waste heat coming from our furnaces. In general, half of our natural gas consumption goes into the aluminium melting process. So, this is definitely an aspect where we can and must make a difference.

We have established an energy ecosystem in our Sierre plant in Switzerland to share waste energy with the surrounding community. It´s running already but we will continue to increase

a multi-year, transformational organic growth investment period to further strengthen our position as the global leader in low-carbon and innovative aluminium solutions. The next 18 to 24 months will be challenging, and we may need to pace some of the capital spending and prioritize growth investments that

the amount of shared energy in the next weeks and months. Other energy recovery systems are established in our Koblenz plant and at our Joint Venture Alunorf in Germany. Moreover, we are planning to engage in pilot projects to test alternative energy sources, such as plasma and hydrogen – just to name some initiatives besides the mentioned onsite renewable energy generation.

are aimed at meeting strong demand and that help us, and our customers, to achieve ambitious sustainability goals. But our long-term view on aluminium is not changing – demand and industry will continue to grow.

Novelis is a global leader in the production of innovative aluminium products and solutions and the world’s largest recycler of aluminium. With the ambition to be the leading provider of low-carbon, sustainable aluminium solutions and to achieve a fully circular economy, the company is partnering with suppliers, as well as our customers in the aerospace, automotive, beverage can and specialties industries throughout North America, Europe, Asia and South America.

Aluminium International Today January/February 2023 ENERGY 10

Stub Heaters for Primary Aluminium Production • Supports all Anode Stub Layouts • Guard Plates to Increase Coil Durability • For Drying and Heating Pre-Straightening • Efficient Heating Reducing Downtime • Tailored to Stub Diameter and Material • Further Customisability for the End User Call +44 (0)1256 335 533 Email: info@inductothermhw.co.uk www.inductothermhw.com AIT 2020 AD 5.indd 1 18/12/2019 10:01:26

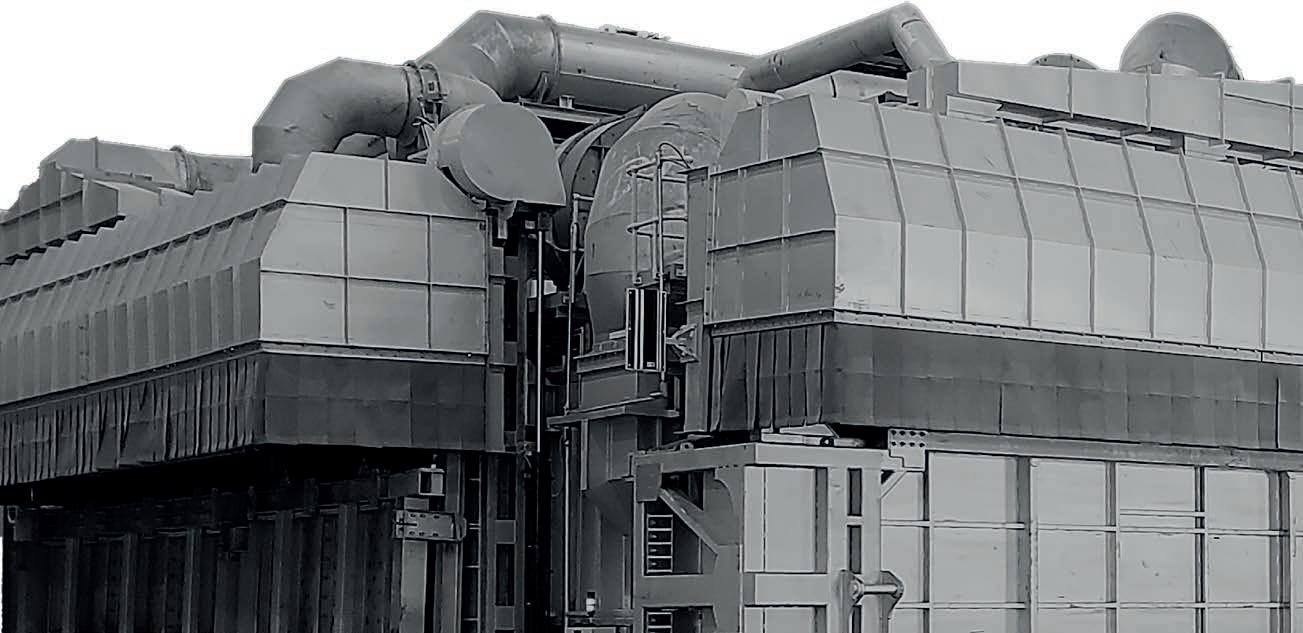

Electrolysis and Environmental Solutions

Offering a unique combination of know-how, state of the art and proven technologies we stand ready to help our clients with their metal production and environmental concerns. With a culture of innovation we also support them in their emission control.

TOGETHER TOWARDS PERFORMANCE

Carbon Area

Our carbon area plant solutions and technologies are designed for excellent reliability and availability. We can provide a complete range of technologies and process solutions in both greenfield and brownfield project environment.

Port Area

From incoming material delivery, to conveying, storage and transport to the smelter, we have been supporting the Aluminium Industry with premium solutions for decades.

Casthouse

REEL international is a leader in the design, fabrication, and supply of casthouse equipment for today’s highly competitive and quality-driven Aluminium Industry.

www.reelinternational.com

Aluminium’s infinite recyclability is the key to a circular economy

Cutting carbon emissions has risen from being an activist issue to an issue on the top of the agenda for politicians, regulators, investors, consumers and society as a whole. Here is how recycling can be an important contributor to achieving a low emission world. By Ingrid Guddal*, and Jean-Marc Moulin**

The 2021 United Nations Climate Change Conference (COP26) concluded with a warning and a heightened sense of urgency to mitigate the consequences of climate change. The stresses on our planet have reached peak levels, with severe droughts, fiercer storms, heatwaves, and rising sea levels impacting all life but disproportionately affecting vulnerable communities. Responding to these challenges, we are witnessing a change in consumers’ preferences as they seek products with fewer adverse environmental impacts. This change is spurring the demand and production of low carbon materials.

Since aluminium came on the scene in 1825, about a billion tons have found its way into a multitude of goods in our lives: the beverage can in your hand, the window frame in your house, parts of that new car you’re driving – the list goes on. An astonishing fact is about 75% of it is still in use. Now, the challenge at hand is ensuring that aluminium is produced with low emissions and is being recycled at the end of its use. Like all industries,

the aluminium industry must work to implement radical solutions for carbon emissions to alleviate threatening climate consequences.

There are few metals stronger, more durable, or more useful than aluminium and recycling it only requires 5% of the energy used to produce primary aluminium. Unlike competing materials, aluminium does not lose any of its unique properties in the recycling process. But

not all recycled aluminium is equal. Much of the scrap generated in the production process of aluminium is already recycled today. To accelerate emission cuts, we need to dramatically increase the use of postconsumer scrap, keeping this material out of the landfill and in productive use.

As the leader in U.S. aluminiium sustainability, Hydro has recently made significant capital investments to drive the green transition in North America through

Aluminium International Today January/February 2023 CIRCULAR ECONOMY 12

*Head of Recycling, Hydro Aluminum Metals **Director of Sustainability, Hydro Extruded Solutions

Hydro Cressona aerial view

Ingrid Guddal

increased use of post-consumer scrap and supporting the goals U.S. manufacturers set in the EV, transportation, and building and construction industries. We are building a $150 million state-of-the-art aluminium recycling plant in Cassopolis, Mich., with production commencing in Q4 2023. This facility will include equipment designed to specifically recycle large volumes of post-consumer scrap. In addition, the company has invested $15 million into our Henderson, Ky. facility to deliver certified recycled aluminium products to the automotive industry and further reduce the environmental impact from production. Hydro invested another $50 million into its extrusion plant in Cressona, Pa. to expand the site’s recycling capabilities, which include remelt and extrusion billet casting that produces a range of aluminium products. Another key capital investment that Hydro has made is a $27 million investment in our remelt facility in The Dalles, Ore. to enable Hydro’s use of post-consumer scrap consumption and further reduce the footprint of our extrusion solutions.

With each of these projects, customers will know where their aluminium is coming from. Transparent, accurate measuring and reporting of content is essential in ensuring that recycling aluminium can significantly contribute to a reduction in carbon emissions. Hydro is committed to being an industry leader in transparency with clear and accurate reporting on Scopes 1 through 3 for all of its products throughout the value chain.

Hydro’s ambition is to be the industry front-runner in reducing our environmental footprint by improving our performance in every aspect of the value chain. This includes research and development into new technologies, better ways of working, spreading best practices on low-carbon solutions, as well

as helping our customers reduce their footprints with product offerings and closed loop recycling solutions.

Measuring the outcomes of our sustainability initiatives against our ambitions and goals – and then making the appropriate adjustments to continually improve our outcomes – is also a critical component, and the main differentiator, in solidifying Hydro as the industry leader in sustainability. There is a vast difference between setting lofty goals and taking the necessary actions to achieve them.

But we cannot do it alone. Hydro has identified pragmatic outcomes, both in the short and long term, that support our mission in accelerating the transition to a more circular economy and help define the material impact of the industry’s sustainability efforts.

The short-term collective goals to drive circularity and lower carbon impacts include:

� Brands driving demand for greener materials based on consumer preferences and scrutiny.

� Growing recycled aluminium consumption with an anticipated annual growth rate of 5.4% from 2020-2030, compared to only 2.2% for primary aluminium.

� OEMs implementing requirements for easy disassembly for automotive components.

� Enacting stronger low-emissions policies and regulations as market forces alone will not ensure the use of lowcarbon materials.

According to the International Aluminium Institute, the global aluminium industry must slash greenhouse gas emissions by 77% by 2050 to meet climate-change goals, while demand for aluminium is due to grow by 80% to around 180 million tons of semi-fabricated products by 2050.

Over the longer term, we see several trends emerging:

� Demand for recycled aluminium overtaking demand for primary aluminium.

� Legislation paving the way for new production and consumption methods and practices.

� Recycling and reusing aluminium will create new ways of working in the supply chain and with partners.

� A design for circularity will be the standard and traceability will be a prerequisite.

Although current global efforts to slow climate change and create a more circular economy are promising, it is clear they will be insufficient without collective efforts. Manufacturers, like Hydro, are making large-scale, efficient investments into low-carbon materials and production processes. Aluminium is uniquely positioned, with its infinite recyclability, to play a key foundational role in a lower carbon future. By working together, and building on the momentum created by the industry, we can ensure we create deciding change and reach our collective climate ambitions.

�

CIRCULAR ECONOMY 13 Aluminium International Today January/February 2023

Jean-Marc Moulin

McKinsey’s Sustainable Materials Hub

To assist the industry on maintaining the sustainable standard we have achieved, McKinsey & Company ‘serve the majority of the world’s largest metals companies across a broad spectrum of topics, bringing a unique blend of industry, capability, and regional expertise’. To find out more, Zahra Awan* spoke with Patricia Bingoto ** and Anna Moore*** about the offerings from the McKinsey’s Sustainable Materials Hub.

The Sustainable Materials Hub is a resource presenting McKinsey’s perspectives on ‘green’ materials supply-demand and pricing outlook.

Looking into the definition of ‘Green’ Materials, Anna Moore listed a summary of requirements that need to be considered, including: “decarbonisation, reduce water usage, increase circularity, biodiversity and social responsibility.”

The Hub aims to encourage the collaboration of the producers and purchasers of materials against the challenge of decarbonisation and provide a roadmap for producers on how they can decarbonise. Ms Moore noted that “materials are about 20% of greenhouse gas emissions; we need to increase material supply in order to make the energy transition happen, therefore, the demand for materials is also expected to increase.” With the anticipation of this domino effect, transparency comes to the forefront of conversation. The Hub enables a level of transparency for companies adding a steppingstone to get

closer to our industry goal. One example of the Hub in use is in the EV industry and Original Equipment Manufacturers (OEM’s) and how they can source low carbon materials, as well as partner with the rest of the value chain to continue the chain of decarbonisation, following our inevitable falling domino trajectory with our own controlled version.

“If done correctly, the sustainability and the energy and materials transition can be one of the biggest economic growth drivers in our lifetimes. We estimate 9 to $12 trillion a year in green value pools.” –Anna Moore.

Decades of functional expertise

McKinsey’s Hub claims to have sourced “decades of expertise” to bulk out the hub’s knowledge. Patricia Bingoto spoke on how the company brought together aluminium perspectives.

“We have a dedicated team of people who only focus on building our assets; doing primary research, secondary research, talking to different experts, to

get a very solid view on what volumes should be supplied. We then translate this and provide our perspective on supply, demand, and costs along the value chain at a very granular level.”

Using this knowledge, the platform can then be tailored to individuals to provide clients with a full personalised roadmap. “We also have a full perspective on cradleto-gate emissions, so from mining until your ingot production, with the possibility of going a bit more downstream. And that’s where we do a bit of tailoring depending on who the clients are, because there’s no standard,” said Ms Bingoto.

Predictions for aluminium amidst the current climate

The climate crisis, the energy crisis, the geopolitical tension, and recession.

Patricia Bingoto named recession as the topic of conversation on aluminium demand reduction: “The current situation with the lower demand is obviously linked to the expected or announced economic recession, which I think Europe is feeling

Aluminium International Today January/February 2023 14

*Editorial Assistant, Aluminium International Today ** Senior Knowledge Expert at McKinsey *** Partner at McKinsey

CIRCULAR ECONOMY

Patricia Bingoto

Anna Moore

quite significantly.”

However, aluminium, especially the automotive sector, Ms Bingoto predicts, “is going to be supported by this transition [to electric vehicles and sustainable demand] as, by default, the industry becomes more aluminium intensive.” With consumers changing their demands, aluminium responds. Not only is the green transition fuelling the need for aluminium, but also a general growth pattern for the number of vehicles produced.

So, there is a conflict in the direction of aluminium. With recession we see decline, but with the nature of our material, there is upturn. The response of the industry to such uncertainty has been placed on hold.

“Demand from society. Are we going to walk back from the demand for great products now that we’re in a tougher economic situation?” – Anna Moore.

Ms Moore states: “Our view is this is a budget, not a run rate problem. We [the industry] need to accelerate investment. The regulatory environment continues to support movement towards decarbonisation; in our view, players who move faster and invest now will be those who capture green premia. There’s a short window of opportunity before more grain

capacity comes online, so we remain quite bullish on the outlook for sustainable materials.”

Future of Sustainability: Catalyst Zero

The industry has committed to decarbonising by 2050. Despite current challenges, it has become apparent that the industry will not let go of their sustainability goals.

Ms Bingoto defined ‘sustainable aluminium’:

“I would say there are three definitions. The first one is going to be just recycled aluminium. So that is the one that is achieving the lowest CO2 footprint. Then the second one is going to be what we call low carbon today, so less than four tonnes per tonne to something much greener at smelting level, almost zero and ideally covering the full value chain. The third is slightly different. Sustainability is not just CO2, I would say that even more important is Environment, Social and Governance (ESG). So, your sustainable aluminium at the end of the day is going to be one that is respectful of the ESG.”

ESG consideration is the basis of the majority of aluminium companies, with this becoming the forefront of the entire value chain, consistency of the quality of

aluminium can be maintained.

Anna Moore went on to define what Catalyst Zero is:

“As a firm we do a lot of sustainability work and transformation work. The intention of Catalyst Zero is to bring these together; we combine our deep knowledge of sustainability with our long track record of successfully serving clients on transformation initiatives to help them know the true end to end sustainability transformations and transparency into where carbon sits across their organisation.

A final message from the McKinsey Firm:

“Of course, the outlook looks very different commodity by commodity. But even while producers may be tempted in this environment to pause on their investment, we really do see that the window of opportunity closes by the end of this decade. And so, this time can be both good for the planet and hugely profitable for players across the aluminium value chain. But that requires being an early mover on investment.”

To conclude, a move in a time of great movement is the way that McKinsey encourages. �

Aluminium International Today January/February 2023 15 CIRCULAR ECONOMY

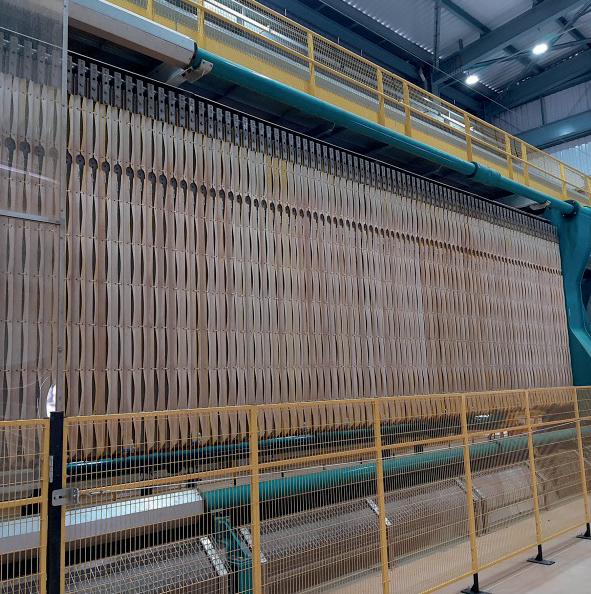

CARBON BAKING TECHNOLOGY The RIEDHAMMER anode baking facility is a key component in a modern anode production plant. Our plants offer many advantages such as: • Customised design • Excellent anode quality • Extended furnace lifetime • Low energy consumption • High productivity • Flexible equipment supply • Safe operation • RH maintenance strategy www.riedhammer.de DESIGN > MANAGEMENT > TURN-KEY PROJECTS

Rodabell T-PLATE: The highest proven lifetime among industry standards https://rodabell.com/ More Info: ventas@rodabell.com

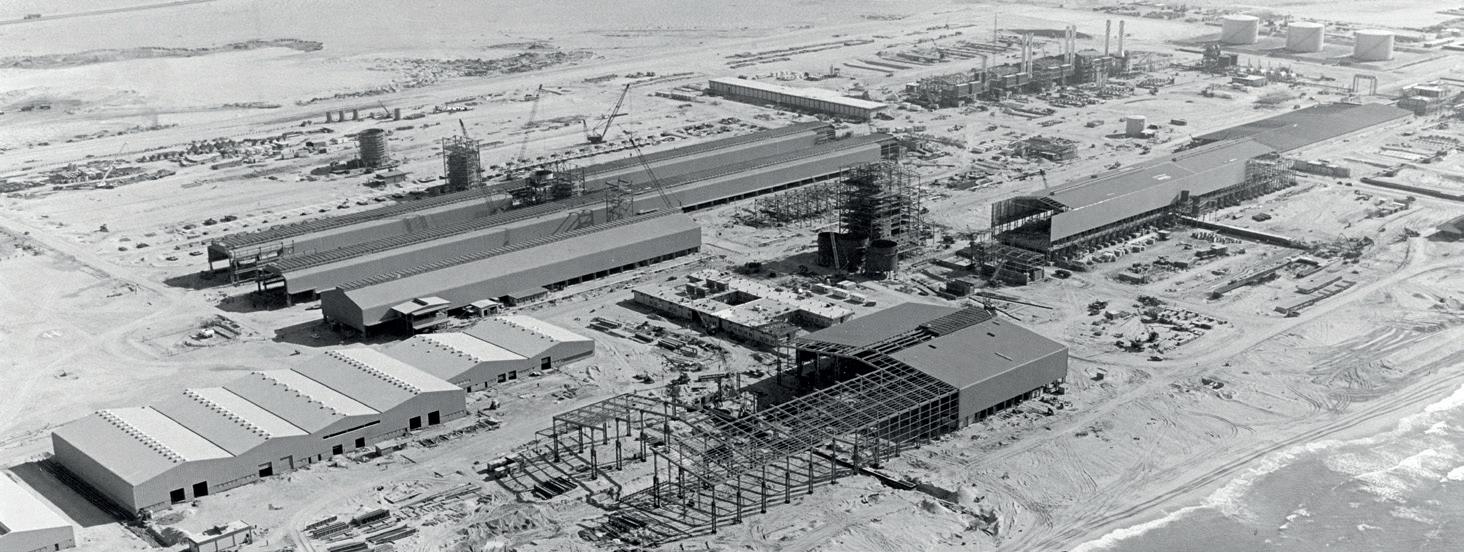

EGA: From small regional smelter to global giant

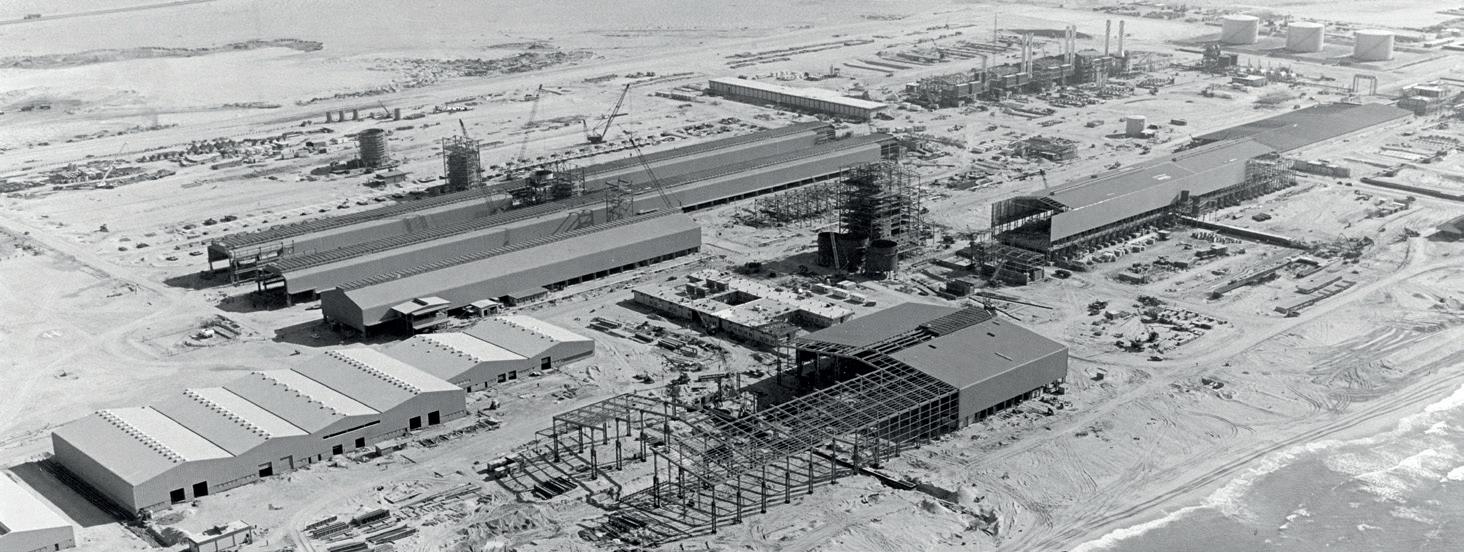

Emirates Global Aluminium (EGA) announced, at the end of 2022, that it had reached the milestone 40 million tonnes of hot metal since start-up in 1979. In just over 40 years, EGA has grown from a small regional smelter into a global integrated aluminium giant. Addressing EGA’s achievements and goals, Abdulnasser Bin Kalban* spoke with Zahra Awan** on EGA’s past, present and future.

1. EGA recently announced that it had reached the milestone of 40 million tonnes of hot metal produced since its start up in 1979. How has production changed from 1979 to 2022?

EGA began production as Dubai Aluminium in 1979. Jebel Ali was a small regional smelter with a capacity of 135 thousand tonnes per year. It took us almost 30 years to produce 10 million tonnes of metal – now we are doing that in less than four years, our mining subsidiary, the Gulf Aluminium Council (GAC), makes us one of the biggest merchant suppliers of bauxite in the world, and we produce well over 40 per cent of our own alumina requirements.

So, EGA’s story is certainly one of ambitious and accelerating growth over more than four decades, and it is my objective that we continue on that path. But I think even more important is how the way we work has changed. I want to give two examples.

The first is safety. When I look at photos of Dubai Aluminium from 1979, what is striking is that people are standing precariously next to unbarricaded heights, and no one is wearing proper

2. Sustainability is now a major topic of conversation; with COP27 being held in Egypt, the attention has turned to the Arab world. What is EGAs sustainable vision for the future? Where is EGA in this vision? Aluminium is an essential material for the development of a more sustainable society. For aluminium to reach its full potential to contribute to human progress, we must make the production of aluminium more sustainable. EGA’s goal is to be a global sustainability leader for the aluminium industry.

PPE – there were even some women employees in office clothes and high heels in the potlines!

Now, safety is our top priority. Over many years, we have invested in inherently safe equipment, our safety management system, and building a culture of safety across our organisation. The result is that our safety performance is significantly better than industry benchmarks. Today, we have a bold aspiration at EGA to eliminate the risk of harm, which is something that has never been achieved before by any company before but which we think we have a duty to future generations at EGA to strive for. The second thing I notice in those

1979 images is the aluminium smelting technology which we were using, which was bought from a technology provider. For more than 30 years now we have developed our own aluminium smelting technology in the UAE. We have used our own technology in every smelter development since the 1990s, and we have retrofitted all our older potlines. We have licensed this technology internationally, and now we are a leader in the global aluminium technology business.

We have a lot to be proud of in our history at EGA, and this gives us a great platform to achieve more in the future.

**

We are strong supporters of the Aluminium Stewardship Initiative (ASI), as the global ESG standard for our industry. We were the first company headquartered in our region to join, and the first to receive a site certification – for our Al Taweelah site. Jebel Ali is also now certified, and we are aiming to achieve the first certification in Guinea. I hope within the next year, and preferably sooner, all our production sites will be certified.

That will be a step towards our aim of producing only ASI-certified metal by

2030.

What is vital about ASI is that it considers all aspects of sustainability, but at EGA we do recognise the central challenge of climate change. Our nation was the first in the region to announce the intention of reaching net zero by 2050, and we are playing a key part in achieving that.

PRIMARY PRODUCTION 17 Aluminium International Today

* Chief Executive Officer, Emirates Global Aluminium

Editorial Assistant, Aluminium International Today

3. What methods of decarbonisation has EGA invested in to assist in the transition to sustainable production? What investments are we to expect?

We have developed a roadmap to net zero, and over the coming decades we must eliminate or offset all our greenhouse gas emissions.

Electricity generation accounts for around 60 per cent of the greenhouse gas emissions from the global aluminium industry, so that is our biggest opportunity and our current focus. We have announced a strategic initiative with TAQA, Dubal Holding and EWEC – all major UAE companies - to divest our natural gas-fired power plants and instead source electricity from the grid, including an increasing proportion of clean energy.

This initiative would unlock significant further development of solar power in Abu Dhabi, and enable EGA to vastly increase our production of CelestiAL solar aluminium. We became the first company in the world to produce aluminium commercially using the power of the sun in 2021, but this still

only accounts for a small proportion of our production today.

We also see great potential in recycling. We are working on a project to build the UAE’s largest recycling facility, with a capacity of 150 thousand tonnes of billet per year. This is just the beginning for us, and we are looking to develop recycling facilities in the UAE and around the world, including with our customers. Looking further ahead, we believe hydrogen may have the potential to replace natural gas as a vector for thermal energy, such as in our Casthouse furnaces and steam boilers, as well as for turbines. We are members of the UAE’s Hydrogen Leadership Coalition, enabling us to explore with others the technical and economic potential of hydrogen within the processes of aluminium production, as well as processes in our local supply chain.

You will also see us deploying our spending power more broadly in our supply chain. EGA was the first UAEheadquartered company to join the First Movers Coalition, a global grouping that aims to send a powerful demand signal to hard-to-abate sectors to decarbonise.

4. What are the greatest challenges that EGA expects to face in the short or mid-term?

I like the quote from John Adams, second President of the United States, who said “Every problem is an opportunity in disguise”. We all know the economic uncertainty that we face currently, and the broader goals we must reach as an industry in the longer term. During COVID-19 we took the opportunity to thoroughly review how we operate and do business at EGA, and we emerged even stronger from the pandemic because of this. I continue to see every challenge as an opportunity.

Contributing to the economy and opportunity in the countries where we

operate is a social aspect of sustainability and a priority for us at EGA.

In the UAE, we have a national strategy called Operation 300bn to more than double the size of the industrial sector over the next decade, and a campaign called Make it in the Emirates to support this. EGA has been making it in the Emirates since 1979.

We have a goal of doubling our absolute contribution to the national economy by 2040, and one way we will do this is by increasing local procurement. We spent some $1.7 billion last year in our UAE supply chain and we sell around 10 per cent of our metal production in the UAE to 26 local companies that make everything from window frames and car parts for local industries and export around the world.

EGA prioritises orders from local suppliers whenever they are competitive commercially and encourages international suppliers to establish facilities within the UAE. In addition, EGA works with Government and other stakeholders to enable the development of supply industries that do not yet exist in the country.

Of course, our goal extends to Guinea, where we believe the long-term future of the industry depends on growing the local supply chain to maximise the economic benefits of bauxite mining for the nation. We spent some $112 million with Guinean suppliers in 2021. One way we have achieved this is by developing a specialist training programme to help potential suppliers meet the quality and integrity standards we require.

Aluminium International Today January/February 2023 PRIMARY PRODUCTION 18

5. What is EGA’s approach to locallymade materials and products?

6. What is EGA’s goal for the future?

At EGA, we are driven by our purpose, which is ‘Together, innovating aluminium to make modern life possible’. These are not just words. We want the EGA employees in decades to come to look back on what we achieved in our generation and see that we fulfilled our purpose. That is why we have bold aspirations for what we will contribute to the world, the societies in which we operate, our people and our business.

These goals are ambitious, and I have talked about several of them already.

I have talked about decarbonisation – which is a fundamental challenge and a great opportunity. Our growth will be in low carbon and recycling over the decades ahead, and that will be transformative.

I have talked about doubling our economic impact, which we will achieve through our own growth, further localising our supply chain, and further localising our workforce. I have talked about safety and eliminating the risk of harm. I want to mention two other bold aspirations we have.

The first, is being the partner of choice for our customers. Serving our customers well has always been a source of competitive advantage and pride at EGA – three-quarters of our customers have bought our metal for at least 10 years. Even deeper partnerships will enable us to serve our customers better, while sharing data and insights will enable us to manufacture our products in a more cost effective way. Together with our customers, we aim to increase the use of aluminium which will be good for our businesses and the world.

And second, I want to mention gender diversity, which is a challenge for our industry in many parts of the world and something very close to my heart. As a business leader, I recognise that diverse organisations are stronger and perform better. As the father of four daughters, I know it is also the right thing to do for our people and society. We have short-term targets to significantly increase the number of women in our workforce, and I am determined that this is just the beginning.

PRIMARY PRODUCTION 19 January/February 2023

Britain’s Global Aluminium Leaders Since 1973

www.mechatherm.com

Aluminium Industry in Brazil

By Richard McDonough*

Brazil is one of the key countries globally when it comes to bauxite mining, production of alumina, and primary aluminium manufacturing. According to a statement from the Ministry of Mines and Energy of Brazil, using data from the Associação Brasileira do Alumínio (ABAL – the Brazilian Aluminium Association), Brazil is the fourth largest producer of bauxite, the third largest producer of alumina, and the fifteenth largest producer of primary aluminium in the world.

The specifics detailed in the statement from the Ministry of Mines and Energy of Brazil: “Brazil is the fifteenth producer of primary aluminium, preceded by China, Russia, India, Canada, United Arab Emirates, Australia, Bahrain, Vietnam, Norway, United States (USA), Saudi Arabia, Malaysia, Iceland and South Africa; fourth producer of bauxite, behind Australia, Guinea and China; and third producer of alumina, behind China and Australia.”

In 2021, Brazil produced 771.7 thousand tonnes of primary aluminium, according to the statement. Alumina production in 2020 was 10.2 million tonnes, whilst bauxite production in 2020 was 32.9 million tonnes.

“More than 80% of aluminium ores in the country are extracted in Serra do Oriximiná in the state of Pará, which has the highest mineral concentration in Brazil, followed by Minas Gerais,” according to a statement from the Government of Brazil issued on 12 August 2022. “In 2021, Brazilian exports of bauxite and aluminium reached (US) $2.9 billion, about 2.5% of our total exports.”

The United States Geological Survey (USGS) reported that Brazil contains the fourth largest reserves of bauxite in the world. This report, issued in January of 2021, indicated that Brazil had 2.7 billion tonnes of bauxite in reserves. Only Australia and Guinea, according to the USGS, have larger reserves of bauxite.

According to a statement from the International Aluminium Institute, “90% of the world’s bauxite reserves are concentrated in tropical and sub-tropical regions.”

“Brazil is also proud to be a world leader in aluminium recycling,” concluded the statement from the Government of Brazil dated 12 August 2022. “Today, thanks to solid environmental legislation, 97% of aluminium consumed in our country is recycled.”

In a report issued by the International Aluminium Institute in May of 2021, nearly 27,000 people were employed in the upstream sectors of the aluminium industry (including secondary aluminium production) in Brazil in 2019. Among all countries surveyed, Brazil was the nation with the third largest employment base in the aluminium industry; only China and India had larger numbers of people working in their aluminium industries. According to the International Aluminium Institute, “The upstream sector of this study accounts for the aluminium industry’s bauxite mining, refining, and smelting processes.”

Norsk Hydro Norsk Hydro (Hydro) is one of the global

companies operating in each of the major sectors of the aluminium industry in Brazil; the company reported that it employs more than 6,100 employees at 11 locations in Brazil.

This company, headquartered in Norway, includes bauxite mining operations at Mineração Paragominas in Paragominas, Pará; Hydro also has a 5% ownership stake in Mineração Rio do Norte (MRN).

Bauxite from Mineração Paragominas and from MRN is utilised to produce alumina at Hydro’s Alunorte refinery. The firm indicated that this refinery is “the world’s largest alumina refinery outside China”; the refinery is located in Barcarena, Pará.

Alumina is used by Hydro to produce primary aluminium at Albras. The firm indicated that “Albras is the largest producer of primary aluminium in Brazil, and has been feeding domestic and external markets with high purity ingots since 1985. Hydro is the company’s main shareholder, with 51% of the shares in this joint venture. The other shareholder is NAAC – Nippon Amazon Aluminum Co. Ltd., formed by a consortium of Japanese companies, trading companies, consumers and manufacturers of aluminium products.”

Alcoa

Headquartered in the USA, Alcoa has major aluminium operations in Brazil. In a news release on 8 September 2022, Alcoa announced that all of its operating locations in Brazil have received certification from the Aluminium

THE ALUMINA CHRONICLES 21 Aluminium International Today January/February 2023

The Brazilian flag is in the foreground. In the background of this photograph is the Christ The Redeemer Statue atop Mount Corcovado in Rio de Janeiro. (The photograph was provided courtesy of Beatriz Marques through Pixabay, 10 June 2013.)

Your

* Do you have questions about the aluminium industry? Governmental regulations? Company operations?

questions may be used in a future news column. Contact Richard McDonough at aluminachronicles@gmail.com. © 2023 Richard McDonough

A. Hydro produces alumina at its Alunorte Alumina Refinery in Barcarena, Pará, Brazil.

(The photograph was produced by João Ramid and provided courtesy of Hydro, 22 July 2013.)

B. Claudiane Miranda, an electrician with Hydro, was seen here at a bauxite mine in Paragominas, Pará, Brazil.

(The photograph was provided courtesy of Hydro, 20 February 2020.)

C. Hydro mines bauxite in Paragominas, Brazil.

(The photograph was produced by Halvor Molland and provided courtesy of Hydro, 12 August 2010.)

Stewardship Initiative (ASI); the most recent one noted was its Poços de Caldas operations.

“Founded in 1965, the Poços de Caldas site was Alcoa’s first venture in Brazil,” detailed this news statement from Alcoa. “It includes a bauxite mine, alumina refinery, and aluminium casthouse, all of which passed the required assessments to earn ASI’s certification to the Performance Standard. In addition, the Poços de Caldas location is the company’s sole producer of aluminium powder that can be used in a variety of industrial applications.”

“This certification marks an important milestone in our efforts to ensure that all of our Brazilian operations adhere to the highest sustainability standards,” said Otavio Carvalheira, Alcoa’s President of Brazil and Vice President of Operations. “It demonstrates our commitment to our stakeholders that we always strive to operate safely, with protection of the environment and respect for people, and to produce products that will create a more sustainable future.”

Alcoa noted that the ASI Certification programme is the most comprehensive in the aluminium industry, applicable to both upstream producers and downstream manufacturers.

“ASI warmly congratulates Alcoa on achieving Performance Standard Certification at its Poços de Caldas operations,” said Fiona Solomon, ASI’s Chief Executive Officer. “Sustainability is an ongoing journey that constantly challenges companies to improve and adapt.”

Globalisation is considered by some to have negative consequences for local communities. One example of where activities in one country are being utilised to help enhance life in another country can be seen through actions by Alcoa.

“Now operating on two continents, Alcoa has successfully completed the installation of press filtration technology

for bauxite residue at our Poços de Caldas refinery in Brazil, further leveraging technology that Alcoa first adapted in Australia,” according to a news statement issued on 18 November 2022.

“Construction of the press filtration facility in Brazil began in late 2021. Today, all of the refinery’s bauxite residue is now being processed through the filter system to

yield dry waste. The team worked more than 800,000 hours throughout the span of the project without a safety incident.”

“We’re so proud of our team and the work to achieve our corporate vision to reinvent the aluminium industry for a more sustainable future,” said Fabio Martins, Manager of the Poços de Caldas refinery. “As we bring this technology online,

1.

Aluminium International Today January/February 2023 THE ALUMINA CHRONICLES 22

An aerial photo of the construction underway as the residue filtration facility was being built at the Alcoa refinery in Poços de Caldas in Minas Gerais, Brazil. (The photograph was provided courtesy of Alcoa, 10 February 2022.)

A B C 2 1

we’re marking a new era of innovation and sustainability for Alcoa in Brazil. In addition to the innovation in the process, the installation of the filtration plant will reduce carbon emissions, due to the lower use of disposal area, lower water accumulation and, consequently, lower energy consumption in the process.”

This news statement noted that “The press filtration plant is the first for Alcoa in Brazil, allowing our facility to use less water to process the residue and less land to store it. Alcoa first adapted the filtration technology to the treatment of bauxite residue at the Kwinana and Pinjarra refineries in Western Australia. Those two refineries have the annual capability to reduce their freshwater use by a collective 2.2 gigalitres (581 million gallons), the equivalent amount of water needed to fill 880 Olympic-sized swimming pools.”

“The filtration plant processes the residue, which is primarily composed of red mud and coarse sand,” the news statement continued. “The residue is pumped into the filter, where plates compact it, removing approximately 70 percent of the moisture. The recovered water is then returned to the refinery’s production process through a closed circuit. The waste that remains is like the moisture content in soil, which is then transported by trucks to a new dry disposal area for further compacting.”

In an earlier news statement issued by Alcoa on 10 February 2022, Brad Klopper, Global Residue Filtration Technology Manager at Alcoa, explained that “This innovative technology allows us to improve our business in a number of different aspects. The geotechnical stability of our ...[residential areas has] improved. We reduce our land use, and we significantly reduce our freshwater usage.”

Alcoa noted that traditionally, bauxite residue is sent to drying areas as a slurry

and then dries in the sun. “Now, with filtration,” Klopper said, “we remove the moisture from the cake and significantly reduce our freshwater usage. In the drying climate of Western Australia, that is a major, positive operational impact.”

On 16 August 2022, Alcoa released a news statement that indicated that testing had begun of the press filtration technology project at Poços de Caldas on 1 August 2022.

“The beginning of the Filter Press operation tests was a very emotional moment for all of us at Alcoa, direct and indirect employees,” highlighted Mr. Martins, in a translation of the news statement issued in Portuguese into English. “The Press Filter is our most important project. In addition to ensuring the continuity of our operations, it meets the Company’s requirements regarding waste disposal and the State Legislation on Dam Safety and allows us to continue advancing in a sustainable way and increasingly reinventing the aluminium industry.”

The news statement, again translated from Portuguese into English, indicated that this filtration project was implemented with an investment of (BRL) 330 million; this amount was approximately (US) $60.6 million.

This global enterprise indicated that it “…has a global goal to reduce global bauxite residue land requirements per metric tonne of alumina produced by 15% by 2030, from a 2015 baseline. Alcoa continues to build partnerships focused on developing innovative pathways for bauxite residue re-use, turning the waste product into a resource. Other examples include using the residue as a material for low-carbon cement as well as transforming it into a soil-like substance.”

On 20 April 2022, Alcoa issued its financial results for the First Quarter 2022.

In that statement, the company noted that “In the first quarter, Alcoa signed an agreement to sell its entire stake in MRN in Brazil to South32 for $10 million with the potential for future contingent payments up to $30 million…Alcoa’s decision to divest its ownership interest is based on sufficient bauxite supplies across its global system, including from the Juruti mine in Brazil.”

South32

This acquisition of Alcoa’s 18.2% ownership stake in MRN, according to a statement from South32, was completed on 29 April 2022, “…further aligning our bauxite supply requirements within our aluminium value chain in Brazil.”

“The acquisition takes our ownership of the mine to 33 per cent and secures the bauxite requirements for our integrated aluminium supply chain in Brazil,” noted a statement on 2 May 2022 from South32.

“The acquisition of an increased interest in MRN is also an important step as we work with our joint venture partners to complete a pre-feasibility study for the MRN life extension project, potentially extending the life of the mine by more than 20 years.”

Headquartered in Australia, South32 describes its business operations as “…a globally diversified mining and metals company. Our purpose is to make a difference by developing partners to realise the potential of their resources. We produce commodities including bauxite, alumina, aluminium, copper, silver, lead, zinc, nickel, metallurgical coal and manganese from our operations in Australia, Southern Africa, and South America.”

In addition to its expanded interests in MRN acquired from Alcoa, South32 also shares ownership with Alcoa in other aluminium operations in Brazil.

During 2022, the two companies worked to restart their jointly owned Alumar smelter in São Luis, Maranhão. Alcoa owns the majority of the smelting and casting capacity at this facility; South32 holds the remaining interest. The smelter had been “on care and maintenance since 2015.”

“The restart of Alumar will build on our competitive strengths in the global and local marketplace and expand our ability to supply growing demand for sustainably-sourced aluminium,” said John Slaven, Executive Vice President and Chief Operating Officer at Alcoa in a statement issued by Alcoa on 1 July 2022. “We’re proud of the positive impact the restart will bring to our customers, investors, employees, and community stakeholders in Brazil’s Maranhão state.”

THE ALUMINA CHRONICLES 23 Aluminium International Today January/February 2023

These three photographs (2 - 3 - 4) are of the bauxite residue filtration project at Poços de Caldas in Minas Gerais, Brazil. (The photographs were provided courtesy of Alcoa,16 August 2022.)

3 4

Mineração Rio do Norte (MRN)

Beyond Alcoa, Mineração Rio do Norte (MRN) also received certification from ASI in 2022. The firm detailed in a statement dated 3 February 2022 that it was honoured to be recognised by ASI: “The ASI Performance Standard establishes 59 principles to meet the three foundations of sustainability, which are: Environment, Social and Governance. In all these dimensions, key issues such as biodiversity, leadership, management policies, transparency, water resources, commitments to indigenous peoples, human/labour rights and greenhouse gas emissions, among others, are addressed.”

Leadership at MRN explained that securing this ASI certification “…was a great challenge.”

“We attribute this achievement to all the employees who are part of MRN, who committed themselves together with their teams and dedicated themselves to improving processes that are already part of our work routine and reinforce the commitment to the sustainability of our operations,” stated Vladimir Moreira, Director of Sustainability at MRN.

Fiona Solomon of the ASI stated that “We warmly congratulate MRN on achieving ASI Standard Performance Certification at its Porto Trombetas operations. Whilst the significant focus in the aluminium sector is currently on GHG emissions, bauxite mining has also been in the spotlight on important ESG issues, including indigenous peoples’ rights, impact on local communities, pollution control, biodiversity management and proper post-mining rehabilitation, among others. These are all key parts of the ASI Performance Standard.”

Guido Germani, Chief Executive Officer of MRN, stated that “the ASI certification is an important achievement, as it attests to the market and society the company’s commitment to sustainable bauxite production. We are in the middle of the Amazon, inside a national forest,

and the constant search for responsible bauxite production becomes even more significant. This must be in line with MRN’s values, which focus on respect for sustainability, safety, health and, above all, people. Certification in the ASI standard is part of this commitment: to foster legacy-focused development for future generations.”

MRN is a privately-held corporation, made up of five shareholder companies. In addition to the aforementioned 33% ownership interest held by South32 and the 5% ownership stake held by Hydro, other owners of MRN include Vale, 40%; Rio Tinto, 12%; and Companhia Brasileira de Alumínio (CBA), 10%.

According to a statement from MRN, “A large part of the bauxite processed by MRN remains in Brazil, where it is transformed into alumina and metallic aluminium by other industries in Pará and Maranhão. The remainder of production is exported to countries in North America, Europe, and Asia. Ships that leave Porto Trombetas stocked sail hundreds of kilometers along the Amazonian rivers until they reach the Atlantic Ocean.”

Companhia Brasileira de Alumínio (CBA)

One of the major aluminium companies operating in Brazil also has its headquarters in the country. Headquartered in São Paulo, São Paulo, Companhia Brasileira de Alumínio (CBA) announced on 16 November 2022 that it was launching Alennium, described by the firm as “…a label certifying the company’s aluminium as low carbon. The new label will make it easier for consumers to identify lowemissions products that are helping to build a more sustainable world for the next millennium.”

Founded in 1955, CBA describes its business as “…a vertically integrated producer, from cradle to gate, including recycling. With renewable generation capacity for 100% of its

energy requirement, CBA provides sustainable solutions for the packaging, transportation, automotive, building and construction, energy and consumer goods sectors, as well as leading the recycling of industrial aluminium scrap.”

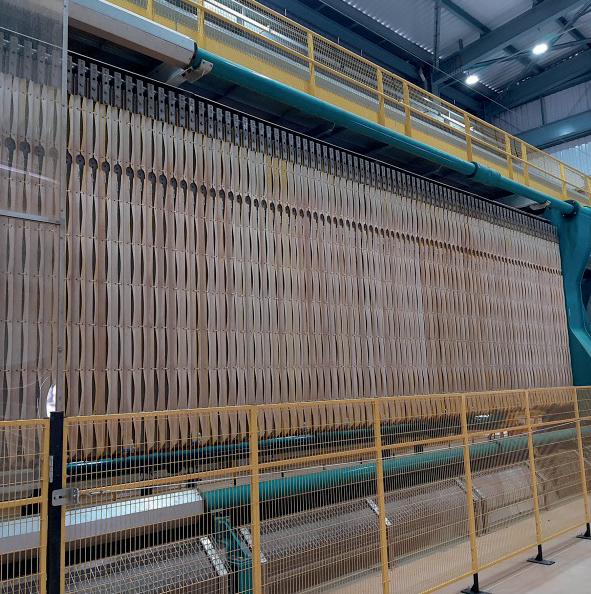

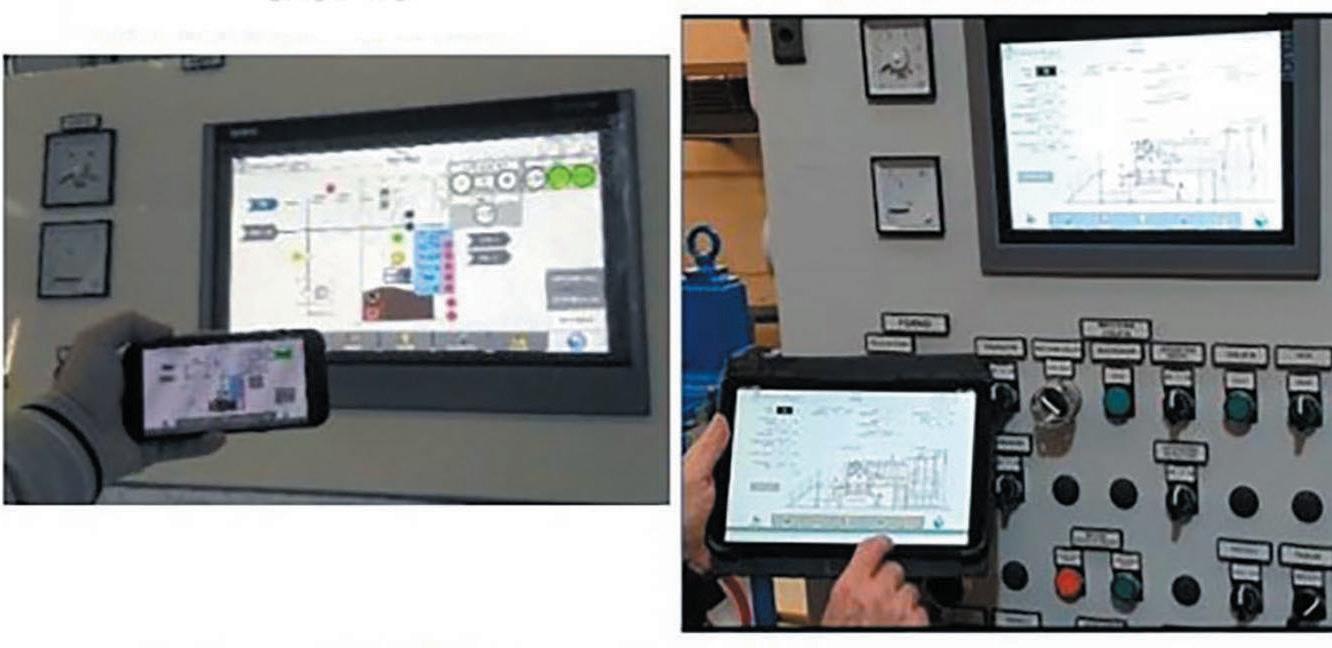

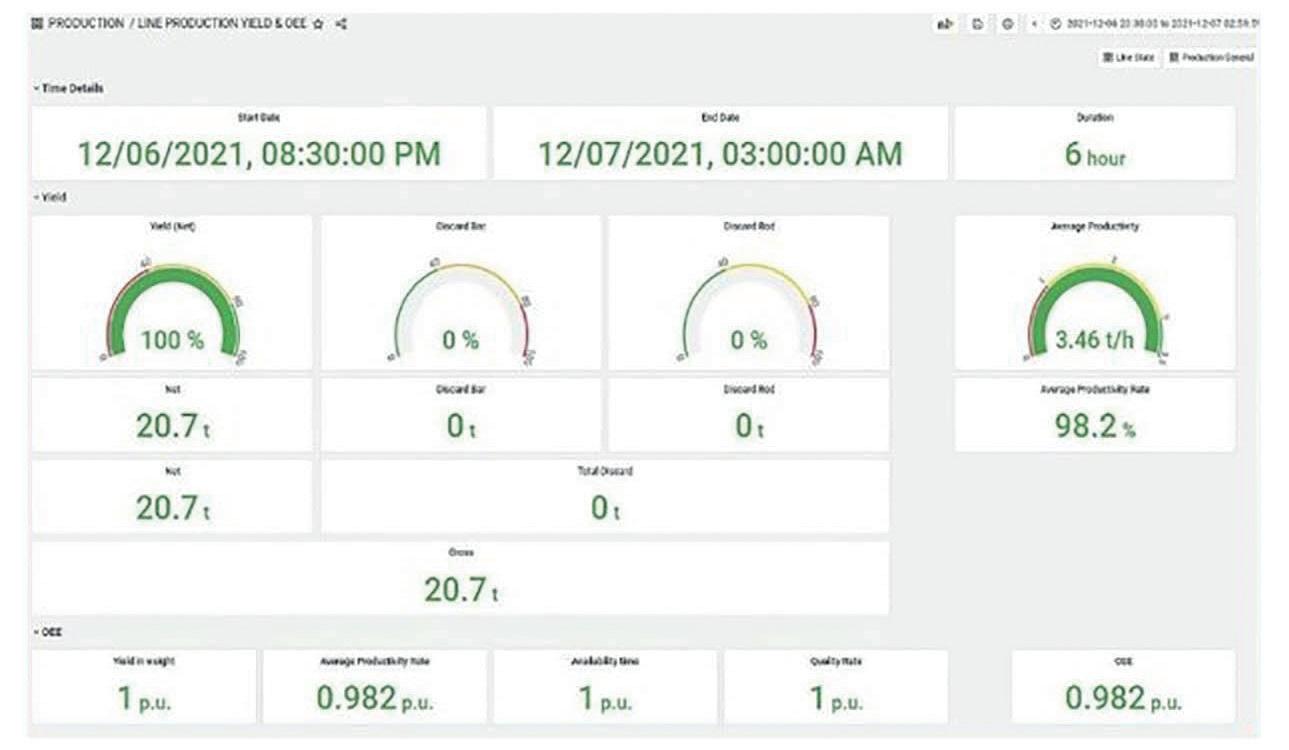

According to CBA, it “…produces aluminium with fully renewable energy, and emits just 2.56 tonnes of CO2 equivalent per tonne of aluminium at the smelting stage, where primary aluminium is produced—in contrast, the global average is 12.8 tonnes of CO2 equivalent per tonne of aluminium, according to the International Aluminium Institute (IAI). Our annual emissions inventories, which we use to calculate the emissions content in Alennium-labeled products, are developed using the GHG Protocol [Greenhouse Gas Protocol] and are third party-verified.”