Solutions for a sustainable casting process precimeter.com INDUSTRY NEWS WOMEN WITH METAL HYDROGEN FOCUS www.aluminiumtoday.com March/April —Vol.37 No.2 THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING THE DIGITAL MINE

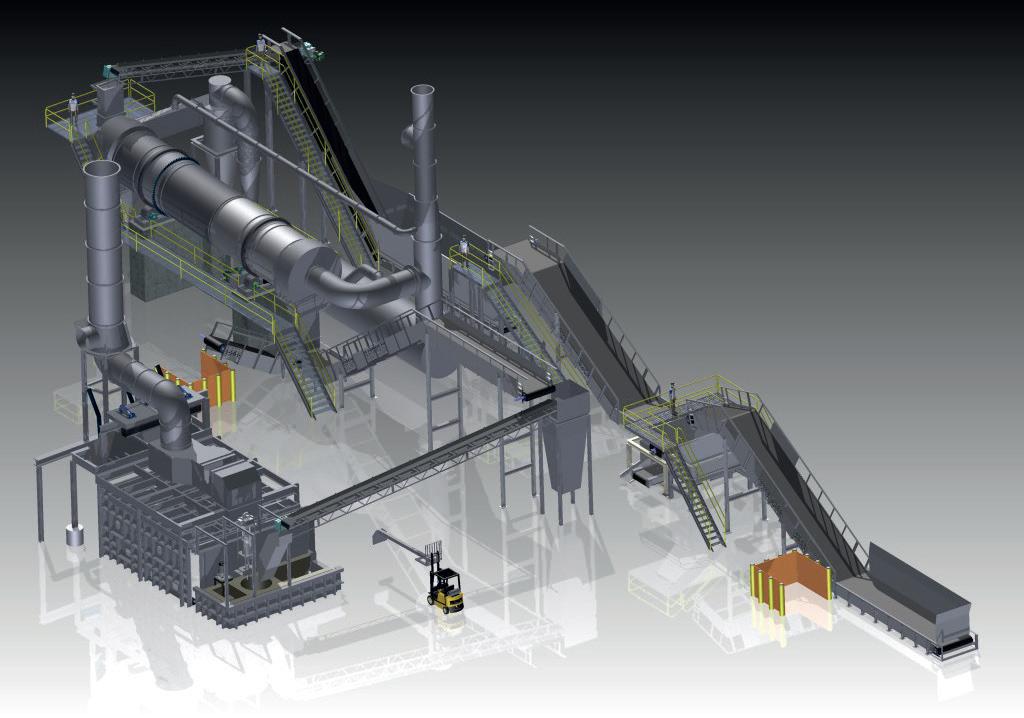

OVER YEARS EXPERIENCE IN THE ALUMINUM MELTING INDUSTRY SINGLE CHAMBER/MULTI CHAMBER FURNACES SCRAP DECOATING SYSTEMS TILTING ROTARY MELTING FURNACES SCRAP CHARGING MACHINES LAUNDER SYSTEMS CASTING/HOLDING FURNACES HOMOGENIZING OVENS COOLERS SOW PRE HEATERS REPAIR & ALTERATIONS www.gillespiepowers.com 314 423 9460 ST. LOUIS, MISSOURI, USA 800 325 7075

Sow Drying

Tilting Melter & Holder

Stationary Melter

Patented Delacquering System

Homogenizing & Cooling

Autotapper

Volume 37 No. 2 – March/April 2024

Editorial

Editor: Nadine Bloxsome

Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Assistant Editor: Zahra Awan

Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com

Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com

Tel: +44 (0)1737 855117

Advertisement Production

Production Executive: Carol Baird

Managing Director: Tony Crinion

CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

email subscriptions@quartzltd.com

Annual subscription: UK £270, all other countries £292. For two year subscription: UK £510, all other countries £527. Airmail prices on request.

Single copies £50

ALUMINIUM

Tel: +44 (0)

Fax:

INTERVIEW

6 Women With Metal

THE ALUMINA CHRONICLES

9 Aluminium industry in Indonesia

EUROPEAN UPDATE

16 European Aluminium calls for a real “industry decarbonisation deal”

TECHNOLOGY

19 Navigating the future of metalworking in 2024

DIGITAL TRANSFORMATION

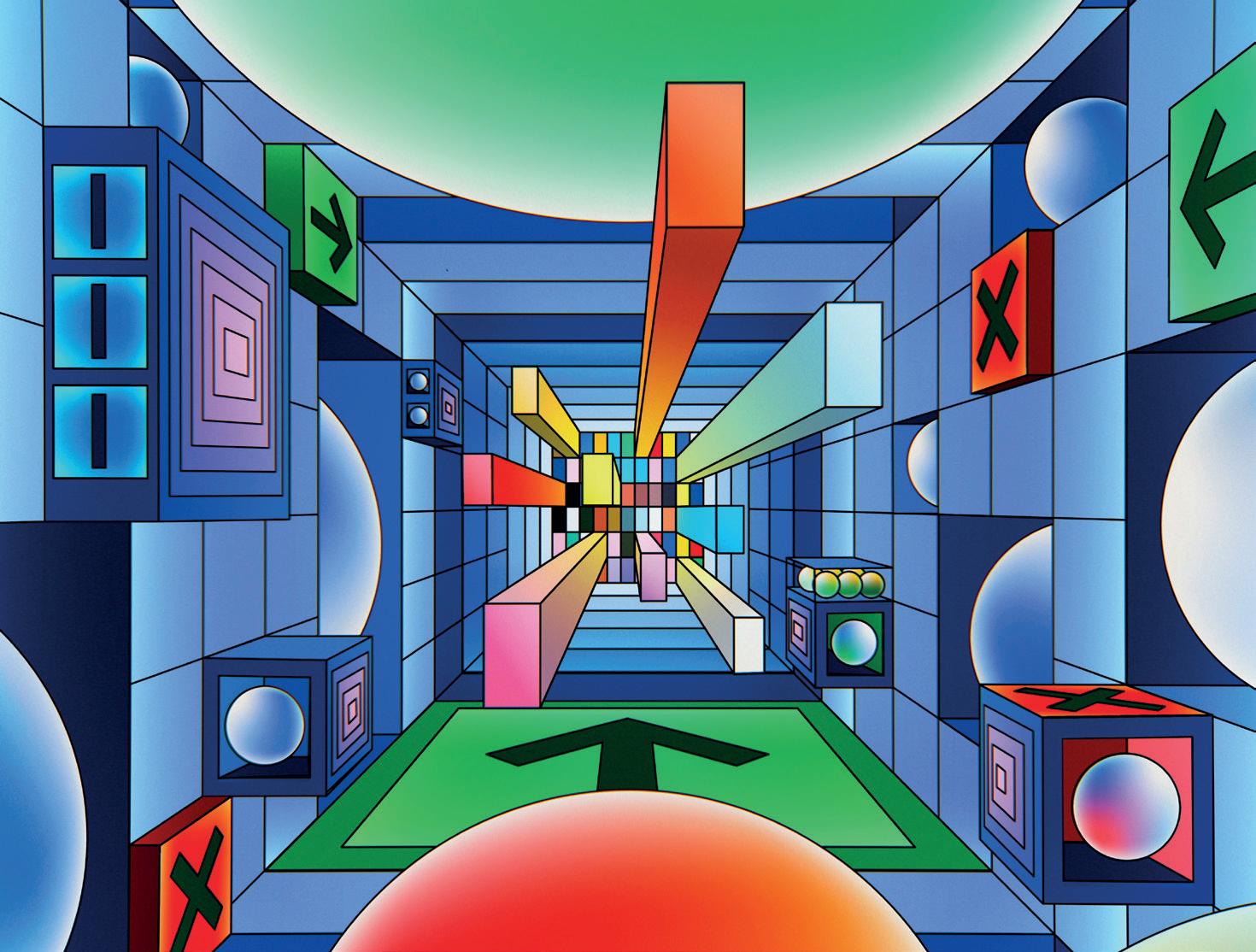

23 Shaping the future: digital transformation in the aluminium industry

TMS PREVIEW

25 Grain refiner specialist to deliver results from canlid stock trials

DECARBONISATION

27 Examining the latest technologies decarbonising the aluminium sector

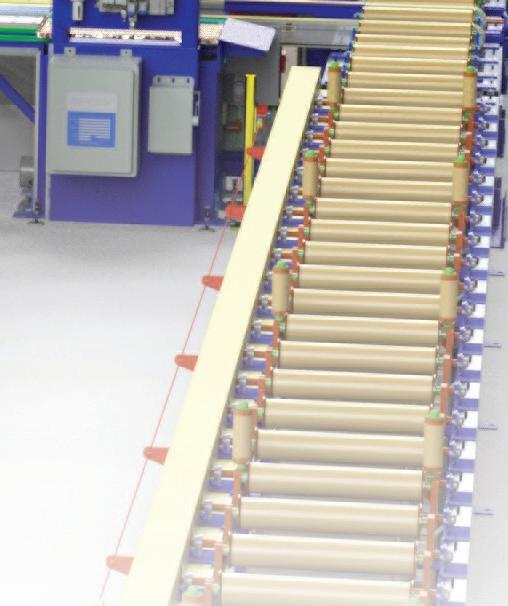

31 Hydrogen in the aluminium industry

PACKAGING

42 What the packaging recycling industry wants to see in 2024

THE DIGITAL MINE

45 Ma’aden and Hexagon partner to launch region’s first digital mine

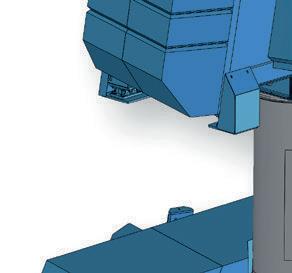

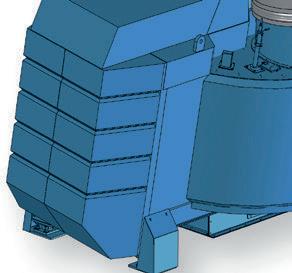

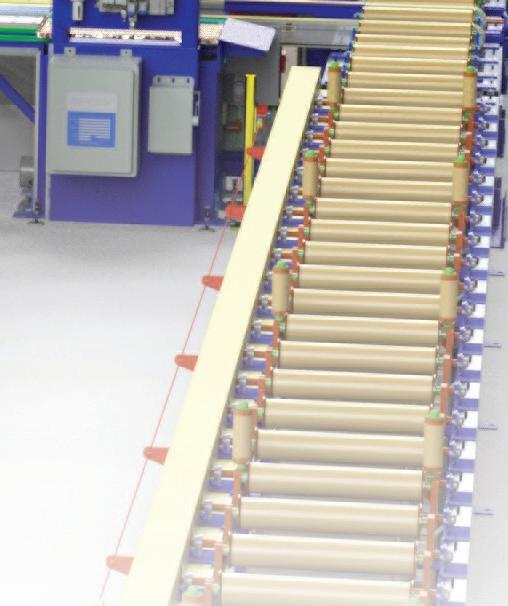

47 Rail mounted charging machines for melting furnace applications

1 www.aluminiumtoday.com Aluminium International Today March/April 2024

CONTENTS

2 LEADER 2 NEWS

COVER Cover picture courtesy of PRECIMETER

INTERNATIONAL TODAY is published

times

year by Quartz Business Media

six

a

Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK.

1737 855000

+44 (0) 1737 855034

aluminium@quartzltd.com

International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in the UK by: Stephens and George Ltd, Goat Mill Road, Dowlais, Merthyr Tydfil, CF48 3TD. Tel: +44 (0)1685 352063 www.stephensandgeorge.co.uk © Quartz Business Media Ltd 2024 ISSN1475-455X Supporters of Aluminium International Today SEARCH FOR ALUMINIUM INTERNATIONAL TODAY 6 27 31 42 19

Email:

Aluminium

HYDROGEN

CASTHOUSE

Welcome to the latest edition of Aluminium International Today magazine. As always, we strive to bring you detailed articles, interviews, and updates that provide valuable insights into the ever-evolving landscape of the aluminium sector.

The year already feels like it is flying! I was asked by a colleague recently what I am planning to do on my ‘Bonus Day’ this year. It took me a second to figure out that they were referring to the extra day in February that we will be gifted and I realised it was exactly that, the gift of more time.

So, rather than saving this column to write then and use my day to do all the jobs I’ve been putting off, I’m going to plan to use it as productively as possible, while also taking some time to enjoy the extra hours and I encourage you to do the same!

One person who is a shining example of using every minute of the day to the max, is Kirsty Davies-Chinnock, founder of Women With Metal. I had the pleasure of speaking to her for this issue and found out what drives her passion for the project and ideas for growth and going global!

Additionally, we turn our focus to Indonesia, a key player in the global aluminium market. Our in-depth feature from regular columnist Richard McDonough, explores the latest developments and challenges in aluminium production in Indonesia, offering readers a comprehensive understanding of this dynamic sector.

And don’t miss Assistant Editor, Zahra Awan’s exclusive article on the use of hydrogen in aluminium production. As the industry continues to explore sustainable alternatives, is hydrogen a promising solution...?

nadinebloxsome@quartzltd.com

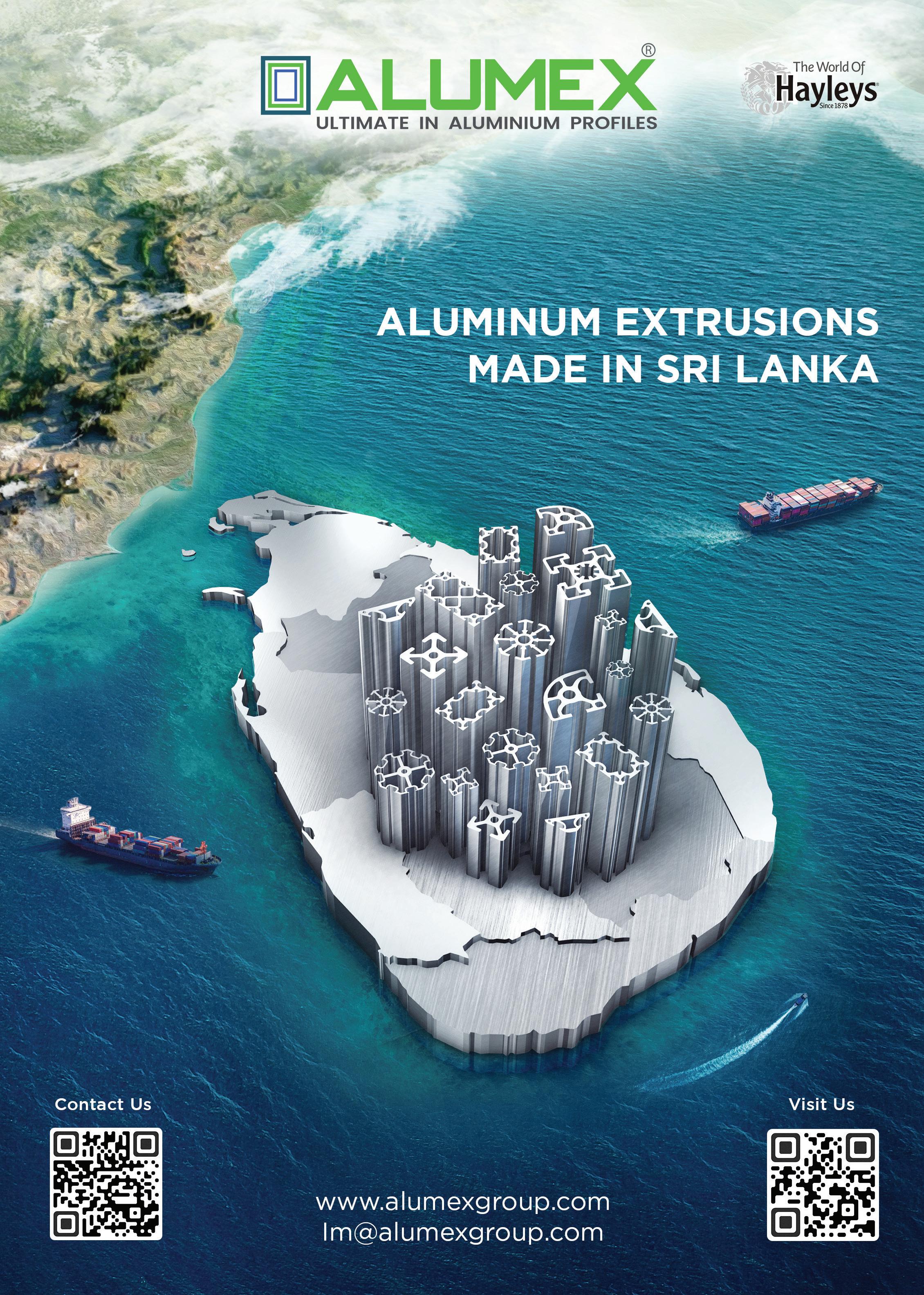

Hydro invests EUR 180 million in new Spanish aluminium recycler

The new recycling plant will produce 120,000 metric tonnes of low-carbon recycled aluminium per year and create approximately 70 new jobs in Torija. The products will be aluminium extrusion ingots for key European industries such as transport & automotive, building & construction, renewable energy installations, and consumer durable markets.

“Worldwide demand for materials like aluminium is growing as we build the infrastructure needed for the green transition. To reach our climate goals, we must

also change how these materials are produced. Key European industries, including the automotive and building & construction sectors, need access to responsibly produced materials with a low-carbon footprint. Hydro’s new state-of-the-art aluminium recycling plant in Torija will be ideally positioned to help customers reach their sustainability goals by offering low-carbon aluminium with a high share of recycled post-consumer scrap,” says Eivind Kallevik, Executive Vice President for Hydro Aluminium Metal.

The investment is pending final build decision, which is expected in the second half of 2024. Production is expected to commence in 2026.

Alcoa to supply Nexans with lowcarbon aluminium from ELYSIS™

Alcoa have announced that it will supply global cable producer Nexans with aluminium produced from a revolutionary process that eliminates all direct greenhouse gas emissions from the traditional smelting process.

Nexans will be the world’s first cable manufacturer to use metal from the breakthrough ELYSIS™ process, which replaces all greenhouse gas emissions with oxygen. The technology uses proprietary materials, including inert anodes, first developed at the Alcoa Technical Center near Pittsburgh. That research and development work became the technological basis for

ELYSIS™, a technology partnership that is working to ramp up the process to commercial scale.

Several Nexans facilities in Western Europe and Scandinavia will use aluminium produced from the ELYSIS™ process to start qualifications for the metal’s use in various

EGA to supply alumina

Emirates Global Aluminium has announced it has signed an agreement to supply alumina to The Alumina Industrial Company, enabling the development of a new industry making speciality products from alumina and contributing to the achievement of the UAE’s industrial growth strategy Operation 300bn.

The Alumina Industrial Company, established by the Maithan Group and Bathwal Corporation, intends to develop the UAE’s first complex to make speciality products from alumina in Khalifa

Economic Zone Abu Dhabi. These products have widespread applications in refractories and abrasives for industrial applications.

The project requires a local source of alumina, and EGA is the only UAE producer. The supply agreement is the first time EGA has sold alumina from its refinery to a third-party, extending EGA’s support to industrial expansion in the country. Alumina is the main feedstock for aluminium smelters. All the production from EGA’s Al Taweelah alumina refinery is currently used in EGA’s smelters.

types of cables, from low, medium to high voltage. Aluminium rod produced with this breakthrough ELYSIS™ technology could eliminate a significant portion of carbon dioxide emissions in the future.

Since the launch of ELYSIS™ in 2018, the technology company has produced R&D quantities of the metal. Alcoa is marketing and selling its share of the ELYSIS metal, which has also been used for the wheels on the Audi eTron GT, the automaker’s first electric sports car. Apple is also an investor in the technology and has used ELYSIS metal for some of its products.

EGA’s supply of alumina to the project is a further expansion of EGA’s local commercial sales that enable downstream industrial activity.

COMMENT 2

March/April 2024 TOP STORIES

BONUS DAY

Henan Yirui starts production on the new aluminium hot rolling mill

Two months ahead of the contractually agreed date, the first aluminium coil was successfully rolled on the new hot mill at Henan Yirui New Material Technology Co., Ltd. The new hot mill is an essential element of the strategic expansion project of Henan Yirui, a subsidiary of the Henan Mingtai group, which is located in the city of Gongyi, Henan Province, China. This underlines Henan Yirui’s trust in the expertise and experience of SMS group and its many success-

ful references in the aluminium industry.

SMS group developed a solution to refurbish and integrate components from a secondhand 1+1 hot rolling mill, comprising a roughing mill and a single-stand finishing mill, into the 1+4 hot strip mill at the Gongyi site.

Rolling of the first coil was originally scheduled for the first quarter of 2024. However, installation and commissioning times were significantly shortened

Alba Inks 10-year gas supply deal with Bapco Energies

“Securing a 10-year Natural Gas Supply Agreement marks a significant chapter for Alba”, as stated by Aluminium Bahrain B.S.C. (Alba)’s Chairman of the Board, Mr. Khalid Al Rumaihi, during the Signing Ceremony with Bapco Upstream, a 100% owned subsidiary of Bapco Energies, on 23 January 2024 at Al Dana Hall, Alba.

The signing ceremony was attended by Alba’s Chairman, Mr. Khalid Al Rumaihi, Bapco Up-

stream’s Chairman, Eng. Faisal Al Mahroos, Alba’s CEO, Ali Al Baqali, Bapco Upstream’s CEO, Johann Pleininger, and other Alba’s officials.

This Agreement takes effect on 23 January 2024, and supersedes all previous agreements. It serves as a continuation of the Company’s current natural gas requirements under one contract. Another key highlight of this Agreement is the fixed price structure for the first

5-year period at US$4 per million British thermal units (MMBTU) post which the price will be determined by the Competent Authority.

Adding further to mark this milestone, Mr. Al Rumaihi stated: “Five years of stable gas price are just the foundation. This partnership with Bapco Energies lays the groundwork for a future where collaboration and transparency will fuel our sustainable growth.”

MYTILINEOS Energy & Metals expanding production activities

MYTILINEOS Energy & Metals (MYTILINEOS) has obtained a Prospecting License from the Ghana Integrated Aluminium Development Corporation (GIADEC) to explore and subsequently extract bauxite deposits in the Ninayhin –Mpasaaso region.

Highlighting the successful Energy & Metals model and the synergies resulting from it, MYTILINEOS have said it seeks to implement a similar mode of operation in Ghana, already having an in-depth understanding of the country’s energy sector, through the execution of a multitude of energy projects.

In the initial 18-month implementation stage of the project,

the company state they will conduct necessary studies to confirm reserves and develop mines. Simultaneously, a comprehensive feasibility study will be conducted.

OTTO JUNKER 100 years

OTTO JUNKER GmbH looks back at 2023. With many successful trade fair participations, new partnerships and major orders, the company has strengthened its position and is looking forward to the future. This year, the company will celebrate its 100 year anniversary.

2024 Outlook for the UKALFED report

Last year, the UK aluminium industry was characterised by low inventories, prolonged and extensive slumps in demand, and sanctions still hanging over Russian metal. There is, however, an expected economic upshift by the end of 2024, and with new EU regulations adding taxes to high carbon imports from 2026, the aluminium industry can expect a year of transitional change, with renewed focus on supply chains and sustainability.

Runaya and TAHA extend their global footprint

The area containing the deposits under concession, designated as Ninayhin Block C, is estimated to possess geological reserves of approximately 300 million tons of bauxite and is anticipated to yield around 10 million tons of bauxite annually, equivalent to an estimated annual turnover of $500 million at current market prices.

MYTILINEOS, in collaboration with GIADEC, have announced they will assess the potential construction of an alumina production unit, projecting an annual production capacity of up to 1.5 million tons. The current annual aluminum production in Agios Nikolaos, Viotia, amounts to 865,000 tons.

Runaya & TAHA International

have announced the extension of their cooperation from India to the rest of the world. Through a strategic partnership, Runaya and TAHA aim to set up end-toend dross processing and refining facilities for major primary global aluminum smelters.

Refractories manufacturer

RATH: Strategic growth in future market Asia

RATH Group announces it acquires 33% stake in Avanee Refsol India as part of its Evolution 2030+ strategic growth plan. Production is scheduled to start at the beginning of 2025.

3 NEWS IN BRIEF NEWS Aluminium International Today

www.aluminiumtoday.com

European Aluminium calls for a real “industry decarbonisation deal”

The European Commission unveiled its Communication ‘Securing our future: Europe’s 2040 climate target and path to climate neutrality by 2050 building a sustainable, just and prosperous society’ outlining the needed climate and energy policy framework post-2030.

The framework recommends an ambitious greenhouse gas (GHG) emissions reduction target of 90% by 2040, compared with 1990 levels. This presents a significant

opportunity and challenge for the aluminium industry, as demand is set to surge in support of the green transition. European Aluminium emphasises the pressing need for coherent energy, trade and industrial policies that facilitate the industry’s decarbonisation and incentivising recycling while remaining competitive on global markets. This will enable the industry to meet the growing demand with sustainable aluminium ‘made in Europe’.

“The link between climate, trade and industrial policy must be strengthened and at the forefront of the agenda of the next EU Commission. We are ready to work with the EU Commission and the Member States on bridging solutions to bring down the cost of energy and boost the transformation of our industry while remaining competitive on global markets,” notes Paul Voss, Director General of European Aluminium.

2024 DIARY

MAY

14th - 16th

CRU: 30th World Aluminium Conference

The 30th World Aluminium Conference will return to the St Pancras Renaissance Hotel, London, co-hosted by the International Aluminium Institute (IAI) and the Aluminium Stewardship Initiative (ASI).

www.events.crugroup. com/aluminium/home

21st - 23rd

Future Aluminium Forum

Aluminium added to Quebec’s list of critical and strategic minerals

The Aluminium Association of Canada (AAC) welcomes the addition of aluminium to Quebec’s list of critical and strategic minerals.

The government’s decision comes at a strategic moment in our industrial development, when Quebec, which produces 75% of North America’s primary aluminium, will play a major role in

the decarbonisation of the North American economy through its contribution to electrification.

“From the production of renewable energy with solar panels through transmission lines and all the way to batteries and electric vehicles, Quebec’s low-carbon aluminium is essential from start to finish,” said Jean Simard, President and CEO of AAC.

Aluminium is listed as a critical mineral in the USA, Canada and, more recently, Europe. Canada produces more than 80% of North America’s primary metal, and nearly 45% of all primary metal in Europe and the United States combined. It is also the largest source of low-carbon metal production from a democracy.

Rio Tinto to drive development of Australia’s largest solar farm

Rio Tinto has announced that they will drive development of Australia’s largest solar power project near Gladstone, after agreeing to buy all electricity from the 1.1GW1 Upper Calliope Solar Farm to provide renewable power to Rio Tinto’s Gladstone operations.

The agreement will bring more renewable power into one of Australia’s most important industrial hubs and marks another step towards Rio Tinto’s climate goal of halving its global Scope 1 & 2 carbon emissions this decade2. If combined with more renewa-

ble power and suitable firming, transmission and industrial policy, it could also provide the core of a solution to repower Rio Tinto’s three Gladstone production assets - the Boyne aluminium smelter, the Yarwun alumina refinery and the Queensland Alumina refinery.

Under a new power purchase agreement (PPA) signed with European Energy Australia, Rio Tinto will buy all power generated from the Upper Calliope solar farm for 25 years. The plant will be built and operated by European Energy, at a site about 50 kilometres

south-west of Gladstone, pending development and grid connection approvals.

Once approved and developed, Upper Calliope would have the potential to lower Rio Tinto’s operating carbon emissions by 1.8 million tonnes per year.

Rio Tinto Chief Executive Jakob Stausholm said “This agreement is a first important step in our work to repower our Gladstone operations and illustrates our commitment to keeping sustainably powered industry in Central Queensland.”

The Future Aluminium Forum was originally developed to explore the transformational impact of digital technologies in the aluminium manufacturing processes. By hosting this next edition in Istanbul, we will be looking to uncover the potential to revolutionise the industry in Turkey and the surrounding regions.

www.

futurealuminiumforum. com/turkey/

29th - 31st

NorCast

NorCast presents highprofile executive leaders as Distinguished Guest Speakers, along with an international line-up of presenters, to cover important aspects of the aluminium industry.

Held in Arendal, Norway

www.norcast-seminar.com

JULY

3rd - 5th

ALUMINIUM CHINA

ALUMINIUM CHINA brings together high-quality resources from the aluminium industry and end-use applications at home and abroad to comprehensively display innovative technologies and products.

Held in Shanghai

www.aluminiumchina.com

For a full listing visit

www.aluminiumtoday.com/ events

Aluminium International Today

4

March/April 2024 GREEN NEWS

Tired of Maintaining Hydraulics?

GRANCO CLARK’S ALL NEW Non-Hydraulic System utilizes servo actuators and pneumatics instead of hydraulics. This includes the Log Lift, Log Pusher, Pullers, Stretchers, Hot Saw, ECS Saw and many others.

Our Hydraulic Free Systems are quiet, quick, powerful and boast incredible new features.

Now that you’re energized, let’s talk! 1-800-918-2600

+1-800-918-2600 | gcinfo@grancoclark.com | www.grancoclark.com

Free : Fully Electric System.

Hydraulic

Women With Metal

Dedicated to creating a connection between all women and allies working in the metal sectors, Women With Metal is the latest and greatest project headed up by Kirsty Davies-Chinnock, Managing Director of Professional Polishing Services Ltd. Nadine Bloxsome* was in attendance at the first Women With Metal conference last year and met with Kirsty to find out more about future plans to align with broader industry trends and initiatives related to gender equality and diversity.

I’m always in awe of those people who

get up at 5am to start their day with a workout and give themselves some time to prepare for what’s ahead. I’m much better at doing this in the summer months, but the dark, winter mornings currently mean I lack this extra motivation. If Kirsty Davies-Chinnock however could bottle up her energy and offer that as a treat in the goody bags at the next Women With Metal conference, I’d be very grateful!

After the success of the first conference in October 2023, the Women With Metal brand has gone from strength to strength.

Now a registered company, Kirsty and her growing team have announced that this year’s conference will be even bigger and there will be a stream of regional workshops organised across the year, focusing on topics such as goal setting and how to unlock success.

With Aluminium International Today recognised as a proud media partner for the event and supporting in the success, it was great to speak with Kirsty to find out about the passion behind the project and her hopes for how it will evolve.

Q1. Can you provide an overview of the Women With Metal conference and its objectives? How it started, to where it is now?

A. The conference was the start of Women With Metal and it was almost accidental. I’d had a conversation with someone who was being asked a lot about gender equity in the metal industry. There were lots of networking events in the industry already, but these were things like golf days and clay pigeon shooting, but there didn’t seem to be anything that’s particularly aimed at women within the metal industry, and there have always been women in the metal industry, and they’re becoming more and more visible.

I took it in the way he intended it, which was very positive. But he said to me, Kirsty, can you arrange an afternoon tea? And that was, I think, on a Wednesday and by the Friday I’d got five speakers booked and, on the Tuesday, secured the Birmingham Park Regis Hotel for a one-day conference!

We had the conference on the 10th of October and by the end of the month Women With Metal was a limited company, and we were already looking for the 2024 conference venue and also starting to plan regional events as well.

Something that started as a way to develop an event that was more inclusive for women, has now moved on and is contributing to this advancement and representation of women in the metals industry. So, it is not just showing as an event form, but actually showing more roles that women are now playing in the sector as well.

Q2. How does the Women With Metal conference contribute to the advancement and representation of women in the metal industry, particularly in the UK?

A. I want to encourage more women to go into more visible leadership roles, without detracting from the men in those roles, who doing a great job, I want to show that there are great women out there, running businesses at C-Suite level or as senior managers with incredible technical skills and showing that there are great careers in the metal sector for both men and women.

When we look at the skill shortages and how difficult it is to change the perception of the metals industry, it’s just going to benefit companies to have this positivity out there for further recruitment, both for skilled men and women coming into the industry.

Aluminium International Today March/April 2024 INTERVIEW 6

*Editor, Aluminium International Today

Q3. In what ways does the conference aim to foster diversity and inclusion within the metal sector?

A. One thing I am very conscious of is not creating a ‘them and us’ agenda, but it’s great to network with people that are like you.

Whilst I focused heavily on delivering a ‘return on investment’ conference for companies who were sending delegates, I was also very keen that they would come away with new skills. It’s nice to have just have a coffee and a chat with somebody who is similar to you; we all find our own tribe. We all get on with some individuals better than others, it doesn’t matter what their gender is. When you find someone, you have a common ground with and someone who has had a similar experience to you, whether that’s being a working mother, being the only woman in your team or having trouble accessing decent PPE, we’re human beings at the end of the day and we want to connect with somebody who has similar experiences.

We’ve already had a number of men booking onto the 2024 conference and whilst there will be aspects that are aimed particularly at women, this doesn’t mean that allies aren’t welcome. When you talk about equity in the workplace, these issues benefit men and women. There are men who want to go and see their children in the school play, or want to do the university run, or have to take their turn in running a parent to a hospital appointment and just feeling confident that they can have those conversations will benefit the whole company.

The more this equity and change becomes visible, the easier it’s going to be to attract new people into the industry, and that’s what we need.

Q4. Can you share some success stories or notable achievements resulting from the latest Women with Metal conference and workshops?

A. We had the first regional workshop recently and we had a mixture of architects and designers, fabrication companies, stockholders, large and small and associated industries, people who have clients within the metal sectors. There was a lot of networking which was great, and I know that one company has started supplying another company that was there, which is fantastic.

One of the things we’re doing with the regional events is they are more workshop based, with a meal and some drinks and just seeing the level of networking afterwards. The feedback so far and during the night has been good, so we’re looking forward to hosting more over the coming months and taking them to different areas of the country.

Q5. How does the Women with Metal conference align with broader industry trends and initiatives related to gender equality and diversity?

A. We are currently preparing the agenda for October, and we will be looking to bring in more elements of building networking skills. I’m also hoping to focus more on mindset and how to not take stresses at work home, because if people have the skills to not do that, it means when they come back to work the next day, they’re not going to have been lying in bed at 2am worrying about something! They’re going to be more refreshed; they’re going to be positive and in a lighter physical and mental frame of mind to deal with that challenge, which means they’ll deal with it better, both for them and for the outcome of that challenge. Another area we are looking at is the development of AI and how potentially that will look in the metal sector moving forward, how we can use it for our benefit, whether it’s using sensors on machinery and then using AI to analyse the data or whether it’s going to be in other areas.

I’m talking to a variety of people about that now and trying to find something that will appeal to the majority of the people attending, because obviously we’ve got people in every department you can think of.

Q6. Looking ahead, what are the future development plans for the Women with Metal conference, and how do you envision its growth and impact in the coming years?

A. Ideally, I would love the main UK conference to turn into a two-day event with a dinner in the evening and the opportunity of splitting off into workshops, looking at how we can add value for individuals going forward.

We’re also producing quite a lot of content in the background, as well as workbooks and eBooks that go out each month and there’s a code every single month so people can download them for free.

We’re also planning to create Continuous development courses which will be a big project, but I really want to get going on that in 2025 and partner with organisations who can help. There’s still a lot of work to do, but we’re all about collaboration overall! The more we can work together and the more we can shout about how these industries are fantastic, we’re all having fulfilling careers that are interesting, dynamic and there are plenty of opportunities there.

INTERVIEW 7 Aluminium International Today March/April 2024

The

But don’t take our word for it, test your current grain refiner against Optifine using the NEW Opticast 2nd gen Contact us to arrange for your samples to be measured by Opticast 2nd gen or to discuss your grain refinement needs.

high efficiency grain refiner that stands head and shoulders above the rest. 5:1 125 5:1

cast

2ndgen

aluminium

50% cost saving 85% less product needed 125% relative efficiency* made with low carbon

+44 (0) 782 333 0676 technical@mqpltd.com

Compared with Optifine 3:1 100 (Optifine 3:1 100 is 3x more efficient than standard grain refiners)

mqpltd.com *

Aluminium industry in Indonesia

Aluminium industry in Indonesia

By Richard McDonough*

Indonesia is one of the largest nations in the world in terms of population and in size of its territory. This Asian nation is also one of the largest producers of bauxite and one of the largest refiners of alumina in the world.

The United Nations Population Fund estimated that 277,500,000 people were living in Indonesia in 2023. This ranks the country as the fourth largest in the world in terms of population. Only India, China, and the United States (USA) have larger populations.

Indonesia includes more than approximately 1,904,569 square kilometers of territory, according to the Central Intelligence Agency of the USA. This size ranks the island nation as the 14th largest in terms of territory in the world.

The International Monetary Fund (IMF) projected the Real Gross Domestic Product (GDP) of Indonesia will grow 5% to (US) $1,540,000,000,000 in 2024. This GDP level would rank Indonesia as the 16th largest economy in the world. To put this level in perspective, the IMF indicated the economy of Indonesia is larger than the economies of such nations as Türkiye, the Netherlands, and Saudi Arabia.

Consumer Prices in Indonesia are projected by the IMF to increase 2.5% in 2024.

According to a report from the United States Geological Survey (USGS) issued in 2023, 1,100,000 metric dry tonnes of alumina was estimated to have been refined in Indonesia in 2022. That was an

*Do

increase from the 1,000,000 metric dry tonnes of alumina estimated to have been refined in the country in 2021.

The estimated level of alumina production in 2022 placed Indonesia as the 15th largest producer of alumina in the world. The estimate for 2021 by the USGS indicated that Indonesia was the 16th largest producer of alumina globally in that year.

The USGS estimated Indonesian bauxite production was 21,000,000 metric dry tonnes in both 2021 and 2022.

With those estimated levels, the USGS indicated that Indonesia was the 5th largest producer of bauxite among all nations in both 2021 and in 2022.

Reserves of bauxite were estimated by the USGS to be 1,000,000,000 metric dry tonnes in Indonesia as of 2022. This would place the country with the sixth largest reserves of bauxite in the world. Only Guinea, Vietnam, Australia, Brazil, and Jamaica are estimated by the USGS to have larger reserves of bauxite.

Trade

Indonesia was ranked as the 28th largest importing nation of aluminium and articles thereof in 2022. In 2021, the country also ranked number 28 among countries importing aluminium and articles thereof. In 2020, Indonesia ranked number 29; in 2019, number 26; and in 2018, the nation was ranked as number 25 worldwide.

In 2022, Indonesia was ranked as the 48th largest country globally in exports of aluminium and articles thereof. It was also

ranked at number 48 in 2021, number 46 in 2020, number 51 in 2019, and number 47 in 2018.

This information is according to the International Trade Centre (ITC). Unless otherwise stated, statistics detailing imports and exports of aluminium and articles thereof (hereafter noted as “aluminium and related products”) to and from Indonesia are approximate and are from the most recent reports issued by the ITC. This also includes the statistics detailing individual segments of the aluminium industry. Pic 1

Imports

Pic 2. Imports of aluminium and related products into Indonesia increased about 11.2% overall from 2018 to 2022. There were, though, decreases in the intervening years. In 2019 to 2020, these types of imports decreased, but then increased in 2021 and 2022.

In 2018, imports of these products amounted to (US) $2,172,792,000; in 2019, (US) $1,891,555,000; in 2020, (US) $1,415,704,000; in 2021, (US) $2,086,137,000; and in 2022, imports of aluminium and related products were valued at (US) $2,416,068,000.

Major sources of aluminium and related products imported into Indonesia included countries in Asia, North America, and other nations in the Pacific Ocean region.

As has been the case with most countries, Indonesia’s largest source of aluminium and related products imported into the country was China for the time

THE ALUMINA CHRONICLES 9 Aluminium International Today March/April 2024

you have questions about the aluminium industry? Governmental regulations? Company operations? Your questions may be used in a future news column. Contact Richard McDonough at aluminachronicles@gmail.com. © 2024 Richard McDonough

(The photograph was provided courtesy of Harry Purwanto.)

period from 2018 to 2022. Indonesia imported (US) $881,213,000 of these products from China in 2018; imports from that country increased to (US) $981,141,000 in 2022.

In addition to imports of these products into Indonesia from China, other nations that saw increases in actual amounts of imports into this country during that five-year time period were the United Arab Emirates (UAE), Australia, Malaysia, South Korea, Thailand, India, Singapore, and Taiwan. India saw its imports of these products into Indonesia more than double during this time period.

There were also decreases in the actual amounts of aluminium and related products imported from some countries. The USA, Japan, and Russia each saw its level of imports of these products into Indonesia decrease from 2018 to 2022.

The level of imports of these products from China amounted to 40.6% of all aluminium and related products imported into Indonesia in these two years.

All of the other sources of imports of aluminium and related products each represented less than 7% of all of these products imported into Indonesia in 2018 and 2022.

The UAE, Australia, Malaysia, the USA, and South Korea were the next five sources of aluminium and related products imported into Indonesia in 2022. Respectively, these countries accounted for imports of these products valued at (US) $155,364,000 and represented 6.4% of aluminium and related products imported in that year; (US) $151,147,000, 6.3%; (US) $141,791,000, 5.9%; (US) $138,638,000, 5.7%; and imports of these products valued at (US) $135,652,000, representing 5.6% of aluminium and

related products imported in 2022.

Other major sources of these products imported into Indonesia in 2022, the amounts of imports, and the percentage that those imports amounted to as a portion of all such imports into Indonesia were Thailand, (US) $82,985,000, 3.4%; India, (US) $81,027,000, 3.4%; Singapore, (US) $78,320,000, 3.2%; Japan, (US) $67,035,000, 2.8%; Taiwan, (US) $60,182,000, 2.5%; and Russia, (US) $50,966,000, 2.1%.

Aluminium and related products imported from these 12 countries into Indonesia represented 87.9% of all of the imports of these products into the nation in 2022.

Five years earlier, in 2018, the USA was the second largest source of aluminium and related products imported into Indonesia with (US) $142,058,000 in these products; this represented 6.5% of all such imports in that year.

Other top sources were Australia, with imports into Indonesia of aluminium and related products valued at (US) $138,747,000 representing 6.4% of the import market for these products; Malaysia, with (US) $135,014,000 representing 6.2%; the UAE, with (US) $121,254,000 representing 5.6%; and South Korea, with these products valued at (US) $101,150,000 representing 4.7% of the overall market for aluminium and related products imported into Indonesia in 2018.

Thailand, Japan, Russia, Singapore, India, and Taiwan were also major sources of these products imported into Indonesia in that year. The amounts and percentages those amounts represented of the import market into this country for 2018 were, respectively, (US) $79,363,000 and

3.7%, (US) $78,332,000 and 3.6%, (US) $71,002,000 and 3.3%, (US) $69,623,000 and 3.2%, (US) $32,425,000 and 1.5%, and (US) $26,226,000 and 1.2%.

The amount of products imported from the 12 countries noted represented 86.4% of all aluminium and related products imported into Indonesia in 2018.

Exports

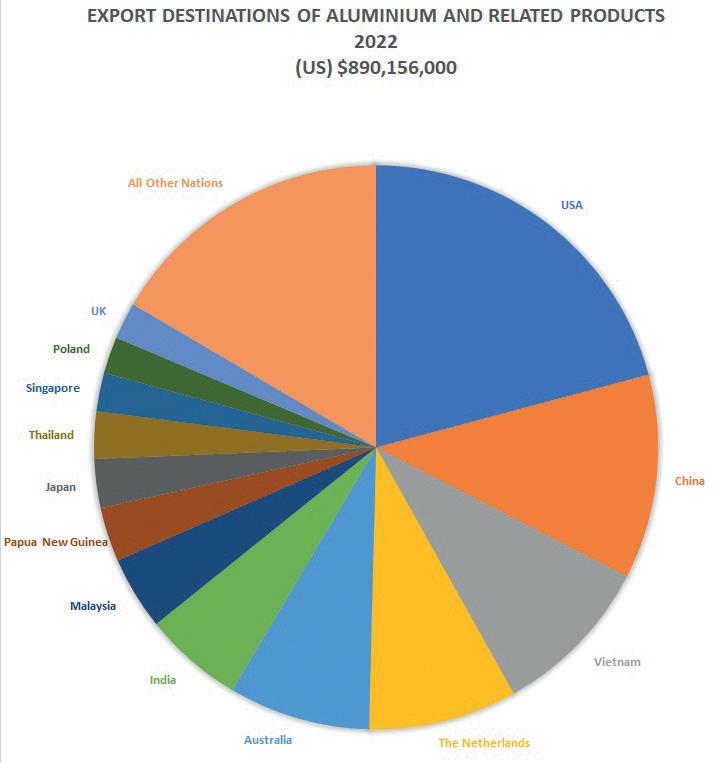

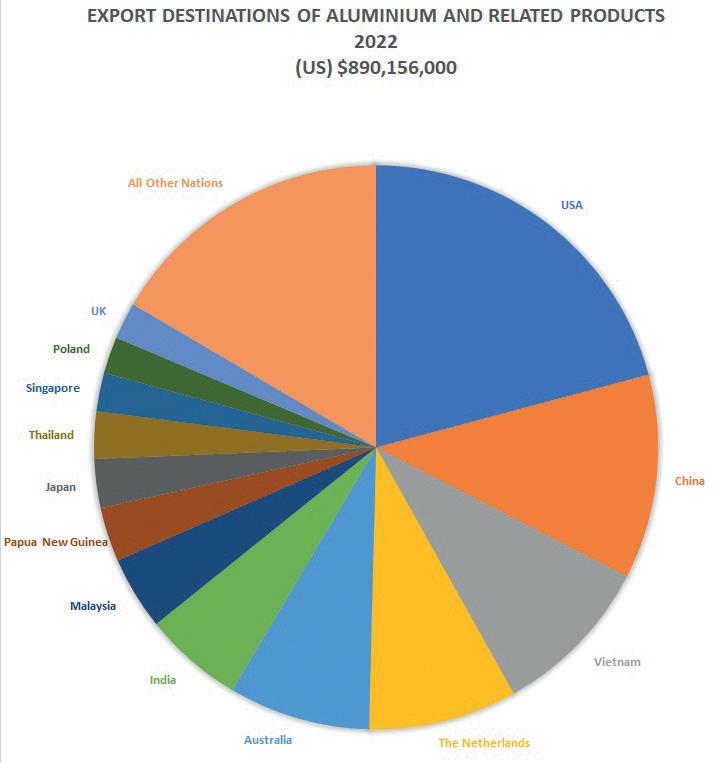

Pic 3. The amount of exports of aluminium and related products from Indonesia increased 14.7% from 2018 to 2022. Other than a large decrease from 2018 to 2019, there were increases in each of the other year-to-year pairings.

Aluminium and related products exported from Indonesia were valued at (US) $775,838,000 in 2018, and (US) $890,156,000 in 2022. In the intervening years, the amounts were (US) $527,027,000 in 2019, (US) $610,105,000 in 2020, and (US) $784,542,000 in 2021.

Key export markets for Indonesia included nations in North America, Asia, Europe, and other nations in the Pacific Ocean region.

During the five-year time period from 2018 to 2022, exports of these products increased to China, Vietnam, the Netherlands, Australia, India, Papua New Guinea, Poland, and the United Kingdom (UK). Substantial increases in these exports occurred with each of these countries, with the exceptions of India that saw a more modest increase.

Exports of aluminium and related products from the USA, Malaysia, Japan, Thailand, and Singapore decreased from 2018 to 2022; exports of these products decreased by more than half to Japan and Thailand during that time period.

In 2022, the top five export destinations

Aluminium International Today March/April 2024 THE ALUMINA CHRONICLES 10

Pic 1. Bauxite is mined and alumina is refined in West Kalimantan, Indonesia. (The aerial photograph is provided courtesy of the United States Geological Survey, 2023.)

Pic 2. Sources of aluminium and related products imported into Indonesia in 2022. (Image created with data provided courtesy of the International Trade Centre.)

for aluminium and related products produced in Indonesia were the USA, China, Vietnam, the Netherlands, and Australia. A total of (US) $185,563,000 in these products were exported from Indonesia to the USA in 2022, (US) $104,178,000 to China, (US) $82,762,000 to Vietnam, (US) $75,964,000 to the Netherlands, and (US) $71,885,000 to Australia.

These amounts represented 20.8%, 11.7%, 9.3%, 8.5%, and 8.1%, respectively, of the exports of aluminium and related products from Indonesia in 2022.

Other top destinations for these products exported from Indonesia in 2022 were India – aluminium and related products valued at (US) $50,635,000, representing 5.7% of the overall amount of these exports;

Malaysia: (US) $37,736,000, 4.2%; Papua New Guinea: (US) $27,632,000, 3.1%;

Japan: (US) $25,060,000, 2.8%;

Thailand: (US) $24,056,000, 2.7%;

Singapore: (US) $19,292,000, 2.2%;

Poland: (US) $19,091,000, 2.1%; and the UK: (US) $19,077,000, 2.1%.

The level of exports to the 13 countries noted represented 83.5% of all aluminium and related products exported from Indonesia in 2022.

In 2018, the top destinations for exports of aluminium and related products from Indonesia were the USA, Malaysia, Japan, Thailand, India, and Vietnam. Other major markets were Singapore, Australia, and Papua New Guinea. The Netherlands, the UK, China, and Poland were all, relatively speaking, small markets for aluminium and related products exported from

Indonesia in 2018.

Indonesia exported (US) $344,265,000 in these products to the USA in 2018, (US) $65,341,000 to Malaysia, (US) $57,623,000 to Japan, (US) $52,073,000 to Thailand, (US) $42,213,000 to India, (US) $39,414,000 to Vietnam, (US) $30,712,000 to Singapore, (US) $15,108,000 to Australia, (US) $9,846,000 to Papua New Guinea, (US) $4,334,000 to the Netherlands, (US) $3,365,000 to the UK, (US) $2,661,000 to China, and (US) $217,000 in aluminium and related products to Poland in 2018.

Exports of these products from Indonesia to the USA represented 44.4% of the overall market of aluminium and related products exported from this country in 2018; to Malaysia, 8.4%; to Japan, 7.4%; to Thailand, 6.7%; to India, 5.4%; to Vietnam, 5.1%; to Singapore, 4%; to Australia, 1.9%; and to Papua New Guinea, 1.3% in 2018.

The Netherlands, the UK, China, and Poland each represented less than 1% of aluminium and related products exported from Indonesia in 2018.

Exports to these 13 countries represented about 84.6% of all aluminium and related products exported from Indonesia in 2018.

The ITC also provided additional details about production and trade for different portions of the aluminium industry. In one of the market segments, for example, Indonesia is a substantial part of this industry: the country is the third largest exporter of aluminium ore worldwide. Unlike with other market segments, though, all of the aluminium ore exported from Indonesia, according to the ITC, has been exported to one nation from 2018 through 2022.

Raw Aluminium

Pic 4. The ITC reported that Indonesia was the 28th largest importer of raw aluminium in 2022. The country imported (US) $726,629,000 in raw aluminium in that year; this amount represented less than 1% of total imports of this product into all nations.

In 2018, Indonesia was the 25th largest importer of raw aluminium among all countries. A total of (US) $641,386,000 in raw aluminium was imported into the nation at that time, representing about 1% of worldwide imports of this product.

Imports of raw aluminium into Indonesia increased from 2018 to 2022 from the UAE, Malaysia, India, Qatar, South Korea, South Africa, Spain, Bahrain, Taiwan, Nigeria, and Singapore. India, South Korea, South Africa, and Bahrain each saw their imports of this product into Indonesia more than double during this time period, whilst Spain and Nigeria saw increases that were more than fourfold in 2022 from relatively small amounts of these imports in 2018.

There were decreases in the actual amounts of raw aluminium imported from Australia and Russia into Indonesia from 2018 to 2022.

Raw aluminium imported into Indonesia in 2022 included products valued at (US) $153,447,000 from the UAE, (US) $108,354,000 from Australia, (US) $98,727,000 from Malaysia, (US) $69,512,000 from India, and (US) $50,703,000 from Russia.

Imports from these top five sources represented more than two-thirds (66.2%) of all raw aluminium imported into Indonesia in 2022. Specifically, imports of this product from the UAE represented 21.1% of the total; from Australia, 14.9%;

Aluminium International Today March/April 2024 THE ALUMINA CHRONICLES 12

Pic 3. Destinations of aluminium and related products exported from Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

PIC 4. Sources of raw aluminium imported into Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

Pic 5. Export destinations of raw aluminium produced in Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

from Malaysia, 13.6%; from India, 9.6%; and from Russia, 7% of the total in 2022.

Other sources of raw aluminium imported into Indonesia in 2022 were from Qatar, (US) $43,276,000; from South Korea, (US) $41,466,000; from South Africa, (US) $18,959,000; from Spain, (US) $16,476,000; from Bahrain, (US) $15,620,000; from Taiwan, (US) $15,351,000; from Nigeria, (US) $14,356,000; and from Singapore, (US) $14,036,000.

Combined, the top 13 sources of raw aluminium represented 90.9% of all of the product imported into Indonesia in 2022.

In 2018, the UAE, Australia, and Malaysia were also the top sources of raw aluminium imported into Indonesia. The amounts and percentages of the total imports of this product were, respectively, (US) $120,637,000, 18.8%; (US) $116,407,000, 18.1%; and (US) $85,971,000, 13.4%.

Russia was the fourth largest source of raw aluminium imported into this nation in 2018. Indonesia imported (US) $70,870,000 in raw aluminium from Russia in that year, representing 11% of all imports of this product.

Amounts of raw aluminium imported into Indonesia from other major sources of this product in 2018 included (US) $39,803,000 from Qatar, (US) $28,239,000 from India, (US) $18,053,000 from South Korea, (US) $13,005,000 from Taiwan, (US) $11,651,000 from Singapore, and (US) $7,363,000 from South Africa.

These amounts represented, respectively, 6.2%, 4.4%, 2.8%, 2%, 1.8%, and 1.1% of all of this product imported into Indonesia in 2018.

Collectively, these top ten sources of raw aluminium imported into Indonesia in 2018 represented 79.8% of all of the imports of this product in that year.

Pic 5.

Indonesia was ranked as the 38th largest exporter globally of raw aluminium in 2022. The country exported (US) $361,190,000 in raw aluminium at that time. In 2018, Indonesia was the 43rd largest exporter of raw aluminium among all countries. A total of (US) $194,105,000 in raw aluminium was exported from the nation in that year.

In both 2022 and 2018, these amounts represented less than 1% of total exports of this product from all nations in those two years.

Exports of raw aluminium from Indonesia more than doubled to Vietnam from 2018 to 2022. According to the ITC, there were zero exports of raw aluminium to China, the Netherlands, and India in 2018; all three nations were destinations of large amounts of raw aluminium from Indonesia in 2022.

There were decreases in the actual amounts of raw aluminium exported from Indonesia to Malaysia, Japan, and Thailand from 2018 to 2022.

In 2022, the main destinations for raw aluminium produced in Indonesia were: China, (US) $102,042,000; the Netherlands, (US) $75,422,000; Vietnam, (US) $70,600,000; India, (US) $28,723,000; Malaysia, (US) $24,226,000; Japan, US) $11,087,000; and Thailand, (US) $8,749,000.

These amounts represented 88.8% of all of the exports of raw aluminium from Indonesia in 2022. The individual

percentages for the top seven markets listed for this product were 28.3%, 20.9%, 19.5%, 8%, 6.7%, 3.1%, and 2.4%, respectively.

In 2018, the top four destinations for raw aluminium produced in Indonesia were Malaysia, with (US) $47,432,000 in this product representing 24.4% of all of this product exported in that year; Japan, with (US) $41,719,000 and 21.5%; Thailand, with (US) $39,796,000 and 20.5%; and Vietnam, with (US) $24,667,000 and 12.7%.

These four nations represented 79.1% of all of the exports of this product in that year.

Aluminium Ore (Bauxite)

Pic 6. Indonesia is not a major importer of aluminium ore. The nation was the 59th largest importer of aluminium ore in 2022. In that year, the country imported (US) $780,000 in aluminium ore; this amount represented less than 1% of all worldwide imports of aluminium ore.

In 2018, the country was the 64th largest importer of this product. At that time, Indonesia imported (US) $608,000 in aluminium ore. Globally, this represented less than 1% of all imports of aluminium ore.

Imports of aluminium ore into Indonesia increased from Guyana, China, Brazil, South Korea, and the UK from 2018 to 2022. Other than China, according to the ITC, the level of imports from each of the other four countries was zero in 2018.

The amount of imports of this product into Indonesia decreased dramatically from the Netherlands and India during this five-year time period.

Guyana was the source of (US) $397,000 of the aluminium ore imported

THE ALUMINA CHRONICLES 13 Aluminium International Today March/April 2024

Pic 6. Sources of aluminium ore imported into Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

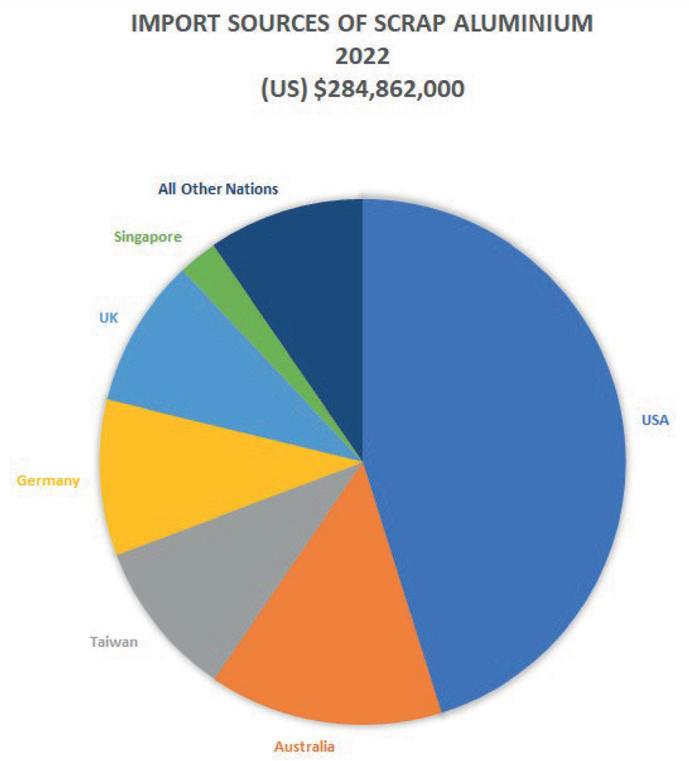

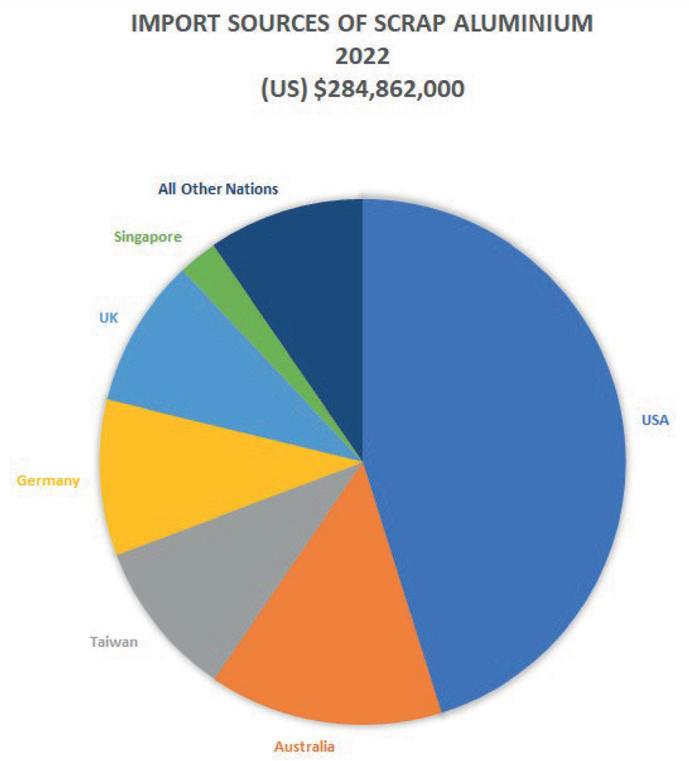

Pic 7. Sources of scrap aluminium imported into Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

Pic 8.Export destinations for scrap aluminium produced in Indonesia in 2022.

(Image created with data provided courtesy of the International Trade Centre.)

into Indonesia in 2022. Other large suppliers of aluminium ore were China, (US) $117,000; Brazil, (US) $78,000; South Korea, (US) $72,000; and the UK, (US) $36,000.

Together, these five countries represented 89.7% of all of the aluminium ore imported into Indonesia in 2022. The percentages of the aluminium ore imported into the country in that year were 50.9% from Guyana, 15% from China, 10% from Brazil, 9.2% from South Korea, and 4.6% from the UK.

In 2018, the Netherlands, India, China, and Germany were the four major sources of aluminium ore imported into Indonesia. The nation imported (US) $313,000 in aluminium ore from the Netherlands in that year, (US) $136,000 from India, (US) $96,000 from China, and (US) $23,000 from Germany.

The four nations represented 93.5% of all aluminium ore imported into Indonesia in 2018. The percentages of the aluminium ore that the country imported in 2018 were 51.5% from the Netherlands, 22.4% from India, 15.8% from China, and 3.8% from Germany.

Whilst Indonesia has been a modest importer of aluminium ore, the nation is one of the major exporters of this product.

Indonesia was the 3rd largest exporter of aluminium ore in 2022; the country was the 4th largest exporter of this product in 2018. Exports of this product more than doubled during that five-year time period. Total exports of aluminium ore were (US) $263,601,000 in 2018 and (US) $623,001,000 in 2022.

These exports represented 8.2% of all aluminium ore exported worldwide in 2022 and 5.3% of all of this product exported globally in 2018.

China, according to the ITC, was the destination of the aluminium ore exported from Indonesia during each year from 2018 to 2022.

Scrap Aluminium

Pic 7. According to the ITC, Indonesia was the 22nd largest importer of scrap aluminium in 2022. In that year, the country imported (US) $284,862,000 in scrap aluminium; this amount represented 1.1% of all global imports of scrap aluminium.

Five years earlier, the country was the 17th largest importer of this product. In 2018, Indonesia imported (US) $204,332,000 in scrap aluminium. Globally, this represented 1.3% of all imports of scrap aluminium.

Indonesia increased its importation of scrap aluminium from 2018 to 2022 from the USA, Australia, Taiwan, Germany, and Singapore, whilst amounts of this product imported into Indonesia decreased from the UK. Imports of scrap aluminium from

Australia almost more than doubled, whilst the levels of imports of this product from Taiwan and Germany increased substantially in 2022 from small amounts in 2018.

The USA, Australia, Taiwan, Germany, the UK, and Singapore were the top six nations from which Indonesia imported scrap aluminium in 2022. The amounts of this product imported from these countries were, respectively, (US) $128,649,000, (US) $40,906,000, (US) $27,509,000, (US) $27,255,000, (US) $26,283,000, and (US) $6,815,000.

Together, these six countries represented 90.4% of all scrap aluminium imported into Indonesia in 2022. The percentages of the scrap aluminium imported into the country in that year were 45.2% from the USA, 14.4% from Australia, 9.7% from Taiwan, 9.6% from Germany, 9.2% from the UK, and 2.4% from Singapore.

In 2018, the USA, Australia, and the UK were the three major sources of scrap aluminium imported into Indonesia. The country imported (US) $112,711,000 in scrap aluminium from the USA in that year, (US) $32,214,000 from the UK, (US) $20,273,000 from Australia, and (US) $5,064,000 from Singapore. The amounts imported from Germany and Taiwan were relatively modest compared to the levels of other nations – (US) $1,728,000 and (US) $801,000, respectively.

These six nations represented 84.6% of all scrap aluminium imported into Indonesia in 2018. The percentages of the scrap aluminium the country imported in that year were 55.2% from the USA, 15.8% from the UK, 9.9% from Australia, and 2.5% from Singapore; imports of this product were less than 1% from both Taiwan and Germany.

Pic 8.

Indonesia was a relatively small source of scrap aluminium exports in both 2022 and in 2018, according to the ITC. In 2022, the country ranked as the 75th largest exporter of this product worldwide. Indonesia exported (US) $19,019,000 in scrap aluminium in that year, representing less than 1% of all global exports of the product.

In 2018, Indonesia exported (US) $15,376,000 in scrap aluminium. The country was ranked as the 67th largest exporter of this product in that year. As in 2022, the nation represented less than 1% of all exports of scrap aluminium throughout the world.

Indonesian exports of scrap aluminium more than doubled to South Korea and Thailand from 2018 to 2022; this type of exports also increased to Japan during the five-year time period. The amount of exports of scrap aluminium to Singapore decreased by more than 40%, whilst exports of this product to Saudi Arabia decreased substantially from 2018 to 2022.

South Korea, Thailand, Japan, and Singapore were the top four export destinations for scrap aluminium produced in Indonesia in 2022. The amounts of this product exported to these countries were, respectively, (US) $10,050,000, (US) $4,541,000, (US) $1,529,000, and (US) $1,320,000.

The four nations represented 91.7% of all scrap aluminium exported from Indonesia in 2022. The percentages of the scrap aluminium exported from the country in that year were 52.8% to South Korea, 23.9% to Thailand, 8% to Japan, and 6.9% to Singapore.

In 2018, those four countries plus Saudi Arabia were the major destinations for scrap aluminium exported from Indonesia. The country exported (US) $4,858,000 in scrap aluminium to South Korea in that year, (US) $3,926,000 to Saudi Arabia, (US) $2,448,000 to Singapore, (US) $1,667,000 to Thailand, and (US) $1,290,000 to Japan.

The five nations represented 92.3% of all scrap aluminium exported from Indonesia in 2018. The percentages of the scrap aluminium exported from the country in that year were 31.6% to South Korea, 25.5% to Saudi Arabia, 15.9% to Singapore, 10.8% to Thailand, and 8.4% to Japan. �

Aluminium International Today March/April 2024 THE ALUMINA CHRONICLES 14

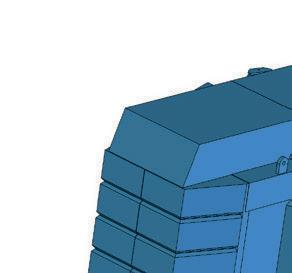

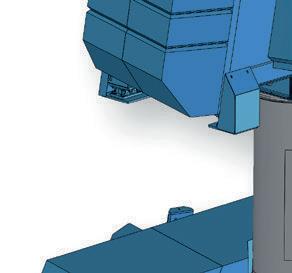

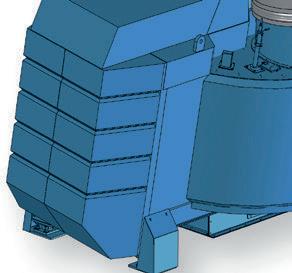

AUTONOMOUS CHARGING & SKIMMING MACHINES

European Aluminium calls for a real “Industry Decarbonisation Deal”

The European Commission unveiled its Communication ‘Securing our future: Europe’s 2040 climate target and path to climate neutrality by 2050 building a sustainable, just and prosperous society’ outlining the needed climate and energy policy framework post-2030. European Aluminium provided Aluminium International Today with an exclusive interview with Emanuele Manigrassi*.

The Industry Decarbonisation Deal: The framework recommends an ambitious greenhouse gas (GHG) emissions reduction target of 90% by 2040, compared with 1990 levels. This presents a significant opportunity and challenge for the aluminium industry, as demand is set to surge in support of the green transition.

European Aluminium emphasises the pressing need for coherent energy, trade and industrial policies that facilitate the industry’s decarbonisation and incentivising recycling while remaining competitive on global markets. This will enable the industry to meet the growing demand with sustainable aluminium ‘made in Europe’.

The EU is significantly ahead of other countries and regions in climate ambition, mandating substantial emission reductions in every sector and installation. Achieving this goal requires a harmonised policy approach across various domains, including trade, energy, and industrial strategy, ensuring that Europe remains competitive while progressing towards decarbonisation. Aluminium is the most used non-ferrous metal globally, delivering energy and CO2 savings in leading sectors, including mobility and transport, packaging, consumer goods, and building and construction. Large volumes of aluminium will also be required to produce solar panels, batteries, electric vehicles, wind turbines, heat pumps and hydrogen electrolysers. To satisfy the EU’s targets for a fast energy transition, the additional demand for aluminium in

Europe will reach 5 million tonnes per year by 2040, equivalent to an increase of 30% compared to Europe’s total aluminium consumption today[1]

However, Europe’s higher climate ambitions cannot be achieved at the expense of its manufacturing capacity nor increase import dependencies across the aluminium value chain. Energy costs in Europe are still too high compared to our global competitors, hindering the possibility to invest in the decarbonisation and recycling processes needed to achieve climate neutrality by mid-century [2 and 3]

“The link between climate, trade and industrial policy must be strengthened and at the forefront of the agenda of the next EU Commission. We are ready to work with the EU Commission and the Member States on bridging solutions to bring down the cost of energy and boost the transformation of our industry while remaining competitive on global markets,” notes Paul Voss, Director General of European Aluminium. The EU needs to therefore step up its overall energy security by scaling up investments in decarbonised energy systems, clean technologies, and infrastructure, while making full use of the provisions of the Critical Raw Materials and Net Zero Industry Acts, which both recognise aluminium as a strategic raw material and component for Europe’s green transition. Both pieces of legislation will have to be thoroughly implemented to ensure aluminium manufacturing, processing and recycling remains and grows in Europe.

Last year, the EU27 lost 50% of its primary aluminium production as a result of the energy crisis. Prior to the crisis, the EU had already lost one-third of its primary aluminium production capacity over the preceding 15 years due to uncompetitive operating conditions in Europe. This European production was replaced by production in other countries, with a much higher carbon footprint.

“The proposed ‘Industrial Decarbonisation Deal’ will have to include strengthened carbon leakage protection measures that go well beyond existing untested mechanisms such as the Carbon Border Adjustment Mechanism (CBAM). We regret to see that in the Communication, there is no reference to any additional carbon leakage protection measures complementing the CBAM. These will be urgently needed to ensure our industry can remain competitive while delivering on our commitment to reach net zero by 2050. The European Aluminium value chain needs enhanced carbon leakage measures beyond the unproven CBAM. The current tool has numerous loopholes and avenues for circumvention, which are insufficient to safeguard the European aluminium industry against carbon leakage and to effectively reduce global emissions[4]” he concludes.

In response to these policy challenges, European Aluminium has published a study identifying technological pathways for which more research and financial resources will be urgently needed to achieve net-zero emissions by 2050.

*Director of Climate Change & Energy, European Aluminium.

Aluminium International Today March/April 2024 EUROPEAN UPDATE 16

European Aluminium emphasises the pressing need for coherent energy, trade and industrial policies that facilitate the industry’s decarbonisation and incentivising recycling while remaining competitive on global markets”. Could you expand on ‘coherent energy’ policy, in light of the energy crisis of 2023? What do you wish to see from the European commission with regards to energy policy, will this focus on energy security over renewability and/or vice versa?

In Europe, energy costs for aluminium producers remain excessively high compared to other regions worldwide. The energy crisis of 2022-2023 highlighted the vulnerability of European producers, resulting in approximately 50% curtailments of EU27 primary aluminium capacity. This trend followed a 15-year period during which the EU lost onethird of its primary aluminium production capacity due to uncompetitive operational conditions because of the too high-power prices in Europe. Furthermore, the spike in gas prices severely hit the recycling and transformation sectors. While gas prices in Europe are lower than last year, they are still too high compared to other regions. Consequently, European production is replaced by production from countries, which tend to have significantly higher carbon footprints.

So what we really need is costcompetitive, low-carbon energy, at a price that allows us to compete with other global players. This issue is particularly sensitive in Europe due to variations in energy cost structures, especially on electricity, among EU Member States. The variations are due to the countries’ electricity mix, national surcharges, and to what extent the indirect carbon costs of the EU Emissions Trading System (ETS) are passed on in the power price by electricity suppliers. Additionally, the possibility to enter long-term contracts varies across the Union, depending on whether

An Interview with Emanuele Manigrassi:

Member States have State Aid schemes to support their national champions, storage, infrastructure, and level of grid interconnections.

The recent energy crisis highlighted this reality: countries with deep pockets could support their industrial champions, whereas others faced challenges. Notably, 82% of total national aid approved by the EU Commission was allocated to just three Member States: Germany (53%), France (24%), and Italy (7.6%). Therefore, a “coherent” energy policy should encompass measures to align with Europe’s broader industrial, trade, and security objectives. This means diversifying energy sources to mitigate overreliance on any single source, implementing a unified European approach to boost investments in renewable energy infrastructure, incentivising renewable energy projects, fostering research and development in renewable energy technologies, and finding ways to reduce the cost of consuming low-carbon energy for tradeexposed industries like aluminium.

“The proposed ‘Industrial Decarbonisation Deal’ will have to include strengthened carbon leakage protection measures that go well beyond existing untested mechanisms such as the Carbon Border Adjustment Mechanism (CBAM).” How do you suggest CBAM is strengthened? How will a strengthened CBAM benefit EU industry?

We have always opposed the idea of the Carbon Border Adjustment Mechanism (CBAM). In our view, it cannot be designed in a way that would offer us the same level of protection provided by the existing carbon leakage protection measures in place in Europe. Additionally, we identify many unaddressed loopholes, ranging from the potential risk of resource shuffling (i.e. redirecting low-carbon aluminium to Europe while exporting carbon-intensive aluminium to other regions) to the manipulation of declared trade codes at the border, the over declaration of scrap content to lower costs, or simply importing higher value-added products further down the value chain that are not yet covered by the CBAM’s product scope.

This is why it is vital for our industry that the EU does two things: firstly, acknowledging that the CBAM cannot serve as the sole carbon leakage protection measure for European industry, and secondly, exploring alternative tools to safeguard industry interests should the CBAM fail to achieve its intended

objectives. Even with the implementation of the CBAM, our low-carbon producers will continue to pay the indirect carbon costs embedded in power prices due to the ETS and the marginal pricing mechanisms applicable to European electricity markets. Conversely, low-carbon imports will remain unaffected. So, we need to look at alternative carbon leakage protection measures that can truly level the playing field.

Interestingly, the need for alternatives was initially included in the first draft of the 2040 target plan but was subsequently removed, probably because of the fear that mentioning “alternatives” could undermine the credibility of one of the EU’s flagship climate policies.

“In response to these policy challenges, European Aluminium has published a study identifying technological pathways for which more research and financial resources will be urgently needed to achieve net-zero emissions by 2050.” More research and financial support are easy to request, but what is the likeliness that this will come about? How can EU industries support your call for an “industry Decarbonisation Deal”?

The report is much more than a request for financial support. It marks the beginning of a journey and dialogue with energy and technology suppliers, as well as other industrial value chains, national, European, and international organisations, on how we can truly deliver a net-zero aluminium value chain in Europe. While European producers are already leading the way in decarbonisation, regulatory constraints and carbon costs in Europe are eroding the resilience of the value chain.

The EU has only 16 years left to achieve its ambitious 90% Greenhouse Gas (GHG) reduction target, yet this imperative should not lead to deindustrialisation, a stark reality faced by industries in Europe. Our report reveals that without intervention, the necessary enabling conditions for a fully decarbonised energy system and most of the technologies required to achieve a fully decarbonised value chain will not be available before 2035. Every sector of the economy must contribute, and we propose three main lines of action: accelerating the decarbonisation of power generation and hydrogen at a competitive price for industry, prioritising and increasing investments in R&D for low-carbon technologies, and increasing scrap recovery and recycling in Europe. �

17

CAN THE FUTURE BE LINKED TO THE ROD? YES, TO PROPERZI ROD

luminium Rod lines with smaller ction output for E.C. grade and common alloys: 1.5 tph to 3.5 tph

R Aluminium Rod lines with medium duction output for E.C. grade and st common alloys: 4.5 tph to 6 tph

R Aluminium Rod lines with medium duction output for E.C. grade and st complex alloys: 4.5 tph to 8 tph

CR Aluminium Rod Lines with large nd extra-large production output for .C. grade and most common alloys: tph to 15 tph, reaching a yearly utput of up to 100,000 tons

sales@properzi.it

Navigating the future of metalworking in 2024

Manufacturers turn to digitalised CNC machining and interconnected smart factories

The rise of smart factories, digitalised CNC machining and the industrial metaverse are set to reshape the manufacturing landscape in 2024. Here, Hakan Aydogdu* looks at the key trends in manufacturing and explores why manufactures should embrace transformative technologies with userfriendly interface and adaptability to keep up with the evolving needs of the metalworking industry –while staying competitive.

“As of July 2023,” according to Deloitte’s latest report on the US manufacturing industry, “annual construction spending in manufacturing stands at $201 billion, representing a 70 per cent year-overyear increase and setting the stage for further industry growth in 2024.” The continued growth of the metalworking industry is driven by several factors. One is rising demand for lightweight, strong and durable materials like aluminum or titanium, particularly in the aerospace and automotive industries where these materials support energy efficiency.

Manufacturers will also seek to invest more in electrification and decarbonisation, in general.

Another driving factor is new technological advancements as, according to Aptean’s Discrete and Process Manufacturing: 2024 Trends and Outlook for North America report, manufacturers “focus on innovation/R&D, product development” to diversify into new markets and “acquire new customers.”

But what are the core technologies that will underpin the continued growth of the metal fabrication industry in the new year?

Let’s look at some examples of systems and processes that manufacturers should embrace to stay competitive.

Artificial intelligence (AI) and Machine Learning (ML)

In 2024, the metalworking and machine shop landscape will witness a profound shift, with Artificial Intelligence (AI) and Machine Learning (ML) emerging as critical trends. AI-driven product design tools are becoming integral to the industry, as they facilitate the creation of intricate and precise components. Meanwhile, ML

*General Manager of CNC automation system manufacturer, Tezmaksan Robot Technologies

TECHNOLOGY 19 Aluminium International Today March/April 2024

20 algorithms are adept at analysing vast datasets, enabling data-driven decisionmaking that enhances overall productivity. Both technologies enhance efficiency and competitiveness within the industry.

Analysis by Deloitte reveals that 86 per cent of manufacturing executives believe smart factories will be primary drivers of competitiveness in the next five years. As soon as 2024, smart factories are poised to be pivotal in the metalworking and machine shop sector, integrating advanced interconnected technologies such as AI, 5G, Internet of Things (IoT), data analytics and cloud computing.

As these machines become more interconnected and automated, so too will digitalised CNC machines, leading to increased efficiency and productivity.

For instance, predictive maintenance within smart factories utilises AI algorithms to forecast equipment malfunctions, minimising downtime and optimising machine performance. The implementation of 5G ensures seamless communication between devices, facilitating quicker decisionmaking and response times. IoT sensors collect and transmit real-time data, allowing manufacturers to monitor and optimise production processes remotely. Furthermore, cloud computing enables the storage and analysis of vast datasets, fostering data-driven decision-making for improved productivity.

Digital twins

The idea of the metaverse once belonged only in science fiction, a concept of the Internet as a single, universal and immersive virtual world accessed through virtual reality (VR) and augmented reality (AR) headsets. This has been changing in recent years, as digital twins — where real-world objects or systems are replicated digitally and virtually — allow manufacturers to create immersive 3D environments and simulate equipment, processes and other assets to support better safer and more profitable decision

making in the real world.

In 2024, manufacturers are set to take the digital twins concept to another level. This will combine the 3D modelling, 3D scanning and immersive environments with the data analytics, cloud computing and IoT technologies of smart factories to create larger metaverses, that replicate real machines and factories, buildings and cities, grids, transportation systems and more in a virtual world. By establishing model-based enterprises, manufacturers can foster global connectivity and collaboration with internal and external stakeholders.

Forbes predicts that industrial metaverses will foster more immersive and collaborative working processes. While, in the 2023 Deloitte and MLC industrial metaverse study, an overwhelming 92 per cent of manufacturers are actively experimenting with metaverse initiatives, projecting a substantial increase in sales, quality, throughput, labour productivity and more.

Interconnected technologies

Digitalised CNC machining is another anticipated trend for 2024, as machines become more automated and interconnected in order to increase efficiency and productivity in metalworking processes. To facilitate this, IoT sensors and devices and data analysis will become more integrated into control systems.

Elsewhere, the July 2023 AI Pulse Survey by Forrester found that manufacturers are growing more intrigued by the potential of AI tools, such as ChatGPT, to generate code for CNC machines. 67 per cent of enterprises researched by Forrester indicated they are bringing generative AI into their overall AI strategy. Although 29 per cent described their company’s use of generative AI as “experimentation” – which suggests many enterprises are proceeding with caution for now.

Nevertheless, the survey suggests manufacturers’ minds are turning

more towards the possibilities of more integrated machinery on the shop floor. A further example of this is the CubeBOX system, a compact robot cell designed to operate up to three CNC machines continuously, addressing the industry’s demand for increased efficiency and productivity. The system operates without downtime during loading and unloading, providing a seamless and uninterrupted 24-hour production cycle.

One of CubeBOX’s key advantages is its user-friendly software, ROBOCAM, which eliminates the need for robot programming and CAM knowledge. This aligns with the industry’s call for simplified processes and enhanced automation. The software converts 2D CAD drawings of workpieces to CAM, streamlining the integration process and allowing operators to focus solely on loading and unloading the workstation.

Moreover, CubeBOX’s lean and flexible design, coupled with the ability to handle various models and adapt to different CNC machines, addresses the industry’s need for versatility. The system’s compatibility with all CNC machines and control units, as well as its adaptability to different robot brands, positions it as a versatile and adaptable solution for manufacturers with diverse Industry 4.0 needs.

In the context of the challenges outlined for 2024, CubeBOX excels in reducing operator intervention and improving night shift efficiency. The system’s capacity to run continuously for 24 hours enhances overall production output, aligning with the industry’s goals of reducing lead times and optimising efficiency. By automating the loading and unloading processes, CubeBOX minimises downtime, contributes to predictive maintenance and digitalised CNC machining, integrating seamlessly with the vision of interconnected technologies in smart factories.

In conclusion, manufacturers must stay on top of current technological trends to address the challenges faced by the metalworking industry in 2024. Ideas once confined to the pages of sciencefiction, like AI and the metaverse, must be embraced with an open mind, and combined with practical Industry 4.0 approaches to interconnecting machines on the shop floor. Such strategies will be essential if manufacturers are to stay competitive in 2024’s rapidly evolving industrial landscape.

If you are interested in improving your manufacturing efficiency and would like to learn more about CubeBOX automation systems, visit the Tezmaksan website. �

For further information please visit www.tezmaksan.com

Aluminium International Today TECHNOLOGY

Introducing Mechatherm Services USA.

We now have a dedicated US-based service team to meet the needs of our valued clients across North America and Canada

+44 (0) 1384 279 132 | services@mechatherm.co.uk | www.mechatherm.com

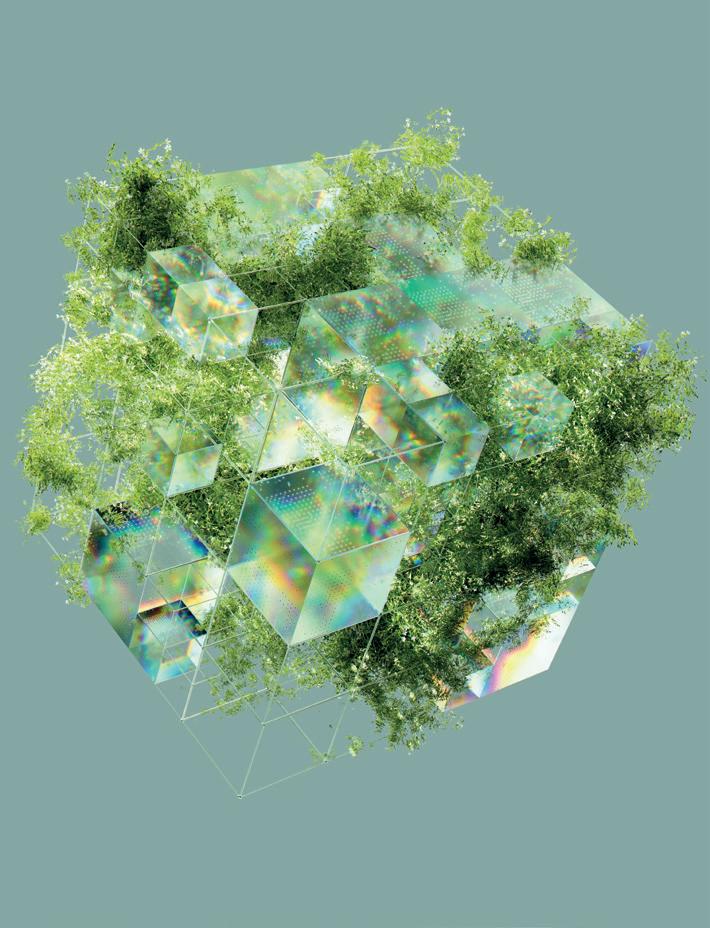

Shaping the future: Digital transformation in the aluminium industry

By Professor Alexeis Garcia Perez*

Introduction

The aluminium industry, a vital cornerstone of the global economy, is on the brink of a transformative era. Traditionally characterised by physical labour and mechanical processes, it is now rapidly embracing the digital age. This shift, driven by the need for greater efficiency, innovation and sustainability, is reshaping the industry’s landscape. For decision-makers, particularly in the European Union, where environmental and technological leadership is a priority, understanding and harnessing this digital transformation is crucial. This article examines the historical evolution of the industry, explores the core aspects of its digital transformation, and discusses the opportunities and challenges it presents, along with a glimpse into the future.

Historical context

The journey of the aluminium industry has been marked by constant evolution and adaptation. From its early days, when aluminium was a precious metal, more valuable than gold, the industry has grown exponentially, especially after the introduction of the Hall-Héroult process in the late 1880s. This process made mass production of aluminium feasible, drastically reducing its cost and laying the foundation for its widespread application. Throughout the 20th century, the industry continued to expand, but it was primarily reliant on manual labour and simple mechanisation of processes.

The advent of the digital age towards the end of the century marked the beginning of a significant shift. Early adoption of computerised systems brought improvements in process control and operational efficiency, albeit modestly. These were the initial steps towards a more connected and data-driven manufacturing environment for the aluminium sector.

Core aspects of the digital transformation of the aluminium sector