ALUMINUM STRONGER THAN EVER

As your leading partner in the world of metals, we offer the full range of plants and machinery for melting, casting, rolling and refining high-quality and high-tech aluminum products. With this strong footprint and 150 years of experience, we’re here to add value now and in the future.

Find out more at www.sms-group.com/plants/the-world-of-aluminum

Volume 35 No. 6 – November/December 2022

Editorial

Editor: Nadine Bloxsome

Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Editorial Assistant: Zahra Awan Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales

Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com Tel: +44 (0)1737 855117

Advertisement Production Production Executive: Martin Lawrence

Managing Director: Tony Crinion CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034 email subscriptions@quartzltd.com

Annual subscription: UK £257, all other countries £278. For two year subscription: UK £485, all other countries £501. Airmail prices on request. Single copies £47

COVER

ALUMINIUM INTERNATIONAL TODAY is published six times a year by Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK.

Tel: +44 (0) 1737 855000 Fax: +44 (0) 1737 855034 Email: aluminium@quartzltd.com

Aluminium International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437.

Printed in the UK by: Pensord, Tram Road, Pontlanfraith, Blackwood, Gwent, NP12 2YA, UK

CHALLENGES AHEAD

The last couple of months seem to have flown by, while at the same time, some days where we have learned of news of more challenging times ahead, have slowed right down.

It’s fair to say that as an indu stry and in our own day-to-day lives, we are all facing a number of hurdles as we race towards the end of 2022. Is it a year we will be glad to see the back of? Or will 2023 prove even more challenging?

I’m forever an optimist, but it was clear to see at the most recent gathering of the alumi nium sector at ALUMINIUM 22 in September, that there were already rumblings and some feelings of doubt being hidden behind beaming smiles as we were welcomed onto shiny, exhibition booths.

Our Editorial Assistant, Zahra Awan, spoke with a number of industry leaders at the show to get their thoughts on how the energy crisis could hit Europe and other challenges on the horizon. You can read all about it on page 19. We also have a dedicated feature on how best to prepare for these uncertain times, with an outlook from a Fastmarkets Analyst (page 14). and a detailed look at Demand Side Response (page 23).

And, with the recent an nouncement that the Future Aluminium Forum will finally return to a live event format in May 2023, this month’s Alumina Chronicles on page 33. focuses on the growth of the aluminium industry in Canada.

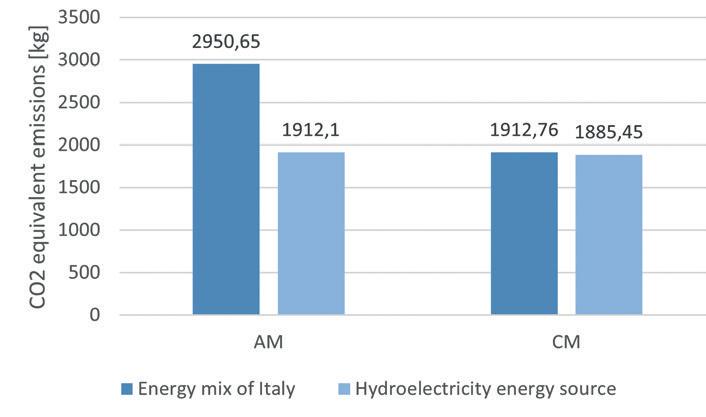

You’ll hopefully also notice a very special supplement in this issue, courtesy of the Aachen Center for Additive Manufactu ring (page 51). Enjoy! nadinebloxsome@quartzltd.com

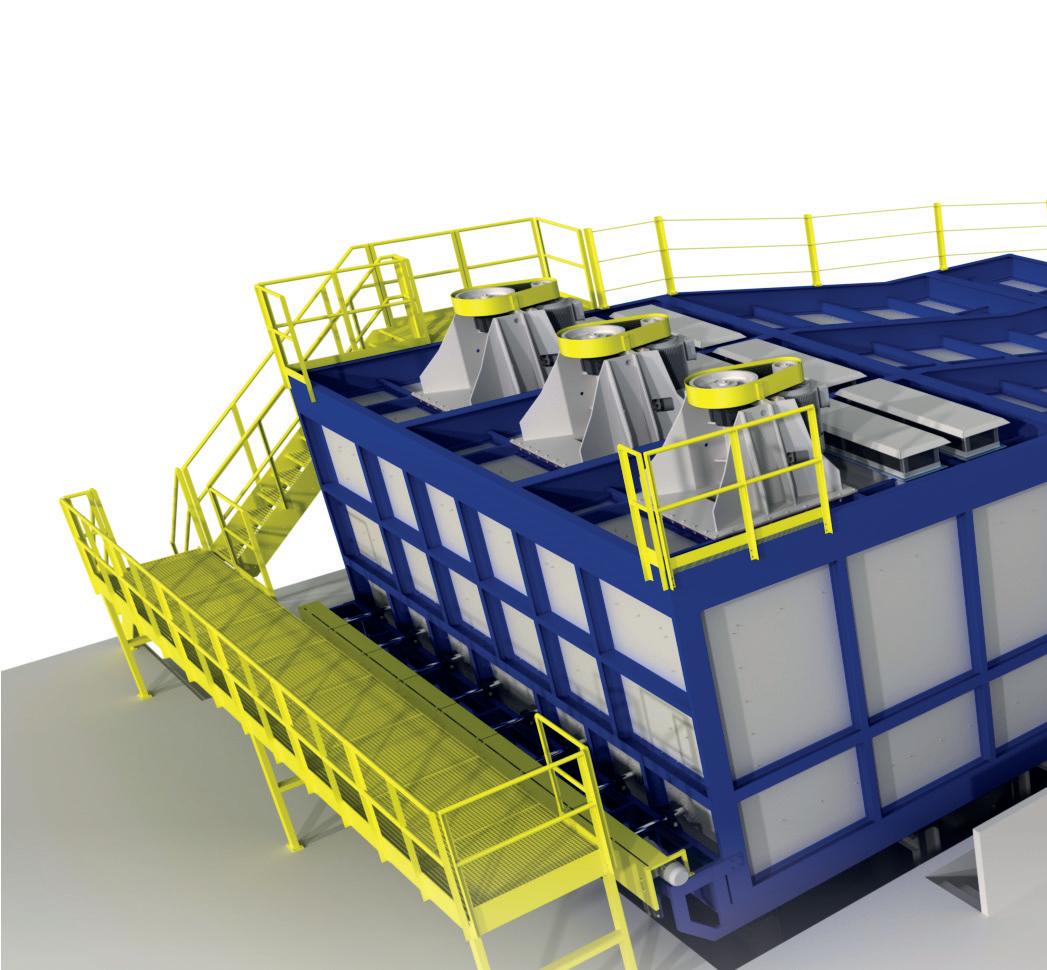

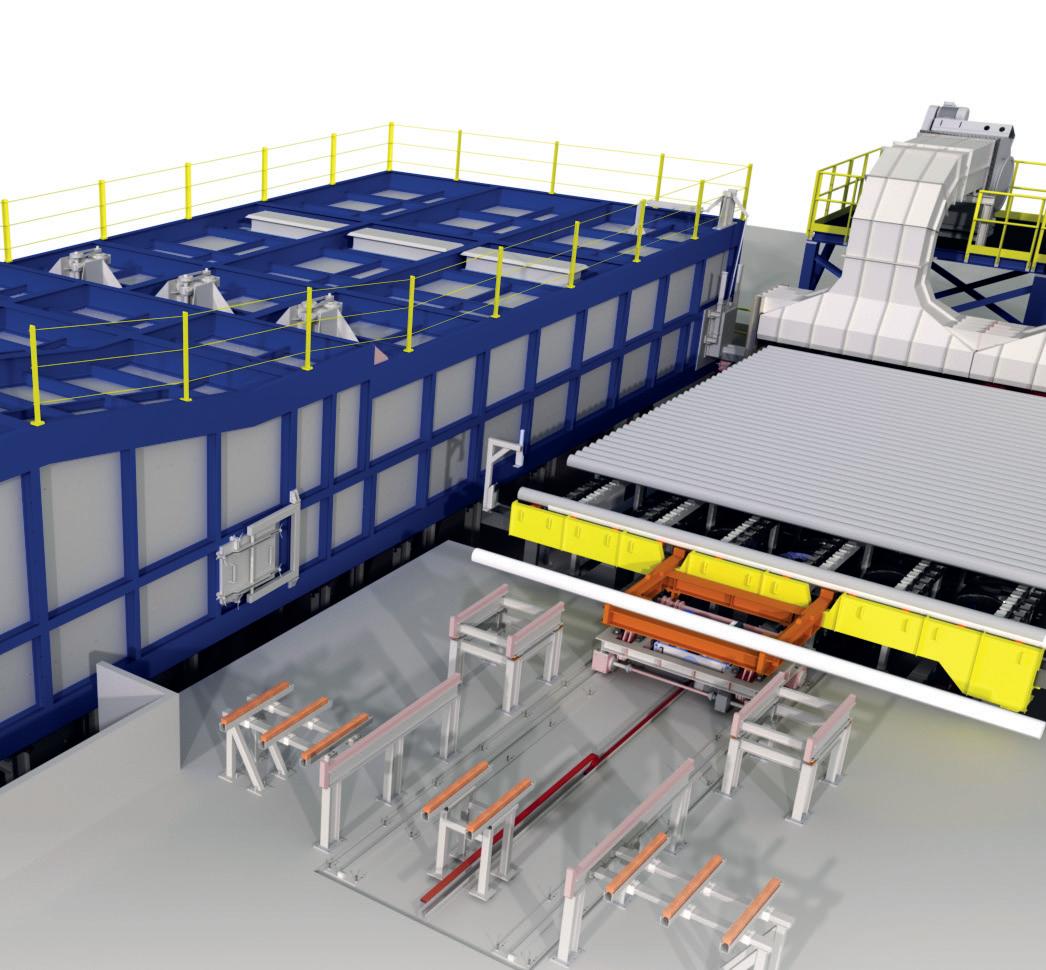

Novelis breaks ground on recycling & rolling Plant

Novelis Inc. broke ground and be gan construction in October on its $2.5 billion recycling and rolling plant in Bay Minette, Ala.

The highly advanced facility is ex pected to create up to 1,000 new jobs and will have an initial 600 kilotonnes of finished aluminium goods capacity per year focused on the beverage container market, with flexibility for automotive pro duction.

It also adds a new recycling cen tre for beverage cans, increasing the company’s recycling capacity by 15 billion cans per year when fully operational.

this investment, we want to demonstrate the strength of our growing customer partner ships, the commitment we have to sustainably grow our business, and the innovative, forward-think ing approach we are taking to modern manufacturing,” said Steve Fisher, President and CEO of Novelis. “We are especially proud to celebrate our groundbreak ing of this state-of-the-art facility on National Manufacturing Day, which highlights the exciting ca reer opportunities available in our industry.”

Site work is also underway includ

ing earthwork, excavation, and piling. Over the next few months, Novelis will construct 2 new road ways on the site and expand the utility infrastructure necessary to begin building construction. Com missioning of the facility is sched uled for mid-2025.

The company selected a leading engineering company as its site layout, engineering and construc tion contractor, an Alabama-based firm to serve as earthworks con tractor, and several manufactur ing equipment providers that have longstanding relationships with Novelis across the world.

Hydro invests BRL 590 million in Paragominas

Over the last 15 years, Hydro Par agominas has actively contributed to the economic and social devel opment in the municipality. The Miltônia 5 project is an investment of approximately BRL 590 million (around USD 110 million) in a new mining front that will begin opera tions in 2023.

“This new mining front consists of the construction of an access road and infrastructure to support the operations. The work is already

underway, with completion sched uled for the first quarter of 2023. Over time, the M5 project will in crease its share in Hydro’s produc tion chain, representing the term investments in the assets in Pará. This is an important contribution to the development of Paragomi nas and the region,” says Anderson Martins, Director of Hydro Parago minas.

The new mining front will gen erate additional jobs during the

HAI to invest €100 Million

Hammerer Aluminium Industries continues the dynamic develop ment course of recent years and invests 100 million euros in the further development of the Group.

With this investment, Hammer er Aluminum Industries (HAI) is setting another milestone in the consistent growth strategy of the HAI Group. With two new extru sion lines, including processing centers and the construction of a logistics center, the course is set for the future.

“With the new investments and the recent investments made at our company locations, we as

the HAI Group are optimally posi tioned to be able to continue to grow with our customers from transport, industry and construc tion,” explains Rob van Gils the orientation for the next few years.

All planned investments corre spond to the latest available stand ards in terms of environmental protection, energy consumption

infrastructure work stage, with an estimated 1,000 workers at the peak of the first stage activities. This maintains the prioritization of hiring local labour, products and services.

“This project includes all the Hy dro values. It was developed during the pandemic and included all are as of the organization, from plan ning to execution. We will continue to follow the highest standard of quality and safety,” says Martins.

and safety. This also underlines the ambitious sustainability strat egy that makes Hammerer Alumi num Industries a pioneer in light weight aluminum construction. By using an average of 80% recycled material and primary aluminum from certified production, which is generated 100% with electricity from renewable energy sources, HAI is a pioneer in climate protec tion. With the sustainable alloys SustainAl 2.0 and SustainAl 4.0, launched in 2021, HAI offers cus tomers a material with a carbon footprint well below the European average.

“Through

Rio Tinto joins First Movers Coalition to help drive low-carbon transition

Rio Tinto has announced it will join the First Movers Coalition, a global initiative to help commer cialise zero-carbon technologies by harnessing purchasing power and supply chains.

More than 50 companies with a collective market value of about $8.5 trillion across five continents now make up the coalition to cre ate early markets for innovative clean energy technologies.

The initiative is led by the World Economic Forum and the US Government and targets sectors including aluminium, aviation, chemicals, concrete, shipping, steel, and trucking, which are re

sponsible for 30 per cent of global emissions. This is expected to rise to over 50 per cent by mid-centu ry, unless there is urgent progress on clean technology innovation.

Rio Tinto Chief Commercial Officer Alf Barrios said: “We want to bring Rio Tinto’s considerable buy ing power to help build sustain able supply chains for emerging green technologies. The low-car bon transition is at the heart of our business strategy and success will require large scale of change throughout the value chain, which our pledges to the First Movers Coalition are aimed at supporting.

“As a member of the First Mov ers Coalition, we also look forward to building on our existing net work of partnerships to support the development of new technol ogies to help power our way to a net-zero future.”

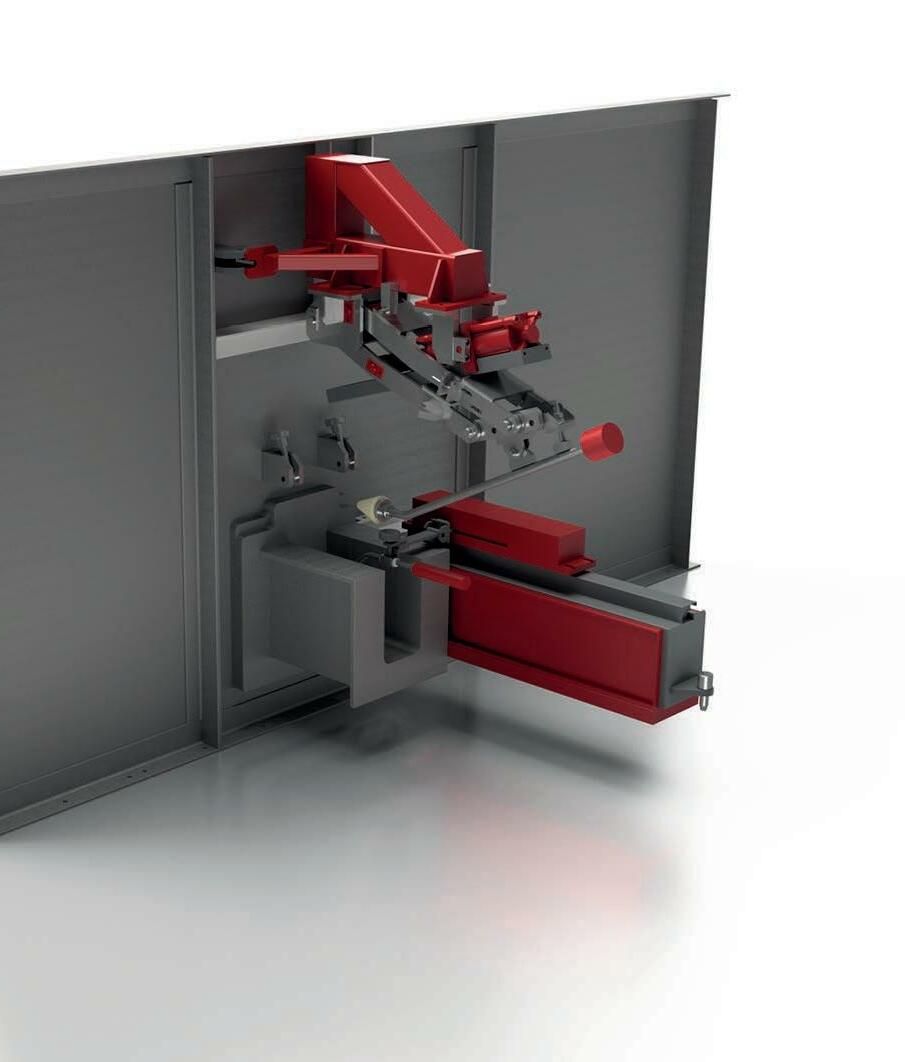

EPIQ Machinery and DTA team up to better serve the aluminium producers

EPIQ Machinery Chief Executive Of ficer, Éloïse Harvey, and DTA Chief Executive Officer, Miguel de Sebas tian Merello are proud to announce their recent teaming agreement. This close collaboration between EPIQ Machinery and DTA is full of potential bringing an array of AGVs possibilities for the international al uminium market.

This partnership offers the al uminium producers proven AGV solutions backed by DTA, the world most advanced manufacturer of autoguided solutions. The goal of EPIQ Machinery teaming with DTA

is to bring the AGV technology accessible and in accordance with our clients’ specific needs. EPIQ Machinery will also act as solution integrator and provide after-sale

technical support.

EPIQ Machinery and DTA want to embrace the aluminium pro ducers towards the shift to Indus try 4.0. by offering global mate rial handling system integration into plants. As the AGV market is booming, the cooperation between EPIQ Machinery and DTA is timely. The combination of the skills of the two equipment manufacturers, leaders in their field, can only ben efit end-user customers. Together, sharing their passion for challeng es, for safer and smarter moves.

ASI certifies Aluminerie Alouette

Aluminium Stewardship Initiative (ASI) has announced that Alumin erie Alouette has been certified against the ASI Chain of Custody Standard for its aluminium smelt

er and casthouse operations. With an annual capacity of 600,000 tonnes of primary aluminium, it is the largest smelter in the Ameri cas.

“We congratulate Aluminerie Alouette on achieving ASI CoC Cer tification for its Sept-Îles, Quebec smelting operations. With this cer tification, the company consortium made up of several ASI-certified Members demonstrates the overall collaborative spirit of our Mem bers to create a responsible aluminium value chain. The noteworthy production capacity at the plant also provides a significant boost to the availability of ASI-Certified aluminium to downstream aluminium users.”

– Fiona Solomon, Chief Executive Officer at ASI

Ball Corporation Expands the Portfolio of its Infinitely Recyclable Ball Aluminum Cup®

Ball Corporation has announced the availability of two new sizes of its infinitely recyclable Ball Aluminum Cup®, therefore broadening the opportunity for venues, concessionaires and more to offer consumers a full portfolio of sustainable cup options. The Ball Aluminum Cup® that is available for food service customers is now composed of 90% recycled content, making it the cup with the highest recycled content rate of any beverage packaging in its category.

AMETEK Land Celebrates 75 Years of Product Innovation and Technology

AMETEK Land, the world’s leading manufacturer of monitors and analysers for industrial temperature measurements, celebrates 75 years of producing innovative systems and solutions for industries including metals, glass, hydrocarbon processing and power generation.

David Primhak, Director of Sales and Product Management at AMETEK Land commented: “As a company, we are incredibly proud of our contribution to industrial manufacturing. We have a magnificent team leading the way in product development and advanced technologies, developing new solutions and updating existing systems to help improve safety, increase yields, and reduce carbon footprints.”

Alba’s delegation, led by its Chairman of the Board, attends LME Week

“The fact that aluminum, especially Canadian aluminum, is a solution to climate change cannot be overstated. This new certification adds value to our metal for our shareholders’ customers, who are increasing ly looking to source green alu minum. Our entire team and our partners can be proud of this news. Everyone works hard every day. This is a key hallmark in today’s globalized world.”

– Claude Gosselin, President and CEO of Aluminerie Alouette

Speaking on this occasion, Alba’s Chairman Shaikh Daij bin Salman bin Daij Al Khalifa said: “Volatility and unpredictability are the new norm and thanks to Alba’s resilience, we will be able to weather the challenges in light of the changing dynamics in the Aluminium market and global economy.

Our participation in the LME Week is a one-stop shop to understand the current market sentiment, gain more insights on the 2023 Market Outlook while addressing more pressing matters in Sustainability and ESG.”

Novelis develops new laminated aluminium surfaces for beverage can ends

Novelis has announced the com pany’s new laminated aluminium surfaces for beverage can ends, which was showcased September ALUMINIUM 2022 in Düsseldorf. This innovative application im proves beverage container ap pearance, increases production process efficiencies and lowers CO2 emissions for European beverage brands and can makers. As a result, it further advances Novelis’ leader ship in the growing market for alu minium beverage packaging.

Coloured aluminium beverage can ends, especially black, are par ticularly popular for new and inno vative beverage products and en

ergy drinks. However, producing lacquered, black ends also poses challenges in terms of colour sta bility and can makers’ production processes.

Novelis’ product innovation supports can makers and beverage brands in reaching their sustaina bility goals. The lamination of alu minium coils for can ends reduces CO2 emissions by 33%, compared to the conventional liquid coating, as the lamination process requires less heat and chemicals. Laminat ed ends have no adverse impact on beverage can recyclability. Similar to the conventional can coating, the laminating film is re

moved as an organic component in the recycling process by thermal pre-treatment and waste heat is reused in the process.

“This innovation meets the food and packaging industry’s require ments for high-quality, lower CO2 footprint material,” said Alexander Kuzan, Vice President of Can for Novelis Europe. “Together with our customers, we are creating better, more sustainable products and effi cient manufacturing processes. Us ing high levels of recycled alumini um in our products helps reduce the consumption of natural resources, strengthen the circular economy and limit climate change.”

Rio Tinto and Volvo Group partner for low-carbon materials supply

Rio Tinto and Volvo Group have signed a Memorandum of Un derstanding (MoU) to create a strategic partnership where Rio will supply responsibly sourced low-carbon products and solu tions to Volvo Group. The compa nies will work towards decarbonis ing Rio Tinto’s operations through piloting Volvo Group’s sustainable autonomous hauling solutions.

The multi-materials partnership will allow Rio Tinto to progress sustainability commitments in its operations and supply chains. It will support Volvo Group in its am bition towards a net-zero future. The partnership aims to secure supplies of materials including lithium, low-carbon aluminium, copper, and metallics.

Rio Tinto Chief Executive Jakob Stausholm said: “We look for

ward to partnering with Volvo to progress our contribution to a net-zero future, as we collaborate to deliver sustainable outcomes from the mine to the showroom floor. We will be working together to support the decarbonisation of Rio Tinto’s operations and deliver low-carbon materials for use in Volvo’s innovative product range, including electric and autono mous vehicles.”

Volvo President and Chief Ex ecutive Officer Martin Lundstedt said: “We are eager to partner with Rio Tinto, a true collabora

tion aiming to accelerate our am bitions towards a fossil-free, de carbonised future. By addressing the full value chain, from the use of low-carbon materials in our products, to providing our cus tomers with sustainable autono mous hauling solutions, we can contribute to a better and more sustainable future.”

The companies will work to gether to strengthen the supply of responsibly sourced low-carbon materials such as RenewAlTM al uminium, aluminium produced using the ELYSISTM zero-carbon smelting technology, Alumini um Stewardship Initiative (ASI) certified aluminium and Copper Mark certified copper, and explore product development opportuni ties such as the supply of lithium for batteries.

www.aluminiumtoday.com

November 29th - 1st December

ARABAL 2022

ARABAL has announced that the 24th edition of ARABAL (the Arab International Aluminium Conference and Exhibition) will be hosted by Egyptalum. Held in Egypt www.arabal.com

December 1st December - 2nd December

SIM USA 2022

To support and facilitate the transition towards cleaner manufacturing in the USA. Hosting leaders from industry, innovation, science, government and investment, SIM USA will bring together those responsible for driving sustainability across hard-toabate sectors. Held in Cleveland, USA www.sustainable industrialmanufacturing.com/ usa

2023 March 19th March - 23rd March 2023

TMS

The TMS Annual Meeting & Exhibition brings together more than 4,000 engineers, scientists, business leaders, and other professionals in the minerals, metals, and materials fields for a comprehensive, cross-disciplinary exchange of technical knowledge. Held in California, USA www.tms.org/AnnualMeeting/ TMS2023

30th March - 1st April 2023

METEF

Expo of customised technology for the aluminium, foundry castings & innovative metals industry. New opportunities for the downstream sector generated by the synergies between Metef and MECSPE. Held in Bologna, Italy www.metef.com/en/

For a full listing visit www.aluminiumtoday.com/ events

Show Review: ALUMINIUM 22 Show Review: ALUMINIUM 22

By Zahra Awan*After four long years of dormancy, the well-known ALUMINIUM trade fair woke to an industry in a frenzy. With the growing demand, applications, sustainability, innovations, and of course, challenges; it is somewhat compulsory for the industry to feel the full spectrum of emotions in response to the single word: Aluminium.

Returning to the black rubber floors and elaborate stands presented the visitors with a strong sense of power, the industry has grown. Despite the pandemic, the industry has evolved. Despite moving to remote communication and online shows, despite countries having to shut down. We are strong. But then came politics and war, igniting woes of inflation, supply, and energy.

Registering 20,400 visitors from 100 nations, ALUMINIUM in Düsseldorf[1] has reported. “Aluminium is and always will be a key material on the path towards climate neutrality and resource efficiency, but the industry is struggling with major challenges related to energy prices, supply security and supply chains,” said RX Austria and Germany.

The opening conference made sure to address the energy crisis, Benedictine

Binder-Krieglstein, CEO RX Austria & Germany called for “politicians to act” and noted that “unfortunately invitations sent to politicians were declined”, but one. And Robert Habeck, Vice Chancellor of Germany, only reiterated that the most important aspect is “tackling the energy crisis.”

The threat to the industry became clear as Rob Van Gils, President Aluminium Deutschland/CEO and Managing Partner Hammerer Aluminium Industries spoke: “It is an honour to be here and speak at the ALUMINIUM 22 Trade Fair. The Developments in the energy market are very concerning for both Europe and Germany. We must not let this happen, we must not let aluminium, this fantastic material, leave Germany.” This was the first mention of the real threat to industry in Germany, and Europe, but it was certainly not the last. Paul Voss, Director General of European Aluminium, reiterated that this topic is “a topic that people don’t want to talk about” but is one that needs to happen. Mr Voss compared his fairly new role to “fixing an aeroplane whilst flying it, and by the way, the airport is on fire.”

*Editorial Assistant, Aluminium International Today

I think this is a relatable story.

The need for “solidarity across the value chain”, as stated by Paul Voss, is key to the success of the industry. Being able to communicate to policy makers and governors as well as clients is key for the industries success.

Zahra Awan has been following up with companies who exhibited and attended the ALUMINIUM 22 trade fair on their view and response to the Energy Crisis. This editorial can be seen on page 19

The event also saw hope for the future, as companies were reminded to keep ‘one eye open to the future’. With deals being made, for example: ASAS’s order with the SMS group. ASAS Alüminyum announced that it is investing in extrusion technology from SMS group to produce profile sizes that currently cannot be produced in Europe. ASAS has been relying on SMS group’s expertise for many years and has ordered two new aluminium m extrusion lines. The plants to be supplied comprise a 150 MN extrusion and tube line, as well as a 45 MN HybrEx® line.

Hydro also announced that it has invested Billions in making its aluminium

more sustainable. Since becoming Hydro’s CEO in May 2019, Hilde Merete Aasheim has been repeating one key message regarding the direction of the company: Lifting profitability, driving sustainability.

Hydro has followed up with back-toback years of strong profitability and many future oriented investments aimed at improving the sustainability of its operations in the aluminium business. “Aluminium is a key material for the green transition. Hydro expects the demand for ‘near zero’ aluminium to grow much faster than the overall market demand growth. We are investing heavily in our operations with the aim of fulfilling the ambition of aluminium production with net-zero emissions,” says Ms Aasheim.

For more on this news, visit: https:// www.hydro.com/en/media/news/2022/ hydro-invests-billions-in-making-itsaluminium-more-sustainable/ Assan Aluminyum also held a press conference where Goksal Gongor, General Manager celebrated the company’s “50th Anniversary,” and discussed their core “sustainable values, ESG and their new program to support women’s empowerment.” They also announceD their plans to expand to North America.

ALUMINIUM recognised Turkey’s ‘strong performance’ at the show with

multiple Turkish representatives attending the event. Çetin Tecdelioglu, Chairman of IDDMIB, says: “There is a growing demand for aluminium each passing day. Its area of use is expanded by new technologies and production models, including defence, construction, and automotive sectors in particular, and it gains an increasingly bigger place in daily life.”[2]

As well as a booth, Aluminium International Today also collaborated with ALUMINIUM 22 in its Innovations Plaza: Digital and Additive Manufacturing. The goal of the three-day conference was to discuss modern, Industry 4.0 inspired solutions to challenges faced across the industry. Nadine Bloxsome, Editor of Aluminium International Today, said “I am excited to hear from some great speakers on topics covering the smelter of the future, opportunities and challenges associated with digital manufacturing and the links between sustainability and digitisation.”

The steady flow of people passing our stand resumed on day three. With the day continuing from a night of networking on the ALUMINIUM boat event, attendees were acquainted further, inspiring more business. But the interval on the boat inspired further talks on the energy crisis, and its individual impacts on those

attending. As sensitive as Aluminium is to the Crisis, is how sensitive everyone is to its fluctuations. There are a number of employees in the industry, without, they would be unemployed, and the production for aluminium would be impacted. “The current challenge: energy, energy, energy,” said Stephan Zegers, Managing Director Alufinish GmbH & Co. KG[3]

The “ALUMINIUM 2022 has exceeded our expectations,” said Barbara Leithner, Chief Operating Officer at RX Austria & Germany, the organiser of ALUMINIUM. “The more challenging the times the more important is communication within, and the unity of, the industry.” With this, we wait for the next two years to pass for ALUMINIUM 24. Announcing that the show will take place on the 8th- 10th October, the industry will certainly transform once again, with new challenges and successes.

�

[1] + [3] https://www.aluminiumexhibition.com/en-gb/media/news/ Aluminium2022-FinalReport_EN.html [2] https://www.aluminium-exhibition. com/en-gb/media/news/AluminiumTurkiye.html

The European way out - securing raw materials for European industry

By Bernd Schäfer*We are living in what can only be described as an epochal time in modern history. We cannot underestimate the unprecedented nature of the volume of raw materials needed to build the wind turbines, fuel cells, solar panels, heat pumps, batteries, and more - just to replace the EU’s imported 155 billion cubic metres of Russian natural gas. The Russian invasion of Ukraine, soaring energy prices, Europe’s lack of resilience with regard to its growing metals needs, and the ever-present possibility of metals and minerals supply shortage, has put us at a worrying disadvantage.

Europe aims to become the first carbon neutral continent, driven by the ambitions of the European Green Deal which will require unprecedented quantities of raw materials. In fact, the World Bank has found, that meeting clean energy targets would increase demand for many metals by 500 to 1,000 percent by 2050. (The World Bank Group, 2020 Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition)

To lead Europe out of this dilemma, European capacities must be promoted and built immediately without hesitation. This must be done with a long-term strategy with political support in place to trigger investments in primary and secondary raw materials production.

For Europe to remain economically successful and globally competitive, while becoming increasingly resilient to external geopolitical factors, it must stimulate a responsible raw materials sector by establishing sustainable, competitive value chains of raw materials and advanced materials, and building up robust secondary raw materials capacities through recycling, for the circular economy.

Urgent and tangible action is needed. Momentum cannot be allowed to slip. We must build on all positive opportunities, such as the recent launch of the European Commission’s Critical Raw Materials

Act ‘Call for Evidence and Open Public Consultation.’ This will remain open until 25 November 2022 and marks a significant and welcome milestone for the European raw materials sector. It provides a vital platform through which we in the sector can contribute to this crucial legislation. EIT RawMaterials, as Europe’s largest raw materials consortium, as a connector and intermediary of industry, academia, RTOS, NGOs and government, will ensure the critical voices of the European raw materials sector are heard in this consultation process.

Magnesium: Evidence of the Urgent Need for European Raw Material Autonomy

The recent magnesium issue is just one example of the urgency of action required on the building of a sustainable, secure, and reliable supply of raw materials for Europe.

While the global magnesium market itself is relatively small, with about 1.2

*CEO & Managing Director, EIT RawMaterialsmillion tonnes of annual production, compared to 67 million tonnes of aluminium, it plays a vital role in giving compressed strength to a wide range of products. Items we rely on in everyday life, from the aluminium beverage can to the wings of a modern Airbus airliner, would not exist without magnesium. The European Commission is worried that any fall in shipments from China which supplies over 90% of magnesium to Europe, could curb production of auto parts, airplane parts, and other products that depend on the mineral.

As we all know, magnesium supplies from China fell late last year, igniting prices in Europe and focusing the EU on efforts to secure domestic supplies. Now, the recent energy crisis and soaring energy costs are causing significant shifts to the raw materials supply-and-demand landscape of the aluminium sector. The electricity prices in Europe have triggered cuts in the energy-intensive production of aluminium and other industries. Europe’s

primary aluminium output capacity has fallen considerably, with further output under threat as new curtailments continue to be announced, due to the power crisis.

In Germany for example, the German Aluminium Association showed that nine out of 10 companies said they were not able to switch to another energy source if gas was no longer available in the short term. Reducing the gas supply by 30% would already bring production to a standstill for half of the companies.

What we are now witnessing is a mad scramble for mineral resources, in conjunction with this unprecedented energy crisis, which is causing a global geopolitical shift in the raw material sector.

The problem is that Europe currently imports a staggering amount of its most critical raw materials from abroad and

chains between member states and likeminded international partners to take full advantage of Europe’s single market opportunities. Because, irrelevant of the current energy supply crisis which urgently needs a reliable solution, Europe’s mission is to decarbonise industry, to be the first climate neutral continent by 2050.

There are several factors that must be urgently put in motion to make this a reality. We need a level playing field in which Europe can compete. Investment must be stepped-up without delay to build and strengthen a highly reliable critical raw material supply chain, and we must scaleup innovative and relevant education and re-skill and upskill the workforce.

We need industry-wide commitment to the highest environmental, social, and governance practices (ESG) because by importing materials from states with

the supply of critical raw materials and to help catalyse investment for strategic opportunities.

As a result of this work, we have several projects in progress which are addressing diversification of supply. For example, for rare earths, we now work with a Canadian company with expertise across the rare earth value chain, one of the few outside of China. Their planned facilities in Estonia can provide over 10% of Europe’s needs, in terms of both rare earth metals and magnets.

Europe’s Great Innovation Opportunity

The great potential for Europe to produce and recycle more of the raw materials needed for the energy transition is significant. Domestic production and recycling of raw materials is beginning

from single economies, putting it at high risk. Europe, for example, imports 98% of rare earths and 93% of magnesium from China, 98% of Borates from Turkey and South Africa provides 71% of the EU’s needs for platinum.

China has established a significant presence across the entire clean energy supply chain which has been done through state-subsidised overcapacities, tax exemptions and under-pricing. This is all to be seen in context of the very successful One Belt One Road (OBOR) initiative, which comprises 65 countries, 900 projects, and a total planned investment volume of $850 billion (approx. €859 billion).

Sustainability and Diversification of Raw Materials Supply

So, what is the solution? The time has come to rapidly build highly innovative and sustainable raw materials supply

values far different from our own, we are supporting deficient ESG practices.

We need a sustainable primary and secondary raw material industry to enable the transition to renewable energy, which means we must build up domestic reserves of raw materials and enhance our recycling capacities.

And Europe must diversify supply also with partnerships beyond our own borders to promote competitiveness, a key driver for innovation. We must forge robust raw materials strategic partnerships with likeminded nations, whose shared values with Europe are rigorously upheld.

The good news is that this process is underway. EIT RawMaterials, along with the European Commission, is working to strengthen our relationships now with governments and markets in Ukraine, Greenland, Australia, Africa, Norway, Latin America, Canada, and the US to secure

to take hold across the continent. At EIT RawMaterials, we are bringing together leaders in academia, research, and business/industry to collaborate and innovate together to accelerate this transition.

Right now, mine sites across Europe are not only modernising, but becoming increasingly safe and sustainable thanks to advances and innovations in robotics, Artificial Intelligence (AI), virtual reality, and electrification. In Spain, for example, we are supporting one of our partners to launch a fully electrified underground mine which is expected to contribute to 13% of the copper mines output of Spain and deliver copper with a 90% lower carbon footprint compared to existing standards.

There are challenges of course, but momentum is building, with, for example, the construction of a silver-zinc-lead

project in Bosnia, and the decision of the Greek government to permit a copper project in Greece, which alone is expected to start an annual average production of 40,000 tonnes of copper in 2025.

In Finland, one of our EIT RawMaterials partners has just secured a permit approval for a lithium plant, and a significant investment of €500 million, with the aim to produce high-purity, sustainable lithium for Europe.

Another partner of ours in Spain is planning to extend its existing processing capacity of high-purity copper, zinc, lead and silver. This is a technologically advanced operation that has achieved a remarkable low environmental footprint in terms of water use and emissions.

We also now support three projects that deal with the production of tungsten, which is critical for the aerospace and defence industries. This has the potential to supply almost 60% of the EU’s needs for tungsten.

Contextualising Aluminium in Europe’s Raw Materials Mission

By galvanising this immense innovation potential, we can continue to rebuild the aluminium sector in Europe. If we look at

the market potential itself - the primary aluminium market here in Europe, will be about nine million tonnes per year by 2050, versus a projected global production of 107 million tonnes. (https://www. european-aluminium.eu/vision-2050)

The sector is one of Europe’s most complete value chains in the raw materials sector and offers widespread energy transition uses. Since 2008 however, Europe has lost more than 30% of its primary aluminium production, and with the current energy crisis, this is expected to increase substantially. (https:// www.european-aluminium.eu/activityreport-2021-2022/market-overview/)

There is a drive now across Europe to restart domestic output of magnesium, used in aluminium and steel products, which places a new emphasis on magnesium and cutting dependence on China.

EIT RawMaterials is also working to support the securing of Europe’s domestic magnesium supplies with at least three firms, two in Romania and one in Bosnia. One of these projects is forecast to produce more than 18,000 tonnes per annum of magnesium covering 13.5% of EU magnesium demand from 2026-2035.

The total development potential is close to self-sufficiency.

In Conclusion

We have the innovation know-how, the technological leadership in Europe, and with EIT RawMaterials’ education and start-up investment, there is a sound foundation to really strengthen the sector and to seize the opportunities that are opening up.

To really return primary and secondary production of aluminium in Europe, action is needed, and it is needed today.

Creating incentives to enable more endof-life products to be recycled in Europe also is necessary in the immediate future. This can lend Europe a distinct advantage in its domestic supply of sustainable raw materials. And, to repeat my earlier point, Europe’s long-term resilience, competitiveness, and secure access to raw materials relies on urgent measures that will enable a level playing field, major strategic investment, scaled-up education and re-skilling, commitments to ESG, and diversification of our raw materials supply through partnerships with nations who share European values and European ambitions for climate-neutrality. �

Aluminium has presented itself as the material of the future. Speaking to key industry specialists at the ALUMINIUM 22 conference and exhibition, Zahra Awan* was able to dig into the challenges, successes, and the future of aluminium.

The Future of Aluminium in Europe

One of the main topics of conversation amongst the European aluminium Industry is the energy crisis. With rising prices in energy, Europe faces a dilemma regarding industrial production. Aluminium production is incredibly energy intensive and with a +100% demand increase for aluminium products, demand has doubled since 2000[1]

PAUL WARTONPaul Voss, Director General of European Aluminium noted that the industry is on pause due to the uncertainty. This tormenting question mark that hovers over the industry has formed great fluctuations in the market. These fluctuations, however, due to past unexpected events, are no longer so shocking.

Policymakers, parliamentary figures, heads of state or organisations are those who are responsible for the outcome of the industry and are those who must consider the effects of their actions across all faculties. Paul Voss highlighted: “It’s the job of policymakers to find adequate solutions. But if I’m honest, I have every sympathy for them too. Their positions are completely overwhelmed by this. Nobody knows what to do and so we talk about different things that you could do but, no one really knows if any of them will work.”

Paul Warton, Executive Vice President, Hydro Extrusions finds himself in a similar position on the uncertainty of the conditions, “nobody has long term positions that protects them from this hostile pricing environment or energy… but I think there is an acceptance that it is the way it is.” He continued, “If I talk on behalf of extrusions, yes, we are very

Assistant, Aluminium International Today

“Europe is the leader of renewable energy implementation.”

concerned. First of all, we’re concerned about supply, will we have supplies?

Throughout the winter months, we’ve heard all the discussion about the risk of curtailments if there’s not enough to go around.”

The curtailment of aluminium has already become a reality for production at Hydro Karmøy and Hydro Husnes in Norway. The partial curtailment resulted in an annual production capacity reduction of 110,000-130,000 tonnes of primary aluminium [2]

The threat to the industry seems to depend on the longevity of this crisis. The longer the difficulty extends, the more strained the industry is. But the longevity of aluminium, its success and future, maintains to be fixated upon its natural draw towards sustainability. And the dedication to sustainability does not seem to be on the sacrificial list.

Paul Warton continued, “Circularity, … has always been part of our roadmap. And that’s because the economics work” Circularity has given the material a new quality amongst aluminium strength lightweight and durability. A perfect quality for automotives.

Automotive aluminium

The automotive industry brought aluminium into the limelight, organisations such as Alumobility, the Aluminium Transportation Group (ATG), the ALFED Automotive Group and HFQ partnership, to name a few, started up to create forums for discussion on the automotive industry and how aluminium will take it into the future.

Light weighting of vehicles is one of the “drivers coming from legislative carbon reduction targets” noted Paul Warton. Another driver for the implementation of aluminium is the idea of producing

sections of a vehicle with hindsight. Designing aluminium sections to be taken out at the end of life of a vehicle, prior to it being scrapped, therefore eliminating the process of scrap sorting. Although scrap will still need to be sorted to ensure maximum retrieval of aluminium in the supply chain, this is a step towards reducing the loss of aluminium to landfills.

The recycling and scrapping of aluminium is made more complex by the amalgamation of multiple materials. This means nonmetals, alloys and particles need to be sorted. The difficulty of the situation is revealed; similar to how the energy crisis effect all industries, members of the public and political relations.

A threat to the industry

What if Paul Voss’s concerns about the deindustrialisation of Europe are not just concerns? “If we allow Europe to be deindustrialised and I think that is a genuine threat right now, we’re in serious trouble. In the medium to long term, we’re going to have a bigger problem because people need work. And we also need to be able to make stuff here, that we’ve learned already during this war, the price of relying on imports.” This falls back

onto policymakers as high unemployment rates are now a conceivable threat.

Investments into renewable energy is one example of the transfer to sustainable production, and one that may come as a saviour to our energy crisis. Even with the strains presented by the energy crisis, companies focus on pursuing their targets on sustainability. Some even agree with Paul Voss on the idea that this challenge will only force the industry to do an energy transition. Already we have seen European branches of companies relying less on natural gas and turning to renewables. As Paul Warton said, ‘Europe is the leader of renewable energy implementation’. Renewables, were it not for their unreliable nature, would be the simple solution. With the economic challenges of the energy crisis, perhaps Paul Voss has a point and the industry will transition at a faster rate.

“The clearer we are about having a sense of common purpose in Europe, the stronger we are,” says Paul Voss. He came into the industry not expecting this would be his role. Paul Warton states, “our material absolutely will recover” it seems to me that the aluminium industry is just beginning its journey. �

[1] https://www.thealuminiumstory.com/ [2] https://www.hydro.com/en-GB/media/news/2022/hydro-responds-to-reduced-aluminium-demand-partially-curtails-production/ [4] https://sweden.se/climate/sustainability/swedish-recycling-and-beyond [5] https://international-aluminium.org/resource/aluminium-beverage-can-study/

“The clearer we are about having a sense of common purpose in Europe, the stronger we are.”

PAUL VOSS

What comes of uncertainty

The topic of the energy crisis, what the industry can expect, or not expect, and what it can do to prepare. As we all know these are unpredictable times, but sometimes that uncertainty is exactly what needs to be addressed to create certainty. Andy Farida* writes a general view and outlook into Q4 of 2022 as well as a quick glimpse into 2023.

Macro

� Interest Rates & Currencies

The US Federal Reserve bank lifted interest rate by another 0.75% on Wednesday September 21 to bring the target range to 3% to 3.25%. Forecasts show another large hike likely by end of the year as the Fed Chairman, Jerome Powell, insisted that there is no painless way to bring down inflation.

Rising interest rates by the US Federal Reserve has bolstered demand for the greenback. Should the unemployment rate start to rise and economic data out of the US continue to deteriorate, Federal Reserve policymakers may choose to step back from being too hawkish.

� Energy Crisis

Spot power prices in Germany were last trading at 163.89 EUR/MWh, down from

its record high seen in August this year at 658.41 EUR/MWh. Even though spot power prices have declined, since German gas storage sites are 92.8% full, the price is still a seven-fold increase since January 2021.

The European Commission has called for member nations to try to reduce their winter gas usage by 15% due to low stock levels and persistently high prices. Germany has introduced new bill to accelerate alternative wind power expansion in a bid to fulfil 80% of its electricity needs from renewable sources by 2030.

Aluminium undeniably plays a critical role in decarbonising the world’s energy systems. With aluminium’s new role in the green economy comes new responsibilities. ESG concerns are finding their way into boardrooms and influencing consumers’ purchasing decisions. The mining industry and the supply chains it feeds into have to adapt to a greener, more secular global economy.

� COVID-19

While the rest of the world is reeling towards slower economic activity and risks an all-out global recession, China has its own sets of economic and social problems. Finetuning and potentially retreating from the dynamic zero-Covid19 policy remains a key topic in China as we head into the final trading quarter of this year.

Loosening covid restrictions will provide global investors with more confidence that domestic economic activity can recover faster, reducing headwinds seen in Q2 and Q3 of this year. If Mr Xi can relax restrictions in a bid to restore market confidence, that could lend strong support for base metals demand as a whole.

Micro

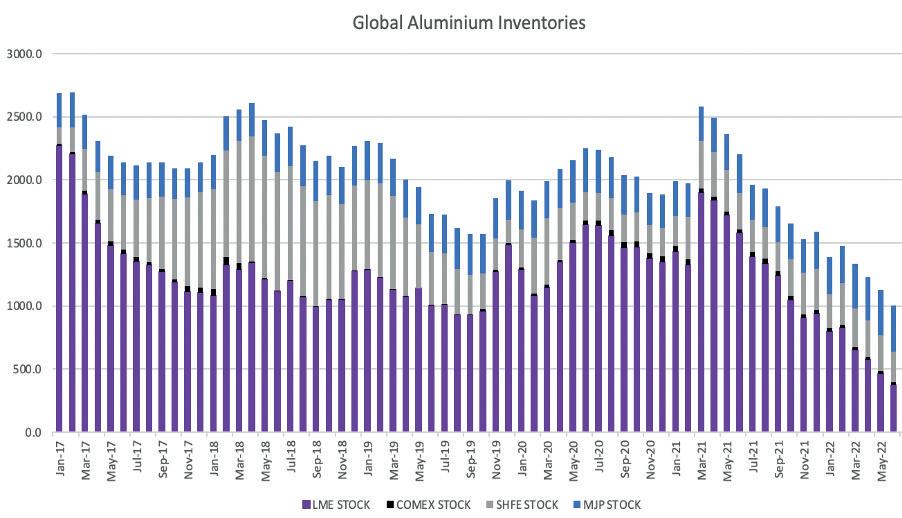

� Global Inventories Level

LME warehouse aluminium stocks totalled

Aluminium speculative funds

Mid-Mountain offers a full range of sealing components for Pot Rooms, Carbon Bake plants, and Cast Houses to withstand the extreme conditions primary aluminium smelters face every day - high temperatures, chemical gasses, and the demands of the electrolytic process.

We at Mid-Mountain welcome the opportunity to work with your company to find better ways to protect your people, your facility, and our environment.

328,525 tonnes on Thursday October 6, up from 271,450 tonnes on August 22, which was its lowest since November 1990. Aluminium stock held in Shanghai Futures Exchange (SHFE) warehouses totalled 174,511 tonnes on September 30: a sizeable contrast to the March 11 high at 345,207 tonnes.

Our supply-demand forecasts predict an essentially balanced global market in the final quarter of this year and throughout 2023 overall, so we see little scope for global inventories to be replenished meaningfully in the foreseeable future.

� Speculative Funds Positioning

LME aluminium net long fund position once stood at 150,481 lots, last seen on February 18, 2022. The latest commitment of traders’ report shows that it now runs a net short fund position of 3,121 lots as of September 30 data, meaning funds have switched from being excessively bullish aluminium to mildly bearish.

We suspect a lot of the weak aluminium longs have now been removed from the market and that the lighter net position could make aluminium attractive again to fresh long position building (and vulnerable to short-covering) if appropriate macro or fundamental catalysts emerge, for example if smelter production cuts in Europe start to intensify during the winter months.

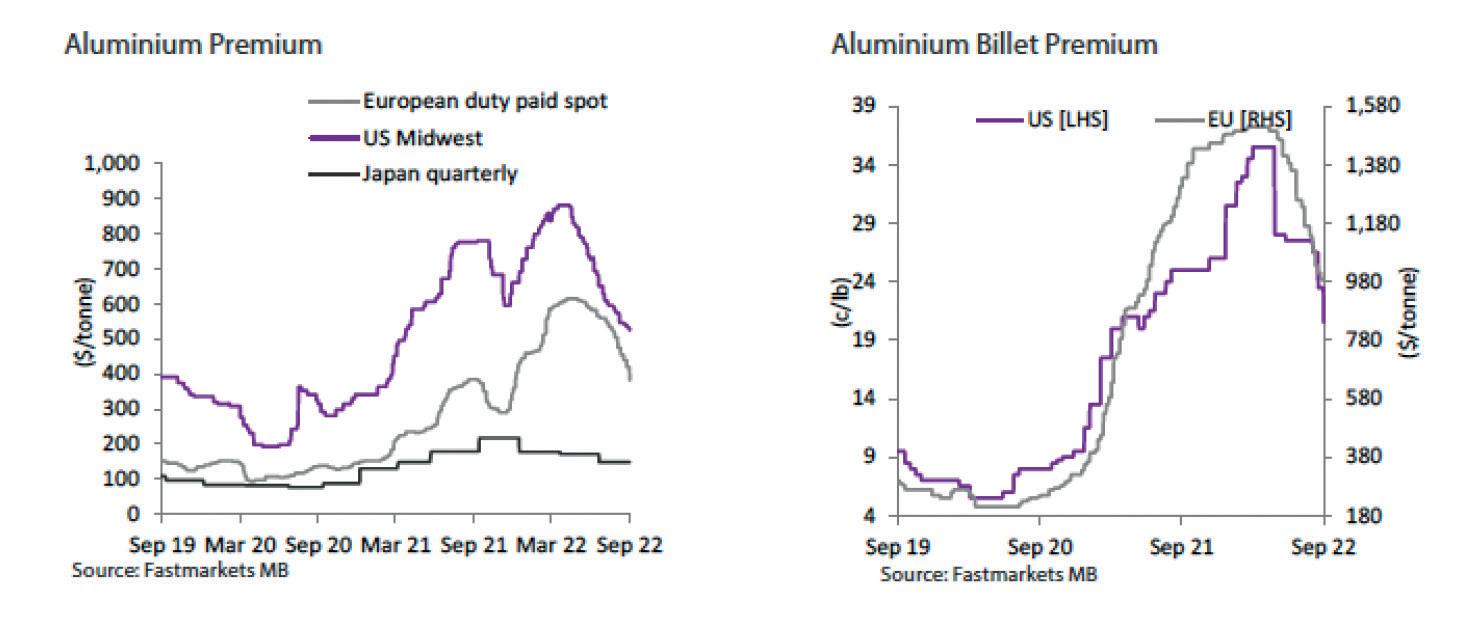

� Premiums

The punchy headlines that European aluminium industry faced more production cuts due to rising energy prices have done very little to support the light metal price action and the regional premiums. This, we think, was mainly driven by the strong export of aluminium products from East to West (no doubt helped by easing logistic issues) which helps offset the market tightness in Europe in Q3 this year.

That could well change in the coming months when the production cuts in Europe start to bite and as supply of aluminium from the east starts to decline due to the unfavourable Rotterdam premium which is 33% below its record high.

We believe, a great deal of the bearish assumptions, from weak order book and uncertain forward market expectations, are mostly priced within the aluminium price. Going forward, what appears to be the unknown factor is the impact from the production cuts and if European market participants have enough buffer stocks should demand improve in Q4 and Q1 of 2023. Will there be enough vessels to send metals from China to the West?

Fastmarkets Research Outlook

Fastmarkets Research Outlook

� Supply

European nations bore the maximum pain when it comes to energy crisis amid their heavy reliant on Russian oil and gas. Up to 1 million tonnes of aluminium output in Europe has been affected and Fastmarkets forecasts another 500,000 tonnes are at risk in the coming months.

Surging power prices in Europe have prompted further production cuts and closures by smelters in the region. Aluminium production in western and central parts of Europe contracted by 10.4% year on year in August and was down by 11.2% overall in the first eight months of 2022, according to estimates from the International Aluminium Institute.

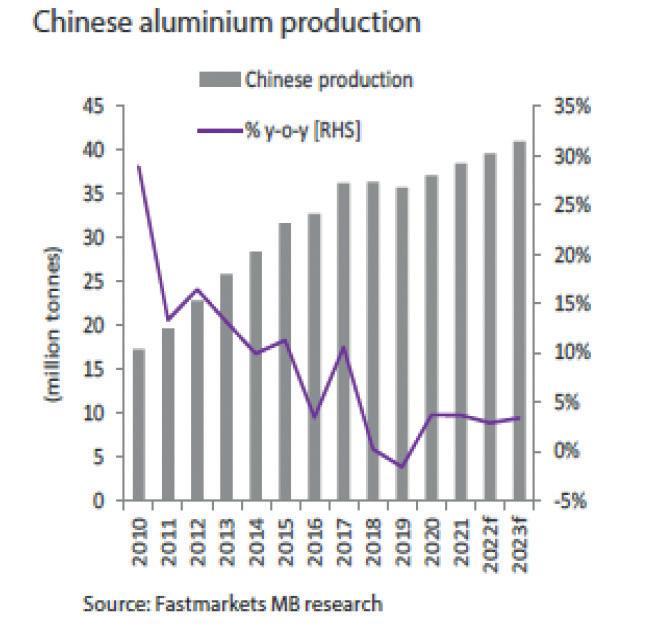

Even though Chinese aluminium production has risen by 11.3% year-onyear in August, the main reason behind the increase was new capacity ramping up (in such areas as Inner Mongolia and Guizhou), which more than offset production disruptions due to curbs on power use in other areas (such as Sichuan). As the winter approaches, fresh power rationing policies in hydro reliant region could see prolonged disruptions that the market has not taken into account.

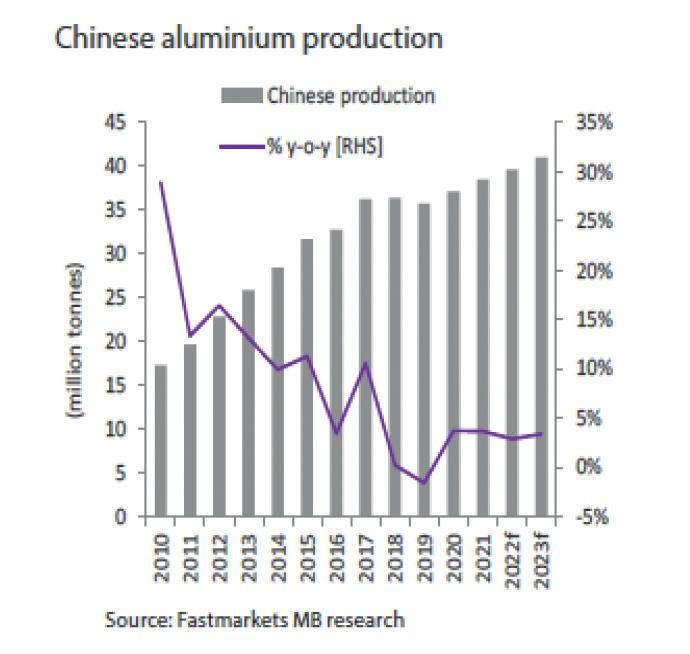

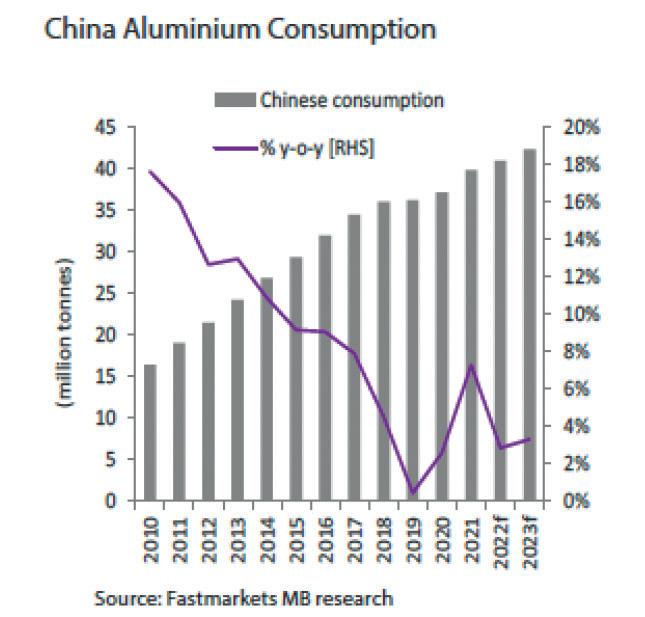

With colder winter months fast approaching, emissions and the availability of power supply will dictate, and no doubt affect Chinese aluminium smelters. Despite threats of a supply disruption within China, Fastmarkets Research forecasts Chinese aluminium production will rise by 2.3% year on year in 2022 to 39.4 million tonnes from 2021’s 38.5 million tonnes. Going forward, power stability and low-cost smelters will boost output in 2023 and we forecast Chinese aluminium production to rise to 41 million tonnes.

In the global aluminium market, Fastmarkets Research forecast that global aluminium production will increase by 2.0% in 2022 to 68.7 million tonnes, up from 2021’s 67.4 million tonnes.

� Demand

Despite the short-term risk of demand destruction caused by slowing macroeconomic activity the decarbonisation agenda remains supportive for aluminium demand across the medium-to-longer term.

New energy vehicles typically have higher aluminium loadings compared with traditional internal combustion engine vehicles. Aluminium is also used extensively in green-energy infrastructure.

The development of aluminiumbased battery chemistries could provide additional demand while plans to reduce the reliance on, and use of, fossil fuels

increase the investment in energy storage systems.

Demand indicators for aluminium in China are mixed. Transport and Packaging demand in China is expected to experience year-on-year (y-o-y) growth of 5% and 4.8% respectively but the badly affected Building and Construction sector is likely to contract 6% y-o-y.

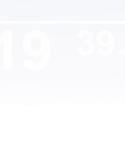

aluminium consumption is forecasted to increase to 42 million tonnes, leaving the domestic market in a deficit of around 1 million tonnes.

Although we are projecting Global Aluminium demand to grow by 2.7% in 2023, macro uncertainty may force us to revise it lower.

particularly green technologies, and in planned infrastructure developments.

Since LME Aluminium price reached an all-time high in March 2022, the light metal has lost 39% of its value, and now finds itself down 232% overall so far this year – a clear indicator that it is trading in a challenging landscape saddled with the growing risk of a global economic slowdown. Despite the overwhelming bearish sentiment, we are cautious about LME aluminium’s price prospects for the final trading quarter of this year.

Technically, the light metal’s configuration remains bearish. But the oversold sentiment in the market space, lighter funds positioning and tight global inventory, as well as the escalating geopolitical tensions between Russia and Europe are potential catalysts that could contribute to renewed volatility with an upward bias.

We still expect Chinese aluminium consumption to grow this year to 40.8 million tonnes, even though it is a small increase from year ago level of 40.5 million tonnes. In 2023, Chinese

� Price Forecasts

Fastmarkets forecasts LME Aluminium Cash price to average $2,250 per tonne for the final trading quarter of 2022 and $2,647 per tonne for 2022. But going into next year, we forecast the aluminium cash price to edge lower to $2,150 per tonne amid ongoing macroeconomic uncertainty. � Refractory

Supercycle enthusiasts remain subscribed to a bullish outlook for aluminium, because of its role in new technologies,

It’s down to us to make a difference.

The challenge of all challenges

By Zahra Awan*The energy crisis, the cost-of-living crisis, the threat to industry, the shadow of Covid-19 and the glaring geopolitical tensions. If 2012 was predicted to be the end of the world, then the ancient Maya prophecies must have disregarded 2022 as post-apocalyptic.

News headlines report countries preparing for ‘blackouts’ and advise members of the European public to ‘wrap up warm’ in response to growing fuel costs, whilst food in supermarkets inflate and children face hunger.

The aluminium industry, in the first

few months of the year, spoke with confidence. Focussing on developing the sustainability, durability, adaptability of the metal; January 2022 was electric. One notable consensus, after speaking with industry representatives during the ALUMINIUM World Trade Fair, was the irreplicable nature of aluminium. On this, all conversations undertaken, for this article, made this point absolute: Aluminium is a material like no other, so perhaps as we delve into this despair, Aluminium still holds a glimmer of hope?

THE ENERGY CRISIS: GEOPOLITICS

The Crisis, despite feeling as though it has crept up on us all, has been in the shadows for months. Some claim that inflation was triggered by the shortages caused by global supply chain issues in response to COVID-19. Whilst others claim it was inevitable, and the geopolitical war was the frosting on top of our cold European cake.

“Don’t forget the driver of this crisis was Putin’s invasion of Ukraine, and it took Europe time to react to find new sources of energy.” - John Courtenay, Chairman, MQP Ltd.

And so, we face another challenge. A challenge that seems to personally dislike industry.

“Unfortunately, we cannot solve the problem. So, first of all I think it is important to understand the consequences of the energy crisis, which started in February, impacting transportation costs, electricity,

gas, olive oil prices, but also, due to the war in Ukraine, we also see steel prices go through the roof.

“It is impacting us in such a way that the prices of our vehicles go up, as do delivery times in Europe. This proves to be an issue for customers outside of Europe, for example, the US, Canada, or the Middle East. They do not have this same energy problem, so it is harder to explain to them the problems we face.”Peter Vanvuchelen, Director Sales, Hencon B.V.

Whilst this European cake is widely distributed, in Europe, those outside are a stranger to its taste. This month the industry has hosted events across the globe, with a global audience. It is clear that whilst Europeans rush to claim a slice, the others look on, unrelating.

“Surging power prices in Europe have prompted further production cuts and closures by smelters in the region.

“Aluminium is the best recyclable product made by humans … it’s not a material that can be replaced, it’s a material that’s always going to be in demand. The demand for aluminium will increase.”

Peter Vanvuchelen, Director Sales, Hencon B.V

Aluminium production in western and central parts of Europe contracted by 10.4% year on year in August and was down by 11.2% overall in the first eight months of 2022, according to estimates from the International Aluminium Institute.” – Andy Farida, Base Metals Research Analyst.

The reactions of companies, throwing some production overboard to theoretically stay afloat, displays the desperation. Industry, not only aluminium, is threatening to abandon Europe. It could be said that the deindustrialisation of Europe is becoming more a reality, and less a prophecy.

“Do we want to allow Europe to become a kind of museum [of industry] and have the rest of the world make stuff?” –Paul Voss, Director General, European Aluminium.

DEMAND DESTRUCTION OF EUROPEAN ALUMINIUM

Why pay £1.35 for organic bananas when you can pay £0.14 for the same bunch? [1]

“What is really tragic is the prospect of our companies being driven out of business, to be replaced by operations in China or elsewhere. Replaced by operations who produce three, four, up to five times more carbon” – Paul Voss, Director General, European Aluminium

Not only are prices increasing, but so is the cost to the environment. As customers find the cost for aluminium unstable in Europe, they seek to source aluminium elsewhere. European aluminium’s cost has been driven up due to cost of energy, but we were already competing with high carbon, cheap aluminium.

“Remember this time last year was the opposite, it was boom time. So, 20% down [in the order intake] sounds like a big number, but it’s not catastrophic, it’s manageable. But if we get the high energy costs on top of the 20% volume reduction, this becomes a challenge for our industry. So, we have to manage the demand destruction.” - Paul Warton, Executive Vice President, Hydro Extrusions

It must also be noted that companies located across the globe are committing to greener production. Assan Aluminyum and Aluminium Bahrain (ALBA) are amongst the many who have been certified by the Aluminium Stewardship Initiative (ASI). For the now, we cannot know what will come of green European aluminium, but the maintenance of green aluminium is something we can hope will persevere?

“The energy crisis only confirms the daring choices we made: working towards an industry that combines performance with energy and environmental efficiency.”

- Sébastien Gauguier, President of Fives – Aluminium Division

SACRIFICE FOR THE GREATER GOOD

Now arises the question of sacrifice.

“ESG concerns are finding their way into boardrooms and influencing consumers’ purchasing decisions.” – Andy Farida, Base Metals Research Analyst.

Aluminium’s good nature goes hand in hand with its blood bond to sustainability. Well known to be the metal of the future; a saint in delivering Environmental, Social and Economic Sustainability, aluminium has dedicated time and resources into preserving its pure state. With the call to global decarbonisation and the reduction of CO2 emissions, aluminium is first in line. However, one cannot help looking to the darkness in the midst of difficulty; the question must be addressed: Will environmental sustainability be sacrificed in the name of aluminium’s survival?

“I think that economic considerations will

always be made, despite moral compass. As soon as we can show and prove that sustainability is not counteracting, but even supporting your economical model, then the customers will be open for that.”

– Peter Vanvuchelen, Director Sales, Hencon B.V.

“The energy crisis only confirms the daring choices we made: working towards an industry that combines performance with energy and environmental efficiency.”

- Sébastien Gauguier, President of Fives – Aluminium Division

“

It cannot be, we just can’t take that position. I don’t accept it. I don’t think it’s good business. I don’t think it’s decent and so we won’t be doing that.” – Paul Voss, Director General, European Aluminium.

And so, it seems aluminium will remain faithful.

PROBLEM AFTER PROBLEM: WHAT TO DO?

“So, what we can do?” - Peter Vanvuchelen, Director Sales, Hencon B.V.

Wait and see. The industry is in such a volatile position, we cannot predict or prepare as we do not know what to predict or prepare for. Speaking with industry specialists, the advice given was to improve efficiency. Improve what the industry is already good at and make it better. Make sure our cold European cake looks beautiful in wait for turmoil, this way we can ward off what is coming as best as we can.

“It’s going to be a matter of holding on.” - Paul Voss, Director General, European Aluminium.

“Well, what we try to do is produce in a smarter way by aligning ourselves better with our suppliers and by standardising a little bit more…, we also need to think about our own strategy.” - Peter Vanvuchelen, Director Sales, Hencon B.V.

“We must continue to innovate to reduce

aluminium industry’s carbon emissions and ensure its digital transformation: 80% of the patents we file concern solutions aimed at reducing our customers’ environmental footprint.

More than ever, Fives is committed to a mutually responsible and virtuous industry”. - Sébastien Gauguier, President of Fives – Aluminium Division

We all, on the other hand, demand action from governments and policy makers in hope for support. This is key for our survival as policies continue to have the upper hand.

“I do think the UK should get on and start fracking and I think we should also open up the North Sea, we shouldn’t be in such a weak position where all of a sudden, we’re worried about energy security. I think we have to take steps to make sure we don’t fall into that trap again. And what about nuclear? With Nuclear we’d have sustainable, green power at low cost forever. It’s inexhaustible.” - ohn Courtenay, Chairman, MQP Ltd.

This being more specific than most.

HOPE

Despite all this doomsday talk, I, with others, remain hopeful. Afterall, 2012 has been and gone.

“I see great prospects for aluminium” - Rob Van Gils, President Aluminium Deutschland/CEO and Managing Partner Hammerer Aluminium Industries.

“I’m optimistic on energy. The world is not short of energy.” – John Courtenay, Chairman, MQP Ltd.

“Nothing lasts forever. Especially not bad times, in my experience.” - Paul Voss, Director General, European Aluminium.

TOGETHER TOWARDS PERFORMANCE

NOW IS THE TIME TO ACT

REEL Aluminium is a major solution provider dedicated to reduce the carbon footprint in the Aluminium industry. Both internal and external partnership, new ways of understanding and innovative technological investments in the development of net-zero solutions for the Aluminium industry are the best conditions for REEL‘s goals to work together on its path to decarbonization and to green Aluminium future.

Demand side responsesomeone else’s problem?

By Geoff Matthews*If you are familiar with the Hitchhikers Guide to the Galaxy, you will recall that one of the main characters was able to hide his ship anywhere in the galaxy without people noticing. He used a S.E.P field, that is a Somebody Else’s Problem field. The idea is that even something as big and as difficult to accept as an alien spaceship, could become completely invisible to people if they thought it wasn’t their concern.

I’ve found aluminium smelting’s response to Demand Side Response (DSR) is very similar, “that’s nice…for other users on the grid”. The logic was always the same, aluminium smelters were such large users of electricity they could set their own price, and “we provide base load”.

But recent world events, and the inevitable push towards decarbonisation of our global power systems, means the cloak of invisibility around DSR has finally been unshrouded to reveal an elephant in the room, and we need to talk about the elephant.

It’s a Big Elephant

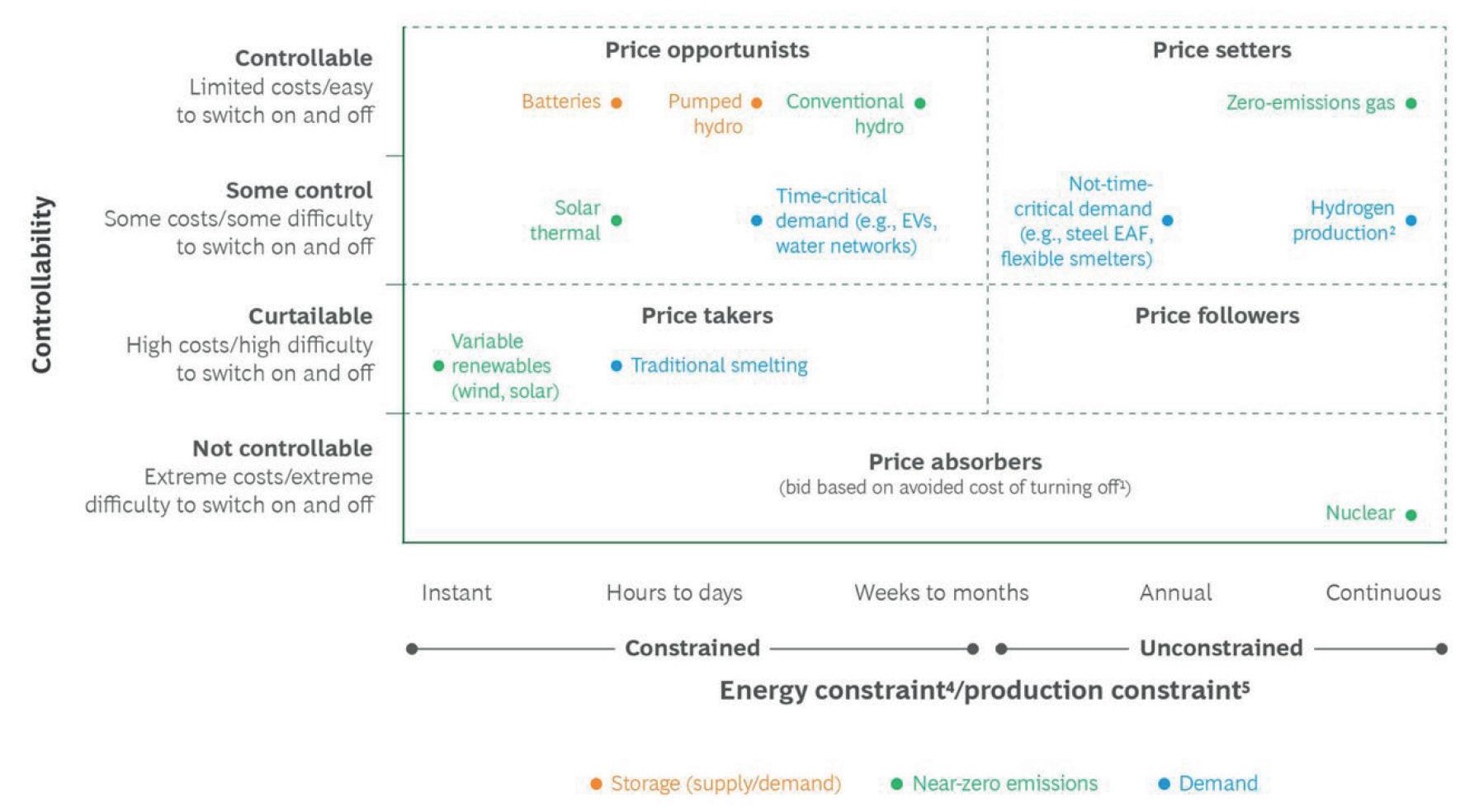

Make no mistake, DSR will become the dominant technology that sets the price of electricity in our power systems as we move at breakneck speed towards decarbonisation. That is, those that can vary load to better match generation will be able to set the price of electricity. Those who can’t will become price takers.

Furthermore, the price of electricity for those that can vary loads will be very low, and those who can’t vary loads, correspondingly very high. How low? Close to zero or even negative. How high? Take a long look at the recent spot prices of electricity and think about what the price will be when we eliminate completely gas as an energy source from our power systems.

The IEA in their latest predictions say global electricity generation needs to grow at least 2.5 times by 2050 as we move to decarbonise and ‘electrify everything’. I’ve seen projections that we need to produce as much as five times the amount of electricity we do today, and it

all needs to come from clean renewable sources. Most of us are still struggling to even comprehend how we replace all of today’s existing fossil fuel generation.

It’s a big elephant, so what are our options?

The Rise and Rise of DSR

In September this year the Boston Consulting Group (BCG) released a thinkpiece titled, ‘Is Electricity Pricing Running Out of Gas? (Hirschhorn et al). It’s the clearest articulation of the future drivers of the pricing of electricity in our power systems I’ve seen. I was one of the industry experts interviewed by the authors, and I have included a link at the bottom of this article.

Essentially the argument boils down to the fact that the cost of ‘firming’ sets the price of wholesale energy-only electricity markets, and currently gas fulfils this role, and therefore “gas prices disproportionately determines the price of electricity.”

Enter Variable Renewable Energy (VRE),

*Futurist, Event Director and Partner, Sustainable Industrial Manufacturing Asia-Pacificand exit gas from our power systems, and we are left relying on three technologies that can fill the role that gas does today. They are; zero-emissions gas, energy storage, and flexible demand.

While the BCG article leaves it open as to which technology will become dominant, I strongly advocate that DSR logically has to become the dominant technology, for two reasons: 1) the sheer size of the elephant, and 2) logic dictates that in the end everything needs to become responsive to the amount of electricity being generated in the grid.

While we can use hydrogen and batteries for short duration firming, we can only recharge from excess. There is a natural circular conundrum to hydrogen production if it’s used to firm supply to make more hydrogen, and it would also be illogical to use electricity to recharge a battery at the very time it should be putting power back into the grid. These two technologies therefore must be subservient to demand in the grid, and become part of the DSR mechanisms and DSR economy.

Power to the People

In 2016 I was interviewed for a think-piece Power to the People, by Dr Linda Wright. A younger version of me had this to say; “Our future homes, cars and businesses will need to be smart enough to take advantage of low spot prices to purchase energy when generation is high and prices are low. For consumers the key to moving away from our twice a day peak power consumption and living with a highly renewables grid, will be household battery storage and physical energy storage such as hydrogen generation”.

There are two important concepts at play here. The first is that I predicted that household consumers will be ‘selffirming’. That is instead of a big battery in the grid or a hydrogen fuelled power station providing a constant electricity source, consumers would need to rely on their own energy storage devices. Secondly, those devices would need to become responsive to demand in the grid (DSR).

There is a third little less obvious concept also. The reference to physical energy storage meant anything that can store energy for later use. For example storing energy in underfloor heating, or installing a second hot water cylinder (the cheapest household battery you can buy). This concept becomes important when we discuss solutions for industrial processes.

Industrial Sized Solutions

These three concepts underpin the opportunity for industry, I use the word opportunity unequivocally, as I believe there is more up-side for industry moving to VRE than downside, it’s a matter of seizing the day. Industry also has an additional advantage of being able to use its own processes to store energy.

Craig Phasey from EnergyFlex in Australia was the first person I know of to really articulate the idea of process energy storage. It’s based around the idea that in every manufacturing process, energy could be stored as partly finished product. Where, how much, and for how long is dictated by the cost of energy at the time, and the individual industrial manufacturing process. It requires us to reexamine traditional economic paradigms developed in the age of constant supply of

cheap electricity from fossil fuels however, and to re-engineer our industrial processes accordingly.

As Craig says, “everything that has been made to run on constant power needs to be reinvented, and that means just about everything.”

Stockpiling is the most basic form of energy storage, particularly in partly manufactured or partly finished goods.

Manufacturing excess component parts during times of low cost or even negatively priced power for utilisation later will become commonplace, and driven by the economics of the cost of power. Not only from day-to-day, but also from season-toseason.

Re-inventing everything will also refocus our deployment of capital. For example, EnergyFlex were part of the Oz Minerals Scalable & Adaptable Mine Challenge team which proved that a mine run from 100% VRE can be cost effective, but only if energy is stored within the process.

The most basic form of process storage utilised by the team (there were a number of innovative ideas) was doubling the crushers and utilising full capacity of the crushed rock stockpile, so the stockpile becomes an extremely effective battery.

The old economic paradigm of running one machine 24x7 (in this case slowly), was cast aside and the solution required two machines running as fast as possible for 12 hours a day. Any efficiency losses associated with running machines fast was overwhelmed by the efficiency gains through not having to push energy through battery storage.

The Role of Aluminium Smelting in Providing DSR Smelters have traditionally migrated to the cheapest sources of electricity, some of it stranded away from areas of population, which could otherwise utilise the resource.

The cheapest source of electricity on the planet today is VRE, which is predicted to decline in price further as technology improves. It’s inevitable that if primary aluminium smelting is to continue, we will have to learn to use VRE, and this in-turn means mastering energy modulation.

Energy modulation technology has been with us for a while now. TRIMET Aluminium installed shell heat exchangers on a full potline in 2019. I predict that when the original patents on the current EnPot technology expire in 2025, there will be a lot more interest and development by smelting companies, who will be free to come up with their own shell heat exchanger designs and installation solutions. This should be welcomed.

By then electricity markets will be more developed, and the value of flexible loads

more established. The advantage of energy modulation technology is that loads can be modulated indefinitely both up and down at the turn of a dial with no change to the heat balance inside the pot. This allows smelters to self-firm and provide large amounts of critical DSR services (for those connected to grids). Once a smelter is able to flex a meaningful portion of its load for long durations, it changes from being a price taker to being a price setter (see diagram below).

Myth Busting

While we are addressing the elephant in the room, lets address the two myths in my opening paragraph. Size and baseload.

At the inaugural meeting of the Aluminium Stewardship Initiative (ASI) in 2016, guest speaker Michael Liebreich, founder of Bloomberg New Energy Finance warned that “there won’t be any baseload”. I distinctly remember the air of disbelief in the room at the time, there was audible scoffing. The problem is that Michael Liebreich was right. The value of baseload in many markets has already diminished, and been replaced with the value of flexibility.

Approaching energy companies saying “we will take a fixed amount of your

generation for an extremely cheap price and provide baseload, but you have to guarantee supply” will become hugely problematic to energy companies when the bulk of their generation is variable. Using the BCG logic and argument, that price of electricity for that particular contract will be dictated by the cost of any firming the energy company can put in place. This means someone else is providing firming to the smelter and it is the price that they set, which will dictate the price the smelter pays for power.

Turn this around to “we will take a fixed amount of your generation for an extremely cheap price but when you are short we will shed 20%, and when you have excess we will take 20% more at negative pricing”, and the conversation starts to get interesting for energy companies who’s number one priority will be flexible demand. At times of high net load, they can take your 20% and sell it elsewhere for more, and that then becomes valuable to them, and in turn allows you to set your price based on the value of your flexible load.

Aluminium smelting will be dwarfed by new entrants

The idea that aluminium smelters are big

enough to set their own electricity price (without flexible load) in a power system heavy with VRE, is at best wishful thinking. Aluminium smelters will become dwarfed by new entrants seeking to decarbonise through electrification; namely steel, cement, fertiliser and hydrogen production, whose demand will be flexible. Competition for every megawatt of power will become intense in the short to medium term. Even aluminium production from stranded captured hydro will be at risk to new hydrogen production initiatives, which are needed on a massive scale going forward. Have no doubt, hydrogen generation will provide a competitive alternative to aluminium production.

In New Zealand, Meridian Energy, the partly state owned company who owns the hydro power station supplying the Tiwai smelter, is going all guns blazing at having a hydrogen solution in play to replace the smelter when its current power deal expires in 2024. There are credible hydrogen players gearing up to build what will be the largest green hydrogen production facility in the world. Furthermore, there is a lot of political will and public support for New Zealand to exit the smelter.

Final thoughts

No one on the planet will be left unaffected by the changes that variable renewable energy will bring. From those who have no access to electricity to our industrialised cities, it has the ability to positively impact the lives of billions of people across the globe. Living with VRE means changing the way we consume electricity. For many of us new technology will make the transition seamless, as our homes, cars and businesses become energy smart and automatically become part of the DSR economy.

Two of the slowest changing industries in the world over the past 125 years have been electricity generation and primary aluminium smelting. Electricity generation is now undergoing fundamental upheaval and the pace of change is staggering. This absolutely must impact aluminium smelting, as it can’t remain untouched by the fundamental changes occurring to what is its largest cost component.

As a futurist I believe aluminium smelting still has time, but only if we start running today, and only if we stop thinking that providing DSR is someone else’s problem, and only if we start addressing the elephant in the room. Good luck, the clock is running. �

Aluminerie Alouette: 30 years already, and a new generation takes flight

Alouette celebrates its 30th anniversary

In 2022, Aluminerie Alouette is celebrating an important milestone: its 30th anniversary! In 1992, the community of Sept-Îles (Quebec, Canada) joined forces with Alouette to produce the highest quality aluminium in the entire world.

Alouette is also the largest aluminium smelter in the Americas and a world leader in the production of responsible aluminium. Throughout its evolution, one thing has remained constant: the company’s close ties to the community. With a renewed vision and commitment,

Alouette is now paving the way for the next generation of aluminium production

Producing the Greenest aluminium in the world

Protecting the environment has always been a priority at Alouette. Over the past 30 years, Alouette’s greenhouse gas emissions per ton of aluminium have decreased by 40%, thanks to ongoing efforts to significantly reduce their environmental footprint by meeting or exceeding the most stringent industry standards.

“Our environmental ambition is simple: to produce more while consuming less energy,” explained Sébastien Scherrer, Director of Procurement.

Thanks to committed experts, responsible environmental management and rigorous monitoring, Alouette has