SAF taking off TRANSPORT Delivering high oleic soya OILSEEDS OILS & FATS INTERNATIONAL NOV/DEC 2022 ▪ VOL 38 NO 8 WWW.OFIMAGAZINE.COM

www.desmetballestra.com Maintaining Long-Term Profitability Our technological solutions implemented with long-term pro tability in mind to improve Total Cost of Ownership for our customers. The plants designed by Desmet Ballestra ■ use reliable equipment with low maintenance ■ minimize downtime and maximize availability ■ improve yield and e ciency Reliable technologies for Food, Feed & Greenfuel and Chemicals for Life industries

Analysis 25 Characterising fats and oils Effective characterisation of fats and oils is integral to ensuring food quality and there are recognised methods to assess their properties USA/Oilseeds 29 Delivering high oleic soya Buying, delivering and storing high oleic soyabeans requires a longer lead time and special handling to preserve the health benefits and greater frying and food manufacturing functionality of the oil OILS & FATS INTERNATIONAL IN THIS ISSUE – NOV/DEC 2022 FEATURES NEWS & EVENTS Comment 2 Ongoing crisis Ukraine/Russia News 4 Probe finds evidence of Russian grain smuggling News 6 Nestlé to stop sourcing palm oil from Astra Agro Lestari Renewable News 12 Stepan to buy surfactants producer PerformanX Transport News 14 Low Mississippi levels threaten soya exports Biofuel News 16 Shell Louisiana site may be re-purposed for HVO/SAF Biotech News 17 ADM to supply non-GM protein from new plant Statistics 36 World statistical data CONTENTS www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 1 Transport 18 SAF taking off The global use of sustainable aviation fuel is rising but challenges such as higher production and feedstock costs remain before it can take off on a wider scale Biofuels 22 Changing landscape Several EU countries have frozen or lowered blending mandates in response to rising food and fuel costs Photo: Adobe Stock Photo: USSEC Photo: Adobe Stock Photo: Adobe Stock

EDITORIAL: Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES: Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION: Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE: Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2022,

0267-8853

Business

WWW.OFIMAGAZINE.COM

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed by Pensord Press, Gwent, Wales

Ongoing crisis

As the war in Ukraine drags on into its seventh month, the situation for its farmers and those in the agribusiness industry still remains critical, the Agro & Food Security Forum organised by Ukraine’s UkrAgro Consult heard in September.

Although 2.7M tonnes of grains and oilseeds have left the Black Sea ports of Chornomorsk, Odessa and Yuzhny/Pivdennyi as of 12 September through the UN-brokered export corridor agreed on 22 July, there are still huge challenges related to logistics.

“Russia has started a war on multiple levels, understanding that agriculture is the bloodline of Ukraine,” Cezary Maciborski, MK Merchants head of trade, said at the event in Warsaw. Ordinary farmers cannot plant crops because fields are mined, exports are blocked and large producers running efficient industrial units are “dying”, he said. “Ukraine can’t produce i-Phones. If you destroy agriculture, people will be dislocated and you are talking about a potential economic and social catastrophe with millions of refugees coming into Europe.”

Maciborski said the crisis can only be solved at a governmental level as individual businesses cannot invest based on small throughput capacities at the Ukraine-European border and the “ludicrous” idea of shipping grains through Poland’s Baltic Sea ports.

This view was echoed by Piotr Pawłowski, chairman of the Council of Stakeholders of the Port of Gdynia, who said that although Poland has the capacity to handle 8-9M tonnes/year of agricultural exports and imports, spare capacity only totals 1-1.5M tonnes/year as terminals already have long term-binding contracts with large agri businesses such as ADM, Bunge, Cargill and Louis Dreyfus.

“The biggest grain terminals are not interested in handling Ukrainian goods because they need just-in-time delivery to load vessels.”

That is virtually impossible due to the ongoing truck and rail problems with grain and oilseed deliveries at the land border including different-sized railway gauges; lack of storage facilities at borders; long waiting times for customs clearance and permits; veterinary/phytosanitary inspections not operating 24 hours/day; drivers unwilling to go to Ukraine because there are no facilities; and trucks having to queue for 10-15 days at the border even when they are empty on the way back, with protests at the border and drivers losing patience.

Before the war, 98% of Ukraine’s agricultural exports went via its sea ports and – after plummeting to 17% in March – exports via ports have risen to some 65% in August, the conference heard. Yet, chartering and insurance issues remain, along with prohibitively high freight rates for containers, barges and other forms of transport, as Ukraine competes against countries such as Romania and Turkey to ship its goods. Building storage facilities at border crossings so Ukraine can connect to regular rail lines has been proposed as a solution. But this surely won’t be enough, given the sheer volume of grains and oilseeds that Ukraine would normally produce – some 100M tonnes/year.

Meanwhile, domestic demand and prices are so low in Ukraine that farmers are unable to cover their production costs and finance their next crop, the greatest risk factor for grain production for 2023 and 2024, says UkrAgro Consult director general Sergii Feofilov.

The end of the 120-day export corridor deal is also looming on 19 November, with no one able to predict what Russian president Vladimir Putin will do next.

Serena Lim serenalim@quartzltd.com

EDITOR'S COMMENT

Quartz

Media ISSN

A member of FOSFA

OILS

& FATS INTERNATIONAL @oilsandfatsint Oils & Fats International 2 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com VOL 38 NO 8 NOVEMBER/ DECEMBER 2022

UKRAINE: Crushing companies in the country are facing tight supply of sunflowerseeds due to farmers holding back sales of old crops and low new stocks, compounded by the harvesting campaign’s slow progress due to heavy rainfall, AgriCensus wrote on 22 September.

Market expectations of high sunflowerseed stocks did not materialise, with estimates of stocks as of 1 September at no more than 2.1M tonnes at plants and among farmers in Ukraine-controlled territory.

Meanwhile, crushing companies were trying to keep prices for old and new sunflowerseeds between US$327-373/tonne carriage paid to (CPT) plant including VAT, as they were limited by prices and the timing of the export corridor due to end in November.

Prices in the range of US$327-US$350/tonne CPT plant were typical for sunflowerseed with 46%48% oil content, and above US$350/tonne CPT plant with 50% oil content, the re port said. Export prices were significantly higher, ranging from US$515-550/tonne (delivered at place) in Roma nia, Bulgaria and Hungary.

The report said estimat ed sunflower exports for 2022/23 would not be lower than 1.6M tonnes and could reach 3M tonnes, mainly to Europe.

RUSSIA: Global agribusiness giant Bunge has agreed to sell its oilseed processing business in Russia to Karen Vanetsyan, the controlling shareholder of Exoil Group, Reuters reported on 19 September. The sale for an undisclosed amount includ ed Bunge's 540,000 tonnes/ year sunflower processing plant in Voronezh, which opened in 2008 and could produce more than 200M bottles of sunflower oil.

Probe finds evidence of Russian grain smuggling

example, investigators found that the bulk cargo ship Laodicea, docked in Lebanon last summer, was carrying grain stolen by Russia. The ves sel likely started its journey in the southern Ukrainian city of Melitopol, which Russia had seized at the start of the war on 24 February.

Melitopol Mayor Ivan Fedorov told AP that Russia was moving vast quantities of grain from the region by train and truck to ports in Russia and Crimea, a strategic Ukrainian peninsula that Russia has occupied since 2014.

The Laodicea reportedly claimed to be carry ing grain from the Russian port of Kavkaz when it arrived in Lebanon. The shipper was listed as Agro-Fregat and the buyer was Loyal Agro Co, a wholesale grocer headquartered in Turkey, according to AP's investigation.

An investigation by Associated Press (AP) and television series Frontline has found that Russia used a smuggling operation to steal Ukrainian grain worth at least US$530M and used the cash to fund its war efforts, World Grain report ed on 3 October.

Using satellite images and marine radio tran sponder data, AP tracked more than three dozen ships carrying grain from Russian-occupied areas of Ukraine to ports in Turkey, Syria, Lebanon and other locations.

The theft was being carried out by wealthy businessmen and state-owned companies in Russia and Syria, the investigation found. For

A spokesperson for Loyal Agro was quoted as saying that the ship’s cargo came from Russia. However, AP said the Laodicea could not have picked up its cargo in Kavkaz – listed on the bill of lading – as its hull, which reached 8m below water, would have run aground in the relatively shallow port.

Another company involved in smuggling grain was United Shipbuilding Corp, a Russian stateowned defence contractor sanctioned by the USA for providing weapons to the Russian war effort, AP said. The company, through its subsidi ary Crane Marine Contractor, bought three cargo ships in the weeks before Putin invaded Ukraine, with the vessels making at least 17 trips between Crimea and ports in Turkey and Syria, according to the news agency.

Russian groups warn of farming disruption

Trade associations in Russia are warning that the country’s planting campaign will be disrupted if farmers are called up for military service.

The warning followed Rus sian President Vladimir Putin’s confirmation at a meeting of regional leaders on 27 September that farm workers would be eligible for military service as part of the coun try’s partial mobilisation of reservists to fight in Ukraine, according to an AgriCensus report on the same day.

“Within the framework of partial mobilisation, agricultur al workers are also called up," Putin was quoted as saying.

Farming groups said the move could disrupt the final stages of the current harvest and new crop planting.

Agro-industrial unions had asked the government for a deferment from the partial mobilisation, AgriCensus quot ed from local media reports.

The Association of Nurs eries and Gardeners of the Stavropol Territory, for exam ple, had sent a letter to the Ministry of Agriculture saying that “mobilisation of workers employed in the industrial nursery and horticulture sec tors will lead to the disruption of the harvesting campaign”.

The Russian Grain Union

was also considering asking the government for a delay in calling up qualified workers, not only to allow field work but also for the processing industry, the report said.

At the time of the report, the Russian grain and oilseeds harvest was near completion with 88% of the crop harvest ed, but winter sowing had only just started with around 9M ha planted.

AgriCensus said this year’s Russian crop was forecast to reach a record level, with wheat expected to exceed 100M tonnes and the total grain harvest totalling around 150M tonnes.

UKRAINE/RUSSIA NEWS 4 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

IN BRIEF

Photo: Adobe Stock

Full-scale aftermarket support. EXPECT IT. Only Crown delivers problem-solving expertise, superior parts and on-site support. Optimize your operation with Crown’s Aftermarket Parts and Field Services. Available to all Crown customers, our comprehensive program includes field engineering support in 13 languages to assist with install, troubleshoot issues, train staff, realize cost savings and more. To minimize downtime, our superior replacement parts are available for immediate shipment anywhere in the world. We also work with you to refurbish or replace equipment nearing the end of its lifecycle. Our aftermarket commitment is another way Crown lowers total cost of ownership to customers around the globe. Get the aftermarket attention you deserve. Choose Crown for the long run. Field Engineering | Replacement Parts | Replace or Refurbish Contact Crown today 1-651-639-8900 or visit our website at www.crowniron.com

AUSTRALIA: Global agri business giant Louis Dreyfus Company (LDC) announced its acquisition of leading Australian grain handling business Emerald Grain from Long River Farms on 26 September.

Emerald Grain operates a network of seven grain storage and reception sites across the Australian states of New South Wales and Victoria, with a combined storage capacity of 1M tonnes.

The company also has a grain export terminal at the Port of Melbourne.

LDC said it had been active for over a century in Australia, originating, processing and exporting grains, oilseeds and cotton. Emerald Grain exports a range of grains including barley, canola and wheat, to over 35 global markets.

USA: Glencore’s agricul ture division Viterra said on 3 October that it had completed its US$1.125bn acquisition of the grain and ingredients business of US firm Gavilon from Marubeni America Corporation.

Gavilon sources, stores and distributes grains, oilseeds and feed and food ingredients to US and global markets. With assets locat ed in key growing areas in the USA, Gavilon’s opera tions have access to major railways, rivers and ports.

The company has 105 grain storage facilities and a total grain storage capacity of 345.5M bushels, ac cording to Sosland Publish ing’s 2022 Grain & Milling Annual.

Glencore is a multination al commodity trading and mining company.

Viterra was formerly known as Glencore Agricul ture but rebranded in 2020. It is active in 37 countries and has a network of agri cultural storage, processing and transport operations.

Nestlé to stop sourcing palm oil from Astra Agro Lestari

Swiss food and drink giant Nestlé plans to stop sourcing palm oil from subsidiaries of leading Indonesian palm oil producer Astra Agro Lestari following environmental groups’ allegations of land and human rights abuses by the company, Reuters reported on 30 September.

Nestlé, the manufacturer of KitKat chocolate and Nespresso coffee, told Reuters that following a recent independent assessment, it had instruct ed its suppliers to ensure palm oil from three subsidiaries of AAL did not enter its supply chain.

Without specifying the claims against AAL other than to say it had been on its “grievance” list for several months, Nestlé said it expected it would not be using any palm oil from the compa ny by the end of the year.

AAL denied the accusations made against it.

“Astra Agro is very serious about implementing our sustainability policy. It is not true that Astra Agro or its subsidiaries carry out land grabbing,” AAL president director Pendidikan Santosa told Reuters

Nestlé was not a direct buyer of products pro duced by AAL but most probably bought from its customers, Santosa added.

The European Commission had proposed several laws aimed at preventing and, in the case of forced labour, banning the import and use of products linked to environmental and human rights abuses, Reuters wrote.

Environmental group Friends of the Earth said Nestlé’s move to stop sourcing from AAL was an important “first step” and called on other leading consumer companies to follow.

CSPO production rises by nearly 6%

make steady progress.

CSPO consumption using RSPO credits or physical supply chains (mass balance, segregated, identity preserved) totalled an estimated 8.53M tonnes last year, a significant 12.2% increase from 2020.

Among the key consumption regions and countries, Europe and North America continued to maintain the high CSPO uptake seen over recent years, the RSPO said.

Production of certified sustain able palm oil (CSPO) rose by almost 6% last year, according to the Roundtable on Sustain able Palm Oil (RSPO)’s latest Annual Communication of Progress (ACOP) report.

RSPO members with palm oil estate and mill operations reported total CSPO produc tion of 14.7M tonnes in 2021, representing 19% of total global production of crude palm oil (CPO). This was a 5.7% increase compared to the previous year, the RSPO said on 15 September.

CSPO sales by mills in creased by 13.5% compared to

2020 with an estimated total of 9M tonnes (RSPO credit volumes or physical supply), representing 61% of total CSPO production.

Total certified land area –excluding independent small holders – farmed by RSPO members reached 4.45M ha in 2021.

Among the five main grow ing countries and regions, Latin American growers continued to perform well, with 27% of the region’s total production as CSPO and a further potential 43% in line for certification, the RSPO said. Malaysia, Indo nesia and Africa continued to

Europe showed a strong rise in CSPO consumption at 3.49M tonnes, representing an overall uptake of 48.6%. North America had an uptake of 82.3% CSPO, up from 81% in 2020. Latin America reached a double-digit uptake of 13.9%, while China and India reached 8% and almost 3% respec tively.

Looking ahead towards 2030, the RSPO said one of the main challenges was the gap between CSPO produc tion and consumption through RSPO supply chain models or other certification schemes for members holding multiple certifications, leading to a portion of CSPO production downgraded to conventional palm oil when traded.

NEWS 6 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

Photo: Adobe Stock

The RSPO says that production of certified sustainable palm oil has risen by 5.7% in 2021 compared with 2020

IN BRIEF

Indonesia to extend export waiver

The Indonesian government is planning to extend a palm oil export tax waiver until the end of the year, Reuters reported the country’s chief economic minister as saying.

Indonesia started removing taxes on exports of palm oil products from mid-July to help reduce excess stocks following a three-week export ban, which had been introduced in late April in a bid to stabilise local cooking oil prices, the 4 October report said. The tax waiver policy was scheduled to end after 31 October.

Indian palm oil imports rise18% in September

Palm oil imports in India rose by 18% compared to the previous month, AgriCensus reported from information published by the Solvent Extractors’ Association of India (SEA).

The world’s largest edible oil importer took in 1.17M tonnes of palm oil – consisting of refined bleached and deodorised (RBD) palm olein, crude palm oil (CPO) and crude palm kernel oil (CPKO) – in September, while soft oils imports totalled 421,625 tonnes, the 13 October report said. The increase in palm oil imports was due to a substantial price difference between palm oil and soyabean oil, with the former trading at more than US$400/tonne less in September.

Year-on-year RBD palm olein imports were higher, with Indian buyers favouring Indonesian exporters due to more competitive prices and lower duties, the report said.

In September, India imported 716,221 tonnes and 428,211 tonnes of palm oil from Indonesia and Malaysia respectively, reflecting the demand for cheaper Indonesian products, AgriCensus wrote. Soyabean oil imports in India increased slightly in September, rising 7% to 261,815 tonnes and sunflower oil imports rose 18% to 159,810 tonnes.

However, overall palm oil imports fell in the first 11 months of the current marketing year (beginning November 2021), with palm oil imports 8% lower than the same period the previous year at 7.03M tonnes.

“The plan is for an extension... until the end of the year,” Indonesia’s chief economic minister Airlangga Hartarto was quoted as telling reporters.

Indonesia collects export levies, on top of a separate export tax, to fund subsidies for its biodiesel and smallholder replanting programmes.

However, following a reduction in palm oil prices with the cost of palm oil-based biodiesel now lower than fossil diesel fuel, Indonesia currently needed less funds for the biodiesel programme, Hartarto said.

The government would continue to monitor the implementation of its Domestic Market Obligation (DMO) policy, which had been introduced in late May to ensure domestic cooking oil supply following the lifting of the palm oil export ban, he added.

Under the DMO policy, palm oil exporters are required to sell a portion of their products to the domestic market before they can receive a permit to export. Companies are currently allowed to export nine times the amount they have sold domestically.

NEWS www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 7

NORTH AMERICA: Danish supplier of rendering and processing technology Haarslev is teaming up with US renewable fuel firm Grön Fuels to evaluate po tential rendering by-product and investment opportuni ties, PR Newswire reported on 4 October.

Grön Fuels would provide capital in exchange for product and Haarslev would provide rendering equip ment to a potential render ing facility, the report said. The alliance would include North American rendering projects within Haarslev’s development pipeline.

Grön Fuels operates a sustainable aviation fuel and renewable diesel plant at the Port of Greater Baton Rouge in Louisiana process ing feedstocks including fats, oils and greases.

CHINA: China is expected to produce 27.52M tonnes of vegetable oil in 2021/22, according to the monthly update to the country’s Agriculture Supply and Demand Estimates (Casde) reported by AgriCensus on 13 September. Imports are forecast at 5.93M tonnes, with rapeseed and soyabean oil imports estimated at 1M tonnes and 380,000 tonnes respectively. Casde said it expected consumption of edible vegetable oil to be stable at 36.34M tonnes for the marketing year, which runs from October to September for vegetable oil, corn and soyabeans.

Argentine farmers sell record volumes of soya

Farmers in Argentina sold a record volume of soyabeans – more than 13.7M tonnes – in Sep tember, following the government’s introduction of a special exchange rate for producers, accord ing to a report by the United States Department of Agriculture (USDA) on 11 October.

The special temporary exchange rate of 200 Argentine pesos/US$1 was introduced for soy abean exports from 5-30 September.

“This [rate] raised the peso-denominated price of soyabeans in the local market by 38% practi cally overnight,” the USDA Foreign Agricultural Service (FAS)’s Global Agricultural Information Network (GAIN) report said. As a result, export ers made almost 4M tonnes in export declara tion, with China the principal destination.

The USDA projected Argentine soyabean ex ports for 2021/22 at 5.5M tonnes. For 2022/23,

production was forecast at 49M tonnes.

Political considerations continued to affect farmers, the report said, and the recent boom in soyabeans combined with elections in 2023, meant that sales of all commodities were likely to slow down until August 2023, when farmers would see the results of primary elections.

“If the conservative opposition performs well, farmers are likely to hold onto as much grain and oilseeds as possible, hoping that a change of government in December 2023 could result in the end of currency controls and potentially lower export taxes,” the report said.

“In contrast, a stronger than expected perfor mance by the ruling coalition in August 2023 could mean that farmers would begin selling in earnest to avoid any new taxes imposed by a re-energised Peronist government.”

China to use less soya meal for food security

lies in feed grains”.

Soya meal reduction and substitution has been intro duced in recent years and the ministry said the proportion of soya meal in feed consumed by its aquaculture industry had dropped to 15.3% last year, a 2.5% fall compared to 2017. This had saved 11M tonnes of soya meal, equivalent to 14M tonnes of soyabeans.

The Chinese government has announced plans to reduce the amount of soyabean meal in feed products as part of a larger plan to boost food security, World Grain reported.

The plan was posted by

China’s Ministry of Agriculture and Rural Affairs following a meeting on 19 September.

The ministry said demand for feed grains continued to grow and "the most prominent contradiction in food security

The US Department of Ag riculture had forecast a record Chinese soya meal output of 75.2M tonnes for 2022-23, and a domestic soyabean crop of 18.4M tonnes, World Grain wrote. However, the country was still mostly dependant on soyabean imports for domes tic use, with a forecast 97M tonnes of imports in 2022-23.

FDA proposes new 'healthy' definition on packaging

The US Food and Drug Administration (FDA) is proposing to change the definition of 'healthy' on food packaging in a bid to improve diet and reduce chronic disease.

The proposed change would bring the ‘healthy’ claim in line with current nutri tional science, the updated Nutrition Facts label and the current Dietary Guidelines for Americans, the FDA said on 28 September.

Under the proposal, in order to be

labelled with the ‘healthy’ claim on food packaging, food products would need to:

• Contain a certain meaningful amount of food from at least one of the food groups or subgroups (such as fruit, vegetable and dairy) recommended by the Dietary Guidelines.

• Adhere to specific limits for certain nutrients, such as saturated fat, sodium and added sugars. The threshold for

the limits is based on a percentage of the Daily Value (DV) for the nutrient and varies depending on the food and food group. The limit for sodium is 10% of the DV/serving (230mg/serving). For example, a cereal would need to con tain 21.2g of whole grains and contain no more than 1g of saturated fat, 230mg of sodium and 2.5g of added sugars.

NEWS 8 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

IN BRIEF

Photo: Adobe Stock

OUR PLANTS THINK GREEN. Special proven technology for organic chlorine removal in low grade feedstocks for HVO production. EXPERTS IN: EDIBLE OIL EXTRACTION AND REFINING • OLEOCHEMICALS • BIODIESEL PRODUCTION USED MINERAL OIL RE-REFINING • WASTE OIL PRE-TREATMENT FOR BIOFUEL PRODUCTION www.technoilogy.it

EUROPE: Global agribusi ness giant Bunge and Olle co, UK, are forming a 50/50 joint venture to create a full life-cycle oil collection business in Europe.

The joint venture would involve the collection of used cooking oil from food service and food manufac turing customers in Europe – excluding the UK and Ireland –for use as a feed stock in the production of renewable fuels, the firms said on 13 October.

Olleco is the renewables division of ABP Food Group and collects oil for con version into biofuels and food waste for conversion into renewable energy and fertiliser.

EU: EU oilseed produc tion is forecast to rise by 3% in 2022/23 based on increased planted areas of rapeseed, soyabeans and sunflower, according to a United States Department of Agriculture (USDA) on 12 October.

Soyabean planted area was forecast to rise by 11.1%, with rapeseed and sunflower areas set to be up by 9.7% and 10.3% respec tively. The rise in rapeseed planting was the first since a signficant decline in 2019, the USDA said.

“Attractive commodity prices, and to some extent uncertainty in the Black Sea market due to Russia’s invasion of Ukraine, are the major drivers for the increases in area."

Fate of Amazon hangs on Brazil presidential election

The Amazon’s future rests on the result of Brazil’s national election, according to experts quoted in a report by The Guardian on 3 October.

Following the close result of the first voting round on 2 October, left wing candidate Luiz Inácio Lula da Silva was due to face far-right incumbent Jair Bolsonaro in a second vote on 30 October. Both candidates fell short of the more than 50% of valid votes needed to prevent a second round.

Experts say the rampant destruction under President Bolsonaro could push the world’s big gest rainforest past an irreversible tipping point, according to an earlier report by The Guardian

In contrast, scientists estimated that a victory for the former president Lula, who oversaw a sharp decline in deforestation when in power, could lead to a 90% drop in the destruction of

forests, the report said.

Bolsonaro became president at the start of 2019 and had slashed environmental protections and promoted colonisation of the forest, The Guardian said, with research showing that CO2 emissions doubled in 2019 and 2020 compared with the average over the previous decade.

Almost 1M ha of rainforest has been burned in the past year, according to the latest data report ed by the newspaper.

If he wins, Lula has said he would reverse Bolsonaro’s legal changes, reform environmental agencies and drive illegal miners out of indig enous lands. Under the presidency of Lula and his Workers’ party successor, Dilma Rousseff, deforestation fell by 72% from 2004 to 2016, according to an earlier report by The Guardian on 30 September.

A third of olive oil from intensive farming

and published by Spanish tree nursery company Agromillora.

The study said that of the world's 11.6M ha of olive groves in 66 countries, 400,000ha were 'super high-density groves' on which about 1,600 olive trees/ha were planted. The groves were dependent on water availabili ty and mostly flat landscapes.

A new report has found that 'super high-density' groves account for more than a third of global olive oil production, with their proportion likely to grow, Olive Oil Times wrote on 10 October.

Although the groves make up just 3% of olive-growing hectares in the world, they ac count for 36% of global olive oil production, according to the study conducted by Juan Vilar Strategic Consultants

Agromillora said this farming method resulted in greater productivity and lower work force costs due to high mecha nisation, with quick delivery of the fruits to the mill, leading to less deterioration. Harvesting a hectare of super high-den sity olive trees required one or two hours, with harvesting costs reduced to US$0.029US$0.059, the company said.

Brazilian firms halt soya crushing due to low margins

Around 10 Brazilian soyabean crushing companies halted processing operations due to falling margins and weak demand, AgriCensus quoted local sources in a 29 September report.

As a result, the country’s crushing rate dropped by 15,000 tonnes/day, represent ing about 8% of the country’s capacity.

In an earlier report, AgriCensus wrote that eight soyabean crushing facilities had halt

ed operations on 12 September but, since then, two more plants had followed.

“Crushing margins are really bad again,” Victor Martins, senior risk manager at HedgePoint Global, told AgriCensus. “But some plants will continue to operate as they are better off crushing with negative margins than having the beans as stock."

Crushing plants usually carried out main tenance work around December/January,

ahead of the soyabean harvest in Brazil, but plants were going offline earlier than anticipated this year, the report said.

Soyabean processing capacity is estimat ed at 194,400 tonnes/day in Brazil, which is the second largest exporter of soyabeans oil globally, behind Argentina. Brazil is expected to export 2.13M tonnes of soy abean oil and 18.8M tonnes of soyabean meal in 2022/23, according to the USDA.

NEWS 10 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

IN BRIEF

Photo: Adobe Stock

www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 11 When you choose Oil-Dri, you get more than a reliable adsorbent . You gain a world-class team of technical service experts to help you make tough decisions and save re nery resources for pre-treatment of oils and fats. LEARN MORE AT OILDRI.COM/GETMORE EDIBLE OILS | BIODIESEL | RENEWABLE DIESEL Proudly Owned and Manufactured in the U.S.A. © 2022 Oil-Dri Corporation of America. All rights reserved. MORE THAN A MINERAL GekaKonus GmbH · Siemensstraße 10 · D-76344 Eggenstein-Leopoldshafen Tel.: +49 (0) 721/94374-0 · Fax: +49 (0) 721/94374-44 · info@gekakonus.net · www.gekakonus.net MORE THAN ENERGY Services by GekaKonus: Engineering | Design | Consulting Commissioning | After Sales Service Efficient high temperature energy solutions with steam and thermal oil.

Stepan to buy surfactants producer PerformanX

US speciality chemicals company Stepan has agreed to acquire surfactants producer PerformanX Specialty Chemicals, the Inde pendent Commodity Intelligence Services (ICIS) reported on 12 September.

Stepan said the deal was expected to close in the third quarter of this year but did not disclose the financial details.

PerformanX was a strong strategic fit for the company’s surfactants business, Stepan CEO Scott Behrens was quoted as saying, which would allow it to diversify its alkoxyl

ation product lines.

The pending acquisition is the latest move by Stepan to increase its surfactants capacity and the company is building a new alkoxylation plant at its existing complex in Pasadena, Texas, according to the report.

Due to become operational in 2024, Stepan said the US$245M project would provide it with flexible alkoxylation capacity for both ethoxylation and propoxylation.

Stepan’s website said the company was active in the agriculture, coatings, house

hold and industrial cleaning, and personal care sectors.

PerformanX Specialty Chemicals offers a range of products and custom formula tions including ethoxylates, disinfectants, lubricant additives and a range of formulat ed speciality products, for sectors including cleaners and detergents, personal care, oil and gas, and paints and coatings.

Alkoxylates are a family of surfactants made by reacting fatty alcohols with eth ylene oxide (EO) or propylene oxide (PO).

BASF and RiKarbon to make bio-emollients

FINLAND: Renewable fuels producer Neste said on 19 September that it had launched a study into transitioning its Porvoo refinery into a renewable site and ending crude oil refining there in the mid-2030s.

The transition could include retrofitting existing units at a later stage, with a long-term production capaci ty of 2M-4M tonnes/year.

The Porvoo site currently produces both fossil and renewable products such as hydrotreated vegetable oil (HVO) and comprises four production lines and more than 40 production units.

Independently of the planned transition, Neste said it would continue sup plying fossil fuel products.

GERMANY: Chemical firm BASF announced on 29 Sep tember that it had launched a new catalyst to process renewable feedstocks.

The CircleStar catalyst achieved 99.5% selectivity for ethanol-to-ethylene con version, with an operating temperature more than 25°C lower than conventional processes, BASF said.

The catalyst’s star shape also increased the active geometrical surface area for the reaction, leading to improved mass transfer and a longer catalyst lifetime due to the lower operating tem perature and pressure-drop profile.

German chemical firm BASF has formed a partnership with US-based technology start-up RiKarbon to produce emol lients derived from bio-waste.

The partnership would involve BASF licensing and commercialising RiKarbon’s proprietary technology, the two companies said on 21 September.

BASF said it planned to bring the RiKarbon technology in-house and was planning a market launch of the initial solutions in 2024.

Founded in 2018, RiKar bon processes bio-waste into renewable chemicals and ingredients, such as base oils and emollients for renewable plastics, healthcare, and spe ciality applications, including cosmetics and hair and skin

care products.

RiKarbon said its emollients were comprised of 100% bio-based carbon, with 60% sourced from agricultural waste materials. The company

said its emollients could be used in personal care products as a bio-based alternative to linear silicones, petrochemi cal-derived hydrocarbons and esters.

Companies investing billions in bioplastics

Billions of dollars are being invested in bioplas tics with the sector set to expand with increased use of corn, sugar, vegetable oils and other materials, AP News wrote on 9 August.

Of the 9bn tonnes of fossil fuel plastic pro duced since the 1950s, only 9% was recycled, with the remainder buried in landfills, burned or polluting land and waterways, the report said.

Bioplastics currently represented 1% of global plastic production, but companies and investors were now seeing opportunities in the sector.

Investment in bioplastic manufacturing reached US$500M in the first three months of this year, according to data from i3 Connect, exceeding the previous high of US$350M in the last quarter of 2021.

Zion Market Research has estimated that the bioplastics market would surge from US$10.5bn in 2021 to around US$29bn in 2028.

US company Danimer Scientific, which makes a bioplastic called PHA or polyhydroxyalkanoate using microorganisms that ferment with canola oil, had recently expanded its plant in Win chester, Kentucky, the report said.

The other primary bioplastic was PLA, or poly lactic acid, widely produced by fermenting sugar from corn and sugarcane, AP News wrote.

NatureWorks, a joint venture between global agribusiness giant Cargill and Thailand’s PTT Glob al Chemical, was producing 150,000 tonnes/year of bioplastic pellets at its plant in Blair, Nebraska. It was also building a US$600M plant in Thailand to increase its production capacity by 50%.

PLA, unlike PHA, did not easily biodegrade in nature and NatureWorks had formed a partner ship with PHA manufacturer CJ Bio to produce a bioplastic that could more easily biodegrade, AP News added.

RENEWABLE NEWS 12 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

IN BRIEF

Photo: Adobe Stock

Emollients are products used to soften and lubricate skin

Venture to produce non-ionic surfactants

German chemical giant BASF is forming a joint venture with South Korean chemical company Hannong Chemicals to produce non-ionic surfactants in Asia Pacific.

BASF said on 6 October that it would own 51% of the BASF Hannong Chemicals Solutions joint venture while Hannong would hold the remaining stake.

Located in the Daejuk site at the Daesan Industrial Complex in Korea, the joint venture would combine BASF’s technology and product capabilities with Hannong’s production of non-ionic surfactant prod ucts. Expected to become operational in

Crop Energies buys Syclus to make ethylene

German ethanol producer Crop Energies has acquired a 50% stake in Dutch bio-chemicals start-up Syclus, the companies announced on 7 September.

The aim of the US$1.75M acquisi tion was to build an industrial-scale plant to produce renewable ethylene from ethanol.

Syclus said it planned to build and operate a production facility at the Chemelot industrial park in Geleen, the Netherlands.

While the plant was under devel opment, the company said it would study the technical and economic viability of producing renewable ethylene.

If the analysis was positive, basic engineering work would start late next year, with production at the 100,000 tonnes/year plant expect ed to begin in 2026. This would require an investment of US$82.8MUS$974.3M.

Applications for ethylene-based plastics and polymers include pack aging, building materials, automo tive applications, paints, adhesives, fibres, clothing and other everyday products.

To date, Crop Energies said it had mainly produced ethanol as a do mestic fuel substitute as well as for food and animal feed products, but the focus in the future would be on the de-fossilisation of other sectors.

In recent years, European demand for ethylene has been approximately 20M tonnes/year, the firms said.

the first half of next year, the joint venture would involve both companies maintaining their own sales and distribution networks.

Used in a wide range of industry sectors – including home care, personal care, industrial and institutional cleaning applications, as well as industrial formu lations – non-ionic surfactants are used in formulations for laundry detergents, surface cleaners and dishwasher deter gents, leather and textile treatment, metal surface cleaning and other applications.

Surfactants help lower the surface ten sion between a liquid and another liquid,

gas or solid. They are a key ingredient in cleaning products and have a water-lov ing head (hydrophilic) and water-hating (hydrophobic) tail. The hydrophobic tails are attracted to dirt while the hydrophilic heads help to wet things more uniformly. The hydrophilic head of each surfactant is electrically charged (negative, positive or neutral), and a surfactant is classified as anionic, non-ionic, cationic or amphoteric, depending on the charge.

Non-ionic surfactants have a neutral charge and are very good at emulsifying oils.

RENEWABLE NEWS www.ofimagazine.com OFI – NOVEMBER/DECEMBER 13

natural bleach_mini_ofi.indd 1 07/06/2019 16:54

WORLD: Leading agribusi ness and one of the world’s largest ship charterers, Cargill, is aiming to boost its vessels’ use of biofuels to 50,000 tonnes by mid to the end of 2023, up from 12,000 tonnes since Janu ary, the firm’s marine fuels lead Olivier Josse said at the Singapore International Bunkering Conference and Exhibition (SIBCON) 2022.

“We are going to [blend] some fatty acid methyl ester (FAME) in the fourth quar ter in Singapore,” Reuters reported him saying.

The move to blend FAME was to try to understand the demand and appetite of customers for biofuels as a bunkering fuel, the 5 Octo ber report quoted Josse as saying.

SPAIN: Oil and gas compa ny Cepsa said on 6 October that it had successfully test ed its marine biofuel pro duced from used vegetable oils (with ISCC certificate of sustainable origin) and very low sulphur fuel (VLSFO).

The biofuel was loaded at Cepsa’s bioenergy plant in the San Roque Energy Park, Cádiz and used by a vessel in the company’s fleet.

“The results showed opti performance of maritime engines, leading to Cepsa being able to offer this bio fuel to its customers in the maritime sector,” it said.

Low Mississippi levels threaten soya exports

A sharp drop in Mississippi river water levels has forced barges to reduce loads by up to 40% and sent barge freight rates soaring just as the USA approaches the peak of its corn and soyabean export season, AgriCensus reported on 30 September.

Costs to transport grains and oilseeds down the Mississippi river have soared nearly 80% since the beginning of Sep tember and over 150% when compared to costs reported at the beginning of August, according to data from the US Department of Agriculture.

The issue had been brought to the fore with the largest US barge operator, Ingram Barge Co, declaring force majeure in a letter to customers, saying “near-historic” low water levels on the Mississippi River meant it could not fulfil deliveries, World Grain wrote on 6 October.

Bloomberg indicated a “log jam” of more than 100 vessels on the river.

World Grain said river water levels were typically at their lowest around this time of year but drought conditions in parts of the Midwest this year had dropped levels even lower, shrinking channels and reduc ing draft levels.

Around 60% of all US grain and oilseed exports moved

down the Mississippi River to ports in Louisiana on the Gulf of Mexico. Some Gulf exporters had pulled offers for corn and soyabean loadings at Louisiana ports in October and November as they were unsure if adequate grain supplies could reach ex port terminals, the report said.

Grain Service Corporation vice president Diana Klemme told AgriCensus that barge freight rates would remain high through the first half of Octo ber, which would be a drag on basis upriver rates and push Gulf basis levels higher.

Klemme added that “the difference between cash bids for September/first half of Oc tober and December are now

big enough that farmers and elevators will look to hold back as many bushels as they have room for – which in turn will only slow US export shipments further near term”.

If higher barge costs pushed FOB Gulf premiums higher, Brazil could overtake the USA in terms of spot price compet itiveness with more export de mand shifting to South America just a month after an incentiv ised exchange rate policy had bolstered Argentine soyabean shipments, AgriCensus wrote.

Brazil’s Agrural senior analyst Daniele Siqueira said that several million tonnes of soyabeans could shift from the USA to Brazil.

Around 15% of Ukraine’s storage damaged or destroyed

Around 15% of Ukrainian crop storage facilities have been destroyed, damaged or are now controlled by Russia, the Conflict Observatory reported on 15 September.

The US non-governmental organisa tion (NGO) said that around 14.57% of Ukraine’s estimated 58M tonnes of crop storage capacity (one in six facilities) had been impacted since Russia’s invasion of the country on 24 February.

“Intentional and indiscriminate target ing of crops storage infrastructure can constitute a war crime and a crime against humanity under international law,” said the

NGO, which was reporting on a Yale School of Public Health’s Humanitarian Research Lab assessment of crop storage facilities through commercial satellite imagery.

“This assessment determines that Russia and its aligned forces controlled approx imately 6.24M tonnes of Ukraine’s crop storage capacity as of July 2022 regardless of damage,” the Conflict Observatory said.

At least 3.07M tonnes of storage capac ity had been destroyed or visibly damaged since 24 February, constituting at least 5.36% of Ukraine’s pre-war crop storage capacity nationwide.

“The assessment also concludes that at least 60 of the 75 facilities (80%) identi fied as damage-affected are found at port facilities or within less than one kilometre of a railroad.”

The US Department of State called for further investigation, adding that the Kremlin’s invasion of Ukraine had led to the damage or outright destruction of many of Ukraine’s arterial roads, railways, ports, and food storage facilities that were essential to getting its agricultural goods to international markets, World Grain wrote on 19 September.

IN BRIEF TRANSPORT NEWS 14 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

Photo: Adobe Stock

Around 60% of all US grain and oilseed exports are moved down the Mississippi River to ports in Louisiana for export

DRIVING

www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 15

STORAGE FORWARD. Koole Terminals is a leading and independent storage, processing, and logistics company, enabling business growth through integrated and innovative service offerings for large-volume products. Driving the energy transition forward for a sustainable future by supporting its worldclass customers. With 11 strategically located terminals in Europe and a total volume of 4,100,000 cbm, Koole reflects the diversity of its customers’ needs. 11 TERMINALS IN EUROPE TOTAL STORAGE CAPACITY 4,100,000 CBM

SPAIN: National oil and gas company Cepsa has started producing biofuels from used cooking oil (UCO) at its La Rábida Energy Park facility in Palos de la Fron tera, Huelva.

Cepsa said on 30 Sep tember that it aimed to produce 2.5M tonnes of biofuels by 2030 and the Huelva development was part of its 2030 Positive Motion strategy to promote the decarbonisation of air, road and sea transport.

USA: Renewable fuels com pany Aemetis has agreed 10 sustainable aviation fuel (SAF) and hydrotreated vegetable oil (HVO) supply deals worth US$7bn with 10 airlines.

Supply agreements had been made with Alaska Airlines, American Airlines, British Airways, Delta Air Lines, Finnair, Iberia, Japan Airlines, Jet Blue Airlines and Qantas, Aemetis said on 7 September. They would involve the delivery of SAF for between seven and 10 years. The SAF deals com prised blended fuel – 40% SAF and 60% petroleum jet fuel – scheduled to be delivered to San Francisco International and Los An geles International airports. The agreed HVO was expected to be delivered to Northern California truck fuelling locations.

USA: The Environmental Protection Agency (EPA) is expected to extend the period of annual biofuel blending mandates from one year to three years, Reuters quoted sources as saying on 2 September.

Switching to a multi-year target aimed to provide longer-term certainty to the refining and biofuels indus tries. The sector has been given annual mandates for more than a decade under the US Renewable Fuel Standard (RFS).

Shell Louisiana site may be re-purposed for HVO/SAF

Global oil giant Shell is close to reaching a final investment decision to re-purpose its Gulf Coast refinery in Louisiana, USA, to produce hydrotreated vegetable oil (HVO) and sus tainable aviation fuel (SAF), the Houston Chronicle reported on 29 September.

The US$1.48bn project’s first phase would include a low carbon fuels facility unit to produce HVO and SAF from plant oils, animal fats and used cooking oils, the report said.

Plans to repurpose the Convent site, northwest of New Orleans, were the first in a series of projects Shell was considering for its chemical facilities along the Gulf Coast to accelerate the transition from fossil fuels. The regional spending plan could reportedly cost as much as US$10bn.

Shell was also considering new projects at facilities in Deer Park, east of Houston; and Geismar and Norco in Louisiana, to help the company

reduce emissions and provide reduced-carbon products and chemicals, the report said.

Shell was prioritising projects in the region based on the most in demand low-carbon products, which now included biodiesel and SAF, said Emma Lewis, Shell’s senior vice pres ident of Gulf Coast chemicals and products.

Before its closure in Novem ber 2020, the Convent refinery processed around 240,000 barrels/day of crude oil.

Total secures feedstock for Grandpuits site

French oil giant TotalEnergies has entered an agreement with German rendering company SARIA to produce sustainable aviation fuel (SAF) at its Grandpuits refinery in Seine-etMarne, France.

The agreement would help TotalEnergies secure a feedstock supply – used cooking oils (UCO) and animal fats – to produce SAF and would increase the facility’s production capacity to 210,000 tonnes/year, 25% higher than forecast in the initial project announced in 2020, the company said on 26 September.

As part of the agreement, TotalEnergies said it would take 50% of SARIA’s production capac ity to supply animal fat esters to the refinery. SARIA would take an equivalent stake in Grand puit’s biofuels business, which TotalEnergies would continue to operate.

The deal is subject to regulatory approval.

China biodiesel production to rise by 32%

Biodiesel production in China is expected to increase by 32% this year compared to 2021 mainly due to a surge in export demand, Biodiesel magazine wrote on 20 September.

The country currently had 46 biodiesel plants, up from 44 last year and 42 in 2020, the magazine quoted from a US Department of Agriculture (USDA) Foreign Agricultural Service (FAS) Global Agricultur al Information Network (GAIN) report.

Nameplate capacity was expected to reach 4.7bn litres

this year, up from 2.8bn litres last year and 2.726bn litres in 2020, with capacity utilisation expected to drop to 51.7% this year, compared to 65.5% last year and 53.4% in 2020.

The USDA estimated that 2.381M tonnes of used cook ing oil (UCO) was expected to be used as feedstock for bio diesel production this year, up from 1.798M tonnes last year and 1.426M tonnes in 2020.

China was forecast to pro duce 2.43bn litres of biodiesel this year, up from 1.835bn litres last year and 1.455bn

litres in 2020, with consump tion expected to reach 600M litres this year, up from 564M litres last year and 522M litres in 2020, the USDA report said.

Biodiesel exports from China were forecast at 2.125bn litres this year, up from 1.835bn litres last year and 1.455bn litres in 2020, with most of the total volume destined for the European Union.

China is expected to import 295M litres of biodiesel this year, up from 204M litres last year and 102M litres in 2020, according to the USDA.

BIOFUEL NEWS 16 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

IN BRIEF

Photo: TotalEnergies

TotalEnergies is securing used cooking oil and animal fats feedstock for its Grandpuits refinery (above)

Non-GM protein from new ADM plant

Global agribusiness giant Ar chers Daniels Midland (ADM) announced the opening of an extrusion facility in Serbia to supply non-genetically modi fied (GM) textured soya protein on 19 September.

Opened less than a year

after ADM’s acquisition of European non-GM soya ingre dients provider SojaProtein, the company said the new facility would increase its extrusion capacity in the region and would extend its production of non-GM textured soya protein

to include origination and extrusion capabilities.

“Our new facility not only increases the supply of local ly-sourced, non-GM textured soya protein in Europe, it also matches the pace of the incredible expansion of the

meat alternatives category in the EMEA region,” ADM pres ident of global foods, Leticia Gonçalves, said.

The facility would produce non-GM soya proteins with 90% of the soya sourced grown locally.

US farmers urging action on Mexico's GM corn ban

US farmers are urging the government to challenge a looming Mexican ban on genetically modified (GM) corn, warning of billions of dollars of economic damage to both countries, Reuters reported on 26 September.

A 2020 decree by Mexico President An dres Manuel Lopez Obrador would phase out GM corn and the herbicide glyphosate by 2024.

Mexico imported around 17M tonnes/ year of US corn, Reuters wrote. Corn for human consumption – including white corn used in food products like tortillas –accounted for some 18%-20% of Mexico's total US corn imports.

Bayer wins fifth consecutive glyphosate cancer lawsuit

A US jury has found that German chemical giant Bayer’s Roundup weedkiller did not cause defendants’ cancer – the company’s fifth consecutive trial victory over such claims, No-Till Farmer reported several media outlets as saying.

Glyphosate is the active ingredient in Bayer brands such as Roundup and has been at the centre of mass litigation in the USA brought by plaintiffs claiming the weedkiller caused

IN BRIEF

their non-Hodgkins lymphoma. Bayer inherited the cancer lawsuits following its 2018 purchase of global agrichemical firm Monsanto for US$63bn.

The trial in St Louis was the first involving multiple de fendants, according to the 9 September report. The three plaintiffs claimed Bayer should have been responsible for warning them about cancer as a potential side effect, No-Till Farmer wrote.

USA: New research by the University of Illinois has shown that modifying the photosynthesis process in soyabeans can lead to a 25% increase in yield, The Guardian reported on 19 August.

Plants could bleach if they absorbed more energy than they could use for growth and used a mechanism called non-photo chemical quenching to get rid of excess energy. In bright sun light, quenching kicked in almost immediately but it could take up to half an hour for the process to switch off again. The research team modified three genes to allow the soyabean plant to be come more responsive to lower light conditions. The modified soyabean had an average improved yield of 25% over five trials.

Mexico's health regulator COFEPRIS had not authorised new strains of glypho sate-resistant GM corn seeds for import since 2018, Reuters said, and the National Corn Growers Association wanted the US Trade Representative to launch a dispute settlement proceeding under the US-Mex ico-Canada trade pact.

A March report by US consulting firm World Perspectives looking at white and yellow corn said Mexico's ban could cost the country US$4.4bn over 10 years for corn imports and push the price of tortillas up 42% by the second year. The USA could also see a US$16.5bn drop in economic output over 10 years, the report added.

BIOTECH NEWS www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 17

Photo: Adobe Stock

Supporters of Mexico's GM corn ban fear biotech seeds contaminating native varieties

SAF taking o

e global use of sustainable aviation fuel (SAF) is rising but the sector still faces a series of challenges – notably higher production and feedstock costs compared to conventional jet fuels – before it takes o on a wider scale Gill Langham

The aviation industry currently accounts for approximately 2-3% of humaninduced carbon dioxide emissions and 12% of emissions from transportation, according to a report on the sector by the International Energy Agency (IEA Bioenergy).

In response, the sector has introduced measures to reduce emissions such as improving fuel efficiency by 1.5%/year (between 2009-2020), achieving carbon neutrality by 2020 and targeting a 50% reduction in emissions by 2050.

Meeting the aviation sector’s climate targets will require significant volumes of sustainable aviation fuel (SAF), the

IEA Bioenergy report says, but current production volumes are less than 150M litres/year, which is considerably less than 0.5% of total jet fuel demand.

Commenting on the sector, Louise Burke, vice president Global Aviation and SAF for Argus Media, says SAF and carbon offsets are considered the “main tools” for the aviation sector to use to meet its decarbonisation goals.

“We know that SAF is here to stay as the aviation industry is difficult to electrify and is unlikely to have other means of decarbonisation. As SAF is a drop-in fuel and can use current logistical transport means – the maximum SAF blend is currently 50% – this also provides ease of logistics in the market.”

Rising demand

Global SAF demand is forecast to range between 2bn-6bn litres/year by 2026, according to forecasts made by the IEA last year, when the total was 0.1bn litres/ year.

Recent investments will see production grow to more than 1bn litres/year over the next few years. However, the vast majority of these biojet fuels will come from hydrotreated esters and fatty acids (HEFA) feedstocks and technology, according to IEA Bioenergy’s

report ‘Progress in Commercialization of Biojet/Sustainable Aviation Fuels (SAF): Technologies, potential and challenges’.

Although other pathways are being developed, significant technological challenges still need to be resolved and the aviation sector remains largely dependent on liquid fuels – and will be for the foreseeable future – despite ongoing research on alternative technologies such as electric motors and the use of green hydrogen, according to the report.

“Unfortunately, these… low-carbonintensity alternative options are unlikely to be ready for commercial, large-scale and sector-wide deployment in the near term plus an additional hurdle is the long lifespan of aircraft,” the IEA Energy report says. “Biojet fuels represent the single greatest opportunity for airlines to achieve significant, long-term carbon reductions and they will be essential if the sector is to achieve a 50% emission reduction by 2050.”

Current pathways

At the time of the IEA Energy report, seven pathways and two co-processing pathways had been certified under international standards organisation ASTM. However, only the HEFA pathway – also known as hydrotreated

18 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

TRANSPORT

Photo: Adobe Stock

vegetable oil (HVO) biofuels – is currently contributing significant volumes, according to the report (see Table 1, right).

Biojet fuel produced using this process is known as HEFA-SPK (synthetic paraffinic kerosene) and this term is used within the ASTM D7566 standard.

More than 5bn litres/year of HEFA, as renewable diesel, are produced worldwide and significant expansion of multiple facilities is currently underway (see Figure 1, right).

The commercialisation of other pathways is ongoing but HEFA technology is expected to supply the bulk of bio-jet over the next five to 10 years until other technologies become fully commercialised, according to the report.

HEFA challenges

Although any type of lipid can be used to produce HEFA, generally referred to as fats, oils and greases (FOGs), there are price differences.

Apart from cost considerations, an equally important element is the “sustainability” and the overall carbon intensity of making the feedstock, according to the report, with the use of vegetable oil in the sector competing with food production demands. The source of oil will also impact a fuel life cycle assessment, which has a direct impact on the carbon intensity of the final fuel.

Opportunities for technical improvements to the fully commercial HEFA pathway are limited, according to the report, but there is “considerable scope” to reduce the cost and carbon intensity of the feedstocks – as demonstrated by the increasing use of used cooking oil (UCO).

However, although several waste feedstocks have been used to date, they are a finite resource, the report says.

“Consequently, existing and evolving oilseed crops will be needed to increase feedstock availability. However, there will be ongoing concerns about the sustainability and cost of feedstocks.”

Other technologies

Large-scale, pioneer facilities for a range of other technologies are under construction or planned and include gasification with Fischer-Tropsch, ethanolto-jet, isobutanol-to-jet and catalytic hydrothermolysis, the report says. In addition, multiple alternative technology pathways, currently in the ASTM approval pipeline, are expected to attain ASTM certification.

By 2030, multiple facilities are expected to produce substantial volumes of SAF annually, with about 8bn litres/year

forecast to be available by 2030, according to estimates by the International Civil Aviation Organization (ICAO), a specialised agency of the United Nations.

“It is hoped that multiple facilities using various technologies/processes will routinely produce bio-jet as, in the longer-term, significant expansion of HEFA volumes will likely be constrained by the availability of low cost, waste lipid/ oleochemical feedstocks,” the IEA Energy report says.

“In order to achieve the significant volumes needed to meet the sector’s targets, aggressive commercialisation and scale-up of all biojet fuel technologies will be required”.

Other challenges

As all biojet fuels used in commercial flights have to be certified to gain market access, the lengthy, arduous and expensive certification process represents a significant hurdle, according to the IEA Energy report.

“Currently, all alternative fuels can only be used in a blend with fossil jet fuel, [but] some biojet fuel technology providers are trying to produce fully synthetic biojet fuels that could potentially be used without any blending with conventional jet fuel”.

Higher production and feedstock costs for biojet fuels also remain a major obstacle for wider use, the report says.

“In 2022, SAF prices continue to price at least three times higher than those for conventional petroleum jet fuel,” Argus Media’s Burke says.

Argus assessed SAF at US$3,530.57/ tonne on 12 August compared to the conventional jet fuel price of US$1,114.50/tonne.

In addition, feedstock dynamics affect overall value of SAF values, Burke says, with European SAF pricing affected by underlying supply/demand fundamentals of HVO and UCO prices.

“For all of the biojet processes, the minimum selling price… is significantly u

TRANSPORT

www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 19

Source: IEA Bioenergy: Task 39 report Table 1: Current world annual production capacity of HEFA drop-in biofuels Source: Argus Media Figure 1: World SAF production capacity (million tonnes/year)

higher than that of fossil-derived jet fuel. Thus, policy will play a very important role in trying to bridge this price gap,” the IEA Bioenergy report says.

Global developments

The increasing commercial use of biojet fuels is reflected in its expanding use at numerous airports worldwide by multiple airlines, according to the IEA Energy report.

At the time of the report, seven airports were regularly distributing biojet fuel blends and about 300,000 commercial flights had used these blends.

SAF providers have also been forming supply deals with individual airline companies.

For example, Finnish renewable fuels producer Neste – one of the leading players in the renewable fuels and SAF sectors – has entered supply agreements with major airlines, including IAG, Lufthansa Group (including SWISS), Delta Air Lines and Southwest Airlines, cargo carriers such as DHL and low-cost airlines such as easyJet.

The company, which expects to increase its SAF production to 1.5M tonnes/year (around 1.875bn litres) by the end of 2023, also expanded its partnership with ITOCHU earlier this year to increase the availability of SAF in Japan.

“It is likely that the increased availability of commercial volumes will see an increase in the establishment of regular downstream supply at multiple locations,” the IEA Energy report says.

In China, for example, the country’s largest oil refiner China Petroleum & Chemical Corporation (Sinopec) produced its first batch of SAF from UCO at its facility in the east of the country, Reuters reported on 28 June, paving the way for industrial-scale SAF production.

Other initiatives

Government initiatives look set to boost SAF production and usage, the report says.

In July, the European Union (EU) approved plans requiring suppliers to blend a minimum of 2% of SAF into their jet fuel from 2025, rising to 37% in 2040 and 85% by 2050.

Transport members of the European Parliament (MEPs) said the plan should include a gradual switch to alternatives to conventional fuel such as synthetic fuel and UCO.

The transport MEPs also proposed the creation of a Sustainable Aviation Fund from 2023 to 2050 to accelerate the decarbonisation of the aviation sector and support investment in SAFs, innovative

aircraft propulsion technologies, or research for new engines, the 27 June statement from the European Parliament said.

In the USA, the White House has vowed to lower aviation emissions by 20% by 2030, with a goal of boosting SAF production to 11.4bn litres/year (3bn gallons/year) by 2030, and to meet 100% of aviation fuel demand of about 132bn litres/year (35bn gallons/year) by 2050, according to a Reuters report on 10 August.

The US government’s landmark Inflation Reduction Act passed in August includes a dedicated tax credit for SAF, which is also expected to boost the sector.

The SAF tax credit of US$1.25/gallon, which could rise to US$1.75/gallon depending on the fuel’s greenhouse gas reduction level, will remain in place until 2024 and transition to Clean Fuel Production Credit (CFPC) payments from 2025.

“It will definitely incentivise renewable diesel producers to move over to SAF in North America as both new plants and the expansion of existing plants for renewable diesel will also produce SAF,” Argus Media’s Burke says.

Alternative feedstocks

As feedstock is generally a significant component of the cost of production (up to 80% of the cost of HEFA), the use of low-cost feedstocks will play a role in reducing SAF costs, according to the IEA Energy report.

Alternative technology pathways offer opportunities for producing SAF with low carbon intensity at a competitive price, the report says, by using low-cost, waste feedstocks such as municipal solid waste, sewage sludge, food processing waste, waste gases and forest and agricultural residues.

Other feedstocks, such as Brassica carinata, Camelina sativa, pennycress,

pongamia and jatropha, are also under development as more sustainable options that do not compete with food, the report says, but these options are only available in small quantities.

In Japan, the New Energy and Industrial Technology Development Organization (NEDO) has been working with engineering company IHI Corporation on the development of SAF using algae as a feedstock. NEDO also worked on a project to develop technology to make SAF using waste wood as a raw material in partnership with Mitsubishi Power, JERA, Toyo Engineering Corporation and the Japan Aerospace Exploration Agency (JAXA).

Both technologies, when combined with conventional fossil fuel (JET A-1), have been certified under ASTM D7566 and SAF produced by both pathways has been used to fuel flights from Tokyo International Airport.

The company said it now plans to continue SAF research and development with the aim of starting large-scale production.

Looking ahead

The aviation sector’s emission reduction target of 50% is likely to require more than 100bn litres/year of SAF by 2050, according to a ‘Reaching Zero with Renewables: Biojet Fuels’ report by the International Renewable Energy Agency (IRENA).

Although future SAF production volumes is expected to increase significantly – based on the expansion of existing facilities and investment in the specific infrastructure required to make HEFA-SPK derived biojet fuel – challenges remain, the IEA Energy report says.

“Although it is likely that ongoing improvements and optimisation of processes will continue to reduce costs and facilitate biojet fuel production and use, meeting the sector’s decarbonisation targets will be challenging.”

Accessing low-cost feedstocks will play a role in reducing SAF costs, the IEA Energy report concludes, but costs – and the future growth of the sector – will be closely linked to policies that incentivise their production and use.

“When we look at announced SAF capacity globally, we see growth from 1M tonnes/year to approximately 18M tonnes/year by 2028,” Argus Media’s Burke says.

“However, this will represent only 5% of global conventional jet fuel demand and clearly more incentives are required to move this number higher.” ● Gill Langham is the assistant editor of OFI

‘For all of the bio-jet processes, the minimum selling price is significantly higher than that of fossil-derived jet fuel’

20 OFI – NOVEMBER/DECEMBER 2022 www.ofimagazine.com

u TRANSPORT

www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 21 18001 012 3500 More than EDIBLE OIL PERFECT SOLUTIONS IN FILTRATION SHARPLEX FILTERS (INDIA) PVT. LTD. An ISO 9001:2015/14001/18001 Company R-664, T.T.C. Industrial Area,Thane Belapur Road, Rabale, MIDC, Navi Mumbai - 400 701, India Tel: Tel : +91-91-3692 1232/39, 022-27696339/6322/6325 sales@sharplexfilters.com • www.sharplex.com VERTICAL PRESSURE LEAF FILTER HORIZONTAL PRESSURE LEAF FILTER FILTER ELEMENTS POLISHING BAG FILTER CANDLE FILTER

Several EU countries have lowered or frozen their blending mandates as a result of rising food and fuel costs, while new incentives are promoting sustainable aviation fuel. Meanwhile, used cooking oil as a biofuel feedstock may be reaching its supply limit Gill Langham

A number of European Union (EU) countries have frozen or lowered biofuel blending mandates in response to rising food and fuel costs due to the conflict in Ukraine, the ACI Oleofuels 2022 conference held earlier this year in May heard.

“In the early days of the Ukraine crisis, disrupted supply had a significant impact on food and fuel prices and, as a result, several countries considered lowering, freezing or waiving biofuel blending mandates,” Cornelius Claeys, manager (biofuels) at Stratas Advisors, said.

The trend was likely to lead to a rise in emissions, but only in the short-term. In the longer term, the ongoing crisis was likely to accelerate the energy transition in Europe, Claeys said.

US approach

In the USA, Claeys said the initial response to rising prices had been to strengthen biofuel incentives by allowing year-round E15 use.

Europe’s approach to (temporarily) waive or freeze biofuel blending to reduce prices – could partially be explained by the European debate having focused more on food than on fuel prices, he said.

In addition, Claeys explained that relatively expensive biodiesel was mainly

Changing landscape

used in Europe, while in the USA, lower cost corn ethanol was the primary biofuel.

EU moves

The European Commission (EC) published a statement in March saying it supported member states finding ways to reduce the blending proportion of biofuels which could lead to a reduction of EU agricultural land used for production of biofuel feedstocks, to ease pressure on food and feed commodity markets. Although countries still needed to comply with the minimum obligations under the EU Renewable Energy Directive (RED) and Fuel Quality Directive (FQD), Claeys said this had opened the door for

a series of reductions in national blending mandates.

In Finland, for example, the 2022 and 2023 blending obligations were reduced by 7.5%, while Sweden froze 2023 obligations at this year’s levels.

“These Nordic countries can afford to reduce their blending mandates while still complying with EU directives, because they generally over-comply,” Claeys added.

The German government published a working paper on 17 May proposing to cap crop-based biofuels at 2.5% in 2023 and phase them down to 0% by 2030, a final decision on which was set to be taken in October. Meanwhile, penalties for non-compliance with blending obligations had been waived in Croatia.

“Despite these short-term bearish signs for (crop) biofuels, legislative incentives in the longer term appear to be strengthening as an indirect result of the Ukraine war,” Claeys said.

“This is exemplified by Finland; despite being the first country to reduce short-term blending obligations and by the largest margin, it simultaneously announced an increase in its 2030 blending obligation from 30% to 34%.”

Although uncertainty in the sector was likely to continue while the conflict in Ukraine remained unresolved, previous periods of recession combined with

u

22 OFI – NOVEMBER/OCTOBER 2022 www.ofimagazine.com BIOFUELS

Source: Stratas Advisors Country Mandate 2020 2021 2022 2023 2030 Table 1: EU medium-term national blending mandates taking shape

www.ofimagazine.com OFI – NOVEMBER/DECEMBER 2022 23 www.dalsorb.com | info@dalsorb.com +1.908.534.7800 Our experts will work with you to optimize your frying operations and oil quality. The addition of DALSORB® oil purifier will extend the life of your frying oil and improve overall product quality. DALSORB® keeps your food wholesome and removes undesirable compounds to keep frying oil clean from: Maximize the life of your frying oil. Off-odors Off-flavors Off-colors Free fatty acids Polar compound formation Tolsa, S.A. C/ Núñez de Balboa, 51 28001 Madrid - Spain Tel.: +34 913 220 100 industrial@tolsa.com High Absorptive Bleaching Earths based on Natural and Activated Clays. Excellent for the treatment of Vegetable Oils & Biofuel Feedstocks • Chlorophylls removal. • Low oil retentions. • Excellent filtration rates. • Phosphorus and metal traces removal. • Reduction of the precursors of 3-MCPD and GE. • Effective stability of oils. OFI Half Page Horizontal Ad - Grow Profits.indd 1 11/27/21 6:16 PM

2% (2025); 5% (2030); 20% (2035); 32% (2040); 38% (2045); 63% (2050). Waste-based biofuels and RFNBOs can contribute

0.7% (2030); 5% (2035); 8% (2040); 11% (2045); 28% (2050)

Phased in

Intra-EU

u

elevated fossil oil prices had generally accelerated rather than slowed down the shift towards alternatives, Claeys said.

“In the medium- to long-term however, a wide variety of European lawmakers share the view that climate objectives and energy independence should be accelerated by firm legislative action,” he added (see Table 1, previous page).

SAF developments

Since the conference, “game-changing” legislation had been announced in the sustainable aviation (SAF) sector, both in Europe and in the USA, Claeys said in August. (see Table 2, above).

“In Europe, the focus is on SAF mandates – the minimum quota which airlines or aviation fuel suppliers need to meet. Such mandates are now active in Norway, Sweden and France, with several other European countries having similar legislation in the pipeline. In parallel to this, the Refuel EU Aviation Regulation includes an EU-wide SAF mandate that will kick off in 2025 and increase exponentially through 2050,” he said.

North American legislators had taken

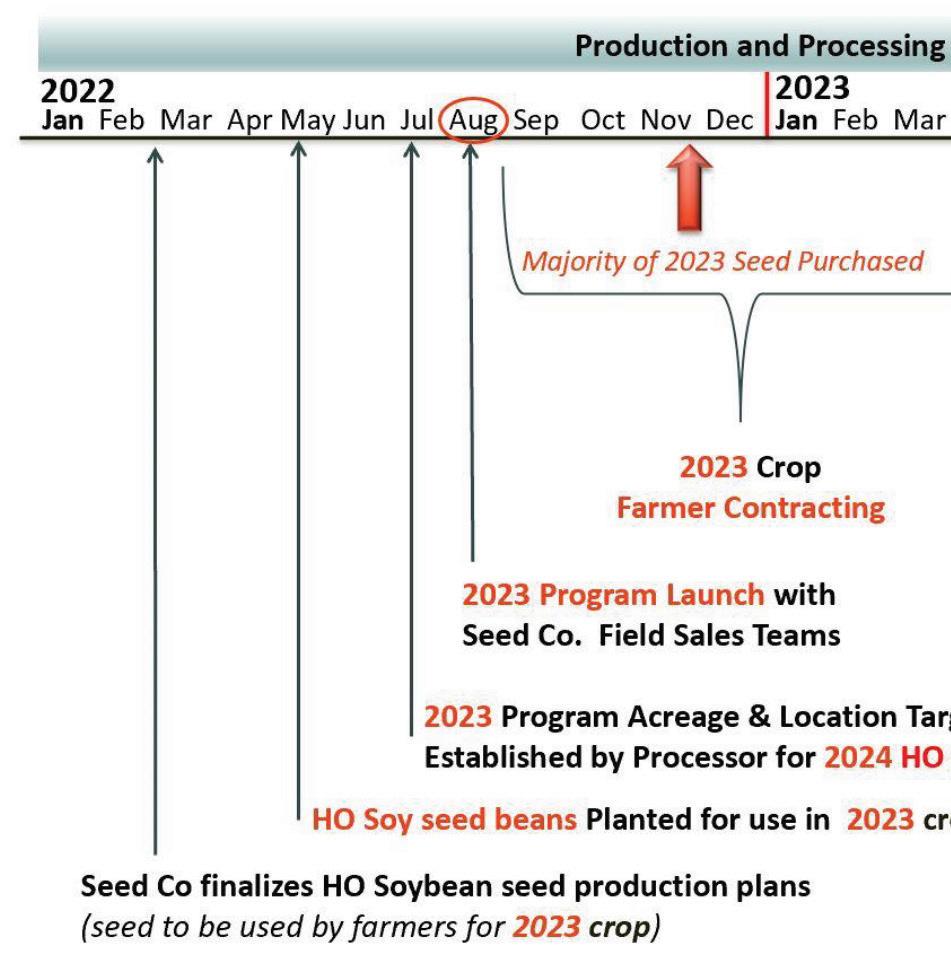

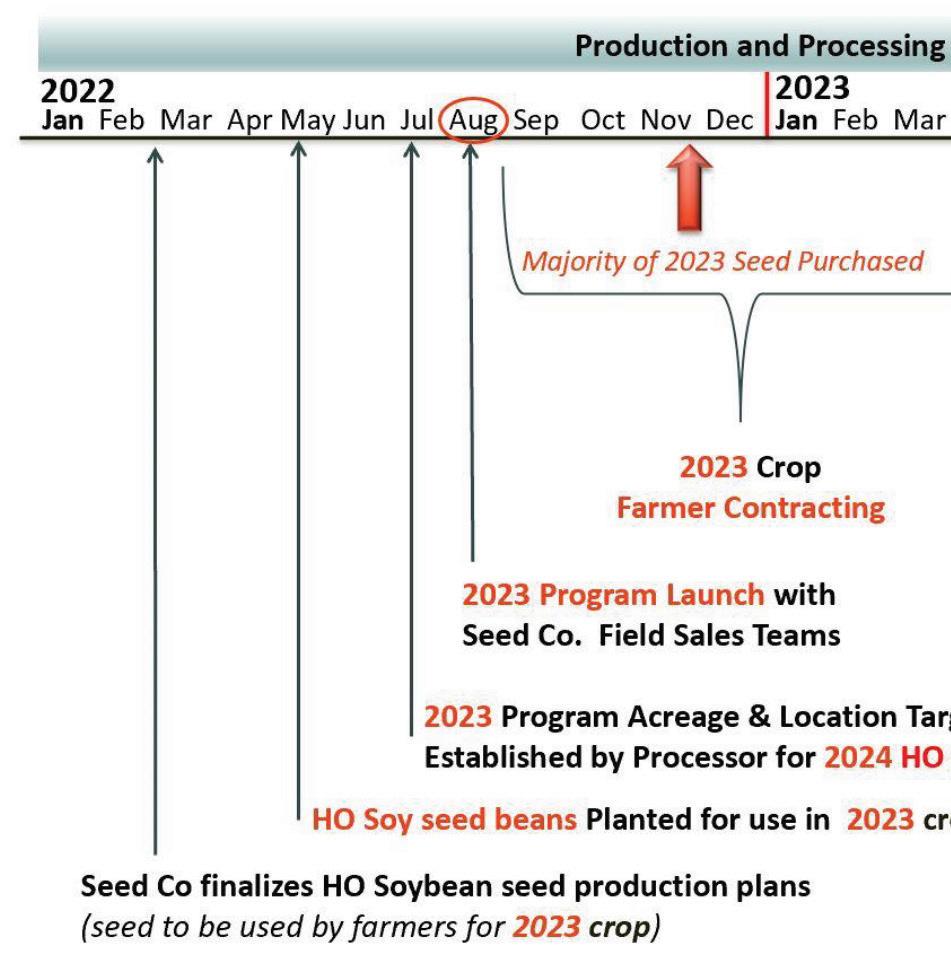

a different approach, Claeys said, opting to incentivise SAF uptake through production subsidies in the recently passed Inflation Reduction Act. The act – the largest climate spending package in US history – includes a new dedicated tax credit for SAF. The credit of US$1.25/ gallon, which could rise to US$1.75/gallon depending on the fuel’s greenhouse gas reduction level, would remain in place until 2024 and transition to Clean Fuel Production Credit payments from 2025.