Insights for the green steel transformation. Coal microlithotypes.

Betting on clean steel.

Nucor’s journey to energy leadership.

Insights for the green steel transformation. Coal microlithotypes.

Betting on clean steel.

Nucor’s journey to energy leadership.

The Thermo Scientific™ ARL iSpark™ Plus Series OES Metal Analyzer uses single-spark acquisition to provide rapid elemental analysis—up to 15% faster than previous models. The increased speed and reliability minimize tap to tap times, save energy, reduce carbon footprints, and realize a faster return on investment.

Capable of providing ultra-fast, on-line analysis of nonmetallic inclusions, the ARL iSpark Plus adds to the versatility, dependability, and productivity of metal processing operations.

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

subscriptions@quartzltd.com

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Front cover photo courtesy of Kocks.

Advanced 4D EAGLE S by KOCKS & LAP allows combined profile measurement and surface inspection in the rolling mill of Saarstahl AG.

Four

20

India update

Import delays slow investment.

Decarbonization

24 Pressure on Russia to be greener.

30 Forging pathways: insights for the green steel transformation.

New

Nucor’s journey to energy leadership.

Biden

Betting on clean steel.

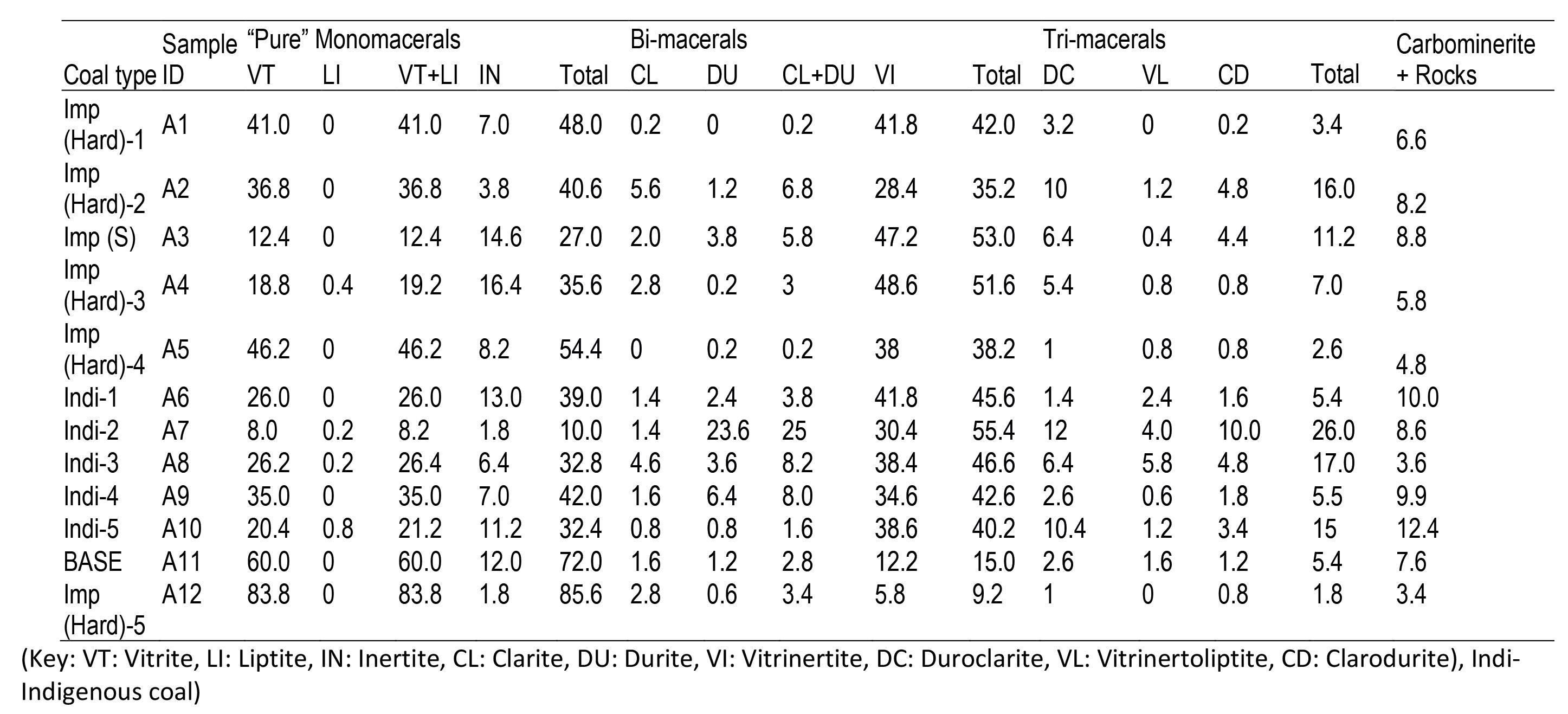

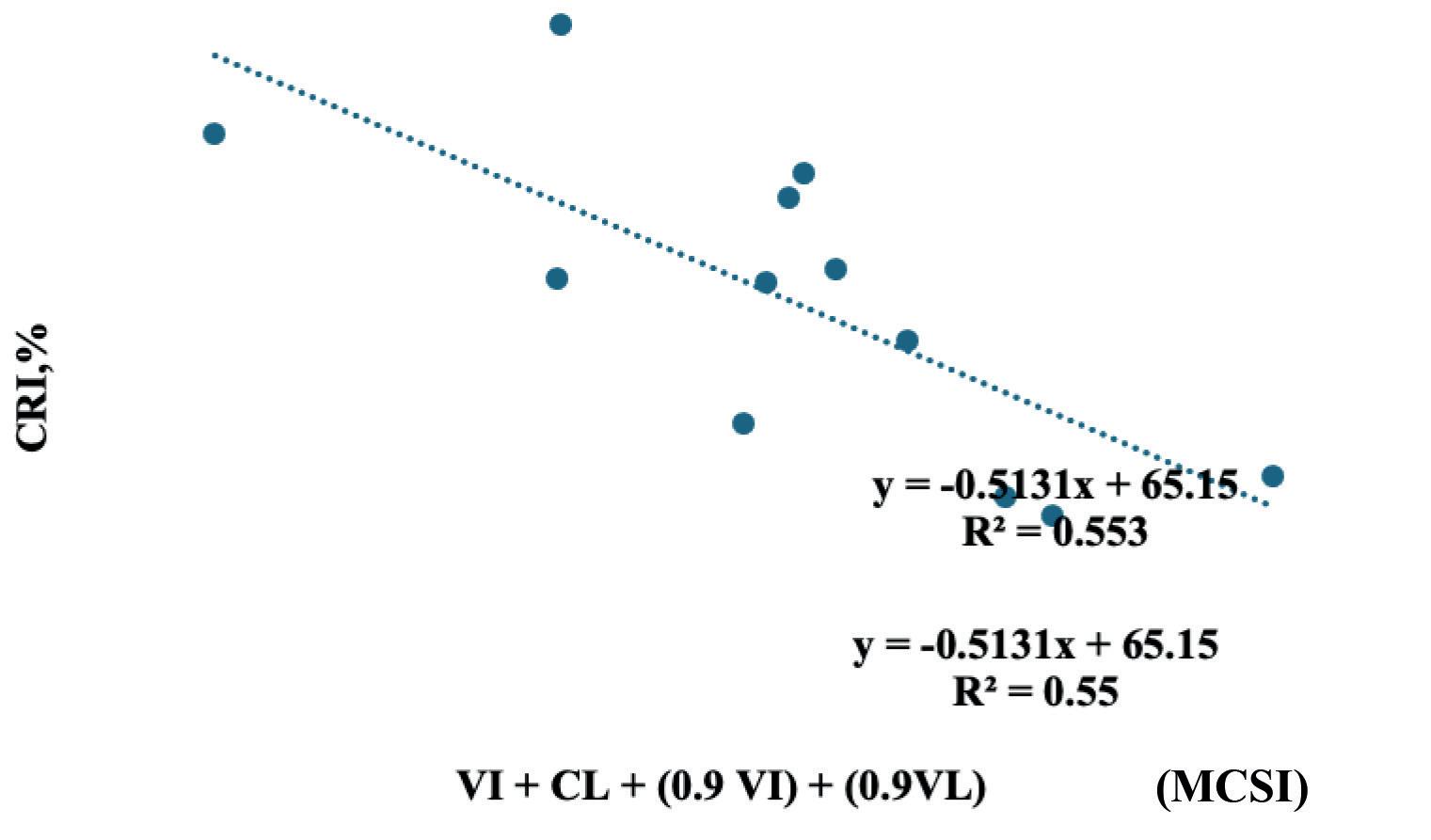

Coal petrography and coke quality.

Perspectives Q&A: OMP Innovation: the foundation of industry.

Catherine Hill Assistant editor

catherinehill@quartzltd.com

Catherine Hill Assistant editor

catherinehill@quartzltd.com

According to Bill Brown’s Thing Theory, an object ‘becomes a thing when it can no longer serve its common function’, that is to say, we begin to confront the ‘thingness of objects when they stop working for us’; when the laptop breaks, when the car stalls, when the shoes wear through. What the theory fails the address, however, are the lost objects–absences that ‘stand before us with which we must contend’; the difference between a set of keys, and the same set being missing. The object in material terms remains, but the negative space of its absence negotiates a new understanding. Not quite a thing, but not quite an object either. It is in this space in which the modern steel furnace now functions; with the blast furnace facing multiple trajectories of relining, closure, demolition, and replacement. It remains a point of contention for governments and industry experts alike; how to modify without compromise; how to rebuild without destruction.

In recently attended events, metallurgists and CEOs have claimed that the blast furnace is here to stay, while environmentalists continue to

urge its timely conclusion. The truth perhaps, lies in a statement found in the feature ‘Forging pathways: insights for the green steel transformation’ from The Australasian Centre for Corporate Responsibility (p.30). ‘‘Steel does not have a ‘climate problem’, it has a coal problem’’; in other words, to decarbonize steelmaking is to decarbonize ironmaking. The two are irrevocably connected, with the potential to enable us in reaching climate targets, or drag us further toward environmental catastrophe. The furnace, once again, lies within this statement; either as an object that performs the task required, or a ‘thing’ that fails to relinquish its carbon-rich history. There are ways in which to negotiate the movement from one to another, with some less costly than others, but it is the urgency that must be prioritised; rather than the argument of what must remain. History is significant in its nature of having been passed; the steel industry must align on a future that offers tangible solutions to maintain its production, and prevent the ideological slippage from objectual action, to malfunctioning disrepair.

For 135 years, steel producers and steel service centers have counted on Butech Bliss to deliver the design, engineering and technological advantages necessary to help them succeed. From entry to exit end we build it all. Our product lines include roller and stretch leveling technology, a full line of shears, material handling equipment and complete coil processing lines. We are more than a scrap chopper manufacturer. Learn more about our world-renowned coil processing technology call +1 (330) 337-0000, visit ButechBliss.com or email sales@butech.com. If our name is on the machine, it’s built better.

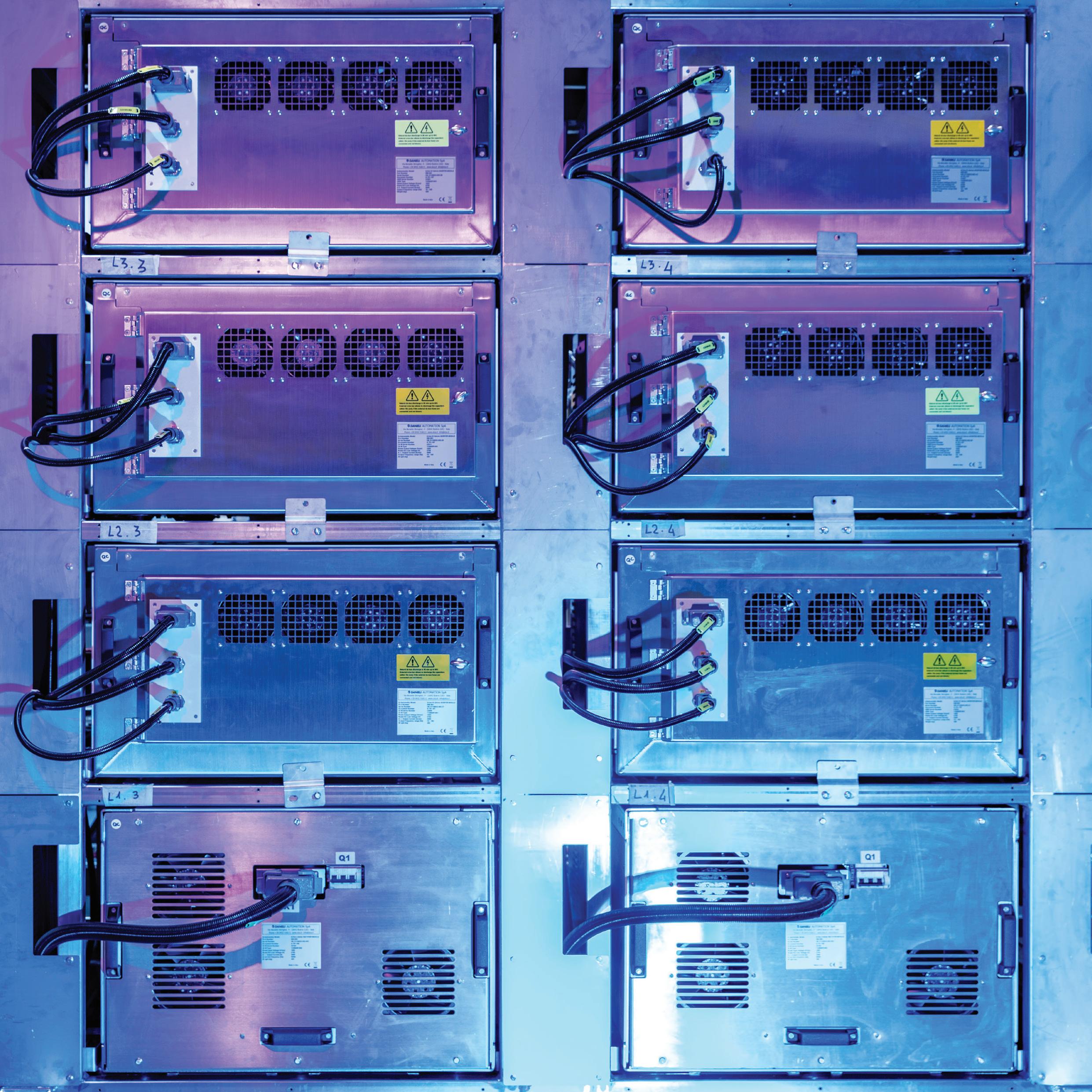

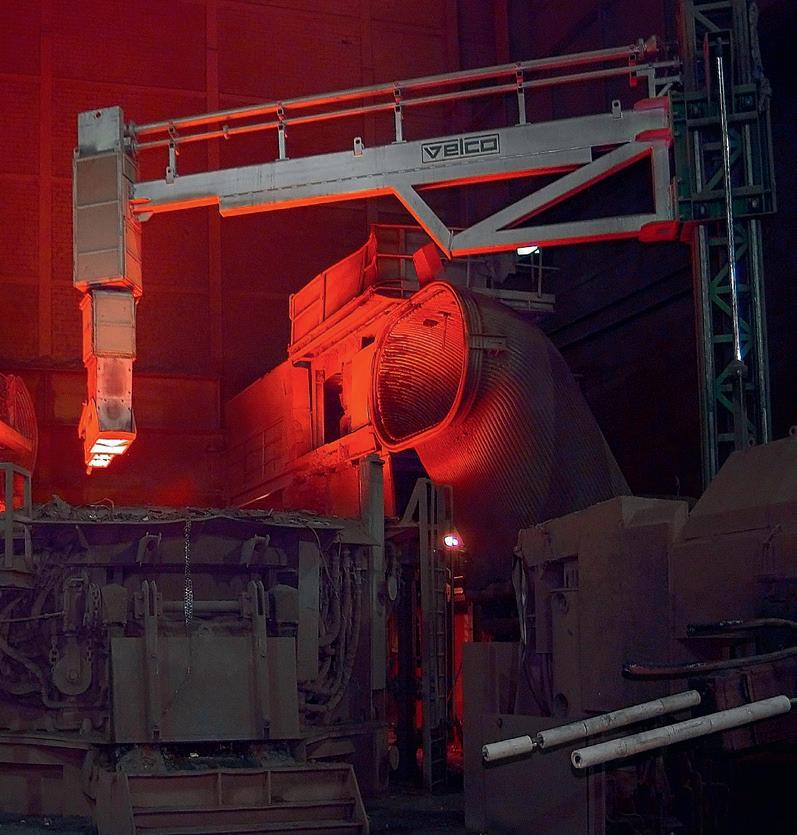

Q-ONE reduces EAF overall OPEX with a shorter power-on time and very low network disturbances. It is a scalable system that can be implemented on new or existing AC EAFs, and it can be directly powered by renewable energy sources.

Singapore-based steelmaker Meranti Green Steel has formally reserved a site in the IRPC Industrial park in Rayong, Thailand, for its new green steel plant. The DRI facility will have an annual production capacity of 2.5Mt, and is scheduled to be commissioned in 2027. The plant will be developed with Danieli, and will use renewable energy.

Source: Steel Orbis, 9 May 2024.

The first minister of Wales, Vaughan Gething, has said that he held a ‘candid meeting’ with Tata Steel on the issue of expected job losses at the company's Port Talbot plant in South Wales. The first minister, who was on a visit to India as part of a trade mission, also expressed hope that the Indian steel major, which has a ‘positive reputation’, would take the same approach for the workers at the Welsh plant.

Source: The Economic Times, 10 May 2024.

The German Embassy in Hanoi, Vietnam, hosted an inaugural panel discussion seeking solutions on decarbonizing Vietnam’s steel industry.‘‘In Vietnam, the steelmaking industry, which ranks number one in Southeast Asia, remains one of the main contributors to the country’s carbon emissions," said Dr. Guido Hildner, ambassador of the Federal Republic of Germany, at the panel. "We all know that the green transition of heavy industries is a global challenge. Therefore, Germany launched the Climate Club during last year’s COP28…to offer support for developing and emerging economies…to leapfrog into climate-friendly industrial development’’.

Source: Vietnam News, 10 May 2024.

Liberty Steel has been strongly criticised by the Czech government for its alleged handling of Liberty Ostrava’s financial issues. Czech minister of labour Marian Jurecka said that Liberty Ostrava has outstanding social security tax payments, while Minister of Finance Zbynek Stanjura said the British-based steel group's restructuring plans were ‘not realistic’. “It would be a different attitude and different search of possible solutions and forms of co-operation if there was an owner here who submits plans that are realistic,” Jurecka stated.

Source: BNE IntelliNews, 10 May 2024.

Three steelworkers from Jindal Steel in Karnataka, Southwest India, drowned when water was suddenly released in a tunnel where they were conducting an inspection of a faulty pipeline, local police have stated. According to police, the incident took place following a disruption in the power supply which had halted the flow of water through the tunnel. The water tunnels, integral to the steel manufacturing process, serve as conduits for cooling hot iron rods, with excess water stored in various tanks within the facility. Source: The Hindustan Times, 11 May 2024.

The US Department of Energy’s Argonne National Laboratory will be receiving $3 million over three years for a project that aims to decarbonize iron production. Alongside partners including the University of Illinois at Urbana-Champaign, Purdue University Northwest, Starfire Industries and ArcelorMittal, the project involves the research and production of a microwave-powered hydrogen plasma in a rotary kiln furnace. The hydrogen plasma allows reduction to take place at much lower temperatures, under 1,400 deg F, according to the parties involved. Typically used in cement production, the rotary kiln furnace eliminates the need for heating the iron ore and forming pellets, also lowering the energy requirement. The culmination of these advances aims to achieve a 50% reduction in energy consumption compared with conventional blast furnaces. Source: Green Car Congress, 12 May 2024.

ArcelorMittal has started the construction of an EAF for long products in Gijón, Spain, with the facility expected to begin ramping up in the first quarter of 2026. The nearly $230 million investment will be the first major EAF project to be implemented within the company’s decarbonization programme in Europe and ‘will constitute the first step toward low-carbon emissions steelmaking’ in the Asturias region of Spain.

Source: Recycling Today, 12 May 2024.

The former minister of health of Victoria, Australia, Daniel Andrews, has teamed up with Andrew Forrest – Australia's ‘wealthiest man’ – to sell 'green' iron to China. Andrews’ consultancy firm, Forty Eight and Partners, is partnering with Andrew Forrest's company Fortescue, the Sydney Morning Herald reported. The two firms have pledged to deliver 100Mt of 'green' iron to China after having recently met at the Boao Forum for Asia in Hainan Province in March. It marks the first high-profile gig Andrews has participated in since stepping down as health minister last year.

Source: Mail Online, 13 May 2024.

British Steel has secured a multi-million-pound contract to supply rail for a new high-speed electric railway in Turkey. The company will provide tens of thousands of tonnes of track for the project from its Scunthorpe steel works, which will connect Mersin with the cities of Adana, Osmaniye and Gaziantep in southern Turkey. The project is expected to help establish a lower-emission transport link between Turkey's secondlargest container port and inland cities more than 150 miles away, potentially reducing CO2 emissions by more than 150kt annually. Source: Grimsby Live, 15 May 2024.

Mining company Anglo American has laid out plans for a potential breakup of the group via a demerger or sale of its steelmaking, coal, nickel, diamonds and platinum businesses, as it attempts to ‘fend off a takeover bid’ from BHP Group, according to media reports. The Londonlisted miner previously rejected a raised $43 billion offer from BHP, saying it continued to significantly undervalue the company and was ‘highly unattractive’ for its shareholders.

Source: Nikkei Asia, 14 May 2024.

Eastern Cape detectives are investigating an incident at a steel plant in the Coega Special Economic Zone, South Africa, where two workers died in a furnace and two others sustained burn wounds. According to a police spokesperson, at approximately 1300hrs on 14 May, police and other emergency services responded to a distress call at a steel plant in Coega where two males aged 39 and 48 had lost their lives. "Two other coworkers aged 38 and 49 years old sustained burn wounds and were taken to hospital for treatment," stated the spokesperson.

Source: PE Express, 15 May 2024

US president Joe Biden has instructed the US Trade Representative to increase tariffs under Section 301 of the Trade Act of 1974 on $18 billion worth of imports from China. This step includes an increase in the tariff rate on certain steel and aluminium products of Chinese origin from 0.0-7.5% to 25% in 2024. The American Iron and Steel Institute (AISI) has welcomed Biden’s decision, noting that ‘China continues widespread unfair trade practices that harm American steel producers’.

Source: GMK Center, 15 May 2024.

Austrian steelmaker voestalpine is embarking on a flagship initiative aimed at showcasing the technical viability of circular economy endeavours within the premium segment. This project, as part of a partnership with Mercedes-Benz and TSR Recycling, entails recycling post-consumer scrap into high-quality scrap, subsequently processing it within the steel-producing industry to yield high-grade steel, which will then be utilized in the automotive sector.

Source: chem analyst, 16 May 2024.

Offshore foundations

manufacturer Sif has reached agreements with German steelmaker Dillinger for the supply of lower-emission steel for offshore wind foundations and to progress monopile recycling efforts. The addendum signing to the companies’ long-term steel plate supply framework agreement aims to achieve full circularity of monopiles. This MOU marks the finalisation of a joint-research project executed by Sif, KCI and Dillinger to produce a detailed design for a monopile recycling factory.

Source: renews Biz, 16 May 2024.

Liberty Steel’s Hungarian subsidiary, Liberty Dunaújváros, formerly known as Dunaferr, has signed a contract to complete a full feasibility study for the installation of a modern electric arc furnace (EAF) with China’s CISDI Engineering. The development of the feasibility study follows a comprehensive technical analysis and engineering study conducted by NPT, a Swiss engineering services company. The contract includes the installation of a new EAF, as well as the modernization of secondary metallurgy and the hot strip mill.

Source: GMK Center, 17 May 2024.

Quinbrook Infrastructure Partners has announced plans to invest in an ongoing project to convert Queensland magnetite ore into green iron, using the state’s wind and solar resources, touted as one of the biggest renewable hydrogen projects under development in Australia. The $3.5 billion Gladstone Green Iron project centres on a ‘world class’ magnetite ore deposit and its ready access to what Quinbrook describes as the ‘exact fundamentals’ to produce and export green iron, including existing port and transmission infrastructure and abundant renewables.

Source: Renew Economy, 20 May 2024.

India's JSW Steel will buy a coking coal company in Mozambique to secure supply of key steelmaking raw material and shield against any price volatility. The company's board of directors approved the acquisition of coal mining firm Minas de Revuboe (MDR) for about $74 million. The purchase of a 92% stake in MDR gives JSW access to more than 800Mt of premium hard coking coal reserves in Mozambique, the steel producer said on 17 May. MDR's mine is not yet operational but the company aims to start developing it between 2024-25.

Source: Argus Media, 20 May 2024.

Tata Steel has signed an agreement with National Grid ESO to build the power infrastructure required to switch its Port Talbot site to a low-carbon plant. The deal will see the British grid operator build the new electrical framework capable of powering the Indian company’s 3.2Mt EAF by the end of 2027. “This will help us replace our ageing and carbon-intensive blast furnaces with a state-of-the-art electric arc furnace capable of producing our customers’ most demanding steel products,” said Rajesh Nair, chief executive of Tata Steel UK, in a website statement.

Source: Bloomberg News, 20 May 2024.

PyroGenesis Canada Inc., a company that designs, develops, manufactures and commercializes advanced plasma processes and sustainable solutions geared to reduce greenhouse gases (GHG), has announced that its subsidiary, Pyro Green-Gas Inc., has signed contracts totalling $1.3 million with a global steel company based in India, for the development and supply of technology to desulphurize and clean the gas that is released during the creation of metallurgical coke from coal.

Source: Canadian Manufacturing, 24 May 2024.

Algerian steelmaker Tosyali Algeria, a subsidiary of Turkey’s Tosyal Holding, has commissioned a new flat-rolled steel plant based on an electric arc furnace with an annual capacity of 2.2Mt. The company has started producing slabs and will soon open a hot strip mill and a new direct reduction module. The current project is part of a phase four expansion of Tosyali Algeria’s steel complex. The 800kt/yr cold rolling mill and 400kt/yr galvanizing line are expected to be commissioned in 2025. Source: GMK Center, 28 May 2024.

ArcelorMittal Liberia has unveiled plans to build an iron ore concentration plant at its Yekepa facility in Nimba County. Valued at approximately $1.7 billion, this project will become one of Africa's largest iron ore concentration plants. The first phase is expected to be completed by December this year. CEO Josephus Cohen revealed that the plant will create local employment opportunities for over 500 young Liberians currently training as mechanical engineers for future management roles.

Source: Yieh Corp Steel News, 28 May 2024.

CHAR Technologies has announced the ‘imminent commencement’ of a production run of 500 tonnes of pelletised biocarbon. The pelletised biocarbon is destined for use at various heavy industrial facilities, including ArcelorMittal sites, to fulfill a portion of the company’s previously announced biocarbon offtake agreement. The production run is an important milestone in the ongoing commercial upgrades at CHAR Tech’s state-of-the-art Thorold facility, according to the organisation.

Source: Bioenergy Insight, 30 May 2024.

American steel giant Cleveland-Cliffs is in talks to acquire the assets of Russia’s largest steelmaker Novolipetsk Steel in the United States, according to news report from Bloomberg, citing confidential sources familiar with the matter. NLMK’s assets –steelmaking facilities in Indiana and Pennsylvania – could be valued at more than $500 million if sold. If the negotiations are successful, it will be Cliffs’ first step towards such a deal after an unsuccessful attempt to acquire US Steel.

Source: GMK Center, 29 May 2024.

A research group at the University of Cambridge, UK, has developed a process that recycles cement from waste demolition concrete – which comprises cement, sand, aggregates and water – by using it as a lime supplement to remove impurities in steel recycling. One of the results of this is that cement is re-clinkered in the process, enabling it to be reused in new concrete, while less lime is needed to recycle steel. The process, argues the project team, could potentially slash carbon emissions for both the cement and steel industries.

Source: Chemistry World, 31 May 2024.

The Commercial Chamber of the Strasbourg Court of Justice has granted Italian steel company Marcegaglia permission to acquire the Ascometal steel plant in Fos-sur-Mer, France, which is currently undergoing rehabilitation. The modernization project envisages increasing the capacity of the EAF to 1-1.2Mt/yr of steel, building a new continuous caster, and a modern hot strip mill. Total production capacity will be 1.6-2Mt/yr of steel.

Source: GMK Center, 3 June 2024.

Rio Tinto, Australia’s biggest iron ore producer, will bankroll a $215 million research facility in the heart of Rockingham’s industrial area in Western Australia, in a bid to drastically decarbonize the steelmaking process. The facility will trial using raw biomass and microwave energy, instead of coal, to convert Pilbara iron ore to metallic iron. The mining giant claims it has the capacity to reduce the process’ carbon emissions by up to 95%. Source: WA Today, 4 June 2024.

Production at ArcelorMittal Mexico's principal steel mill in Lazaro Cardenas, Michoacan, was halted by a blockade at its entrance by members of the miners union, a company source said on 31 May. "There is no production, and this situation hampered both markets: flat and long steel; however we had enough inventories to deliver May orders without problems," the source stated at the time.

Source: SP Global, 31 May 2024.

AIC has been awarded an order by a major Italian steel producer for a robot guidance system for the drawing line.

The system operates after the load of the coil is delivered by forklift onto the reel in a horizontal position. The application handles stainless steel products from 11 to 40 mm diameter and rotates the reel so that the retaining wire of the coil can be identified using an artificial intelligence-based vision system. With this technology, AIC claims that it can detect any type of alloy regardless of the light present and the brightness of the surface. Once the image acquisition is complete, the robot proceeds to remove the bands. Afterwards, the search for the start of the coil is made and once this is reached, the robot proceeds with the clamping.

Once the material has been clamped, the combined movement of the reel and the translation of the robot allows the reel to be placed in its working position (vertical position), thus enabling the robot to unroll the coil for its introduction into the pre-bending machine and consequently into the drawing line.

The robot is equipped with a vision system with an hydraulic clamp and a de-strapping system. The robotic island consists of a 600 kg KUKA KR robot with a slide to allow the robot to move along the axis of the drawing line. The cycle time is three minutes from the loading of the reel from the forklift to the introduction of the tip into the pre-conveyor, while the slide/seventh axis has a run of eight metres.

AIC was also responsible for securing the plant,

supplying perimeter guards, destrapper and safety devices that allow the line to be CE certified.

The main objectives of the job were to increase safety and reduce the heavy workload for operators. Future developments of the project may include the loading of the coil with AGV autonomous driving systems.

The AIC machine is the first of its kind to make the process fully automated using mechanical manipulators and avoiding human intervention.

The installation of the system was carried out alongside modernization activities without interrupting the production activities, claims AIC.

For further information, log on to www.aic.it

Ma’anshan Iron & Steel (Masteel), part of Baowu Group, chose Fives, an international engineering group, to supply an annealing furnace equipped with the latest technologies to expand the steelmaker’s capabilities to produce coils for the automotive industry.

The project includes the design and supply of Stein Digiflex®, an annealing furnace with an annual capacity of 450kt, and for a new continuous galvanizing line dedicated to Advanced HighStrength Steel (AHSS).

“We look forward to launching this new CGL NO6 to further enhance our product quality and market competitiveness. We plan to build this new production line as a benchmark project in the steel industry together with Fives Group, which has rich experience in steel making technology and in which we have great confidence,” said Yuxiang Jiang, chairman of Masteel Group.

The new furnace will be equipped with the latest generation AdvanTek® combustion system, pre-oxidation control and FlashCooling®, a tech-

nology with high hydrogen content. The furnace will be supported by VirtuoTM-L, a thermal optimization solution to achieve the desired mechanical properties.

Masteel already operates four strip processing lines dedicated to automotive steel grades, all equipped with Stein Digiflex® furnaces.

For further information, log on to www.fives.com

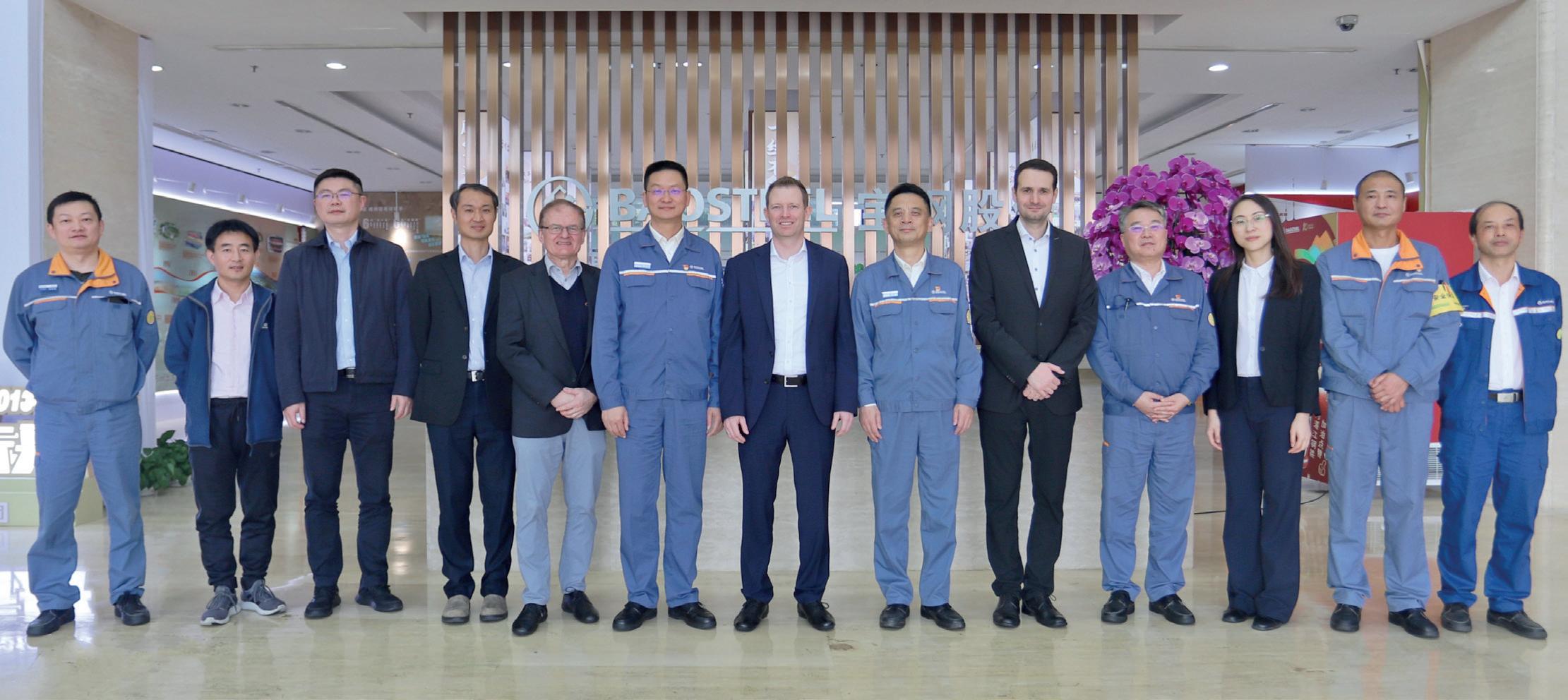

Chinese steel producer Baosteel Zhanjiang has awarded Primetals Technologies a contract for the engineering, supply, and start-up of a bowtype 2-strand continuous caster for the production of thick slabs. The caster will be implemented at Baosteels’s plant in Zhanjiang, Guangdong province. It will produce slabs measuring up to 2,700 mm, with a width of 450 mm.

Primetals Technologies is responsible for the engineering and implementation as well as the supply of mechanical equipment and a comprehensive Level 2 automation package. With

an annual capacity of 3.5Mt of slabs, the new equipment will enable Baosteel to produce plates for heavy-gauge sectors like the shipbuilding and wind turbine industries.

Baosteel’s caster will be equipped with unique Single Roll DynaGap (SRD) segments from Primetals Technologies. When changing parameters that influence production, like steel grade, cooling practice, and casting speed, the process models of the Level 2 automation package dynamically determine the best casting gap, allowing for the SRD segments to optimally

adjust individual roll gaps and forces. The caster’s SRD segments can handle capacities of 5,000 kN per roll, enabling large thickness reductions in the casting process. This, says Primetals, leads to superior internal quality of the cast slabs, and, in turn, results in the production of defect-free ultra-thick plates of high quality.

For further information, log on to www.primetals.com

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

Tata Steel Nederland, one of the largest steel producers in Europe, has selected Tenova, a company specializing in sustainable solutions for the metals and mining industries, to develop a new steel production line at its IJmuiden facility in the Netherlands.

In 2023, Tata Steel Nederland launched its current Green Steel Plan, an ambitious initiative to transform the production of liquid steel to dramatically reduce the environmental impact of the IJmuiden site. The project is based on the installation of a Direct Reduction Plant (DRP) and a new steelmaking line that will replace the largest blast furnace on the site (BF7) and one of the coke-making plants (KGF2).

The overall contract will include engineering, supply, and advisory services for a 3Mt EAF equipped with Consteel® and Consteerrer®, the electromagnetic stirrer developed through an exclusive global partnership with ABB. It will also comprise secondary metallurgy facilities (ladle

furnaces and RH vacuum degassers) required to refine the liquid metal from the EAF to the quality needed to meet current operational specifications (high-quality steel for the automotive sector).

The production equipment will also include a range of technologies aimed at minimizing the environmental impact of the new plant, including a fumes treatment plant, a waste energy recovery system, and a dry slag granulation unit.

ENERGIRON®, jointly developed by Tenova and Danieli, was already selected last year as the technology for the facility’s Direct Reduction Plant.

“Tenova’s strategy of focusing on cost-effective and environmentally friendly technologies is paying off with customers like Tata Steel Nederland who are aligned with our priorities. From the outset of negotiations, our teams have worked with mutual esteem, resulting in a smooth co-operation and full agreement on technical and contractual aspects. We are honoured to be part

of Tata Steel Nederland’s investment plan and to accelerate its path to decarbonization”, said Paolo Argenta, executive vice president for the Tenova upstream business unit.

“The demand for steel continues to grow, with an increasing need for recycled and sustainably produced steel,” said Hans van den Berg, CEO of Tata Steel Nederland. “Due to our location on the North Sea, we are in one of the best locations to make the transition to a more responsible steel production – clean, green, and more circular. And we are working hard to realize that ambition.

“At the same time, we recognize the call to further minimize the impact of our company on the immediate living environment at an accelerated pace.”

For further information, log on to www.tenova.com

The PROFILEMASTER® SPS is a light section measuring device for measuring contours and dimensions on profiles of all kinds in cold and hot steel applications.

Benefits:

Maximum measuring accuracy thanks to temperature-stabilized measuring systems

Shape fault detection (SFD) thanks to high sampling rate

High-precision measurements

Detects process problems at an early stage

Fast maintenance and easy cleaning

KOCKS and LAP presented their jointly developed 4D EAGLE S measuring system for precise profile measurement and surface inspection at Wire & Tube 2024 in Dusseldorf. As part of a strategic alliance, the two companies offer steel producers advanced measuring systems for various applications in the future.

In December last year, KOCKS Measure + Inspect GmbH & Co.KG and LAP Measurement Technology GmbH went public on a long-term

development and sales co-operation initiative. This collaboration has now resulted in the 4D EAGLE S measuring system.

The system uses laser light section technology to capture the complete profile of long products and precisely detect and classify various rolling defects. According to KOCKS, users can access SMART CORE X, a modern software application, for a detailed analysis of acquired data, claims the company. 4D EAGLE S can also be integrated

into higher-level quality assurance systems using OPC-UA.

Two systems had already been successfully installed and put into operation at a well-known German steel producer before their official premiere at the global trade fair.

For further information, log on to www.kocks.de

US president Joe Biden continues to drive policies that aim to protect the national steel industry from Chinese overcapacity. By Manik Mehta*

THE US steel industry has welcomed the 30 April announcement by the administration of president Joe Biden, who faces a tough election in November this year, that it had recommended to the US trade representative to treble the duties against Chinese steel and aluminium shipments to the US market.

A White House statement; a so-called ‘fact sheet’, dated 17 April, a copy of which was sent to this correspondent, suggests that president Biden – as someone who ‘knows that steel is the backbone of the American economy, and a bedrock of our national security’ – is keen to preserve American jobs by preventing cheap, heavily subsidized steel and others products from entering the US market.

Indeed, the statement notes that president Biden’s strategic trade and

investment agenda was to protect workers, consumers, and businesses from unfair competition.

American workers in the steel and aluminium industries face a ‘significant challenge from Chinese exports of steel and aluminium which are among the most emissions-intensive products in the world’.

“China’s overcapacity and non-market investments in the steel and aluminium industries mean high-quality US products have to compete with artificially low-priced alternatives produced with higher carbon emissions,” the statement maintained.

The Biden administration is facing pressure in an election year to crack down on what is widely described as ‘unfair Chinese trade practices, including flooding the market with below-market-cost steel’.

A separate petition outlining such concerns

* US correspondent, Steel Times International

was made to the US Trade Representative (USTR) by five labour unions calling for an investigation into Chinese acts, policies and practices.

Indeed, president Biden has asked the USTR to consider trebling the existing section 301 tariff rate on Chinese steel and aluminium; the current average tariff on certain steel and aluminium products is 7.5% under section 30. American workers continue to face unfair competition from Chinese imports of steel and aluminium products which, according to the Biden administration and environmental experts, are among the world’s most emissionsintensive.

The administration underscores the fact that since president Biden took office, the Department of Commerce has imposed over 30 anti-dumping and countervailing

duties on steel-related products. These are, essentially, tariffs on steel imports ‘that are priced below the fair and competitive value’. The Department of Commerce has also conducted some 27 investigations into anti-competitive actions by Chinese exporters and efforts by countries like China to evade trade rules.

The Biden administration is making what it calls ‘historic investments’ in American steel and manufacturing; while maintaining that the previous (Donald Trump) administration failed to deliver an infrastructure bill, and stating that president Biden’s Bipartisan Infrastructure Law, CHIPS and Science Act, and inflation Reduction Act were ‘spurring hundreds of billions of dollars’ in privatesector manufacturing and clean energy investments. Construction of new factories had more than doubled, ‘after falling under the previous administration even before the pandemic’, while creating a record high of nearly 800,000 manufacturing jobs. The administration said that the US trade deficit with China was the lowest in over a decade – lower than any year under the previous administration.

American workers in the steel and aluminium industries face a significant challenge from Chinese exports of steel and aluminium; China’s over-capacity and non-market investments in the steel and aluminium industries mean high-quality US products have to compete with artificially low-priced alternatives produced with higher carbon emissions, the administration said.

Steel is a critical input for the US domestic shipbuilding industry – from the commercial shipping vessels that carry American products, to the US naval vessels that keep global seas safe. Commercial shipyards provide industrial capacity for

maintaining the US Navy’s dominance and support thousands of suppliers and jobs.

The administration said that it recognizes growing concerns that unfair Chinese trade practices, including flooding the market with below-market-cost steel, are distorting the global shipbuilding market and eroding competition. These concerns were also outlined in the petition to the USTR from five labour unions requesting an investigation into Chinese acts, policies, and practices.

AISI applauds Biden’s China tariff hike announcement

The American Iron and Steel Institute (AISI), which calls itself the ‘voice’ of the US steel industry, applauded the administration’s call on the USTR to treble the existing Section 301 tariff on Chinese steel. Kevin Dempsey, AISI’s president, said that the AISI was ‘very concerned about the recent significant increase in Chinese steel exports to world markets and welcomes president Biden’s actions to strengthen the US tariffs on steel from China and to take other actions to address the threats from China’s unfair trade practices’.

“As the largest contributor to the global steel overcapacity problem, China continues to engage in widespread unfair trade practices that harm American steel producers,” Dempsey said, citing OECD figures to the effect that Chinese steel exports grew from 68Mt in 2022 to 95Mt in 2023, a 40% increase in just one year.

“While we have not yet seen a similar surge in direct Chinese steel shipments to the United States, Chinese steel exports to third country markets are often further processed into other steel or downstream manufactured products that are then exported to the US market,” he said.

According to a company statement, ArcelorMittal Calvert, wholly owned by ArcelorMittal, is planning to set up an advanced manufacturing facility in Calvert, Alabama that could deliver 150kt of domestic production capacity of non-grainoriented electrical steel (NOES) annually. The US Department of Energy (DOE) describes electrical steel as a critical material for energy as part of its 2023 Critical Materials Assessment.

In support of this clean energy project, ArcelorMittal Calvert was awarded $280.5 million in investment tax credits from the US Internal Revenue Service (IRS) as part of the Qualifying Advanced Energy Project Credit (48C) programme, funded by the Inflation Reduction Act of 2022 (IRA). The 48C program, which provides a tax credit of up to 30% for investments in advanced energy projects, is designed to support secure and resilient domestic clean energy supply chains.

“We know that around the world, demand is increasing for clean products, produced with less pollution, built to last. And we want all those products stamped Made in America,” energy secretary Jennifer Granholm said during a visit to ClevelandCliffs’ Butler facility in Pennsylvania.

The Butler facility produces grain-oriented electrical steels (GOES). The plant and its GOES product were at risk under originally proposed efficiency standards for power transformers set forth by the Energy Department.

The standards were later amended to include the GOES product to protect American steel manufacturing and American jobs. �

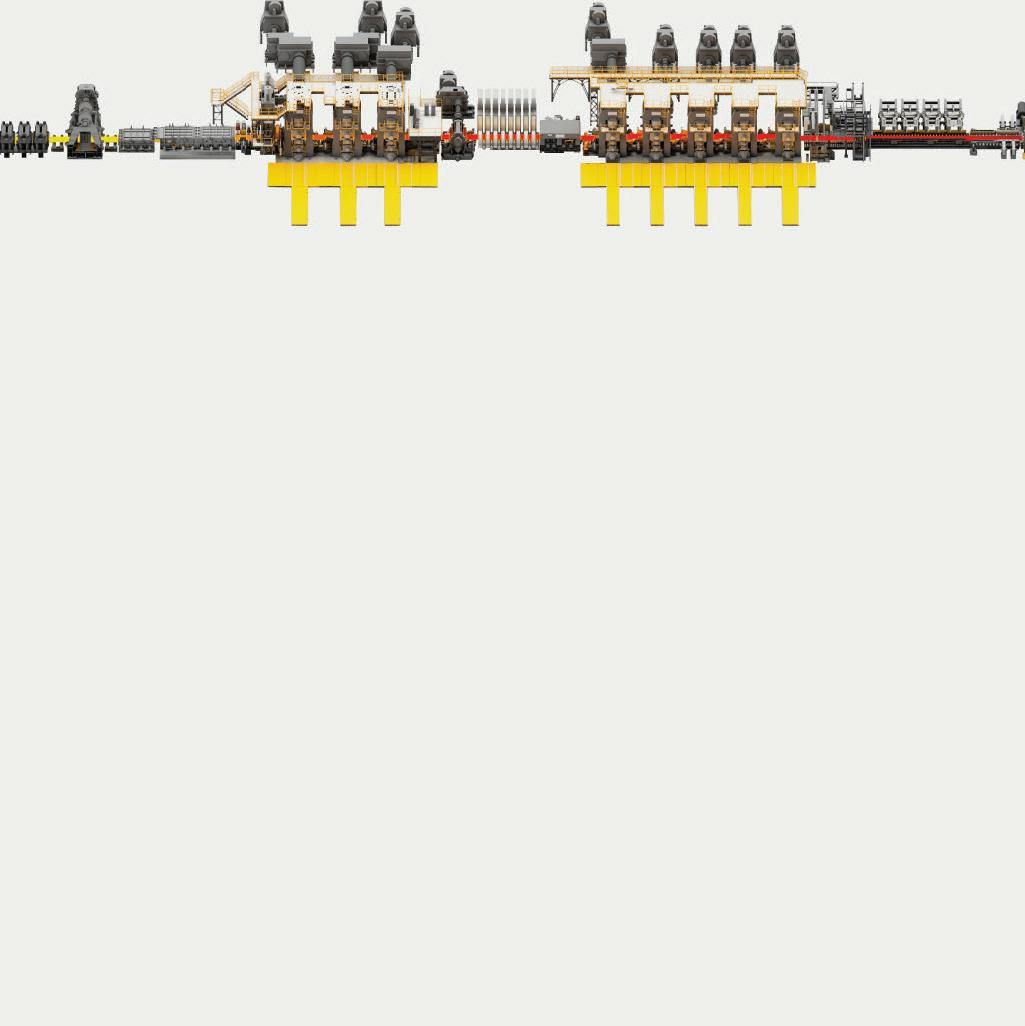

and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE

Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

Chinese steel continues its assault on the Chilean steel market, with steelmakers demanding long-term legislative action to prevent dumping. By Germano Mendes de Paula*

ACCORDING to the Chilean Steel Institute (ICHA), the national apparent consumption of steel reached 2.34Mt in 2022, showing a 4.4% y-o-y improvement. However, this growth was still not enough to recover to the levels recorded prior to the pandemic.

ICHA highlights that since 2016, the domestic players have been experiencing a gradual loss of market share, even though in 2023, imports fell from 69% in 2022 to 67%. In addition, concerning the origin of imported steel, 65% of it came from China, which is the highest figure recorded since 2016.

The apparent consumption of long steel products was equivalent to 1.04Mt in 2023, reflecting a drop of 3.9% compared to 2022. This was the lowest value between 2019-2023. It is worth mentioning that since 2016, around 80% of long steel

imports has come from just six countries, of which China and Turkey are the nations that ship the largest volumes each year, approximately 75% of total long steel imports.

The apparent consumption of flat steel products totalled 1.31Mt in 2023, which represented a 12.3% jump in relation to the previous year. Imports of flat steel are mainly of Chinese origin, followed by Brazil and Japan. It is important to highlight that Compañía Siderúrgica Huachipato (CSH), a subsidiary of Compañía de Acero del Pacífico (also known by its acronym CAP Group), which is the only coke-integrated mill in the country, paused the production of flat steel products in 2013. Since then, Chile has been totally dependent on imported flat steels.

ICHA estimates that the country’s apparent steel consumption will experience a 1.5% retraction in 2023 y-o-y and a 1.6% recovery in 2024 y-o-y. In this sense, the expected performance can be described as quite a stable trajectory.

CSH’s fight for surviving

In October 2023, CSH asked Chile’s AntiPrice Distortion Commission (CNDP), an independent body that advises the country’s presidency, to initiate an investigation into unfair competition from Chinese steel at prices that were below market costs. The request was accepted and the process began in December.

In March 2024, the Commission stated that there was ‘evidence of dumping’ and recommended applying restrictions on the

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

import of steel grinding balls (mainly consumed by the mining industry) and steel bars from China, a country with which Chile has had a free trade treaty since 2006. The same body specifically recommended applying surcharges of 9.2%, 14.2% and 22.5% (average of 15.3%) to three Chinese companies that represent more than 85% of steel grinding ball imports; and additional tariffs of 10.3%, 10.4%, 19.8% and 19.8% (average of 15.1%) to four Chinese companies that account for 100% of steel bar imports.

Located in the southern city of Talcahuano, 500km from the country’s capital, CSH decided, one day after the Commission’s recommendation, to indefinitely suspend its operations. The company claimed that the additional duty was insufficient to resolve the market imbalance that Chinese steel has been producing, which is 40% cheaper than Chilean steel, based on its calculations. The closing of CSH would create serious problems for Talcahuano, as the steel mill has been key to its economy for more than 70 years, and plays an important social role. CSH also claimed to be the largest steel producer for mining in Latin America, in particular serving the Chilean and Peruvian copper miners.

The political reaction to CSH’s decision was quite strong, due to the elimination of direct and indirect jobs. Parliamentarians of different political colours from the Biobío Region, where the steelmill is located, announced a proposal of constitutional reform to establish temporary 50% anti-dumping duties against Chinese steel during a three-year period. The minister of finance, nevertheless, said this practice would be totally incompatible with international trade rules, besides the fact that China is a priority commercial partner.

CSH has appealed to the Anti-Price Distortion Commission, which decided to enlarge the temporary anti-dumping duties. According to the published decree, Chinese steel grinding balls and steel bars will be subjected to anti-dumping duties of 33.5% and 24.9%, respectively. The measures are applicable from April 2024 for a six-month period. Consequently, CSH withdrew its previous plan to cease steel operations.

CSH, however, defended that the provisional measure should be converted into a definitive one. Moreover, the company, which is a coke integrated mill, will continue to study the feasibility of developing projects for the future production of green steel from a pilot plant based on direct reduction using green hydrogen. In this sense, it can be argued that CSH has won a battle, but it is still far from winning the war.

CSH’s experience shows the difficulties faced by the Chilean steel industry due to the massive volume of imports. CSH was created to serve as an instrument to foster industrialisation. The construction of the steel plant began in early 1947 and it was officially inaugurated in late 1950. It was privatised in 1987. In 2011, even before pausing its flat steel production, iron ore mining was already responsible for 94% of CAP’s EBITDA generation, against zero for steel production (STI, July/August 2012, p. 12). In 2023, CAP’s EBITDA was equivalent to $842M, of which mining contributed with $907M, steel production with -$156M, infrastructure with $58M, and steel processing with $42M (Graph 1). Furthermore, CSH’s net losses increased from $122M in 2022 to $386M in 2023. CSH’s fight against Chinese imports is difficult, especially when large forthcoming investments that will be required to decarbonize its steel operations are taken into consideration. �

INDIAN steelmakers slowed investment in greenfield and brownfield expansions in the financial year 2023-24 (April-March) due to delays in importing machinery from China, following a diplomatic row between New Delhi and Beijing. New approvals for the export of plant and machinery from China faced an unprecedented delay from Chinese officials, with India retaliating by holding up visa issuances for Chinese experts for project installations at the production sites in India. Consequently, Indian investors extended the project deadline for the

recommencement of steel production. India has emerged as the world’s second-largest crude steel producer since 2018 and the second-biggest consumer of finished steel since 2019.

The Indian government launched a production-linked incentive (PLI) scheme to encourage steelmakers to increase fund allocations in fresh capacity additions either through brownfield or greenfield routes. The PLI scheme was confined only to the specialized steel sector, to which India continued to be a net importer.

*India correspondent, Steel Times International

Under this PLI scheme, 27 leading Indian steelmakers, including Tata Steel Ltd, JSW Steel Ltd, ArcelorMittal Nippon Steel Ltd, among others, signed 57 agreements with the government and proposed a cumulative investment of $3.54 billion (INR 295.30 billion) for five years beginning in the financial year 2023-24, to create new value-added steel production capacity of 24.7Mt. In the first year of this period, the government proposed to create 1Mt of speciality steel production capacity and accelerate gradually later.

Indian steelmakers’ investments in new projects have slipped below target due to delays in machinery imports.

By Dilip Kumar Jha*

Of the total investment, a sum of $2.52 billion (INR 210 billion) was allocated for the financial year 2023-24. However, Indian steel mills managed to invest only $1.8 billion (INR 150 billion), falling 40% short of the target. The slowdown in investment has yielded a proportionate decline in capacity expansions despite Indian steel demand remaining strong in the current financial year and expected to continue double-digit growth in the short term. India’s valueadded steelmaking capacity was recorded at 18Mt/yr in the financial year 2020-21, which is estimated to have increased to 23 Mt/yr against the consumption of

25-26Mt/yr as of today. Therefore, the PLI scheme was aimed at plugging the import loopholes. India’s high-value special steel production was estimated at 7.5Mt.

An Indian steel ministry official, stated, “Steel companies have been facing challenges in importing machinery from China due to diplomatic rows between the two Asian neighbours. The unresolved border issues came into the limelight with the Galwan Valley clash in June 2020 that killed soldiers from both sides, followed by claims of illegal territory occupation, and thus strained bilateral relations. Indian steelmakers who managed to import plant

and machinery on time failed to commence commercial production due to the inordinate delay in visa approval for Chinese experts.”

The government of India outlined the border infrastructure plan, encouraging steelmakers to ramp up investment and boost capacity. In the financial year 202324, the Indian steel industry demonstrated unprecedented performance, achieving its highest levels of production and consumption compared to analogous periods in previous years.

#itsmorethanjustamachine

A Reducing & Sizing Block for long products keeping its promises. Achieve your goals with KOCKS RSB®

finishing size in round or hexagonal dimensions up to 160mm

increase in production up to 20% up to 10% energy savings in the mill line

Source: Ministry of Steel, Indian government

The production of crude steel was recorded at 143.6Mt, indicating a growth of 12.9% from the previous year. Similarly, India’s finished steel production increased by 12.4% to 138.5Mt, and its consumption grew by a staggering 13.4% to 135.9Mt in the financial year 2023-24. The substantial increase in India’s finished steel consumption was supported by increased demand from the automotive and infrastructure sectors, comprising approximately 40% of overall demand.

The construction sector, which consists of approximately 40% of consumption, also recorded stellar growth in the past few years. Total steel consumption in India was recorded at 119.17Mt in the preceding financial year.

Demand from the automotive industry improved in the financial year 2023-24, with an increasing focus towards electric vehicles. The infrastructure and construction

sectors showed resilience with investments, mostly supported by government-funded development projects, including the modernization of existing projects and the construction of new ones. T V Narendran, managing director of Tata Steel, estimates a 10% growth in India’s steel consumption in the financial year 2024-25 due to increasing fresh investments in infrastructure projects. Once these newly invested projects come on stream, India will be able to bridge the import-centric gap. �

Russia’s large steel industry is dominated by emissions-intensive, coal-based blast furnace-basic oxygen furnace (BF-BOF) steelmaking technology. However, the opportunity to switch to low-emissions electric arc furnace (EAF) steel production is growing in response to pressure from international decarbonization initiatives, including carbon tariffs and corporate climate disclosures. Caitlin Swalec*, Hanna Fralikhina**, Zhanaiym Kozybay***

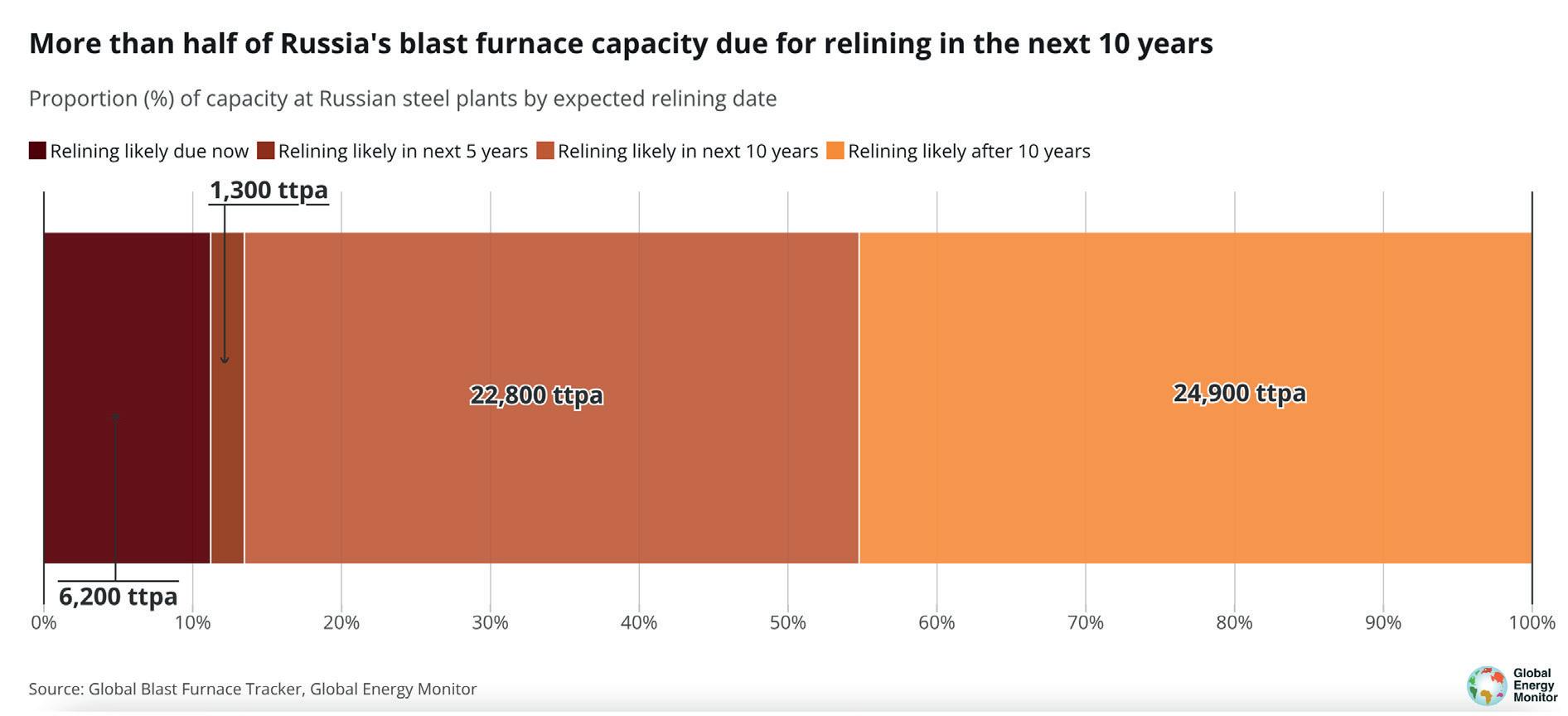

DESPITE this opportunity, Russia continues to cling to dirty steelmaking technologies by refurbishing blast furnaces through relinings, rather than investing in new, low-emissions direct reduced iron (DRI) production (Fig 1).

In 2022, Russia was the fifth-largest producer of steel, with a total annual production of 71.5 million tonnes. Nearly two-thirds of Russia’s steel industry uses the coal-based BF-BOF steelmaking route (Table 1). The country also has smaller amounts of less carbon-intensive steelmaking processes, including scrapbased EAF and DRI-fed EAFs.

The most promising technology for decarbonizing the steel industry is hydrogen-based DRI-EAF production, which can fully replace BF-BOF steelmaking. Currently, Russia’s DRI units operate using fossil fuels, but they could be modified or replaced with hydrogen-based units. (Table 2)

will continue trade with the EU, thus becoming subject to CBAM.

In addition, corporate sustainability reporting is now mandatory in the EU under the Corporate Sustainability Reporting Directive and is set to become mandatory in the United States next year under the Securities and Exchange Commission’s Climate Rule. While these rules mainly target the EU and US-based companies, respectively, they will also affect tens of thousands of companies globally, including exporters from Russia.

capacity represents total nominal capacity. It’s unclear

While Russia’s national plan for decarbonization has been deemed critically insufficient, international pressures from carbon tariffs and corporate climate disclosures mean that the country’s exportheavy iron and steel industry will need to act.

One such pressure, the EU Carbon Border Adjustment Mechanism (CBAM), entered into force in October 2023 and will be in full effect starting in 2026. Unless Russian industry cleans up its production routes, Russian exports to the EU are expected to become more difficult and expensive due to

carbon pricing.

Although Russian steel companies were impacted by EU sanctions applied in response to Russia’s invasion of Ukraine, extended grace periods have enabled Russia to maintain the EU as a main customer of iron and steel product exports.

For example, the latest EU sanctions package extended the grace period for Russian steel slab imports through 2028, rather than the original plan to stop imports in 2024. While the EU market has gradually decreased Russian iron and steel imports, the lack of consistency in restrictions leaves steel trade experts predicting that Russia

Despite the mounting pressures of international decarbonization efforts, numerous reconstruction and modernization works keep Russian coalbased blast furnaces online. While Russia has operated many blast furnaces for decades, regular reconstruction works have renewed the lifecycle of units, positioning the Russian blast furnace fleet to continue operating for many years to come unless there is a change in current operations (Fig 2).

Russian steel companies have investment plans to build new and refurbish old blast furnaces and associated infrastructure, including new units equipped with carbon capture and storage projects (Table 3).

Carbon capture and storage (CCS) has not yet been proven at scale in the iron and steel industry, and even if top capture rates are achieved, CCS is limited in its ability to decarbonize the BF-BOF process. Instead, these investments could be redirected to a transition away from BF-BOF processes and towards hydrogen-based DRI-EAF

steelmaking, creating domestic demand for hydrogen, which the country currently lacks.

Russia’s hydrogen production strategy Russia has a plan to produce 550,000 tonnes of hydrogen per annum (ttpa), but it currently faces major challenges with limited options for export and few incentives to encourage domestic consumption. Russia’s hydrogen strategy initially focused on exports to the EU, but, in the face of energy export sanctions, has pivoted to hydrogen production intended for domestic consumption. Russia’s main hydrogen goal is to become a prominent producer globally.

In the absence of ready customers abroad, Russia now needs to foster domestic demand and has identified the transportation sector as a possible target. But its steel industry also presents a promising opportunity to absorb some of the hydrogen supply.

If Russia reallocated future investments from building new blast furnace units and relining old units to building out more hydrogen-based DRI units, Russia could stimulate its domestic hydrogen demand, while also aligning itself with an increasingly decarbonized global market.

The average emissions intensity for hydrogen-based DRI-EAF steelmaking is less than a third that of coal-based BF-BOF steelmaking (at 0.7 tonnes CO2 per tonne of crude steel, compared to 2.2 tonnes

CO2 per tonne for BF-BOF steelmaking) and approximately half that of fossil gas-based DRI-EAF (1.4 tonnes CO2 per tonne of crude steel).

Russia faces challenges in building its planned DRI-EAF units – a few of them have been postponed (Table 3) due to the exit of Midrex, Danieli, and Primetals from the Russian market, three of the world’s top iron and steel furnace suppliers.

Additionally, Russia’s hydrogen strategy is vague about which type of hydrogen production the country will pursue, meaning it’s unclear exactly how big the emissions savings will be by switching to hydrogen-based DRI.

Grey hydrogen is produced using fossil gas without capturing the greenhouse gas emissions, while blue hydrogen is produced in a similar manner but includes the use of carbon capture and storage technologies (CCS). Green hydrogen is produced via electrolysis with renewable energy sources providing electricity for this process, producing hydrogen with near zero emissions.

Regardless of hydrogen type, the hydrogen-based DRI process still produces steel at a lower emissions intensity than BFBOF or gas-based DRI-EAF steelmaking.

Russian steel giants need to awaken to decarbonization

A few Russian steel giants like Metalloinvest and NLMK experience particularly strong outside pressure to switch to low-carbon

production to accommodate the EU CBAM and increasingly more stringent corporate sustainability reporting requirements.

NLMK accounted for 80% of Russian slab imports by the EU in 2022. NLMK’s process is dominated by coal-based BF-BOF steelmaking. With the grace period for the import of slabs extended from 2024 to 2028, NLMK’s products will be subject to EU CBAM pricing starting in 2026, significantly raising the costs for NLMK if the company does not transition away from BF-BOF production.

Metalloinvest operates both BF-BOF and gas-based DRI-EAF steelmaking plants. In 2021, Metalloinvest accounted for 60% of all EU imports of DRI and, in 2022, DRI imports increased to 1.65 million tonnes. But with the new sanctions package, Metalloinvest can now export only 1.14 million tonnes and 652kt of DRI in 2024 and 2025, respectively.

With diminishing markets, Metalloinvest has an added incentive to transition from fossil gas-based DRI to the cleaner hydrogen-based DRI sooner, since it would face additional profit loss from carbon pricing in the future. The company plans to switch its BF ironmaking to DRI production between 2026 and 2036, while also beginning to implement green hydrogen, though Metalloinvest remains vague about how it will use green hydrogen in its production processes. The company currently uses fossil gas as a reductant to produce DRI, but it can switch to 30%

hydrogen in existing units today. In the short term, the company plans to focus on CCS instead, which is risky given the unproven success of CCS in the steel industry thus far.

Other Russian steel companies impacted by the sanctions, such as Magnitogorsk Iron & Steel Works and Severstal, seem to focus on domestic demand, exports to the Commonwealth of Independent States (CIS) countries, as well as new markets in Asia and North Africa. Nonetheless, the growing global need or decarbonization of steel made its way to their agenda, visible in their decarbonization and GHG reduction

initiatives (Evraz, Severstal, OMK).

Russia’s nascent hydrogen economy could play a key role in decarbonizing its steel industry

The growing need to decarbonize steel, coupled with domestic hydrogen production goals, creates an opportunity for Russia to transition away from emissionsintensive steelmaking toward cleaner production technologies. Switching from blast furnace steelmaking to low-carbon hydrogen-based DRI would create domestic demand for hydrogen, with the added benefit of decarbonizing the country’s

steel industry, thus aligning Russian steel producers with the requirements of CBAM and other international emissions standards.

To realize these goals, further development of DRI technology in Russia is necessary. The Russian government intends to develop its own domestic technology and equipment in hydrogen production, storage, and transportation. As for the proposed new EAF and DRI units, the dissolution of partnerships with Western suppliers and lack of domestic technology to produce the necessary equipment has halted projects. Russian steel companies are

searching for new partners, yet the progress is unknown.

While the cost of hydrogen and switching to hydrogen-based DRI production may represent a significant challenge for Russian

steelmakers, reallocations of the millions of dollars of investments planned for blast furnace relinings and government support and financing of the projects could narrow this gap. Given Russia’s efforts to keep up

with the growth of the global hydrogen market, strategic government support could help to transition the ailing steel industry and build the nascent hydrogen market. (Fig 3) �

BACKGROUND ON GLOBAL ENERGY MONITOR

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. Follow us at www.globalenergymonitor.org and on Twitter/X @ GlobalEnergyMon.

NOTE:

Global Energy Monitor’s report, ‘Shifting decarbonization to high gear’, published in the April issue of Steel Times International, contained some potentially outdated figures, due to publication delays within the issue. For updated reports and information, please visit www.globalenergymonitor.org

The decarbonization of the steel sector is underway, yet nearterm decisions by investors, companies and policy makers will determine if emissions from steel drop significantly or stay stubbornly high, according to a new report from the Australasian Centre for Corporate Responsibility (ACCR).*

While the steel industry is actively committing to long-term decarbonization, with nearly all the analysed companies setting ambitious net-zero targets by 2050 alongside quantifiable medium-term reduction goals, short-term commitments are scarce – suggesting the steel industry is deferring the majority of its decarbonization efforts to after 2030, raising concerns about its ability to meet net-zero emissions targets and achieve Paris alignment.

According to the report, not all technologies labelled ‘green’ offer the same potential for decarbonization, and steel makers and iron ore companies are distributing investments across technological solutions that vary in their potential to reduce emissions. Investors and companies need to reallocate capital towards genuine green steel processes in the next six years to prevent the lock-in of carbon-intensive steelmaking methods.

Green steel’s moment is here, but there is a critical investment window.

Between now and 2030, 71% of the world’s steelmaking assets will reach the end of their operating lives, necessitating significant investment in relining coaldependent blast furnaces. Reallocation of capital to genuine green steel processes is urgently required to prevent locking-in coalbased methods for the next 20 years – the typical lifespan of a blast furnace.

There is evidence of an appetite to move away from conventional, coal-based production. This includes:

• a surge in market demand for greenproduced steel

• significant investments and advancements in green steel technology

• industry-wide commitments to reduce

Scope 1, 2, and 3 emissions across the value chain

• rapid growth in green steel partnerships, new supportive initiatives, and a rise in green steel procurement policies boosting industry-wide transformation

Eliminating steel’s coal problem

Steel does not have a ‘climate problem’, it has a coal problem. Around 90% of the emissions from steel production are due to the use of metallurgical coal in conventional blast furnaces to produce iron. Eliminating coal-dependent processes from ironmaking is key to steel decarbonization.

To achieve zero emissions steel production, the most energy-intensive part of the steel value chain – ironmaking – is

best undertaken near plentiful renewable energy resources to produce high-value green iron. This strategy would involve a shift where the ironmaking and steelmaking process is decoupled, with green iron production occurring where there is significant renewable energy potential, either close to iron ore mines or within a reasonable distance for transport. The resulting green iron, preferably transported as hot briquetted iron (HBI), can then be moved to locations where green steel is manufactured in EAFs powered by renewable energy or basic oxygen furnaces (BOFs).

Using renewable energy to produce green iron, either closer to iron ore mines or within a reasonable distance, would:

*The full report can be found via this link: https://www.accr.org.au/research/forging-pathways-insights-for-the-green-steel-transformation/

• capitalise on the availability of renewable resources in or accessible to ironrich regions

• create logistical and economic efficiencies to help facilitate green iron offtake agreements

• situate green hydrogen production at the point of iron reduction, circumventing the complexities associated with shipping hydrogen.

Capital allocation toward innovative, green iron technologies in regions with abundant renewable energy resources is imperative to realising this shift.

Differing decarbonization potential

Advancements in technology and production innovation are enabling steelmaking to become less carbon-

intensive during every stage of the steelmaking process. Yet the emissions reduction potential of each process differs significantly.

• Green hydrogen-based processes, supported by renewable energy, are the most promising for emissions reductions.

• Gas-based direct reduced iron and other lower-emission technologies offer some emissions reductions in the near term, yet to avoid reinforcing fossil fuel reliance, these should not be adopted as permanent solutions.

• Carbon capture utilisation and storage or offsets are looking less cost-effective, with significant uncertainty around viability and effectiveness.

Terminology including ‘net-zero’, ‘carbonfree’, ‘green’ and ‘low-emissions’ are all

used interchangeably, which can lead to confusion and misinterpretation. Without clear definitions, it becomes challenging to measure and compare the environmental impact of different steel production methods accurately.

The global iron and steel market is valued (by revenue) at approximately $167 trillion, and is expected to reach a market size of $2.25 trillion by 2030, with a compound annual growth rate (CAGR) of 3.7%.

Fairfield Market Research expects the market size for green steel to increase, projecting a CAGR of over 122% from 2023-2030. In this context, the shift towards green steel production and the potential for higher prices in green steel sales presents a major opportunity for companies and their investors.

As EAF technology becomes more prevalent, the demand for high-quality steel, particularly advanced high-strength steel used in automotive applications, is expected to triple by 2030. In the USA, 71% of steel is now produced using EAFs, utilising scrap steel as the primary input. China anticipates it will grow its scrapbased EAF production share from 12% in 2022 to 34% by 2030.

Customers are demonstrating a willingness to bear higher prices to ensure low-emissions steel:

• Swedish steelmaker H2 Green Steel has a 25% premium on its steel.

• SSAB, also a Swedish steelmaker, estimates the gross premium on steels with almost zero CO2 emissions will be around EUR 300/tonne ($325) by 2026, in line with the full implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM).

• Japan’s JFE Steel Corporation currently charges a 40% premium on its mass balance approach, which allocates emissions reductions to its specific steel product, “JGreeX”.

Given the limitations of mass balance’s material impact on emissions reduction, it would be optimal for any revenue made to be reinvested into authentic green steel production.

Government policies are also shifting to drive green steel demand, with many nation states, including almost all OECD countries, enacting green public procurement (GPP) programmes and other policies.

Green steel off-take agreements

Off-take agreements have become crucial mechanisms for locking in green steel demand and ensuring a stable supply chain.

Various sectors, including transportation, automakers, and construction, have shown significant interest in procuring green steel using these agreements, demonstrating the depth and breadth of consumer demand.

• Mercedes-Benz has partnered with H2 Green Steel (H2GS) to secure around 50kt of green steel per year for its manufacturing plants in Europe and North America.

• Automakers like Volvo and BMW have entered agreements with H2GS, SSAB and HBIS to obtain green steel and lowemissions steel.

• Cargill has signed a multi-year offtake agreement with H2GS. This agreement not only secures a supply for Cargill but expands the availability of green steel to markets beyond the European Union.

• IKEA’s agreement with H2GS for the delivery of green steel to be used in warehouse racking from 2026 onwards highlights the demand from the retail and logistics sectors.

The prevalence of green steel offtake agreements within European companies highlights the region’s proactive stance on decarbonisation, supported by robust financial structures and policy settings. It also highlights the need for wealthier nations, especially those with historic contributions to carbon emissions, to take the lead and invest in technologies with green potential.

ACCR reviewed 16 steelmaking companies, collectively representing 27% of global steel production (521 Mt) and 23% of global steel sector emissions.

Of these 16 companies, 94% have ambitious net-zero-by-2050 targets, alongside quantifiable mediumterm reduction goals, but short-term commitments are scarce. While this shows that steel decarbonization is a real industry concern, it also suggests there is a challenging path ahead to deliver the rapid and substantial emissions reductions the companies’ targets require.

• 50% of the projects steelmakers have invested in have significant emissions reduction potential, while 40% of the projects still focus on solutions with limited

potential to reduce emissions.

• Less than 20% of companies have net-zero emissions targets that explicitly encompass Scope 3 emissions, raising concerns about the industry’s alignment with the Paris Agreement and global decarbonization goals.

• None currently verify whether their decarbonization targets are in alignment with the Science Based Target Initiative’s (SBTi) Steel Science-Based Target-Setting Guidance, and at the time of the report’s publication, only two plan to do so in the future.

ACCR reviewed four iron ore companies – Rio Tinto, Fortescue, BHP and Vale –representing 41% (1.1 Gt) of global iron ore production. The collective Scope 3 emissions of these four companies represent 54% of the global steel sector’s emissions.

These scope 3 emissions, predominantly from steelmaking, also account for more than 95% of the four miners’ total emissions footprint, and pose a unique emissions reduction challenge that is both separate to and enmeshed with the challenges steelmakers are facing.

Like the steel companies ACCR reviewed, the four miners are showing a mix of caution and ambition in their climate targets and decarbonization investments, collectively pursuing 64 steel decarbonization projects that span an array of technologies with varying degrees of emissions reduction potential.

Furthermore:

• All are directing substantial capital expenditure towards operational decarbonization by 2030. However, all need to improve disclosure of their expenditure, which should include detailed breakdowns of capital allocations toward steel decarbonisation projects, including forward-looking allocations for the next three years.

• Market certainty would be enhanced if all four companies commit more specific funding towards steel decarbonization –the largest portion of the miners’ respective emissions profiles. This would help provide clear signals to shape policy and guide investments.

While Europe is currently at the forefront of technological and product innovation, the majority of steelmaking capacity development occurs in Asia, particularly in

China. Despite a noticeable shift towards EAF production in China, the overall pace of decarbonization in Asia is inconsistent with global decarbonization goals.

For example, India’s expansion of coal-based blast furnace capacity would potentially quadruple the country’s steel emissions between 2021 and 2050 –jeopardising its 2070 carbon neutrality target.

Japan and South Korea, with limited natural resources, rely heavily on imports of raw materials, complicating their green steel transition. Their challenges are exacerbated by ageing infrastructure, high energy costs, and reliance on thermal power, hindering renewable energy integration for steel production.

On the other hand, the EU and USA, leveraging their industrial legacies, lead in steel innovation and sustainability. The EU’s stringent regulations – including its Carbon Border Adjustment Mechanism (CBAM) and renewable resources drive its green practices, while the USA’s abundant scrap supply and the Inflation Reduction Act (IRA) are catalysing a shift towards technologies with low-carbon potential.

Policymakers can hasten green steel’s trajectory

While policy initiatives like the CBAM and IRA, alongside green public procurement policies and international agreements like the Paris Agreement, set solid frameworks for incentivising clean energy use and penalising carbon-intensive production, they address only a portion of the global equation.

There is an immediate need for policy initiatives that help facilitate access to renewable energy and quality green iron for EAF-based production globally, especially in emerging markets, where gaps in policy and regulatory settings are creating distinctive challenges for the steel industry as a whole. The absence of comprehensive carbon pricing mechanisms outside of the EU and parts of North America is one such gap. Although China has announced its emissions trading scheme, its impact and breadth in driving significant steel decarbonization is yet to be fully seen. This disparity in carbon pricing creates unequal pressures for steel producers worldwide, and can lead to ’carbon leakage’, where production moves to regions with less stringent regulations, undermining global decarbonization efforts.

Furthermore, the financial incentives and support for transitioning to green steel technologies, like those offered by the IRA, are lacking in many steel-producing nations. This deficiency impedes the adoption of EAF technology and the development of infrastructure for renewable energy and green hydrogen production, particularly in countries that could most benefit from these solutions.

International collaboration and funding mechanisms intended to address these gaps are still in their infancy. For example, while the Industrial Deep Decarbonisation Initiative (IDDI) aims to stimulate global demand for low-carbon steel, the effective implementation of supportive policies and investments in necessary infrastructure across major steel-producing regions remain inconsistent.

The way forward Investors have five key levers available to them that can help ensure that a decarbonized steel sector is a reality by 2050.

1. Reallocate capital away from coaldependent blast furnaces and towards processes with high decarbonization potential.

• Engage with companies, using escalation where necessary, to ask for disclosures of transition pathways to lowemissions iron/steelmaking, along with a detailed outline of the capital allocation for the transition.

• Direct investments towards regions lagging in green steel production capability, specifically to accelerate decarbonization efforts.

• Engage with policymakers directly and indirectly to encourage positive policy settings for steel decarbonisation.

2. Increase renewable energy capacity

to enable the green electricity and green hydrogen required for low-emissions steelmaking.

• Fund renewable energy projects, particularly in developing countries with steelmaking operations.

3. Work towards standardised, comprehensive, and robust emissions disclosure across the industry.

• Engage with companies to ask for transparent disclosures.

• Integrate emissions data and trends into investment analysis, so shareholders can invest in companies that demonstrate transparency, lower carbon intensities and a strong commitment to reducing absolute emissions.

• Update financial risk assessment models to accurately incorporate the physical impacts of climate change, ensuring investment strategies adequately address climate risk.

4. Catalyse immediate action towards decarbonization with short-term climate commitments that are ambitious and science-based.

• Engage with companies, using escalation where necessary, to ask for the disclosure of short-term climate targets and alignment with the Science-Based Targets initiative (SBTi).

5. Ensure that the transition of iron and steelmaking to green processes is just and equitable, supporting communities and workers.

• Hold companies to account on providing a just transition timeline, clear framework, and outcomes for impacted workers.

• Incorporate just transition metrics and information into investment analysis and decision-making.

• Advocate for policies promoting a just transition �

IN early March, I found myself onstage at SXSW – a culture-moving conference that, in the organizers’ words, “proves that the most unexpected discoveries happen when diverse topics and people come together”.