US energy pipe and tube market – where to now?

Supervisory control systems for the future.

GLOBAL MARKETS

Steel continues to be a pillar of the global trade landscape.

SPECIAL STEELS

Nant de Drance: a giant rechargable battery.

Since 1866

www.steeltimesint.com

March 2024 - Vol.48 No2

PIPE

TUBE AND

DIGITALIZATION

DECARBONIZING IN 2024

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Carol Baird

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com

Steel

Published

2 Leader By Matthew Moggridge.

4

News round-up

The latest global steel news.

7 USA update Politicians oppose Nippon plans.

10

Latin America update Deacero’s new minimill and shredders.

13

India update Banking on capex.

17

Iron ore Ferrexpo undaunted by Ukraine War.

18

Global markets Trends and policies.

CONTENTS – MARCH 1

Decarbonization

22 Challenges and strategies.

29 Redrawing the map.

32 Decarbonizing in 2024: from both sides of the pacific.

38

Special steels

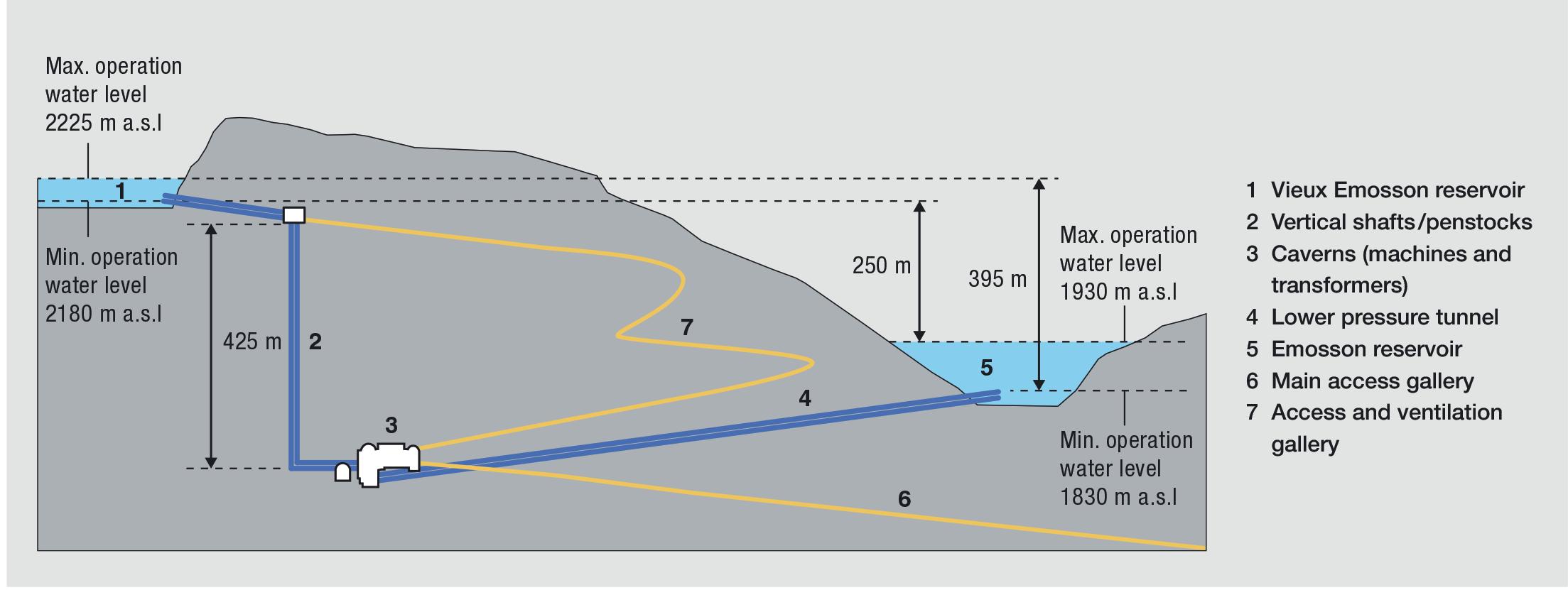

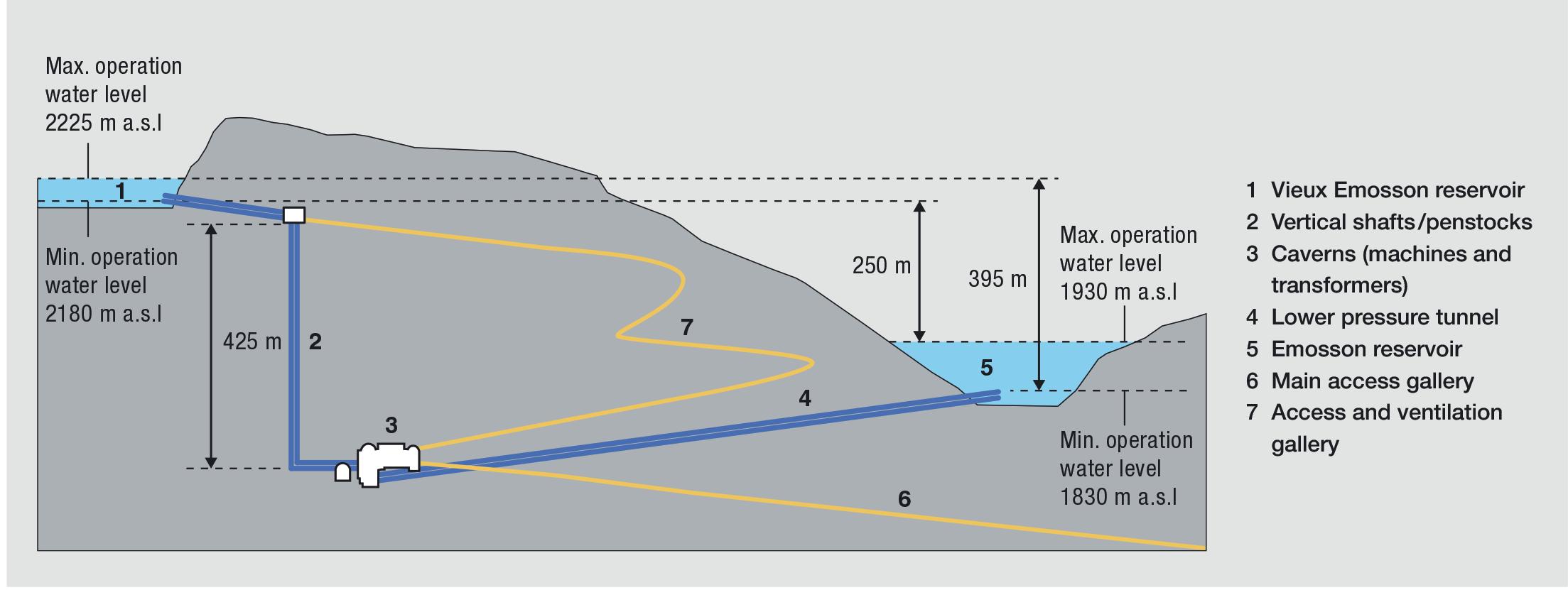

Nant de Drance: a gigantic rechargeable battery.

42 Digitalization

Supervisory control systems for the future.

46

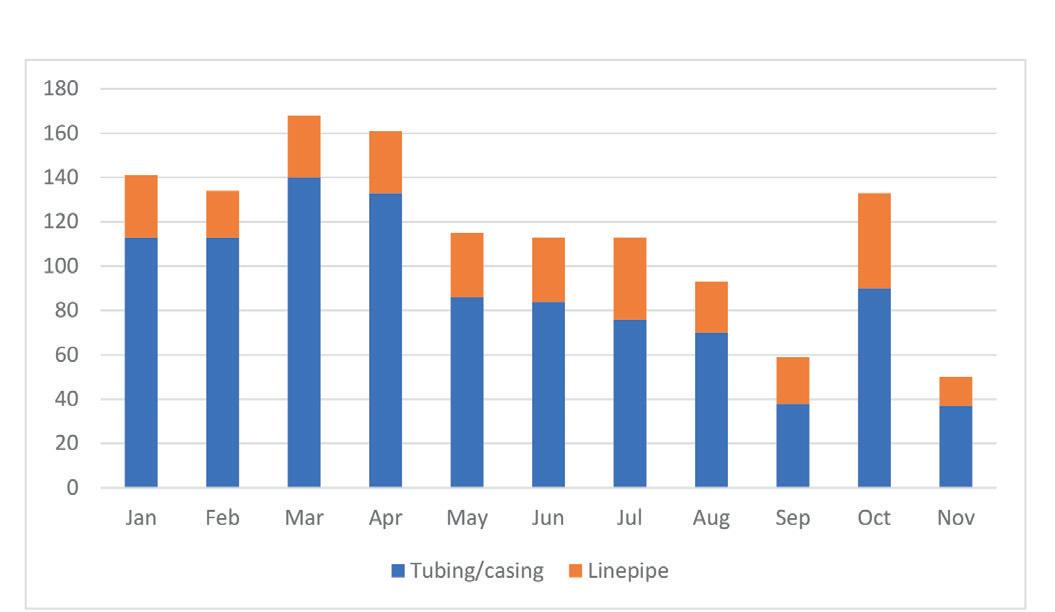

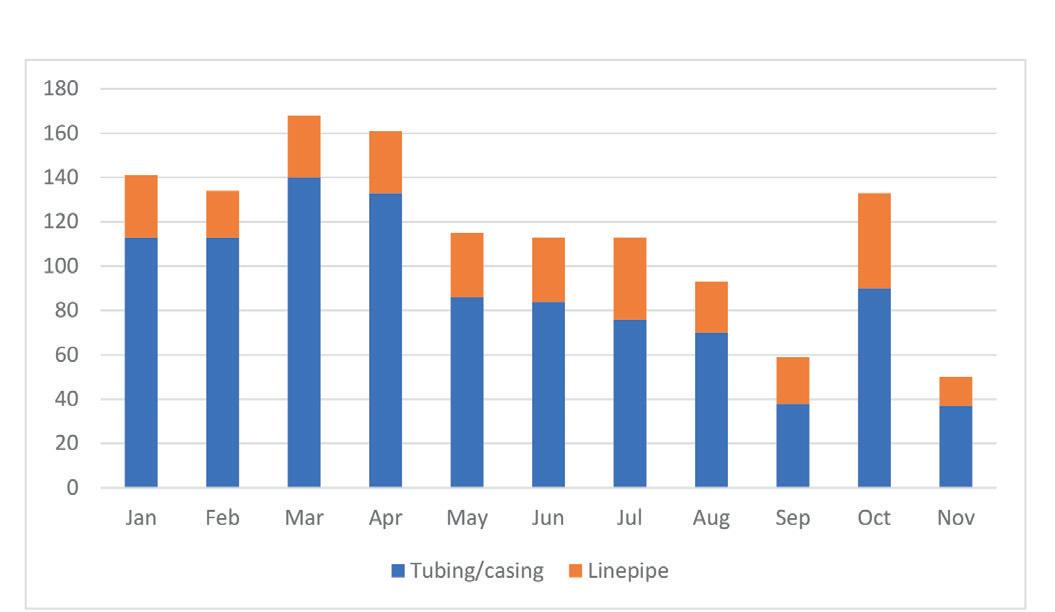

Tube & pipe

Where to from here?

50

Perspectives: Woodings

Strong solutions, strong business.

52 History

A vanished plant Part 2, 1900-2009.

18

www.steeltimesint.com

Times International is published eight times a year and is available on subscription. Annual subscription: UK £226.00 Other countries: £299.00 2 years subscription: UK £407.00 Other countries: £536.00 3 years subscription: UK £453.00 Other countries: £625.00 Single copy (inc postage): £50.00 Email: steel@quartzltd.com

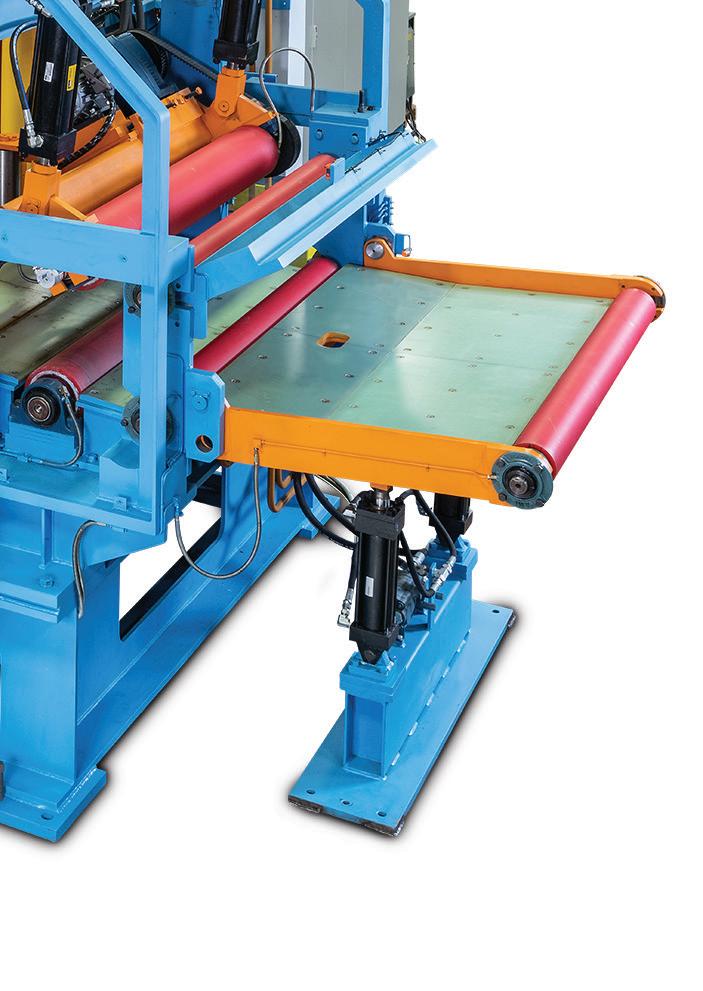

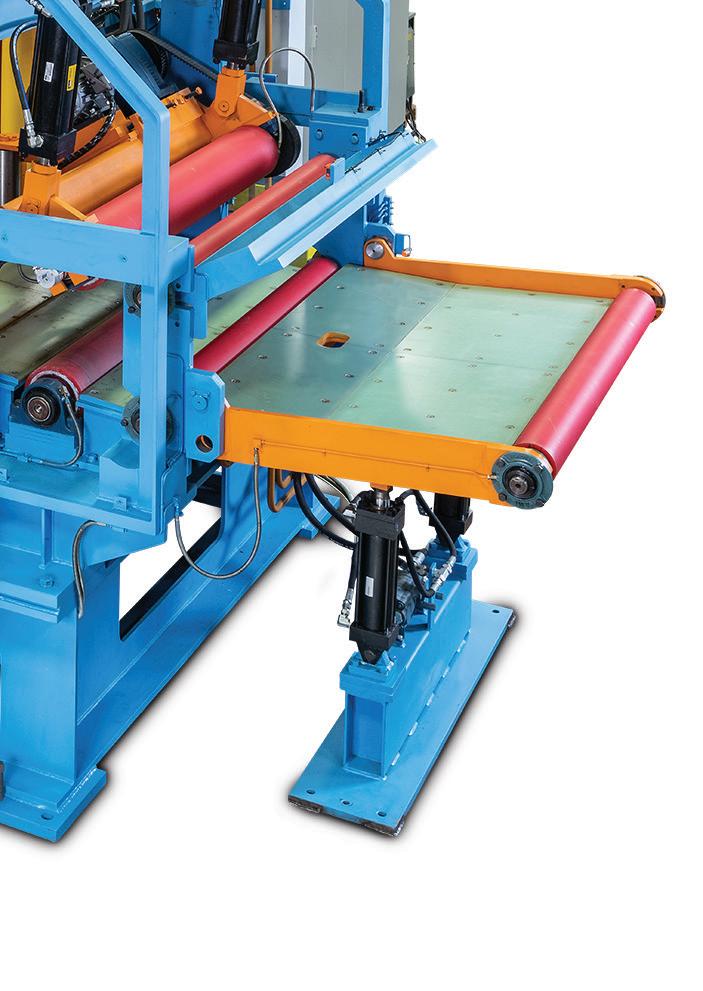

by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063 Web: www.stephensandgeorge.co.uk ©Quartz Business Media Ltd 2023 ISSN0143-7798 Cover photo courtesy of Superior Machine. Installation of a new tilt platform. Superior is now part of the Woodings Equipment Group

March 2024

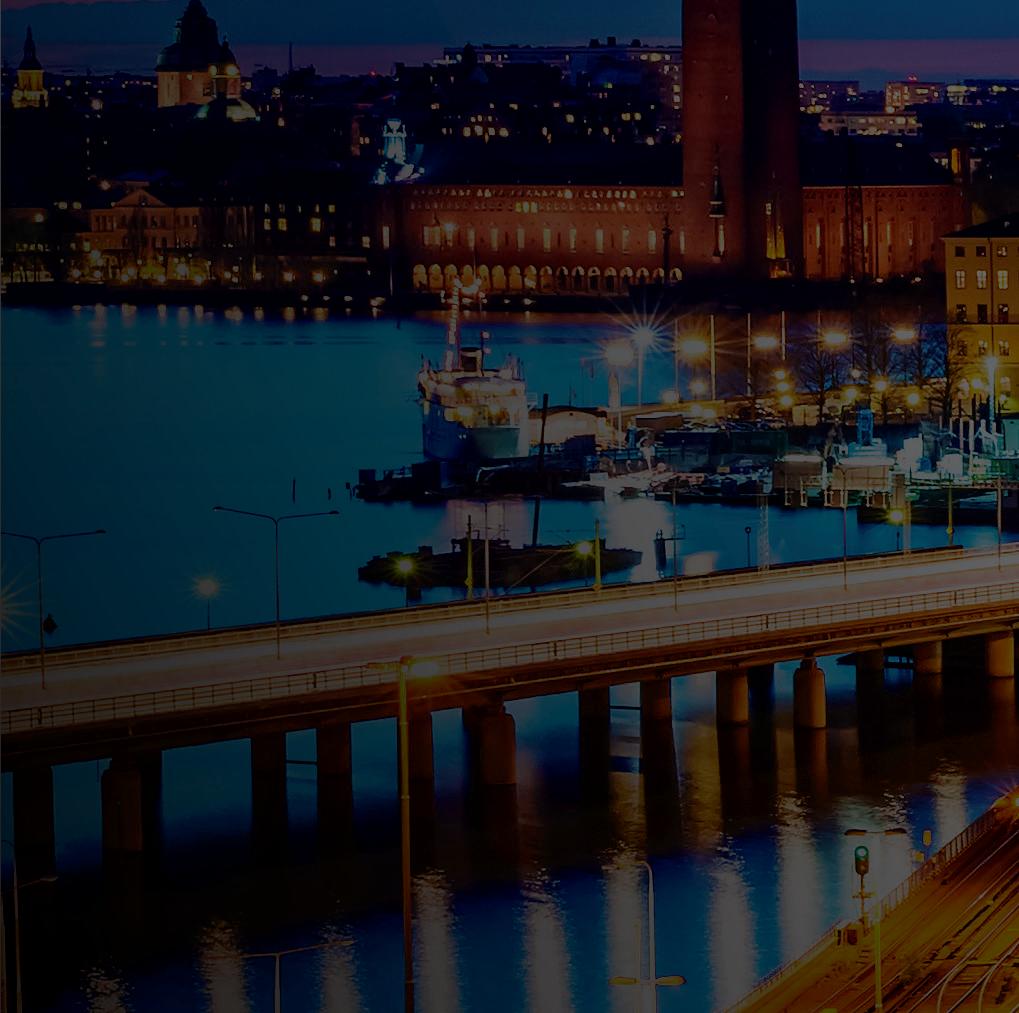

The best conference of 2024? You bet it will be!

Matthew Moggridge Editor matthewmoggridge@quartzltd.com

Matthew Moggridge Editor matthewmoggridge@quartzltd.com

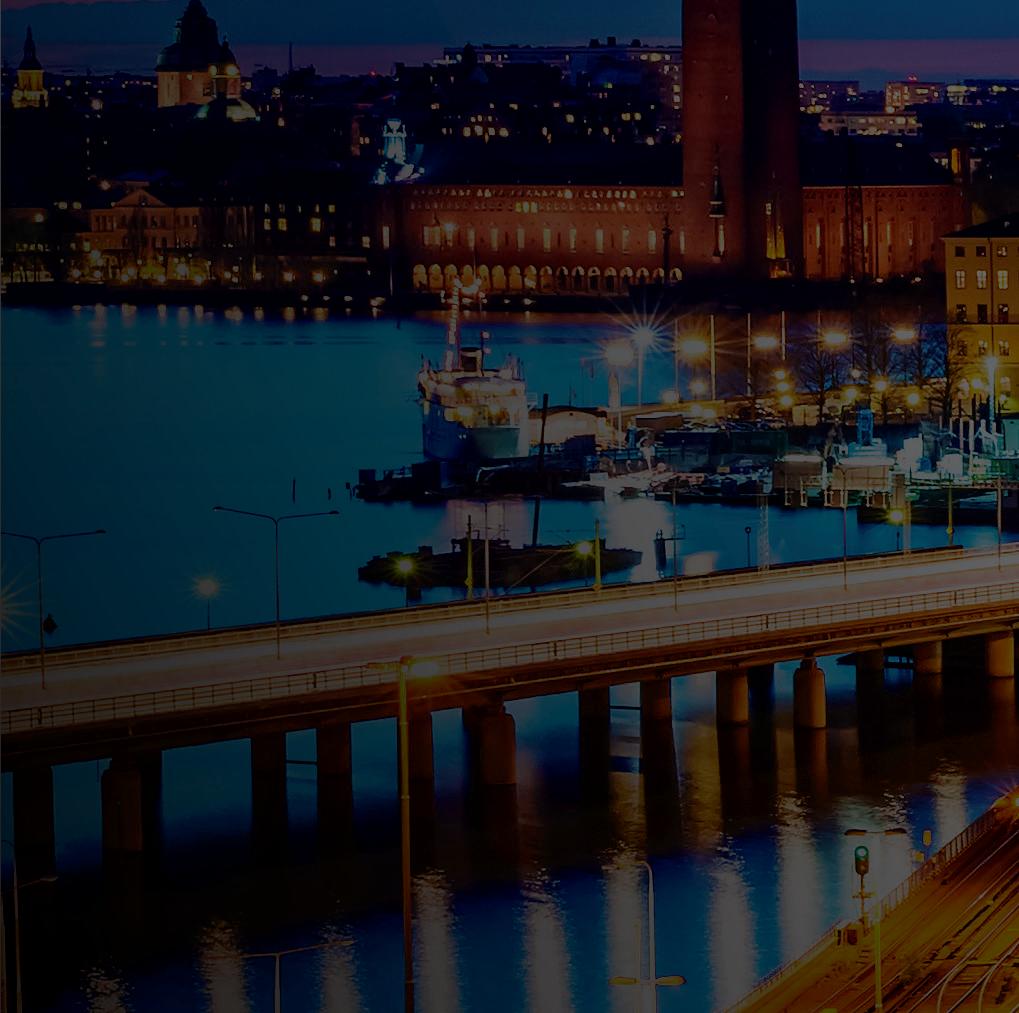

The Future Steel Forum 2024 takes place in June in Stockholm (18-19 June). This year’s event promises to be incredible, amazing, brilliant and, dare I say, the best yet. Why? Because we’re in the Swedish capital for good reason. The Swedish steel industry is leading the way when it comes to decarbonizing the steelmaking process. Both SSAB with its HYBRIT initiative and H2 Green Steel are based in Sweden. So is Ovako and all three are pushing the envelope when it comes to making fossilfree or ‘green’ steel a reality – something we all talk about and we’re all working towards, but let’s just say the Swedes are way ahead of the game. They are the pioneers of green steelmaking and should be applauded. If you’re interested in hearing about what they’re doing and would rather hear it live and from the horse’s mouth, then the Future Steel Forum is for you and I would strongly suggest you register now. As I write this the programme is hours away from ‘going public’ and I can say now that I have met with SSAB, H2 Green Steel and Ovako in Stockholm and they’ve all agreed to speak on Day One of what I can assure you will be the best Future Steel Forum to date.

And the Swedes are not alone. We have presentations from ArcelorMittal, Tata Steel Europe, Tata Steel India, JFE Steel from Japan and many more.

How do we define green steel? It’s a good question and one based on the need for standardisation as a future world hoves into view, where steelmakers around the world start to make claims about the products they produce which might be false or in some way ‘economical with the truth’. I’m not for one minute saying steelmakers are corrupt, of course they’re not, but if a steel end user wants ‘green steel’ it needs a certified product that meets its demands and that’s where standards come into play. We have a discussion panel on this very subject at the 2024 Future Steel Forum and we have big names on the panel ready to discuss it. There is also a panel on direct reduced iron (DRI) featuring all the leading global companies in the sector: Midrex, Energiron and HYBRIT.

This year’s Forum is different, very different, and you would be advised to register now for what I know will be the best conference of 2024. To register, visit https://www.futuresteelforum.com

2 www.steeltimesint.com March 2024 LEADER

aic group_half page.indd 1 07/03/2024 11:07

#turningmetalsgreen

At SMS group, we have made it our mission to create a carbon-neutral and sustainable metals industry. We supply the technology to produce and recycle all major metals. This gives us a key role in the transformation towards a green metals industry.

ArcelorMittal's Zenica steel plant in Bosnia suffered a loss of $88.2 million in 2023, with long-term debt up 400%, it said last month. The results were due to a 12% annual drop in demand, a 20% rise in electricity prices and metal prices on the global market down 22%, the Bosnian business added. "As our 2023 financial results published today show, ArcelorMittal Zenica has found itself in a very challenging situation," the company said, adding that it did not expect market conditions to improve in the coming months.

Source: Business Standard, 23 February 2024.

India Ltd. has drawn up a road map to cut emissions by 20% from 2021 levels by the end of the decade, chairman Aditya

German steel manufacturer

Salzgitter Flachstahl has signed a 10-year power purchase agreement with Octopus Energy Generation. Under the agreement, Salzgitter Flachstahl, a subsidiary of Salzgitter AG, is to be supplied with 126,000MWh of clean energy per year generated from Octopus’ Schiebsdorf solar farm in Brandenburg. Starting when the project is commissioned later this year, it will both secure more clean electricity and provide a hedge against rising electricity costs for Salzgitter Flachstahl, while underpinning its objective of producing green steel.

Source: PEI, 23 February 2024.

Mittal said in the company’s first Climate Action Report. The firm aims to significantly enhance its use of renewable energy to meet 100% of its grid electrical energy needs by 2030. Furthermore, it plans to maximise the utilisation of the scrap mix in total steelmaking capacity, increasing it from the current 3%-5% to 10%.

Source: CNBC, 25 February 2024.

Ukrainian drones hit a major Russian steel factory overnight, causing a large fire, a Kyiv source said on 24 February, the second anniversary of Russia's fullscale invasion of Ukraine. The governor of Russia's Lipetsk region identified the plant as one in the city of Lipetsk, some 400 km north of the Ukrainian border, that is responsible for about 18% of Russian steel output. He said a fire apparently caused by a drone strike had been extinguished at the plant, operated by Russian steelmaker Novolipetsk (NLMK), and there had been no casualties.

Source: Reuters, 24 February 2024

Switzerland-based Terra Quantum is collaborating with South Korean steel manufacturer POSCO Holdings to deploy quantum AI for optimizing steel production, specifically focusing on

Liberty Primary Metals

Australia (LPMA), a subsidiary of British steelmaker Liberty Steel Group, will install a 160-ton low-carbon emission electric arc furnace at its Whyalla steelworks. The new electric arc furnace will take Whyalla's steelmaking capacity to more than 1.5Mt/ yr. The electric arc furnace programme will also receive $63 million in funding from the Australian government.

Source: Yieh Corp Steel News, 25 February 2024

POSCO’s advanced blast furnaces. The partners will demonstrate the potential of Quantum Neural Networks, aiming to enhance efficiency, and target tangible outcomes such as reduced emissions and energy consumption. POSCO has been digitizing its steelmaking process since 2016 and has been applying technologies such as big data, artificial intelligence, and the Internet of Things to its steelmaking operations.

Source: Green Car Congress, 25 February 2024

Czech steelmaker Liberty Ostrava, a subsidiary of UK-based Liberty Steel, is seeking to negotiate lower prices and volumes with Tameh Czech and has made a takeover offer for the insolvent energy producer, Reuters reports. This would allow the company to restart blast furnace No. 3 at its Ostrava plant. Liberty European upstream business executive director Teuns Victor told Reuters that the company is in the process of finalising a proposal to be sent to Tameh, adding that if the energy supplier does not want to restructure, the next step may be the sale of the blast furnace. Source: GMK Center, 28 February 2024.

4 NEWS ROUND-UP

ArcelorMittal Nippon Steel

ArcelorMittal Brasil has entered into a memorandum of understanding with Petrobras, a Brazilian oil and gas producer. The collaboration is geared towards exploring potential business models within the low-carbon economy, encompassing areas such as low-carbon fuels, hydrogen, renewable energy production, and carbon capture and storage (CCS). The focal point of the partnership revolves around joint efforts to establish a carbon capture and storage hub in the state of Espírito Santo.

Source: Chem Analyst, 28 February 2024.

JSW Steel has taken the step to incorporate a new whollyowned subsidiary, JSW Green Steel Ltd, on 27 February in Mumbai. The move, claims the company, underscores its commitment to green initiatives, focusing on the production of hot-rolled and cold-rolled steel products. The subsidiary, with an authorized capital of Rs 500,000, will manufacture hot-rolled and cold-rolled steel products, essential in various industries, including automobile, agriculture, construction, and home appliances.

Source: BNN Breaking, 29 February 2024.

Tata Motors has delivered its next-generation, green fuel-powered commercial vehicles to Tata Steel. The fleet includes Prima tractors, tippers and the Ultra EV bus, powered by Liquefied Natural Gas (LNG) and electric technologies. The vehicles were flagged off by Tata Steel’s chairman, N Chandrasekaran, as part of the Tata Group’s founder’s day celebrations in Jamshedpur. The vehicles were handed over to Tata Steel’s delivery partners for transporting steel products and raw materials, a company press release stated.

Source: ET Auto, 4 March 2024.

India is looking at developing its own pure-hydrogen based DRI to be used in the production of green steel. The process will be ‘unique to the country’, and the detailed project report ‘is under scrutiny’ across ministries, a senior government official aware of the discussions, told The Hindu Business Line. “This technology is still developing and some of the ministries – such as steel and MNRE – and industry players such as integrated steel makers and secondary steelmakers, are working together to get the pilots going on-ground,” the official said, requesting anonymity.

Source: The Hindu Business Line, 5 March 2024

this month, in what

the company claims is a ‘ground-breaking venture in line with its commitment to sustainability and India’s targets of achieving net zero carbon emissions.’ Shri Jyotiraditya Scindia, the union minister of steel and civil aviation, commented: ‘‘This path-breaking green hydrogen initiative will make the steel sector greener and more sustainable.’’

Source: Hydrogen Central, 5 March 2024

South Korea’s Hyundai Steel Co. is expected to resume steel production in Russia two years after it took its

plant offline in the country amid the country’s invasion of Ukraine, which later forced its auto-making sibling Hyundai Motor Co. to sell its factory to a Russian company. According to steel industry sources, Hyundai Steel has decided to restart its automotive steel sheet plant in St. Petersburg, which has remained idle for about two years.

Source: The Korea Economic Daily, 6 March 2024

JSW Steel has picked Robert Simon as the chief executive officer of the steelmaker's US unit. Simon will lead the overall business, comprising slab, coil, pipe and plate production, and sales at Baytown and Mingo Junction, the company said in a statement on 6 March. He will report to the respective boards of both the subsidiary companies of JSW Steel, the company stated. Source: Business Today, 6 March 2024

EDITOR'S NOTE

In our February digital issue, Yushan Lou, lead author of 'China's hydrogen strategy: national vs regional plans' (p.28) and research associate at the Center on Global Energy Policy, Columbia University, SIPA, was not credited on the feature. We apologise to Yushan for this error.

5 NEWS ROUND-UP

Jindal Stainless commenced the first usage of green hydrogen in its stainless steel plant in Hisar, Haryana earlier

Towards green steel

Technologies turning steelmakers’ decarbonization goals into reality.

Jet Vapor Deposition (JVD): Sustainable, highquality and cost-effective steel coating

The JVD line introduces a technological breakthrough in the steel coating of advanced high resistant steel grades difficult to galvanize by hot dipping. This genuine alternative to Electro-Galvanizing and Hot-Dip-Galvanizing considerably reduces the cost of galvanized steel and provides multiple advantages when it comes to quality, speed and OPEX. Developed for ArcelorMittal with the help of our experts, John Cockerill is in charge of commercializing this unique technology worldwide.

Electrical Steel Processing Technologies to produce the steel grades of tomorrow

Our E-SiTM equipment and processing lines are designed for the production of strong, ultrathin, lightweight, and highquality Non-Grain Oriented (NGO) steel grades essential for the future of e-mobility.

Other developments & technologies aiming at decarbonizing the steel industry:

VolteronTM: CO2-free Steel Production Process

Furnace Electrification

Carbon Capture Heat Recovery

Eco-friendly Acid Regeneration Plants

High-performance Acid Regeneration supporting responsible steel making and the circular economy

John Cockerill Industry’s ARPs come with smart plant control systems, provide waste energy recovery and drastically reduce pickling process plants’ fresh acid demands and waste streams in general. What is more, they are providing the lowest emissions in the market.

Follow us on

johncockerill.com/industry

JVD (Jet Vapor Deposition) Line

Electrical Steel Processing Technologies

Politicians oppose Nippon plans

The United Steelworkers (USW) union’s opposition to Nippon Steel’s takeover bid of Pittsburgh-based US Steel is now followed by politicians opposing Nippon Steel’s move; Nippon Steel has quoted a purchase price of $14.9 billion which is roughly twice the offer made by US rival steelmaker Cleveland-Cliffs. By

“IT’S not just Nippon’s attractive price offer. Remember, this is an election year and both President Joe Biden and his potential rival Donald Trump (he has, as of writing this update, not yet been officially nominated though he is leading over the other Republican candidates), are reacting to Nippon’s takeover of US Steel,” explained Joseph Marciano, a New York-based analyst. “Then there is the national security element … and no candidate would like to appear less nationalistic when it comes to protecting American interests.”

An otherwise free economy, inherent with opportunities for foreign companies investing in the US corporate sector, nationalism is today on a high pitch, and politicians seem to be outdoing each other in opposing a takeover by a foreign company, although Nippon Steel is based in an allied country.

Manik Mehta*

Manik Mehta*

JD Vance, a Republican senator, argued that it was “not just this transaction I’m worried about, but that this could be a precedent”, fearing that US Steel would be less responsible to US national security needs and that this would allow Nippon Steel to avoid US tariffs on imported steel through the purchase. He has called for a blanket ban on any foreign buyer of a US company that benefitted from the tariffs. Foreign companies, keen to access the US market, should engage in Greenfield investments.

Former President Donald Trump has vowed to block Nippon Steel’s acquisition of

US Steel.

“I would block it instantaneously. Absolutely,” Trump said after meeting the president of the Teamsters labour union, which represents workers in the transportation industry. “We saved the steel industry. Now, US Steel is being bought by Japan. So terrible.”

USA UPDATE 7 www.steeltimesint.com March 2024

*US correspondent, Steel Times International

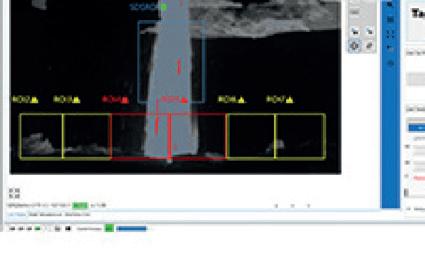

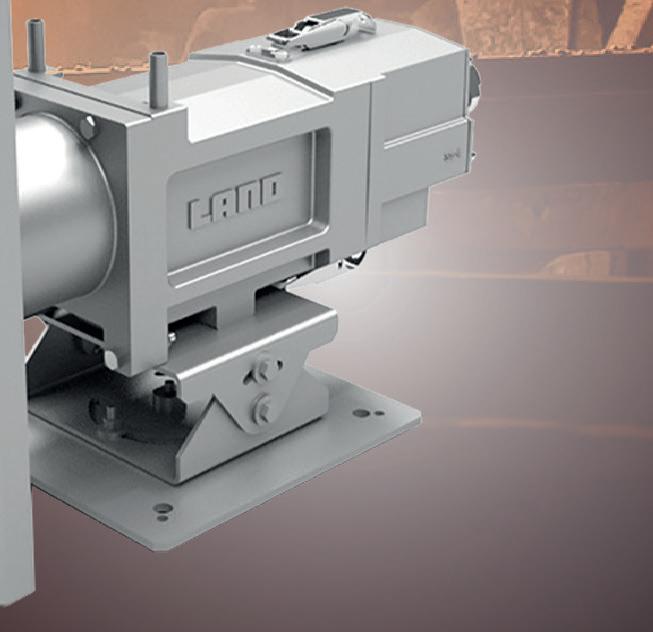

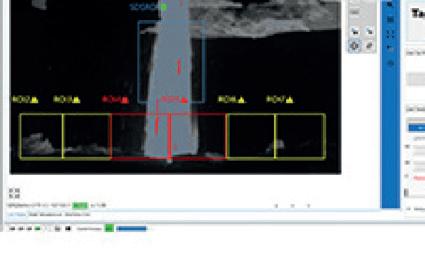

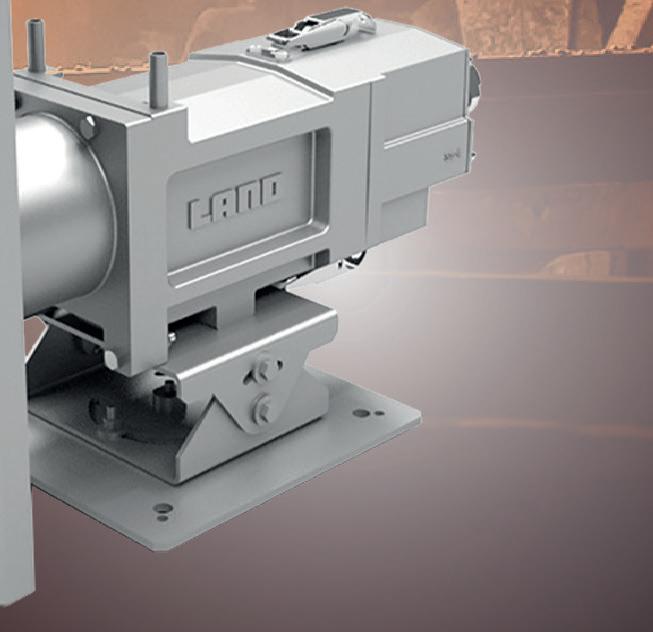

SLAG DETECTION SYSTEM

DELIVER IMPROVED YIELDS, HIGHER-QUALITY STEEL AND REDUCE COSTLY DOWNSTREAM PROCESSING ON THE BOF/EAF STEEL MAKING

The high-resolution Slag Detection System (SDS) thermal imaging camera detects the transition between steel and slag and has been specifically designed to survive in harsh operating conditions, whilst utilising a particular wavelength to reduce obscuration caused by smoke and fumes.

Suitable for operators of secondary steel making vessels including stainless steel, SDS can also be used in other smelting operations such as copper and platinum. Its automatic operation ensures that only the predefined amount of slag is carried over before an alarm is triggered.

GET THE BENEFITS:

SDS is AMETEK Land’s definitive solution for monitoring and reducing slag carry-over in steel production facilities whilst saving money and improving operator safety.

Automatic detection and tracking accurately identifies the stream, reducing background interference

Accurate detection independent of charge weight

Fully automatic operation and clear alarm notifications

Improved connectivity through the use of Open Data Interface

MWIR-640 SDS CAMERA TEMPERATURE RANGE 500 to 1800 °C / 932 to 3272 °F

ACCURATE. SLAG & STEEL. DETECTION.

IMAGEPro SDS 2.2 Thermal Software LEARN MORE: WWW.AMETEK-LAND.COM | LAND.ENQUIRY@AMETEK.COM Proudly exhibiting at:

Biden’s election strategists face pressure with the growing number of Republicans opposing the Nippon Steel acquisition. Biden has in the past underlined the importance of US alliances and has welcomed foreign investment; nevertheless, he knows Nippon’s acquisition would anger the USW which had endorsed Biden’s 2020 candidacy and wields a constituency of over a million members, with many thousands in swing states Ohio, Pennsylvania, Michigan, Wisconsin, etc.

While foreign investments for new US factories were welcomed months back, Nippon Steel’s venture has rung alarm bells among politicians over security issues. Foreign investors can generally benefit from the administration’s massive infrastructure allocations of roughly $3.5 trillion, combined with subsidies.

Experts argue that tariffs on imported steel would draw foreign companies to invest in production in the US, reminding that Japanese carmakers invested in the US in the past; former President Trump in 2018 imposed 25% tariffs on imported steel and Biden continued with the tariffs, though he reached agreement with the EU replacing tariffs on European products with quotas, extending the arrangement until 2025. US Steel’s chief executive David Burritt had also remarked that his company benefitted from ‘accelerating de-globalization’; other countries also reviewed their risks of growing interdependence.

Meanwhile, both Nippon Steel and US Steel, trying to allay doubts in the US, said that they would submit their agreement to the Committee on Foreign Investment in the US (COFIUS) which is chaired by Treasury Secretary Janet L. Yellen, to examine if the

deal would affect any national security interest.

However, COFIUS scrutiny, guarded and discussed by responsible members of the agency, is a protracted process and the wheels move slowly. Also, the deliberations weigh the political implications of such a sale, and US intelligence’s assessment of Nippon Steel.

Some critics object to national interests being put in jeopardy, but others argue that the US military uses roughly 3% of total domestic steel production, according to Pentagon data; modern fighter systems today consume less steel than in the past, using more of materials such as titanium and aluminium.

Besides, the Defense Department does not directly purchase any materials from US

Steel, though the latter has said that some customers, with defense and commercial businesses, may use the company’s raw steel for defense hardware.

COFIUS has taken controversial stands on deals with Chinese companies. Japan, however, is considered a US ally. Also, Nippon Steel is known to have some stakes in eight US steel companies.

Nippon Steel representatives have been talking to US lawmakers to allay their concerns, promising that US Steel would remain in Pittsburgh, with its name intact, and they would honour the steelworkers’ collective bargaining agreement. Nippon Steel, operating 11 blast furnaces, is expected to improve the efficiency of US Steel’s furnaces and also reduce the carbon footprint.

US Steel had spurned the nearly $ 8 billion offer made by Cleveland-Cliffs which,

as details now emerge, had come close to winning over US Steel.

Nippon Steel, which eventually won the bid, was not, apparently, interested in other plants in the region but in US Steel’s minimills in Arkansas and the latter’s iron-ore mining operations in Minnesota.

Nippon originally estimated the value of US Steel’s modern electric arc-furnace plants and the mines at $ 9.2 billion, according to regulatory filings; in late September, it indicated that it had bid at $ 9.5 billion. Its nearly 15 billion dollar offer, made two months later, was finally accepted.

But US Steel also had some concerns about Nippon Steel; David Burritt had called, two days before the deal’s finalization, Nippon’s executive vice president Takahiro Mori, to get assurance that Nippon would work with COFIUS. Nippon finally agreed on ‘all actions required’ to obtain COFIUS’ clearance, if it did not hurt its business.

Indeed, both companies sought the COFIUS review even before the Biden administration called for ‘serious scrutiny of the deal and the opposition by lawmakers of both parties.

Meanwhile, US steel imports totalled 2,082,000 net tons (NT) in December 2023, including 1,614,000 NT of finished steel (+ 2.6% and 7.7 respectively) over November 2023. For the year 2023, total and finished steel imports were 28,156,000 and 21,694,000 NT, down 8.7% and 14.1% respectively over 2022, the American Iron and Steel Institute (AISI) reported.

The top 2023 suppliers were Canada, Mexico, Brazil, South Korea and Japan. �

USA UPDATE 9 www.steeltimesint.com March 2024

Deacero’s new minimill and shredders

Mexican long steel company, Deacero, has announced investments in a new minimill and shredders, demonstrating its aim to reinforce its competitive advantages.

By Germano Mendes de Paula*

DEACERO, a leading Mexican long steel company, fully controlled by the Gutiérrez family, announced late last year investments in the construction of its fourth minimill and the addition of five shredders. However, before analysing these projects, it is important to examine Mexico’s long steel market. According to the country’s National Chamber of Iron and Steel Industry (Canacero), long steel output grew from 8.6Mt in 2017 to 9.5Mt in 2022 (Graph 1). Meanwhile, imports remained relatively stable around the 1.7Mt plateau, while exports increased from 1.4Mt to

1.9Mt, respectively. Therefore, apparent consumption rose from 8.8Mt to 9.3Mt from 2017-2022.

In 2017, Mexico had net imports of 240kt in terms of long steel products. In 2020, it reached net exports of 580kt, but this value reduced to 190kt in 2022. Deacero’s announced investments can be understood as a means of maintaining (and even improving) its prominence in the growing Mexican long steel market.

Current operations

Deacero was established in 1952 as a

modest business employing 12 people installing wire fences. The following year, it began to manufacture some steel wire products. The enterprise became increasingly devoted to wire products as it grew. In 1981, the company decided to start producing its own steel, and for that purpose, it launched its first minimill in Saltillo.

In 1997, Deacero bought its second minimill, in Celaya. Its third mill, located in Ramos Arizpe, started-up in 2011. Although the company’s expansion in steelmaking has been based on greenfield projects rather than acquisitions of existing crude steel capacity, it has purchased many downstream facilities, including in the US.

Today, Deacero operates three minimills (with roughly 4.5Mt/yr capacity) and 14 wire plants (1.4Mt/yr). Celaya is able to produce 2.8Mt/yr of billets and 2.7Mt/ yr of wire rod and rebar. Ramos Arizpe’s capacity consists of 1.5Mt/yr of billets and blooms and 1Mt/yr of rebar, merchants, and beams. Billet is no longer produced in Saltillo, which has a capacity of 600kt/ yr of wire rod. Deacero’s product portfolio comprises wire rod, drawn products, rebars, bars, small sections and large (structural) sections. It has also 30 distribution centres in North America.

Deacero has 21 scrap processing centres,

www.steeltimesint.com March 2024 LATIN AMERICA UPDATE 10

Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

*

Graph 1. Mexican long steel market, 2017-2022 (Mt)

which have a combined capacity of 4Mt/yr, doing business with more than 1,000 suppliers. It consumed 3.8Mt of scrap in 2022, which was equivalent to 43% of the Mexican steel industry. Consequently, it is the country’s largest ferrous scrap recycler. According to the company’s sustainability report, shredded scrap was equivalent to 36% of metallic charge in 2022.

Deacero’s strategy can be summarised as a long steel maker, fully based on minimills, with a large degree of backwards vertical integration (scrap processing) and a degree of forward verticalisation (distribution centres). The investments announced last November aim to reinforce its current competitive advantages.

New plant and new shredders

In September 2023, Deacero announced plans to invest $1bn in production capacity expansion of its mill located in Ramos Arizpe. At the time, the project would expand the minimill capacity by 1.2Mt/yr, of which 700kt/yr would consist of small and large sections from 8” to 27”, 300kt/yr of wire rod and rebar. Nevertheless, when the project was formally announced in November 2023, it consisted of a new 1.5Mt/yr minimill for production of sections up to 27”.

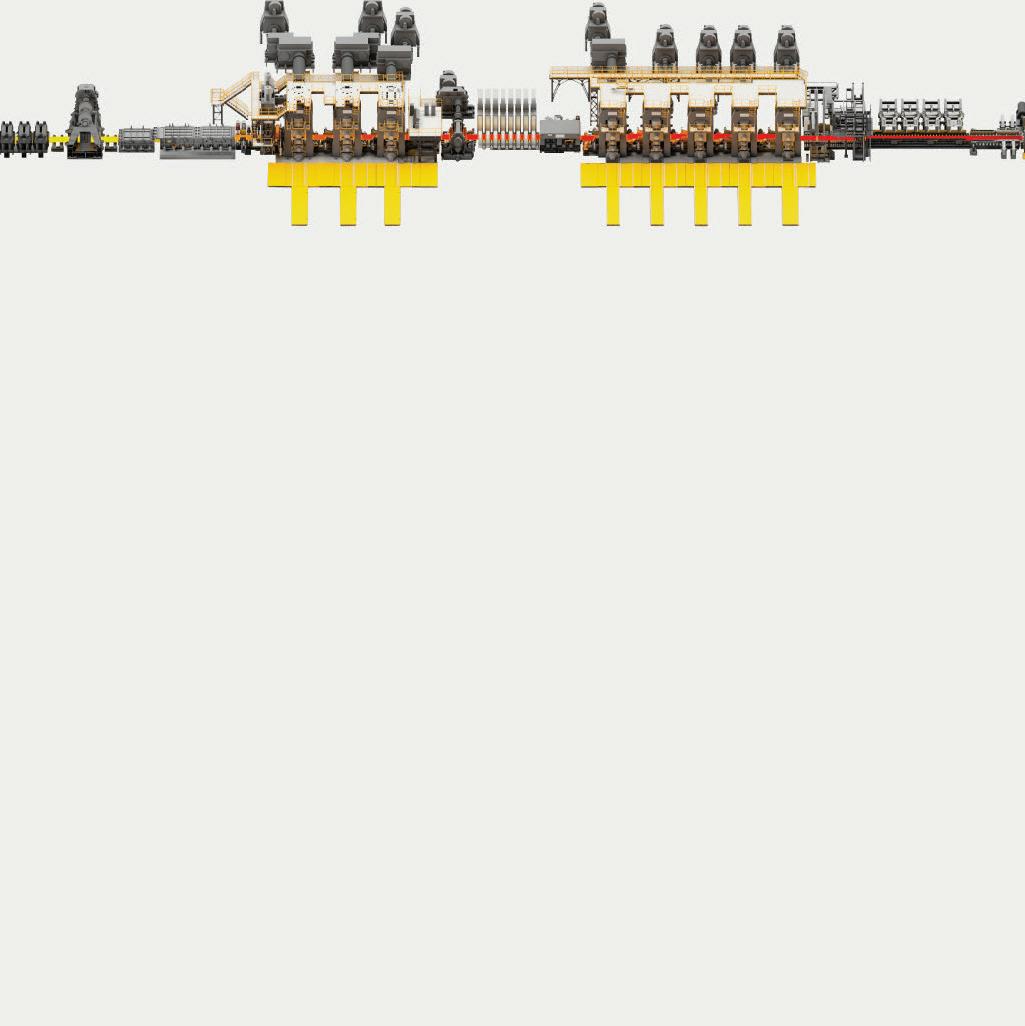

The new mill will be strategically located in Ramos Arizpe, very close to an existing minimill for small sections (from ¼” to 10”). Danieli will supply the key equipment (from scrap processing to melting and secondary refining, beam blank and billet continuous casting, a medium-heavy section mill, a reheating furnace and mill stands). The steelmaking facility will include a 150-tonne capacity EAF and a twin ladle furnace secondary refining station. The continuous casting machine will deliver 180x180mm and 280x220mm billets/blooms, 480x150mm mini-slabs, and 280x220x90mm and 480x380x90mm beam blanks. Plant start-up is scheduled for Q1 2026.

Also in November 2023, Deacero announced the acquisition of five new shredders from Danieli. Four will operate 2000hp (capable of processing 50tonnes/hr), while the fifth, equipped with 4000hp, will guarantee 100tnnes/hr. Each new plant will feature shredder machines, ferrous scrap cleaning, and non-ferrous separation lines. This will consolidate Deacero’s leadership in scrap processing in Mexico.

Finally, and more importantly, Deacero is implementing a decarbonization plan, which aims to lower CO2 emissions by 56% in steel shops and rolling mills. This goal includes direct emissions (scope 1) and indirect energy consumption (scope 2). In 2022, its emission intensity reached 0.24tCO2/t liquid steel produced in the steel mills (excluding rolling mills), which is substantially lower than the world average of 1.9t CO2/t, according to worldsteel. The company’s target is to decrease its emission intensity to 0.14tCO2/t liquid steel from 2027 onward. As a fully EAF-scrap based producer, Deacero is in a very comfortable situation to be a player in the decarbonization era.

Preparation Technologies for Metallurgy

Tailor-made Solutions

• Preparation of pellets and micropellets

• Sinter mix preparation

• Recycling of valuable residues like dusts, ashes, sludges, slurries

• Fine grinding

• Preparation of carbon paste for graphite electrodes, anodes, cathodes

• Coal preparation :»

• eirich.de

11 www.steeltimesint.com March 2024 LATIN AMERICA UPDATE

eirich_half page vertical.indd 1 07/03/2024 11:08

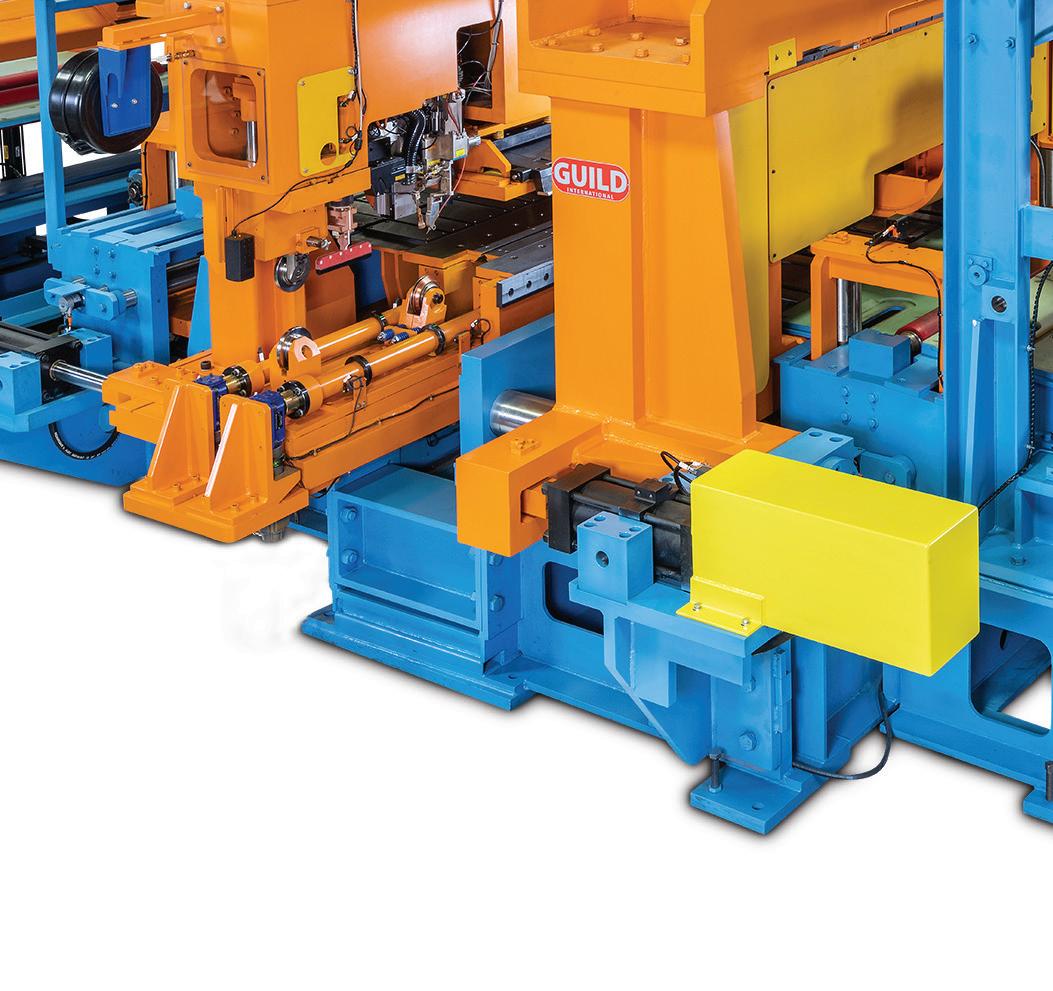

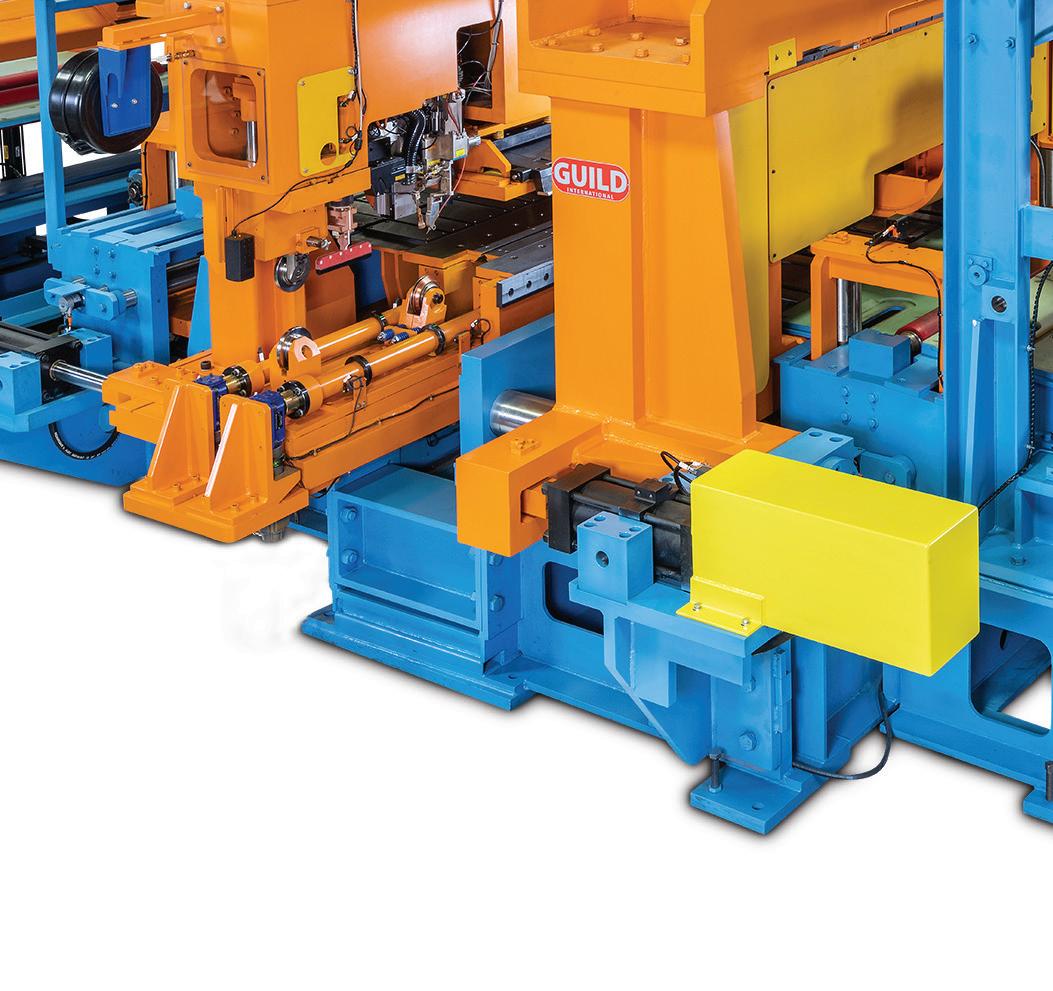

The most technically advanced coil joining equipment available. Period.

Guild International can design and build the welding machinery you need to keep your coil processing lines up and running smoothly and profitably. We are the world leader in supplying highly-engineered coil processing equipment known for reliability and performance. Contact us today to begin designing the perfect coil joining equipment for your processing lines.

For more information, visit our website at www.guildint.com or call +1.440.232.5887

World Leader in Coil Processing Equipment for the Steel Processing, Tube Producing and Stamping Industries Since 1958

Banking on capex

Increased investment in India’s steel industry continues to drive demand, and enhance operating capacity. By Dilip Kumar Jha*

SLIPPING by 9% in the financial year (FY) 2022-23 (April-March), India’s government-owned Central Public Sector Enterprises (CPSEs) have secured INR 133 billion (~INR83.2 = US$1) capex for FY 2024-25. This allocation aims to expedite the completion of stalled and under-construction projects and increase demand for additional allocations to help the country achieve an overall production capacity of 300Mt/yr by 2030-31, as envisaged in the National Steel Policy, 2017. During FY2022-23, steel CPSEs achieved a capex of INR 105.26 billion, the highest in the past five years, out of the total allocations of INR 115.9 billion.

Against the capex target of INR 103.01 billion for FY 2023-24, steel CPSEs achieved a figure of INR 54.15 billion, i.e. just 52.6%, during April-November 2023. The capex target is being monitored regularly for the timely completion of projects and to achieve the physical and financial milestones. The government is making all efforts to ramp up production of crude and specialized steel to make India ‘aatmanirbhar’ (self-reliant) and reduce imports. The capex on CPSE projects yields a multiplier effect on private investment in the core steel production and its upstream and downstream segments.

Additionally, India has approved the inclusion of ‘specialty steel’ under the Production-Linked Incentive (PLI) scheme, with a five-year financial outlay of INR 63.22 billion to promote the manufacturing

of this sector within the country by attracting capital investment and promoting technology upgrades in the steel sector. The government signed a memorandum

of understanding (MOU) with 57 companies, covering 67 applications from 30 companies for different categories of specialty steel under the PLI scheme. The

*India

13 www.steeltimesint.com March 2024

International Estimated steel consumption in India’s various infrastructure projects on completion Project details Volume (Mts) Pradhan Mantri Awas Yojana (Urban+Gramin) 70-80 Bharatmala Project 25.1 Sagarmala Project 23.5 Jal Jeevan Mission 18.5 Expansion of gas pipeline network 12.0 UDAN-100 additional functional airports 8.0 National Solar Mission 4.5-5.0 Metro network in 50 additional citiesSmart Cities MissionSource: Ministry of Steel, Indian government Note: Pradhan Mantri Awas Yojana (Urban+Gramin) Prime minister, housing scheme Major Central Public Sector Enterprises (CPSEs) investment (INR billion) Steel mills 2020-21 2021-22 2022-23 2023-24* Steel Authority of India Ltd (SAIL) 42.83 60.13 54.74 68.00 National Mineral Development Corporation (NMDC) 16.22 11.98 14.01 16.00 Rashtriya Ispat Nigam Ltd (RINL) 7.37 7.39 5.81 7.01 Manganese Ore India Ltd (MOIL) 1.37 2.16 2.45 2.95 Kudremukh Iron Ore Company Ltd (KIOCL) 0.41 0.29 4.23 8.05 Source: Ministry of Steel, Indian government; Financial year (April-March), *Estimated; $1= INR83.2 Indian steel Production^ (million tonnes) Category 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24* Pig iron 6.41 5.42 4.88 6.26 5.86 4.14 Sponge iron 34.71 37.10 34.38 39.20 43.62 29.10 Total finished steel 101.29 102.62 96.20 113.60 123.20 77.78 Source: Joint Plant Committee; ^April-March period; *April-October 2024

correspondent, Steel Times

INDIA UPDATE

PLI scheme is set to commence from FY 2023-24, with funds to be released in FY 2024-25. These companies have committed an investment of INR 295.30 billion with a downstream capacity addition of 25Mt/yr. Also, capex was raised to develop enabling infrastructure to drive demand and enhance the operating capacity of domestic steel mills which have remained between 7782% in recent years.

Among bulk material transportation pipeline projects, the Paradip Slurry Pipeline project by Essar Minmet is expected to attract an investment of $880.31 million and to commence by September 2024.

Similarly, Joda Slurry Pipeline with a capex of $1.06 billion will be completed by June 2024, Joda to Kalinganagar Slurry Pipeline Project with a capex of $405.89 million by December 2026, and NMDC Slurry Pipeline Project Phase 1 with an investment of US$365.53 million will be completed by May 2025. Additionally, private steel mills such as JSW Steel, Tata Steel, and a host of others have announced a substantial capex to benefit from the infrastructure growth.

Mitigating adverse pandemic effects

The large capex across infrastructure development aims to mitigate the impacts of the Covid-19 pandemic, which dampened consumer sentiment (from 2019-end to 2021-end). Governmental and private investors waited for the receding of Covid-19 cases to restart construction work on stalled and under-construction projects. Fresh investment during this period came to near zero across all sectors, including infrastructure development, automotive, and manufacturing, with steel being no exception.

However, the government ramped up investment towards the end of FY202122, especially in the peak demand season towards 2022-end by prioritizing capex across CPSEs to revitalize the Indian economy from the Covid-19-induced contraction. To recover production loss and boost the economy, the capex for CPSEs was allocated to the tune of INR 101.47 billion but spent INR 84.95 billion in FY 2021-22. Given the importance of capex in strengthening infrastructure and enhancing production capacity in the post-pandemic period and the significantly higher targets set for the current year, the government is examining the progress regularly.

Additionally, the government is also addressing the inter-ministerial issues for faster implementation of capex projects. These targets aim to motivate the workforce, enhance India’s steel production, and spur higher growth.

Budget bang

India’s Finance Minister Nirmala Sitharaman, allocated INR 11.11 trillion (~US$133.87 billion) capex for infrastructure creation in the Interim

Budget 2024-25, representing over 11% increase from INR 10 trillion allocated in FY 2023-24. The government aims to achieve a $5 trillion economy by 2024-end, with an enhanced focus on infrastructure. These allocations are intended for the development of projects in housing, roads, railways, and airports, to boost steel demand. According to Ranen Banerjee, partner, and leader for economic advisory at PwC India, these allocations should provide continuity in the pace of infrastructure creation and in bringing down logistics costs in India progressively. Alok Sahay, secretary general of the Indian Steel Association, stated, “The government’s focus on infrastructure development will result in robust steel demand, attracting investments and job creation, leading to unprecedented growth in the next five years.”

Steel is a deregulated sector, and therefore, the government acts as a facilitator by creating a conclusive policy environment for the development of the entire sector.

The National Steel Policy envisions the development of a technologically advanced and globally competitive steel industry, providing an environment to attain selfsufficiency by offering policy support and guidance to domestic producers.

The National Steel Policy aims to achieve a production capacity of 300Mt/yr, crude steel production of 225Mt/yr, and per capita finished steel consumption of 158 kgs by 2030-31.

Presently, India stands at a steel production capacity of around 165Mt/yr, finished steel production of 124Mt/yr, and per capita consumption of 86.7 kgs. �

www.steeltimesint.com March 2024 INDIA UPDATE 14

THERE ARE ONLY BENEFITS WITH OUR ELECTRIC HEATING SOLUTIONS!

Steel is going electric: Are you part of the change?

TEMPERATURES 1,850°C

ZERO CO ²

95% ENERGY EFFICIENCY EMISSIONS

100%

SILENT

Download our litepaper Electric heating in numbers by scanning the QR-code.

PRECISION

TEMPERATURE

+/- 1°C

BIGGER . STRONGER .

BETTER TOGETHER .

WOODINGS AND SUPERIOR HAVE JOINED FORCES!

woodings.com // smco.net

BIGGER.

STRONGER. BETTER FOR YOU.

Superior Machine has joined the Woodings’ group creating the most capable hot metal equipment supplier group in North America. Offering the combined knowledge, engineering, manufacturing, and construction expertise for all your equipment needs.

BLAST FURNACE, BOF, EAF AND CASTER.

Wherever hot metal is produced, you will find equipment from Woodings, Superior Machine, and

Munroe operating at the highest level in the most demanding conditions. Our products and professional installation services reduce downtime and extend campaign cycles.

SOLE SOURCE VALUE.

We can provide you with more value than ever before from concept to installation, service to replacement, our size, scope, and experience gives us a unique ability to help you increase productivity and solve problems.

We are better together. Let us show you.

WORLD CLASS EQUIPMENT FOR HOT METAL

Ferrexpo undaunted by Ukraine War

Ferrexpo undaunted by Ukraine War

While the war in Ukraine continues to affect those at the front line in the worst possible way, enterprises operating there have needed to make changes. Michael Schwartz* explains how iron-ore pellet-producer Ferrexpo is rising to the challenge.

MOST immediately, Ferrexpo’s pelletproduction figures for H12023 are 57% higher over H12022, topping 1.96Mt. In this respect, Ferrexpo has two advantages.

First, as the company pointed out to Steel Times International, “Ferrexpo is blessed with high-quality ore reserves, which mean that the average grade of the Group’s iron ore production in 2022 was 65% iron for premium blast-furnace pellets (5.7 Mt) and 67% iron for Direct-Reduction (DR) pellets (353kt). This is significantly higher quality than the industry average.”

Secondly, the company offers DirectReduction (DR) pellets, which obviate the need for sintering, the practice required for 62% of all iron ore consumed last year.

And the effects of the war?

Steel Times International asked Ferrexpo whether the fighting in Ukraine has deterred any further forms of development, exploration or investment. The company pointed out that such activity was halted, Ferrexpo’s regional marketing manager (Middle East) Aly Mansour replying:

“Following Russia’s invasion, Ferrexpo paused its Wave 1 production expansion programme, which would have added 3 Mt/yr of pellet production, in order to focus on supporting staff and local stakeholders, and right-size the business to ensure a continuation of operations.’’

While the image of Ukraine is one of a country that is engulfed in conflict, it should be mentioned that Ferrexpo’s operations

are based in central Ukraine, a region that continues to be served by transport and power infrastructure and is away from the front lines. One factor that has been affected is the transportation of the iron ore. Mansour again: “Our strategy of moving early and right-sizing our business – so that we are more responsive to everchanging circumstances – is working. While our primary seaborne export route through the Ukrainian Black Sea ports has been unavailable since the full-scale invasion, the Group has been able to transport the ore to premium European customers via rail and barge and to export to global seaborne customers via alternate logistics routes.”

Ferrexpo also informed Steel Times International that it continues to assess the cost-effectiveness of alternative seaborne options, notably shipping out of nonUkrainian Black Sea ports. The company is assessing the potential opening of a safe corridor from Ukrainian Black Sea ports and the associated safety and costs.

Green issues have not been forgotten Ferrexpo has not allowed the war in Ukraine to deflect from its drive towards supplying pellets, which have the potential to contribute to the manufacture of lower emission steel. It sums up its achievements as follows: “the Group has been able to upgrade its Scope 1 and Scope 2 carbon emissions reduction target to a 50% reduction by 2030 (previously 30%) and to net-zero by 2050, as well as broaden the

*Iron ore correspondent

Group’s emissions target to include Scope 3 emissions. High grade iron ore pellets, such as those produced by Ferrexpo, are known as a direct charge material, which means they can be placed directly into blast furnaces and do not require the additional sintering process which uses coal. This, added to the high iron quantity, means that Ferrexpo pellets can help reduce carbon emissions by 40% for every tonne of sinter fines replaced with pellets.”

What is more, Ferrexpo points out that DR grade pellets for DR iron/electric arc furnace steelmaking reduce the company’s Scope 3 emissions for steelmaking by 49% for every tonne produced. Such DR pellets represented 6% of the company’s production, itself 50% up over 2021.

Would Ferrexpo look elsewhere?

Aly Mansour answered this question as follows: “Ferrexpo is fortunate to have the licences to some of the largest quality magnetite ore deposits in the world, and established operations with a 50-year heritage. It would be difficult to replicate the quality reserves and operations to produce premium quality iron ore pellets anywhere else. Furthermore, Ukraine is uniquely well-positioned to serve the established MENA and growing European markets.”

The bottom-line comment is his: “We remain a significant contributor to Ukraine’s export economy, representing 3% of total exports by value in 2022.” �

IRON ORE 17 www.steeltimesint.com March 2024

Trends and policies Trends and policies

Steel continues to be a pillar of the global trade landscape, supporting industrial growth and forming the backbone of national infrastructure. India’s steel capacity has now surpassed 161Mt. In the fourth Indian Steel Association (ISA) Steel Conclave, steel secretary Nagendra Nath Sinha highlighted that the steel industry is projected to grow. The steel trade is navigating a sea of trends and policies, including economic shifts, environmental imperatives, geopolitical dynamics, and more. Let’s take a closer look at the global steel trade trends and what shapes trade policies. By Kairavi Mehta*

TRADE policies, specific tariffs, and trade barriers have a significant impact on how the world’s steel trade is shaped. The dynamics of international trade have become even more complex as a result of trade tensions between the major steelproducing countries, which have led to the imposition of tariffs and anti-dumping measures. The need for green steel, rising carbon prices, and new technologies are all driving changes in the global market. Asian manufacturers have to choose between putting money into antiquated coal technology and putting themselves at the forefront of the transformation of the steel industry.

Global issues

The United States has played a vital role in this field by imposing tariffs on imports in order to stand by its own industries. Globally, these policy decisions have an impact on end-user cost structures and the business plans of steel producers. Recently, former US president, and current presidential nominee Donald Trump mentioned in his 2024 presidential

campaign that he would propose a fouryear plan to phase out Chinese imports of essential goods, including electronics, steel, and pharmaceuticals. Steelmaking, in general, has several areas of improvement and vital agendas to look into, especially in terms of reduction in carbon emissions.

Eiji Hashimoto, president of Japan’s biggest steelmaker, Nippon Steel, said in an interview that if the conflict between Russia and Ukraine lasted for a long time, it would have a huge impact on the demand for steel globally. Hashimoto also emphasized that global steel trade will be impacted due to Russia and Ukraine both having a big presence in the market.

Prior to the Ukraine crisis, Hashimoto highlighted three factors that led to the dent in steel demand – China’s slowdown, the global chip shortage, and soaring energy and natural resources prices. These risks have grown bigger due to the Russia-Ukraine conflict and it will have a massive impact on global steel demand. Similarly, the ongoing Israeli-Palestinian conflict is also expected to impact India’s steel industry, said Shri Sanjeev Agrawal,

* Executive director, VK Industrial Corporation Ltd.

the president of the PHD Chamber of Commerce and Industry (PHDCCI).

Policy implications: managing environmental resources

The environmental impact of the steel industry is coming under more and more scrutiny. Trade policies are increasingly incorporating environmental standards as countries make commitments to ambitious climate goals. The future of the global steel trade is expected to be shaped by nations that impose strict environmental regulations, as they will have an impact on sustainability practices, emission standards, and production methods. Adoption of lowcarbon technologies, collaborative efforts, and green practices are critical for ensuring long-term sustainability while aligning with national and international environmental goals.

Similarly, investing in innovation and newer technology is propelling the steel industry to new heights in the Industry 4.0 era. Digitalization, automation, and artificial intelligence are revolutionizing production processes and increasing efficiency. To

GLOBAL MARKETS 18 www.steeltimesint.com March 2024

remain competitive and sustainable, players in the global steel trade need to adjust to these technological developments.

Here are 10 crucial factors that are shaping the global steel trade trends in 2024:

• China’s dominance: No discussion of global steel trade is complete without mentioning China’s formidable presence. The Asian behemoth has long dominated both the supply and demand sides of the steel equation. While China’s mammothsized construction endeavours continue to drive domestic demand, its steel exports have global ramifications, influencing market dynamics and pricing globally. However, in recent years, China has taken steps to reduce excess steel production and address environmental concerns. This shift is upending the conventional narrative, having an impact on both domestic and international steel markets.

The effects on the global steel trade are unavoidable as China navigates its own economic rebalancing. China, as the biggest manufacturer and consumer of steel, continues to play a key part in the global steel trade. China’s economic policies, output levels, and rapidly building infrastructure all have a direct effect on global steel trends.

• Tariffs and trade disputes: Ongoing trade disputes between major steelproducing countries, particularly the United States, have resulted in the imposition of tariffs and trade barriers. These measures have an impact on the flow of steel across borders and add to market uncertainty.

• COVID-19 Impact: COVID-19 has disrupted global supply chains and impacted steel demand. Steel trade has been influenced by lockouts, reduced economic activity, and fluctuations in the construction and manufacturing sectors.

• Infrastructure development: Steel demand is driven by global infrastructure projects, particularly in emerging economies. The emphasis on construction, urbanization, and transportation projects in regions such as Asia and Africa has an impact on the global steel trade landscape.

• Environmental concerns: The growing emphasis on environmental sustainability is having an impact on steel trade trends. Countries are enacting

stricter environmental regulations, which are influencing production methods and material selection in the steel industry.

• Trade balance changes: Changes in the trade balances of major steel-producing and steel-consuming nations have an impact on the global steel market. Changes in manufacturing capacity, export volumes, and import reliance all contribute to changing trade dynamics.

• Technological innovation: The steel industry is being transformed by the adoption of Industry 4.0 technologies such as automation, artificial intelligence, and digitalization. This innovation improves production efficiency, quality control, and overall market competitiveness. In addition, the Indian government has been a proactive catalyst for technological advancement in the steel sector. Initiatives like the ‘National Steel Policy’ emphasize the importance of technology infusion in order to boost competitiveness, improve energy efficiency, and reduce the industry’s environmental footprint. Subsidies and incentives are frequently offered to encourage the adoption of cleaner technologies and best practices.

• Price fluctuations in raw materials: Price fluctuations in raw materials, particularly iron ore and coking coal, have an impact on the cost structure of steel production. Variations in these prices can have an impact on the competitiveness of steel-exporting countries.

• Trade treaties and alliances: Regional and bilateral trade treaties, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), shape the terms of steel trade among participating countries.

• Demand from automotive sector: Steel demand is influenced by the automotive industry’s transition to electric vehicles and lightweight materials. The types and quantities of steel traded globally are impacted as automakers seek innovative materials for sustainability and fuel efficiency.

Roadmap ahead

The manufacturing sector of the steel industry has observed a compound annual growth rate (CAGR) of 7% - 8%, anticipated to drive the increasing demand for it in the sector. On a myopic level, India’s domestic steel demand is estimated to grow annually by 7.5% to reach 128.8Mt in the current financial year. As per the National Steel Policy, India has an ambitious target of installing 300Mt steel capacity by 2030.

Conclusion

Adaptability and foresight become essential as the global steel trade weathers the storms of changing trends and policy impacts. The steel industry’s boundaries are defined by trade laws, technological developments, and geopolitical changes that affect stakeholders, from producers to consumers. It takes a sharp awareness of the world at large and a proactive strategy to take advantage of opportunities when faced with obstacles to successfully navigate complex waters.

Reducing energy use and debris is vital in this industry because it produces a lot of waste and uses a lot of energy. Additionally, the development of cuttingedge technologies aid in the enhancement of steel bar manufacturers’ operations, the reduction of their carbon footprint, and their competitiveness in the world market. Those who embrace innovation, sustainability, and strategic collaboration will emerge as captains of a resilient and prosperous global steel industry in the ever-changing seas of international trade. Innovation and a sustainable approach is necessary for the steel industry to expand.

�

19 www.steeltimesint.com March 2024

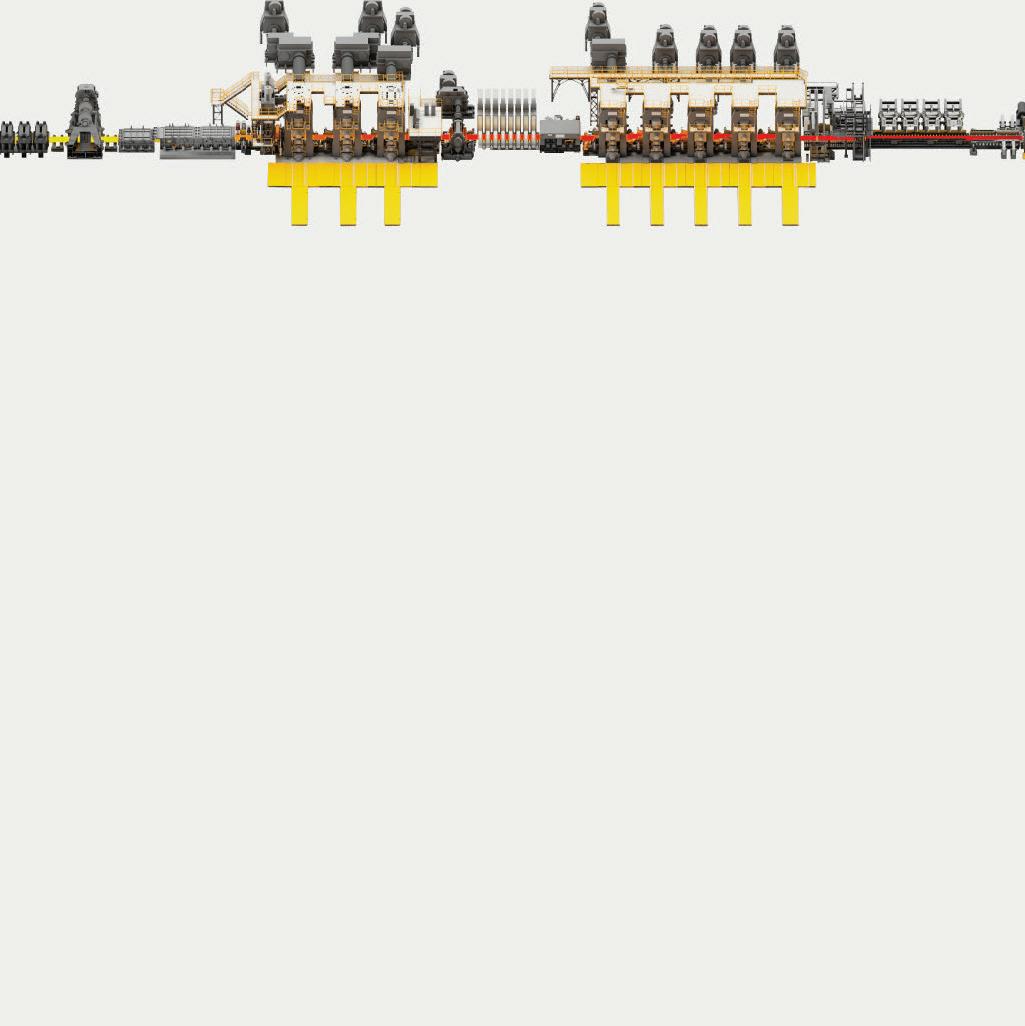

DAN IELI T R U E GRE EN ME T A L Buy the Original MIDA–QLP QSP–DUE Danieli Headquarters in Buttrio, Udine, Italy www.danieli.com Italy, Germany, Sweden, Austria, France, The Netherlands, UK, Spain, Turkey, USA, Brazil, Thailand, India, China, Japan @danieligroup

MIDA–QLP

and QSP–DUE

are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE Equipment and layout may be copied, but experts know that details make the difference.

Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

Challenges and strategies

The steel sector is a foundation of modern society and is present in many aspects of our lives. The industry has over the last decade been facing increased environmental and climate pressure to lower its carbon footprint while remaining economically competitive. Decarbonizing this sector is challenging but nevertheless key for achieving climate goals. OECD data has shown that the sector accounts for around 6-8% of man-made global emissions

energy sector. There have been efforts to decarbonize iron and steel production globally, and this article examines those challenges along with the strategies available to industry to achieve low-carbon and, ultimately, green steel in the coming decades.

By Aliyu Aliyu1 Dirk Schaefer2, Amire Bdiee1, Peter Warren3 and David Talbot4

1. The road to decarbonization: current status

The global steel industry is a major carbonemitting industrial sector and accounts for 6-8% of global anthropogenic CO2 emissions from the energy sector [1], [2] Decarbonizing this industry globally is essential to meeting the overall goals of the United Nations Paris Agreement (COP21) to limit global warming to well below 2°C above pre-industrial levels [3]. To achieve this target requires immediate action and innovations need to be brought on-stream quickly. Highlighted in the agreement is the urgency of raising ambition for decarbonizing industrial production using ‘breakthrough’ technologies. Steel was specifically mentioned as one of the key industrial sectors where progress in implementing carbon ‘near-zero’ technologies will deliver towards achieving CO2 emissions and global warming goals. It has been calculated that this involves reducing emissions in steel production by 90% from 2020 levels by 2050 [4]. However,

the OECD [2] has highlighted that while the steel industry has made progress in several areas, the sector is not on a trajectory to achieving decarbonization. This involves reducing the current global total of more than 2,800 MtCO2 per year [5]–[7] and is a difficult endeavour as worldwide steel consumption has been growing steadily over the years, driven by demand from economies such as China and India.

In 2019, global steel consumption was 1,800 Mt, an increase of 3% over 2018 consumption[3]. While China is the largest exporter of steel products, Japan is the largest importer fuelled by its strong export vehicle and machinery manufacturing sector[8]. The same can be said for most industrialised countries with a strong export market for steel products. Hence, to achieve decarbonization, the sector requires deep transformation since technological solutions currently available only provide limited mitigation capability [9]. As steel is an internationally traded product any ambitious decarbonization

policies will have international implications. Difficulties include the huge capital outlay in the processes capable of operating in extreme conditions and at massive scale, the nascence of many decarbonization technologies such as carbon capture and green fuel systems which are still at laboratory or pilot stage and scaling them up is an equally huge issue. Fig 1 shows that most green steel projects and initiatives are situated in Global North countries, however, the bulk of demand for steel (though not necessarily all green) will likely be from emerging and developing economies.

These highlight the magnitude of the challenge facing steel if targets are to be achieved to reduce emissions by 90% by 2050 based on 2020 levels. While the steel industry is beginning to tackle the problem, spreading zero-emission steel technologies worldwide requires responding where most of the future steel production will come from. So far, mature countries in Europe, are leading this charge. The steel industry

DECARBONIZATION 22 www.steeltimesint.com March 2024

1 School of Engineering, University of Lincoln, Brayford Pool, Lincoln, LN6 7TS, UK 2 Faculty of Science and Engineering, University of Hull, Cottingham Rd, Hull, HU6 7RX, UK 3 Binding Solutions Ltd, Materials Processing Institute, Eston Road, Middlesbrough TS6 6US, UK 4 CATCH UK, Redwood Park Estate, Stallingborough DN41 8TH, Grimsby, UK

from the

is a focal point of political considerations in most developed nations especially given its central role in climate policy. It is paramount to achieving international targets of COP21 and other multi-lateral agreements. Nevertheless, decarbonizing steel production is not without significant challenges. As a result, this article aims to examine the main issues surrounding the decarbonization of the global steel industry and will assess the possible pathways available for producers to achieve lowcarbon footprint production of iron and steel.

1 Challenges facing the industry’s decarbonization

There are a myriad of economic and technological challenges hampering decarbonization efforts in the global steel industry. While trade barriers, and volatility in raw material prices are wider issues for the sector, the main economic challenge hindering decarbonization initiatives include securing sufficient public and private sector investment to power relevant projects.

1.1 Technological and carbon accounting challenges

There are several technological challenges needed to realise low-carbon steel and these include adequately increasing the energy efficiency of current processes, the difficulty of scaling up green technologies (fuels and CCUS), and sufficiently utilising the enabling automation and digitalisation

technologies. Other challenges include hiding technologies behind patent protection walls hence inhibiting the sharing of Intellectual Property. Joint ownership is a solution, but fair negotiation of royalties is a complex business requiring the involvement of governments and multi-lateral international organisations, which can take years if not decades [11] –further complicated by differing standards in various jurisdictions. For example, while there has been several attempts at standardisation by the International Standards Organisation, the US, EU, UK, and China have their own carbon footprint accounting standards [12]. Consolidation is key to ensuring that technological solutions (in steel and other industries) deployed worldwide can be assessed

equally to evidence emissions reductions. In steel specifically, there has been a giant step in establishing industry-specific sustainability standards. Responsibility for the SASB Standards has been taken by the Iron and Steel Producers Sustainability Accounting Standard. Common definitions and measurements of greenhouse gas emissions, other air pollutants, water, and waste management, and those related to health and safety in the industry have been adopted in these standards [13]

1.2 Economic challenges

Trade barriers such as tariffs and quotas are affecting the global steel trade limiting producers exporting to certain markets to help generate much needed revenue – indirectly hampering the deployment of novel interventions. Indeed, scaling up from laboratory or pilot to commercial proportions are not always straightforward and can be fraught with uncertainty. Additionally, governments are grappling with the aftermath of the COVID-19 pandemic, fall-out from the energy crisis caused by the Ukraine war has precipitated an unprecedented global rise in the cost of energy and inflation. Investment in many economic sectors were hindered by massive workforce support schemes to cushion any effects in the last three years. Investment has hence been short to fund innovation and delivery of cost-competitive fossil-free energy projects. While full recovery from the two main shocks is expected within this decade, targets may have been set back a few years by the economic troubles caused by the pandemic and the ongoing war in Ukraine.

1.3 Challenges of digitalisation and skills

A report by McKinsey [14] surveying 30 leading metals and steel producers indicated that the major players have a digital programme and see it as a leading strategic priority. McKinsey’s survey showed that, although most players have already deployed digital and analytics programmes over the past few years which have begun to generate impact, there is still huge potential that remains unexploited. One is affected by what is termed the ‘pilot scale trap’ where a number of hurdles are hindering large-scale deployment of digitalisation tools. A lack of investment in capacity building is one hinderance.

DECARBONIZATION 23 www.steeltimesint.com March 2024

Fig 1. the global steel decarbonisation gap (source: Hermwille et al. [3] with data from the Green Steel Tracker [10])

Others are a requisite commitment from leaders, the struggle to keep digital talent in-house, and difficulty in securing scalable IT infrastructure. Branca et al. [15] noted that in Europe, the difficulties are slightly different. They found that along with adjusting digitalisation tools to the constantly changing nature of demand –which is a major issue – there is also the struggle to maximise plant performance while minimising maintenance times, preventing capital lock-up, and planning flexible production to guarantee timeliness of delivery to customers [10]. Furthermore, many countries are far behind Europe in the decarbonization journey. In economies such as Brazil, Saudi Arabia and the rest of the Middle East and South American countries, the road to digitalisation is not that advanced with widely differing progress. Increased investment in capacity building is required to advance digitalisation related to new low-carbon technologies in these countries.

2 Strategies for decarbonizing iron and steel

Decarbonizing the steel industry is a complex endeavour that requires significant investment in innovation and research and development (R&D). Just as the challenges facing the sector, potential solutions are both economic and technological in nature. Summarising the literature, a pattern has emerged, and five main solution pathways identified, namely: (i) the reduction or complete elimination of direct emissions in steelmaking plants (ii) reduction or the complete elimination of carbon emissions by using renewable electricity, sustainable coal alternatives, or low-carbon fuels such as hydrogen, and (iii) capturing CO2 emissions for utilisation to high value products or for underground storage. (iv) training and retraining of staff, mostly engineers and technicians, to facilitate the realisation of these technologies, and (v) sufficient counterpart investment from the public sector and at least match-funded by private investment. The foregoing can be broken up into specific technological interventions. The geographical spread of various interventions around the world is depicted in Fig 2 and are summarised below.

2.1 Carbon capture utilisation and storage (CCUS)

role in steel industry decarbonization – especially so during the transition to low-carbon steelmaking where electric arc furnaces, and hydrogen-fired furnaces, for example, or other technologies are in full use. Depending on the configuration, CCUS has the potential to reduce emissions intensity of the integrated steelmaking process by up to 60% [16]. While CCUS has not yet been widely integrated into the steelmaking process due to a myriad of technical and economic difficulties, it is anticipated that some of the problems will be overcome within the next two to three decades. Carbon capture also has the benefit of being a technology that can be applied across sectors, such as stationary power generation, cement production and chemicals processing. Therefore, breakthroughs made in other sectors, and

economies of scale from wider deployment across hard-to-abate sectors, may bring down costs for steelmakers.

2.2 Blast furnace hydrogen injection

Blast furnace hydrogen injection involves introducing hydrogen into the blast furnace through the tuyeres and can either be in the form of pure hydrogen or as hydrogenrich gases such as coke oven gas (which contains 50-55% hydrogen) or natural gas. Hydrogen injected through the tuyeres acts as a reducing agent to partially replace crushed coal injected into the blast furnace. Trials are being conducted by leading steelmakers such as ArcelorMittal, China BaoWu and ThyssenKrupp Steel [17]–[19]

While it is promising, injection rates are modest because of the cooling effect hydrogen has inside the blast furnace and carbon is still required to provide heat by gasification to CO. This restricts the possible emission intensity reduction of hydrogen injection to less than 20% [16]. Furthermore, blast furnace hydrogen injection forms part of Japan’s National COURSE50 (CO2 Ultimate Reduction in Steelmaking Process by Innovative Technology for Cool Earth 50) programme which aims to “capture, separate, and recover CO2 from blast furnace gas” [20]

2.3 Electric arc furnaces

An important additional strategy is the use of electric arc furnaces (EAFs) which can provide a massive decarbonization potential. EAF steelmaking uses scrap metal

CCUS is widely expected to play a critical Fig 2. location and scale of low-carbon steel projects worldwide (source: Vogl et al. [10])

DECARBONIZATION 24 www.steeltimesint.com March 2024

25 www.steeltimesint.com March 2024 HAVE SPARE PARTS AVAILABLE WHEN THEY ARE NEEDED If critical components fail, this can lead to unexpected machine downtimes. The resulting costs can be disastrous. To prevent this, we have expanded our spare parts warehouse. Consumables and high-demand spare parts are always kept in stock to ensure immediate availability. ASK FOR MORE: +49 271 401-3000 · aftersales@dango-dienenthal.de www.dango-dienenthal.de/en/service/spare-parts MORE SUPPLY REQUEST SPARE PARTS STOCK LIST: Making our world more productive Learn more at www.lindeus.com/steel For over a century, Linde has provided gases and energy-efficient technologies to support the steel industry. Today, Linde also successfully covers every part of the hydrogen value chain, including its use to decarbonize steel production. The Linde logo and the Linde wordmark are trademarks or registered trademarks of Linde plc or its affiliates. Copyright © 2024, Linde plc. 3/2024 Increased Efficiency Reduced Environmental Impact Visit Linde at AISTech Booth 1639

as the primary raw material. Its carbon emissions can be as low as 27% of that of other steel production methods at 0.6 t-CO2/t-steel (mostly due to the carbon footprint related to the electricity source) [21]. Therefore, the EAF is considered a critical and operable process in achieving low-carbon, sustainable or green steel if renewable electricity is used. The ratio of steel production based on the EAF route in China (the world’s largest emitter) is 10% while the global rate (excluding China) is around 48% [22]. In mature economies with a high scrap supply, such as the USA, the figure is over 70%. However, due to global demand exceeding supply of scrap, and the accumulation of residuals in scrap steel, ore-based metallics will be needed for many years to come. These are in the form of Direct Reduced Iron (DRI)/Hot Briquetted Iron (HBI) from direct reduction plants or hot metal from the blast furnace [23]. Additionally, renewable electricity can be used to make steel that is low-carbon via the EAF route. In many countries, renewables are not yet produced in sufficient capacity.

2.4 Blast furnace with low-carbon input and CCUS (for cement and glass industries)

There is room for blast furnace steel as its by-products can be important feedstock to other industries involved in cement and glassmaking. For example, between 250 and 300 kg of blast furnace slag can be produced per tonne of liquid iron. Slag is supplied to the cement industry as granulated blast furnace slag (GBS) which is then fine ground to produce ground granulated blast furnace slag (GGBS or GGBFS). GGBS is considered a high value cement (or mortar) alternative, in some cases an additive. Every tonne of GGBS saves the cement industry up to 900 kg of CO2 emissions[24] because cement production involves de-carburation of limestone in the furnace (producing ca. 525 kg CO2/tonne of clinker), burning of fuel in the furnace (ca. 335 kg CO2/tonne of cement) and use of electrical energy (ca. 50kg CO2/tonne of cement) [25]. The CO2 from converting CaCO2 to CaO has already been released in the blast furnace, hence, no further CO2 (chemistry-wise) is emitted and very little energy is expended to convert GGBS to cement or mortar use. Therefore, the whole life cycle and the extended supply chain needs to be considered. While GGBS

cement is being heralded as a miracle ultra-low CO2 cement, it will not be possible without the blast furnace. Hence, a wider inter-sector consideration needs to be made in considering decarbonization options and sectoral contributions to CO2 emissions.

2.5 Use of biomass

Biomass can be used across integrated steelmaking as a source of fuel or reductant, substituting coal or other fuels in the sintering process. This can be done as a blend component in the production of coke, as a direct replacement for coke or as an injectant to replace injected pulverised coal in the blast furnace, as well as being a carbon source in the steelmaking process. The use of sustainable coke alternatives such as certain biochars can be a suitable short-to-mid-term solution. When sourced from renewable resources, biomass has the potential to reduce emissions intensity by as much as 50% across the integrated steelmaking process. However, we believe 10%-20% is a more achievable objective

[16]. While biomass can play a part in decarbonizing the steel industry, it is not considered to have a long-term reduction potential due to a lack of availability of sustainable sources of biomass and competing demand from other industrial sectors such as farming.

2.6 Use of cold agglomeration technology

Cold bond agglomeration or briquetting is mechanical compacting and bonding (with appropriate binders) of iron ore particulates and was originally developed as a method of recycling arising from process waste dusts. More recently the technology has been further developed to agglomerate virgin iron ore to produce a product with technical properties that compare with those of an equivalent indurated pellet. A life cycle analysis has calculated the carbon intensity of such a pellet to be 0.04 t-CO2/tpellet compared to 0.13 t-CO2/t-pellet for an indurated pellet [26]

2.7 Energy efficiency

Energy efficiency can be achieved in the steel industry by retrofitting existing sites. This can be done by heat integrating heat sources and heat sinks within a site to improve efficiency and reduce heating and cooling utility demands. The most used methodology for achieving energy integration is through pinch analysis. Other competing process integration tools have been developed in recent years. Important energy efficient innovations in other sectors that can be brought to steel production include alternative heat recovery processes such as heat pumps and heat transformers, as well as the development of pinch analysis for the varied types of steel furnaces. Furthermore, pinch analysis should be used in the design of new processes and plants rather than only for retrofitting existing ones. Indeed process integration has been shown to go beyond the optimisation of heat exchanger networks [27]–[29]. In new engineering designs, further opportunities for energy efficiency improvement can be identified through water and hydrogen recovery that can significantly facilitate steel decarbonization. For example, by using top gas recycling, CO2 emissions could be reduced by almost 50% according to modelling studies [30], albeit the requisite process plant technology is yet to be developed.

DECARBONIZATION 26 www.steeltimesint.com March 2024

2.8 A brief UK roadmap

The UK has a roadmap for industrial decarbonization of which several UK steel manufacturers are funded to deliver on government initiatives, including through the Industrial Decarbonization Challenge (IDC). The Zero Carbon Humber (ZCH) Partnership is one of the winning bids under this initiative. It aims to create the world’s first net zero industrial cluster by 2040 [31] using mainly low-carbon hydrogen and carbon capture to accelerate efforts in the region under the Cluster Plans workstream of the IDC. For context, the Humber Industrial Cluster is the UK’s largest concentration of industries of which there are six major ones. Additionally, Humber is the most CO2 emitting of the country’s industrial clusters given that 12Mt of CO2 are emitted annually. The ZCH partnership is a shared scheme where infrastructure is shared among steel, refineries, chemicals production, thermal and biomass power generation plants. The plan includes building a pipeline network to carry hydrogen to sites in the cluster and carbon dioxide from emitters to permanent storage in an offshore aquifer below the seabed in the UK’s Southern North Sea. While some government decisions suggest that the ZCH project may be delayed [32], we highlight this as a flagship development that can pioneer other cluster plans all over the world. Indeed, since there are interdependencies between industrial concerns co-located in a region with similar decarbonization goals, such planning can help catalyse country plans to limit emissions not just from steel but industrially cross-cutting. These are echoed independently by researchers[1] and the UK government’s Industrial Decarbonization Strategy [33]

2.9 Strategies in summary

In the foregoing sections, several approaches that can be adopted to aid steel decarbonization have been highlighted. As the problem is multi-faceted and extremely intricate, it has to be stressed that implementing any of these solutions in isolation is simplistic and possibly reductive. The cases of GGBS and EAFs are cases in point and the future of low-carbon steel could well be a mix of the methods outlined in this article. Furthermore, while there are laudable practices worldwide, such as ZCH above, it must be stressed that good local decisions to suit local solutions could be an overall bad global solution.

As such, the problem of steel decarbonization needs to be tackled holistically across sectors and internationally with countries and companies working multi-laterally to share technologies, strategies, and policies.

3 Concluding remarks