SteelWatch on the future that lies ahead. We report from the Global Steel Dynamics Forum.

Pinkham on the US stainless steel market.

How Coolbrook decarbonizes high-temperature processes.

SteelWatch on the future that lies ahead. We report from the Global Steel Dynamics Forum.

Pinkham on the US stainless steel market.

How Coolbrook decarbonizes high-temperature processes.

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

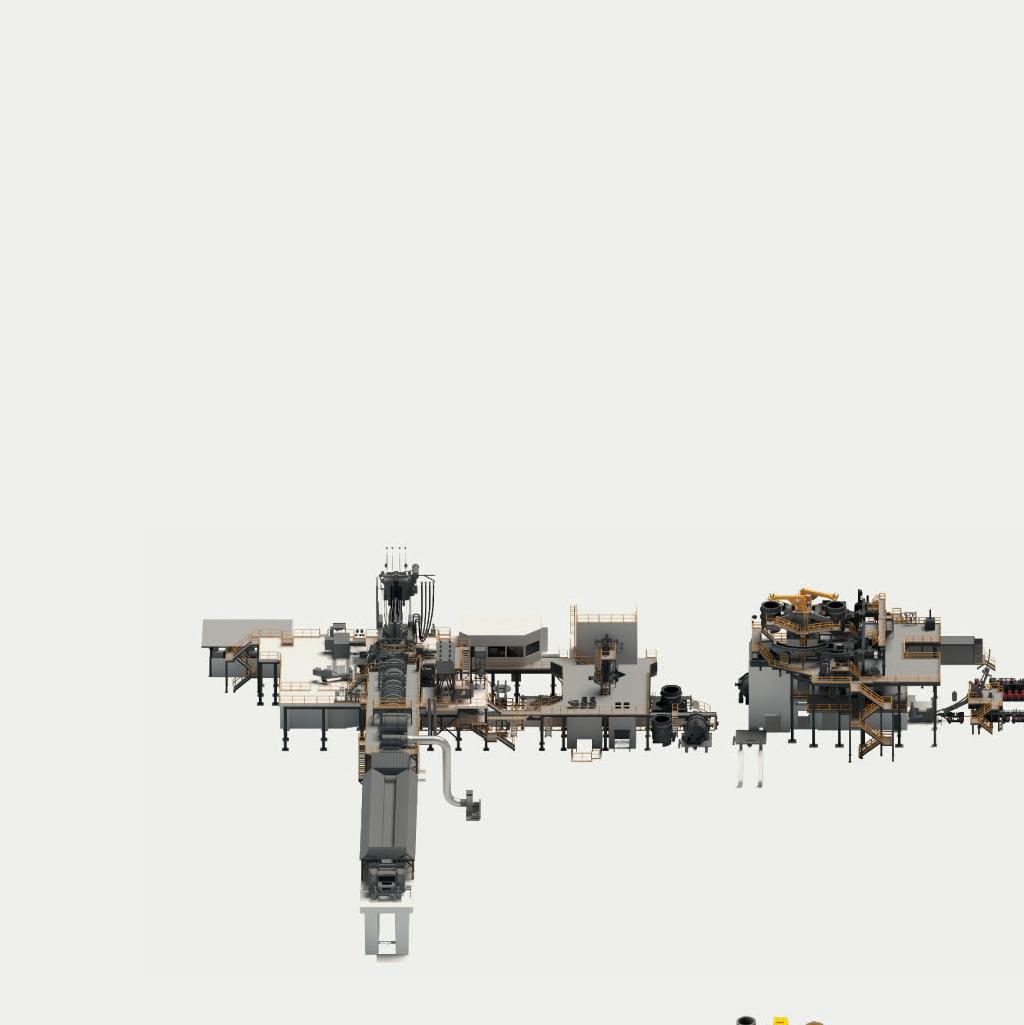

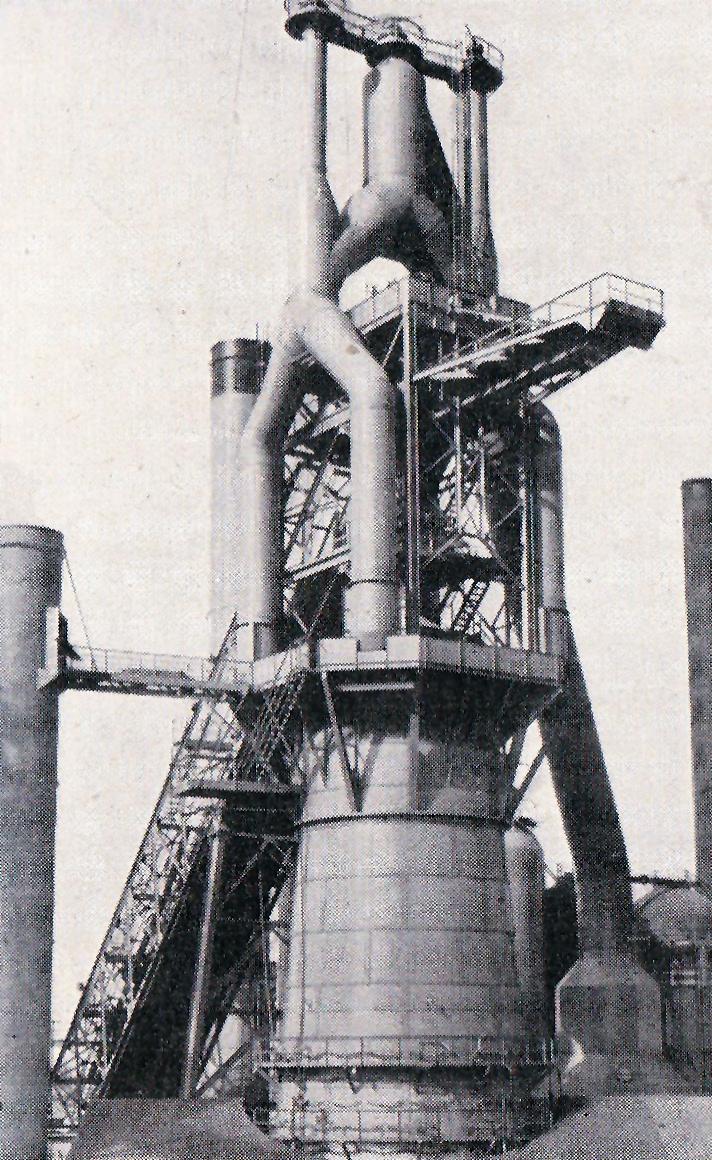

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

photo courtesy of

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

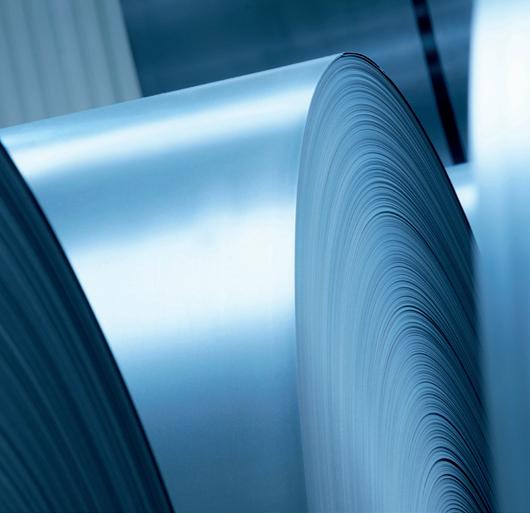

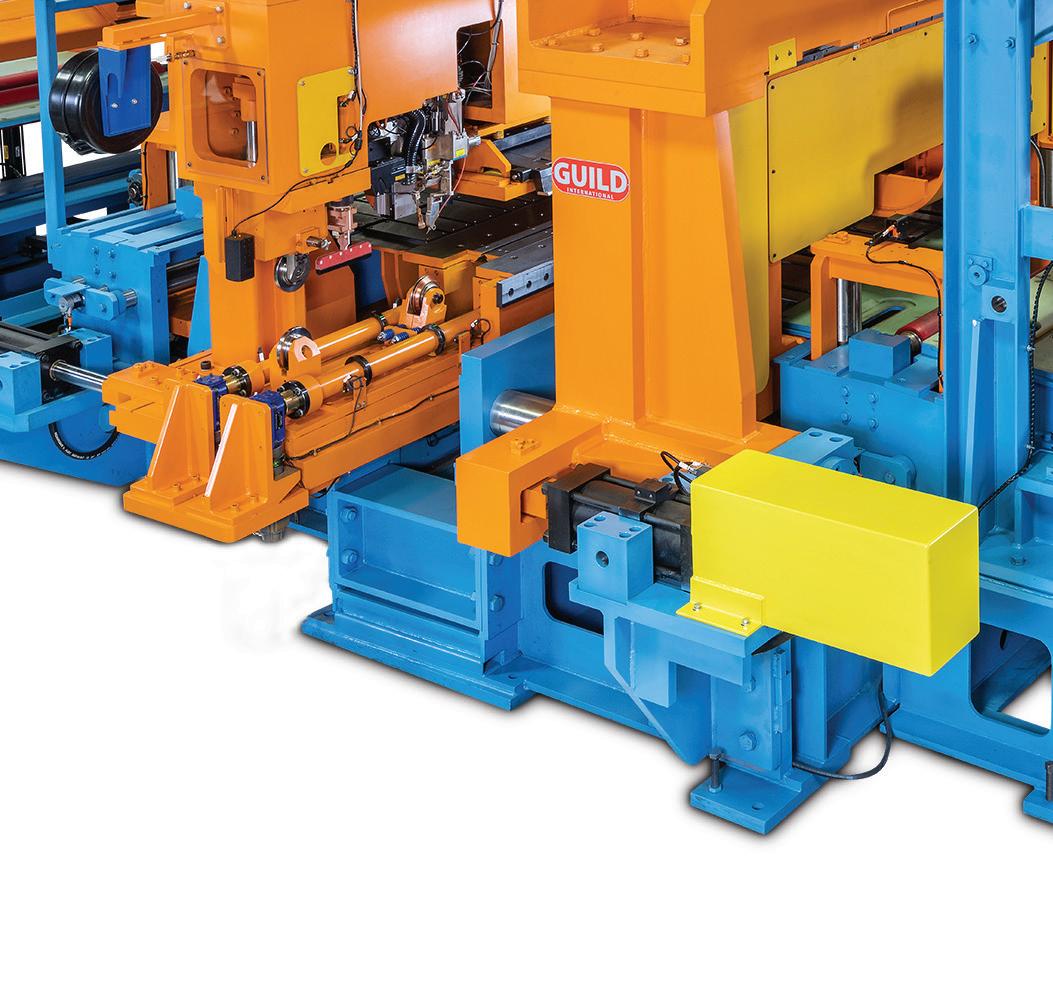

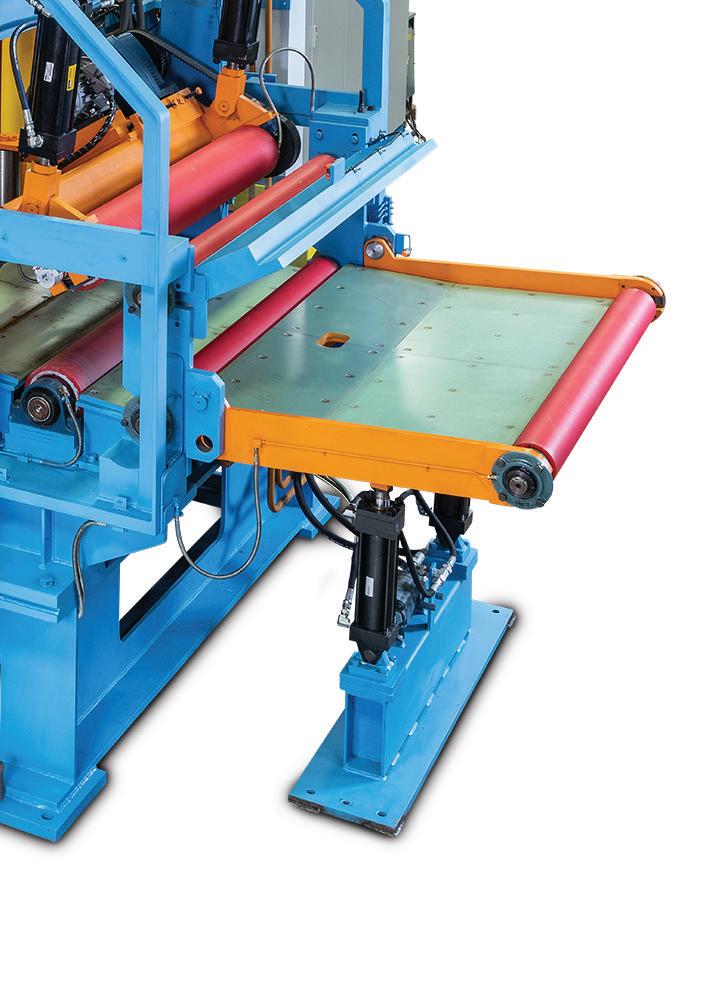

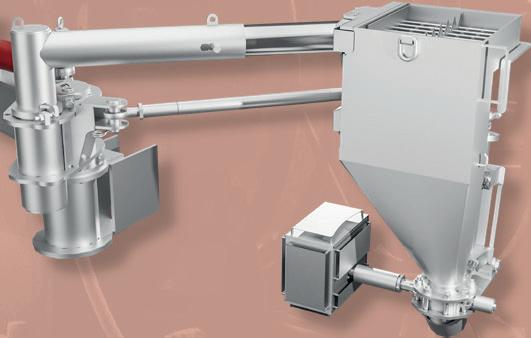

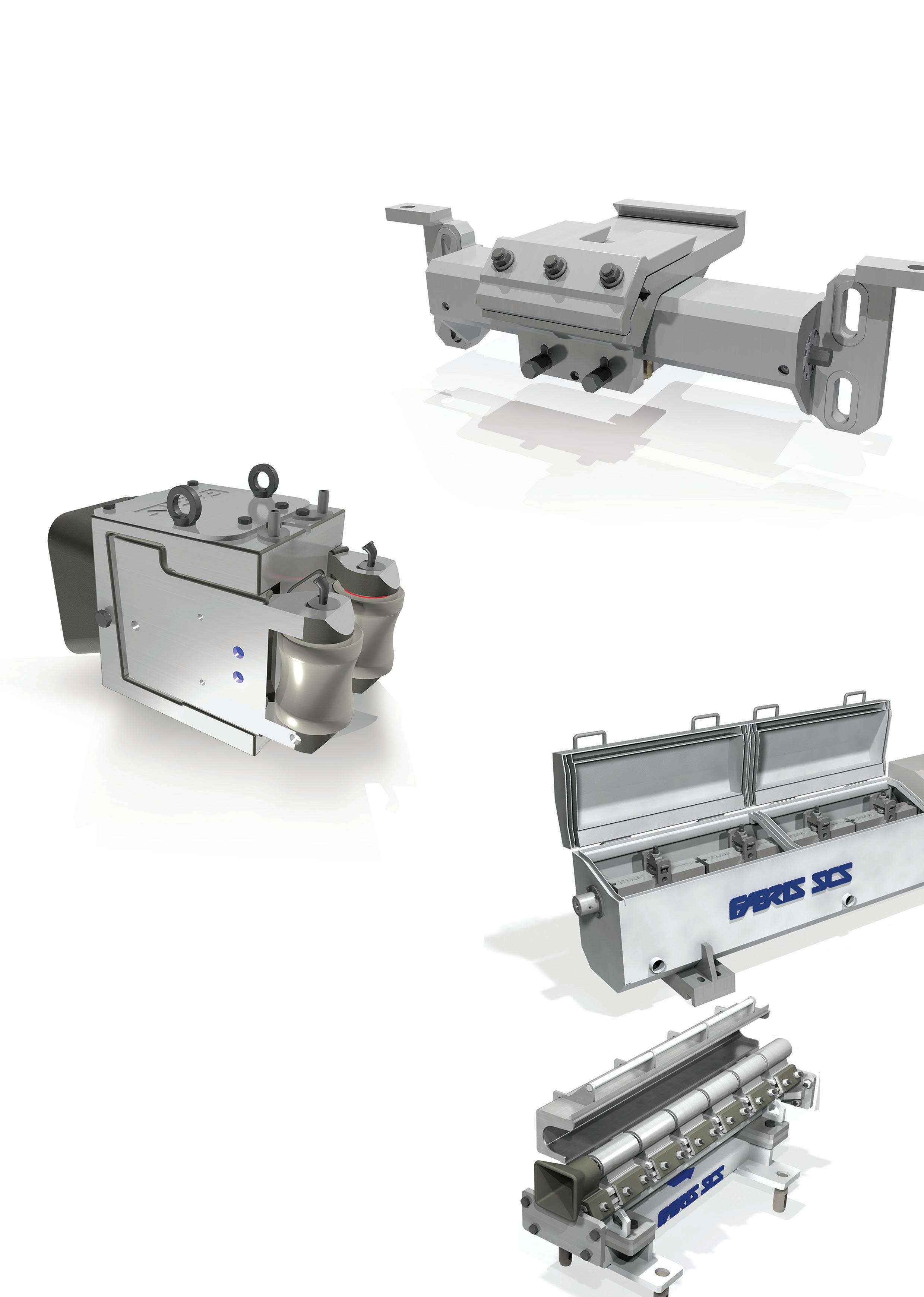

International Guild International has been an industry leader in the development of coil processing equipment used around the world in the steel processing, tube producing, and stamping industries since 1958. Guild has led these industries in innovative design and manufacturing processes to build cutting-edge equipment to aid companies improve production, reduce scrap, and become more efficient and profitable.

Matthew Moggridge.

The latest global steel news.

Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063 Web: www.stephensandgeorge.co.uk ©Quartz Business Media Ltd 2024

The latest products and contracts.

Innovations special

Harnessing RotoDynamicTM technology. 18

Latin America update POSCO and Tsingshan’s Argentine adventure.

20 India update Budget cheers for Indian steel producers. 22

African steel industry

Africa’s steel industry: plans and strategies.

Global Steel Dynamics Forum 2024

Big players, big issues.

Climate action

Just how different will future steel be?

Green steel

Groundbreaking success for sustainable mobility.

Special & stainless steels

Demand recovery ahead!

Digitalization

Pathways to green steel excellence. 50

Perspectives: Schaeffler

Shaping the transformation. 52 History

Dr. Tim Smith looks back at the history of Tata Steel’s Port Talbot plant in South Wales, United Kingdom.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

AUTOMATION & MECHATRONIC SOLUTIONS

Over the weekend I had two moments where I sat back and thought long and hard. The first was after returning from a trip to the supermarket where I spied an elderly lady working on the check-out. I think she’s great and for two reasons: one, she’s very friendly and nice, and two, she looks like the sort of woman who would make a really good roast dinner, somebody who probably makes her own gravy and might offer home-made apple pie and custard. I’ll never know, of course, because I don’t possess the cheek to ask her whether I could pop round of a Sunday and enjoy the fruits of her labour, it simply won’t happen and besides, I’m pretty good at making roast dinners myself although I doubt whether anybody would deduce this fact from my appearance, and perhaps I’m not the wizard I think I am at roast chicken, roast potatoes, greens and gravy followed by a traditional dessert.

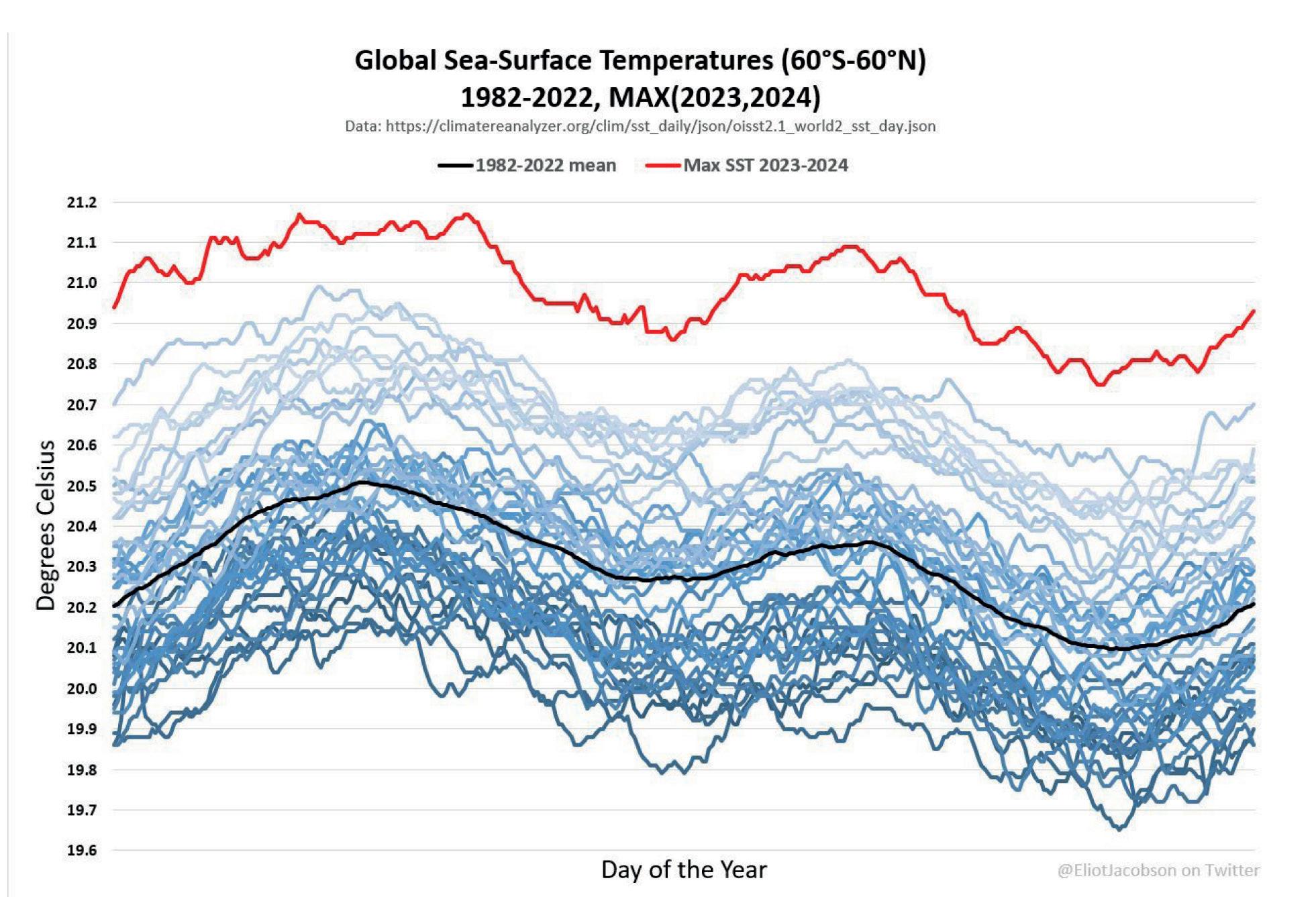

The second moment of deep thought came when I was told that somebody close to one of my family members believes that in the not-too-distant future we will all be underwater, meaning that the world will be flooded as a direct result of climate change, or rather the adverse effects of

climate change. At the moment, a lot of people joke about it, saying things like they’d welcome tropical summers in the UK as they wouldn’t have to go abroad for their holidays. Fair point, but I was taking the doom-laden view of global flooding, having read JG Ballard’s Drowned World, a book I highly recommend to anybody looking for something decent to read. Anyway, I was thinking along the lines of buying a boat instead of an electric car or perhaps ‘going direct to Mayfair without passing go’ and getting a houseboat on the Thames; that way, I could ready myself for when the floods begin: I’d just sail off into the sunset, possibly ride a few tsunamis, but by and large I would get away with it. I would probably try to find the woman from Waitrose, the one who I believe would make a good roast dinner, just in case I can’t, and invite her along for the voyage because life would be unbearable if I couldn’t enjoy such a meal as I headed towards the inevitable oblivion awaiting me and the rest of humanity. The message here is simple: we need to look after the environment and address the pressing case of climate change before it’s too late. See page 34 for more.

AIC has 50 years of experience in steel automation.

AIC offers state-of-the-art systems and technological solutions designed for meltshops, casters, long and flat rolling and processing lines.

We take care of every step from Power Control, PLC, HMI and level 2 systems, we also handle robotic applications, automatic tying machines for bundles and stacks, and manage every phase from design to after sales services

At SMS group, we have made it our mission to create a carbon-neutral and sustainable metals industry. We supply the technology to produce and recycle all major metals. This gives us a key role in the transformation towards a green metals industry.

DR. KEITH WALKER, 1963-2024

Dr. Keith D Walker, who recently passed away, adored working in the steel industry. Having been born in Skipton, Yorkshire, he grew up near Sheffield and studied metallurgy at Leeds University, eventually leaving in

1987 having completed a PhD concerning continuous casting.

He went to work for British Steel in Scunthorpe and stayed with the company through its various name changes, staying on the technical side and eventually becoming head of technology with Corus and finally group director of R&D Programmes, before setting up his consultancy Steelfolk. He served as secretary of the Lincolnshire Iron and Steel Institute between 1992-93, and as director from 2003 to 2014, eventually becoming president.

Keith loved the beauty and excitement of steelmaking and found it disappointing how so many people (including at government level) simply didn't understand steel's complexity, versatility and importance. He was often frustrated by incorrect portrayals of steel in film and on television, and metallurgical inaccuracies in many documentaries.

Away from work he played piano and enjoyed walking, tai chi, nature – birds and wild flowers in particular, good food and wine, music of all kinds (especially Pink Floyd) and following Test cricket.

Keith very kindly wrote a number of informative and accessible articles on metallurgy for Steel Times International

UK-based Cocoon, a climate technology company, which ‘enables steel and concrete to decarbonize in tandem’, has announced it has raised $5.4 million in pre-seed funding from Wireframe Ventures, Celsius Industries, Gigascale Capital and SOSV. The company will use the funding to scale its engineering and science teams, accelerate commercialization efforts, and build an industrial lab and demonstrator plant in the UK.

Source: Reuters, 8 August 2024.

Chile’s largest steel mill has said it will shut down in the face of competition from cheap Chinese imports, in a blow to the country’s government, which had imposed tariffs on China earlier this year in a bid to save it. Chilean steelmaker CAP, which runs the Huachipato mill in Chile’s central BiobÍo region, said that it would shutter its steel operations ‘indefinitely’ by September, blaming an influx of imports from China for more than $500 million in losses over the past two years.

Source: The Financial Times, 7 August 2024.

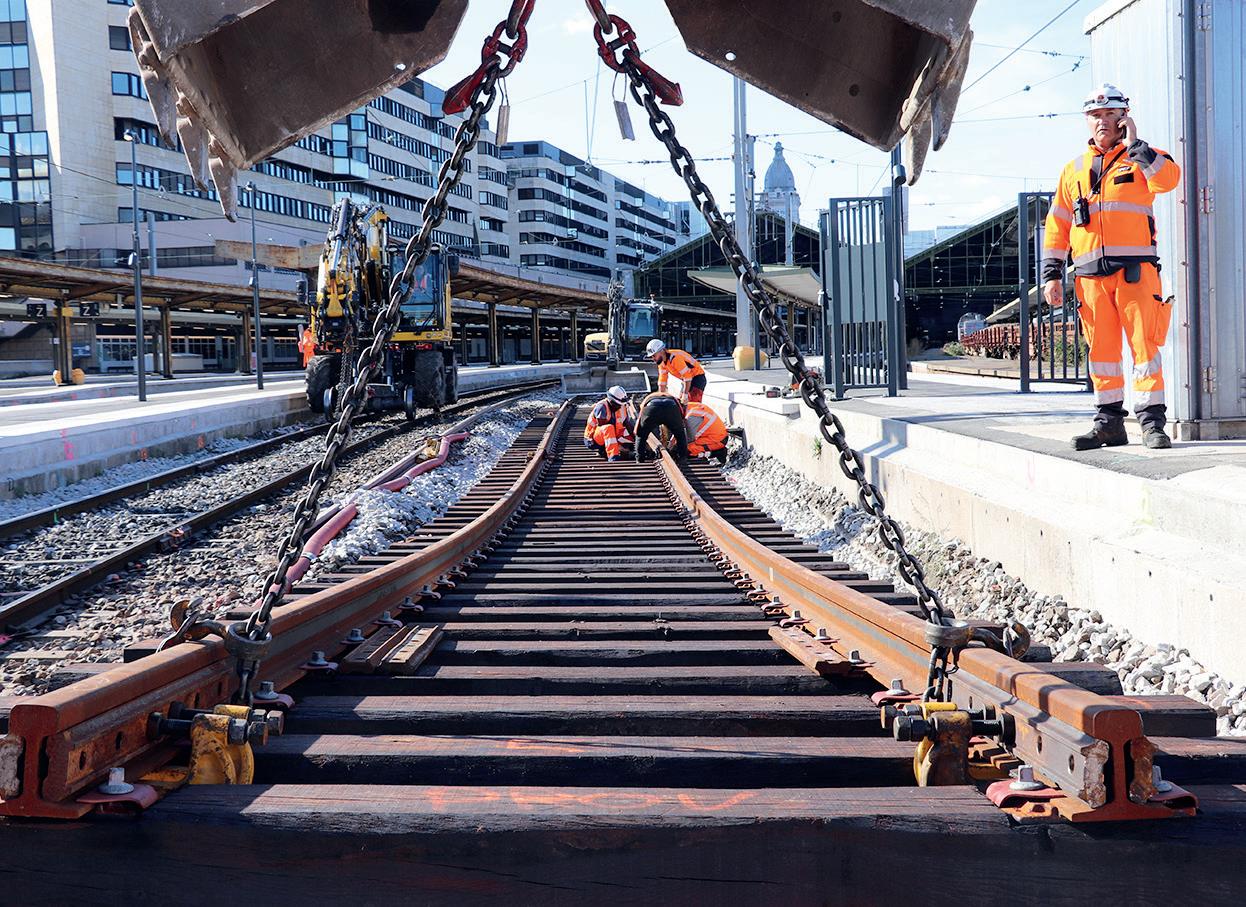

An investigation has unveiled that officials from Northwestern Liberia directed the illegal removal of scrap assets belonging to ArcelorMittal Liberia. The scrap was gathered as a result of ongoing work on the railway, involving the repair of a damaged bridge and replacing old wooden ties with new steel sleepers as part of the company’s phase two expansion project to increase the rail’s capacity. ArcelorMittal intends to donate the now recovered scrap to local communities, with 30% of sales going to the county authority, and 70% going to local people.

Source: Front Page Africa, 9 August 2024.

The board members of Turkish steel producer Tosyali Holding have stated that the company will continue to invest in increasing its annual spiral pipe capacity. At the beginning of the year, the company acquired Spanish steel pipe manufacturer Baika Steel Tubular System (STS) to ‘strengthen its position in Europe’ and increase its annual global pipe production capacity.

Source: Steel Orbis, 8 August 2024.

Steelmaker Rudra Global Infra Products has said the company will invest around Rs 190 crore to set up a 30-megawatt captive solar project in Gujarat. The solar plant is scheduled to commence operations by January 2025, the company said in a statement. "The first phase of the project entails a capital expenditure of Rs 190 crore, with 80% of the funding secured through financial institutions over a five-year tenure. The remaining 20% will be invested by the company," the statement said. The clean power generated will be primarily utilised to meet the energy requirements of the company's existing billet and TMT bar manufacturing operations.

Source: Business Standard, 9 August 2024.

Miner and steelmaker

EVRAZ has confirmed that there has been a fatality at its Pueblo steelmaking facility. A spokesperson from the company stated: “We are saddened to confirm there was a fatality at our steelmaking facility in Pueblo. Our deepest condolences go out to the family, friends, and coworkers of our deceased team member. We will work with all relevant agencies, including OSHA and the United Steelworkers, to ensure a full investigation. As the investigation is ongoing, it would not be appropriate to provide further comment at this time.”

Source: KOA NEWS5, 9 August 2024.

Kazakhstan's Qarmet steel company, formerly ArcelorMittal Temirtau, plans a further $1.5 billion investment in coal and iron ore mining, the Kazakh president's press office said. During his working visit to the Karaganda Region, president KassymJomart Tokayev toured the Qarmet metallurgical plant

Thyssenkrupp's steel division requires around $1.4 billion in additional funds beyond what its parent is prepared to pay in a planned separation process, the division's supervisory board chairman has said.

Sigmar Gabriel, who spoke after a supervisory board meeting of Thyssenkrupp Steel Europe (TKSE), said an external audit would now be carried out to determine the unit's restructuring and funding needs, adding that this could happen before yearend.

Source: Mint, 10 August 2024.

in Temirtau, where he was briefed on plans to expand the plant's capacity and make additional investments. Qarmet's new investor and board chairman, Andrei Lavrentiyev, and CEO Vadim

The UK Trade Remedies Authority (TRA) has proposed to increase the import quota for hot-rolled flat products due to a reduction in domestic production. The proposal is driven by the recent closure of a blast furnace at Tata Steel UK’s Port Talbot plant as part of the transition to an electric arc furnace. Changing market conditions have affected domestic flat steel production in the country. According to the TRA, this led to an increase in imports, which consistently exhausted part of the quota for hot-rolled steel for four consecutive quarters, which, in turn, led to an increase in the cost of these products on the British market.

Source: GMK Center, 12 August 2024.

Basin said ongoing and upcoming projects total over $3.5 billion. "Additional investments include $500 million for the coal department and $978 million for the iron ore department," the president's press service stated. Source: Interfax, 14 August 2024.

Polish steelmaker Liberty Czestochowa, a subsidiary of global steelmaker Liberty Steel, has filed an appeal against a Czestochowa court decision to initiate bankruptcy proceedings. Liberty intends to restart an electric arc furnace with a capacity of 700kt of steel per year and a rolling mill (1.2Mt/yr). The company believes that it has demonstrated strong support from its largest creditor and has the prerequisites to maintain a €100 million working capital loan from a reputable financial institution. Source: GMK Center,14 August 2024.

China’s steel industry is facing a crisis more serious than the downturns of 2008 and 2015, Hu Wangming, chairperson of China Baowu Steel Group warned at the company’s half year meeting, highlighting a need to preserve cash and likening conditions to a ‘severe winter.’ The crisis will likely be ‘longer, colder and more difficult to endure than we expected,’ Wangming added.

Source: Engineering News, 14 August 2024.

South African coal exporter Thungela Resources is searching for new mines to buy and may consider acquiring coking coal assets if it finds a good fit, CEO July Ndlovu has said. The thermal coal producer bought Ensham mine in Australia last year to diversify from South Africa where shipments are hobbled by lack of sufficient rail capacity – although Ndlovu said that situation was set to improve. The performance and returns from the Australian mine so far justify Thungela’s strategy of growing through acquisitions, Ndlovu told Reuters in an interview. “We’re always looking for opportunities and coal in general, including coking coal, is of interest to us,” Ndlovu said.

Source: Mining.com, 19 August 2024.

AM/NS India, the country’s fourth-largest steel producer and a joint venture between ArcelorMittal and Nippon Steel, has introduced a new colour-coated steel brand, a patented product originally developed by ArcelorMittal. This move comes as India’s annual consumption of coated steel reaches around 3.2Mt, with demand in this valueadded segment growing faster than the broader steel market. The newly launched product, branded as ‘Optigal,’ will be produced at a volume of 700kt/yr, with plans to increase production to 1Mt over time. The initial manufacturing will take place at AM/NS India’s facility in Pune, with further expansion to other locations planned.

Source: Machine Maker, 20 August 2024.

British steel foundry Furniss & White, which specialises in high integrity stainless steel castings, fabrications and precision machining, has signed a long-term agreement to produce its castings using ‘high-performance alloys’ from the N’GENIUS Series under license. The Sheffieldbased firm has successfully completed a range of Manufacturing Procedure Qualification Tests at its facilities in various grades from the N’GENIUS Series and will be providing castings for engineering products made using these advanced materials to its customers.

Source: Manufacturing Management, 21 August 2024.

Global steelmaker

ArcelorMittal, in co-operation with energy company

ENVERIO, is implementing a project to build a solar power plant with a capacity of 4.1 million kWh per year to meet the needs of the ArcelorMittal

Auto Processing Deutschland service centre in Neuwied, Germany. The solar power

Atlas Renewable Energy and ArcelorMittal will form a joint venture to build a solar plant in Minas Gerais state in Brazil, the companies said on 21 August. The aim is to supply power to the steelmaker's operations in Southern and Southeastern Brazil. The joint project in the city of Paracatu will have an installed capacity of 264.6 megaWatts alternating current (MWac) and an associated energy transmission system.

Source: yahoo! Finance, 21 August 2024.

plant will be built on the roof of the production facilities and will cover more than 50% of the company’s annual demand.

Source: GMK Center, 22 August 2024.

Japanese steelmakers Nippon Steel Corporation and JFE Steel have collectively bought 30% of Whitehaven Coal’s Blackwater metallurgical coal mine in Queensland, Australia. Whitehaven Coal is seeking to extend the life of the Blackwater mine by an additional 60 years, pushing the mine’s life out to 2085, as part of its Blackwater North Extension Project. Commenting on the announcement, Fiona Deutsch, lead analyst at the Australasian Centre for Corporate Responsibility said: “The recent strong support for three climate-related shareholder proposals at Nippon Steel’s annual general meeting suggests investors see a delay in decarbonization as a risk to corporate value, and this investment will raise questions about the company’s commitment to decarbonization and meeting investor expectations.’’

Source: ACCR, 22 August 2024.

Tata Steel Utilities and Infrastructure Services has outlined its plan to convert all food waste produced in Jamshedpur, India, into biogas by March 2026. Managing director of Tata Steel UISL, Ritu Raj Sinha, announced the initiative during a press conference, in which he emphasised the potential of biogas production. According to Sinha, biogas production could ‘transform the city's waste management’ and, if all goes to plan, Jamshedpur will be the first city to utilise its entire food waste for biogas production. The city currently generates around 260 tonnes of waste each day, with 40% of the total estimated to be food waste.

Source: Bioenergy Insight, 22 August 2024.

thyssenkrupp Steel Europe (Duisburg, Germany) is scaling up its research activities in the field of lowcarbon steel production to include a co-operation with BlueScope Steel. The focus of this co-operation is on the smelting units, which form a core component of the first step in the transformation towards carbon-neutral steel production, namely the replacement of the first blast furnace by a direct reduction (DR) plant with downstream smelters.

Source: Chemical Engineering, 22 August 2024.

Liberty Ostrava has started issuing layoff notices to around 1,600 employees. The affected workers have been offered two-month notice periods or the option to leave by mutual agreement. The plant, which had about 4,000 employees, has been inactive since December due to halted energy supplies. Earlier this year, the company announced plans to close its coke plant and reduce its workforce by 2,600 employees by autumn.

NLMK Indiana recently restarted a 118-ton-capacity EAF after it was shut down for six weeks to undergo the installation process, and a single-point roof lift system and an integrated gantry, both provided by Primetals, were added. “With this solution, operator safety is improved when replacing small roofs or lifting the roof, as direct contact with the roof is no longer required when disconnecting the chain,” Primetals says. “Within four days [after restart], the furnace reached an astonishing 21 heats per day and has maintained a steady performance since then, now exceeding the 5,000 heat mark.”

Source: Recycling Today, 23 August 2024.

Many workers have already left voluntarily, with over 600 resigning in July alone.

Source: Radio Prague International, 23 August 2024.

India-based NMDC Steel (NSL) has hit the milestone of 1Mt of hot rolled coil output, four days ahead of the first anniversary of hot-rolled coil production. This achievement, claims the steelmaker, underscores its position as one of the fastest and most efficient plants in the industry and builds on the company having produced 1.5Mt of hot metal from its blast furnace on 21 July. Source: The Hindu, 23 August 2024.

Swedish energy company

Vattenfall and newly formed industry collaboration Industrikraft will work together to research the conditions for joint investments in new, green electricity production in Sweden. Industrikraft currently consists of Alfa Laval, Boliden, SKF, Stora Enso and the Volvo Group, which will work towards meeting Sweden’s increasing power demand in a way that ensures its industrial competitiveness.

ArcelorMittal Nippon Steel India (AM/NS India) – a joint venture between ArcelorMittal and Nippon Steel, has announced the launch of Optigal® – a colour coated steel brand with a Zinc-Aluminium-Magnesium (ZAM) metallic coating. The brand is currently available only in global markets but now it is being produced and distributed in India for the first time by AM/NS India. AM/ NS India has stated that the new offering ‘reinforces the company’s pioneering efforts to introduce internationally benchmarked quality products’ to meet the growing need for colour coated steel. Source: Realty Plus, 23 August 2024.

The collaboration with Vattenfall aims to address issues such as a framework for co-investment, identification of projects and assessment of feasibility in terms of permits, grid connections and profitability. Source: Power Engineering International, 23 August 2024.

Local British council leader Rob Waltham is set to lead a small delegation to China to meet British Steel’s owner in an attempt to protect the future of steelmaking in Scunthorpe. British Steel’s owner, Jingye, has previously announced a £1.25bn development plan to create new green steel making facilities in Scunthorpe. North Lincolnshire Council has pledged to develop 300 acres at the site to create new, green engineering and energy jobs, creating more opportunities for residents to access sustainable, high-paid jobs.

Source: NorthLincs.gov.uk, 23 August 2024.

For more information, visit our website at www.guildint.com or call +1.440.232.5887

Motion technology company Schaeffler has announced that more than 5,000 additional charging points for electric vehicles are to be constructed worldwide by 2030. These include 3,000 charging points at European locations alone. The locations at Herzogenaurach and Schweinfurt in Germany are acting as pilot projects for the technology and the operator model. Following the successful completion of the test phase, the project will be gradually rolled out in all other regions of the Schaeffler Group.

“Schaeffler stands for sustainability and is committed to e-mobility,” said Andreas Schick, chief operating officer of Schaeffler AG. “We are pursuing the higher-level objective of reducing our CO2 emissions on a continuous basis. This includes the carbon footprint for individual mobility. Through this project, we will increase Schaeffler’s attractiveness as a sustainable em-

ployer and further motivate our workforce to act in an environmentally conscious manner.”

As part of the redevelopment of a parking lot in Herzogenaurach, 40 charging points have been installed, which are initially available for employees without charge. These charging stations are the standard model used at all Schaeffler locations. They provide up to 22 kiloWatts of charging capacity per station and are to be operated and maintained by an external partner in the future. The expansion plan for the Herzogenaurach location allows for the construction of a further 245 charging points for employees, company cars and visitors in 2025. In Schweinfurt, the electrical infrastructure will first be expanded to allow the construction of a further 122 charging points. Initial operation is planned for 2025. In the UK, the Schaeffler production plant in Sheffield and the Vehicle Lifetime Solu-

tions distribution centre in Hereford have already installed charging points for electric vehicles.

For further information, log on to www.schaeffler.com

A British steel foundry has become the first company in the world to manufacture castings using an new series of high-strength austenitic stainless steels.

Furniss & White, which specialises in high integrity stainless steel castings, fabrications and precision machining, signed a long-term agreement to produce its castings using high-performance alloys from the N’GENIUS Series under license.

The Sheffield-based firm has successfully completed a range of Manufacturing Procedure Qualification Tests at its facilities in various grades from the N’GENIUS Series and will be providing castings for engineering products made using these advanced materials to its customers.

The N’GENIUS Series, which is patent protected in 30 countries, represents the total reinvention of conventional austenitic stainless steels – commonly known as the 300 Series.

Dr Ces Roscoe, CEO of N’GENIUS Materials Technology and inventor of the N’GENIUS Series, said: “Furniss & White is a company that shares our own passion and drive for innovation and we are absolutely delighted to be collaborating with them on what is destined to be an industry changing technology. With a long history of steelmaking, Sheffield is widely regarded as the birthplace of stainless steel and it seems befitting that it will essentially be ‘reborn’ in the same city more than a century later.”

Sam Scholes, managing director of Furniss & White, said: “For more than 44 years we have built a strong reputation as a high-quality British

manufacturer of high integrity castings made in our modern foundry in the UK. Now, as an approved licensed N’GENIUS manufacturer, we are writing an exciting new chapter in our history and to be the first foundry in the world to have this capability makes us extremely proud. We expect these game-changing N’GENIUS materials

will be extremely popular with our existing customers and help open up new opportunities in other markets including the US and Canada and in clean energy industries such as hydrogen.”

For further information, log on to www.ngeniusmaterials.com

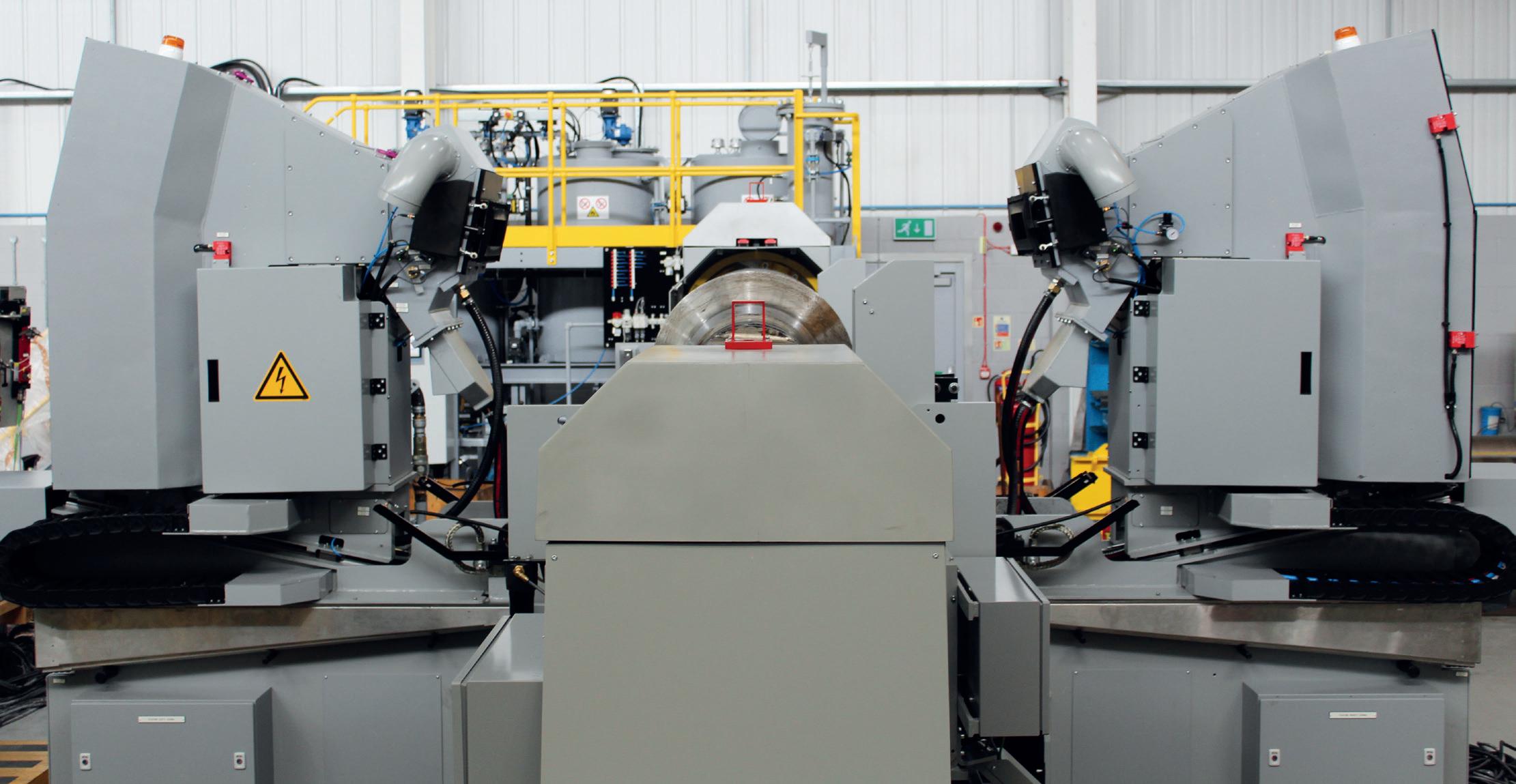

Steel Dynamics Inc. (SDI) and ArcelorMittal/Nippon Steel (AM/NS) have chosen Sarclad’s latest electro discharge texturing technology (EDT) featuring the company’s ‘MultiServo Array’ (MSA) system for their flagship plant expansions.

The AM/NS installation is the second such system to be delivered and is the first to be specified in the full 72-electrode configuration, for the

company’s Cold Mill No.2 expansion in Hazira, India. This ‘EDT-MSA’ machine features two texture heads, each with 36 individually controlled electrodes.

The texturing efficiency generated by MSA technology, enables unrivalled accuracy, speed and consistency of surface texture on the roll and ultimately on the strip, claims Sarclad.

Plant supplier Fives recently installed a new Taylor-Wilson hydrostatic tester for one of its clients. The hydrostatic tester, claims Fives, has the highest bench load capacity in its size range category which ensures greater productivity, flexibility, and

better product requirements.

The customer needed a reliable solution in order to adapt to challenging market requirements and increased capacity. As a result, Fives designed, supplied, and installed a new Taylor-Wil-

Steel Dynamics Inc. (SDI) has selected Sarclad’s Rolltex MSA 36 for its mill investment in Sinton, Texas. The system features a single-sided texture head, which could be expanded to a 72-electrode capacity by adding a second texture station.

For further information, log on to www.sarclad.com

son hydrostatic tester for tubes and pipes in the oil and gas sector. The supplied hydrotester can test pressures of up to 21,700 PSI.

“This project is a great achievement for us. Not only does it mark the highest bench load capacity in its size range category, which is a major milestone in Fives Bronx history, but we were also able to commission, start-up, and fine tune the machine in rapid time. I am proud of our team for their efforts to make the project successful,” said Gary Lisitsa, director of operations at Fives Bronx, Inc., a subsidiary specializing in finishing equipment.

For further information, log on to www.fives.com

ZUMBACH Electronics has developed the PROFILEMASTER® SPS product family with high-speed versions. The latest generation of high-speed cameras acquires full product contours at a rate of 2000Hz. This, claims the company, allows it to achieve six times more contours within a certain length, which enables classification of the defects instead of only detection.

The maps are created from multiple ‘unfolded’ contour images. Depending on the user’s preferences, the surface faults are also shown as single contours or as a 3D model (partial or full view of

the profile).

The new set-up design aims to improve the performance of the optical path of the cameras, optics and lasers by a factor of eight, which eliminates the limitation of camera exposure times. The new high-speed set-up enables the PROFILEMASTER® SPS product family to work even under harsh light absorbing the surface conditions of hot steel products, says ZUMBACH.

For further information, log on to www.zumbach.com

Primetals Technologies has recently received the final acceptance certificate (FAC) for a plate finishing mill at Kobe Steel’s plant in Kakogawa, Japan. This rolling mill was ordered in 2021 as Kobe Steel wanted to improve product quality and further enhance its delivery times. Primetals Technologies was responsible for the supply of core mechanical equipment, auxiliary and ancillary technologies, as well as on-site supervision for construction work and implementation.

The plate finishing mill at Kobe Steel’s Kakogawa Works had been in operation since 1972.

The new finishing mill processes plates with thicknesses from 4.5 to 360 millimetres at widths of 1,000 to 4,500 millimetres. The plate finishing

mill enables Kobe Steel to enhance mill performance both in terms of product quality and delivery times while increasing its competitiveness within the steel plate industry, stated Primetals Technologies.

Kobe Steel is a global company operating worldwide under the unified group brand of ‘KOBELCO’. The company’s proprietary portfolio of steel plate products includes Ecoview Plus, a steel plate for the bridge sector, and EX-Facter, a fatigue-resistant steel plate.

For further information, log on to www.primetals.com

Konecranes has introduced a heavy-duty version of its flagship E-VER electric forklift for lifting capacities of 18-25 tons. With growing industry demand for low-carbon solutions, this new range of lift trucks is part of the company’s commitment to electrify its entire lift truck fleet by the end of 2026.

“Higher capacity on the E-VER is the next step on the road to zero tailpipe emissions across all of our lift trucks portfolio. As the global market transitions to carbon neutrality, an even broader environmental responsibility is clear. We have a product road map to deliver the right products at the right time, paving the way to a decarbonized and circular world by eliminating emissions in the entire value chain from production to usage and eventually enabling repurposing and efficient recycling,” said Jeffrey Stokes, director, product and technology management, lift trucks, Konecranes.

“Konecranes has received a Gold rating from EcoVadis three years in a row which shows that

we are a leader in sustainability. Focusing on electrifying the offering is an enabling factor. Major industry awards like this help spark customer enthusiasm as we bring them the latest developments in our technology. Soon our customers will be able to enjoy the benefits of electrification and power up for the future through every one of our lift truck models,” added Andreas Falk, senior vice president, lift trucks, Konecranes.

The new 18-to-25-ton Konecranes E-VER is intended for heavy-duty industrial applications with low energy consumption and zero tailpipe emissions. Manufactured with clean energy, a lithium-ion (Li-ion) battery pack fuels the truck’s electric motors. A combination of high voltage and low current reduces energy consumption and losses, claims Konecranes, allowing the truck to use up to 90% of available energy. When no longer able to hold enough charge to run the motors, the battery can be repurposed as a power reserve at charging stations, or a back-up power supply if regular sources fail.

The truck is equipped with safety features, including a battery management system (BMS) that monitors battery condition, a thermal management system (TMS) that controls the battery, and a protective frame around the battery to prevent physical damage in the event of a collision. Redundant sensors throughout the machine provide data for faster analysis and safer functioning.

The Konecranes E-VER is a Smart Connected Lift Truck, using TRUCONNECT® to collect real-time data on a range of variables, including battery charge monitoring and estimated truck autonomy; energy consumption per lift, distance or load; the amount of energy recovered from braking; and alarms, alerts and other diagnostics. All this data transmits to the yourKONECRANES customer portal to monitor and control the truck’s operational efficiency, productivity, safety and environmental impact.

For further information, log on to www.konecranes.com

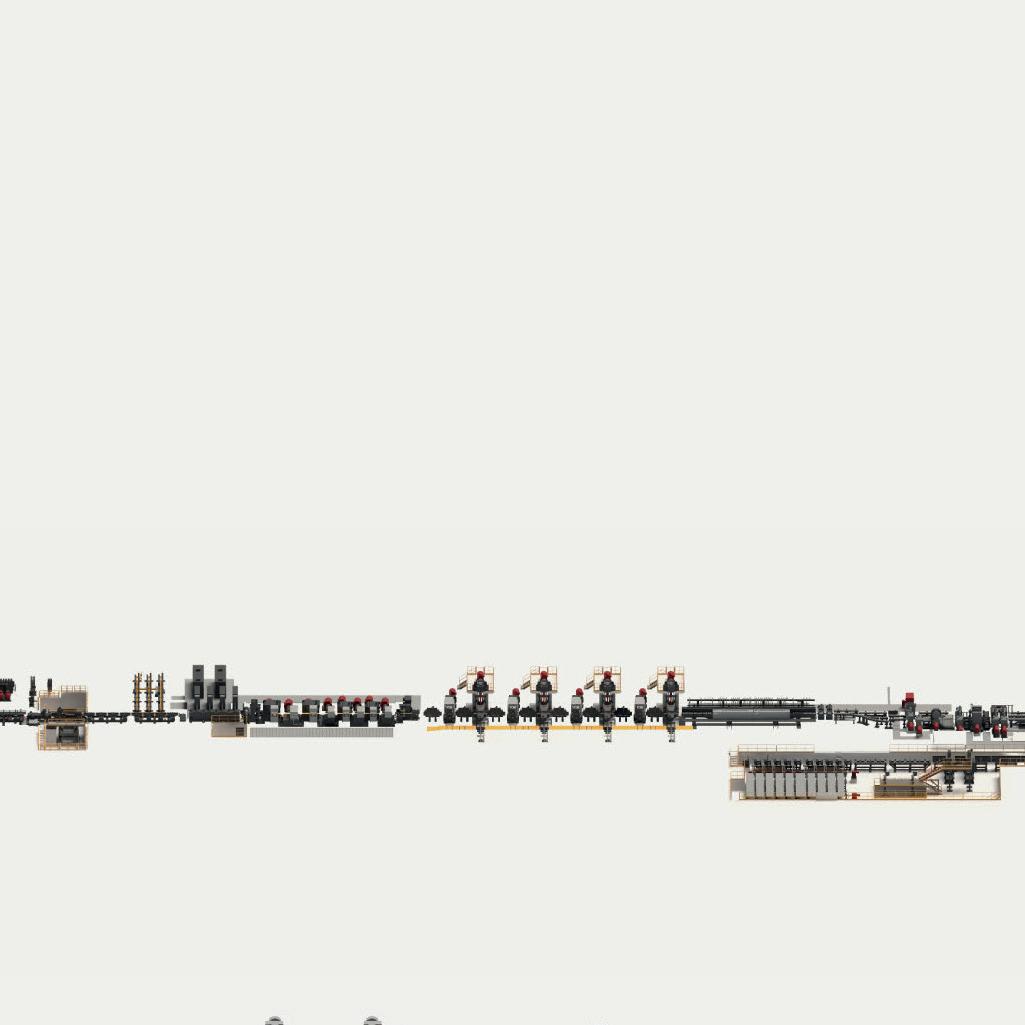

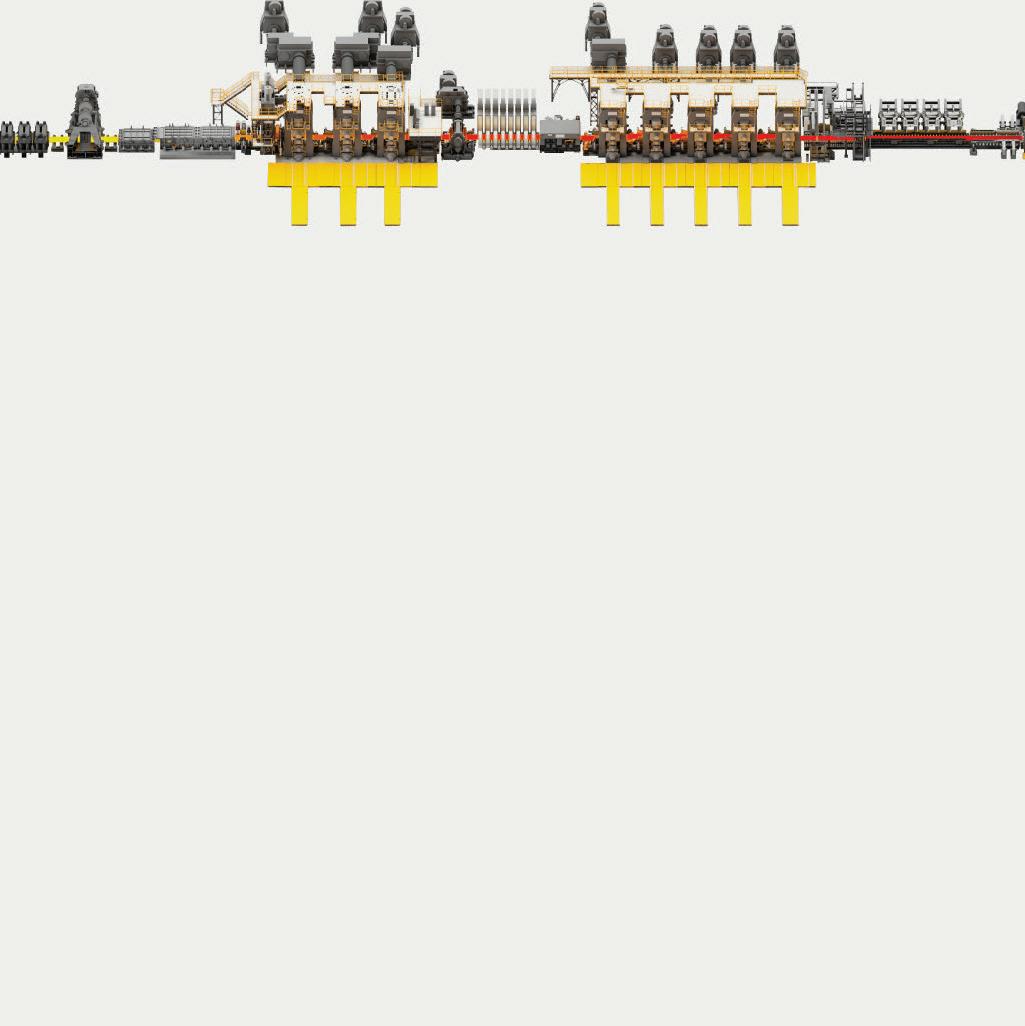

and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE

Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

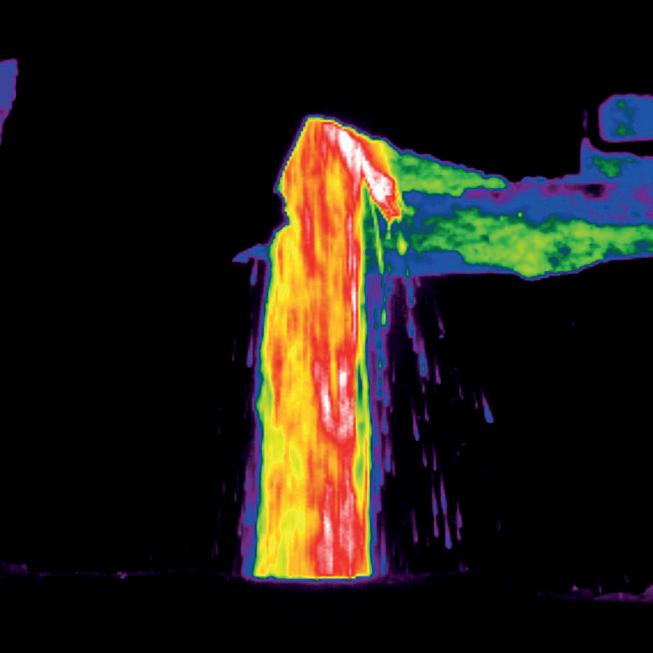

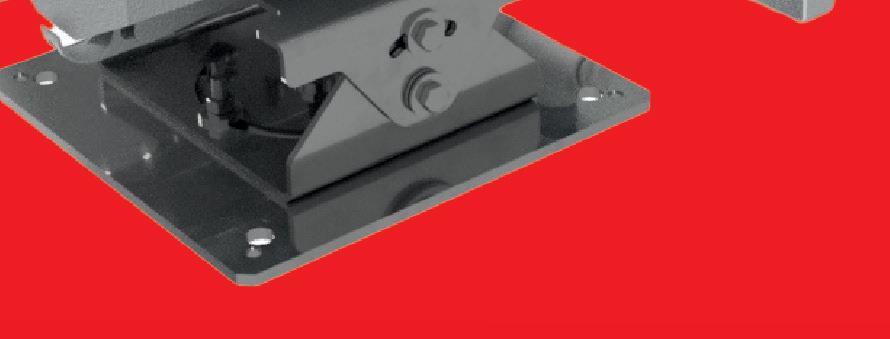

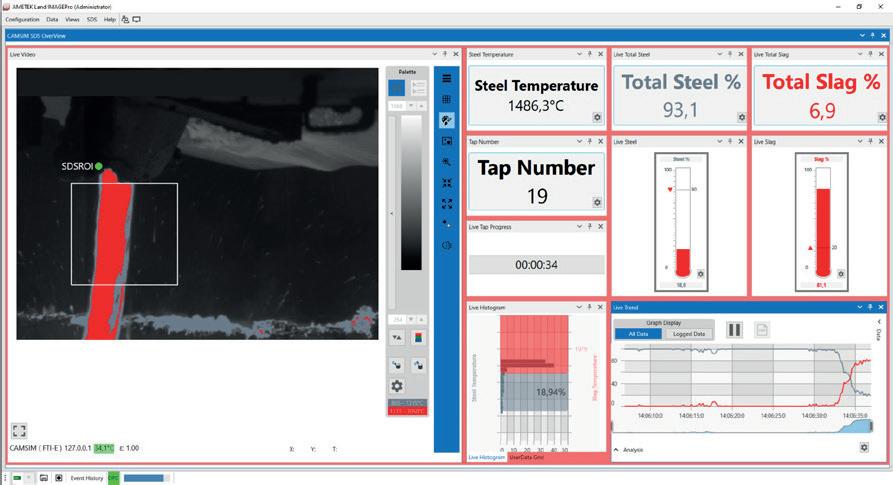

This article explores the intricacies of decarbonizing high-temperature processes within the steel industry using electrification. By Joonas Rauramo*

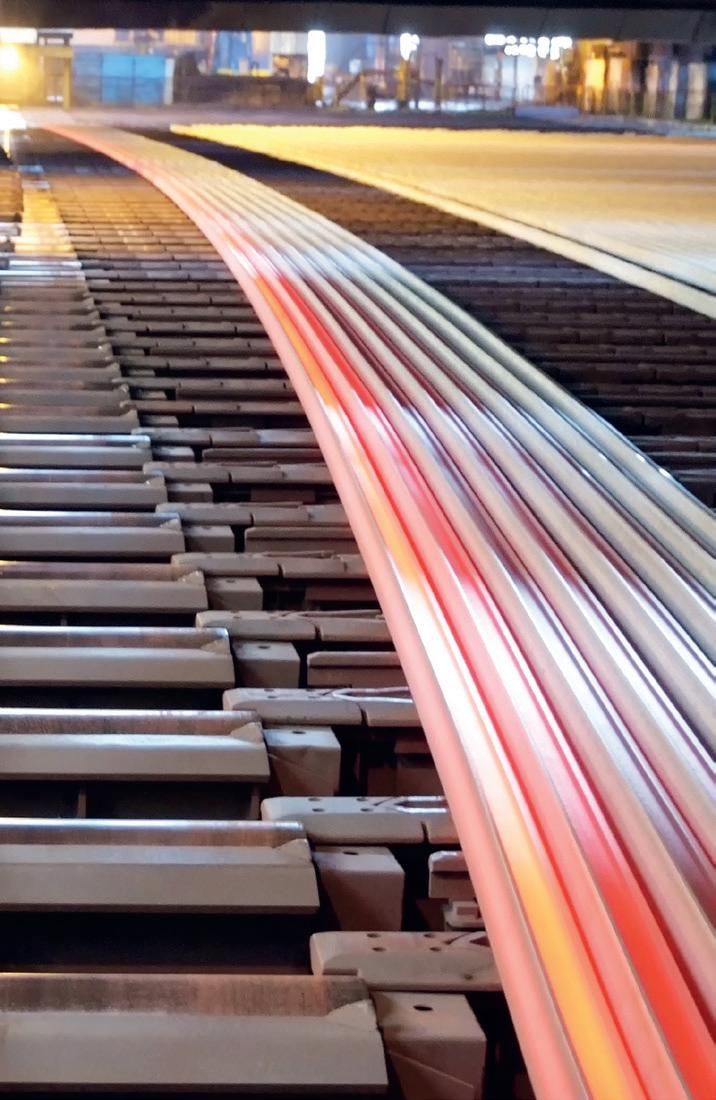

STEEL is a fundamental building block within virtually every sector in the global economy, valued for its high durability, ease of mass manufacturing, and 100% recyclability. However, as it stands, the steel industry is the largest emitting manufacturing sector, accounting for 7% of all man-made emissions worldwide, and requires urgent transformation if it is going to meet the goal of net zero emissions by 2050. This becomes even more of a priority as global demand for steel continues to rise, from 1.8 billion tons in 2020 to an estimated 2.0 billion tons by 2030. Steel is primarily made up of iron, which is bonded with a low percentage of carbon to give it its unique properties. In the first stage of primary steel production, mined iron ore is taken and reduced to metal using carbon and simultaneously smelted into pig iron in a blast furnace – a process that requires a considerable amount of energy – and then, in the second stage, the molten pig iron is converted into steel in a converter or blast oxygen furnace (BOF) and alloyed to the desired composition. This process is known as the BF-BOF process. Secondary steelmaking involves taking recycled iron and smelting it in an electric arc furnace (EAF) to remove impurities and add carbon and other alloying elements. Both processes require temperatures of over 1,600°C to bring iron to its melting point and

purify and alloy the steel.

In addition to smelting, steel also goes through additional processes including casting, hot rolling, often also cold rolling, annealing and tempering to optimise its qualities – requiring temperatures of up to 1,200°C. Around 85% of total energy consumption in steel manufacturing primarily arises from the burning of fossil fuels. In primary steelmaking, the production of hot metal iron in a blast furnace requires coke made from coal as a raw material. The production of coke itself requires additional energy and, therefore, releases further CO2 emissions.

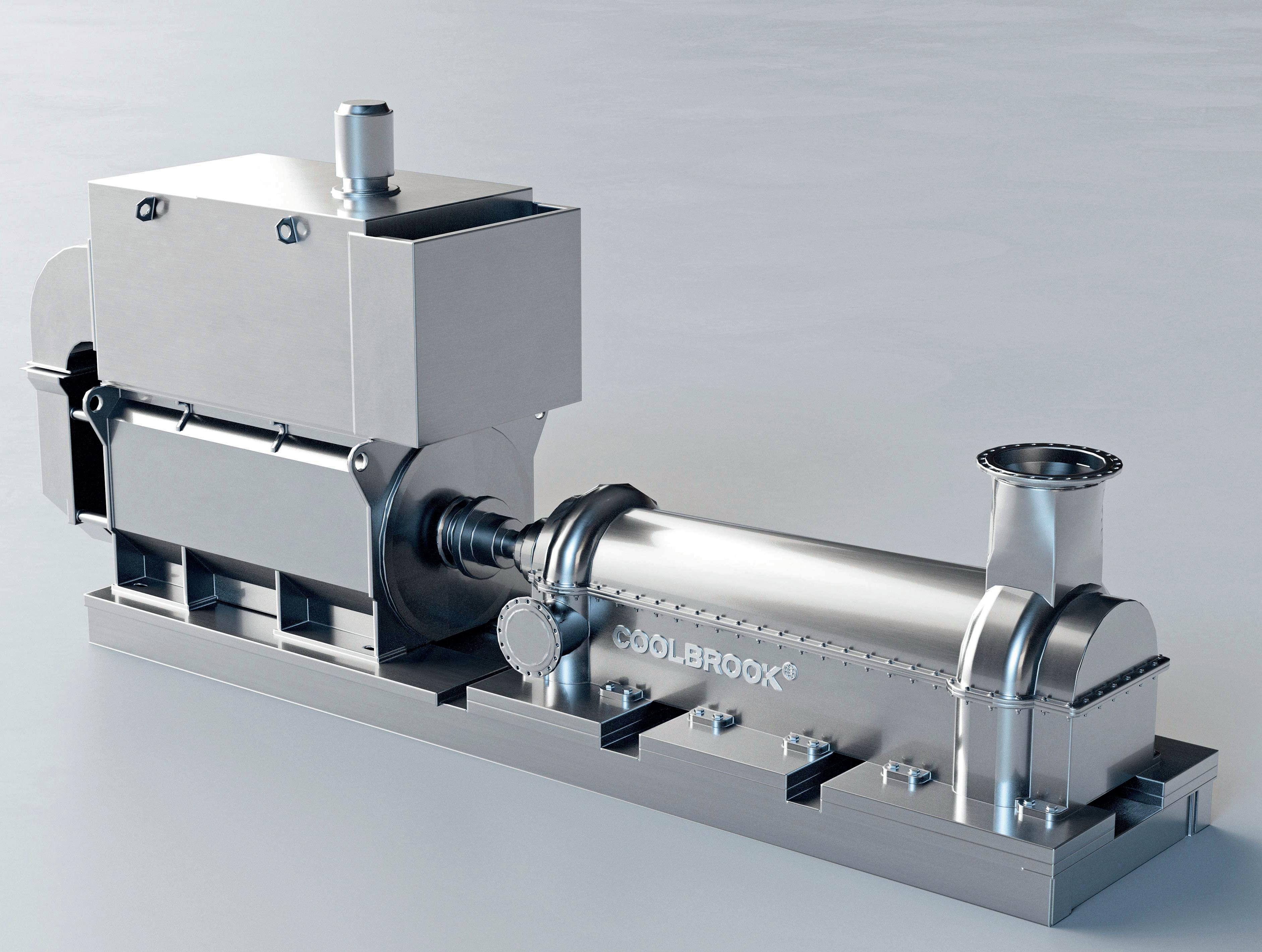

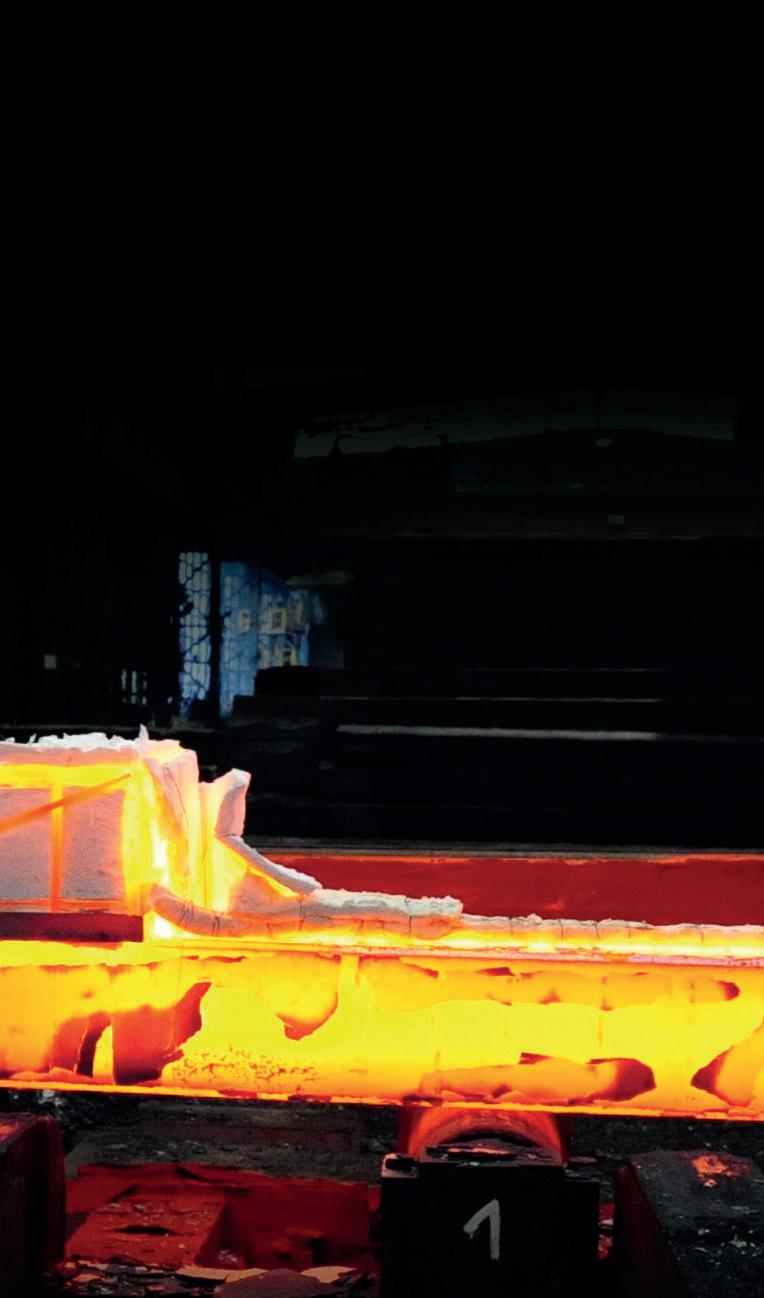

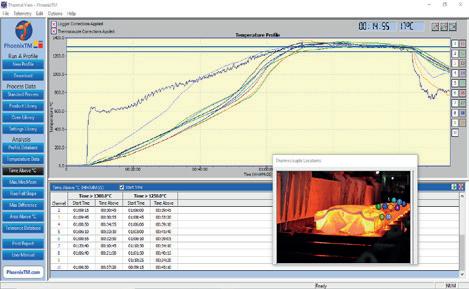

Now, cutting-edge electrification technologies are ushering in a new era for the steel industry, paving the way for steel manufacturers to make significant progress towards net zero emissions. Coolbrook’s RotoDynamic HeaterTM (RDHTM), a patented heating technology powered completely by renewable electricity, is on track to generate temperatures up to 1,700°C. On the point about a system being ‘powered completely by renewable electricity’, Joonas Rauramo responded to the fact that not everywhere in the world has access to renewable energy by saying: “While it’s true that not all parts of the world currently have widespread access to renewable energy, there are a few important factors to consider.

*CEO at Coolbrook

Firstly, renewable electricity can be accessed directly in many regions or through Power Purchase Agreements (PPAs), where companies can source green energy even if it’s not locally available. This is a key strategy for global decarbonization, as the demand for green electricity drives further investment in renewable infrastructure.

“Moreover, transitioning to renewable energy often happens in phases. Even in regions where green electricity isn’t yet fully established, investing in technologies like RDH helps accelerate the shift by increasing demand. Many of our customers are also investing directly in renewable projects to secure their supply.

“It’s also important to note that CO2-free power sources, such as nuclear energy, play a significant role in some regions. For example, in Europe in 2023, the electricity mix included 22.8% from nuclear and 44.7% from renewables, meaning that over 67% of the electricity was completely CO2-free. This highlights the ongoing shift towards cleaner energy and shows that a substantial portion of electricity in some areas is already sourced from carbon-free technologies.

“So, even if renewable energy isn’t yet universally accessible, adopting technologies powered by it is a crucial step in the global transition to sustainable energy.”

This novel technology can replace fossil fuel combustion as the heat source throughout the steel manufacturing process, eliminating 600Mt of global CO2 emissions annually in the steel industry alone. The RotoDynamic HeaterTM is a product of two decades of research and development by Coolbrook, and partnering with notable academic institutions such as the universities of Oxford and Cambridge in the United Kingdom.

A better way to reach steelmaking temperatures

In mere milliseconds, the RotoDynamic HeaterTM can generate the temperatures required for steel production, boasting an impressive 95% conversion rate of electrical energy to thermal energy, without relying on the combustion of fossil fuels. This feat is accomplished through a cyclical sequence of steps.

Initially, powerful electric motors, optimised for industrial use, set rotor blades in motion, propelling gas molecules – such as air, nitrogen, steam, CO2, or hydrogen – at supersonic speeds. Subsequently, these swiftly moving gas molecules undergo rapid deceleration upon encountering a diffuser, transitioning to subsonic velocities. This abrupt change in speed triggers turbulence and shockwaves, effectively converting the kinetic energy of the gas into thermal energy, thereby generating heat. This process iterates through multiple stages, each seamlessly transitioning to the next within milliseconds, progressively elevat-

ing temperatures up to a remarkable 1,700°C. By directly heating the gas efficiently within itself, this method eliminates the necessity for bulky resistive heating components. Consequently, the RotoDynamic HeaterTM boasts a compact footprint of just a few metres for capacities of dozens of megaWatts while achieving the desired temperatures with unparalleled efficiency and speed.

Another key advantage of the RotoDynamic HeaterTM lies in its seamless integration potential into existing steel manufacturing plants without imposing complexities on current infrastructure. Due to very high energy intensity and compact equipment size the RotoDynamic Heater can be installed directly at the location where heat is needed thus enabling efficient energy integration also in brownfield sites. This straightforward application facilitates swift adoption of the technology by steel manufacturers, sidestepping additional complications, laborious tasks, or infrastructure investments. Utilisation of the RotoDynamic Heater also enables capture of waste heat streams which can significantly improve the overall energy efficiency of the process.

Other decarbonizing technologies for steelmaking are aiming to facilitate the reduction of iron ore into metallic iron using hydrogen gas, instead of the conventional natural gas. However, the reaction between hydrogen and iron oxide still requires temperatures up to 1,000°C, and the process itself has to be constantly heated as it consumes thermal energy. The RotoDynamic Heater can be integrated into hydrogen-based iron oxide reduction plants to provide the high temperatures and constant heating needed for the reaction and process without fossil fuels or emissions.

Moreover, RDH technology can be used to improve efficiency and reduce emissions in recycling of steel. For instance pre-heating of scrap metal can be used to remove impurities and reduce the energy input required in electric arc furnaces improving plant throughput in addition to a lower carbon footprint per ton of steel.

As a result, the RotoDynamic Heater can decrease fossil fuel usage per tonne of steel, decarbonizing processes ranging from the preheating of air to blast furnaces, provisioning of heat for hydrogen-based reduction processes, casting, hot rolling, annealing, coking, tempering lime

production for use in removing impurities from steel, reheating furnaces, and other supporting processes. In electric arc furnaces, the RotoDynamic Heater can be used in scrap preheating to shorten the smelting sequence.

By reducing fossil fuel usage per tonne of steel throughout the manufacturing process, the RotoDynamic Heater significantly brings down the cost to decarbonize each tonne of steel produced, allowing manufacturers to improve the overall return on investment of their decarbonization efforts and more efficiently advance towards a prosperous net zero future.

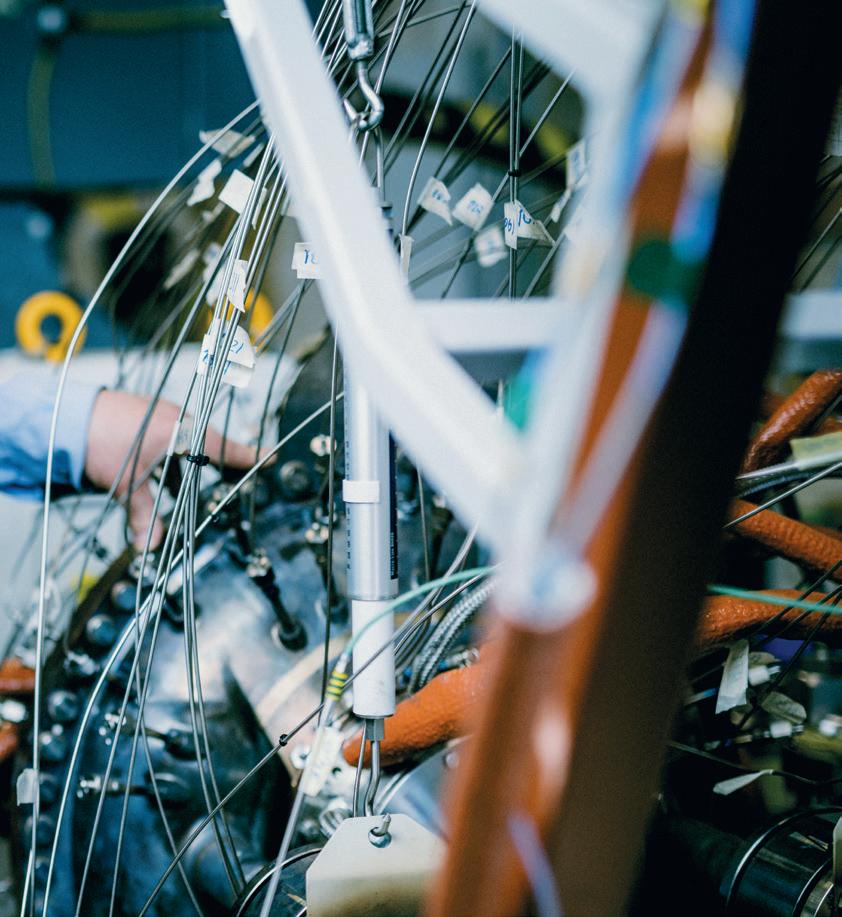

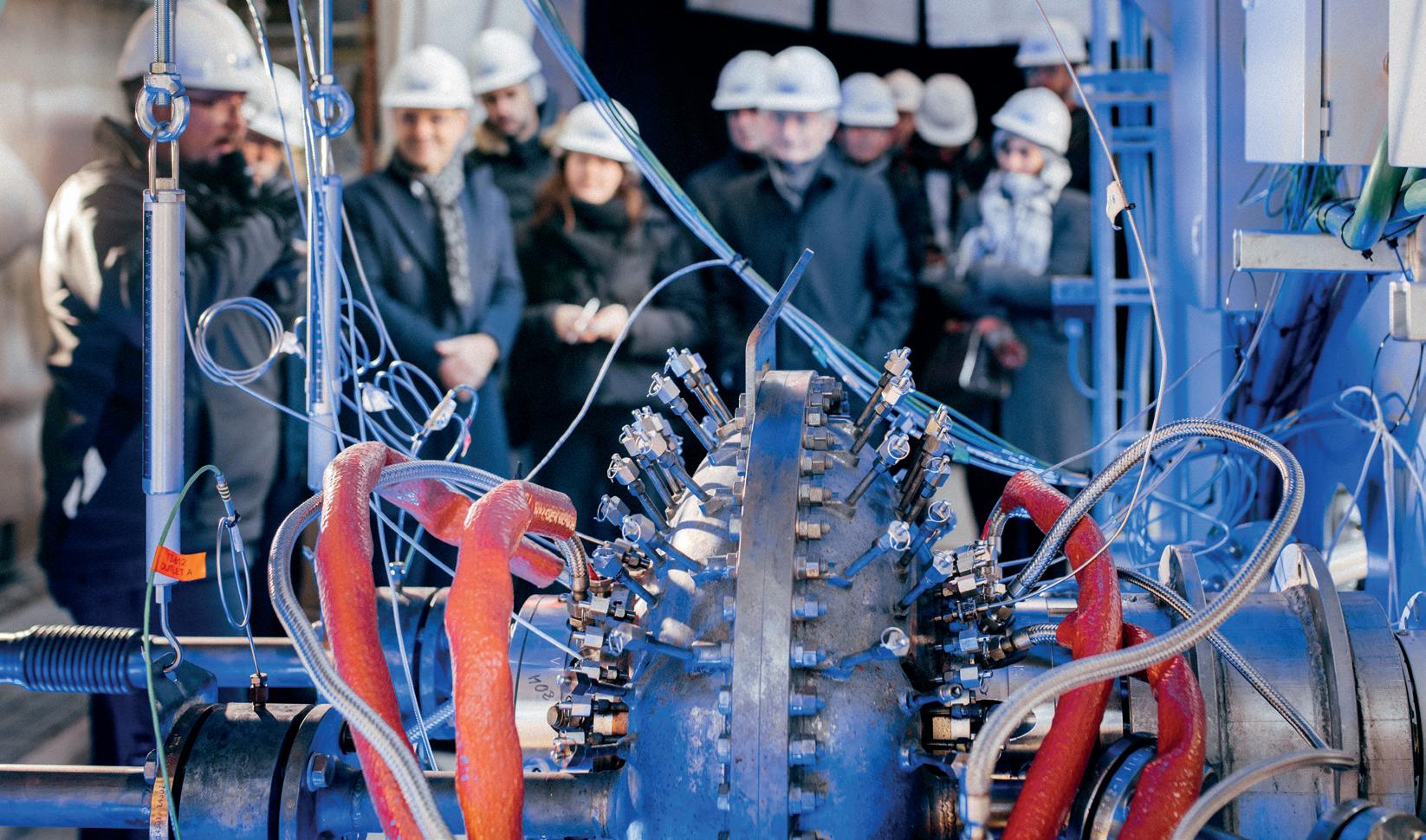

The technical feasibility of the RotoDynamic Heater has been proven at Coolbrook’s largescale pilot facility, inaugurated in December 2022 at the Brightlands Chemelot Campus in Geleen, the Netherlands. There, its capability to attain the required temperatures for heavy-duty industrial operations was successfully showcased. The initial phase of pilot testing concluded in September 2023, surpassing the 1,000°C threshold and validating the RotoDynamic Heater’s suitability for industrial-scale high-temperature process heating; underscoring its potential to annually reduce global industrial CO2 emissions by 30%. Furthermore, this breakthrough not only unlocks a significant portion of the €1 trillion global industrial heating market for RotoDynamic TechnologyTM but also paves the way for its deployment in large-scale projects at customer sites.

The steel industry holds great decarbonization potential

In the pursuit of net zero emissions within the steel industry, the integration of complementary decarbonization technologies is paramount. For instance, the lime used in steelmaking is obtained through the decomposition reaction of calcium carbonate, which releases CO2 as a natural byproduct.

While clean heating technologies such as the RotoDynamic Heater can provide the heat required for this reaction, the CO2 byproduct must also be removed to achieve total decarbonization, which can be achieved using carbon capture and storage processes. Combustion-free heating technologies such as the RotoDynamic Heater can enable a more efficient, streamlined carbon capture process by producing a much higher concentration of CO2 gas from the decomposition reaction, eliminating the nitrogen and argon from the exhaust gases.

A clean, new industrial era for all

At the forefront of catalysing full decarbonization in the steel industry, the RotoDynamic Heater boasts a compact footprint, delivering the extreme temperatures required for steel manufacturing, with an excellent 95% energy efficiency, without reliance on fossil fuels. Manufacturers that invest in existing and developing decarbonization technologies now can have a competitive advantage moving forward by operating at the cutting edge of steel manufacturing and contributing to the widespread implementation of steel decarbonization worldwide — leading a clean, new industrial era for all.

Solar Turbines is your total solutions provider and can offer you the latest power plant technology tailored to your specific requirements. Generating power with our highly flexible gas turbine packages contributes to sustainable development, enabling you to meet your growing needs for great power, efficiency and availability − all while helping to protect the environment. Solar ® gas turbines will provide your business with a competitive edge. There has never been a better time to review your energy strategy. Contact us today.

Visit us at www.solarturbines.com , call +1-619-544-5352 or email infocorp@solarturbines.com

Argentina, Bolivia, and Chile are known as South America’s ‘lithium triangle’, with approximately 55% of the world’s reserves, writes Germano Mendes de Paula*

ACCORDING to JP Morgan, Chilean share of global lithium production is projected to be 23% in 2024, while Argentina is expected to contribute 7%, and other Latin American countries are set to provide 8%. In comparison, Australia will lead with a 33% production share, followed by China at 21%. Africa will have a 5% participation in global lithium output.

This year marks the commencement of operations for two lithium projects in Argentina, supported by investments from two of the world’s largest steelmakers: Posco Holdings from South Korea (ranked 7th in worldsteel’s ranking for crude steel production in 2023) and Tsingshan Holding from China (ranked 23rd in terms of crude steel, but the world’s largest producer of stainless steel and nickel).

In 2018, Posco ventured into Argentina’s lithium sector by acquiring a brine lithium project from Galaxy Resources, an Australian mining company, for approximately $280M. Brine lithium is extracted from high-concentration saltwater solutions typically found in salt flats, known as salars. The project is situated in the Hombre Muerto salt flat, which is located in the Provinces of Salta and Catamarca. By April 2024, Posco completed the construction’s first stage of a

commercialization plant adjacent to the lake for the production of lithium hydroxide. As of December 2023, this project was estimated to cost $1bn, of which $169M was the projected remaining cost of completion. The second phase, scheduled to start-up in June 2025, is projected to require $962M. Upon conclusion of both stages, the commercialization plant is expected to have a production capacity of 25kt/yr of lithium hydroxide and 23kt/yr of lithium carbonate, essential materials for cathode fabrication.

Posco’s lithium initiatives extend beyond Argentina globally, reflecting its broader ambition to secure critical materials for the expanding electric vehicle (EV) and energy storage markets, providing an input essential for lithium-ion batteries. For instance, it made inaugural shipments of hard rock lithium from its 43kt/yr capacity Gwangyang plant in Korea in April 2024. This project, which has capex of $848M, is an 82:18 joint venture between Posco and Pilbara Minerals. Additionally, in 2018, Posco acquired a 2.74% stake in Pilbara Minerals and secured off-taking of the mineral spodumene from the Pilgangoora Project, which is located 120km from Port Hedland, Western Australia.

JP Morgan reported that the Gwangyang plant’s operating utilisation has already achieved 70%-80% in Q2. The Argentine

plant, with a capacity of 25kt/yr, is expected to reach 50% utilization by Q3. Upon full ramp-up in 2025, the company anticipates a double-digit EBITDA margin. However, this margin is likely to be lower than under a $30k/t lithium price environment. JP Morgan assumed a mid-term lithium price of $17k/t compared to the spot lithium price range of $12-14k/t in late July 2024. Moreover, JP Morgan’s Sum-Of-The-Parts (SOTP) analysis in July 2024 indicated that the steel business is equivalent to 46.5% of the valuation, stakes in affiliated companies to 32%, and lithium business for 21.5%. This is an impressive breakdown considering that the lithium projects are still in the ramping-up phase.

In July 2024, Salar de Centenario-Ratones Project Phase 1, situated in the Province of Salta, was inaugurated. It is operated as a joint venture owned by Eramet (50.1%) and Tsingshan (49.9%). The venture plays a critical role for Tsingshan’s strategy to secure a reliable lithium supply for its downstream battery manufacturing operations. Production is scheduled to begin in November 2024, with ramp-up expected to be achieved by mid-2025. Once operating at full capacity, the plant is projected to produce 24kt/yr battery-grade lithium carbonate equivalent (LCE), meeting

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

the needs for 600k EVs annually.

Nonetheless, production in 2024 is anticipated to be limited. The plant is designed to extract lithium from the salar brine as well. During the construction phase, the project has contributed to job creation, resulting in over 2,500 direct jobs. The Centenario Phase 1 plant is expected to employ approximately 350 individuals.

The total investment initially planned for Centenario Phase 1 was $735 M, but was later increased to $800M (of which $480m funded by Tsingshan) reflecting the impact of local inflation. Previously, Eramet had invested more than $30M in research to develop in-house a Direct Lithium Extraction (DLE) technology and additional $15M in external costs for development studies. At full capacity, the cash cost for Phase 1 is expected to be positioned in the first quartile of the industry cost curve, estimated at around $4.5k to $5k/t of LCE. The annual EBITDA is projected to range between $210M and $315M, based on a long-term price assumption of $15k-$20k/t of LCE.

In addition, in March 2023, Tsingshan

announced that it will invest $120M to install a 100kt/yr hydrogen chloride and 35kt/yr sodium hydroxide manufacturing plant in the Perico industrial park, Province

of Jujuy, Argentina, to produce lithium carbonate. Construction work is expected to last 18 months and employ more than 1,000 people for the construction period, and some two thousand workers during its

operational stage.

In October 2023, Chilean President Gabriel Boric revealed that Tsingshan intends to make a $233M investment in lithium-related projects in the country. According to the government, the plant is planned to produce 120kt/yr of lithium iron phosphate.

Located in northern Chile and projected to commence operations in May 2025, the plant is expected to generate 668 jobs when operating at full capacity.

The Chilean economic development agency Corfo has stated that Yongqing Technology, which is owned by Tsingshan, will have access to 11kt of battery grade lithium carbonate from Chilean lithium miner Sociedad Química y Minera de Chile (SQM) at a preferential price until 2030. Furthermore, the project will involve importing lithium carbonate from Tsingshan’s joint lithium venture with Eramet in Argentina.

In summary, Argentina has become an essential hub for the diversification strategies of both Posco and Tsingshan towards the lithium industry. �

We are your premium partner for refractory solutions for the heat treatment of steel

We offer solutions of the highest performance to meet your most demanding requirements. With RATH you can count on:

• A comprehensive range of premium refractories

• Engineering, production, on-site supervision

• Solutions to reduce your carbon footprint and to save energy

• No compromise on quality, here we remain as tough as steel

www.rath-group.com/metals

India’s infrastructure-centric Union Budget 2024-25 has brought good news for domestic steel producers with an 18-month extension of the customs duty exemption on ferrous scrap and a reduction in the import duty on ferronickel from 2.5% to ‘nil’. The current financial year’s Union Budget proposes to extend the ‘nil’ customs duty regime on ferrous scrap until March 2026, extending it from the earlier deadline of September 2024. By

Dilip Kumar Jha*

THIS decision bodes well for Indian steel producers, especially given the robust production growth expected in the near future. The government’s increased focus on infrastructure has led steel producers to augment production capacity through both greenfield and brownfield projects to meet the growing demand. In addition to large steel mills that use ferrous scrap for blending with sponge and pig iron, as well as separately melting the waste in foundries, India’s micro, small, and medium enterprises (MSMEs) will also benefit from this proposal. India’s MSMEs have been struggling to cope with higher interest rates, a lack of working capital, and outdated plant and machinery, which makes it difficult for them to compete with large steel mills.

While the government has already introduced several schemes for their revival, these MSMEs were hesitant to invest due to fears of the re-imposition of the ferrous scrap customs duty levy. However, the 18-month extension of the duty exemption will help them plan their businesses for long-term sustainability. The government considers MSMEs as the backbone of the Indian economy, especially in terms of employment generation and regional reach.

Source: Directorate General of Commerce,

India’s steel industry has been enjoying ‘nil’ import duty on ferrous scrap since 2021, following the announcement by Union Finance Minister Nirmala Sitharaman in the Union Budget 2021-22. The duty exemption was introduced after steel producers, particularly MSMEs, were severely impacted by the Covid-19 pandemic and the resulting periodic lockdowns worldwide. In the 2021-22 Budget, the Finance Minister also revoked the anti-dumping duty (ADD) and

correspondent, Steel Times International.

countervailing duty (CVD) on certain steel products, while reducing customs duty uniformly to 7.5% on semis, flat, and long products of non-alloy, alloy, and stainless steel, down from the previous 10-12.5%.

The customs duty on ferrous scrap was reduced to ‘nil’ to support user industries that were hit hard by the sharp increase in steel prices. Initially, this duty cut was announced for one year, which was later extended by another year in the Budget 2022-23, and further extended until

September 2024. It was expected that the duty exemption on ferrous scrap would provide MSMEs with a new ‘lease on life’, but the erosion of their working capital and the prolonged period of elevated interest rates failed to protect them from bankruptcy

Additionally, the lower import duty was expected to help MSME user industries bring in end products at competitive prices from overseas, allowing them to compete with prevailing prices in India. It was also intended to provide a check on domestic metal producers to prevent prices from rising to abnormally high levels. Unfortunately, India’s steel MSMEs failed to fully benefit from the duty exemption, primarily due to market volatility, despite phenomenal demand growth. Now, the government hopes that the continued duty exemption will help bring them back to business.

Import reliance

India’s ferrous scrap demand was estimated to have reached a record 28Mt in FY 2022-23 (April-March), but it declined

by 7% to 26Mt the following year due to unavailability from domestic sources. During the financial year 2024-25 (AprilMarch), India’s steel scrap consumption is likely to set another record of 31Mt due to rising steel production capacity, and a proportionate increase in raw materials demand. If this trend continues, India’s ferrous scrap consumption may rise to a record 55Mt by the end of 2030.

Interestingly, the country showed an increased appetite for imported scrap. Data revealed that India’s ferrous scrap imports reached 11.03Mt in FY 2023-24, a 13% increase from the previous year. The sharp spurt in imports can be attributed to decreased demand from other consuming countries such as Turkey, Pakistan, and Bangladesh. Industry sources noted that shipments meant for these destinations were redirected to India, resulting in a dramatic increase in imports. Thus, India met up to 45% of its ferrous scrap demand through imports.

The volume of ferrous scrap imports has tripled in the last three years, primarily due to rising domestic demand and the

growing importance of scrap usage in steel manufacturing. India’s steel production through electric arc furnaces – using ferrous scrap and sponge iron – rose by 15% to 82Mt in FY2023-24 (April-March). Surprisingly, India’s ferrous scrap generation is likely to rise substantially – by 70% – to 45Mt by 2030.

T V Narendran, managing director and CEO of Tata Steel, said, “The increased provision for capital expenditure of approximately INR 110,000 billion is a major boost for building and improving infrastructure and would have a strong effect on the economy. As a key component of all infrastructure development, steel will see an increased demand going forward.”

Echoing a similar statement, Amarendu Prakash, chairman of Steel Authority of India Ltd (SAIL), commented, “Focus on urban housing, enhancement of rural infrastructure, further improvement in road connectivity and development of various corridors is expected to boost domestic steel consumption.” �

The African steel industry plays a crucial role in the continent’s economic development, however, it faces multiple challenges that must be overcome in order to achieve sustainable growth.

By Joseph X

F Ribeiro1, Umaru Musa 2,3, Faiz Iqbal4, Aliyu Aliyu4

THE steel sector significantly contributes to global economic development, providing over six million direct and indirect jobs (Vögele et al., 2020). As one of the most valuable metals globally (Pal et al., 2014), steel production and consumption increased from about 1,450Mt in 2010 to approximately 1,900Mt in 2023 and is projected to reach 2,030Mt by 2030 (World Steel Association, 2022). Steel is essential for numerous manufacturing industries (Muslemani et al., 2021), with the global steel market valued at around $1 trillion and expected to grow. With ongoing urban development, steel remains crucial for the infrastructure, transport, energy, and technology sectors, as well as for renewable energy deployment in wind turbines, solar panels, and electric vehicles (The Commonwealth, 2023). The steel industry in Africa has evolved significantly since

the colonial era, driven by technological advancements, globalisation, and changing market dynamics amidst political transitions and conflicts. Initially reliant on imports from Europe, the USA, and the Far East, African countries now produce steel from small-scale to large integrated plants, serving various sectors like construction, automotive, machinery, and energy (UN Comtrade). Steel production involves primary conversion from raw ore and secondary recycling via basic oxygen furnaces (BOF) and electric arc furnaces (EAF). Raw material availability varies across the region, with some countries like South Africa and Egypt having selfsufficient deposits, while others rely on imports (CABARO Group, 2024). As Africa pursues sustainable development goals, the steel industry faces unique challenges and opportunities, highlighting the importance

of effective policy frameworks and market mechanisms for growth, sustainability, and decarbonization.

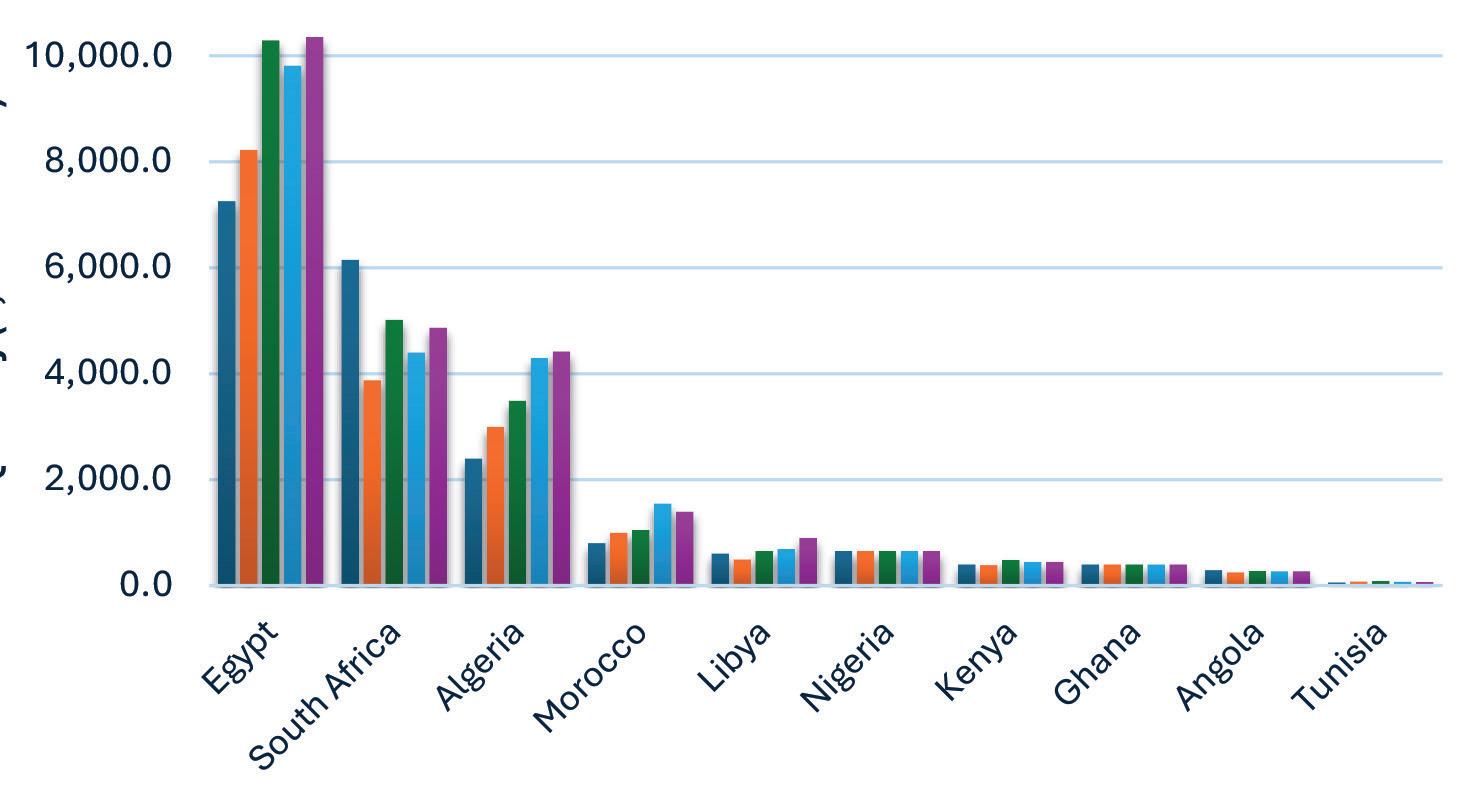

As of 2023, African steel production reached approximately 39.49Mt and is projected to grow at a CAGR of 3.10% from 2024 to 2032, reaching 51.86Mt by 2032 (African Steel Market Report, 2024). This growth is driven by increasing infrastructure projects across the continent, including roads, bridges, and power plants, which boost steel demand (African Steel Market Report, 2024). Governments are promoting the use of locally produced steel to stimulate domestic industrial activity, job creation, and economic development (African Steel Market Report, 2024). Table 1

The industry is also attracting investments from public and private

1. Department of Petroleum Engineering, Kumasi Technical University, Ghana

2. Faculty of Engineering, University of Nottingham, Triumph Road, Nottingham NG7 2TU, United Kingdom

3. Department of Chemical Engineering, Federal University of Technology Minna, PMB 65, Minna, Nigeria

4. School of Engineering, University of Lincoln, Brayford Pool, LN6 7TS, United Kingdom

(Source: The World Steel Association, 2024a, b)

sectors, leading to capacity expansion. Despite these advancements, Africa’s global steel production contribution remains relatively low. Key countries driving steel production include Egypt, South Africa, Algeria, Morocco, Libya, Nigeria, Kenya, Ghana, Angola, and Tunisia, as depicted in production figures from these top 10 African nations (The World Steel Association, 2024). To unlock its full potential, experts emphasise the importance of adopting sustainable practices, fostering innovation, and enhancing collaboration within the African steel industry (Expert Market Research, 2024). Egypt, South Africa, and Algeria, ranked 20th, 34th, and 39th in the 2022 global rankings, respectively, appear to occupy the top three positions in steel production within Africa. In the Eastern African region, the Abyssinia Group of Industries (AGI) has grown to become one of the largest steel producers, with an annual capacity close to 1Mt throughout the group, with manufacturing and mining operations spread in East Africa, namely Kenya, Uganda, Ethiopia, and Rwanda. Fig 1

Major current investments and expansion plans

Africa’s steel production success is driven by increasing public and private investments supported by infrastructure development, government policies, and rising demand (Expert Market Research, 2024). Significant private sector investments in Egypt, South Africa, Morocco, Nigeria, and Kenya have led to the establishment of modern steel mills, reducing reliance on imports and meeting local demand (SAISI, 2022; CABARO Group, 2024). For instance, Libya’s LISCO partnered with Danieli to construct a direct reduction plant, while Kenya’s Devki Steel Mills invested in a large plant in Kwale, creating jobs and boosting the local industry (Expert Market Research, 2024). Liberia produced 5Mt of iron ore valued at

$346.9 million in 2021 (International Trade Administration, 2024), and Zimbabwe is set to become a major steel producer with Tsingshan’s $1.5 billion Dinson Iron and Steel project (The Herald, 2024). In Nigeria, the ANRML’s iron ore processing plant in Kaduna represents a significant FDI, expected to enhance the country’s steel production and create thousands of jobs (African Industries, 2024). Kenya also plans substantial investments in new iron and steel plants over the next five years (Nation, 2024).

Several African countries, including Algeria and Libya, are investing heavily in steel production infrastructure to reduce import dependency and enhance economic self-sufficiency. West African nations like Liberia are attracting significant investments from companies like ArcelorMittal and Fortescue to expand iron ore production capacity (Forbes, 2023). South Africa, Nigeria, Algeria, and Morocco have announced plans to expand their iron and steel production capacities (Steel Radar, 2024). Governments across the continent are implementing strategies to promote local steel consumption and discourage imports through tariffs. For instance,

Egypt has supported its steel industry since the late 1990s, including imposing tariffs and establishing local production facilities (ZAWYA, 2023; Selim, 2006). In South Africa, a master plan for the steel industry aims to revitalise the sector and boost production (The DTIC, 2021). Nigeria has also focused on revitalizing its steel industry, refurbishing the Ajaokuta Steel Company and developing comprehensive plans for sector revival and attracting foreign investments (Udofia, 2024; Nigerian Steel, 2024). The African steel market is expected to grow significantly due to a rise in construction projects across the continent. Increased investments from both public and private sectors, supported by government initiatives, are set to boost the construction industry and drive demand for steel. Governments are promoting the use of locally produced steel to stimulate economic development and employment, leading to greater adoption of local steel in construction projects throughout Africa (Africa Steel Market Report, 2024).

Innovation, technology, and local content

Traditionally, steel production in Africa has employed basic oxygen furnaces. Gradually, innovations including electric arc furnace (EAF) technology, capable of recycling scrap metal into high quality steel products, has become prevalent. The reduced energy requirements, coupled with its flexibility makes it a suitable alternative for regions with limited access to natural resources such as coking coal (CABARO Group, 2024). Numerous green steel projects are underway in Mauritania. Société Nationale Industrielle et Miniere

(SNIM) and ArcelorMittal signed an MoU in 2022 to develop a 2.5Mt green iron ore pelletizing and direct reduced iron plant. A €300 billion European Union Global Gateway grant will facilitate a new road network and high-power transmission line to support green hydrogen plant development. Mauritania aims to capture 1% of the global green steel market by 2050 (Energy Capital and Power, 2024). In South Africa, the Leadership Group for Industry Transition and Trade & Industrial Policy Strategies workshop in 2023 highlighted green hydrogen direct reduced iron (GH-DRI) technology as transformative for green iron ore production, leading to a national plan to decarbonize the steel industry (Stockholm Environment Institute, 2023). In Kenya, Abyssinia Steel and Spenomatic partnered with Empower New Energy to solarise the Awasi steel factory with a 2.5MWp solar project, generating 4.8 GWh of clean electricity annually, saving 2,500 metric tons of carbon emissions, and reducing electricity costs (AFSIA, 2023). African production systems are increasingly embracing digitalisation and automation. Industrial Internet of Things (IIOT) platforms enable real-time monitoring, predictive maintenance, and optimised production flows. Advanced materials handling systems and CNC machinery facilitate precision shaping and

cutting of steel products. Companies are also integrating innovations to reduce CO2 emissions and water consumption, meeting sustainability targets (CABARO Group, 2024). Heavy investment in advanced technologies by South African companies has led to efficient production processes, making them leading suppliers domestically and competitive exporters in Africa. Similar investments in Egypt’s steel industry have increased its market share and made it a significant player in the MENA region.

Africa’s steel sector holds significant opportunities fuelled by abundant natural resources and increasing demand from the construction sector. Expanding the steel industry could create jobs and drive industrial development. Regional collaborations, particularly through initiatives like the African Continental Free Trade Area (AfCFTA), offer prospects for unified markets and streamlined trade in raw materials and steel products across borders (CABARO Group, 2024). Adoption of advanced technologies such as AI, IoT, and automation presents opportunities to enhance productivity, efficiency, and global competitiveness in steel manufacturing in Africa (Fig 2).

Promoting sustainable practices and green steel production also offers a

significant opportunity for African steel producers. By investing in renewable energy and eco-friendly production methods, they can align with global sustainability goals and enhance their competitiveness in markets that prioritise environmentally friendly products. Mauritania, Africa’s second-largest producer of iron, exported 13Mt of raw iron in 2022 and aims to reach 39Mt by 2030. Despite this, the country has not fully capitalised on manufacturing and exporting steel due to high production costs and energy poverty. However, renewed interest in renewable energy, such as green hydrogen, could enhance domestic green steel production, boost local industry growth, generate revenue, and facilitate steel exports to Europe (Energy Capital and Power, 2024). In Uganda, Muko town has 150Mt of highquality hematite iron ore deposits. Meeting the Ugandan market’s demand requires at least 800kt of iron ore annually, while 4Mt/ yr are needed to satisfy the East African region (Kenya, Tanzania, Uganda) (Regional Investment Agency, 2024).

Despite Africa’s strides in steel production, several challenges hinder further growth. Access to capital remains a significant barrier, limiting modernisation and expansion efforts in the industry.

Infrastructure deficiencies, including inadequate railways and ports, also impede efficient transportation of raw materials and finished steel products. The high cost and unreliability of energy sources further exacerbate challenges, impacting production costs and efficiency in the energy-intensive steel manufacturing process (CABARO Group, 2024). The steel industry in Nigeria, for instance, faces significant challenges due to unreliable power and transportation infrastructure. Corruption further exacerbates the situation, potentially deterring the foreign direct investment necessary for the industry’s development (Nigerian Steel, 2024). This issue is common across many African countries. In Sierra Leone, the Chinese company Shandong Iron and Steel Group plans to invest $700 million in an iron ore processing plant at its Tonkolili mine. However, currently, Shandong exports all the unprocessed ore produced at this mine to the Port of Qingdao in China (African Business, 2016).

Raw materials, critical to steel production,

BIGGER.

Superior Machine has joined the Woodings’ group creating the most capable hot metal equipment supplier group in North America. Offering the combined knowledge, engineering, manufacturing, and construction expertise for all your equipment needs.

Wherever hot metal is produced, you will find equipment from Woodings, Superior Machine, and

Munroe operating at the highest level in the most demanding conditions. Our products and professional installation services reduce downtime and extend campaign cycles.

We are better together. Let us show you. woodings.com

We can provide you with more value than ever before from concept to installation, service to replacement, our size, scope, and experience gives us a unique ability to help you increase productivity and solve problems.

are also not uniformly available and well distributed across the continent. For instance, countries like Egypt and South Africa are well endowed with iron ore and coking coal, making their industries self-sufficient. Others rely on imported materials, which present economic and logistical challenges (CABARO Group, 2024). The Nigerian steel industry, exemplified by the Ajaokuta plant, relies heavily on imported raw materials and machinery despite having ample iron ore at the Itakpe mine (Essien, 1997). In Eastern Africa, countries like Tanzania, Kenya, and Uganda import around 4 metric tons of steel products annually, with expected annual growth of 5%. Uganda’s steel imports alone are valued at $350 million (Regional Investment Agency, 2024).

African steel production varies widely, with facilities ranging from small to

References

Africa Steel Market Report (2024). Online at: https://tinyurl.com/4mwh6b49. Accessed on 09.06.24.

African Industries (2024). Nigeria to start steel production, https://tinyurl.com/mwbp5s34. Accessed on 09.06.24.

African Business (2016). Sierra Leone: Chinese steel firm to invest in $700m iron ore processing plant. https://tinyurl.com/299dj2cr. Accessed on 10.06.2024.

AFSIA (2023). African Solar Industry Association. https://tinyurl.com/3299hp7f. Accessed on 19.06.2024.

CABARO Group, Steel Production in Africa: Opportunities and Challenges, https://tinyurl. com/2hdy85jh. Accessed on 17.05.24.

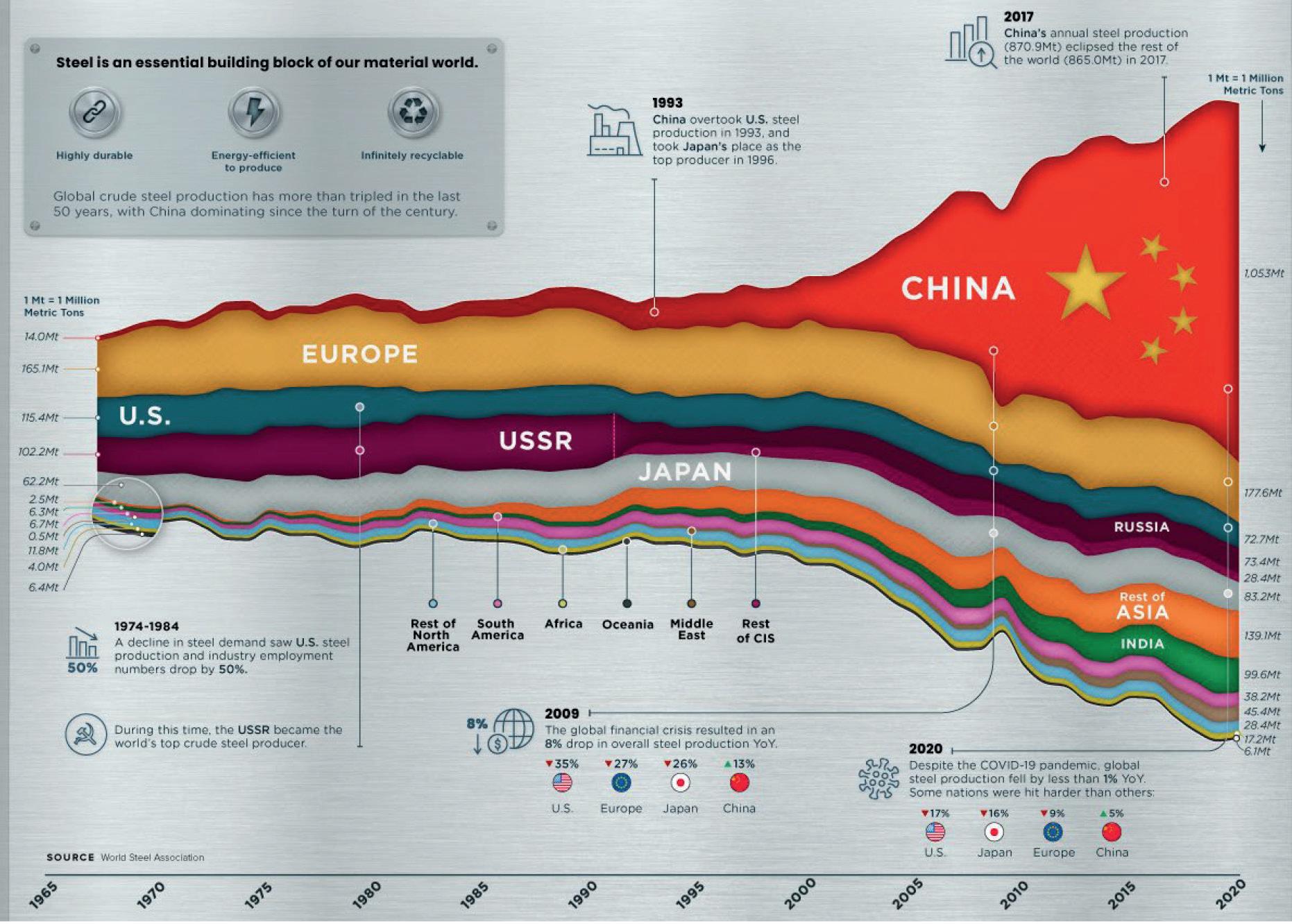

Niccolo Conte. (2021, June 2). Visualizing 50 Years of Global Steel Production. Visual Capitalist, https://tinyurl.com/j2a2f3cw. Energy Capital and Power (2024). Mauritania’s Steel Industry Fueled by Green Hydrogen. https:// energycapitalpower.com/mauritania-steelindustry-fueled-by-green-hydrogen, accessed on 09.06.24.

Expert Market Research, 2024, Africa Steel Market Size, Share, Growth, Analysis 2024 –2032.

Forbes, 2023, Africa’s Heavy Industrial Revival: A Future Hub of Industrial Goods

International Trade Administration (2024). Liberia- Country Commercial Guide. https:// tinyurl.com/7e6v2hsj, accessed on 10.06.2024.

Muslemani, H., Liang, X., Kaesehage, K., Ascui, F., & Wilson, J. (2021). Opportunities and challenges for decarbonizing steel production

large integrated plants. The industry’s technological sophistication and modernity of equipment are critical, with some countries still using outdated machinery, which hampers both quality and quantity of production (CABARO Group, 2024). Market competitiveness is a major challenge, as cheaper imported steel, especially from China, forces local producers to incur high costs, reducing profit margins and market share. Additionally, inconsistent trade policies, high tariffs, and bureaucratic red tape further complicate operations and inhibit industry growth. Stricter environmental regulations are being enforced to reduce pollution and carbon emissions, necessitating investments in green technologies that may lack funding. Additional challenges include infrastructure deficits, energy supply constraints, skilled labour shortages, competition from

by creating markets for ‘green steel’ products. Journal of Cleaner Production, 315, 128127. Nation (2024). State takes on steel tycoons with new Sh220bn plants. https://tinyurl. com/29t2v7fj. Accessed 19/06/2024.

Pal, P., Gupta, H., & Kapur, D. (2016). Carbon mitigation potential of Indian steel industry. Mitigation and adaptation strategies for global change, 21, 391-402.

Regional Investment Agency (2024). Muko Iron and Steel Project. https://tinyurl.com/ msht8shp. Accessed 19/06/2023.

Francisca Oluyole. (2017). Ajaokuta: How Nigeria’s largest industrial project failed. Premium Times Nigeria. https://tinyurl.com/5c94w22s.

SAISI, 2022, A South African Steel Industry Report, Reflecting on 2021 and an Outlook for 2022, https://tinyurl.com/3s4mfyur. Accessed on the 19.05.24.

Selim T. H., 2006, Monopoly: The Case of Egyptian Steel, Journal of Business Case Studies, third quarter, 2(3).

Steel Radar, 2024, Iron and Steel Markets, Investments in the iron and steel industry are increasing in Africa, https://tinyurl. com/2p88nb27. Accessed on 19.05.24.

Stockholm Environment Institute (2023). The green steel production in South Africa: insights from decarbonization workshop. https://www. sei.org/features/the-green-steel-transition-southafrica/, Accessed on 10.06.2024.