Issue 40: Summer 2023 POWERING THE SMART GRID www.energystoragejournal.com

many

is that?

frightening cost of future storage

How

trillions

The

Lead's unlikely heroes Industry innovation award shows potential in a neglected chemistry Korea: the fight back The gloves are off in the battle against the US giga-favoritism rules Too many pundits ... ...not enough thought! Time for a better debate on our battery futures

Better Paste. Better Plates. Better Battery. Engineered to Customers’ Specific Particle & Batch Size Documentable Savings of Paste Material & Curing Time More Tested & Proven Benefits of Hammond Original & Treated SureCure® Improved Charge Acceptance • Strengthened Positive Plates • Enhanced Curing Consistency Increased Cycle Life • Improved Partial-State-of-Charge Cycling • Reduced Carbon Footprint Treated SureCure® Accelerates TTBLS Crystal Growth INDUSTRY NEWS North American Investment Doubles Treated SureCure® Production Capacity Hammond Group, Inc. recently announced full-scale operations of its new North American Treated SureCure® manufacturing line, a multi-million dollar investment that doubles production capacity for one of its most effective and in-demand additives.

of

planning

technical

in early 2023.

uses

manufacturing practices

materials

products at

locations.

facilities

ISO:9001 certified for quality, and the Indiana location is IATF

to

with more strict US automotive industry requirements. Read more at HammondGlobal.com/news.

Years

advance

involving

experts from across Hammond’s global team brought production online at its Indiana facility

Hammond

similar

and raw

to produce identical

both its US and Malaysia

The

are

certified

conform

KOREA: THE FIGHT BACK

The gloves are off in the battle to become the world leader in lithium battery mass production. The US' IRA act is being challenged by nations across the planet with Korea proving a strong contender.

HOW MANY TRILLIONS IS THAT?

All the noise about how energy storage is vital to the energy transition still seems to be ignoring the fact that a huge amount of investment is needed immediately — there's too much of talk of funding sometime in the future.

LEAD'S UNLIKELY HEROES

Innovation has been the key theme in the energy storage markets for the past decade. But dismiss lead batteries at your peril, the incumbent technology for the last 150 years has a way of bouncing back!

There's too many pundits and not enough experts — it's time for a serious debate on storage

IN THIS ISSUE

The European Union has been urged to form a battery raw materials club with the US.

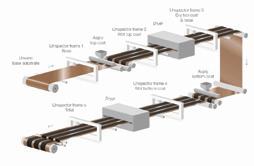

It's time to remember that precision measurement in battery production is a must.

2 EDITORIAL: Let mature debate prevail over lies, damned lies and statistics | 4 PEOPLE NEWS Dunckley appointed EMEA president for Leoch | Farewell to John Devitt battery pioneer | 8 RECYCLING NEWS | 10 NEWS | 19 COVER STORY: WHAT’S A TRILLION OR TWO BETWEEN FRIENDS? The investment sums needed just in storage for the energy transition are eye-watering | 31 INNOVATION IN LEAD ENERGY STORAGE: The contestants and the winner of the BCI innovation Award | 37 ZINCFIVE: Tod Higinbotham discusses choosing the right battery for data centers | 39 IN FOCUS: THERMO FISHER SCIENTIFIC The future of battery production is in automated metrology technology | 42 UPCOMING EVENTS: ESJ details the conferences and shows ahead

Editor: John Shepherd | email:john@energystoragejournal.com | tel: +44 7470 046 601

Advertising manager: Jade Beevor | email: jade@energystoragejournal.com | tel: +44 1 243 792 467

Finance: Juanita Anderson | email: juanita@batteriesinternational.com | tel: +44 7775 710 290

Subscriptions and admin: admin@energystoragejournal.com | tel: +44 1 243 782 275

Energy Storage Journal — business and market strategies for energy storage and smart grid technologies

Publisher: Karen Hampton karen@energystoragejournal.com

+44 7792 852 337

Editor-in-chief: Michael Halls mike@energystoragejournal.com

+44 7977 016 918

Design: Antony Parselle | email: aparselledesign@me.com

Reception: tel: +44 1 243 782 275

The contents of this publication are protected by copyright. No unauthorized translation or reproduction is permitted. Every effort has been made to ensure that all the information in this publication is correct, the publisher will accept no responsibility for any errors, or opinion expressed, or omissions, for any loss or damage, cosequential or otherwise, suffered as a result of any material published.

Any warranty to the correctness and actuality of this publication cannot be assumed. © 2023 HHA Limited. UK company no: 09123491

CONTENTS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 1 Contents Energy Storage Journal | Issue 40 | Summer 2023 The new titan of lead Ecoult’s UltraBattery, ready to take lithium on, head-to-head The CEO interview Anil Srivastava and Leclanché’s bid for market dominance Next gen integrators Coming soon to a smart grid near you, the ideal middle man Let cool heads prevail The lead-lithium storage debate steps up a notch

2 12

FEATURES ALSO IN THIS ISSUE ABOUT US

The US DoE launch a contest to find the next generation of battery industry leaders.

10

INNOVATION IN ENERGY STORAGE 31 COVER: FUNDING THE TRANSITION US GIGA-FAVORITISM BATTLE

19 16 39

Let mature debate prevail over lies, damned lies and statistics

“Ceilings and floors, my boy,” a banker once told me.

It was a phrase that baffled me well over a quarter-of-a-century ago as a trainee journalist writing about financial markets.

My topic: the inexorable rise of the Japanese stock market. In just five years the value of corporate Japan had trebled. The Nikkei stock index had soared to 39,000 and showed no sign of flagging.

“What’s ceilings and floors?” I asked.

“Don’t you know anything?” laughed the banker with just the right measure of scorn. “Once the price of the index hits its ceiling, then it’s the floor for its next rise. The only way is up. I expect to see the Nikkei at 40,000 in three months.”

As financial bubbles go Japan’s bubble was spectacular.

At one time the price of the land in the Imperial Palace in the heart of Tokyo was so inflated that, if you could have sold it, you would have had enough money to buy Canada. (And that’s including everything inside Canada too.)

And then came the crash. Floors dropped through ceilings. And then fell through floors again, inexorably downwards.

That same stock index just 12 months later was down at 22,000 — $2 trillion of value had dropped in the value of corporate Japan.

And, to make the point more brutally, that same index 33 years afterwards is standing at an average of 25,600 for this April.

So why mention all this in a magazine dedicated to reporting about batteries and the energy storage industry?

What’s true about financial markets is equally true about commercial ones.

This is now a key issue at the heart of the lead battery and energy storage markets. Very simply, the forces of hype and unreality loom large over the entire energy storage market — and vast swathes of information, misinformation, and disinformation are at play.

A quick glance at the world of start-ups reveals a huge number of extravagant claims about various technologies — many of which have yet even to leave the laboratory bench — which may or may not be true.

It’s in the nature of start-ups to boast technologies that are up-and-ready while still not finalized. But frankly they can’t all be true and we all know it.

Then there’s informed opinion.

One sector of the industry reckons that lead batteries are yesterday’s technology (and suppliers are moving away from the chemistry).

Yet other suppliers are predicting that all things will be well and there are huge untapped markets in the developing world about to be tackled.

And yet others see an imminent world energy shortage crisis. Although reputable market analysts predict steady and not explosive growth for lead battery sales, other

A quick glance at the world of start-ups reveals a huge number of extravagant claims about various technologies — many of which have yet even to leave the laboratory bench — which may or may not be true.

Mike Halls • editor@energystoragejournal.com

EDITORIAL 2 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

super-optimists are preaching a gospel where lead batteries will become desperately needed in our decarbonized future.

Much as I respect the people who say this — one group sees the energy storage market at 585GW by 2030, and worth between $30 billion-$50 billion and that lead batteries can capture 20% of that market. Really? It presently captures less than 1% and its market share is falling?

Looking in another direction, what this magazine finds so puzzling is why are so many players, big and small alike, so entrenched in their thinking? Where is the balanced view? Where is the mature debate?

Each year our editorial team attends literally dozens of conferences and events. We dutifully try to follow the best presentations, hear the best speakers and keep up to date with an industry that is (perversely) both slow to change yet rocketing away at an unbelievable pace.

But choose the right conference and the right speaker and you may hear that lead acid is yesterday’s news (boo-sucks from the lithium ion community) or that lithium is explosive, costly and will probably bring you out in spots (courtesy of the lead acid gentlemen).

For this magazine we deliberately have to choose a middle path. Because, despite our occasional reservations, our job is to represent what people in this business say and are thinking, not our opinions.

For a profession where its leading lights see themselves as visionaries — and sometimes quite rightly too — there needs to be more coherence in that vision.

There are a host of issues facing this industry now that need to be dealt with in a concerted fashion. For example, irrespective of any belief that lithium/lead/nickel/ something-bright-and-shiny is going to save the planet, a reasonable debate has to be conducted over issues such as recycling batteries.

At the practical level there is a very real risk of an explosion if a lithium battery is smashed in a lead acid battery breaker. The chances of this happening are growing as both types of batteries can look similar.

Other super-optimists are preaching a gospel where lead batteries will become desperately needed in our decarbonized future

At the financial level, the commercialities of a huge range of recycling options need to be faced. At present it’s clear that it’s unlikely that anyone is going to be making a profit by selling the elements from a LiFePO4 cell (and other lithium variants also have question marks over them).

Is the world really crying out for more iron, phosphorous or oxygen?

So away from the world of hype will tolling arrangements be the future for most lithium recycling? Sensible discussions are needed over what that means for lead batteries too.

Let the debates begin.

Mike Halls, Editor-in-Chief

EDITORIAL www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 3

Mike Dunckley appointed EMEA president for Leoch

tries including lithium, redox flow and nickel-metal hydride.

He is one of the founding members of the Hawker Batteries Group and also one of the developers of the firm’s pure lead business.

Dunckley is also a former business development director for Fiamm.

Gao heads up Hammond lab as director of R&D

ing as a PhD student at Iowa State University.

Battery industry veteran Mike Dunckley has joined Leoch to help spearhead the lead and lithium giant’s continued expansion in new and existing markets.

Dunckley, who was appointed EMEA president for Leoch as of April 1, told Energy Storage Journal he was looking forward to the challenge of helping strengthen Leoch’s global presence.

His appointment came just days after Leoch chairman and founder Dong Li announced the group planned to build a manufacturing plant in Mexico to ramp up its presence in the Americas ( see article elsewhere in our news pages ).

“The challenge now is to build the Leoch brand, its identity and its role to take advantage of the opportunities in existing and future markets,” said Dunckley, who will be based in Europe.

Dunckley has been brought in as a result of his 30-plus years knowledge of the battery industry and his deep understanding of a wide range of technologies, having worked in various chemis-

For the past 14 years he has been running his Catalyst Solutions consultancy, focused on advising companies on technology selection, business strategy and development in the energy storage and electric mobility markets.

Now he will draw on his experience to help drive what he said will be the next phase of development of Leoch’s $2 billion international business, with an increasing reach into the Americas, Europe and Asia.

The China-centred company has its corporate HQ in Singapore and a US HQ in Los Angeles, with an extensive sales team across North America.

In May 2021, the company bought Madrid-based distribution business Meibat — from which it launched its Leoch Iberia subsidiary.

Dunckley said: “One of the things that really interested me about Leoch is they are one of the few incumbent battery manufacturers that have their own lithium operation.

“So having lithium iron phosphate in addition to pure lead and a full range of different technologies and the ability to serve all the markets — gives Leoch all the components that are needed as we drive the next stages of growth forward.”

Hammond Group has formally announced the appointment of Enqin Gao as R&D director, who is also heading up the company’s E=(LAB)² research unit in Indiana.

Hammond confirmed the appointment on April 6, although Gao told Energy Storage Journal he took up the post last November.

Gao has more than three decades of management and R&D experience in the lead acid battery industry.

He has previously worked on the manufacturing side of the industry with Trojan Battery and Camel Group and has held a number of top industry posts during his career including chief engineer, product specialist and research chemist.

He received his MS in physical chemistry from Peking University and a BS in chemistry from Wuhan University. He also studied materials science and engineer-

Metair makes interim CEO, CFO appointments permanent

Interim CEO of batteries and auto components groups Metair Investments, Sjoerd Douwenga, has been appointed to the role permanently, the company said on May 31.

Interim CFO Anesh Jogia has also been appointed permanently. He will also work as executive director and a member of the firm’s investment committee.

Hammond president and CEO Terry Murphy said Gao was uniquely qualified to lead E=(LAB)², which was set up in 2015 to work with industry to improve battery charge acceptance and cycle life.

“Lead acid batteries are central to the growing demand for energy storage as the world transitions away from fossil fuels, but we have to continue innovating,” said Murphy.

“Enqin is a key addition to our R&D team as we help drive further innovations for the industry.”

Gao said Hammond’s technical assistance programs allow customers to treat the lab as an extension of their own.

“Using our state-of-the-art instruments, many of which our customers don’t have in their own labs, our engineers can perform TGA/DSC analysis, BET analysis, SEM and more on material evaluation and cell and battery tests.

“Our team is composed of experts from material science, battery research, design, manufacturing and testing with a total industry experience over 200 years.”

The interim appointments of Douwenga and Jogia were announced in March, following the resignation of then CEO Riaz Haffejee.

Flow battery pioneer Skyllas-Kazacos joins Tivan advisory group Vanadium redox flow battery pioneer Maria Skyllas-Kazacos has joined a new technical advisory group set up by minerals processing tech company Tivan.

PEOPLE NEWS 4 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

PEOPLE NEWS IN BRIEF

Nickel veteran Fetcenko joins CHASM

he joined Sion Power in April 2019 as executive chairman of the board.

vehicles on the road,” said a CHASM announcement.

Battery veteran Michael Fetcenko was appointed chairman of the board of directors at CHASM, the carbon nanotube developer, effective January 18.

Fetcenko brings extensive experience in the battery industry to CHASM. He joined Ovonic Battery Company in 1980, and was the key figure and inventor in its development of NiMH batteries which became the basis for an early generation of electric vehicles.

He was president of the company when Ovonic was acquired by BASF in 2012. He subsequently became managing director of BASF Battery Materials, North America before taking on the position of director for global licensing.

After retiring from BASF

Tivan said on May 31 Skyllas-Kazacos’s technical knowledge and experience will be keenly sought in developing and standardizing the global value chain in VRFB.

Other initial appointments to the group include Stéphane Leblanc and Simon Flowers.

Leblanc is a former MD of Rio Tinto Iron & Titanium. Flowers is the director and principal of Sustainergy Consulting and a former international

Fetcenko holds more than 70 patents and has authored 100+ publications in the NiMH and Li ion field. He has over 40 NiMH licences and led the successful Argonne National Laboratory NCM patent enforcement and licensing effort which resulted in 14 licences and sub-licences.

“His inventions are used in all NiMH batteries for consumer, stationary, and hybrid vehicle applications such as the iconic Toyota Prius with over 10 million

“Michael served on the board of directors and Technical Steering Committee for Sion Power for five years, a leader in advanced ultra-high energy lithium battery systems including protected metallic lithium anodes for Li ion batteries.”

Fetcenko said: “The potential for carbon nanotubes to deliver benefits such as improved battery performance has been known for some time. What is new is that CHASM has achieved breakthroughs that will lead directly to

widespread adoption: affordability, production at massive scale, methods for safe and easy handling and tunability to customer specifications.”

David Arthur, co-founder and CEO of CHASM said: “This appointment comes at a critical time as we accelerate the development and commercialization of our advanced materials solutions. Michael’s experience in the areas of intellectual property, building strategic partnerships with large corporations and his successful track record of scaling businesses are equally important.”

US Battery Manufacturing announces promotions

US Battery Manufacturing announced new promotions to the firm’s executive management team on February 17. The appointments became effective at the start of the year.

Leading the changes was Zachary Cox, who was promoted to EVP of operations. Cox has been with US Battery for nine years and has held various engineering, technical sales, and

management posts in the company.

Eric Rueter was promoted to EVP of manufacturing. He has been with US Battery for the past two years. He has an extensive background in process engineering and management in and outside the battery industry.

Marvin Ho was promoted to VP of product engineering and quality. Ho has been with US Battery for more than

a year and was previously lead researcher on Hammond’s lead silicate additive product that won the BCI Innovation Award in 2021.

COO Don Wallace said: “Our administrative, engineering, sales and manufacturing teams are helping the company spearhead new technologies that are moving US Battery into the future as we approach our 100year anniversary.”

team leader with US energy firm ConocoPhillips.

The group will provide independent technical advice to support development of two projects, including Tivan’s Mount Peake in Australia’s Northern Territory — which the company says has one of the largest flatlying, shallow vanadiumtitanium deposits in the country.

The other is the Speewah vanadium-titaniumiron project in Western

Australia, of which Tivan acquired 100% ownership in April.

Macchiarola joins ACP as chief policy officer

Frank Macchiarola is joining the American Clean Power Association as chief policy officer, the trade organization said on May 17.

Macchiarola, senior VP of policy, economics and regulatory affairs at the American Petroleum Insti-

tute, will start on June 20. ACP said he will lead a team working on regulatory and legislative proposals to boost development of advanced clean energy technologies.

Jason Grumet, ACP’s chief executive officer, said: “The clean energy sector is at a pivotal moment, and growing our team to embrace the opportunities before us will ensure this industry has the bench strength in place to match the moment.”

PEOPLE NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 5

EnerSys appoints Thomas as chief human resources officer

ion, Apex Tool Group, and the Eramet Group.

Thomas holds an MBA in HR management from the University of Houston and a bachelor’s degree in HR management from Marietta College.

BMZ Germany names new executives

change through innovation, collaboration and challenging the status quo”.

EnerSys announced the appointment of Shannon Thomas as its new chief human resources officer effective May 1.

EnerSys said Thomas will be responsible for the strategy, leadership and operations of the company’s HR globally, overseeing talent lifecycle and development, total rewards, as well as diversity, equity, and inclusion initiatives.

Thomas has over 20 years’ experience as a global HR officer.

She spent her most recent five years at Chemours, where she helped set up several transformational initiatives, EnerSys said.

Before Chemours she held senior HR positions at several publicly traded and private companies including Owens Corning, Hex-

She succeeds Ted Fries — who is retiring after 26 years of service — and she joins the battery giant’s executive team, reporting directly to president and chief executive officer David Shaffer.

Shaffer said Thomas had extensive experience leading HR teams in a variety of industries and a “proven track record of driving

Thomas’s vision and leadership will support the company’s moves to attract, develop and retain top talent from around the world, while fostering a culture that values diversity, equity, and inclusion, Shaffer said.

On Ted Fries, Shaffer said his business acumen had been invaluable to the growth and success of EnerSys.

“We can’t thank him enough for the many contributions he has made to our business and community.”

Brian Leen leaves Gopher to join Vivify as new CEO

Brian Leen has quit as president and CEO of lead battery recycler Gopher Resource to become CEO of Vivify Specialty Ingredients.

Vivify, which provides additives and ingredients for the food, beverages and other markets, said on April 6 that Leen had joined the firm with immediate effect.

Leen succeeds Devlin Riley,

who has left the company.

Leen has been a member of Vivify’s board since it was acquired in December 2021 by Gryphon Heritage Fund. His appointment as CEO came four years after he joined Gopher.

Leen had previously been president and CEO of Colorado-based ADA Carbon Solutions since 2010.

H&V appoints Martinez as VP, chief people officer

human resource experience.

H&V said the title of chief people officer represented “an evolution beyond the traditional responsibilities of human resources”.

was VP of human resources and compensation and benefits at Spanishlanguage media company Univision.

Lithium ion battery systems company BMZ Germany announced that Oliver Makko had been appointed as CFO and Andreas Krist as chief purchasing officer and M&A manager effective May 1.

Makko, who has degrees in aerospace engineering and business administration, has 15 years of leadership experience in the finance sector.

He succeeds Jörg Dinkat, who left the company in March. Makko will report to BMZ Group CFO Stefan Kreysa.

Krist, a graduate engineer in physical technology, has 18 years of management experience in pre-development, value analysis and strategic purchasing, including responsibility for procuring battery production materials.

Sandra Martinez has been named as VP and chief people officer at Hollingsworth & Vose as of April 18. H&V said Martinez brings a strong blend of

Before joining H&V, Martinez was head of human resources for the industrial segment of Barnes Group, a global industrial and aerospace manufacturing company.

She has worked in the manufacturing industry since 2015. Before that she

Martinez has also been a member of the Diversity and Inclusion Council for the US Manufacturers Alliance.

CEO Josh Ayer said: “We selected Sandra due to her business acumen and experience working with a global workforce in key markets such as the Americas, APAC and Europe.”

He succeeds Oliver Reichertz, who was to leave the company at the end of May. Krist will report to BMZ Group CPO Magdalena Mozler.

On March 15, BMZ signed a memorandum of understanding with Shanghai’s Pingshan district government, under which BMZ’s China arm is set to have access to governmental support programs.

PEOPLE NEWS 6 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

Oliver Makko

Andreas Krist

Farewell to John Devitt, VRLA pioneer

with the lead battery industry some five years before and his death, until now, has been unreported.

It is with sadness that Energy Storage Journal has to record the death of John Devitt, arguably the key figure in the development of the modern VRLA battery. He passed away, aged 96, on December 7, 2021. He had lost contact

John was born on September 27, 1925 in Denver, Colorado, a city where he was to spend most of his life. An early aptitude for science — he was making electromagnets at home aged eight — translated into a degree and later a masters in electrical engineering at Cornell university in Denver.

After a spell in the US Navy — he was in the naval reserve from 1943 to 1955 — mostly spent in battery research, he worked as chief engineer for a variety of Denver located companies. A

Haffejee quits as Metair CEO, Douwenga steps up to fill in during interim

The CEO of batteries and auto components group Metair Investments, Riaz Haffejee, resigned effective March 31.

The South Africa based group said in a regulatory filing on March 22 that Haffejee was also stepping down from its social and ethics committee.

CFO Sjoerd Douwenga was appointed as interim CEO and joined Metair’s social and ethics committee. Finance executive Anesh Jogia was appointed interim CFO.

Metair said Haffejee, who joined the company two years ago, was leaving to pursue other opportunities “more in line with his personal career goals”.

Haffejee successfully led the group through the impact of Covid-19, floods and riots and the group’s board wished him well, Metair said.

He would remain available for a period of two months up to the end of May to ensure a smooth transition and handover, Metair said.

pivotal moment in John’s life was when local manufacturing giant, Gates Rubber Company, then the largest manufacturer of rubber belts and hoses in the world, decided to go into the battery business,

He joined Gates in January 1965. Three months later John with his co-developer Don McLelland submitted a nine-page memo to CEO Charlie Gates called “Lead-Acid Sealed Cells”. The memo was to make history.

In effect Devitt’s proposal recommended the development of a cell that would perform in a manner similar to that of the sealed nickel-cadmium batteries then being sold.

It was an idea that John later said had been fermenting in his brain since listening to a presentation about nickelcadmium batteries five years before. John and McLelland issued the definitive patent in 1972.

Ken Peters, the man who perfected much of the design of later VRLA batteries, described its importance: “The development of gas recombining valve regulated designs has potentially been the most

important advance in the development of the lead battery in the last half of the 20th century.

“Offering improved highrate output, higher specific energy and operating flexibility never previously envisaged, their use in telephone and UPS systems grew quickly replacing previously-used designs in standby applications.

“Within 10 years of the first installation by British Telecom in 1981, 60% of the telephone systems in Western Europe relied upon VRLA batteries for emergency power. Today [in 2006] it must be approaching 100%.”

John, who remained a pioneer in advancing battery storage technology until his late 80s, was honoured over the years with the International Lead Medal, the Gaston Planté award and membership of the Alpha/Beta society.”

“One of the legends of the lead battery industry has disappeared for good,” said one commentator. “We may not see men of such like again in our lifetimes.”

John Devitt, electrochemist, 1925-2021

Further promotion for Stryten’s Dickie

Ian Dickie was appointed director of OEM sales at Stryten Energy at the start of February.

He began his career at Exide Technologies in June 2012 as a district sales manager based in Mississauga, Ontario and moved to GNB Industrial Power, a division of Exide, in April 2014.

Dickie had increasing sales responsibility over the next few years and

by 2020 was regional sales director for Canada, a position he carried further as the GNB Industrial Power segment was absorbed into Exide’s metamorphosis to Stryten Energy.

In July 2022 he became Stryten’s director of National Accounts which also included managing the new business development team for North America.

PEOPLE NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 7

Riaz Haffejee

Sjoerd Douwenga

Fortum launches Finnish lithium processing plant

Energy company Fortum said on April 27 it had started commercial operation of its lithium hydrometallurgical battery material recycling facility in Finland.

Fortum claims the plant is the largest in Europe in terms of recycling capacity and the region’s first commercialscale facility for hydrometallurgical recycling. The plant can also recover 95% of the valuable and critical metals from battery black mass and reuse them to produce new lithium ion battery chemicals, Fortum claims.

At the time of going to press, the company had yet to respond to Battery International’s request for recycling capacity details or say what happens to residual black mass that cannot be

VinGroup and Li-Cycle assess new plant plan

recycled.

Fortum said the facility in Harjavalta will reduce Europe’s dependency on imported battery raw materials.

Head of the batteries business line at Fortum Battery Recycling, Tero Holländer, said the “low-CO2 plant can sustainably produce the materials urgently needed for new EV lithium ion and industrial-use batteries”.

The plant is already producing nickel and cobalt sulfates, Fortum said.

Recycling pre-treatment services for the Finnish plant will be conducted around 2,400km away at Fortum’s new operation in Kirchardt, Germany, The company said on March 16 it had received its environmental permit for Kirchardt from regulators.

Campine posts record figures after take-over

European metals recycling and speciality chemicals group Campine posted a record performance for 2022 on March 13 including increased sales of more than €317 million ($335 million) — less than a year after acquiring two lead battery recycling plants from French lead recycler Recyclex.

The Belgium-based group reported full-year Ebitda (earnings before interest tax debt and amortization) of €26.6 million and saying it had become Europe’s second largest lead-acid battery reprocessing company.

Ebitda was up 18% compared to €22.6 million achieved a year earlier. This comprised €17.2 million from its Belgian operations and €1.8 million from the French ones together with a one-time positive non-cash effect of €7.6 million.

Campine reported total consolidated revenue of €317.4 million, including six months of revenue of the ac-

quired French plants, which was an increase of more than 40% compared to 2021.

Campine said the revenue was related to increased material/metal prices as the volumes remained almost equal.

The battery breaker activities in France are hosted in a new recycled batteries business unit. Campine’s C2P recycling company has become its recycled polymers unit.

“With the expansion, we now recycle a volume of 180,000 tonnes of used batteries, which is the equivalent of 10 million car batteries per year,” said division director David Wijmans.

Wijmans said the group also expanded its feedstock and is now collecting batteries from a broader region.

CEO Wim De Vos said: “There is a clear consolidation in Europe with some temporary and definite lead metal production plant closures, which currently creates a relative shortage of lead metal in Europe.

Vietnam’s Vingroup and Canada’s Li-Cycle are assessing proposals to build a lithium ion recycling plant in Vietnam, the companies revealed on April 12.

The plant could be built near battery manufacturing facilities operated by Vingroup’s VinES Energy Solutions subsidiary, under an agreement where Li-Cycle would become VinES’ preferred recycling partner for its Vietnamese-sourced battery materials from 2024.

The move came five months after the firms agreed an international battery recycling partnership.

Separately, on April 10, VinES said it was joining forces with Turkey’s Altinay Elektromobilite to produce advanced batter-

ies as part of a full-service business for energy storage and mobility systems in the Turkish market.

Altinay general manager Mert Uygun said the partners also aimed to attract investment from the domestic energy sector.

VinES will offer the technology, system design, production and verification of the ESS units, while Altinay will head up sales and marketing as well as after-sales services in the Turkish market, Uygun said.

In November 2022, Vingroup auto subsidiary VinFast agreed to expand cooperation with China’s Contemporary Amperex Technology to develop battery systems for the EVs market.

Gravita makes first moves into Middle East

Gravita India is to invest in the construction of a lead batteries recycling plant in Oman — its first in the Middle East, the company announced on February 24.

Gravita Netherlands, its subsidiary, has agreed a memorandum of understanding for the project in which it will hold a 50% stake, with the remainder held by undisclosed Omanbased partners.

The plant, to be designed and developed in India, will be managed by GNBV and have an initial, first-phase battery recycling capacity, of 6,000 tonnes per annum.

Gravita said the total investment for the first phase was around Rs40 crore ($5 million) of which GNBV’s share of investment would be around Rs20 crore.

The company has yet to disclose the location of the plant or comment on further development phases.

Gravita operates similar recycling facilities in Togo,

Senegal, Ghana, Mozambique, Tanzania and Sri Lanka in addition to India.

CEO Yogesh Malhotra revealed in August 2022 that the company was eyeing opportunities to further expand its operations outside India.

Battery recycling investment in the Middle East has gathered pace since March last year, when Italian group Seri Industrial said ground had been broken for a combined lead acid battery manufacturing plant and recycling facility in the United Arab Emirates (UAE).

The company behind the Dubai Industrial City project — Dubatt Battery Recycling — is a joint venture between Dubai-based Regency Group and Seashore Group. Dubatt is investing AED110 million (about $30 million) in the project.

In August, Royal Gulf Industries said it would invest more than AED62 million to build a lead batteries recycling centre in the UAE.

RECYCLING NEWS 8 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

Lohum, ACKO in ‘pioneering’ EV battery insurance partnership

Indian recycler Lohum said on May 2 it was teaming up with insurer ACKO for what the firms say is a pioneering EV battery warranty insurance partnership.

Lohum said the move will pave the way for future partnerships with OEMs to launch “battery buy-back products” and improve the resale value of vehicles.

The collaboration will also benefit EV battery OEMs that already have their products underwritten by ACKO.

Under the partnership, ACKO will continue to provide performance warranty insurance for EV batteries

to multiple OEMs and “offer hassle-free redressal” in the event of performancerelated issues.

Meanwhile, Lohum will work towards collecting, repurposing, and recycling

used batteries that are returned as a result.

Lohum founder and CEO Rajat Verma said the partnership “weaves sustainability into India’s first EV battery performance war-

ranty insurance.

“We applaud ACKO’s emphasis on performance warranty, which ensures that customers get immediate replacements as soon as the battery performance drops even by a small margin over time.”

Animesh Das, ACKO’s chief underwriting officer, said the introduction of the 2022 Battery Waste Management Rule in India required end-to-end tracking of batteries to ensure safe disposal.

“Our partnership with Lohum will help OEMs comply with the necessary EV-specific rules.”

ABTC acquires former Aqua Metals facility

American Battery Technology Company (ABTC) has acquired a former Aqua Metals facility in Nevada in a $27 million deal to launch a lithium ion battery recycling operation, the company said on March 8.

ABTC has acquired the 137,000 ft2 facility in the Tahoe-Reno Industrial Center (TRIC) from Comstock, majority owner of lithium recycler LiNiCo, which originally had a lease-tobuy arrangement for the site with Aqua Metals.

Aqua Metals bought a 10% stake in LiNiCo in 2021 as part of a move into lithium recycling and LiNiCo had already agreed the lease-to-buy deal for the former lead-based AquaRefining facility.

In February, Aqua Metals said it would build its own 10,000 tonne-per-year lithium battery recycling campus and it plans to start phased development later this year, based on the design of its pilot TRIC facility.

Comstock executive chairman and CEO Corrado De Gasperis said:

“The sale of this asset was opportunistic and strategic since we secured our permitted 200-acre battery metal storage facility in Mound House, Nevada, and recently freed up our existing Storey County operating platform and facilities with the termination of the lease with Tonogold.”

An ABTC spokesperson told Energy Storage Journal

it would be operating the facility alone and had no collaboration with LiNiCo.

The spokesperson declined to give a start-up date for the facility, but said construction, commissioning, and operations were of the highest priority.

“ABTC has significantly increased the resources devoted to its execution including the further internal hiring of technical staff, expansion of laboratory

facilities, and purchasing of equipment.”

The facility is already equipped with necessary infrastructure equipment including electrical distribution, compressed air, nitrogen, water treatment, material handling, analytical quality control, and operational control rooms necessary to implement ABTC’s internally-developed lithium ion battery recycling technologies, the spokesperson said.

Lead recycling capacity at Gravita India’s Mundra

Port plant in Gujurat has been increased by 40,500 tonnes per annum, the firm announced on April 20.

Gravita said in a regulatory announcement that the expansion took overall recycling capacity at the flagship facility to 60,000 tpa.

Around 19,500 tpa

of the new capacity comes from switching some recycling from the firm’s existing facility at Gandhidham, about 60km northeast.

The company said it had also started commercial production of red lead and plastic granules at Mundra, with a capacity of 4,800 tpa and 7,500 tpa respectively.

Increasing recycling

at Mundra will boost operational efficiency in the import of scrap batteries and the export of new products and increase profitability in business from overseas markets for lead, red lead and plastic recycling, Gravita said. Gravita announced the start of the first phase of battery recycling operations at Mundra in December 2021.

RECYCLING NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 9

Gravita expands recycling at Mundra

Gloves are off as Korea joins fight over US incentives for batteries

South Korea has launched a multibillion dollar program to defend and expand its battery industry amid fears lucrative US tax breaks and incentives are tipping the global battery trade balance stateside.

Trade, industry and energy minister Lee Changyang announced the move on April 7 after chairing a meeting of the governmentbacked Korean Battery Alliance.

Lee said the government’s new ‘post Inflation Reduction Act (IRA) public-private joint strategy’ policy was needed to support domestic manufacturing and battery material suppliers following the introduction of the US government’s own IRA.

A leading industry commentator told Energy Storage Journal: “The gloves are really off now and Korea, just like the Europeans, is concerned about US incentives.

“Korea fears its battery and EV industry could suffer because they source a significant amount of battery raw materials from China, which the US has designated as a foreign entity of concern.”

The Export-Import Bank of Korea and the Korea Trade Insurance Corporation (K-Sure) will support investments by battery firms and material suppliers in facilities within North America with KRW7 trillion ($5.3 billion) of loans and guarantees over the next five years.

Firms will also qualify for Korea-backed higher credit lines, interest rate cuts, lower insurance premiums and other financial incentives.

Lee also pledged support for market penetration schemes for Korean-made lithium iron phosphate batteries.

Starting this year, the government plans to launch more than KRW50 billion ($38 million) of LFP battery projects to support companies entering overseas markets, the minister said.

Korean companies are already developing LFP batteries with some close to activating production lines.

In a related move, at the end of March, Korea’s National Assembly passed a bill proposing to boost tax credit rates for investments related to national strategic technologies for large firms of up to 15% and SMEs, 25%.

The government said that meant major incentives were lined up for firms throughout the battery supply chain. Lee said the public and private sectors must work together “to solve major challenges and respond effectively to the rapidly changing post-IRA global landscape”.

He said the government would aggressively push for a KRW150 billion nextgeneration battery R&D pre-feasibility study as part of investments to secure cutting-edge technology.

Meanwhile, an existing cap on how much industrial firms can expand floorspace in Korea will be increased by 1.4x for battery

companies and others designated as being of strategic national importance and who invest in a new hightech industrial complex to be unveiled in the first half of this year.

In a related move, Korean battery giant LG Energy Solution plans to shore up its battery materials supply chain by producing lithium hydroxide in Morocco, in partnership with China’s Sichuan Yahua Industrial Group.

On March 24, the company announced it would invest KRW7.2 trillion to build two battery production facilities in Arizona.

One plant will produce cylindrical batteries for EVs while the other will manufacture LFP pouch-type batteries for energy storage systems.

Lee said “mother factories” would also be established in the country to nurture and expand competitiveness within the domestic battery industry.

He said three major battery makers were aiming to invest KRW1.6 trillion in developing batteries over the next five years and building an all-solid-state battery pilot line in Korea.

Lee said the government would “fully support domestic firms’ efforts to keep achieving the best outcomes in the global market”.

From 2024, under the IRA in the US, credits will not be available for consumers to buy a ‘clean energy vehicle if it contains any battery components manufactured by a ‘foreign entity of concern’ — one of which designated is China.

From 2025, credits will not be allowed for vehicles containing any critical minerals that were extracted, processed, or recycled by a foreign entity of concern.

According to the US Treasury, at least $45 billion in private-sector investment has been announced to support the EVs and battery supply chain across the country since the IRA was introduced.

Investment in battery tech has the potential to supercharge Turkey’s economy, the country’s president said at the launch of an EV battery manufacturing plant in the country on April 24.

Recep Tayyip Erdogan was speaking at the ground-breaking ceremony for the Siro Battery Development and Produc-

tion Campus in Gemlik — which will have a 20GWh battery cells production when it starts commercial operation in 2026.

Siro, a joint venture between China-based Farasis Energy and Turkish electric car manufacturer Togg, said that the facility intended to manufacture lithium ion nickel manganese cobalt batteries,

modules, and packs.

Erdogan said: “Turkey’s progress on green technologies is important not only in terms of the environment, but also economically and strategically.

Investments in battery technologies especially “have the potential to change Turkey’s place in the world”.

ENERGY STORAGE NEWS 10 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

Erdogan

welcomes launch of Turkey EV battery project

A leading industry commentator told Energy Storage Journal: “The gloves are really off now and Korea, just like the Europeans, is concerned about US incentives."

Report says funding for corporate ESS in first quarter hits $2.2bn

Corporate funding for energy storage companies amounted to $2.2 billion in the first quarter of this year, according to a report published on April 17.

Mercom Capital Group’s report said smart grid companies raised $1.1 billion over the same period.

The $2.2 billion of total corporate funding — including venture capital (VC) funding, debt financing, and public market financing — was achieved in 27 deals.

The total was down on the $4.3 billion in 31 deals Mercom reported in the fourth quarter of 2022.

Meanwhile, Mercom said funding decreased significantly year-on-year compared to $12.9 billion in 27 deals in Q1 2022.

LG Energy Solution’s $10.7 billion IPO contributed 83% of Q1 2022 funding and skewed funding totals, Mercom said.

Energy storage firms’ VC funding, including private equity and corporate venture capital, amounted to $1.1 billion in 19 deals in Q1 2023, an 8% decrease year-on-year compared to $1.2 billion in 22 deals in Q1 2022.

Quarter-over-quarter funding was 35% lower compared to $1.7 billion in 22 deals in Q4 2022.

According to Mercom, the top five VC-funded battery storage companies in Q1 2023 were Electriq Power ($300 million), Our Next Energy ($300 million), WeView ($87 million), NanoGraf ($65 mil-

lion) and Caban Systems ($51 million).

Announced debt and public market financing for EES tech in Q1 2023 fell 58% quarter-on-quarter with $1.1 billion in eight deals, compared to $2.6 billion in nine deals in Q4 2022.

However, announced ESS project funding came in at $2 billion in nine deals in Q1 2023, compared to $749 million raised in seven deals in Q4 2022.

Corporate funding in the smart grid sector amounted to $1.1 billion in 18 deals in Q1 2023, a 42% decrease compared to $1.9 billion in 23 deals in Q4 2022, according to Mercom.

In a year-on-year comparison, funding in Q1

2023 increased 230% compared to $331 million in 15 deals in Q1 2022.

There was a 66% decrease quarter-over-quarter for smart grid VC funding in Q1 2023, with $280 million raised in 14 deals compared to $846 million in 15 deals in Q4 2022.

In a year-on-year comparison, funding in Q1 2023 was 14% lower compared to Q1 2022, when $327 million was raised in 13 deals.

Mercom said the top five VC funded smart grid companies in Q1 2023 included EO Charging ($80 million), CHARGE+ZONE ($54 million), Magenta Mobility ($40 million), ConnectDER ($27 million), and Indra ($21 million).

ENTEK picks contractor for building new $1.5 billion Indiana plant

ENTEK Lithium Separators said on April 20 that Chicago-based Clayco will be its design-build contractor for a new facility in Indiana.

ENTEK announced in March that it was investing $1.5 billion in building the new Terre Haute lithium ion battery separator production facility in the state.

Clayco will design and build the production facilities in Terre Haute to house equipment for the production of lithium battery separators across an area of about 1.4 million ft2

ENTEK said Clayco brings significant experience in the EV segment from projects with companies such as SK On and Group14, which recently announced the world’s

biggest factory for production of advanced silicon battery materials that is being designed and built by Clayco in Washington state.

Clayco has also delivered manufacturing plants throughout the entire electric vehicle supply chain, including battery component and mineral plants for anode and cathode providers, lithium-ion battery cell production plants, and vehicle manufacturing and assembly plants.

The Indiana site will help ENTEK scale its US production to be capable of supporting 1.4 to 1.6 million EVs annually by 2027.

The company plans to break ground on the campus in 2023-2024 and launch operations be-

Clayco will design and build the production facilities in Terre Haute to house equipment for the production of lithium battery separators across an area of about 1.4 million ft2

tween 2025-2027.

ENTEK CEO Larry Keith said: “We’re embarking on a project that will have positive impacts on the local and larger economy, as well provide a key component required for the electrification of vehicles to further US cli-

mate goals — and a partner like Clayco brings the experience to make informed decisions to help us achieve our objectives.”

ENTEK is the only producer of wet-process lithium ion battery separator materials owned and based in the US.

ENERGY STORAGE NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 11

EU urged to form battery raw materials club with US

Transport industry leaders have urged the EU to form a ‘raw materials club’ with the US to ensure a stable battery supply chain.

The European Automobile Manufacturers’ Association (ACEA) issued the call on March 17, the day after the European Commission published a longawaited Critical Raw Materials Act and Net-Zero Industry Act.

The draft raw materials regulations include an updated version of the EU’s list of critical raw materials and defines, for the first time, a list of strategic raw materials vital to powering the bloc’s green tech agenda, including domestic battery manufacturing for EVs and energy storage systems.

ACEA broadly welcomed the proposals but questioned the “potential effectiveness and overall coherence” of the proposals with the EU’s green agenda.

The body said more work needed to be done on the concept of establishing a raw materials club in conjunction with the US.

Meanwhile Recharge, the European association for advanced rechargeable and lithium batteries, said on March 16 the Commission’s proposals could become a game-changer for competitiveness in the battery value chain.

However, Recharge general manager Claude Chanson said it was crucial for the Commission to deal with “incoherencies” between the new proposals and existing EU laws that continue to delay investments and impede the bloc’s Green Deal.

The Commission said on December 9 it had concluded talks with Chile to unlock investment potential

for supplies of lithium for Europe’s batteries manufacturing market.

Last March, EU leaders and battery industry chiefs agreed to expand funding to support gigafactory projects and speed-up permitting processes, amid fears that investors are being lured away from Europe by lucrative tax breaks and incentives in the US and Asia.

According to new analysis published on March 6, nearly 70% of Europe’s overall planned pipeline of lithium ion battery cells production capacity by 2030 is at risk of being delayed, scaled down or cancelled, according to stark new analysis published on March 6.

The study by clean transport campaign group Transport & Environment indicated around a fifth (285GWh) of Europe’s 1.8TWh expected EV battery factories potential is at ‘high risk’ and a further 52% (around 910GWh) at ‘medium risk’.

Overall, 68% of the potential battery cell supply in Europe is at risk if further action is not taken — and the EU will be unable to satisfy its battery demand without imports from foreign rivals, T&E said.

T&E’s senior director for vehicles and e-mobility Julia Poliscanova said: “EU battery manufacturing is caught in the crossfire between America and China. Europe must act or risk losing it all.

“A green industrial policy focused on batteries with EU-wide support for scaling up production is urgently needed to react to US subsidies and China’s years of dominance.”

The study increased pressure on EU leaders following crisis proposals unveiled in December 2022 to avert a potential investments meltdown for European gigafactory plans, amid fears cash is instead flowing into projects in the US and Asia.

T&E’s analysis was derived from publicly avail-

able information assessing 50 gigafactories planned for Europe by 2030 — based on the projects’ maturity, financing, permits, secured factory sites and project companies’ links to the US.

On top of China’s dominance in EV supply chains the US Inflation Reduction Act, which is expected to pour at least $150 billion into battery components and metals manufactured in the US or ‘friendly countries’, is “changing the rules of the game fast”, the study said.

In terms of global investment into lithium ion batteries tracked by Bloomberg New Energy Finance, Europe’s share dropped from 41% in 2021 to a meagre 2% in 2022, while investment in China and the US continued to grow, according to T&E.

Germany, Hungary, Spain, Italy and the UK stand to lose the most if batterymakers change their plans, according to the study.

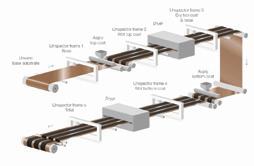

AM Batteries is teaming up with Amperex Technology to develop solvent-free electrode manufacturing technology for lithium ion cell production, the firms announced on April 5.

The partnership will further develop AMB’s dry-electrode fabrication technology with the lithium battery manufacturing expertise of Amperex, from which Chinese battery giant CATL was spun off in 2012.

Amperex is now owned by Japan’s TDK Corporation.

The firms said they want

to tackle critical challenges facing the Li battery sector including its heavy carbon footprint, energy consumption and high infrastructure costs derived from existing solvent evaporation process used for electrode fabrication.

US-based AMB says it has developed an electrostatic spray-deposition technique to produce key battery electrode components sustainably.

Dry cathode and anode electrode materials are electrostatically charged and deposited on to metal-foil current collectors,

which are then processed to their final state without the use of toxic solvents, the company claims.

AMB’s CEO Yan Wang said: “One of the fundamental problems for battery manufacturers is refining manufacturing techniques to remove the solvents used in wet-coating of electrodes.

“Our dry-electrode manufacturing technology allows for the coating of lithium ion battery electrodes without the need for any solvents or energy-intensive evaporation.”

ENERGY STORAGE NEWS 12 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

AM Batteries, Amperex partner to develop solvent free electrodes

Israel gives its go-ahead for first national ESS prototype park

Planning chiefs in Israel have approved a blueprint for an 800MW/3,200MWh energy storage park comprising a variety of ESS technologies, the government announced on May 2.

The energy and infrastructure ministry said the National Council for Planning and Construction had given the green light for the project in the north of Haaretz — the first time Israel had approved a detailed national outline plan dedicated to energy storage.

The plan, which was set for formal sign-off by the

government as Energy Storage Journal went to press in mid-May, provides for the construction of four ESS complexes, each with a capacity of around 200MW to be built in stages “according to the needs of the system and different storage technologies”.

The battery systems would collect and store renewable power produced by solar facilities in the region for transmission via the grid during hours of electricity peak demand.

Energy and infrastructure minister Israel Katz said

Rimac accelerates into battery storage market

Autos and battery tech group Rimac said on May 4 it was entering the ESS market with the launch of Rimac Energy.

The Croatia-based group, whose Rimac Automobili division develops and produces electric sports cars, drivetrains and battery systems, said it would reveal details about its ESS technology later this year.

Rimac Energy will feature utility-scale systems, commercial and industrial applications plus integrated battery buffered charging.

The group claimed its proprietary battery architecture will provide more efficient stationary ESS units with a system footprint reduction of 40% compared to current systems.

The Rimac Energy team has been built up over the past 18 months and is now 60 strong.

Rimac Energy’s director Wasim Sarwar said the group is already in talks with several customers, including for a pilot project

with a leading renewable energy company to provide battery storage for its solar and wind plants.

“These pilot systems are expected to be produced by the end of this year and commissioned in 2024.”

Rimac said high volume ESS production will begin in 2025 at the Rimac Campus in Croatia, scaling to more than 10GWh of annual production.

in a subsequent Tweet on May 4 the ESS plan “includes the ability to provide ‘kosher electricity’ to ultraOrthodox neighborhoods on Shabbat (the Jewish day of rest) instead of the current polluting generators, without raising the price of electricity for the general public”.

In a separate announcement, Katz said: “Saving energy in this way will allow us to increase the production of renewable energy, improve the reliability of the electricity supply and stabilize the functioning of the network — measures that will contribute directly to the growth of the economy.”

SKIET hails China separators breakthrough with Sunwoda

South Korea’s SK IE Technology said on May 1 it had agreed a deal to supply separators to Chinese EV battery maker Sunwoda.

SKIET said the companies had signed a memorandum of understanding for the lithium ion separators deal, marking the Korean firm’s first large-scale supply of EV battery separators to a Chinese EV battery manufacturer.

Financial details were not disclosed, but SKIET said the separators will be produced and supplied from its Changzhou factory in China. The agreement also strengthens the firms’ existing business relationship.

To date, SKIET has been supplying separators for IT and electronic products to the Sunwoda Group.

Sunwoda’s major customers include the Geely Auto Group, Dongfeng Cummins Engine, SAIC Motor, Volvo Cars, and Volkswagen.

SKIET, which has a European manufacturing operation in Poland, said it now expects to work with Sunwoda in other countries.

The Korean firm is also considering entering the North American market — where, like a new generation of hopefuls, it hopes to benefit from incentives provided under the US Inflation Reduction Act.

Gravitricity adding weight to tech with crowdfunding

Scotland-based gravity storage system company Gravitricity has secured nearly £829,000 ($1 million) from a crowdfunding raise.

A company spokesperson told Energy Storage Journal on May 3 that the start-up had exceeded its initial goal of £550,000, with 1,085 investors participating in the Crowdcube raise.

The cash boost will be invested in hiring and de-

veloping the firm’s technology, the spokesperson said.

A larger institutional round is set to follow in which Gravitricity is seeking up to £40 million.

Commercial director Robin Lane said: “The funds have come at the perfect time for Gravitricity as we progress our plans to develop energy storage projects on three fronts here in the UK and in mainland Europe.”

The company has devel-

oped a gravity-harnessing method of generating electricity by dropping weights in underground areas such as abandoned mines and is also working on belowsurface green hydrogen storage.

Last year, Gravitricity secured UK government backing towards a £1.5 million feasibility study to develop a multi-weight energy storage system to be built on a brownfield site in northern England.

ENERGY STORAGE NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 13

EcoGraf signs milestone deal for Tanzania graphite mining operation

Australia-listed EcoGraf said on April 18 it had signed a milestone deal to move ahead with development of a natural graphite mining operation in Tanzania to supply its battery anode materials business.

EcoGraf signed a framework agreement with Tanzania’s government for the Epanko graphite project, which is also to support lithium-ion EV battery manufacturing operations in Asia, Europe and North America.

Epanko will be developed and operated by a newly

formed joint venture mining firm, Duma TanzGraphite, in which EcoGraf has an 84% stake to the Tanzanian government’s 16%.

EcoGraf said it will use its proprietary HFfree purification technology to process Epanko’s flake graphite without the use of hydrofluoric acid to produce high performance BAM.

EcoGraf said in March that initial operations at Epanko should produce 60,000 tonnes per annum of graphite flake product over a lifespan of more than 17 years.

LG Chem, Huayou to invest in Korea battery precursors plant

LG Chem and China’s Huayou Cobalt are to invest KRW1.2 trillion ($909 million) in a joint venture to build a battery precursor plant in South Korea.

LG Chem announced on April 17 that it expects to start construction of the facility in Saemangeum later this year.

The battery maker said the facility will also be able to produce metal sulfates, giving it a domestic metals refining capacity to ease raw material supply chain concerns.

The deal came just days after South Korea’s government announced a multibillion dollar package of support for its battery sector in the face of lucrative US incentives for the battery industry stateside (see our report on page xx).

LG Chem and Huayou have signed a memorandum of understanding for the joint venture with other investment partners including the Saemangeum Development and Investment Agency.

The facility will have an annual production capac-

ity of 50,000 tonnes by 2026, following the first phase of development.

Production capacity will later be doubled.

LG Chem said about 100,000 tonnes of precursors is enough to annually produce cathodes for more than one million EVs with 75kWh batteries providing a driving range of 500km.

In February 2022, EcoGraf received conditional approval for a loan from the Australian government for the equivalent of up to $40 million to support the expansion of the company’s BAM facility in Western Australia.

As Energy Storage Journal went to press there were rumours that EcoGraf was about to conclude a supply agreement with Korean conglomerate Posco to provide battery grade graphite for the coming 10 years.

CATL commits to 2025 carbon neutral battery production plan

Chinese lithium batteries major Contemporary Amperex Technology (CATL) has said it plans to achieve carbon neutrality across its battery plants by 2025.

Board secretary Jiang Li told the 20th Shanghai International Automobile Industry Exhibition on April 18 that carbon neutrality would apply across its battery value chain, including raw materials, by 2035.

Meanwhile, Li said CATL would use its position as a new board member of the Global Batteries Alliance to play an active role in formulating and improving the organization’s battery passport initiative — a pilot program to provide

a ‘digital twin’ of physical batteries to aid supply chain transparency through to eventual recycling.

Li also cited latest data by SNE Research, indicating CATL had sold 289GWh of lithium-ion batteries in 2022, giving it a 37% share of the global EV batteries market and a share of more than 43% of the global energy storage batteries market.

In September 2022, CATL said cobalt and lithium used in a battery cells supply deal with Germany’s BMW would be sourced from certified mines, in a move to head-off potential criticism over sustainability and human rights issues.

VARTA cutting jobs despite plans for ESS expansion

VARTA said on April 25 it would cut around 800 full-time jobs across the group, just days after pledging a significant expansion of ESS sales and production following a restructure of the business.

Around 390 of the job cuts will be in Germany over the next two years — 240 of those taking place this year. VARTA employs around 4,700 worldwide.

The company said the cuts were a result of its restructuring and in

response to massive price increases for materials amid global crises, including the RussiaUkraine war and impact of the pandemic.

VARTA board of directors speaker Markus Hackstein said: “We have to shape the specifications of the restructuring plan in such a way that we can secure the future of our company while retaining as many jobs as possible.”

On April 19, the company said it planned a significant expansion of production and sales

of energy storage systems after proposals to restructure its business were given the go-ahead by financing banks.

The restructuring programme includes making targeted investments in growth areas, which the battery maker said included focusing on strong demand for ESS systems from the renewable energy market.

In addition, the company said it wanted to expand its market share of large format lithium ion cells.

ENERGY STORAGE NEWS 14 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

Invinity Energy to build 30MWh UK flow battery

Invinity Energy Systems is to develop a 30MWh vanadium redox flow battery in the UK, the company announced on April 12.

Invinity said it had been awarded £11 million ($14 million) from the UK government for the VRFB longer duration energy asset demonstrator project, which it claimed will be the largest grid-scale battery ever manufactured in the country.

The battery will provide a broad range of grid balancing services.

Invinity said the battery’s storage capacity will be equivalent to the daily energy use of more than 3,500 homes and it will have the ability to deliver full power for a discharge duration of over four hours.

The battery, to be built at Invinity’s factory in Scotland, should start commercial operation in early 2025 and will be around six times larger than the company’s BESS at the Energy Superhub Oxford in southern England.

Invinity said the battery would also be one of the

Avesta plans solid-state R&D center in Portugal

Belgium-based Avesta Battery & Energy Engineering is to develop an R&D center for solid state battery cells in Portugal, the company announced on March 29.

world’s biggest flow batteries — although it should be noted that the China Energy Storage Alliance reported in July 2022 that the 100MW first phase of a planned 200MW/800MWh vanadium redox flow battery energy storage system had been connected to the grid in Dalian, China.

Vingroup, Altinay in Turkey batteries plan

Vietnam’s Vingroup said on April 10 it was joining forces with Turkey’s Altinay Elektromobilite to produce advanced batteries as part of a full-service business for energy storage and mobility systems in the Turkish market.

Altinay general manager Mert Uygun said the partnership with Vingroup’s VinES Energy Solutions subsidiary aimed to attract investment from the domestic energy sector.

VinES will offer the technology, system design, production and verification of the ESS units, while Altinay will head up sales and marketing as well as after-sales services in the Turkish market, Uygun said.

Altinay will also draw on its own experience of designing and building lithium-based energy storage systems and battery packs over the past 12 years, Uygun said.

Last November, Vingroup auto subsidiary VinFast agreed to expand cooperation with China’s Contemporary Amperex Technology to develop battery systems for the EVs market.

Meanwhile, VinES and Canada’s Li-Cycle are assessing proposals to build a lithium ion recycling plant in Vietnam, the companies revealed on April 12.

The plant could be built near battery manufacturing facilities operated by VinES, under an agreement where Li-Cycle would become VinES’ preferred recycling partner for its Vietnamesesourced battery materials from 2024.

The move came five months after the firms agreed to form an international battery recycling partnership.

Avesta has signed a memorandum of understanding with the municipality of Figueira da Foz to develop the 500MWh-1GWh capacity plant at a total cost of more than €1.8 billion ($1.9 billion) on a 17,000m² site owned by the authority.

Avesta CEO Noshin Omar (pictured left) said the plant would be built in two phases and would eventually employ more than 2,000.

Figueira da Foz mayor Pedro Santana Lopes (pictured right) said the project was in line with aspirations to become a center of high-tech development in the region.

In January, Avesta unveiled plans to develop a combined battery packs and recycling complex in Seneffe-Manage, Belgium.

The ‘BE-VOLT’ plant should have an annual manufacturing capacity of 3GWh, which Avesta said would make it Belgium’s first gigafactory.

Tesla to invest and build Shanghai Megapack factory

Tesla is investing an undisclosed sum to manufacture its Megapack energy storage systems at a new plant in Shanghai, the firm said on April 9.

The factory will have an annual production capacity of 40GWh, producing some 10,000 Megapacks each year.

According to Chinese state media, Tesla will

break ground for the project in the Lin-gang pilot free trade zone area in the third quarter of this year and start production in the second quarter of 2024.

Zhuang Mudi, deputy secretary-general of the Shanghai municipal government, said the project would help drive the development of the

energy storage industry as well as the low-carbon transformation of Shanghai.

In January 2019, Tesla broke ground on a car manufacturing plant in Shanghai, becoming the first company to benefit from a policy allowing foreign carmakers to establish wholly-owned subsidiaries in China.

ENERGY STORAGE NEWS www.energystoragejournal.com Energy Storage Journal • Summer 2023 • 15

Invinity’s 5MWh VFB at the Energy Superhub Oxford

US contest to find future battery industry leaders

A three-year engineering competition to find the next generation of battery industry specialists has been launched by the US Department of Energy and auto firm Stellantis.

Called the Battery Workforce Challenge the aim is to nurture the next generation of battery specialists.

The collegiate program, which includes vocational training and youth education in science, tech, engineering and maths, will be managed by the Argonne National Laboratory when it gets underway in the autumn of this year.

The program will feature

an advanced battery design and development student competition, with universities and vocational schools from across North America invited to design, build, test

and integrate an advanced EV battery into a future Stellantis vehicle.

Teams will follow realworld industry milestones focused on battery design,

simulation, controls development, testing, and vehicle integration and demonstration.

Argonne said participants will also learn project management, communications, teamwork and problemsolving skills that will provide “unparalleled educational experience and ready them for future careers throughout the battery industry”.

Mark Stewart, Stellantis North America COO said: “The Battery Workforce Challenge will help train the engineers of tomorrow and is a win-win for Stellantis and the entire battery industry as we address our nation’s toughest energy and mobility challenges by helping to build a highly skilled and productive future workforce.”

No recovery for sunken ‘EV battery fire’ ship

A vessel carrying 4,000 vehicles that sank in the Atlantic last year after a suspected EV battery fire will likely never be recovered and the cause of the disaster will remain a mystery, the ship’s owner told Energy Storage Journal on March 30.

EVs were among the vehicles on board the Felicity Ace car carrier, which caught fire in February 2022 southwest of the Azores while sailing from Germany to the US.

A spokesperson for MOL Shipmanagement Singapore, whose Car Carriers subsidiary owned the vessel, said the depth of the sea where the Felicity Ace sank while being towed in a failed rescue attempt is an estimated 3,000 metres, making a potential salvage operation “quite difficult”.

The spokesperson declined to comment when asked if MOL had received claims for compensation relating to the potential environmental hazard

and loss of the vehicles on board — worth an estimated $400 million-$500 million, according to the Safety & Shipping Review 2022 , published by corporate insurance carrier Allianz Global Corporate & Specialty.

AGCS said that after more than 70 reported fires on container ships alone in the past five years, a major rethink of vessel designs, fire detection and fire-fighting capabilities

may also be required.

The MOL spokesperson said the company continues to transport EVs, taking necessary safety measures, but declined to say whether vehicle cargo handling rules had been reviewed or changed in the wake of the Felicity Ace incident.

Energy Storage Journal , revealed in March 2022 that China had called on the International Maritime Organization to con-

sider a shake-up of maritime safety rules for EVs being shipped by sea, amid a rising tide of fires involving lithium ion batteries.

An IMO spokesperson said that proposals relating to fire protection and the tackling of fires involving transport of EV/ new energy vehicles are expected to be discussed by the organization’s subcommittee on ship systems and equipment during the next year.

SMC, Fluence launch 1,000MW BESS park in Philippines

SMC Global Power Holdings inaugurated a 1,000MW/1,000MWh fleet of battery energy storage systems in the Philippines on April 4 — 570MW of which was supplied by Fluence Energy.

Fluence said the BESS portfolio, which is spread across 32 sites, is the largest in southeast Asia and provides

advanced grid stability as increasing amounts of intermittent renewable energy sources are added to the grid.

SMC is one of the biggest power suppliers in the Philippines and US-based Fluence’s biggest customer.

Fluence said the BESS projects provide critical grid stability services throughout the National

Transmission Network in the Philippines including frequency response, reserve power, and voltage regulation.

“The deployment of these energy storage systems marks a significant milestone in the clean energy transition journey of the Philippines towards a cleaner, more resilient, and flexible grid,” Fluence said.

ENERGY STORAGE NEWS 16 • Energy Storage Journal • Summer 2023 www.energystoragejournal.com

Freyr launches cell demonstration plant

Freyr Battery held an inaugural ceremony on March 29 for its battery cells customer qualification plant in the north of Norway.

The CQP in Mo i Rana hosts an industrial-scale demonstration battery cells production line based on 24M’s semi-solid lithium ion technology.

The ceremony came a day after Freyr announced plans to work with Glencore, Caterpillar, Siemens and the Nidec Corporation.

Freyr co-founder and CEO Tom Einar Jensen said potential areas of commercial collaboration for

the partners included battery cell manufacturing, recycling, mining and refining and stationary battery storage for the power market.

The launch of the CQP came as Freyr pushed ahead with construction of its ‘Giga Arctic’ battery production plant at the same location.