What to do about market volatility in the run-up to retirement

What to do about market volatility in the run-up to retirement

We’ve solved it in one fund.

The investment world likes to complicate everything. Our Managed Fund likes to keep it really simple. It’s made up of equities, bonds and cash, and we think to generate great returns, that’s all you need. The result is a balanced portfolio with low turnover and low fees. Beautifully straightforward, it’s been answering questions since 1987. Capital at risk. Find out more by watching our film at bailliegifford.com

What if you had missed the market’s worst days? NEWS

07 Markets recover some poise after tariff U-turn

08 Tesco shares drop on fears it will launch ‘price war’ to raise market share

09 After discovery bright spot for BP what next for UK energy giants?

10 Housing services provider Mears hits five-year high on ’beat-and-raise’

10 Weak US market and operational difficulties sink TT Electronics stock

11 Can RELX maintain its strong performance in the first quarter?

12 Is this the end of the road for Tesla bulls?

13

Supermarket Income REIT is a durable cash machine to own

15 A rare opportunity to buy high-quality antibody specialist Bioventix on the cheap UPDATES

17 Why we’re staying sweet on Treatt FEATURES

20 COVER STORY GOLD AT $4,000 What it would take for the precious metal to hit this milestone

19 Why now is the time to sharpen your pencil and make a shopping list

24 What to think about when markets are volatile in the run-up to your retirement

27 Why do share buybacks matter so much nowadays?

30 How money market funds work and the role they can play in a portfolio

How to spring clean your portfolio

37 RUSS MOULD

Time for a new era of an unexceptional America?

40 ASK RACHEL

What is the tax situation when making withdrawals from my pension?

42 INDEX Shares, funds, ETFs and investment trusts in this issue

Could gold reach $4,000 next?

Few people would have predicted the gold price could hit $3,000 per ounce yet thanks to the turmoil in financial markets caused by US trade policy we’re already at $3,200, so what would it take for the yellow metal to hit the next big level?

The increase in market volatility is unhelpful for those who are approaching or already in drawdown mode, so here are some suggestions to help you avoid ‘pound cost ravaging’.

Why share buybacks aren’t the be-all and end-all

Despite the stampede by UK companies to buy back their own shares, some businesses are quite happy to hold onto their surplus cash or let shareholders decide what to do with it.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

It’s probably the least of all our worries and this is written without the expectation of any sympathy but it’s not easy putting a weekly magazine together in the Trump 2.0 era.

No sooner had we put last week’s issue to bed then the US administration announced a 90-day delay on most of its reciprocal tariffs (9 April). In truth, we stand by the messages we put out about staying the course and sticking with your long-term investment plan. Nothing which has emerged has altered our thinking here.

After all, there could be few better arguments for time in the market rather than timing the market given anyone selling in the wake of ‘Liberation Day’ and before President Trump hit pause would have missed out an all-timer of a day for the markets.

Our reference to research from BlackRock detailing the impact of missing the market’s best days prompted some interesting reader correspondence on what the effect would be of missing the market’s worst days.

We managed to dig out some (somewhat dated) research which reveals the answer and the impact would indeed be highly dramatic.

However, the sheer nerve and foresight required to achieve this level of market timing would be beyond most of us mere mortals. If you could execute such a strategy, good luck to you and you would certainly be well rewarded. Unlike staying invested, which doesn’t require you to do anything, you would have to be extremely agile to achieve this feat given the proximity of the best and worst days.

For the vast majority of us, accepting that the rough comes with the smooth and allowing time to be our friend is probably a better policy. For those of you where time is not on your side because retirement is in view, Sabuhi Gard’s article offers some insights.

After the initial sharp relief rally, volatility has returned with the latest bout of uncertainty now relating to just how long a potentially significant tariff exemption for tech like smartphones and laptops might last.

We examine the latest market moves in more detail in this week’s news section. As we discuss in our main feature this week, gold continues to shine allowing gold bugs to dream of the precious metal hitting the $4,000 level.

If you’re keen to capture the potential offered by global investment markets, take a look at Aberdeen Investment Trusts. Managed by teams of experts, each of our trusts are designed to bring together the most compelling opportunities we can find to generate the investment growth or income you’re looking for.

Tap into abrdn’s specialist expertise across a wide range of different markets and investment sectors – both close to home and further afield. There’s plenty of choice to target your specific investment goals, whichever stage of life you’re at.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Uncertainty remains over where US trade policy will land after tumultuous week

Markets around the world have reacted with palpable relief to two major decisions by the Trump administration. First, on 9 April, reciprocal tariffs (except on China) were delayed for 90 days – which proved the catalyst for the thirdlargest daily gain for US stocks since the Second World War.

Many observers pegged the U-turn on movements in government bond yields which revealed declining confidence in the US. While yields have settled, they remain elevated.

The second significant move was a tariff exemption for semiconductors, smartphones and other consumer electronics like laptops unveiled late on 11 April, which significantly encompassed China, although subsequent comments from president Trump have raised uncertainty about how long exactly the exemption might last.

A look at some of the best-performing stocks on both sides of the Atlantic is instructive. The tariff exemptions clearly gave a boost to Apple (AAPL:NASDAQ), which has a significant chunk of its supply chain not just in China but in other Asian countries hit by substantial tariffs.

A similar dynamic was at work for Dell Technologies (DELL:NYSE) as well as chip makers Nvidia (NVDA:NASDAQ), Broadcom (AVGO:NASDAQ) and Advanced Micro Devices (AMD:NASDAQ).

Broader relief at the White House’ apparently more measured approach on tariffs also boosted aerospace firms Boeing (BA:NYSE) and Melrose Industries (MRO) as well as quality UK industrial stocks Halma (HLMA) and Intertek (ITRK)

Hopes the US might now escape a widely predicted recession helped put Walmart (WMT:NYSE) on the front

Selected top US and UK market performers since Trump hit pause on tariffs

Source: Sharescope *Since close on 8 April for US stocks and since close on 9 April for UK stocks to 15 April

foot while reduced concern about global financial stability helped lift Barclays (BARC) and Standard Chartered (STAN), the latter also supported by an improved Asian outlook.

However, the strong showing for precious metal miners Newmont (NEM:NYSE) and Fresnillo (FRES) hint at lingering nervousness as gold’s safe haven credentials have helped push it to new record highs. [TS]

Disclaimer: The editor of this article (Ian Conway) owns shares in Halma.

The supermarket group wants ‘flexibility’ to meet the competition

Since taking over the helm at Tesco (TSCO) four years ago, chief executive Ken Murphy and the rest of the team have done a fine job of steering the grocery giant to record profits and its highest market share in a decade.

It was a surprise, therefore, when the shares dropped 6% on the day the company posted its 2024/25 annual results, but the reaction was based on what was to come rather than what went before.

For the year to the end of February, the group posted operating profit and free cash flow ahead of forecasts and investors were treated to a 13% increase in the dividend which together with share buybacks meant total shareholder returns for the year were £1.9 billion.

Chief executive Ken Murphy put the strong results down to the firm’s relentless focus on value, its highest grocery market share in almost a decade (roughly 28%) and increased customer satisfaction scores.

In terms of the outlook, Murphy said: ‘Building

on our strong financial performance, robust balance sheet and positive momentum, we are setting ourselves up for the year ahead with the flexibility to continue to win in a highly competitive market.’

Murphy noted there had been ‘a further increase in the competitive intensity of the UK market’ since the start of the year but told analysts he was ‘determined to win’ in the battle for sales.

Therefore, in order to lure more shoppers through the doors, Tesco will divert a greater proportion of its 2025/26 profit to schemes such as successful Aldi Price Match and Clubcard Prices to deliver on its number one strategic goal of ‘magnetic value for customers’.

As a result, operating profit for 2025/2026 is likely to be between £2.7 billion and £3 billion or as much as 14% lower than last year depending on how much ‘firepower’ the firm needs to respond to current market conditions.

This news immediately triggered headlines along the lines of ‘Tesco to start price war’ and prompted Clive Black of Shore Capital to ‘get the knuckleduster out’ as he revised his forecasts downwards.

There is no question the market has become more competitive of late – discounters Aldi and Lidl now have a combined market share of 18.8%, well above even Sainsbury’s (SBRY), the number two full-line grocery chain.

However, Murphy smells an opportunity to take even more market share from smaller rivals Asda and Morrison by investing in prices and we suspect the dust will settle fairly quickly and investors will get behind his strategy. [IC]

Shell has outperformed its UK-focused rival to a significant degree

Together, BP (BP.) and Shell (SHEL) accounted for more than 10% of the FTSE 100 index at the end of the first quarter, meaning their fortunes matter to anyone with exposure to the UK market through a tracker fund.

Both firms are finding life difficult thanks to slumping commodity prices, although BP gave investors a rare bit of good news on 14 April as it unveiled a major oil discovery at its Far South prospect in the Gulf of Mexico.

This provides something of a fillip after a poorlyreceived strategic refresh, with the company abandoning a long-derided green push, but is unlikely to prove enough in isolation to convince sceptics it is on the right course.

Chair Helge Lund has fallen on his sword but chief executive Murray Auchincloss remains very much in the spotlight with activist investor Elliott remaining on the shareholder register and pushing for more radical changes than were outlined at BP’s crunch investor day at the end of February.

The company has subsequently guided for a ‘weak’ first-quarter gas marketing and trading result and warned of an uptick in net debt, heaping further pressure on management.

BP vs Shell

Rebased to 100

Source: LSEG

compared with its peers is one of the key sticking points for investors, this uptick in net debt is not helpful. There remains a sense that more radical action is required at BP to quieten Elliott and really get the market on side.

Ahead of its results for the first three months of the year in full on 29 April, BP said debt at the end of the first quarter was expected to be ‘around $4 billion’ higher compared to the fourth quarter.

Given the company’s elevated level of borrowings

While the final shape of trade policy remains uncertain, demand shocks in the world’s two largest oil consumers [US and China] will be another negative for already soft oil demand”

Shell is clearly not immune to wider macro factors and unveiled its own relatively disappointing first-quarter teaser ahead of the detailed numbers on 2 May, cutting guidance for LNG (liquefied natural gas) volumes and gas production thanks to weather-related outages in Australia.

However, chief executive Wael Sawan is at least able to point to a much better showing than its UK-listed rival – reflected in the share price performance shown in the chart.

Shell’s move into natural gas over the last decade or more has paid off and it had already gone further in walking back its commitments to the energy transition, which were never as far-reaching as BP’s in the first place.

Ultimately both firms will, to varying degrees, be at the mercy of future movements in oil prices. As consultancy outfit Capital Economics observes: ‘While the final shape of trade policy remains uncertain, demand shocks in the world’s two largest oil consumers [US and China] will be another negative for already soft oil demand.’ [TS]

Stronger-than-expected 2024 results lead to improved 2025 guidance

Shares in Gloucester-based social housing and care provider Mears (MER) surged 10% to a new five-year high last week after the firm posted strong full-year 2024 earnings and raised its 2025 outlook.

Revenue at the FTSE 250 group increased to £1.13 billion, helped by around £220 million in new contracts awarded last year, while pre-tax profit jumped 37% to £64 million.

Chief executive Lucas Critchley commented: ‘A strong period of contract retention has bolstered the order book and provides improved

revenue visibility over the medium term. An increased operational focus has delivered improved service metrics and is also evident in the continued progress in operating margin.’

During the year, the board carried out a strategic update and set several key objectives, including positioning Mears as the leading provider of services to the UK Housing sector, becoming a leader in Compliance and delivering additional services to its key Central Government clients, ensuring the business is well-positioned for the next round of procurement from 2027 to 2029.

Shareholders benefitted from a £40 million buyback and a 23%

Mounting losses see chief executive unceremoniously ousted

Shares in TT Electronics (TTG) slumped as much as 21p or 25% to a decade-low price of 62p at the open on 10 April after the specialist manufacturer reported widening losses for 2024 and announced its chief executive would step down.

For the year to December 2024, the Woking-based company, which supplies electronic parts to the health care, aerospace and defence and automotive sectors, posted a 15% fall in sales to £521 million and a pre-tax loss of £33.4 million against £6.8 million.

The firm blamed the deterioration in its results on weakness in the North American region caused by a ‘subdued’ components market and ‘operational challenges’ in Cleveland and Kansas City.

It also said that while it expected to be compliant with its covenants in both its base and severe downside cases, the ‘uncertain and volatile macroeconomic backdrop could have an impact beyond severe downside case creating material uncertainty over going concern in certain extreme scenarios’.

Given the increased market uncertainty arising from president Donald Trump’s trade tariffs and the possible impact on demand for its

Source: LSEG

increase in the total dividend to 16p per share ‘reflecting the board’s confidence in the positive outlook’. Mears said it had made a ‘strong start’ to 2025, and although it was still early in the year it was raising its sales and profit to guidance to ‘not less than’ £1.05 billion and £50 million respectively. [IC]

Source: LSEG

products, the company said it saw ‘a wider range of potential outcomes’ for this year.

Peter France, who was appointed chief executive just 18 months ago, is stepping down with immediate effect to be replaced on an interim basis by chief financial officer Eric Lakin while the board explores other candidates. [IC]

FULL-YEAR RESULTS

21 April: Elixirr International, Frenkel Topping

22 April: MPAC Group

23 April: Sanderson Design Group, Strix Group

24 April: Keystone Law Group

FIRST-HALF RESULTS

22 April: Arecor Therapeutics

23 April: AB Dynamics, Northcoders, Ten Lifestyle

24 April: ASOS, Pennant International, Tracsis TRADING ANNOUNCEMENTS

23 April: Bunzl

24 April: Inchcape, Jupiter Fund Management, RELX, Spirent Communications, Unilever

Early adoption of artificial intelligence and strategy shift has lifted the shares

Back in February, business information and data analytics firm RELX (REL) reported a strong set of full-year results and investors will be hoping for more of the same when it posts its first-quarter earnings on 24 April.

The shares are up 12% over the past year, hitting a 52-week high of £42.05 on 13 February, and have fared relatively well during the recent bout of global stock market volatility.

So, what makes RELX a success? It reported 10% growth in full year operating profit and underlying revenue for the year to December increased by 7% to £9.43 billion.

In addition, the company announced £1.5 billion in share buybacks.

The secret sauce seems to be the shift towards higher-growth analytics and decision tools which is being delivered to customers across the business, according to the company.

RELX has also been using artificial intelligence across its four core segments: risk, legal, exhibitions and scientific, and technical and medical.

In January, it launched Protégé, an AI assistant which drafts documents for lawyers and automates tasks.

Exhibitions have also proved to be a bright spot for RELX in terms of profit growth and revenue, with operating profit up 31% year-on-year to £398 million.

Global ratings agency S&P recently upgraded the stock due to the company’s consistent earnings growth and prudent financial policy, with revenue expected to grow between 5% and 6% annually on an organic basis from this year to 2027.

S&P rates RELX’s earnings stability, profitability and free cash flow generation favourably compared to its peers Wolters Kluwer (WKL:AMS), Thomson Reuters (TRI:NASDAQ) and Experian (EXPN). [SG]

Source: Stockopedia

‘Unprecedented brand damage’ being inflicted by Musk, say analysts

Could it get any worse for Tesla (TSLA:NASDAQ)? Top executives have been fleeing the ship, demand is plummeting, sales slipping, and government incentives at home and abroad are under threat, and that’s not the worst of it.

JPMorgan analysts recently slashed their forecasts after citing ‘unprecedented brand damage’ being inflected on the carmaker by… Elon Musk. Yes, he may be the Tesla hype initiator general but his association with the Trump administration has got potential Tesla buyers and investors thinking twice. Even as Musk departs the DOGE (Department of Government Efficiency), it’ll be hard to undo the damage that’s already been done.

At the start of April Tesla reported its worst quarterly sales in nearly three years, with the rough 12% drop far worse than 3.7% expectations. Notably it came before any impact from tariffs on the company.

Even Tesla bull Dan Ives at Wedbush called the delivery numbers ‘a disaster’, adding that the ‘brand crisis issues are clearly having a negative impact on Tesla ... there is no debate’.

QUARTERLY RESULTS

18 April: HCA

21 April: WR Berkley

Source: Zacks

Source: LSEG

At the same time, the company is facing a significant competitive threat from Chinese electric vehicle maker BYD (1211:HKG), both inside and outside China. In the first three months of 2025, BYD shipped nearly one million cars.

Miss Q1 2025 revenue and earnings forecasts on 22 April, pitched at roughly $21.85 billion and $0.45 per share respectively, according to consensus, and it could lead to another big sell-off in Tesla stock. The company has already lost a third of its market value year to date. JPMorgan reckons the share price could halve from current $252 levels. [SF]

22 April: Baker Hughes, Chubb, Equifax, GE Aerospace, Lockheed Martin, MSCI, Netflix, Tesla, Verizon

23 April: AT&T, Boeing, Chipotle Mexican Grill, Ford Motor, IBM, Philip Morris, ServiceNow, Texas Instruments, Thermo Fisher Scientific

24 April: Amazon.com, American Express, Apple, Caterpillar, Comcast, Dow, Eastman Chemical, Freeport-McMoran, Hasbro, Intel, Keurig Dr Pepper, Mastercard, P&G, PepsiCo, VeriSign

This vehicle is an attractive way to invest in supermarket safe havens

Income

(SUPR) 77.1p

Market cap: £959 million

Experts reckon we could survive three days or nine meals with empty supermarket shelves before a full-blown societal collapse. That’s how vital supermarkets are to our everyday existence. So, invest in shares of Tesco (TSCO), Sainsbury’s (SBRY) or Marks & Spencer (MKS) during times of market turbulence?

That is a possible option, but Shares thinks there’s a more interesting way to play the theme –Supermarket Income REIT (SUPR).

As the name suggests, this is a real estate investment trust that makes money by leasing retail space to supermarkets. It has a portfolio of 82 properties worth an estimated £1.8 billion, scattered across the UK and France. These include Morrisons, Asda, Waitrose and Carrefour (France)

Source: LSEG

stores, but roughly three quarters of the rent roll comes from Tesco and Sainsbury’s outlets.

You might argue that this represents considerable concentration risk, but we believe this is not a major concern given the blue-chip status of both. Tellingly the trust has never failed to collect 100% of rents since floating on the stock market in 2017.

These are not run-of-the-mill stores, but omnichannel grocery pitches that are dominant in their area, providing the full range of in-store, click and collect and online shopping. That means net rental yields of 6%, higher than real estate sector averages below 5%, with in-built inflation-linked reviews.

They are also long-term contracts, lending that income streams a high level of security. The portfolio has an average term to expiry of 12 years. In short, long-run rental agreements with bluechip clients that won’t expire for years, resulting in an income stream which should be predictable and durable.

Dividends are paid quarterly and have

incrementally increased since the 2017 IPO. A 6.12p per share dividend is expected for the full year to end June 2025, rising to 6.24p in 2026, and presumably, up again thereafter.

If that doesn’t sound like much, it represents a near 8% dividend yield at the current 77.1p share price, which has struggled against higher interest rates like the rest of the sector. That makes now a great time to invest, not only locking in a very attractive yield, but at a near 14% discount to net assets to boot.

Why such a wide discount? We previously mentioned that higher base rates reduce the attractiveness of income assets, but that should reverse once rates start to come down. The other issue of costs has recently been addressed – the trust bringing the portfolio management team inhouse. This function was previously outsourced to Atrato, but Supermarket Income REIT has reached the scale to do this internally.

This saw Atrato’s Rob Abraham and Mike Perkins, both crucial to the REIT’s progress in recent years, join Supermarket Income REIT as chief executive and finance chief respectively, solving any issues around long-term leadership. Supermarket Income REIT estimates that these steps will save it around £4 million a year.

Something else that could improve the market’s

mood towards the trust is its recent pledge at capital recycling, which sounds to us like it means to take a more proactive approach to asset trading. Earlier this year Supermarket Income REIT sold a Tesco store in Newmarket to the chain for £63.5 million, 7.4% above its estimated value in June 2024.

Future proceeds might be reinvested back into the portfolio or perhaps returned to shareholders through share buybacks or even special dividends, time will tell. These deals should also help address the discount as they demonstrate the true value in the portfolio.

With the UK big-four supermarkets (Tesco, Sainsburys, Morrisons and Asda) increasingly under pressure from retailers like Aldi and Lidl, owning their own real estate to make operating cost savings that can be funnelled into product price cuts may become an increasingly attractive lever to pull, which should help Supermarket Income REIT secure other stores sales at higher than book value.

Investors may need to be patient. Getting the market to reevaluate Supermarket Income REIT stock is likely to be a slow process. But, in the interim, investors will be getting paid an 8% yield for their patience, a very attractive low-risk return. Ongoing charges are 1.36% according to industry body the Association of Investment Companies. [SF]

The complication of substituting an antibody in an approved test provides continuity of revenue for AIM outfit

(BVXP:AIM) £24.11

Market cap: £127.9 million

Opportunities to buy high quality businesses at knock-down prices do not come along every day. We believe specialist antibody maker Bioventix (BVXP:AIM) now falls into this camp.

Over the last year Bioventix shares have halved, taking the one-year forward PE (price to earnings) ratio down to 16 times from 29 times.

Bioventix is known as more of a growth than an income stock, but the depressed share price means the shares today offer an attractive 6.4% dividend yield.

The company’s cash generative business model has allowed it to grow the dividend by an annualised 16% a year over the last five years.

To put that into a longer-term context, since moving to AIM in April 2014, the company has paid shareholders a cumulative £11.73 in dividends per share.

Why then have the shares fallen out of favour? We suspect they have been caught between the crosshairs of UK smaller companies enduring weak market sentiment and AIM stocks being clobbered following changes to the inheritance tax rules.

At the same time 2024 has seen a hiatus in terms of growth. At the half year results to 31 March, the company reported a 4% fall in pre-tax profit to £5.1 million, reflecting increased investments on new projects.

The company said full year revenue to 30 June is expected to be flat with pre-tax profit slightly lower on the year. This is expected to be temporary,

2,500 3,000 3,500 4,000 4,500 5,000

2021 2022 2023 2024 2025

Source: LSEG

with a return to growth in 2026 driven by new products contributing a higher proportion of group revenues.

Bioventix creates and manufactures SMAs (sheep monoclonal antibodies) which are used in diagnostic applications. The company has built a reputation for creating superior antibodies which confer improved diagnostic test performance.

The company sells liquid antibodies and derives royalty revenues from their downstream use.

Antibody-based blood tests are used to help diagnose many different conditions including, among others, heart disease, thyroid function, fertility, infectious disease and cancer.

Bioventix has built a portfolio of roughly 30 antibodies that are sold globally to large multinational laboratory diagnostics companies.

It takes about a year for Bioventix to create a new antibody. It can take a further two to four years for customers to conduct field trials, submit regulatory data and obtain marketing approval.

Source: Stockopedia. Cavendish. Year end: 30 June

Assuming the resulting antibody works as untended, the long development time and expense creates a natural incentive for customers to continue using a Bioventix antibody.

This creates an effective barrier to entry for potential replacement antibodies. It also means the company has a dependable revenue stream from existing products.

The company’s predominately royalty-based revenue and capital light business model mean a high proportion of revenue is translated into operating cash.

In 2024 the company generated £8.3 million of operating cash, representing 54% of revenues.

Gross margins (gross profit minus cost of sales) are above 90% while operating margins have averaged 77% over the last five years. The company operates with 12 full-time employees and has 14 staff in total, which keeps costs low.

million of cash on the balance sheet at the end of March 2025.

Given the long lead times to develop new antibodies, the company is constantly researching new applications for its technology.

Bioventix has been working with the University of Gothenburg since early 2020 to develop antibodies for use in Alzheimer’s disease diagnostics. The prevailing view is that bloodtesting machines will soon offer new neurological tests which reveal important information about brain health.

For context, a typical gross margin for a UK company is around 50% and a mid-teens operating margin is considered healthy.

It is not surprising that the business generates a healthy return on equity which has averaged 65% over the last five years.

The company is debt free and had roughly £5

Another promising area of growth is the environment. The company has developed a lateral flow system for industrial biomonitoring to detect sewage contamination of rivers and lakes.

Drugs like paracetamol and caffeine have previously been used as a surrogate marker of sewage in waterways.

Bioventix has made antibodies which can be used in lateral flow tests to facilitate rapid riverside tests, the results of which can be uploaded and shared with many parties.

In summary, we believe the depressed share price offers investors a great opportunity to get on board a quality growth business. [MG]

Natural ingredients supplier’s warning leaves a sour taste, but our long-term thesis remains intact

Shares made Treatt (TET) one of our key selections for 2025 at 465p on the basis the extracts-to-ingredients supplier had a recipe for long-term growth and many of the hallmarks of a high-quality company such as a focus on innovation and strong cash generation.

We also argued Treatt was well-placed to profit as end-markets recovered from a period of customer destocking and noted new chief executive David Shannon’s big growth ambitions for the business.

SAID

Rather than the upgrades and re-rating we’d hoped for, Treatt has suffered a de-rating with the stock plunging to a five-year low following a weak first-half trading update (10 April) and accompanying profit downgrade pinned on ‘short-term trading challenges’.

The Suffolk-headquartered supplier of natural ingredients for the beverage, flavour and fragrance industries now expects full-year pre-tax profit

Source: LSEG

to weigh in at between £16 million and £18 million, below the £20.9 million consensus, amid a softening of consumer confidence in North America and the impact of sustained high citrus prices on customer demand.

On tariffs, the company is watching developments closely, though its diverse supply chain and significant manufacturing presence in the US and UK gives it the flexibility ‘to support our customers in diverse ways in different markets’.

We hold our hands up for being too early but volatility and price swings are a part of smallcap stock picking and Treatt remains a long-run beneficiary of the low- and no-sugar trend.

The firm expects a stronger second half to come, during which it should realise the benefit of selfhelp measures, while Shannon is encouraged by the company’s robust order book and sales pipeline with new wins coming through, including an unnamed large new customer in North America.

A £5 million buyback demonstrates confidence and indicates the board believes the shares are materially undervalued; broker Peel Hunt lowered its price target from 800p to 485p following the news but retained its ‘buy’ rating, while Jefferies’ 650p price target implies the stock could more than treble from here. [JC]

If the current market turmoil continues there will be bargains to be had

Watching the wild gyrations of the stock market every day is not healthy, and even those of us whose job it is to analyse and comment on events need to step away every now and then to try and see the big picture.

Our motto throughout the sell-off prompted by president Donald Trump’s ‘Liberation Day’ tariff announcements has been ‘keep calm and carry on’, as typically major sell-offs have presented good buying opportunities for long-term investors.

As the dramatic turnaround in stock market fortunes seen after Trump hit pause on the most punishing ‘reciprocal’ tariffs shows, the best days for the market often follow some of the worst.

Since none of us can control what happens in the market, nor can we know with any certainty when the low has been reached, a productive way to use this time is to make a ‘shopping list’ of stocks you would want to own and the prices at which you would buy them.

It’s often said you make a profit when you buy rather than when you sell, because your purchase price dictates the returns you can generate. Buy too dearly and your returns will be poor, but buy cheaply with a ‘margin of safety’ and your upside is far greater.

As for markets: ‘The US administration’s attempt to reset the global trade framework through tariffs is causing a volatility shock through markets,’

says Mark Richards, head of dynamic multi-asset investing at BNP Paribas Asset Management.

‘Now the question is which utility curve Trump is trying to maximise: one, bring revenues or two, bring jobs back home or three, negotiating tariffs & trade barriers. The situation is tricky given that the three curves are mutually exclusive. Signing trade deals could be ahead, but the range of outcomes is wide,’ cautions Richards.

One approach to the situation would be to look for companies with strong pricing power in niche markets, preferably providing services rather than manufactured goods and potentially with low or no exposure to the US economy.

It also helps to think as if you were buying the whole business rather than just a few shares, which means focusing on companies with high-quality asset backing, including property, and solid free cash generation which can be reinvested at high rates of return.

Companies which tick all these boxes and are trading at attractive valuations are likely to appeal not just to private investors but to private equity funds who invest for the very long term and can ride out market fluctuations.

By Ian Conway Deputy Editor

By Tom Sieber Editor

In mid-February we posited the idea that gold might hit $3,000 per ounce in the not-to-distant future, and within a month the precious metal had pushed through this level.

After sharing in the broader sell-off which followed ‘Liberation Day’, gold has begun to shine once more and in this article we examine the prospects for the precious metal

to hit the $4,000 mark and the different ways investors can achieve gold exposure.

The selling in gold follows a similar pattern to that which we have seen in previous market sell-offs. Because gold is relatively easy for investors to buy and sell, it is often a victim of initially indiscriminate selling before its safe haven credentials come back to the fore.

1,000 2,000 3,000

As Capital Economics climate and commodities analyst Hamad Hussein says: ‘While gold prices have edged down since “Liberation Day”, this is not unusual during a sudden equity market selloff. In fact, gold’s track record suggests prices are likely to rise from here, especially if a worst-case scenario for the US economy and equity markets did materialise.’

Gold, which has limited applications in industry, tends to be in demand during periods of economic or geopolitical strife, when inflation threatens paper currencies or there are significant falls in bond and equity markets.

The precious metal’s role as a store of value goes back thousands of years and investors often reach for it in a crisis because, unlike currencies, its value cannot be manipulated through adjustments to interest rates. Also, it is a scarce resource which is costly to mine, so it’s supply cannot be increased rapidly unlike the supply of money.

A longer-term driver has been buying by central banks looking to diversify their reserves out of dollars. This has been particularly evident with countries like Russia and China who have had been at odds with the US.

As shown on the chart, based on data from the World Gold Council central banks have been

net buyers of gold for 15 consecutive years up to the end of 2024 and with this trend already having accelerated in recent years the current US administration’s policies may encourage further diversification away from dollardenominated assets.

The chief executive of small cap UK-listed gold miner Thor Explorations (THX:AIM), Segun Lawson notes: ‘A trend we see on a daily basis at the moment is gold dropping in US daytime and then rising in Chinese daytime, reflecting Chinese buying, and that seems unlikely to change.’

As the table show’s previous bull markets for gold have seen materially larger percentage gains than we have seen thus far in the precious metal’s current rally. Although the duration of this bull run is approaching the decade or so over which the previous two were sustained, a similar percentage increase from its December 2015

A second and somewhat related catalyst which is coming to the fore right now is reduced appetite for other traditional ports in a storm, perhaps most notably US government debt, amid investor concern about the size of the country’s deficit and the credibility of the current trade policy. Weakness in the US dollar is another tailwind given gold is denominated in dollars.

At the same time, in the background, geopolitical concerns remain relevant given

low to that seen during the 1970s would take the price to $20,000 per ounce.

No-one is suggesting this is on the table, but to get to $4,000 would require a further 24% move higher from current levels. To put that into perspective, the precious metal is already up a similar amount since the start of 2025.

the ongoing conflicts in the Middle East and in Ukraine.

Negatives for gold include the excellent run it has already enjoyed, its limited practical usage and the possibility that jewellery-related demand might suffer if we see prolonged economic weakness. A more lasting resolution to current tariff uncertainty could also clip gold’s wings.

Also, gold itself offers investors zero income unlike alternatives like stocks, bonds and cash.

While this will always count against its attractions relative to other asset classes, a solution to this conundrum for individual investors could be to buy gold miners who have the capacity to pay dividends out of their cash flow.

We have previously highlighted exchangetraded fund iShares Gold Producers (SPGP) as a relatively low-cost way of getting diversified exposure to this area and it has delivered a oneyear total return of 44.4%.

Capital preservation trust Ruffer (RICA) has been investing in gold mining shares rather than bullion itself and notes it has benefited from having done so during the recent volatility.

In its latest commentary, the trust says: ‘The largest contributions came from precious metals, primarily through gold mining companies and silver bullion, which appreciated as demand for safe haven assets grew. Notably, gold miners outperformed gold bullion – which we do not currently own – over the quarter, after largely tracking the gold price for much of 2024.’

A relatively low-risk way of getting gold price exposure and some, albeit modest income, would be to look at Wheaton Precious Metals (WPM).

Wheaton isn’t a gold miner as such, it is a royalty streaming company – providing money to miners to help them develop projects in return for a percentage of their production.

As Berenberg observes: ‘While the shares can be viewed as a gold proxy, we think Wheaton offers a different dimension to the physical metal, through both yield (a dividend yield of around 1%, with scope for increases) and scope to grow production to one million ounces per year, which should translate into increased free cash flow and dividends.

‘This is supported by a net-cash balance sheet, which provides plenty of flexibility to pursue value accretive transactions. Growth could also come through longer dated projects currently in the portfolio.’

Investors comfortable with taking on greater risk could look at Thor Explorations, which has just announced a maiden dividend and has committed to this payout for the next two years.

The annual dividend of 2.75p will be paid on a quarterly basis and implies a yield of some 9.2% at the current price of 30p per share.

This generosity to shareholders is underpinned by the ramp-up in output from its Segilola mine in Nigeria.

Canaccord Genuity forecasts that even after paying this dividend the company would finish 2025 with net cash of around $144 million if gold prices hold above $3,000, which means it still has the means to invest in exploration opportunities across its portfolio of assets in Nigeria, Cote D’Ivoire and Senegal.

Buying gold coins or bars is possible but likely to be fraught with too many storage and insurance complications for most investors.

Fortunately, there are convenient ways to add gold to a portfolio through exchange-traded products which are backed by physical bullion in storage vaults. Examples include iShares Physical Gold (IGLN), Invesco Physical Gold (SGLD) and Amundi Physical Gold (GLDD), which are among some of the largest and cheapest products available.

It is worth examining your options carefully and being aware of some of the major pitfalls

The recent volatility in the global stock markets triggered by Trump’s ‘Liberation Day’ tariff announcement may have panicked people approaching retirement or already in drawdown.

For those who are still more than a decade away from retirement, they can sit tight and not be too fazed by shortterm movements in the market, however wild. The situation is a little different for someone who is about to or has already moved from the accumulation phase to leaning on their investments to help fund their living costs having stopped full-time work.

DC pensions are typically invested in the stock market and might see a direct hit on their value when global equities ‘hit the skids’ says AJ Bell’s director of public policy Tom Selby.

‘[However], members of DB schemes are largely shielded from such events [global stock market volatility], provided the employer standing behind their pension promise remains in business.’

The amount of money in dormant pensions is expected to reach £750 billion by 2050 according to the UK government.

One modest silver lining if you’re in the run-up to retirement is it provides a spur to think about these issues, do some planning and start framing your decisions. First, it is important to find out how many pension pots you have. The average person has around 11 jobs in their lifetime so there is the possibility of accruing 11 different pension pots with each employer. You might have a DC (defined contribution) pension or a DB (defined benefit) pension.

If you have worked at a few different places in your lifetime look through your paperwork or emails for any pension information, ask current and past employers about any pensions you had with them.

Other ways to find out about the number of pensions you have is to use a pension tracing service.

The DWP (Department for Work and Pensions) has a free pension tracing service which is a quick way to locate pension savings.

DO YOU CHANGE YOUR ASSET ALLOCATION?

There are no hard and fast rules on what asset

Let’s assume we have two pension pots of £100,000. Pension pot B produces a steady 5% a year in annual performance over three years and pension pot A has two years of significant 5% falls before a bumper year which sees its value

appreciate 25%. For both examples £4,000 a year is drawn from the pot and the cumulative performance of 15% is the same but pension pot A is worth less than at the start of the period whereas pension pot B has appreciated in value.

Hypothetical example for illustrative purposes does not include fees

allocation you should have in your retirement portfolio. If you are approaching retirement you may well have already begun to increase your exposure to lower-risk assets like bonds but much will depend on your personal circumstances and appetite for risk.

Andrew Craig, founder of Plain English Finance, says: ‘One elegant way to think about how to approach investment as you go through life is by using the idea of 100 minus your age.

‘Traditionally this gave you a rough idea of how to split your pension and other investments between equities and bonds, based on your age, with the amount allocated to equities calculated as 100 minus your age. If you are 30, you might save and invest 70% in shares and 30% in bonds. If you are 70, your allocation might be the other way round.’

reaction to short-term global stock market volatility. ‘A reactionary approach risks locking in any losses you have made. For those taking a flexible income through drawdown, sustained dips in the value of your fund, particularly in the early years of retirement, may require you to review your withdrawal strategy to make sure it remains on track,’ says AJ Bell’s Selby.

What is important is not to have a knee-jerk

WHAT IS POUND COST RAVAGING?

Pound cost ravaging is a term used to describe the impact that a downturn in financial markets has on investment withdrawals.

We all know that if there’s a market drop our investments are likely to fall too, but the effect of this is far worse if you’re taking money out of your pension. When you take money out of your pension you sell down your fund to generate income, unless you

are withdrawing cash from dividend payments. Fund values change regularly and to generate a specific level of income you’ll sell down different proportions of your pension fund depending on its value.

When fund values drop, you need to sell a higher proportion of your fund to generate the same income. This will deplete your fund faster, shorten its duration, and reduce your ability to benefit from any market recovery. In the worst-case scenario, you could run out of money to fund your retirement and the impact is greater in the early stages of retirement.

For this reason, you might consider taking income from other savings or investments if you have them or relying on any income-paying investments you have in your portfolio – sometimes referred to as its ‘natural yield’ – and leaving the capital untouched.

Scott Gallacher chartered financial planner at Rowley Turton believes it is important to have a well-thought-out plan to counteract any market falls just before, just after, or midway through retirement.

‘It’s also worth remembering that for many clients, the recent market falls only brought values back to where they were, perhaps 12 months ago. It’s not a disaster – just part of the normal investment journey.

‘The real risk tends to come when large sums, like the 25% tax-free lump sum, are taken and spent or gifted early on. However, if the 25% was simply being withdrawn to reinvest elsewhere, the falls are largely irrelevant as those non-pension assets will also likely have fallen in value. It’s all still invested, just in a different wrapper.

‘That said, for those who had planned to take their 25% tax-free lump sum soon, it may be worth

delaying if practical, at least until markets begin to recover.

‘Finally, if the recent volatility has made you uneasy, it’s worth asking whether drawdown is the right option for you.

‘Now might be the time to take a fresh look at annuities. Rates are significantly higher than they were just a couple of years ago, and while annuities fell out of fashion for many years, they’re very much back in vogue. For more cautious retirees-or those with less margin for error annuities can offer the certainty and peace of mind that drawdown may not.’

One issue with buying an annuity during periods of market volatility is, if you make such a purchase when the value of your retirement pot is diminished then you are, in effect, crystallising these losses and will get a reduced rate of income as a result.

Darius McDermott, managing director at FundCalibre believes it is important to have a multiasset income strategy: ‘It’s always frustrating to see volatility in markets, but these periods are an inevitable part of long-term investing. Hopefully, those approaching drawdown will have already derisked their portfolios to some extent, so won’t be fully exposed to equity market falls.

‘It’s also worth noting that bonds have generally risen since the recent tariff concerns began, so it’s not all bad news. When drawing down a pension, one option investors might consider is a multi-asset income strategy. By generating a steady income stream from a diversified portfolio, it can help reduce the need to sell capital in tougher markets.’

It is important to reiterate that everyone’s individual circumstances when approaching retirement or in drawdown are different so before doing anything you should consider seeking financial advice.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Sabuhi Gard) and the editor (Tom Sieber) own shares in AJ Bell.

By Sabuhi Gard Investment Writer

FTSE 100 companies have agreed to spend £29 billion already this year

These days it seems as though every company and their dog are buying back shares, if the morning flood of RNS (regulatory news service) announcements is anything to go by.

Out of 300-odd news stories each day from 7am, by our reckoning over a third are ‘transaction in own shares’. Although it remains to be seen whether that trend will continue in the face of market turbulence. Notably Tesco (TSCO) unveiled a £1.45 billion buyback on 10 April in the wake of the tariff-related selling.

So, what is it with buybacks that makes every chief executive and chief finance officer think it’s a good way to allocate capital?

WHY ARE SHARE BUYBACKS SO POPULAR?

Buybacks are a clever (and tax-efficient) way to increase shareholder returns as they reduce the number of shares in issue.

end up paying tax on the extra income unless they hold the shares in a tax wrapper such as a SIPP or an ISA.

When a company buys back shares, on the other hand, it usually cancels them, which means each of the remaining shares receives more in earnings and dividends and is more valuable as a result.

Now that companies are familiar with the need to ‘maximise’ shareholder value – including investment trusts, thanks to the arrival of activists – everyone wants to be seen to be doing the right thing by their investors.

When companies pay special dividends, investors

According to AJ Bell investment director Russ Mould, who keeps a close eye on buybacks and other corporate actions, in the first three months of this year FTSE 100 companies have announced a whopping £29 billionworth of share purchases.

Annualising that figure for the whole of 2025 would mean £116 billion of buybacks, which is more than the combined total of 2023 and 2024 and gives you some idea of just how popular they have become.

Even small-cap companies with barely any surplus cash are buying their own shares, either because they think they are too cheap or as a sign they are confident about the outlook and therefore they are a good bet – time will tell.

All companies have what is known as a capital allocation framework which sets out what they will do with surplus cash flow once they have spent what they need to on maintenance, settled all their bills and paid interest on their debt, assuming they have any.

For most companies, it reads as follows:

• Invest in the business for organic growth

• Look for acquisitions to supplement growth

• Pay down existing debt

• Increase shareholder payouts via dividends or buybacks

Probably the best example of a company which generates genuinely surplus capital – because its investment needs are minimal, it never makes acquisitions and it has no debt – is FTSE 100 newcomer Games Workshop (GAW). Every now and then, when the company finds itself with surplus cash, it announces a dividend. It doesn’t have a calendar and it doesn’t make regular payouts, but in the last 12 months it has announced five ‘one-off’ dividends (last July, last October, last December, this January and this

March) to rid itself of unwanted cash to the tune of 520p per share.

It could, of course, use the money to buy back its own shares, but we suspect the company would rather let investors make that decision for themselves.

Buying back its own stock at current levels may not add value for shareholders, if the intrinsic value of the business is below that level (we’re not saying intrinsic value is below the current price, but if it is then the company would be doing shareholders a disservice by launching a buyback).

One company with a huge cash pile, which isn’t buying back shares, is investment conglomerate Berkshire Hathaway (BRK-B:NYSE)

As of the end of 2024 its cash pile of $334 billion exceeded the value of its listed holdings, leading founder Warren Buffett to go on the defensive.

‘Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference will not change,’ said Buffett.

‘Berkshire will never prefer ownership of cashequivalent assets over the ownership of good businesses, whether controlled or only partially owned,’ emphasised Buffett.

All that was offered by way of explanation for the cash pile was that ‘often, nothing looks compelling; very infrequently, we find ourselves knee-deep in opportunities.’

Source:

Berkshire halted share buybacks in the final quarter, suggesting Buffett doesn’t believe the stock is undervalued, and there was no hint the firm would pay a dividend.

Buffett loves receiving dividends, but it is very much a one-way street – only once has Berkshire paid a dividend, back in 1967, and to this day Buffett jokes he must have been in the bathroom when the decision was made.

He would rather invest in the businesses he owns to grow their margins, grow their markets, improve their existing products or come up with new ones.

There is nothing fundamentally wrong with companies sitting on cash – like investors, having cash gives them options, added to which if interest rates are going to stay higher for longer, it can earn a decent income to boot.

Shares quizzed a couple of chief executives and finance directors at firms with cash on the balance sheet to ask what they planned to do with it, and the responses were quite eye-opening.

John Morgan, managing director of urban regeneration and fit-out firm Morgan Sindall (MGNS), was unapologetic about the build-up of cash on the company’s balance sheet.

Having ended 2024 with net cash of £492 million, equivalent to almost a third of its market cap, Shares asked whether a buyback was on the cards.

Morgan was quite clear – his, and the board’s single, overarching principle surrounding capital allocation is to maintain a strong balance sheet and hold ‘significant net cash balances at all times’, giving the group a competitive advantage in winning future work but also giving it a ‘buffer’ in the event of a downturn in the economy.

There are likely to be ‘significant’ opportunities to grow the partnership business, which will require cash, and Morgan is open to opportunities to acquiring pre-existing partnership development schemes or land to complement the existing business.

Only once all options have been considered and cash is truly deemed ‘surplus’ would it be returned to shareholders, so we wouldn’t hold our breath. Since announcing its full-year results, the firm

has raised its outlook for 2025 thanks to an acceleration in trading at the fit-out division, and over the last year the shares are up 45% against a 1% loss for the FTSE 250 so shareholders haven’t exactly lost out.

Another firm with a large cash pile relative to its market cap is workplace benefits and health insurance provider Personal Group (PGH:AIM).

As at the end of last year the company had cash and bank deposits of £27.4 million and no debt, compared with a current market cap of £80 million.

Some of that cash came from the sale of Let’s Connect, but the majority is from operating free cash flow, which is only set to grow as the company wins more business.

Shares asked chief executive Paula Constant and chief finance officer Sarah Mace what their plans were for this growing cash pile.

‘We’ve really refined our go-to-market approach to make it even easier for customers to sign up, and we’ve got great momentum,’ said the chief executive.

‘There is a significant market opportunity in front of us, our insurance and benefits offerings are more relevant than ever in the current climate and having cash gives us options in what is an underpenetrated but huge addressable market.’

That doesn’t mean Constant and Mace are about to go on a spending spree, however – any M&A target would need to be absolutely right, financially and culturally, to justify management time and resources as well as cash.

Again, with the firm having just notched up its best-ever two months of leads through its partnership with Sage (SGE) and the shares up almost 60% over the past year, investors aren’t exactly being shortchanged.

Disclaimer: AJ Bell, referenced in this article, owns Shares magazine. The author (Ian Conway) and editor (Tom Sieber) of this article own shares in AJ Bell.

By Ian Conway Deputy Editor

These products can offer some security but typically at the expense of returns

Investors have flocked to money market funds in recent years, attracted by the high rates on offer, reflecting the sharp rise in official interest rates since 2022.

Despite the Bank of England cutting base rates from a peak of 5.25% in August 2024, the current 4.5% rate is relatively high compared to the 0.5% which prevailed during the Covid era and, indeed, the relatively low rates seen ever since the 2007/8 financial crisis.

Typically, money market funds pay a higher rate of interest than the Bank of England base rate and savings accounts at banks.

This makes them a good instrument to park cash

and earn a steady, if unspectacular, return. Money market funds provide a diversified portfolio of cash and cash-like investments like short-term loans and high-quality bonds.

Bonds are a type of I.O.U issued by a government or corporation in return for paying regular, interest payments. Income is typically paid semi-annually.

The downside of investing in money market funds is the relatively low return they offer compared with riskier investments like stocks. It is also important to understand that inflation can seriously erode purchasing power over long periods.

So, while money market funds are great for ‘parking cash’ while deciding where to invest or providing a short-term ‘buffer’ during periods of heightened market volatility, they are not a necessarily a great long-term investment.

That said, longer-dated bonds such as those with maturities over five years can play an effective role in diversifying portfolio risk and typically provide a higher return than short-dated cash. More on the role of bonds later.

Finally, remember that, unlike stocks and shares, bonds do not as a matter of course provide capital growth. Investors get back what they put in plus the interest paid along the way.

Money market funds can be held in an ISA which means no tax is liable on the income paid.

Funds in the money market space are predominately actively managed with the objective of beating the benchmark SONIA (sterling overnight

indexed average) rate.

SONIA is the average interest rate that banks lend to each other overnight and is used as a reference rate for various financial transactions.

The £750 million Amundi Smart Overnight Return GBP Hedged ETF (CSH2) aims to beat the SONIA benchmark return with low variability. It has an annual charge of 0.1%.

Over one year it has achieved a return of 5.49%, compared with the 5.1% return for SONIA.

A popular money market fund is the £7.5 billion Royal London Short Term Money Market Fund (B8XYYQ8) which has an ongoing charge of 0.1%. Over one year the fund has returned 5.13%.

The BlackRock ICS Sterling Liquid Premier fund (B43FT80) is the big daddy in the space with assets of £45 billion. It targets returns above standard deposits by investing in a broad range of highquality bonds and money market instruments.

Seasoned managers Matt Clay and Paul Hauff have run the fund since 2009. The fund has returned 5.1% over one year and has an ongoing charge of 0.1% a year.

While many investors find it easier to stick to investing in bonds through ETFs and managed funds, investment platforms give investors access to individual UK government bonds.

This section describes what government bonds are and explains the mechanics of how they work.

UK government bonds are sometimes referred to as gilt-edged securities or ‘gilts’ for short. The name originates from the practice putting golden or gilded edges on the paper certificates.

Gilts are a form of debt issued by the HM treasury on behalf of the government so it can borrow money from investors.

The price of a conventional gilt is quoted in terms of price per £100 face value, which is also called ‘par’ value. This is the capital value of the gilt at issuance and at maturity. While gilt prices are quoted this way, they can be traded in units a little as a penny.

A gilt is denoted by its coupon and maturity, for example, 1.5% Treasury Gilt 2047. An investor holding £1,000 worth of the gilt will receive two coupon payments of £7.50 each on 22 January and 22 July every year until the security matures in 2047.

At maturity an investor would receive a repayment of capital and the final coupon.

It is useful to think about gilts in terms of yield to maturity because this is the total expected return from buying and holding the gilt to maturity.

For example, if an investor paid £100 to buy a 3.25% Treasury Gilt 2033 in April 2023 and held to redemption (maturity) there would be no capital gain or loss and the yield to maturity would be the annual coupon earned, or 3.25%.

However, if an investor purchased the same bond for £90 and held to maturity, the investor would make a £10 capital gain in addition to the coupon payments, giving a yield to maturity of 4.53%.

Looking at the other side of the coin, an investor paying £110 would receive a yield to maturity of only 2.11%, including a capital loss of £10.

The prospect of treating the return from a gilt as a capital gain rather than income has attracted a lot of investor interest in the last couple of years. The reason is, income from gilts is taxable when held outside an ISA or SIPP but capital gains are tax free. Many gilts issued before the pandemic had low coupons, reflecting prevailing interest rates at the time.

To generate the same yield as a higher-coupon gilt, a lower-coupon gilt of similar maturity will be

Source: LSEG

Source: Morningstar

Source: Morningstar

sold at a lower price. For example, for a 1% Treasury Gilt 2032 to yield 3.25% in April 2023, it would have to be priced at £82.93.

This means most of the yield to maturity comes from a capital gain (sometimes referred to as pull to par) made on maturity.

Longer-dates gilts are more sensitive to changes in interest rates and provide capital gain potential if interest rates fall. The opposite is also true, so longer-dates gilts will fall in price more than shortdates gilts, if rates increase.

A gilt’s sensitivity to interest rates is called its duration. Duration helps investors understand the potential price movement of a bond due to interest rate fluctuations.

The thing to remember is short duration gilts are less sensitive to interest rate changes and long duration gilts are more sensitive.

For example, the price of a 10-year gilt with a duration of seven years would be expected to fall 7% for every 1% increase in interest rates.

In contrast, a short-dated two-year gilt with a duration of one-and-a-half years would be expected to fall by 1.5%.

Lastly, gilts have the potential to provide ballast to a portfolio of shares during times of market turmoil. That is partly because during such events investors tend to flock to the relative safety of fixed income, driving prices of gilts up and yields down. If things get bad, central banks tend to step in

and lower interest rates to stimulate the economy, which is also good for gilts and bonds.

Investors looking for a ready-made diversified exposure to the total UK gilt market might consider the iShares Core UK Gilts ETF (IGLT).

The £3.5 billon fund seeks to track the FTSE Actuaries UK Conventional Gilts All Stocks index and has an ongoing charge of 0.07% a year.

The fund has a weighted average yield to maturity of 4.46% and an average duration of 11.3 years.

Another alternative is treasury bills or T-bills for short. These are government bonds with a very short time until they mature. Unlike gilts these do not come with income included, your returns is based on the difference between the price at which they are sold and the redemption price, which is in turn heavily influenced by UK base rates. There is no secondary market for these products which have to be held to maturity. Returns from T-bills are taxed as income, however they can be held in an ISA or SIPP to shield them from HMRC. AJ Bell offers three-and six-month T-bills.

Disclaimer: AJ Bell owns Shares magazine. The author (Martin Gamble) and editor (Tom Sieber) of this article own shares in AJ Bell.

As one of the largest sectors globally, financial companies play a vital role in the health and development of modern economies. An activelymanaged portfolio, the Polar Capital Global Financials Trust seeks to find the best investment opportunities across the world of financials, with the aim of delivering income and capital growth.

abrdn Asia Focus (AAS)

Gabriel Sacks, Fund Manager

abrdn Asia Focus plc (AAS) We aim to find the best managed Asian smaller companies that are setting the new standard. The Company strives to maximise total return to shareholders over the long term from a concentrated, high-conviction portfolio focusing predominantly on exciting, smaller, listed companies in Asia (excluding Japan).

Law Debenture (LWDB) At Law Debenture our objective is to achieve long-term capital growth in real terms and steadily increasing income. The aim is to achieve a higher rate of total return than the FTSE Actuaries All-Share Index Total Return through investing in a diversified portfolio of stocks. We have grown or maintained our dividend for each of the last 44 years through our value driven, diversified portfolio managed by James Henderson and Laura Foll of Janus Henderson Investors.

Six steps to get your investments in the best possible shape

Spring is upon us and many of us will be tempted to rejuvenate our houses with a little elbow grease, and maybe even venture out into the garden to get a head start on the annual plant lifecycle. Not everybody will spare a thought for their investments this spring though, but they probably should. Even the most considered portfolios still need regular reviews in order to keep them on course, and to account for any changes in your circumstances which might call for a different tack.

Spring is a good time for this activity, as you may well be using your pension and ISA allowances, and so already have some investment decisions to make. There’s no need to make changes simply for the sake of it, but equally you might find a few holdings in your portfolio which leave you scratching your head as to why they’re there. Everyone will approach a portfolio spring clean slightly differently, but if you’re searching for a bit of structure, there are six questions around which you can base your review which should cover a lot of bases.

Probably the most important thing to assess is whether there have been any material changes in your personal situation. Getting married, having a child, or buying a bigger house can have an impact on your finances, such as your life insurance requirements, and the need to update your will. But life events might also affect how much risk you’re willing to take with your investment portfolio.

Perhaps you’ve come into an inheritance which means you feel more comfortable dialling up your investment risk, because your financial security has increased. Or maybe you now plan to retire earlier and draw on your pension, so it might be a good time to reduce the volatility of your portfolio. Consider what, if anything, has changed personally,

how this might affect your attitude to risk, and whether your portfolio is still a good match.

Market prices aren’t static, and as a result, neither is the shape of your portfolio. Over short periods this won’t make much difference, but given time, the equilibrium in your portfolio can be lost as some bits move up faster than others and may mean that your portfolio becomes too reliant on one fund, or one region.

Regular rebalancing is therefore an important discipline to keep your portfolio in good order. After a review you might conclude you’re happy with the current split, but at least you would have made a considered decision, rather than simply letting the balance in your portfolio be dictated by market movements.

As well as the regional split of your portfolio, you should give some consideration to the allocation across asset classes (if you aren’t fully invested in shares). That means taking a look at your exposure to shares, bonds, property, cash, gold and any other assets you might hold. This is all easier than it might sound at first, as many investment platforms will offer you an online tool that breaks down your accounts by region and asset class.

You should also check whether any specific

funds you hold have done a lot better than others and now constitute a large part of your overall pie. That’s clearly a good sign, but it’s worth making sure that your portfolio isn’t too heavily reliant on just one fund manager, no matter how good they are, because even the very best can go off the boil.

You should also check your portfolio for any serially poor performers. These aren’t funds which have had a bad year, or even three years, simply because their investment style is out of favour, but rather funds which have lagged behind competitors for a long period and show little sign of change for the better.

You should consider replacing fund duds with more promising active funds, or cheaper tracker funds. The latter won’t outperform, but at least they aren’t charging the higher fees associated with active management for the privilege.

As well as inspecting performance, it’s worth checking that the fundamental reasons you bought an investment are still in place. For funds and investment trusts, make sure there hasn’t been a change in fund manager or strategy, and if there has, consider whether it’s still fit for purpose. If you invest in individual shares in your portfolio, consider if the reason you bought into a company has now run its course, or has still got some legs. Also consider if the business has undergone a material change in strategy or circumstances which make it a less attractive investment proposition.

A portfolio review is a decent time to scout around for new investment ideas, which might replace

funds or stocks you’re selling. Are there any emerging trends you might want to buy into?

Or are there any fund managers who have impressed you with performance, and now merit inclusion in a portfolio, or perhaps a bigger share of your assets?

One thing which has changed over the last couple of years is a big fall in bond prices, and a rise in yields. Those who have shunned bonds as part of the diversification in their portfolio, preferring instead perhaps property, gold, cash, or absolute return funds, might pause to give thought to whether bonds should be back on the menu.

The final piece of the jigsaw is to make sure your portfolio is invested as tax efficiently as possible, most pertinently using pensions and ISAs which provide shelter from income and capital gains tax. The sooner you put your investments inside the ISA or pension, the sooner the protection kicks in.

By Laith Khalaf AJ Bell Head of Investment Analysis

1 MAY 2025 FARMERS AND FLETCHERS IN THE CITY

3 CLOTH ST

LONDON EC1A 7LD

Registration and coffee: 17.15 Presentations: 17.55

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

FIDELITY EMERGING MARKETS LIMITED (FEML) Draws on Fidelity’s resources across the globe to build a carefully curated portfolio of companies with a strong growth runway. High-quality emerging market companies should deliver strong and sustainable investment returns over the long term but keeping an eye on potential risks is vital. These markets may be more volatile, and company valuations can move to extreme levels in both directions.

TARGET HEALTHCARE REIT (THRL)

The leading listed investor in UK care home real estate. We are a responsible investor in modern, ESG-compliant, purpose-built care homes which are commensurate with modern living and care standards. We partner with high-quality care providers on long leases to provide shareholders with an attractive level of income together with the potential for capital and income growth.

TOUCHSTONE EXPLORATION (TXP)

The largest independent onshore oil and natural gas producer in Trinidad, listed on the LSE and TSX. The team has over a decade of experience operating in Trinidad’s oil and gas sector and has built a diverse portfolio comprised of highly exciting exploration, development, and production assets across southern Trinidad.

Previously unloved areas like UK stocks and commodities may have their time in the sun

When a presidential social media post is capable of sending stock, bond, currency and commodity markets spinning, up or down, there is a danger that any article, podcast or comment has a limited shelf life. Even this is of value in some ways, as it makes it clear that no-one – but not one –knows what is coming next.

It may, therefore, be worth bearing in mind legendary investor Warren Buffett’s observation that: ‘The job of the stock markets is to take money from the impatient and give it to the patient.’ Longterm investors’ may therefore wish to step back from the day-to-day noise and assess the three of the possible scenarios that may develop in the wake

of president Trump’s decision to pause reciprocal tariffs for ninety days but stick with the 10% baseline levies and continue to slap extra duties on imported Chinese goods.

One is that the White House continues to change its mind, and new policies emerge before the ninety days are up, with the possible result that the world stops taking America’s word on trust (perhaps rather as it did the UK’s as it wrestled with how to implement Brexit). Volatility predominates and the president does what he wants until the stock or bond market tells him otherwise.

The job of the stock markets is to take money from the impatient and give it to the patient”

WARREN BUFFETT

Another is that the world just goes back to where it was before and American exceptionalism continues to carry all before it, politically and economically and also in stock market terms.

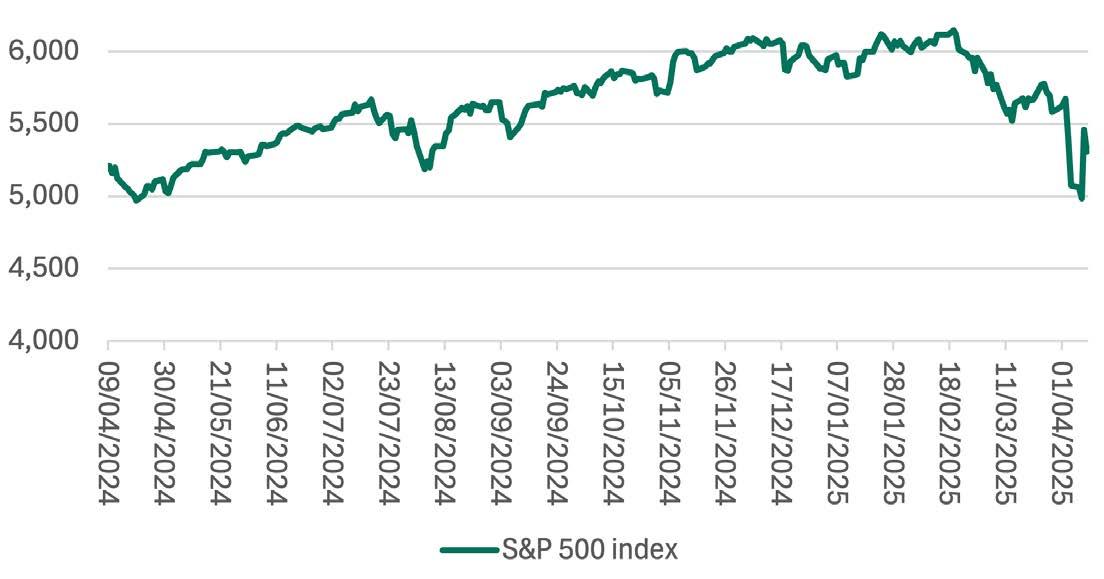

And another is that the world was already looking different before president Trump launched tariffs –the S&P 500 had already rolled over, confronted by weighty Federal debts and uncomfortable annual deficits, the Department of Government Efficiency’s version of austerity, DeepSeek’s challenge to the AI narrative and, ultimately, lofty valuations which left little margin for error should anything untoward happen (which it just might have).

US equities had already rolled over before the tariff turmoil

Source: LSEG Refinitiv data

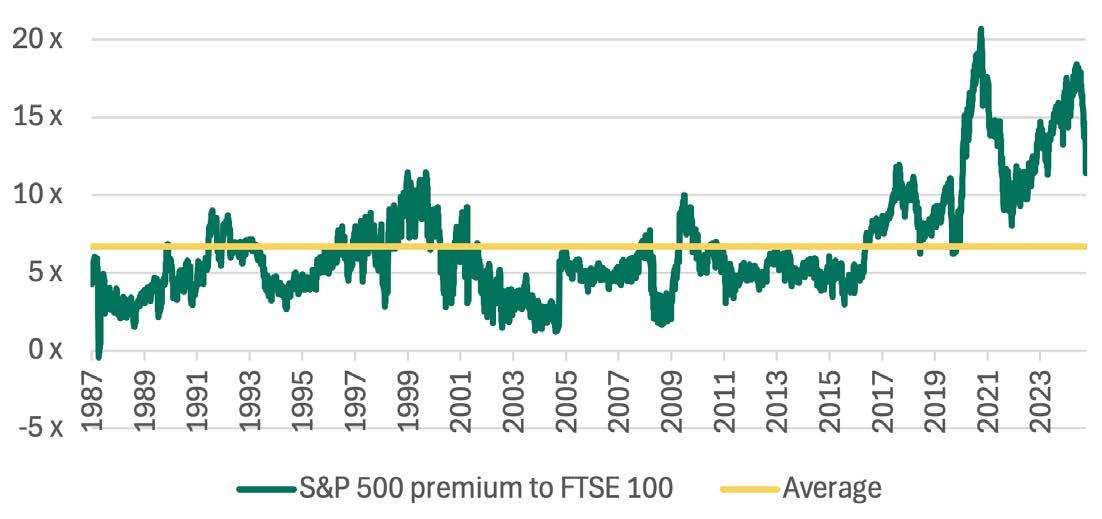

Investors have to decide for themselves which, if any of these, scenarios are most likely to occur and which offers the best balance between risk and reward when it comes to portfolio construction and any weightings toward US assets, and American equities in particular.