TESLA AT A CROSSROADS

CAN CONCERTED MOVE INTO MASS MARKET RECHARGE THE SHARES?

VOL 26 / ISSUE 17 / 02 MAY 2024 / £4.49

Your call may be recorded for training or monitoring purposes. Issued and approved by Baillie Gifford & Co Limited, whose registered address is at Calton Square, 1 Greenside Row, Edinburgh, EH1 3AN, United Kingdom. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund Manager and Company Secretary of the Trust. Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies and are not authorised or regulated by the Financial Conduct Authority. The Monks Investment Trust In a world of twists and turns, you need to look at growth in three dimensions.

1929, the Monks Investment Trust’s mission has been to grow wealth for our investors whatever has been going on in the world. Today our active managers aim to do this by looking at growth in three dimensions: Growth

established, reliable businesses. Rapid Growth: companies aiming for impressive growth in the future. Cyclical Growth: businesses whose growth cycle has come round again. Capital at risk.

out more by visiting monksinvestmenttrust.co.uk A Key Information Document is available. Call 0800 917 2112.

Since

Stalwarts:

Find

06 Alphabet joins Meta in shareholder dividend commitment 07 Stagflation fears rise on turgid US economy and sticky core inflation

08 What is happening at Smithson after continuation vote dissent?

09 Barclays breaks to 52-week high despite lower earnings 09 Shoe Zone shares slump on fears over trading and higher costs

1 1 What will investors want from BP’s first-quarter results?

1 2 Disney theme parks and subscriber numbers at the forefront when the entertainment giant reports

1 4 No change expected in Fed policy after data throws up more mixed messages

1 6 Market share gains and dividend growth are on the menu at Premier Foods

1 8 Take advantage of Scottish American’s discount to NAV to pick up quality companies on the cheap UPDATES

19 Whitbread re-rating yet to materialise despite clear progress

21 Would UK companies get a higher rating by moving their listing to the US?

COVER STORY Tesla at a crossroads Can concerted move into mass market recharge the shares?

UNDER THE BONNET Discover the secrets behind Danaher’s huge

02 May 2024 | SHARES | 03 Contents

NEWS

GREAT IDEAS

FEATURES

26

31

success story 35 SECTOR REPORT

can

recovery 40 PERSONAL FINANCE How to use ‘refer

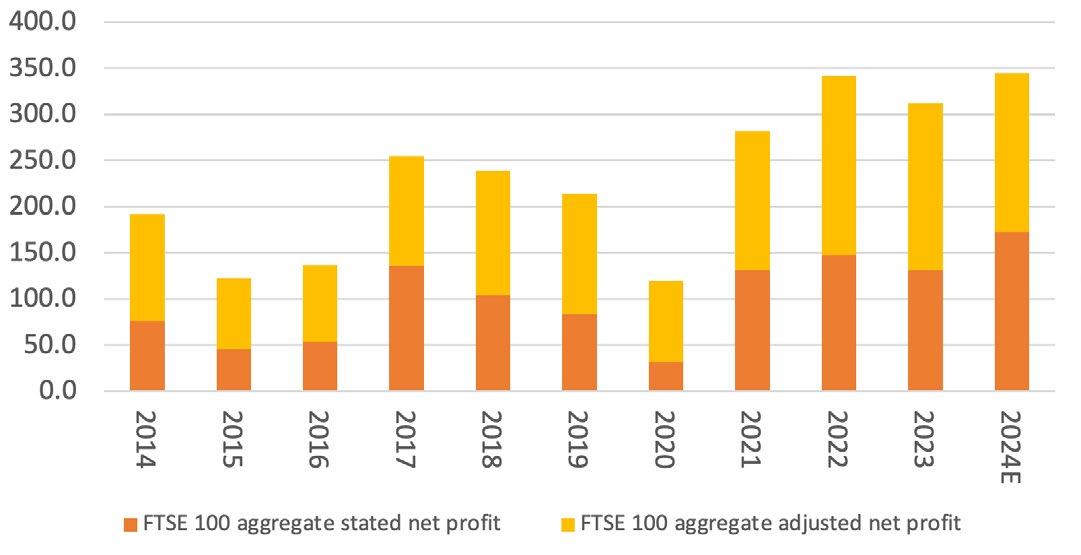

deals to boost your savings 42 RUSS MOULD Why

finally finding some friends 44 EDITOR’S VIEW

to the markets? 46 ASK RACHEL

pension withdrawal? 48 INDEX Shares, funds, ETFs and investment trusts in this issue 40 31 2 6 46

Understand the chemicals sector and whether 2024

see a

a friend’

the FTSE 100 is

Are we back in 1995 when it comes

Can I avoid emergency tax on a

Three important things in this week’s magazine

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

04 | SHARES 02 May 2024 Contents

22 SHARES 02 May2024 Feature: UK vs US market The way to achieve a better return for shareholders may lie closer to home I n the last few weeks, the drumbeat of companies complaining about the lowly valuation of their shares and floating the idea of moving to the US market has grown steadily louder. First there was miner Glencore (GLEN), then oil major Shell (SHEL) started making noises and most recently online retailer Ocado (OCDO) has come under shareholder pressure to move its listing. What is significant is these aren’t diddy AIMlisted businesses who are contemplating throwing in the towel (although plenty are) – all three are FTSE 100 companies, and if any or all of them decide to move their main listing to the US then a whole swathe of companies could follow suit. The question is, why are they so keen to move to the US and what good will it do shareholders? POTENTIAL LEAVERS Last year, mining group Glencore acquired a majority stake in a coal business previously owned by Canadian firm Teck Resources (TECK.B:TSE) with the aim of combining it with its own coal operations and listing the business in New York. The rationale for listing there rather than here is US investors are more open to investing in fossil fuels than investors in Europe, where around half of mutual funds don’t own coal assets due to their ESG (environmental, social and governance) guidelines. Would UK companies get a higher rating by moving their listing to the US? However, some shareholders are seen opposing listing the business in the US, in which case the company might consider moving its main listing to the US in order to benefit from the higher rating afforded to commodity stocks, according to analysts. Irish cement group CRH (CRH) shifted its primary quote from London to New York last year on the basis the US is a huge market for its products, and investors have been richly rewarded with a 60% rally in the shares helped by strong earnings upgrades. In 2022, mining group BHP (BHP) switched its primary listing from London to Sydney given most of the trading in its shares already happened in Australia. Meanwhile, both the current and former chief executives of oil giant Shell, the largest company in the FTSE 100 by market cap, have talked about the advantages of moving the firm’s main listing to the US. In an interview with Bloomberg, chief executive Wael Sawan pinned the valuation gap between his firm and US-listed rivals Exxon Mobil (XOM:NYSE) ConocoPhillips (COP:NYSE) and Chevron (CVX:NYSE) on the fact Shell has ‘a location that clearly seems to be undervalued’. Sawan’s priority for now is to improve returns over what he calls a ‘sprint’ of 10 quarters, buying back shares in the meantime, but ‘if we work 30 | SHARES 02 May2024 Under the Bonnet: Danaher This could be one of the best companies you have never heard of USbiotechnology, life sciences and diagnostics company Danaher (DHR:NYSE) is one of the most successful companies to list on the New York Stock Exchange that few people outside the US have heard of. This feature peeks under the bonnet to see how the company has achieved its success and explores itsStevenprospects. and Mitchell Rales and a group of investors acquired a struggling conglomerate in the 1980s and renamed it Danaher Corp. A $1,000 investment in Danaher in 1984 would today be worth around $1.8 million excluding reinvested dividends. That is equivalent to a CAGR (compound annual growth rate) of 21% a year. To put that into context Warren Buffett’s Berkshire Hathaway (BRK- B:NYSE) has delivered a CAGR of 17% a year over the same period. A lot can change over 40 years, yet interestingly one aspect of Danaher has not changed in that time. The brothers originally envisioned building a company with a focus on continuous improvement and customer satisfaction. The idea was inspired by the Japanese business philosophy of Kaizen which means change for the better. HOW HAS THE BUSINESS EVOLVE? Today the DBS (Danaher Business System) sits at the core of the company’s operations and strategic focus. Before describing the business in more detail, it is worth looking back to see how it evolved. The Rales brothers originally established a group of manufacturing businesses with a view to improving them and extracting value. From the early 1990s the company started to organise around strategic platforms with sustainable competitive advantages and structural growth drivers. Over the next few decades Danaher built leadership positions in the science and technology sectors which define the company today. Strategic acquisitions have played a key role in expanding and broadening Danaher’s reach and capabilities. For example, in 2012 Danaher purchased Kiva Systems, a robotics company which has helped drive efficiency and productivity at Amazon’s (AMZN:NASDAQ) fulfilment centres worldwide.Management believes DBS is at the heart of the company’s success. It nurtures innovation, reduces time to market and delivers ground-breaking products and solutions. WHAT IS THE SHAPE OF THE OVERALL BUSINESS TODAY? The company is organised under three platforms or divisions which house companies operating in their own niche. The largest is diagnostics which contributed 44% of revenue and 64% of group operating profit respectively in the first quarter of 2024. Discover the secrets behind Danaher’s huge success story DANAHER Fast facts Ticker: DHR:NYSE Share price: $253 Market cap: £141.5 billion TESLA

CROSSROADSA CAN CONCERTED MOVE INTO MASS MARKET RECHARGE THE SHARES? By Steven Frazer News Editor Samsung profits surge 10-fold in first quarter thanks to AI boom Card Factory rallies 6% as dividend reinstatement demonstrates confidence HSBC shares hit new high as earnings and buyback beat forecasts AstraZeneca shares up after breast cancer drug shows positive results 1 2 3 Telsa at a crossroads Looking at whether the wellreceived plan for mass market vehicles can recharge the EV maker’s share price. A US listing may not be a panacea for UK companies

to why some Londonlisted firms trade at a discount may lay closer to home. The best company you may never have heard of Find out more about Danaher and how it has delivered such extraordinary returns over time.

AT

Answers

To be ahead in Asia, be on the ground.

abrdn Asian Investment Trusts

In Asia, life and business move fast. To invest here successfully, you need local knowledge.

abrdn has had investment teams in Asia for over 40 years. So we get to know markets, companies, trends and innovations first hand. And you get to select from investment trusts featuring the most compelling Asia opportunities we can find.

To harness the full potential of Asia, explore our Asian investment trusts on our website.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested. Asian funds may invest in emerging markets which can carry more risk than developed markets.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London, EC2M 4AG. Authorised and regulated by the Financial Conduct Authority in the UK. Please quote Q206. Find out more at abrdn.com/asiatrusts Invest via most leading platforms.

Alphabet joins Meta in shareholder dividend commitment

Five of ‘Magnificent Seven’ to make quarterly payout to investors

Google-owner Alphabet (GOOG:NASDAQ) shocked the market with a first-quarter announcement that it plans to kick-start regular quarterly dividends. In February 2024, Meta Platforms (META:NASDAQ) made headlines with its own dividend announcement, joining Apple (AAPL:NASDAQ), Microsoft (MSFT:NASDAQ) and Nvidia (NVDA:NASDAQ) in committing to quarterly shareholder payouts, and Alphabet’s move means five of the so-called ‘Magnificent Seven’ big tech stocks will pay dividends in future.

Alphabet’s initial $0.20 per share payout implies a tiny yield of just 0.2%, but there is scope for rapid payout growth in future. It will leave just Amazon (AMZN:NASDAQ) and Tesla (TSLA:NASDAQ) of the seven without any commitment to dividends.

February, it helped send shares soaring more than 14%. The response to Alphabet’s plans was similar, sending the stock surging around 10% to register an all-time of $173.69 (26 April).

It marks a major transition for big tech as their respective businesses mature, with major job layoffs and tightened spending plans having been pushed through since 2022.

Every major tech firm announced layoffs and tightened spending beginning in 2022. Investors rewarded those efforts and have shown a similar reaction to share buybacks and dividend initiations. When Meta announced its first ever dividend in

As with Meta, Alphabet has previously returned cash to shareholders via hefty share repurchases. In 2023, the internet search giant spent $61.5 billion on share buybacks as profits rose. But changes to US corporate tax rules may be a factor in big tech rebalancing shareholders returns towards dividends and away from share buybacks. Buybacks now incur a 1% tax as the US government continues to grapple with its budget deficit. This could rise to 4% if changes proposed last year are pushed through. However, Alphabet’s announcement that it also plans to buyback up to $70 billion worth of stock going forward suggests this line of thought may be less meaningful than answering the simple question of what to do with the enormous amounts of cash sitting idle on major tech firms’ balance sheets. According to Stockopedia data, Alphabet, Apple, Meta, Microsoft and Nvidia have more than $345 billion of cash on deposit.

Putting this monumental capital to work is not easy given the reluctance of regulators to allow major tech firms to pursue significant acquisition strategies for fear of unfairly tilting the competition scales away from smaller tech firms. [SF]

2023's monumental big tech share buybacks ($bn)

News 06 | SHARES | 02 May 2024

Apple Alphabet Meta Platforms Microsoft Nvidia 77.6 61.5 20.7 18.1 8.09 Chart: Shares magazine • Source: Company accounts

Stagflation fears rise on turgid US economy and sticky core inflation

A strong US dollar is increasing tension in currency markets

With around 40% of S&P 500 constituents reporting earnings last week including heavyweights Microsoft (MSFT:NASDAQ) and Alphabet (GOOG:NASDAQ), the micro picture was widely expected to be the main investor focus.

As things turned out, a surprisingly weak first quarter GDP (gross domestic product) print and higher-than-anticipated March inflation gave investors and the Federal Reserve further pause for thought on the likely path for inflation and interest rates.

For the first time in a few months, the dreaded phrase ‘stagflation’ began to be uttered in some corners of the market.

Fitch Ratings head of research Olu Sonola said: ‘If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly out of reach.’

Market implied cumulative rate cuts in 2024 have

been slashed from 1.5% in January to just 0.35%.

The US economy grew at an annualised 1.6% rate in the three months to March compared with the 3.4% rate seen in the final quarter of 2023 and well below economists’ forecasts of 2.4%.

A closer inspection suggests the message of a slowing economy is not as clear cut as the headline numbers first suggest: slower federal government spending and inventories acted as a drag on GDP, as did foreign trade.

Stripping out these effects, underlying demand as measured by inflation-adjusted final sales to the private sector rose at an annualised 3.1% rate. Spending on services increased by the most since the third quarter of 2021 as healthcare and financial services-fuelled growth.

Meanwhile, core PCE (personal consumption expenditures), the Federal Reserve’s preferred measure of inflation, jumped at a 2.8% annualised rate in March driven by a larger-than-expected 0.5% increase in inflation-adjusted consumer spending.

A consequence of US resilience and a Fed on hold is playing out in currency markets as the US dollar is buoyed by diverging central bank interest-rate policies.

The Japanese yen weakened to its lowest level since 1990 on 29 April, after briefly surpassing ¥160 before retreating to ¥156 on suspected intervention by the Bank of Japan.

A weak yen makes imports of food and other products more expensive and potentially increases domestic inflation. Last week, finance minister Shunichi Suzuki said he was concerned about the impact a falling yen could have on inflation. The currency has dropped by around a tenth so far in 2024. [MG]

News 02 May 2024 | SHARES | 07

Japanese yen to US dollar (¥) 1990 1995 2000 2005 2010 2015 2020 80 100 120 140 Chart: Shares magazine • Source: LSEG

What is happening at Smithson after continuation vote dissent?

The investment trust has irked investors with its approach

Investment trust Smithson (SSON) has work to do to repair its relationship with shareholders after recent controversy over a continuation vote at the stablemate of Terry Smith’s Fundsmith Equity (B41YBW7).

Smithson, which looks to apply Smith’s ‘buy good companies, don’t overpay, do nothing’ approach to small- and mid-cap companies, had said to investors at its inception it would consider holding a vote on its future if the trust’s average discount to NAV (net asset value) in any individual year was greater than 10%. In 2023 the average discount was 10.7% amid patchy recent performance.

However, in the trust’s annual report released 27 February chair Diana Dyer Bartlett said there would be no such vote. The reasoning given was the discount related to broader market conditions rather than being specific to the trust, with previous strong performance flagged alongside the board’s confidence in future prospects.

This created a real stink with Peter Spiller of Capital Gearing Trust (CGT), which holds Smithson, saying he was ‘horrified’ and pledging to vote against Dyer Bartlett’s re-election. The backlash prompted a U-turn and a vote was held at the AGM (annual general meeting) on 25 April.

The result saw 9.6% of votes cast against continuation and 19.2% against the re-election of Dyer Bartlett, with 10.2% of votes also cast against the re-appointment of Lord St John of Bletso as chair of the audit committee.

Numis describes the debacle as a ‘corporate governance own goal’ but also says: ‘We believe positive lessons have been learnt by the manager. The manager now has more willingness to sell if there are early warning signs that the business case may not be playing out, and to take profits on valuation grounds.

‘We believe this approach is more pragmatic and reduces the risk of inertia leaving the portfolio skewed to very expensive stocks, whilst the manager’s mantra is likely to ensure turnover

remains low. We believe that the portfolio has sound fundamentals that place it in a strong position to outperform over the long run.’ [TS]

WHAT IS A CONTINUATION VOTE?

IT’S QUITE COMMON for trusts to have a provision in their Articles of Association for a continuation vote every three or five years, to determine whether said trust should continue as normal or liquidate its assets and wind down. Some trusts have ‘conditional triggers’ which require or prompt them to hold a continuation vote if, say, their market value falls below a certain level or the discount to NAV is persistently wide.

News 08 | SHARES | 02 May 2024

(p) 2019 2020 2021 2022 2023 2024 1,000 1,500 2,000 Chart: Shares magazine • Source: LSEG

Smithson

Barclays breaks to 52-week high despite lower earnings

The bank reaffirmed its plan to return over a third of its market cap to shareholders

It has been a while since investors in UK banks had cause to celebrate but shareholders in Barclays (BARC) were toasting a small win last week as the high-street lender posted first-quarter profit above market expectations, sending its shares to new 12-month high of 200p.

The core UK retail business saw net interest income dip 4% to £1.55 billion as customers borrowed less and depositholders shifted their money into higher-earning accounts, but credit quality

remains healthy for now so the bank only took £58 million of provisions for bad loans against nearly double that amount in the same period last year.

Barclays’ investment bank had a weak quarter compared with the likes of Goldman Sachs (GS:NYSE) and JPMorgan (JPM:NYSE), posting a 7% drop in income due to lower activity in its fixed-income and commodities business, but overall investors seemed happy with the results.

Chief executive C.S. Venkatakrishnan was keen to draw attention to the bank’s success in raising its return on tangible equity

Shoe Zone shares slump on fears over trading and higher costs

It has been a turbulent couple of months for value retailer Shoe Zone (SHOE), which seems to have metamorphosed from cost-of-living-crisis winner to stock market pariah on the strength of a single comment by chief executive Anthony Smith.

In the firm’s extremely brief AGM statement in midMarch, Smith celebrated a successful year of growth in 2023 while cautioning current-year trading was ‘marginally’ below company

expectations due to issues with shipping through the Suez Canal, higher costs associated with store upgrades and a slower than anticipated end to the Autumn/Winter season.

Bearing in mind the firm is in the middle of transforming its estate into ‘big box’ and hybrid formats, which generate higher sales than its old stores, and it expects product margins to increase due to lower container costs and canny buying, ‘marginally’ lower trading is far from disastrous.

And, as Next (NXT) and Primark have shown,

to above its medium-term target of 12%, and reiterated the bank’s target of returning at least £10 billion to shareholders between 2024 and 2026, or more than one third of its current market cap, through dividends and buybacks. [IC]

consumers are prioritising spending on good-value essentials like clothing and footwear rather than nice-to-have products like watches and jewellery, which plays directly to Shoe Zone’s strengths.

The firm is due to publish its interim results for the period to March in three weeks’ time (21 May) and Shares for one will be keen to see what the firm has to say. [IC]

News 02 May 2024 | SHARES | 09

Unguarded

a

DOWN in the dumps HIGHER Moving

comment in

press release sends stock price tumbling

Barclays (p) Jan 2024 Apr 150 200 Chart: Sharesmagazine • Source: LSEG Shoe Zone (p) Feb 2024 Mar Apr 200 250 Chart: Sharesmagazine • Source: LSEG

There’s no better investment return than the freedom to live well Whatever your financial goals, a Janus Henderson Investment Trust invests for your future actively, expertly and diligently. Whether you’re looking for growth or a steady income, our range of trusts aims for competitive returns across a diverse selection of global investments. And with decades of investment trust experience behind us, you can look forward with confidence. Explore our Investment Trust range at www.janushenderson.com/JHIT INVESTMENT TRUSTS Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

3 May: Trainline

7 May: Arecor Therapeutics, Ebiquity

8 May: Alliance Pharma, Brighton Pier, Cornerstone FS

9 May: Airtel Africa

3 May: InterContinental Hotels, Mondi

7 May: BP, IWG

8 May: OSB, Renishaw

9 May: Balfour Beatty, Wheaton Precious Metals, Wood Group

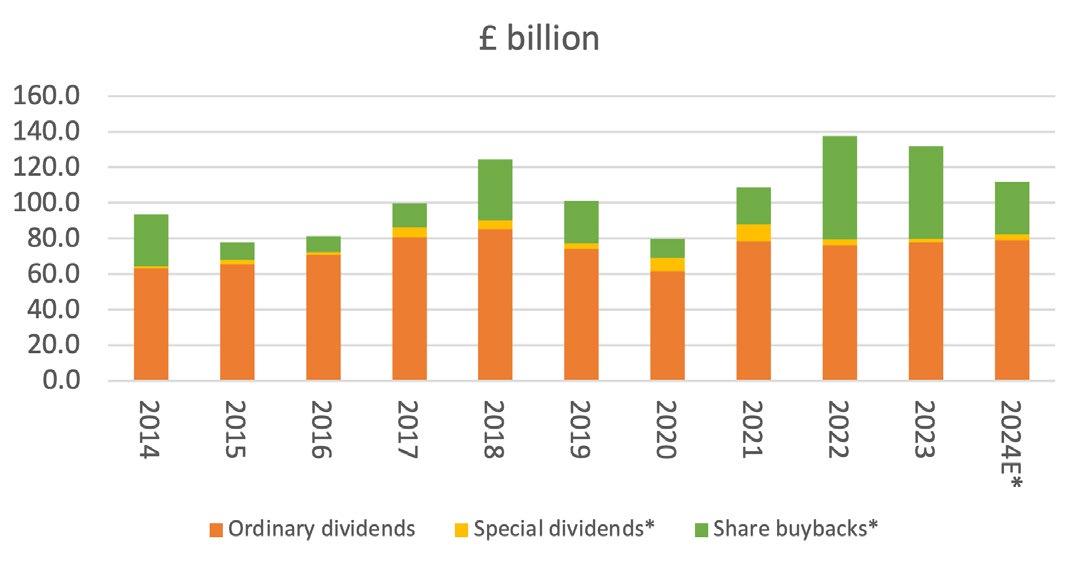

What will investors want from BP’s first-quarter results?

Operational progress and shareholder returns among the areas in focus

Since BP (BP.) reported its full-year results on 6 February, events in the Middle East have helped drive Brent crude oil prices higher to bubble around the $90 per barrel mark.

While this has already provided a boost to BP’s share price, it is only likely to have affected the last few weeks of the first-quarter trading period which BP will be reporting on when it updates the market on 7 May.

Investors will want to see evidence of further operational improvements after progress on this front in the last three months of 2023 helped lift cash flow to $9.4 billion. BP, like its UK counterpart Shell (SHEL), is looking to play catch-up with US rivals which have opened up a meaningful valuation gap in recent years.

Looking ahead at 2024, Berenberg analyst Henry Tarr says: ‘The company expects higher upstream production, along with growth in convenience and Castrol within C&P (customers & products). Refining margins are

expected to be lower with realised margins affected by narrow American heavy crude differentials. Lower gas and liquefied natural gas prices will likely also be headwinds for the group in 2024.’

BP has committed to a $3.5 billion buyback for the first half of 2024 and its plan to return at least 80% of surplus cash flow to shareholders (up from 60%) could lead to positive news on dividends. [TS]

News: Week Ahead 02 May 2024 | SHARES | 11

FULL-YEAR RESULTS

UK UPDATES OVER T HE NEXT 7 DAYS

TRADING

ANNOUNCEMENTS

What the market expects of BP 2024 84.4p £218.8bn 2025 92.8p £207.8bn EPS Revenue Table: Shares magazine • Source: Stockopedia What the market expects of BP 2024 84.4p £218.8bn 2025 92.8p £207.8bn EPS Revenue Table: Shares magazine • Source: Stockopedia BP (p) Jul 2023 Oct Jan 2024 Apr 450 500 550 Chart: Shares magazine • Source: LSEG

Disney theme parks and subscriber numbers at the forefront when the entertainment giant reports

CEO Bob Iger hopes to quieten activist noise with second

Walt Disney (DIS: NYSE) is due to report second quarter earnings on 7 May.

Analysts expect the House of Mouse to deliver revenue of revenue to come in at $22.11 billion for the quarter and EPS (earnings per share) of $1.09.

Disney reported stronger-thanexpected first quarter earnings back in February boosted by cost cutting and revenue from the entertainment giant’s theme parks.

Revenues for Disney Parks and Experiences were up 13% in the first quarter to $8.3 billion and segment operating income increased 11% to $2.4 billion.

The company is hoping a for a repeat performance as well as higher attendance and spending at its international parks and resorts in Shanghai and Hong Kong.

All eyes will also be on Disney’s streaming business which has been under pressure due to increased competition and price hikes. Over

quarter earnings

What the market expects of Walt Disney

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

3 May: Hershey

6 May: Vertex, Simon Property, Loews

7 May: Arista Networks, Electronic Arts, McKesson, Occidental, Walt Disney

the previous quarter, the Disney+ subscriber base fell by 1.3 million. With the latest set of earnings, Disney CEO Bob Iger is probably once and for all looking to silence activist investors like Nelson Peltz who failed to get a seat on the board of directors at the company's AGM in early April.

Peltz wanted to shake up Disney and prioritise cost cutting, making the streaming operations profitable, improving the quality of output from its film studios and finding a successor to Iger. [SG]

8 May: Airbnb, Emerson, Fox Corp, News Corp, Uber Tech

9 May: Constellation Energy, Warner Bros Discovery

News: Week Ahead 12 | SHARES | 02 May 2024

Q1 forecast $1.09

EPS Revenue Table: Shares magazine • Source: Zacks Walt Disney ($) Jul 2023 Oct Jan 2024 Apr 80 100 120 Chart: Shares magazine • Source: LSEG

$22.11bn

Sophisticated global investing made effortless

Since 1888, The Bankers Investment Trust has enabled people to access a wide range of quality global investments in one expertly blended portfolio. Targeting long-term growth and income, for those aiming to invest for their future. Enjoy sophisticated investing made available to everyone at www.janushenderson.com/BNKR BANKERS INVESTMENT TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

No change expected in Fed policy after data throws up more mixed messages

UK consumption and housing market in focus in the coming days

While the market’s focus moved on to US company earnings last week, spurring a strong rebound, investors received another reality check in the form of the first-quarter GDP and core PCE (personal consumption expenditure) figures.

GDP grew at the slowest rate in two years while the PCE came in sticky as expected, presenting the Federal Reserve with an unwelcome combination as it prepares to meet for two days on Tuesday and Wednesday as Shares goes to press.

Confusing matters further, while the annualised GDP growth figure of 1.6% disappointed the market, which was primed for a 2.1% increase, consumption of services was the strongest since

Macro diary 2 May to 8 May 2024

the first half of 2021 and service-sector inflation is one of the Fed’s major bugbears.

Also before Shares goes to print are the US JOLTS (job openings) figures, which are an important guide to the strength of the labour market, as well as the so-called ‘quit rate’ which shows how easy it is for workers to find better jobs at higher wages.

Sticking with US economic data, the week ends with non-farm payrolls which have been a source of stock market volatility in previous months.

There is also a swathe of service-sector PMIs with the UK, the US and Europe all expected show continued expansion, while the focus in the coming week will be on a round of UK house price surveys, which seem to be pointing upwards again, and retail sales statistics which last time surprised to the upside. [IC]

Next Central Bank Meetings & Current

News: Week Ahead 14 | SHARES | 02 May 2024

02-May UK Nationwide April House Prices 1.6% US April Challenger Job Cuts 90.3k 03-May UK April Services PMI 53.1 US April Services PMI 51.7 US April Non-Farm Payrolls 303k 06-May Eurozone April Services PMI 52.9 UK April BRC Retail Sales Monitor 3.2% 07-May UK April Halifax House Prices 0.3% 08-May UK April RICS House Price Balance -4.0% Date Economic Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Interest Rates 09-May Bank of England 5.3% 22-May European Central Bank 4.00% 11-Jun US Federal Reserve 5.5% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Looking for the comfort of growing income? There’s a wider world of investment income opportunities beyond the UK. With a broader perspective, Henderson International Income Trust invests in established leading businesses around the world. Helping investors access and enjoy the potential for consistent and growing income. Explore a world of income from the comfort of one investment at www.janushenderson.com/HINT HENDERSON INTERNATIONAL INCOME TRUST Marketing communication. Not for onward distribution. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Not for distribution in European Union Member countries. Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg. no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg. no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Market share gains and dividend growth are on the menu at Premier Foods

The branded food group’s attractive free cash flow is likely to be seized on by investors

Premier Foods (PFD) 159.6p

Market cap: £1.39 billion

Ownership of some of Britain’s best-loved brands including Mr. Kipling, Batchelors and Bisto, appetising growth potential and a transformed financial position that should support double-digit dividend growth are reasons to buy cooking sauces, cakes and custards maker Premier Foods (PFD).

Admittedly, the stock has already rallied 350% over the past five years to reflect an impressive turnaround and balance sheet rehabilitation under CEO Alex Whitehouse, yet the shares remain attractively valued and falling debt levels combined with forecast upgrades should offer a

The company observes it is well on track to deliver against its previously raised profit expectations”

powerful re-rating catalyst. Shares believes further upwards earnings revisions could be on the menu, potentially as early as the full-year results (16 May), driven by domestic market share gains, growth in the US and Australia and a tailwind from an improving consumer backdrop.

RECIPE

FOR SUCCESS

Guided by Whitehouse and CFO Duncan Leggett, Premier Foods is one of Britain’s biggest food producers and the owner of well-loved brands including Mr. Kipling, Ambrosia, Oxo, Paxo, Sharwood’s and Lloyd Grossman, which form great components of affordable meals.

In fact, over 90% of UK households buy one or more of Premier Foods’ products every year, giving the FTSE 250 constituent’s earnings a resilient bent, while management believes three brands

Great Ideas: Investments to make today 16 | SHARES | 02 May 2024

Premier

(p) 2020 2021 2022 2023 2024 0 50 100 150 Chart: Shares magazine • Source: LSEG Premier Foods' improving financial profile 2023 (A) 137 274 1.4 2024 (F) 152 253 1.7 2025 (F) 160 161 2.1 2026 (F) 168 58 2.5 Year to March Adjusted pre-tax profit (£m) Net debt (£m) DPS (p) DPS = dividend per share Table: Shares magazine • Source: Shore Capital

Foods

Net debt to adjusted EBITDA

have global potential, namely Mr. Kipling, cooking sauce brand Sharwood’s and The Spice Tailor, a fast-growing Asian ingredients label bought in 2022 which marked Premier’s first acquisition in 15 years.

This deal was followed by 2023’s takeover of FUEL10K, a granola, oats and drinks products business which boosted the group’s position in the breakfast category, building on the success of its Ambrosia porridge pots.

Premier Foods’ shares trade on an undemanding prospective PE (price to earnings) ratio of 11.2 which implies re-rating scope”

The £1.39 billion cap also issued an upbeat outlook statement, insisting it continued to trade strongly, delivering further progress against its strategy backed by by another quarter of doubledigit sales growth and market share gains. Now into the final quarter of its financial year, the company observes it is well on track to deliver against its previously raised profit expectations, commentary which implies potential for further upwards forecast revisions in the months ahead.

Over the past decade, Hertfordshireheadquartered Premier Foods has undertaken considerable heavy lifting in rebuilding its balance sheet and reducing onerous cash commitments to debt holders and pension schemes. This has allowed it to invest behind its brands and deliver consistent growth and a cycle of forecast upgrades.

In the third quarter to 30 December 2023, Premier Foods cooked up a 14.4% rise in group sales as the international business had another very good quarter and sales in new categories more than doubled, with Ambrosia Porridge pots and Mr. Kipling and Angel Delight ice-cream both proving standout performers.

Mr Kipling market share progression in Australia

DIVIDEND GROWTH ON THE MENU

On 6 March 2024, Premier Foods announced it had struck an agreement with the RHM Pension Scheme Trustee to suspend pension deficit payments from 1 April 2024. The suspension will save Premier Foods £33 million in cash contributions in the year ending 29 March 2025 and deliver a healthy boost to its already attractive free cash flows. This can support targeted acquisitions, accelerated capital investment to drive growth as well as a progressive dividend; Premier Foods returned to the dividend list in 2021 with a modest distribution after a 13-year absence.

With debt continuing to reduce, Shore Capital forecasts a jump in pre-tax profits from £152.3 million to £160.3 million for the year to March 2025, which translates into EPS (earnings per share) of 13.6p and a 2.1p dividend that is 6.5 times covered by earnings. The broker’s estimates for full-year 2026 point to pre-tax profits of £168.3 million, EPS of 14.3p and a 20% increase in the shareholder reward to 2.5p.

Based on 2026 estimates which look conservative, Premier Foods’ shares trade on an undemanding prospective PE (price to earnings) ratio of 11.2 which implies re-rating scope. And if this undervaluation persists, Premier Foods, which fended off a bid from US spices-to-condiments company McCormick (MKC:NYSE) back in 2016, could once again become the subject of takeover interest. [JC]

Great Ideas: Investments to make today 02 May 2024 | SHARES | 17

FY19/20 FY20/21 FY21/22 FY22/23 3.2 2.8 2 1.7 1.5

FY18/19

Chart: Shares magazine • Source: Premier Foods, EBITDA = earnings before interest, tax, depreciation and amortisation

FY18/19 FY19/20 FY20/21 FY21/22 FY22/23 4.1% 6.8% 8.8% 10.2% Chart:

Shares magazine • Source: Premier Foods

Take advantage of Scottish American’s discount to NAV to pick up quality companies on the cheap

2023 saw the trust deliver its 50th consecutive dividend increase

Scottish American Investment Company (SAIN) 503p

Market cap: £898 million

Ballie Gifford-managed Scottish American (SAIN), also referred to as ‘SAINTS’, is trading at an 8% discount to net asset value which offers a great opportunity to buy high-quality assets on the cheap.

The fund is steered by co-managers James Dow and Ross Mathison, after Toby Ross stepped away from co-managing the fund in February.

The managers are focused on finding and investing in steady, long-term compounders which throw off sustainable, resilient dividends.

The trust was founded in 1873 to seek higher income outside the UK and has grown its dividend for 50 consecutive years. The last time the dividend was cut was 1938, before the Second World War.

Over the last decade, the trust has grown its dividend at an annualised rate of 3.3% per year, which is ahead of UK price inflation as measured by consumer prices, which has annualised at 2.9% per year.

The team believe dividend growth is closely associated with compounding and enhances investment returns.

The manager’s approach is similar in style to investment legend Warren Buffett and Fundsmith founder Terry Smith. SAINTS likens compounding to the effect of a snowball rolling down a long hill: the further it travels, the faster it gains in size.

American

Chart: Shares magazine•Source: LSEG

return of 218.2%.

The portfolio consists of around 60 holdings, with the top 10 representing 31% of the portfolio’s total value.

Top holdings include software giant Microsoft (MSFT:NASDAQ), Danish diabetes and weight-loss specialist Novo Nordisk (NOVO-B:CPH) and US distributor of air-conditioning equipment Watsco (WSO:NYSE).

The latter two companies were strong contributors to performance over the last 12 months, gaining 54% and 30% respectively.

The fund has a robust track record over the longer term, delivering a total return in net asset value of 222.6% over 10 years, equivalent to a compound annual return of 12.4% per year, and outperforming the FTSE All-World Index total

The managers trimmed the Novo position many times through the year as the position size nudged up against the fund’s 6% size limit.

The managers invested in five new companies over the last year including US home improvement retailer Home Depot (HD:NYSE), intimate healthcare product maker Coloplast (COLOB-B:CPH), analytical testing and assurance provider Eurofins Scientific (ERA:EPF), drinks group Diageo (DGE) and semiconductor maker Texas Instruments (TXN:NASDAQ).

The trust has an annual ongoing charge of 0.58% per year. [MG]

Great Ideas: Investments to make today 18 | SHARES | 02 May 2024

Scottish

(p) 20202021202220232024 300 400 500

Whitbread re-rating yet to materialise despite clear progress

Whitbread (WTB) £31.76

Loss to date: 8.5% The new growth plan could supercharge profits if it comes off

When we initially recommended buying Premier Inn owner Whitbread (WTB) last summer our thesis was the shares were too cheap given the firm’s prospects and the renaissance in travel in general.

Throw in an element of self-help, such as the sale of certain low-yielding assets, and we expected the market to come to its senses and re-rate the company’s shares.

WHAT HAS HAPPENED SINCE

WE SAID TO BUY?

The firm has delivered on its side of the bargain, posting third-quarter and full-year results which were in line with if not slightly ahead of forecasts

as the UK hotel market continues its post-pandemic recovery.

The group’s German division has reduced its losses as it gains in critical mass, with revenue per available room jumping 20% in the 12 months to the end of February, and is expected to reach breakeven at the pre-tax profit level this calendar year.

If there is a disappointment it is that the firm hasn’t sold as many of its under-performing Beefeater and Brewers’ Fayre restaurants as hoped, although under its new accelerated growth plan just under half the lower-returning restaurants are being converted into rooms which will boost margins.

There is a cost to this plan, with this year’s results due to show a one-off hit of £20 million to £25 million, but by February 2029 the company is predicting incremental profits of between £80 million and £90 million per year.

WHAT SHOULD INVESTORS DO NOW?

Trading in the core UK hotel business has been as good as can be expected, so it now comes down to getting the German business into profit and executing the growth plan.

Investors who are short of patience may want to cut their losses but we think long-term investors will be rewarded with earnings upgrades and a re-rating of the shares, assuming management sticks to the plan. [IC]

Great Ideas Updates 02 May 2024 | SHARES | 19

Whitbread Jul 2023 Oct Jan 2024 Apr 3,100 3,200 3,300 3,400 3,500 3,600 Chart: Shares magazine • Source: LSEG

Leading the energy transition and driving positive impact on the environment and society.

VH Global Sustainable Energy Opportunities plc (GSEO) invests globally in a diverse range of sustainable energy infrastructure assets, working towards its strategic goals of accelerating the energy transition towards a net zero carbon world and providing shareholders attractive risk-adjusted returns.

Why invest in GSEO?

A vehicle presenting a distinctive combination of access, return and impact.

Access Return Impact

• Access to global private markets energy investments

• A geographically and technologically diversified portfolio of actively managed, high-impact investments which aim to ensure an effective and just climate transition

• Targeting total NAV return of 10%, net of costs and expenses

• Progressive dividend target of 5.68p reaffirmed for 2024

• High degree of inflation-linkage with over 90% of revenues that are inflation-linked

• Minimal interest rate risk exposure

• Creating environmental and social impact transforming lives and communities without compromising on returns

• Transparent impact reporting

• SFDR Article 9 fund

Disclaimer Important Information: This document may contain promotional information issued by Victory Hill Capital Partners LLP (VHCP), authorised and regulated by the Financial Conduct Authority (FCA) (FRN 961570). This document is intended for summary information purposes only and does not constitute investment advice. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. It is important to remember that past performance is not a guide to future performance. Furthermore, the value of any investment or the income deriving from them may go down as well as up and you may not get back the full amount invested. The target dividends and total returns referred to in this document are targets only and not a profit forecast. There can be no assurance that these targets can be met. If you are in any doubt about the contents of this document or the suitability of the investment to which it relates, you should seek professional advice. LONDON STOCK EXCHANGE TICKER: GSEO ✉ info@victory-hill.com Find out more by visiting www.vh-gseo.com

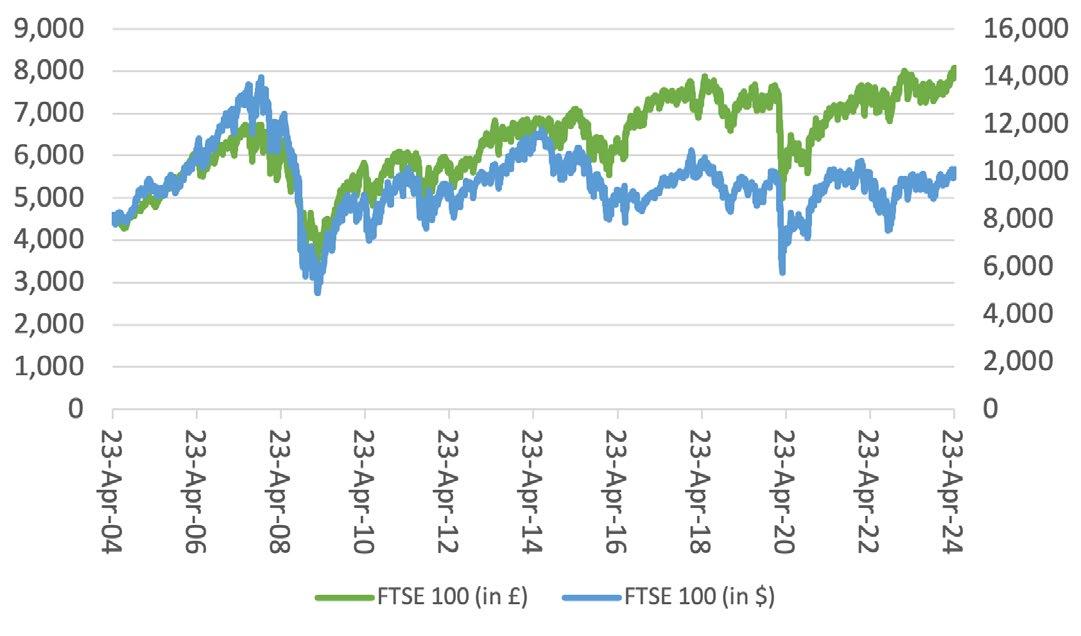

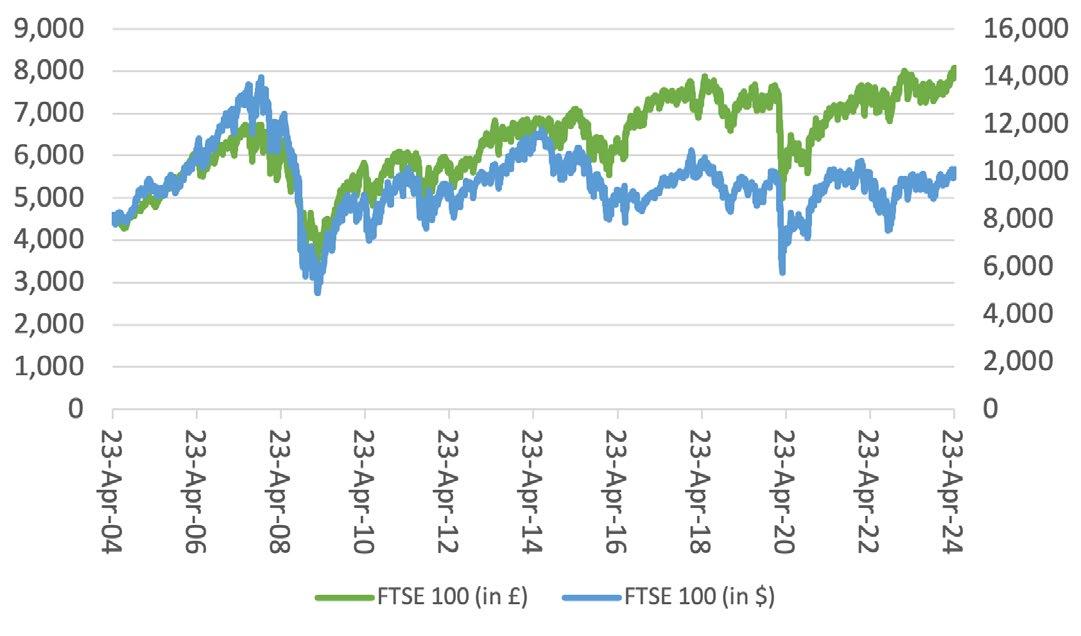

IWould UK companies get a higher rating by moving their listing to the US?

The way to achieve a better return for shareholders may lie closer to home

n the last few weeks, the drumbeat of companies complaining about the lowly valuation of their shares and floating the idea of moving to the US market has grown steadily louder.

First there was miner Glencore (GLEN), then oil major Shell (SHEL) started making noises and most recently online retailer Ocado (OCDO) has come under shareholder pressure to move its listing.

What is significant is these aren’t diddy AIMlisted businesses who are contemplating throwing in the towel (although plenty are) – all three are FTSE 100 companies, and if any or all of them decide to move their main listing to the US then a whole swathe of companies could follow suit.

The question is, why are they so keen to move to the US and what good will it do shareholders?

POTENTIAL LEAVERS

Last year, mining group Glencore acquired a majority stake in a coal business previously owned by Canadian firm Teck Resources (TECK.B:TSE) with the aim of combining it with its own coal operations and listing the business in New York.

The rationale for listing there rather than here is US investors are more open to investing in fossil fuels than investors in Europe, where around half of mutual funds don’t own coal assets due to their ESG (environmental, social and governance) guidelines.

However, some shareholders are seen opposing listing the business in the US, in which case the company might consider moving its main listing to the US in order to benefit from the higher rating afforded to commodity stocks, according to analysts.

Irish cement group CRH (CRH) shifted its primary quote from London to New York last year on the basis the US is a huge market for its products, and investors have been richly rewarded with a 60% rally in the shares helped by strong earnings upgrades.

In 2022, mining group BHP (BHP) switched its primary listing from London to Sydney given most of the trading in its shares already happened in Australia.

Meanwhile, both the current and former chief executives of oil giant Shell, the largest company in the FTSE 100 by market cap, have talked about the advantages of moving the firm’s main listing to the US.

In an interview with Bloomberg, chief executive Wael Sawan pinned the valuation gap between his firm and US-listed rivals Exxon Mobil (XOM:NYSE), ConocoPhillips (COP:NYSE) and Chevron (CVX:NYSE) on the fact Shell has ‘a location that clearly seems to be undervalued’.

Sawan’s priority for now is to improve returns over what he calls a ‘sprint’ of 10 quarters, buying back shares in the meantime, but ‘if we work

02 May 2024 | SHARES | 21 Feature: UK vs US market

through the sprint and we are doing what we are doing, and we still don’t see that the gap is closing, we have to look at all options’, he admits.

Former chief executive Ben van Beurden is more forthright, describing Shell as ‘massively undervalued’ due to its London listing.

In an interview with the Financial Times, van Beurden pointed to the fact US companies benefit from deeper pools of capital and enjoy higher valuations thanks to ‘more positive’ attitudes from US investors.

‘These factors conspire against companies listed in Europe. I think increasingly that will be a problem, something will have to give,’ added the former chief executive.

Javier Blas, Bloomberg’s energy and commodities analyst, believes the risk for London of companies moving their primary listings is ‘far higher than the market – and exchange officials – perceive’.

He adds: ‘I expect the gap to persist simply because there are fewer buyers of oil stocks in Europe than in the US. Companies should list their shares where investors welcome them, and where they are properly valued – neither of which is currently true for fossil-fuel firms and the UK.’

MIND THE GAP

One way to value companies, favoured by Shell boss Sawan, is using free cash flow yield, or dividing the free cash flow per share by the stock price, so the higher the yield the cheaper the company.

On that basis, Shell trades on a yield of more than 12% and BP has a yield of almost 16% whereas Chevron and Exxon both trade on less than a 7% yield.

Using an even simpler measure of value, the PE or price-to-earnings ratio, there also seems to be a gap between the US companies and the two big UK-listed firms.

BP and Shell trade on 12-month forward PEs of 7.7 and 8.9 respectively, whereas the US trio of Chevron, ConocoPhillips and Exxon Mobil all trade on PEs of over 12 at current prices.

As oil prices and therefore energy company profits can be both cyclical and volatile, it helps to know what the cyclically-adjusted earnings trend looks like.

Smoothing out the peaks and troughs tells us what the underlying growth rate is for a company, as well as how volatile earnings are around their trend, and what the market typically pays for the shares based on the first two factors.

Using LSEG data going right the way back to 1987, we estimate BP and Shell have grown their earnings by an average of just over 4% and just over 5% per year respectively, albeit with significant peaks and troughs.

By comparison, Exxon Mobil has grown its earnings by just over 6% on average since 1987 while Chevron and ConocoPhillips have compounded earnings at more than 8% per year on average, all with a similar level of volatility to the UK duo.

22 | SHARES | 02 May 2024 Feature: UK vs US market

Apr 19 Jul Oct Jan 20 Apr Jul Oct Jan 21 Apr Jul Oct Jan 22 Apr Jul Oct Jan 23 Apr Jul Oct Jan 24 Apr 0 20 40 60 80 100 120 140 FTSE 350 Oil & Gas S&P 500 Energy

to 100 Chart: Shares magazine • Source: LSEG

Rebased

companies compare?

What this suggests is the US energy companies are valued more highly than their UK peers because they grow their earnings at a faster rate, and when we look at the price-to-trend-earnings multiples that is exactly the case.

Using current prices, BP and Shell trade on 9.3 and 10.4 times trend earnings while the US firms

trade on 13.4 to 14 times trend earnings.

Which raises the question, can simply moving its primary listing to the US improve a company’s stock market rating or does the answer lie in companies doing more themselves to raise their growth rates and improve their valuations?

IT’S ALL ABOUT GROWTH

There is a danger that UK companies – and to an extent UK investors – are guilty of crying wolf when they complain about the gulf in valuations between what seem to be similar businesses listed here and in New York.

Take pest control and hygiene firm Rentokil Initial (RTO), which generates a substantial proportion of its revenues in the US and trades on a forward PE of 27 times, which is far from cheap.

Yet Rentokil’s US rival Rollins (ROL:NYSE) is currently trading on 43 times this year’s earnings, so why the premium?

On the face of it both firms do the same thing, but a look at the long-term earnings of Rentokil and Rollins paints a very different picture – Rentokil has barely grown its earnings in the past 20 years, whereas Rollins has compounded earnings at more than 13% per year with very low volatility over two decades.

If a company has a high growth rate and good visibility over the trajectory of future earnings, why wouldn’t investors pay up? In contrast, we are left scratching our heads over the valuation of Rentokil.

Tool-hire firm Ashtead (AHT), one of the bestperforming UK stocks of the last decade, generates the great majority of its sales and earnings in the US and therefore could be considered a prime candidate to move its listing.

The shares trade on a forward-looking PE of 19.7 times, whereas shares in its US-listed arch-rival United Rentals (URI:NYSE) trade on just over 16 times this year’s earnings.

The pat explanation would be that Ashtead grows its earnings faster than United Rentals, but in fact that isn’t the case – United Rentals has grown its earnings since 1998 at a mind-blowing rate of almost 24% per year compared with a stillimpressive but not-even-in-the-same-ballpark rate of around 15% for Ashtead.

So, moving its listing to the US would be unlikely to generate a major uplift in Ashtead’s valuation, in fact it might even lead to a de-rating given there is

02 May 2024 | SHARES | 23 Feature: UK vs US market

BP Shell Chevron ConocoPhillips Exxon Mobil Last 12m PE 12m Forward PE Current Trend PE Trend Growth Rate (%) 6.9 11.5 13.1 12.3 11.2 7.7 8.9 12.4 14.2 13.3 9.3 10.4 13.6 13.4 14 4.1 5.2 8.2 8.9 6.1 Chart: Shares magazine • Source: S&P Market Intelligence, Refinitiv, Shares

One of these is a growth company, one isn’t

These companies do the same thing but one grows a lot faster than the other

a direct competitor with a better growth record on a lower rating.

In other words, while there may indeed be a general valuation disparity between the US and the UK, typically the reason for this at a micro level is US many companies tend to grow faster than their UK counterparts and therefore they deserve a higher rating.

If UK companies really want to do something

about the valuation of their shares, they need to start looking closer to home and not assuming that decamping to the US will automatically lead to a re-rating.

By Ian Conway Deputy Editor

By Ian Conway Deputy Editor

24 | SHARES | 02 May 2024

Feature: UK vs US market

Rebased to 100 Rentokil Rollins 2004 2024 0 500 1,000 2004 2024 Chart: Shares magazine • Source: LSEG Rebased to 100 Ashtead United Rentals 1998 2024 0 10,000 20,000 1998 2024 Chart:

Shares magazine • Source: LSEG

TESLA AT A CROSSROADS

CAN CONCERTED MOVE INTO MASS MARKET RECHARGE THE SHARES?

By Steven Frazer News Editor

By Steven Frazer News Editor

Just when investors think they have got the measure of Tesla (TSLA:NASDAQ), Elon Musk drops a bomb. Having feared the worst, Tesla’s first quarter (Q1) 2024 report (25 April) gave investors the clarity they were seeking on mass-market vehicles, and while detail remains thin, Musk said production would likely begin ‘in early 2025, if not later this year’ and would include ‘more affordable models.’

This was classic Musk, whose playbook seems at times to have been written with the express purpose of keeping investors on their toes.

It was important news. Competition in the EVs (electric vehicles) space has been fierce and consumers have been thinking twice about big-ticket purchases as their finances come under pressure from the higher interest-rate environment. A mass market Tesla, priced at around $25,000 and referred to by most as ‘Model 2’, is seen as giving the company the next growth lever to pull.

Bank of America analysts said the earnings update ‘addressed key concerns’ and ‘revitalised the growth narrative’. Tesla shares rallied 18%. ‘In the near-term, the tide in news flow appears to suggest the risk to the stock is skewing more positively,’ the investment bank added.

Bernstein said: ‘We struggle with why Tesla needs a discrete robotaxi offering, and we believe widespread deployment of full self-driving is five to 10 years away.’

WHAT IS TESLA?

This narrative is crucial to understanding how Tesla is perceived. A 21st Century energy company, an AI (artificial intelligence) play, a full self-driving fleet operator, even a robotics developer? All of these are based in truth, and SolarCity (solar energy installations, Megapack (energy storage), Dojo (AI platform) and Optimus Gen 2 (Tesla’s humanoid robot) could all drive substantial shareholder value down the line but ask the average person in the street what Tesla is and they’ll tell you it is a car manufacturer, and EVs – sales, deliveries, ticket prices – are what drive the share price.

Producing these new affordable models on the same production lines as its current vehicle range should mean limited new investment and the ability to make the most of existing facilities, a strategy rejig that should be good for the bottom line.

Deutsche Bank also expressed relief that Tesla ‘is not completely giving up on selling cheaper consumer models, nor is it staking the company’s entire future on robotaxi’, referring to the firm’s plans to produce a fleet of full self-driving taxis.

But not everyone was drinking the Kool Aid.

Where Tesla used to be about first-mover advantage over profits, the road ahead will see the company and its shares judged like a more mature business where financials really matter.

Few entrepreneurial chief executives get the leeway afforded to Musk, and with good reason – his investor returns track record is right up there with the best, thanks to first PayPal (PYPL:NASDAQ), now Tesla and, for those exposed

02 May April 2024 | SHARES | 27

Tesla vehicles are more expensive than Chinese domestic alternatives Model Y Model 3 Yuan Plus Seagull $37,000 $34,000 $16,600 $9,700 Chart: Shares magazine • Source: Visual Capitalist Tesla vehicles are more expensive than Chinese domestic alternatives Model Y Model 3 Yuan Plus Seagull $37,000 $34,000 $16,600 $9,700 Chart: Shares magazine • Source: Visual Capitalist Tesla vehicles are more expensive than Chinese domestic alternatives Model Y Model 3 Yuan Plus Seagull $37,000 $34,000 $16,600 $9,700 Chart: Shares magazine • Source: Visual Capitalist

to certain private equity investments, SpaceX and Neuralink, although data is a little more foggy on Musk’s brain chip meditech start-up.

If you invested $1,000 at IPO (worth approximately £668 at then $1:£0.668 rate), you’d have bought 59 shares (rounded up slightly to £1,003, excluding dealing charges). Allowing for subsequent stock splits, your $1,003 would today be worth more than $13.2 million, based on Google Finance data.

TESLA FUNDAMENTALS

This is at least part of the reason why Tesla and

Musk have built a loyal following of investors, with legions of people, willing to back the business with their cash. But if Tesla really is a primarily vehicle manufacturer, can it justify its still lofty valuation even after 2024’s dismal start.

Before the recent rally, Tesla had a market cap of about 437 billion. That’s 4.4 Ferrari’s (RACE:NYSE) or 5.75 BYD’s (1211:HKG), the Hong Kong-listed Chinese EV maker, and arguably Tesla’s most direct competitor.

On Koyfin’s consensus forecasts, Tesla traded on a 2024 PE (price to earnings) multiple of 56 before the recent rally, now up at 66, and 5.4-times sales.

Tesla ($) 2020 2021 2022 2023 2024 0 100 200 300 400 Chart: Shares magazine • Source: LSEG Tesla versus BYD EV sales 2022 Q1 310,048 143,223 2022 Q2 254,695 180,296 2022 Q3 343,830 258,610 2022 Q4 405,278 329,011 2023 Q1 422,875 264,647 2023 Q2 466,140 352,145 2023 Q3 435,059 431,603 2023 Q4 484,507 526,409 2024 Q1 386,810 300,114 Quarter Tesla BYD Table: Shares magazine • Source: Visual Capitalist

This falls to 4.4-times sales and a 47 PE on 2025 estimates. That’s clearly out-of-kilter with legacy car makers like Volkswagen (VOW3:ETR) General Motors (GM:NYSE) and Ford (F:NYSE), on single-digit PEs.

As it should, argue Tesla fans. Legacy manufacturers have threadbare operating margins and face enormous costs down the line to transition petrol and diesel production lines and bulk up EV output, as hard as they are trying. But where production efficiency used to show up in glaringly better operating margins, no more, months of vehicle price cuts have seen to that.

Since peaking at 16.7% in 2022, according to

Key valuation metrics

Stockopedia data, they have fallen dramatically to 9.2% in 2023 and to just 5.5% in Q1 2024, and that’s including full self-driving, leasing and carbon credit income. Returns on capital have also dived, from 24.5% in 2022 to 9.3% over the past 12 months, That’s still a lot better than the 3% to 6% range of the previously mentioned legacy firms, but miles behind Ferrari’s 26.7%. which sported 27.1% operating margins in 2023, up from 24.1% in 2022.

Financials in Q1 2024 provide little hope that things will get better either, where adjusted EPS fell from $0.85 to $0.45 year-on-year and missed $0.52 consensus. That was on a $2 billion year-on-year

02 May April 2024 | SHARES | 29

Ferrari ($) 2020 2021 2022 2023 2024 0 100 200 300 400

Chart: Shares magazine • Source: LSEG

Operating Margin −1.8% −0.3% −6.3% 12.1% 16.7% 9.2% Return on Capital −2.0% −0.3% 5.3% 15.4% 24.5% 11.4% Return on Equity N/A −15.1% 4.5% 21.1% 33.6% 27.9% 2018 2019 2020 2021 2022 2023

Table: Shares magazine • Source: Stockopedia

revenue decline to $21.3 billion, versus the $22.3 billion analyst projections. Operating profit fell to $1.2 billion and adjusted net income fell to $1.5 billion, both down 50%.

Despite Musk’s optimism that 2024 deliveries will ‘grow’ on last year’s record 1.81 million, EV demand is slowing this year. Tesla’s 386,810 deliveries tally in Q1 undercut even the lowest estimates and marks the lowest quarterly deliveries since 344,000 in Q2 2022. Since then, analysts have been revising lower delivery estimates.

‘Apart from further price cuts we believe full year sales growth may require help from the market as well as seamless execution on cheaper new model introductions,’ Morgan Stanley analyst Adam Jonas wrote.

WHAT SHOULD INVESTORS DO?

As ever, this is no easy question and the answer will depend on each investor’s portfolio, time scale, risk appetite and view of what Tesla is. Analysts remain supportive of the company and stock with twice the number of buy to sell recommendations, based on Koyfin data. That said, it is notable that there are far more fencing-sitting holders than in the past, an indication of the increased uncertainty facing the company in the short term.

recommendations

‘Following the decline in first-quarter deliveries, we think Tesla will reduce costs in 2024 to maximise profits,’ says Morningstar’s Seth Goldstein. ‘This reflects our view that the firm will aim to stabilise unit gross profit margins in the automotive segment and focus on improving companywide operating profit margins.’

Post Q1, Goldstein nudged up his stock fair value estimate from $195 to $200, implying 18% upside in the coming months. ‘We view Tesla as undervalued,’ he said.

Another way to look at the stock is to strip human judgement altogether and rely on AIpowered analysis, certainly in the short term. New York and Barcelona-based Danelfin has developed an AI stock analytics platform that calculates more than 40 different fundamental, technical and sentiment features that are reckoned to hold greatest sway over stock performance, the gives a score out of 10.

Tesla scores a nine because of its overall probability of beating the S&P 500 over the coming three months. But before you hand the keys to your portfolio over to automation, Danelfin’s Tesla probability percentage is 41.3%, so in other words, less than a 50/50 chance. This suggests that the fence-sitters may be right and that the best course of action for investors today is to keep the Tesla shares you have, but don’t buy any more for the time being.

30 | SHARES | 02 May 2024

Analyst

Holds Buys Sells Holds 23 Buys 17 Sells 8 Chart: Shares magazine • Source: Koyfin

Discover the secrets behind Danaher’s huge success story

This could be one of the best companies you have never heard of

US

biotechnology, life sciences and diagnostics company Danaher (DHR:NYSE) is one of the most successful companies to list on the New York Stock Exchange that few people outside the US have heard of.

This feature peeks under the bonnet to see how the company has achieved its success and explores its prospects.

Steven and Mitchell Rales and a group of investors acquired a struggling conglomerate in the 1980s and renamed it Danaher Corp. A $1,000 investment in Danaher in 1984 would today be worth around $1.8 million excluding reinvested dividends.

That is equivalent to a CAGR (compound annual growth rate) of 21% a year. To put that into context Warren Buffett’s Berkshire Hathaway (BRKB:NYSE) has delivered a CAGR of 17% a year over the same period.

A lot can change over 40 years, yet interestingly one aspect of Danaher has not changed in that time. The brothers originally envisioned building a company with a focus on continuous improvement and customer satisfaction.

The idea was inspired by the Japanese business philosophy of Kaizen which means change for the better.

HOW HAS THE BUSINESS EVOLVE?

Today the DBS (Danaher Business System) sits at the core of the company’s operations and strategic focus. Before describing the business in more detail, it is worth looking back to see how it evolved.

The Rales brothers originally established a group of manufacturing businesses with a view to improving them and extracting value. From the early 1990s the company started to organise around strategic platforms with sustainable competitive advantages and structural

Ticker: DHR:NYSE

Share price: $253

Market cap: £141.5 billion

growth drivers.

Over the next few decades Danaher built leadership positions in the science and technology sectors which define the company today. Strategic acquisitions have played a key role in expanding and broadening Danaher’s reach and capabilities.

For example, in 2012 Danaher purchased Kiva Systems, a robotics company which has helped drive efficiency and productivity at Amazon’s (AMZN:NASDAQ) fulfilment centres worldwide.

Management believes DBS is at the heart of the company’s success. It nurtures innovation, reduces time to market and delivers ground-breaking products and solutions.

WHAT IS THE SHAPE OF THE OVERALL BUSINESS TODAY?

The company is organised under three platforms or divisions which house companies operating in their own niche. The largest is diagnostics which contributed 44% of revenue and 64% of group operating profit respectively in the first quarter of 2024.

02 May 2024 | SHARES | 31 Under the Bonnet: Danaher

DANAHER

Fast facts

Portfolio transformation at Danaher

Source: Danaher

The diagnostics platform is comprised of cancer diagnostics company Leica Biosystems, blood sample testing firm Radiometer, and complex biomedical diagnostics specialist Beckman Coulter. First-quarter diagnostics revenue grew 7.5% to $2.5 billion.

The life sciences platform generates 30% of group revenue and 18% of operating profit. Firstquarter revenue grew 2% to $1.75 billion.

Companies on the platform include the recently acquired Abcam which some readers may recall was one of the most successful AIM stocks before it moved its main listing to Nasdaq. Abcam is a producer, distributor, and seller of protein research tools.

Other life sciences businesses include Sciex, a leader in mass spectrometry, Molecular Devices which provides instruments and services for clinical and pre-clinical bioanalysis, and Aldervron which notably provided the technology which supported the DNA template for Moderna’s (MRNA:NASDAQ) Covid-19 vaccine.

Cytiva is Danaher’s biotechnology arm and provides deep expertise, technology and services to accelerate the commercialisation of life changing therapies. It generated 26% of group revenue and 25% of group operating profit in the first quarter as revenue fell 18% to $1.5 billion.

The business was purchased from General Electric (GE:NYSE) in 2020 for $21.4 billion.

HOW DO THE FINANCIALS STACK-UP?

The franchises operating under the Danaher umbrella have established leading market positions in attractive, fast growing end markets with secular growth drivers. A focus on high value, mission critical applications helps to generate steady

32 | SHARES | 02 May 2024

Under the Bonnet: Danaher

Dx E A S D e n t a l L S 2018 Dx B T L S Total Revenue ~$24B 2023 Portfolio Exits Total Revenue ~$20B ~$2.8B Dental revenue at 2019 IPO ~$4.8B EAS revenue at 2023 spin MSD ~56% ~21% ~$3.4B Acquisitions Market Expansion HSD ~59% ~29% ~$5.1B Long - Term Core Revenue Growth (anticipated) Gross Pro t Margin Adjusted Operating Pro t Margin Free Cash Flow Annual Revenue Divested ~($7.6B) Cytiva 2023 Revenue (Acquired n 2020) >$5B Incremental Annual Respiratory Revenue since 2018 >$ 1B 1 Anticipated Future Annual Revenue Combined ~ $1B Long - Term Core Revenue Growth (anticipated) Gross Pro t Margin Adjusted Operating Pro t Margin Free Cash Flow 3 2 4 1 Reflects reported revenue for 2018 prior to the presentation of the Dental and Environmental & Applied Solutions businesses as discontinued operations; 2 Reflects reported revenue for the last full year prior to separation; 3 Based on Aldevron 2023 revenue and Abcam 2023 revenue including for periods prior to acquisition by Danaher; 4 2023 financial metrics reflect results from continuing operations only

Danaher 2023 revenue by division Diagnostics 40.2% Biotechnology 30.1% Life Sciences 29.7% Chart: Shares magazine • Source: Danaher

recuring revenues and high margins.

It is therefore perhaps not surprising to see high quality financial metrics at the group level. Danaher generates healthy gross and operating margins of 60% and 30% respectively.

The company generated $1.4 billion of free cash flow in the first quarter of 2024 which represents a conversion ratio to net income of 130%.

In the 2023 financial year, the company converted more than 100% of net profit into free cash flow for the 32nd consecutive year.

Turning to the balance sheet and financial strength, net debt to equity, a measure of financial leverage is a modest at 23% and net debt to total assets is 15%.

Stripping out goodwill and net intangible assets to arrive at the amount of tangible operating capital deployed, the business generates a very respectable return on capital of around 35%.

Looking at consensus earnings estimates the market is forecasting 30% growth in 2024 and 14%

DANAHER SWOT ANALYSIS

Strengths

• A globally diversified portfolio of businesses mitigates macro risks

• High margin, high growth businesses are resilient

• Focus on consumables increases revenue visibility

Weaknesses

• Acquisitions can be challenging to integrate successfully

• Increased debts can restrict operational flexibility

Opportunities

• Global footprint presents more opportunities

• Capitalise on technological leadership to leverage new growth markets

Threats

• Company must continually innovate to stay ahead

• Rapid technological advancements can erode market share and margins

Danaher consensus earnings forecasts

in 2025. At the current share price that translates into a forward PE (price to earnings) multiple of 33 times and 29 times, respectively.

Over the last year earnings forecasts for 2024 and 2025 have been revised down by around 25% according to Refinitiv data.

CURRENT TRADING

The company delivered better than expected first quarter earnings (23 April) with adjusted EPS (earnings per share) coming in at $1.92 compared with Wall Street estimates of $1.71.

Revenue dropped 2.5% year on year to $5.8 billion but this was ahead of consensus estimates calling for $5.6 billion. Broad-based strength in diagnostics was offset by declines in biotechnology and weakness in China where the economic landscape remains challenging, according to the company.

CEO Rainer Blair said: ‘We were especially pleased to see improving order trends in our bioprocessing business and believe we continued to gain market share in our molecular diagnostics business.

‘Looking ahead, the powerful combination of our leading portfolio and our team’s commitment to executing with the Danaher Business System provides a strong foundation for differentiated long-term performance while helping to meaningfully improve human health.’

For the full year management expect a gradual improvement to a core revenue growth rate of high-single digits or better as the business exits 2024.

By Martin Gamble Education Editor

By Martin Gamble Education Editor

02 May 2024 | SHARES | 33 Under the Bonnet: Danaher

Revenue ($bn) EPS ($) 2024 2025 0 5 10 15 20 25

• Source:

Chart: Shares magazine

Refinitiv, Stockopedia

Join

Evening webinar on Wednesday 8 May

2024 at 18:00

EUROPEAN GREEN TRANSITION PLC (EGT)

Is a business operating in the green conomy transition space in Europe. EGT intends to capitalise on the significant opportunity created by Europe’s transition away from fossil fuels to a green, renewables-focused economy. The company sees substantial opportunities to deliver value from its M&A pipeline, targeting distressed and undervalued assets, which includes critical material, wind, solar, processing and recycling projects.

INTERNATIONAL BIOTECHNOLOGY TRUST PLC (IBT)

Targeting high growth, backs innovative companies addressing high unmet medical needs with the aim of offering investors the opportunity for good returns while making a positive social impact.

PUBLIC POLICY HOLDING COMPANY (PPHC)

Operates a portfolio of independent firms that offer public affairs, crisis management, lobbying and advocacy services on behalf of the corporate, trade association and non-profit client organisations. A leading bi-partisan full-service U.S. government and public affairs business based in Washington DC.

Sponsored by WEBINAR

Shares in our next Spotlight Investor

Click here to register for this free event www.sharesmagazine.co.uk/events

to hear the following companies presenting their plans for 2024

Register

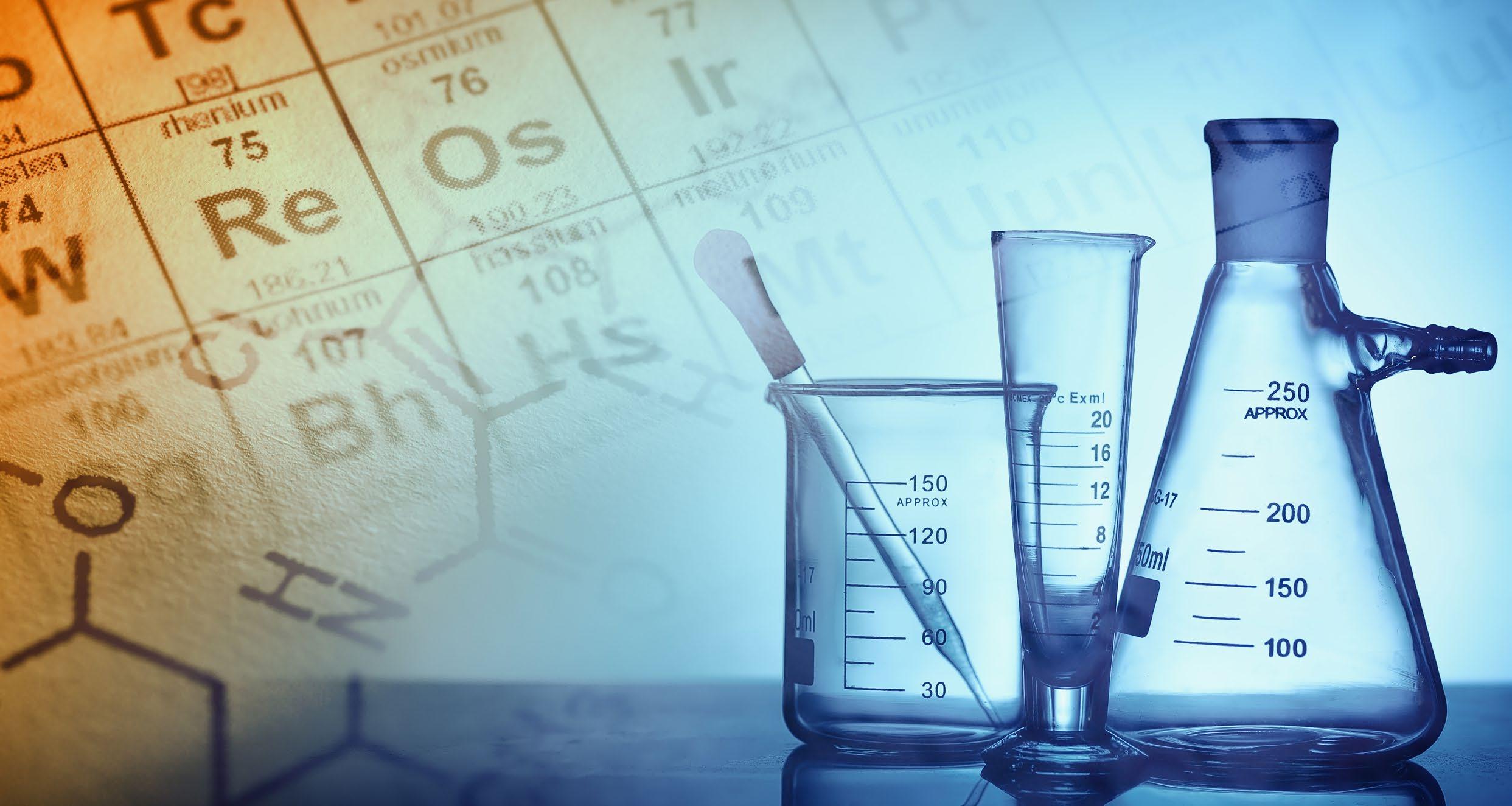

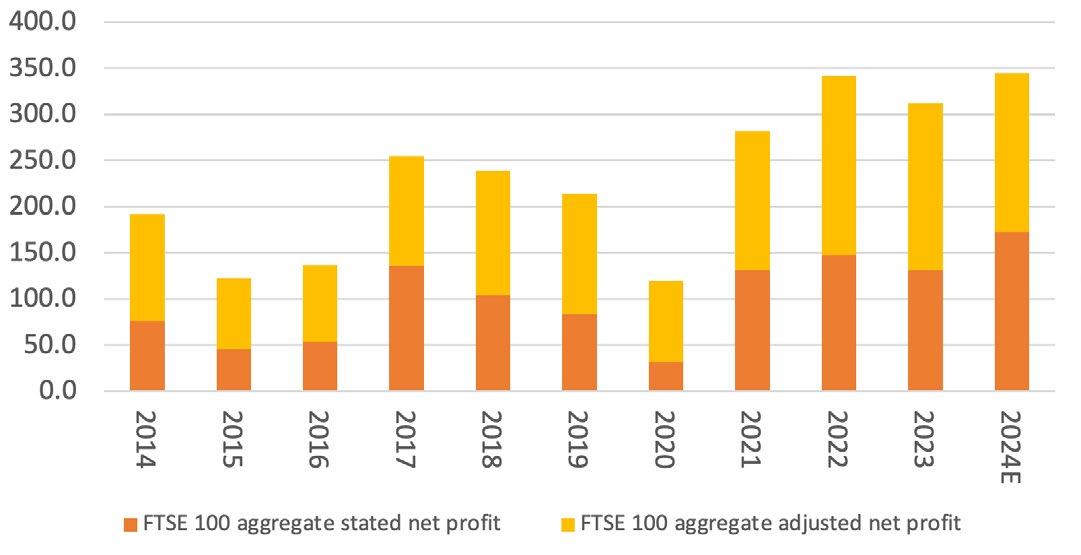

Understand the chemicals sector and whether 2024 can see a recovery

Big players like Johnson Matthey and Air Liquide are investing in areas such as energy transition and sustainable technologies

Chemicals companies produce the compounds used in a huge variety of different industrial and consumer products across sectors which include agriculture, healthcare, technology, aerospace, sports, leisure and beauty.

The breadth of the industry’s focus means its fortunes are closely tied to the economy and movements in GDP as well as volatility in raw material prices and energy costs.

In 2023 the sector endured a particularly difficult year. ‘Disruptions to supply chains raised costs; and – most significantly – buying trends after the pandemic reduced demand: customers stocked up on chemical products just after the end of the pandemic and have not yet exhausted this stock,’ says Edison analyst Neil Shah.

In its industry outlook for 2024, ratings agency Fitch said: ‘We expect little to no recovery, and high uncertainty, despite bottom-of-the-cycle conditions in 2023. The weaker-than-expected post-lockdown chemical demand recovery in China, where significant new capacity has been and continues to be built, is fuelling global deflation of chemical prices and margins.’

Berenberg have a more positive view on how this year could play out arguing: ‘For investors in chemicals companies, 2024 will in our view, by H2, develop into the type of year that the market had hoped for in 2023 – one of gradual volume recovery and improving profitability. Until recently starved of good news, investors may slowly warm on chemicals through 2024.’

In 2023 the FTSE 350 Chemicals sector fell 18.3% and year-to-date there has been little sign of recovery with a near-4% decline. Not all chemicals companies are created equal though and this article will look at the businesses which are shining and taking advantage of the opportunities provided by drivers like the energy transition and developments in the pharmaceuticals space.

HOW DO CHEMICALS COMPANIES MAKE MONEY? Companies in this sector take raw materials like oil, natural gas, air, water, metals and minerals and convert them into chemical compounds. The industry can be split into five sub-sectors –basic chemicals, specialty chemicals, agricultural

SUSTAINABLE FUELS