TRACKING DOWN UK MID CAP STARS

Why now is a great time for the FTSE 250 to shine

Why now is a great time for the FTSE 250 to shine

Finding great UK mid caps

Why it could be a great time for the London market’s second tier

As UK goes to polls, French and US political developments dominate agenda

Exploring the fall-out from the first round of French parliamentary elections as well as Biden’s widelycriticised debate performance.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

What an Alliance Trust and Witan merger means for investors

The rationale behind a combination which could create a new FTSE

MAGAZINE HELPS YOU TO:

• Learn how the markets work

• Discover new investment opportunities

• Monitor stocks with watchlists

• Explore sectors and themes

• Spot interesting funds and investment trusts

• Build and manage portfolios

As the UK heads to the polls, it is political events across the Atlantic and the Channel which are really dominating market discourse.

In France the first round of voting in parliamentary elections suggested president Emmanuel Macron’s gamble of calling a snap poll last month had backfired.

Marine Le Pen’s far-right National Rally won 33.1% of the vote, with a left-wing alliance behind on 28% and the Macron camp behind on 20.76%. This outcome actually prompted some relief, as National Rally did slightly worse than polling implied.

France now enters a fairly complex second round of run-off elections which will determine the makeup of the French parliament. If the far-right or leftwing alliance take office there is concern they could bring in spending increases which put France’s strained public finances under further pressure.

Invesco’s global head of asset allocation research, Paul Jackson, thinks the most likely outcome (60% probability) is some sort of fudge with no-one in overall control. He says: ‘Looking at the reality of the situation, some sort of temporary solution designed to allow a government to pass necessary legislation until further elections (not before 12 months).

‘This could be a technocrat PM (Michel Barnier, for example) or a continuation of the current government (as seen in countries such as Spain, Belgium and the Netherlands). I think this would be the most reassuring outcome for markets, but would just delay the issue.’

Assuming president Macron stays in office until mid-2027, as he has vowed, Jackson says he can see ‘some positive outcomes for French and Eurozone assets’.

‘However, if French public opinion remains as it is, 2027 could see Marine Le Pen elected as president, accompanied by a far-right government. That would give me pause for thought,’ he adds.

In the US, president Joe Biden’s shaky performance in a debate with Donald Trump on 27 June has prompted speculation the Democrats might pressure him to stand down before November’s vote. Most observers think the net upshot of the debate is a second Trump presidency is more likely.

Consultancy Capital Economics’s deputy chief markets economist Jonas Goltermann notes investors have not reacted too much to this shift but notes that a return to the White House for Trump would likely ‘put upward pressure on the dollar, bond yields, and pose a headwind to equity markets’. [TS]

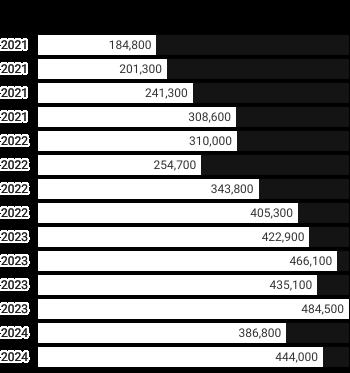

The firm’s global sales have shrunk for two consecutive quarters

The race for pole position in the EV (electric vehicle) market looks to be coming to a head this year with Elon Musk-steered Tesla (TSLA:NASDAQ) on the verge of losing its long-held record of outselling every other manufacturer put together in the US.

In the 12 months to the end of May, Tesla sold roughly 618,000 vehicles in the US whereas its rivals sold a combined 597,000 fully-electric vehicles, according to sales data provider Marklines.

Tesla has had the best-selling EV since 2015 when its Model S surpassed the Nissan Leaf and

has sold more EVs than the rest of the industry combined in the US since the launch of the Model 3 in 2018, according to Bloomberg.

The Model Y is now not just the top-selling EV but the world’s top-selling car full stop – however, Tesla’s rivals have been gaining ground relentlessly.

While the US firm’s domestic sales dropped 13% in the first quarter, carmakers Hyundai-Kia (005380:KRX) and Ford Motor (F:NYSE) saw deliveries soar 56% and 86% respectively.

With the release of each manufacturer’s calendar second-quarter sales, analysts will be able to build a clear picture of who is overtaking who.

Tesla reported global deliveries of almost 444,000 vehicles in the three months to June, a drop of around 5% on last year but marginally above the consensus forecast of 439,000 which was enough to spark a 5% rally in the shares.

However, 95% of sales come from just two vehicles, the lower-priced Model 3 and Model Y, revealing the glaring gap in Tesla’s line-up which other car-makers are only too happy to exploit.

Chinese maker BYD (BYDDY:OTCMKTS) posted record June and second-quarter sales, as did XPeng (XPEV:BYSE), Li Auto (LI:NASDAQ) and startup Nio (NIO:NYSE)

Tesla doesn’t just face competition from rival EVs – sales of hybrids now outstrip fully-electric cars as consumers opt for the greater convenience of a petrol engine combined with electric drive.

Carmakers went all-out on battery technology in 2021 believing fully-electric vehicles were the way forward, but getting beyond the early-adopters to the mass-market is proving much harder than they thought as there is still a reluctance to go allelectric due to ‘range anxiety’.

A classic example of the challenges facing EV adoption is rental company Hertz (HTZ:NASDAQ), which bet big on fully-electric cars in 2021, splurging on 100,000 brand-new Teslas to add to its US fleet, only to announce in January this year it was selling off a third of the vehicles due to low customer demand. [IC]

US investment bank analysts impressed by the media group’s growth acceleration strategy

Shares in Future (FUTR) accelerated as the media group received a double upgrade from ‘underperform’ to ‘buy’ at investment bank Jefferies.

Analyst Oliver Conroy says he expects a return to strong growth in revenue, positive audience trends and further upside from high yielding US direct ad sales.

He observes: ‘We expect Future to outperform peers, due to its highly cyclical tech & gaming portfolio, monetised largely via digital ads and affiliate product.’

Over the past year Future shares have advanced 56% to sit at the £10.67 mark although this

is still short of highs close to £40 attained in 2021.

Back in May the company, whose growth has been driven by acquiring specialist media assets and exploiting avenues like e-commerce, licensing and digital advertising, said it had made a ‘return to organic growth’ in the second quarter of the year helped by a robust performance from price comparison site GoCompare. At the time, the company announced plans to invest between £25 million and £35 million over the next two years to make the business ‘more agile’ and ‘less complex’. [SG]

Sportswear firm is struggling amid mounting competition and Chinese woes

Sportswear firm Nike (NKE:NYSE) has extended the losses it has endured since a big preChristmas warning, with the shares now down more than 30% over the last year.

A big chunk of those losses came after fourth quarter results on 27 June. While earnings beat Wall Street expectations, thanks to cost-cutting, revenue of $12.61 billion came in 2% light of consensus. But the real damage was done by cuts to 2025 guidance, partly because of weakness in China, but also on its

home court.

Revenues in North America, Nike’s largest market, came in below market expectations at $5.28 billion and the company now expects sales to fall 10% in the current quarter amid ‘uneven consumer trends’ across its markets, including a decline in online sales and a poor performance from its Converse brand.

Competition from specialist players in areas like running have also hit the business, so having previously guided towards full year 2025 sales growth, Beaverton-based Nike now forecasts sales to be down by mid-single digits. [JC]

9 July: Loungers,

11 July: Jet2

8 July: Hunting

10 July: Barratt Developments

11 July: Hays

While the shares prices of many housebuilders are still well below where they were pre-pandemic, so are their earnings which means although the sector may look cheap at first glance it could be a classic ‘value trap’ instead.

In the case of Barratt Developments (BDEV), whose shares are still almost 50% below their March 2020 level and which has a trading update on 10 July, sales for the year to June 2024 are seen at just over £4.1 billion against 2019’s £4.76 billion while normalised EPS (earnings per share) are seen at 26.4p against 72.6p, which is why it has decided to take a short cut and ‘buy’ growth with the all-share acquisition of Redrow (RDW) for £2.5 billion.

Paying a 27% premium isn’t ideal, but the offer price of roughly 760p when the offer was made was still a small-ish discount to Redrow’s pre-pandemic price and Barratt is looking to generate ‘significant cost synergies from procurement savings and a rationalisation of divisional and central

functions, which are expected to drive a combined lower cost’.

In theory a change of government should be good news, if the planning system can be unblocked so more homes can be built, but we fancy any change is likely to be slow and cumbersome and will sorely test investors’ patience.

Although everyone accepts the UK needs more new homes, lack of affordability is still a major issue and increasing the size of the company doesn’t automatically mean Barratt’s sales rate will improve – that depends on the availability of mortgages and how confident buyers feel, both of which are beyond the developers’ control. [IC]

Slower US growth and a price hike pushback from consumers are headwinds for the Doritos-to-Mountain Dew maker

Short-term concerns over slower growth in the US, where the consumer is feeling the inflationary pinch, and the potential negative long-term impact of anti-obesity drugs on demand for sugary snacks and drinks mean PepsiCo’s (PEP:NASDAQ) shares have lacked fizz over the past year.

As such, investors will be hoping the food and beverage giant can maintain full year 2024 guidance for ‘at least’ 4% organic sales growth and a bare minimum of 8% earnings per share growth when it serves up second quarter earnings on 11 July; Wall Street is calling for a 1.4% year-on-year rise in sales to $22.63 billion and earnings per share up 3.4% to $2.16.

PepsiCo bulls will be counting on a solid overseas markets showing to counterbalance the expected weaker performance in North America, where price hikes from the New York-based company and arch-competitor Coca-Cola (KO:NYSE) have led price-sensitive consumers to trade down to

cheaper alternatives or purchase PepsiCo’s products less frequently. For the first quarter to 23 March, the dividend aristocrat suffered a 5% volume decline in its North America beverages business, as well as a plunge in sales and an earnings crunch at its Quaker Foods North America arm following product recalls. In summary, the pressure is on well-regarded CEO Ramon Laguarta to pep up PepsiCo’s performance on home turf in the quarters ahead. [JC]

QUARTERLY RESULTS 11 July: PepisCo, Progressive, Cintas, Conagra Brands

Recent UK data has been robust while the US is showing signs of a slowdown

The week began with a better-than-expected Nationwide survey showing average UK house prices rose 1.5% in June compared with the same month last year to stand at a 12-month high of £266,000.

This was still 3% short of the summer 2022 peak but the direction of travel is clearly upward, and with the Labour party promising to deliver 300,000 new homes each year of the new parliament, assuming they are elected, there was plenty of positivity among the housebuilding stocks.

US manufacturing survey data was generally a tad disappointing, but the ISM June new orders figure of 49.3 was above forecasts and a big

improvement on May’s 45.4 reading while the Federal Reserve will have been pleased to see the both the prices index and the employment index fall.

Less pleasing were obvious signs of a slowdown in demand for machinery, where respondents reported a falling backlog of sales resulting in staff being put on furlough, and customers cutting orders at short notice for transport equipment ‘causing a ripple effect among lower-tier suppliers’ according to the survey.

At the time Shares went to press, investors were still awaiting the US May JOLTS survey and the June ADP non-farm employment index, both of which are keenly watched.

However, with the US celebrating a market holiday on Thursday and the UK going to the polls, all eyes are on Friday’s events.

Unless the polls are way wide of the mark, the Labour party is expected to win a clear majority, which unlike in previous years seems to be well received by the business community and the investment world.

Friday also sees the release of US non-farm payrolls, which are seen retracing from May’s 272,000 to more like 190,000 in June, providing more evidence of a cooling US economy.

Next week’s economic calendar is fairly light with the focus on UK housing and retail sales and US consumer and producer prices. [IC]

The UK’s leading self-storage firm is an underappreciated gem

£11.74

Market cap: £2.28 billion

It may not be a glamorous sector, but selfstorage is a remarkably stable and lucrative business with tremendous growth prospects.

As the UK market leader, with a portfolio of 109 stores and 6.4 million feet of lettable space, Big Yellow [BYG) is easily the most recognisable brand.

The business is driven by ‘life events’, which can range from selling a house, moving home, carrying out home improvements, getting married or separated, starting a family, downsizing, dealing with an inheritance or just needing somewhere to put excess ‘stuff’.

UK market penetration is low, with limited new supply coming onto the market, and Big Yellow’s stores are all located in prominent sites close to major centres of urban conurbation with easy access from a main road.

Buildings are purpose-built with security the number one priority: every storage room is individually alarmed and each customer has unique PIN-code access to the site, which has perimeter fencing, 24-hour CCTV and fire and smoke detectors.

Data correct as of 1 July 2024 Table: Shares magazine • Source: Stockopedia

By driving revenue and cash flow from its existing portfolio and adding new stores the firm has, by our calculations, increased earnings by a remarkable 17% per year on average since 2005, including during the pandemic, with very low volatility.

Over half of customers rent for more than a year and more than a third rent for two years meaning good visibility of revenues, and with low maintenance spending margins are high.

Its stores are either owned freehold or on very long leases, so the challenge is to grow occupancy and revenue while keeping costs down, which judging by its results for the year to March 2024 it clearly has a handle on.

Store revenue for the period increased 6% to £197 million with average net rent per square foot up 7.5% while EBITDA (earnings before interest, tax, depreciation and amortisation) came to £143 million, meaning a margin on sales of 72.5%.

The group has added 127,000 of space in King’s Cross and has a pipeline of 14 new stores which will add 1 million square feet in total to its portfolio.

The consensus sees earnings rising from 56p per share in March 2024 to just 57.6p next year and 61p the year after, which we suspect is too conservative given rent rises on existing space, the addition of new space and a likely increase in housing market activity post the general election.

In addition, the recent agreed bid for smaller rival Lok’n’Store (LOK:AIM) at a premium to its all-time high by Brussels-based Shurgard, Europe’s biggest self-operator, suggests industry consolidation is on the cards. [IC]

Stocks in the developing world are trading at record discounts to the S&P 500

Mobius Investment Trust (MMIT) 136p

Market cap: £163.5 million

Who doesn’t like a discount? How about two discounts? Not only are emerging markets trading at a deep discount to US stocks, the Mobius Investment Trust (MMIT) is trading at a 7.5% discount to its NAV (net asset value).

Managed by co-founder Carlos Hardenberg and the team at Mobius Capital Partners the Mobius Investment Trust specialises in investing in founderled, innovative mid cap companies across emerging markets.

Founded on 1 October 2018 the Mobius trust now has a five-year track record which investors look for when deploying capital, meaning it is now on the radar of more institutions.

Total NAV return over the five years to October 2023 is 52.19%, comfortably ahead of the MSCI Emerging Markets Mid Cap index total return of 24.3% and 39.5% ahead of the broader MSCI Emerging Markets index.

Around two-thirds of the investment return has come from stock selection rather than market allocation. Over the last three years the portfolio has outperformed in both rising and falling markets as demonstrated by an upside market capture of 121.2% and downside capture of 65.6% (both calculated by dividing the manager’s returns by the returns of the index during the upwards and downwards movement in markets and multiplying that factor by 100).

This unique strategy gives investors access to a concentrated portfolio comprising 25 to 30 of the manager’s best high conviction stock ideas with a market capitalisation below $15 billion.

Hardenberg excludes sectors which are not ESG

friendly such as tobacco, fossil fuels, and gambling and actively engages on governance issues with investee companies.

The team seeks out political and regulatory environments which are supportive to business growth and entrepreneurial activity. The manager has access to a broad network of renowned experts, curated over the last 40 years.

One feature we like about the investment approach is the importance it places on governance and on conducting deep due diligence on the people and businesses in which it is looking to invest.

The fund is heavily weighted in the technology and healthcare sectors which make up 55% and 11.6% of the fund’s assets respectively. Taiwan is the biggest country weighting at 25.5% with India at 18.6%, South Korea at 12.6% and Brazil at 10.4%.

Compared to investing in the index, the trust’s portfolio of holdings on average are higher quality with strong balance sheets and high returns on capital and have deep economic moats and sustainable growth opportunities.

Investors should be aware of the trust’s relatively high ongoing charge of 1.45%. This is due to its modest assets relative to operating costs of running the trust. As the assets grow the ongoing charge percentage may fall. [MG]

Strong returns from its top 10 holdings continue to benefit the trust

In March 2024 we made the case for investing in the newly merged JPMorgan UK Small Cap Growth & Income (JUGI)

The trust is the result of a merger between JPMorgan Mid Cap and JPMorgan UK Smaller Companies, finalised in November 2023, and since then it hasn’t disappointed investors.

Managers Georgina Brittan and Katen Patel are bottom-up stock pickers with an impressive performance record.

The gradual recovery in UK consumer confidence and the economy returning to growth this year has helped the trust’s portfolio which consists of UK mid- and small-cap companies.

The trust also counts cooking sauces, cakes, and custards maker Premier Foods (PFD) as its second largest holding (at 3.8%). The stock which owns some of Britain’s best-loved brands including Mr Kipling, Batchelors and Bisto has rallied 350% as it has delivered on a turnaround strategy. Over the past year it has gained 23%.

The trust has an ongoing charge of 1.02% and trades at a 5.9% discount to net asset value. [SG] JPMorgan UK Small Cap Growth & Income (JUGI) 322p

Other strong performers in the trust’s top 10 include Bank of Georgia (BGEO) – shares have gained more than 10% in the past month.

WHAT SHOULD INVESTORS DO NOW?

Stick with the trust which offers an enhanced dividend policy since merging, targeting a 4% yield on NAV to be paid from a combination of income and capital.

Managers Brittan and Patel remain confident: ‘We believe UK equities offer an attractive and we remain focused on selecting high-quality, resilient companies that can invest at high returns to drive strong and sustainable earnings growth.’

WHAT HAS HAPPENED SINCE WE SAID BUY?

Some of the trust’s top 10 constituents have performed exceptionally well.

AIM-listed colour cosmetics supplier Warpaint (W7L:AIM) delivered a strong first-half results on 26 June. Warpaint is the trust’s fourth largest holding and its shares have gained 23% over the past month.

We

Investment trust mega-merger creates a FTSE 100 contender

Two of the biggest investment trusts are combining in the sector’s largest-ever merger, with Witan (WTAN) to be rolled into Alliance Trust (ATST) in a mega-deal expected to complete later this year.

The combination of these two FTSE 250 constituents will create ‘Alliance Witan’, an investment trust goliath with net assets north of £5 billion and big enough for FTSE 100 inclusion.

Shares in Witan rose 4.5% to 272.5p on the day of the news (26 June), while Alliance Trust’s shares ticked up 1% to £12.14.

Representing the largest-ever conventional equity investment trust combination, the merger follows a comprehensive strategic review of Witan’s management arrangements by the board after long-serving chief executive Andrew Bell announced plans to retire.

Both trusts follow a multi-manager approach and their boards believe the combination will create an ‘even more liquid, high-profile and cost-efficient “one-stop shop” investment vehicle’ for global equities.

Alliance Trust’s current manager, Willis Towers Watson (WTW:NASDAQ), will assume overall responsibility for managing the assets of the combined fund using the same multi-manager approach it has since it was appointed in 2017, selecting a diverse team of stock pickers, each of whom invests in a selection of 10 to 20 of their ‘best ideas’.

Over the seven years since Willis Towers Watson’s appointment at the start of April 2017 to 31 March 2024, Alliance Trust’s NAV (net asset value) total return was 104.2% against 95.7% for the MSCI All Country World Index benchmark.

Witan shareholders who roll over into Alliance Witan will benefit from an immediate uplift in the value of their shareholding, since Alliance Trust’s shares trade at a tighter discount to NAV than Witan’s; they’ll also be given the opportunity to elect for a cash exit at a price close to NAV.

A new management fee structure and economies of scale resulting from the merger will allow

Alliance Witan to target an ongoing charges basis points ratio in the high 50s in future financial years, below Witan’s and Alliance Trust’s current ongoing charge ratios of 76 and 62 basis points respectively.

Witan chairman Andrew Ross said the board was ‘unanimous’ in recommending the combination, which ‘allows the continuation of our multimanager approach at lower fees and in a larger, more liquid vehicle. The companies share similar cultures and a mutual desire to provide a “one-stop shop” for retail investors in global equities. I am delighted to announce this transaction, the largestever investment trust combination, in Witan’s 100th year as a quoted company on the London Stock Exchange.’

THE EXPERTS WEIGH IN Deutsche Numis analyst Ewan Lovett-Turner says in relation to Witan: ‘The fund has underperformed in recent years. It was hurt by a transition to have more growth mangers, which were hit in the 2021/22 growth sell-off. In addition, the exposure to specialist funds such as unquoted growth companies, emerging markets and investment trusts which saw discounts widen has also been a headwind to performance of late.’

On the deal in general he adds: ‘The merger appears to be well-structured and we agree that there are benefits of creating a scale player, with an improved fee structure and a manager’s cost contribution.’

Winterflood Investment Trusts points out that against a backdrop of sustained wide discounts and increasing pressure on sub-scale funds due to wealth manager consolidation, the last two years has seen ‘a significantly elevated level of corporate activity in the investment trust sector, including numerous mergers. However, none so far have been of this scale, with two of the top 30 largest investment trusts proposing a merger to create a circa £5 billion fund eligible for FTSE 100 inclusion’.

Winterflood adds: ‘We think the combination of Witan and Alliance Trust makes sense and is not a great surprise given the recent announcement by Witan it was reviewing its management arrangements and the similarities between the two funds’ investment approaches, with both being multi-manager global equity funds.’

However, as one professional fund manager put it to Shares, merging the assets without incurring ‘massive’ dealing costs will be a major challenge given the two trusts have wildly different portfolios and only one adviser in common.

‘The portfolio managers will have to absolutely ruthless, otherwise they risk being landed with a mass of holdings which counter each other out,’ observed the manager.

By James Crux Funds and Investment Trusts Editor

NBy James Crux Funds and Investment Trusts Editor

ow the ballots have been cast at the general election, the UK could become the ‘reassuringly boring’ market, both politically and fiscally, when compared to the more extreme politics on the other side of the English Channel and Atlantic Ocean. So suggests Jean Roche, manager of the

Schroder UK Mid Cap Fund (SCP), who notes capital allocators know more or less what to expect, which could explain the flurry of takeover bids seen in the FTSE 100, but also among FTSE 250 constituents such as beverages business Britvic (BVIC) and building products supplier Tyman (TYMN) to name a few.

The FTSE 100 may hog the headlines, but the FTSE 250, which comprises the next 250 largest companies outside of the blue-chip benchmark, has beaten most developed market indices over the long term, and that includes the tech-heavy S&P 500 across the pond.

Surprisingly, the FTSE 250 has also produced a higher proportion of ‘30 baggers’ than the US stock market over the past 30 years. While perceived as more of a play on the domestic economy, the FTSE 250 is the domain of a diverse set of often disruptive and growing businesses and roughly half the revenue its firms generate comes from outside the UK.

Within a UK market that remains inexpensive, as demonstrated by a growing number of takeover bids and share buybacks, mid caps have lost the premium valuation they historically enjoyed.

Yet mid caps are anything but a low-growth proposition, insists Roche. ‘The FTSE 250 is forecast to grow earnings per share in the low- to mid-teens this year, followed by a high-teens rate next year. What’s notable is that earnings growth has also been achieved by many high-quality UK mid caps this year, despite the rise in corporation tax from 19% to 25% which took effect in April 2023. This technical detail, which may have held domestic UK shares’ earnings back this year therefore, falls away from April 2024.’

With wage growth outstripping inflation and interest rate cuts on the way, a brighter UK consumer outlook offers another positive catalyst for the ‘second liners’ index. ‘It is just one measure, but we would point to the ASDA income tracker that has now shown double-digit growth for two months in a row as real earnings growth begins to feed through,’ adds Roche.

‘The level of disposable income is now the highest it has been since September 2021 This should be a welcome relief for many households and could benefit various UK mid cap retail and household goods stocks such as Dunelm (DNLM) and Pets at Home (PETS), which are 100% UK and, perhaps to a lesser extent, because they are more international, Games Workshop (GAW) and ME Group (MEGP).'

The FTSE 250 has comfortably outperformed the FTSE 100 over the long term

Mid-cap companies are attractive to investors for a variety of reasons; more established than smaller firms, they are regarded as less risky, yet they also tend to be faster-growing than their larger, more mature counterparts and are a sweet spot for innovation and disruption.

Unlike many smaller companies, they have proven business models and unlike many large companies they may have a steep growth trajectory ahead of them.

Hugely diverse, the UK mid-cap sector is home to many fast-growing firms riding the wave of longterm structural growth trends, from the adoption of 5G and growing need for cybersecurity to the humanisation of pets and monetisation of strong intellectual property.

Schroder UK Mid Cap Fund’s managers Roche and Andy Brough refer to the FTSE 250 as the ‘Heineken Index’ given its potential to ‘refresh’ portfolios in a way other parts of the market cannot.

The mid-cap universe is constantly being disrupted by new challengers via market events such as IPOs, mergers and acquisitions, promotions from the small cap ranks and demotions from the large cap index.

Alexandra Jackson manages the Rathbone UK

Opportunities Fund (B7FQM50), which seeks the best of British quality growth companies and had 44.84% of its portfolio invested in the FTSE 250 as of 31 May.

Jackson tells Shares there is still ‘a lot to go for in the UK market given valuations, positioning, ownership, M&A activity. We’ve barely even started down the road of all these catalysts.’

She highlights that ‘on a long-term basis, FTSE 250 names really do outperform their largercap peers, and quite surprisingly, they actually outperform their small-cap peers. Although 2022 and bits of 2023 saw an unusual reversion of the “mid-caps tend to outperform” truism, mid-caps provide the alpha in the UK.’

Why is it that mid caps outperform? ‘What you see is better earnings growth in the FTSE 250. It’s not just the top line – anyone can drive sales by buying other companies or pricing products very low – it’s about earnings growth and earnings growth in the FTSE 250 is superior to the FTSE 100, which is partly due to the sector make-up.’

The FTSE 100 is famously flush with stocks operating in old-economy industries such as oil and gas, mining, utilities and tobacco. ‘But it is also that mid caps tend to have lower leverage and higher margins and therefore higher ROIC (return on invested capital), which is the best predictor of share price return. When we look at FTSE 250 names, they kind of stack up more similarly to those really high-performing US shares,’ enthuses Jackson.

Also chiming in is Guy Anderson, manager of mid- and small-cap UK growth investor Mercantile Investment Trust (MRC), who points out that ‘over the past 30 years, the FTSE 250 (excluding investment trusts) has delivered a total return of 10% per annum, a significant margin above the FTSE 100, which has delivered just over 6%’.

‘Our view is that the long-term factors driving the outperformance of mid-cap companies, such as the potential for superior growth, remain intact, and from where we stand today, the outlook is looking increasingly promising.’

Anderson continues: ‘From a top-down perspective, and perhaps counter to the prevailing narrative, consumer and business confidence indicators are pointing to an improving picture. This could lay the foundations for greater consumer demand, more business investment, and thus lead to a better environment for corporate earnings growth.’

Investors can gain actively-managed exposure to the theme through dedicated trusts including Schroder UK Mid Cap Fund, trading at a 10.9% discount to NAV (net asset value) with a 3.3% dividend yield at the time of writing.

Roche aims to pick companies with the potential of being tomorrow’s UK market leaders before the wider market has priced this potential into the shares.

Top 10 positions include international autos distributor Inchcape (INCH), IT reseller Computacenter (CCC), pork, poultry and pet food supplier Cranswick (CWK) as well as curtains-tocushions seller Dunelm (DNLM).

Also offering plays on the mid-cap space are J.P. Morgan Asset Management stablemates JPMorgan UK Small Cap Growth & Income (JUGI) and the aforementioned Mercantile.

Managers Georgina Brittain and Katen Patel are bottom-up stock pickers with an excellent performance track record who look to capitalise on the lack of research at the smaller end of the UK market to find highly innovative or disruptive firms.

Mercantile, managed by Guy Anderson and Anthony Lynch, is a capital growth-focused, diversified portfolio of UK mid- and small-caps that pays quarterly dividends and aims to grow its shareholder reward at least in line with inflation.

The trust, which Anderson says remains focused on selecting ‘structurally strong individual companies likely to operate effectively in a range of market environments’, trades at a wide 11.7% NAV discount with a 3.3% yield which should appeal to bargain seekers.

Anderson is bullish about the outlook for software and hardware reseller Softcat (SCT). ‘As a supplier of technology products and infrastructure, customer service is key to standing out from the

competition. The company’s focus on maintaining its unique culture, including driving employee engagement and running a highly successful graduate recruitment programme, has helped it deliver strong and sustained growth,’ explains Anderson.

‘Softcat is well placed to continue on this trajectory in an environment of improving business confidence, in addition to the increasing focus placed on technology to drive corporate productivity.’

Another actively-managed option is multi-cap stock picking fund Rathbone UK Opportunities, whose manager Alexandra Jackson gravitates towards mid-caps with durable business models and capable management who can take advantage of growth opportunities in their industry.

Holdings include Softcat, infrastructure products and galvanizing services supplier Hill & Smith (HILS) and electronic components designer DiscoverIE (DSCV).

There are several ETFs (exchange-traded funds) which track the FTSE 250 index. These ETFs offer a cost-effective way to invest in the second liners without the hassle of having to manage individual investments.

Among the ETFs available is the income-paying Vanguard FTSE 250 ETF (VMID), which has an ongoing charge of only 0.1% a year, and its accumulation class ‘VMIG’, which ploughs dividends back into the fund.

Alternatives include the £30 million Xtrackers FTSE 250 ETF (XMCX), with a total expense ratio of 0.15%, and the £122 million Amundi Prime UK Mid and Small Cap ETF (PRUK) with an ongoing charge of just 0.05%. Though this offers exposure to a different index than the FTSE 250, albeit with meaningful crossover. [JC]

Greggs (GRG) £27.62

Market cap: £2.8 billion

Food-on-the-go purveyor Greggs (GRG) almost needs no introduction, being so embedded in popular culture and across the UK retail landscape.

Although the pandemic pushed the Newcastlebased firm into losses for a couple of quarters, it managed to rebuild earnings and in late 2021 it set out an ambitious plan to double sales to £2.4 billion by 2026.

Key to the plan was an acceleration in store openings to around 150 per year along with extended evening opening hours, building on the initial success of its online and delivery channel and broadening the take-up of its app.

Half-way though the plan, the firm is on track to register close to £2 billion in sales this year thanks to more new stores, some in conjunction with supermarket chains Sainsburys (SBRY) and Tesco (TSCO), strong organic growth and new lines.

Hot products such as pizza and southern fried chicken have sold well in stores which stay open later, and alongside healthier choices and new over-ice drinks are being rolled out to more stores, while delivery sales and the app are all supporting volume growth.

With disposable income on the rise, Liberum analyst Wayne Brown argues low-ticket discretionary

spending stocks like Greggs are likely to lead any recovery in the UK retail sector.

Shareholders already have been well rewarded this year with a 6% gain in the share price and a special dividend of 40p per share, equivalent to another 1.4%, on top of the increased ordinary dividend of 62p.

Despite this, the shares are cheap relative to their history on a cyclically-adjusted earnings basis, and when the firm reports first-half results at the end of July we expect chief executive Roisin Currie to stick to her plan to double sales which should give the stock a further lift. [IC]

The multi-utility supplier has a lot going for it right now: it recently passed the one million customer milestone in the three months to the end of March, the energy market is more ‘normalised’ and it continues to be an ‘asset light business'.

The group, which offers insurance, broadband and energy services under the Utility Warehouse

brand, says over the medium term it is confident of doubling the business to two million customers.

The company’s shares have added 12% year-todate compared with a gain of 4% for the FTSE 250 thanks to the resilience of its business against a tough macroeconomic backdrop.

In the firm’s favour, the energy market has become less volatile and energy prices have come down over the past year, while co-chief executive Stuart Burnett is positive about the company’s ‘unique multi-service model’ which he says has helped to provide market-leading savings for families across the UK while inflation remains high.

Unlike other suppliers, the company employs a word-of-mouth model for acquiring customers which it refers to as UWP (utility warehouse partners).

The company says almost 60,000 self-employed

It has been a fabulous year for Trustpilot (TRST), and as correctly predicted by Shares, the share price bounce has been high and sustained. Since featuring as one of our Great Ideas investment picks (18 Jan) , the stock has jumped 33%, capturing most of 2024’s year-to-date 55% rally. Yet we remain convinced that this is a long-run growth story and that there remains substantial upside on the table for new investors.

Like many digital commerce businesses, Trustpilot grew rapidly during the pandemic and its

‘distributors’ earn an income by referring Utility Warehouse to friends, family, and people they know.

Partner numbers increased by 14.1% to 68,251 for the year ending 31 March 2024 compared to 59,824 in 2023, and the firm is confident customer numbers will continue to grow, forecasting organic net growth of between 12% and 14% in the year to March 2025.

Adjusted pre-tax profit for the year to March 2025 is seen between £124 million and £128 million, with excess capital expected to be returned to shareholders through a combination of dividends and share buybacks. [SG]

review platform now hosts more than 213 million consumer reviews of businesses and products across more than 893,000 websites. The company estimates posts are growing by more than one review per second and the platform generates almost nine billion monthly online impressions.

Increasingly, consumers don’t buy without the confidence of positive back-up from those who previously have. Crucially, network benefits hold huge promise in the years to come, creating a virtuous circle where consumers feel drawn to Trustpilot ratings because it is where meaningful services are listed and reviewed, and the more consumers who use Trustpilot, the more businesses will feel they cannot afford not to be on the platform.

It’s a very similar dynamic that has powered the likes of Rightmove (RMV) and Auto Trader (AUTO) to put up market-beating returns for years.

Table: Shares magazine • Source: Stockopedia, data correct as of 28

expansion will quickly whittle away the premium. Bear in mind, the stock is still nearly 20% below its 265p IPO (initial public offering) price, a level that at the time generated huge excitement in the markets. When analysts at Berenberg and Peel Hunt began covering the Danish company in summer 2021, both saw the stock hitting 430p. While it has taken a little longer than originally hoped for Trustpilot to make a profit breakthrough, it now has, and rapid progress is on the cards. [SF]

Sure, the stock continues to look pricey. Stockopedia has the 12-month rolling PE (price to earnings) multiple at 105, but as high-growth companies often prove, time and rapid earnings Online sales conversion rates soar when

Shares magazine • Source: Statista 2022

Three reasons why the UK stock market could be heading for better times

The Labour Party’s 1997 election theme song feels like a timely nod to the current attractions of the UK equity market, for so long the wallflower at the global equity party.

The UK stock market is cheap – if you focus solely on valuation rather than growth. Sitting on about a 12x price/earnings ratio, compared to 17x for global equities and 21x for US markets. But the UK has been ‘cheap’ for many years. So what’s different now?

First, other investors are noticing the attractions of UK equities. In the first five months of this year we’ve seen over £60bn of bids for UK listed companies. A threefold increase in M&A activity compared to the whole of 2023, with an average bid premium of over 30%. And for once it’s not just private equity, corporate bidders represent more than two thirds of this year’s bid activity by value.

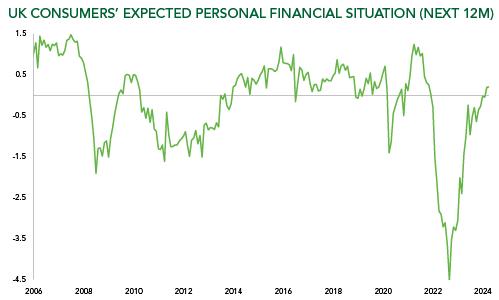

Second, the outlook for the domestic economy looks like it’s improving. This month’s chart shows UK consumers’ perceptions of their likely financial position over the next 12 months. Two things standout immediately. Just how catastrophically the cost of living/inflation/mortgage crisis hit consumers –perceived as far worse than either the 2008 financial crisis or covid, and then quite how rapidly perceptions have improved recently. The outlook for the domestic economy does appear to be brightening, driven largely by rising real wages. This should be good news for UK companies, and sterling too, though it does raise doubts over how quickly the Bank of England should be cutting interest rates.

Disclaimer

Source: Gfk, European Commission, Ruffer calculations, series is seasonally adjusted and normalised

Finally, for many years a key disadvantage for the UK stock market has been its high exposure to commodities and financials, rather than growth or technology. Might this now turn into an advantage? Our research suggests commodities are the best performing asset class in periods of elevated inflation. If we are right in predicting a more inflationary future, then commodities may be the next big thing. Copper, gold and silver have all outstripped the S&P 500 so far this year, with silver up over 25% since the end of March. Meanwhile global commodity giant BHP has (now unsuccessfully) bid over £37bn for fellow miner Anglo American. Could this be the start of a new trend?

At the same time, normalised interest rates accompanied by a better-than-expected economic outlook, both domestically and internationally, have delivered a boost to beleaguered bank stocks. NatWest and Barclays are both up over 40% year to date.

A recovery in the relative fortunes of the UK stock market has been predicted many times before, but almost always based solely on valuation grounds. Today we can see additional catalysts that could boost the UK market. We have a very cautious view on global equities at Ruffer but have been adding to our UK exposure which now represents about 40% of our equity allocation.

Steve Russell, Fund Manager

Subscribe to receive a monthly email containing an interesting chart, plus a short commentary from Ruffer here.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This article does not take account of any potential investor’s investment objectives, particular needs or financial situation. This article reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP which is authorised and regulated by the Financial Conduct Authority in the UK and is registered as an investment adviser with the US Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. © Ruffer LLP 2024. Registered in England with partnership No OC305288. 80 Victoria Street, London SW1E 5JL. For US institutional investors: securities offered through Ruffer LLC, Member FINRA. Ruffer LLC is doing business as Ruffer North America LLC in New York. Read the full disclaimer.

Lots of limited companies will have money sitting on their balance sheet which, given the returns from cash have historically lagged inflation, is being gradually eroded by rising prices. If this is genuinely surplus cash and not needed for the

day-to-day running of the business, a potential remedy could be to open a company dealing account which would enable the investment of these funds in the financial markets.

Accounts can be funded using a company debit card or you can set up regular payments through a direct debit from a nominated banking account. Typically, the charges for investing will be the same as those on standard dealing accounts for individuals, although some platforms will charge more. With AJ Bell there is no limit on how much you can invest and you can withdraw the money at any time.

Several platforms offer this type of account. To open AJ Bell’s Limited Company Dealing Account, you need to complete a form which must be signed by a minimum of two directors or one director and the company secretary (unless it’s signed in accordance with the company’s signing resolution).

If there isn’t a company secretary then a sole director must sign in the presence of a witness and the nominated contact on the account must be among the signatories.

This nominated contact is the person authorised to act on the account and they must be an employee of the company. All controlling persons would be subject to antimoney laundering and tax checks. Plus, you’ll need a Legal Entity Identifier which is used to identify the company as the entity executing trades.

Once you’ve sent off the form your account would typically be opened within 48 hours although it can take slightly longer.

You will usually be able to choose from a wide selection of funds, investment trusts, shares and exchange-traded funds. Investment choices will likely depend on how long a business can afford to have the cash tied up. Typically, to invest in the stock market, whether as a corporate entity or individual, you would want to allow at least five years before you need to access the money to avoid being caught out by short-term volatility.

Until you sell an investment it will sit on your company’s balance sheet as an asset and any gains will be subject to corporation tax.

It’s important to note this brief guide is not exhaustive and if you have questions on tax or accounting it is worth seeking expert advice.

DISCLAIMER: Financial services firm AJ Bell, referenced in this article owns Shares magazine. The author (Tom Sieber) and editor (Ian Conway) own shares in AJ Bell.

By Tom Sieber Editor

Ways to play the industry as it reaches a major inflection point

In the space of a decade there has been a dramatic shift from people watching linear TV to streaming shows through various platforms. In the US 99% of households pay for at least one streaming service with Netflix (NFLX:NASDAQ), Amazon’s (AMZN:NASDAQ) Prime Video and Apple’s (AAPL:NASDAQ) Apple TV being the most popular.

Streaming has become part of peoples’ everyday lives. According to US lifestyle website Forbes Home the video streaming industry is valued at $544 billion. Projections from consultancy Exploding Topics indicate that by 2030, the industry could be worth $1.9 trillion.

Shore Capital’s Roddy Davidson says: ‘Kantar’s latest Entertainment on Demand (EoD) report, which covers Q1 of 2024, flags that the competitive environment remains intense with leading streaming players jockeying for position and achieving varied levels of growth across geographies and local services also forging ahead in specific markets by offering “highly tailored” content.

‘Overall, Apple TV+ showed the strongest progress in new subscribers during the period with Prime Video

seeing a partial reverse of strong gains during Q4 2023 (see below). Encouragingly, VoD household penetration increased across nearly all markets on a quarter-on-quarter basis, with only the UK showing a marginal reduction.’

However, the industry is at an inflection point. The focus is shifting from spending millions on content, marketing and subscription deals to try and attract more and more people to a platform and not worrying too much about profitability.

Now the emphasis is on making streaming pay by cracking down on password sharing, increasing the cost of the premium ad-free service and adding an adsupported cheaper offering, which also has the effect of diversifying revenue streams.

Emphasis is on making streaming pay by cracking down on password sharing, increasing the cost of the premium ad-free service and adding an ad-supported cheaper offering”

Netflix’s success in forging this path has seen it be rewarded by the market with a 290% gain from its 2022 nadir and rivals like Disney (DIS:NYSE) are following suit. Though interestingly, this shift towards carrying advertising as well as moving into areas like live sport, brings streaming much closer to the linear

television set-up it has sought to supplant.

Breaking down the streaming industry, Netflix is the only major ‘pure’ streamer listed on the stock market. Disney has its theme parks, cinema releases and cable television operations. For Amazon and Apple streaming has largely been a loss leader to bring people into their wider ecosystem.

While in the UK, for the likes of ITV (ITV) and STV (STVG), streaming sits alongside their broader terrestrial TV and production businesses.

Investors can either put money into the shares of entertainment companies involved in the

streaming industry or diversified ETFs (exchange-traded funds) which offer some exposure to the streaming names.

Putting Apple and Amazon to one side, Netflix is the biggest streaming giant by market capitalisation at $264 billion, followed by Walt Disney, Comcast (CMSCA:NASDAQ), Warner Bros. Discovery (WBD:NASDAQ) and Paramount (PARA:NASDAQ). Disney+ reported a four million increase in new subscribers for the second quarter of this year, giving the company a total of 153.6 million subscriptions.

Importantly, the company managed to achieve operating profit in the streaming segment, and Disney announces that it is on track to maintain a positive streaming result throughout 2024.

The company achieved an operating profit in the Entertainment segment of $780 million (up 72% year-on-year), with streaming contributing $47 million in profit (compared to a loss of $587 million the previous year).

ITV has recently sold its 50% interest in Britbox International to BBC Studios (the public broadcaster’s commercial arm) for £255 million to focus on ‘supercharging’ its UK advertiser-funded streaming service, ITVX (whilst growing the ITV Studios production business).

In its latest set of results, ITV saw total streaming hours up 16% in the first quarter of the and digital

Netflix is being priced by the market as a growth stock, trading on 37.1 times 2024 consensus forecast earnings, so its share price performance is likely to be dependent on its ability to deliver or exceed the 53.1% and 21.1% earnings growth forecast for 2024 and 2025 respectively.

Disney trades at 21.5 times

2024 earnings. Having faced off activist pressure from Nelson Peltz, CEO Bob Iger needs to demonstrate he can lead its streaming operation towards sustainable profitability while dealing with the cable TV arm, controlling a major investment programme in its parks and dealing with the succession issue. His return after the

failure of his previous anointed successor Bob Chapek means the market is particularly concerned about this issue.

Finally, ITV is very much a recovery play, trading on just 8.8 times 2024 earnings. If it can maintain the momentum in ITVX and deliver growth in its production arm it could achieve a re-rating.

Music streaming revenue is dwarfed by that of video streaming but still stands at a hefty $19.3 billion (as of 29 April 2024 according to figures from Statista).

Global music streaming revenue increased by 11.5% worldwide in 2022, to account for 67% of total global recorded music revenue.

Spotify (SPOT:NYSE) dominates this space and its shares are up 107% over the last 12 months at the current $319 mark, as it has been able to consistently push through increases in the price of subscriptions.

Other players in the music streaming sector include Apple Music, Tencent Music, Amazon

Deezer (1.5)

(2.2)

(6.1)

Music, YouTube Music and Deezer. Amazon also has its Audible audio book platform.

According to Statista, Apple Music has a 13.7% market share, Tencent Music and Amazon Music occupy a similar market share at 13.4% and 13.3% with Spotify leading the way with a share of 30.5%.

HOW TO INVEST THROUGH ETFS Investors looking to gain diversified exposure to streaming through ETFs could

consider iShares S&P 500 Communication Sector (IUCM).

Not only does it have a significant weighting towards Netflix, but it also holds Disney+ parent company Walt Disney (8.55%) and Comcast Corp which created a streaming bundle in May combining its Peacock service with Netflix and Apple TV+ called StreamSaver.

The ETF with the largest weighting in Spotify is iShares Digital Entertainment and Education (PLAY).

and digital advertising revenues grow by 14%. The company said ITVX’s monthly active users ‘continue to grow in line with expectations’ and it remains on track to deliver at least £750 million of digital revenues by 2026.

This has helped revive a bombed-out share price with the shares up 25% over the last six months. Shore Capital analyst Roddy Davidson observes that ITV’s ITV Studios production arm and STV’s own production operation could be a beneficiary of ongoing competition in the streaming space.

He says: ‘We see particular upside for companies with strong creative talent / track records and production resources, well-established industry

relationships and the financial strength to capitalise. Within our coverage universe, we would particularly highlight ITV and STV, both of which tick these boxes and have made considerable progress in building momentum within their production businesses.’

Another potential beneficiary of streaming’s growth is Zoo Digital (ZOO:AIM) which runs an in-house designed, multi-tools cloud technology platform that allows media owners to repackage their TV and film content for different geographies, languages, formats, and technologies. CEO Stuart Green told Shares: ‘There has been a structural shift in the ways media companies deliver film & TV content to audiences, away from traditional linear models and towards streaming.

‘A similar shift led to fundamental changes years ago in the music business where you only need to look at the likes of Spotify to see the impact of reimagining the economic model for an entire industry, yet we’re listening to more music today than ever before.’

Green adds: ‘Film & TV is now going through a similar change [to the music industry] and this brings its own disruptions. Big players like Disney and Paramount are moving away from making cash through linear TV channels to VOD (video on demand). They are also targeting new territories for future growth, and we are helping the media giants do this by localising their content for international audiences.’

By Sabuhi Gard Investment Writer

Tim McCarthy, Chairman

Incanthera (AQSE:INC), the company specially focussed on innovative technologies in dermatology and oncology. Our current focus is Skin + CELL, its luxury skincare brand, utilising ground-breaking formulation and delivery expertise, to bring scientifically proven formulations to cosmetics and unmet skincare solutions.

Claire Milverton, CEO

1Spatial (LON:SPA) is a global leader in providing Location Master Data Management (LMDM) software and solutions, primarily to the Government, Utilities and Transport sectors.

Yoojeong Oh, Investment Director

abrdn Asian Income Fund Limited (AAIF) targets the income and growth potential of Asia’s most compelling and sustainable companies. It does this by using a bottom-up, unconstrained strategy focused on delivering rising income and capital growth by investing in quality Asia-Pacific companies at sensible valuations.

Starting early and saving often are key to a comfortable retirement

For those approaching or entering retirement, the idea of being able to live off the income generated by their investments and not having to touch the underlying capital is hugely appealing.

For the lucky few who have a ‘pot’ worth millions that dream may well be a reality, but for most of us it is something we are going to have to work on well before we get to the stage where we can finally stop labouring.

In this article we will look at how to best construct a portfolio ahead of time to give you a comfortable income in retirement.

According to research by financial trade body the PLSA (Pensions and Lifetime Savings Association), half of us are fully-focused on our current needs and wants at the expense of providing for the future and less than a quarter of us are confident we know how much we need to save.

Therefore, with the aim of improving pensions adequacy, the organisation has developed a guideline called the Retirement Living Standards to help everyone picture what kind of lifestyle they could have in retirement.

The standards take into account the cost of a common range of goods and services and work out how much you would need to achieve one of

three living standards: minimum, moderate and comfortable.

The minimum amount is considered to be £14,400 for a single person and £22,400 for a couple, which given the full UK state pension for the current financial year is £11,500 per person means most people should be able to attain this standard of living even with a small private pension or savings pot.

To afford a ‘moderate’ retirement, however, the estimate is £31,300 for a single person and £43,100 for a couple, which is quite a difference in terms of the amount you would need to have put by in private pensions, savings and investments in order to generate the extra income you would need over and above the state pension.

For a ‘comfortable’ retirement, the estimate rises to £43,100 per year for a single person and £59,000 for a couple, which for most people would be a major stretch especially as these figures are calculated net of income tax, which is deducted from everything you earn over the individual personal allowance of £12,570 per year.

The PLSA bases its assumptions on a set level of spending for each standard excluding costs such as a mortgage, rent and basic energy and utility bills.

For a ‘moderate’ lifestyle it suggests £55 per week on groceries, £30 per week on food-on-the-go, £10

per week on takeaways and £100 per month to take others out for a meal; up to £1,500 per year on clothing and footwear; the usual running costs of a nearly-new car; plus a fortnight’s holiday abroad and a weekend ‘staycation’ in the UK.

Despite the slowdown in food-price inflation, it is quite possible most of spend more than £55 per week on groceries, although on the other hand most of us probably don’t spend £1,500 a year on new clothing and footwear, so there is an element of swings and roundabouts in the figures.

However, if we take the two amounts of £31,300 and £43,100 at face value, how much would we need to have put aside in order to generate enough income to enjoy a ‘moderate’ lifestyle in retirement either as a single person or as a couple?

In order to illustrate the level of private pensions or investments needed to generate enough income without dipping into your capital we have built a table using several different rates of return and two time periods over which you might look to invest.

An individual aiming to enjoy a ‘moderate’ lifestyle in retirement would need to find an extra £19,800 in income per year over and above their full state pension – and bear in mind, to keep things simple we have not factored tax into our calculations.

To fund this additional £19,800 every year, without eating into your capital, you would need a pot of almost £400,000, assuming it paid out a 5% return.

Obviously, the higher the return the lower the size of the pot you would need but even with an 8% return you would still need to have investments

worth roughly a quarter of a million pounds.

The next question is, how long would it take to build up such a large pot in the first place?

Again, using a base case of a 5% return, to build up an investment pot worth £250,000 would take 30 years of paying in £300 every month, which may sound like a tall order but is not a bad outcome given a total outlay of £108,000 and clearly demonstrates the power of compounding over many years.

If you started later and only had 20 years to build up your pot, all else being equal you would need to put in over £500 per month to even come close to hitting the £250,000 mark which again shows the advantage of giving yourself a head start by investing early and putting away as much as you can reasonably afford.

For a couple targeting a ‘moderate’ lifestyle the calculations are barely any different – to reach the target income of £43,100 after subtracting two lots of state pension the shortfall would be £20,100, or just £300 more than for an individual, so the sums involved are roughly the same.

The products in the table are just examples to help with your own research but if you were aiming to use your investments to help pay regular bills, it makes sense to consider funds and investment trusts which pay out income regularly. Unlike companies, because these portfolios contain a

diversified mix of income streams, you’re less at the mercy of an individual dividend being cancelled or cut.

There are several open-ended funds and closedend investment trusts paying monthly dividends, so we have compiled a list of some of the highestyielders, making sure they have assets of more than £100 million to avoid any issues with liquidity. Most of these invest in bonds.

There are also plenty of open-ended funds and trusts paying quarterly dividends, although they vary more in terms of the underlying assets which they own.

Data correct as of 27 June 2024

Table: Shares magazine • Source: Morningstar

17 JULY 2024

NOVOTEL TOWER BRIDGE

LONDON EC3N 2NR

Reserve your place now!

Registration and coffee: 17.00

Presentations: 17.55

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

Sponsored by

COHORT (CHRT)

Cohort is the parent company of six innovative, agile and responsive defence technology businesses providing a wide range of services and products for UK and international customers. It has headquarters in Reading, Berkshire and employs in total over 1,100 core staff there and at its other operating company sites across the UK, Germany, and Portugal.

CUSTODIAN PROPERTY INCOME REIT (CREI)

Offers investors the opportunity to access a diversified portfolio of UK commercial real estate through a closed-ended fund that seeks to provide an attractive level of income and the potential for capital growth.

PATHFINDER MINERALS PLC

Pathfinder Minerals Plc is a natural resources company, seeking to mine heavy mineral sands in countries that include Mozambique and Cameroon, and pursue opportunities in battery metals projects in countries including Zimbabwe, Madagascar,and Malawi

VERICI DX (VRCI)

Verci Dx is developing a complementary suite of proprietary, leading-edge tests forming a kidney transplant diagnostics platform for personalised patient and organ response risk to assist clinicians in medical management for improved patient outcomes.

Investors should be thinking about a potential market rotation in the months ahead

Have we just seen the first hints of a market rotation away from tech and go-go growth and back to value stocks?

Nvidia’s (NVDA:NASDAQ) recent 13% three-day share price decline was newsworthy as it knocked $429 billion off its market valuation. Look beyond the headlines and you will see something else interesting bubbling under the surface.

It is impossible to draw any firm conclusions from such a short trading period, but what happened over the three trading days to 24 June 2024 is worth bearing in mind if we get a full-blown market correction in the future. It provided a shop window into where investors might switch investments if there is a change in sentiment.

The worst-performing shares during this period were highly rated growth style companies and the best performers were lowly-rated value ones.

Looking at the S&P 500 index of US shares, the average price to earnings or PE ratio for the top 20 fallers was 37.7 during the period where Nvidia slumped, a level that classifies as a premium rating. The average PE for the top 20 risers was 14.5 which is a cheap rating.

Technology shares dominated the sell-off, while the risers included a media group, a fertiliser producer and an agribusiness specialist.

In the UK, it is also notable that classic value style stocks in the tobacco and supermarket sectors have started to perk up on the market in recent months. Investors are often less willing to hold highly rated shares during a market downturn, for fear they could de-rate. Put another way, investors are less willing to pay higher multiples of earnings when markets are going through a bad patch.

Value or lowly rated shares tend to shine in tougher market conditions as investors look for cheap stocks that offer jam today, rather than more expensive ones that offer the prospect of jam tomorrow.

Tech has been a wonderful place to make money over the past few years but shares rarely travel in

a straight line so you have to be slightly nervous when they keep rising, which is the current situation. Certain big tech names are looking expensive – the higher their shares climb, the bigger the potential fall if markets turn.

The key thing to watch is whether a company’s fundamentals justify its share price rise. Nvidia has beaten expectations for the last six quarters in a row.

Earnings growth has been strong and so analysts have had to upgrade forecasts following each of these six quarters and that created back-to-back catalysts to sustain the share price growth. In this case, the fundamentals have supported the stock’s high valuation.

Nvidia will publish its next set of quarterly results in August and failure to beat expectations might cause the share price to wobble. No-one knows for certain what will happen to the share price, but

history suggests stocks in its situation might behave this way.

For example, shares in food retailer Greggs (GRG) fell 12% on 1 October 2019 when it published what initially felt like a solid trading update. A quick look closer and the reason behind the big share price decline was obvious.

Three things had fuelled Greggs’ shares over the preceding 12 months: earnings upgrades, investors happy to pay a higher rating for the stock and the company being one of the few ways for UK investors to play the fast-growing vegan theme. The business has historically traded in a PE range of 16 to 25 but Greggs’ valuation exceeded 35-times during 2019 amid euphoria around its growth prospects.

Greggs continued to report strong trading as 2019 progressed and that led to more upgrades from analysts as they raised their future earnings estimates. The music then stopped and so did the share price gains.

With the October 2019 trading update, everything was riding on the company once again beating expectations and Greggs saying there was still big interest in its vegan products. Sadly, neither happened and the shares quickly de-rated as investors were no longer prepared to pay a high earnings multiple to own a slice of the company.

This illustrates what could potentially happen with Nvidia when it stops beating expectations with quarterly results. That would be negative for its share price and the wider market.

and US equity trusts. We are always wary of the consensus view and potential bubbles and think when the Magnificent Seven move out of favour, the shift could be dramatic.’

‘Magnificent Seven’ is a term used to describe seven mega-cap tech-related names: Nvidia, Microsoft (MSFT:NASDAQ), Apple (AAPL:NASDAQ), Amazon (AMZN:NASDAQ), Alphabet (GOOG:NASDAQ), Meta (META:NASDAQ) and Tesla (TSLA:NASDAQ). A sell-off in any of these names could lead to volatility in the market, but Nvidia and Microsoft are the ones to watch closest because they are the biggest names in the group.

Nvidia’s stellar share price gains since the start of 2023 have made it one of the most closelywatched stocks on the market – if it falls, sentiment might turn and have a knock-on impact on the wider market.

In March, analysts at Stifel wrote: ‘The Magnificent Seven collectively doubling in value last year has been an important driver of returns for global, tech

It is important not to be alarmist, but all investors must think about how markets behave and history suggests they regularly go through cycles. At some point – and we have no idea when – the current wave of go-go growth tech stocks will find it harder to keep rising. Thinking about what to do with portfolios in advance of that situation could be advantageous as it feels safe to say it is a question of ‘when’ and not ‘if’.

By Daniel Coatsworth AJ Bell Editor in Chief and Investment Analyst

If you’re thinking about using property to fund your retirement, you wouldn’t be the first. The post-financial crisis boom in house prices, propelled by low interest rates and government support schemes, led many budding property tycoons towards investing in buy-to-let instead of saving in a pension.

For many, that gamble probably paid off, thanks to the long period when mortgages were super cheap, and house prices rocketed. But the future might not be so rosy for buy to let, and those who are thinking of prioritising property investment over a pension should certainly pause for thought.

So, house prices can still be expected to rise over time, though the same could be said of the stock market your pension might be invested in.

But the cost of buying a property is now much higher than it was because of the huge rise in interest rates we’ve witnessed over the last two and a half years. Those additional costs will eat into rental income and make buy-to-let property investment less profitable.

The UK suffers from a chronic housing shortage, and while that makes things difficult for people trying to get on the housing ladder, it’s also supportive of prices, because demand is greater than supply.

At the same time there have been significant tax changes in the last few years which have been to the detriment of buy to let investors. There is now an additional 3% stamp duty surcharge which is levied on the purchase of second properties. The way buy-to-let profits are taxed has also shifted unfavourably.

You used to be able to fully offset mortgage payments against your tax bill, so if you were a higher or additional rate taxpayer, this used to mean saving 40% or 45% tax. But now that saving has been restricted to just 20%.

There are other costs to holding a property which might be easy to overlook before you experience life as a buy to let landlord. Legal fees, survey costs and stamp duty all take their toll on returns. There are ongoing maintenance and repair costs, letting fees, landlord insurance and void periods to consider, which will also make a substantial dent in rental income, before factoring in your mortgage interest.

Pensions also come with attractive perks attached which you would be missing out on if you divert your retirement savings into a buy-to-let property. Employers are now required by law to pay into a pension on your behalf, and many will match whatever you pay in. In this scenario your employer adds £100 for each £100 you contribute, doubling your money immediately.

It’s actually even better than that because you receive tax relief too, even if you’re self-employed and don’t get employer contributions. For each £100 you pay into a pension, this actually only costs you £80 if you’re a basic rate taxpayer, £60 if you’re a higher rate taxpayer and £55 if you’re an additional rate taxpayer.

You do pay tax on your pension income when you retire, but often that’s at a lower rate than the tax relief you get on the way in when you’re working and earning more money. Bear in mind property income is taxed in retirement too. And with a pension you can also take 25% of the value as a tax-free lump sum, which is another nice bonus. It’s also important to note that while in your pension, your investments grow free from income and capital gains tax. By contrast, property income is taxed as it’s received, and when you sell a second property you’re liable to capital gains tax of 18% or 24% depending on whether you’re a basic or higher rate taxpayer.

‘Decumulation’ is not a word many outside the pensions industry will recognise, but it’s an important concept. It refers to the process by which you draw down your retirement savings. Both property and a pension investment can provide you with an income stream in retirement, but with a pension you have greater flexibility.

You can sell some of your investments in a pension to supplement your income in years when

you need a bit more cash. You can’t do this with a property because it’s just one unit, so you can’t sell half the living room to boost your income.

Using property as part of your retirement plan can be a successful venture, but it’s no walk in the park. For most people, using pensions and also ISAs to save for retirement will be preferable in terms of returns, costs and tax, not to mention the hassle factor.

The familiarity of bricks and mortar will no doubt mean buy-to-let property continues to be used for retirement income purposes. But even if you’re keen on this approach, make sure you do your homework and dive in with your eyes wide open, taking into account all the risks, costs and taxes first. Otherwise, you’re probably in for a few nasty shocks.

By Laith Khalaf AJ Bell Head of Investment Analysis

Shoe Zone’s profit warning speaks to wider ramifications for the world economy

It was an eight-line statement from a UK small-cap budget footwear maker but Shoe Zone’s (SHOE:AIM) latest profit warning tells a much bigger story about the way global trade and supply chains could be changing.

The company has been hit by rising container prices as shipping routes have been disrupted, largely thanks to attacks perpetrated by Houthi rebels in the Red Sea. Vessels are rerouting away from the Suez Canal and this is pushing up costs for businesses like Shoe Zone, for whom upwards of 80% of its products are manufactured in China.

Notably, LED lighting specialist Luceco (LUCE), which also has a significant chunk of its manufacturing in China, saw its shares fall in sympathy with Shoe Zone’s warning.

In the short term this is a reminder that inflationary pressures continue to exist in the global economic system, perhaps helping to explain central banks’ relative caution over rate cuts.

Longer-term though it plays into the idea of deglobalisation, with the rise of populist political movements and increased geopolitical tensions affecting global trade and leading to more ‘reshoring’ with countries expanding their own manufacturing capacity.

Recent work by academics at the London School of Economics suggested claims of deglobalisation were overdone, at least during the period between

2000 and 2021, although there is evidence of reduced direct trade with China in the US through 2023. The authors of the study, Guy Erb and Scott Sommers, observed that the introduction of the IRA and CHIPS acts with their ‘Buy-America’ provisions had some impact.

At the very least, investors probably need to consider if the old model of producing goods in low-cost manufacturing centres across the globe and then shipping them to domestic markets is still viable, particularly for consumer-facing firms operating at the value end where there is limited scope to pass on increased costs to customers without fatally undermining said value credentials.