How the BANKS BOUNCED BACK

Comparing the big UK names after their year-to-date rally

VOL 26 / ISSUE 22 / 06 JUNE 2024 / £4.49

06 Why Shein’s £50 billion IPO will give ASOS and Boohoo the shivers 07 Indian stocks retreat from record high on third term for prime minister Modi 08 Latest index shake-up sees Darktrace bump Ocado out of the FTSE 100

Bloomsbury’s purchase of US academic publisher signals acceleration of strategy

Ferrexpo shares slump on war, government spats and legal issues

10 Can Fuller’s show further progress against a tough backdrop?

Nerves frayed as investors ponder Adobe’s AI

12 Signs of slowing US inflation send stocks higher while UK data also pleases

13 Why On The Beach is worth buying right now

Now is the time to use the strong pound to buy high-quality European

16 Why undervalued Currys can continue to rally

17 Investors have four options with the blockbuster National Grid rights issue 20 COVER

06 June 2024 | SHARES | 03 Contents NEWS

09

09

11

GREAT IDEAS

15

UPDATES

promise

stocks

FEATURES

year-to-

rally 28 UNDER THE BONNET Has Uber become a business worthy of investment? 31 EDUCATION How to invest in shares, investment trusts, ETFs and funds 34 DAN COATSWORTH Nvidia is taking steps to make its stock more affordable 37 EDITOR’S VIEW What will a new government do to revive UK plc? 39 FINANCE Are investment trusts better than open-ended funds? 41 INDEX Shares, funds, ETFs and investment trusts in this issue 34 17 20 39

STORY How the banks bounced back Comparing the big UK names after their

date

Three important things in this week’s magazine

1

Why have UK banks performed so well this year?

After a strong run year-to-date based on a combination of high interest rates and a recovery from 2023’s brief technical recession, Shares compares and contrasts the fortunes of the ‘Big Four’.

2

Analysing National Grid’s bumper rights issue

We explain how rights issues work, why companies use them and what options individual investors have when a company announces it is issuing new shares.

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

3

Is it time to hitch a ride with gig economy stock Uber?

Shares in the ride-hailing app have been volatile to say the least since it listed, but with margins increasing and food delivery expected to make up more than half of bookings can investors expect a smoother ride from here?

04 | SHARES 06 June 2024 Contents

06June 2024 | SHARES 17 Feature: NationalGridrightsissue How shareholders can respond to the £7 billion fundraise O n 23 May, power network operator National Grid (NG.) announced a bumper £7 billion fundraise to help finance a five-year £60 billion investment plan. Known as a ‘rights issue’, the exercise involves shareholders making a decision whether or not to buy discounted shares in the group. As is the case for most major rights issues, National Grid’s fundraise is fully underwritten by banks, in this case Barclays (BARC) and JPMorgan (JPM:NYSE), who will step in and buy any rights not taken up by existing shareholders. Shareholders must take one of four routes: • Buy some or all their allocated stock • Sell all their rights • Sell some of their rights and use the proceeds to buy some of the cut-price shares (known as ‘tail swallowing’) • Do nothing Investors have four options with the blockbuster National Grid rights issue National Grid (p) Jul 19 Oct Jan 20 Apr Jul Oct Jan 21 Apr Jul Oct Jan 22 Apr Jul Oct Jan 23 Apr Jul Oct Jan 24 Apr 800 900 1,000 1,100 Chart: Shares magazine Source: LSEG 28 SHARES 06June 2024 Under the Bonnet:UberTechnologies Ride-hailing platform is improving profit profile, but big threats remain S ince spearheading the so-called gig economy over the past decade, Uber Technologies (UBER:NYSE) has emerged as a volatile investment. Having whipped up a frenzy among investors with valuation pitches of up to $120 billion ahead of its 2019 IPO (initial public offering), bigger even than Facebook’s $104 billion 2012 float. In the end, its debut was a disaster, the $45 stock plunging on day-one to chalk-up one of America’s biggest debut flops ever and wiping more than $7 billion off the market cap. The world has turned, and much has changed yet investors seem to retain a love/hate relationship with the stock, with sharp share price rallies interspersed with prolonged spells in the doldrums. During the past 15-months, Uber stock has more than doubled, a rally which included hitting a record $81.39 in February 2024, before losing oomph and drifting back to the current $64.56. It is a run that was preceded by a near two-year slide, halving the $60-plus levels of early 2021. Not everyone wants a ticket to this kind of investment roller-coaster. Others are comfortable accepting more risk in their portfolios, but is Uber worth the hassle? UBER IN A NUTSHELL Uber’s rise has been rapid. In barely a decade and a half it has turned the simple cab ride industry on its head, becoming a verb for ride hailing in much the same way we talk of ‘googling’ in internet search. The $106 billion company operates across three clear markets: ride-hailing (roughly 55% of revenue in first quarter 2024), food delivery (32%) and freight services (13%). After years of aggressively investing in its platforms and marketing to grow sales and the user base, Uber has seemingly turned the financial corner.In2023(to31Dec)itposteda$1.31billion operatingprofitonjustshyof$37.3billionrevenue. Thecompanythrewoff$3.36billionoffreecash flow.Grossbookingslastyearjumped19%to$137.9 billion and rose again in the Q1 of the current year, up21%(atconstantcurrencies)to$37.7billion, smackbanginthemiddleofthe$37billionto$38.5 billion range issued in February 2024. ‘Uber continues to execute on all fronts, further strengthening its network effect, as seen Uber Technologies 2020 2021 2022 2023 2024 20 40 60 80 Chart: Shares magazine Source: LSEG Has becomeUber businessa worthy of investment? 20 SHARES | 08 February2024 UK banks have enjoyed a renaissance in 2024. And, while the snap UK election put paid to plans for a big share sale in NatWest (NWG), anticipation of a ‘Tell Sid’ style offer definitely put the spotlight on the sector. As such, now is a perfect time to take an in-depth look at the banks’ relative merits, particularly off the back of their annual 2023 and first-quarter 2024 results. It’s worth saying making comparisons isn’t that easy because they each have different business models and different moving parts, so while they all have a high-street presence and we may think of them just as somewhere to put our wages or our savings they do a lot more besides. Ultimately, though, from an investor’s perspective, banks are no different to any other business – what matters is how well managed they are, how they control their costs and whether they offer an attractive risk-adjusted return. EARNINGS ARE CYCLICAL The first thing to flag is banking is a fairly cyclical business, in as much as demand for loans both from individuals and businesses tends to depend on the state of the economy and how confident people are feeling.When times are good and companies and households are borrowing the banks can turn a tidy profit, but when there is a downturn some of their loans inevitably turn bad and they have to put aside provisions for credit losses. Unlike most businesses, UK banks don’t tend to put aside money for bad loan provisions when they are making hay, they seem to wait until they start losing money to do it, which can make their earnings even more cyclical. However, since the pandemic they have maintained or grown their loans and deposits at a steady clip, and so far at least there don’t seem to be any signs of strain in terms of credit quality, meaning provisions are generally much lower than in 2020. How

BACK Comparing the big UK names after their year-to-date rally GSK sinks to bottom of the FTSE on Zantac ruling Chemring announces £1 billion sales target as order book hits new record Auto Trader shares hit new record high after results top forecasts US growth disappoints, Salesforce slumps on weak guidance, American Airlines nosedives | Wall Street Week

the BANKS BOUNCED

BECOME A BETTER INVESTOR WITH

SHARES

MAGAZINE HELPS YOU TO:

• Learn how the markets work

• Discover new investment opportunities

• Monitor stocks with watchlists

• Explore sectors and themes

• Spot interesting funds and investment trusts

• Build and manage portfolios

Why Shein’s £50 billion IPO will give ASOS and Boohoo the shivers

As Shares goes to press, reports suggest online fast-fashion behemoth Shein is preparing an IPO (initial public offering) on the London Stock Exchange after its attempt to list in New York faced opposition from US lawmakers due to perceived China links.

The IPO could value the fashion group at around £50 billion, making Shein the biggest-ever IPO in London by value, topping the £36.3 billion tag ascribed to commodities giant Glencore (GLEN) in 2011.

Shein’s IPO, which is expected to raise over £1 billion of new money for the company ahead of a summer or early autumn debut, would be welcome news for the London market amid the recent dearth of flotations.

But Shein’s debut will send shivers down the spines of peers such as Inditex (BME:ITX) and H&M (HM-B:STO) and embattled online-only rivals ASOS (ASC) and Boohoo (BOO:AIM).

Valued at $66 billion in its last fundraising, Shein originally launched as ‘SheInside’ in China in 2011 and its meteoric rise, powered by the sale of low-cost garments, has stunned the world of fast fashion. Alongside changing shopping habits and a cost-of-living crisis, Shein’s meteroric rise is one of the factors that has hurt sales at UK-listed fastfashion duo ASOS and Boohoo.

The disruptive company’s annual profits more

than doubled to $2 billion-plus in 2023 and cakedup with cash post IPO, Shein will present an even more formidable competitive threat to ASOS and Boohoo. Smart in its use of social media, Shein has the ability to turn around new items rapidly to suit the shifting tastes of fashionistas.

Fund managers who do back the float will hope Shein can emulate the stock market success of PDD Holdings (PDD:NASDAQ), the owner of rival cut-price clothing site Temu. Shares in PDD are up almost 650% over five years, reflecting the exceptional growth being delivered by Temu, which is growing like topsy in the US and expanding across Australasia, Europe and the UK.

However, Singapore-headquartered Shein’s float poses a conundrum for sustainability-focused investors given concerns about its governance, supply chain and business practices. Shein has been at the centre of controversy surrounding its use of cotton from China’s Xinjiang region and other issues related to workers’ rights and its sprawling supply chain.

Joining the public markets would only put the spotlight on these issues. It will be interesting to see if the company opts for a standard or a premium listing. The latter would allow it to join FTSE indices but bring greater levels of scrutiny and increased governance demands. [JC]

News 06 | SHARES | 06 June 2024

The fast-growing fashion giant is reportedly lining up London’s biggest ever float Previous largest UK IPOs Glencore UK Main Market 24 May 11 36.3 Sberbank of Russia International Main Market 01 Jul 11 32.8 Orange International Main Market 16 Feb 01 29.1 Company Market Date opening price (£bn) Table: Shares magazine • Source: LSEG Previous largest UK IPOs Glencore UK Main Market 24 May 11 36.3 Sberbank of Russia International Main Market 01 Jul 11 32.8 Orange International Main Market 16 Feb 01 29.1 Company Market Date opening price (£bn) Table: Shares magazine • Source: LSEG Previous largest UK IPOs Glencore UK Main Market 24 May 11 Sberbank of Russia International Main Market 01 Jul 11 32.8 Orange International Main Market 16 Feb 01 29.1 Company Market Date Table: Shares magazine • Source: LSEG Previous largest UK IPOs Glencore UK Main Market 24 May 11 36.3 Sberbank of Russia International Main Market 01 Jul 11 32.8 Orange International Main Market 16 Feb 01 29.1 Company Market Date opening price (£bn) Table: Shares magazine • Source: LSEG

Indian stocks retreat from record high on third term for prime minister Modi

Turnout impacted by extreme heat

Indian stocks have been on a roller-coaster ride this week buffeted by uncertainty on the outcome of the election as prime minister Narendra Modi was on course to bag his third consecutive term in office.

The BSE Sensex index comprising India’s 30 largest companies by market capitalisation surged 3.4% to record highs on 3 June as exit polls pointed to a comfortable victory for Modi’s Bharatiya Janata-led coalition, before slumping over 5% on 4 June as the extent of his win looks to be narrower than the polls predicted.

This might make it harder for Modi to push through the business-friendly policies the market expects.

Accordingly, the indices suffered what represented their worst drop since the onset of the pandemic, with state-run companies and banks taking the brunt of the pain, falling around 15%, while infrastructure stocks dropped by a tenth.

The world’s largest election, canvassing almost a billion voters was fought over six gruelling weeks. A party or coalition needs to win 272 seats in the 543 Lok Sabha assembly to from a government.

Looking at the longer-term picture, strategists at Bank of America believe India will continue to benefit from several tailwinds.

Shifting global supply chains could help the country to scale-up manufacturing in sectors like electronics, autos, pharma and textiles. A capital expenditure programme aimed at building up the country’s infrastructure assets is expected to have positive knock-on effects for economic growth.

Bank of America believes India is a major beneficiary of the global transition to AI (artificial intelligence) given its historical strength in coding.

The country’s huge population and burgeoning affluent middle class should drive consumptionled growth.

‘As India has circa 500 million Gen Z and Millennials who are a mobile first generation, the affinity towards US & global brands is much higher,’ writes Bank of America.

Total return in domestic currency, data to 3 June 2024

Total return in domestic currency, data to 3 June 2024

•

The IMF’s (International Monetary Fund) latest projections for GDP (gross domestic product) growth sees India growing twice as fast as the global average at 6.5% a year from 2024 to 2029 putting it in the top 10 fastest growing countries.

A rising India is considered a more friendly trading partner by the West, argues Bank of America. In accordance with its growing influence the country is redefining its foreign policy to navigate a complex geopolitical

This includes procuring oil from Russia, collaborating with the US where the two countries reaffirmed their close and enduring relationship at the G20 meeting last September. [MG]

News 06 June 2024 | SHARES | 07

landscape.

How Indian funds and trusts have performed India Capital Growth −2.7 112.7 Stewart Investors Indian Subcontinent Sustainability B Acc 10.0 123.2 JPMorgan Indian IT 10.9 49.9 Ashoka India Equity Investment Trust 13.4 194.6 FSSA Indian Subcontinent AllCap B Acc GBP 14.5 104.3 Liontrust India C Acc 18.0 118.6 abrdn New India Investment Trust 23.3 78.8 Jupiter India L Acc 23.7 131.0 Fund/trust Six-month performance (%) Five-year performance (%) Total return in domestic currency, data to 3 June 2024 Table: Shares magazine • Source: FE Analytics. How Indian funds and trusts have performed India Capital Growth −2.7 112.7 Stewart Investors Indian Subcontinent Sustainability B Acc 10.0 123.2 JPMorgan Indian IT 10.9 49.9 Ashoka India Equity Investment Trust 13.4 194.6 FSSA Indian Subcontinent AllCap B Acc GBP 14.5 104.3 Liontrust India C Acc 18.0 118.6 abrdn New India Investment Trust 23.3 78.8 Jupiter India L Acc 23.7 131.0 Fund/trust Six-month performance (%) Five-year performance (%)

Table: Shares magazine

Source:

Analytics.

performed India Capital Growth −2.7 112.7 Stewart Investors Indian Subcontinent Sustainability B Acc 10.0 123.2 JPMorgan Indian IT 10.9 49.9 Ashoka India Equity Investment Trust 13.4 194.6 FSSA Indian Subcontinent AllCap B Acc GBP 14.5 104.3 Liontrust India C Acc 18.0 118.6 abrdn New India Investment Trust 23.3 78.8 Jupiter India L Acc 23.7 131.0 Fund/trust Six-month performance (%) Five-year performance (%)

FE

How Indian funds and trusts have

Source:

Analytics.

Table: Shares magazine •

FE

Latest index shake-up sees Darktrace bump Ocado out of the FTSE 100

For readers who may not be aware, being market-cap weighted both the FTSE 100 and the FTSE 250 index are reviewed and rebalanced every three months to take account of share price movements.

In the previous review, which took place at the end of February, budget airline group EasyJet (EZJ) won promotion to the FTSE 100 while precious metals group Endeavour Mining (EDV) was relegated to the FTSE 250 where it was joined by newcomers Kier Group (KIE) and Wincanton (WIN).

In the latest review, which took place earlier this week, there were two promotions to the FTSE 100 index and six stocks joined the FTSE 250 index.

Cyber security and software firm Darktrace (DARK) has joined the premier index, although how long it will remain a member is moot as it is currently the subject of a $5.3 billion recommended cash offer from Chicago-based private equity firm Thoma Bravo.

Also joining the big league is housebuilder Vistry (VTY), whose shares and market cap have jumped more than two thirds in the last year since it moved to a partnership model.

Making way for the new joiners are online grocery delivery platform Ocado (OCDO), whose shares are among the most volatile in the UK market, as Shares has previously demonstrated, and wealth management firm St James’s Place (STJ), with both stocks dropping into the FTSE 250 mid-cap index.

Joining them in the index are four financial companies, beginning with Alpha Group International (ALPH) which describes itself as half fintech, half consultancy, and which only recently changed its listing from AIM to the main market.

Also promoted to the mid-cap benchmark are investor favourite Brunner Investment Trust (BUT), steered by Julian Bishop and Christian Schneider; specialist fund management group Liontrust Asset Management (LIO); and Reading-based pensions consulting and administration business

XPS Pensions (XPS)

Leaving the FTSE 250 index are Ukraine-based iron ore miner Ferrexpo (FXPO); transport operator Mobico (MCG), better known to most investors under its previous incarnation as National Express; specialist energy and energy storage fund NextEnergy Solar (NESF); and ‘net-zero transition’ fund Octopus Renewables Infrastructure Trust (ORIT), which together with NextEnergy Solar tells the story of how the renewables theme has fallen out of favour with investors. [IC]

Liontrust Asset Management

St James's Place Octopus Renewables Infrastructure Trust

News 08 | SHARES | 06 June 2024

FTSE 250 gains several financial firms while renewables fall from favour FTSE 100 Additions FTSE 100 Deletions Darktrace Ocado Vistry Group St James's Place FTSE 250 Additions FTSE 250 Deletions Alpha Group Darktrace

Ferrexpo

Mobico Ocado

Brunner Investment Trust

NextEnergy Solar Fund

Table: Shares magazine • Source: FTSE Russell

XPS Pensions Vistry Group

Ocado has dropped into the FTSE 250

Bloomsbury’s purchase of US academic publisher signals acceleration of strategy

Investors welcome publisher’s diversification as shares gain nearly 10% in a week

Shares in Bloomsbury (BMY) gained more than 10% last week as the publisher increased its footprint in North America with a strategic acquisition. Bloomsbury shares have gained nearly 30% year-to-date.

The successful publisher of science fiction and fantasy books showed investors it was intent on diversifying its revenue base and increasing its digital offering with the £65 million purchase of academic publishing firm Rowman & Littlefield. The deal adds 40,000 academic titles to Bloomsbury’s portfolio and

builds upon the publisher’s six-year 2030 strategy unveiled at the time of its annual results on 23 May.

The company saw pre-tax profit soar to £41.5 million for the year ending 29 February, amid strong demand for American author Sarah J Maas’ romantic fantasy series and its Harry Potter back catalogue.

Rowman & Littlefield generated revenue of $36 million (£28 million) and pre-tax profit of around $6 million (£5 million) for the year ended 31 December 2023.

Investec analyst Alastair Reid said: ‘On our forecasts, we increase revenues by circa 10% longer-term as the acquisition impact annualises, which leads to a circa 12% increase

Ferrexpo shares slump on war, government spats and legal issues

Iron ore producer’s operational progress is being overshadowed

Ukrainian iron ore mining group Ferrexpo (FXPO) has seen its shares slump 40% in the last three months amid ongoing nervousness over the conflict with Russia as well as spats with the government and legal issues.

This has overshadowed operational progress with the company reporting on 23 April its best quarterly production figures since the invasion of Ukraine. In the first three months of 2024, the company achieved commercial output of two million tonnes. This represented a 203% increase quarter-on-quarter and 115% uplift

year-on-year.

As Liberum analyst Ben Davis has previously observed, the impact on domestic power infrastructure from Russian attacks is a key risk to production forecasts.

The company has also set aside a $131 million provision to cover any negative outcome from two legal cases. These largely relate to its controlling shareholder Kostyantin Zhevago who, alongside two family members, controls 49.3% of the shares. The company is also in dispute with the Ukrainian government over royalty payments.

The company is likely to post its update on second-quarter output in early July before first-half numbers in early August. [TS]

in earnings, underpinning our target price increase.

‘The group’s growth potential, and management’s track record, continues to be under-appreciated in our view.’ [SG]

News: Risers and fallers 06 June 2024 | SHARES | 09

Bloomsbury Publishing (p) Jul 2023 Oct Jan 2024 Apr 400 600 Chart: Shares magazine • Source: LSEG

Ferrexpo (p) Jul 2023 Oct Jan 2024 Apr 40 60 80 100 Chart: Shares magazine • Source: LSEG

UK UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

11 June: FirstGroup, Iomart, Cake Box, Oxford Instruments

12 June: Castings, Molten Ventures

13 June: Motorpoint, PayPoint, Halma, NetScientific

FIRST-HALF RESULTS

12 June: RWS Holdings, Safestore, Driver Group

TRADING ANNOUNCEMENTS

11 June: Bellway

Can Fuller's show further progress against a tough backdrop?

Analysts expect earnings per share to have risen nearly 40% in the last year

The pub and hospitality sector continues to recover from the pandemic and inflationary pressures, and premium pub and hotel group Fuller Smith & Turner (FSTA) is due to update the market with full-year results to the end of March on 13 June.

The shares are trading close to 12-month highs, reflecting strong momentum in the business which saw the company deliver like-forlike sales growth of 11.5% for the 40 weeks to 20 January.

At the last trading update (25 January), chief executive Simon Emeny said the business was ‘in great shape’ and despite the challenging economic backdrop and significant increase in the National Living Wage he was confident the company would meet full-year expectations.

According to Refinitiv data, consensus sales forecasts call for a 5% increase year-on-year to £355 million while EPS (earnings per share) are expected to grow 39% to 24.6p. Consensus analyst EPS forecasts have risen by around 3% over the last year.

At the half-year stage, the company hiked its dividend by 42% and announced a further one million ‘A’ shares buyback. Investors will be looking for further signs of waning inflationary pressures and continued margin improvement as profitability continues to climb back towards prepandemic levels. [MG]

News: Week Ahead 10 | SHARES | 06 June 2024

Fuller

(p) Jul 2023 Oct Jan 2024 Apr 600 700 Chart: Shares magazine • Source: LSEG What the market expects of Fuller Smith & Turner Sales (£m) 355 358 EPS (p) 24.6 29.2 2024 2025 Year end: 31 March Table: Shares magazine • Source: Stockopedia, Refinitiv What the market expects of Fuller Smith & Turner Sales (£m) 355 358 EPS (p) 24.6 29.2 2024 2025 Year end: 31 March Table: Shares magazine • Source: Stockopedia, Refinitiv

Smith & Turner

OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

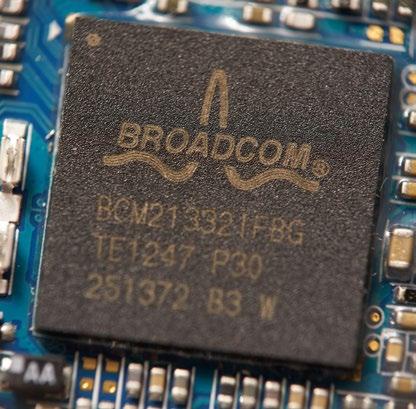

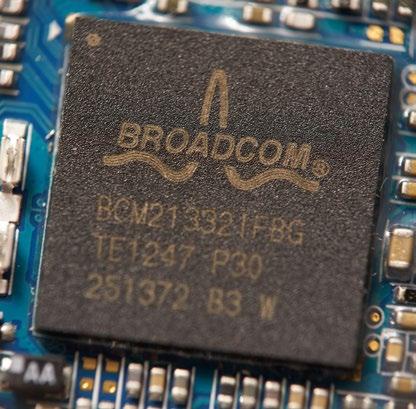

12 June: Broadcom

13 June: Adobe, Kroger, Jabil Circuit

Nerves frayed as investors ponder Adobe’s AI promise

More soft guidance could do serious damage to an already

After the AI (artificial intelligence) miss from Salesforce (CRM:NYSE) last week, the foreboding mood around Adobe (ADBE:NASDAQ) is almost tangible. Like many enterprise software firms, it has been happy to talk up the potential growth power-up of integrating AI across its suite, but if the proof of the pudding is in the eating, and so far investors have been left hungry.

In March, Adobe shares tumbled nearly 14% after the creative design software maker issued strong fiscal first-quarter results but came up short on quarterly revenue guidance. More of the same in fiscal Q2 (13 June) could

do serious damage to a stock already licking its wounds following a 23% year-to-date slump.

Technology followers have learned, often painfully, that new developments take longer and are usually more costly than initial projections, so while analysts seem largely confident Adobe is not destined for the AI scrap heap, progress may come in increments rather than a rapid surge.

Analysts at Mizuho recently suggested Adobe might be ‘one of the most out-of-favour and underowned large-cap software stocks out there’, with ‘horrible’ sentiment, a view largely shared by Shares, hence our 2024 plug on the stock, but the pressure is mounting on Adobe to deliver on the promise. [SF]

News: Week Ahead 06 June 2024 | SHARES | 11

US UPDATES

battered share price Adobe ($) Jul 2023 Oct Jan 2024 Apr 400 500 600 Chart: Shares magazine • Source: LSEG What the market expects of Adobe Q2 forecast $4.39 $5.29bn Fiscal 2024 forecast $18 $21.46bn EPS Revenue Table: Shares magazine • Source: Investing.com, Koyfin What the market expects of Adobe Q2 forecast $4.39 $5.29bn Fiscal 2024 forecast $18 $21.46bn EPS Revenue Table: Shares magazine Source: Investing.com, Koyfin

Signs of slowing US inflation send stocks higher while UK data also pleases

Key events this week and next week are the ECB and Federal Reserve meetings

Markets ended last Friday in the green after the US April CPE (core personal expenditure) deflator rose by 2.7%, in line with expectations and lending support to the argument inflation is heading towards the Federal Reserve’s official 2% target even if there are a few bumps in the road.

This week started on a bright note with the UK Manufacturing PMI (purchasing managers’ index) showing a return to growth in May as output expanded at the quickest pace in over two years thanks to a jump in new orders.

‘May saw a solid revival of activity in UK

manufacturing with levels of production and new business both rising at the quickest rates since early-2022,’ commented Rob Dobson of S&P Global Market Intelligence, which compiles the index.

As Shares went to press, the ECB (European Central Bank) was expected to begin cutting interest rates having raised them 10 times between July 2022 and October 2023 and held them steady in the intervening period.

However, with Eurozone inflation topping forecasts last month the ECB seems unlikely to cut rates rapidly so investors will pay close attention to comments regarding the outlook.

The end of this week will be dominated by US May non-farm payroll figures, with the market expecting a slight uptick to 185,000 new jobs added from 175,000 in April, and as ever the report has the potential to drive markets sharply one way or the other.

Next week is fairly light in terms of data but the market’s whole focus will be on Wednesday’s US core consumer prices and the Fed interest rate meeting.

While bets on US rate cuts this year have been drastically pared back, investors will still hang on chair Jerome Powell’s comments for an indication of when to expect the easing cycle to begin. [IC] Macro diary 06 June to 12 June

Next Central Bank Meetings

Bank

News: Week Ahead 12 | SHARES | 06 June 2024

2024 06-Jun Eurozone April Retail Sales 0.7% ECB Interest Rate Decision 4.5% US May Challenger Job Cuts -3.3% 07-Jun UK May Halifax House Price Index 1.1% Eurozone Q1 GDP 0.1% US May Non-Farm Payrolls 175k 11-Jun UK April Unemplyment Rate 4.3% 12-Jun UK April GDP 0.7% US May Core Consumer Price Index 3.6% US Federal Reserve Interest Rate Decision 5.5% Date Economic Event Previous Table: Shares magazine • Source: Morningstar, central bank websites Macro diary 06 June to 12 June 2024 06-Jun Eurozone April Retail Sales 0.7% ECB Interest Rate Decision 4.5% US May Challenger Job Cuts -3.3% 07-Jun UK May Halifax House Price Index 1.1% Eurozone Q1 GDP 0.1% US May Non-Farm Payrolls 175k 11-Jun UK April Unemplyment Rate 4.3% 12-Jun UK April GDP 0.7% US May Core Consumer Price Index 3.6% US Federal Reserve Interest Rate Decision 5.5% Date Economic Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Current Interest Rates 06-Jun European Central Bank 4.5% 12-Jun US Federal Reserve 5.5% 20-Jun UK Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Central

Meetings & Current Interest Rates 06-Jun European Central Bank 4.5% 12-Jun US Federal Reserve 5.5% 20-Jun UK Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

&

Next

Bank

Current Interest Rates 06-Jun European Central Bank 4.5% 12-Jun US Federal Reserve 5.5% 20-Jun UK Bank of England 5.25% Date Event Previous Table: Shares magazine • Source: Morningstar, central bank websites

Next Central

Meetings &

Why On The Beach is worth buying right now

The shares look good value as earnings recover towards pre-pandemic levels On The Beach

On The Beach (OTB) 142p

Market cap: £237 million

Positive first-half results and an analyst upgrade are reigniting investors’ interest in the online package holiday provider

On The Beach (OTB) and we think there is a big value opportunity here for investors to take advantage of.

Based on consensus forecasts the company trades on just 8.6 times September 2025 forecast earnings and after a hiatus imposed by the pandemic the company is returning to meaningful dividend payments – yielding 2.5% for the same 12-month period.

The 16.8p the company is forecast to generate in the year to 30 September 2025 would represent a return to the level achieved in 2018 and would be within striking distance of the 17.5p pre-pandemic high posted in 2019.

WHAT THE BUSINESS DOES

On The Beach sells beach holidays online and earns

a commission on these sales – it has no physical sites and does not own its own planes – and this means it does not need to employ lots of capital to grow. Its main costs lie in marketing. The company also sells holidays offline through third-party travel agents.

As Berenberg analyst Benjamin Sandland-Taylor observes: ‘The wider business operates across the value, premium and long-haul segments with

Great Ideas: Investments to make today 06 June 2024 | SHARES | 13

(p) 2020 2021 2022 2023 2024 100 200 300 400 500 Chart: Shares magazine • Source: LSEG

differing market positions among each. In value for example, OTB estimates that it has a 22% market share of the segment’s circa five million passengers. In the premium segment, which the company estimates to be a similar size in terms of passenger numbers, OTB has a circa 5% share. Long-haul encompasses three million passengers, with OTB having a 2% share.’

It’s in these two latter areas which On The Beach sees scope to grow. In the middle of May, On The Beach reported a 11% increase in group revenue to £80.8 million for the six months to 31 March 2024.

STRONG DEMAND

Passenger bookings during this period were up 15% (and there was an increase in the average value of holidays sold) highlighting the fact that people are still prioritising holiday getaways despite the cost-of-living crisis.

TTV (total transaction value) for the period was £597.8 million, up 22% year-on-year. Berenberg’s Sandland-Taylor believes that the online package holiday provider has ‘potential for further market share growth’ in the long-haul and premium holiday markets.

He adds: ‘We anticipate consumers’ appetite for travel to remain healthy – with positive comments on forward-looking bookings from On The Beach as well as across the wider travel space.’

CEO Shaun Morton tells Shares: ‘Destinations like Turkey, Greece, Southern Spain, Canaries, North Africa are all proving popular destinations for customers, and we have chosen to expand on offering to these countries.’

As well as focusing on long haul and diversifying into the premium areas, the online package holiday

On The Beach financial forecasts

30 September year end

Table: Shares magazine • Source: Stockopedia

provider has been investing in brand proposition, technology, and customer experience. Customer ‘perks’ being offered to drive loyalty include lounge access, free mobile data and fast track security.

RYANAIR AGREEMENT

On The Beach’s agreement with Michael O’Leary’s low-budget airline Ryanair (RYAAY:NASDAQ) has enabled the company to offer its customers flexible payment plans and ATOL protection under the terms of the long-term distribution deal signed in February this year.

Ryanair’s Dara Brady said at the time: ‘On The Beach customers can now book Ryanair flights, seats, and bags as part of their holiday package with the guarantee that they will have full price transparency of Ryanair products (without any overcharges), and that they will receive any information regarding their flight directly from Ryanair as well as having direct access to their booking through their myRyanair account.’

Shaun Morton adds: ‘The Ryanair agreement solves a long-term challenge. We now have secure seat supply with one of the biggest airlines in Europe. The way the partnership with Ryanair works is through direct technology link and it is also going to enable us to be more efficient in terms of how we operate, and it should improve the customer experience as well.’

VALUE MARKET CHALLENGES

One area of risk for the online package holiday provider is the value market segment of the business – or three-star holiday market, which Morton told Shares has seen ‘constrained demand,’ as people’s spending priorities have changed post-pandemic and during the cost-of-living crisis.

In the company’s last trading update, On The Beach said the value market only reported 1% TTV growth year-on-year. [SG]

Great Ideas: Investments to make today 14 | SHARES | 06 June 2024

2024 14.5p £24.39 million 2025 16.8p £28.21 million EPS Net profit (£)

Now is the time to use the strong pound to buy high-quality European stocks

As well as capital appreciation, this trust offers a reliable dividend

JPMorgan European Growth & Income (JEGI)

106.5p

Market cap: £465 million

The pound is currently trading close to two-year highs against the euro, and the interest rate differential between the UK and Europe is set to widen as the ECB (European Central Bank) begins easing this month.

Not only is this great news for holiday makers traveling to the continent this summer, it is also a blessing for investors looking to buy top-grade European stocks as their pound goes further these days.

The MSCI Europe ex-UK, like many other indices, may be making new highs this month, but despite the abundance of high-quality large-caps stocks it has significantly lagged the US S&P 500 over one, three and five years.

One investment trust which has beaten the benchmark consistently over all three time periods is JPMorgan European Growth & Income (JEGI), part of a stable of funds run by the US manager using the same approach which includes a global version, a UK small-cap version and an Asian version.

In the year to the end of March, the trust’s total return on net assets was 16.8% against 12.7% for the index thanks to superior stock selection in what was a tricky environment with the ongoing war in Ukraine and now conflict in the Middle East.

European Growth & Income

For the year to March 2024 that equated to a dividend of 4.2p per share, while for the year to next March the dividend will be 4.8p in line with the increase in NAV over the last 12 months.

The managers take a balanced approach to the portfolio, picking stocks on a bottomup basis with a strong focus on valuation, quality and positive momentum and less of a focus on yield despite the enhanced income policy.

As co-manager Tim Lewis explained to Shares, whether the overall level of yield on the portfolio is 3% or 5% doesn’t matter as dividends are paid out of capital gains meaning there is no need to chase highyielding stocks.

As well as delivering ‘the best of capital growth’, the trust offers a consistent stream of income through its commitment to distribute 4% of its starting NAV (net asset value) to shareholders each year in quarterly payments.

To illustrate this point, at the end of April the top five stocks – representing over 20% of the portfolio – were ASML (ASML:AMS), Nestle (NESN:SWX), Novartis (NOVN:SWX), Novo Nordisk (NOVO-B:CPH) and SAP (SAP:ETR), none of which yield much more than 3%.

The trust currently trades at discount to NAV of roughly 11% and has an ongoing charge of 0.66% per year. [IC]

Great Ideas: Investments to make today 06 June 2024 | SHARES | 15

JPMorgan

(p) 2020 2021 2022 2023 2024 60 80 100 Chart: Shares magazine • Source: LSEG

Why undervalued Currys can continue to rally

The electricals retailer remains cheap and positive trading momentum sets it up well for a UK consumer demand rebound

Currys (CURY) 79.5p

Gain to date: 32%

We highlighted Currys’ (CURY) exciting recovery potential on 21 March and urged readers to buy at 60.1p on the basis the electricals retailer’s self-help measures under CEO Alex Baldock’s leadership were starting to pay off and the washing machines-to-smartphones seller offered a compelling play on the improving consumer backdrop.

Shares also suggested that while Currys had successfully fended off recent suitor Elliott, the emergence of other predators shouldn’t be ruled out and the recent takeover interest highlighted the FTSE 250 tech products seller’s strong underlying value.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Shares in Currys have sparked up 32% to 79.5p with investors plugging into the turnaround potential of the super-size TVs-to-tumble dryers purveyor, whose stock is now trading well above Elliott’s top bid of 67p.

Currys

(p)

On 14 May, Currys upgraded pre-tax profit guidance for the third time this year following a ‘strong finish’ to the year ended 27 April 2024, with like-for-like sales growth of 2% in both the UK and the Nordics in the 16 weeks to 27 April implying firm share gains in some tough markets.

‘Our performance is strengthening,’ insisted Baldock. ‘With good momentum in the UK & Ireland, and with the Nordics getting back on track. Sales are now growing again, margins are benefiting from higher customer adoption of solutions and services, and cost discipline is good.’

WHAT SHOULD INVESTORS DO NOW?

Keep buying Currys for its re-rating scope and the potential for future takeover interest. Even after the recent rally, shares in Currys are swapping hands for a grudging 8.5 times the 9.4p of earnings Berenberg forecasts for the current financial year.

The broker sees Currys as ‘a sound way to play the expected improvement in UK retail demand’ and expects the significant valuation discount to peers to diminish ‘as trading momentum continues, indebtedness reduces further and growth accelerates’. [JC]

Great Ideas Updates 16 | SHARES | 06 June 2024

Jul 2023 Oct Jan 2024 Apr 45 50 55 60 65 70 75 Chart:

•

Shares magazine

Source: LSEG

Investors have four options with the blockbuster National Grid rights issue

How shareholders can respond to the £7 billion fundraise

On 23 May, power network operator

National Grid (NG.) announced a bumper £7 billion fundraise to help finance a five-year £60 billion investment plan.

Known as a ‘rights issue’, the exercise involves shareholders making a decision whether or not to buy discounted shares in the group.

As is the case for most major rights issues, National Grid’s fundraise is fully underwritten by

banks, in this case Barclays (BARC) and JPMorgan (JPM:NYSE), who will step in and buy any rights not taken up by existing shareholders.

Shareholders must take one of four routes:

• Buy some or all their allocated stock

• Sell all their rights

• Sell some of their rights and use the proceeds to buy some of the cut-price shares (known as ‘tail swallowing’)

• Do nothing

06 June 2024 | SHARES | 17 Feature: National Grid rights issue

National Grid (p) Jul 19 Oct Jan 20 Apr Jul Oct Jan 21 Apr Jul Oct Jan 22 Apr Jul Oct Jan 23 Apr Jul Oct Jan 24 Apr 800 900 1,000 1,100 Chart: Shares magazine • Source: LSEG

1.

FOUR OPTIONS FOR NATIONAL GRID INVESTORS WITH THE COMPANY’S RIGHTS ISSUE

TAKE UP YOUR RIGHTS

Shareholders are typically offered the right to buy a set number of shares in proportion to the number they already hold. National Grid is offering seven new shares at 645p each for every 24 existing National Grid shares held as of 8am on the 24 May. The official deadline to subscribe for the new shares is 11am on 10 June, but for most investment platforms the actual deadline may be earlier.

To illustrate, if you own 240 National Grid shares you have the chance to buy 70 new shares costing £451.50 in total. You would then have 310 shares and own the same percentage of the company as you did before the rights issue.

2.

SELL ALL YOUR RIGHTS

The rights associated with shares in a rights issue have an intrinsic value and can be traded separately in the market. These are known as nilpaid shares or nil-paid rights.

Shareholders can sell their rights to someone else and receive some money, all without having to sell their existing shares.

To calculate the price at which the shares could trade after a rights issue, analysts seek to calculate something called the TERP or theoretical ex-rights price. This is based on a combination of the value of the existing shares at the share price before the rights issue was announced and the new shares at the subscription price.

In reality the actual share price will also be affected by what motivated the rights issue and the company’s particular circumstances at that time.

The TERP (adjusted for the 2024 dividend of 39.12p) is 988p so the 645p issue price represents a 34.7% discount.

What if you want to sell your rights? An indicative value would be the difference between the theoretical ex-rights price and the subscription price which is 343p per share in the case of National Grid (988p minus 645p).

Therefore, someone holding 240 shares could in theory net £240.10 in cash by selling their rights (343p x 70 new shares). However, in reality the rights would sell for what other investors are willing to pay for them.

3. SELLING SOME RIGHTS TO PAY FOR THE COST OF SOME NEW SHARES

An alternative is to sell some of the nil-paid rights to cover the cost of buying some of the new shares in the rights issue.

Here, you would sell enough rights to take up the balance of your entitlement under the rights issue, using the net proceeds of the sale, and you wouldn’t need to invest any new money to take up the balance of your rights.

4. DO NOT TAKE UP THE RIGHTS

You could allow your rights to lapse. If the National Grid share price is trading below the offer price of 645p on the subscription deadline, the nil-paid rights would expire worthless.

But if they are trading above 645p you could receive a cash payment per nil-paid share equivalent to the National Grid share price less the offer price.

18 | SHARES | 06 June 2024 Feature: National Grid rights issue

NATIONAL GRID RIGHTS ISSUE OPTIONS

National Grid shareholder with 240 shares Buy 70 shares at 685p Sell all of the rights Sell sufficient rights to take up the balance of the entitlement Do nothing

WHY DO COMPANIES UNDERTAKE RIGHTS ISSUES?

Rights issues can be an effective way for companies to raise new money for large acquisitions, big capital investments or to strengthen their balance sheet.

This method of raising capital was heavily-used by companies in the wake of the financial crisisbanking group Lloyds (LLOY) undertook a £13.5 billion issue in 2009, for example. More recently, EasyJet (EZJ) was one of several firms to use a rights issue to rebuild its balance sheet coming out of the pandemic. National Grid’s rights issue is the largest since Lloyds went cap in hand to the market 15 years ago.

Investors do not always welcome rights issues as their discounted price tends to pull down the market price of a stock, so shareholders typically take a hit to the value of their investment. Many companies would argue that is the price investors pay to allow their business to grow, and the longer-term benefits will more than compensate them for the short-term hit to the value of their shares.

WHAT HAPPENS NEXT IF YOU’RE INVESTED IN A FIRM HOLDING A RIGHTS ISSUE?

You need to ascertain why the company you’re invested in is asking for more money. Does the desired cash only provide a quick fix to a financial problem and not a permanent solution?

In the case of National Grid, the focus is on investing for the future rather than fixing a broken balance sheet. The company plans to double the level of its investment of the previous five years, allocating £60 billion between 2024 and 2029. This encompasses £23 billion on energy transmission in the UK to help expand offshore wind development as well as £8 billion on ‘asset replacement, reinforcement and new connections’, with the balance to be spent in the US.

23 May 2024

Publication of the prospectus

24 May 2024 @8am

Subscription period begins; existing shares of the company quoted exsubscription rights on the London Stock Exchange

10 June 2024

Deadline to take up rights

12 June 2024

Source: National Grid

Results of rights issue announced

By Tom Sieber Editor

By Tom Sieber Editor

06 June 2024 | SHARES | 19 Feature: National Grid rights issue

TIMETABLE

UKbanks have enjoyed a renaissance in 2024. And, while the snap UK election put paid to plans for a big share sale in NatWest (NWG), anticipation of a ‘Tell Sid’ style offer definitely put the spotlight on the sector.

As such, now is a perfect time to take an in-depth look at the banks’ relative merits, particularly off the back of their annual 2023 and first-quarter 2024 results.

It’s worth saying making comparisons isn’t that easy because they each have different business models and different moving parts, so while they all have a high-street presence and we may think of them just as somewhere to put our wages or our savings they do a lot more besides.

Ultimately, though, from an investor’s perspective, banks are no different to any other business – what matters is how well managed they are, how they control their costs and whether they offer an attractive risk-adjusted return.

How the BANKS BOUNCED BACK

Comparing the big UK names after their year-to-date rally

EARNINGS ARE CYCLICAL

The first thing to flag is banking is a fairly cyclical business, in as much as demand for loans both from individuals and businesses tends to depend on the state of the economy and how confident people are feeling.

When times are good and companies and households are borrowing the banks can turn a tidy profit, but when there is a downturn some of their loans inevitably turn bad and they have to put aside provisions for credit losses.

Unlike most businesses, UK banks don’t tend to put aside money for bad loan provisions when they are making hay, they seem to wait until they start losing money to do it, which can make their earnings even more cyclical.

However, since the pandemic they have maintained or grown their loans and deposits at a steady clip, and so far at least there don’t seem to be any signs of strain in terms of credit quality, meaning provisions are generally much lower than in 2020.

20 | SHARES | 08 February 2024

Life is good for the Big Four

TAILWIND FROM HIGHER RATES

One of the key measures of how well a bank is doing is how much net interest income it is making, that is the difference between the amount it charges people to borrow money and the amount it pays out on deposits.

If we compare how much the Big Four made in 2020 with how they did in 2023, net interest income increased by around 30% at HSBC (HSBA)

and Lloyds Banking Group (LLOY), around 40% at NatWest and by more than 50% at Barclays (BARC).

In every case except HSBC, net interest income grew faster than total income over the period thanks not just to the banks lending more money but also to the rise in interest rates which allowed them to increase their lending rates by more than they increased their deposit rates.

Net interest income and net interest margins have fattened up nicely

Table: Shares magazine • Source: company annual reports. All share prices as of 30 May 2024

06 June 2024 | SHARES | 21

2023 Barclays HSBC Lloyds NatWest Customer Loans £400bn $938bn £450bn £352bn Customer Deposits £539bn $2,162bn £471bn £419bn Total impairments (£1.88bn) ($3.4bn) (£303m) (£3.6bn) 2020 Barclays HSBC Lloyds NatWest Customer Loans £343bn $1,038bn £440bn £272bn Customer Deposits £481bn $2,093bn £451bn £293bn Total impairments (£4.8bn) ($8.8bn) (£4.2bn) (£2.2bn) Table:

• Source: company annual reports. All share prices as

30 May 2024

Shares magazine

of

2023 Barclays HSBC Lloyds NatWest Total Income £25.4bn $66bn £17.9bn £14.75bn Net Interest Income £12.7bn $35.8bn £13.8bn £11bn Net Interest Margin 3.13% 1.66% 3.11% 3.04% 2020 Barclays HSBC Lloyds NatWest Total Income £21.8bn $50.4bn £14.4bn £10.8bn Net Interest Income £8.1bn $27.6bn £10.8bn £7.7bn Net Interest Margin 2.61% 1.32% 2.52% 1.71%

It has been a good year for banks' share prices so far

Net interest margins – or the difference between the interest rates the banks charge on loans and the rates they pay on deposits – increased by around 0.3% or 30 ‘basis points’ at HSBC, 0.5% of 50 ‘basis points’ at Barclays and Lloyds and an impressive 1.3% or 130 ‘basis points’ at NatWest.

In other words, the banks had a big tailwind from higher interest rates at the same time as demand for loans increased substantially, but the general consensus is that ‘golden period’ is now over, and as competition for deposits increases the scope for net interest margins to continue rising is minimal.

KEEPING A LID ON COSTS

Given, as we said at the outset, banking is fairly cyclical, the fact the UK economy seems to have avoided a ‘hard landing’ despite a significant rise in interest rates is a big plus for the Big Four, but their top lines aren’t likely to grow as fast as they have in recent years so there is an increasing focus on costs – which is one of the reasons they are all shutting so many branches, sadly.

You might think banking as a business is fairly low cost when all it involves is moving money around, yet the Big Four have a fairly high cost-to-income ratio across the board.

The best performer is HSBC, where costs account for ‘just’ 48.5% of income, while the worst is Barclays where costs account for 67% or more than two thirds of income.

To put these in perspective, using a Terry Smith analogy, on average it costs the banks more than 50 pence to generate one pound of revenue, which is a pretty poor margin and explains why there are no bank stocks in his popular Fundsmith Equity (B41YBW7) fund.

If shareholders want to see profits rising, and more cash handed out in the form of dividends and buybacks, then they need to see progress on the cost front.

BEWARE OF HIDDEN LIABILITIES

For the time being, credit quality seems to be reasonable and the banks aren’t worried about the prospect of bad loans coming out of the woodwork, although as we said previously instead of provisioning counter-cyclically – i.e. putting money away when times are good, which would be the sensible thing to do – they seem to leave it until the last minute which exacerbates the volatility of their earnings.

There are other costs investors should be aware of too, notably for litigation and poor conduct, which despite the banks describing them as ‘exceptional’ actually seem to be a recurring theme through the years.

Having not long consigned the PPI (payment protection insurance) scandal to the history books, the banks now face a regulatory probe into car loans which while not as big as PPI still has the potential to cost them real money in ‘remediation’

22 | SHARES | 06 June 2024

Jan 2024 Feb Mar Apr May 90 100 110 120 130 140 Barclays HSBC Lloyds Banking NatWest

100 Chart: Shares magazine • Source: LSEG

Rebased to

Cost cutting is key to increasing profits from now on

charges if they are found to have given consumers a poor deal.

Lloyds has put aside £450 million of cash as a contingency, as its Black Horse agency is a major provider of motor finance, although some estimates put the bank’s potential liability at up to £1 billion, while NatWest is reckoned to have the least exposure.

Meanwhile, charges for litigation and previous poor conduct can also eat into shareholders’ returns, with Barclays having to take a £1.6 billion provision in 2022, a third more than it took in bad loan provisions that year.

In contrast, HSBC didn’t publish a figure for 2023 but set aside three pages of its annual report for the various legal proceedings which could have a ‘material’ impact, from fixing interbank rates to foreign exchange, precious metals, gilts trading, tax and even film finance cases, so it pays to take a good look at the notes to the accounts.

VALUATIONS ARE UNDEMANDING

Despite their decent stock-price performance this year, shares in the Big Four banks don’t look expensive relative to the market or to their history. Returns on tangible equity are in the mid-teens percent for three of the four, which is highly respectable, although Barclays clearly has some catching up to do which is why its shares trade at a big discount to tangible net asset value while the others trade at a small premium.

Barclays also trades at a discount when measured on a PE (price-to-earnings) basis with a ratio of 6.2 times earnings for the coming 12 months, according to Stockopedia, and a prospective 4.1% dividend yield.

By comparison, HSBC is on 7.1 times with a prospective 8% yield, Lloyds is on eight times with a 6% yield and NatWest is on just below eight times with a yield of 5.3%, all of which compare favourably with 14.4 times and 3.2% for the FTSE 100 benchmark.

Returns on tangible equity are highly respectable for the most part

06 June 2024 | SHARES | 23

Barclays 9.0% 331p 217.5p −34% 40% HSBC 14.6% $8.19 (655p) 690p 5% 9% Lloyds 15.8% 50.8p 55p 8% 15% NatWest 17.8% 292p 314p 7% 42% 2023 ROTE TNAV/share Last price Premium Shares YTD Table:

2024

Shares magazine • Source: Company annual reports. All share prices as of 30 May

Barclays £25.4bn (£16.9bn) 67.0% HSBC $66bn ($32bn) 48.5% Lloyds £17.9bn (£9.1bn) 54.7% NatWest £14.75bn (£8.0bn) 51.8% 2023 Total Income Operating Costs Cost-Income Ratio Table: Shares magazine • Source: Company annual reports. All share prices as of 30 May 2024

Schroders Capital Global Innovation Trust –a focus on the life sciences portfolio

Capturing the innovative potential of global life sciences

With eight of the 18 new investments bought for the Schroders Capital Global Innovation Trust (INOV) portfolio since 2019 being life sciences companies, it is clear that its portfolio managers see this as a key area of focus for the trust going forward. Here we take a closer look at the INOV life sciences portfolio to assess its progress and prospects.

THE LIFE SCIENCES OPPORTUNITY

The global healthcare industry benefits from several fundamental tailwinds that look capable of driving structural growth for many years, if not decades, into the future including a globally aging population and biomedical innovations. The confluence of advances being seen across scientific and technological disciplines is fuelling an unprecedented wave of innovation from within the life sciences industry, with biotechnology companies leading the way.

It is perhaps little wonder, therefore, that INOV’s portfolio managers, Tim Creed and Harry Raikes, have been finding abundant new opportunities for the life sciences part of the portfolio. Indeed, across all the exciting themes that Tim and Harry invest across, they cite life sciences as having the “greatest opportunity” for new investments over the last couple of years, and we are beginning to see the results.

CLINICAL MILESTONES

It is the nature of development-stage life sciences investing that results can be “binary”, with individual company contributions inevitably driven by the results of clinical trials. The potential rewards are significant when the results of a trial read-out positively, but by contrast, the downside for investors can also be considerable should a trial fail to demonstrate the hoped-for efficacy in patients.

Overall, the INOV team is pleased with the development progress of the life sciences portfolio. By way of example, the valuation of Anthos was recently

increased, driven by the positive result of its Phase 2 ANT-006 “Azalea” clinical trial in Abelacimab. Anthos is developing therapies for patients that are at high risk of cardiovascular and metabolic problems such as heart disease and stroke. This particular study was assessing Abelacimab’s ability to prevent thrombosis while mitigating the risk of bleeding in a cohort of atrial fibrillation patients that were deemed at moderate-to-high risk of stroke. Encouragingly, the study was stopped early due to evidence of bestin-class thrombosis prevention an “overwhelming reduction in bleeding”, when compared to the current standard of care.

Meanwhile, Neurona Therapeutics, a US-based clinical-stage cell therapy business, recently secured a notable investment of $1.6m (£1.3m) from INOV in Q1 2024, as part of a financing round which successfully raised $120m for the company’s ongoing development. Neurona is dedicated to developing innovative cell therapies for chronic diseases of the nervous system. In December 2023, Neurona reported positive results from a Phase I/II clinical trial, for its lead asset NRTX-1001 for the treatment of drug-resistant mesial temporal lobe epilepsy (MTLE). NRTX-1001 was well tolerated by all initial subjects and the first two subjects who received the treatment experienced a significant reduction of over 95% in their overall average monthly seizure counts one year after treatment. The investment from INOV further supports Neurona’s mission and contributes to the advancement of its first-in-class cell therapy research and development efforts.

ADVERTISING FEATURE

The quoted position in Autolus, which is developing Car-T cell therapies for cancer patients, also performed very well in 2023, with the share price increasing by more than 200% in US dollar terms. This share price movement reflected both encouraging results from clinical trials and other pipeline developments. In May and December 2023, Autolus presented positive results from a pivotal Phase 2 clinical trial for Obe-Cel, which is aimed at patients with relapsed / refractory adult B-cell acute lymphoblastic leukaemia. The company has filed a Biologics License Application with the FDA, seeking US regulatory market approval for the therapy.

As is usually the case, not all progress from within the INOV life sciences portfolio was positive, however. For example, AMO Pharma, an emerging biopharmaceutical business developing new treatments for serious and debilitating diseases, including rare genetic disorders, was one of the main detractors to performance during 2023. In September, the company reported that its Phase 3 Reach-Com clinical trial for AMO-02 for the treatment of congenital myotonic dystrophy did not meet its primary endpoint.

These examples are all clear demonstrations of the binary nature of this part of the INOV portfolio. They also provide a strong indication as to why Tim and Harry seek a diversified approach across different businesses, medical areas and development stages, as well as by combining the life sciences theme with several other exciting areas of innovation such as artificial intelligence, cybersecurity and fintech.

ENCOURAGING DEVELOPMENT

Overall, however, the investment team is strongly encouraged by the progress made by the life sciences element of the INOV portfolio. Out of the 12 life science portfolio investments shown below, 10 have now reached clinical stage, which means they have products being tested in humans via highly-regulated clinical trials. Of these, five have already shown clinical proof of concept, which typically occurs during Phase 2 of the three-stage clinical trial process. Additionally, device business Cequr has received regulatory approval, which means it now has permission to sell its Simplicity insulin patch for diabetes patients.

The majority of the life science opportunities listed below are new investments, committed since Schroders took on the INOV mandate in 2019. Furthermore, these have typically been introduced to the portfolio at a later stage of their development than the inherited investments, as a result of intentional changes to the life sciences approach under Schroders stewardship.

REALISING VALUE

When making investments in life sciences businesses, the portfolio managers normally expect to hold them throughout their development phase and into the early stages of their commercial journey. It doesn’t always work out that way, however, because these businesses are often attractive acquisition targets for larger pharmaceutical businesses.

The stars on the diagram above indicate two businesses that have already been acquired, allowing us to realise value from the holdings. The first of these,

Carmot, was a business with high potential obesity and diabetes therapies in development, which was first bought for the portfolio in early 2023. This was through a highly access-restricted funding round, which Schroders was only able to participate in due to its deep expertise in biotech investing and close relationships with other high-quality biotech investors.

In December 2023, it was announced that Roche was to acquire Carmot for $2.7bn, at a price that is more than three times higher than our initial investment in the business. Tim and Harry had always anticipated this would be a successful investment but had been prepared to wait three-to-five years for the value to be realised. Ultimately, Carmot may be worth considerably more than Roche has paid for it, but in the context of a holding period of less than twelve months, this seems like an excellent price at which to exit. The deal allows the portfolio managers to quickly realise value and they can now redeploy capital in other exciting opportunities.

Meanwhile, the deal with Roche has been structured with potential future “milestone payments”. These allow exiting shareholders to maintain an exposure to the acquired company’s future success. If certain development milestones are met, INOV and other prior shareholders in Carmot, are entitled to further payments from Roche worth up to an additional $400m in total, on top of the $2.7bn initial acquisition price.

These milestone payments are relatively common in life science investing. Indeed, last year INOV benefited from additional contingent payments relating to the sale of Kymab to Sanofi in 2021. That deal was struck

for an upfront payment of c. $1.1bn with the potential for future milestone payments of up to $350m. This translated into initial proceeds of $87m (£63m) to INOV for its holding in Kymab in 2021, with the potential for a further $27m once certain milestones were met. Kymab’s continued development success led to INOV receiving a further payment of $5.8m (£4.6m) in the first quarter of 2024. Tim and Harry are confident that positive development progress can continue.

IDEAL FOR A GLOBAL INNOVATION MANDATE

The ability to invest globally is a positive as far as life sciences are concerned, because it allows the team to add another perspective to diversification. The UK is well known for its expertise in early-stage life sciences technology, in large part thanks to our excellent academic infrastructure. However, the US and Switzerland are also hotbeds of life sciences innovation, and the INOV portfolio has exposure to these countries as well.

With 180 investment professionals focused on private equity at Schroders Capital, INOV benefits from significant resources in finding exciting opportunities, not just in life sciences, but across all eight of the innovation themes that INOV is exposed to. Two of those themes are related to life sciences – oncology and biotech discovery platforms. In combination with the other six themes, and the tremendous potential to be found in the venture and growth parts of the portfolio, this builds a positive story of encouraging development for the INOV portfolio as a whole.

Click here to find out more about the trust >

• Investment risk: Long-term outcomes are more binary – extremely attractive rewards for success but some businesses will inevitably fail to fulfil their potential and this may expose investors to the risk of capital losses.

• Overseas investment risk: The trust may invest in overseas securities and be exposed to currencies other than pound sterling – as a result, exchange rate movements may cause the value of the trust, individual investments, and any income paid to decrease or increase.

• Private companies risk: The trust may invest in unquoted securities, which may be less liquid and more difficult to value, because they are generally not publicly traded – the lack of an open market may also make it more difficult to establish fair value.

• Share price risk: The price of shares in the trust is determined by market supply and demand, and this may be different to the net asset value of the trust. This means the price may be volatile in response to changes in demand.

• Small companies risk: As it can take years for young businesses to fulfil their potential, this investment requires patience.

IMPORTANT INFORMATION

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as

• Young companies risk: Young businesses have a different risk profile to mature blue-chip companies – risks are much more stock-specific, which implies a lower correlation with equity markets and the wider economy.

• Gearing risk: The company may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

Important information

For help in understanding any terms used, please visit www.schroders.com/en/insights/invest-iq/investiq/ education-hub/glossary/

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor. co.uk. Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www. schroders.co.uk/investor or on request.

amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Fund

Capital

risk disclosures – Schroders

Global Innovation Trust plc

Has Uber become a business worthy of investment?

Ride-hailing platform is improving profit profile, but big threats remain

Since spearheading the so-called gig economy over the past decade, Uber Technologies (UBER:NYSE) has emerged as a volatile investment.

Having whipped up a frenzy among investors with valuation pitches of up to $120 billion ahead of its 2019 IPO (initial public offering), bigger even than Facebook’s $104 billion 2012 float. In the end, its debut was a disaster, the $45 stock plunging on day-one to chalk-up one of America’s biggest debut flops ever and wiping more than $7 billion off the market cap.

The world has turned, and much has changed yet investors seem to retain a love/hate relationship with the stock, with sharp share price rallies interspersed with prolonged spells in the doldrums. During the past 15-months, Uber stock has more than doubled, a rally which included hitting a record $81.39 in February 2024, before losing oomph and drifting back to the current $64.56.

It is a run that was preceded by a near two-year slide, halving the $60-plus levels of early 2021. Not everyone wants a ticket to this kind of investment roller-coaster. Others are comfortable accepting more risk in their portfolios, but is Uber worth the hassle?

UBER IN A NUTSHELL

Uber’s rise has been rapid. In barely a decade and a half it has turned the simple cab ride industry on its head, becoming a verb for ride hailing in much the same way we talk of ‘googling’ in internet search. The $106 billion company operates across three clear markets: ride-hailing (roughly 55% of revenue in first quarter 2024), food delivery (32%) and freight services (13%).

After years of aggressively investing in its platforms and marketing to grow sales and the user base, Uber has seemingly turned the financial corner. In 2023 (to 31 Dec) it posted a $1.31billion operating profit on just shy of $37.3 billion revenue.

The company threw off $3.36 billion of free cash flow. Gross bookings last year jumped 19% to $137.9 billion and rose again in the Q1 of the current year, up 21% (at constant currencies) to $37.7 billion, smack bang in the middle of the $37 billion to $38.5 billion range issued in February 2024.

‘Uber continues to execute on all fronts, further strengthening its network effect, as seen

28 | SHARES | 06 June 2024 Under the Bonnet: Uber Technologies

2020 2021 2022 2023 2024 20 40 60 80

•

Uber Technologies

Chart: Shares magazine

Source: LSEG

How Uber's quality metrics stack up

How Uber's quality metrics stack up

How Uber's quality metrics stack up

in its growth in users, requests, frequency, user monetisation, and suppliers,’ says Morningstar analyst Ali Mogharabi.

Network effects create a virtuous circle for the company. Put simply, the more drivers/riders/ restaurants it has, the more users will be attracted by increased availability and choice, and as user numbers rise, so more drivers/riders/food outlets sign-up to the platform, making it more valuable to all stakeholders, including shareholders.

Morningstar’s Mogharabi also flagged Uber’s efforts to further diversify its services. Grocery delivery is on pace to represent more than 50% of the company’s total gross bookings (45% in 2023), he says, with strengthened cross-selling capabilities due to its network effect.

‘We think Uber is likely to attract and maintain more users and limit growth on other platforms, including Instacart (CART:NASDAQ).’

BACK TO MARGINS

Sharp-eyed readers may have noted 2023 operating margins at 3.5%, the sort of ballpark you might get from a supermarket, not a highgrowth internet business. Optimists will say it is not where they are now that matters, but where margins are going.

The firm also provided better-than-expected margin expansion guidance on its analyst day in February this year, says Morningstar. Based on consensus data from Koyfin, that’s between 10% and 11% for full year 2025, 200% up on 2023.

‘Uber’s network effect, leaner operation, and continuing gross bookings and revenue growth will likely create further operating leverage and drive an impressive 30% to 40% average annual adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) growth over the next three years, with more than a 90% free cash

06 June 2024 | SHARES | 29 Under the Bonnet: Uber Technologies

Operating margin 3.5% −6.3% −12.3% −57.0% −62.7% Return on capital employed 4.5% −8.6% −7.2% −24.1% −31.2% Return on equity 20.3% −83.9% −3.7% −51.2% −81.1% 2023 2022 2021 2020 2019 Table: Shares magazine • Source: Stockopedia

Operating margin 3.5% −6.3% −12.3% −57.0% −62.7% Return on capital employed 4.5% −8.6% −7.2% −24.1% −31.2% Return on equity 20.3% −83.9% −3.7% −51.2% −81.1% 2023 2022 2021 2020 2019 Table: Shares magazine • Source: Stockopedia

Operating margin 3.5% −6.3% −12.3% −57.0% −62.7% Return on capital employed 4.5% −8.6% −7.2% −24.1% −31.2% Return on equity 20.3% −83.9% −3.7% −51.2% −81.1% 2023 2022 2021 2020 2019

Table: Shares magazine • Source: Stockopedia

UBER FIRST QUARTER BREAKDOWN

Source: Uber

Under the Bonnet: Uber Technologies

flow conversion,’ says Mogharabi.

According to Gridwise, the average Uber driver earned $1,410 in gross monthly earnings in 2023, which was down 17% year-on-year. That sum is still significantly higher than Lyft (LYFT:NASDAQ) drivers made (although they do work less). Uber Eats saw a similar double-digit decline for monthly earnings. Drivers who feel they aren’t getting compensated fairly could stop working for Uber or instigate strike action.

Clearly, there’s a limit to how much a user will be willing to pay for food delivery and cab rides, which could leave Uber squeezed in the middle. The emergence of driverless vehicles could change the dynamics, but we are years away from fleets of driverless vehicles on our streets, such are the yawning gaps technological and regulatory framework gaps.

In the meantime, there are questions about Uber’s capital allocation, with return on capital employed sat at just 5.7%, according to Stockopedia data. The firm’s new $7 billion

The emergence of driverless vehicles could change the dynamics, but we are years away from fleets of driverless vehicles on our streets”

share buyback programme may provide some reassurance of a more mature handling of capital going forward, but Stockopedia has Uber on a 17 out of 100 rating for value.

Morningstar reckons the stock could hit $80 over the next 12 to 18 months, yet on a 2025 price to earnings multiple that tops 30, shareholders may well feel that the threat of pratfalls is not balanced attractively enough to the upside potential.

By Steven Frazer News Editor

By Steven Frazer News Editor

How to invest in shares, investment trusts, ETFs and funds