THE COPPER AGE

06 Sky-high expectations leave no room for earnings disappointment

07 UK IPO market hots-up after Shein accelerates plans for London listing 08 UK takeovers and premiums back to record levels of 2018

ITV up 30% as streaming platform proves its worth

Intel dealt Huawei blow by US government

Can Marks & Spencer deliver some more earnings magic?

Bruised Palo Alto investors praying for

14 Bank of England a step closer to cutting rates as it lowers inflation outlook

GREAT IDEAS

16 Time to buy the Kainos tech transformation growth story

18 Caledonia Investments is a diamond in the rough waiting to shine

20 Infrastructure investor 3IN is finally catching the market’s eye

Revealed: the rare investment trusts trading for more than their assets are worth

THE COPPER AGE

What

Three important things in this week’s magazine

THE COPPER AGE

Find

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Sky-high expectations leave no room for earnings disappointment

Soft guidance has cost some US equities dearly in latest earnings season

Have US equity expectations run ahead of themselves? Certainly, for some companies, the answer seems to be yes. One of the features of secondquarter earnings season has been the number of companies that have met or ever beaten revenue and earnings expectations yet have cost share prices and investors dearly.

High-growth companies including ARM (ARM:NASDAQ), Airbnb (ABNB:NASDAQ) and Shopify (SHOP:NYSE) are among those that stand out, having comfortably reported recent results ahead of consensus forecasts but whose share prices have fallen, sometimes sharply.

What links these three companies is a weakening of their respective trading environments and the perception among investors that guidance was soft. The market’s reaction to lower sales growth and narrower margins for Shopify’s current quarter to 30 June saw a particularly savage sell-off, the shares more than 19% one day decline in response their largest one-day drop on record.

Airbnb, after issuing similarly tepid growth guidance, lost 7% on the day, while ARM’s modest decline in the end followed pre-market data that suggested a 6% to 7% fall was incoming. But the theme has not only impacted high-growth companies.

‘When valuations and expectations are sky high, any bad news can shake investors’ confidence,’ says Morningstar analyst Michael Field.

Disney (DIS:NYSE) beat earnings estimates for the quarter to 30 March 2024 as Disney+ and Hulu turned a profit for the first time, but revenue was shy of forecasts for the fourth quarter on the spin. Disney also guided for a decline in third quarter subscriptions which it hopes to reverse by

copying the Netflix (NFLX:NASDAQ) playbook of preventing password sharing.

Coupled with slowing growth from its moneyspinning parks business, as the post-pandemic travel boom fades, this led to a more than 9% share price decline on the day of its own earnings report (7 May) to barely $105, a sell-off from which the stock has yet to stage any recovery.

With the market mood dominated by AI (artificial intelligence) in recent months, it casts Nvidia’s (NVDA:NASDAQ) looming first quarter 2025 earnings (22 May) into sharp relief. Having beating expectations that have been raised multiple times over the past couple of years, investors are left with the question of how long it can keep shooting the lights out.

Core AI plays like Microsoft (MSFT:NASDAQ) and Alphabet (GOOG:NASDAQ) have continued to perform well and their share prices have responded positively. This may suggest that Nvidia still has scope to positively surprise, and fuel further share price gains. Investors will find out soon. [SF]

UK IPO market hots-up after Shein accelerates plans for London listing

Companies tend to list on the stock market when conditions look ripe for a healthy reception from investors so as to get a deal away at the best price.

After a fallow period for IPOs (initial public offerings) in 2022/23, activity appears to be gathering pace buoyed by the FTSE 100 and FTSE All-Share notching up new all-time highs in recent weeks.

In an unusual turn of events, London could benefit from US-China trade tensions after Chinese fashion group Shein was reported to be accelerating plans for a UK listing after receiving pushback from US and Chinese regulators.

A London listing would be subject to Beijing’s approval after new listing rules were introduced for Chinese firms going public offshore, including clearance from the Cyberspace Administration of China.

A source told Reuters the regulator was conducting a cybersecurity review of Shein’s data handling and sharing practices.

In 2023 Shein was valued at $66 billion (£52.6 billion) according to a Reuters source.

Table:

Shein is such a big name in the retail space it could attract other companies to consider listing in London, argues AJ Bell investment analyst Dan Coatsworth.

‘The key negative is that Shein comes with more baggage than a celebrity takes on holiday. Questions continue to be asked about its corporate governance standards, working conditions, supply chain and accusations of intellectual property theft,’ cautions Coatsworth.

Technology company Raspberry Pi is teeing up a £500 million London float which would be a welcome addition after seeing so many technology firms exit in recent years.

Meanwhile, the first REIT (real estate investment trust) IPO this year, Special Opportunities REIT, is due to go live on 20 May.

The seven IPOs which have listed in 2024 have so far shown a clean pair of heals to the market average, gaining 40% compared with 8% for the FTSE All-Share.

Leading the pack is low-sodium salt maker MicroSalt (SALT:AIM) whose shares have more than doubled since debuting on 2 February at 43p per share as investors recognise its potential to disrupt the global food industry.

Holding the wooden spoon is Kazakh airline Air Astana (AIRA) which is down by a tenth after failing to ignite much enthusiasm from investors. [MG]

Disclaimer: Financial services company AJ Bell referenced in the article owns Shares magazine. The author of the article (Martin Gamble) and the editor (Ian Conway) own shares in AJ Bell.

UK takeovers and premiums back to record levels of 2018

Cheap valuations are encouraging more corporate activity FTSE 100

One of the factors undoubtedly helping lift the UK stock market to new highs this year is an upturn in M&A (merger and acquisition) activity.

According to Dealogic, the value of UK takeovers so far in 2024 is more than $78 billion, the highest level since 2018, as overseas buyers in particular home in on the undervaluation of the market.

‘The UK has become structurally very attractive for M&A. There’s a lot of frustration behind the scenes with valuations and the sense that the market is not properly rewarding UK companies,’ observes Bank of America’s head of UK Investment banking Peter Luck in an interview with the Financial Times.

Luck believes the lowly valuation of Londonlisted firms together with an improving economic picture and the prospect of lower interest rates later in the year could lead to yet more M&A activity.

Not only have deal volumes hit 2018 levels, the median takeover premium of 34% so far this year is almost back to that year’s record level of 37% according to data from Bloomberg

Rather than suggesting UK companies are being greedy or bidders are becoming more generous, the premium reflects depressed valuations says Cannacord Genuity’s head of Quest Research Graham Simpson.

Corporate buyers seem to be leading the way in terms of deal size, with BHP Group (BHP) pursuing rival Anglo American (AAL) in a potential $38 billion deal and International Paper (IP:NYSE) seeing off rival Mondi (MNDI) with an agreed takeover of DS Smith (SMDS) for an enterprise value of $9.75 billion.

Private buyers have generally been chasing smaller targets, for example US firm Thoma

Bravo clinched UK cyber security specialist Darktrace (DARK) for just £4.2 billion or $5.25 billion, while Czech billionaire Daniel Kretinsky offered £4.5 billion for Royal Mail-owner IDS (IDS), with talks said to be ongoing despite the UK firm’s initial opposition, and Nationwide snapped up Virgin Money (VMUK) for £2.9 billion.

Private capital’s reluctance to engage in bigger deals is part of a wider trend and not just a UK phenomenon according to M&A experts.

Pitchbook reports the deal value for North American and European take-private deals shrank 50% in the first quarter of 2024 compared with the final quarter of 2023 to just $12.5 billion, as rising valuations have encouraged buyers to look for smaller targets.

Private buyers’ share of global M&A deal volume dropped to below 40% last year from 44% in 2022, reversing a trend of eight years of increases. [IC]

ITV up 30% as streaming platform proves its worth

With the Euros football tournament due to start this summer, broadcaster could make further progress

Shares in ITV (ITV) have advanced nearly 30% over the past six months as the free-to-air broadcaster has found success with its ondemand streaming service ITVX.

Total streaming hours were up 16% in the first quarter and digital advertising revenues grew by 14%.

venture with the BBC for £255 million back in March.

The company said ITVX’s monthly active users ‘continue to grow in line with expectations’ and it remains on track to deliver at least £750 million of digital revenues by 2026. ITV sold its Britbox joint

Intel

The only damp squib for the free-to-air broadcaster was the first-quarter performance of its ITV Studios production business which reported a 16% fall in total revenue to £382 million due to the strike by Hollywood writers and actors last year.

However, ITV Studios continues to deliver popular programming for ITV itself like Mr Bates vs The Post Office, formats such as Love Island – which has been sold to 27 countries – as well as shows like

The Reluctant Traveller for Apple TV+ and The Red King for Alibi. ITV is also set to benefit from the forthcoming Euros football tournament this summer, which will provide the usual kicker to advertising spend. [SG]

dealt Huawei blow by US government

Chip firm caught up in Washington’s advanced tech battle with Beijing

This year has been a struggle for Intel (INTC:NASDAQ) – investors don’t seem to be buying the optimism the chip firm has spun around its PC and data centre business, while it has thus far failed miserably when it comes to convincing the market it hasn’t missed the AI (artificial intelligence) boat.

Data from Sharepad shows Intel is the secondworst performer on the S&P 500 in 2024, down nearly 40% on where it started the year.

Now the US government has revoked licenses which allowed Intel and others to ship chips used in laptops and handsets to sanctioned

Chinese telecoms equipment-maker Huawei Technologies. It’s hard to quantify how big a hit this could be, but it does nothing to dispel the negative sentiment currently enveloping the company.

‘We have revoked certain licenses for exports to Huawei’, said the US Commerce Department in a statement, although it neglected to specify which licenses were involved. The Commerce Department’s move, first reported by Reuters, comes after concerted pressure by China hawks on the Republican side in Congress who have urged the Biden administration

to take tougher action to thwart Huawei.

Meanwhile, the US chip maker is reported to be in talks with asset management company Apollo to provide more than $11 billion of financing to build a new manufacturing plant in Ireland. [SF]

Sophisticated global investing made effortless

UK UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

17 May: Land Securities

20 May: Union Jack Oil, Kainos, Likewise

21 May: Pennon, Caledonia Investments, Cranswick, Assura, Diaceutics

22 May: HICL Infrastructure, British Land, Marks & Spencer, SSE, Severn Trent, Great Portland Estates

23 May: Johnson Matthey, Wizz Air, Helical, National Grid, Investec, Bloomsbury Publishing

FIRST-HALF RESULTS

21 May: SSP Group, Watkin Jones, Topps Tiles

23 May: Essentra

TRADING ANNOUNCEMENTS

21 May: Smiths Group

22 May: Empiric Student Property, Kingfisher, Aviva, Close Brothers

Can Marks & Spencer deliver some more earnings magic?

Expect the retail stalwart to highlight further market share gains and deliver a solid outlook with its full-year results

Retail bellwether Marks & Spencer (MKS) may need to deliver a modest ‘beat’ to the £679.8 million consensus pre-tax profit estimate, along with a reasonably confident outlook statement, when it serves up full-year results (22 May) if the foodsto-fashion giant is to sustain recent positive share price momentum.

Led by CEO Stuart Machin, the FTSE 100 company’s turnaround is gaining traction and Marks & Spencer has been winning market share over recent quarters. Peel Hunt believes the FTSE 100 firm’s food like-for-like sales should have remained strong in the fourth quarter of the year to March 2024, and the broker also predicts ‘good news’ on the product evolution front in the clothing and home division where a new ex-Arcadia team is ‘pulling the strings’.

Yet while real UK incomes are rising, Marks & Spencer’s management may refrain from upgrading year-to-March

the market expects of Marks & Spencer

Spencer

Investors will also be eager for an update on the performance of Ocado Retail, the loss-making 50/50 joint venture with Ocado (OCDO), which according to Kantar saw sales grow by a rapid 12.5% in the 12 weeks to 14 April 2024, ahead of the 6.8% growth of the total online market. [JC] Marks &

2025 profit guidance given prevailing wage cost pressures and the fact the company is lapping tough first half comparatives. Both divisions saw a slowdown in the pace of third quarter growth versus the prior first-half period, while recent downpours won’t have helped the retailer shift seasonal clothing lines.

Bruised Palo Alto investors praying for improvement

Investors got seriously spooked back in February 2024 when Palo Alto Networks (PANW:NASDAQ) lowered revenue and billings guidance for fiscal year 2024 (to 31 May), causing analysts to lower forecasts and price targets.

Palo Alto stock tanked, losing nearly 30% in a day, a savage reckoning after running hot since the start of 2023. That’s been a problem. Equity markets can get carried away when a stock keeps shooting the lights out, and it doesn’t take much to send the bulls scurrying for safety.

It is not that the guidance was terrible. Palo Alto reported second quarter revenue up 19% year-onyear at $2 billion, with net income surging from $0.3 billion to $0.5 billion. Where the cybersecurity company came unstuck was with soggy guidance, expecting billing for fiscal 2024 to be in the range of $10.1 billion to $10.2 billion, down on the previous $10.7 billion to $10.8 billion range.

The revenue forecast was lowered from between $8.15 billion and $8.2 billion to $7.95 billion and $8 billion.

The company has been shaking up its product offering and is incentivising customers by offering them ‘no-cost’ periods until their legacy product contracts expire and shifts in strategy are seldom pain-free. Which means third quarter earnings, due 20 May, will get plenty of market attention. Consensus is pitched at $1.25 per share of earnings on $1.97 billion revenue, which would be solid double-digit year-on-year growth. But any hint of a further weakening in the trading environment could see the stock hung out to dry again. [SF]

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

20 May: Palo Alto Networks

22 May: Nvidia, Target, Synopsys

23 May: Intuit, Medtronic, Autodesk, Dollar Tree, Deckers Outdoor, Hewlett Packard, Ralph Lauren

Bank of England a step closer to cutting rates as it lowers inflation outlook

Excitement at the MPC meeting is quickly tempered by a strong GDP report

As Dinah Washington used to sing, what a difference a day makes, although its relevance to central bank meetings and stock markets was probably the last thing on the great jazz musician's mind.

While there was no change in official UK interest rates at the latest Bank of England MPC (Monetary Policy Committee) meeting, there was plenty of chatter around governor Andrew Bailey's distinction between the outlook for UK and US inflation, leading some commentators to speculate on a rate cut as soon as next month rather than in September.

UK headline inflation fell to 3.2% in March, below the US for the first time since peaking in 2022, and the bank now sees inflation falling to 1.9% in two years’ time, below its official target, which as EY chief UK economist Peter Arnold says ‘is an indication the MPC thinks current market pricing is too high and rates are likely to be cut more significantly’.

Rate cuts are happening in Europe – specifically in Sweden and Switzerland – and the European Central Bank is widely expected to lower rates next month.

Yet, less than 24 hours later, UK first-quarter GDP came in ‘roaring ahead of expectations’, as Morningstar’s European strategist Michael Field put it, at 0.6% against a consensus forecast of 0.3%, with manufacturing and services both in growth territory, suggesting a June rate cut is anything but a forgone conclusion.

Attention switches back to the US economy this week with the release of core consumer and producer prices as well as industrial production, retail sales and housing starts, all of which will feed into the Federal Reserve’s data bank and inform its thinking on when it might move to cut interest rates.

Next week brings the focus back to the UK again with news on house prices, consumer and industrial prices, including the all-important core reading which strips out food and energy, and trends in industrial orders. [IC]

Jump

European growth

Time to buy the Kainos tech transformation growth story

Why this normally expensive stock looks like a long-run bargain

Kainos (KNOS) £10.16

Market cap: £1.28 billion

We believe that market sentiment towards Kainos (KNOS) is on the cusp of a reversal, and that creates a buying opportunity for investors. Shares in the Belfast-based digital services expert are now trading at a 30% discount to 12-month highs and are barely half all-time peaks of more than £20.

This is largely because of what analysts have called a cyclical slowing of corporate digital services growth, possibly a function of decision-making delays as management teams grapple with their own AI (artificial intelligence) strategies. We believe this could be about to turn.

PROMISING BACKCLOTH

Technology has been transforming how organisations operate for decades but the pace of change has never been faster, and now AI is powering the next growth leap forward.

According to PwC, AI will contribute approximately $15.7

trillion to the global economy by 2030. Experts uniformly say the idea of AI disruption is very real, and that there is huge scope to improve things in the business world, whether it’s around making individuals more productive, improving decision making, driving down costs or creating innovative end user experiences and interactions.

Because there is no one-size fits all AI adoption pack, with each use case requiring tuned, domain-specific models trained with quality, proprietary data, we and analysts believe there is a fundamental opportunity for Kainos in the years ahead.

Recent commentary has also been supportive of a slowly

Kainos' run of quality returns

changing demand dynamic, with the likes of IBM (IBM:NYSE) and Cap Gemini (CAPP:EPA) reporting fuller order pipelines as clients shift from experimentation to deployment. Next week (20 May), Kainos will report full year 2024 results (to 31 March) and we anticipate the tone to be one of carefully managed optimism, but it could trigger a swathe of bargain buying given the relatively lowly valuation.

WHAT DOES KAINOS DO?

Kainos is a FTSE 250 IT business that does two things. Digital Services helps (typically large) organisations transition their processes and operations into the 21st Century digital world, including as a key supplier to UK government departments, often writing bespoke tools and software.

Then there’s its Workday (WDAY:NASDAQ) practice, its partnership with the $65 billion US enterprise human resources and financial planning software platform, providing clients testing, training, installation and audit for the platform, plus designing new products to enhance the Workday platform.

The Workday practice has powered much of the growth in recent years and revenues are now worth almost half of Kainos total, seen at £392 million, according to Stockopedia 2024 consensus data. Consensus for 2025 has come down in recent months to the current £424 million revenue and £63.3 million net profit, again based on Stockopedia data.

WHAT’S THE PITCH?

relationships, and the calibre of our people, who continue to excel in delivering high-impact solutions for our customers,’ said chief executive Russell Sloan in an update in April.

‘In the near-term, an increased backlog, a robust pipeline and a strong balance sheet provide excellent visibility of the strength of our performance in the current financial year’, Sloan added.

Sloan may have only been in the top job since September 2023, but like predecessor Brian Mooney, he has been at Kainos man and boy, joining out of Belfast University in 1999.

True, digital services demand could remain soggy for longer than optimists anticipate, while slower than expected Workday growth could drag on sentiment. This latter option looks unlikely, with analysts at Megabuyte in April pointing out ‘sales records’ for new product lines.

As investors have latched on to the short-term negatives, it has left the shares trading at valuations not seen in years. The implied 2025 PE (price to earnings) multiple is barely 20, versus a five-year average PE closer to 40.

A strong balance sheet provide excellent visibility of the strength of our performance in the current financial year”

Yes, growth has slowed, but there is strong scope to accelerate again through the rest of this year and beyond. ‘Our confidence is reinforced by our long-term customer

Yet throughout this recent slower spell, the company has maintained exceptional returns metrics. Data from Stockopedia shows returns on capital and equity of 38.7% and 32.9% respectively, with operating margins running at 14%, scoring the company a Stockopedia ‘quality’ score of 96 out of 100.

The share price might not suddenly surge 20% or 30% but the opportunity for an incremental re-valuation higher remains strong, as do the underlying fundamentals of this, in our opinion, excellent business. We think time will show this is a great buying opportunity. [SF]

Caledonia Investments is a diamond in the rough waiting to shine

Rare opportunity for retail investors to buy into a quasi-‘family office’

Caledonia Investments (CLDN) £35.18

Market cap: £1.92 billion

Amid all the talk of the UK market being full of ‘hidden gems’, we think Caledonia Investments (CLDN) could be one of the best examples of ‘hidden value’ in the mid-cap FTSE 250 index.

The global multi-asset investment company tends not to get much air-time, but Shares caught up with chief executive Mat Masters and finance director Rob Memmott after the publication of the full-year results.

Caledonia was originally a shipping company, founded by Sir Charles Cayzer in 1878 and today, six generations later, the company is still 48% owned by the Cayzers, making it less an investment trust and more of a ‘family office’ whose job is to create and protect wealth for generations to come.

For that reason, the firm doesn’t take big risks, rather it buys stakes in businesses it understands, both public and private, and takes a long-term view.

Nothing demonstrates that long-term view quite like the fact Caledonia has raised its payout for 57 years in a row, making it not just a Dividend Aristocrat but dividend royalty.

For the year to March, NAV (net asset value) total return was up 7.4% to £3 billion or £50.68 per share, putting the shares on a 30% discount at the current price.

All three investment pools made a positive contribution, with public equity up 12%, well ahead of its 8.6% annual 10-year average, private equity up 12.3%

against its 10-year average of 13.9% and the funds side up 2.2%, well below its 17.3% 10-year average due to a decidedly ‘off’ year for Asian private markets.

Within the £950 million public equity allocation, the ‘capital portfolio’ which is invested for gains returned 14% thanks to holdings in Fastenal (FAST:NASDAQ), Hill & Smith (HILS) and Microsoft (MSFT:NASDAQ) among others, while the ‘income portfolio’ returned 7% driven by DS Smith (SMDS), Fastenal and RELX (REL).

The £820 million private capital allocation, which is UK-centric, enjoyed £90 million of net valuation gains thanks to realisations and positive operating performances from its investee companies.

The firm doesn’t take big risks, rather it buys stakes in businesses it understands, both public and private, and takes a longterm view”

Assuming Asian private markets –which in any case are a small part of the funds business – recover steadily, and the quoted and unquoted portfolios continue to grow at or close to their decade-long averages, we would expect the 30% discount to NAV to narrow over time.

We would also note that given over a third of NAV is made up of liquid stocks and cash, the implied discount on the unquoted assets is more than 50% so the potential for upward reversion is significant. [IC]

Infrastructure investor 3IN is finally catching the market’s eye

As the M&A market heats up there are more opportunities to realise value

3i Infrastructure (3IN) 342.5p

Gain to date: 8.7%

When we recommended buying into private equity firm 3i Infrastructure (3IN) last summer at 315p we flagged the undervaluation of its portfolio, as shown by the sale of Dutch waste treatment and recycling firm Attero for more than 30% above its most recent valuation and 2.7 times the purchase price.

We stuck with our call even when the shares dipped to 290p in November on the basis the company’s ability to create value would sooner or later shine through, which it certainly has in the last six months.

WHAT HAS HAPPENED SINCE WE SAID BUY?

The company recently posted its results for the year to March 2024, beating its internal target of 8% to 10% NAV (net asset value) total returns for the tenth year in a row with an 11.4% increase to 362.2p per share.

There were no further realisations – or asset sales – but the firm’s investee companies enjoyed continued earnings momentum helped to a degree

3i Infrastructure

by a positive correlation with inflation.

None of its businesses are start-ups, and all have a significant presence in each of their markets, so 3IN’s management helps them grow, which could mean giving them the right capital structure, guiding them as they expand into new markets or assisting with bolt-on acquisitions.

A good example is ESVAGT, which originally provided offshore support vessels for the oil and gas industry but under 3IN’s stewardship has pivoted to offshore wind, a much faster growth market, making it a more valuable business when it comes time to sell.

WHAT SHOULD INVESTORS DO NOW?

We would sit tight as the market for private assets is really starting to heat up, creating what 3IN calls ‘a visible route to exit’ for some of its investments.

At the same time there are plenty of opportunities to continue increasing the value of its portfolio businesses as they expand and grow their earnings, creating a sustainable flow of money back into the company and allowing it to continue increasing its dividend as it has done again this year. [IC]

The author owns shares in 3i Infrastructure

Revealed: the rare investment trusts trading for more than their assets are worth

Most names trade at a discount right now but stellar performance and bumper investor demand are sustaining premiums for a select few

Discounts and premiums to NAV (net asset value), which is the value of all the investments an investment trust holds minus any debt or loans, are among the trust universe’s unique quirks and can confuse novice investors. At the moment the vast majority of trusts trade at a discount.

Annabel Brodie-Smith, the AIC’s (Association of Investment Companies) communications director, says: ‘Only around 20 investment trusts are currently

Since investment trusts are publicly traded companies listed on the London Stock Exchange, you invest in them by buying their shares. If the share price is higher than the NAV per share, the trust trades at a premium, which means it is popular with investors and there is bumper demand for its shares. Conversely, if the share price is lower than the NAV per share, the trust is on a discount, which suggests the fund is out of favour and demand for its shares is weak.

trading at a premium as demand for trusts has been hampered by the impact of rising interest rates, unhelpful cost disclosure regulation as well as consolidation in the wealth management industry.’ Few trusts trade at consistently high premiums, but these rare situations do occur; they can reflect bumper demand from investors due to a fund’s strong performance record, its focus on an investment hotspot or perhaps faith that the manager can continue to outperform the market.

Generally speaking, investing in trusts at a discount is an opportunity for investors to purchase the underlying assets for less than their true worth. Investing at wider discounts should lead to better returns since not only are you buying assets on the cheap, but periods when discounts have widened often coincide with lower underlying valuations. This sets the investor up for a strong recovery when market conditions improve, although large discounts can persist for long periods.

A

selection of trusts trading at a premium to net asset value

Table: Shares magazine • Source: The AIC, 10 May 2024

However, premiums can put investors in a bit of a quandary. Paying a share price that is higher than the value of the underlying assets means immediately giving up some future performance, since there is no discount to close. Trusts on a premium also carry de-rating risk. When a oncepopular trust becomes unpopular and slides from premium to discount, investors lose money.

WHICH TRUSTS TRADE ON PREMIUMS?

Investing in the small band of trusts trading at a premium may seem counter-intuitive to the ‘buy low, sell high’ mantra, but dismissing this cohort means ruling out some first-rate funds with copperbottomed reputations. Among these rarities is private equity trust 3i (III), a market darling whose 34.3% premium reflects strong performance and investor appetite for exposure to Action, the fastgrowing Dutch value retailer which makes up the bulk of 3i’s portfolio. 3i generated a total return of £3.84 billion or 23% on shareholders’ opening funds for the year to March 2024, a performance built off the back of a 36% increase the previous year. Shares has a positive stance on JPMorgan Global Growth & Income (JGGI), which merits its

1.2% premium as the top share price total return performer in the AIC Global Equity Income sector over one, five and 10 years, with a formidable fiveyear haul of 114.6%.

One of our running Great Ideas selections, JPMorgan Global Growth & Income is among the ‘most bought’ trusts on investment platforms. This popularity reflects the balance it offers between growth and income, which allows the fund to perform well in different style regimes. The trust also pays quarterly distributions that are set at the beginning of each financial year, and on aggregate the intention is to pay dividends totalling at least 4% of the fund’s NAV at the time of announcement.

This can be topped up using the trust’s capital reserves in the event of a shortfall. The unusual feature of paying out a dividend from net assets and share buybacks has helped keep the shares trade close to NAV or at a premium. Co-managers James Cook, Tim Woodhouse, and Helge Skibeli look for the best companies wherever they are listed and focus on high-quality, cash-generative businesses which can ‘control their own destiny’ and not be knocked off course by the economy or competitive forces.

Investment trusts: Rare premiums

A PRIVATE EQUITY PREMIUM

Besides 3i, the only other fund on a premium in an AIC Private Equity sector awash with double-digit discounts is the high-flying Literacy Capital (BOOK), whose managers focus on smaller businesses they can help grow in size and value, which drives superior returns for shareholders.

Given its strong NAV returns since listing in 2021, Literacy Capital remains a compelling investment proposition and is also doing some good in the world through its charitable mission of helping disadvantaged children in the UK learn to read, with donations equivalent to 0.9% of NAV made each year, although investors might want to wait for a discount to open up again before buying the shares.

Excitement surrounding the hot returns on offer from the globe’s fastest-growing major economy combined with a spicey performance since launch explain Ashoka India Equity’s (AIE) 2.3% NAV premium. The fund has been the best-performing India specialist trust since its 2018 inception with the market cap swelling to almost £390 million through strong asset performance and share issuance that has improved the trust’s liquidity. While Ashoka India remains an attractive vehicle for tapping into India’s positive economic picture and a stock market delivering solid earnings growth, any growth slowdown in the populous Asian nation or stock picking mistakes from the manager could see the trust’s premium evaporate.

SMALL CAP STAR TURNS

its March 2023 IPO (initial public offering) to the end of December. That compares to a 3.7% decline for the AIM All Share Index and demonstrates that manager Laurence Hulse’s process of spotting dynamic, yet undervalued companies and actively engaging with them to realise hidden value is already paying off. Thanks to this premium Onward, which raised £12.8 million from an IPO priced at 100p per share, has been able to issue new shares and expand its capital base.

Managed by Richard Staveley, ravenous demand for value-focused fund Rockwood Strategic reflects its stellar performance. Another running Shares Great Idea, Rockwood has delivered a five-year share price total return of 177.5%. Harwood Capital’s Staveley, who has personal ‘skin in the game’, manages a highly concentrated portfolio of stocks with ‘deeply undervalued future cashflow potential’ and re-rating catalysts in place. The fund has benefited from a series of net asset value-boosting takeover approaches. Odyssean invests in a concentrated portfolio of well researched UK small caps, typically too small for inclusion in the FTSE 250. Constructive corporate engagement is a key part of managers Stuart Widdowson and Ed Wielechowski’s winning approach, with the duo able to draw on a lengthy and successful track record in public and private equity investing.

DON’T FORGET THIS DIVIDEND MACHINE

The select bunch of trusts trading at premiums also includes a trio from the UK Smaller Companies sector. This may surprise some readers given the prevailing negative sentiment towards the market’s small fry which has left most sector constituents languishing on double digit discounts. Stock market newcomer Onward Opportunities (ONWD:AIM) trades on a 5.1% premium, while two trusts with a knack for selecting takeover targets, namely Odyssean (OIT) and Rockwood Strategic (RKW), sit on premiums of 0.6% and 2% respectively.

Onward recently (11 April) reported an 11.3% NAV total return to 106.5p for the nine months from

Also trading on a premium that Shares believes is well-deserved is the unique Law Debenture (LWDB), a rare combination of an investment trust and a cash-generative professional services operating business that continues to generate strong results.

Investors are paying up for a trust with a longrun record of outperforming peers and the FTSE All Share benchmark, while Law Debenture’s dividend growth of 69.3% over the last five years is the highest in the UK Equity Income Sector. In addition, the trust has either increased or maintained the dividend for 45 years.

By James Crux Funds and Investment Trusts Editor

By James Crux Funds and Investment Trusts Editor

THE COPPER AGE

CBy Tom Sieber Editor

CBy Tom Sieber Editor

opper is already one of the most important materials underpinning human civilisation, and the energy transition is only likely to see demand for the industrial metal build in the years to come.

Limits and pressures on supply and this growing demand profile are already seeing copper prices mount a charge and recent M&A activity – with BHP’s (BHP) unsuccessful (for now) attempt to take over Anglo American (AAL) – is being driven by a need to capture copper supply.

The chief executive of miner and commodities trader Glencore (GLEN), Gary Nagle, warned last year of a ‘massive copper deficit’ coming down the road.

Copper market deficits (kt)

Source: Company filings, Jefferies estimates

In this article we’ll discuss the copper market in detail, just why the metal is so important and look at ways to play potential further upside in prices.

Copper mining production in Chile

Tonnes (000s)

SUPPLY AND DEMAND DYNAMICS

The roll-out of electric vehicles and renewable energy are both heavily reliant on copper thanks to its role as a critical component in electrical systems. Copper is a highly-conductive metal which transports electricity more efficiently than almost all alternatives, is resistant to corrosion and has high thermal resistance which prevents overheating.

A base-case estimate from consultancy Wood Mackenzie suggests the share of global copper demand coming from green sectors will double over the next decade from 8% to 16% while copper consumption across the world will increase by 24% between 2023 and 2033 hitting 32 million tonnes.

In the short term, economic uncertainty means copper demand could be unpredictable. Like other industrial metals, demand from major commodities consumer China will play a crucial role. There have already been signs of a slowdown in electric vehicle sales as consumers cut back on buying bigticket items.

Wood Mackenzie notes at the beginning of 2023 production from copper mines was forecast to

DR COPPER

Copper’s reputation as a reliable barometer of the health of the global economy has earned it the nickname ‘Dr Copper’. The red metal is used in a very broad variety of different industries and products including electronics, homes and infrastructure.

grow 6% year-on-year in 2024 – by the end of last year that forecast had dropped to 3.9% reflecting cuts in production announced during the final quarter of the year. Over the last few years, drought conditions in Chile – dubbed in some quarters the ‘Saudi Arabia’ of copper thanks to its dominant position in global copper production – have affected output.

SNAPSHOT OF THE COPPER SUPPLY CHAIN

Copper is typically extracted from two types of ore. Sulphide ores contain higher concentrations of the metal but are less abundant and costly to process. Oxide ores are more abundant and found closer to the surface but tend to be lower-grade. The copper ores are processed

through a series of physical steps using high temperatures to extract and purify the copper. These include froth flotation, thickening, smelting and electrolysis.

The metal can then be turned into wire, plates, tubes and other copper products.

In some countries, regulation and governmental intervention have had an impact. One notable example is First Quantum Minerals’ (FQM:TSE) Cobre Panama mine which was shut in 2023 by the outgoing administration in Panama after public protests about the environmental impact of mining in the Central American state.

Copper mining grades have also been dropping and bringing new mines on stream is a lengthy and complicated process, typically taking at least a decade from the point of discovery and three to four years from when development has been green-lit.

Mining has also become increasingly capitalintensive. Olivia Markham, co-manager of sector investment trust BlackRock World Mining (BRWM) says: ‘Margins haven’t changed drastically but what has changed significantly is capital intensity. You often see substantial uplift in capital costs from when projects initially get approved and sanctioned and initial decisions are made and that’s quite challenging for companies.’

In this context it is no surprise management teams might be more comfortable pursuing acquisitions instead. BHP’s $39 billion all-share bid for Anglo American would have added four copper mines – Los Bronces, El Soldado, and Collahuasi in Chile, and the Quellaveco mine in Peru – at a stroke without using lots of cash. If a big surge in copper demand and prices is coming then BHP would also have got in ahead of the boom.

WHAT ARE MINING GRADES

Mining grades refer to the concentration of a mineral or metal within an ore (i.e., the rock which contains the mineral or metal) and is typically measured as a percentage or sometimes per tonne. Ores are extracted from the earth through mining and then refined to extract the mineral.

There is a grade below which it is not profitable to mine a mineral even though it is still present in the ore. If the material has already been mined there is also a grade at which it does not make economic sense to refine or process it. The minimum grades vary on a project-byproject basis.

A good copper grade, for example, is anywhere around 1% although some mines are economic at grades of 0.5%.

Berenberg analyst Richard Hatch says: ‘In our view, the crux of the deal was copper, as the transaction would increase BHP’s copper exposure by around 46% over 2025 to 2030.’

However, dealmaking of this sort will do nothing to increase the global supply of copper, which begs the question, what price is required to incentivise new copper developments?

WHAT COULD HAPPEN NEXT WITH ANGLO AMERICAN?

BHP’s two rebuffed all-share approaches for Anglo American valued the company at £25.08 per share and £27.53 per share – a 14% and 25% premium respectively to the undisturbed share price. When the first bid was made

Berenberg pitched BHP’s absolute limit at £29 per share – arguing if it was pushed above this level the company would walk away. Anglo American has mounted a defence – announcing plans to sell off its diamond, platinum and coal mining assets in a bid to improve shareholder returns. Given other companies are looking to grow their copper production, it’s possible another heavyweight joins the fight for Anglo American or a bid comes from China. BHP has until 22 May to put up or shut up.

Work by investment bank Jefferies suggests a price of at least $5 per pound (approaching $11,000 per tonne) is needed, which is around the all-time highs seen in March 2022, and analyst Christoper LaFemina observes the price would need to stay above this threshold for an extended period for large greenfield projects to be sanctioned. This compares with a current price of $4.71 per pound and $9,875 per tonne.

Technologies like coarse particle recovery, sulphide leaching and process optimisation with machine learning could also help address the supply deficit by increasing the amount of copper extracted from the ore.

SUBSTITUTION RISK

It is often said the cure for high prices is high prices, and if copper does spike then it could hit demand and lead end-users to look for alternatives. The main substitute for copper is aluminium. Aluminium is much more abundant and therefore cheaper than copper. It is also more lightweight, but it only has around 60% of the red metal’s conductivity, and mining bauxite – the common ore from which aluminium is sourced – is highly energy intensive.

BlackRock’s Markham says: ‘We always have substitution and aluminium for copper is an obvious one although there are technical limitations. There is a level of pricing where you would see demand destruction and we’re realistic about that.’

Technology and innovation will play a role here – Wood Mackenzie cites the example of Tesla’s

Grade A Cash U$/MT

(TSLA:NASDAQ) Cybertruck. ‘Tesla moved from 12 volts to 48 volts for the low-voltage wiring, from a distributed to a zonal loop-based architecture for the communication wiring, and from 400 volts to 800 volts for the high voltage wiring. These measures, along with a possible application of aluminium high voltage busbars have, according to Tesla, significantly reduced the vehicle’s copper requirements.’

It will be worth watching developments here closely for signs of meaningful progress which could affect demand for copper over the longer term.

WHO DOMINATES COPPER MINING?

According to the International Trade Administration, Chile accounts for 24% of global production and state operator Codelco makes up a good chunk of that production. Other major producers of copper include Arizona-headquartered Freeport-McMoRan (FCX:NYSE), which also operates the world’s largest gold mine, BHP, Glencore, Mexico’s Southern Copper (SCCO:NYSE), Rio Tinto (RIO), Anglo American and Antofagasta (ANTO).

Over recent months these companies have started to price in the strength of the copper market. However, Markham at BlackRock says there is ‘frustration’ at the lack of movement in the valuation of the broader sector despite the greater capital discipline it has shown in recent years and companies’ improved financial performance. She attributes this in part to the ‘carbon intensity of the sector’.

‘We talk about a brown-to-green transition, and we think the sector is very committed to reducing its carbon intensity and demonstrating real progress,’ she adds.

HOW TO INVEST

You can gain pure exposure to the copper price through exchange-traded product Wisdomtree Copper (COPA) which has an ongoing charge of 0.49%.

A consideration when buying this type of vehicle, which applies particularly to long-term investors, is the impact of the futures market phenomena

‘contango’ and ‘backwardation’. Over time these can have a material impact on returns. Over one year this product has generated a return of 19% compared with a 23% rise in the price of copper.

Investing in copper miners, while it comes with operational risk, also allows you to potentially secure income from dividends and enjoy outsized gains if they can deliver growth. Broad-based mining funds will have material exposure to copper producers and therefore the copper price and will also offer diversification.

In terms of actively-managed funds, BlackRock World Mining has been increasing its exposure to copper and, while its one-year performance is poor reflecting some headwinds for key holdings, over three and five years it has comfortably outperformed the benchmark with annualised returns of 17% and 8.7% respectively. It offers a dividend yield of 5.5%, trades at a 2.2% discount to net asset value and has an ongoing charge of 0.91%.

A lower-cost alternative is tracker fund Van Eck Global Mining ETF (GIGB), which has ongoing charges of 0.5% and tracks a basket of global mining firms.

For investors interested in individual miners, we think Rio Tinto is an interesting option. Currently heavily dependent on iron ore for revenue and profit, it is expanding its exposure to copper with copper output from its Oyu Tolgoi mine in Mongolia set to grow to half a million tonnes a year by 2028 making it the fourth-largest copper mine in the world. Additionally, the company has a newlydeveloped process being trialed by its Nuton unit

CONTANGO AND BACKWARDATION EXPLAINED

Most commodities are traded using futures contracts, which entail the purchase or sale of a commodity agreed at a fixed price for delivery on a specified date - typically either one month, three months or six months ahead.

This facilitates the buying and selling of the respective commodity without anyone having to take physical delivery of a tonne of copper (or barrel of oil or bushel of corn, say). Only a tiny fraction of these contracts are actually settled through deliveries, with the bulk instead ‘rolled over’ to the next month and the pattern repeated.

Contango refers to the market condition whereby the price of a futures contract in a commodity is above the spot price (the current market price). The resulting futures ‘curve’ would be upward sloping with prices for dates

which it says can increase the amount of copper it can extract.

Rio’s current chief executive Jakob Stausholm had to address some serious ESG (environmental, social and governance) failings early in his tenure and this means the company may well be ahead of the curve on an issue which is growing in relevance for the sector.

In the small-cap space, Central Asia Metals (CAML:AIM) has a copper operation in Kazakhstan (Kounrad) alongside a zinc-lead mine in Macedonia.

Commenting on the company, Berenberg’s Richard Hatch says: ‘We think there is further upside for this cashed-up, high-yielding producer, underpinned by two consistent operations in the lowest quartile of their respective cost curves. With net cash of $57 million as of December 2023 (zero debt) and a FCF (free cash flow) yield that is set to rise from around 8% in 2023 to a three-year forward average of circa 14%, we envisage upside in additional shareholder returns beyond the current 6% dividend yield.’

Investors looking for development upside, albeit with significantly more risk attached, could look at Anglo Asian Mining (AAZ:AIM). It has a target to produce 36,000 tonnes per year of copper by 2028 as it develops new projects in Azerbaijan.

The company has been hit by lower production from its Gedabek gold mine in the country as the government restricted the use of the existing

further in the future trading at ever higher levels.

Backwardation describes the reverse - where futures are trading below the spot price –often because of short-term tightness in the underlying market. Arguably contango is a more natural state as it reflects costs of ownership such as storage and insurance.

Because contracts are rolled over to avoid taking delivery of the physical asset, contango sees returns diminished, a phenomenon known as ‘negative roll yield’. Meanwhile, backwardation sees returns enhanced due to a ‘positive roll yield’.

It is worth pointing out these phenomena are more pronounced and prevalent in energy markets than they are in the metals market, but they can and do occur.

tailings dam (containing the waste material from mining operations) which lies downstream of the Gedabek town and mine. This has put pressure on the share price but management are hopeful of a resolution soon.

1

What can I invest in and how do the relative risks stack up?

Investment returns can vary a lot year to year but average out over longer periods

This is the first in a series of articles focused on the fundamentals of investing. Don’t worry if you are relatively new to investing because the series starts at the very beginning and explains what investing is, how it works and is intended to provide a useful framework for thinking about investing.

The series is not exclusively for beginners and later on it will include more advanced features such as how to analyse company results in under five minutes and the difference between ROE (return on equity) and ROIC (return on invested capital).

This article explores the types of investments available and how they differ in terms of return potential and riskiness.

First, it is important to emphasise investing is a long-term endeavour. Whether investing for a child’s school or university fees or your own retirement, the timeframe should be more than five years and ideally more than 20 years.

There are good reasons why investing works better over longer time-frames and future articles will touch upon the key ideas and benefits of developing a long-term mindset.

WHAT IS INVESTING AND WHAT CAN I INVEST IN?

Investing involves laying out cash today and therefore delaying consumption in return for receiving a larger sum of money in the future.

The more time investments are given to earn a return, the greater the potential rewards.

The investment landscape can appear overwhelming at first, because there are thousands of investment products available. Therefore it’s useful to break the investment universe down into three core components consisting of cash, bonds and equities (also referred to as stocks and shares).

Cash is the safest investment choice but provides the least attractive return potential while shares are the riskiest but offer higher rates of return, Clued up

SHARE BOND

WHAT ARE SHARES AND BONDS?

A share is a unit of ownership in a company which gives the owner a financial interest in a company’s future profits and dividends. Multiplying the total shares outstanding by the share price gives the market capitalisation of the company.

For example, drinks company Diageo (DGE) has roughly 2.26 billion shares outstanding and at the current price of £27.46, its market capitalisation is £62 billion.

Market capitalisation is the stock market’s best guess of the value of a company. In effect, a shareholder has an economic interest in future profit and dividends. Over the longterm share prices tend to follow profits. Therefore, owning shares is based on a presumption that a company will grow profits and dividends over time. However, it is worth adding firms can and do go out of business from time to time which means in extreme circumstances a company’s share price could go to zero.

Alongside the high volatility of share prices, this is the biggest risk to share ownership and

a good reason to diversify as discussed earlier.

A bond is a type of I.O.U. issued by governments and companies in return for a fixed payment called a coupon, which is paid over a fixed term. This explains why bonds are also referred to as fixed-income investments.

Generally, bonds are purchased for steady income rather than capital gains. They are issued at par or 100 and redeemed at par as well. During the life of a bond the price can move up and down as it does with shares and therefore capital gains or losses can be made, but if you hold a bond to maturity there is no capital gain or loss.

Bond prices tend to be less volatile than share prices, and bond income is more secure than dividend income because it is contractual unlike a dividend which is discretionary.

The main risk with bonds is the capital might not be paid back in full at maturity. Governments have the power to raise taxes, which means their bonds are safer than corporate bonds.

and bonds - which are a type of I.O.U issued by governments and companies - are somewhere in the middle.

How much cash an investor puts into each of the three investment types will depend on their individual risk appetite, age and personal financial circumstances.

In general, younger investors and those willing to take greater investment risk may be comfortable investing a bigger proportion in stocks. Older, more conservative individuals may feel more comfortable with a bigger proportion invested in relatively safe bonds and cash.

DIVERSIFICATION

One of the most important ideas in investing is diversification, which means spreading investments broadly rather than putting all your eggs in the same basket. Academics have described the benefits of diversification as the only ‘free lunch’ in investing.

It is better to think about investments as a portfolio or group of companies rather than individual companies. A well-diversified and balanced portfolio will be more resilient to swings in share prices and provide a smoother return.

Education: What can I invest in?

efficiently tracking major indices. Investors starting out should consider index ETFs as a fast and easy way to achieve a diversified portfolio.

For example, the iShares Core MSCI World ETF (SWDA) provides investors with exposure to nearly 1,500 companies across 23 developed countries for an annual charge of 0.2% or just £2 for every £1,000 you invest.

The $74 billion fund is managed by BlackRock, one of the world’s largest asset managers, and tracks the MSCI World Index which is the most widely-followed global benchmark.

Similar products track global bond markets. Investing in individual bonds requires specialist knowledge and an understanding of how they work which means for most retail investors the fund route is not only more convenient but safer for non-experts.

The iShares Core Global Aggregate Bond Index ETF (AGBP) seeks to track the Bloomberg Global Aggregate Bond Index, which is composed of global investment grade bonds, and has an annual charge of 0.1% or £1 for every £1,000 invested.

Once a broad exposure has been achieved an investor can consider adding individual stocks and actively-managed funds. These decisions require research as well as a certain amount of skill and judgement. Consequently, they also add more risk to a portfolio.

There are many investment platforms aimed at the retail investor which give access to the stock and bond markets and provide tools to help with investing and managing a portfolio.

Academics have described the benefits of diversification as the only ‘free lunch’ in investing.”

Diversification is achieved by spreading investments across several industries and sectors, different sizes of companies, and overseas markets. Exchange traded funds or ETFs provide readymade diversification and are good vehicles for

It is worth considering investing through tax-efficient wrappers such as ISAs (individual savings accounts) and SIPPs (self-invested personal pensions) before investing in other types of account because capital gains are free of tax.

In the current tax year an individual can invest up to £20,000 in a single ISA or split the allowance across multiple accounts.

By Martin Gamble Education Editor

By Martin Gamble Education Editor

Material world

Commodities are trading cheaply compared to equities, which may present an opportunity to prepare portfolios for higher and more volatile inflation

“Things last longer than emotions” claimed Madonna in her 80s hit, Material Girl. And it has been an emotional ride for markets in recent months, with disinflation euphoria and hopes of multiple interest rate cuts making way for sticky inflation and interest rates staying higher for longer. Investors are increasingly questioning whether they need more exposure to the material world for a truly diversified portfolio.

The latest data – especially in the US – show that disinflation has stalled. Core CPI rose at a three-month annualised rate of 4.5% in March and core PCE – the measure targeted by the Federal Reserve (Fed) – ticked up to a three-month annualised rate of 4.4%. Both uncomfortably above central banks’ 2% target.

There is a growing risk that inflation will be both higher and more volatile than the market (and the Fed) currently expects. Another uptick would threaten richly valued equity and credit markets but at today’s prices, investors have an opportunity to prepare portfolios for a new regime.

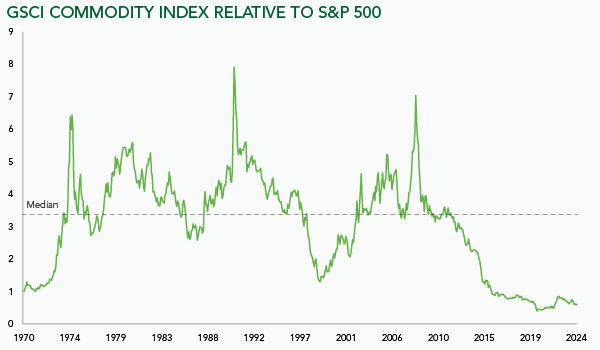

This month’s chart looks at the relative pricing of ‘real’ and ‘financial’ assets over the past 50 years –shown here as the performance of commodities versus US equities since 1970. When the green line is high, commodities trade expensively compared to stocks, and vice versa. On this measure – with history as a guide – commodities are as cheap as they have ever been, even with the strong rally we’ve seen over recent weeks.

Ruffer’s Head of Investment Strategy, Teun Draaisma recently published research which explored asset class performance during inflationary episodes across the US, UK and Japan over the past 100 years. The findings were clear: bonds and equities tend to do badly, and commodities perform very well. In aggregate,

Disclaimer

Source: Refinitiv Datastream. Data to March 2024

commodities had a perfect track record of generating positive real returns during inflation regimes, averaging an annualised real return of 14%. This contrasts with non-inflationary periods when commodities typically produced low single digit returns.

We see the potential for commodities to be a key diversifying asset in a world where 2% is the inflationary floor rather than the ceiling. It’s also worth noting that whilst gold played a role in the broader historical outperformance of commodities, it was found to be unreliable on its own, having returned 13% annualised on average, but with positive returns only two thirds of the time. A diversified basket of commodities appears to be the key. The Ruffer portfolio has 10% in the commodity theme, across oil and gold mining equities, copper and silver bullion exposure (which proved effective through April, rising by around 20%).

So, whilst investors have been loading up on bonds and growth equities in the hope of imminent rate cuts, if interest rates stay higher thanks to a motoring US economy, the next market winners could look very different. But many portfolios appear to be anchored to those assets which worked well during the past two decades of disinflation.

To leave the herd carries risk – a risk many investors are unable or unwilling to take – but one we believe will be vital to successfully navigate the next phase in markets.

Jasmine Yeo, Fund ManagerSubscribe to receive a monthly email containing an interesting chart, plus a short commentary from Ruffer here.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This article does not take account of any potential investor’s investment objectives, particular needs or financial situation. This article reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP which is authorised and regulated by the Financial Conduct Authority in the UK and is registered as an investment adviser with the US Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. © Ruffer LLP 2024. Registered in England with partnership No OC305288. 80 Victoria Street, London SW1E 5JL. For US institutional investors: securities offered through Ruffer LLC, Member FINRA. Ruffer LLC is doing business as Ruffer North America LLC in New York. Read the full disclaimer.

World’s biggest sovereign wealth investor is a fan of UK equities

We lift the lid on Norway’s $1.6 trillion government pension fund

If we took a straw poll of readers and asked which country has the world’s biggest sovereign wealth fund, the chances are Saudi Arabia and Singapore would come high up the list if not at the top.

In fact, the largest is Norway’s Government Pension Fund Global which has a value of more than $1.6 trillion.

When the country discovered large offshore oil fields at the end of the 1960s, the government decided it should use the huge amounts of revenue created by oil and gas energy exports to build a fund to shield the economy from the ups and downs of energy prices.

Also, the government acknowledged that one day its oil and gas would run out, so the fund was created to invest for the long term and ‘safeguard the future’ of the economy.

The fund was created in 1990 and in 1996 it made its first investments – today half the money in the fund comes from oil and gas and the other half is from its return on investment.

The good news is, the managers of the fund, Norges Bank Investment Management, are and have for a long time been fans of the UK market.

HOW DOES THE FUND INVEST?

Ever since inception, and unusually for a pension fund, the Norwegian state scheme has preferred equities to bonds and today stocks account for around 70% of the portfolio.

Amazingly, the fund owns close to 1.5% of all the shares in listed companies worldwide with holdings in 9,000 different businesses and large exposure to the US.

In 2023, the fund posted record profits bolstered by big gains on its tech holdings including Alphabet (GOOG:NASDAQ), Amazon.com (AMZN:NASDAQ), Microsoft (MSFT:NASDAQ) and Nvidia (NVDA:NASDAQ)

The next largest asset type is fixed income, which makes up 27.1% of the portfolio. The greatest share

Top 10 global equity holdings

is held in government bonds, but the fund also invests a portion in debt issued from the corporate sector.

In addition to equities and fixed income, the fund invests in unlisted real estate and renewable energy infrastructure, generating rental income.

This part of the portfolio is small but covers 890 investments globally, mainly in the office and retail sectors. Between 2012 and 2022, these investments grew over eight-fold, including a 25% stake in London’s Regent Street, one of the city’s busiest shopping districts with over 7.5 million visitors annually.

Finally, the fund lends to countries and companies which generates a steady flow of income.

HOW HAS THE FUND PERFORMED?

In 2023, the fund gained 16.1% in Norwegian krone to NOK15.76 trillion or $1.45 trillion, led by a 21.3%

return on its equity investments, while its fixedincome holdings gained just 6.1% by comparison, its renewable infrastructure investments returned 3.7% and its unlisted real estate portfolio lost 12.4%.

As well as an outstanding performance by US tech stocks, the depreciation of the Danish krone against several of the main currencies helped lift returns.

In the first quarter of this year the fund did better still, registering a 6.3% return (over 25% annualised) taking its total value to NOK17.9 trillion or $1.625 trillion.

The equity portfolio returned 9.1%, while fixed income returned -0.4%, unlisted real estate returned -0.5% and renewable energy infrastructure posted an 11.4% loss, but once again the weak krone had a positive effect.

Despite the distinctly lacklustre returns on its infrastructure investments, the fund has signed two new deals this year for a total of more than €500 million to increase its exposure to solar plants and onshore wind generation in Spain and Portugal.

Reinforcing its ‘green credentials’, every so often the fund excludes certain companies from its investment list, presumably with the idea that exclusion will force the firms in question clean up their act.

The most recent companies to be excluded are Hong Kong-based Jardine Matheson Holdings (JAR) and Jardine-controlled PT Astra International ‘due to unacceptable risk contributing to or being responsible for severe environmental damage’, while Israeli conglomerate Delek was excluded late last year due to an ‘unacceptable risk of contributing to or being responsible for serious breaches of ethical norms’ due to prospecting for oil offshore of West Sahara.

WHICH UK STOCKS DOES THE FUND OWN?

At the end of last year, the fund owned shares in more than 330 UK companies with a total market value of around $69 billion making the UK the third-biggest market behind the US and Japan in terms of size of investment.

UK holdings run the gamut from private equity firm 3i (III) to specialty chemical maker Zotefoams (ZTF) and vary in size from a $6 billion-plus stake in oil giant Shell (SHEL) all the way down to a $500,000 holding in appliance safety control maker Strix (KETL:AIM)

10 UK Holdings

UK sector exposure

In terms of sectors, the fund’s biggest exposure as of last December was in financial stocks with a combined investment of $12.9 billion, from a $4.3 billion holding in HSBC (HSBA) down to an $80,000 holding in emerging market bond investor Ashmore (ASHM)

Interestingly, the next-biggest exposure is industrials where the fund holds just under $10 billion worth of shares in 80 companies, the highest number of stocks in any UK sector, including significant exposure to engineering through companies such as Halma (HLMA), Melrose (MRO), Rolls-Royce (RR.) and Spirax-Sarco (SPX).

Also, alongside its exposure to unlisted real estate, the fund has big positions in half a dozen UK real estate companies including a 25.2% voting stake in Shaftesbury Capital (SHC) worth over $800 million, a 9% stake in Segro (SGRO) worth more than $1.25 billion and an 8% stake in student accommodation provider Unite Group (UTG) worth over $460 million.

Disclaimer: The author owns shares in Halma.

By Ian Conway Deputy Editor

By Ian Conway Deputy Editor

Should I overpay my student loan?

The pros and cons of paying off your university debts more quickly

The cost of going to university has ballooned, and it means the average graduate leaves university with around £50,000 worth of debt. That’s a large sum to pay off, and the way the student loan system has changed means that many people will have this debt for 40 years before it’s wiped out.

The debt doesn’t work like typical debt, as you only repay it once you earn more than a set threshold – meaning that if you lose your job you won’t have to repay the debt each month. It also won’t affect your credit report in the same way as credit card or overdraft debt, for example.

BIG DRAIN ON INCOME

But because you repay it at a rate of 9% of your earnings over the salary threshold, it can represent a big drain on your income. For example, someone who graduated university last year who earns £30,000 a year would repay £20 a month on their student loan. If those earnings rose to £50,000 they’d be paying off £170 a month in loan repayments – or more than £2,000 a year.

If you had some money stashed away, would it be better to overpay your student loan to pay off the loan when you graduate? In reality that’s a fiendishly tricky question to answer and depends on a lot of variables – many of which are unknown. It all depends on your starting salary, how much of a pay rise you see over your career, whether you take any career breaks or whether you work part time at any point. It also depends what future governments do with the interest rate you pay on the debt and the threshold for repayments.

Frustratingly for graduates they can’t look into the future to see what their earnings will be and whether it’s worth repaying the debt early. However, there are some helpful rules of thumb.

REAL BENEFIT FOR HIGH EARNERS

If you know that you’re going to be a high earner, then paying off the loan when you graduate could save tens of thousands of pounds in interest charges. For Plan 2 loans, for those who started university between September 2012 and July 2023, a starting salary of around £40,000, that gradually increases over the next 30 years, is the tipping point where you’ll end up repaying the same amount that you borrowed.

That means for any salaries higher than this you’ll pay off more than you initially borrowed (see tables). But there is a huge gamble involved — a career break, a drop in pay, a move to part-time working or a period where your salary plateaus could tip the balance the other way.

For Plan 5 loans, for those who started university last year, the repayment terms are different. There’s a higher salary threshold when you start to repay the loan, but a lower interest rate and a longer repayment period, as the loan isn’t wiped out until after 40 years (rather than the 30 years for the previous system).

It means that the tipping point is a starting salary of around £30,000, where you’d repay the same amount as the original loan you took out. Again, you have to bear in mind any career breaks or reductions in income you might received during your working life.

Plan 2 loan: for those starting university from 1 September 2012 and 31 July 2023

Plan 5 loan: for those starting university after 1 August 2023

Based on £50,000 of student loan debt. Assumptions: Assumes RPI inflation of 3%, and that the repayment threshold rises by 3% a year. Assumes the graduate's salary increases by 3% a year and that they

Table: Shares magazine • Source: AJ Bell

OTHER USES FOR THE CASH

Another factor to consider is what else you could do with that money. The average student debt is around £50,000 so if you were in the (perhaps unlikely) position of having a pot worth £50,000 available to use you could invest it instead. If you instead invested that £50,000, getting a 5% return a year, you could grow that pot considerably over time. After 10 years it would have grown to almost £81,500 and after 15 years it would be worth almost £104,000. That is a significant pot of money to use, whether that’s buying a first property, for retirement or any other purpose. Alternatively, if you wanted to save for a first

property you could drip-feed the £50,000 into a Lifetime ISA account. You can pay in up to £4,000 a year, but the money gets a 25% boost from a government bonus. It would take you just over 12 years to put the whole £50,000 into a Lifetime ISA, but at the end of that period it would be worth just over £83,500, assuming returns of 5% a year. That’s a significant house deposit for anyone getting on the property ladder.

By Laura Suter AJ Bell Head of Personal Finance

By Laura Suter AJ Bell Head of Personal Finance

BECOME A BETTER INVESTOR WITH

SHARES

MAGAZINE HELPS YOU TO:

• Learn how the markets work

• Discover new investment opportunities

• Monitor stocks with watchlists

• Explore sectors and themes

• Spot interesting funds and investment trusts

• Build and manage portfolios

Time to follow the money

This big factor is often ignored when central bankers note the causes of inflation

The American financial markets writer and publisher Jim Grant once observed that: ‘Successful investing is having everyone agree with you …. Later.’ This makes perfect sense, as it distils the concept of going against the crowd to buy cheaply and then sell expensively to lock in the gain and the initial thesis is now the consensus view and thus reflected in the valuation.

However, this column does wonder whether there may be one instance, at least, where following money flows could be useful. It can be found in the field of macroeconomics and the trend in question is growth in money supply, because it might just be the most reliable indicator when it comes to fathoming where inflation goes next.

And if investors have a view on where inflation goes next, they can formulate a view on where interest rates go next and if they have a view on interest rates then that can help to forge their strategy when it comes to a whole host of asset classes, ranging from equities to bonds to commodities to cash and cryptocurrency.

MONETARIST MEMORIES

The University of Chicago’s Milton Friedman is seen as the leading exponent of monetarism, a theory whereby the quantity of money (and its velocity) is a key factor in the rate of inflation. Margaret Thatcher, encouraged by Alan Walters and Keith Joseph, latched on to the concept when she became Conservative Party leader in 1975 and as a team, they applied it with rigour during her term as prime minister from 1979 to 1990.

The initial results were government spending cuts, soaring interest rates and – detractors would argue – a recession and lofty unemployment. Supporters will argue that the long-term benefits were huge decreases in the rate of inflation, a problem that had bedevilled the 1970s, and an economic boom that only hit the buffers in the early 1990s.

Successful investing is having everyone agree with you …. Later.”

But now Bank of England governor Andrew Bailey talks of being data dependent, with a particular focus on jobs and inflation. Similar noises come from Jay Powell and the US Federal Reserve.

This seems odd when a clear case can be made that the monetary and fiscal stimulus applied during

the Covid pandemic had a major role to play in the subsequent spike in inflation, on both sides of the Atlantic.

PRICE AND SUPPLY

Note how zero interest rate policies and quantitative easing (QE), when coupled with government borrowing, drove double-digit percentage year-on-year growth in the supply of money in America and the UK.

Basic economics teaches us that the price of something goes down when its supply increases, especially when the supply increases a lot.

The same applies to money. More of it was created during the pandemic, to stave off a feared economic meltdown. But there is no such thing as free money and now we have to foot the bill, in the form of higher taxes and debt repayment (reduced money supply), higher interest rates and quantitative tightening (reduced money supply) or higher inflation (reduced value of money). It is not an appetising list, but we are where we are.

NOTHING TO SEE HERE