UK’S HOTTEST FUNDS

Is their popularity deserved?

Is their popularity deserved?

Now more than ever, investors want to know exactly what they’re investing in.

abrdn investment trusts give you a range of carefully crafted investment portfolios – each built on getting to know our investment universe through intensive first-hand research and engagement.

We deploy over 800 professionals globally to seek out opportunities that we think are truly world-class – from their financial potential to their environmental credentials.

Allowing us to build strategies we believe in. So you can build a portfolio with real potential.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

06 US bank results highlight divide between Wall Street and Main Street

07 Weaker-than-forecast second-quarter GDP adds to pressure on Chinese leaders

08 Burberry shares tumble to 10-year low on latest profit warning

09 Capita shares rally 40% following strategic rethink and software sale

09 Shares in drinks firm Diageo hit three-year lows as sales stagnate

10 2024 has seen quite a revival of fortunes for consumer goods giant Unilever

11 Microsoft primed to kick-start Big Tech earnings season

12 Data keeps traders guessing as to timing and scope of rate cuts

GREAT IDEAS

13 The Gym Group’s expansion plans could yield big returns UPDATES

16 Why Trustpilot shares can continue to rise this year

FEATURES

18 A Melrose by any other name should smell just as sweet

19 COVER STORY

UK’s hottest funds Is their popularity deserved?

28 EDUCATION

Revealed: the pros and cons of active and passive management

30 DANIEL COATSWORTH

How Nike and Schweppes messed up and let rivals eat their lunch

34 FINANCE

What are T-bills and why they might hold appeal for investors?

36 EDITOR’S VIEW

Does the FCA’s new listing regime really offer better protection for investors?

38 ASK RACHEL

What happens to my pension if I die before 75 and what are the tax implications?

40 INDEX

Shares, funds, ETFs and investment trusts in this issue

1

Do the most popular funds deserve their blue-chip reputation?

We look at some of the most widely-held funds on investment platforms and ask whether they are doing a good job for investors or if there is a need for improvement.

2

How competition from new (and old) rivals can derail big brands

Companies with dominant market shares can often become complacent and overlook the threat to their business from young upstarts and rejuvenated rivals alike.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

3

Why investors are excited about the prospects for a new ‘mini-Melrose’

The Rosebank Industries float has generated even more of a buzz than Raspberry Pi in anticipation of more stellar returns from the team behind the ‘buy, improve, sell’ model.

ME Group International on track to

Consumer sentiment fell to an eight month low according to the latest survey

Big US banks kicked-off the second-quarter earnings season on Friday (12 July) and despite earnings largely coming in ahead of Wall Street expectations, the share prices of JPMorgan Chase, (JPM:NYSE), Citigroup (C:NYSE) and Wells Fargo (WFC) all ended the day lower.

The results showed a widening divide between the rude health of Wall Street and a struggling Main Street with the former boosting investment banking and wealth management income while consumer lending income was more subdued.

Covid-19 stimulus packages have hitherto helped insulate most Americans from higher inflation but there are increasing signs lower-income households are starting to feel the pinch.

Citigroup’s chief financial officer Mark Mason noted customer account balances were now below pre-pandemic levels and US consumers were more cautious leading to slower spending.

Net income at the bank’s consumer lending division, which includes credit cards, slumped 74% driven by a higher cost of credit which jumped to $2.3 billion from $1.5 billion and was only partially offset by higher revenue and lower costs.

Growth in cards issued on behalf of retailers such as Costco (COST:NASDAQ) dropped to 6% from 18% in the prior quarter.

In contrast, Citi’s investment bank saw revenue jump 38% year-on-year to $1.63 billion driven by strength in debt capital markets issuance and an increase in IPO (initial public offering) activity.

Group EPS (earnings per share) grew 14% to $3.2 billion or $1.42 per share billion, beating analysts’ estimates of $1.39 per share. Citi is half-way through a major restructuring exercise where it has promised to cut as many as 20,000 jobs by 2026.

JPMorgan also noted weakness in its lessaffluent customers with a ‘little bit’ more evidence of some rotation away from discretionary into nondiscretionary spending which is a traditional sign of consumer weakness.

The company set aside $3.1 billion in bad and doubtful loan provisions against future credit losses, 62% more than the first quarter.

The country’s biggest lender reported a record quarterly profit of $18.15 billion or $6.12 per share, up 25% on a year ago, as investment banking and equity trading smashed expectations.

Stripping out one-off effects including an almost $8 billion gain from selling its stake in credit card company Visa (V:NYSE), the bank’s net income was up less than 1% to $4.26 per share, marginally above consensus estimates of $4.19.

Unlike smaller regional banks, JPMorgan has benefitted from being able to attract deposits despite being slow to increase interest paid on customer deposits as interest rates rose.

Even so, net interest income, which is the difference between what the bank earns on loans and what it pays on deposits, increased 4% to $22.9 billion. [MG]

So far, China’s Year of the Dragon hasn’t brought investors a great deal of prosperity with the Shanghai Shenzhen CSI 300 index of Chinese shares up by less than 3% against a 15% gain for the FTSE World Index.

Recent data also suggests the economy is slowing with second-quarter GDP (gross domestic product) only rising by 4.7%, its slowest pace for five quarters and well below economists’ forecasts for a 5.1% increase.

Retail sales rose 2%, their slowest pace since December 2022 and also well below the market’s expectation of 3.4% growth, suggesting Chinese government efforts to encourage consumers and stimulate significant growth have missed the mark.

Dan Coatsworth, investment analyst at AJ Bell said: ‘China’s economic growth continues to disappoint, with the latest GDP figures missing expectations once again.

‘Investors are having to become accustomed to China running in second gear, a far cry from a decade ago when GDP growth was in the 7% region and it was the envy of the world.

‘While 4.7% GDP growth is still better than many

parts of the world, and certainly streets ahead of what the UK is currently managing, it is seen as failure in the context of China’s bold ambitions to be a superpower.’

The collapse and subsequent slowdown in the Chinese property sector hasn’t helped either – the property industry accounts for approximately 70% of household wealth.

New-home prices in major Chinese cities fell for the thirteenth straight month in June.

Last year, property developers Evergrande (3333: HKG) and Country Garden (2007:HKG) fell into liquidation and in May this year Beijing relaxed mortgage rules and urged local councils to buy up unsold homes to bolster confidence.

The Chinese government also removed the nationwide mortgage rate floor for individual buyers of first and second homes and lowered the size of down-payments, as well as putting up 300 billion yuan of central bank funding to help state-backed firms to buy unsold properties from builders.

The only bright spots for the Chinese economy at the moment would seem to be industrial production and exports, although China’s strained relations with the US and the EU and the likelihood of more tariffs being introduced could represent further headwinds.

‘The government will need to mull greater policy supports to deliver its annual growth target of around 5% after the disappointing secondquarter data,’ said Xiaojia Zhi, an economist at Credit Agricole in Hong Kong, in an interview with Bloomberg.

‘The increasing likelihood of Trump 2.0 also means China will need additional policy efforts to boost its domestic demand in a timely manner as external demand downside risks loom,’ added Zhi.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Sabuhi Gard) and the editor (Ian Conway) own shares in AJ Bell.

Dividends suspended and chief executive replaced as firm faces tough markets

Shares in luxury goods group Burberry (BRBY) slumped more than 15% to 747p, their lowest level in more than a decade, after the firm warned it could make a first-half operating loss if weakness in its core markets persisted.

In its first-quarter trading update covering the three months to the end of June, the company said its performance had been disappointing due to a luxury market which is proving ‘more challenging than expected’.

Sales during the quarter were down by 21% on a like-for-like basis with Asia-Pacific and the Americas, its two key regions, both registering a 23% drop in revenue, while Europe, the Middle East, India and Africa posted a slightly less painful 16% decline.

As a result, the firm warned if the current trend persisted through the second quarter to September it expected to report an operating loss for the first half instead of a profit as previously forecast.

In light of the situation, the board suspended the dividend for the current financial year and promised ‘decisive action to rebalance our offer to be more familiar to Burberry’s core customers whilst delivering relevant newness’.

It added: ‘We expect the actions we are taking, including cost savings, to start to deliver an improvement in our second half and to strengthen our competitive position and underpin long-term growth.’

In addition to pulling the dividend, the firm let go of chief executive Jonathan Akeroyd and appointed industry insider Joshua Schulman in his place with immediate effect.

Group

US luxury brand Coach (now part of Tapestry (TPR:NYSE)) and most recently chief executive of Michael Kors, which is owned by Capri Holdings (CPRI:NYSE)

Morningstar’s senior equity analyst and luxury goods expert Jelena Sokolova described Akeroyd’s departure as ‘not unexpected given the disappointing results’.

‘Burberry’s issues include having raised prices strongly against a weaker industry backdrop and rather weak brand momentum. New hire

Schulman may pivot the brand towards a more affordable direction, which some market participants have been calling for,’ added Sokolova.

Schulman was previously chief executive of Jimmy Choo in London before becoming president of Bergdorf Goodman, then chief executive of

The UK firm isn’t alone in finding it tough going in the luxury market at the moment. Swiss watch-maker Swatch Group (UHR:SWX) also posted weak first-half sales and earnings sending its shares to a postpandemic low the same day. The maker of Omega, Longines and Tissot watches as well as its namesake brand said sales dropped 14% and operating profit fell 70% due to a slump in sales in China, echoing Burberry’s comments. [IC]

Shares in Capita (CPI) surged after the outsourcing firm announced (9 July) the sale of its standalone software business Capita One to a subsidiary of MRI Software.

Capita One provides software solutions across the UK public sector to local authorities, local education authorities and housing associations. In 2023, the business generated pretax profits of £19 million on revenue of £55 million. The sale will bring in gross cash proceeds of approximately £207 million to Capita, which also expects to receive a cash dividend of £4.8 million.

Year-to-date, Capita’s shares are down almost 10% amid struggles with the strategic direction of the

business. But the stock has rallied more than 40% over one month following the announcement (13 June) of a strategic shake-up of two divisions – Capita Public Service and Capita Experience.

The business process services provider said it will reduce costs and drive efficiency and set out improved medium-term targets, including the delivery of low to mid-single digit revenue growth. CEO Adolfo Hernandez insisted Capita is ‘becoming a leaner and more agile business, delivering services with much greater use of technology, particularly through partnerships with the hyperscalers.’ [SG]

Investors in spirits giant Diageo (DGE) could probably use a stiff drink after analysts at Goldman Sachs downgraded the stock to sell and cut their target price from £31.50 to £24.50.

The shares have already lost more than 10% this year, against a 7% rise in the FTSE 100, due to concerns over sales in the US and the Caribbean and a less than resounding welcome for the new chief executive.

Despite claims by fans such as Nick Train, manager of Finsbury Growth & Income (FGT), that

Diageo is ‘anything but an average company’ and its shares should trade at a premium, the uncomfortable truth is more people – in particular young people – are drinking less as a lifestyle choice.

Studies show young adults (aged 18-34) in the US are less likely to drink alcohol than was the norm a decade or two ago; also, fewer drink regularly, and Gen Z consumes about 20% less alcohol per capita than millennials did at the same age.

Spirits sales obviously took off post-Covid as people entertained themselves at home, then we had

a period of ‘normalisation’, but there is no evidence to suggest consumption will return to historic levels so hopes of a re-rating may remain just that. [IC]

TRADING UPDATES

25 July: Paragon Banking, Vodafone

INTERIMS

19 July: Capricorn Energy

23 July: SThree

24 July: Breedon, Primary Health Properties, Unite Group

25 July: AstraZeneca, Centamin, Howden Joinery, Lloyds Banking Group, Rentokil Initial, Sound Energy, Unilever

After a positive first-quarter trading update which helped power the shares to a 16% gain year-to-date all eyes are on Unilever’s (ULVR) first-half update on 25 July.

In the three months to March, the group reported 4.4% underlying sales growth with a positive performance in all five divisions led by Beauty and Wellbeing where growth topped 7% during the quarter.

Moreover, the firm’s ‘Power Brands’, which account for 75% of group sales, notched up growth of 6.1% led by Dove, Knorr, Rexona and Sunsilk.

New chief executive Hein Schumacher said the company was ‘implementing the Growth Action Plan at speed, focused on three clear priorities: delivering higher-quality growth, creating a simpler and more productive business, and embedding

a strong performance focus’. By doing fewer things better and with greater impact, Unilever has gone some way to answering its critics, but the board is still highly conscious of the presence of several activists including Trian Partners on the shareholder register.

Last week it was reported the company planned to cut up to a third of all office jobs in Europe, meaning the loss of up to 3,200 roles, by the end of 2025.

No doubt investors will press the group for more detail both on its operating performance and its future plans when it reports next week. [IC]

The starting gun has sounded for the second-quarter US earnings season but expect the excitement level to climb next week when big tech firms start reporting, with Microsoft (MSFT:NASDAQ) among the first out of the gate on 23 July.

These results will be crucial as there’s a great deal riding on whether the AI (artificial intelligence) runners, which have driven most of the gains for US markets this year, can keep the pace hot.

If the Big Tech company beats Wall Street’s expectations, this will mark eight consecutive quarters that earnings have topped estimates having missed only once (in fiscal Q4 2022) in the last five years.

In April, Microsoft guided investors to expect another strong performance albeit a tad weaker than some analysts had projected.

The primary segment to monitor is Intelligent Cloud, renowned for its leadership in AI through its Azure cloud platform, where revenue growth is seen around 19% to 20% in the fourth quarter allowing for some impact from AI capacity availability.

Microsoft’s finance chief Amy Hood predicted $64 billion in total revenue for the fiscal fourth quarter, which would be a touch light compared to the $64.4 billion consensus according

to Investing.com, while market expectations are for $2.93 of earnings per share.

Microsoft has been increasing its capital expenditure to secure Nvidia (NVDA:NASDAQ) graphics processing units for training and running AI models, which is surely a sensible move, but keep an eye on PC market unit volumes too, which could throw off some surprises.

QUARTERLY RESULTS

19 July: American Express, Halliburton, Schlumberger, Travelers 22 July: Cadence Design, Nucor, NXP, Universal Health Services, Verizon 23 July: 3M, Alphabet, Coca-Cola, CoStar,Danaher, Freeport McMoran, General Motors, General Electric, Hasbro, Kimberly Clark, Lockheed Martin, Microsoft, Mondelez, Philip Morris, Tesla, Texas Instruments, Visa 24 July: Apple, AT&T, Boston Scientific, Chipotle Mexican Grill, Ford Motor, General Dynamics, Hilton Worldwide, IBM, Qualcomm, ServiceNow, UPS, Waste Management 25 July: AbbVie, Amazon, Dow Chemical, Honeywell, Intel, Linde, Mastercard, Royal Caribbean Cruises, Starbucks, VeriSign

Fed confidence is growing that inflation is on its way to the 2% goal

They say a week is a long time in politics, but even a day can be a long time in the markets as we found out on Tuesday.

After last week’s lower-than-expected June US inflation print, traders loaded up on bets the Federal Reserve would start lowing interest rates to the point where a 25 basis point or 0.25% cut in September was fully priced-in by Friday’s close.

When, on Monday, Fed chair Jerome Powell said the recent economic data had bolstered the central bank’s confidence that inflation was heading towards its 2% target, paving the way for near-term easing, two cuts were being priced in by Christmas.

Except that on Tuesday, US core retail sales rose by more than expected, and because central banks are so ‘data-dependent’ even the slightest deviation from the script can cause the dollar and bonds to jump around and bets to be unwound.

As for the UK, the Labour party has inherited an economy which is far from rude health but has skirted a hard landing, and the IMF (International Monetary Fund) has just upgraded its forecast for growth this year from 0.5% to 0.7%.

In terms of rate bets, two-year gilt yields here have actually gone below 4% for the first time this year and grocery price inflation fell to 1.6%, its lowest level in three years, encouraging traders to price in two 0.25% rate cuts before the end of the year.

In Europe, the ECB (European Central Bank) is expected to leave rates on hold when it meets today so economists and analysts will look for clues in the commentary on when the next cut is likely.

Next week brings several keenly-watched industrial surveys, where the focus will be on services and service prices, which look to be the last obstacle to concerted rate cuts, as well as US second-quarter GDP (gross domestic product) which is expected to show a mild slowdown from the 1.4% expansion seen in the first quarter.

Over three quarters of members live within a three-mile radius of their gym

GYM Group (GYM) 137.8p

Market Cap: £219.8 million

Shares in low-cost, no-contract gym operator The Gym Group (GYM) are languishing 55% below pre-pandemic levels despite the firm seeing a recovery in site profitability and growing its estate by 40% since 2019.

In recent months the business has got itself back in shape and appears to be building strong growth momentum with like-for-like sales up 9% in the first half of 2024 leading management to raise its fullyear 2024 profit guidance.

In March 2024, the company announced an accelerated site acceleration programme aimed at opening 50 sites over the next three years funded entirely from free cash flow.

We believe the depressed price offers an attractive risk/reward investment opportunity with the shares trading on a free cash flow yield of 12% based on Liberum’s estimates.

This low valuation could also attract a competitor or private equity buyer given the business trades around 15% to 20% below replacement cost, which looks anomalous given the strong track record of sites generating returns on invested capital of around 30% on average.

The Gym Group operates 237 sites in the lowcost gym sector which is the only segment of the wider exercise market displaying growth. Low-cost gyms have increased by almost four-fold over the last decade according to a 2024 companycommissioned report by PWC.

Based on population growth, expansion of health and fitness and low-cost gyms entering wider catchment areas, PWC identified potential for a further 600 to 850 sites in the low-cost segment

from 756 currently.

Management has identified the key characteristics of high-returning sites which are those in Greater London and urban residential locations. With a favourable rental market persisting and cost inflation abating, new sites are performing well against expectations.

The company is focused on yield management, which means getting more customers through the doors and increasing retention rates through targeted digital marketing.

Memberships reached a record 905,000 in

the first half of 2024 while average revenue per member per month increased 9% to £20.44. The group increased the average headline rate of a standard membership by 8% in December 2023, but it still remains £2 per month cheaper than competitor PureGym.

Management sees scope to lower the price gap and improve yield by focusing on profitable promotions and increasing premium membership penetration, which grew to 31.7% in the half year from 30.7% at the end of 2023.

The company has a three-tier pricing model starting at £13.99 a month giving it flexibility to optimise price and enhance yield.

A 2023 study commissioned by the company showed consumers perceive it offers a highvalue service at a low perceived price which demonstrates the company’s strong value-formoney proposition.

The Gym Group’s major advantage is its low labour intensity and high asset efficiency. For example, the company operates with just one or two staff for each of its sites and has built strong technology solutions to make a visit to the gym easier and more fun.

It doesn’t provide any wet facilities, which means no swimming pools, saunas or steam rooms. There are also no social areas or coffee machines, which means the company achieves higher revenue density and improved efficiencies.

Adding further to efficiencies compared with traditional gyms, its customers can use the facilities

24/7 which opens the gyms to a wider segment of society, for example shift workers, taxi drivers and participants in the ‘gig’ economy.

Looking at the cash a business generates is more important than scrutinising profit, and with The Gym Group it is even more essential because the firm spends a lot of money up front to open and equip new sites.

Currently, high depreciation charges related to a growing estate and amortisation of leases are acting as a headwind (roughly £73 million) to reported pre-tax profit numbers. As the estate matures, these should turn into tailwinds.

The business is highly cash-generative, delivering £33 million of free cash flow in 2023 equivalent to 16% of revenue after charging £10.3 million for maintenance capital expenditure.

A key performance measure used by the company is adjusted EBITDA LNR (earnings before interest, tax, depreciation and amortisation less normalised rent) which was £38.5 million in 2023. Liberum estimates adjusted EBITDA LNR will reach £54.8 million by 2026 representing annualised growth of 12.5% per year.

Optically, The Gym Group looks to be quite indebted but most of that is related to property leases. Non-property net debt (£54.6 million) to trailing EBITDA (£38.5), a measure of leverage, is a conservative 1.4 times, and Liberum forecasts this ratio will drop to one times EBITDA by 2026 as net debt shrinks and profit grows. [MG]

MAGAZINE HELPS YOU TO:

• Learn how the markets work

• Discover new investment opportunities

• Monitor stocks with watchlists

• Explore sectors and themes

• Spot interesting funds and investment trusts

• Build and manage portfolios

Over the last 12 months the shares have topped the mid-cap leaderboard

On 18 January, Shares suggested Trustpilot (TRST) shares ‘could easily surge past 200p this year and far higher over time.’

Fast-forward six months and shares in the online review platform have already topped the 200p mark despite a short bout of profit-taking after a positive set of first-half results.

So far, it has been another great year for Trustpilot with its review platform now hosting more than 213 million consumer reviews of businesses and products across more than 893,000 websites.

The company estimates posts are growing by more than one review per second and the platform generates almost nine billion monthly online impressions.

The online review platform said recently it had notched up 19% growth in first-half bookings to $118 million.

We remain positive. The online review platform is innovative and progressive, releasing new product features which provide businesses with AI (artificial intelligence) driven insights into customer behaviour and market dynamics, and feedback has been positive.

The company expects first half revenue to grow 17% in constant currencies to $100 million and to achieve strong cash generation, with net cash sitting at $76 million after completing an initial $20 million share buyback.

This strong cash position obviously means there is potential for further share repurchases, although management hasn’t so far hinted it is looking at a new buyback programme.

Trustpilot chief executive Adrian Blair is sticking

Chart: Shares magazine • Source: LSEG

with his earnings guidance though: ‘As we look ahead, we remain confident in the significant growth opportunities available to us in our focus markets of the UK, US, Germany and Italy, and beyond.

‘The combination of new sales and an improvement in net dollar retention, supported by product innovation, underpins our confidence to reiterate our guidance of mid-teens constant currency revenue growth and margin improvement for the full year.’ [SG]

New listing Rosebank aims to repeat the success of the former FTSE 100 star

Hot on the heels of the UK election and the float of Raspberry Pi (RPI) comes another highly-anticipated UK IPO (initial public offering), this time on AIM. Rosebank Industries (ROSE:AIM) placed 20 million shares at 250p last week raising £50 million, yet as it stands the company has no assets, revenue or profits – instead it is a holding company set up to buy, improve and sell other companies.

If that ‘buy, improve, sell’ model sounds familiar, it is because Rosebank was set up by two of the former founders of Melrose Industries (MRO), Simon Peckham and Christopher Miller.

Together with David Roper, who isn’t involved with the new venture, Peckham and Miller took Melrose’s market value from £13 million when it listed on AIM in 2003 to £12 billion in 2020, in the process handing back $8.3 billion of capital to investors and generating a staggering 3,400% total return.

Those investors will be hoping the dynamic duo can repeat the process at Rosewood, where the model is to buy industrial businesses with an enterprise value (market cap plus net debt) of up to $3 billion suffering from temporary distress, fix them up and sell them on for a handsome profit.

Even though the firm’s only asset is cash, the

The company has been set up by part of the original Melrose management team who coined the phrase ‘buy, improve and sell’”

placing was heavily oversubscribed as institutions scrabbled to own a slice of a business linked to individuals with a strong track record of success.

The shares soared to a 98% premium on the first day of dealing and jumped another 55% the following day valuing the business at almost £150 million or three times its worth pre-IPO.

Joining Peckham and Miller at Rosebank are four more Melrose alumni including finance director Matthew Richards, and the firm is chaired by Justin Dowley who currently chairs Melrose and Scottish Mortgage (SMT).

Using the same strategy they employed at Melrose, where the average return on equity for businesses sold was 250%, the Rosebank team aim to double their money on each deal in three to five years.

Trevor Green, head of UK equities at Aviva Investors, summed up the appeal: ‘The company has been set up by part of the original Melrose management team who coined the phrase ‘buy, improve and sell’, a model which they successfully delivered on for over a decade.

‘Their clear strategy has been a scarcity in the UK market as very few other managements have been so explicit in their intentions, which unsurprisingly has led to strong international investor support.

‘As shareholders in their new vehicle we await with interest their first move. Track records matter and theirs is a very long and illustrious one of creating shareholder value.’ [IC]

By Ian Conway Deputy Editor

Funds can often be in vogue with investors thanks to a big-name manager or a past reputation, but just how well-earned is the popularity of the UK’s most popular funds and investment trusts?

In this article we’ve taken a look at the performance of a select group of funds which regularly feature among the most bought and most widely-held in the market to judge whether they are truly delivering the goods.

The table shows our selection, their annualised returns over one, three and five years and which quartile they sit in. As a reminder, quartile rankings provide a measure of how well a fund has performed against all other funds in its category, with rankings ranging from ‘Top Quartile’, often referred to as ‘First Quartile’, to ‘Fourth Quartile’ or

‘Bottom Quartile’, over various time periods.

Put simply, if a given fund category has 100 funds each quartile will be made up of 25 funds. The 25 funds with the highest returns will belong to the top or first quartile, while the next best 25 funds will inhabit the second quartile and so on.

We discuss some of the names at either extreme performance-wise in more detail below, looking at three whose long-term performance still stacks up, two which have struggled of late and two which have underperformed even on a decade-long view.

The emphasis on how managers have done over the long run is important though. All stock pickers will underperform at some point, what’s important is they remain true to their process and don’t fall victim to ‘style drift’ when it’s not working.

of Allianz Technology Trust (ATT) and Polar Capital Technology Trust (PCT) have rallied hard this year, up 35% and 34% respectively year-to-date.

Both aim to capture structural technology growth themes through their stock selection, things like AI, cloud computing, cybersecurity, online commerce and much else, although there are differences.

Polar has a larger portfolio (about 100 stocks) whereas Allianz is more concentrated, typically owning around 40 companies, which gives retail investors the choice of greater diversification or heightened exposure to tech winners, depending on your preference.

THESE TWO SPECIALIST investment trusts are arguably retail investors’ easiest route into the exciting technology space without buying individual stocks, an area which has come to dominate growth generation and many portfolios’ asset allocation.

That AI (artificial intelligence) chip champion Nvidia (NVDA:NASDAQ) is the largest holding for both is a major reason why the share prices

With the discount to NAV (net asset value) of both trusts still trailing 15% to 20% below their long-run averages there is scope for further rerating, potentially driving strong share prices gains through the rest of 2024 and beyond as underlying portfolio valuations rise driving discounts to narrow.

DISCLAIMER: The author owns shares in Allianz Technology Trust and Polar Capital Technology Trust.

and partly due to the managers’ track record of successfully picking winning stocks using their highconviction, bottom-up research process.

THERE AREN’T MANY investment trusts trading at a premium to NAV (net asset value), but as of last week shares in JPMorgan Global Growth & Income (JGGI) were priced 1.1% above the value of the portfolio. This is partly down to the trust’s popularity

Five of the top 10 stocks are members of the ‘Magnificent Seven’ – Amazon.com (AMZN:NASDAQ), Apple (AAPL:NASDAQ), Meta Platforms (META:NASDAQ), Microsoft (MSFT:NASDAQ) and Nvidia.

As of the end of May, these five holdings accounted for over quarter of the portfolio, making the trust another way to play the AI (artificial intelligence) theme.

Demand for shares – not just from retail investors but also from large wealth managers –has been so strong this year the trust has been issuing new stock at a premium to NAV. Also, as it grows, it becomes a natural ‘home’ for other funds, not just internally (it is in the process of absorbing JPMorgan Multi-Asset Growth & Income (MATE)) but also externally where trustees are looking for a change of manager, as was the case with Scottish Investment Trust. [IC]

Market cap: £11.55 billion

SHARES IN THE EVER-POPULAR growth fund have staged a modest recovery this year as talk of interest rate loosening has bolstered risk appetite, but it may take that rate cut talk to turn into action to power a further rally with the market largely tagging September for the US Fed’s first move.

For most of this century, long-term investors have backed Scottish Mortgage (SMT) to the hilt, enjoying a string of successes, including stakes in Amazon, Tencent (0700:HKG) and Tesla (TSLA:NASDAQ) long before the rest of the market caught on.

It is a run which has made Scottish Mortgage a foundation stone of thousands of private investor portfolios, powering the trust into the FTSE 100.

During the three years to 31 December 2023, the shares lost 32.8%, according to manager Baillie Gifford, versus a 28.7% gain for its FTSE All World Index benchmark, and even lead managers Tom Slater and Lawrence Burns admit the trust is not for everyone.

A big part of that underperformance came from Scottish Mortgage’s appetite for owning stakes in private companies, which are notoriously difficult to value especially during dry spells for funding rounds and an IPO (initial public offering) drought.

In a bid to narrow the discount to net assets the trust announced a £1 billion share buyback, but clearly there is work still to do – the discount is currently 9.2% against a long-run average of 6%. [SF]

Disclaimer: The author owns shares in Scottish Mortgage.

Market cap: £22.7 billion

FROM ITS INCEPTION in 2010 to the end of 2023, Fundsmith Equity (B41YBW7) has racked up a cumulative gain of 550%, meaning if you had invested £10,000 on day one, by last Christmas you would be sitting on £65,000.

If you had put your £10,000 in an MSCI World tracker instead, you would still have done nicely but your pot would be £43,167, and if you had bought bonds it would be worth just £12,800.

On a one-, three- and five-year view though, while it has still made money for investors, the fund has struggled to keep up with its benchmark.

The obvious reason for this, particularly over the last 12 months, is the dominance of the ‘Magnificent Seven’, which to illustrate the point powered 46% of the advance in the MSCI World index in the first half of 2024 with Nvidia alone accounting for 25% of the gains.

While the managers are happy owning Apple, Meta Platforms and Microsoft, they have side-stepped Nvidia as they aren’t convinced the outlook is as predictable as they would like.

As the fund’s Owner’s Manual says, short-term comparisons aren’t very helpful and even a year is too short a time to measure performance as it doesn’t reflect the business cycle. [IC]

Disclaimer: The author owns shares in Fundsmith Equity.

Shares magazine • Source: LSEG

CAPITAL GEARING TRUST (CGT) boasts a strong long-run record of protecting shareholders’ funds, having delivered an NAV (net asset value) total return of more than double the rise in the consumer price index (CPI) over the 10 years to March 2024.

The wealth preservation specialist has disappointed more recently, however, with bottomquartile performance over one, three and five years due to an overly-cautious stance on equities as global stock markets roared higher.

In the year to 31 March 2024, the fund delivered a muted 1.8% NAV (net asset value) total return which was ‘far from satisfactory’ according to managers Peter Spiller, Alastair Laing and Chris Clothier given CPI’s 3.2% rise and the MSCI AC World’s 21% advance over the same period.

The managers remain wary of valuations in the US, particularly mega-cap tech, but see exceptional value in investment trusts where they have increased the fund’s exposure with wide discounts meaning the outlook for trusts is ‘the most attractive that it has been for years’.

On the plus side, Capital Gearing’s ultradiversified multi-asset portfolio, which includes exposure to index-linked bonds, should offer protection in the event of future market shocks.

Moreover, share buybacks, which were temporarily restricted last year due to an administrative error, should ensure the 1.9% discount doesn’t widen from here. [JC]

Finsbury Growth & Income Trust

Shares magazine • Source: LSEG

ANOTHER POPULAR TRUST now showing fourthquartile performance over one, three and five years is Nick Train’s Finsbury Growth & Income (FGT), a concentrated portfolio of quality growth companies, which have encountered stiff headwinds amid high inflation and rising interest rates.

Despite significant share buybacks, the trust’s discount has widened beyond the board’s 5% target, standing at 8% at the time of writing.

Train, who uses a bottom-up stock-picking approach to find ‘excellent companies that appear mostly undervalued’, has apologised to shareholders for three years and more of underperformance.

Returns have lagged the benchmark FTSE AllShare as sizeable holdings such as Diageo (DGE) and Burberry (BRBY) have dragged on performance along with the absence of oil or mining shares and the fund’s insufficient exposure to technology or companies well-positioned to exploit technology.

However, Train believes there is ‘tremendous value building in the portfolio’ and has increased exposure to companies with first-class data or technology assets by adding new holdings such as Experian (EXPN), Rightmove (RMV) and Fevertree Drinks (FEVR:AIM), while upping exposure to data, analytics and software companies already in the portfolio.

Falling inflation and rate cuts would be a tailwind for Finsbury Growth & Income, which as Investec notes, delivered spectacular performance between 2008 and 2020 with a NAV total return CAGR (compound annual growth rate) of 14.4% versus a benchmark total return CAGR of just 5.1%. [JC]

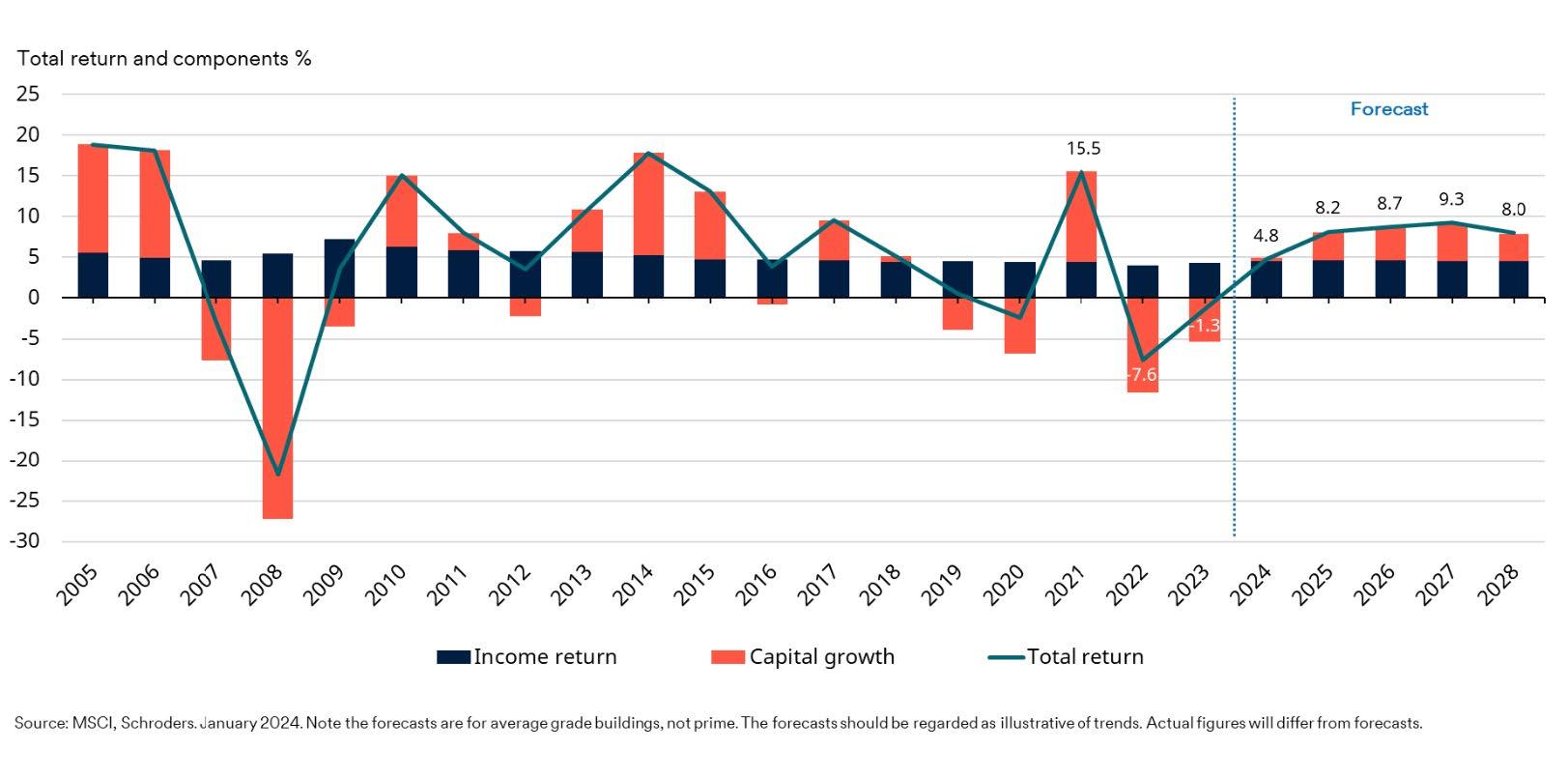

The UK real estate market has undergone a substantial correction and now appears to be stabilising, with capital values in some sectors such as industrials, already starting to recover. While uncertainties around inflation and interest rates persist, the market is well-positioned for a gradual, but sustainable, recovery.

After a challenging 2022, the UK real estate market demonstrated renewed resilience in 2023 and there are encouraging signs that this stabilisation may mark the start of a recovery as we move through 2024 and into 2025. Following the publication of Schroder Real Estate Investment Trust’s (SREI) annual results earlier this month, we explore the outlook for the UK real estate asset class and the SREI portfolio in particular.

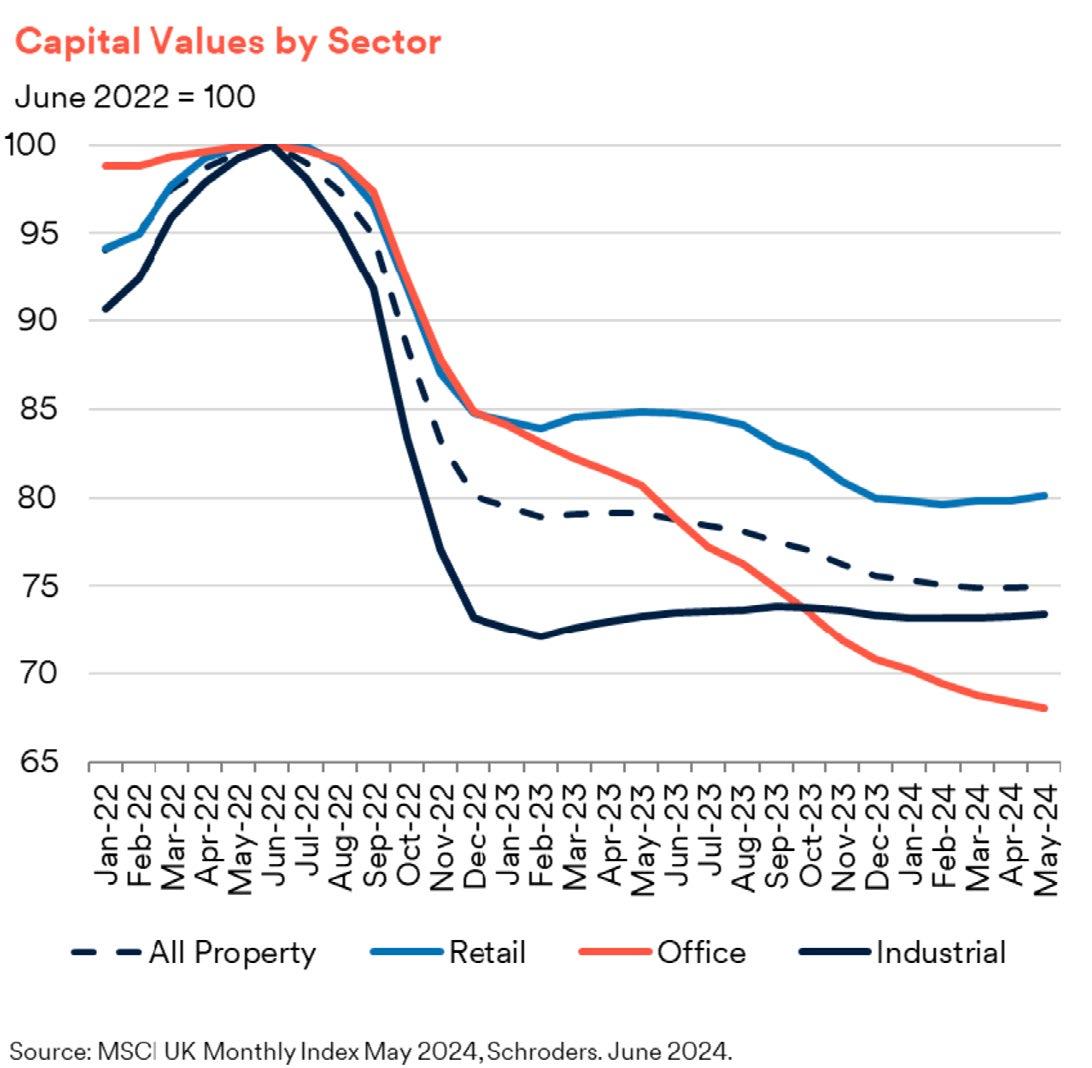

Following the market’s recent peak in June 2022, average UK real estate values have fallen by approximately 25%, with SREI’s underlying portfolio value falling by 18% over the same period1. Though significant, this correction is less severe than the declines seen in previous downturns, such as the 44% average market peak-to-trough decline experienced during the 2007-2009 global financial crisis and the equivalent 27% decline seen during the recession of the early 1990s.

As the chart on the right illustrates, the majority of the correction occurred in 2022, with signs of resilience emerging in 2023, particularly in sectors such as industrial property, where capital values have already started to modestly recover in the first half of 2024.

Disclaimer: Past performance is not a guide to future performance and may not be repeated.

Turning to SREI specifically, a favourable sector allocation and stronger income return contributed to a positive net asset value total return of 1.1% in the year to 31 March 2024. In particular, the Company’s overweight exposure to the industrial sector, which is almost entirely multi-let industrial estates, was a key

1 Schroders to 31 March 2024. Past performance is not a guide to future performance and may not be repeated.

driver of outperformance. Active asset management also made a positive contribution to performance across all sectors, including our ongoing efforts to improve the sustainability performance of assets to benefit from the growing demand for green buildings and the higher rental income that accompany it.

For example, the investment to improve the sustainability characteristics of the Stanley Green Trading Estate in Cheadle, Manchester has added value for shareholders, and we are now embarking on similar “brown-to-green” projects for assets such as the University of Law Campus in Bloomsbury, London and the Churchill Way West Retail Warehouse in Salisbury.

The strong income performance and continued rental growth allowed a 4% increase in SREI’s dividend for the year. Importantly, this dividend is fully covered by earnings. A further increase of 2% has been announced for the quarter ended 31 March 2024, and the dividend now stands 10% above its pre-pandemic level.

An unusual characteristic of this cycle has been the presence of continued rental growth. In previous downturns, rents have tended to decline, as evidenced on the left-hand chart below. In this cycle, however, rental values have continued to increase. This has been most noticeable in structurally supported sectors such as industrial, retail warehousing, rental housing, prime offices, and operational assets such as self-storage and hotels, where there have been relatively low levels of new supply coming on to the market, and where demand has remained relatively resilient. This is evidenced for industrial on the righthand chart below.

Overall, we view the presence of rental growth as an encouraging sign that the UK real estate market is better placed now than in other recent cyclical recoveries. Together with the potential for future beneficial yield adjustment, UK commercial property looks well placed to deliver above average long-term total returns, which should in turn encourage capital flows back to the sector. Indeed, there are already signs of renewed private equity interest in the asset class, and banking markets are starting to open up, which could stimulate increased activity from a broader range of investors.

Interest rates have a direct influence on the cost of borrowing, so they are always relevant to real estate investors. When interest rates are rising, as they were in 2022 and 2023, the higher cost of borrowing inevitably impacts activity in the sector, which in turn can weigh on capital values. Conversely, if interest rates are being cut, this should stimulate more activity and lead to a more attractive environment for real estate investors.

Importantly, most market commentators now believe that we are at the peak of the rate cycle, and there are widespread expectations that interest rates can be cut now that inflation looks under better control. This would imply a more favourable environment for real estate markets in the period ahead.

Nevertheless, we should point out that inflation has

Disclaimer: Past performance is not a guide to future performance and may not be repeated.

remained more stubborn than many had predicted, and it might therefore be too early to start predicting an imminent turn in the interest rate cycle. Further increases in interest rates look unlikely, however, and stability in the cost of borrowing could be enough to drive improved sentiment towards real estate. In other words, we don’t necessarily need to see lower interest rates for the asset class to deliver positive performance. The absence of further rate hikes should be enough to support a gradual recovery in the coming years.

The UK real estate market has undergone a substantial correction and now appears to be stabilising, with capital values in some sectors such as industrials, already starting to recover. While uncertainties around inflation and interest rates persist, the market is well-positioned for a gradual, but sustainable, recovery. As the chart below demonstrates, we believe UK real estate can deliver attractive returns in the years ahead, driven

by supportive fundamentals such as rental growth, a lack of supply in large parts of the market and an expectation that capital will start to return to the sector.

In the meantime, the SREI portfolio is performing well, particularly when compared to its peers. The portfolio is well placed to continue to benefit in this environment due to its exposure to higher growth sectors, the presence of low-cost long-term debt and our ability to add value through positive active asset management. Indeed, the strategic evolution that we announced in December 2023, which places sustainability at the centre of our investment proposition, will involve significant investment and active management, and should enhance the trust’s long-term total returns.

We are confident that, in combination, these factors should allow SREI to outperform a rising market in the years ahead.

• Interest rate risk - The fund may lose value as a direct result of interest rate changes.

• Credit risk - A decline in the financial health of an issuer could cause the value of its bonds, loans or other debt instruments to fall or become worthless.

• Currency risk - The fund may lose value as a result of movements in foreign exchange rates.

• Liquidity risk - The fund is investing in illiquid instruments. Illiquidity increases the risks that the fund will be unable to sell its holdings in a timely manner in order to meet his financial obligations at a given point in time. It may also mean that there could be delays in investing committed capital into the asset class.

• Market risk - The value of investments can go up and down and an investor may not get back the amount initially invested.

• Operational risk - Operational processes, including those related to the safekeeping of assets, may fail. This may result in losses to the fund.

• Performance Risk - Investment objectives express an intended result but there is no guarantee that such a result will be achieved. Depending on market conditions and the macro economic environment, investment objectives may become more difficult to achieve.

• Property development risk - The Fund may invest in property development which may be subject to risks including, risks relating to planning and other regulatory approvals, the cost and timely completion of construction, general market and letting risk, and the availability of both construction and permanent financing on favourable terms.

• Real estate and property risk - Real estate investments are subject to a variety of risk conditions such as economic conditions, changes in laws (e.g. environmental and zoning) and other influences on the market.

• Concentration risk - The company may be concentrated in a limited number of geographical

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as

regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the company, both up or down, which may adversely impact the performance of the company.

• Gearing risk - The company may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

For help in understanding any terms used, please visit www.schroders.com/en/insights/invest-iq/investiq/ education-hub/glossary/

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor. co.uk. Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www. schroders.co.uk/investor or on request.

amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

What investors need to think about when comparing trackers with other types of fund

Amajor development in retail investing in recent years is the increased availability of vehicles which simply look to track the performance of a market. Thanks to their low cost, these passive funds have proved very popular and drawn money away from actively managed funds, where a professional stock picker makes the investment decisions. In this article we flesh out what active and passive investing are and discuss their respective advantages and disadvantages. Most research suggests the majority of active managers fail to beat the market but there are some notable exceptions.

Active investment involves a fund manager selecting stocks, bonds, property, and other assets with portfolio weightings which match their investment objectives.

The aim of active management is to outperform a benchmark, for example a specific stock market index. The investor pays a fund manager a fee to do this. Typically, the figure to look for is ongoing charges which can vary from around 0.5% or lower in some cases all the way up to 1.5% and beyond.

The way funds levy charges may vary so it is

important to check the fund factsheet or contact the fund provider to uncover what the fees are in total.

Charges can reflect the management style, the asset classes being invested in and/or the prestige of the fund manager. It can also reflect the amount of money invested in a fund. Funds with lots of assets can usually afford to reduce ongoing charges in percentage terms.

Paying a higher fee to a fund manager doesn’t necessarily mean they will perform better in the long term. Paying out a high fee can have a significant impact on returns – as the crude example below shows – and this can really stack up over time.

Passive investment is where an investor buys a product such as an ETF (exchange-traded fund) or tracker fund based on a specific index. For example, a FTSE 100 tracker fund will track the performance of the top 100 companies.

While ETFs dominate the passive investing space there are traditional funds which also track an index for similarly competitive costs. For example, Fidelity Index World (BJS8SJ3) provides exposure to global developed market shares for 0.12% which

is lower than the 0.2% levied on the comparable iShares Core MSCI World (SWDA) ETF.

Reflecting the fact that they are simply looking to achieve the return of an underlying market, fees for tracker funds are traditionally lower than those for actively-managed funds. Most passively managed tracker funds charge between 0.05% to 0.85%.

Typically, funds tracking plain indices like the FTSE 100 have much lower fees than those tracking more esoteric markets, assets or themes.

There are several advantages to active investing.

The fund manager will employ an active strategy regularly reviewing the fund’s portfolio, making adjustments as they see fit – for example buying or selling holdings, and monitoring the wider stock market movements - so you don’t have to.

Mark Ellis, fund manager at the Nutshell Growth Fund (BLP46Q1) – an actively managed fund – tells Shares: ‘We carry out regular portfolio rebalancing to uphold our commitment to investing in the highest quality companies at the best price relative to other opportunities.

‘This ensures sustainable performance. Our process is very research, quantitative and relative value trading based, using many tools and methods usually more prominent in the hedge fund arena.’

Ellis adds: ‘Active managers with a consistent process can outperform over the long run, especially boutique funds in the global space. These funds also tend to preserve capital in a risk off environment, as they can have significant exposure to quality companies which tend to outperform, higher cash holdings and also benefit significantly when there is a flight to the US dollar. By definition active share is likely to be higher (Nutshell Growth fund is typically around 90%) which means they could also offer investors diversification benefits.’

‘Passive funds ignore the underlying expected returns, disregard valuation and only rebalance at infrequent intervals. At Nutshell we compare likefor-like across the globe and select stocks which offer exposure to important factors for the best possible price.

‘We sell when expected returns fall due to price appreciation and buy when expected returns

increase. We can react instantly to new company specific news or extreme price action. Active managers can be nimble, allocate more defensively during turbulent times, and increase exposure during bull markets.’

One of the biggest turn-offs for investing through an active fund is the higher annual charges (depending on the type of portfolio the fund manager is running) compared to passive investing. Another disadvantage of active investing is that the investor is very much at the mercy of the fund manager’s performance and their ability to navigate any volatility within the global stock markets. Before you embark on buying an active fund it is worth looking at its performance over at least a five-year period along with that of its managers. Saying that, past performance is not necessarily a reliable measure of future performance. One of the advantages of passive investing through a tracker fund is the lower fees. ETFs also enjoy the transparency of being traded on a stock market. You can see a full list of their holdings and unlike traditional open-ended funds you instantly know the price you’re trading at rather than within 24 hours of making the trade.

This is not an either/or situation: it’s perfectly possible to have some passive funds as building blocks of a portfolio alongside some actively managed funds. But it’s important to keep tabs on any active funds in your portfolio to judge if they are justifying the fees they levy.

By Sabuhi Gard Investment Writer

The biggest brands often draw in investors who believe these giants of industry are surefire winners on the stock market.

Nike (NKE:NYSE) has shown that brand achievements do not always equate to strong earnings and this is a lesson worth remembering if brand strength has ever influenced investment decisions.

Nike has taken its eye off the ball in the sporting shoes market. Two sets of rivals have eaten its lunch – one is a group of upstarts with fresh ideas, the other is playing the nostalgia ticket. Both of these factors are worth exploring individually as they tell us about broader market trends.

There is a danger for big brands in becoming too complacent, believing their strong market position guarantees them sales indefinitely.

Schweppes is an example of this situation whereby it became a giant in mixers for spirits and took its foot off the gas, becoming a sleepy business. Management did not react quickly enough to the appearance of Fevertree Drinks (FEVR:AIM) which pitched its products as the high-

quality alternative.

Fevertree’s marketing strategy was to ask drinkers why they would want to spoil an expensive spirit with a cheap mixer. Fevertree argued its products might be more expensive than the ones people had been buying for years (i.e., Schweppes), but they ensure drinkers were getting quality throughout their gin and tonic, or spirit-based drink of choice. It was a clever move and paid off, with the company quickly grabbing market share and damaging the Schweppes empire.

Nike has now stepped into Schweppes’ shoes where sales growth is becoming harder to achieve. Running shoe brands On and Hoka have successfully branched out from a niche market into the mainstream and they are taking share from Nike. It has become fashionable to wear running shoes for everyday use and their brands are front of mind for shoppers.

Greater choice of products means consumers are no longer gravitating to the core brands which used to be the classic go-to names such as Nike. Normal business behaviour would see the threatened brands produce something new to fight back, but in Nike’s case it has suffered from a lack of innovation.

Making matters worse is a shift in fashion trends and consumers also flocking to brands which had previously been gathering dust, but their moment in the sun has come again. In the trainers market, we have seen a revival for the likes of Asics and New Balance, Adidas’ (ADS:ETR) Samba and Gazelle ranges, and much more. The nostalgia effect extends to other parts of the footwear market such as Ugg boots and the eponymous products from Crocs (CROCS:NASDAQ).

Nostalgia is a powerful force and it is common for things that are two decades old to make a resurgence. This spans beyond fashion – think how many musicians and celebrities from the 2000s are in the spotlight today as people retain a fondness for what they have done and now appreciate them with more respect.

We have also seen the ‘vintage’ tag becoming a powerful way to market products. The phrase ‘second hand’ has morphed into ‘pre-loved’ and ‘vintage’ and these often make something more desirable.

What looks tired and outdated to one person is highly desirable to another, particularly as a new generation discovers the products. Certain people consider modern items to be cringey – they want the classics. In this context, the resurgence in popularity for early-noughties fashion brands makes sense.

A cynic might dismiss Crocs footwear as nothing more than a lump of plastic with holes in it. However, these products are big business. The consensus forecast for Crocs’ 2024 revenue is $4.1 billion.

Having celebrities like Justin Bieber and Kendall Jenner wear Crocs has clearly helped to shift more products, so too has the trend for people to customise their footwear. Crocs’ plethora of holes embedded in its design means individuals can easily add items to their shoes and the company is laughing all the way to the bank.

A 148% share price gain over the past two years also shows how investors have benefited from its success.

Deckers Outdoors (DECK:NYSE) is another company on the stock market generating strong returns for shareholders. Having products which straddle both the young upstart and nostalgia territories, namely Hoka running shoes and Ugg boots, respectively, is a key driver of its success.

Having a bunch of celebrities snapped wearing Hoka shoes has helped, but so has the public’s desire for comfort which is at the heart of the

product design. They have gone from being the footwear of choice for grandad to embraced by fashionistas. Hoka is now one of the most envied footwear brands in the industry and has significant growth potential as clever marketing techniques have increased its appeal to a wider range of people.

The share price performance of Abercrombie & Fitch (ANF:NYSE) might shock investors, a brand certain people associate more with the history books than a current staple of global fashion. A 944% share price rise over the past 24 months tells a different story.

Driving this performance has been a significant improvement in the business and a broadening of its product categories to appeal to a wider age group. It helped that its teen target market in the 1990s is now in their 40s and 50s, an age range where they might have money to spend and a nostalgic fondness of the brand.

EVOLUTION IS NECESSARY Businesses must keep evolving and it feels as if Nike has failed on this count. The shoemaker is now looking for solutions including the launch of lower-priced shoes around the £70 mark. Quite whether that is enough to revive sales is unknown.

It is not the only one feeling the pressure. Big food brand owners like Unilever (ULVR) have

battled competition from supermarket ownlabel products over the past few years as consumers look for cheaper options. They have resorted to shrinkflation –keeping prices stable but reducing the size of the product – to try to stay competitive but it feels like popular products like ice creams and chocolate bars cannot get any smaller.

Even companies already operating at the value end of the market are having to keep one eye over their shoulder at all times. Just look at Shoe Zone (SHOE:AIM) which has historically mopped up the market for people looking for cheap shoes. Now it faces growing competition from the likes of Temu and other Chinese retailers flooding the West with goods.

One could argue this is just the normal course of doing business. But what you need to ensure is that any company in which you have an investment – either directly through shares or indirectly through funds – is alert to the competition and doing something about it. If they are shrugging it off and coming across as either overly confident or simply ignorant to the threat, then it might be time to reappraise that investment.

By Dan Coatsworth AJ Bell Editor in Chief and Investment Analyst

Claire Milverton, CEO

1Spatial is a global leader in providing Location Master Data Management (LMDM) software and solutions, primarily to the Government, Utilities and Transport sectors.

Alex Crooke, Portfolio Manager

The Bankers Investment Trust aims to be a core portfolio holding for its shareholders by focusing on finding the best investment ideas globally in a bid to deliver capital growth and inflation-beating income over the long term. Founded in 1888, the trust has paid a dividend every year and has a 57 year record of raising dividends.

Tim McCarthy, Chairman

Incanthera specially focusses on innovative technologies in dermatology and oncology. Their current focus is Skin + CELL, its luxury skincare brand, utilising groundbreaking formulation and delivery expertise, to bring scientifically proven formulations to cosmetics and unmet skincare solutions.

Anew market is opening up for retail investors, and it may be coming to a broker near you soon. Traditionally the preserve of institutional investors, T-bills offer investors a secure way of storing money in the short term while getting a return in line with current interest rates. So what are T-bills exactly and how do they work?

T-bills are basically short-dated government bonds. They come with a minimum maturity of one day, and a maximum maturity of 364 days, but in reality most T-bill issues have maturities of one month, three months, or six months. Like gilts, they are loans to the government, and so have a very high level of safety, as you are guaranteed your money back unless the UK government defaults on its debt, which is extremely unlikely.

Unlike gilts they don’t come with any income attached, the investment return comes solely from the difference between the price at which the government sells to investors and the redemption price when the government pays them back. So for instance, you might buy a six month T-bill for £98 which will be worth £100 at maturity,

in other words a return of 2.04% (£100 divided by £98) over six months. T-bills are not traded on the secondary market, meaning if you buy one you have to hold it to maturity, so you must be willing to give up access to your capital over this period.

T-bills are auctioned by the UK’s Debt Management Office on a weekly basis, so the price is set by supply and demand through the bids which investors submit. In reality these are likely to reflect other short term interest rates, and so will be heavily influenced by the Bank of England’s base rate. If the Bank cuts the base rate, this will dampen the returns provided by T-bills at auction. However, if you already hold a T-bill, your return isn’t affected as you will still receive the same maturity value.

There is an extremely low chance of the UK government not paying back the money it owes through T-bills, so they are very safe from this point of view. They do come with inflation risk, because inflation might be more than the return provided

by the T-bill, which could mean your money actually losing its buying power. This is common to all fixed interest investments, unless they have a specific inflation link attached.

You also face interest rate risk with T-bills. If interest rates rise just after you have bought the T-bill, the return you’re getting might look less attractive by comparison. However, this risk is mitigated to a large extent by the short-dated nature of T-bills. Ultimately if rates rise, you don’t have to wait too long to get your money back, at which point you can put it to work getting a higher return.

Probably the greater risk for T-bills is reinvestment risk, which is the risk you may not be able to achieve a similarly favourable rate when your T-bill matures. If interest rates fall while you’re invested, at maturity you’ll probably get a lower rate if you roll it over into another T-bill. By contrast, if you buy a government bond which is longer dated you lock into the return for a longer period. Depending on how interest rate expectations move, that could end up being better or worse than the return achieved by buying a series of T-bills.

Many people have been buying low coupon, short-dated gilts in recent years, because most of the returns form these instruments are capital gains, and gilts are not subject to capital gains tax.

It’s important to recognise though that the tax treatment for T-bills is very different. They are taxed as what are called ‘deeply discounted securities’ which means that returns are taxed as income, even though intuitively they look like capital gains. So you will potentially be subject to income tax on your return. Happily though, T-bills can be held in a stocks and shares ISA where the gain can be harvested tax free.

T-bills are an interesting addition to the retail market and an extra tool for investors to keep in their armoury. As ever though it’s important to make sure you understand the ins and outs of an investment before parting with your money.

By Laith Khalaf AJ Bell Head of Investment Analysis

featuring AJ Bell Editor-in-Chief and Shares’ contributor

Dan Coatsworth

UK stocks soar on election landslide, Fed comments excite markets again, Nike’s big stumble

Enforcing the existing rules would be preferable to bringing in new ones

In an effort to encourage more companies to float on the London Stock Exchange, and presumably encourage more people to invest in them, the FCA (Financial Conduct Authority) has unveiled a new listing regime which comes into force at the end of July.

The rules – described by the FCA as ‘Big Bang 2.0’ in a nod to the reforms of the mid-1980s – are weighty, running to nearly 200 pages, and we at Shares can’t claim to have read them in full, but they do indeed represent the biggest change to the regime in more than three decades.

So, what are the key points? For starters, instead of Standard and Premium listings there will be a single, ‘streamlined’ listing process with fewer eligibility requirements to make it easier for companies to join the market.

The UK will also move to a ‘disclosure-based’ system where rather than companies having to put big decisions before shareholders for them to vote on, the FCA hopes they will ‘put sufficient information in the hands of investors so they can influence company behaviour and decide how they want to invest’.

As Lindsey Stewart, director of investment stewardship research at Morningstar, says, the

operative word here is hope.

‘The new listing rules represent a big gamble that cutting red tape for company founders and executives will unleash a wave of new and innovative businesses listing and raising capital in London’, says Stewart.

However, that ‘red tape’ includes a number of long-cherished shareholder protections which are integral to the UK’s culture of strong corporate governance, says Stewart, and a number of institutional investors claim the rollback of these protections would simply attract more companies with inadequate arrangements to the UK market.

‘It feels as if the reforms could make the UK market a riskier place for investors if we get a wave of companies of questionable quality taking advantage of the relaxed rules and listing in London,’ cautioned AJ Bell investment analyst Dan Coatsworth.

‘The FCA even says that access to a wider range of companies may result in increased risk of exposure to individual company failure. Ultimately, the reforms will put a greater onus on investors to do thorough research before making an investment.’

If we want to make the UK a more attractive

investment destination, then rather than watering down the rules to attract lower-grade companies surely we should be tightening the rules on corporate governance to offer better protection to investors, particularly where new and smaller companies are involved.

Along with the ‘de-equitisation’ of the London market as more companies are taken private, there is a steady stream of firms quitting – particularly on AIM – because they claim being listed no longer suits them.

On Monday this week, Destiny Pharma (DEST:AIM) notified shareholders it planned to cancel its listing arguing it stood a better chance of raising funds for clinical trials and product marketing as a private company.

The company already has the backing of 26% of the votes, presumably held by directors and institutions, while minority shareholders have the option to decide on the delisting at a general meeting at the end of the month – which is a case of turkeys voting for Christmas as there will be no official market in its shares, rather there will be a ‘matched bargain facility’.

Shares in the company tanked 65% on the announcement, with more than eight million shares traded compared with an average daily turnover of less than 100,000 as investors tried to salvage something from the dying embers.

According to the Financial Times’ Lex column, more than 100 companies have gone from AIM since early 2020 which is around a fifth of those listed at the start of the decade.

As one reader wrote in the Letters section of last weekend’s FT , ‘The private investor experience of most of these exits from AIM would have, in many instances, offered a significant disincentive to want

Chart: Shares magazine • Source: LSEG

to support this market again.’

The author of the letter was an investor in a firm which delisted over four years ago arguing, like Destiny and at least a dozen more companies we could name which have thrown in the towel this year, that access to capital would be a lot easier away from the glare of public markets.

In practice, writes the investor, ‘further multiple fundraisings have been agonisingly slow, and shareholder updates have been sporadic and partial’ with no consolidated accounts published for four years and no general meetings, while the matched bargain facility was never put in place.

They go on to add: ‘It would be fanciful to conclude the shareholder covenant implicit in the legally verified de-admission circular has ever been met, but the London Stock Exchange, responsible for the regulation of AIM, seems not in the slightest bit interested in following this up.’

Rather than bringing in looser regulation, actually applying the existing rules could do a great deal more to encourage retail investors to support the UK’s push to attract ‘growth companies’ and reinforce confidence in The City.

‘Having invested under AIM’s much-heralded protections and protocols, private shareholders have in effect been abandoned’, laments the investor in closing.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The editor (Ian Conway) owns shares in AJ Bell.

For those approaching their mid-70s there are lots of variables to consider

I am 72 and retired. I am aware that if I die after my 75th birthday my Pension Pot would be taxed as income by my beneficiaries (wife and children).

As this would no doubt incur some 40% liability, would it make sense to draw from the SIPP up to my 20% income tax limit in the next 3 years rather than use other savings such as ISA’s to live off?

I have every intention of spending enough not to fall into the inheritance tax trap by the way. John

Rachel Vahey, AJ Bell Head of Public Policy, says:

One of the more appealing aspects of pensions –particularly as you get older – is the tax advantages pension funds enjoy when a pension saver dies.

For a start, pension funds are usually sheltered from inheritance tax. That is because, unless the member makes a binding nomination, it will be up to the pension scheme to exercise discretion and decide who to pay the benefits to.

Pension savers can nominate whoever they want to receive the leftover pension funds, and pension schemes must consider these nominations together with anyone who was financially dependent on the pension saver.

Nominating someone to receive leftover pension funds also can give them flexibility to take pensions as ‘income’ through drawdown, rather than only as a lump sum. This is useful as beneficiaries can stagger how they take their income – gradually, in

ad-hoc chunks, or all at once – but also because if the pension saver dies before age 75 then payments will always be tax-free.

On the other hand, if they took a lump sum it would only be tax-free up to a point depending on how much the member took as tax-free lump sums throughout their life and how much is paid out on their death.

All pension funds are taxed as income in the hands of the beneficiary if the pension saver dies after age 75, whether the money is taken out as income through drawdown or paid as a lump sum.

That means those who don’t need an income, and survive beyond age 75, have a decision to make – whether to take their pension income out now or leave it in the pension wrapper.

What choice they make depends on a range of factors – whether they can spend or gift the money, who they want to benefit from the pension funds, what other assets they have, and of course tax rates.

If they take the money out, they will pay income tax on it. They could manage their tax affairs to keep that as basic rate rather than creeping up to a higher tax bracket, but then they still need to have a plan on what to do with the money.