WWelcome to Spotlight, a bonus report which is distributed eight times a year alongside your digital copy of Shares.

It provides small caps with a platform to tell their stories in their own words.

The company profiles are written by the businesses themselves rather than by Shares journalists.

They pay a fee to get their message across to both existing shareholders and prospective investors.

These profiles are paidfor promotions and are not

independent comment. As such, they cannot be considered unbiased. Equally, you are getting the inside track from the people who should best know the company and its strategy.

Some of the firms profiled in Spotlight will appear at our investor webinars and live events where you get to hear from management first hand.

Click here for details of upcoming events and how to register for free tickets.

Previous issues of Spotlight are available on our website.

profiles. The latter are commercial presentations and, as such, are written by the companies in question and reproduced in good faith.

Members of staff may hold shares in some of the securities written about in this publication. This could create a conflict of interest. Where such a conflict exists, it will be disclosed. This publication contains information and ideas which are of interest to investors. It does not provide advice in relation to investments or any other financial matters. Comments in this publication must not be relied upon by readers when they make their investment decisions.

Investors who require advice should consult a properly qualified independent adviser. This publication, its staff and AJ Bell Media do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Julian Bishop, Co-lead Portfolio Manager

Brunner Investment Trust (LSE:BUT) Seeking out the best opportunities for growth and reliable dividends wherever they may be, The Brunner Investment Trust invests in companies all over the world. Brunner aims to provide investors with growth in capital and dividends over the long term.

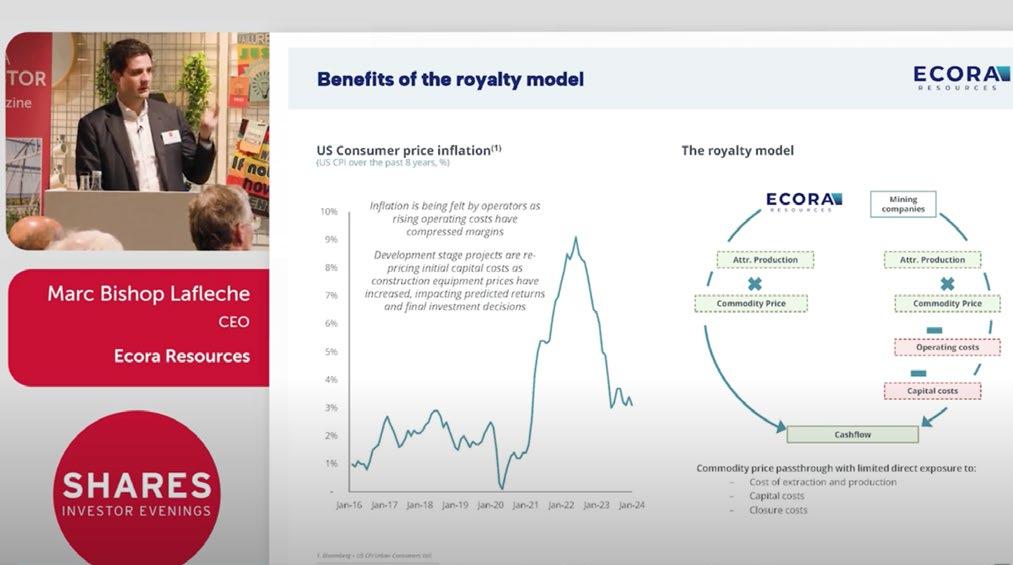

Marc Bishop Lafleche, CEO

Ecora Resources (ECOR) is engaged in obtaining royalties from a diversified portfolio focusing primarily on base metals and bulk materials. It focuses on commodities such as Copper; Nickel; Iron Ore; Gold; Cobalt; Vanadium; Met Coal and Uranium. Some of its assets include Voisey’s Bay; Mantos Blancos; Maracas Menchen and others.

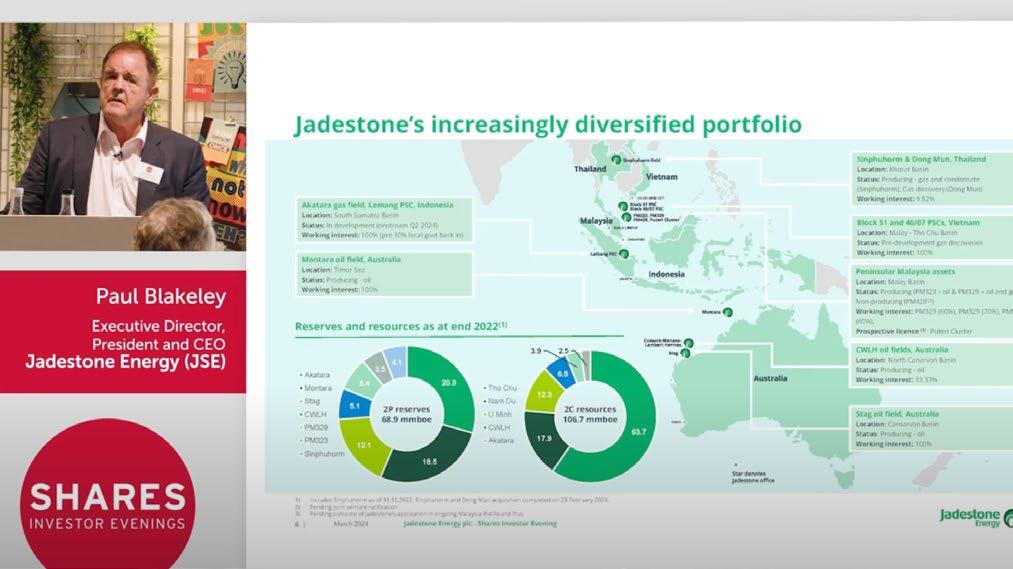

Paul Blakeley, Executive Director, President and CEO

Jadestone Energy (JSE) plc is an independent oil and gas company focused on the Asia-Pacific region. It has a balanced and increasingly diversified portfolio of production and development assets in Australia, Malaysia, Indonesia, Thailand and Vietnam, all stable jurisdictions with a positive upstream investment climate

While people tend to focus on small caps for growth rather than dividends they can be a genuine option as a source of income.

The table shows the top yielding stocks from the AIM 100 index, made up of the 100 largest companies on London’s junior exchange, based on information from Sharepad.

The yield is based on the share price on 20 March 2024.

However, as with any share on the stock market, dividends are not guaranteed payments and so investors must not assume they will always get the predicted level of income when buying the shares.

A high yield can often be a signal from the market that a dividend is likely to be cut.

Polar Capital (POLR:AIM) has a forecast yield of 10.6% and is one of the third highest dividend yielding stocks on the AIM market. For the six months ending 30 September 2023, the fund manager reported a slight fall in assets under management of £19.1 billion due to a ‘challenging period for equity markets.’

Despite this the fund manager reported net inflows into its several of its larger funds.

A bit further down the table is Brickability Group (BRCK:AIM) the construction materials distributor has a forecast yield of 5.3% despite

warning that full year 2024 (earnings before interest taxation depreciation and amortisation) EBITDA would be at the lower end of expectations between £44.8 million to £47.2 million.

Leading pawnbroker H&T Group (HAT:AIM) has a lower forecast yield (than the others mentioned above) of 4.7%. The company reported a strong set of results on 12 March benefiting from an increase in pawnbroking demand and higher gold prices.

The group’s loan book at

the start of 2024 is at a record high. Analysts Shore Capital expect both divisional and group gross profit to soar by 21% this year.

Increased demand for its pawnbroking services stems from the cost-of-living crisis and higher inflation in the UK.

The market cap for these companies varies from £436.4 million for Polar Capital to £199.5 million for Brickability and £172.4 million for H&T.

There are plenty of AIM stocks forecast to pay considerably more than the

FTSE 100’s average 3.75% yield.

However, there can be greater risks of investing for income in the AIM market as many are less mature businesses and do not have diverse revenue streams.

This means a setback in one part of the business can have a larger impact.

The idea behind our investment philosophy is quite simple. We’re living on a planet of around eight billion people – that planet is finite, and its population is growing but also demanding higher standards of living.

The necessary switch to a more sustainable way of running the global economy is being facilitated by new technologies, smart entrepreneurial activity, and government actions to shape new markets.

We describe this as ‘the transition to a more sustainable economy’ in which leading companies are growing rapidly and offering excellent potential investment returns for shareholders. As these trends are often difficult to analyse, there’s a compelling opportunity for an active manager like Impax to offer significant value to asset owners.

Impax has been focused on investing in the transition to a more sustainable economy for more than 25 years, so our team has extensive experience. We were one of

the first investors to identify and classify the investable opportunities within environmental markets in the late 1990s.

Today, with more than 80 investment professionals in the UK, Europe, the US, and Asia, and approximately £40 billion AUM (assets under management), we have one of the largest investment teams dedicated to this area and employ many specialists with deep sector expertise. As this is our sole area of activity, we stand out from mainstream asset managers and as a result have picked up mandates from major asset owners around the world.

Within listed equities we invest in two main areas: thematic strategies, which focus primarily on environmental markets, and our core strategies, which invest in the broader economy using the Impax Sustainability Lens to generate investment ideas.

Environmental markets is where we started as a business: it’s a phrase that Bruce Jenkyn-Jones (Impax’s chief investment officer) and I coined to describe the idea that there’s money to be made solving environmental problems like climate change or water pollution. These strategies make up approximately 60% of our AUM.

About ten years ago we developed the Sustainability Lens to support a second type of investment portfolio that identifies opportunities and risks related to the transition to a more sustainable economy as it affects a wider section of the economy than just environmental markets. The lens underpins our largest strategy, Global Opportunities, which has around £10 billion in AUM.

We have identified fixed

income as a growth area and recently acquired a team of corporate credit specialists based in Copenhagen to complement our existing capabilities. We also have a well-established private markets team investing in new energy infrastructure, which recently closed its largest fund to date.

In my last year as an undergraduate I discovered ‘Our Common Future’, the report of the United Nation’s Brundtland Commission, which coined the phrase ‘sustainable development’, describing how the planet was going to suffer major damage if we didn’t change the direction of economic growth.

With a background in science and a personal interest in the environment, I was inspired to seek a career in this area - a process which took the next decade. Over these ten years, I completed spells as a management consultant (one being in McKinsey’s first environmental strategy team), a second degree in the US and a short

stint as an entrepreneur in the solar sector. In 1998 I founded Impax Asset Management, with our first client being a mandate with the World Bank to set up one of the world’s first solar energy funds.

Probably the most exciting opportunities today are centred on the industrial revolution that’s underway in the energy sector as we move rapidly to adopt clean power generation and zero emissions transportation solutions. In parallel, there’s astonishing potential for information technology and innovations in smart materials to transform the way we provide services around the world.

New technology is also helping to address challenges in the decarbonisation of heat, both low-temperature formats for space heating and higher temperature solutions across industry. This includes the production of steel, as well as cement, where there’s also a need to capture or avoid direct CO2 emissions.

Elsewhere, breakthroughs

in the food and agriculture sector in regenerative farming, smarter logistics and product manufacturing are offering exciting opportunities, while in the financial and healthcare sectors, technology-based solutions are unlocking new markets and enabling better outcomes.

Finally, we all need to pay much closer attention to climate change. We urgently need to raise the resilience of physical infrastructure and overhaul how insurance markets are treating this critical topic, presenting considerable opportunities for investors. Impax is ideally placed to support asset owners as they decide how best to allocate to this trend that is completely reshaping society.

The London Tunnels is a major new heritage and cultural experience in central London.

The company intends to apply for admission on a major stock exchange, as part of its plans to extensively restore, adaptively reuse and bring back to life the Kingsway Exchange Tunnels, near Holborn, originally built in the early 1940s, and designed to shelter 8,000 people during the London blitz.

In collaboration with its leading expert design partners which includes WilkinsonEyre, the practice behind the major restoration and repurposing of London’s Battersea power station, the company will develop the Tunnels through to full commercial launch of what is anticipated to be a major, large-scale heritage, historical and cultural attraction.

The company is ideally positioned to capture the growing global demand for such attractions, with the ability to welcome two million visitors per year post-launch, which is expected in 2027. The company intends to offer a combination of heritage experiences and a cultural, sophisticated, multi-sensory, digital experience.

It is anticipated that the Tunnels will ultimately have a design capacity of approximately three million visitors a year, and that the company will target approximately two million visitors a year to ensure a high-quality experience and to avoid overcrowding.

The content could be based around a single theme or could form a series of continually changing exhibitions.

The technology and the appeal of such experiences can be seen in digital art galleries that have opened around the world over the

last five years. Such galleries present, amongst other things, laser video projections or digital screens of art as part of choreographed sound and light shows, often using historic building interiors as the backdrop.

Ahead of full launch, the company is planning to offer public Explorer Tours, providing guided tours for small groups to see the heritage of the Tunnels in their present condition, enabling early revenue generation.

The Tunnels are over a mile in length located below

Shares Spotlight

London TunnelsHolborn/High Holborn and Chancery Lane tube station in central London, at approximately 30 metres below ground level, and have a rich history as an instrumental piece of London infrastructure.

Constructed by the British as a defence measure during the London blitz, beginning in September 1940, The Kingsway Exchange Tunnels stand as a testament to the resilience and strategic planning of the UK . The Tunnels housed the offices of the special operations executive from January 1944 to May 1945 as the allies prepared for D-Day on 6 June 1944.

The Tunnels are thought to have provided the real-world inspiration for ‘Q-Branch’ from James Bond.

Ian Fleming, with his role as the navy liaison officer to the special operations executive and head of special unit called ‘30 assault unit,’ brought to life many of his real-life experiences within the James Bond novels.

As a contingency measure, the Tunnels functioned as the ’reserve’ war rooms to the cabinet war rooms in case the

cabinet rooms were damaged by bombing during WW2.

Between 1950-1954 the Tunnels were expanded and housed the first operational trans-Atlantic telephone cable, TAT1, between the UK and the US in 1956. This trans-Atlantic cable played a pivotal role as the ‘hotline’ connecting the White House and Kremlin during the Cuban missile crisis in October 1962.

Later, the site was the backup and temporary site of the war control bunker known as ‘Pindar’ which replaced both the cabinet office’s crisis control centre (better known as COBRA) and the central military control room, the defence situation centre. Pindar is now located below the MOD (Ministry of Defence) in Whitehall.

Given the location and historical significance, the Tunnels additionally offer a unique setting for a potential themed attraction, drawing inspiration from blockbuster films or a renowned film studio franchise, with the Tunnels providing a remarkable backdrop.

The company also plans to reactivate what is thought to be the deepest licensed bar

in the UK, offering a unique blend of history, culture, and hospitality.

Developing the site remains subject to planning permission from The City of London Corporation and the London Borough of Camden. Applications for planning permission were submitted to both planning departments on 30 November 2023 and planning permission is targeted for the second or third quarter of 2024.

The London Tunnels team, seasoned investment specialists with a successful record in diverse portfolios, will collaborate with the broader project team to preserve the Tunnels’ heritage while shaping their future purpose. Leading experts in the sector have been engaged for planning, engineering, and design including WilkinsonEyre, WSP, Montagu Evans and Gardiner and Theobald.

Following admission, the company expects to launch an offer to retail investors as soon as practicable, offering them a chance to support and own a part of this unique and irreplaceable heritage and cultural attraction.

The business of Space has arrived, impacting our everyday lives for the better

‘Space is the new industrial revolution- transforming all industries and addressing humanity‘s biggest challenges from climate change to global security; creating a better Earth. With a market forecast to reach $1 trilion by 2030, there is no sector or technology that Space Innovation won’t impact.’

The Space sector is experiencing unprecedented growth and development. In the past few years, we have witnessed significant technical and commercial progress with a new phase of innovation based on the maturing of first-generation disruptive technologies such as reusable launch vehicles and low-cost satellites. Such developments within the industry have enabled the cost to access space to decrease exponentially - by over 100 times in past decades, and it continues to fall with the success of every launch. Leaders like SpaceX are now sending rockets to space over 100 times per annum carrying, in some cases, over 50 satellites owned by private companies. These companies are working across multiple sectors including climate change, insurance,

finance, agriculture and defence, utilising space infrastructure to map, model and manage whole earth ecosystems in near-real time. From terrestrial navigation services to earth observation and telecommunications the business of space is very much now and the ‘digital infrastructure in the sky’ is already impacting our everyday lives.

Today’s new satellite constellations mean it is now feasible to pass over every single point of the Earth every hour, using cuttingedge sensors to capture novel information about the Earth in exquisite detail and close to real time, from the individual object level all the way up to global scale.

These datasets are of an enormous scale, diversity and depth and hold the potential to open up entirely new insights that could transform virtually every sector. Climate change is taking centre stage among global priorities and Earth observation data is playing a crucial role in monitoring the planet. With meteorology heavily reliant on space technology for weather forecasting, space data has also helped us better monitor deforestation and the health of oceans and ecosystems. Satellites equipped with multispectral and hyperspectral imaging sensors can detect and map mineral deposits, oil reserves and vegetation health. These satellites hold the

promise of blanketing the entire world in ubiquitous broadband internet connectivity. With almost half the world’s population still suffering from ‘internet poverty’ through an inability to get online, the pervasive connectivity these systems are expected to offer could have a profound impact by potentially facilitating billions of people joining the global digital economy for the first time.

Together, such universal abundant connectivity combined with the collection of vast quantities of data about every square metre of the planet will deliver capabilities that will power many of the key technologies that will define societal change over the next decade and beyond. Seraphim Space Investment Trust (SSIT) are investing into global scale companies that are creating these new opportunities in these very broad markets, disrupting every industry on the planet.

As the rate of satellites entering space increases, the level of investment has also increased and the entrants matured. According to Bloomberg the global space economy grew 8% to $546 billion in 2022 and is on track to become a trillion-dollar market by 2030, growing 41% over the next 5 years. Even despite the global economic downturn, SpaceTech investment for 2023 remained near an all-time high, with around $7bn in the last 12 months.

Meanwhile, leading countries realise that now is the time when the future of the space economy will be decided and are acting to stake their place and

build up their strength and position in the global space race. Rising geopolitical tensions have brought space technologies to the forefront of the mainstream media, showcasing their importance in preserving life. Sovereign nations desire to develop their own resilience and space capabilities has become of utmost importance, resulting in a surge of Government contracts reflecting the strategic imperative to harness cutting-edge technologies and innovations from New Space companies.

SpaceTech’s key driversclimate change, sustainability and global security - are expected to continue to ignite unprecedented growth in the market, fostering the development and deployment of cutting-edge technologies that facilitate more accurate, independent, globally comparable metrics for monitoring our planet’s vital signs.

According to Seraphim’s research, investment into early stage SpaceTech companies rose by 551 per cent in the last 12 months. Investment into the sector is not just from traditional technology innovation investors like Venture Capital funds but across the whole funding landscape from traditional aerospace and satellite companies to Corporates, Sovereign Wealth funds, Private Equity and large Asset Managers. With the existential challenges posed by heightened geopolitical tensions and climate change, the counter-cyclical nature of the space sector continues to result in its outperformance of the wider market.

The ‘Digital Infrastructure’ is just the beginning. The

microgravity environment of Space gives a unique platform for advancements in other sectors such as life and material sciences. This environment will provide a potential gold mine for new classes of drugs, and novel materials to be developed which could have a transformational impact on verticals like pharmaceuticals, telecoms, and microelectronics. Science fiction is already turning into science fact.

Seraphim Space Investment Trust PLC (the “Company” or “SSIT”) is the world’s first listed SpaceTech fund. It is an externally managed closedended investment company that was launched in July 2021. SSIT seeks to generate capital growth over the long term through investment in a diversified, international portfolio of predominantly early and growth stage privately financed SpaceTech businesses that have the potential to dominate globally and are category leaders with first mover advantages in areas such as global security, cybersecurity, food security, climate change and sustainability . The Company’s shares are traded on the London Stock Exchange.

Source: FE Analytics09 APRIL 2024

NOVOTEL TOWER BRIDGE

LONDON EC3N 2NR

Registration and coffee: 17.00

Presentations: 17.55

Reserve your place now!

A leading fabless chipmaker focused on custom ASIC for OEMs and system houses, as well as IC design services for companies with their own design teams. EnSilica has world-class expertise in supplying custom RF, mmWave, mixed signal and digital ASICs to its international customers in the automotive, industrial, healthcare and communications markets.

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

Sponsored by

Foresight aims to deliver sustainable investment returns to investors alongside strong environmental, social and governance (“ESG”) benefits. The Company pursues its investment objective by acquiring ground-based, operational solar power plants.

A developer and supplier of electricity in the United Kingdom. It is engaged in the purchase, generation, and sale of electricity from renewable sources, the sale of gas, services relating to micro-renewable generation, and the development of new electricity generation sites.

London Tunnels owns the Kingsway Exchange Tunnels the which are the largest set of tunnels designed for people in a metropolitan City in the World. Built by the British to defend the British against Nazi Germany during the London Blitz. The Tunnels are over a mile long and can have an annual capacity of 3m visitors.

The trust offers an attractive level of income as well as the potential for income and capital growth from a diversified portfolio of continental European property in the economically strongest cities.