Edition 54 | OCTOBER 2023 AND POLICE FRAUD WARNING, HMRC TAX CHECKS, FEATURES UK TAXI NEWS ROUND-UP AND MORE THE UK’S #1 TAXI NEWS SOURCE OVER 4.7 MILLION MAGAZINE READS AND COUNTING... TFL: CROSS-BORDER ‘LOOPHOLE’ BEING ‘EXPLOITED’ TRAFFIC COP Q&A LONG GAME VAT WHEN AND WHERE YOU ARE COVERED BY TAXI INSURANCE

TaxiPoint Chief Editor:

Perry Richardson

TaxiPoint Publishing & Advertising Manager:

Lindsey Richardson

Visit us online at: www.taxi-point.co.uk

Write to us at: contact@taxi-point.co.uk

Advertising enquiries at:

advertising@taxi-point.co.uk

The publishers reserve the right to refuse, withdraw, amend or otherwise deal with all advertisements without explanation. All advertisers must comply with the British Code of Advertising practice.

The views expressed in this publication are not necessarily those of the publishers.

All written and image rights are reserved by the author as displayed. Reproduction in whole or in part without prior permission from the publisher is strictly prohibited.

Copyright brand TaxiPoint 2023. Creative Common image licenses displayed where applicable.

FROM THE EDITOR

PERRY RICHARDSON

WHAT COMES NEXT WITH VAT?

Hello and welcome to the October 2023 edition of TaxiPoint.

Over the coming months we’ll be taking a closer look at what comes next for the taxi and private hire sector when it comes to VAT principality following the landmark Sefton versus Uber case.

In this edition we’ve got expert insight on the matter and we’ll be asking all corners for further updates and where the trade heads next.

We’ll also be taking a keen interest in the ‘war on motorists’

over the coming weeks and how a change of heart at government level may help the taxi trade when it comes to access.

We hope you enjoy this month’s edition and we always welcome feedback. You can contact us via email at contact@taxi-point.co.uk

Kind regards and be lucky!

TaxiPoint Editor and Founder

TaxiPoint Editor and Founder

2 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

TAXI CROSS BORDER HIRING

LOOPHOLE IN THE CURRENT LEGISLATION BEING EXPLOITED’ SAYS TFL

Transport for London (TfL) have expressed concerns over potential ‘serious safety risks’ posed to passengers and other road users as a result of limited enforcement and inspection of drivers and vehicles operating outside their licensed areas.

In a recent statement given to TaxiPoint, the capital’s regulator emphasised the need for new legislation to put an end to cross border hiring within the taxi and private hire industry.

TfL have been focused on enhancing regulations within London to prioritise passenger safety. However, the exploitation of a loophole in the current legislation undermines these efforts, distorts the market, and potentially compromises passenger safety, according to the statement.

While acknowledging that cross-border hiring may be lawful under specific circumstances, TfL firmly believes that the potential risks associated with this practice necessitate intervention from the Government.

TfL said in a statement to TaxiPoint: “While lawful in specific circumstances, we believe cross-border hiring potentially presents serious safety risks to passengers and other road users due to the limited enforcement and inspection these drivers and vehicles are subject to when operating outside of the area they are licensed in. Furthermore, we have spent considerable time reviewing and enhancing the regulations in London to ensure passenger safety and to ensure that taxi and private hire services are fit for the diverse city we serve. These regulations are potentially being undermined, the market distorted, and therefore passenger safety compromised by the loophole in the current legislation being exploited.

“As such we have, for a number of years, maintained our position that we would like the Government to bring forward legislation that ensures a journey starts or finishes in the area where a licence was granted, ending cross-border hiring. We wrote a detailed policy paper on this topic in 2018 setting out proposals for change. In 2019, the Government committed to giving this topic consideration and we remain open to working with Government to stop this unsafe practice.”

4 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK ‘

PHV VAT

LONG GAME

JONATHAN MAIN

VAT AND INDIRECT TAXES PARTNER MHA MOORE AND SMALLEY

The imposition of VAT on private hire revenues would be the biggest single increase in the VAT burden since 2010 when the standard rate increased from 15% to 17.5%. It may also disproportionately affect those least able to shoulder the burden.

If you are a private hire operator (PHO), the High Court decision in Uber v Sefton Borough Council (Sefton MBC) could cause VAT to be added to cab fares. Read on to discover what it may mean for you and what you may be able to do about it.

WHAT HAPPENS AT PRESENT?

With the possible exception of account work, a PHO will almost always treat itself as an

agent acting on behalf of the driver for private journeys.

• The PHO will charge a fee to the driver for the introduction of business.

• The self-employed driver will accept the journey at their discretion.

• The driver will agree a fare with the passenger.

• The driver will retain the fare and be liable for any taxes, including VAT.

For private journeys, the PHO’s VAT liability will be limited to fees charged to drivers and fares collected from drivers employed by the PHO.

I THOUGHT THAT UBER V SEFTON MBC CASE WAS ALL ABOUT LICENSING REGULATIONS?

That’s right, it is not a VAT case at all.

Uber succeeded in its argument that Sefton MBC incorrectly licenced PHOs in its borough and that a PHO should in fact be treated as a principal in the provision of the travel service provided to the

6 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

JONATHAN MAIN IMAGE CREDIT: MHA MOORE AND SMALLEY

passenger. Uber used Sefton MBC as a test case for other local councils in England and Wales. Uber lost an earlier decision against Transport for London (TfL), which dealt with separate but similar licencing regulations applying to PHOs licenced by TfL. Having said this is not a VAT case, it is in fact all about VAT and the licencing argument was just a means to an end.

In the TfL case, Uber wished to be treated as an agent and only liable to VAT as set out above. In losing this case, Uber is now a principal in the provision of private hire journeys in London. Consequently, the author understands that Uber now pays VAT on private hire journeys in London and may be litigating a VAT saving strategy in the Tax Tribunal in relation to this VAT bill. The VAT saving strategy is likely to be based on an interpretation of the Tour Operators Margin Scheme (TOMS).

To level the playing field across most of England and all of Wales (there are different licencing regulations in Scotland, Northern Ireland, London, and Plymouth), Uber seeks the same outcome already suffered in London, that a PHO operates as a principal and should therefore pay VAT.

Subject to a successful appeal in the Sefton MBC decision, Uber has succeeded in its endeavours, at least to the extent of licencing.

WHAT DOES IT MEAN FOR ME?

We know two things so far:

• If the PHO acts as agent, it is not liable for VAT on the cab fare.

• Following the decisions in the TFL and Sefton MBC cases, the PHO cannot be an agent in London, most of the rest of England, and Wales.

There is an uncomfortable tension between those statements.

If your licencing authority acts on the Sefton MBC judgment, you can no longer act as an agent. HMRC guidance is clear that a PHO acting as principal must pay VAT on the full fare received by the driver. The driver is acting as agent for the PHO.

As a diligent taxpayer, you cannot use HMRC guidance that does not apply to your circumstances. This would not be a defence against an HMRC assessment nor an argument that would succeed in court.

WHAT CAN I DO?

There are actions which can be taken at an individual business level and more coordinated industry actions to influence the future VAT profile of your sector. The first step is to stress test the profitability of your business model and the practicality of accurate data collection on fares from your drivers.

If you must pay VAT on all fares, is your business still profitable?

If not, can you increase fares and remain competitive?

From a more practical perspective, do you have a reliable means to collect fare data from your drivers, to ensure you pay the right amount of VAT to HMRC?

You may wish to consider the suitability of the TOMS structure implemented by Uber and whether you could lodge similar claims with HMRC.

The imposition of VAT on private hire fares may disproportionately impact those less able to bear the increased cost. That applies both to PHOs operating on tight profit margins and parts of society for whom a cab journey is a necessity. Think about GP and hospital appointments for those unable to take public transport, food shopping for those who cannot afford a car.

7 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

“HAVING SAID THIS IS NOT A VAT CASE, IT IS IN FACT ALL ABOUT VAT AND THE LICENCING ARGUMENT WAS JUST A MEANS TO AN END.”

unable to take public transport, food shopping for those who cannot afford a car.

The Sefton MBC litigation may proceed to the higher courts, potentially including the Supreme Court, which will see this as a matter of significant public interest. In the meantime, you can influence thinking at local and national levels. For example:

• Ask your local council to resist any change to licencing requirements until the outcome of the Sefton MBC litigation.

• Ask your local MP to raise the issue in Parliament.

• Work with trade bodies to ensure they are lobbying HM Treasury (HMT) and HMRC.

The author understands that HMT are considering several options for the longer term. These may include a reduced or zero-rate of VAT on private hire journeys. They may also be open to stalling any changes until the outcome of the litigation in Sefton MBC. At the very least, it is very unlikely that the current administration would wish to hike VAT in such a public way in election year. We can help you better understand the impact of this issue on your business and assist with modelling the impact, optimising profits, dealing with systems changes, and influencing the thinking of HMT and HMRC.

8 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

VAT ARREARS

WHAT

HAPPENS TO TAXI AND PRIVATE HIRE OPERATORS SHOULD THEY BE FORCED TO PAY VAT ON ALL RIDES?

10 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

U

backdated VAT bill is still being disputed after they made an initial £615million backdated VAT payment in 2022. Since then, they have made a second payment amounting to £386million, but they are currently contesting the amount with HMRC.

So far HMRC have taken a strong stance on VAT since the Supreme Court decision was made.

WHAT HAPPENS IF THE OPERATORS CANNOT AFFORD THE VAT ARREARS?

Taxi and PHV operators could soon be facing crippling VAT arrears, but there may be several potential solutions available to alleviate their financial burden say experts from Wilson Field Limited.

Operators can explore various options to address any debts that may arrive if HMRC were to claw back VAT appears.

One such solution, proposed by insolvency experts Wilson Field Limited, is the possibility of repaying the HM Revenue & Customs (HMRC) in affordable instalments. By applying for a Time to Pay Arrangement (TTP), companies can customise a repayment plan that suits their financial capacity. This arrangement can cover outstanding liabilities, including corporation tax, PAYE/NI, and VAT. While TTPs typically last for 6 or 12 months, in certain cases, longer repayment periods can be negotiated if there is a realistic prospect of full debt repayment.

11 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

SO FAR HMRC HAVE TAKEN A STRONG STANCE ON VAT SINCE THE SUPREME COURT DECISION WAS MADE.

In cases where VAT arrears are only a part of a taxi firm's financial problems, operators can opt for a Company Voluntary Arrangement (CVA). This formal repayment plan allows insolvent companies to repay their unsecured debts through monthly instalments at an affordable rate. By including HMRC-related debts, such as outstanding VAT, in the CVA, taxi firms can gain protection from creditor pressure and continue their operations while working on their debt repayment.

For more severe financial distress, experts recommend restructuring the company through administration. This step involves a thorough assessment of the business to identify areas that can be restructured to restore profitability. Parts of the company that cannot be salvaged are sold off, allowing the remaining portions to function in a reinvigorated state.

In cases where recovery is deemed impractical or unachievable, operators may need to consider closing the company through a Creditors Voluntary Liquidation (CVL). This approach ensures an orderly liquidation process, effectively ending the company's operations and providing closure to its outstanding debts. A CVL can potentially generate a better return for the company's creditors compared to a compulsory liquidation carried out by HMRC.

Lastly, depending on the unique circumstances of the taxi firm, directors may have the option to purchase some of the old company's assets at market value and utilise them in a new limited company. Known as 'phoenixing' through a prepack liquidation process, this practice can be controversial but offers benefits when appropriately executed.

As the threat of insolvency for operators burdened by VAT arrears looms, exploring potential solutions now may provide a glimmer of hope. By working closely with experts in insolvency procedures, operators can navigate through these challenging times and possibly emerge on the other side with their financial stability intact.

Kelly Burton, Director & Licensed Insolvency Practitioner at Wilson Field Limited, said via a blog post:

“Following a series of legal proceedings, Uber has had to classify its drivers as employees rather than contractors. Now, there’s a possibility that other ridehailing taxi companies might have to follow suit and add VAT to current bookings, potentially having to backdate it onto historic bookings too.

“This extra cost and liability to HMRC could push some taxi companies into insolvency. If you’re the director of a taxi firm and you’re worried these new liabilities will push your company into insolvency, you should speak to us for free, impartial, confidential advice with no obligation.

“Depending on your company’s circumstances, you may have several options to relieve the debts. Repaying the debts in instalments, either through a Time to Pay Arrangement to HMRC or as part of a larger, formal Company Voluntary Arrangement (CVA), could be a viable solution. If the debts are more severe, restructuring through an administration could be an option, or if the debts are of such a level that recovery isn’t feasible, the company can close voluntarily through a Creditors Voluntary Liquidation (CVL) and draw a line under the debts.”

12 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

“THIS EXTRA COST AND LIABILITY TO HMRC COULD PUSH SOME TAXI COMPANIES INTO INSOLVENCY.”

KELLY BURTON

PC PATRICK

QUINTON TAXI Q&A COP

Policing the taxi industry is never an easy task given the differing work patterns enjoyed by each cabbie. There’s also a plethora of rules and regulations to understand and follow. However, in two regions in England, licensing authorities have an ace card up their sleeves in the form of a ‘Taxi Cop’.

We speak to PC Patrick Quinton, a Taxi Compliance Officer for Avon & Somerset Constabulary, to see how his role helps the south-west community and industry.

HOW DO YOU GO ABOUT BUILDING A GOOD WORKING RELATIONSHIP WITH LICENSED TAXI AND PRIVATE HIRE DRIVERS IN YOUR REGION?

When I started as the “Taxi Cop” 6 years ago it quickly became clear to me that the best way of

supporting the trade and carrying out effective law and licensing enforcement would be to use a “Neighbourhood Policing” approach.

It means I need to be highly visible on the streets, easily contactable, and have good lines of communication with the community. A listening approach means I better understand what drivers have to cope with, the challenges they face and what is important to them. I’ve grown increasingly sympathetic to drivers having listened to what they say.

It’s important to me to build relationships with key contacts, whether that’s the local Taxi Association, the Private Hire Operators or influential drivers. One of the best ways to communicate is the WhatsApp groups I run for drivers. It allows them to privately ask me questions and give information by video and text, and it allows me to share information with them.

14 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE CREDIT: PC PATRICK QUINTON

HOW IMPORTANT IS IT TO HAVE RESOURCES AVAILABLE TO TAXI DRIVERS TO BETTER UNDERSTAND THE RULES AND REGULATIONS THEY MUST FOLLOW, AND HOW DO YOU HELP DELIVER THAT?

Have you seen how detailed and technical Licencing Policy and Conditions often are? It’s a lot for many drivers to understand and follow, so I’ve written a series of Information Sheets for our drivers on many topics such as CCTV, signage on vehicles, runners, and parking in an easy to understand format.

I also use our WhatsApp group to give reminders of what is needed, warnings following Court & Committee decisions and information about offences I deal with. One of the things I’d love to see in the future for the trade is nationally unified Licence Conditions with an easy-to-understand version for drivers – although I suspect that’s as likely as a new law to replace the 1847 and 1976 Acts!

WHAT TAXI ISSUES ARE MOST COMMON IN THE AVON AND SOMERSET AREA?

The Avon and Somerset Police area is a real mix of rural, town and city with the biggest being Bristol. Issues such as runners, illegal plying for hire and offences against drivers are common. I suspect that racial abuse of drivers is very common too, but regrettably it doesn’t often get reported to us. The wider Bristol area is covered by two different Licensing Authorities which can lead to some challenges when their standards differ. Cross border hiring (“out of towners”) is an issue for the trade and causes conflict between drivers, but it’s not so much an enforcement issue, especially since the new law earlier this year and that my police powers allow me to deal with drivers and vehicles immediately whoever they are licensed by. Our crime figures suggest that drivers are far more likely to be victims than perpetrators, but when they are accused of crime it tends to be the more serious offences such as sexual assault. As you’d expect, I also work to keep the peace between drivers!

15 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

DO YOU WORK CLOSELY WITH TAXI DRIVER ASSOCIATIONS AND REPRESENTATIVE GROUPS IN THE INDUSTRY?

I work closely with the Bristol Blue Licensed Taxi Association, and I often approach them for their advice on specific matters or to let them know changes which will affect their members. I’d love to work more closely with the Private Hire drivers who massively outnumber Hackney Carriage drivers, but sadly there is no formal local group to represent them in my area.

NOT ALL POLICE FORCES HAVE A DEDICATED OFFICER FOR TAXI AND PRIVATE HIRE. WHAT PROMPTED SOMERSET AND AVON POLICE TO CREATE THE ROLE AND HOW IMPORTANT HAS IT BECOME IN THE REGION?

Outside of London, it’s just West Midlands and A&S who have full time Taxi Officers. The drivers literally pay my wages: my post is fully funded from their licence fees which is why I tell people I have four bosses – the police, two Councils and the drivers.

It can be difficult to keep everyone happy, but I work hard to try. It’s a bit of a mystery to me why more Councils don’t fund a police Taxi Officer from their licensing enforcement budgets – the added value to all parties is enormous, if sometimes difficult to quantify.

Avon and Somerset Police worked with SARI (Stand Against Racism and Inequality), Bristol City Council and South Gloucestershire Council to create a post to support and protect the drivers and the public following concerns from the trade about what was happening. Our other local Licensing Authorities also benefit from having me in post and we often share information.

One of the things I am most proud of is the support I have from our local drivers, and many of them have relied on me for help and assistance both with law and licensing matters.

WHAT WOULD BE ON YOUR ‘WISH LIST’ AS A TAXI COP MOVING FORWARDS?

In no particular order:

• A new Taxi Act to replace the 1847 and 1976 Acts (I’m available to write it!)

• National (not minimum) Standards, Policy and Licence Conditions

• Private Hire Drivers parking legally and considerately (and not on ranks!)

• A safe shift - every shift - for our hardworking, honest and helpful Hackney Carriage and Private Hire drivers.

16 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE

CREDIT: PC PATRICK QUINTON

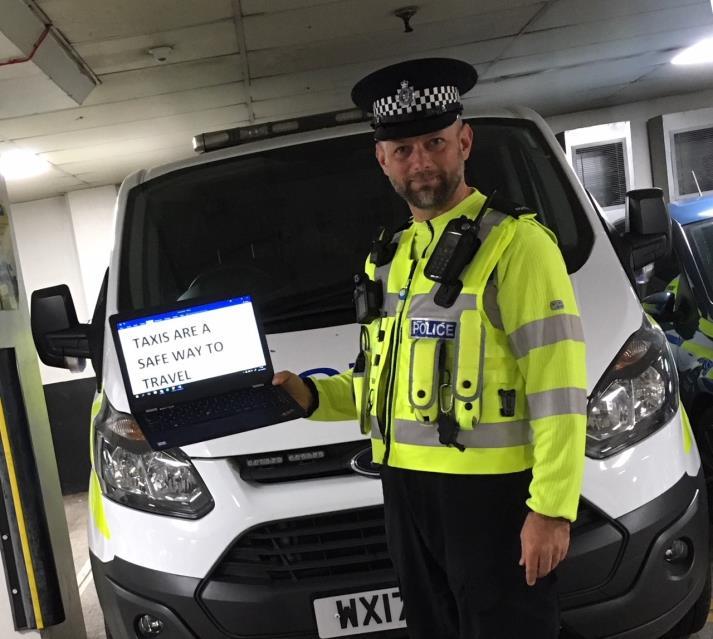

FRAUD WARNING

WEST MIDLANDS POLICE

HIGHLIGHT TAXI DRIVERS PART IN FIGHT AGAINST FRAUD TARGETING

VULNERABLE COMMUNITIES

18 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

closure of numerous branches, fraudsters have increasingly directed victims to withdraw money from Money Service Bureaus (MSBs) like Bureau de Chance and Post Offices. Staff at MSBs often possess less awareness of courier fraud and are therefore more likely to dispense cash without alerting the police.

The impact of such offenses is particularly severe as it disproportionately targets the elderly and vulnerable individuals. Victims may be manipulated into travelling long distances to withdraw money or obtain goods. They are often monitored closely by the fraudsters, resulting in significant financial and psychological distress. This type of fraud is not confined to a specific region but is rather a nationwide concern.

Taxi drivers occasionally unwittingly become accomplices in these crimes, similarly to couriers who transport perpetrators to victims, assist in their transportation, and collect goods or money. Recognising the gravity of the situation, efforts are being made to engage and educate taxi drivers, as well as other public, in the fight against this alarming trend.

West Midlands Police have issued specific requests to the taxi driver community in light of these incidents:

• Stay alert and acquainted with this crime type.

• If requested to transport an elderly or vulnerable passenger to a bank or jewellery store, be cautious as they may have been targeted. In such cases, dial 999 and report a potential courier fraud victim as your passenger.

• Exercise vigilance when transporting individuals to and from local train stations, as they may be couriers. If you suspect you have a courier in your taxi, immediately call 999 to report the situation. Provide details

such as your taxi vehicle index, location, and destination.

Taxi drivers may also contact Crime Stoppers, an anonymous charity that facilitates the submission of reports that do not reveal the informant's identity.

By working collectively, the taxi driver community and law enforcement authorities aim to eliminate this type of fraud and safeguard the well-being of vulnerable individuals not only in the West Midlands region, but across the UK.

Police spokesperson, Shannon Oliver, said: “As the West Midlands Regional Fraud Development Officer, my focus is ensuring both law enforcement and the public take fraud seriously and ensure victims of fraud are safeguarded.

“Fraud has often been perceived as a low-risk crime with limited consequences despite the mounting evidence that fraud is used by Organised Crime Gangs to fund firearms, terrorism and illicit substances. Furthermore, victims are regularly groomed and manipulated, often resulting in them being financially and psychologically abused.

“It is therefore time for us to recognise fraud, including Courier Fraud, as the high-risk crime it is due to the devastating impact it can have on our communities both financially, psychologically and emotionally. With Fraud accounting for more than 40% of all crime in England and Wales, the West Midlands Region (consisting of West Midlands, West Mercia, Warwickshire and Staffordshire Police) are dedicated to tackling Fraud. Our focus is reducing offending and safeguarding vulnerable victims.”

19 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

WHAT IS STOPPING NEW BLACK CAB VEHICLE MANUFACTURER ENTRANTS?

There’s no denying the taxi industry is facing a significant challenge finding more affordable and diverse options for black cab vehicles. But what is stopping new entrants coming onto the market?

Potential black cab manufacturers are being hindered by two main factors, namely the high unit prices of suitable vans and the costly conversion process.

Presently, only three vans meet the required vehicle length criteria for a London taxi: the Mercedes E Vito van, a Stellantis van (also known as Vauxhall, Citroen, Peugeot, Toyota vans), and a Maxus van. The base model of the electric Maxus van begins at £40,000, while the E Vito starts at an eye-watering £65,000. In addition to these prices, the conversion cost for the Dynamo taxi is approximately £23,000. If the Maxus van were to be converted and approved as a London taxi, its price would likely

reach around £63,000, while the Vito would soar to a staggering £85,000.

Some industry experts argue that reducing the barriers to entry for new manufacturers could help. Knocking off some of the conversion costs around the increased tighter turning circle would reduce price, but in turn it would also remove a unique selling point offered to customers.

Given these figures, one must question whether the current electric taxi option, the LEVC TX, is actually an expensive option in today's market. The stark reality is that the electric vehicle market is far from cheap for all, with prices rising due to inflation and substantial finance interest costs.

The taxi industry will no doubt continue to voice the need for more affordable alternatives, but in all honesty there is very little in the way of options on the horizon.

21 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

WHEN ARE YOU AND WHEN AREN’T YOU COVERED BY TAXI INSURANCE?

DAVID SWEENEY

ARTICLE BY: THE TAXI INSURER SENIOR OPERATIONS MANAGER

Unless explicitly confirmed by their insurer or insurance broker at the time of purchase, many taxi drivers may unwittingly find themselves in routine situations while at work where they may not be covered by their policy. This article examines some of the more common circumstances and explains how drivers can ensure they’re not at risk.

PUBLIC LIABILITY

The biggest risk relates to public liability. Drivers without the correct public liability taxi cover in place could be held financially and legally liable for any accidents or damage that their passengers suffer while under their care. Public liability taxi insurance protects drivers and their business from any unforeseen circumstances in which they could be held liable for someone else’s wellbeing. Traditionally, the majority of insurers offered public liability as a separate cover from the main taxi insurance policy; these days, an increasing

number of insurers offer it as standard. Although only a relatively small number of drivers ask for public liability cover, some councils or contract owners insist that drivers working for them must have it in place.

Drivers who have taken out a conventional taxi policy that excludes public liability as standard are only covered while they’re inside their vehicle. A soon as they step outside of the vehicle to help a passenger in any way, their taxi insurance is no longer valid.

A typical example could involve an elderly person who has called for a taxi and asks the controller if the driver could help them from their front door into the vehicle because they’re using a walking frame. The driver is good enough to do so but, in helping that person, they may cause them to fall over. That would not be covered under the driver’s taxi insurance. If they’d taken out public liability insurance, it would.

22 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

Another common scenario would see a parent returning from the supermarket with children and several bags of shopping. As the taxi driver drops their fare home, they offer to help carry the shopping into the house. Unfortunately, while putting some of the bags into the porch, the driver knocks over and damages a vase – without public liability cover, the driver is liable for the cost of repairing or replacing the damaged item.

School runs are the third commonplace situation in which drivers without public liability could find themselves at risk. If they're taking kids to school, drivers are liable for the child’s welfare from the moment the child gets out of the vehicle until they walk through the school gates. Some councils are very strict about this responsibility and will ask insurers to complete documentation confirming that a driver’s policy does cover school runs.

Drivers may also want to check the differing levels of public liability indemnity required by some councils. Using school runs as an example, councils occasionally ask for an increased indemnity limit for drivers contracted to carry out such activities.

DRIVING TO ANOTHER PLACE OF WORK

Beyond public liability, the other familiar situation drivers are often not covered for is travelling to another place of work. Drivers with an additional occupation should ensure that their policy covers them to drive their taxi to the location of their second job.

The examples above demonstrate how important it is for drivers to check that their insurance policy covers them for every situation in which they find themselves while at work. Whether issues of public liability or driving to a second place of work, policyholders can contact their insurer or broker to confirm that they are currently covered, particularly if their professional tasks or responsibilities have recently changed.

23 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

TAX CHECKS IN SCOTLAND AND NORTHERN IRELAND START NOW

Starting from 2 October 2023, taxi drivers in Northern Ireland and Scotland need to complete new HM Revenue and Customs (HMRC) tax checks when renewing their licence.

These checks were introduced in England and Wales in April 2022 and have a straightforward online process to confirm tax registration for income from licensed taxis when applying or renewing operating licences. More than 120,000 people have gone through this process in England and Wales since then.

The introduction of these checks marks a significant step in promoting tax compliance within the industry across the UK and making it fairer to the majority of drivers who already pay their taxes correctly. The Department for Infrastructure will administer the process in Northern Ireland, while local councils will in Scotland – ensuring applicants

complete the tax check before their licence applications are considered. In Scotland those renewing their licence to operate a booking office will also need to complete the tax checks.

WHAT THE CHECK INVOLVES

With a Government Gateway account, completing the tax check on GOV.UK should be quick, simple and straightforward. After answering a few questions about your tax registration, HMRC will provide applicants with a tax check code. This code must be given to the licensing body before they can proceed with your licence renewal application.

HMRC recommend that applicants, if they do not already have a Government Gateway account, go to GOV.UK and search ‘register for HMRC services’ to sign up. Anyone who needs extra support will be able to complete the tax check by phone through HMRC's customer helpline.

24 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE CREDIT: HMRC

The licensing body will only use the code to confirm that someone has completed a tax check with HMRC. They won't have access to information about your tax affairs.

If you have not used your taxi licence, you will still need to complete the tax check if renewing.

The only time you won’t need to do the tax check is if you are applying for a licence for the first time or held a licence that expired more than a year ago. However, the licensing body will ask you to read HMRC guidance on what you need to do to be properly registered for tax in the future and you’ll need to confirm you have done this.

I haven’t registered for tax, what should I do? If you haven’t registered to pay tax on earnings from your licensed trade, please go to GOV.UK to check if you need to register as soon as possible by searching ‘how you pay income tax’. If you should have been registered to pay tax, HMRC will work with you promptly and professionally to get you back on the right track. It’s your responsibility to get your tax right, but HMRC is here to help.

You can get help from HMRC if you need extra support, for example if you require information in a

different format or want help filling in forms. Visit GOV.UK and search ‘Get help from HMRC if you need extra support’.

WHY IS HMRC IMPLEMENTING THIS CHECK?

The aim of these rules is to level the playing field and combat the hidden economy, estimated to cost the UK Government £2 billion in unpaid taxes, which deprives funds for the vital public services we all rely on. By linking tax compliance to licence renewal, the Government hopes to discourage participation in the hidden economy and encourage drivers and operators to fulfil their tax obligations.

The introduction of this tax check is a collaborative effort between HMRC, sector representatives, and licensing bodies across the UK. Full guidance has been published on GOV.UK to support you with the changes. Go to GOV.UK and search ‘complete a tax check’. As these tax checks come into effect, they will play a crucial role in ensuring a fair and transparent industry for all involved.

25 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

‘THE AIM OF THESE RULES IS TO LEVEL THE PLAYING FIELD AND COMBAT THE HIDDEN ECONOMY, ESTIMATED TO COST THE UK GOVERNMENT £2 BILLION IN UNPAID TAXES.’

THE FUTURE OF TAXI LICENSING IN NORTH NORTHAMPTONSHIRE: A UNIFIED APPROACH

ARTICLE BY:

North Northamptonshire Council is contemplating the merger of four distinct taxi zones into a single licensing authority.

Currently, North Northamptonshire operates with four separate zones for taxi licensing, each with its own set of rules and regulations. This fragmented approach has often led to inefficiencies and complexities for operators, drivers, and the council.

The council is reviewing a proposal to consolidate these four zones into one unified licensing authority. The aim is to streamline the licensing process, making it more efficient for all stakeholders involved.

The anticipated benefits of this merger include simplified administrative procedures, costeffectiveness, and a unified set of standards that would elevate the quality of service across the region.

The Department for Transport has issued comprehensive best practice guidance for taxi and private hire vehicle licensing. The guidelines

cover everything from the role of taxis in the community to enforcement measures.

The council's proposal to merge the four zones aligns well with these national guidelines, particularly in terms of streamlining processes and enhancing efficiency. This alignment adds further credibility to the council's initiative.

LESSONS FROM NORTH YORKSHIRE

North Yorkshire Council set a precedent by successfully implementing a single taxi licence fee across the county. This move simplified the licensing process and reduced administrative burdens, serving as an early win for the council.

The initiative in North Yorkshire has been met with positive feedback from operators and has streamlined the application and renewal processes. These early successes make a compelling case for North Northamptonshire to consider a similar approach.

26 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

THE ROAD AHEAD

The council is in the review phase, with public consultations and stakeholder meetings planned for the coming months. The final decision is eagerly awaited by the industry.

The proposed merger could have far-reaching implications, affecting taxi and private hire drivers, operators, and licensing professionals. The unified approach could set a new standard for the industry, making North Northamptonshire a model for other regions to follow.

North Northamptonshire Council's proposal to merge four taxi zones into a single licensing authority is a significant step towards modernizing the industry. By aligning with successful models like North Yorkshire and adhering to national guidelines, the council is poised to set a new benchmark for efficiency and service quality in the taxi and private hire sector.

ARTICLE BY:

ARTICLE BY:

27 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

CITY TAXIS REBRANDS AS VEEZU

City Taxis, one of the most prominent private hire operators in North Yorkshire and Derbyshire, has announced its transformation into Veezu. The rebranding comes following its acquisition by the Veezu Group earlier this year, marking a new chapter for the wellestablished company.

Arnie Singh, Veezu's Regional Managing Director, said: "This change bring with it efficiencies for our business and creates a consistent brand of choice for driver-partners, passengers, and business accounts. Our footprint continues to grow, and this name change is another step on our journey to providing smarter local rides to communities nationwide."

ENSO'S TYRE TECHNOLOGY EARNS FINALIST SPOT FOR THE EARTHSHOT PRIZE

London-based EV tyre technology company, ENSO, has been recognised as one of the global finalists for The Earthshot Prize, a prestigious environmental award aimed at identifying and expanding innovative climate and environmental solutions. Launched by Prince William in 2020, The Earthshot Prize aims to safeguard and restore our planet.

28 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

BUSINESS NEWS

CREDIT: ENSO

IMAGE CREDIT: VEEZU IMAGE

Addison Lee's CEO, Liam Griffin, has expressed concerns regarding the recent announcement made by the Prime Minister to delay the ban on new petrol and diesel vehicle sales until 2035.

Griffin said: "As a leader in the transition to electric, we know how difficult the shift has been for businesses looking to create a greener London. The reliability and availability of charging infrastructure continues to be the most significant barrier.

“Where charging providers once had confidence that a 2030 ban meant a guaranteed increase in the

ELEVEN UBER-FUNDED GRADUATES CELEBRATE OPEN UNIVERSITY DEGREES

Eleven students across the UK have become the first to receive Open University (OU) degrees fully-funded by Uber.

Uber partnered with the OU in late 2019 to give eligible drivers, or a nominated member of their family, the opportunity to access higher education with their fees fully-funded by Uber.

Graduates studied a range of subjects including Business, Maths, Law and Psychology – with

ADDISON LEE CEO CONCERNED BY

PRIME MINISTER’S DELAY TO BAN NEW PETROL AND DIESEL SALES

number of electric vehicles on the road – and therefore a greater need for charging provision across the city – they no longer have this assurance, putting the roll-out of further infrastructure at risk.

“

Pulling back on the 2030 commitment reduces the ability of operators to confidently invest in the transition. Similarly, in London, the removal of financial incentives - such as the electric vehicle exemptions within London’s Congestion Zone - will deter many from moving to EVs and slow the reduction of air pollution across the capital."

drivers fitting in their studies around working flexibly on the Uber platform. The programme was specifically designed to help those who were otherwise locked out of learning opportunities – part of the OU’s social remit to provide opportunities to many who previously thought higher education study in the UK was not accessible to them.

All drivers have access to courses on the OU free OpenLearn

platform, with those in the Diamond tier – the top level in terms of the number of completed trips and service provided – receiving access to paid courses. These paid courses range from full undergraduate degrees to short courses such as microcredentials.

29 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE CREDIT: ADDISON LEE

IMAGE CREDIT: UBER

GRANT ENDS 2024: TAXI DRIVERS COULD BE HIT WITH £7,500 EXTRA COST FOR NEW ELECTRIC TAXIS

Taxi drivers could be hit with a further £7,500 electric taxi bill should the Government not extend further grants currently in place.

The taxi industry continues its shift to greener Zero Emission Capable (ZEC) vehicles with thousands of electric black cabs roaming the roads in London and beyond.

The Government has been helping with that shift with a Plug-in Taxi Grant (PiTG) which was introduced as an incentive scheme designed to support the uptake of purpose-built ZEC taxis.

The grant is also designed to bridge the cost gap that currently exists between taxis powered by

internal combustion engines versus new ultra-low emission technologies.

Transport ministers extended the PiTG scheme back in 2022 to run until at least the financial year 2023/24 for new electric taxis.

Since then no further discussions have been made public about whether the scheme will run past April 2024.

Currently the PiTG scheme offers a discount on the price of eligible purpose-built taxis up to a maximum of £7,500 or £3,000 – depending on the vehicle’s range, emissions and design.

30 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

UK NEWS

FREENOW UK BECOMES FIRST IN EUROPE TO OFFER PHV DRIVERS A CHOICE OF BEING WORKERS OR SELF-EMPLOYED

The option is said to be available from October, and the decision was informed by an internal survey conducted this year among FREENOW minicab drivers. The survey revealed that while the majority would like to remain independent contractors (59%), almost a third (31%) would prefer to have worker status, while 10% are undecided.

The survey also revealed that holiday pay (71%) is the most sought-after benefit for minicab drivers.

Drivers on the FREENOW app will be able to freely choose their employment status. Those who choose worker status will be entitled to:

• National Living Wage guarantee - each week FREENOW will ensure all driver earnings are equal to or greater than the National Living Wage

• Holiday pay - total earnings will be topped up by 12.07%, while drivers will retain the freedom to decide when and where to work without any restrictions

• Access to FREENOW’s pension schemeFREENOW will contribute 3% towards the driver’s pension, based on drivers making a 5% contribution, and drivers will have the option to opt-out.

Ultimately, FREENOW commits to maintaining a comparable sum of earnings and benefits between all minicab drivers regardless of whether they have chosen the worker status or the independent contractor. All Private Hire Vehicle drivers will continue to be self-employed for tax purposes.

All taxi drivers at FREENOW will remain independent contractors in line with overwhelming driver preference (only 10% of taxi drivers preferred worker status) and higher independence thanks to their access to street-hailing and taxi ranks. FREENOW consulted individual taxi drivers as well as representative bodies before reaching this decision.

Mariusz Zabrocki, UK General Manager at FREENOW, said: “We always do the utmost for our drivers and we regularly listen to them. It’s now clear that minicab drivers in London want to have more than one option regarding their employment status. Therefore, we are taking an industry-first approach empowering the 20,000 minicab drivers on our platform to make the best choice for them. We’re also proud to be the first company to offer trade union protections to both workers and independent contractors.”

PORTSMOUTH UBER DRIVERS STAGE COORDINATED ‘MORNING OFF’ IN PROTEST OF FARE REVIEW DELAY

In a display of growing discontent, over 170 Uber drivers in Portsmouth and surrounding areas withdrew their services last month as part of a coordinated protest against the lack of a much-needed fare review.

The drivers claim that the absence of any price adjustment in five years, coupled with decreasing fares, is no longer tolerable or justifiable.

The actions were reportedly prompted by a broken pledge made six months ago to address the fare review issue during a meeting between Uber representatives and drivers at the Ageas Bowl in Southampton. However, according to driver representatives, no tangible progress has been made since then, leaving drivers frustrated and without a direct line of communication with Uber management to address their concerns.

Taking matters into their own hands, the drivers have resorted to organised downtime in an attempt to capture Uber's attention through financial losses. This marks the second such protest, with drivers warning that future actions will occur on a regular basis and potentially involve even more participants.

An Uber spokesperson said: “We are committed to making Uber the best platform for all earners and will continue to engage with drivers in Portsmouth and around the country. We have increased prices in the city on three separate occasions since 2018 and regularly review pricing in Portsmouth as we do across the UK.”

CARDIFF TAXI DRIVERS PROTEST AS COUNCIL LIFTS CAP ON TAXIS PERMITTED TO WORK IN THE CITY

after Cardiff Council lifted the cap on the number of hackney vehicles permitted to operate in the city.

The demonstration saw drivers expressing their concerns about the potential impact of this decision on their livelihoods.

The protest, organised by Unite Wales, began outside County Hall in Cardiff. Taxi drivers from across the city came together to voice their concerns and demand that their livelihoods be protected.

Removing the cap on hackney vehicles has

Opponents are worried that it will lead to oversaturation and economic instability for drivers.

A Unite Wales spokesperson said: “Today Cardiff Council have opened the floodgates by removing the cap on the amount of hackney cabs that are permitted to work in the city.

“THIS IS

UNACCEPTABLE.

“Our members are determined to fight this decision and will have our full support and backing as the fight continues.”

32 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK REGIONAL NEWS

IMAGE CREDIT: UNITE WALES

COUNCIL FUNDING FOR TAXI TRIPS FOR HAVERING SCHOOL CHILDREN WITH SPECIAL NEEDS TO CEASE

Havering Council has unveiled plans to discontinue council-funded taxi trips for school children with special needs in a bid to address its multi-millionpound budget deficit.

Alongside this measure, the council also intends to reduce the number of bus journeys it financially supports. The proposed transport policy emphasises the need for cost-effective options, while promoting ridehailing and direct payments to enable parents in organising their own transportation solutions.

As part of these changes, the council plans to implement stringent eligibility criteria to

EAST DUNBARTONSHIRE COUNCIL BRINGS IN STRICTER REGULATIONS FOR TAXI AND PHC TESTING CENTRES

East Dunbartonshire Council has recently strengthened the regulations surrounding centres responsible for conducting roadworthiness tests on taxis and private hire cars (PHCs).

The move aims to further enhance passenger safety and ensure compliance with safety and specification requirements, in addition to taximeter settings.

Currently, there are 12 authorised testing centres operating in the local authority. These centres play a vital role in evaluating whether vehicles meet safety standards and in certifying that

significantly decrease the number of school bus trips subsidised by the council.

The council highlights a significant and continuous rise in the number of residents with Education Health and Care Plans (ECHP). Between 2018 and 2022, this figure surged by over 60 percent, reaching a total of 2,189 individuals. A report on the proposed policy, presented to the cabinet recently, outlined potential savings totalling £1.4 million over the next four years.

The policy breakdown revealed that the council's most costly daily taxi charge covers a distance of 16 miles, which, together with the cost of a passenger assistant escort, amounts to approximately £45,000 per school year. Under the new policy, reimbursement for fuel or a trip via ride-hailing service Uber would cost approximately £30 per day, equating to approximately £5,500 per year.

taximeters are correctly calibrated with the appropriate fees and charges.

The newly adopted policy, unanimously approved at the council's audit and risk management committee, entails stricter requirements for garages seeking to register or renew their status as testing centres. The application process will now include the submission of comprehensive forms, which will list all authorised staff responsible for conducting inspections. Additionally, the application must outline the method used to check taximeters.

33 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

CAMBRIDGE CITY COUNCIL EXTENDS TAXI AGE LIMITS BY TWO YEARS TO BOOST ACCESSIBILITY AND AFFORDABILITY

In a move described as a "lifeline" for struggling drivers, Cambridge City Council (CCC) has unanimously approved a change in policy to increase the age limit for taxis from nine years to 11. This decision aims to provide more affordable options for drivers, increase the number of wheelchair-accessible taxis, and address the challenges faced by disabled individuals in accessing transportation.

The decision comes after a petition signed by 159 licensed taxi drivers called for these policy changes.

According to Cambridge Independent, Ahmed Karaahmed, chairman of Cambridge City Licensed Taxis, stressed the importance of the new policy

MANCHESTER CITY COUNCIL APPROVES 17% TAXI TARIFF INCREASE TO SUPPORT STRUGGLING CABBIES

struggling with the rising cost of living.

One other significant change is the removal of the requirement for new taxi drivers to have a car under four years old when applying for a licence. Instead, the council now mandates that new taxis must meet a Euro 5 standard or higher, focusing on environmentally friendly and more accessible vehicles rather than solely on age.

Officials confirmed that the policy change will mainly impact wheelchair-accessible taxis, as the majority of saloon-style taxis have already transitioned to ultralow or zero-emission vehicles. The change aims to address the shortage of accessible taxis and prevent disabled individuals from being confined to their

Manchester City Council’s Executive has approved plans to increase taxi tariffs by around 17% for a two-mile journey in a bid to support cabbies.

Acknowledging the ongoing cost-of -living crisis and the lingering effects of the Covid-19 pandemic, the Council has been actively exploring additional measures to benefit those working in the taxi trade across Manchester.

After careful consideration and consultation with the GMB and Unite unions, a set of recommendations has been presented to the Executive to ensure a balanced and fair approach for both drivers and customers.

The approved recommendations include making card payment acceptance mandatory in Hackney Carriages, an 8% increase in the unit cost per mile across all tariffs, a 23% increase in waiting time fare, a rise in the Day flag tariff to £3.40, and an increase in the Night flag tariff to £3.80. As a result, the cost of a two-mile journey will rise from £7 to £8.20, or from £9.20 to £10.30 during nighttime or on public holidays.

34 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

‘TAXI TRADE IS VITAL TO KEEPING THE BEATING HEART OF A CITY CENTRE THRIVING’ SAYS GLASGOW MSP

“The taxi trade is vital to keeping the beating heart of a city centre thriving” said Glasgow’s Labour MSP as concerns for the Food and Drink Sector in Scotland mounts.

During a recent debate in the Scottish Parliament regarding the Food and Drink Sector, concerns were raised about the impact on the industry due partly to the struggling taxi trade. Pauline McNeill, Labour MSP for Glasgow, highlighted the vital role played by the taxi trade in keeping the city centre thriving.

Speaking passionately about the impact of rising costs on the hospitality industry, McNeill emphasised the need for proper support to ensure the sector's growth and resilience. She expressed her concern regarding the lack of confidence in public transport and its aftermath on the taxi trade, ultimately affecting cities like Glasgow.

McNeill highlighted the crucial role of the taxi trade, particularly when facilitating access to the hospitality

industry. McNeill said: “I will talk about Glasgow, in my region, which is Scotland’s largest city. The hospitality industry is critical to the supply chain of the food and drink sector and it has been hugely exposed to rising costs, including utility costs and many others.

“There is a lack of confidence in public transport. There has been a huge impact on the taxi trade and a failure to properly support it, which has had an impact on cities such as Glasgow. The taxi trade is vital to keeping the beating heart of a city centre thriving.

“Growth and resilience are important, as Colin Smyth mentioned in his contribution when he talked about the bus industry. Young people rely on the night bus service in Glasgow to get home from work in the hospitality sector. Many parents who were driving their sons and daughters home from a late shift were met with the introduction of the low-emission zone in Glasgow. The way in which that was done was a disaster. I fear the proposed congestion charges, simply because hospitality is so vital to a city such as Glasgow. If the public lack confidence to come into Glasgow or there is a perception that people cannot do that, and if we do not have the standard of public transport necessary to meet the city’s needs, that will impact on recruitment and jobs.”

35 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE CREDIT: ROSS CAMPBELL

ACCESS ALL AREAS: CITY OF LONDON COUNCILLOR LAUNCHES CAB CAMPAIGN FOR TAXI ACCESS AT BANK JUNCTION

In a bid to restore taxi access to Bank Junction, Councillor James Thomson from Walbrook Ward has spearheaded the launch of the CAB (Cabs Across Bank) campaign.

Calling for fresh evidence, the campaign aims to grant licensed Hackney Carriages unrestricted access across Bank Junction and other currently restricted streets in the City of London.

The newly unveiled campaign website states: "CAB believes that Licensed Hackney Carriages should be able to go where buses go, including the use of bus lanes and other routes authorised by Transport for London, 24 hours a day, 7 days a week, 365 days a year – 24/7/365."

CAB also envisions similar restrictions being lifted in other areas across the capital, emphasising the significance of black cabs within London's public transport system.

Lifting restrictions would ensure access for individuals with mobility challenges, making London more inclusive and accommodating.

Allowing black cabs to operate across London at all hours would enhance safety, particularly for women and vulnerable users, as they rely on the well-regarded reliability and trustworthiness of black cabs.

Black cabs have gained global recognition for their safety and are trusted by tourists visiting London. Lifting restrictions would further contribute to the tourism and hospitality sector.

Black cabs are relied upon by businesses for their fast and readily available transport services. Their presence in the City of London and Central London plays a significant role in attracting companies to establish offices in the area.

Moreover, black cabs have made substantial progress towards becoming zero-emission capable (ZEC), with over half of the fleet now operating as electric vehicles, offering an environmentally friendly alternative for transportation.

Individuals are encouraged to email CabsAcrossBank@gmail.com to provide evidence and opinions on the matter.

36 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

LONDON NEWS

UBER CLAIM: BULIT21 REPS SEEN CANVASSING TAXI DRIVERS AT HEATHROW REIGNITES CABBIE INTRIGUE

London taxi drivers were intrigued to see ‘RGL BULit21’ representatives once again canvassing cabbies, this time at the busy Heathrow taxi ranks.

Updates on the progress of the action have been thin in recent months prompting many to ask questions on social media groups about its future.

WWII VETERANS ENJOY BIGGIN HILL EVENT WITH TWO SPITFIRE FLIGHTS HOSTED BY TAXI CHARITY

WWII veterans enjoyed an event hosted by the Taxi Charity at Biggin Hill with two Spitfire flights and entertainment from the D Day Darlings.

On 12 September a group of nineteen WWII Veterans were joined by veterans from other conflicts for a Taxi Chairty event in the Heritage Hangar at Biggin Hill, a working hangar for Spitfire restoration projects.

Thousands of London taxi drivers signed up to action looking to recover losses as a result of Uber’s operations.

Approximately 11,000 London black cab drivers have signed up to join an action, which is seeking to recover losses incurred as a result of Uber’s operations between June 2012 and March 2018.

The Group Legal Action being brought by London cabbies against ride-hailing firm Uber has reportedly concluded discussions on funding and ATE insurance, which will cover ALL legal costs of nearly 11,000 taxi drivers should they win or lose.

HARRODS RANK: TAXI DRIVERS EXPRESS FRUSTRATION OVER ONGOING GLUT OF PCNS AT BROMPTON ROAD RANK

Licensed Taxi Driver's Association (LTDA) columnist, Sam Houston, has voiced strong concerns over the increasing number of Penalty Charge Notices (PCNs) received by taxi drivers attempting to access the Brompton Road rank.

Drivers have reportedly used various justifications, including traffic congestion or passengers quickly entering or exiting the taxi before the driver had a chance to act. While accepting that these explanations may be valid in some cases, Houston pointed out that being stuck behind other drivers also seeking access to the rank is not the same as being stuck in traffic.

37 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE

TAXI CHARITY

CREDIT:

ENFORCEMENT NEWS

CAUGHT: EX-TAXI DRIVER WHO FAILED TO RENEW LICENCE FINED OVER £900 FOR PLYINGFOR-HIRE

CITY OF WOLVERHAMPTON COUNCIL JOINS FORCES WITH LICENSING COLLEAGUES AND POLICE FOR JOINT OPERATION

In a bid to ensure the safety and compliance of licensed drivers and vehicles, City of Wolverhampton Council's Public Protection department initiated a joint operation in collaboration with licensing colleagues from Hyndburn, Blackburn & Darwen.

An unlicensed taxi driver was ordered to pay £918 in fines and legal costs after being prosecuted by the St Albans City and District Council.

Mohammed Tufayel Ahmed, who had been previously licensed by the Council as a taxi driver in 2013, failed to renew his licence when it expired in August of last year, despite receiving multiple reminder letters.

The Council's attention was drawn to Ahmed's illegal activities in January of this year when a complaint was received about his touting for business near a taxi rank and picking up a paying customer.

During the court hearing, Ahmed pleaded guilty to charges of plying for hire and driving a paying passenger without a private hire licence. As a result, he was fined £80 for plying for hire and an additional £40 for driving without a licence. In addition to the fines, Ahmed was also ordered by the magistrates to pay a victim surcharge of £48 and contribute £750 towards the Council's costs.

Assisted by Lancashire Police and the Vehicle and Operator Services Agency (VOSA), the operation aimed to conduct thorough checks and inspections on vehicles working outside of the licensed area. The joint operation recently saw compliance officers and licensing colleagues conducting comprehensive examinations of licensed drivers and their vehicles. The operation evaluates various aspects, including the condition and functionality of the vehicles, validity of licences, and compliance with relevant legal requirements.

A City of Wolverhampton Council Public Protection spokesperson said: “Compliance

Officers are taking part in a joint operation in Accrington with Licensing colleagues from Hyndburn, Blackburn & Darwen as well as Lancashire Police & VOSA undertaking checks on Licensed Drivers & Vehicles.”

38 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

IMAGE CREDIT: CITY O F WOLVERHAMPTON COUNCIL'S PUBLIC PROTECTION

INSURANCE

TAXI TYRES

39 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

FINANCE

APPS CARD

PAYMENTS

40 | TAXIPOINT | OCTOBER 2023 | EDITION 54 WWW.TAXI-POINT.CO.UK

EMISSIONS SYSTEMS MEMBERSHIP

TaxiPoint Editor and Founder

TaxiPoint Editor and Founder