THE OFFICIAL DIGITAL MAGAZINE OF THE CEA

SPRING 2023

PLANTWORX INNOVATION AWARDS – TV CELEBRITY CONFIRMED AS HOST

“TODAY’S CHALLENGES –TOMORROW’S OPPORTUNITIES” – CEA CONFERENCE PROGRAMME FOR 30TH MARCH

PERSPECTIVES ON HYDROGEN – FROM HYDROGEN UK & KGP

CWX DIGITAL ONLINE ONLY

THE VOICE OF THE UK CONSTRUCTION EQUIPMENT INDUSTRY Construction Worx is an official partner publication for PLANTWORX

The UK's Only Live Demo Construction Equipment Event in 2023 13-15 June 2023 East of England Arena and Events Centre, Peterborough. BOOK NOW! • Attracting 450 Exhibitors and 15,000 Visitors • Live demonstrations across the site • Exhibition zones including machine innovation and technology Supporting a safer, smarter and more productive industry. Call Angela now - 07807 623640 or email angela.spink@plantworx.co.uk More details at www.plantworx.co.uk FOR THE INDUSTRY, BY THE INDUSTRY

WINTER 2022 WHAT'S INSIDE! THE OFFICIAL DIGITAL MAGAZINE OF THE CEA Plantworx Innovation Awards TV’s Shaun Wallace named as host for Awards Dinner. 29 Perspectives on Hydrogen From Clare Jackson (Hydrogen UK) & Alex Woodrow (KGP). 16 New EU Machinery Regulation Dale Camsell reports on the regulation’s final journey to publication. 26 Go West, young man Chris Sleight reflects on record numbers for the North American market. 40 Fuel theft – in the post red diesel world Can VENOM provide a solution to escalating reports of fuel theft? 06 Machine safety special Contributions from Spillard, SiteZone, Xwatch & Prolec. 34 What’s the Big Idea? New features confirmed for June’s Plantworx event. 22 Today’s Challenges –Tomorrow’s Opportunities Speaker roster confirmed for CEA Conference. 28 SPRING 2023 3 ConstructionWorX DIGITAL

Suneeta Johal Chief Executive Construction Equipment Association

CEA Management Council

Rory Keogh

Gomaco International Ltd

Sam Mottram

Caterpillar (UK) Ltd

Nick Ground

GKD Technik Ltd

Charles Stevenson

JCB Sales Ltd

Paul Ross

Ricardo Plc

Mark Ormond

Manitou

Kate Wickham MBE Gate 7

David Waine

British Steel

Nick Allen SMT

Damien McCormack

Nylacast Engineered Products

Executive Board

Nick Ground

Suneeta Johal

Mark Ormond

Paul Ross

Charles Stevenson

Honorary President

David Bell

Patrons

Dr Susan Scurlock MBE

Malcolm Harbour CBE

From the Chief Executive

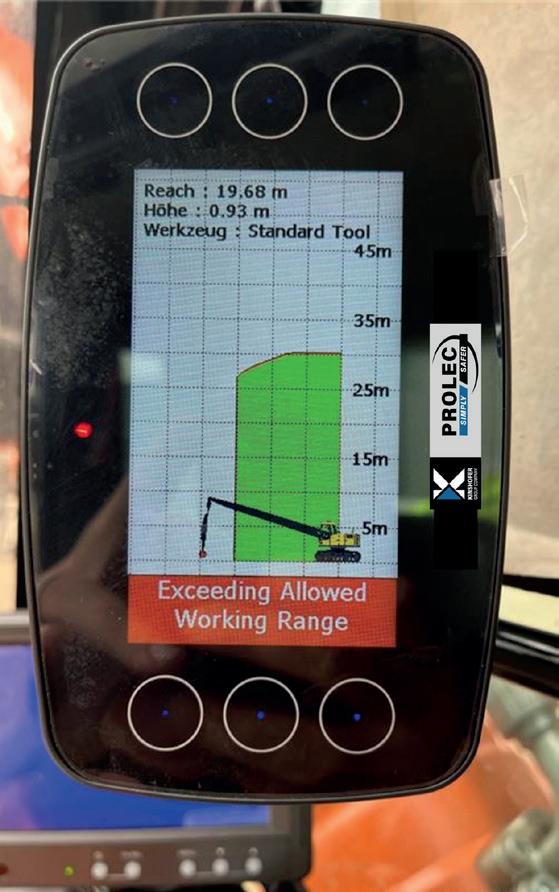

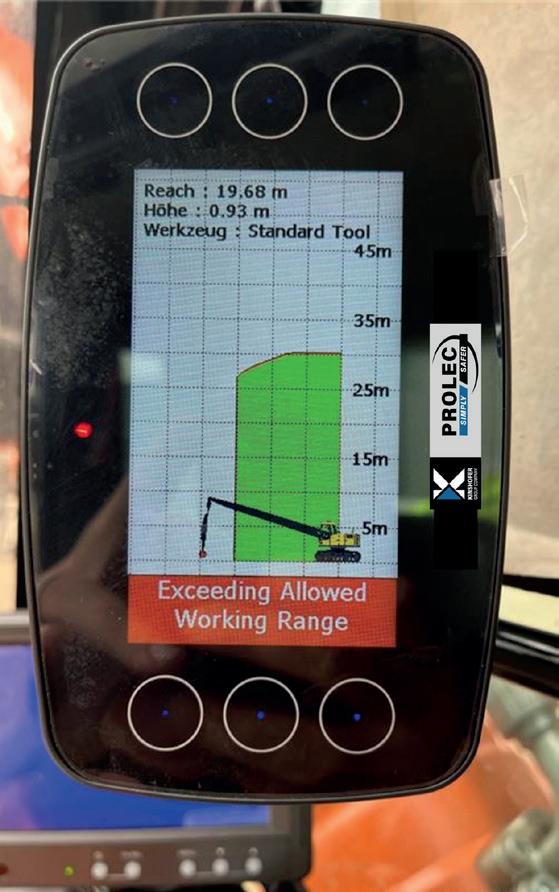

Welcome to the Spring issue of Construction Worx. One of the themes in this issue is safety - which is paramount in our sector when working on busy construction sites. A number of our members are at the forefront of safety and, in the magazine, we have solutions from Spillard and SiteZone for protecting personnel. Xwatch and Prolec talk about retrofit systems for construction machinery and National Highways address ‘safe loads’.

You will also find an invite to the CEA Conference (30th March, Peterborough), the first CEA in person conference since the COVID pandemic. It promises to be an excellent event with key industry speakers, talking about the hottest topics and challenges facing the construction sector today. CEA members are also invited to attend the CEA AGM on the morning of the conference.

The Plantworx Innovation Awards Dinner is taking place after the conference and it promises to be a fantastic event with excellent networking opportunities and a celebration of the most innovative products to come to market. We really do hope you can join us – we even have the Dark Destroyer from the quiz show, the Chase, to host the event!

The forthcoming Plantworx is looking very exciting as the exhibitor list continues to grow. The Plantworx team has also introduced some new initiatives, which include the BIG Ideas Zone for tech

startup companies and the Get Connected Zone which is dedicated to connected technology. The Plantworx feature can be found starting on page xxx

We also take a look at the Bauma exhibition, where electrification was very much the order of the day!

In addition, Hydrogen is a big part of this issue. Construction Worx correspondent Peter Haddock talks to Clare Jackson, Chief Executive of Hydrogen UK and KGP’s Alex Woodrow takes us on a deep dive into the cleantech topic of Hydrogen and supporting our journey to Net Zero.

The MTC (Manufacturing Technology Centre) reports on how it is currently exploring a range of alternative fuels and power sources and how construction and infrastructure will have one of the hardest journeys to achieve greenhouse gas reductions.

Then there’s the latest regulatory report and market trends, including a special feature on North America, from our colleague, Chris Sleight, MD of Off Highway Research.

There’s plenty more in this issue and we hope you enjoy the read. I look forward to meeting with many of you in person at the CEA AGM and conference.

Suneeta Johal Chief Executive Construction Equipment Association

CONTRIBUTING EDITOR

The Construction Equipment Association (also trading as CEA) Unit 19 Omega Business Village, Thurston Road, Northallerton, North Yorkshire, DL6 2NJ. UK.

PUBLISHER – Enigma Creative Unit 19 Omega Business Village, Thurston Road, Northallerton, North Yorkshire, DL6 2NJ. UK.

W: www.enigmacreative.co.uk

Louise Carney E: louise@louise-carney.co.uk

REPORTER AT LARGE

Peter Haddock E: content@contentwithmedia.com

ADVERTISING SALES

Angela Spink E: angela.spink@thecea.org.uk

EDITORIAL SUPPORT

Rob Oliver E: rob.oliver@thecea.org.uk

www.constructionworx.co.uk ConstructionWorX DIGITAL The Construction Equipment Association (also trading as CEA) is a company registered in England and Wales with company number 04930967. VAT number 243 3858 54. Registered Office: Unit 19 Omega Business Village, Thurston Road, Northallerton, England, DL6 2NJ. UK. © 2022 The Construction Equipment Association. Although care has been taken in preparing the information supplied in this publication, the CEA does not and cannot be held responsible for any errors or omissions and accepts no liability whatsoever for any loss or damage howsoever arising. Any views expressed do not necessarily represent those of the CEA.

T: +44 (0)20 8253 4502 E: info@thecea.org.uk W: www.thecea.org.uk 4 SPRING 2023

Fuel theft is the ‘Bane’ of Construction sites – could VENOM be the solution?

With the dramatic increase in the cost of fuel and the demise of red diesel in 2022 cases of fuel theft from construction sites have increased significantly.

Datatag through its work with the Construction Equipment Association’s CESAR official security scheme, recognised the issue of fuel theft and took up the challenge to develop a technological solution. The result was VENOM, a unique forensic DNA identifier. Construction Worx has a Q&A session with Kevin Howells, managing director of Datatag ID who explains the technology behind VENOM…

Q What exactly is ‘VENOM’?

A: VENOM is simply a combination of specific fuel dyes and a unique forensic DNA material which are suspended in a hydrocarbon solvent.

Q: How does VENOM work?

A: Once added to fuel, the DNA material and the dyes disperse easily through the fuel. VENOM is fully miscible (meaning capable of being mixed) with diesel, petrol and HVO fuels.

The DNA can be linked specifically to an individual, a company, a site or fuel location - or even an individual machine. The dyes provide a distinct visual identifier of its presence that also acts as part of the theft deterrent.

The use of our particular formulation of DNA even allows fuels with different DNA codes to be mixed and still individually detected by qPCR testing.

FUEL THEFT

6 SPRING 2023 ConstructionWorX DIGITAL

As far as we are aware VENOM is the only commercially available forensic fuel dye on the market in the UK at this present time which offers this level of fuel security and traceability.

Q: Q: How does it act as a deterrent?

A: The visual colour change in the fuel is the first deterrent, anyone taking this fuel will be well-aware it is treated with VENOM. The high visual impact signage we supply along with VENOM for fences, notice boards, bowsers and vehicles provides a second line of deterrent, this makes everyone aware that it is being used. Datatag will also be embarking on several social media campaigns to highlight the use of VENOM around the country at major exhibitions, conferences and trade shows including highly publicised Motor and Auto Competition events.

Q: Is there a colour in it, and if so, will it still be compliant with HMRC’s decision to stop construction machinery running on red diesel?

A: The colour we have chosen is a vivid green. We are aware that some European countries still operate rebated fuel, our closest neighbours France use blue. Ireland uses green and whilst there isn't an issue to put additives into tax paid fuel, including white diesel, there are regular discussions and tests planned with government bodies etc.

Q: Could I use a bespoke dye in the fuel which will still be VENOM, HMRC and manufacturers’ warranty compliant?

A: VENOM has been tested to EN590 by SGS in Germany. EN590 provides the necessary certification to prove that any dye or additive added to a fuel does not change the base fuel’s performance in any way whatsoever, such as changing the octane or cetane rating. This is (as you may know) the critical test for any dye or additive going into fuel. It gives the user and the equipment manufacturer the confidence that VENOM will not damage any part of the fuel system, nor will it affect the emission of that piece of equipment.

Because VENOM is already a dye and DNA combination, there is no need to add another dye. If another were added it would change the colour but the DNA would still be detectable. It would be the responsibility of the person or company administering the other dye to make sure that it is also EN590 tested and compliant to machine manufacturer's warranty and HMRC rules.

While we are on the subject and for clarity, VENOM is simply, as mentioned, a combination of dyes and a forensic DNA. It is not a fuel additive to enhance performance, there has been some misconception around this from others. An additive as you know enhances fuel by increasing octane or cetane ratings as well as other aspects of the fuel. Additives also contain surfactants for fuel system cleaning precombustion and potential heavy metal elements to clean exhaust systems post combustion. Some hire companies and manufacturers may not want additives used as with all these things there could be a wear risk to components, such as injectors.

As VENOM contains no surfactants or heavy

metals, in short, it removes nothing and leaves nothing. The dyes we use are commonly used dyes found around the world in rebated diesel which have been used for years with no detrimental effects on combustion engines. They are similar to the dye used in red diesel. If you have time look at this pagehttps://en.wikipedia.org/wiki/Fuel_dye you will see there are several in common use.

Q: Would you be able to supply a bespoke dye with the VENOM to make it unique to that company?

A: The simple answer is Yes. However, any change in the formulation, such as a change in the dyes would ideally call for a re-certification to EN590. The full test cost is in the order of £5,000, so as such it would not be cost effective for a volume of less than 1,000 litres.

Q: How will it be affected if a customer refills the plant with their own fuel. Will that dilute VENOM’s effectiveness?

A: If a full tank of fuel was treated with VENOM and that tank was then drained to half its original amount and refilled with natural fuel, the colour would still be visible and the DNA detectable. But this is the lowest limit we are prepared to support. Ideally vehicles would be filled from a fully treated bowser where feasible and that bowser should be constantly treated.

Q: What does it cost?

A: We are aim to keep VENOM down to an economical cost. It depends on the volume per order and the number of different codes. As an example, an order of 20 litres with the same DNA code is enough to treat 400,000 litres of fuel. The per litre treated cost is in the order of just a few pennies. The product is supplied in 1 litre bottles.

Within this cost Datatag supply a limited number of A3, A4 and A5 size warning signs. Datatag will be embarking on a significant awareness campaign over the coming months.

For further details visit Datatag VENOM - An Antidote to Fuel Theft

Seumas Ascott, Group Security Manager at Murphy's, an ex-Met Police officer said, "Fuel theft causes our industry a major headache. lt causes severe inconvenience and increases our operating costs. The associated costs arising from fuel theft often far outweigh the cost of the fuel stolen, and so anything which can help avoid these issues is to be welcomed."

SPRING 2023 7 ConstructionWorX DIGITAL

Supporting the Construction Industry in the journey towards Net Zero

As the impacts of climate change become increasingly clear, the Manufacturing Technology Centre (MTC) is focused on achieving milestones on our own journey towards net zero. MTC’s Liz Scoffins Advanced Research Engineer, Technology Transformation talks to Construction Worx…

“We are aiming to reach carbon neutrality by the end of 2023 in line with PAS2060 and be fully Net Zero ahead of our West Midlands Pledge date of 2041. Our baseline year is 2021 when our pledges went ‘live’, up to the UK Government’s 2050 Net Zero requirement date. By having a top-level plan, key milestones and taking direct action on our own greenhouse gas emissions, we can create a significant, positive impact on society whilst preparing support for UK manufacturing organisations across many sectors and industries.”

our learnings - including successes and failures, we are able to support others from all industries. One particular area of focus for the MTC are the construction and infrastructure sectors, as the Institution of Civil Engineers (ICE) highlighted in 2020, the total infrastructure carbon accounts for 54% of the UK’s consumption-based carbon emissions .

A key milestone towards achieving net zero in construction and infrastructure is by developing alternative, greener fuels for powering construction sites (including plants, machineries, welfare facilities etc.). The current diesel fuel not only releases carbon dioxide (CO2) into the atmosphere but also other air pollutants such as nitrous oxide (NOx) and other greenhouse gases (GHGs), which are often overlooked as the attention tends to be focussed on carbon dioxide. Alternative fuels such as Hydrotreated Vegetable Oil (HVO) or biofuels produce less GHG emissions, but are not yet available for use at scale. Batteries, tethered and hydrogen systems produced by renewable means, all have less emissions when compared to other fuels but are not without their own challenges.

The MTC is currently exploring a range of alternative fuels and power sources, including increasing the number of solar panels on our roof at our Ansty site in Coventry. Aiming to stay technology and alternative fuel agnostic, we believe that a mixture will be needed to satisfy the varying demands across and within different sectors. Through sharing

Construction and infrastructure will have one of the hardest journeys to achieve greenhouse gas reductions and mitigations of climate change, given the hierarchal nature and complex interdependencies across the supply chain. Vehicles and generators make up a large part of the industry emissions and the elimination of these will take collective action across the supply chain to tackle.

8 SPRING 2023 ConstructionWorX DIGITAL

Whether it is through industrial projects directly with arm’s length bodies (ALBs), tier one contractors and SMEs or via large scale industrial programmes such as the Construction Innovation Hub, the MTC is committed to supporting these sectors achieve their net zero goals in line with the UK Government’s 2050 target.

One on-going project has seen us team up with High Speed 2 (HS2), Network Rail, National Highways and Transport for London to examine ways of achieving net zero construction sites, in line with government policy. Other stakeholders include the Department of Transport and Transport for Wales, who guide and shape that future vision for the sector alongside the main project partners. This project aims to provide a framework for future engagement and an action plan for the removal of diesel from all new and existing national infrastructure and construction sites, as well as maintenance works managed and operated by the ALBs and their supply chains. Cutting GHG emissions associated with the development and operation of the transport network is a key strategic objective of the Department for Transport. A vital part of the project and internal sector strategy planning is gathering first-hand insights directly from industry. This will rely on more than just one company and one viewpoint, and this is why the MTC is inviting you to take part in our research. We aim to establish the development pathway to achieve GHG emission reductions and support the whole industry in achieving the Net Zero target on or before 2050. We want to hear from the widest range of organisations across all levels of the supply chain to truly understand the impact, issues and challenges that you face every day. For this to be effective, we are asking you to lend us your voice by answering our questionnaire, which will remain live until June 1st, 2023.

The MTC is taking its own learnings and using this knowledge to support the construction and infrastructure sector transition towards a Net Zero future. Through direct industrial work, collaborative research and development projects and largescale programme, this knowledge is being disseminated and new findings shared. To continue the great work so far, MTC is calling on industry to share their thoughts and be a part of the conversation.

1 Net Zero - where carbon emissions are equal to the amount of carbon (or equivalent) taken out of the atmosphere.

2 Carbon in Infrastructure – where and how much? | Institution of Civil Engineers (ICE)

SPRING 2023 9 ConstructionWorX DIGITAL

DIGITAL

Stage V engines have the power to reduce carbon emissions

Dave ConstructionWorX

Stollery

With the move away from red to white diesel and a greater focus on carbon emissions and sustainability in general, it was timely to see just how many new Stage V powered machines were launched at Bauma 2022.

Coupled with 2022 seeing record breaking new rental fleet deals announced as fuel prices rose dramatically, 2023 looks set to be a big year for Stage V engines and fuels like HVO.

On a recent visit to Perkins Engines, Construction Worx correspondent, Peter Haddock spoke to Rental Sector expert Dave Stollery to understand both the opportunities and challenges of rolling out Stage V equipment.

Dave: “Stage V is an EU emissions engine standard that aims to dramatically reduce tail pipe emissions and also offers the opportunity to improve fuel efficiency overall through the technologies implemented. The key emissions being targeted are particulate matter (PM) and oxides of nitrogen (Nox). And now all new equipment manufactured for UK and European markets will be required to use newly designed Stage V engines.

“To achieve greater energy efficiency and power output demands, Stage V engines are designed to be run harder than previous versions.

This is to support the engines after treatment systems such as Diesel Particulate Filters (DPF) which we have designed to satisfy the lifetime expectancy of our engines.

“The industry is familiar with DPF, but with Stage V, we now have self-managing engines with integrated DPF systems among other technologies to satisfy the requirements of Stage V. Utilising the heat generated from the combustion process ensures these aftertreatment systems are working at maximum efficiency and removing as much of the Nox and PM as possible, therefore, the exhaust of the equipment they power is far cleaner. This eliminates any purging and maintenance requirements whilst also allowing engines to be run harder, increasing both efficiency and performance.

“Clever design has also seen the new generation of Stage V engines able to increase power and torque significantly with a much smaller displacement and packaging overall. This has enabled equipment manufacturers to design more compact machines with greater hydraulic 10 SPRING 2023

capabilities. For example, the new Wacker Neuson EW100 compact wheel loader launched at Bauma can use either a Perkins 4 cylinder 2.8 litre 55 kW or a 3.6 litre 100kW engine without any design changes.

“This is all to do with the increased power density achieved with Stage V. In practical terms, this means we are now able to achieve the sub one litre per cylinder displacement engine sizes highlighted above. Previously a 4 litre plus engine would have been needed to produce the same output.

These engines can also work with a variety of fuel types, with the key to delivering high levels of uptime always reliant on the quality of the fuels used. And the same principles apply to the many fluids designed for use within these engines, like low ash synthetic oils and AdBlue. For rental companies, it’s now about ensuring end users understand this, to ensure they benefit from the fuel savings and efficiencies Stage V can deliver. And this is where maintenance benefits can also play a key role. For example, when it comes to the life of fluids these can now be extended

to 500+ hours and thanks to the dramatic reduction in particulates we can expect greater levels of uptime.

Bring in regular fluid sampling to the maintenance mix, and each machine can have a tailored approach to fluid management, potentially extending hours further. This can also reduce the cost of other consumables like filters. On the flip side, if fluids have been contaminated, sampling will pick this up, supporting better preventative maintenance.

“The payback for rental businesses, in particular, can be significant. Less maintenance means longer working cycles, increased uptime and ultimately happy customers, and with Stage V there are further engine health advancements. This is due to the increased number of sensors that are now built into an engine.

“They send data and information on engine health and fuel burn, further supporting better maintenance. And with customers looking at how to measure sustainability and carbon emissions, this data will become even more important in future purchasing and fleet renewal processes.

“A good example of the value of this information was the impact the pandemic had on new equipment supply and how businesses had to ramp up maintenance spending to extend fleet renewal periods. With well-maintained Stage V equipment, there is certainly an opportunity in the future to extend product lifecycles and even replace engines for a second or third life.

“The key to unlocking all of these benefits is understanding how to look after the engines themselves.”

SPRING 2023 11 ConstructionWorX DIGITAL

To achieve greater energy efficiency and power output demands, Stage V engines are designed to be run harder than previous versions.

Mecalac worked closely with Perkins engineers to optimise the Perkins® 904J-E28TA Mecalac chose to power the Revotruck

Fuelled by data

Construction Worx correspondent Peter Haddock talks to Flannery Plant Hire’s Strategic Manager, Chris Matthew about positive training and carbon reduction impacts – all fuelled by data.

For some time, I have been following the journey of Flannery Plant Hire as it embraces technologies like 3D machine control, from the likes of Leica Geosystems and Trimble, and invests in advanced laser safety solutions from Xwatch Safety Solutions.

More recently on a visit to its Operator Skills Hub, near Birmingham, I discovered just how much the business has been able to integrate everything it does, thanks to another long-term industry partnership with global telemetry specialist MachineMax launched in June 2020.

The partnership has seen Flannery connecting all of its mobile plant equipment to the MachineMax integrated dashboard. And nearly three years later, the business has transformed its approach to plant hire, thanks to all the data it can now draw upon, as Chris Matthew explained to me:

Chris: "Since the business was formed in 1972, we have always looked forward. And having celebrated our 50th year last year, we haven't changed the fundamental five pillars the business has operated on, namely, People, Safety, Innovation, Sustainability and Value.

"Having one of the UK's largest mixed

fleets, we have always recognised the importance of understanding how each machine operates and, ultimately, how to get the best productivity out of each asset in the safest and most efficient way possible.

"There are numerous challenges to tackle to achieve this, but as we recognised in 2020, we needed first to know what each machine was doing, where it was and how much fuel it was burning. MachineMax gave us a simple way of doing this with its easy to install hardware and intuitive dashboards. The impact has been significant, and impact has become an important word in our business ever since as we have recognised its every small impact that ultimately makes a big difference to our overall performance.

“The first major impact however on the back of our partnership with MachineMax, was the ability to also launch our Eco Operator Training Course in 2020, supported by the new dashboard. This in-turn saw us sign up for the Sustainability Supply Chain School Plant Charter in the same year.

“The Eco Operator Training Course has now been delivered numerous times to operators across the country,

12 SPRING 2023 ConstructionWorX DIGITAL

with every person taking the course making a positive impact on reducing our idle time and carbon missions.

“We have also added to our overall training programme with the opening of our first Operator Skills Hub in a joint venture with Balfour Beatty in February 2021. Through the combination of Tenstar Simulators linked to machine control, we are able to train teams of operators on the latest technologies like 3D machine control. And the individuals can literally walk into the dig area next to the classroom to try the latest machine using the relevant technology, in a safe job site scenario.

“This is particularly impactful when it comes to delivering our Trailblazer Apprenticeship Programme, which has been a big success and allowed us to more recently work with Government to offer boot camp training to potential new recruits. In 2022 we even started taking training 'On the Road' with our specially designed mobile HGV classrooms with simulators and, more recently, our investment in single simulator vans.

“This is all about making an impact on site by training staff where they work and reducing the need for them to travel, as it's not just the fuel savings related to the usage of a machine that we are trying to reduce."

Over the last three years, Flannery has also worked with the wider industry and key organisations like the Connected and Autonomous Plant (CAP) Group and National Highways Plant & Earthworks Community (PEC) to support better industry collaboration.

Chris continues: "CAP and PEC represent really important opportunities where we can share our experience with key clients, Tier 1 contractors and fellow hirers to support wider industry strategies and goals.

“Two of those key areas are safety and the use of new innovations, including advances in machine control. By working together, we can develop standardised approaches that positively impact the safe operation of equipment, productivity and efficiency. We can also raise important issues like designing earthworks models for the equipment we use to deliver them.

“Equally, with our MachineMax historical data sets collected over the last three years and our general documenting of projects we have delivered, we can now provide important benchmark data for future projects. This is already helping to set up and manage sites more effectively, removing bottlenecks whilst realising incremental improvements from day one.

Culturally we haven't changed as a business, but I think we are now much more aware of everyone's individual impact on the overall success of a project. And this is all about making small improvements, recognising trends and supporting each other as roles transition and new roles are required. For example, in the future, we will have more digital plant managers, data analysts and digitally enabled site managers, all with expertise that can support each other.

“So, when we think about how we cost a job, we will take information on potential fuel burn, payloads to be carried, haul routes and material movements before a machine lands on the site or the job is even at design, let alone tendered stage.

And in the future, this will also be about using real-time information that supports and informs actions onsite from black hats to operators and clients. Ultimately, we need to move material as short a distance as possible, handle it preferably once or twice but certainly not three times, whilst maximising payload and minimising carry-back.

And if we can show client procurement teams how this works and can deliver safer, more effective sites with minimal people plant interface and logistics, then we can add more value to each project.

This, in turn, will make the biggest impact by reducing the associated carbon emissions of operating and maintaining plant and equipment. And with Net Zero targets already published by clients like National Highways, every positive impact we can make adds up to a more sustainable future.

Since working with MachineMax Flannery has:

● Collected over 8 million hours of machine data to date.

● Connected and supported over 1,000 sites.

● Reduced idle time by 20% per month over a three month project with Amery Construction in 2022.

● Delivered 700+ training courses.

● Carried out 131 bootcamp completions with 59% successful bootcamp outcomes (Attendees securing employment).

● Delivered 20+ Eco-Operator training sessions.

● Trained 40+ apprentices to date.

SPRING 2023 13

NEW MEMBER PROFILE

The elephant in the room

Mammoth-MTS is a leading provider of Trenchless Installation and Suction Excavation Technology

Mammoth Equipment Ltd and their subsidiary company MTS Suction Systems UK Ltd, based out of Ely in Cambridgeshire, are suppliers of Trenchless Installation and Suction Excavation equipment across the UK and Eire.

Both companies were established in 2014 by Directors Russell Fairhurst and Frank Gowdy, who together brought over 60 combined years of experience in the sales, rental and support of market leading Trenchless Equipment and Suction Excavation systems.

Mammoth Equipment Ltd is the sole UK and Eire suppliers for a range of Trenchless and Limited Dig equipment for the installation of pipes, ducts and cables under roads, footways and sensitive surfaces with limited need of excavation. Products are manufactured by well-established manufacturers including Hammerhead® for Moles, Rammers, Pipe Bursters and Winches together with specialist compact Rotair high performance compressors as well as the Mammoth range of

safe excavation non-conductive air lances and tooling for wet and dry suction/vacuum excavation systems.

MTS GmbH the German based specialist body builder of MTS Suction Systems provides all sales, support, service, spares, maintenance, and training requirements for the full range of MTS equipment supplied to clients in the UK and Eire. Originally introduced to the UK market by Russell and Frank in 2006, the MTS range of DINO truck mounted suction excavators have become the No1 in the UK, according to Frank, and gained a reputation for quality, performance and longevity within the safe excavation market with 1000’s units of operating across the globe.

Due to the ongoing, growing demand for both company’s products and services, inward investment is seen as a key to continued success to ensure the highest levels of support and back up is available to all clients. This policy of investment has included the appointment of two additional Fitters in the north and south together with a Service

14 SPRING 2023 ConstructionWorX DIGITAL

Manager running both the Ely service centre and the recently opened Northern service centre, near Doncaster. The internal team has also been increased with additional support staff and investment in new software packages in respect of CRM, workshop/job control systems and stock control, sales and accounts systems.

Frank said, “Mammoth-MTS, together with its suppliers are fully focused on the provision and development of new and innovative products related to their core business to ensure current and future clients have the highest levels of choice, performance and support for all their trenchless and Suction Excavation needs.”

Please visit mammoth-mts.co.uk, or mail info@mammoth-mts.co.uk, or call on 01352 664888 for further information.

The UK's Only Live Demo Construction Equipment Event in 2023 BOOK NOW! • Attracting 450 Exhibitors and 15,000 Visitors • Live demonstrations across the site • Exhibition zones including machine innovation and technology Supporting a safer, smarter and more productive industry. Call Angela now - 07807 623640 or email angela.spink@plantworx.co.uk More details at www.plantworx.co.uk FOR THE INDUSTRY, BY THE INDUSTRY 13-15 June 2023 East of England Arena and Events Centre, Peterborough.

SPRING 2023 15 ConstructionWorX DIGITAL

MTS range of DINO truck mounted suction excavators have become the No1 in the UK

Green Hydrogen is key to Net Zero and future careers

Construction Worx correspondent Peter Haddock talks to Clare Jackson, Chief Executive of Hydrogen UK, about the trade body’s future vision for hydrogen.

In 2022 the word Hydrogen was everywhere, with key prototype machines launched at Bauma from Liebherr and Hyundai, quickly followed by a special Hydrogen press event from JCB revealing and operating its Hydrogen machines and mobile refuelling solution.

And there was a lot more activity last year thanks in part to the formation of its own industry trade body Hydrogen UK, in November 2021. With over 60 members all focused on bringing Hydrogen into the UK's energy mix, the organisation's CEO, Clare Jackson, is pushing hard to ensure the UK has a share of a global market set to be worth trillions of pounds.

Clare: "The aim of Hydrogen UK is to develop a common vision for what Hydrogen could and should look like in the UK and then to work out what we need to do to make that a reality. This involves developing a whole infrastructure for Hydrogen, from the creation of green Hydrogen to its storage, transportation and use in an increasingly varied range of applications.

“In the UK, we are one of the front runners in what will be a huge global market and an enabler for supporting our road to Net Zero. The key to this is the creation of green Hydrogen from renewables, and in 2022 the Government supported this with the launch of a new Low Carbon Hydrogen Standard, which defines what constitutes 'low carbon hydrogen' at the point of production.

“By having a defined standard, we can ensure Hydrogen production is measurable and that industries wanting to use Hydrogen have confidence in the fuel. Having this standard also allows us to accelerate the Hydrogen economy and benefit from the economies of scale this will deliver.

“We are already seeing large industrial clusters which are located near storage solutions like salt caverns, ramping up investment in Hydrogen powered equipment like boilers. And

Hydrogen is also being considered by the aviation sector as a decarbonisation pathway. Similarly, Hydrogen in the form of ammonia is also being used in the maritime sector.

But what is exciting is the work being done with on and off road vehicles.

For example, the West Midlands already has 20 hydrogen double decker buses in operation, and it will soon have 144 hydrogen buses on the streets, the largest fleet in the Western World.

When it comes to this sector, there are two ways of using Hydrogen, the Fuel Cell and combustion. A fuel cell is essentially a reverse electrolyser, extracting electricity to power a motor by mixing Hydrogen with oxygen, whose only emission is water. With combustion, you won't produce carbon emissions, but you will still produce Nox and Sox, so engine after treatment will need to be considered.

“Like all alternative fuels, it really depends on the application you are looking to use Hydrogen for as to what method you choose. And if we are to deliver on Net Zero, the more solutions we have, the better chance we have of pulling it off.

For me, it's all about pulling the Hydrogen puzzle pieces together at the same time. Now we've got the production, were able to enable the infrastructure, which includes storage. Then we have the demand sides technologies like the mobile plant and equipment from OEM's like JCB.

“And all of these must be ready simultaneously, which means we need to think about the jobs and skills puzzle piece. Here we are very fortunate to have adjacent sectors that are used to working with gases, so we can upskill individuals to work on Hydrogen.

But critically, if we are to fill all the new roles and build careers, we need to talk to young people about getting excited about STEM subjects and getting Hydrogen onto the curriculum. As it's not just about getting people into engineering degrees but also about getting people into technical courses to develop the skills we need to deliver Net Zero, in general.

And with Hydrogen set to be worth over £2 trillion globally by 2050, it's certainly a great career path to take.

16 SPRING 2023 ConstructionWorX DIGITAL

Clare Jackson

Knowing the rules for abnormal loads to ensure safer roads

Marie Biddulph, Assistant Regional Road Safety Co-ordinator devotes her days to improving safety on National Highways’ road network.

Marie says, “I get a real sense of satisfaction when I see an abnormal load that is properly secured and following all the latest guidance. There is a lot of legislation around load safety, particularly on bigger loads, but it is important, it keeps us all safe. I am over the moon when operators recognise that and I take pride in the fact that National Highways has helped to raise that awareness across the industry and beyond.”

Many hours are spent out in the cold speaking to drivers of HGVs, commercial and private vehicles, motorcyclists and people towing trailers or caravans sharing important safety advice.

And a key part of her work is focussed on load safety - from the smallest to the biggest loads carried on the road network - making sure drivers know and abide by latest guidelines and are carrying out the basic checks that will help prevent incidents occurring. Marie, who covers the Midlands, explains:

“We know that no driver sets out to cause injury, or worse, but they risk doing just that by failing to carrying out a few simple checks and not keeping up to date with the latest guidelines.

“There is a huge responsibility that comes with transporting any load and it is essential that drivers make sure their cargo is safe and secure. Every journey should start with a walk around the vehicle to make sure everything is secure, the appropriate straps or chains are being used and the load isn’t too heavy.

“Companies must also make sure that drivers understand the importance of the walkaround checks and that they are afforded the time to do that.

“It is also important that drivers and their bosses keep up to date with

legislation. Often drivers who have been in the job for a long time simply fall back on that experience rather than learning and following new rules.

“I spend a lot of time working out on the network with our police and DVSA partners. Drivers stopped for breaching legislation will sometimes say ‘I’ve been doing this job for years’. But over time, things improve, and they get better. This is true of guidelines and legislation, so we certainly urge all drivers to keep up to date with the current laws.”

Legislation around carrying ‘abnormal loads’ is particularly substantial and Marie is keen to ensure all operators who work with this loads, the largest that are transported by road, do familiarise themselves with the very latest regulations.

“If you are ever unsure of anything please ask, don’t just chance it. Take the time to plan and notify your route correctly, adhere to any local restrictions and travel within the appropriate speed limit for the weight that you are carrying.”

For Marie, success in her role is not spotting those breaking the law – it is not finding anyone breaking the law as all vehicles travel safely and legally.

“Safety is always the primary concern at National Highways. We’re not an enforcement agency, we are there to support road users and make our roads as safe as they can be. I want to share our appropriate safety advice, whatever that may be, to help everyone get home safe and sound.”

National Highways will be exhibiting at the forthcoming Plantworx Construction Exhibition which is taking place from the 13th – 15th June 2023 at the East of England Arena and Showground in Peterborough.

SPRING 2023 17 ConstructionWorX DIGITAL

Marie Biddulph

Hydraulic line breaks and electrical sensor failures are two of the most common reasons for excavator and wheel loader breakdowns, costing construction businesses valuable time and money.

Give your customers the confidence their investments are protected with our extended warranty programme.

THERE FOR YOUR CUSTOMERS WHEN LUCK ISN’T www.epgglobal.com Get in touch at info@epgglobal.com to discuss your total warranty solution We provide your construction office! Fast availability in different sizes Easy to dismantle and relocate Adaptable and expandable at any time www.containex.com CTX_Inserat_Construction Magazine-UK (180x132)_123-rz.indd 1 18.01.23 12:30 18 SPRING 2023

Plantworx 2023 – a ‘one stop shop’ for the latest in construction equipment and new technologies

Face-to-face business events have gained a renewed importance and this was more evident than ever at the recent Executive Hire Show, in Coventry, where visitor attendance beat all previous records.

This year’s Plantworx live action event, which will include a host of innovations and new Zones, is one show in the event calendar that is not to be missed! Building on the success of the Futureworx 2022 ‘show and tell’ technology event, Plantworx 2023 will demonstrate to visitors what’s new to the market but also what’s coming along the technology pipeline.

The original allocation of space for digging demonstrations has been sold out – and an impressive 28% of exhibitors at Plantworx 2023 will be making their show debuts. Many of these have technology solutions working towards a whole connected site.

“Key machinery OEMs have confirmed their presence at the show and many companies will be revealing their electrification strategies for off-road vehicles and equipment”

Visitors can expect to see showcases from leading brands including Hitachi Construction Machinery, Caterpillar, Hidromek, Hyundai, SMT (Volvo), Takeuchi, Sany, Sunward Europe, Liugong, Mecalac, Yanmar Compact Equipment, Avant, Kubota, Doosan, Bobcat, BOMAG and many more.

“Excavators are the modern day equivalent to the ‘Swiss Army Knife” – the ‘Polymath’ of the construction sector”

It’s not just about the excavator – it’s the telematics, cameras, and sensors that work together to enhance how operators use excavators. The data allows contractors and fleet owners insight into their equipment and its performance. Through a single platform, contractors and fleet owners can track the location, health, and use of their equipment in real-time, all in one place.

Attachments also play a pivotal part in a machine’s versatility –Plantworx 2023 has a record number of attachment manufacturers exhibiting, these include Auger Torque, Digger Attachments, BPH Attachments, leading tiltrotator companies including Engcon and Steelwrist.

“The digital revolution is truly upon us and what started as a trickle has now become a flood of technology and connectivity companies coming to market.”

Plantworx has already attracted a number of these businesses to exhibit in 2023 – these include, telematics specialists MachineMax, ABAX Telematics and Plant Tracking, and connectivity solutions company, Onwave and more…

Machine control and machine guidance will be a big part of the show, these systems are now the norm on the majority of site machinery whether factory or retrofitted – iDig 2D & 3D by Nasco Digtec will be demonstrating the very latest in dig technology.

In addition to Plantworx will feature the Get Connected Zone, BIG Ideas, The Simulation Zone all of which we talk about further on in this issue. Plantworx has also partnered once again with National Highways, who will also be exhibiting at this event.

Registration to attend the event (13-15 June 2023, at the East of England Arena and Events Centre, Peterborough) is now open and the Plantworx App is now live – visit Plantworx-2023

A full list of exhibitors can be found here Exhibitor ListPlantworx 2023

What are you waiting for? Register now and sign up for the Plantworx 2023 App - for all things Plantworx!

The 5th biennial construction machinery exhibition is less than four months away – taking place from 13-15 June 2023, at the East of England Arena and Events Centre, Peterborough.

SPRING 2023 19

Training meets technology – the Simulation Zone returns to Plantworx 2023

As the industry is heavily focused on delivering digitally-enabled sites, the requirement for operators to understand the use of machine control and GPS equipment has

The Simulation Zone at Plantworx is once again being sponsored and delivered by Plantforce Rentals. The company has been at the forefront of simulation training for some years and was responsible for introducing the technology to tier-one contractors on many of the major infrastructure and rail projects - such as HS2 and, the nuclear project, Hinkley Point C.

The 2019 Plantworx Simulation Zone was arguably the most popular destination for show visitors. The Zone was a true example of advanced technology – a look into the future of plant operative training. The Plantforce team reported that the simulators clocked up a staggering 280 hours of use at the event – and were featured on ITV Anglia News.

Plantforce were also presented with the ‘Outstanding Contribution Award’ by the CEA and Plantworx organisers. The award was in recognition of the Plantforce team’s immense effort and hard work putting the Simulation Zone together and introducing a whole new dimension to the event.

The interactive construction Simulation Zone will promote virtual training for operator novices through to experienced operators who wish to upskill and learn machine control systems and advanced

technologies. It is performed in a safe, virtual and fully immersive environment, in which operators can practice and develop their skills.

The simulators, with the support of a qualified trainer, assist operators to focus on the application of the technology on-site to drive safety and efficiently. The machines also prepare the user for the reality of working on construction sites and developing real-world skills. Whilst no simulation can duplicate every potential outcome in the ‘real-world’, a “sim” is an excellent tool to train an operator based on the most likely outcomes.

Using state-of-the-art simulation, Plantforce has teamed up with a number of industry key players such as Trimble, Leica Geosystems and Tenstar Simulation. Visitors to the Zone will be able to experience each of the technologies and work together on construction site challenges.

All Plantworx visitors are invited to participate. Immersive training experts are on hand to guide each participant through the virtual world of simulation technology. Companies and contractors who would like to investigate this type of training are also invited to experience what the Zone has to offer. No previous experience is necessary!

never been more important.

20 SPRING 2023

Get Connected –the Technology Zone at Plantworx 2023

The Plantworx Get Connected technology zone is the brain child of Dale Hawkins of Awesome Earthmovers and former digital manager at Plantforce Rentals.

Dale’s vision was to create a dedicated zone to focus on the technology providers within the construction equipment sector that specialise in machine control, telematics, GPS and machine safety systems.

The inaugural Futureworx event in 2022 was a resounding success and proved the industry is hungry for new technology. As a result, the Futureworx team were asked by leading construction innovators to recreate an element of that event at Plantworx. The new zone will demonstrate the technology and innovation that will drive productivity on the construction site leading us into the construction site of the future.

Dale said, “We want to bring together companies that have new and innovative ways of delivering solutions. The role of machine control, telematics and data is transforming planning operations in modern-day construction. It really is a complete game changer for companies which embrace the new technology and integrate these systems into their everyday operations.

Get Connected will have a strong focus on the people-plant interface, telematics, the connected site, and safety systems.”

The zone will be linked to an outside demonstration area – where the exhibitors (where able) can demonstrate their products in action on working machinery which will have their technology installed. Exhibitors will arrive ready ‘to plug and play’.

*Sean Scarah, Plant and Logistics Director for Balfour Beatty Asset and Solutions Division, “It’s not all about diggers anymore… it’s about a whole connected site where 3D machine control, and

in the future, autonomous plant helps to deliver a project and help us on our journey to Net Zero.

And to succeed, we all must work more collaboratively together with industry solution and equipment providers as well as supply chain partners, IT specialists and, of course, clients.”

Concept innovations are also welcome – and exhibitors can use their stand space to demonstrate prototype systems – a chance to show key construction professionals – ‘what’s in the pipeline’.

The Get Connected area will feature as part of the VIP Preview Event (on 12th June) – together with the Simulation Zone, brought to Plantworx 2023 by Plantforce Rentals, and the BIG Ideas showcase. Guests will include decision makers from key infrastructure projects, National Highways, tier one contractors and plant hire companies.

There are a limited amount of booths reamining in the Get Connected Technology Zone at a package price of £1,850 (ex VAT). Interested companies are encouraged to get in touch as soon as possible to avoid disappointment.

Sales contact - Angela Spink: angela.spink@plantworx.co.uk / +44 (0) 208 253 4517

More from Sean Scarah with Peter Haddock in this special podcast….

Spotify – https://bit.ly/3XiViPq

Apple Podcasts – https://bit.ly/3XC46AB

Anchor – https://bit.ly/3ZIEGC3

SPRING 2023 21

BIG Ideas at Plantworx

Plantworx 2023 will provide a platform for start-ups engineering the future, connecting them to some of the UK's most influential companies, potential investors and the media. The BIG Ideas showcase will be a hotspot for the industry’s newest and brightest rising stars.

Plantworx is reaching out to individuals, “start-ups” and smaller companies with products, technologies or services new to the construction industry – which can make a Big IMPACT on the sector. Offerings that can improve efficiency, sustainability, safety, security and more.

THE BIG IDEAS PACKAGE COMPRISES:

● An exhibition pod, under the BIG Ideas banner located close to the main entrance to the inside exhibits at Plantworx.

● Participation in a VIP preview event – with trade press and invited contractors, specifiers, influencers and opinion formers.

● Starred listing on the Plantworx website and the Plantworx App.

● Invite and tickets to the CEA Conference and Awards evening (30th March 2023) providing excellent networking opportunities with key decision makers.

THE SELECTION PROCESS:

Construction Equipment Events Director Rob Oliver explains, “We are looking for ‘start-up’ or similar companies with products, technologies or services new to the construction industry – which can make a Big IMPACT on the sector in the years to come. New products and concepts launched at the last Plantworx can now be seen embedded in today’s applications. We are now looking for the next generation of ideas that might just make a difference in the future. We have managed to devise a low cost and very affordable package to give companies a leg up in the market”.

The Plantworx organisers will determine which companies have products, technologies or services appropriate to the BIG Ideas promotion. Contact rob.oliver@plantworx.co.uk or louise.carney@ plantworx.co.uk for more information.

22 SPRING 2023

Awesome Earthmovers host Operator Challenge at Plantworx 2023

Plantworx has built a reputation for pioneering innovation and showcasing leading technological advancements from all sectors of the construction industry. Yet there remains a key place in the cab for the skilled operator to shine….

Awesome Earthmovers has been invited by the Plantworx team to host the inaugural Operator Challenge at the 2023 show, which is taking place at the East of England Arena and Showground from the 13th to the 15th of June this year.

AE’s have teamed up with some of the leading names in the construction industry to bring a range of eight different challenges to the arena where operators of varying skill levels can pitch themselves against each other in a series of timed trials.

Whilst many traditional operator trials competitions are aimed at experienced operators, the Awesome Earthmovers Operator Challenge has been designed to allow operators of any skill level to take part.

The event will be hosted by our good friend Peter Haddock from Content with Media and will feature guest appearances by many of the UK’s leading social media influencers such as Amy the Digger Girl aka Amy Underwood, Conor the Digger Driver aka Conor Kelly, Bearded Excavation aka Lloyd Peckham, Lord Muck aka Kurt Mills, Tracklass1 aka Lana Edwards and newcomer, Ben ‘the operator’ Wade, who has a very bright future ahead of him.

Dale Hawkins, Director, Awesome Earthmovers said, “The trials have been designed to be 100% accurate and 100% fair with each registered operator being supplied with their own timecard and invited to complete all 8 challenges.

Each time a challenge is completed, the time is officially recorded and the operator with the fastest combined time including penalties on the last day of the show will be crowned the winner.”

There will be goodie bags and trophies for the top five runners up and a holiday for two for the winner to the value of £3,000.

Dale added, “It’s not just a challenge but a great place to meet up with fellow operators and industry celebs at the catering tent over a coffee, situated right next to the Get Connected Zone where visitors can view all the latest technology equipped machinery demonstrations in action.”

To register to take part in the Operator Challenge visit Plantworx Registration - Awesome Earthmovers

Lana Edwards Amy Underwood Ben Wade Conor Kelly

Lloyd Peckham

Peter Haddock (l) & Kurt Mills (r)

TO VISIT

EXHIBIT

MOUSE-POINTER

MOUSE-POINTER TO

PLANT WORX NEEDS YOU!

OVER 220 EXHIBITORS ALREADY REGISTERED VIEW ALL EXHIBITORS

SPRING 2023 25

DALE'S DIARY New EU Machinery Regulation finalised

The CEA’s Senior Technical Consultant, Dale Camsell, charts the progress of the major regulatory update of what was the Machinery Directive and will metamorphosise into a formal EU Regulation. This is relevant to all companies selling machines into the EU…..

State of play – 2022 ends in agreement

In December 2022, the EU legislative bodies (European Commission, European Council and European Parliament) came to a provisional agreement on the final content of the new Machinery Regulation. Compliance with this piece of legislation, which will replace the current Machinery Directive, is fundamental to being able to sell machinery into the EU market, hence it is of significant interest to machine manufacturers.

December’s agreement was classed as provisional because it was agreed only by the negotiating representatives of the three institutions and still required full endorsement by the European Council and European Parliament before it could be considered finalised. However, further progress has since been made and, in January this year, the European Council approved the agreement. Following this endorsement, the text was made public; the CEA has made an initial analysis of the text and is sharing the details with members.

Complete endorsement by the institutions is expected to occur when the European Parliament votes on the acceptability of the negotiated text during a plenary session planned for mid-April. Once that is complete all that remains is for certain internal procedural matters to be dealt with. For example, translations into all official EU languages is required before it can formally published. Our best guess is for this to happen during the latter part of Q2 2023.

Until publication, industry can prepare itself for the implementation of the new regulation on the basis of January’s provisional text - since this is highly unlikely to be modified prior to its formal release.

General outlook

When the European Commission first published its initial proposal for the content of this regulation back in April 2021, it contained a great

many requirements that industry felt were disproportionate, overly burdensome, or simply unworkable. However, through CECE, the CEA has tirelessly advocated for a fairer, more reasonable set of requirements and I'm pleased to report that, as a result of this successful advocacy campaign, the end result is a regulation that is, on the whole, better balanced. This underlines the value of concerted and co-operative effort from the representative trade associations.

Key implications – timing and content

The European Commission’s proposal originally was a cause of concern as it offered an unreasonably short transition period - just 30 months. This would have meant that any product modifications needed in order to comply with the new requirements would have to be completed within that time period after the regulation’s publication. The good news is that following successful advocacy through CECE, the institutions agreed a 42 month transition period, which industry has warmly welcomed.

It is expected that the new Machinery Regulation will be fully implemented during the latter part of 2026. Thus, any machinery within scope must be compliant with its requirements by that date in order for it to be able to be sold on the EU market.

One notable difference in the new regulation compared with the current directive is that the regulation explicitly allows manufacturers to provide operator manuals in either digital or paper form. From a legal perspective, this had previously been a highly divisive matter but industry, with CECE at the forefront, had promoted the many benefits of operator manuals being provided in digital form. In addition to this, the new regulation also allows the declaration of incorporation to be provided in digital form. Another win for manufacturers.

26 SPRING 2023 ConstructionWorX DIGITAL

In keeping with other recently published legislation, this regulation includes provisions that give the European Commission certain empowerments. These include the ability to modify the content of Annex I (more on that later) and also to publish so-called common specifications (more on that later too). Whilst industry in general did not object to the principle of this empowerment, there were significant concerns about the lack of transparency and lack of stakeholder engagement during the development of such common specifications. Due to these concerns, CECE had asked for greater industry involvement in these matters. This resulted in changes being made to the legal text that guarantees stakeholder involvement should any of these empowerment provisions be invoked.

One of the most controversial requirements in the Commission's original proposal concerned conformity assessment procedures, especially for machine types listed in Annex I. The issue was that any machines included in the list would require the conformity assessment to be performed by a notified body, even where harmonised standards were available. The original list had 25 machine types included but, following industry pressure, this has been reduced to just 6. The only machinery of concern to CEA members being those that include an artificial intelligence element that provides a safety function.

For the first time in our sector, the new regulation includes the provision for the European Commission to produce common specifications. These are equivalent in status to a harmonised standard, i.e. they provide a presumption of conformity. However, industry had concerns that common specifications will diminish the value of the harmonised standard process and could lead to a lack of stakeholder engagement in the development of future harmonised standards. However, under the terms of the empowerment, the European Commission can only produce common specifications where the European Standardisation Organisations (e.g. CEN) have failed to develop a harmonised standard when requested by the European Commission. The Commission has assured stakeholders that the development of common specifications is most certainly a last resort and that they have no intention of undermining the harmonised standards process.

With regard to the technical requirements contained in the regulation, these remain broadly unchanged, with the majority being copied over from the current Machinery Directive. Of course, some have been modified and there are some additional provisions, which mostly deal with new hazards such as cyberattack. Compliance with the cyber requirements of the Machinery Regulation can be achieved by complying with the, currently in development, Cyber Resilience Act. This new piece of legislation will set requirements for the robustness of a product to cyberattack and it specifically states that compliance with its provisions will automatically confer a presumption of conformity with the Machinery Regulation. The main issue for industry is that there are currently no harmonised standards available for compliance with the Cyber Resilience Act and they are unlikely to be available in time for its publication. CECE is firmly advocating for a more reasonable timeline for the implementation of the Act to allow sufficient time for the relevant harmonised standards to be developed.

Another proposal of concern to CEA members is the requirement that, where relevant due to its height, machinery shall be equipped to prevent the risk of contact with overhead power lines or prevent the risk of creating an electric arc between the operator and power line. This is an entirely new requirement, meaning that there are no harmonised standards available that describe state of the art protection measures. These standards can and will be produced but there is a great deal of

concern as to whether they’ll be ready in time.

Finally, there are new requirements demanding that manufacturers provide repeated shock vibration information to which the hand-arm system is subjected. This is another new requirement for which no harmonised standards exist. Again, industry fears that development of such standards will take some time, meaning that they might not be ready for when the regulation is implemented.

Guidance

It is customary that, after the publication of a new piece of EU legislation, the European Commission produces an official guide to the directive/regulation. Since this document is a guide, it has no legal status but it proves to be extremely helpful to stakeholders in understanding the intent of the various requirements contained within the legislation.

Such a guide exists for the current Machinery Directive, hence stakeholders were anticipating that the European Commission would immediately begin the process to revise the existing guide once the new regulation was published. However, the Commission is not prioritising the revision of the guide; in fact it shows little interest in taking on this task any time soon. CECE, as well as other industry associations, believe that the guide is an essential element in the smooth and uniform application of the new regulation. Many EU member states, including some of the major players, have also raised their concerns with the Commission. We expect to hear further from the Commission in late March as to whether they’ve changed their view on the development of a guide.

Given the Commission’s position, industry has decided that it will produce its own guidance document. Orgalim will lead the drafting of this guide and the CEA, through CECE, will provide significant input. Work on this task is due to commence imminently.

The UK situation

One big question that remains unanswered is whether the UK will adopt the new EU regulation. As a reminder, since the end of the Brexit transition period the UK has been free to implement its own laws, independent from the EU. However, to date, it has adopted all EU product compliance legislation relevant to the construction equipment sector without any technical modification. Once the EU Machinery Regulation is published we await with interest how the UK government will react. The CEA has previously raised this query with BEIS but, as expected, the response was vague. We will, however, continue to engage with BEIS in the hope that we can get a clear understanding of the future GB market situation in a timely manner.

Of course, the UK government only has jurisdiction over the product compliance laws affecting the sales of machinery into the GB market; all EU product related legislation, including the new Machinery Regulation, will continue to apply in Northern Ireland since that remains in the EU Single Market by virtue of the terms of the Northern Ireland Protocol. At time of writing there are political efforts underway to revise the terms and interpretation of the Protocol which may change the situation.

Further information

Dale Camsell provides detailed briefings on regulatory and standardisation issues to quarterly meetings of the CEA’s General Technical Committee (GTC). CEA members may nominate representatives to participate in the work of the GTC by contacting Dale via dale.camsell@thecea.org.uk

SPRING 2023 27 ConstructionWorX DIGITAL

CEA’s 2023 Conference

Thursday 30 March 2023 | East of England Arena & Events Centre, Peterborough

09.30 – 10.00 CEA AGM CEA members only

10.10 – 16.30 CEA Conference

Open to non-CEA members

Construction Equipment – a Global and Domestic Market Overview

The impending EU Regulatory Tsunami – the outlook for UK

National Highways – Introducing CAP 3

Decarbonising the Megaprojects

The Conference is free to CEA members and Plantworx 2023 exhibitors. Non-members’/exhibitors’ tickets £150 (ex VAT).

Chris Sleight, MD Off Highway Research (Global)

Alex Woodrow, MD Knibb Gormezano (UK)

Dale Camsell, CEA, Senior Technical Consultant

National Highways Connected, Autonomous Plant Unit

A Panel Discussion with representatives from Plant Hire, Contractors, and Mega Projects including Merrill Lynch (Lynch Plant Hire), Mark Crawford Digital Plant Manager (Balfour Beatty plc).

Addressing both sides of the Skills Gap

Susan Scurlock MBE, CEO, Primary Engineer

Anna Burrows CEO, See it, Be It

Harry Dean, COO, British Forces Resettlement Services

ESG (Environment, Social and Governance) Energy Efficiency of Assets and Buildings

Data Flipping and Manipulation

The Hydrogen Panel – discussion around Hydrogen

19.00 – 23.00 Plantworx Innovation Awards Dinner

Dress Code: Business attire / cocktail

Lara Young, ESG Lead, Cromwell Property Group

Mark Lawton CEng FCInstCES, Head of Engineering Surveying at Skanska

Riccardo Sardelli, Volvo Penta

Richard Payne, Cummins

Jon Regnart, Senior Policy Advisor, Hydrogen UK

Conference kindly sponsored by

28 SPRING 2023 ConstructionWorX DIGITAL

Plantworx Innovation Awards Dinner

Ticket price for the awards dinner

Table of 8 CEA Member Rate £699

Table of 8 PWX Exhibitor £699

Note: all prices ex-VAT

Ticket price includes:

● Sparkling Networking Reception

● Three Course seated Dinner

● Half a bottle of wine or soft drinks

Single Ticket Member £95

Single Ticket Non-member £125

● The Plantworx Awards

● Your host for the evening is Shaun Wallace (the Dark Destroyer from ITV’s The Chase)

MOUSE-POINTER CLICK HERE to reserve a table or individual tickets (or visit https://forms.office.com/e/SZ0JznJzcM)

Dinner sponsorship packages available – contact joanna.oliver@thecea.org.uk

SPRING 2023 29 ConstructionWorX DIGITAL

THANKS TO THE CEA FOR THE UK PAVILION AT BAUMA OKO, THE UK-MADE WORLD LEADER, WAS DELIGHTED TO EXHIBIT WITH OTHER UK CONSTRUCTION EQUIPMENT SUPPLIERS IN MUNICH. Get OKO Mining X-Tra Heavy Duty in your tyres –Max performance, max value – from less sealant per tyre, than imported competitors. Available next-day in the UK from: OKO Sales Ltd | 0121 356 6565 | www.okosales.co.uk OKO Bauma Advert 2022 v1.indd 1 11/11/2022 16:23 For more information, visit our website – www.thecea.org.uk ARE YOU A MEMBER? If you are not already a member of the CEA and are interested in finding out more about the benefits of becoming a member, then contact us by email at info@thecea.org.uk or visit www.thecea.org.uk for more information. The CEA represents over 140 companies in the construction equipment industry... Recognised by Government, Valued by our Members 30 SPRING 2023

HARD DATA

UK Construction equipment sales – 2022 beats 2021

The CEA’s Market Analyst, Paul Lyons, provides his insight into what is happening in and around the construction equipment market …

Retail sales of construction and earthmoving equipment showed very strong growth at the end of 2022. Sales in Q4 were 20% above the same quarter in 2021, and as a result, sales for the full year were just under 3% above 2021 levels, reaching 37,400 units. As a result, 2022 saw equipment sales at “record” high levels. By exceeding 2021 numbers, which were higher than the peaks reached in 2018 and 2019, they became the highest annual sales since before the financial crash in 2008.

The pattern of sales in the UK last year saw a weak first half due to supply chain constraints which impacted on machine production as well as the import of equipment from overseas. However, as highlighted above, sales in the second half of the year were very strong, with clear signs of supply chain issues improving in the last quarter. Sales in the early months of 2023 should benefit from the ongoing catch-up effect, as lead times for supply of equipment continue to return to a more normal pattern.

An additional feature in the construction equipment statistics scheme run by Systematics International has been the recording of machine sales by engine type, including sales of electric powered equipment.

For 2022, this shows that sales of electric powered machines were double the level of sales in 2021. While this illustrates the progress that is being made to decarbonise within the sector, annual sales of electric powered equipment are still in the hundreds and highlights the need for more investment in charging infrastructure and the need for further development and promotion of electric power within the industry.

The pattern of sales for the major equipment types provided quite a mix of performances in 2022. Telehandlers (for the construction industry) showed the highest sales last year, at 15% above 2021. In contrast, sales of Wheeled loaders were the weakest, ending up at 3.5% below 2021’s figures. Sales of the two most popular equipment types, Mini/Midi excavators and Crawler excavators saw sales fairly similar to 2021. Crawler excavators ended up at just under 3% above the previous year and the most popular product, Mini/Midi excavators, saw sales matching 2021.

In their most recent forecast, Off-Highway Research are anticipating that sales of construction equipment will show a fall of 7% this year as the impact of reduced activity in the construction market is experienced. The high level of uncertainty from the ongoing war in the

SPRING 2023 31 ConstructionWorX DIGITAL

Ukraine is expected to result in a weaker economic climate and lower levels of investment. Combined with the effects of higher costs for materials and energy, activity in the construction sector is expected to decline by close to 5% in 2023, as forecast by the Construction Products Association (CPA).

Construction equipment sales in the Republic of Ireland are also recorded in the statistics scheme run by Systematics International. Sales in 2022 were disappointing compared with the UK and ended up at 8% below 2021 levels, reaching 1,800 units. Sales in the last three quarters of the year all saw declines compared with 2021.

The UK construction Purchasing Managers Index (PMI) published by IHS Markit is a good indicator of current prospects within the UK construction industry. The latest update for January is shown in the chart below and indicates that the index is continuing to decline in recent months, with the last two months falling below the 50.0 “no change” level. The latest survey in January indicated that new orders are declining across the industry and housebuilding is currently the weakest sector. Rising interest rates and unfavourable economic conditions are being identified as factors impacting on housing demand.

CONSTRUCTION OUTPUT IS FORECAST TO DECLINE IN 2023

The latest figures from the Office for National Statistics (ONS) show that growth in construction output was slowing down in 2022 with growth at 5.6%. This followed growth of just under 13% in 2021, following the recovery from the pandemic. The quarterly pattern of output last year provides a clear indication of the current market situation, with output being virtually flat across the last three quarters of the year, following strong growth in Q1. The statistics on new orders for construction show a declining situation. While achieving modest growth of 1.2% for 2022 overall, orders at the end of the year were on a downward path, with Q4 showing a 4.3% decline compared with the previous quarter.

The Construction Products Association (CPA) published their Winter forecast for the UK construction market at the end of January. This latest update anticipates a decline of 4.7% in construction output in 2023, more severe than the Autumn forecast which indicated a 3.9% downturn. Private housebuilding is identified as the worst effected sector this year, both in terms of new building and repair and maintenance activity. Falls in activity in these areas are expected to be partially offset by continued growth in infrastructure, which is already at historically high levels of activity. This sector has benefitted from multi-billion pound projects such as HS2, the Thames Tideway Tunnel and Hinkley Point C as well as long-term frameworks activity in sub-sectors such as rail, roads and energy. Going forward, further growth in infrastructure output is expected but it is likely to be slower than in previous years due to cost inflation and financial constraints. The forecast for 2024 is for construction output to stabilise and show modest growth of 0.6% compared with 2023.

https://www.constructionproducts.org.uk/

32 SPRING 2023 ConstructionWorX DIGITAL

CEA MEMBERSHIP LIST

ABAX UK

www.abax.com/uk

Adams Cundell Engineers Ltd (ACE Plant)

www.aceplant.co.uk

Airboss Ltd

www.airbosstyre.com

Air-Seal Products Ltd

www.air-sealproducts.com

Amber Valley Developments LLP

www.amber-valley.com

AP Air Ltd

apairltd.com

Armcon Ltd

www.armcon-online.com

Ashtree Vision & Safety Ltd

www.avsuk.co

ATG Ltd

www.atg-global.com

Beckers Industrial Coatings Ltd

www.beckers-group.com

Becool Radiators / Gallay Ltd

www.gallay.co.uk

Bergstrom Europe Ltd

www.bergstromeurope.com

BKT Europe SRL

www.bkt-tires.com

Blackwood Engineering

www.blackwoodengineering.co.uk

Blue Group

www.blue-group.com

Bobcat Company

www.bobcat.com

Bomag (GB) Ltd

www.bomag.com

Brendon Powerwashers

www.powerwashers.co.uk

Brigade Electronics Group Plc

brigade-electronics.com

British Steel

Britishsteel.co.uk

BSP TEX Ltd

www.bsp-if.com

Cabcare Products Ltd

www.cabcare.com

Caepro Ltd

www.caepro.com

Caldervale Group Ltd

www.caldervalegroup.com

CanTrack Global Ltd

www.cantrack.com

Caterpillar (UK) Ltd

www.cat.com

Clarios UK Ltd

www.clarios.com

CLM Construction Supplies Ltd

www.clm-supplies.com

CNH UK Ltd

www.cnhindustrial.com

Con Mech Engineers Ltd

www.conmecheng.com

Cummins Engine Co Ltd

www.cummins.com

Curtis Instruments UK Ltd

www.curtisinstruments.com

Danfoss Scotland Ltd

www.digitaldisplacement.com

Dawson Construction Plant Ltd

www.dcpuk.com

DF Capital

www.dfcapital.co.uk