Banks’ Long-Term Investments Paid Off in 2022

With demand for office and retail space still not recovered from the effects of the pandemic, having an experienced team of commercial lenders has helped Webster Five pivot as commercial real estate markets have changed, said Christopher Watson, the bank’s senior vice president and senior lending officer.

The $1 billion-asset Webster Five grew its commercial mortgage volume more than 800 percent year-over-year. Some of that activity included deals that the bank began working on 2021 and closed in the first half of this year, Watson said.

portunities to get involved with multiple deals. Much of the bank’s growth has come locally.

“People automatically think that a lot of the growth came out of the Boston area, but Worcester is our backyard,” Watson said. “We’ve been able to successfully be part of quite a few projects in the Worcester area.”

Investments in Gateway Cities Pays Off

The $691 million-asset Reading Cooperative Bank does not have a branch in Lawrence, but the city has been the site for much of the bank’s recent commercial real estate growth, said Phil Bryan, Reading Cooperative Bank’s executive vice president and chief banking officer.

Reading Cooperative saw the number of commercial real estate loans increase yearover-year in the first half of 2022 by more than 200 percent.

The commercial lending team started focusing on the Lawrence market about three years ago, Bryan said, and opportunities there have included construction, small multifamily projects and apartment building renovations in that post-industrial, immigrant-driven Gateway City market.

come out of past successes.

“Because we’ve got such a good reputation in Lawrence, and we’re becoming kind of a household name, we’re seeing a lot [of activity],” Bryan said.

The commercial loan pipeline remains similar to what the bank saw at the end of 2021, Bryan said, though the number of opportunities for new deals has recently started to slow down as interest rates rise.

Industrial warehouses for last-mile distribution drove the bank’s commercial real estate lending last year, Watson said. He added that while that activity has since tapered off, the bank has more recently seen an increased demand for industrial flex spaces, as well as housing-related deals.

Watson said Webster Five’s lending team has built relationships with commercial real estate brokers over the years, leading to op-

The bank saw the flow of commercial real estate deals begin to build about 18 months ago, Bryan said, and the bank entered 2022 with a strong lending pipeline.

He added that most of the opportunities the bank has found are with borrowers experienced in commercial real estate, with few newcomers getting involved with properties in the current business environment. Some of Reading Cooperative’s opportunities have

The bank also acquired branches in Lynn and Nahant from Coastal Heritage Bank last year, and Bryan said that Reading Cooperative has started building its commercial lending business in that other Gateway City market, as well.

“That’s new territory for us, and we see some similarities with what we have in Lawrence,” Bryan said. “We think we can make a pretty good splash there and really get ingrained in that community as well.”

Merger Sets Lender Up for Success

While commercial real estate drives lending on the commercial side of its portfolio, Bryan said, the bank has seen growth in its residential mortgages business in 2022, particularly with adjustable-rate mortgages. He added that looking ahead, the bank plans to do more consumer lending to balance its loan portfolio.

Continued on Page 19

10 | BANKER & TRADESMAN AUGUST 15, 2022

1 FAST 50

Continued from Page

For several local lenders, long-term investments in building relationships or teams set them up for success in 2022.

BANKING & LENDING

“Because we’ve got such a good reputation in Lawrence, we’re seeing a lot [of activity].”

– Phil Bryan, chief banking officer, Reading Cooperative Bank

AUGUST 15, 2022 BANKER & TRADESMAN | 11 WE KNOW COMMERCIAL LENDING LIKE THE BACK OF OUR HOOF. MountainOne Bank is honored to be one of Banker & Tradesman’s Fast 50 in Commercial & Residential Lending, and we are proud to guide businesses in Eastern Massachusetts and the Berkshires to reach their peak potential. www.mountainone.com

COMMERCIAL VOLUME OF LOANS

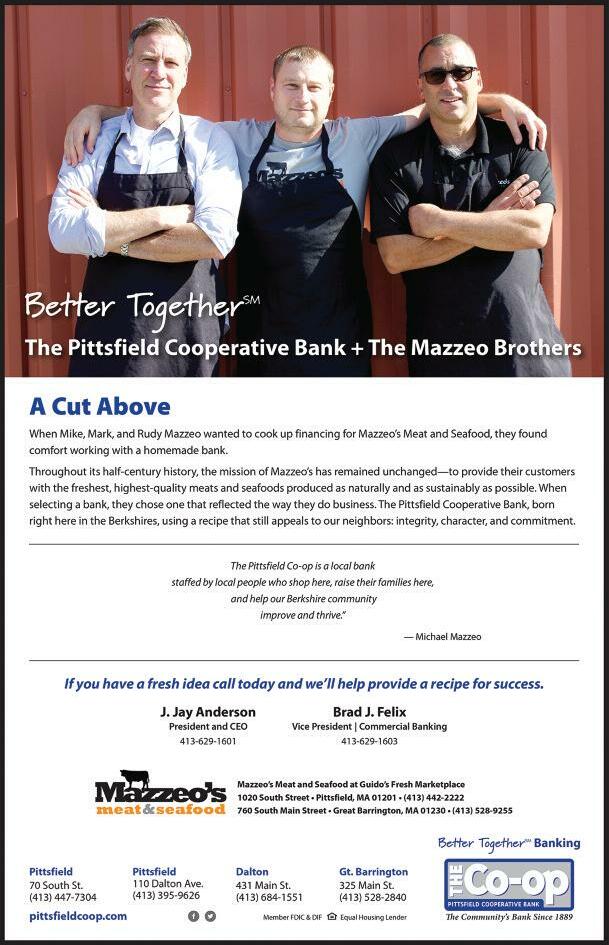

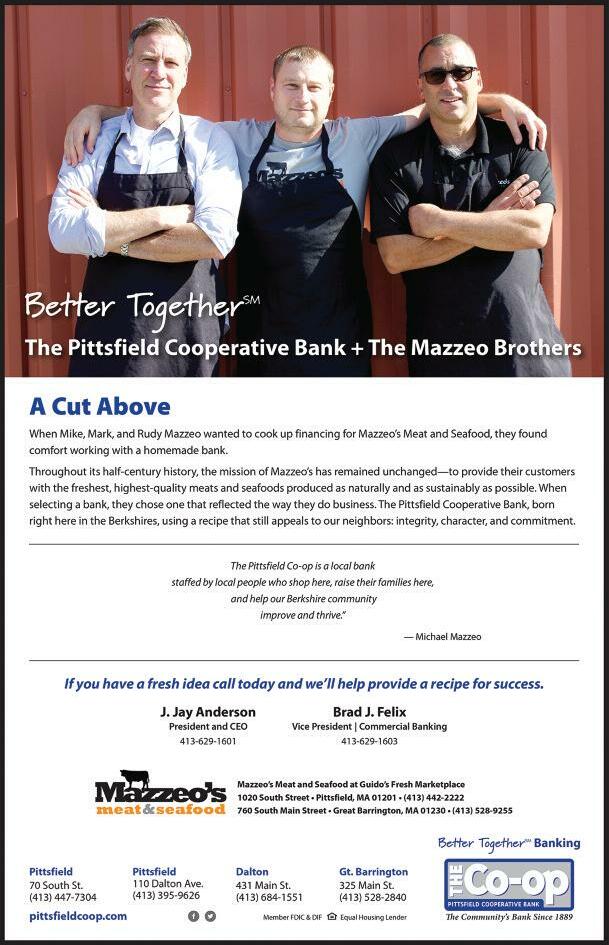

12 | BANKER & TRADESMAN AUGUST 15, 2022 making our mark. To be named a top lender on the Banker and Tradesman Fast 50 is a testament not only to the hard work and dedication of our Commercial Lending Team, but also to the people of our community who trust us with their lending needs. Contact our Commercial Lending Team today to start making your mark. Christopher Watson Senior Vice President, Senior Lending Officer Business Banking Division cwatson@web5.com (508) 407-0636 Ann Kane Senior Vice President, Team Leader Commercial Lending akane@web5.com (508) 438-4705 Steven Anderson Senior Vice President, Team Leader Business Lending Officer sanderson@web5.com (508) 438-4727 John Mannila Senior Vice President, Team Leader Business Banking jmannila@web5.com (508) 407-0639 NMLS: #523049 1 Capital One Bank $2,477,110,000 $168,185,000 1373% 2 Webster Five Cents Savings Bank $61,961,000 $6,605,798 838% 3 Bank of Rhode Island $119,115,000 $13,092,931 810% 4 Citizens Financial Group $621,646,055 $68,918,345 802% 5 Clinton Savings Bank $29,830,000 $3,379,688 783% 6 Pittsfield Cooperative Bank $11,963,000 $1,459,250 720% 7 Primary Bank $8,359,250 $1,073,020 679% 8 MountainOne Bank $88,743,307 $11,457,400 675% 9 Polish National Credit Union $9,363,200 $1,242,751 653% 10 Align Credit Union $20,149,228 $2,872,000 602% 11 North Brookfield Savings Bank $6,639,500 $1,020,835 550% 12 Farm Credit East ACA $34,900,986 $5,655,585 517% 13 Walker & Dunlop LLC $481,973,200 $81,238,100 493% 14 Haverhill Bank $14,657,500 $2,882,250 409% 15 Massachusetts Housing Finance Agency $131,901,508 $30,185,000 337% 16 Taunton Federal Credit Union $5,897,950 $1,399,500 321% 17 Camden National Bank $7,588,500 $1,861,976 308% 18 NorthEast Community Bank $20,608,000 $5,191,000 297% 19 East West Bank $41,635,000 $11,410,000 265% 20 Webster Bank $158,812,530 $44,142,350 260% 21 Florence Bank $24,002,100 $6,696,674 258% 22 Freedom Credit Union $21,503,172 $6,103,200 252% 23 Bluestone Bank $56,724,250 $16,407,406 246% 24 First Boston Construction Holdings LLC $46,350,000 $13,595,000 241% 25 Hingham Institution for Savings $272,310,936 $81,515,875 234%

LENDER 2022 2021 % Change LENDER 2022 2021 % Change FAST50 • All figures are statewide comparing Jan. 1 - June 30, both years • Commercial minimum $1M both years, minimum 3 loans • Source: The Warren Group’s Marketshare Module

AUGUST 15, 2022 BANKER & TRADESMAN | 13

FAST50

COMMERCIAL NUMBER OF LOANS

Reading Cooperative Bank is honored to be recognized as a finalist in Banker & Tradesman’s Fast 50 in Commercial & Residential Lending for 2022 as one of the 50 fastest-growing loan providers in Massachusetts (ranking #5 in Commercial Loans)!

We owe this recognition to the dedication of our commercial and residential lenders. Their commitment to serving our customers and community best represents our cooperative values. Because of their efforts, we have been able to expand our reach to new communities and continue our mission to provide Banking For All

781.942.5000 readingcoop.com

14 | BANKER & TRADESMAN AUGUST 15, 2022

1 Align Credit Union 22 4 450% 2 Santander Bank NA 14 3 367% 3 North Brookfield Savings Bank 11 3 267% 4 Polish National Credit Union 19 6 217% 5 Reading Cooperative Bank 34 11 209% 6 First Boston Construction Holdings LLC 15 5 200% 7 Key Bank N.A. 20 7 186% 8 Taunton Federal Credit Union 14 5 180% 9 Pittsfield Cooperative Bank 21 8 163% 10 Primary Bank 10 4 150% 11 Citicorp Mortgage Inc 12 5 140% 12 Colonial Federal Savings Bank-Quincy 7 3 133% 13 Fidelity Cooperative Bank 28 12 133% 14 Berkshire Bank 51 22 132% 15 Cooperative Bank 16 7 129% 16 Walpole Cooperative Bank 16 7 129% 17 MutualOne Bank 41 19 116% 18 Provident Bank 15 7 114% 19 Country Bank for Savings 25 12 108% 20 Massachusetts Housing Finance Agency 12 6 100% 21 Wells Fargo Bank NA 45 23 96% 22 Pulte Mortgage Corp 19 10 90% 23 Institution for Savings Newburyport 36 19 89% 24 Bank of Rhode Island 11 6 83% 25 Caliber Home Loans 9 5 80%

FAST50

LENDER 2022 2021 % Change LENDER 2022 2021 % Change

• All figures are statewide comparing Jan. 1 - June 30, both years • Commercial minimum $1M both years, minimum 3 loans • Source: The Warren Group’s Marketshare Module

AUGUST 15, 2022 BANKER & TRADESMAN | 15 WE INVEST IN RELATIONSHIPS Thank you to our long-time Borrowers for making First Boston Capital Partners one of the 50 fastest growing lenders in Massachusetts! For many generations, we have consistently been Boston’s most trusted private lender. Ben Stillwell ben@grossmanco.com 617-657-5784 David Grossman david@grossmanco.com 617-472-2028 Patrick Bourque patrick@grossmanco.com 617-657-0058 Chris Michaud chris@grossmanco.com 617-657-5788 CONTACT US TODAY $160M IN VOLUME IN 2021 89 LOANS LEARN MORE AT FIRSTBOSTONCAPITALPARTNERS.COM

RESIDENTIAL VOLUME OF LOANS

Bluestone Bank is proud to be named one of this year’s Fast 50 in Commercial Lending according to Banker & Trademan!

Congratulations to Bluestone’s Commercial Lending Team for being named one of this year’s Fast 50 growing lenders in Commercial Lending in number of loans and volume.

The Cooperative Bank is proud to be named one of this year’s Fast 50 in Commercial Lending.

Our roots have been planted in Boston for more than four generations. Our Commercial Lenders are here to help you navigate your decision making and set you on the path to success.

SUBHEADLINE IF NEEDED BOSTON’S NEIGHBORHOOD BANK

16 | BANKER & TRADESMAN AUGUST 15, 2022 1 Massachusetts Housing Finance Agency $124,723,972 $8,924,124 1298% 2 CCG Fund 1 LLC $98,103,500 $13,109,700 648% 3 Hometown Equity Mtg $15,074,323 $2,080,852 624% 4 Goldman Sachs Bank USA $562,203,180 $86,223,255 552% 6 Provident Bank $27,118,058 $5,058,881 436% 7 Quontic Bank $29,462,800 $5,852,588 403% 5 MIT Federal Credit Union $37,084,239 $7,904,500 369% 8 Boston Trust Corporation $17,806,000 $3,984,500 347% 9 Everett Fncl Inc dba Supreme Lending $23,451,794 $5,420,853 333% 10 Nations Direct Mortgage LLC $9,074,745 $2,161,674 320% 11 Commonwealth of Massachusetts $9,039,385 $2,275,290 297% 12 Geneva Financial LLC $8,064,890 $2,168,595 272% 13 HomeXpress Mortgage Corporation $21,450,210 $6,030,116 256% 14 Velocity Commercial Capital LLC $9,187,181 $2,613,250 252% 15 Huntington National Bank $21,965,372 $6,443,220 241% 16 Hometap A Heloc Alternative $11,938,880 $3,785,102 215% 17 Longbridge Financial LLC $49,398,749 $16,922,624 192% 18 Members Plus Credit Union $14,843,470 $5,889,971 152% 19 Brotherhood Credit Union $12,467,565 $4,999,250 149% 20 USA Housing and Urban Development $121,578,727 $49,389,855 146% 21 Kwik Mortage Corporation $12,707,634 $5,297,328 140% 22 Probuilder Financial LLC $4,865,000 $2,195,000 122% 23 Cathay Bank $9,490,900 $4,312,000 120% 24 Cendant Mortgage Group $84,946,364 $39,713,586 114% 25 RF Boston $11,936,656 $5,630,395 112%

LENDER 2022 2021 % Change LENDER 2022 2021 % Change FAST50 • All figures are statewide comparing Jan. 1 - June 30, both years • Residential includes all property types, 1- to 3-families and condos, purchase and refi • Residential portfolios minimum 5 loans both years, minimum $2M in total volume • Source: The Warren Group’s Marketshare Module Member FDIC | Member DIF | NMLS ID: 403265 bluestone.bank

Our commitment to helping you achieve your goals means we’re always here to answer the call. That’s backed by Bluestone. Contact us today! 508.884.3300 CHARLESTOWN | JAMAICA PLAIN | ROSLINDALE | WEST ROXBURY thecooperativebank.com MNLS #453076

AUGUST 15, 2022 BANKER & TRADESMAN | 17 Clarity. Confidence. LifeDesign is our unique approach to banking. We give you the clarity you need to make informed decisions, so you can always move forward with confidence. Proud to be one of this year’s Fast 50 Growing Lenders! YOUR BUSINESS DESERVES A BANK THAT CARES — That’s Fidelity Bank Connect with our Business Banking Team! 800.581.5363 | FidelityBankOnline.com REAL ESTATE COMMERCIAL AUCTION RESIDENTIAL REAL ESTAT E EDUCATIO N EDUCATIO N HEL WA HELP WANTE D PROFESSIONAL SERVICES PROFESSIONAL SERVICES C L A SS I F I E D S THE ONE PLACE TO FIND OPPORTUNITIES To Place An Ad In This Section Contact The Advertising Department At (617) 896-5397 + AMESBURY + DANVERS + FRAMINGHAM + HAVERHILL + LOWELL + METHUEN + SEABROOK + WILMINGTON + Membership required. Insured by MSIC | Federally insured by NCUA NMLS ID 423280 Meet Our Commercial Lending Team Andrew Patton Erin Kelly AlignCU.com + (800) 942-9575 VP of Commercial Lending Commercial Loan Officer 978-275-2760 978-275-2733 APatton@AlignCU.com NMLS ID 751835 NMLS ID 531631 EKelly@AlignCU.com We’re in the Business of Helping Yours. + Commercial Real Estate Mortgages + Business Line of Credit + Income Property Loans + Equipment/Vehicle Loans Our Commercial Lending team can help you find solutions that fit. Our goal is to support you so your company can grow and succeed. + Term and SBA Loans + Business Checking and Savings Accounts + Business Overdraft Line of Credit + Local Decision-Making and Servicing Proud to be named one of Massachusetts’ Fastest Growing Lenders! #1 in Number of Commercial Loans + #10 in Commercial Loan Volume

18 | BANKER & TRADESMAN AUGUST 15, 2022 1 CCG Fund 1 LLC 61 11 455% 2 Hometown Equity Mtg 37 7 429% 3 Southcoast Health Federal CU 52 10 420% 4 Everett Fncl Inc dba Supreme Lending 67 15 347% 5 Boston Trust Corporation 27 7 286% 6 Quontic Bank 54 14 286% 7 Geneva Financial LLC 22 6 267% 8 HomeXpress Mortgage Corporation 43 13 231% 9 Rd W SPV LLC 29 9 222% 10 Cendant Mortgage Group 161 51 216% 11 Hometap A Heloc Alternative 119 40 198% 13 Velocity Commercial Capital LLC 18 7 157% 12 MIT Federal Credit Union 139 55 153% 14 RF Boston 25 10 150% 15 New Bedford Credit Union 99 40 148% 16 Nations Direct Mortgage LLC 14 6 133% 17 G Capital LLC 16 7 129% 18 Longbridge Financial LLC 56 25 124% 19 Provident Bank 11 5 120% 20 Huntington National Bank 24 11 118% 21 Massachusetts Housing Finance Agency 43 20 115% 22 Kwik Mortage Corporation 32 15 113% 23 Members Plus Credit Union 42 20 110% 24 Brotherhood Credit Union 31 17 82% 25 Della Ripa Real Estate 26 16 63% RESIDENTIAL NUMBER OF LOANS LENDER 2022 2021 % Change LENDER 2022 2021 % Change FAST50 THANK YOU! S ee what makes us one of this year ’s Fast 50 in Commercial Lending! (413) 447-7304 Pittsfield • Dalton • Gt Barrington pittsfieldcoop.com Member FDIC & DIF Equal Housing Lender • All figures are statewide comparing Jan. 1 - June 30, both years • Residential includes all property types, 1- to 3-families and condos, purchase and refi • Residential portfolios minimum 5 loans both years, minimum $2M in total volume • Source: The Warren Group’s Marketshare Module