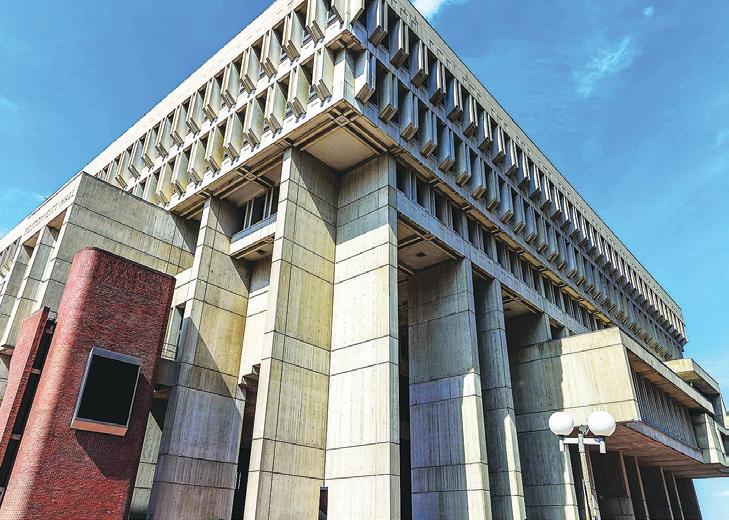

A battery manufacturer signed the biggest lease to date at Berkeley Investments’ repositioning of 200 Exchange St. in Malden Center, a project that originally targeted life science tenants.

A battery manufacturer signed the biggest lease to date at Berkeley Investments’ repositioning of 200 Exchange St. in Malden Center, a project that originally targeted life science tenants.

BY STEVE ADAMS BANKER & TRADESMAN STAFF

Clean energy companies’ demand for commercial real estate could fill part

of the void caused by the biotech leasing downturn. Life science lab supply in Greater Boston outstrips demand by an 8-to-1 margin, according to brokerage JLL, with just 2 million square feet of tenant requirements having a choice of 16 million square feet of availabilities.

“There’s not enough demand to keep everyone happy,” said Mark Bruso, JLL’s director of Boston research. “The math is the math.”

The prospect of tapping into engineering talent from local universities to tackle climate change has developers and economic development officials salivat-

ing at the growth prospects for a Bay State clean energy cluster.

Life science developer BioMed Realty cast a $361 million vote of confidence in the future of the climate tech economy with this month’s acquisition of 750 Main St. in Cambridge.

The property is the home of The Engine, a leading climate tech incubator backed by venture capital firm Engine Ventures, which also is headquartered in the 220,000-square-foot building and has raised over $1 billion to invest in startups.

Continued on Page 10 P hoto courtesy of Berkeley Investments

Timothy M. Warren Jr., Chairman of the Board

David B. Lovins, President and CEO

ESTABLISHED 1872

Published by The Warren Group

PUBLISHING

Associate Publisher: Cassidy Norton

Managing Editor: James Sanna

Associate Editor, Commercial Real Estate: Steve Adams

Finance and Data Reporter: Sam Minton

Contributing Writer: Scott Van Voorhis

Senior Customer Support Specialist: Sarah Ahlgren

Advertising Account Manager: Caitlin Bobe

Graphic Designer: William Samatis

DATA SOLUTIONS

Communications Manager: Mike Breed

Executive Data Solutions Account Manager: William Visconti

Client Service Specialist: Mike Sweeney

Sales Development Representative: Matthew Griffin

Advertising Account Manager: Caitlin Bobe

INFORMATION SERVICES

Director of Operations & Product Strategy: Samantha Bullock

Data Operations Manager: Tammy Dandurant

Data Quality/Key Accounts Manager: Ellen Gendron

Data Quality Auditor: Katherine Snow

Key Accounts Coordinator: Amy Guenthardt

Parcel Acquisitions Coordinator: Christina Doucette

Transaction Acquisitions Coordinator: Wally Bullock

INFORMATION TECHNOLOGY

Software Development Manager: Michael Paul

Senior Applications Developer: Joe Chan

IT Technical Assistants: Matt Paul, Joey Roundtree and Tyler North

FINANCE & ADMINISTRATION

Controller: Janeen Silvestri

Assistant Controller: Olga Khalaydovsky

Accounts Recievable Specialist: Valarie Wickey

Human Resources Generalist: Nesima Bartlett

BANKER & TRADESMAN (ISSN 0005-5409)

Volume 204, Number 44 Published each Monday. ©2023 The Warren Group LLC, 2 Corporation Way, Suite 250, Peabody, MA 01960. All rights reserved. No part of this publication may be reproduced without the written consent of the publisher.

Banker & Tradesman™ and The Warren Group™ are trademarks of The Warren Group LLC.

Subscriptions to Banker & Tradesman:

Premium: One year – $399 Two

POSTMASTER:

www.bankerandtradesman.com

Periodicals Postage paid in Boston, MA USPS #536710 and additional mail offices..

• Alexandria Real Estate Equities has been steadily selling off what it describes as “non-strategic location” real estate in Massachusetts and other life science industry clusters after lab vacancies skyrocketed in the past two years.

• But in its third-quarter earnings call, the leading U.S. life science landlord has agreed to sell additional, unspecified properties in Greater Boston for nearly $370 million. The company said they are 100 percent leased for another 18 years and the buyer is the current tenant.

• Alexandria also recorded a $30.8 million impairment charge from the cancellation of two acquisitions in Greater Boston after deciding not to pursue 1.4 million square feet of development “due to the existing macroeconomic environment that negatively impacted the financial outlooks for these projects.”

• Chicago-based L3 Capital sold 149 Newbury St. for $101 million in a deed recorded at the Suffolk registry Wednesday.

• The 43,500-square-foot complex in one of Boston’s premier shopping districts contains 27,000 square feet of office space on its four upper floors and 16,000 square feet of ground-floor retail. Retail tenants include Google and luxury athleisure clothing brand Alo Yoga.

• The building is 81 percent leased, Spanish investment manager Azora said when announcing its purchase. Only the third floor hasn’t been leased and the company said it planned to fill the space with 9,586 square feet of spec office suites that will be leased “ready to move in.”

MODERATE UPTICK IN REMODELING SPENDING PREDICTED FOR 2025

• The Joint Center for Housing Studies of Harvard University projects that annual expenditures for home renovation and maintenance will grow by 1.2 percent through the third quarter of 2025.

• Part of the reason for the increase in remodeling activity is the lack of new construction and a continued lack of home sales. According to the latest data from The Warren Group, publisher of Banker & Tradesman, Massachusetts singlefamily home sales were down 3.7 percent last month from September of 2023.

• “Stronger gains in home values and thus home equity levels should boost both discretionary and ‘need-to-do’ replacement projects for owners staying in place,” JCHS Remodeling Futures Program director Carlos Martín said in a statement.

• The five-building, 295-unit project at 78 Crafts St. will include a 20 percent affordable component, with those units reserved for households earning a maximum 50 percent of area median income.

• The project was reduced by 12 units and its parking count increased to 278 spaces during the approvals process. A Boylston Properties spokesperson said no timetable has been set for starting construction.

• The project is one of several recently filed that will put Newton over the “safe harbor” threshold under the Chapter 40B affordable housing law. One of those, a stalled, 292-unit project near Boylston’s, received funding after being sold to New Jersey-based Garden Homes.

• The deal will see the mayor file a new home rule petition with the Boston City Council, which will then have to be passed by the Legislature before November to allow the city to exceed state caps on the share of its property tax haul that can be borne by commercial property instead of residential property.

• Under the deal between Mayor Michelle Wu and four business-backed groups battling her will see the city shift the burden of taxes borne by commercial properties from 175 percent this year to no more than 181.5 percent in the next fiscal year – a red line for real estate interests –180 percent in fiscal year 2026 and 178 percent in fiscal 2027 before returning to the normal 175 percent in fiscal 2028. That means the increase in commercial rates will last two years less than Wu’s initial five-year proposal.

• In addition, Wu’s office said the city will work to reduce the rate increase’s impact on small businesses, many of which would have been hit hard by the mayor’s initial plan thanks to common triple-net lease structures, which pass property taxes on to tenants.

Boston Faces a Bigger Office Crisis Than You Think

Street Trophy

BY SAM MINTON BANKER & TRADESMAN STAFF

Worsening extreme weather, linked to climate change, is bringing catastrophic flooding to homes that have never seen it before, and it’s putting financial institutions risk of serious losses.

The biggest culprit, as identified in a recent report on banks’ exposure to climate risk, is a serious weakness in the nation’s flood insurance system.

First Street Foundation found that 57 banks in the United States with a total of $627 billion in real estate loans could face material financial risk from climate change, although it did not publicly name them. Seven of these banks are in New England.

The report also found that regional and community banks face the most pressure given the geographically concentrated nature of their lending portfolios.

Using a risk model it developed, First Street analyzed 191 banks in the country that have 20 or more branch locations. Using branch locations as a proxy for a bank’s lending area and its previous assessments of flood threats to estimate risk to mortgages held by each institution, First Street was able to identify banks that might have climate-related risks that are reasonably likely to pose a material impact on

their financial condition, and hence could be subject to the Security and Exchange Commission’s proposed climate disclosure rules.

“Through climate risk financial modeling, we are able to get the first glimpse of the financial institutions which have material financial risk from their exposure to the physical impacts of climate change,” said Jeremy Porter, head of climate implications at First Street, “While this risk is material by definition, banks are finally in a position where they can proactively manage these risks to dramatically change their risk profile over time.”

Swansea-based BayCoast Bank executives say thir bank is an example of a mortgage lenderthat is taking climate change and climate risk seriously. They have recently created a climate heat map to analyze the bank’s lending portfolio, and the bank also analyzes how various natural disasters affect its customers and tits residential lending.

The lender identified 55 loans in that area worth about $7.2 million that were impacted by Hurricane Helane.

If homeowners aren’t properly insured or don’t have flood insurance, they can face massive repair costs or lose their home entirely with no financial fallback.

But this isn’t just a problem for homeowners. The financial institutions that provided mortgages for these homes can find themselves with a borrower under serious financial stress or, in the worst case, a borrower unable to repay their loan.

BY STEVE ADAMS BANKER & TRADESMAN STAFF

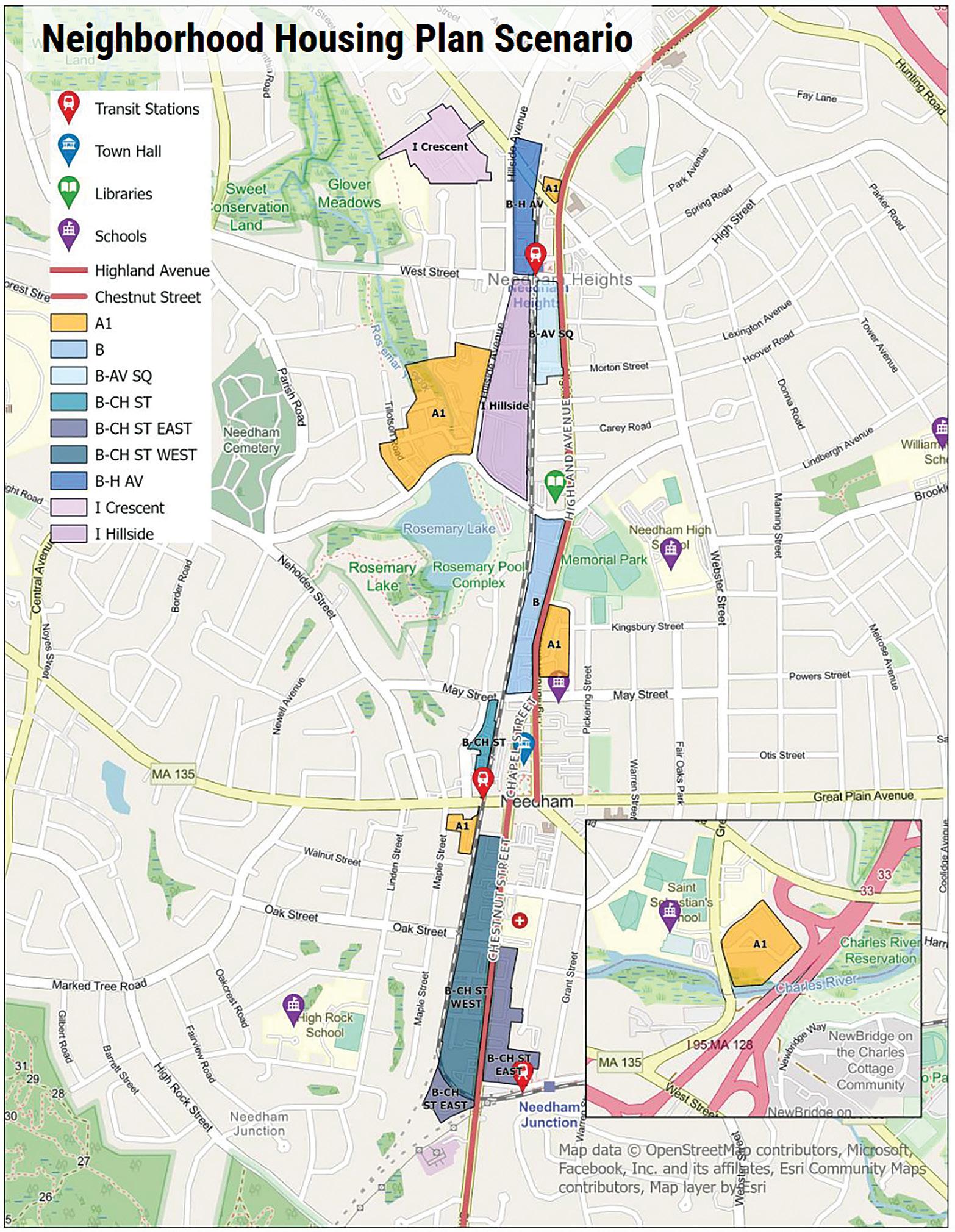

Sara Bronin has personally witnessed the extremes in how zoning regulations shape the landscapes where people live and work.

A native of Houston, America’s largest city without formal zoning regulations, Bronin saw the effects of unregulated development on the neighborhood where she grew up.

“Looking across the street is a gas station, a self-storage facility, a nightclub and a large strip mall surrounded by a giant parking lot,” Bronin said. “I wouldn’t say those kinds of uses are fulfilling for a child growing up there today.”

sultant to review the city’s zoning code with the goal of simplifying and modernizing the over 3,700-page document. In a 2023 report, Bronin recommended rezoning areas near public transit stops for higher-density development to encourage multifamily housing production.

In her professional career, Bronin taught law at University of Connecticut and served as Hartford Planning Board chair for seven years in a state where the vast majority of land is zoned for single-family homes.

The Yale-educated architect finds middle ground between the free market latitude of Houston and restrictive regulation of New England in her new book, “Key to the City: How Zoning Shapes Our World,” released Oct. 1 by W.W. Norton & Co.

“For me, zoning has always been this fascinating but understudied aspect of law that affects virtually every American, yet few people actually recognize zoning’s power or understand how it works,” Bronin said in a phone call after returning from the first leg of her book tour in Charlottesville, Virginia this month.

Bronin’s influence now is being felt in Boston during the first city-wide rezoning process since the 1960s.

Mayor Michelle Wu tapped Bronin as a con-

It’s even possible a homeowner might walk away from a property in the future if homes remain improperly insured, said Gary Vierra, senior vice president and chief risk officer at BayCoast

And, unfortunately for mortgage lenders, the federal resources that should be making sure homeowners are adequately insured are not being properly maintained. A 2023 report from First Street found that around 15 million properties in the U.S. not covered by a Federal Emergency Management Agency flood map are at risk of losing insurance coverage due to flood risk.

“People that were going to buy a new home, oftentimes, relied on FEMA zones as their sort of truth for flood risk,” Porter said. “We know FEMA zones are outdated. They only cover something like 45 percent of the actual flood risk across the country, and so they’re not the best source for that.”

The concepts are already being implemented through Boston’s “Squares + Streets” initiative, which this spring rezoned a portion of Mattapan for more by-right housing approvals, and is expected to issue recommendations on 16 other neighborhood districts. Rezoning studies and public engagement processes are under way in Roslindale Square, Hyde Park’s Cleary Square, and Dorchester’s Fields Corners, Codman Square and Four Corners neighborhoods.

A professor of architecture and planning at Cornell University, Bronin is making the rounds of East Coast college towns this fall promoting her book, which adds to a growing national debate on how zoning can perpetuate inequality and contribute to higher housing costs.

For example, only 12 of BayCoast Bank’s 55 loans impacted by Hurricane Helane were within FEMA-designated flood zones. These flood maps are crucial as homes within flood zones are required to have flood insurance. But that insurance is expensive, thanks in part to the high values of the homes it has to pay for in the event of a disaster. In recent years, FEMA has implemented a new National Flood Insurance Program pricing approach, called “Risk Rating 2.0” intended to more accurately reflect the costs of insuring homes in existing flood zones. Under these revamped guidelines, the median “riskbased” premium in Massachusetts according to FEMA was at $1,762 up from $1,106. A possible solution to bring down those premiums, offered by Laurie Goodman of the Urban Institute, is to make flood insurance required for all homeowners, thereby increas-

Continued on Page 10

In 2021, California legislators enacted a law that allows homeowners to subdivide singlefamily lots for up to four homes, subject to a 1,200-square-foot lot minimum. In April, a Los Angeles County Superior Court judge ruled the law unconstitutional, placing its enactment in doubt.

But eliminating single-family zoning is only one ingredient in the housing production recipe, Bronin said, along with increases in maximum building height and density. One of the most successful zoning reforms for housing production has been legalization of accessory dwelling units, or backyard cottages, in singlefamily zones, Bronin said.

Warren’s Attack on Private-Sector Builders Misses Mark on Causes

BY SCOTT VAN VOORHIS BANKER & TRADESMAN COLUMNIST

It was one of the most telling exchanges of Democratic Sen. Elizabeth Warren’s debate with Republican challenger John Deaton. And is so often the case these days, its significance blew right past what’s left of the mainstream media.

In response to a question on the housing crisis, Deaton, an attorney and cryptocurrency advocate, quite reasonably pointed to one of the main culprits for the shortage – onerous local zoning and other regulations.

Deaton argued local regulations needed to be reformed so the private sector can build more housing – a statement that a pragmatic progressive like Gov. Maura Healey wouldn’t quibble with.

“That’s what they’ve been saying for decades now, and the price goes up, and up, and up,” Warren said in response to Deaton’s reference, according to Boston.com.

Warren’s Home Value Up Eightfold

If anyone should know about escalating home prices, it would be Warren.

A former Harvard professor, Warren has lived for decades in Cambridge, where the median price now tops $2.2 million, according to The Warren Group, publisher of Banker & Tradesman.

The city’s special blend of upscale NIMBYism and restrictive zoning laws has kept new construction to a trickle at best.

However, apparently the mention of those two words – “private sector” – had the effect of waving a red flag in front of Warren, eliciting from the senator one of her famously tart retorts.

By that’s nothing compared to what has happened to the value of her spacious, 1890 Victorian in Cambridge’s leafy Avon Hill neighborhood.

It’s jumped eight-fold since Warren and her husband, Bruce, bought the two-bed, three-and-a-half-bath home in 1995 for $447,000.

Today it’s worth nearly $3.9 million, according to both Zillow and the city of Cambridge’s assessor’s office.

This astronomical increase in the value of Warren’s home and home prices in Cambridge more generally has not happened in a vacuum.

The city’s special blend of upscale NIMBYism and restrictive zoning laws and regulations has kept new house, condominium and apart-

ment construction to a trickle at best, even as demand for living in the city has increased by leaps and bounds.

Warren’s retort suggests that the private sector has been talking a great game for years about being the key to solving housing crisis, yet failing to produce results – or worse, exacerbating the problem by greedily jacking up prices.

But the good senator, who was an accomplished scholar of the American economy even before her election, also must surely know there is a big difference between developers complaining for years about onerous local regs and actual legal and policy changes made to address these concerns.

It has only been in the last few years that state governments, first in California, and now in Massachusetts, have finally started to take action to rein in local obstruction of housing development along with fitful movement in some towns and cities here.

In Cambridge, even the most progressive of local pols now recognize that the city has a housing supply problem that is preventing real estate firms and nonprofits alike from building desperately needed new housing.

A pair of Cambridge city councilors are now pushing a proposal that would eliminate single-family zoning through the city, allowing new apartment and condo construction of up to 6 stories.

Continued on Page 9

BY LEW SICHELMAN SPECIAL TO BANKER & TRADESMAN

Sometimes, homebuyers are hesitant to pull the trigger. They might love the house they found – it’s priced right and mortgage rates are coming down –but they just can’t decide whether to move forward.

So what can sellers do to sweeten the pot a bit – to get buyers to make an offer and sign a contract, especially as we head into what’s often the slowest selling season of any year?

In previous down markets, sellers have offered all kinds of incentives to seal the deal with hesitant buyers. They’ve thrown in trips to Europe, island cruises, even fancy sports cars. And they are likely to do so again, at least in the luxury sector.

Those are nice, to be sure. But let’s get real: They hold little sway with the typical buyer. (Besides, the insurance on those sports cars can be just as breathtaking as a drive down Pacific Coast Highway with the top down.)

On a more practical note, here are some incentives and concessions sellers might want to consider.

First and foremost: buy-downs. The majority of builders now offer to cover the cost of lowering a buyer’s mortgage rate for the first year or two. And individual sellers can do the same. It works!

At a cost to you of roughly 1 percent of the sales price, you can cut the buyer’s rate by 0.25 percent for

C assidy N orto N Associate Publisher cnorton@thewarrengroup.com

t imothy m . W arre N J r Publisher t imothy m . W arre N Publisher 1975-1988

the first 12 months. Pay a little more, and you can trim their rate further, and for longer periods.

According to an analysis by Zonda Home, half of all builders are willing to buy rates down to as low as 4 percent. Whether you need to go that far – or can afford to – is for you to decide. To determine the actual costs, sit down with your agent or mortgage broker and run the numbers.

And of course, think about agent commissions.

Speaking of low rates, if you already have a low-rate mortgage, find out if you can pass it on to your buyer. Loans insured by the Federal Housing Administration and backed by the Department of Veterans Affairs can be assumed by another borrower, and so can some other mortgages.

Check with your lender to ascertain whether your loan can be taken over. If it can, advertise that fact. After all, a mortgage at 3 percent, 4 percent or even 5 percent is extremely attractive in today’s market.

Then, there’s the matter of what you’re trying to sell. Savvy sellers have their homes inspected – and get any flaws fixed – before putting them on the market. And savvy buyers will want their own inspections before moving forward. So why not offer to pay the cost of the buyer’s inspection?

If the buyer’s inspector turns up some real problems your guy missed, offer to pay for at least part of the repairs. Of course, if the second exam turns up nothing, you are off the hook.

Most buyers now expect the house to come with a seller-paid warranty that lasts for a year. When the year is up, the warranty company will badger the new owner about the benefits of renewing – but by then, they’ll have to pay the freight. So throwing in an extra year or two of coverage could be meaningful.

If you want to get to the settlement table quickly, offer a credit at closing as an incentive. On the other hand, if the buyer wants to proceed more slowly, allowing them the time they need may make a difference. Also think about closing costs. Buyers will have to pay a slew of settlement fees and charges that add up to anywhere from 5 percent to 7 percent of the sales price. Sellers will have to pay some fees, too. But if you offer to take some of the burden off your buyer’s shoulders, it could be just what the doctor ordered.

If your community is run by an HOA, think about paying the buyer’s dues for a year or longer. That will help ease their first year’s costs, which can be substantial, especially for a first-time owner. Some homebuyers don’t even realize they’re becoming default members of the HOA and that they have to pay dues – whether or not they use the golf course, pool or exercise room.

Sometimes concessions are really sweeteners. If the buyer has an eye on something in the house that you had planned to take with you – say, your favorite leather couch – consider letting it go. If they want it bad enough, it may be enough to seal the deal.

You could also offer to pay some or all of the buyer’s moving costs, which can run several thousand dollars. Moving from one residence to another is daunting enough without worrying about how you are going to pay for it.

And of course, think about agent commissions. Nowadays, buyers are obligated to pay their agents, just like you are obligated to pay yours. So consider paying the buyer’s agent on their behalf (which is the way it used to be, anyway).

Remember, in real estate, everything is negotiable. Everything!

In short, any cost you can take off the buyer’s shoulders is a good thing.

Lew Sichelman has been covering real estate for more than 50 years. He is a regular contributor to numerous shelter magazines and housing and housing-finance industry publications. Readers can contact him at lsichelman@aol.com.

BY SUSAN GITTELMAN

In one way, demographics are aligning to offer up some hope in Massachusetts’ ongoing battle to create enough housing to meet demand and tame skyrocketing prices. Consistent public school enrollment declines across the commonwealth mean that surplus school buildings in many communities could provide a significant number of affordable housing units – particularly for seniors.

But making these school-to-affordable senior housing conversions a reality at scale will require helping municipalities navigate the challenges the conversions pose.

Even as the state population has grown, reaching 7 million for the first time in the 2020 census, public school enrollment has declined by more than 100,000 since it peaked more than two decades ago.

The drop has been very dramatic in Boston; Boston Public Schools enrollment is more than 40 percent lower than in 1980 and 22 percent below the 2000 level.

Well-Suited for Conversion

Empty or under-utilized school buildings don’t generate revenue, pose a liability risk and are costly to maintain. If they’re not maintained, they will degrade, which brings another host of headaches. The alternative is to demolish the buildings – and that costs money, too.

Older school buildings that are more modest in scale often have characteristics that make them attractive for housing, such as wide hallways, large windows, high ceilings, wood floors and athletic fields that provide room for more units. They also rarely come with the challenges presented by many former industrial sites, such as soil contamination.

Former classrooms are also well-suited to conversion to the one-bedroom units that are dominant in affordable senior housing. This matters because as public-school enrollment shrinks, the number of older Americans is on the rise. People 65 and older made up 15 percent of the nation’s population in 2016 and are expected to account for 23 percent in 2060.

The sentimental value of buildings where many residents attended school back in the day can also soften NIMBY opposition to affordable housing. They’re already part of the neighborhood fabric, and newly converted housing units would generate far less traffic than the buildings did as schools.

“Few buildings have more meaning to people than their old schools,” said Jason Korb, principal of Capstone Communities LLC, who recalled a school conversion his company did. “Former students and staff attended the ribbon-cutting. The former principal’s family went up to where his office was. It was very emotional.”

But the conversions aren’t without challenges, and few municipalities have the expertise to navigate them efficiently. Creating an initiative under which entities such as MassHousing, the Massachusetts Housing Partnership or the Citizens Housing and Planning Association provide municipalities with direct technical assistance to streamline school-to-housing conversions and bring them to scale.

Designating properties as surplus can be a lengthy procedure. In Boston, the community engagement process alone can take more than six months.

Making the conversions happen in a timely manner requires navigating financial challenges about which most municipalities aren’t well informed. Making the numbers work also requires low-income housing tax credits and both state and federal historic preservation credits. Access-

BY AMY WALLICK

Multiple-offer situations continue to proliferate in the Massachusetts housing market, despite a slight decrease in monthly median sales prices over the summer (down 9.77 percent between June and September for single-family homes and 9.65 percent for condominiums). This is largely due to the continued low inventory of available housing keeping market competition high.

So, if you’re an agent, what counsel can you offer buyers and sellers on the opportunities to embrace –and pitfalls to avoid– when dealing with multiple offer scenarios?

It all starts with being well-prepared and well-informed.

Multiple-offer scenarios occur when there are more buyers than sellers, and “bidding wars” may escalate when two or more parties compete to purchase a home. Each buyer presents an attractive offer, and the next prospective buyer responds with an even higher price point – often driving the home’s price beyond the original listing price. While these situations present opportunities for both buyers and sellers, multiple offer scenarios can also result in misunderstandings, complaints and even potential legal implications.

Being prepared means making sure your clients understand the implications of multiple offers and are setting clear expectations for what their goals are, including price, turnaround time and communications.

Buyers should put themselves in a position to be the most attractive bidder by getting pre-approved for a

mortgage, and setting a budget and sticking with it –they should know their maximum offer capacity.

Buyers should also move quickly to offer a competitive price, potentially above the asking price, and understand how contingencies, such as home sales and financing, can affect an offer.

Above all, buyers should try and not get too emotionally attached to a given property and be prepared to walk away if the bidding war escalates beyond their maximum price point.

While sellers may think they are in the driver’s seat in multiple offer situations, things can quickly spiral out of control, discouraging buyers and potentially making them break off negotiations to pursue other properties. Here are a few seller “dos and don’ts.”

Do consider all strategies, including best offers, counter-offers or considering all offers on the table; set clear deadlines for reviewing offers; and understand how other terms and contingencies in an offer may affect its desirability.

But don’t accept a buyer based on a “love letter.” Love letters are any type of personal appeal, such a letter, video or any form of communication. These communications may inadvertently reveal personal information with potentially discriminatory implications, e.g. religion, disability status, etc.

And don’t decide based on a “feeling.” Instead, make sure a buyer is fully vetted, including pre-approval letters from a reputable financial institution, a positive debt-to-income ratio and whether they are flexible on a closing date.

There’s a reason multiple offer situations are referred to as “bidding wars,” with emotions running high on both sides. According to a recent article in U.S.

ing the credits efficiently requires listing properties on state and national registers. As a result, cities and towns should be engaging the Massachusetts Historical Commission and other offices early in the process for these projects.

Another potential reform to scale this effort could be to prioritize or create set-asides for municipalities that partner with developers to apply for historic preservation credits.

“Resources ultimately drive the deal,” said Adam Stein, executive vice president at WinnCompanies. “Unfortunately, it is not enough just to make these properties available. Municipalities need to be housing advocates and partners by pulling together matching funds and tax incentives to make the conversions work.”

The Housing Bond Bill approved earlier this year doubles the annual funding for state historic preservation tax credits from $55 million to $110 million. The credits have been distributed in three rounds each year, with most projects needing to reapply multiple times. While the increased funding is still less than the demand, it should speed the process and make it more predictable, with fewer rounds and larger amounts allocated.

The ways in which municipalities could benefit from technical assistance on school-to-housing conversions aren’t just financial. While classrooms can often be smoothly converted to housing units, gyms and auditoriums are problematic. For example, finding a partner to use a gym as a recreation facility can also make conversions more feasible.

The combination of declining public-school enrollment, a rising number of older residents and new resources from the commonwealth’s housing bond bill supercharge an opportunity for school-to-affordable senior housing conversions to make housing more plentiful and affordable in Massachusetts. Realizing the potential these demographic and policy changes represent will require providing municipalities with the assistance they need to make the projects a reality.

Susan Gittelman is executive director of B’nai B’rith Housing, a nonprofit affordable housing developer currently working in Boston, Cambridge, MetroWest and the North Shore.

News and World Report, buyers who enter a bidding war may have already lost out on another property, so the stake and emotions are high for them. In tight markets, properties move quickly, and buyers and sellers must be prepared for the stress of a fast-moving transaction. Being emotionally prepared means making rational decisions rather than impulsive ones.

For all parties, maintaining respectful and clear communications is critical. While listing agents represent the seller and buyer-representatives the prospective buyer, Realtors should be honest with all parties. They should provide counter offers quickly and cooperate with other brokers. Both buyers and sellers should be in regular communication with their respective representatives to stay ahead in today’s fast paced real estate environment.

They should also have a backup plan. Buyers can always walk away instead of making a higher offer, particularly if the offer exceeds their maximum price point. Sellers can entertain multiple counter-offers, or even go with a lower offer if the second-highest bidder is less reliant on financing, is more flexible with closing dates or is willing to submit a higher deposit with their offer.

And remind your clients that multiple offer situations will result in only one sale. Ultimately, it all comes down to the following dynamics: Sellers want the highest price and best terms for their property. Buyers want the lowest price at the most favorable terms. Only one offer will be accepted, but if all parties come to the table knowledgeable and prepared, the chances of misunderstandings and disappointments will be reduced.

I am often asked if these bidding wars will slow down. I am hopeful that with the recent decline in the median sales price, more sellers will be able to enter the market. This also may help increase the number of prospective homes on the market. For the latest on market conditions and multiple offer strategies, consumers should be sure to consult with their real estate professional or visit our website, MARealtor.com.

Amy Wallick is the 2024 president of the Massachusetts Association of Realtors and a Realtor with Lamacchia Realty in Beverly.

BOSTON 1

Address: 1 Dalton St. #5701, Boston

Price: $14,250,000

Buyer: Pomegranate Purchase JT

Seller: 1 Dalton Owner LLC

Size: 3,264 square feet

Sold: 10/8/2024 CONCORD BOSTON

The second home in this week’s Gossip Report is probably familiar to any Nantucket readers who’ve been paying close attention to their local news. The big home a few minutes’ drive from the island’s village center was sold at a foreclosure auction after its owner, fugitive Colorado investor Daniel Burrell, was arrested on the island last month after allegedly writing a bad check to a Las Vegas casino for $1.5 million and defaulting on over $75 million in bank loans.

BOSTON 3 5 NANTUCKET

Address: 3 Brewster Road, Nantucket

Price: $12,525,000

Buyer: Cmrd LLC

Seller: 3 Brewster Rd LLC

Size: 6,644 square feet on 0.92 acres

Sold: 10/8/2024

Address: 150 Seaport Blvd. #PH1E, Boston

Price: $9,000,000

Buyer: Seaport Ph1e NT

Seller: 150 Seaport LLC Size: 2,881 square feet

10/7/2024

Address: 300 Pier 4 Blvd. #8D, Boston

$7,000,000

Buyer: Luna RT

Pier 4 Wharf NT

2,247 square feet

10/10/2024

Address: 113 Oak Road, Concord

Price: $6,150,000

Buyer: Erik Ramanathan and Ranesh Ramanathan

Seller: Haidong Wang

Agent: Matthew Coyle and Ying S. Coyle, Compass Size: 9,644 square feet on 7.06 acres Sold: 10/11/2024 2 5 1,3,4

■ Showcase your listings alongside The Gossip Report, reaching high-net-worth individuals eager for the latest in luxury real estate.

■ Get noticed with exclusive online banner placements on bankerandtradesman.com, ensuring your name and listings shine bright in the digital sphere.

■ Stand out in Banker & Tradesman’s Weekly Newsletter with native ad property links and images, captivating engaged subscribers.

Contact Caitlin today at 617-896-5307 or cbobe@thewarrengroup.com for more details!

Q:Can you walk me through the first moments when you thought that a deal could happen with First Tech, and walk me through the process of getting across the finish line?

A:Greg Mitchell, who’s the CEO at First Tech, and I have talked about this being a one-of-one, so we were not searching for mergers for the sake of mergers and growth for the sake of growth. Everything that we have done at each of our institutions has been very intentional with an eye on the “people experience.” As we learned more about each of our credit unions and our focus, we have jokingly but fondly referred to each other as kind of the East Coast and West Coast twins.

We are very similar in the story of how we were each founded by technology companies that, while they no longer exist as companies, they were formed as their spirit of innovation, the way they were delivering technology, the way they built up the workplace – we both still continue those legacies. First Tech was founded by Tektronix. DCU, of course, was founded by Digital Equipment Corporation, which, even over 20 years since its merger with Compaq, is so fondly remembered by all of our residents here [in MetroWest]. We have similar origin stories, right down to the fact that both of us have foundations that are focused on children’s wellbeing. We also have very similar focuses: We truly focus on people, from employees and members, which a lot of companies will talk about, but the proof is always in the experience. It’s in your Glassdoor ratings, it’s in what members are saying about you. We really focus on that as our barometer of success.

Everything about us is so similar, from origin to values to the people that we’re serving, and even our foundations, so it was very easy when we started talking. Greg was looking at retiring, and so we started to talk a little bit about retirement, his retirement plans, where he was going. We also recognized some of the challenges that financial institutions are facing with rapid consolidation, and so we were able to say that’s not a problem for us. But doesn’t this leapfrog what we can do better and faster for all of our consumers? So, the genesis was just a mutual respect, a shared vision and shared values, and it morphed into good timing and an opportunity to bring two really healthy financial institutions together for further growth.

How do you approach making that leap into a new territory?

So interestingly, at DCU, 50 percent of our members are in-footprint, which is predominantly Massachusetts and New Hampshire. The other 50 percent are completely out-of-market, meaning there’s not a branch nearby. We have a lot of members who are out-of-market in places like New Jersey and New York, but we also have a lot of members who are out-of-market in Texas, California, Washington, Oregon and even Colorado. They’re spread throughout the nation, and we have, as a digital credit union, been serving their needs extensively. What we will have [postmerger] will be two strong branch footprints on the West Coast, with the California, Oregon, Washington branches, very specifically coming from First Tech and then the East Coast, where we have our DCU branches.

BY SAM MINTON BANKER & TRADESMAN STAFF

Digital Federal Credit Union, better known as DCU, announced recently that it will merge with California-based First Tech Federal Credit Union.

DCU is the largest credit union in Massachusetts and First Tech, headquartered in San Jose, is the largest credit union in the San Francisco Bay Area. Following completion of the merger, the new entity will emerge as a $28.7 billion credit union serving nearly 2 million members with more than 50 branches and a presence in all 50 states under DCU’s charter.

DCU President and CEO Shruti Miyashiro will become president and CEO of the newly combined credit union, which will retain First Tech’s branding.

We are planning on maintaining our branch presence on both coasts and then continuing to serve members throughout the nation digitally. We’re finding fewer and fewer members are really going into branches, but when life happens, they want to be able to connect with a person, which is by branch or even video meetings, phone calls or chats. So, the delivery has expanded but our own members’ migratory patterns, which were rooted in Massachusetts and New Hampshire due to our DEC founding, shifted even without us trying. We also have a lot of referrals of family members. DCU has grown organically through our core members and then referrals of family members, so they’re all over the nation, so this won’t be new to us.

There’s a general expectation of more bank M&A looking ahead to 2025 and beyond. Just what does the M&A projection look like for DCU?

We’re focused on doing things well and not focused on quantity, so this is not about chasing growth or chasing scale or chasing mergers. Our goal is to make sure everything we do is done very intentionally. I always say: do a few things and do them really well. Our goal for 2025 and 2026 is to work on having a really strong pre-planning and integration experience. That’s it. That’s our definition of success, because then we can continue our past record of organic growth. There’s nothing more frustrating than mergers that don’t go well and system problems for consumers, so we are very focused on taking care of our employees through the merger and then also taking care of our members through the merger with systems – not chasing M&A just for the sake of checking another one off the list.

BY SAM MINTON AND STEVE ADAMS BANKER & TRADESMAN STAFF

While Rockland Trust saw deposit and net interest margin growth, a $54.6 million office loan was reclassified as non-performing executives said during the bank’s third-quarter earnings call, hampering the gains the bank made in the third quarter.

Jumbo Capital and Greenwich, Connecticut-based Sound Mark Partners bought the Stony Brook Office Park in Waltham in January 2018 for $80.1 million, when it was 100 percent leased. The property contained 270,196 square feet of office, lab and R&D space in four interconnected buildings.

The acquisition financing was provided by East Boston Savings Bank, which issued a $59 million mortgage. Independent Bank Corp., Rockland Trust’s parent company acquired East Boston Savings Bank in 2021.

The property is being marketed for sale and is expected to trade for approximately $35 million, according to a research note issued by investment advisory firm Piper Sandler in September. The property added four new tenants in early 2023, Jumbo Capital announced at the time, leasing a combined 50,000 square feet to tech equipment manufacturer Veeco, Alcresta Therapeutics, Cugene and Opinion Dynamics.

Jumbo Capital did not return requests for comment following the research note’s publication.

Continued from Page 4

That in theory may even open the door to new multifamily construction in Warren’s own neighborhood, where nothing has been built for decades beyond the occasional mansion upgrade.

Where’s Warren in Cambridge’s Housing Debate?

That said, it is unlikely that Warren and her neighbors will be faced with an invasion by the hated private sector anytime soon, in the form of developers looking to build new housing.

Avon Hill’s status as a conservation district, combined with the unlikely scenario of a builder buying a multimillion-dollar restored Victorian in order tear it down to build apartments, makes it unlikely those sweeping zoning changes will much of an impact there.

Still, that hasn’t stopped a fierce debate in Cambridge over the proposal.

Meanwhile, Warren, even as she takes stands on local issues like a ballot question on repealing the MCAS test high school graduation requirement, has been silent on the housing debate roiling her hometown.

Paul Toner, a veteran Cambridge city councilor, said he has not heard a peep from Warren on this or any other Cambridge housing issue.

“In my three years on the Cambridge City Council I am not aware of her being involved in any conversations or made any statements about local housing in Cambridge other than general statements about need for more housing as a national and state issue,” Toner said. I reached out to Warren’s office for comment but did not hear back by Banker & Tradesman’s deadline.

Warren Looks to the Wrong Sector

Maybe it’s unrealistic to expect Warren to start talking about the need to cut regulations, even if we are talking about anti-development local zoning that many progressives have come to hate as much – or more – than the housing builders they constrain.

Warren clearly believes there is a housing supply problem, having said so much herself during that recent debate.

But she her vision for solving the crisis would have the government play a leading role, not the private sector.

With the loan moving to non-performing status, Rockland’s non-performing loan total has increased to $104.2 million, 0.73 percent of all loans. CEO Jeffrey Tengel told investors during the earnings call that this was a proactive move by the bank after the property was re-appraised following Jumbo’s decision to repurpose some of the Stony Brook Office Park’s lab space back into office space. The property is around 65 percent occupied, bank executives said.

“We have one large commercial real estate office loan that matures in the first quarter of 2025 which is experiencing stress,” Tengel said. “While this loan is current and continues to pay, we proactively moved it to NPA status, given the uncertain outlook and lack of commitment from the sponsor. Recall this loan came over with the East Boston savings acquisition and has been adversely rated since close. The sizable reserve was set up in the third quarter in anticipation of its ultimate resolution, and we’re actively exploring all avenues for resolution prior to maturity.”

Third-quarter research from commercial brokerage CBRE found the Route 128 West life science market is 25.9 percent vacant with another 5.7 percent of its 11.12 million square feet of space available for sublease despite 109,226 square feet of positive absorption so far this year.

Due to the status of the loan, Rockland has created a $22.4 million reserve specifically for the non-performing office loan. Whether it be

through foreclosure, a loan sale or some other outcome, a potential resolution for the nonperforming loan is still unknown.

“It doesn’t appear that the sponsor has an interest in contributing any capital, which we think is a sign that things aren’t going to end well here, per se, which is why we’ve been exploring all of the above,” Tengel said in response to a stock analyst’s question. “We continue to interact with the sponsor and hopefully they’ll see some value in the property, but we’re prepared to take whatever action we think is necessary.”

On top of the $54.6 million office loan for Stony Brook Office Park, Rockland executive said the bank also part of a $30 million syndicated office loan that matures in the fourth quarter, which the bank downgraded after the unspecified property lost an important tenant.

It is still to be determined if the syndicated loan will get an extension, as requested by the asset’s owner, and Rockland executives described it

Warren this summer reintroduced her $500 million American Housing and Economic Mobility Act bill in the Senate.

The core of the proposal involves a $44.5

billion federal outlay each year for a decade to plus up the national Housing Trust Fund, which states can use to build, renovate and preserve housing for families at or near the poverty line.

as a “fluid situation” dependent on a decision by all the banks that participated in the loan. Unlike the office loan, the $30 million syndicated loan doesn’t have a specific reserve against it.

Bank executives also said they extended a roughly $50 million loan on an unspecified, speculatively-built life science facility, out to 2026 after the developer secured enough tenants to bring the building up to roughly 50 percent occupied. Executives called the lease activity and the extension a “positive” development. Rockland Trust’s net income was $42.9 million in the third quarter, down from the second quarter due to the reserve set aside for the Stony Brook loan. The bank’s net interest margin of 3.29 percent was up 4 basis points compared to the second quarter. Average deposits for the third quarter increased by $330 million, or 2.2 percent.

Banker & Tradesman staff writer James Sanna contributed to this report.

While arguably a worthy effort, it’s not going to solve the housing crisis on its own.

Basically, this is public housing we are talking about, not homes for middle-class families that make up the bulk of the American economy.

The Math Doesn’t Work

And there is also another warning here from Cambridge, Warren’s adopted hometown, about her desire to have the government, not the private sector, lead the way in solving the housing crisis.

The Cambridge Housing Authority is spending nearly $900,000 to build each of the 278 new apartments it plans for the site of the Jefferson Park public housing project, the Cambridge Day has reported.

Now multiply that by the 200,000 new houses, condos and apartments we need in Massachusetts, and you arrive at $200 billion.

That’s a staggering sum, half the money in Warren’s national housing plan.

Whether Warren likes it or not, when it comes to the housing crisis, we need the private sector, not government, to lead the way.

Scott Van Voorhis is Banker & Tradesman’s columnist and publisher of the Contrarian Boston newsletter; opinions expressed are his own. He may be reached at sbvanvoorhis@hotmail.com.

Beacon Hill legislators are inching closer to agreement on the state’s widely anticipated and long-stalled economic development bill, which could provide hundreds of millions in tax credits for clean energy industry expansion.

Developers of officeto-lab conversions are making deals with Massachusetts’ growing clean tech industry to fill vacancies.

Office-to-lab conversions that looked like a can’t-lose strategy as recently as 2022 now are considering deals with clean tech startups, many getting their start at incubators and accelerators such as Somerville’s Greentown Labs and The Engine in Cambridge.

The risks for lenders and developers from failed lab conversions are starting to become apparent.

Rockland Trust Co. this month reported a $54.6 million non-performing loan stemming from a lab conversion by Jumbo Capital and Sound Mark Partners’ at Stony Brook Office Park in Waltham.

Clean tech tenants present an obvious backup option, biotech tenants still in the market for space overwhelmingly gravitate toward subleases of existing lab space, brokers say.

“Any smart landlord right now is looking at an office building where they have significant vacancy, and if there’s an opportunity for them to introduce critical infrastructure to support these [clean tech] groups, they’ll take a look at it,” said Nate Heilbron, a senior adviser with brokerage Cresa.

But the deals also include significant drawbacks that may prompt developers to think twice.

Clean energy tenants’ lower rents reflect companies’ requirements for a mix of R&D, manufacturing and office space.

“It’s not as easy a pivot as you might think,” JLL’s Bruso said. “There are a lot of physical infrastructure reasons it might not work. There’s also geographical reasons. Climate tech wants to be in the city, but there’s no supply so they generally go north of the city because that’s where there’s cheaper infrastructure that meets their needs.”

Many startups are researching battery technologies connected to the transition from fossil fuels to electric energy sources, which require costly building-wide power capacity upgrades.

week, Banker

real estate reporter Steve Adams spotlights a commercial real estate property in Massachusetts notable for its high deal activity, unique design or one-of-a-kind special features.

WHAT: TRIDENT LOGISTICS CENTER

WHERE: 101 LEE BURBANK HIGHWAY, REVERE

OWNER: LINK LOGISTICS AND SARACEN PROPERTIES

BUILT: 2024-2025

• A former fuel tank farm is being redeveloped as a 635,000-square-foot logistics center targeting tenants focusing on last-mile distribution and proximity to air cargo and marine freight hubs.

• Newton-based Saracen Properties and Blackstone’s Link Logistics recently broke ground on the first phase of Trident Logistics Center, which is scheduled for completion in late 2025. Demolition and remediation of the former Global Petroleum tank farm was completed earlier this year on the 23-acre site.

• Gilbane Building Co. is overseeing construction of the speculative project, located less than 2 miles from Logan International Airport and 6 miles from the Conley Terminal in South Boston. Building A is a 376,000-square-foot warehouse with 40foot ceilings, 60 loading docks and a tilt-up precast concrete building envelope.

THEY SAID IT:

“Just 3 miles north of downtown Boston, the forthcoming Trident Logistics Center will provide optimally located space for a variety of urban industrial uses. With 20 percent of the state’s industrial workforce – over 146,000 people – located within 10 miles of the project, the site offers unparalleled access to a local, skilled talent pool.”

— Justin MacEachern, vice president of Massachusetts and Northern New England, Gilbane Building Co.

THINK YOUR PROPERTY IS HOT?

Drop Steve a line at sadams@thewarrengroup.com

Rents are significantly lower than biotech uses, so some developers may opt to wait for the life science space surplus to recede and eventually attract higher-rent-paying life science companies.

And clean tech tenants’ unique processes can create extra capital expenses for landlords after they vacate.

“You need to find the next tough tech company that needs the same space,” said Dave Thomann, a managing director at Cushman & Wakefield. “Finding the one that needs the exact layout can be challenging.”

Older factory buildings fit clean tech companies’ requirements better than office conversions in many cases, said Kevin Sheehan, co-founder of Boston-based Greatland Realty Partners.

“You start to look at buildings that are 100 years old and were built for a printing press or a technology we don’t use anymore, but they end up being perfect for these types of users,” he said.

Greatland Realty Partners is converting two former Liberty Mutual office buildings on Riverside Road in Weston into lab-ready shell space. The project has leased 30,000 square feet to one life science tenant, Modex Therapeutics, but has another 310,000 square feet available in the two existing buildings and an approved development site.

Developers now are studying the potential for the building’s infrastructure to support non-life science tenants, ranging from floor

load to HVAC capacity and power supply.

“The question is: is it the right location and the right economic package?” Sheehan said.

Boston-based Berkeley Investments has found a way to make the economics work at a pair of non-traditional commercial properties in the inner suburbs.

A sprawling former Bank of America operations center occupying an entire block in downtown Malden was originally envisioned as a life science conversion. Berkeley partnered with Chicago-based Singerman Real Estate and Acore Capital on the $135 million project at 200 Exchange St. in mid-2021.

As life science venture capital funding for expansion declined in 2022, it became apparent that developers had to widen their horizons for tenants, said Dan McGrath, Berkeley’s director of asset management.

The project got its biggest lease commitment in September, when Woburn-based Alsym Energy leased 60,000 square feet for a new headquarters. The company develops batteries for grid and home storage, and recently raised $78 million in venture capital funds.

“We’re seeing there are a lot of other users who need lab space,” McGrath said. “There are a lot of the same requirements.”

Email: sadams@thewarrengroup.com

Continued from Page 3

ing the pool of people paying into the National Flood Insurance Program. While people living outside of risky areas might be averse to paying more when buying a home, she noted that their costs will be lower if there are remote chances of flooding occurring in a locality.

For now, some local financial institutions are trying to protect themselves with an old tactic: diversifying their lending portfolios and avoiding concentration of risk.

“It’s a little bit like diversifying your investment portfolio. You can’t put too many eggs in one basket,” said Robert Talerman, president of Cape Cod Five Cents Savings Bank. “It’s all about managing exposure. You might get to a point where you can’t do more of this [lending] in this area, because you’re at your exposure cap. So, we obviously look very carefully at the exposure in special flood hazard zones and those coastal high-hazard zones.”

First Street’s Porter said that small and regional banks shouldn’t reduce lending to their communities but should look to spread out the risk in their lending strategies.

“It’s not that you’re going to stop lending to your community, especially if you’re a community bank,” Porter said. “Just having that information [about climate risk] gives banks the ability to make relatively simple decisions

around investment and how to start diversifying that risk on the climate side on top of all the other risk metrics that they’re already taking into account on the bank side.”

Certain properties could have a harder time getting insured in the future which could cause lenders to be unable to provide funding, Talerman said. He said Cape Cod Five has even encountered situations where the bank was unable to provide a loan to a property with significant risk of coastal erosion.

“It’s going to continue to evolve,” he said. “The cost of insurance and the insurability of certain types of properties in certain types of locations, I think is going to become an issue. Without affordable insurance and adequate coverage, it gets awfully tough to get a loan.”

While residential lending was the focus of First Street’s report, Porter said that the effects of climate change could start to weigh on other areas of lending.

“On the commercial side, we’re finding a very similar problem, where insurance rates are increasing rapidly over the last five years and as those insurance rates are increasing, we are finding that operating expenditure side of the commercial world is starting to outpace revenues that are coming in,” he said. “All of a sudden, the cash flow that businesses and institutional investors are expecting to see from properties are not returning the same that they have in the past.”

Email: sminton@thewarrengroup.com

Commercial Land With A Permitted Gas Station To Be Sold On The Premises Wednesday, October 30, 2024 At 11:00 AM 447 Onset Avenue

Cape Cod Gas Station On Three Lots Containing 2.12± Acres Of Commercial Land With A Permitted Gas Station, 4 Bay Garage, Gift Shop And An Additional Building With 2 Offices. On High Traffic Highway With Access Just Off Rt 6 & 28. Mortgage Reference: Plymouth County Registry of Deeds In Book 56866, Page 110. Terms Of Sale: A Deposit 0f $10,000 In Cash, Bank Or Certified Check Will Be Required At Time And Place Of Sale. Balance Due Within 30 Days.

Rockland Trust Co. provided $5.1 million in financing for conversion of the Henry Gustavus Dorr building at 281 Franklin St. in Boston into 15 apartments under Boston’s downtown office-to-residential conversion tax incentive program.

BY CAMERON SPERANCE

Massachusetts has a housing shortage, and there are plenty of underutilized office buildings in Boston’s urban core.

At first glance, it seems like a no-brainer for housing conversion projects. Maybe not so fast.

As the national commercial real estate industry continues to grapple with a pandemic hangover sending office vacancy rates to their highest levels in recent memory, the potential for residential conversions is at the top of mind

for many brokers, developers and municipal leaders.

Nearly 70 million square feet of office space – or 1.7 percent of the national supply – was undergoing conversion to other uses over the first three months of this year, according to CBRE. That’s up from the 60 million square feet of conversions taking place in the office sector in the third quarter of last year.

Conversions to multifamily use account for 63 percent of the office conversions either planned or currently underway, according to the same CBRE report. And this year, fully one-third of the 120 office conversions slated for completion across the country are destined for multifamily in their new life. But despite the momentum, there isn’t

necessarily equal wind in the sails in some of the country’s historically top commercial real estate markets.

Of the top 10 markets for planned or underway office conversions, Cleveland has the highest percentage of total office inventory – at 11 percent – slated for conversion or already in the process of converting. Houston, at 6.2 million square feet, has the most office square footage primed for conversion to other uses.

Other cities and markets in the top 10 include Cincinnati, New Jersey, Phoenix and Minneapolis-St. Paul. Boston didn’t make the top 10.

Continued on Page B6

BY STEVE ADAMS

BANKER & TRADESMAN STAFF

Q: As an ever-growing number of developers and architects focused on life science projects in recent years, what are some of the pitfalls that inexperienced firms could run across?

A:It’s fairly easy to go online or to some educational conference to understand the current trends in lab design, whether it’s floorto-floor heights or column spacing or certain types of layouts. One of the biggest pitfalls is not having a clear view on where science is going. That’s one thing that TRIA has always been important to us. We’ve always had scientists on staff, chemists on staff, so that we are working with our clients and understanding where their science and technology is going in the future. We are able to help developers design core-and-shell lab buildings that are not going to have the right floor-to-floor height and column spacing, but the right core, understanding what ratio of office to lab to service areas, and whether or not we think there are going to be folks working in the labs, or whether it’s going to be more automated and robotics in the future.

Q: Will that trend toward automation affect the cost of lab buildings?

A:I would love for the price of lab buildings to come down, but I don’t think it’s going to happen. Over the past 20 years, it seems like labs were moving much more toward automation, and a lot of that was driven by genetic sequencing. As the human genome was mapped and a number of other technologies have advanced, these labs still need scientists to run them. I think we are back currently to the trend of using automation and robotics and AI to do the maximum amount possible, but we’ve ultimately learned in 2024 we still need people in these labs.

Q: How do adaptive reuse projects compete in today’s lab market?

A:In 2020 when the pandemic hit, a lot of the other market sectors took a big hit. I’ve had conversations with the top developers across the country to help them reposition mostly office assets to either R&D, lab or GMP. In the past five years, we’ve probably repositioned 12 to 15 large-scale developments to life science. However recently with the market correction, we’ve been seeing a little bit more happen with office to residential as well as office to hotel.

Q:Do lab buildings translate to other uses such as clean energy and tough tech, and is there interest among developers in those types of conversions?

A:We’ve worked on a couple of core-and-shell buildings with larger floor plates in recent years. We are currently working on two large battery manufacturing products going into purposebuilt lab buildings. The infrastructure, the loading, everything about the lab buildings suits it perfectly to be used for these other sectors.

Q:What areas is TRIA focusing on for growth?

A:We recently brought on a senior principal to the office [Haril Pandya] who has 25 years’ experience in residential, mixed-use and corporate interiors, hospitality and retail, so those are the current sectors we are looking at.

Q:How do you incorporate AI applications?

A:

We compete with the Genslers and the Jacobs and the Perkins + Wills of the world, so we have to be where they are in the advancement of this stuff. We were one of the first architects using virtual reality and augmented reality to allow our clients to interact on design, especially in lab and tech environments. We are fortunate to work with some of the most brilliant people on the face of the Earth who have come out of Harvard and MIT, but believe it or not, a lot of them cannot read nor do they have the time to understand floor plans. So, years ago we started with AR and VR and it’s a process where we’ve won two [International Society for Pharmaceutical Engineering] facility of the year awards through working with our clients to make sure they understand what they are seeing in their offices and in their lab and manufacturing spaces. We have another initiative in our office looking at the impact of AI on design assistance, BIM and predictive analytics. Clients will come to you and ask how many linear feet bench scientists get today in a typical biology lab, or how many air changes. I think it is going to help make another revolution in architecture, but we don’t want to ever remove the human element. That’s something that has made architecture something special. We could be on the verge of losing that if we’re not careful.

TITLE: CEO, Tria

AGE: 54

INDUSTRY EXPERIENCE: 29 years

After graduating from Wentworth institute of Technology, Sherwood Butler joined a tiny architecture firm in Cambridge and immediately began designing life science projects for a local research institute. Butler’s on-the-job training prepared him for the rising demand for lab design in the past two decades, a specialty he continued in roles after selling the firm to Perkins + Will in 2012. In 2015, Butler founded Bostonbased TRIA, which has grown to a staff of approximately 25 employees and recently added Haril Pandya, a former CBT Architects principal, as a senior principal to expand its business lines beyond its traditional life science specialty.

The infrastructure, the loading, everything about the lab buildings suits it perfectly to be used for tough tech.

BUTLER’S FIVE FAVORITE ALBUMS:

1. “Is This the Life We Really Want?” by Roger Waters

2. “Purple Rain” by Prince

3. “Unplugged” by Neil Young

4. “Licensed to Ill” by The Beastie Boys

5. “Among My Swan” by Mazzy Star

Provide Key Source of Equity for Reuse Projects

BY CHRISTOPHER R. VACCARO SPECIAL TO BANKER & TRADESMAN

Developers looking to reposition historic properties have a double advantage in Massachusetts – federal and state income tax credits based on qualifying historic rehabilitation costs.

The federal historic rehabilitation tax credit program is administered through the Internal Revenue Service and the National Park Service. The credit amounts to 20 percent of “qualified rehabilitation expenditures” on a “qualified rehabilitated building,” as determined by the National Park Service.

The Affordable Homes Act enacted last August significantly increased the commonwealth’s financial commitment to this tax incentive program, doubling the annual limit on the tax credit from $55 million to $110 million, and extending its expiration date to 2030. REINFORCING REHABS

The credit is available for substantial rehabilitations of “certified historic structures,” which are buildings listed in the National Register of Historic Places or certified by the National Park Service as contributing to the significance of a registered historic district. In general, a building is considered “substantially rehabilitated” if, during a 24-month measuring period, the qualified rehabilitation expenditures exceed the greater of the adjusted basis of the building and its structural components, or $5,000. The U.S. Department of the Interior publishes detailed standards and guidelines governing rehabilitations that qualify for the tax credit.

The federal credit is only available for capital expenditures on existing depreciable buildings that are income-producing. It is not available for personal residences. The federal credit is unavailable for acquisition costs, newly constructed buildings, and enlargements or additions to buildings, but it is available for qualified expenditures that increase floor area through interior remodeling. The federal credit cannot be claimed for landscaping, sidewalks, or parking lots. Unlike the Massa-

chusetts historic rehabilitation tax credit discussed below, the federal credit generally is not transferable.

Before 2018, the entire 20-percent federal tax credit could be taken in a lump sum, but now it must be spread out over a 5-year period. The federal rehabilitation credit is one of the general business credits that taxpayers can claim against the income tax. As such, if the available credit exceeds income taxes owed in a given year, taxpayers generally can carry back for one year and carry forward for up to 20 years the unused portions of the federal tax credit.

The Massachusetts historic rehabilitation tax credit is available through the Massachusetts Historical Commission. The historic rehabilitation tax credit can offset state income taxes for up to 20 percent of a developer’s qualified expenditures to rehabilitate an historic building. Qualified buildings are those listed with the National Register of Historic Places or deemed eligible by the MHC for such listing. Qualifying projects must be certified by the MHC. The credit is earned when the completed project is placed in service. This state tax incentive program originally was only in effect from 2005 through 2009, with a limit of $10 million in annual tax credits. The program became popular with developers and the state legislature, which amended the statute a few times. The annual limit was soon increased to $15 million, then to $50 million in 2006, and eventually to $55 million in 2018. The sunset provision of the program was steadily extended beyond 2009 to 2027.

The Affordable Homes Act enacted in August significantly increased the commonwealth’s financial commitment to this tax incentive program, doubling the annual limit on the tax credit from $55 million to $110 million, and extending its expiration date to 2030. Because of the annual limit on the Massachusetts credit, investors must go through an approval

process to qualify, and the MHC has discretion when allocating the available credit. In making this allocation, state regulations require MHC to consider several enumerated factors, such as whether the project will create affordable housing, the historical significance of the building being rehabilitated, the availability of other beneficial funding sources to the taxpayer, and the overall economic effect of the project on the surrounding community.

Similar to the federal tax credit, the Massachusetts credit is not available for personal residences, or for acquisition costs. But unlike the federal historic tax credit, taxpayers who qualify for the Massachusetts tax credit can transfer the credit to a different taxpayer without transferring the qualified historic struc-

ture itself. This is particularly useful for developers whose taxable income is less than the amount of the credit. Taxpayers can only carry forward unused credits for only up to five years, but taxpayers’ ability to transfer tax credits enables those who cannot utilize the full credit, to realize a financial benefit by selling the unused credit to a taxpayer who can use it. Historic rehabilitation tax credits are attractive for those committed to preserving historic buildings, but taxpayers must use them with caution. There are numerous complexities that cannot be fully explained in a short column. Consultation with tax professionals is advised.

Christopher R. Vaccaro is a partner at Dalton & Finegold in Andover. His email address is cvaccaro@dfllp.com.

72 Grove St, Worcester

$25,600,000

Size: 89733sf Prior Sale: $16,139,500 (10/17)

91 Glenn St, Lawrence $21,110,000

Use: Manufacturing Building

B: Stag Industrial Hldg LLC

S: Atlantic Oliver Ii 91 Gle

Date: 09/13/24

Total Assessed Value (2024): $4,684,200 Lot Size: 270943sf Prior Sale: $15,770,000 (12/21)

65 Prescott St, Worcester $20,400,000

Use: Hotel

B: Prescott St Lodging LLC

S: Breit Mass Prop Owner LLC

Date: 09/13/24

Total Assessed Value (2024): $9,100,000

Lot Size: 39277sf Prior Sale: $13,624,076 (10/17)

7 Connector Rd, Andover $14,080,000

Use: Industrial Warehouse

B: Stag Industrial Hldg LLC

S: Atlantic Oliver Ii Connec

Date: 09/13/24

Total Assessed Value (2024): $3,927,000 Lot Size: 135036sf Prior Sale: $10,350,000 (08/21)

353 Middlesex Ave, Wilmington $12,180,000

Use: Industrial Warehouse

B: Stag Industrial Hldg

BY JARED KRIEGER

Boston is at a critical juncture as it faces a growing housing shortage alongside an abundance of underutilized office space. While the city has a strong history of bold urban development, it has been slower than others in adopting office-toresidential conversions as a solution.

Of particular note is New York, which has emerged as a leader in this effort. Gensler recently completed New York City’s largest officeto-residential conversion to date, Pearl House, and is now embarking on an even larger project that will deliver over 1,500 housing units.

There are a few key reasons why New York City is experiencing faster conversion momentum than Boston, starting with the scale of the available office inventory here.

In contrast, Boston’s 70 million square feet of office space limits the pool of candidates, and there are fewer buildings to choose from.

New York’s more regular street grid and building footprints make office-to-residential conversions easier to execute. Manhattan’s rectangular blocks are more conducive to laying out residential units efficiently, allowing for adequate access to daylight and fresh air. Boston’s historic neighborhoods, while charming, often feature irregularly shaped buildings and blocks that pose significant challenges when trying to reconfigure floor plans for residential use.

We are still encountering inflated expectations around buildings’ valuations and their ability attract office tenants.

New York simply has a much larger volume of buildings to work with. The city’s five boroughs comprise nearly 730 million square feet of office space, with the vast majority – 82 percent, or about 600 million square feet – located in Manhattan. This gives developers a broader range of potential properties to evaluate for conversion.

New York also had a headstart offering incentives since prior to the COVID-19 pandemic. City policymakers have also loosened zoning restrictions for residential conversions. And New York’s housing market supports a higher tolerance for unconventional layouts and unique units, which can make conversions more feasible, reducing uncertainty for developers.

New York City also has an ally in New York State, in the form of property tax abatement for between 25 and 35 years for conversions. This policy helps offset the high costs associated with conversions and makes it easier for projects to be financially viable. For developers, this

reduces long-term costs factored into underwriting. In June, Massachusetts Gov. Maura Healey announced a statewide pool of $15 million that gives developers $215,000 for each income-restricted unit in office buildings converted into housing.

In some parts of New York, the value of office buildings has declined significantly, making conversions more economically attractive than keeping them as office space. Lower acquisition costs give developers the breathing room needed to make the financials work. In Boston, however, we are still encountering inflated expectations around building valuations and their future viability to attract office tenants.

Ultimately, the biggest factor of all is clarity of risk in the process, expectations and cost. Developers won’t commit to converting an office building if they can’t clearly see how the project will pencil out financially.

One of the biggest challenges in Boston is the fear factor associated with being the first to undertake a large-scale office-to-residential conversion. Most of Boston’s current conversions are relatively small in scale. In contrast, New York has already seen substantial conversions. Developers in New York have had the benefit of seeing these large-scale conversions succeed, which reduces perceived risk for future projects.

So, when will the first large-scale conversion project in Boston finally take off? The