The Italian Ministerial Decree of 30 May 2023: how to apply biosecurity measures in poultry farms

WOAH: why Avian Influenza vaccination should not be a barrier to safe trade

High-quality chicks: from breeders to hatchery

2024 Zootecnica International − March 2024 –POSTE ITALIANE Spa –Spedizione in Abbonamento Postale 70 %, DCB Firenze

3

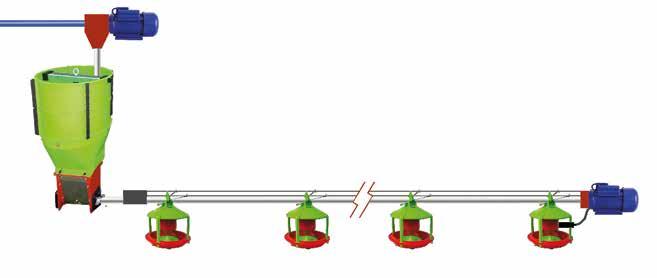

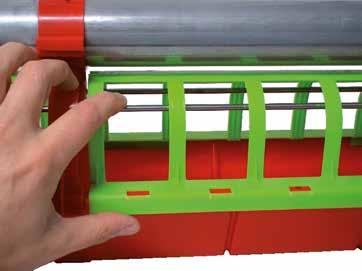

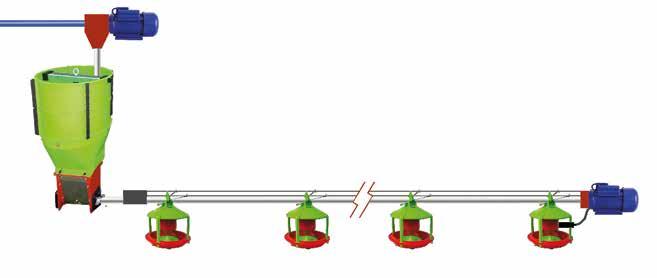

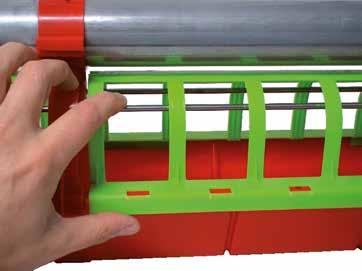

The new feeders of the «Gió» range, specifically developed for great poultry farms, thanks to the easiness in the regulation of the feed and to the absence of grill (that avoid chicks perching) have many advantages: they are easy to use and their cleaning is extremely easy and fast too, leading to an overall reduction in labour costs.

CODAF Poultry Equipment Manufacturers • Via Cavour, 74/76 • 25010 Isorella (Brescia), ITALY Tel. +39 030 9958156 • Fax: +39 030 9952810 • info@codaf.net • www.codaf.net

for the rearing phase (first 30 days of life) for the growing phase (no anti-waste ring)

EDITORIAL

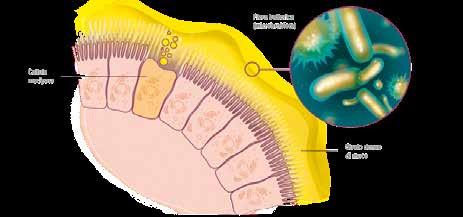

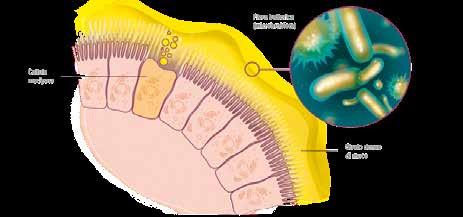

For some time, research by various nutritionists have tried to understand how calcium and phosphorus interact and interfere with the metabolism of hens in the different phases of their life cycle and how a targeted intake of minerals can help meet daily needs in order to allow breeders to prolong the laying cycle. The evolution of research in the poultry field is surprising particularly as regards the nutritional aspect; where it has been possible to establish the daily requirement of calcium and phosphorus in the gastrointestinal tract and at a metabolic level. Technicians now agree that the well-being of a flock depends largely on the gastrointestinal status of the birds.

Starting from this point of view, researchers concentrated on trying to improve the absorption of phosphorus and calcium in the bones, and managed to verify that large limestone particles interact less with phytase and the size of the fine particles reduces the enzyme efficiency. Larger limestone particles, in fact, remain in the gizzard for longer and, given that egg shells form during the night, when the hen eats less, they represent an available source of calcium. In general, chickens need to remove some calcium from their bones to lay eggs; this process produces phosphorus, which is however dispersed in the manure. Thanks to these studies it was possible to predict the daily nutritional needs during the life cycle of a hen and establish the optimal time for intake of these minerals throughout the day.

BREEDAZA THE RATIONING SYSTEM FOR BROILER BREEDERS AND

LAYERS

Leader in livestock feeding systems

ADJUSTABLE ANTI-COCK GRID

NO OBSTACLE INSIDE

EASY ACCESS TO FEED

System designed for equal, controlled and immediate distribution throughout the line.

The obstacle-free linear trough feeder allows an easy access for the animals which can easily spot the feed.

Easy cleaning and no residual feed inside the trough.

QUALITY MADE IN ITALY www.azainternational.it

VIDEO

I WANT AZA!

SUMMARY WORLDWIDE NEWS ......................................................................... 4 COMPANY NEWS 8 REPORTAGE The Italian Ministerial Decree of 30 May 2023: how to apply biosecurity measures in poultry farms 10 DOSSIER WOAH: why Avian Influenza vaccination should not be a barrier to safe trade 18 FOCUS High-quality chicks: from breeders to hatchery 24 MARKETING Broiler economics ............................................................................................ 28 TECHNICAL COLUMN The progression of turkey nest boxes .............................................................. 36 NUTRITION Nucleotide supplementation: a crucial defence against necrotic enteritis and coccidiosis 40 MARKET GUIDE 44 UPCOMING EVENTS ......................................................................47 INTERNET GUIDE 48 24 patterns of high pathogenicity avian influenza (HPAI) have recently evolved from a historically known scenario to a new one. scenarios coexist in the current epidemiological situation. and control measures Avian influenza: understanding new dynamics to better combat the disease scenario New scenario wild birds Low pathogenicity avian influenza (LPAI) High pathogenicity avian influenza (HPAI) LPAI mutates to HPAI at barn level Biosecurity at farm level LPAI and HPAI in wild birds LPAI mutates to HPAI at barn level Mass culling Biosecurity at barn level Constant monitoring and surveillance + HPAI spreads to other poultry in the farm HPAI spreads to other farms HPAI spreads to other farms All the barns can quickly get infected through contaminated environment Movement restriction Mammals 18 10

Risks for animal health related to the presence of ergot alkaloids in feed

The European Commission requested EFSA to provide an update of the 2012 Scientific Opinion of the Panel on Contaminants in the Food Chain (CONTAM) on the risks for animal health related to the presence of ergot alkaloids (EAs) in feed.

EAs are produced by several fungi of the Claviceps and Epichloë genera. This Opinion focussed on the 14 EAs produced by C. purpurea (ergocristine, ergotamine, ergocornine, α- and β-ergocryptine, ergometrine, ergosine and their corresponding ‘inine’ epimers). Effects observed with EAs from C. africana (mainly dihydroergosine) and Epichloë (ergovaline/−inine) were also evaluated. There is limited information on toxicokinetics in food and nonfood producing animals. However, transfer from feed to food of animal origin is negligible.

The major effects of EAs are related to vasoconstriction and are exaggerated during extreme temperatures. In addition, EAs cause a decrease in prolactin, resulting in a reduced milk production. Based on the sum of the EAs, the Panel considered the following as Reference Points (RPs) in complete feed for adverse animal health effects: for pigs and piglets 0.6 mg/kg, for chickens for fattening and hens 2.1 and 3.7 mg/kg, respectively, for ducks 0.2

mg/kg, bovines 0.1 mg/kg and sheep 0.3 mg/kg. A total of 19,023 analytical results on EAs (only from C. purpurea) in feed materials and compound feeds were available for the exposure assessment (1580 samples). Dietary exposure was assessed using two feeding scenarios (model diets and compound feeds). Risk characterisation was done for the animals for which an RP could be identified.

The CONTAM Panel considers that, based on exposure from model diets, the presence of EAs in feed raises a health concern in piglets, pigs for fattening, sows and bovines, while for chickens for fattening, laying hens, ducks, ovines and caprines, the health concern related to EAs in feed is low.

Full article is available here: https://efsa.onlinelibrary.wiley.com/doi/epdf/10.2903/j.efsa.2024.8496

Source: EFSA

© EFSA 4 - worldwide newsWORLDWIDE NEWS

Global poultry quarterly Q1 2024: outlook 2024

The 2024 outlook for the global poultry market is moderately positive, with a forecast of 1.5% to 2% growth. Though a decline from the long-term average of 2.5% per year, it’s a sign of recovery from 2023’s 1.1%.

With declines expected in pork and beef markets, poultry is expected to be the fastest-growing protein in a global animal protein market forecast to grow just 0.4% YOY. Lower input costs, and therefore lower-priced chicken, should help stimulate chicken consumption in 2024 and accelerate growth in the industry.

Report summary

Most growth is expected in Southeast Asia, the Middle East, and Latin America, but at below-average levels. Producers will need to keep balancing supply growth with relatively slow demand growth, especially in the US, Thailand, Indonesia, and more recently in China and the EU, which have been struggling with oversupply.

Price-driven markets will be an ongoing challenge for producers in 2024, as the industry will still face relatively high costs and potential volatility. As consumer spending power is expected to gradually recover, the focus on prices will be less than in 2023, while demand for higher-value products will improve.

Feed costs will move slightly lower, but global geopolitical issues like the Ukraine war, turmoil in the Middle East, and weather risks could affect feed costs, as well as oil and gas prices.

The fast growth in global trade seen in 2022 and early 2023 has started to slow. Raw chicken will still grow. However, processed poultry meat trade is expected to stay slow in foodservice markets in key import countries, challenging global traders in Brazil, Thailand, and China. But the market will gradually recover on improving consumer spending power. Avian Influenza remains a major challenge, with early winter season outbreaks in the Northern Hemisphere and heavy impacts in South Africa. More countries will start vaccination, in addition to biosecurity measures, to address this.

In this ongoing price-driven market context with high and volatile input costs and avian influenza risks, producers

should focus on optimal efficiency, procurement, and biosecurity, but improving spending power should gradually lead to improving demand for more premium and value-added products.

Source: Rabobank

- march 2024 - 5 WORLDWIDE NEWS

RearMotion: perfect balance between pullet quality and user-friendliness

VDL Jansen, a leading manufacturer of poultry equipment, proudly introduces a new aviary system for rearing pullets.

The RearMotion system creates the perfect balance between quality pullets and easy management for farm management. This system offers a unique approach to rearing, combining efficiency, animal welfare and user friendliness.

Rearing high quality layers in traditional aviary systems requires close attention from farm management. The development of pullets should be closely monitored, and housing systems should be able to adjust to this development with a stepped approach opening the system and providing extra live area to the birds. In the RearMotion, pullets are able to move up and down in the system, before they have access to the house floor. This makes the system much easier to manage, in comparison to traditional aviary rearing systems.

Brian van Hooff, CEO at VDL Jansen emphasizes, “the RearMotion has been designed, based upon the knowledge coming from our many years of experience in aviary housing systems. We ensured optimum development of the hen, but at the same time thinking about user-friendliness.”

Proofpoints of the user-friendliness are the front doors of the system, that can be opened in different positions, and the foldable stairs and platforms in the system. Inspection during the first weeks is easy, as the spacious worktable-level living area is easy accessible. When birds start to develop, and start moving up and down, the foldable stairs and platforms provide extra live surface in the systems, which facilitates optimum movement. During catching or vaccination, the front doors can be fully opened, and the foldable platforms are used to create compartments in the system.

Key features of RearMotion include:

• In-system stairs can be put in three positions

• Front doors can be put in multiple positions

• Foldable platforms creating compartments

• Possibility to stand in the system

• System easy accessible for inspection

• Durable design and materials

The first projects with RearMotion have recently been installed, and the system was officially released during the recent LayerTech summit, that VDL Jansen organized for their dealers. VDL Jansen invites the industry to experience the benefits from firsthand, getting into contact with your local VDL Jansen dealer.

6 - company newsCOMPANY NEWS

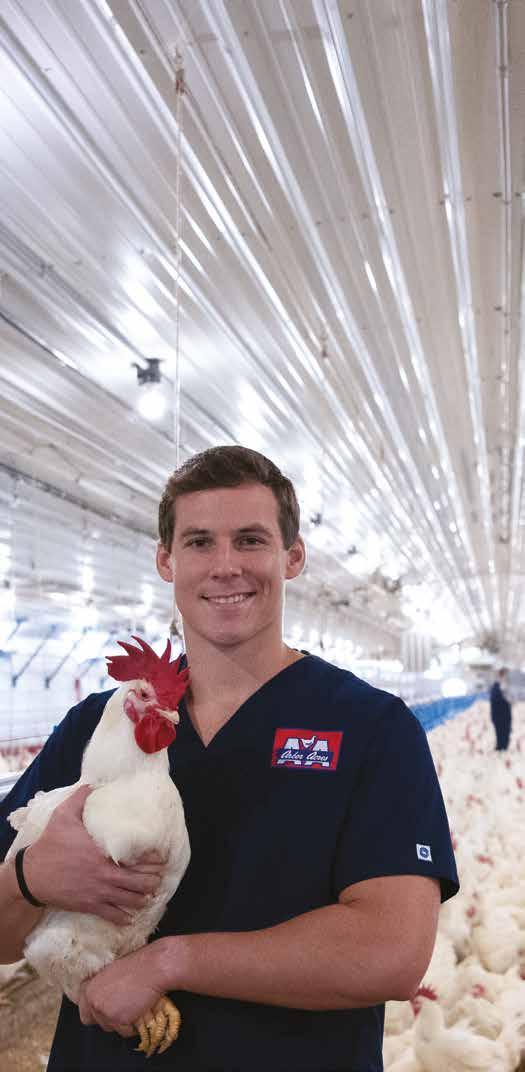

Aviagen Advantage Welfare

We are a champion of bird welfare. Through balanced breeding, the health, livability and robustness, combined with performance and feed efficiency, provide a sustainable bird with strong welfare and viability. Learn more at Aviagen.com.

Companies belonging to the Italian Giordano Holding continue under the name GIORDANO GLOBAL

From a corporate identity point of view, with the aim of better positioning our trade name in the international poultry sector, we have chosen to have the companies belonging to the Italian Giordano Holding continue under the same name. The name is GIORDANO GLOBAL. The effective date of the transition is April 1st 2024.

The companies involved are the Dutch limited GI-OVO and its affiliated entities in the US and Brazil, Eddygypt Giordano from Egypt and of course Giordano Poultry Plast from Italy. Each individual company has built up an excellent reputation over the past decades and has acquired an important position in their markets.

To further emphasize our ambitions to become an internationally recognized brand, we have designed a new logo to represent all three companies that will be part of Giordano Global, starting with that of Giordano Poultry Plast, the head company. The P in the that logo stands for Poultry-Plast is now replaced with a CIRCLE as in globe, world, circularity and global offer. Perhaps a small adjustment, but with great significance.

In addition to adjusting the company name, we are also adjusting our domain name. This will become giordanoglobal.com.

Even though we are changing our name, nothing will change for our customers, suppliers and stakeholders. They keep the same contact persons as before. Also, our quotes and invoices are sent from the same body. In addition, our company details, bank account and registration numbers remain unchanged.

No change applies to our valued brands either: EggsCargoSystem - HatchCargoSystem - Eggyplay and Valery Technologies, which will continue to be fully operated under the GIORDANO flag.

A new name naturally also means a new website: www. giordanoglobal.com. On this site, visitors will find the complete GIORDANO GLOBAL offer, which of course means that all products and systems are brought together under one roof.

We are convinced that by continuing together under one name, this will strengthen our international position and further increase brand recognition among our customers, suppliers and stakeholders.

For more information, please contact your account manager or our back office colleagues in the countries known to you.

www.giordanoglobal.com

8 - company newsCOMPANY NEWS

Aviagen releases new parent stock handbooks for Arbor Acres, Indian River and Ross Brands

The Aviagen® Global Technical Transfer (GTT) team is pleased to announce the release of its updated Parent Stock Handbooks for the Arbor Acres®, Indian River® and Ross® brands. Aviagen has designed these resources to offer the latest best-practice management advice, enabling poultry producers to achieve the highest level of health, welfare, and efficiency with their Parent Stock (PS) flocks.

The primary focus of the GTT team is to deliver practical benefits to customers, and these handbooks are designed with their success in mind.

Updated every four years, the handbooks undergo a rigorous review process led by a dedicated team of experts from various areas, including genetics, nutrition, veterinary science, hatchery and incubation, and ventilation. This comprehensive approach ensures that the information provided is both current and relevant to the industry’s evolving needs.

Within these handbooks, customers will discover expert advice on critical topics that drive bird productivity and well-being, including rearing, management into lay, care of hatching eggs, environmental requirements, nutrition, and health and biosecurity. In this edition, the team has revised and expanded key management advice to include the most up-to-date information, reflecting an ongoing commitment to staying at the forefront of industry knowledge. This includes:

• Revised mating ratio advice

• An amended male fleshing guide and the addition of firmness testing

• A change to recommended CV% guidelines

• Additional information regarding mating-up and pin bone spacing

• Completely updated Care of Hatching Eggs and Ventilation sections

To enhance the user-experience several features have been included:

• A refreshed, engaging look and feel with user-friendly diagrams and illustrations

• A hyperlinked table of contents for easy navigation to specific sections

• Hyperlinks within the text for quick cross-referencing

• Direct links to documents containing supporting information on the Aviagen website

• Short management-based videos for enhanced understanding

Dr. Vanessa Kretzschmar-McCluskey, Head of the Global Technical Transfer team, expressed her excitement about offering these new resources to benefit customer operations, saying, “Our GTT team is delighted to present the new PS handbooks to our customers. Aviagen continually improves the genetic potential of our birds, and these newest documents are filled with advice to help them maximize this potential. We invite our customers to download and engage with the interactive documents. Our ongoing goal is to strengthen their success as they work tirelessly to feed their communities with an excellent, wholesome and sustainable protein source.”

These interactive PDF documents are available on Aviagen.com

- march 2024 - 9 COMPANY NEWS

Giuditta Tilli1, Francesco Galuppo2, Alessandra Piccirillo1

1 Department of Comparative Biomedicine and Food Science, University of Padua, Viale dell’Università 16, Legnaro, 35020 Padua, Italy

2 Unità Locale Socio-Sanitaria (ULSS) 6 Euganea, via Enrico degli Scrovegni 14, 35131 Padua, Italy

The Italian Ministerial Decree of 30 May 2023: how to apply biosecurity measures in poultry farms

In Italy, following the outbreaks of Avian Influenza (AI) in 1999-2000, a legislation establishing mandatory standards on the implementation of biosecurity in poultry production was issued. Since then, the outgoing legislations have been updated yearly. To date, the legislation in force is the Ministerial Decree (MD) of 30 May 2023 on biosecurity in poultry production, following the same principles and requirements of the EU Regulation 429/2016. The purpose of this technical article (created within the framework of the “NetPoulSafe - G.A. 101000728” project) is to describe the new legislation, as well as its differences and improvements compared to the previous one.

10 - reportageREPORTAGE

In 1999-2000, the Italian poultry production suffered the widest highly pathogenic Avian Influenza (AI) epidemic, which affected over 16 million animals in 413 outbreaks. The distribution of the outbreaks was mainly in the high-density poultry areas of Northern Italy (i.e., Veneto, Lombardy and Emilia Romagna), representing about two thirds of the Italian poultry sector in terms of number of farms, animals and eggs produced and animals slaughtered. Since then, the Competent Authorities and the legislators started posing attention on how to prevent new outbreaks by considering biosecurity in poultry farms. Among the first regulations, a specific regional legislation, namely the Decree of the Regional Committee (DRC) of Veneto Region (DRC 311 of 15 June 2005) was issued. Lately, its technical contents, i.e. biosecurity measures to implement, constituted the core of the first national legislation: the Ministerial Order (MO) of 26 August 2005.

Biosecurity: from Ministerial Order of 26 August 2005 to Ministerial Decree of 30 May 2023

The Ministerial Order of 26 August 2005 was the first national regulation on biosecurity, representing an innovation and an impetus towards the future, considering that no other legislation on biosecurity in any livestock production was ever implemented. This was the first tangible effort in considering the importance of biosecurity as a preventive tool for new epidemics. However, the MO was a tool with a limited temporal value; therefore, its statements were re-proposed from year to year, considering the changing epidemiological situation. Among the most significant con-

cepts developed over the years, a special mention goes to the introduction of the filter area for people and the disinfection station for vehicles, as well as the introduction of a house hygiene lock

Meanwhile, the epidemiological scenario also changed at European level, resulting in wide and recurring epidemics of highly pathogenic AI. At the same time, an innovation from a regulatory point of view was the issuing of the EU Regulation 429 of 9 March 2016 (Animal Health Law). This regulation aims to define a logical framework for the management of major diseases (the so-called “Big Five”), as Foot and Mouth Disease, African Swine Fever, Classical Swine Fever, African Horse Sickness and highly pathogenic Avian Influenza, with the same methodological approach and strategy.

Furthermore, the afore mentioned Regulation addresses the issue of biosecurity in the recitals (43): “[…] Biosecurity

Royal

- march 2024 - 11 REPORTAGE

Figure 1 – Access to the farm through a fixed and automated disinfection station (© F. Galuppo).

Hatchery

www.pasreform.com pas2020_adv-Zootecnica-180x61mm.indd 1 25-02-2020 11:16

Pas Reform Integrated

Solutions

Ministerial Decree of 30 May 2023

The new EU Regulation 429 in 2016 immediately entered into force but became applicable from 21 April 2021. As a consequence, a chronological/administrative overlap of the provisions MO of 10 December 2019 (providing an extension of the measures to 21 April 2021), the subsequent MO of 21 April 2021 (providing an extension of the same to 30 April 2022) and lastly the MO of 8 April 2022 (providing an extension of the measures to 30 April 2023) occurred.

In the meantime, two new regulations, namely the Legislative Decree 134 of 5 August 2022 regarding the “identification and registration of operators and establishments” and the Legislative Decree 136 of 5 August 2022 regarding the “prevention and control of animal diseases” came into force for the purposes of a full and harmonized application of the EU Regulation 429.

The Decree of 30 May 2023 is therefore placed in the historical administrative context described above and, while maintaining many of the contents of the previous orders, presents a new logical framework with partly different contents.

First, the Decree is divided into three main parts:

1. Text, consisting of seven articles;

2. Annex A, “Methods for the implementation of biosecurity measures”, representing the core;

3. Annex B, “Criteria for identifying areas at high risk of introducing AI”.

is one of the main prevention tools available to operators […]” and clearly defines it (art. 4, par. 23) as: “[…] the sum of management and physical measures designed to reduce the risk of the introduction, development and spread of diseases to, from and within: (a) an animal population, or (b) an establishment, zone, compartment, means of transport or any other facilities, premises or location; […]”.

Since the national legislation has to agree with the European legislation, the logical assumptions of the MO of 26 August 2005 and subsequent amendments and additions changed over time, a new regulatory tool to be applied in the poultry sector in terms of biosecurity (Ministerial Decree (MD) of 30 May 2023) became necessary. Furthermore, an attempt was made to integrate into the text of the new provision other regulatory elements, which defined some aspects regarding biosecurity over the years, in order to have a vision as much complete as possible.

As regards the first seven articles, it should be highlighted the novelty that Regions and the autonomous provinces of Trento and Bolzano must prepare assessment plans to achieve minimum targets (at least 10% of the total amount of conventional farms and at least once a year all weaners) (articles 2 and 3). Secondly, art. 7 establishes: “[…] the operators responsible for establishments already registered in the National Database (BDN) must guarantee the compliance with the provisions of Annex A by adapting their establishments within twelve months of the entry into force of this decree […]” or by 30 June 2024, whilst the required obligations are immediately mandatory for newly registered establishments, with possible exceptions limited to “[…] poultry farms not yet registered in the BDN for which, on the date of entry into force of this decree, all the qualifications required by the current legislation for the building of the establishment have been issued […]”.

12 - reportageREPORTAGE

Figure 2 – Farm hygiene lock functionally organized into a dirty area and a clean area (© F. Galuppo)

Figure 3 – System aimed at reducing the dispersion of dust in the surrounding environment (© F. Galuppo).

Table

Structural

Washable/disinfectable

As regards the Annex A , some important novelties are present in terms of the logical setting of its contents compared to those previously provided in the Annex of the MO 26 August 2005 and subsequent amendments and additions.

First of all, a series of definitions is given, among which the homogeneous areas are defined as: “[…] restocking program for conventional turkey farms belonging to various companies and approved by the territorially competent veterinary services, characterized by the placement of

- march 2024 - 13 REPORTAGE

Backyard farms Conventional farms with a capacity of up to 250 animals Conventional farms with a capacity of over 250 animals Weaners Fairs/ Markets Egg packaging, processing and storage plants Hatcheries

feeding/ drinking YES YES YES (nets only for game birds) YES (not explicit)

feed storage YES YES YES YES (not explicit)

farming, if necessary YES (Local Authority) YES YES YES (not explicit)

requirements

Indoor/closed

Protected

Enclosed

floor YES YES YES (not explicit)

structures YES YES YES (not explicit) Trash bin YES YES YES (not explicit) Disinfection station YES (pumps permitted) YES (fixed and automated in Zone A and Zone B) YES (not explicit) Farm hygiene lock YES (clothes changing room) YES (clean area/dirty area) YES (not explicit) Clean surrounding areas YES YES (at least 2 meters) YES (not explicit) Barriers YES YES (not explicit) Signages YES YES (not explicit) Parking YES YES (not explicit) House drain wells YES (new farms) YES (not explicit) Loading area YES YES (not explicit) House hygiene lock YES YES (not explicit) Equipment/materials storage room YES YES (not explicit) External feed loading YES (new farms) YES (not explicit) Systems aimed at reducing the dispersion of dust YES (Zone A and Zone B) YES (not explicit) Fencing YES (free range farms) YES (free range farms) YES (not explicit) Dead birds’ storage YES YES YES (not explicit)

material below the cages YES

material YES Sink YES (Filter zone) YES (Filter zone) YES (not explicit) YES (eggs room) One-way circulation YES (Filter zone) YES (Filter zone) YES (not explicit) YES

Washable

Waterproof

Disposable/disinfectable

new

30

1 – Structural biosecurity requirements for the categories included in the

Ministerial Decree of

May 2023.

Table 2 – Managerial biosecurity requirements for the categories included in the new Ministerial Decree of 30 May 2023.

Managerial requirements

Visitors’ ban

Ban of working in other farms/dedicated

Hunting: ban of entry before 48 hours

Protected

Storage of disinfectants delivery note/PPE

Ban of animals’ movements

Ban of keeping birds for personnel

Ban of markets reintroduction

animals of only one sex for every farm. In turn, the areas can be with separate sexes or mixed sexes. Complete emptying of the area in 21 days must be guaranteed [...]”.

The novelty lies in determining the “ simultaneous loading for slaughter ” as a fundamental criterion, identifying the end of the breeding cycle as a risk factor for the introduction of AI into the area.

Then, the identification of measures for the different categories of establishments, i.e., backyards (for the first time,

albeit very limited and essential, specific indications are included in the legislation: “[...] in case of increased risk of introduction and spread of epidemic diseases […]”, feeding/ drinking and storage of food must be indoor), conventional farms with a capacity of up to 250 animals, conventional farms with a capacity of over 250 animals, conventional outdoor farms (for which specific additional measures are provided), weaners, poultry fairs and markets, egg packaging, processing and storage centres and hatcheries (another novelty), is addressed in specific sections.

14 - reportageREPORTAGE

Backyard farms Conventional farms with a capacity of up to 250 animals Conventional farms with a capacity of over 250 animals Weaners Fairs/ Markets Egg packaging, processing and storage plants Hatcheries

YES YES YES (not explicit)

boots YES YES YES (not explicit) YES (visitors) Dedicated clothes YES YES YES (not explicit) YES Selling YES

logbook YES YES YES (not explicit)

control YES (possible pest control) YES YES (not explicit)

weeks) YES YES (Anatidae dedicated rooms) Cleaning/disinfection YES (yearly) YES YES YES YES YES

farm personnel YES YES YES (not explicit)

Dedicated

Visitors

Rodent/pest

Quarantine (2

YES (recommended) YES (compulsory) YES (not explicit)

YES YES YES (not explicit) Eggs truck disinfection YES YES YES YES

of increased mortality/drop egg

symptoms YES (mortality only) YES YES (disease suspicion)

Hand washing before/after working

Notification

production/other

manure storage YES YES YES (not explicit)

feed storage YES YES YES YES (not explicit)

YES YES (not explicit) YES YES

procedures YES YES (not explicit) YES YES

Protected

Personnel’s compliance with biosecurity measures

Cleaning/disinfection

YES YES (not explicit)

YES

(derogations)

YES YES (not

YES Personnel training YES YES (not

YES

explicit)

explicit)

YES Biological/sanitary break YES YES YES (yearly)

YES

Ban of market during expositions

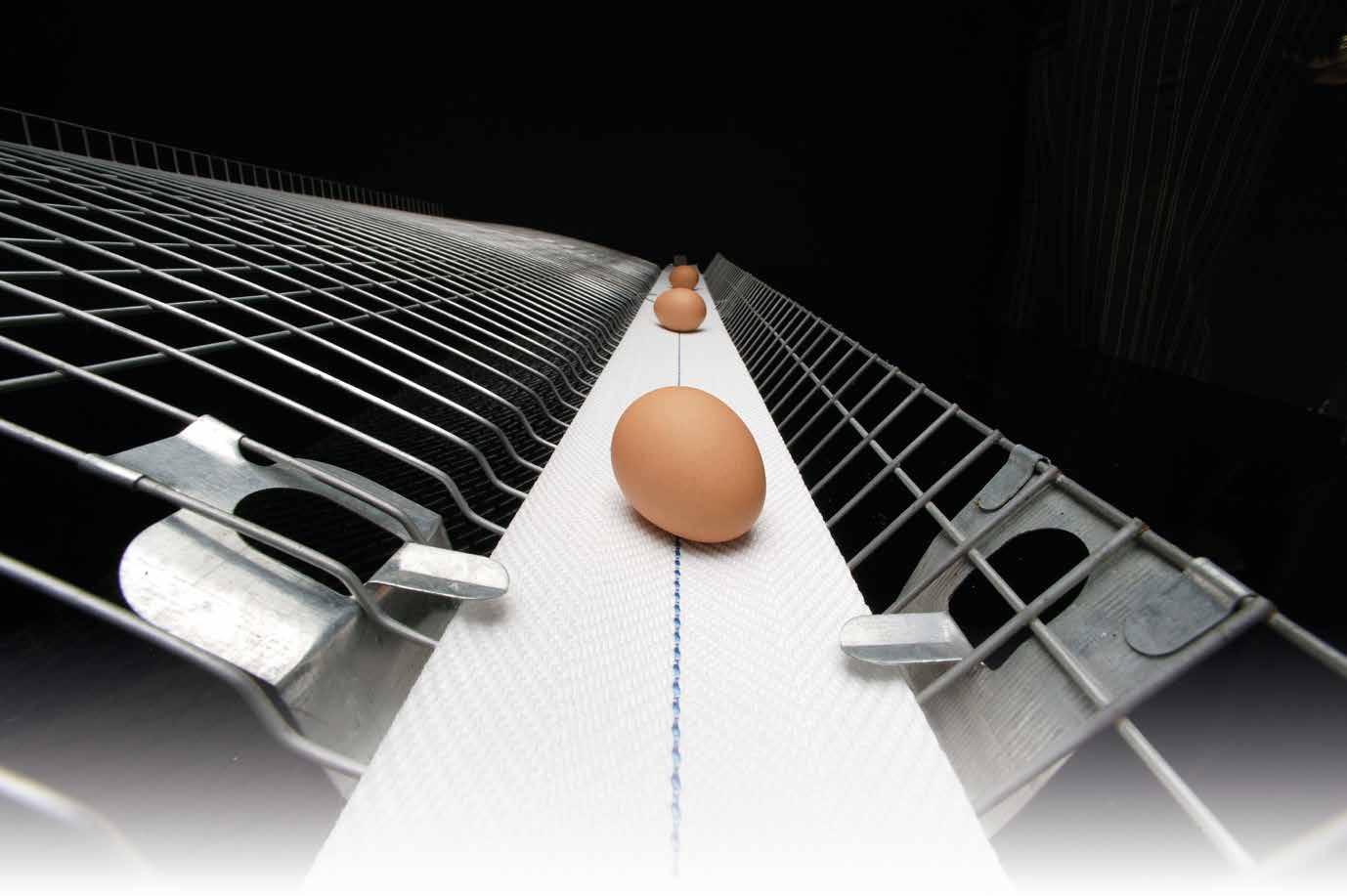

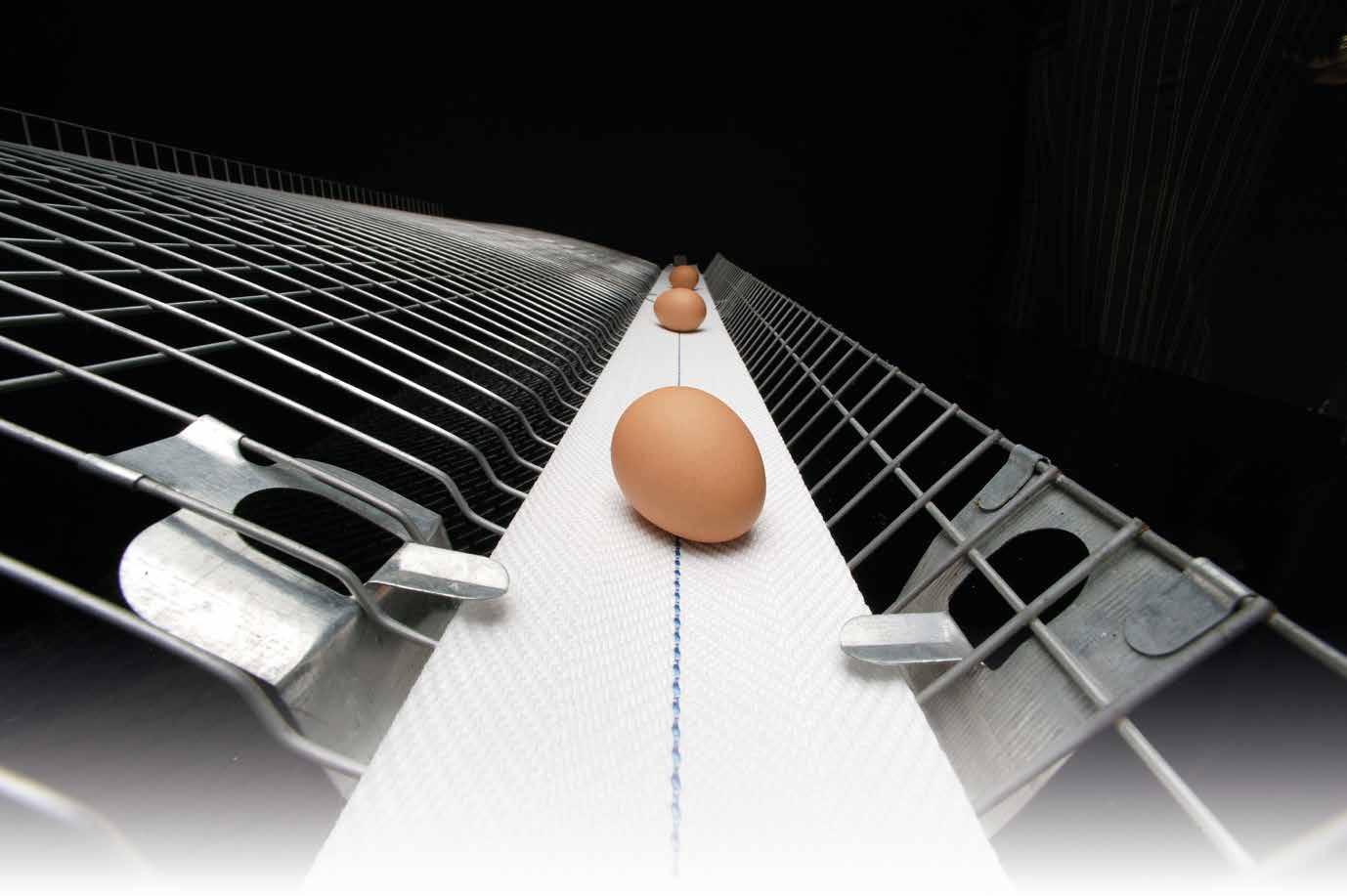

In particular, a functional and structural separation of the different areas (i.e., storage and classification of eggs, disinfection of eggs, pre-incubation, incubation for hatching, sexing and vaccination of day-old chicks, conditioning of hatching eggs and day-old chicks for delivery) is required in the hatcheries in accordance to the principle of one-way circulation of hatching eggs, equipment, personnel and (for the new establishments) the “[…] unidirectional flow of air inside the premises [...].”

As regards the details of the measures for the different types of establishments (already defined previously, in some cases revised and re-modulated with the possibility of exceptions for some), refer to Tables 1 and 2 in which they are schematically summarized.

Specifically, for the structural measures included in the Decree (Table 1), the main novelties concern:

- the obligation of a disinfection area with a fixed automated system for conventional farms with a capacity of over 250 animals, to be abided by new and renovated farms, but also by the pre-existing ones located in areas

with a high risk of introduction and spread (zones A) and high risk of introduction and greater spread (zones B) of AI;

- the farm hygiene lock (filter area) functionally organized into a dirty area and a clean area (with the obligation to keep documents proving the purchase of personal protective equipment (PPE) available to staff and visitors) for conventional farms with a capacity of over 250 animals (while for those with a capacity of up to 250 animals there is “[...] a dedicated space for storing the clothing [...]” );

- the obligation to place the rendering tank for dead birds in a place where the floor is made up of washable and disinfectable material;

- the presence of structures capable of hosting indoor, the animals usually raised outdoor;

- the presence of systems aimed at reducing the dust dispersion (i.e., natural/artificial barriers or nebulizers) in conventional poultry farms with forced air extraction systems and a capacity of over 250 animals, located in zone A and zone B, where possible and in particular

BOOST YOUR BREEDER PERFORMANCE

VDL provides total solutions for the best performance in your breeder barn. We support poultry producers to achieve highest number of hatchable eggs and maximizing day old chick production.

OUR SOLUTIONS FOR BREEDERS

• Automatic laying nest

• Perfection in egg handling

• Chain-feeding for hens

• Matrix feeder for males

• Feed weighing and distribution

VDL Jansen is well known for its excellent nest and egg handling systems. www.vdljansen.com

VDL Agrotech specializes in feeding solutions to ensure high uniformity. www.vdlagrotech.com

- march 2024 - 15 REPORTAGE

STRENGTH THROUGH COOPERATION

when located at a distance of less than 1,000 meters from other farms of the same type;

- the presence of tanks for the collection of wastewaters (deadline for adaptation within twelve months of the entry into force of the decree).

As regards the management measures included in the Decree (Table 2), the main novelties concern:

- the obligation to place day-old chicks and turkeys, coming directly from the hatchery for fattening chickens, layer hens pullets and fattening turkeys, with the possibility of derogation (decided by the veterinary authority) limited to exceptional situations, but with the exclusion of establishments located in high risk areas;

- the ban of moving animals from one house to another during the rearing cycle;

- the ban (recommendation in case of conventional farms with capacity of up to 250 animals) of contacts with poultry during the 48 hours following the hunting activity

In addition, there are other sections dedicated to the minimum rules to follow, namely:

- correct management of movements of conventional poultry farms;

- minimum distances for building new conventional farms with a capacity of over 250 animals and for adaptation of the pre-existing ones;

- correct management of cleaning and disinfection;

- management of the biological/sanitary break;

- correct management of dead animals;

- management of litter and manure.

An important section of Annex A is dedicated to the minimum distances for the building of new conventional farms with a capacity of over 250 animals and for the adaptation of pre-existing ones. The new elements consist in the determination of minimum distances from other conventional poultry farms with a capacity of over 250 animals (1,500 meters in zones A and B, reduced to 1,000 in the remaining parts of the national territory) and pigs (500 metres), as well as biogas plants (the only element already foreseen in the latest versions of the MO) using poultry manure (500 metres), with the possibility of exceptions for the minimum distances from other farms (but never lower in zone A and in the remaining zones of the national territory at 1,000 and 500 metres, respectively) excluding zone B.

As regards the contents of Annex B, they concern:

- the definition of the risk factors for the introduction of AI into the farms and the spread between them, used for updating the classification of the territory in terms of risk;

- the identification of additional measures to be applied in zone A and zone B, respectively; in particular, the management of outdoor farms, the possible suspension of poultry concentrations, the use of live decoys belonging to the orders of Anseriformes and Charadriiformes, as well as the release of game birds.

Additionally, although a specific sanctioning regulation is missing in the decree, the art. 23 of the Legislative Decree 136 of 5 August 2022 (which refers to art. 10 of the same, regarding specific regulations on biosecurity to be subsequently issued) provides that “[...] the operator who does not adopt biosecurity measures […] is punished with the administrative pecuniary sanction to the payment of 500 to 5,000 euros […]”

Finally, the evolution of the contents of the MO of 26 August 2005 and subsequent amendments and additions over time has led to the addition of biosecurity measures aimed at providing guarantees not only to the threat posed by AI, but also to other biological threats (e.g., house hygiene lock). Therefore, the current Ministerial Decree of 30 May 2023 represents an extension of the MO and constitutes an all-round disease prevention tool.

16 - reportageREPORTAGE

Till 40 silos in 1x40’ O/T container Till 23 silos in one complete truckload

s.r.l. Via Rimembranze, 7 25012 Calvisano (BS) Italy

Tel. + 39 030 9968222 r.a. Fax + 39 030 9968444 commerce@agritech.it www.agritech.it

Fiberglass

silos: the most practical, effective and durable solution to any bulk storage requirement Agritech

Avian influenza: understanding new dynamics to better combat the disease

WOAH: why Avian Influenza vaccination should not be a barrier to safe trade

Since 2005, Avian Influenza has had a staggering toll, with over 500 million birds lost to the disease worldwide. Its devastating impact extends beyond domestic and wild birds, threatening livelihoods, food security and public health.

Since 2005, Avian Influenza has had a staggering toll, with over 500 million birds lost to the disease worldwide. Its devastating impact extends beyond domestic and wild birds, threatening livelihoods, food security and public health. The recent shift in the disease’s ecology and epidemiology has heightened global concern as it has spread to new geographical regions. It has also caused unusual die-offs in wild birds and led to an alarming increase in mammalian cases. The rapidly evolving nature of Avi-

an Influenza and changes in its patterns of spread require a review of existing prevention and control strategies. To effectively contain the disease, protect the economic sustainability of the poultry sector and reduce potential pandemic risks, all available tools must be reconsidered including vaccination.

The current spread of Avian Influenza is a major concern for the poultry industry, public health and biodiversity. Given recent de -

The spread patterns of high pathogenicity avian influenza (HPAI) have recently evolved from a historically known scenario to a new one. Both scenarios coexist in the current epidemiological situation. Prevention and control measures

Historical scenario New scenario LPAI in wild birds Low pathogenicity avian influenza (LPAI) High pathogenicity avian influenza (HPAI) LPAI mutates to HPAI at barn level Biosecurity at farm level LPAI and HPAI in wild birds LPAI mutates to HPAI at barn level Mass culling Biosecurity at barn level Constant monitoring and surveillance + HPAI spreads to other poultry in the farm HPAI spreads to other farms HPAI spreads to other farms All the barns can quickly get infected through contaminated environment Movement restriction Mammals 18 Policy Brief World Organisation of Animal Health DOSSIER - dossier -

DOSSIER

velopments in its epidemiology, and the increasing circulation of high pathogenicity Avian Influenza (HPAI) in wild animals, stricter biosecurity measures and mass culling of poultry may no longer be sufficient to control the disease. With the seasonal north-south migration of wild birds, countries must be prepared for an increase in outbreaks and should consider complementary approaches, such as vaccination, in line with existing international animal health and welfare standards.

Key facts

• The epidemiology of Avian Influenza is evolving: the disease is gradually losing its seasonal nature, and high pathogenicity strains are circulating in wild birds.

• This intensified circulation increases the likelihood of virus evolution and spillover to new species, including mammals, posing a risk to human health.

• All available science-based disease control tools must be considered. In certain epidemiological contexts, vaccination can be an effective complement to other control strategies.

• If properly implemented, vaccination should not be a barrier to safe trade.

• Wider use of vaccination stimulates research innovation, improving the quality of available vaccines.

Considering vaccination as part of available Avian Influenza control measures

Traditionally, HPAI has been of concern mainly in domestic birds, with its control envisaged at farm level. Current transmission patterns show it is now circulating in wild bird populations, driving its spread not only across different farms, but also within farms. In practice, this has made it more and more difficult to protect a farm from disease introduction, due to increased exposure, both from neighbouring poultry farms and wild birds.

There has been a global rise in HPAI outbreaks and an increase in the genetic diversity of circulating virus strains. Thus, the use of sanitary control measures alone may no longer be a sustainable solution to effectively contain the disease. One such measure is the systematic mass culling of poultry, which results in heavy economic losses for farmers, has a lasting impact on their livelihoods and raises social, animal welfare and en-

vironmental concerns. Due to its negative impact on the sustainability of production practices and the image of the poultry industry to consumers, its acceptability must be scrutinised.

Measures such as surveillance for early detection and monitoring of Avian Influenza viruses, preventive health measures (biosecurity) and disease control measures (culling, movement controls, quarantine) remain at the core of any Avian Influenza control strategy.

However, poultry vaccination can no longer be excluded from the available alternatives and should be considered a complementary tool. When scientifically justified, it offers several advantages:

• Prevention and control of outbreaks in vaccinated domestic bird populations resulting in reduced virus circulation within and between flocks and lower risk of spillover to wildlife.

• Reduced economic losses, both direct (e.g. bird deaths) and indirect (e.g. mass culling and trade disruption). When properly implemented, Avian Influenza vaccination is compatible with safe trade, according to WOAH international standards.

• customised advice and inhouse production

• high-quality raw materials and strict quality standards

• chicken house equipment from planning to support www.specht-germany.com

19 - march 2024 -

• Lower risk of human exposure to Avian Influenza viruses, and thus of a potential pandemic, in line with the One Health approach.

• Minimised environmental impact by reducing the risk of spill over to wild animals.

• Incentives for innovative research to maintain the efficacy of vaccines over time, thanks to the experience gained. This encourages manufacturers to develop and improve access to effective and up-to-date vaccines.

In certain socioeconomic contexts, vaccination against Avian Influenza can contribute to the overall sustainability of the poultry industry and to the preservation of outdoor production systems. These are often a cultural heritage, even though such systems are not optimal in their biosecurity. It helps to maintain the health of domestic and wild birds, ensuring a stable supply of poultry products for consumers and preserving biodiversity. In addition, vaccination programmes with pre-established risk-based protocols enhance a country’s outbreak preparedness, both in the speed of response and preparation for the increased risk.

Responsibilities of countries opting for poultry vaccination

Avian Influenza vaccination should be considered as part of a broader disease prevention and control strategy. This must include other provisions, such as biosecurity measures, disease surveillance for early detection, rapid response to outbreaks and a well-planned exit strategy. Vaccination can be a temporary measure to better control the disease situation. National Veterinary Authorities are charged with the decision to vaccinate based on a risk-evaluation, which depends on several factors and involves varied responsibilities, including:

• The availability of high quality and reliable registered vaccines that meet WOAH international standards and remain effective against circulating strains. Vaccine composition must be under constant review to respond to changing circumstances and epidemiology.

• Sufficient surveillance capacity to demonstrate that vaccination does not interfere with virus monitoring and early detection of outbreaks in vaccinated and unvaccinated bird populations. Robust surveillance systems are essential to monitor the potential presence of Avian Influenza viruses in domestic and wild birds, as well as

in mammals. This determines which strains are circulating and ensures that immunisation targets are met, and appropriate control measures are implemented. However, building and maintaining this capacity is resource-intensive and not possible in all countries.

• The commitment of poultry producers to adhere to the disease control strategy in place.

• Data collection from producers and veterinarians on the duration of protection provided by vaccination and the time of virus shedding after vaccination if live vaccines are used. Such data will help to better define vaccination strategies.

• The capacity to ensure the traceability of the entire process, from vaccine production to on-farm administration and post-vaccination monitoring, including the traceability of vaccinated animals and their products.

Vaccine selection, vaccination protocols and monitoring are critical components of a successful vaccination programme. The level of flock immunity required to prevent transmission hinges on several factors. Depending on the disease epidemiology, Veterinary Authorities – in consultation with the poultry sector – may decide to vaccinate only certain species in a selection of production systems.

Vaccination is compatible with the pursuit of safe trade in poultry and poultry products

To date, despite the global crisis, vaccination has been used only in a limited number of countries as a preventive, emergency or systematic measure to protect poultry or other captive bird populations from HPAI. Concerns about international trade restrictions hamper its use, although the inclusion of vaccination as a control tool has been endorsed by international standards adopted by the World Assembly of WOAH national Delegates.

Unjustified trade restrictions on poultry and poultry products from vaccinated flocks have a huge impact on a sector that contributes significantly to global food security and the economy. In fact, poultry meat exports account for 11% of total production, while egg exports account for 3% of production. Imports of commercial genetic stocks of poultry are also essential to support meat and egg production systems of all countries. In addition, poultry meat and eggs are a low-cost, high-quality, low-fat protein food source, providing commodity redistribution and economic benefits and supporting the live -

20

- dossier -

DOSSIER

lihoods of small-scale farmers. It is vital to maintain their international trade while ensuring the safety of these exchanges. This can be guaranteed in two ways:

• Countries that vaccinate will need to provide appropriate certification to their trading partners to ensure that their measures comply with WOAH science-based international standards. They must also demonstrate their plans to carry out necessary surveillance of circulating strains once vaccination is in place, and their capacity to prove the absence of virus circulation.

• Importing countries should make risk-based decisions and implement science-informed measures that allow for safe trade while preventing the spread of Avian Influenza. This is critical to avoid the closure of trade

use of vaccination does not affect the status of a country or zone as being HPAI-free if surveillance supports the absence of infection. Trade in poultry and poultry products can be conducted safely alongside vaccination. 81% of WOAH Members (107/133 answers) did not use any sort of Avian Influenza vaccination in the past five years, whereas 112 countries and territories reported disease presence over this period.

Policy recommendations

The use of vaccination in poultry against HPAI remains the decision of each national Veterinary Authority in consultation with poultry producers. It should be tailored to

info@barbieri-belts.com www.barbieribelts.com

21 - march 2024DOSSIER

Barbieri srl

Tel. (+39) 0375 / 95135 • Fax (+39) 0375 / 95169 • Manu re re moval belt s • Manu re belt wi th hole s for dr yi ng system s

Via Garibaldi, 54 • 26040 Scandolara Ra vara (CR) Italy

BELTS and ROP ES fo r AV I CULTURAL US E BE LT S

“Poultry meat and eggs are a low-cost, high-quality, low-fat protein food source, providing commodity redistribution and economic benefits and supporting the livelihoods of small-scale farmers. It is vital to maintain their international trade while ensuring the safety of these exchanges”

dress the dynamic nature of the disease and its potential threat to domestic and wild bird populations, and to public health. Some key considerations for national policies are outlined hereafter.

Decision-making

As described in WOAH standards, the decision to vaccinate poultry must be:

• part of a broader Avian Influenza control strategy with an exit plan;

• accompanied by an solid monitoring and surveillance system for domestic and wild bird populations to guide the selection of appropriate vaccine strains;

• based on the availability of sufficient financial, tech -

nical and human resource s for disease surveillance and the maintenance of effective vaccination campaigns;

• combined with the enforcement of relevant regulations, including licensing, quality control, and safety standards for vaccines.

Monitoring

and evaluation

The maintenance of vaccinations should rely on the regular evaluation of vaccination programmes to gather evidence on their effectiveness and adjust them as necessary, based on surveillance data and scientific developments.

International cooperation, including trade

The implementation of Avian Influenza vaccination programmes requires a careful balance between disease control and maintenance of safe international trade. Prior to exchange, trading partners should:

• establish mechanisms to ensure cooperation and transparent communication between relevant stakeholders, including ministries, Veterinary Authorities and producers;

• engage in bilateral discussions to agree on certification requirements and trade protocols, and to address trade concerns, so mutual recognition can be ensured in peacetime

Ultimately, multilateral dialogue and adherence to WOAH standards are key to ensuring that if a country decides to introduce vaccination against Avian Influenza, it will be carried out appropriately, without sanitary risks and will not form an unnecessary barrier to safe trade. Efforts should be made to maintain open lines of communication, thus minimising trade disruption while protecting animal health and welfare, as well as human and environmental health.

For any further information: www.woah.org

22 DOSSIER - dossier -

Aitor Arrazola, Research biologist, Ph.D. in Animal Behaviour & Welfare

Aitor Arrazola, Research biologist, Ph.D. in Animal Behaviour & Welfare

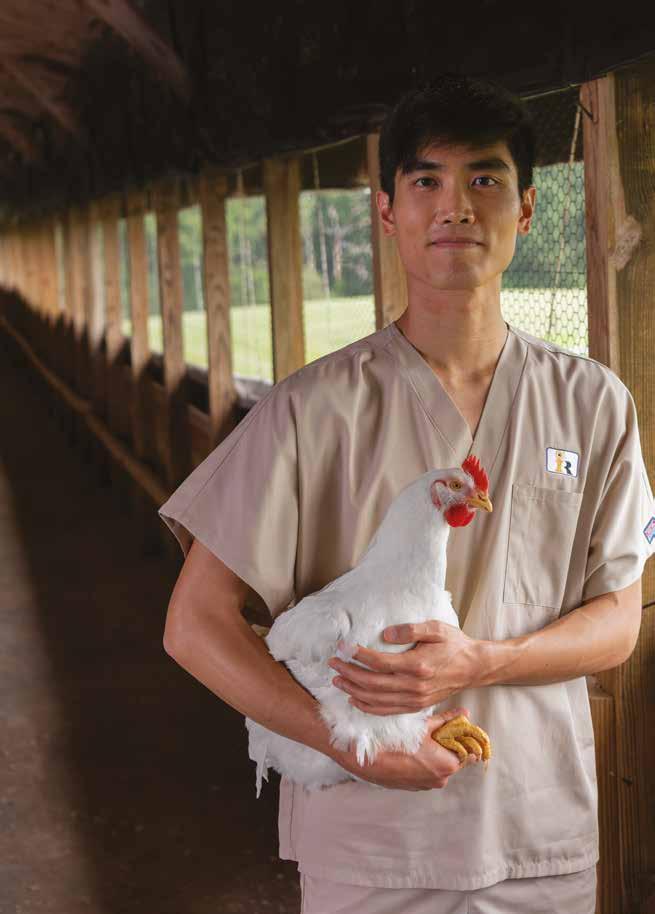

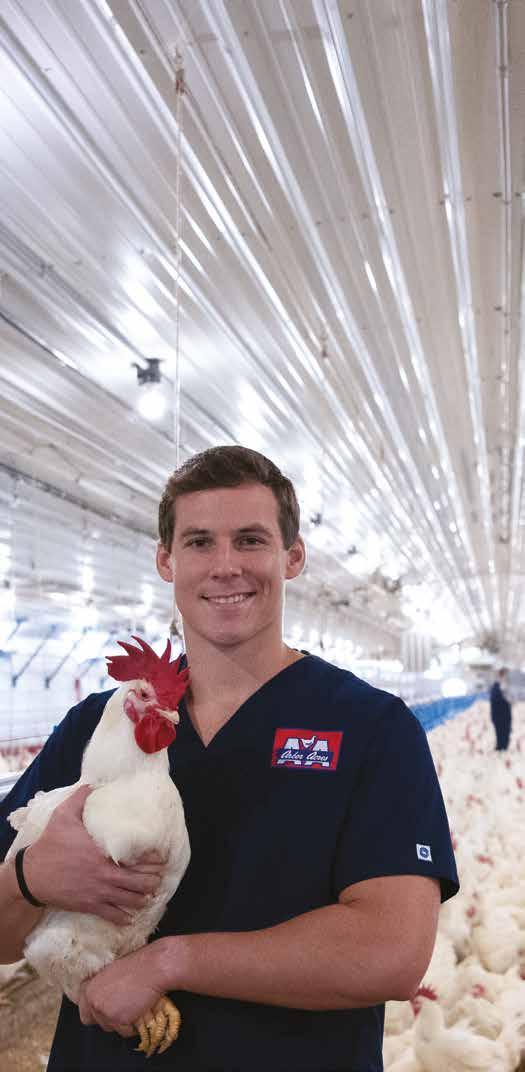

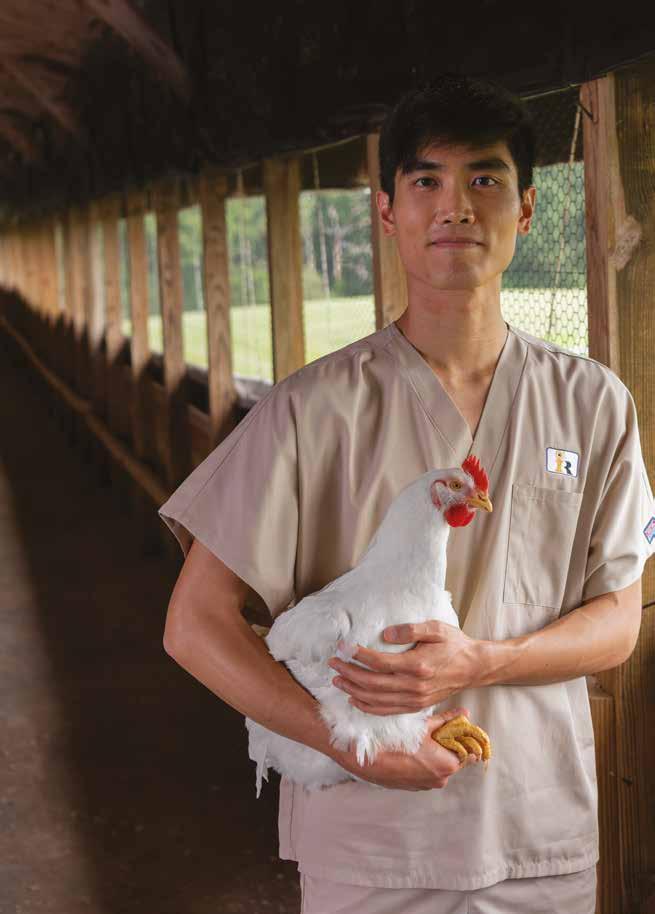

High-quality chicks: from breeders to hatchery

A successful performance during production begins with a good start. Beside genotype and genetic improvement, good quality of layer and broiler chicks relies on proper management of breeder folks, at the hatcheries, and during the first days in the grower barn.

In more detail, monitoring breeder health, proper biosecurity protocols in hatcheries, minimizing stress during transport of fertile eggs and chicks, and promoting early feeding and drinking in newly-hatched chicks are recommended practices to achieve prime chick quality.

Breeder flock traits

First, and in addition to hatchability, chick livability and performance during the first days of life directly depend on egg weight.

As hens age, egg size increases so egg components do too. Certainly, yolk of fertile eggs laid by old hens is not only relative bigger but also contains more fat than those laid by young hens. Growing embryos rely on fatty acids for energy production, and yolk nutrient availability determines embryo and chick development from incubation to their first days of life. Indeed, during the last days of incubation, yolk is absorbed inside chick’s belly (so called residual yolk) providing them with nutrients and calories for their first 72h hours of life as they figure things

24 FOCUS - focus -

out. So, yolk size and its composition are important considerations throughout the entire process for chick quality. Breeder nutrition must also not be disregarded, particularly vitamin and mineral requirements, to avoid malformations during embryo development and ensure appropriate nutrient content inside yolk. Research looking at in-ovo nutrient injection described beneficial effects on chick performance, although its feasibility under commercial conditions is questionable.

Next, optimal biosecurity standards in the breeder flocks are not only crucial as proper management practices for profitable production outcomes and good welfare in breeder barns but also to prevent vertical transmission of pathogens (i.e., across generations). Pathogens are capable of passing from breeder flock to chicks through egg contamination (internally) and, as few bacteria can transfer into the egg during its development in the hen’s ovary and oviduct, this can be a source of chick contamination before hatch. For example, high prevalence of economically-relevant pathogens responsible for food-borne diseases (like Salmonella spp.) in breeder flocks can result

in chicks positive for Salmonella spp. since fertile eggs were contaminated before harvesting. As food safety emerged as a major top consumer concern, preventing potential safety hazards within the food chain becomes a priority and reducing vertical transmission is a forward step to enhance chick quality.

Key considerations at the hatchery

Proper health care and biosecurity in hatcheries should successfully prevent disease outbreak, contain and remove any possible health threats to chicks, and protect hatchlings of pathogen exposure. This is paramount because newly-hatched chicks are naïve to pathogens and very sensitive to infectious agents until they develop a healthy microbiota and strengthen their immune system. Consequently, to safeguard chick survival and health, hatchery management practices must follow an action plan to 1) prevent pathogens from entry; 2) if breach hap pens, clean and sanitize the contaminated area to avoid spreading and kill potential pathogens to chick and hu

PLASTIC PADS FOR THE

PAD COOLING

The LUBING Pad Climate system is made entirely of plastic. It is used in systems where highly efficient cooling is required.

• For evaporative cooling of poultry and pig houses.

• Excellent cooling capacity - patented design.

• Easy to clean.

• Long service life.

• Lowest pressure loss.

• High UV resistance.

• Impermeable to light.

• Chemical resistance.

- march 2024FOCUS

Original! The Via Marco Polo, 33 - 35011 - Campodarsego (PD) ITALIA +39

- lubingsystem.com - info@lubing.it

0499202290

mans; and 3) support chick health by taking preventing and protective actions such a vaccination program.

When it gets to poultry health and welfare, prevention is always a better and cheaper approach than treatment. Then, adequate biosecurity protocols at the hatchery should prevent pathogenic bacteria from entering inside via personnel and fertile eggs. Either at the breeder barn or at the hatchery, fertile eggs should be checked for cleanliness. Eggshell is rather porous than rock solid to ease gas exchange for embryo/chick breathing, and bacteria can across it and infect egg interior. Indeed, dirty spots (like faecal matter or litter stuck on the surface) on eggshell can host pathogenic bacteria that can contaminate settable eggs and proliferate at warm temperatures during incubation resulting in exploding eggs or residual yolk infections. In the same way, floor eggs should not be incubated even if apparently look clean as they could be already contaminated prior to collection. These practices, altogether, support chick quality by promoting health and liveliness upon hatching and on their first weeks of age.

In addition to following a carefully-designed health program, cooler, setter, and hatcher settings must resemble embryo development requirements to optimize hatchability and narrow hatching window. Any step down the way (from harvesting to hatching) can be stressful for embryos and jeopardize chick quality due to development starts before egg laying and continues slowly in the coolers. Moving settable eggs, from breeder barns to coolers and from coolers to setters, should be done gradually to alleviate thermal stress by letting settable eggs acclimate to new environments and not placing eggs below air flow to avoid condensation. Likewise, transferring eggs from setters to hatchers should be planned efficiently to lessen thermal stress during this process. Finally, hatching is by nature a stressful lifetime event in which chicks must peck through the eggshell and release themselves successfully. Although this is a necessary challenge that chicks must face themselves, caretakers can easy this process by increasing the relative humidity in the hatcher and ensure that most chicks have hatched before moving trays out. In the hatcher, humid conditions within optimal temperature threshold help soften eggshells facilitating hatching so chicks need to invest less effort into this task. When trays are taking outside, eggshells harden again at room conditions. So, proper monitoring of timing can prevent chicks from being stuck during the hatching process or requiring more effort to free themselves which, ultimately, can result in weaker chicks.

After hatch and along with aforementioned preventive and sanitation efforts, other practices that can boost chicks’ immune system and set them for success include vaccination programs and probiotic administration. Chicks lack microbiota in their intestinal tract at hatch and are vulnerable to any pathogen in the environment. Vaccination provides chicks with passive protection against pathogens that, beside good biosecurity, can help prevent the prevalence and severity of local diseases. As vaccination plans should be limited to local pathogens and regulations, probiotics can help protect chicks from infection of undesirable, harmful bacteria due to competitive exclusion. Therefore, these two practices together and good biosecurity are the best management practices to support chicks’ physical health.

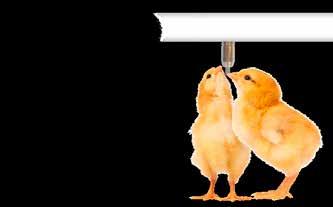

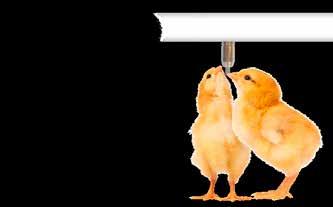

From hatching to yolk deprivation

Any steps from the hatchery to placement in the rearing barn imposes a stress risk that can compromise chick quality the longer they stay under suboptimal conditions. For example, transporting chicks for long distances without food or water definitely take a toll on chicks’ health and performance. All these procedures have an additive effect on chicks, building up over time, resulting in longer recovery time and putting their current and future wellbeing at risk. To mitigate this effect as much as possible, low-stress handling warm, temperature during transport, and early feeding can help chick stay strong until arrival.

When they hatch, chicks do not know neither how to feed/drink nor spot food/water. Hens would naturally encourage and teach chicks to feed and drink as soon as they can walk. Under commercial conditions, this is not feasible and chicks imprint in themselves. Therefore, it is up to them to learn on their own. Residual yolk can last up to the third day of age, yet practices that promote early feeding and drinking are greatly advised so chicks learn quickly where to find food and water. The sooner they acquire this knowledge, the faster they will growth during their first week of life and later as well. Although weight at hatch is thought to predict future body weight, the actual body weight at yolk deprivation (day 3) seems to be a better estimate of individual growth rate during rearing. To sum up, on top of good health and low stress management, promoting early feeding and drinking behaviours as soon as possible can help chicks achieve their full potential.

26

- focus -

FOCUS

High strength and quality materials

Excellent seal, zero water wastage, dry litter

Easy and fix regulation of min and max feed levels

Fast pan filling without any waste of feed

Avoiding the step in by the animals in the pan

Anti-UV and chemical resistance

Use a QR code scanner on your device to access our website.

www.cortizootecnici.it

corti_ zootecnici

Corti Zootecnici

Corti Zootecnici’s Feeder

Broiler economics

MARKETING - marketingPaul W. Aho, Ph.D. PaulAho@PaulAho.com Dr. Paul Aho is an international agribusiness economist specializing in projects related to the poultry industry. Dr. Aho now operates his own consulting company called “Poultry Perspective”. In this role, he works around the world with poultry managers and government policy makers.

world chicken industry expanded

0.5% in 2023. Slow growth was due to a slowing world economy and recent relatively high grain prices in addition to some losses due to Avian Influenza. Production in 2024 is expected to grow 1%. 28

The

just

MARKETING

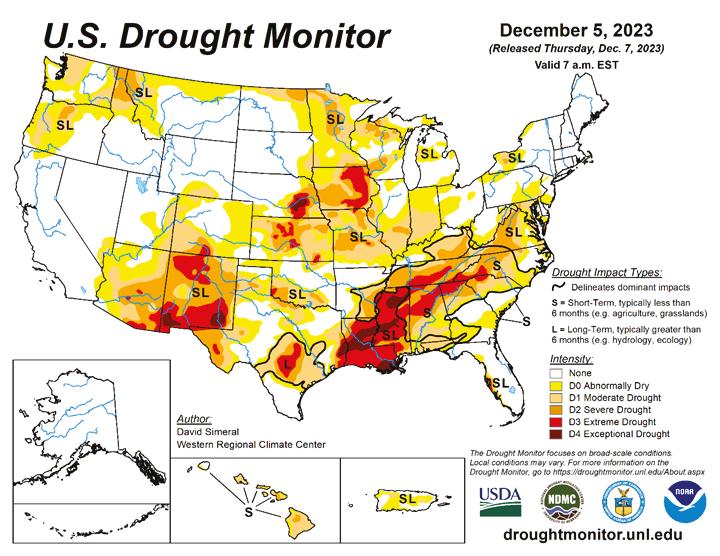

US harvest secure, Brazil in doubt

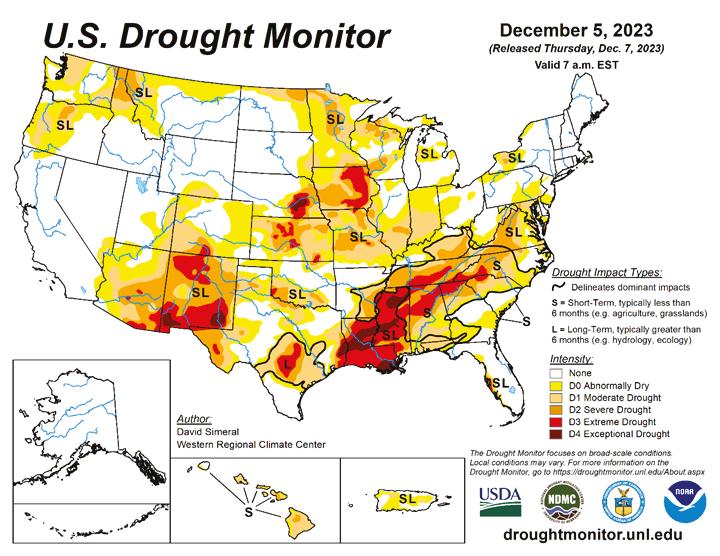

Despite persistent dry conditions in the US Corn Belt this year, a crop was harvested which exceeded that of last year and brought ending stocks up sharply for corn. Now attention shifts to Brazil where a dry spell during planting has observers worried. Recent rains helped, but the situation is still uncertain. The US Drought monitor shows

the Corn Belt in various stages of drought. However, no crop was ever lost due to a drought in December. What happens next spring will be much more important.

One consequence of the lack of rain this year was low water on the Mississippi river. The river stage at Memphis, Tennessee two months ago was minus 11 feet, a point at which shipping was disrupted. Now the river is at minus 6 feet, a much better level. It is interesting to note that the river stage on the Amazon in Brazil is unusually low due to lack of rain in Brazil.

Over the course of this crop year, grain prices are likely to move sideways or down. Grain use will be tempered by a slowing world economy and increased grain supply. Grain prices could, of course, rise from some unexpected consequence of wars or a persistent drought in Brazil.

Corn

World corn production is expected to rise this crop year due to increases in the US and Argentina. With higher production, and higher ending inventory, prices can be expected to average less than in crop year 2022-2023. The current price of $5 per bushel ($200 per metric ton) is still a bit higher than the average price for crop year 2023-2024. The average price for last crop year was much higher; $6.54 per bushel ($262 per metric ton).

29 - march 2024 -

World Economic Growth - World Bank World Production of Corn Million Metric Tons World Ending Stock of Corn USDA - Metric Tons US Ending Stock of Corn Millions of Bushels Argentina Corn Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024 Harvest 503755 Imports 000 Exports 362541 0 2 4 6 2021 2022 2023 % 2020-20212021-20222022-20232023-2024 MMT 1129121911571222 1000 1050 1100 1150 1200 1250 20202021202220232024 Bushels 19191235137713612131 0 500 1000 1500 2000 2500 2021 2022 2023 2024 MMT 293 310 300 315 225 250 275 300 325 350 World Production of Corn Million Metric Tons World Ending Stock of Corn USDA - Metric Tons US Ending Stock of Corn Millions of Bushels 2020-20212021-20222022-20232023-2024 MMT 1129121911571222 1000 1050 1100 1150 1200 1250 2500 2021 2022 2023 2024 MMT 293 310 300 315 225 250 275 300 325 350 World Economic Growth - World Bank World Production of Corn Million Metric Tons World Production of Corn Million Metric Tons World Ending Stock of Corn USDA - Metric Tons US Ending Stock of Corn Millions of Bushels 2020-20212021-20222022-20232023-2024 MMT 1129121911571222 1000 1050 1100 1150 1200 1250 2500 2021 2022 2023 2024 MMT 293 310 300 315 225 250 275 300 325 350 World Ending Stock of Corn USDA - Metric Tons

US Corn Supply and Demand –WASDE December 2023 Millions of Bushels

Argentina Corn Supply and Demand WASDE December 2023 Million Metric Tons

WASDE December 2023 Million Metric Tons

503755

000

362541

1

Brazil Corn Supply and Demand WASDE December 2023 Million Metric Tons

Brazil Corn Supply and Demand WASDE December 2023 Million Metric Tons

Brazil Corn Supply and Demand WASDE December 2023 Million Metric Tons

Brazil Corn Supply and Demand WASDE December 2023 Million Metric Tons

2021-20222022-20232023-2024

2021-20222022-20232023-2024

Harvest 116 125129

2021-20222022-20232023-2024 Harvest 116 125129

Harvest 116 125129

Imports 21 1

21 1

Exports 475055

Imports 21 1 Exports 475055

Ending Inventory478

Ending Inventory478

475055 Ending Inventory478

Ukraine Corn Supply and Demand WASDE December 2023 Million Metric Tons

Ukraine Corn Supply and Demand WASDE December 2023 Million Metric Tons

Ukraine Corn Supply and Demand WASDE December 2023 Million Metric Tons

Ukraine Corn Supply and Demand WASDE December 2023 Million Metric Tons

2021-20222022-20232023-2024

2021-20222022-20232023-2024

2021-20222022-20232023-2024

Harvest 422730

Harvest 422730

Harvest 422730

Imports 000 Exports 272721

Imports 000 Exports 272721

Imports 000 Exports 272721

Ending Inventory527

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Ending Inventory527

Ending Inventory527

China Corn Supply and Demand WASDE December 2023 Million Metric Tons

China Corn Supply and Demand WASDE December 2023 Million Metric Tons

China Corn Supply and Demand WASDE December 2023 Million Metric Tons

China Corn Supply and Demand WASDE December 2023 Million Metric Tons

2021-20222022-20232023-2024

2021-20222022-20232023-2024

2021-20222022-20232023-2024

Harvest 273277277

Harvest 273277277

Harvest 273277277

Imports 22 1823

Imports 22 1823

Imports 22 1823

Exports 000

Exports 000

Exports 000

Ending Inventory209207202

Ending Inventory209207202

Ending Inventory209207202

US Corn Supply and Demand –WASDE December 2023 Millions of Bushels

US Corn Supply and Demand –WASDE December 2023 Millions of Bushels 2021-20222022-20232023-2024

US Corn Supply and Demand –WASDE December 2023 Millions of Bushels 2021-20222022-20232023-2024

2021-20222022-20232023-2024

Harvest 15,07413,71515,234

Harvest 15,07413,71515,234

Harvest 15,07413,71515,234

Soybeans

2021-20222022-20232023-2024

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024 Harvest 442548

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024

442548

Imports 396 Exports Beans + Meal 312530

Harvest 442548 Imports 396 Exports Beans + Meal 312530

Ending Inventory241824

Ending Inventory241824

396 Exports Beans + Meal 312530 Ending Inventory241824

Note: Production in Argentina last crop year was lower due to drought.

Production in South America increased 10 MMT last crop year despite a severe drought in Argentina. The enormous capacity of Brazil to increase soybean production negated the effect of the drought in Argentina. This crop year is likely to see an increase of 25 MMT in South America due mostly to higher production in Argentina.

Note: Production in Argentina last crop year was lower due to drought.

Note: Production in Argentina last crop year was lower due to drought.

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024

2021-20222022-20232023-2024 Harvest 125

125 160161

125 160161

11 1

30

- marketing -

MARKETING

2021-20222022-20232023-2024 Harvest 273277277 Imports 22 1823 Exports 000 Ending Inventory209207202

Bushels 2021-20222022-20232023-2024 Harvest

Supply

Ethanol 5,3285,1765,325 Exports 2,4711,6612,100 Feed 5,7175,5495,650 Total Use 14,956 13,769 14,490 Ending Inventory1,3771,3612,131 Farm Price$6.00$6.54 $4.85 Average US Farm Price of Corn USDA to 2023-2024 - $/Bushel Average US Farm Price of Corn USDA to 2023-2024 - $/Metric Ton Exports Meal Ending Note: Production Brazil WASDE Harvest Imports Exports Meal Ending US ending ending severe 2023-2024 of increased resulting $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $7.00 2020-20212021-20222022-20232023-2024 0 25 50 75 100 125 150 175 200 225 250 275 300 2020-20212021-20222022-20232023-2024 MB 0 100 200 300 MMT 0 20 40 60 80 100 120 140 Average US Farm Price of Corn USDA to 2023-2024 - $/Metric Ton Note: Production in Argentina was lower last crop year due to drought. US Ending Stock of Corn Millions of Bushels Argentina

Supply

Demand

2021-20222022-20232023-2024 Harvest

Imports

Exports

Ending Inventory11

Note: Production in Argentina was lower last crop year due to drought 20202021202220232024 Bushels 19191235137713612131 0 500 1000 1500 2000 2500 2021 2022 2023 2024 MMT 293 310 300 315 225 250 275

US Corn Supply and Demand –WASDE December 2023 Millions of

15,07413,71515,234

Total16,33315,13016,621

Corn

and

Harvest

Imports

Harvest

Imports

Exports Beans

100 116 121

11 1

+

Imports

Exports

Harvest

Imports

Exports

Beans + 100 116 121

160161 Imports 11 1 Exports Beans + Meal 100 116 121 WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024 Harvest 273277277 Imports 22 1823 Exports 000 Ending Inventory209207202 US

WASDE December 2023

of Bushels 2021-20222022-20232023-2024 Harvest

Supply Total16,33315,13016,621 Ethanol

Exports

Feed 5,7175,5495,650 Total Use 14,956 13,769 14,490 Ending Inventory1,3771,3612,131 Farm Price$6.00$6.54 $4.85 Average US Farm Price of Corn USDA to 2023-2024 - $/Bushel Average US Farm Price of Corn USDA to 2023-2024 - $/Metric Ton Imports Exports Meal Ending Note: Production Brazil WASDE Harvest Imports Exports Meal Ending US ending ending severe 2023-2024 of increased resulting $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $7.00 2020-20212021-20222022-20232023-2024 0 25 50 75 100 125 150 175 200 225 250 275 300 2020-20212021-20222022-20232023-2024 MB 0 100 200 300 MMT 0 20 40 60 80 100 120 140 WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024 Harvest 273277277 Imports 22 1823 Exports 000 Ending Inventory209207202 US Corn Supply and Demand –WASDE December 2023 Millions of Bushels 2021-20222022-20232023-2024 Harvest 15,07413,71515,234 Supply Total16,33315,13016,621 Ethanol 5,3285,1765,325 Exports 2,4711,6612,100 Feed 5,7175,5495,650 Total Use 14,956 13,769 14,490 Ending Inventory1,3771,3612,131 Farm Price$6.00$6.54 $4.85 Average US Farm Price of Corn USDA to 2023-2024 - $/Bushel Average US Farm Price of Corn USDA to 2023-2024 - $/Metric Ton Imports Exports Meal Ending Note: Production Brazil WASDE Harvest Imports Exports Meal Ending US ending ending severe 2023-2024 of increased resulting $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $7.00 2020-20212021-20222022-20232023-2024 0 25 50 75 100 125 150 175 200 225 250 275 300 2020-20212021-20222022-20232023-2024 MB 0 100 200 300 MMT 0 20 40 60 80 100 120 140 Average US Farm Price of Corn USDA to 2023-2024 - $/Bushel US Ending Stock of Corn Millions of Bushels Argentina Corn Supply and Demand WASDE December 2023 Million Metric Tons 2021-20222022-20232023-2024 Harvest 503755 Imports 000 Exports 362541 Ending Inventory11 1 Note: Production in Argentina was lower last crop year due to drought 20202021202220232024 Bushels 19191235137713612131 0 500 1000 1500 2000 2500 2021 2022 2023 2024 MMT 293 310 300 315 225 250 US Ending Stock of Corn Millions of Bushels

Corn Supply and Demand –

Millions

15,07413,71515,234

5,3285,1765,325

2,4711,6612,100

Production of soybeans in South America (Argentina, Brazil and Paraguay) is now twice as high as production in the US (221 MMT versus 112 MMT). Therefore, important clues about what will happen to the future price of soybeans and SBM now come from South America not the US. Rising production in South America suggests

Average US Farm Price of Corn USDA to 2023-2024 - $/Metric Ton

severe drought in Argentina. Lower prices next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in Brazil and Argentina and the resulting higher world inventory.

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons

2021-20222022-20232023-2024

Argentina Soybean Supply and Demand WASDE December 2023 Million Metric Tons

442548

2021-20222022-20232023-2024 Harvest 442548

2021-20222022-20232023-2024

396 Exports Beans + Meal 312530

Harvest 442548

Inventory241824

Imports 396

Ending Inventory241824

Note: Production in Argentina last crop year was lower due to drought.

Exports Beans + Meal 312530

Note: Production in Argentina last crop year was lower due to drought.

Note: Production in Argentina last crop year was lower due to drought.

Ending Inventory241824

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons

Note: Production in Argentina last crop year was lower due to drought.

2021-20222022-20232023-2024

Brazil Soybean Supply and Demand WASDE December 2023 Million Metric Tons

2021-20222022-20232023-2024

Harvest 125 160161 Imports

2021-20222022-20232023-2024

Inventory213537

Inventory213537

US Soybeans – USDA - WASDE

December 2023 Millions of Bushels 2021-20222022-20232023-2024

4,4654,2704,129

4,738

US ending stock fell somewhat this crop year while world ending stocks were remarkably stable in the light of the severe drought in Argentina. Lower prices next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in Brazil and Argentina and the resulting higher world inventory.

US ending stock fell somewhat this crop year while world ending stocks were remarkably stable in the light of the severe drought in Argentina. Lower prices next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in Brazil and Argentina and the resulting higher world inventory.

that soybean meal prices, now around $400 per ton, will average lower than $400 in this current crop year (less than $440 per metric ton).

US ending stock fell somewhat this crop year while world ending stocks were remarkably stable in the light of the severe drought in Argentina. Lower prices next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in Brazil and Argentina and the resulting higher world inventory.

US ending stock fell somewhat this crop year while world ending stocks were remarkably stable in the light of the

Price short ton

Average US Crop Year Price of Soybean Meal USDA to 2023-2024 - Short Ton

Average US Crop Year Price of Soybean Meal USDA to 2023-2024 - Short Ton

US Crop Year Price of Soybean Meal

31 - march 2024MARKETING 2021-20222022-20232023-2024 125129 475055 Inventory478 2021-20222022-20232023-2024 422730 272721 2021-20222022-20232023-2024 273277277 1823 Inventory209207202 2021-20222022-20232023-2024 15,07413,71515,234 Total16,33315,13016,621 5,3285,1765,325 2,4711,6612,100 5,7175,5495,650 14,490 Inventory1,3771,3612,131 $4.85

Imports

Exports

Ending

Harvest

396

Beans + Meal 312530

Harvest

Imports 11 1 Exports Beans + Meal 100 116 121 Ending

125 160161

US Ending Stock of Soybeans USDA - Millions of Bushels World Ending Stock of Soybeans USDA - Million Metric Tons 2020-20212021-20222022-20232023-2024 2021 2022 2023 2024 MB 257 274 268 245 0 100 200 300 60 80 100 120 140

2021-20222022-20232023-2024 125129 475055 Inventory478 2021-20222022-20232023-2024 422730 272721 2021-20222022-20232023-2024 273277277 1823 Inventory209207202 2021-20222022-20232023-2024 15,07413,71515,234 Total16,33315,13016,621 5,3285,1765,325 2,4711,6612,100 5,7175,5495,650 14,490 Inventory1,3771,3612,131 $4.85

Imports

11 1 Exports Beans + Meal 100 116 121 Ending

US Ending Stock of Soybeans USDA - Millions of Bushels World Ending Stock of Soybeans USDA - Million Metric Tons 2020-20212021-20222022-20232023-2024 2021 2022 2023 2024 MB 257 274 268 245 0 100 200 300 80 100 120 140 2021-20222022-20232023-2024 125129 1 475055 Inventory478 2021-20222022-20232023-2024 422730 000 272721 Inventory527 2021-20222022-20232023-2024 273277277 1823 000 Inventory209207202 2021-20222022-20232023-2024 15,07413,71515,234 Total16,33315,13016,621 5,3285,1765,325 2,4711,6612,100 5,7175,5495,650 14,490 Inventory1,3771,3612,131 $4.85

Harvest 125

Imports 11 1 Exports Beans + Meal 100 116 121 Ending

160161

Inventory213537