Group Economics Emerging Markets

China Watch

Arjen van Dijkhuizen +31 20 628 8052

Volatile stock markets, improving data

05 August 2015 •

The sharp stock market correction adds downside risks to the economy, but these should not be overstated in our view.

•

In fact, recent macro economic data point to further economic stabilisation on the back of large-scale easing measures.

•

Still, the authorities’ policy reaction to the stock market correction poses questions on their reform commitments.

•

All in all, we expect China’s growth slowdown to remain gradual and have left our growth forecasts unchanged for now.

Stock market rout to be placed into perspective

confidence effects that could spill over to the real economy.

After having more than doubled since October 2014, Chinese

Still, the recent Purchasing Managers’ Indices once more

stock markets lost some 30% since mid-June. More recently,

highlighted the divergence between a struggling manufacturing

markets showed signs of stabilisation following large-scale

sector and healthy services sectors.

policy measures, but volatility remains high. The sharp correction should be placed into perspective. The extreme rally

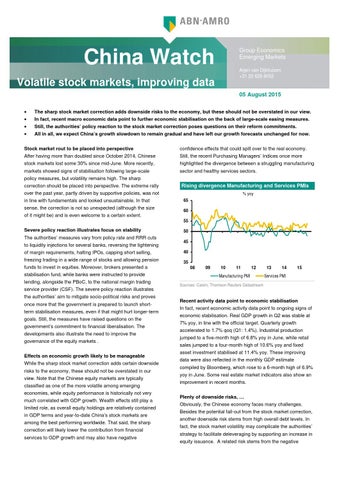

Rising divergence Manufacturing and Services PMIs

over the past year, partly driven by supportive policies, was not in line with fundamentals and looked unsustainable. In that sense, the correction is not so unexpected (although the size

% yoy

65 60

of it might be) and is even welcome to a certain extent. 55

Severe policy reaction illustrates focus on stability The authorities’ measures vary from policy rate and RRR cuts to liquidity injections for several banks, reversing the tightening

50 45

of margin requirements, halting IPOs, capping short selling,

40

freezing trading in a wide range of stocks and allowing pension

35

funds to invest in equities. Moreover, brokers presented a stabilisation fund, while banks were instructed to provide lending, alongside the PBoC, to the national margin trading

08

09

10

11

12

Manufacturing PMI

13

14

15

Services PMI

Sources: Caixin, Thomson Reuters Datastream

service provider (CSF). The severe policy reaction illustrates the authorities’ aim to mitigate socio-political risks and proves once more that the government is prepared to launch shortterm stabilisation measures, even if that might hurt longer-term goals. Still, the measures have raised questions on the government’s commitment to financial liberalisation. The developments also illustrate the need to improve the governance of the equity markets . Effects on economic growth likely to be manageable While the sharp stock market correction adds certain downside risks to the economy, these should not be overstated in our view. Note that the Chinese equity markets are typically classified as one of the more volatile among emerging economies, while equity performance is historically not very much correlated with GDP growth. Wealth effects still play a limited role, as overall equity holdings are relatively contained in GDP terms and year-to-date China’s stock markets are among the best performing worldwide. That said, the sharp correction will likely lower the contribution from financial services to GDP growth and may also have negative

Recent activity data point to economic stabilisation In fact, recent economic activity data point to ongoing signs of economic stabilisation. Real GDP growth in Q2 was stable at 7% yoy, in line with the official target. Quarterly growth accelerated to 1.7% qoq (Q1: 1.4%). Industrial production jumped to a five-month high of 6.8% yoy in June, while retail sales jumped to a four-month high of 10.6% yoy and fixed asset investment stabilised at 11.4% yoy. These improving data were also reflected in the monthly GDP estimate compiled by Bloomberg, which rose to a 6-month high of 6.9% yoy in June. Some real estate market indicators also show an improvement in recent months. Plenty of downside risks, … Obviously, the Chinese economy faces many challenges. Besides the potential fall-out from the stock market correction, another downside risk stems from high overall debt levels. In fact, the stock market volatility may complicate the authorities’ strategy to facilitate deleveraging by supporting an increase in equity issuance. A related risk stems from the negative