1 minute read

ESG Investment Methodology Overview

In order to align ADNEC’s investment model with ESG practices; an understanding of the target acquisition’s ESG parameters is critical in evaluating whether this investment aligns with the Group’s ESG goals and aspirations. This effort should be done by the ADNEC team in the early stages of the investment assessment – prior to a technical due diligence and non-binding offer (NBO) where applicable in order to establish an ESG risk rating for the investment opportunity.

Link to the Group’s Current Investment Evaluation Stages

Company Overview

Preliminary Screening

In this stage, the aim is to determine if the target acquisition / investment meets the minimum ESG eligibility criteria for further consideration.

These criteria are used as a checklist to ensure that there are no critical infringements or risks identified, and that the target acquisition / investment follows the values of the Group, and global guidelines such as the principle of “Do No Harm”.

Tools to Support ESG-based Investment Decisions

Investment Rationale

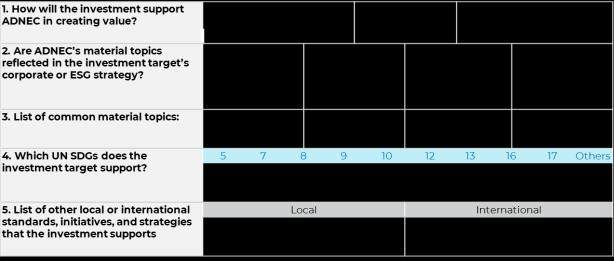

Alignment to ESG Strategy

The purpose of this assessment stage is to mobilize investments that compliment and support the Group’s material ESG topics and overarching ESG Strategy.

In doing so, this helps to ensure that new investments and business activities are aligned with the Group direction on ESG, and help to further improve its ESG performance rating.

Business Plan Assessment and Due Diligence

ESG Maturity and Performance Assessment

The final stage is aimed at conducting a ‘deep-dive’ in order to support in delivering superior risk-adjusted returns on investment.

This stage looks at the level of ESG maturity of the organisation in terms of management systems and culture towards ESG, as well as establishing the level to which policies, strategies, goals and targets are defined and managed against.

Preliminary Screening Tool

ESG Alignment Assessment Tool

ESG Scoring Tool