CELEBRATING MORTGAGE STARS

WOMEN WHO RISE ABOVE THE REST

> PAGE 51

THE INTERNET PIONEER

ROCKET’S EILEEN TU HELPED CHANGE MORTGAGES FOREVER

INSIDE:

STEP OUTSIDE THE ZONE > PAGE 5 TURN UP THE EMPATHY > PAGE 18

SINGLE MEN ARE LOSERS >PAGE 30

ISSUE 4, 2023 AMBIZ MEDIA $20. 00 A PUBLICATION OF AMERICAN BUSINESS MEDIA

HHHHH

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. In 2022, we had a record turnout for our best event … yet. Let’s just say, you won’t want to miss this year’s Originator Connect and these exclusive programs: Free NMLS Renewal * Build-A-Broker Non-QM Summit Private Lender Forum & so much more! OCN MODESTLY PRESENTS: Visit originatorconnect.com August 17 – 20, 2023 Las Vegas Don’t miss the Hollywood Old OPENING RECEPTION Scan here to register for free, use code MWMFREE

CELEBRATING MORTGAGE STARS

WOMEN WHO RISE ABOVE THE REST

> PAGE 51

THE INTERNET PIONEER

ROCKET’S EILEEN TU HELPED CHANGE MORTGAGES FOREVER

INSIDE:

STEP OUTSIDE THE ZONE > PAGE 5 TURN UP THE EMPATHY > PAGE 18

SINGLE MEN ARE LOSERS >PAGE 30

ISSUE 4, 2023 AMBIZ MEDIA $20. 00 A PUBLICATION OF AMERICAN BUSINESS MEDIA

HHHHH

as recognized by Mortgage Women Magazine

38

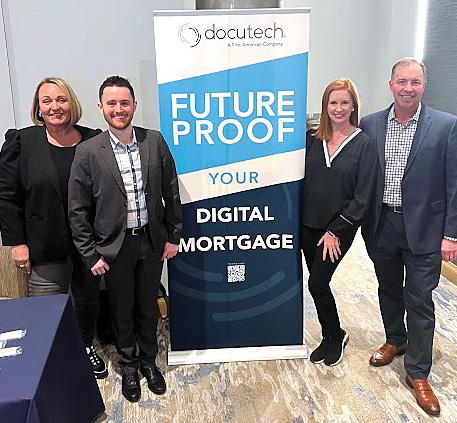

PUSHING HER LIMITS OFF-ROAD

Docutech’s Emily Shapiro keeps on trucking, off-road trucking that is, in her off-hours.

By SARAH WOLAK

FEATURES

12 NOT THE FAINT OF HEART

Be a leader who helps — not hurts — her team.

By CHRISSY BROWN

14 THE ‘ONE THING TRICK Remove unnecessary distractions from your life.

By TINA ASHER

16 A REGULATORY CRACKDOWN APPROACHES

Error-drenched loans are an invitation to unwanted oversight.

By TYNA-MINET ANDERSON

18 PUT SOME EMPATHY IN YOUR MARKETING

Tapping into the human connection will help expand your audience.

By MARY MARGARET HOGAN

22 THE ROAD TO BECOMING LICENSED

A step-by-step guide to obtaining a state mortgage license.

By VANESSA BODNAR

30 IN THE HOUSING MARKET, MEN ARE LOSERS

Single women bought 1 in 6 homes in 2022.

By SARAH WOLAK

32 THE CREDIT STINGERS

Unmasking minority financial literacy.

By MICHELE BODDA

ISSUE 4, 2023

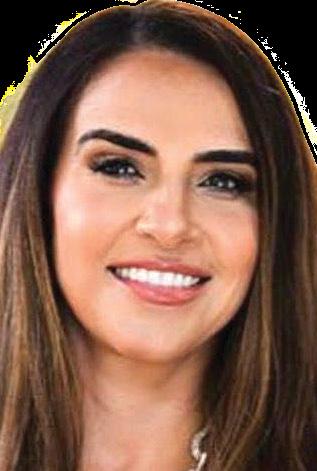

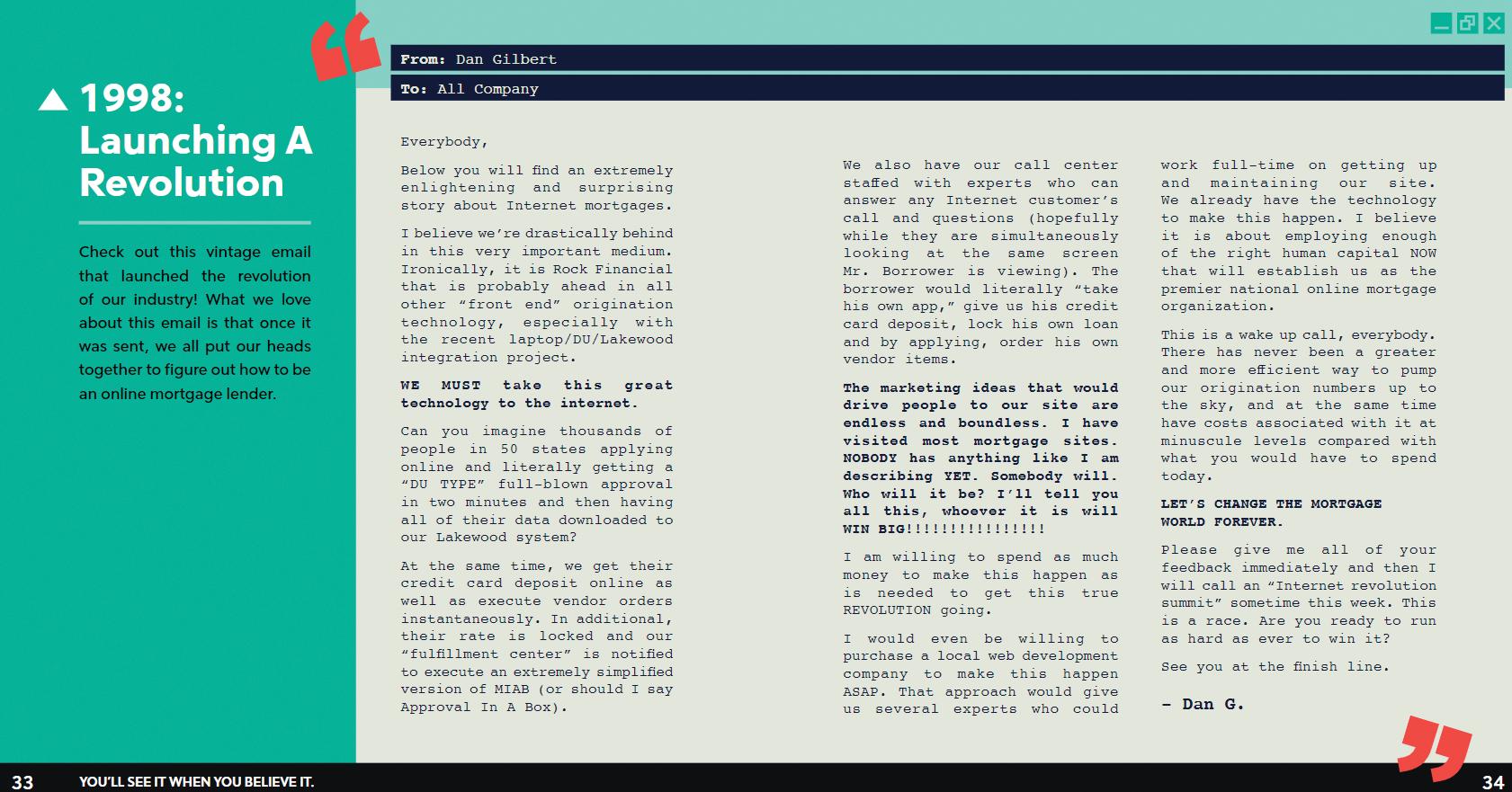

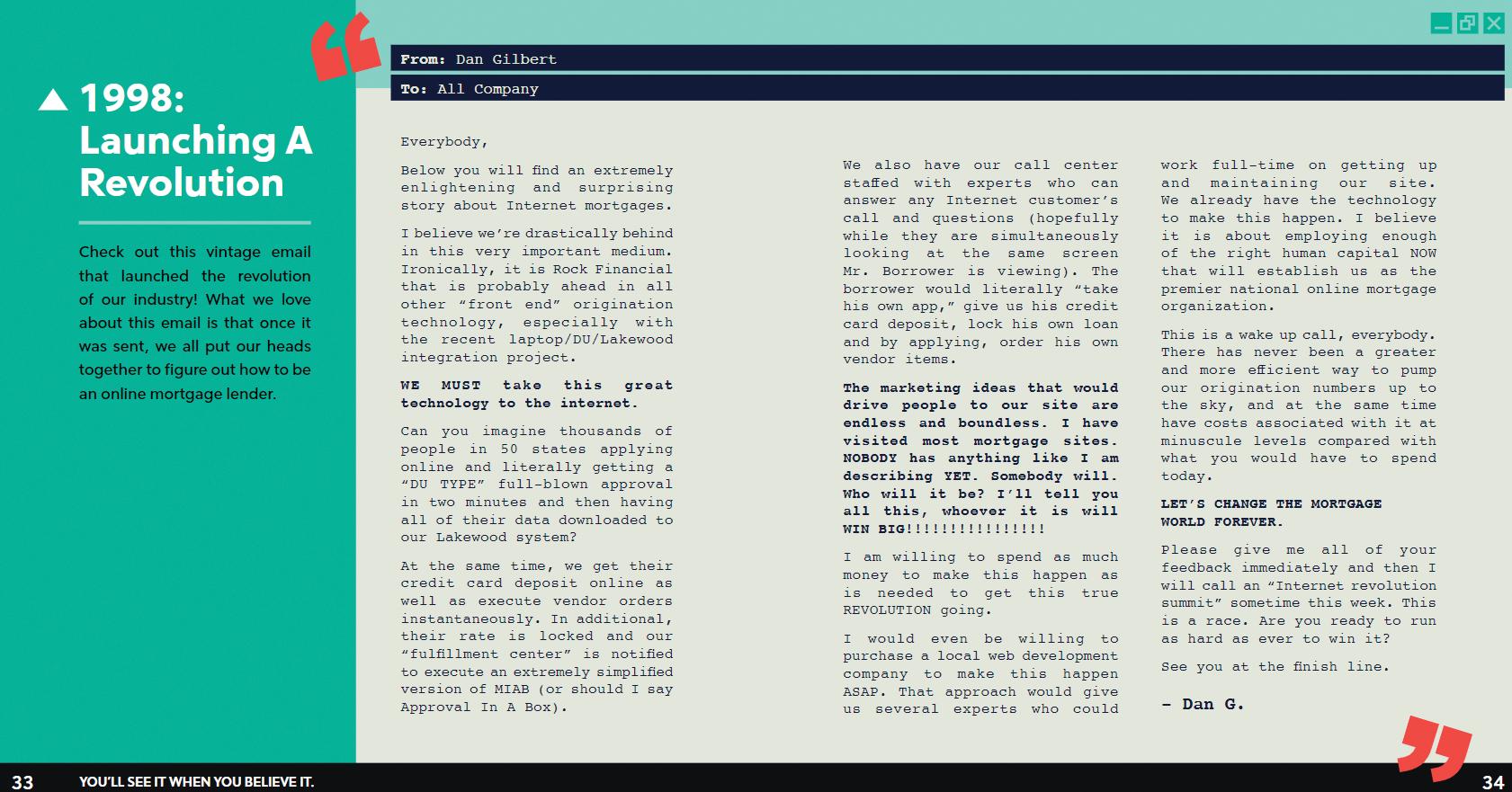

34 LAUNCHING A REVOLUTION

This Internet pioneer helped change mortgages forever.

By KATIE JENSEN

48 WOMEN ON THE MOVE

Major new hires or promotions in the mortgage industry.

SPECIAL RECOGNITION SECTION

51 CELEBRATING THE NATION’S MORTGAGE STARS

Mortgage Women Magazine sought out women making special marks in the industry and in their companies. From hundreds of nominations, we present 23 ladies of achievement who are clearly among those who Rise Above The Rest, in our annual Mortgage Star Awards special section.

Monthly Departments

4 Editor’s Letter: Breaking Out Of The Box

5 First Cup: Map Your Route To A Happy Future

6 Trailblazers: From Army Brat To Chief Operating Officer

26 Ask The Experts: How Machine Learning Is Supercharging The Industry

44 Mortgage Moms: Stressing Out On Summer

COVER STORY

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 3

Encouraging & Inspiring News T

he mortgage industry is constantly evolving, and with it comes challenges such as managing staffing to volume, compliance, and guideline changes. Despite these challenges, the industry has continued to adapt and thrive.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Kelly Hendricks

MANAGING EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mary Quinn

MULTIMEDIA PRODUCER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Hendricks

A recent positive development is the announcement from the Federal Housing Finance Agency (FHFA) to rescind loan level pricing adjustments (LLPAs) for borrowers with high debtto-income ratios. This move will make it easier for lenders to navigate pricing changes throughout the loan process, and ultimately make homeownership more accessible to a broader range of borrowers. It is encouraging to see the FHFA taking steps to ensure that the mortgage industry continues to meet the needs of customers.

As the mortgage industry continues to evolve, it is essential to recognize the women who are leading they way. This issue of Mortgage Women Magazine features inspiring stories of women who have received this year’s Mortgage Star Award. These women have made significant contributions to the mortgage industry through their hard work, dedication, and leadership.

We hope their stories will inspire other women in the industry to pursue their goals and make a difference.

Tyna-Minet Anderson, Tina Asher, Michele Bodda, Vanessa Bodnar, Laura Brandao, Chrissy Brown, Ashley Gravano, Mary Margaret Hogan, Stacy Wilson

CONTRIBUTING WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Kelly Hendricks

Managing Editor, Mortgage Women Magazine Khendricks@ambizmedia.com

Mortgage Women Magazine welcomes your feedback. If you have comments, questions, criticisms, praise, or information to share with us and our readers, please write us at Khendricks@ambizmedia.com.

OUR MISSION

Mortgage Women Magazine is dedicated to providing quality informational/ educational content that betters women in the mortgage process at every step. The content is oriented to help women progress their understanding of the residential mortgage banking business and develop their skills at improving efficiency, effectiveness and profitability at all levels.

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Women Magazine Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Women Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

FROM THE EDITOR

Kelly

4 www.mortgagewomenmagazine.com

MAP YOUR ROUTE TO A HAPPY FUTURE

These steps will make your journey forward more encouraging

By ASHLEY GRAVANO, Mortgage Women Magazine, Contributing Writer

By ASHLEY GRAVANO, Mortgage Women Magazine, Contributing Writer

Do you remember before GPS we would follow a map (that paper thingy that has thousands of little lines) in hopes to find your location? Then we upgraded to Mapquest that was awesome! Until GPS came along and now none could ever imagine using that old map again. Getting from Point A to Point B without any issue, detour, or accident is important for many reasons. Mainly safety and sanity.

Sometimes I think how nice it would be to have a map to follow for life. One with no detours, accidents or unexpected events that can ruin your trip. But at the same time, isn’t life all about learning to reroute yourself as needed in your professional and personal environments? You have to learn to follow a different road, even when unexpected.

I think post-COVID many people have decided to take a different road: a road three years ago they would never take. Whether it be getting a job in a new industry or a different position with maybe less responsibility so they can “enjoy the ride” a bit more. We’ve seen massive changes in our industry, some by choice, some not so much.

So, when you’re finding yourself changing routes or maybe you’re lost and not sure where to go, what do you do? Slowww down. Pull over even and take some time to rest. Ask yourself what happened, how it happened, and what can you learn from it.

Call a friend. It’s always helpful to talk to your friends and get their thoughts on how to get back on track.

Read and research. So many books out there can help you with change of all sorts.

Talk to a career/life coach, someone who’s trained to help people find their way.

Listen to a podcast. There are so many great motivational ones out there. I love Gary V and Mel Robbins.

Find hobbies that bring you joy. The more you’re happy and satisfied, the easier that road will become.

Learn to say no! Yes I said it! Too often we just say yes to save someone else’s feelings or make someone else happy, but it’s OK to say no. If they don’t understand, then that’s on them!

Say yes to things that you hesitated on in the past that you really wanted to do but were maybe out of the way. The road of life is short although sometimes it doesn’t feel like it.

Don’t be afraid! I really believe in the cliché everything happens for a reason! We may not know that reason right away but trust that the reason makes sense.

Sit back and enjoy the ride! n

Ashley Gravano is vice president of product solutions at Mortgage Cadence.

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 5

From Army Brat To Chief Operating Officer

Blazing a Path … Raising the Bar Trailblazers

6 www.mortgagewomenmagazine.com

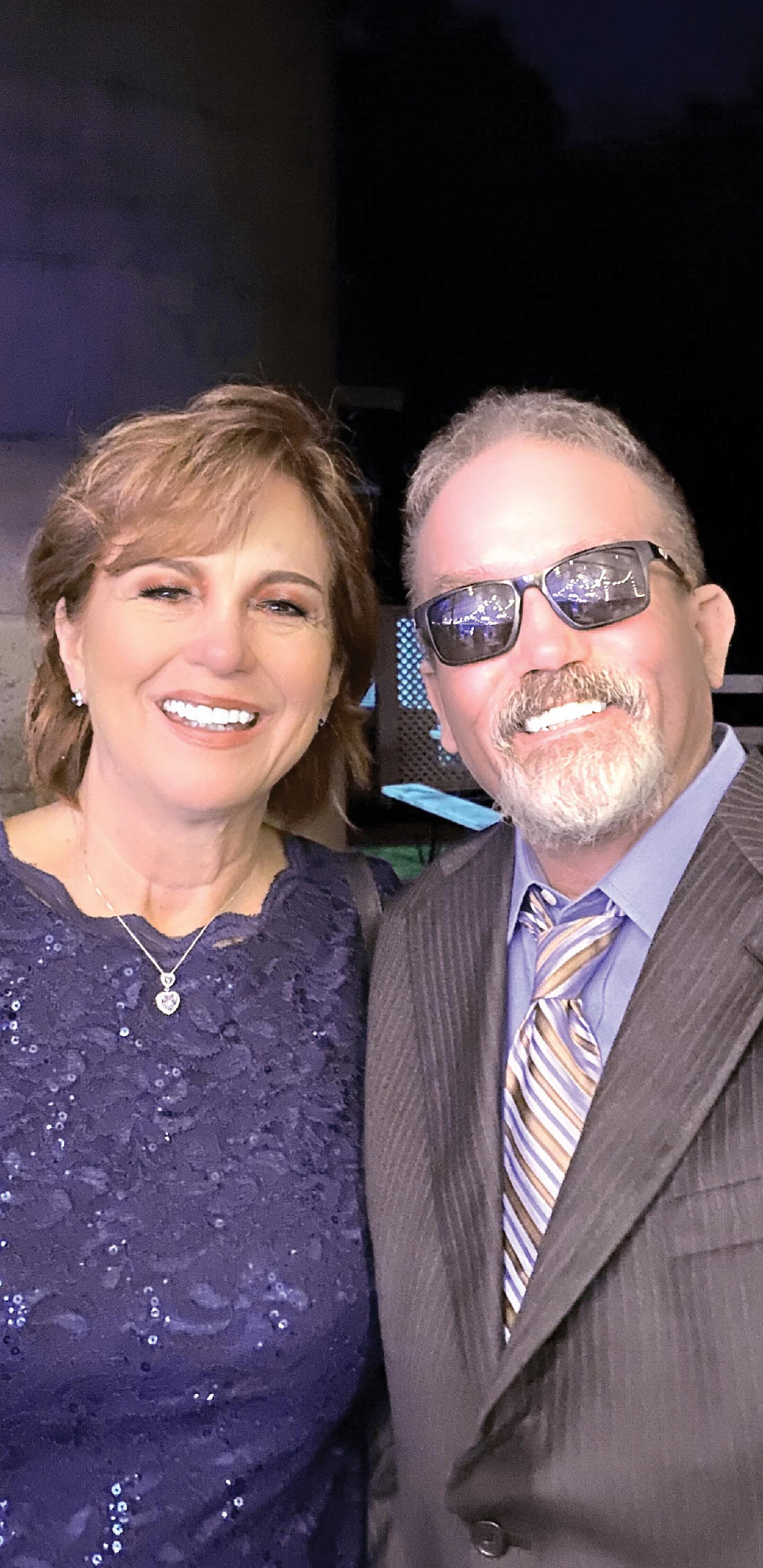

Suzy Lindblom in front of her 7th generation great grandmother, Hannah Duston, the first woman to have a statue in the United States.

ARC HOME’S SUZY LINDBLOM ADVOCATES STEPPING OUT OF YOUR COMFORT ZONE AND BEING HEARD

By LAURA BRANDAO, Contributor, Mortgage Women Magazine

This month I have had the pleasure of speaking with Suzy Lindblom. She is the chief operating officer of Arc Home LLC, and lives in the Dallas, Texas area. Suzy is responsible for the operations, post closing, credit risk, training, and strategic initiatives for the corporation.

She was born in Germany, growing up as an “army brat” with her family moving around constantly during her younger years. Her dad was a master drill sergeant; Suzy credits her upbringing for her having a thick skin from the start and being able to handle anything that comes her way.

How did you get your start in the mortgage industry?

SL: I started my career at the California School of Mortgage Banking. I was hired there as a receptionist, but I found the work interesting and started taking their classes as well. After a year, I found a job at a mortgage company and started as a processor, working my way up to an underwriter in three years. I worked my way up from there.

I have been in this industry for nearly 40 years, but I still find the work fascinating and fulfilling!

What does being a trailblazer mean to you?

SL: For me, being a trailblazer means being willing to step up, speak up and make your presence heard and seen. I am particularly honored to be considered a trailblazer.

When I started in this industry over 40 years ago women were only considered for administrative roles, not management nor decision-making positions. That has changed considerably, although there is still a long way to go.

I consider myself lucky to have been surrounded by strong female role-models who provided such amazing support and guidance to help me in my journey to the C suite. Whenever I felt like I was an imposter and didn’t deserve to be promoted or advanced, I could look at the ladies around me. Seeing what they had accomplished, I was inspired to follow their example and keep moving up.

I make it a point these days to mentor young women coming up through the ranks, so they know they are not alone on this path. I remember how important it was for me to have role models to look up to and rely on for encouragement. I want to provide that for the next generation of female change makers.

Where do you see yourself and women in general in the industry over the next five years?

SL: I want to continue to mentor and help young women in our industry build successful careers.

My hope is that we see more and more women working their way up the ladder, all the way to CEO and other leadership roles in our business (and other fields as well!). We don’t have enough yet and that is a detriment. Women have a different approach, so having a balanced view of the challenges we face can only benefit everyone today and into the future.

“F-E-A-R has two meanings: Forget everything and run or face everything and rise. The choice is yours.”

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 7

> Zig Ziglar

What is your professional superpower?

SL: My superpower is my intuition about people. I can see the potential in others; now from the position I have reached, I can help them recognize their own worth and encourage professional growth.

Many people get scared when a big goal is within reach. It can be overwhelming and cause a lot of anxiety about what will happen next.

I love being there to support them when that happens and help them realize they have what it takes to move up. It is an incredibly satisfying feeling!

Tell us something about your career in the mortgage industry that was pivotal to your achievements today.

SL: The pivotal moment was when the president of the company took a chance on me (a 25-year-old underwriter) and basically forced me to take a step up. He believed in me even when I didn’t, and it gave me the confidence I needed to take a leap of faith.

I still had doubts on my journey but that first push got me through a door that led to the next and the next. Each time I moved forward, I felt my confidence grow. I might not have had the chance to learn that if I had not had the initial impetus he gave me.

What advice would you give to a woman entering or trying to move up in their mortgage career?

SL: My advice is to learn, learn, and keep learning. I would implore them to make time to volunteer in their

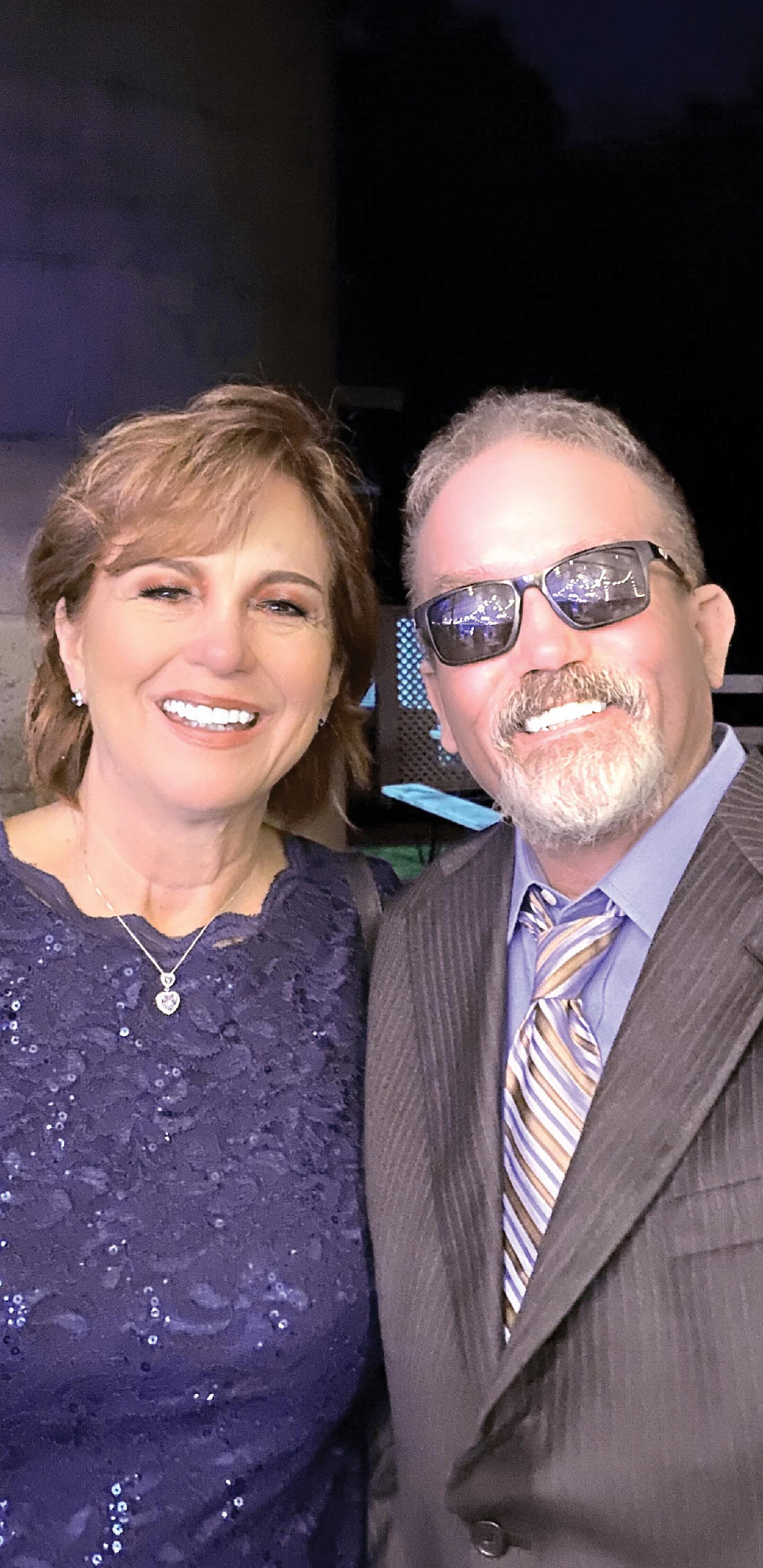

Suzy Lindblom with her husband, Ron.

8 www.mortgagewomenmagazine.com

Find a mentor who you can trust to let you know when you are on the right path and when you are not.

communities and become a known, trusted face. Trust is a hugely important component in our industry.

Make their aspirations known to those who have the capacity to make it happen. Be prepared to work hard and step forward when necessary. Let their voice be heard even if the confidence is not always at its strongest, because it lets those around you know you are committed to your goals and willing to push toward them with determination.

It is so important not to let anyone tell you there is something you cannot do. Letting that negative voice into your head will be unhelpful and damaging to your confidence. I am not afraid to admit it took me years to get past the feeling that I was not capable of the things I am very good at.

I can’t overemphasize the importance of finding a trusted mentor. Surrounding yourself with people who will support you and provide honest and constructive feedback as you move through your career is paramount.

What does success mean to you?

SL: To me, success means eventually leaving my chosen career secure in the knowledge that I have made a positive and lasting impact on the lives of those I have encountered.

My feeling of success will be through leaving a legacy of being a mentor and a valued teammate; someone who made the lives of others better for my involvement in their life and career.

How do you recommend navigating change in an industry that is always changing and growing?

SL: It is vital to always be open to learning new things, and a great way to do this is to get involved with industry groups. Speaking with colleagues and sharing ideas provides you with opportunities to improve your own processes alongside offering suggestions to others who want to do the same. There will always be that new piece of software or innovative way of streamlining the lending process and if you are “in the loop” with others, you stand a better chance of being able to take advantage of the information.

One of my biggest regrets is that I didn’t do this sooner. I likely missed out on some chances to improve processes in my role. I can’t state strongly enough the importance of keeping current and informed about innovations in our industry.

Another thing I think is necessary is to have a good sense of humor. This may sound strange but if you can laugh or share a lighter way of looking at a situation, it not only helps you reduce stress, but it can also help to bond with colleagues and assist them in navigating difficult days.

I asked a colleague one day how he was doing. He said bluntly, “I woke up this morning.” I found that to be a lighthearted yet profound way of setting expectations; understanding that life (and work) can be tough and unpredictable but there are always blessings to be grateful for. Look for those blessings disguised as humorous moments and you will be able to weather even the toughest of storms.

Do you think it’s important to have a mentor?

SL: Having a mentor is critical to a successful career. I have had a few over the years and I have been a mentor to others as well.

Mentors provide honest feedback, support, and sage advice

when you need guidance, are at a crossroads, or simply need a boost to your confidence.

Mentors don’t always have to be positive either. I once had a moment when I looked at someone on a call with me and they praised me for being stressed and negative. I realized this person was not someone I wanted to emulate. It gave me pause, making me think about my own actions and reactions to the situation. I came to understand that I was not acting in the way I would expect of myself and changed my attitude about my own behavior.

Find a mentor who you can trust to let you know when you are on the right path and when you are not. The honest feedback will let you adjust as needed and see yourself reflected in another’s eyes, which is invaluable.

What do you enjoy doing outside of work time?

SL: I love to spend time with my grandchildren and my family. We are a very close family, and we treasure the time we get to be together, whatever we happen to be doing.

My husband and I love to travel; we are planning a cruise to England, Ireland, and Scotland this year.

How do you want to be remembered in our industry?

I want to be remembered as someone who helped others to advance and thrive in their careers. I would like to be the type of boss who is thought of as fair and motivating to those who work for me.

I am passionate about pushing people to do their best and be their best. That is the kind of legacy I would like to have. To have left the industry better because of the people that I inspired to aspire to excellence and use their talents to the fullest.

How do you find your voice?

SL: It honestly took me years to find my voice. When I finally did, it was because of people who saw potential in me, pushing me to speak up when I had an idea or wanted to state an opinion.

Finding your voice means stepping out of your comfort zone and letting yourself be heard. Even if every idea isn’t the best, the confidence to speak up comes from practice. It comes from taking a deep breath and putting your ten cents worth into the discussion, then learning from the results. The more you speak, the more confident you become that what you have to say has value and needs to be expressed.

It is also important to remember that even if someone doesn’t like or appreciate your idea or opinion, that doesn’t

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 9

If you can laugh or share a lighter way of looking at a situation, it not only helps you reduce stress, but it can also help to bond with colleagues.

mean you were wrong. Sometimes others simply don’t understand or aren’t ready to process what you have to say. Or they process information differently than you do. Present your ideas to their presentation style. Keep trying!

By far the most important piece of advice I was ever given was that I should learn to stand up for myself and my values no matter what the situation I find myself in. That has resonated with me all my life and throughout my career.

What’s your biggest fear and why?

SL: My biggest fear is failure. I have always had imposter syndrome and although it has lessened over time, it has never completely dissipated.

The feeling that I might have overreached my abilities or would let others down still shows up now and then. I think it will always be there lurking but that isn’t necessarily a bad thing. What I have found is that generally, my fears aren’t reality and they can actually encourage me to push myself harder toward achieving the goals I have set.

I always want to be the one who sets the example and makes sure I don’t ask anyone else to do more than I am willing to do myself. A little bit of fear can add just the edge I need to succeed.

What is your favorite book or podcast that you would recommend and why?

SL: I have two favorites. “Spark” by Annie Morgan, Courtney Lynch and Sean Lynch. It is an incredible book that talks about how any individual can change a company by being the spark. Someone who is willing to step up and be the change that is needed to push everyone to higher levels of achievement.

My other favorite is “You’ve Got This!” by Margie Warrell. It is a very motivating book that helps you to realize you

do have what it takes to make the next bold move in your life and your career. It gives you a confidence boost to believe yourself worthy of the advancements you seek and to seize the opportunities that arise without letting fear or feelings of unworthiness hold you back.

How do we propel more women into leadership roles within our industry?

SL: Be a mentor and support each other. It sounds simple but I think we must realize that it will take women to get more women into senior positions in our industry and other businesses as well.

We are each other’s biggest asset when it comes to encouragement, support and leading by example.

When I started in this industry, women were in lower administrative roles and rarely, if ever, advanced to management positions. I think this was not only a function of society and business seeing those roles as inherently male, but also women themselves not feeling that they could aspire to higher career goals.

That has changed but we still have work to do. When women reach down and offer their hand to pull others up with them, we all benefit. I want to see that to continue and to be more prevalent as the future unfolds.

As this article is all about being a trailblazer, I would like to say that I feel that I have been all about encouraging others to be their best. I have always been passionate about giving others the confidence to pursue their dreams and learn their value for themselves instead of having to rely on others for validation.

I once had a young woman approach me at a conference and refer to me as the “fairy godmother of VP.” This was after a speech that was given at the conference referred to me as having given another young woman a chance to advance. That moment has always stuck with me and showed me how important it is for women to lift each other up.

I have learned, over a long career, that standing up, speaking out and having the courage to express yourself is the path to success. I also have had the honor of being able to pass those lessons onto women in whom I see potential and don’t deserve to be pigeonholed into roles that they see as their only options.

All options are on the table for all of us; I am hopeful that we will see exponentially more women reaching for their dreams in the knowledge that they are worthy, capable, and deserving of success. n

Suzy Lindblom and her granddaughter, Halloween 2022.

10 www.mortgagewomenmagazine.com

When women reach down and offer their hand to pull others up with them, we all benefit.

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.azmortgageexpo.com PRODUCED BY CHANDLER, AZ Wild Horse Pass Resort & Casino Register for FREE with promo code MWMFREE JUL 20 Arizona’s top gathering for mortgage pros. Innovate. Educate. Motivate.

Infectious Or

Insidious?

IS YOUR LEADERSHIP STYLE HELPING OR HURTING YOUR TEAM?

By: CHRISSY BROWN, CMB, AMP, CRU, Contributor, Mortgage Women Magazine

By: CHRISSY BROWN, CMB, AMP, CRU, Contributor, Mortgage Women Magazine

Leadership certainly isn’t for the faint of heart. You have heard the saying, “It is lonely at the top”. That always sounded untrue to me until it became a reality. Not only is it lonely but everyone is watching. Your attitudes, your stress levels, your reactions, your confidence, your balance, among other things. I have a co-worker that constantly reminds us that “the employees will take on the personality of the leader.” Too often we brush that off as another “leadership cliché” or something that feels untrue. I think as leaders we don’t realize we have that much impact. What we want is to make solid decisions that are the best for both the company and the employee. Outside of that, we don’t think we carry that much impact; however, that simply is not true. I challenge you to look around your organization. If you think through your organization, think of a team that is generally known for

being positive, upbeat, kind, and hardworking. Now examine their leader. Most likely you will find that their leader is positive, upbeat, kind, and hard-working. If you think of another team that is analytical, conservative, docile. I would probably guess that their leader carries those qualities as well. Same goes for a team that is stressed, reactionary, dramatic and burned out. Their leader is most likely

exhibiting their stress to the team. Why does this matter? Well, in my humble opinion, it matters now more than ever. Everyone in our industry has experienced a great deal of stress, anxiety, and pressure for years now. The beginning of the pandemic was over three years ago. As an industry, think about what we have been through in the last three years. Navigating a global pandemic. Employees that have their children home with them and were responsible for at-home learning. The interest rate drop to historical lows. The desperation to hire operations folks to handle the influx of volume. Mortgage professionals working long grueling hours just to make it all happen. Followed by the largest rate hike we have seen in history. Multiple layoffs. Instability. Companies being sold. Companies closing. The financial pressures to exist in this market. Anxiety, fear, pressure, and stress. As leaders we are not exempt from

CORNER CHRISSY'S

12 www.mortgagewomenmagazine.com

feeling all those things. In fact, the pressure throughout the last few years can feel overwhelming. It is so very hard to try and appear positive when you are experiencing that anxiety and fear. It feels impossible to hide your overreactions when you are operating from complete burn out. The problem with this incredibly human response to intense pressure and stress lies in the fact that when we show up like this, our employees begin to take on that personality. When you have a staff of folks that are reactive, burned out, negative and so on, you end up creating an environment that is unhealthy. Which in turn creates more stress for yourself. It becomes a cycle. It is imperative, in this environment, that we show up as our best selves. Show up the way we want to see our employees show up. This will in turn create an environment that will ease your stress.

So how do you break the cycle? The first thing I would suggest is to create

some accountability for yourself. Ask a colleague to keep you aware of how you are showing up. As much as it seems impossible, create balance in your life. Understanding that operating out of a state of exhaustion only creates more work, it is crucial that you take control of your stress and build a balance. Balance looks different for everyone. Take a moment, pause, and think about what balance looks like for you. Once you determine that, begin to build that into your schedule. Remember, gone are the days where burn out is worn as a badge of honor. We have progressed past that and now have enough scientific

evidence that shows burn out serves no one well. Make sure you stay highly aware of how you are showing up. Lastly, remember your why’s. What keeps you in a leadership role? What motivates you? What inspires you? Continually reflect on those things and create a strong center of balance and purpose. Like I said, leadership certainly isn’t for the faint of heart. However, leadership has the ability to change the experience your employees have daily, which in turn changes lives. n

Chrissy Brown is chief operations officer for Atlantic Bay Mortgage.

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 13

What we want is to make solid decisions that are the best for both the company and the employee.

The ‘OneTrickThing’

REMOVE

UNNECESSARY DISTRACTIONS FROM YOUR LIFE

14 www.mortgagewomenmagazine.com

By TINA ASHER, Contributing Writer, Mortgage Women Magazine

It’s tough to succeed at just about anything with too many distractions. Not too many people will argue with that. Think back on the times when you got the most accomplished. You probably had a laser focus. Your energy was high. Whatever the situation, you were fortunate to find few distractions. There weren’t too many roadblocks or hurdles that got in your way. Your time, energy, and possibly money were devoted to a singular vision. That focused effort leads to the desired result because the human brain loves order.

Your brain doesn’t like distractions. It hates lots of sensory clutter, whether physical, visual, or from your other senses. Structure and order are beautiful to the human brain. So when you focus on one objective, with few to no distractions, you have a great chance at success.

One way to lead a more fulfilling, rewarding, and successful life is to use the “one thing” trick.

CHANGE JUST ONE THING IN YOUR LIFE

What small change can you make today that will push you closer to making some incredible dream a reality? You want to think about just one thing. Don’t give yourself a laundry list of activities, or you’ll lose focus. Even if all those things need to happen before you achieve something, you can only do one thing at a time. Studying several different necessary steps to achieve a goal will distract you.

SO JUST TAKE ONE STEP

Whenever you have some free time, ask yourself what one thing you can do right now to give yourself a more focused approach to achieving a goal. What one thing could you accomplish in the next few minutes that would remove an unnecessary distraction or time-waster from your life?

When you have more time to devote to this

task, take it one step further. Sit down with your planner. Ask yourself what one thing you can do over the upcoming weekend to give you more clarity and focus regarding something important to you. Then think about a larger “one thing” activity you can tackle next week. It might take several days to accomplish, but it’s still just one thing.

Do the same thing for next month and next year. The farther ahead you plan, the bigger that one thing can be.

THEN BREAK IT DOWN INTO BITESIZED ACTIONS THAT ARE EASY TO TAKE

Maybe the most important thing you want to do next year to remove distractions from your life and accomplish what really matters is to relocate. The place you live now is not conducive to achieving an important goal. It could be that geography is holding

you back. For whatever reason, you know that relocating to a specific city will not only clear away distractions but also provide you with the mental and emotional energy to stay focused on some big task.

Start asking yourself some questions. What’s it going to take to relocate in one year? You need to do several things to accomplish that one big thing. Start scheduling those smaller actions. Put them in a logical sequence and get to work.

Removing distractions one at a time may not seem like much at first. Eventually, they add up and make an exponential impact on your life. They can reveal what’s necessary for you to achieve your goals and live your dream life. They also remove the unnecessary from your life, so you can make more efficient and productive use of your time. n

Tina Asher is a coach and founder of Build U Up Consulting.

Tina Asher

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 15

Whenever you have some free time, ask yourself what one thing you can do right now to give yourself a more focused approach to achieving a goal.

On The Brink Of A Regulatory Crackdown

ERROR-DRENCHED LOANS ARE AN INVITATION TO UNWANTED OVERSIGHT

By TYNA-MINET ANDERSON, Contributor, Mortgage Women Magazine

By TYNA-MINET ANDERSON, Contributor, Mortgage Women Magazine

Interest rate hikes take time to work through the economy. Since the Fed started raising the rate last year, we have seen a massive decrease in mortgage business and major banks fall. We don’t know yet what other parts of the economy could fall under the strain of the higher rates, but it’s likely to come with some additional regulation. The IRS received $80 billion in funding, a majority of which is set to go towards auditing companies. As high inflation continues to be persistent, higher interest rates, higher home prices, limited housing stock, are all pushing home buyers and mortgage borrowers to the maximum qualifying ratios. According to a recent Fannie Mae report, many of those borrowers exceeded

allowable ratios, requiring lenders to consider a more robust Quality Control (QC) program. Time to start increasing compliance across the board. Might I recommend making the first step a more robust QC policy.

“In the past 12 months, Fannie Mae has seen a notable increase in loans that have both loan-to-value (LTV) ratios over 90% and debt-to-income (DTI) ratios over 45%. We’re also seeing that borrowers are more likely to fall outside of traditional credit boxes; examples include purchasers whose credit approval is partially based on rental income history or borrowers who have no credit score at all. To meet this challenging environment, lenders are highly encouraged to maximize

16 www.mortgagewomenmagazine.com

Tyna-Minet Anderson

the benefits from their prefunding QC program and look closely at loans with little margin for error.” *

QC starts with building a relationship with the borrower, understanding what their intentions are in the next 12 months. Are they retiring, plan to change jobs, buy a new car, or become an entrepreneur? At the time of the loan application, everything may be 100% correct; however, this is the time to listen to your clients and their aspirations for the future. Guide the borrowers on a path of home ownership that has the opportunity for success.

The second most important QC component is processing and underwriter due diligence. This means developing a strategy that will identify high risk loans that will have additional reviews, and QC audits prior to funding. Some real-life examples of QC issues that I personally know of include:

• The loan file was missing two rental receipts, which caused the DTI to exceed the eligibility guidelines.

• A loan funded just shy of the cash out seasoning requirements; it was missed by five days.

• The borrower quit their job after the loan funded.

• The borrower retired after the loan funded.

These are critical defects that may lead to a request from the investor and require your mortgage company to repurchase the loan. Hopefully you are asking yourself how you can avoid the fate of a repurchase. While you may not have control over what the borrower does post-closing, you do have control over the quality of the loan file as it pertains to meeting the investor’s guidelines. Best practice is to set a QC standard for all high-risk loans. For example, self-employed income, rental income, loans with high DTI, or high LTV, limited credit profiles, or large cash out transactions, are all highrisk factors. While there remain some

failures are internal controls that need to be adjusted or external activities that need to be mitigated.

Fannie Mae recently updated their guidance on lender quality control efforts in the seller guide SEL-2023-2.

“In an effort to improve overall loan quality and reduce the number of loans requiring remediation by lenders, we have enhanced both our prefunding and post-closing quality control policies. Lenders must complete a minimum number of prefunding reviews monthly. The total number of loans to be reviewed must equal either: 10% of the prior month’s total number of closings or 750 loans.”

misconceptions that an effective QC plan is only to detect mortgage fraud, that is not the case. The real goal of QC is to ensure the mortgage loan file meets all the investor’s guidelines. Detecting mortgage fraud is a great bonus.

Another essential component of QC is training, make sure that the mortgage loan originators, loan processor and underwriters are notified of any updates to guidelines, or eligibility requirements. Discuss the best ways to calculate complicated income sources. Create a culture within your organization that allows for collaboration, and the ability to ask for help when working on complicated loan files. Implement technology-based hard stops within your loan origination software programs that will detect potential investor guideline failures.

QC changes with the economy, the housing market, and the borrower. Following the trends will help your company to determine whether the QC

The seller guide also indicated that Fannie Mae will decrease the timeframe for the post-closing quality control efforts from 120 days to 90 days of funding the loan. This will also shorten the timeframe in which a loan with serious defects may be sent back to the lender for repurchase.

Even if you are not a direct seller to Fannie Mae or Freddie Mac you will be impacted by these changes because QC starts at the source of the loan application. Regardless of the size of your mortgage company, your QC policy and procedures should reflect the best effort to control the quality of all your loan files. Protect your company against future buy backs that can potentially put you out of business with a robust QC plan that will ensure that all loans see the same level of scrutiny. n

Tyna-Minet Anderson is an attorney and co-owner of Mortgage Educators and Compliance.

Hopefully you are asking yourself how you can avoid the fate of a repurchase.

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 17

* Fannie Mae Quality Insider February 2023

The Power Of Empathetic Marketing

18 www.mortgagewomenmagazine.com

TAPPING INTO THE HUMAN CONNECTION WILL HELP EXPAND YOUR AUDIENCE

By MARY MARGARET HOGAN , Special To Mortgage Women Magazine

“Put yourself in their shoes.” While the phrase may be cliché, understanding and empathizing with your audience is a necessary step to identifying and retaining your customer base as a marketer. Far more valuable than other marketing hacks, tapping into human connection is one of the most underrated tricks to expanding your audience and significantly improving your consumer relationships.

Empathetic marketing is an approach that seeks to capture the unique

behaviors, the ever-amorphous audience can now be seen as individuals with their own emotions, backgrounds, and stories. With empathetic marketing, marketers look beyond the numbers and metrics and instead, step into the world of customer perspective, making sure every audience experience is represented and accounted for.

ACTIVE LISTENING

So, where does one begin? How can a marketer behind their computer and phone emit empathy through marketing materials, outreach, and strategy? Hint: It involves the very crucial, but sometimes difficult, skill of active listening.

To gain insight on individual customer profiles, it is imperative to collect data on consumer identities, emotions, and needs. Unfortunately, this type of information won’t naturally find its way into your CRM without some active listening efforts.

identities of customers to create relevant and responsive content that puts their needs at the center. In our field, discussions of increasing databases and contacts are so frequent that there is the default to group thousands of names and figures into one giant entity.

When we generalize an audience, the individualistic desires of each customer can be lost and result in a decrease in engagement, business, and trust. Yet when collecting data about a base’s demographics, values, lifestyles, and

Internally, gathering knowledge of customer interactions from those who work closest to them is a great first step. Whether through a companywide survey or a routine check-in with the sales and business development teams, your team members should be encouraged to share the patterns of desires and expectations they are seeing in their customers. Tracking of customer interactions should extend beyond the standard intake of post-sale feedback and instead focus on collecting statistics of the customers themselves.

Are their customers confident in this economic climate?

Did their confidence affect their purchasing experience?

Do their customers have a family behind them to support?

Are they the sole wage earner in their household?

Are they yearning for a major shift in their day-to-day life?

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 19

Mary Margaret Hogan

How does your service fit into their lifestyle or how do they need it to fit in?

These questions can certainly vary but should derive from a genuine, noninvasive place of getting to know your customers to better their experience. By implementing this standing checkin, team members will be reminded to actively listen beyond the details of the deal and furthermore, supply both marketing and sales with tangible ways to improve the customer experience with empathetic responses.

Externally, there are quite a few ways to break down your audience into individual customer profiles. To begin, it is beneficial to take note of their buying environments. Of course, this can be gathered from existing data in a CRM platform and/or economy-driven data, but how can we expand upon geography and market climate?

Once again, surveys act as a great gateway to insight that would not normally be documented otherwise, but this time they should be taken directly by the customer. These surveys could be crafted to capture a range of data such as consumer confidence levels, customer demographic data, and/or experiential scores after a networking event. In all cases, audiences are granted the rare space to provide their personal insight while your team gathers invaluable consumer profile data.

Monitoring social media is also a prime way to elicit intel on audience identity, emotion, and confidence.

of Instagram and Facebook “stories.” Here, these platforms provide the simplest version of intake forms that can get you quick, easy, and non-invasive customer feedback. Just a “poll sticker” away, this 24-hour feature collects customer data from one-answer polls on your story and with immediate shared results, your audience can be informed too. Collecting this data doesn’t have to be elaborately difficult!

RESONATE WITH AUDIENCES

Active listening on social media comes in the form of taking note of comments and reactions to your posts as well as their responses to other competitors. The convenience of social media acts as the perfect playground for unfiltered customer feedback so it’s important to pay close attention and tailor marketing tactics as needed.

Do not underestimate the power

While there are quite a few methods to acquire customer profile data, it’s ultimately up to each marketing team to decide which captures the most informative and authentic customer responses. By actively listening to customers, companies will be able to craft an empathy-based and customercentric marketing strategy that resonates with audiences in no time. Empathetic marketing campaigns should not only be a direct reflection of the newfound customer data, but should retain messages of inclusion, consideration, and transparency. If there’s a trend of customers feeling nervous in this volatile market, marketers can employ empathetic marketing to provide comfort. This might include an email blast that highlights the more positive existing market trends or perhaps includes a webinar invite for a free educational session that offers reassurance and negates fear.

There’s no place for false promises or outlooks in empathetic marketing. All experiences and deliverables should address customer needs without sacrificing authenticity,

In addition to maintaining transparency, empathetic marketing also requires upholding inclusive narratives across all marketing initiatives. When a company’s marketing neglects diversity of race, gender, culture, and more, they are ostracizing entire populations deserving of representation. From designing imagery that includes people of various ethnicities to adding closed captions across all video marketing campaigns, there are endless ways to transform your marketing materials into spaces of inclusion and accessibility. However, remember, employing diverse campaigns must extend beyond mere tokenization. These efforts should derive from a place of establishing a genuine human connection and ensuring that all customers feel valued. With all the previous active listening endeavors, it’s essential to return with affirming messages that say: “We see you. We heard you. And now here’s what we’re going to do for you.”

Applying a lens of empathy throughout your marketing strategy can make a major impact on your business. When seeing empathetic campaigns, clients will feel represented and cared for and in return will reciprocate with loyalty. Being able to identify your individual customers at a granular level ultimately increases your knowledge of your audience base and therefore maximizes your reach and retention.

By demonstrating a clear knowledge of your customers’ needs, your empathetic marketing efforts will show that your company values customers more than just faceless numbers; they are at the integral to your company’s story. n

Mary Margaret Hogan is an event marketing specialist at RCN Capital.

Applying a lens of empathy throughout your marketing strategy can make a major impact on your business.

20 www.mortgagewomenmagazine.com

When we generalize an audience, the individualistic desires of each customer can be lost and result in a decrease in engagement, business, and trust.

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 21

The Road To Becoming Licensed

A STEP-BY-STEP GUIDE TO OBTAINING A STATE MORTGAGE LICENSE

By VANESSA BODNAR, Special To Mortgage Women Magazine

Despite a turbulent mortgage market, it is my opinion that now is the time to get licensed. Often the process of becoming licensed seems elusive and you have no idea where to start. I will give you a roadmap to help you get licensed and as quickly as possible.

For those of us who have worked in the mortgage industry for a while we have proven that the industry always bounces back and when it does it’s good to be prepared to participate in this exciting space. In addition, you may be a loan officer assistant or a processor, becoming licensed can give you a leg up in your career as you’re able to help your loan officers in a way that you won’t have to worry about unlicensed activity.

BEFORE YOU START

Being that you are interested in working in the financial industry or desiring to become a loan officer, it is important that you look at your credit and background. You will want to pull a credit report, preferably from TransUnion (that is the

credit bureau of choice for NMLS). If you have any credit infractions, you will probably want to start clearing them up. Also, if you’ve had a bankruptcy or foreclosure within the past 10 years, get your documents in order as you will have to provide them to NMLS. If you have committed a felony, please refer to the state you’re applying for and their regulations. If you have something on your criminal record, be sure to have all your court documents and so forth prior to applying for a license.

EDUCATION

Prior to getting initially licensed, you need to complete 20 hours of education. You can look in the resource center of NMLS to see who has been approved to provide education. In your 20-hour class you will learn Federal laws, ethics, and lending principles. You will also learn about major regulations such as the Real Estate Settlement Act, the Truth in Lending Act, the Equal Credit Opportunity Act, and the Secure and Fair Enforcement for Mortgage Licensing Act. Thankfully most providers have several options for completing your 20

Vanessa Bodnar

22 www.mortgagewomenmagazine.com

hours such as webinars and one-week and two-week online courses. It is very important to not only get through the 20 hours but comprehend what you are learning. It will not only serve you well on the exam but also in your career to remain as compliant as possible.

In addition, you will need to complete any state-specific education hours. For instance, in Texas you are required to take 3 hours of Texas law in addition to the 20 hours. Not all states require additional education, you can refer to the NMLS resource center or state regulations to find out if your state requires more education.

EXAM PREPARATION

In 2018 there was a shift from a national exam and state tests to one uniform state exam called the Uniform State Test (UST). This streamlined the process of getting licensed to allow for just one exam. However, the UST is designed to only allow the best to pass. To that end, you will want to enroll in a test prep course. It is important to find one that is comprehensive and gives you several ways to study such as flash cards, pre-tests and post-tests, and subject focused study. It has been my rule of thumb that when you are making an 80-90% consistently on the practice tests you are likely ready to take your exam. Many education providers will give you an exam prep course with your 20 hours, just make sure it’s one that allows you to learn in different ways.

THE NATIONAL UST EXAM

As mentioned previously, you will be required to take the Uniform State Test (UST). The exam consists of 120 multiple choice questions. The questions are spread out among 5 content areas. This is demonstrated by the table below:

that, you are probably worried about failing. If you have no previous mortgage experience, you may not pass the first time. If you don’t pass, don’t give up, in 30 days you will be able to re-test. Because you will have prior knowledge of how the exam works and what it looks like, it’s likely you will pass the second time. The test retake cycle is below:

Initial Fail 30 days

2nd Fail 30 days

3rd Fail 180 days

Initial (New retake cycle starts) Fail 30 days

2nd Fail 30 days

3rd Fail 180 days

Initial (New retake cycle repeats the previous cycles)

APPLYING FOR YOUR LICENSE

You’ve finished your education and passed your exam, now it’s time to file your license. Each state, in the NMLS Resource Center, has a checklist. It is very important to review the checklist for the state you’re applying, as they each have requirements that may differ from each other.

Once you’ve applied for your license you will need your company to sponsor your license. Most licenses will become inactive if not sponsored and some rare states won’t approve your license without a sponsor. I would check with your company prior to paying for your license to be sure they will sponsor your license after you apply.

The hardest part of this step is to be patient. Each state has different turn times depending on how long it will take to get an approval. It’s fine to follow up with a state after you have applied but I would wait a couple of weeks so as not to overwhelm your state regulator. You can also ask your Licensing/Compliance department to follow up as many of these employees have developed good working relationships with the regulators.

TEMPORARY AUTHORITY

You pay for the exam through NMLS and then you schedule it through Prometric. Prometric now offers two options for completing your exam. You can either take your exam at a testing center or online. Thanks to the Pandemic, Prometric developed an online proctored exam. It is important to note that, with no exceptions, tests must be rescheduled 48 hours prior to the exam. If you try and reschedule or cancel within 48 hours of the exam you will lose the money you paid for it and it’s non-refundable.

To pass the exam, you must score 75% and because of

Congress, on March 15, 2018, passed the Economic Growth, Regulatory Relief and Consumer Protection Act. This Act was a new provision under the SAFE Act of 2008. The provision is known as Temporary Authority to Operate. This allows Loan Officers, who have worked for a bank and have been federally registered for more than 365 days, to go to a non-depository institution (such as mortgage company) and retain the ability to originate while seeking licensure.

If you want to seek Temporary Authority, you apply for your license prior to taking your education and exam, and if

Content Area Percentage of Test Federal Mortgage Related Laws 24% Uniform State Content 11% General Mortgage Knowledge 20% Mortgage Loan Origination Activities 27% Ethics 18%

Test Attempt Test Result Retake Waiting Period

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 23

the state agrees, you can continue to originate while you finish the steps to getting licensed. This relieves the burden of moving from a bank to a mortgage company.

Temporary Authority also applies to Loan Officers seeking licenses in another state. However, this does not apply to those who have not been previously licensed and have not worked for a bank for more than a year.

APPROVED!

You have received notification from NMLS that your state has approved your license, now what do you do? Your next step will be to notify your Licensing or Compliance department that you are licensed.

If your state issues a paper license or emails you a license, you will display it where consumers can see it and it’s readily available to any visiting regulators. When you created a profile in NMLS you were issued a Unique Identifier number.

This number will need to be listed on all marketing materials where you are listed, on your business cards and in your email signature. In addition, some states require you to list that you are licensed in their state. You can find out if this is the case for you by referring to the state regulations and/or your Licensing/Compliance department.

Finally, each year you will have to renew your license in NMLS, even if you were just licensed. Sometimes if you were licensed after November 1st you won’t have to renew until the following year. If you renew the same year you took your 20-hours, you won’t be required to take Continuing Education (CE). But if you waited until the following year to get licensed you will be required to take CE.

Getting licensed can sometimes seem hard and confusing, but if you follow this roadmap and your state’s license checklist, you will be licensed in no time! n

Vanessa Bodnar is founder of The

Licensing Hub.

24 www.mortgagewomenmagazine.com

Getting licensed can sometimes seem hard and confusing, but if you follow this roadmap and your state’s license checklist, you will be licensed in no time!

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.camortgageexpo.com PRODUCED BY LA JOLLA, CA Marriott La Jolla Register for FREE with promo code MWMFREE AUG 10 California’s top gathering for mortgage pros. Innovate. Educate. Motivate.

ASK THE EXPERTS

In the mortgage industry, staying ahead of the curve is crucial to success—which can be a problem when the industry itself is filled with new daily twists and turns. Thankfully, the increasing use of automated technologies can help mortgage organizations stay ahead of these curves, both from a technology and market standpoint.

And yet, it reminds me of a famous Bill Gates quote about the limitations of automation. “The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.”

LEARNING

Indeed, not all automation has been helpful, especially when it comes to the intricacies involved with managing documents and data. However, machine learning technology is proving to be the difference maker. Properly applied, machine learning tools can improve and transform automated processes to create greater efficiency throughout the mortgage lifecycle.

As a product information analyst who trains machine learning tools to produce better results, I’ve had the good fortune to experience this transformation up close. And the results are pretty stunning.

ERADICATING DOCUMENT AND DATA DILEMMAS

One of the costliest tasks most mortgage organizations perform is accurately classifying loan documents and extracting data from them. While automation helps, alone it can only do so much. The reason is many documents display information differently, which makes it difficult for

HOW MACHINE

IS SUPERCHARGING THE INDUSTRY

WHILE AUTOMATION HELPS, ALONE IT CAN ONLY DO SO MUCH

THE MODERN MARKETER 26 www.mortgagewomenmagazine.com

WITH Stacy Wilson

automated technologies to classify and index these documents correctly.

Using machine learning technology—aided by human experts— document and data automation tools can “learn” to recognize certain patterns to classify documents and more accurately extract data. This includes the ability to recognize key fields in structured and unstructured documents, such as names, addresses, dates, and other relevant information, regardless of where they are displayed.

Machine learning algorithms are also being used on large volumes of documents to identify patterns, so similar documents can be classified automatically. Once classified, data extraction tools can be used to extract relevant information from these documents at several times the speed of manual, “stare-and-compare” processes. In fact, machine learning algorithms are being trained across such a breadth of document types that contain so much more data than ever before, enabling lenders to process large volumes of loan files quickly and accurately.

FASTER, SAFER LOAN PRODUCTION

When properly applied, the benefits of machine learning technology are tremendous. For example, accurate document classification and loan data verification are critically important when it comes to regulatory compliance. With the help of machine learning technology, critical loan documents can be indexed more accurately so that data can be captured and rules applied to verify missing documents and identify data consistencies, which reduces the risks of fines and penalties.

To get the most out of machine learning, however, the machine must be constantly trained, which requires an

analysis of the results so the algorithms can be continually fine-tuned and improved. This is a big part of my role at LoanLogics. My counterparts and I regularly analyze the accuracy of our document classification technologies and make adjustments to improve the results. By doing so, we’re improving the accuracy of our machine learning algorithms over time, which leads to greater accuracy and confidence in the results.

This training process has proven to be highly effective in improving indexing for documents like paystubs and W-2s, which contain a lot of important information, but often have different formats and layouts. The same applies to the many different disclosure documents found in loan files. While it’s relatively easy for automated technologies to classify and read standardized disclosures like the loan estimate and closing disclosure, there are many other types of state and local disclosures that vary a great deal in terms of format, layout, and how information is presented.

In my job, there are certain techniques and training principles that help our machine learning tools learn how to classify these documents. Based on good quality samples, for example, we can review documents in batches and have both machine learning and human operators perform the indexing. At first pass, we can evaluate machine learning confidence scores and where machine learning actually failed. Then, by feeding the results of this human analysis back into the machine, the machine can be trained to produce better results.

ENHANCING SECONDARY MARKET ACTIVITIES

While AI and machine learning have made a growing impact on loan production in recent years, they are just now beginning to revolutionize

secondary market processes. For example, because of the prevalence of manually driven tasks, the process of selling and onboarding loans is often tedious and inconsistent, making loan trading and onboarding a cumbersome endeavor. The historic lack of loan file data transparency in our industry hasn’t made things easy.

Recently, however, machine learning tools are being applied to secondary market processes that enable smoother trades and loan onboarding. For example, if an originator or investor needs to check 30 critical document types with corresponding critical data elements when selling or buying a pool of loans, they can rely on machine learning to classify documents correctly and then let data extraction and rules-driven data validation tools do the heavy lifting.

With a high degree of confidence, trained machine learning tools can pass or fail these critical documents, ensuring that only accurate classification moves to data extraction and validation steps. Ultimately, this allows loan sellers and buyers to accelerate loan file review times and only focus their attention on managing document and data exceptions. With better data, servicers and investors can gain greater insights into their portfolios and make more informed trading decisions, especially when minimizing inherent data accuracy risks.

REMEMBER THE TWO RULES

There are a couple of “twists” involved with machine learning tools that make all the difference in their effectiveness. The first twist is that machine learning will produce limited results without a sizable database of documents to train from, including unstructured documents.

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 27

To get the most out of machine learning, the machine must be constantly trained.

When machine learning tools are built on a large enough library, they can help companies achieve triple-digit increases in productivity. So, getting back to Gates’ rule #1 — Before investing in machine learning technologies, understand how the machine is being trained and the depth of sample size being used.

The other twist? Too often, automated technologies create just as many inefficiencies as efficiencies if a lack of confidence persists in the manual processes you are trying to eliminate. There is a science behind machine learning that predictably measures confidence. So, regarding rule #2, it’s important to understand the maintenance and tuning efforts your machine learning vendor is conducting to give your teams more confidence in the technology.

Remember, it takes the proper machine learning tools — and often, the right partner — to truly excel.

As we continue to see more use of machine learning, I recently had the opportunity to ask two mortgage technology experts how it is being used to leverage more data and improve operations. Here’s what they have to say.

LYNNE MCLAIN Account Manager LoanLogics

While there are still some mortgage organizations relying on clunky spreadsheets and manual processes, a growing number are embracing automation driven by new machine learning technologies to gain a competitive advantage in the marketplace. At LoanLogics, we’ve seen first-hand how machine learning tools are helping retail, wholesale and correspondent lenders, mortgage servicers, and investors improve productivity and profitability.

One area that is particularly ripe for data and document improvements is whole loan and MSR mortgage loan commerce. Many sellers are selling to many buyers, and there is no consistency on either side of that coin. Document naming, stacking order and data field naming are as varied as the organizations in the market and the loan origination and servicing systems they use. This lack of standardization creates the “heavy lifting” work that persists in the secondary market that continues to slow down transactions and increase costs.

These reasons are why machine learning holds so much promise for the secondary market. By being able to classify documents and extract data more accurately and consistently, regardless of a buyer or seller’s taxonomy, machine learning-driven automation can overcome these hurdles and help create more efficient mortgage commerce. These tools can also accommodate any subset of documents and data that might be appropriate for a given use case, allowing organizations to process once, map once, and use broadly.

Ultimately, the value of machine learning will increase for all of these participants as the breadth of document types classified and data fields extracted grows. I know our clients are just as excited about that happening as we are.

JANET MARTIN Vice President, Digital Solutions Cornerstone Servicing

How are you using machine learning tools to leverage more data to improve operations at your company or for your clients?

Cornerstone Servicing has a series of machines that supply information to improve our overall customer experience and address potential risks.

For example, AI is taking the guesswork out of why customers communicate with us here at Cornerstone. It gives us the ability to identify trends in our customer interactions, which in turn allows us to nimbly design an intuitive digital experience that meets their needs and communication preferences. Our technology analyzes every page a customer views; every conversation with our AI-driven virtual assistant and natural language IVR, and our customer care team members; and two-way email and secured message correspondence. This 360-degree view allows Cornerstone to continuously improve and personalize the experience we create for homeowners. Machine learning tools have also enhanced Cornerstone’s recently launched subservicing business. We are committed to providing our subservicing clients with full transparency into their portfolio and analytics, and we partner with them to apply learnings and take their customers’ experience to the next level. Our servicing platform also enables us to tailor the experience to a clients’ unique branding and messaging, offering consistency and helping to deepen their customer relationships for the long-term. We are also beginning to leverage AI for proactive borrower retention campaigns, which we believe will be a real game-changer. You will see Toby Wells, president of Cornerstone Servicing, mention technology in everything he says because our integrated servicing platform and these machine learning tools are core to our overall strategy. Technology is a big part of what differentiates us as a mortgage servicer. It is helping us get smarter and more efficient across our operations so we can continuously improve our customer experience. n

Stacy Wilson is a product information analyst for LoanLogics.

Lynne McLain

28 www.mortgagewomenmagazine.com

Janet Martin

Discover Where Your Competitors Stand In The Mortgage Market

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Mortgage MarketShare Module

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Loan Originator Module

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

GET A FREE MORTGAGE COMPETITOR ANALYSIS

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

NEED MORE DATA?

Inquire about our NMLS Data Licensing and LO Contact Database options.

In The Housing Market, Men Are Losers

SINGLE WOMEN BOUGHT 1 IN 6 HOMES IN 2022

By SARAH WOLAK, Staff Writer, Mortgage Women Magazine

More single women swipe right on homeownership than single men. Owners of 1 in 8 homes in the U.S., it’s a group that can’t be ignored. Woman may earn 83 cents to every dollar a man makes, but they’re dominating the housing market and doing it on their own.

A LendingTree study using data from the U.S. Census Bureau found that single women are more likely than single men to own a home in 48 of 50 states.

In 2022, single women made up 17%

of recent buyers, compared to 9% of men. For the past decade, these numbers have been fairly stable; single women have maintained between 15% and 19% of the buyer pool, and single men have maintained between 7% and 9%.

Jacob Channel, senior economist at LendingTree, said that this trend will most likely continue since there haven’t been any major demographic shifts, such as women’s graduation rates plummeting or men suddenly living longer than women.

It’s not a small gap, either.

LendingTree says single women own about 10.76 million homes, while single men own about 8.12 million. Put another way, single women own an average of 12.9% of the owner-occupied homes in the U.S.

BEATING THE ODDS

Prior to 1974, it was not legal for women to secure a mortgage without a male cosigner. Once that barrier was broken, women have outpaced single males as homebuyers since the National

30 www.mortgagewomenmagazine.com

Association of Realtors (NAR) started tracking this data in 1981.

“We’ve seen this need for independence throughout the ‘80s generation into today,” said Jessica Lautz, NAR’s deputy chief economist and vice president of research. “Single women have really made it their mission to not be at the mercy of a landlord. They want their own spaces, and homeownership seems more important to their demographic.”

Lautz remarked also that single women are continuing to “surpass

odds” in the housing market, still managing to hold onto their purchase power even though housing affordability hit a three-decade low in August last year. Lautz says that there is a laundry list of factors as to why single women are dominating: they live longer than men, marriage rates are declining, women are more likely to move closer to family and friends, they express a desire for stable homes to raise a family in potentially, and they make more sacrifices when it comes to their house wish lists.

“Historically, women tend to be caregivers, and they see a home as a place to either be a caregiver or as proximity to family,” Lautz said. “Their willingness to make sacrifices when it comes to their wants for a home speaks about the importance of homeownership to them.”

Lautz said that single women are also consistent in their buying behaviors and continue outperforming against the odds. “Their mortgage behaviors are almost the same as single men. 72% of single women financed compared to 73% of men,” Lautz said. “Even though they’re older in age as first-time buyers, single women of all ages are buying alone.”

MARKETING TO SINGLE WOMEN

Marketing to single ladies doesn’t have to be a completely different formula. Lautz says that LOs should approach women with the promise of ease and accessibility. “They need to take into account that women make less income, but they’re willing to make financial sacrifices to get a home, such as getting a second job or not taking a vacation,” she said. “What they want is to hear that an originator is willing to work with them.”

Channel, from Lending Tree, said that LOs also need to take into account the

struggles that some women face during the homebuying process. “Women may have to stretch their budgets more in order to afford a home, and they may also face other, harder-to-quantify challenges, like dealing with sexist sellers,” he said. “Some lenders might not necessarily realize how much of a market there is for single women homebuyers, and, as a result, they might feel less inclined to seek out single women clients or cater their offerings to be more appealing to single women.”

To avoid issues such as sexism or hopelessness in the home buying process, Channel recommends antibias training to lenders. “People may not realize they have a bias until it’s actively pointed out to them and they’re given tools to help avoid it,” he said. “It’s also important for lenders to be sure that they’re properly highlighting different loan options that might be appealing to single buyers, like FHA loans, for example.”

Scott Cange, Delmar Mortgage’s chief marketing officer, says that while it’s tough to target mortgages specifically toward single women, an LO can use a different approach. “Something that we have seen via our Google analytics is that around 70% of people clicking on our website are women,” he said. “So that data allows us to really gauge our audience.”

Cange also said that everyone carries data, such as their gender, location, preferences, and interests. This can be used – especially by marketers – to reach their target audiences. “The biggest thing an LO can do is make sure they personalize their message towards their demographic, based on the data that they carry,” he said. “Everybody’s on a different journey. You [as an LO] have to be broad when it comes to public outreach, but your personal touch and attention will impact your clients.” n

“Women make less income, but they’re willing to make financial sacrifices to get a home.”

MORTGAGE WOMEN MAGAZINE • Issue 4, 2023 31

> Jennifer Lautz, deputy chief economist and vice president of research, National Association of Realtors

Hackathon Magic

UNMASKING MINORITY FINANCIAL LITERACY

By MICHELE BODDA , Special To Mortgage Women Magazine

By MICHELE BODDA , Special To Mortgage Women Magazine

Our research shows more than a quarter of Black and Hispanic consumers are credit invisible and lack access to fair and affordable credit. Closing this gap will require unique approaches to getting our country’s youngest consumers and diverse communities actively engaged in financial literacy and taking steps to build their credit histories. This can help ensure these consumers can one day purchase homes and increase intergenerational wealth.

Meaningful change in driving financial inclusion and ensuring an equitable path to homeownership for consumers in diverse communities requires all of us working together.

When this is done effectively, amazing things are possible. I’d like to share an example of this principle in action — which also serves as one of the highlights of my 20+ year career.

We recently hosted a hackathon in partnership with HomeFree-USA — an organization dedicated to giving people of color the guidance they need to achieve and sustain homeownership. Their organization serves the diverse interests of over 6 million consumers through its nationwide network of 50 community-based nonprofits that specialize in guiding people to first-timehomeownership, sustainability and increased financial capacity.

The hackathon was the grand finale of a six-month Center for Financial Advancement Credit Academy. Through live sessions with Experian credit education experts and selfpaced content, more than 250 students from 14 Historically Black Colleges and Universities (HBCUs) learned about credit, financial tools, and how to build generational wealth

through steps like homeownership.