With 2024, we embark on the 14th year of this magazine’s life. Every issue is available on our website, including the first one with just 12 pages. “What you are holding in your hands is not a promotional flyer, but a real newspaper. Written by professionals and dedicated to manufacturers of recreational vehicles,” was stated in the brief space dedicated to the Editor’s note. It was back in 2011 that we embarked on an extraordinary journey, one that leads us today to extend our heartfelt thanks to the entire caravanning industry. First and foremost, our sponsors, the companies that produce components, who have understood the value of quality B2B communication as guaranteed by the journalistic work of our contributors scattered around the world. We have colleagues in Germany, the United Kingdom, the Netherlands, (France is missed, but

Contents

Interviews

• 26 Alexander Leopold EHG

Columns

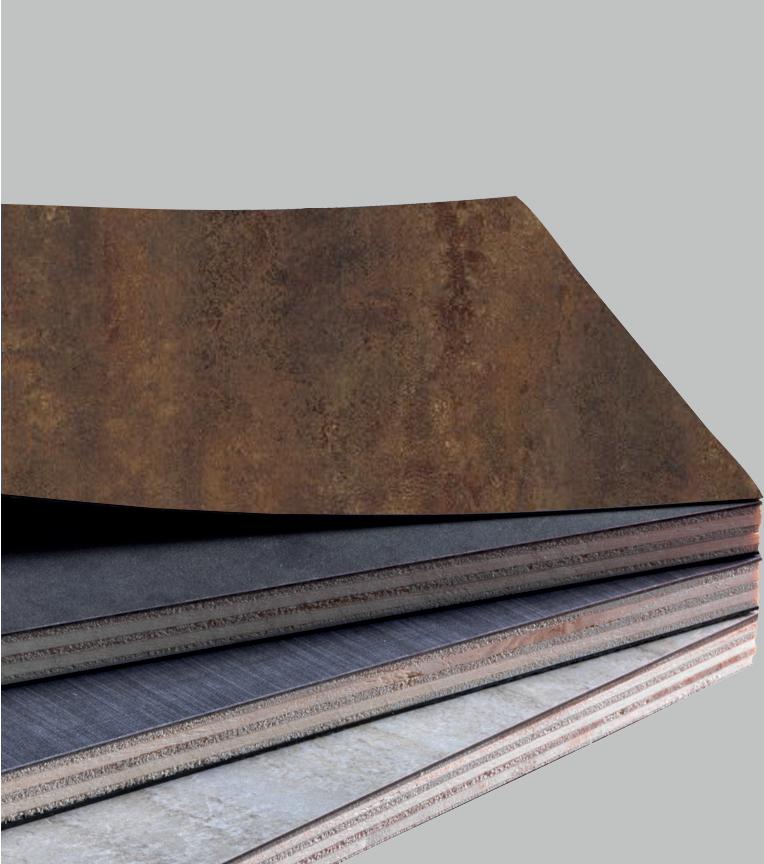

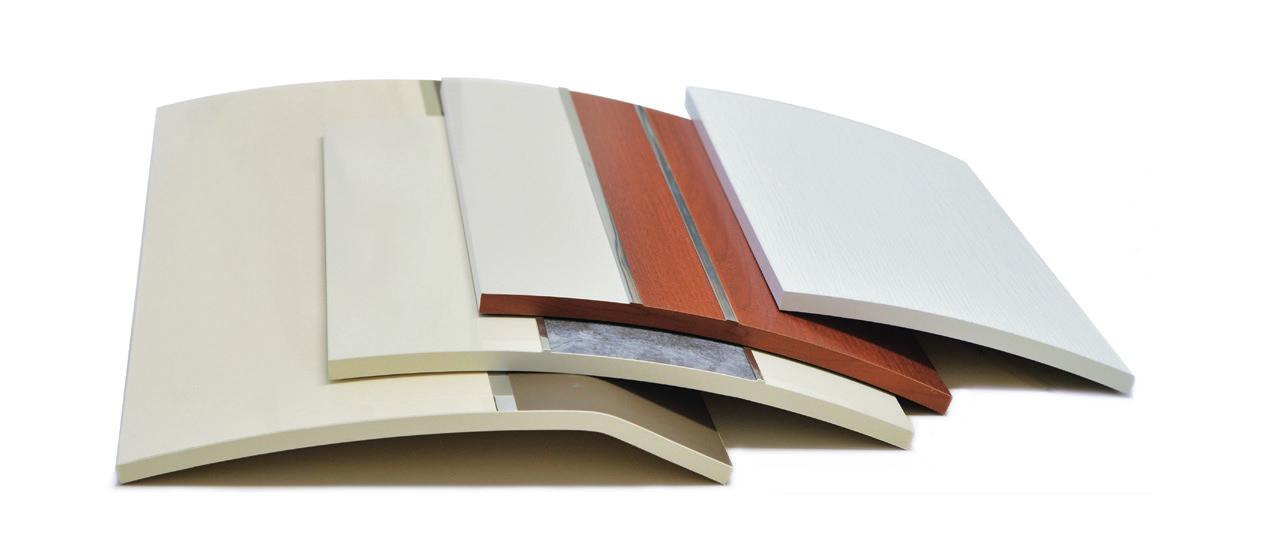

• 48 Lamilux

The camper’s skin

• 32 Armin Mäder Tabbert

applications are open), North America, Australia, Japan, and naturally in Italy, where this newspaper is produced then distributed all over the world, because Aboutcamp BtoB is a global newspaper. We become aware of this when we travel to international shows and are welcomed with great warmth and affection. This happens regularly at European fairs, but it has also happened in Melbourne, Elkhart, Tokyo, and recently during our visit to Istanbul. The market in Turkey is quite surprising and is developing rapidly. You will find an extensive report on the Karavanist Fair in this issue. And we also report on the German CMT fair in Suttgart, which serves as a barometer for the market in Europe. Germany, with its extraordinary registration numbers, is the driving force of all of Europe. Operators seem satisfied with the market trend, which is slowing down, but for now, does not worry the industry. We invite you to delve into this issue, which is brimming with interviews, reports, technical analysis, and a wealth of information.

Antonio Mazzucchelli

• 50 CTA Quality, flexibility, sustainability

• 52 Gok

Pressure regulation systems

• 54 AMA Composites Advanced solutions for the future

• 56 Vetroresina

Style & features

• 38 Fabrizio Giugiaro GFG Style

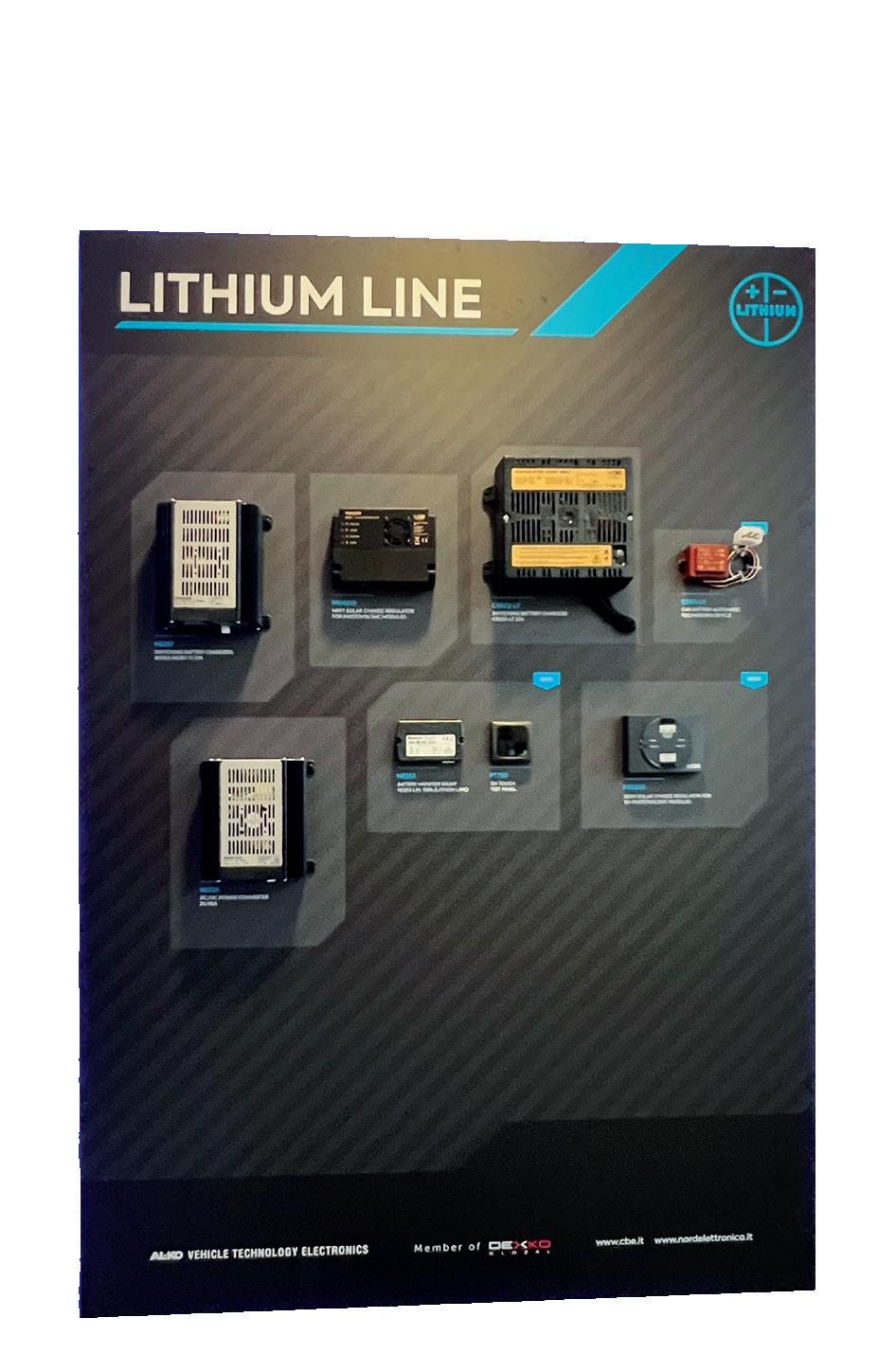

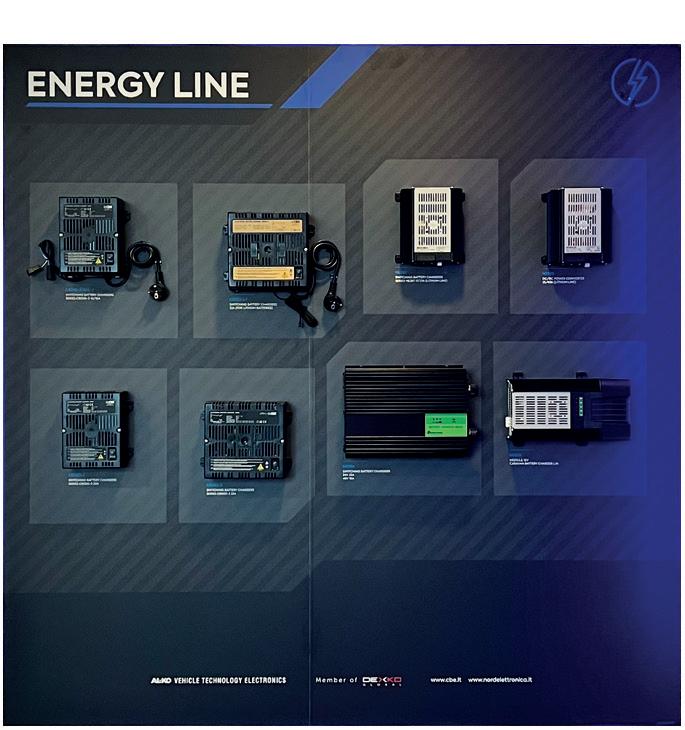

• 58 AL-KO VTE Integrating past and future

• 62 Thetford Sustainability drives Thetford

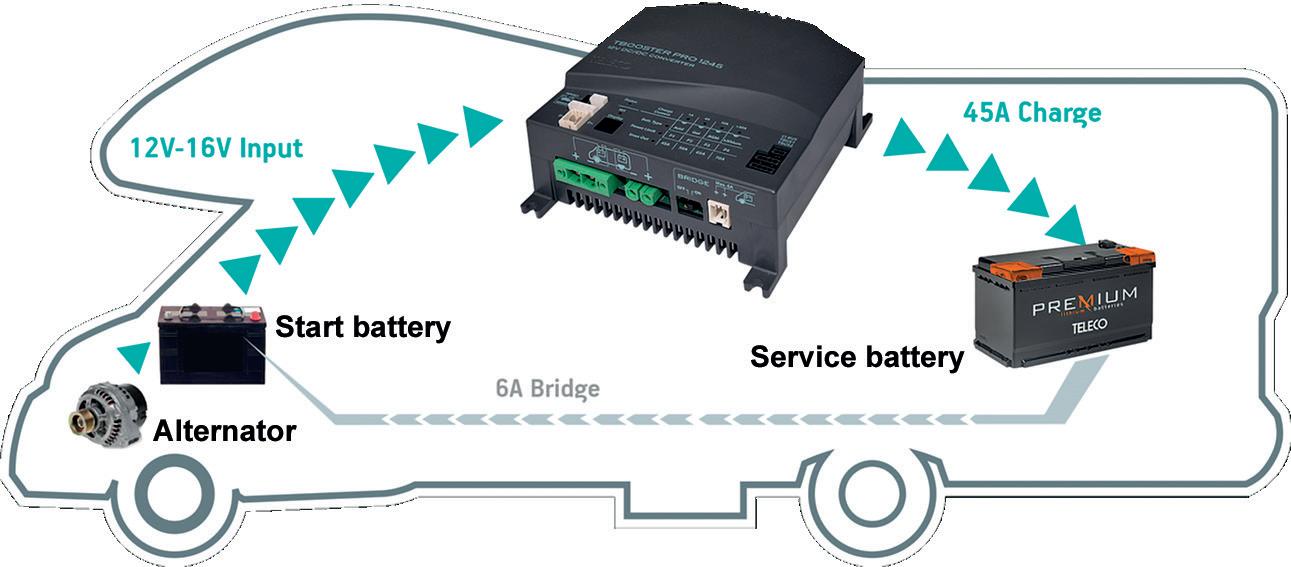

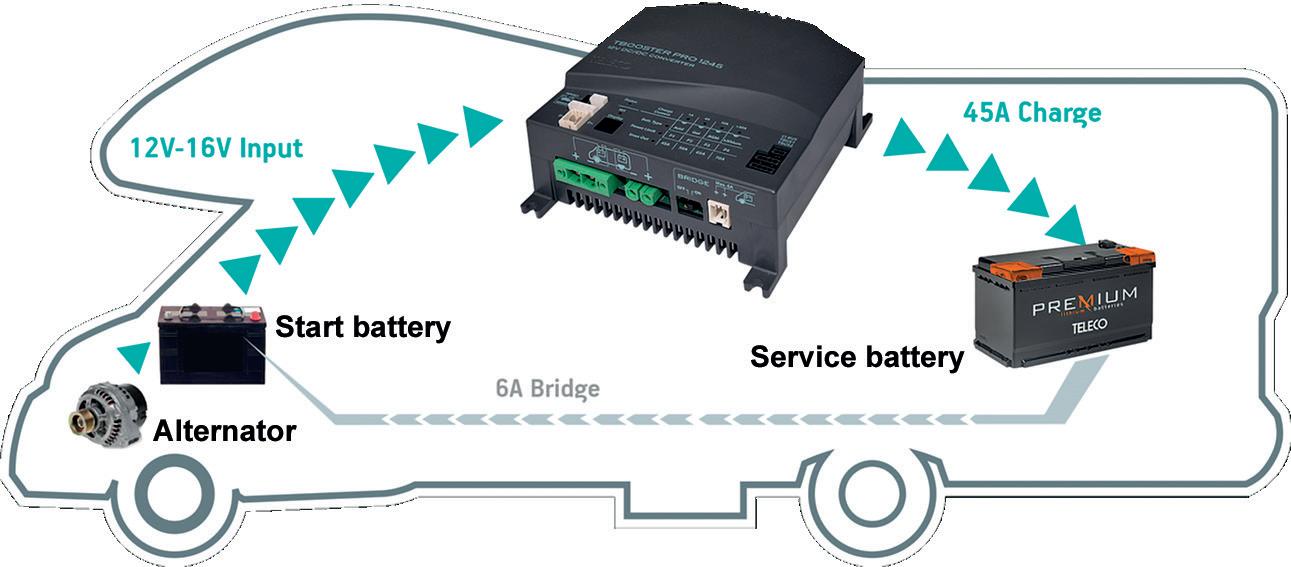

• 64 Teleco Improving service battery charging

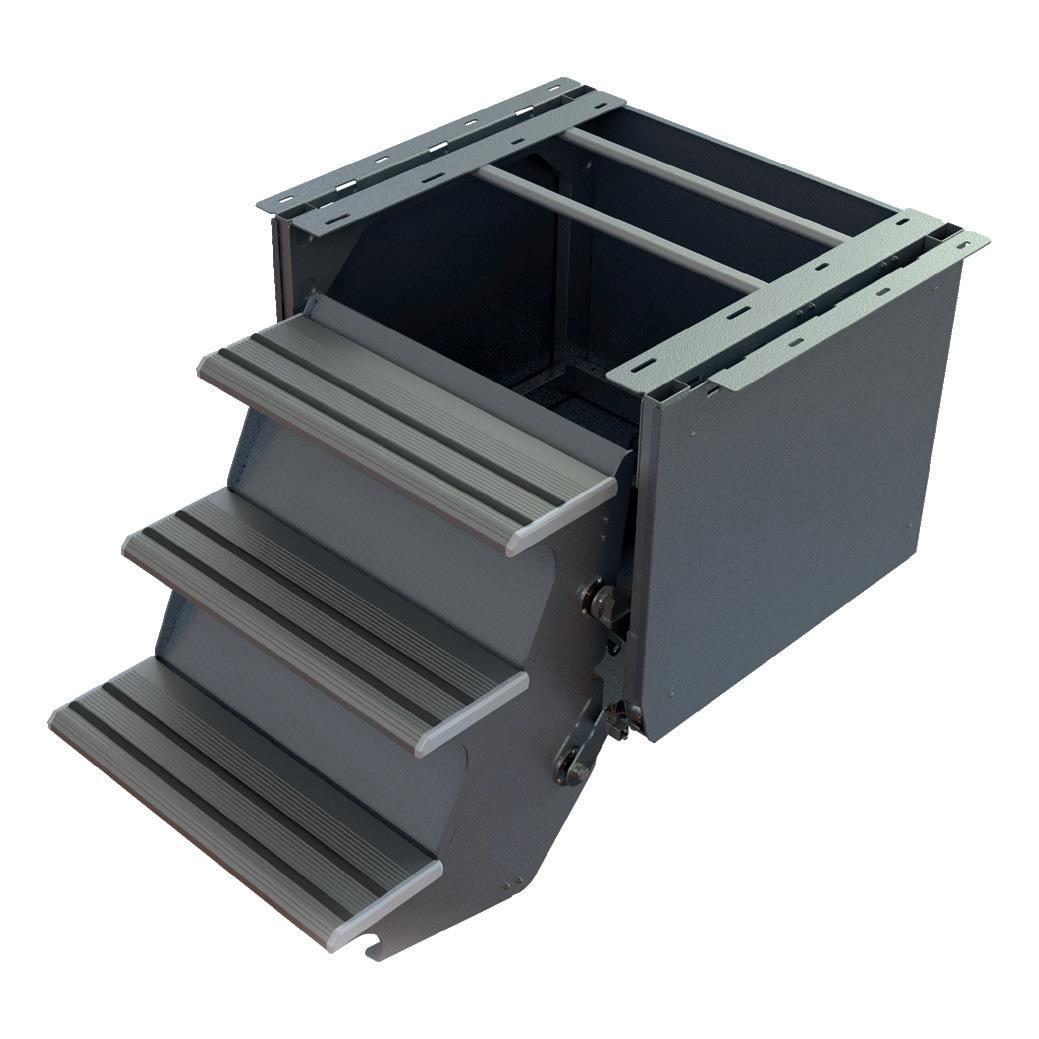

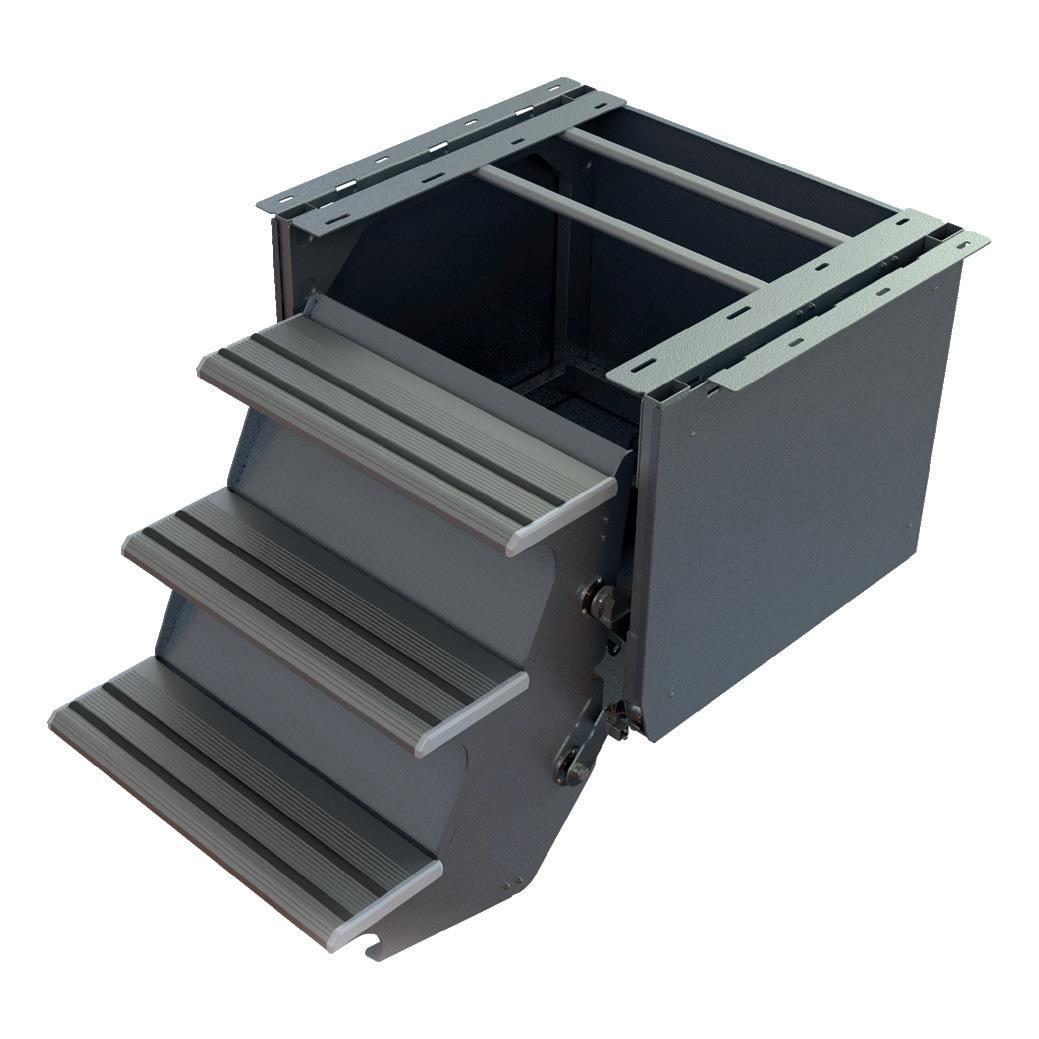

• 66 Lippert Versatile and customised solutions

• 70 Indel B Air, light, refrigeration

• 44 Ariane Finzel DCHV

News from the world

• 20 Updates from leading markets

Reports

• 72 Karavanist Istanbul

Let’s discover a market that has skyrocketed in just few years: Turkey

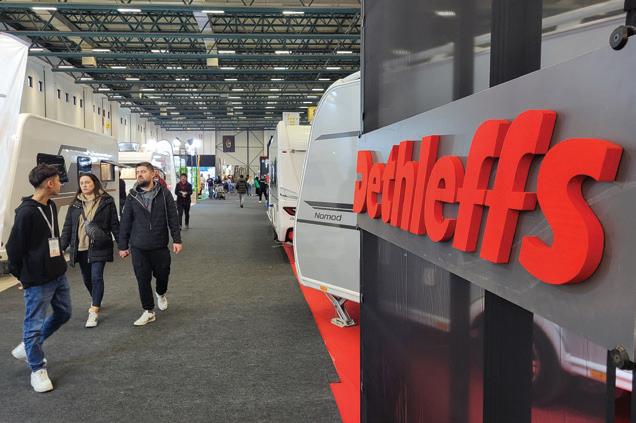

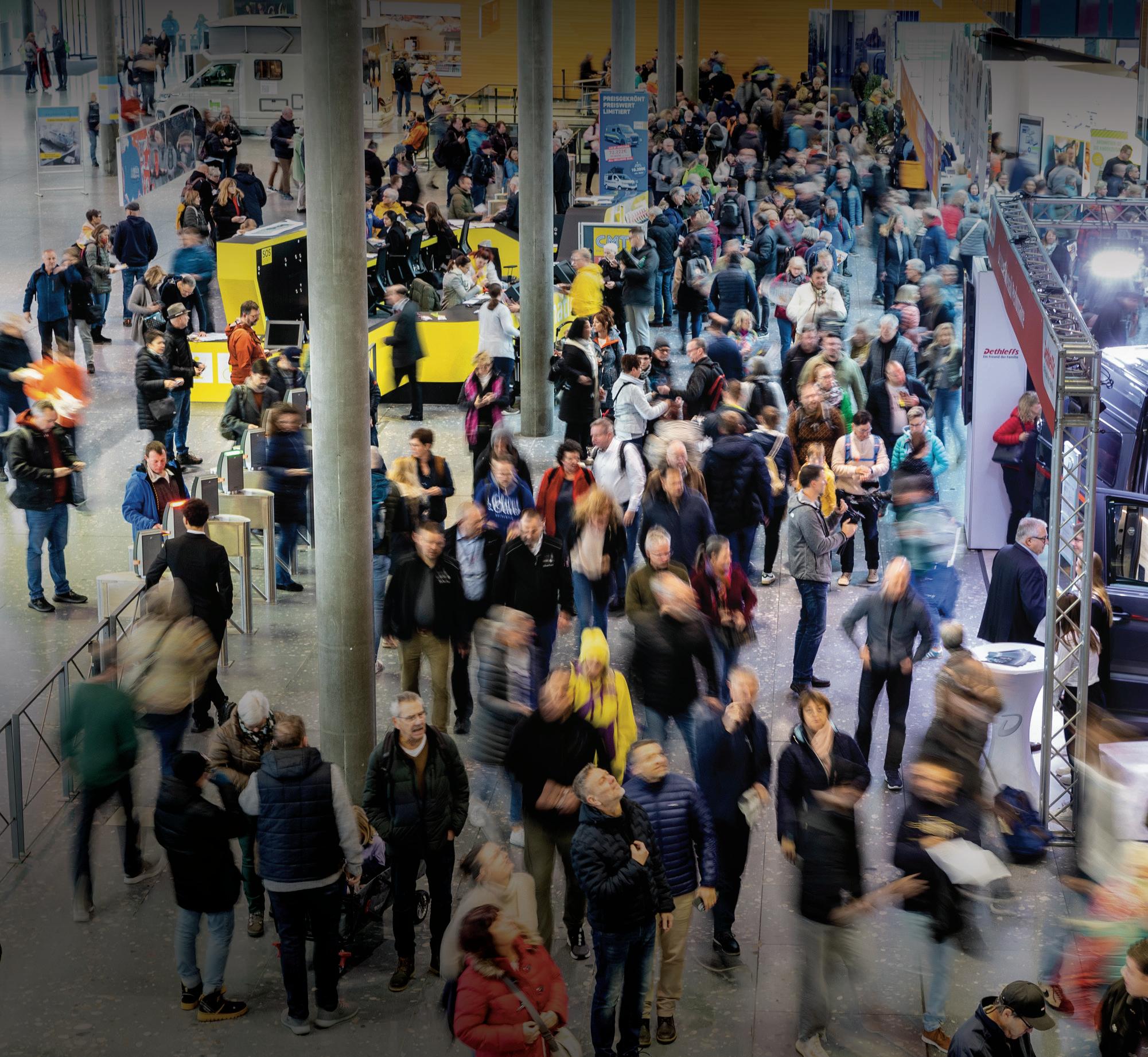

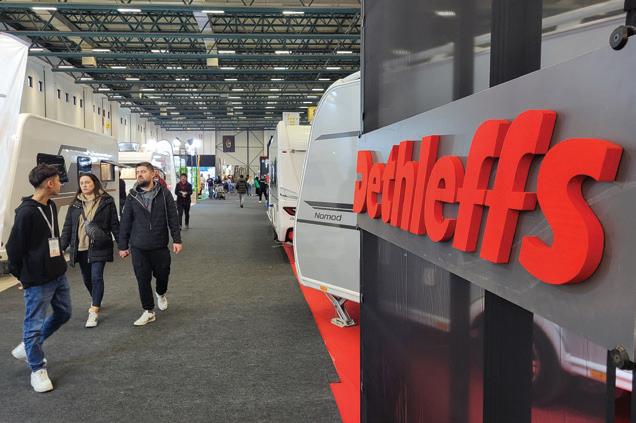

• 92 CMT Stuttgart

CMT again proves to be a “mood lifter”

• 104 Germany

Overview of the largest European RV market Market

3

42

Issue

Editor’s note

MARCH/APRIL/MAY 2024

N ews

Fit Your Camper 2024: the first fair dedicated only to RV accessories

Fit Your Camper (www.fityourcamper.it) is a new show purely dedicated to accessories for motorhomes, caravans and vans. It is aimed at both industry professionals and the public and takes place from 4 to 7 April, 2023 at the Lariofiere exhibition centre at Erba, near Como in northern Italy. There will be a wide range of national and international exhibitors displaying their latest creations in terms of equipment, accessories and aftermarket components for motorhomes, caravans and vans.

“Fit Your Camper” is not just a product fair: it will also be a place for learning and entertainment. Technical areas will be dedicated to product and service presentations, while the entertainment area will host speeches and discussions on topics related to motorhome and caravan travel, with the participation of experts, influencers and journalists in the sector.

already confirmed their participation, including, to name just a few: Airxcel, AL-KO and AL-KO VTE, Brunner, CBE, Eberspächer, GOK, Filippi1971, Indel B, Lippert, Macrom, Sr Mecatronic, Teleco, Thetford, Thule, Viesa, Vitrifrigo. Many other brands will be represented by leading Italian and European distributors such as Dimatec, Ges International, Vecamplast, Campertools, Contec Group, who will showcase products from Truma, Fiamma, Webasto, VB Airsuspension and Efoy, among others, at their stands.

The first two days of the fair are reserved for industry professionals, offering them an exclusive opportunity for networking, discovery and business. Aboutcamp BtoB would like to invite industry professionals to its welcome booth where the team will be delighted to see you.

Nearly all of the most relevant brands in the sector have

Editorial

Editor in chief: Antonio Mazzucchelli direttore@aboutcamp.eu

Senior editor: Renato Antonini

Art director: Federico Cavina

Editorial team: Paolo Galvani - Terry Owen

John Rawlings - Enrico Bona - Peter Hirtschulz

Steve Fennell - David Guest - Bartek Radzimski

Irene Viergever - Giovanni Ricciardi

Giorgio Carpi - Andrea Cattaneo

Web team: Maurizio Fontana - Gabriel Lopez

Advertising

Sales International: direzione@fuorimedia.com

Sales Italy: Giampaolo Adriano

+39 338 9801370 adriano@fuorimedia.com

Web edition

Tickets are free for all trade professionals and can be booked here: https://www.fityourcamper.it/en/biglietti-pro/

Aboutcamp BtoB helps professionals in the caravan/RV and leisure industry around the world keep up to date with all the latest business news and market trends in this sector. It’s the most well informed source of B2B information in the caravan industry, with a unique global perspective and an international team of correspondents delivering daily news online at www.AboutcampBtoB.eu, a bi-monthly e-newsletter, and a high quality print magazine delivered (free) in Europe, the United States, Australia, New Zealand, South Africa, Japan, China, Korea, Argentina, Brazil, Chile. The Aboutcamp BtoB magazine is published four times a year with features including exclusive interviews with senior management from the industry, reviews of the major exhibitions around the world, and reports about the latest market trends, plus in-depth profiles of OEM suppliers who specifically manufacture components for this sector. With all the recent acquisitions, new technological developments and more and more consumers buying leisure vehicles around the world, Aboutcamp BtoB is essential reading for everyone working in any business related to the caravan industry. While so many flock to the internet, and have an inbox full of emails, Aboutcamp BtoB decided to print a paper magazine so that it gets more noticed, read, appreciated and discussed; so, we wish you happy reading!

Aboutcamp BtoB is also a website updated daily with news and information dedicated to RV builders and OEM producers. The website is supported by a professional newsletter sent monthly to the professionals in the RV sector. We also strengthened our presence on LinkedIn, where we manage the business page of the magazine but also the group “Caravanning Professional” which allows us to develop direct and informal relationships with decision-makers in the RV industry.

On our website is possible to read online the print edition of all Aboutcamp BtoB issues at: www.aboutcampbtob.eu/read-the-magazines

Fuori Media srl

Viale Campania 33 - 20133 Milan – Italy

Ph +39 0258437051 - E-mail: redazione@aboutcamp.eu

Internet: www.aboutcampbtob.eu

4

with the Milan Court on 22 Dec. 2016 at No.310. Subscription ROC 26927 Printed at Graphicscalve SpA - Vilminore di Scalve (BG) Italy

Registered

Headquarters

Would you like to receive the print edition of Aboutcamp BtoB? It is free of charge! Subscribe on www.aboutcampbtob.eu

Print edition

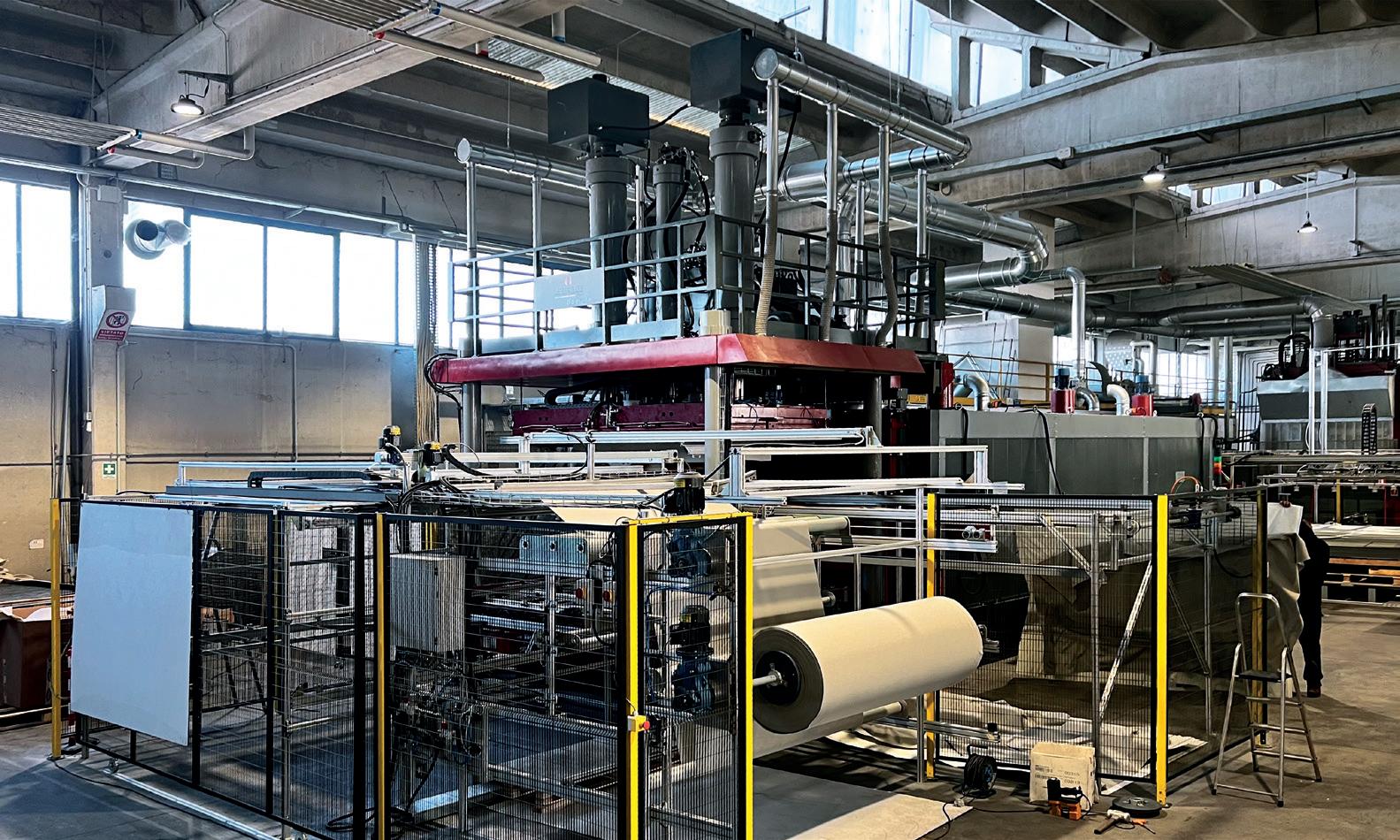

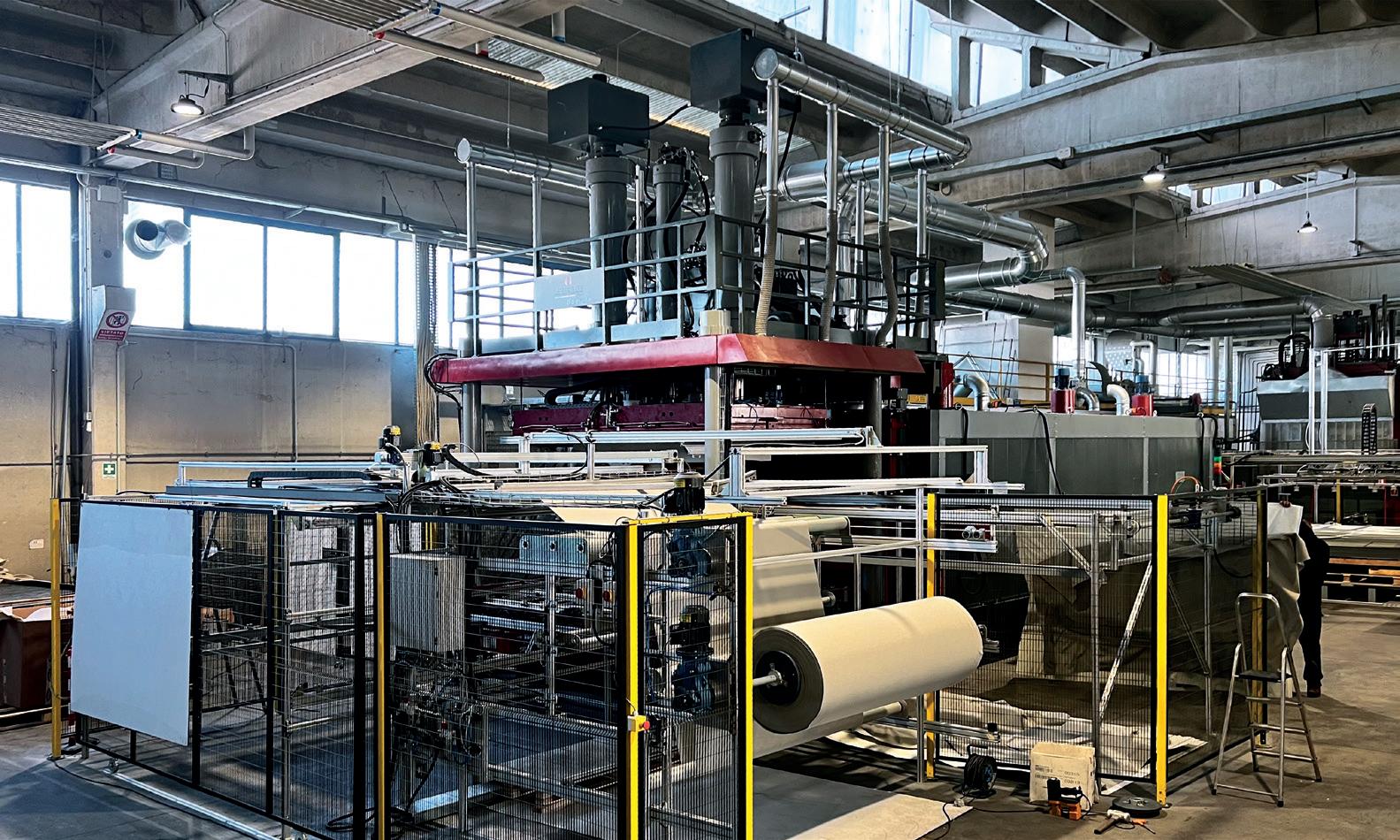

Amerimax for Mobility joint venture

Lippert has announced that is entering into a strategic alliance with Euramax for Mobility, the largest European supplier of aluminum products for recreational and transportation vehicles, through its affiliate, Amax Mobility, LLC, to form a new joint venture: Amerimax for Mobility. With over 50 years of experience in partnering and supplying custom aluminum sidewalls and panels to the recreational and transportation OEM markets, Lippert and Euramax are combining efforts to provide one of the most diverse product catalogues, including a wide range of new products, as well as industry-leading customer service, for the recreational vehicle and transportation OEM markets. The combined product lines of Amerimax for Mobility will of-

fer a complimentary range of products from traditional metal fabricated panels, prepainted aluminum sheets and coils with a width up to 103 inches, to highstrength premium laminates, as well as fiberglass reinforced polyester panels. The new joint venture combines Lippert’s deeply rooted North American RV industry relationships with Euramax for Mobility’s extensive manufacturing expertise. Amerimax for Mobility’s North American OEM customer base can expect immediate manufacturing and supply chain advantages, most notably an increase in manufacturing capacity and product availability that will bring customer experience and service to all new levels. Amerimax for Mobility has also strategically expanded the geographic footprint of its service locations to provide world-class customer service at three locations in Elkhart County, Indiana, as well as single locations in Mansfield, Texas; Stayton, Oregon; and Perris Valley, California.

Winnebago: first quarter fiscal 2024 results

The financial results for Winnebago Industries, Inc. in its Fiscal 2024 first quarter (ended November 25, 2023) show total revenues of $763.0 million, a decrease of 19.9% compared to $952.2 million for the Fiscal 2023 first quarter. This decrease was primarily driven by lower unit sales related to market conditions, product mix, and higher discounts and allowances compared to prior year, partially offset by carryover price increases related to higher motorized chassis costs. Gross profit for the Fiscal 2024 first quarter was $115.8 million, a decrease of 27.8% compared to $160.4 million for the Fiscal 2023 first quarter. Gross profit margin decreased 160 basis points from prior

year to 15.2% primarily as a result of volume deleverage and higher discounts and allowances. Operating income was $39.1 million for the Fiscal 2024 first quarter, a decrease of 54.5% compared to $85.9 million for the first quarter of last year. Fiscal 2024 first quarter net income was $25.8 million, a decrease of 57.1% compared to $60.2 million in the prior year quarter. Revenues for the Towable RV segment were $330.8 million for the Fiscal 2024 first quarter, down 4.8% compared to the prior year, primarily driven by a reduction in average selling price per unit related to product mix and targeted price reductions, partially offset by unit volume growth. Revenues for the Motorhome RV segment were $334.4 million for Fiscal 2024 first quarter, down 28.0% from the prior year, primarily driven by a decline in unit volume related to market conditions and higher levels of discounts and allowances, partially offset by product mix and price increases related to higher motorized chassis costs.

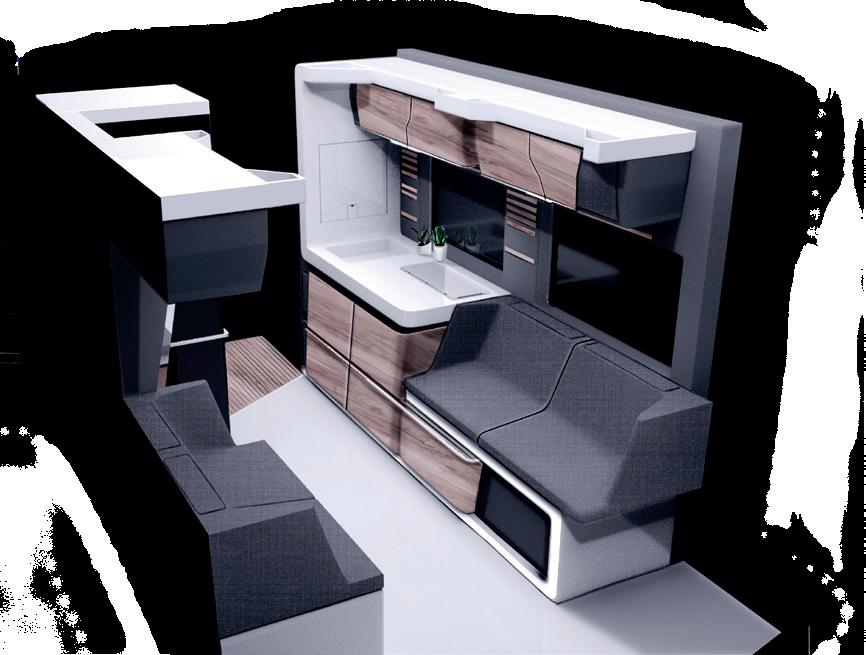

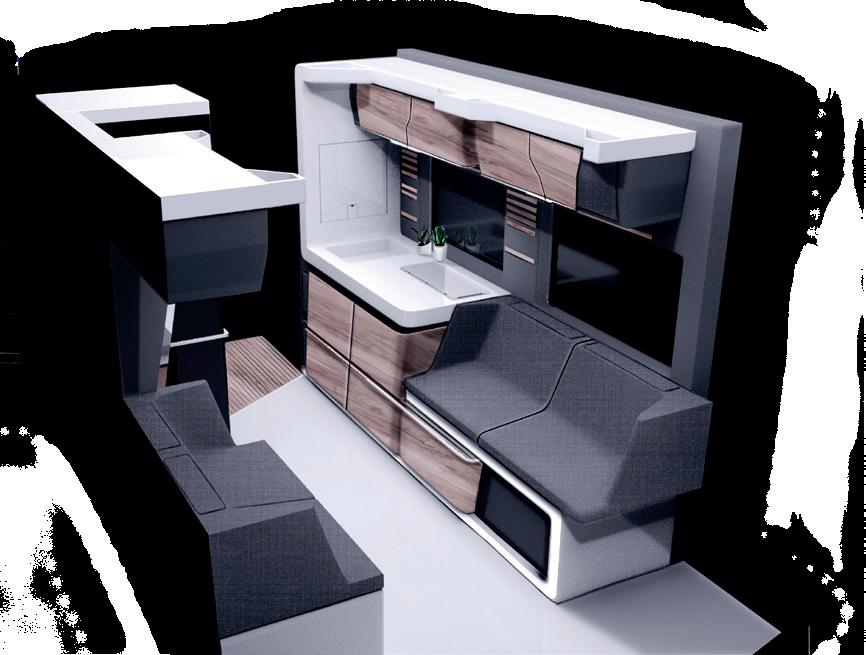

Pininfarina-designed electric motorhome stars at CES 2024

The iconic Italian design house, Pininfarina, has partnered with AC Future, an innovator in developing futuristic living solutions, to conceptualize and design an electric RV called the eTH – Electric Transformer House which was shown to the public at the CES 2024 show in Las Vegas in January. The eTH is more than just an RV, and offers a sustainable living platform, providing an extraordinary travel and living experience with various expandable structures tailored to everyone’s living habits and preferences. Each product features Starlink connectivity, copilot assistance, and customizable interior and exterior colour options to provide an optimal living, working, and travelling experience. Among eTH’s distinctive features are moveable walls, which expand to 400 sq ft at the push of a button to significantly enhance the living space, redefining the concept of a home on wheels. The retractable solar panel roof captures and converts sunlight into electricity, generating +25kWh, and prioritizes sustainable living. Further, eTH’s Atmospheric Water Generator system converts moisture from the air with up to 50L of ambient clean water daily. In addition to its expandable walls, eTH boasts collapsible and modular furniture that condenses for easy driving and parking — striking a balance between maneuverability and spacious living. It can also serve as both an Accessory Dwelling Unit (ADU) and a moving office. All of eTH’s features as well as the vehicle itself are powered entirely by green energy with 7 days of off-grid capabilities.

6

N ews

Aboutcamp BtoB is media partner of interzum forum italy

Aboutcamp BtoB has partnered as a media partner of interzum forum italy, the new major international appointment signed Koelnmesse for subcontracting and interior design sector. A biennial event that will alternate with interzum Cologne and will be held at the Fiera di Bergamo on 6 - 7 June 2024. The format is innovative: a two-day event in which the latest innovations will be presented in a modern and functional exhibition area, and where sector operators will have the opportunity to keep up to date with the latest trends, thanks to a rich and articulated program of high-level congresses - talks, trend stages, product stages - that will see the participation of prestigious Italian and international speakers. On June 6 at 1:00 PM, our senior editor Renato Antonini will speak at a talk titled “LIFESTYLE TREND-

SETTING: living, working, sailing, and cruising, moving.” The speaker lineup includes Giulio Salvadori, Director of the Internet of Things, Connected Car & Mobility, and Smart City Observatories at the Digital Innovation Observatories - School of Management - Politecnico di Milano; Sergio Buttiglieri, Style Director at San Lorenzo (+ Matchmaking); and Edi Snaidero, President of EFIC (European Furniture Industry Confederation) and kitchen sector representative within FederlegnoArredo. Renato Antonini, architect and journalist, started his career as a designer. But soon he decide to dedicate full-time to his passion: recreational vehicles, particularly motorhomes. Since 1997, he has been working as a journalist, specializing in the specific theme of RVs. “The world of recreational vehicles is undergoing rapid transformation; motorhomes and caravans still represent the main categories, but new derivative types are emerging, implying dif-

ferent internal living layouts and multiple furnishing solutions” says Renato Antonini. “The ways of usage are also changing. The difference is not only in the color tones of the decorations; today’s challenge revolves around the relationship between lightweight design and cost. New materials are entering the scene, and home automation is taking its first steps on RVs. The industry partly embraces trends from the home furnishing sector and partly creates its own language, resulting in specialized products. Motorhomes and caravans are no longer just holiday vehicles; they have become multifunctional spaces, perfect for remote work as well as supporting various sports activities”.

7

Sonja Gole retires from Adria Mobil

After almost 28 years of managing Adria Mobil, Sonja Gole, has decided to retire and left the company at the end of February. She will be succeeded by Gregor Adler. Adler has a Bachelor degree in economics (University of Ljubljana) and has extensive, long-term experience in various companies and management positions. Based on the confirmation of the company’s supervisory board, Gregor Adler took over the management of Adria Mobil in the position of General Manager as of March 1st, 2024. Sonja Gole has been connected with Adria Mobil throughout her entire professional career, and in 1996 was entrusted with the most important function – at that time she became the General Manager and took over the leadership of Adria Mobil. At that time the company only had 186 employees, and Sonja Gole and her team laid new foundations for the business strategy and reorganized both the business model and the sales network across Europe. In the following decades Sonja Gole managed to stabilize the company and successfully lead it through all the turbulent periods of crises, economic fluctuations and geopolitical friction. The sales network expanded, the amount of products sold grew and the Adria brand became more and more recognizable, respectable and desirable among customers. Adria Mobil is today recognized as one of the most reputable manufacturers in the European industry of recreational vehicles, while its products are among most desired in Europe and produced in one of the most technologically advanced production facilities in the industry.

Mercedes: longwheelbase versions

Mercedes-Benz product range expanded in small van segment: sales launch for long-wheelbase versions of the Mercedes-Benz T-Class and Mercedes-Benz Citan Tourer and Marco Polo camper module. The Mercedes-Benz T-Class and the Citan Tourer are around 42 centimetres longer than before, with a vehicle length of just under five metres. The flexible Marco Polo camper module is now also available from dealers in Germany. It makes it possible to transform standard-length small vans into a micro camper and back in no time.

8 N ews

Extension of driving licences to 4.25 tonnes gets one step closer

Further progress has been made towards an extension of the B driving licence to 4.25 tonnes for motor caravans by the European Parliament. In its first reading on the reform of the Driving Licence Directive, the European Parliament approved an extension of the B driving licence to 4.25 tonnes for motor caravans and in December 2023, the second EU institution also gave the green light for the driving licence amendment the caravanning industry has been calling for. The exact framework conditions for the extension of driving licences will be negotiated in the trialogue between the Commission, Council and Parliament after the new elections to the European Parliament (6 to 9 June 2024). An extension to 4.25 tonnes offers the opportunity to make sustainable and family-friendly travel by motor caravan accessible to millions of people in the future. The European caravanning industry has been campaigning for years through its umbrella association, the European Caravan Federation (ECF), to extend the weight limit of the B driving licence to 4.25 tonnes for all motorhomes.

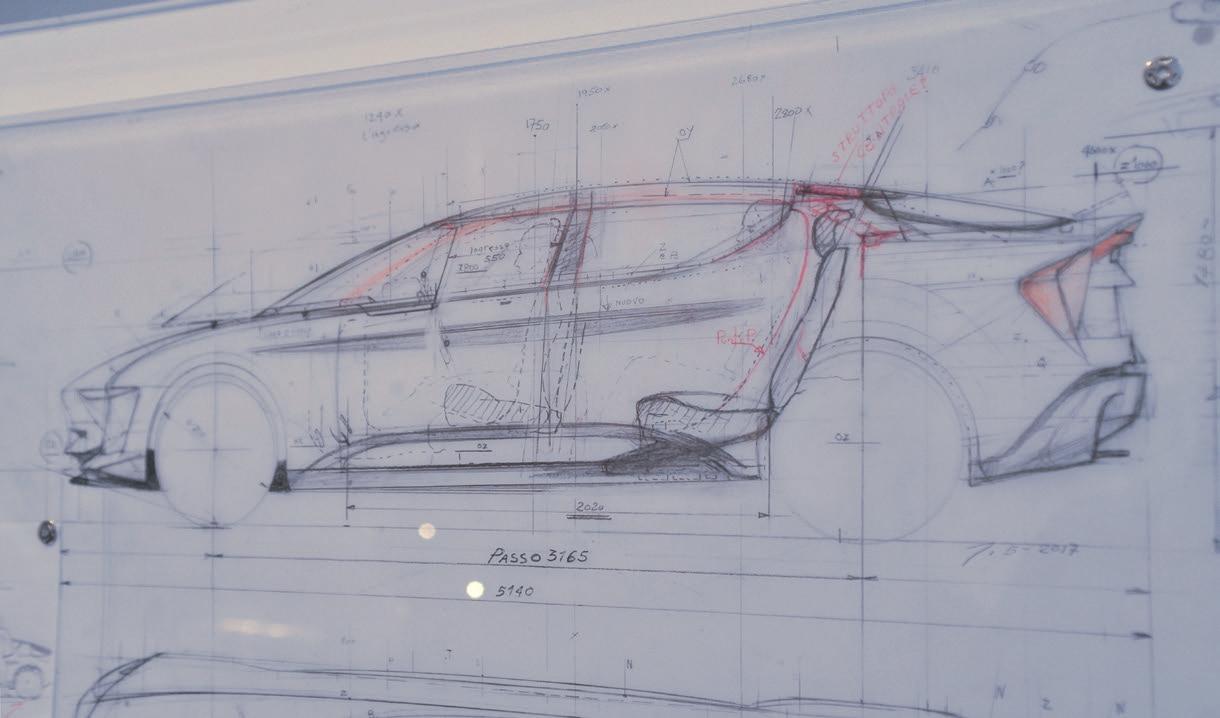

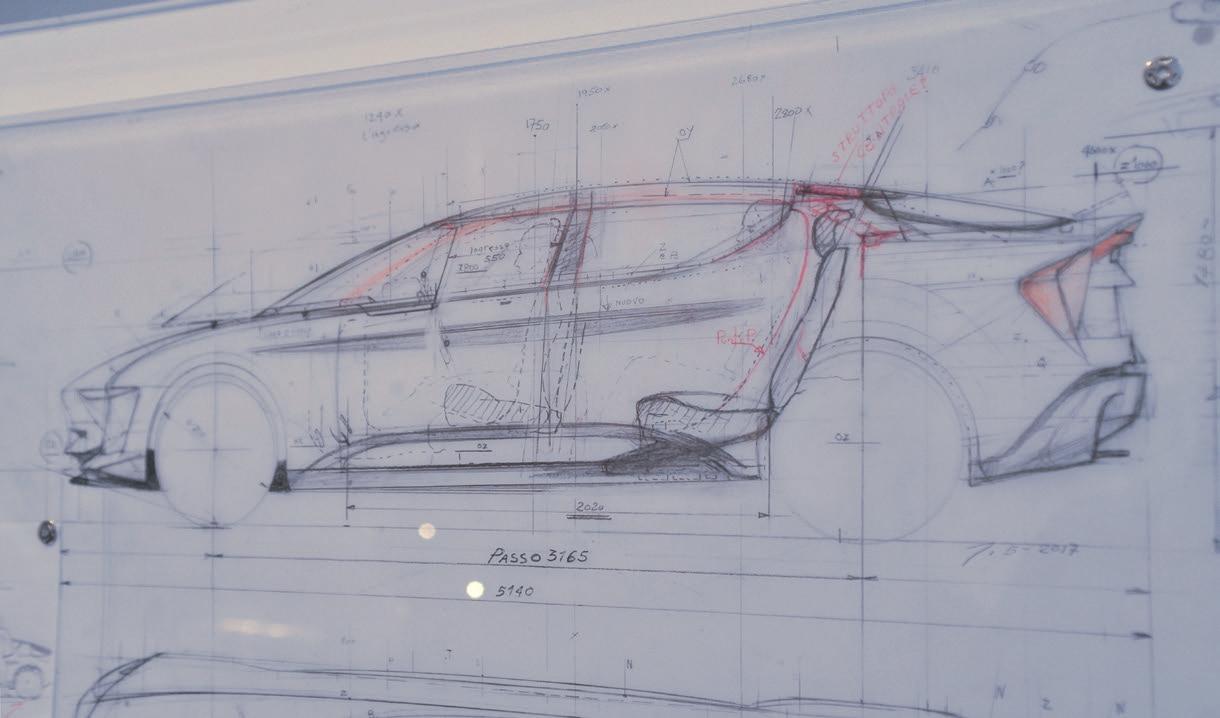

Laika wins top awards for its Kreos motorhome

The Erwin Hymer Group brand, Laika, is celebrating receiving two awards for its new Kreos motorhome range. Kreos is the flagship of the Laika motorhome range and it won “Best Luxury Motorhome” category at the Motorhome Awards 2024 in the UK. It also received a “Special Mention” at the German Design Award in the “Excellent Product Design – Automotive Parts and Accessories” category. Introduced in August 2023, the Kreos H 5109 was developed from concepts by the Italian design studio “GFG Style”: a choice that focuses on quality and the continuation of a fruitful relationship that began in 2021 with the design of the Kreos L 5009. The Motorhome Awards, in association with Creation Personal Finance, are organised every year by the magazines “MMM”, “What Motorhome” and “Campervan”. The German Design Award is a prize of absolute international standing that has been organised by the German Design Council since 2012 and is awarded to those who present innovative projects in the field of design.

9

Dometic full year 2023 results show organic net sales declined by 12 percent

Dometic’s latest financial results report that tougher market conditions caused full year 2023 organic net sales to decline by 12 percent.

President and CEO, Juan Vargues said: “We are very proud of the results that we have achieved in a very challenging 2023. Thanks to our dedicated employees around the globe, we continued to take several important steps on our strategic transformation journey while we at the same time took necessary short-term cost reduction actions to protect margins and cash flow. In a challenging market environment, impacted by geopolitical and macroeconomic uncertainty in combination with high inventory levels, we continued to demonstrate that we have become a resilient, fast-moving and more effective company. Due to the tough market situation, full year 2023 organic net

sales declined by 12 percent, while the EBITA-margin before items affecting comparability showed solid year-on-year improvements in the second half of the year and ended at 12.5 percent for the full year. Reducing working capital was a top priority and operating cash flow of SEK 5.2 b for the year was our strongest ever. The long-term trends in the Mobile Living industry are strong, however it remains difficult to predict how the current macroeconomic situation and market conditions will impact the business in the short term.”

Four RV companies named as some of America’s Most Responsible Companies

Newsweek has named no less than four big companies in the RV industry, Winnebago Industries, Thor Industries, Lippert and Cummins, as some of America’s Most Responsible Companies for 2024. For the fifth year, Newsweek has partnered with global research and data firm Statista for its annual list of America’s Most Responsible Companies. Out of 600 of the largest corporations in the United States, the highest scoring company involved with the RV industry were Cummins, ranked 195, Lippert (LCI Industries), ranked 221, and Thor Industries and Winnebago Industries ranked equal at 476. Corporate responsibility encompasses environmental, social, and corporate governance (ESG). However, at the core is the idea that businesses should support the communities in which they belong.

Filippi 1971 opens new warehouse in Australia

In addition to its new website it recently introduced for its OEM customers in Australia, Filippi 1971 has now opened a new, larger warehouse in Epping, Melbourne to increase the amount of stock it can store and provide a quicker delivery service to RV manufacturers. The new 1,000 m² warehouse is in Epping, Melbourne, which is closer to the Victorian caravan industry than the previous one in Thomastown, meaning it can provide quicker deliveries and demonstrate Filippi 1971’s commitment and service level to its customers in Australia.

Leisure-Tec Australia becomes distributor for Vitrifrigo fridges

Leisure-Tec Australia is now a distributor for the Italian refrigeration manufacturer, Vitrifrigo, adding to its portfolio of caravan, motorhome, camping and 4WD premium products. Leisure-Tec Australia CEO, Paul Widdis, said: “With Vitrifrigo being added to its distribution in Australia, we can provide caravan and motorhome manufacturers with the opportunity to provide their customers with a world-leading premium brand, as well DIYers and 4WD enthusiasts. Vitrifrigo,” he continued, “have a world class reputation in refrigeration and the new Chromelock series of light weight fridges we have added to our product portfolio range, will add reliability and durability to caravans, camper trailers, motorhomes, vanlifers and 4WDs, and more importantly keep food and drinks nice and cold and fresh.”

10

N ews

THOR Industries Q2 fiscal 2024: net sales of $2.21 billion

The second quarter 2024 fiscal highlights for THOR Industries include consolidated net sales of $2.21 billion (compared to $2.35 billion for the second quarter of fiscal 2023) and a consolidated gross profit margin of 12.3%.

North American Towable RV net sales were down 11.9% for the second quarter of fiscal 2024 compared to the prior-year period, driven by a 10.2% increase in unit shipments offset by a 22.1% decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to the combined impact of a shift in product mix toward travel trailers and more moderately-priced units along with price compared to the prior-year period. North American Towable RV gross profit margin was 7.4% for the second quarter of fiscal 2024, compared to 6.4% in the prior-year period. The increase in gross profit margin was primarily driven by a decrease in the material cost percentage, due to the combined favorable impacts of product

mix changes and cost-savings initiatives, partially offset by higher labor and manufacturing overhead percentages.

North American Motorized RV net sales decreased 22.8% for the second quarter of fiscal 2024 compared to the prior-year period. The decrease was primarily due to an 18.4% reduction in unit shipments, partly due to independent dealer restocking in the prior-year period, as well as a 4.4% decrease resulting from changes in product mix and net price per unit as current-year shipments trended toward more moderately-priced units and included elevated sales discounts compared to the prior-year period. North American Motorized RV gross profit margin was 10.6% for the second quarter of fiscal 2024, compared to 14.5% in the prior-year period. The decrease in the gross profit margin for the second quarter of fiscal 2024 was primarily driven by an increase in sales discounts and chassis costs as well as an increase in manufacturing overhead cost

as a percentage of net sales due to the reduction in net sales.

European RV net sales increased 20.9% for the second quarter of fiscal 2024 compared to the prior-year period, driven by a 3.9% increase in unit shipments and a 17.0% increase in the overall net price per unit due to the total combined impact of changes in foreign currency, product mix and price. The overall net price per unit increase of 17.0% includes a 4.1% increase due to the impact of foreign currency exchange rate changes.

European RV gross profit margin was 15.3% of net sales for the second quarter of fiscal 2024 compared to 14.1% in the prior-year period. This improvement in the gross profit margin for the quarter was primarily driven by net selling price increases, product mix changes and a reduction in labor costs as a percentage of net sales.

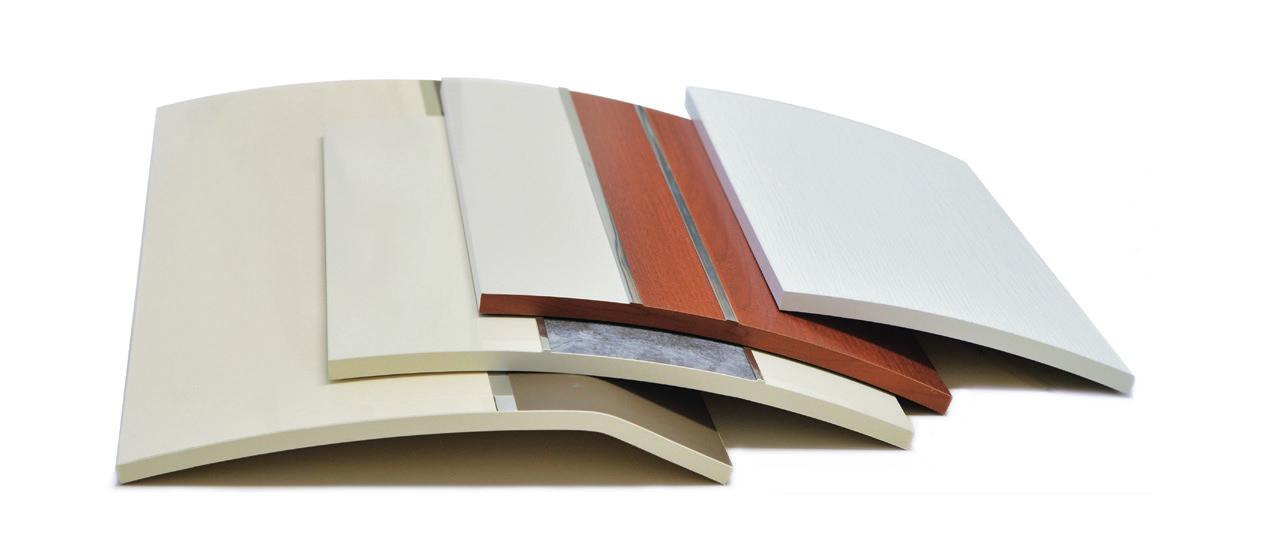

11 Manufacture of furniture and accessories: we are proud to guarantee to our customers flexibility and a high degree of customizability. Fratelli Naldini is one of the Italian companies with the most extensive experience in the RV sector, thanks to 60 years of successful activity. Via del Chianti, 31 • 50028 Barberino Tavarnelle FI • Italy Tel: +39 055 8077928 • naldinisrl@naldinisrl.com www.fratellinaldini.com furniture care quality since 1961 Our experience at your service Production of flat and curved kitchen doors and lockers

Naldini Srl

Fratelli

Over 95,000 visitors to the UK’s Caravan, Camping and Motorhome Show

Against a backdrop of a difficult economic climate, 95,647 visitors headed to the UK’s 2024 Caravan, Camping & Motorhome Show at the National Exhibition Centre (NEC), Birmingham between 13-18 February. This compares to 108,000 visitors to last year’s show.

Karen Dodd, Marketing Director at NCC Events, said: “We are really pleased with the outcome of the Show. The economic environment is

challenging at the moment, so it was great to welcome so many visitors to the event and in turn, sales for our exhibitors. The appetite for spending quality time touring and exploring the outdoors whether it be camping under canvas, in a caravan, campervan or motorhome, is as popular as ever. We’re looking forward to building on the success of the Show to deliver an even greater choice of products, travel inspiration, advice and activities for visitors in 2025 – watch this space!”

Ben Parking, Sales Director at Coachman, said: “The Show was very well attended and we’re really happy with what we sold. We’ll definitely be back in October with even more vehicles.”

Slavica Sterk, Managing Director at Adria, said: “The Caravan Camping

& Motorhome Show is always a great start to the year for Adria, generating the start of the Spring sales. The Show has a great energy and is full of enthusiastic prospective buyers who share our passion for the great outdoors. The Show is the best opportunity for visitors to see all things camping under one roof, and also great for us as manufacturers to showcase all of our ranges to tens of thousands of people over just a few days. It was a great Show with strong sales figures and a strong customer demand for Adria vehicles, and we are all looking forward to the next show in October 2024.”

Many exhibitors will be returning to the NEC later this year to see the new for 2025 model launches from UK and European manufacturers and dealers at the Motorhome and Caravan Show, 15-20 October 2024.

Billed as the UK’s biggest leisure vehicle showcase, tickets are now on sale at https://mcshow.co.uk

12

N ews

AL-KO opens new centre in Sweden to serve Scandinavia

AL-KO Vehicle Technology (VT) has expanded its service centre in Skene near Gothenburg, Sweden, into a fully equipped AL-KO VT customer centre to serve the entire Scandinavian region. The opening has extended its European network of customer centres to eight sites (which are in France, the Netherlands, Italy, Austria and three in Germany). The new customer centre covers 980 m² and is located 50 kilometers south of Gothenburg. It offers a customer reception area and a showroom as well as a large, fully-equipped workshop. It sells and fits products from the group’s brands of AL-KO, E&P, CBE and SAWIKO, including towbars, bicycle and motorbike carriers, levelling systems, air suspensions, maneuvering aids, stability aids and solar panels. It also offers caravan payload-increase services and classic service and repair work on chassis and braking systems.

RV Industry Association: federal legislative priorities

The RV Industry Association’s Government Affairs team has shared its 2024 federal legislative priorities. It has four main goals for the year: reauthorizing the Generalized System of Preferences; reforming competitive needs limitations through the CNL Update Act; passing the outdoor recreation package; and passing the Travel Trailer and Camper Tax Parity Act. The definition of motor vehicle in the federal tax code inequitably impacts certain segments of the RV industry. While floor plan financing interest charges on motorhomes remains fully deductible, towables— which make up 85% of RVs— are now limited to deductions of only 30% of interest expenses based on earnings before interest and tax. This is unfair and was not the Congressional intent behind changing the definition of motor vehicle. The Government Affairs team continues to urge Congress to pass House and Senate Travel Trailer and Camper Tax Parity legislation. Progress was made on this issue during the summer and fall of last year.

13 … AND

CAMPER

A

BECOMES A SUITE.

FIAT Ducato voted Motorhome Base Vehicle of the Year 2024 by readers of Promobil

For the 16th year in a row, readers of the motorhome magazine “Promobil” in Germany have voted the FIAT Professional Ducato as the “Best Motorhome Base Vehicle of the year” in its annual readers’ choice awards. Promobil readers could choose from 270 motorhome series divided in 10 different categories, and a total of

23 vehicles were nominated as base vehicle. The Recreational Vehicle sector represents a significant proportion of the total production of the Fiat Ducato and this award for “Best Motorhome Base Vehicle 2024” confirms the trust customers have in FIAT Professional Ducato as their leisure companion. The cornerstone of the Ducato’s success is the strategy of designing the vehicle as a platform for extensions right from the development stage. The FIAT Professional Ducato has been manufactured at the Atessa plant in Val di Sangro (near Pescara, Italy) for more than 40 years. Today, the community of Ducato-based motorhome owners has grown to over 1 million members who travel all over Europe.

KOA reports another year of growth in 2023

Kampgrounds of America, Inc. (KOA) had a successful year of growth in 2023 with 12 independent park conversions secured and eight new construction contracts last year, contributing to its growth in branded locations to 511 across North America. The 20 agreements are attributed to the KOA franchise development team’s dedicated efforts, which mark a significant rise from 14 agreements in the previous year and underscores the organization’s resilience and adaptive strength in the evolving travel, camping and outdoor hospitality industry. “KOA is the go-to partner for conversion and new build campgrounds,” said Chris Fairlee, chief acquisition officer. “The equation is easy for owners to see how our brand and services set them up for success and create operational efficiencies.”

KOA maintains a pipeline for future expansions, including six parks in the process of converting to a KOA-branded campground and 26 new construction franchise campgrounds, plus three owned properties earmarked for development. With a healthy franchise renewal rate of 95%, KOA

could easily reach 550 campgrounds in the next few years.

“The combination of high renewal rates amongst our existing franchisees, along with the healthy influx of new franchisees and new campgrounds, is a clear indication that KOA is meeting the needs of our customers – both campers and franchisees alike,” said Toby O’Rourke, president and CEO of Kampgrounds of America, Inc. “Our comprehensive range of services, from marketing and KOA.com to campground design and our proprietary Property Management System, K2, we are undoubtedly valuable at every stage of our franchisees’ business lifecycle. I am incredibly proud of what our teams have accomplished and am excited for what 2024 and beyond holds for KOA.”

Thetford top for Toilet Systems

In an annual survey, readers of the German RV magazine, Promobil, who voted for their best brands of 2024 put Thetford as number one in the Toilet Systems category (again) by an overwhelming majority. They also placed Thetford second in the Refrigerators and Cool Box category. There are few brands in any market that have been a market leader for such a long period of time, which suggests high customer satisfaction.

A fair and balanced approach to EVs

The Caravan Industry Association of Australia is calling for a ‘fair and balanced approach to electric vehicles’ in relation to the proposed New Vehicle Efficiency Standards (NVES) in Australia. Stuart Lamont, CEO of Caravan Industry Association of Australia, has pointed out that the Australian caravanning industry is just one industry which can be expected to be heavily impacted and a unintended casualty of an aggressive and accelerated move towards a low emission environment. “We can certainly argue surprise at some of the hard line targets and timings which have been suggested, and what appears to be a lack of consideration for a range of other technologies which could also assist in better outcomes for the planet – in many cases the infrastructure needed to support electrification of Australia’s new vehicle fleet in the regions and between regional centres simply appears to be insufficient for what is required in the timeframes needed, let alone allowing for other low emission technologies such as hydrogen or bio fuels to be able to be commercially developed in time to meet the Government’s speedy desires,” commented Stuart Lamont.

14 N ews

Kia’s Platform Beyond Mobility concept vehicles at CES 2024

Kia has revealed its Platform Beyond Vehicle (PBV) future strategy at CES 2024 in Las Vegas. Kia’s PBV business will initially be based around the introduction of an all-new modular vehicle, previewed by the Kia Concept PV5, and includes commercial vehicle variants that might be of interest to the RV sector. Kia says its PBVs are a ‘total mobility solution’ that combine fit-for-purpose EVs with advanced software solutions based on the Hyundai Motor Group’s software-to-everything, or SDx, strategy. As a Platform Beyond Vehicle, Kia PBVs will open the door to new businesses and lifestyles by redefining the concept of space thanks to advanced, tailored interiors that provide ultimate freedom and flexibility. The launch of Kia’s PBV business will see the brand commit to providing a varied range of customised vehicle types to meet customers’ individual

requirements. Phase one will see the introduction of the Kia PV5, a versatile EV optimised for major domains such as hailing, delivery and utilities that features conversion capability for diverse

customer needs. Enhanced data connectivity between vehicles and external data such as route or delivery information will enable convenient operation of multiple vehicles as a software-defined fleet. This emergence of customised

business fleets and PBV-specific solutions means less downtime and enhanced cost-effectiveness. Phase two will see the completion of the dedicated PBV model line-up, and PBVs will evolve into AI-based mobility platforms that use data to interact with users and ensure that the vehicles are always up to date. An integrated PBV solution will provide a customised, seamless experience across devices and software. Meanwhile, new forms of business linked with robotics and other future technologies will emerge. In phase three, Kia PBVs will evolve into highly customisable, bespoke mobility solutions by integrating with the future mobility ecosystem. This is where Kia PBVs will ultimately become life platforms that turn any inspiration into reality. Connected self-driving vehicles will be managed as part of a single smart city operating system.

15

Derubis to start caravan production in Saudi Arabian market

Derubis, the boat and caravan manufacturer from Bosnia and Herzegovina, is entering the Saudi Arabia market with the establishment of the first leisure vessel shipyard and caravan factory in the Kingdom of Saudi Arabia, within the King Abdullah Economic City (KAEC). This expansion marks a significant milestone in Derubis’ global growth strategy, positioning the company as a key player in

the region’s maritime and leisure industries. Derubis has signed a Joint Venture agreement with Zahrani Holding Group, an investment conglomerate established in 1975 specializing in a broad spectrum of industries ranging from construction and contracting to travel and tourism. This collaboration leverages both groups’ industrial expertise to expand within the luxury vessel and caravan market, regionally and globally. Construction of the first leisure vessel shipyard and caravan factory commenced in February 2024, marking a historical moment for Saudi Arabia and the beginning of Derubis’ journey into the Saudi Arabian market. The first leisure vessel shipyard and caravan factory will be located within the King Abdullah Economic City (KAEC) industrial valley

development area, which spans 185 square kilometers across the coast of the Red Sea, home to King Abdullah Port, which was named Most Efficient Container Port Globally by The World Bank in 2021. In the first year, Derubis plans to produce 16 power catamarans (hybrid and electric propulsion), and 240 caravans. Looking ahead, the company aims for a maximum annual production of 50 power catamarans and 480 caravans. This strategic move aligns with Saudi Arabia’s Vision 2030, a blueprint aimed at diversifying the kingdom’s economy and reducing its reliance on oil. By investing in sectors such as leisure and tourism, Derubis contributes to the realization of Vision 2030’s goals, fostering economic growth, job creation, and sustainable development in the region.

Lippert full-year results describe 2023 as a ‘challenging environment’

Full year (2023) results for LCI Industries (“Lippert”) show sales of $3.8 billion and net income of $64 million. As a result of a year for the RV industry that Lippert describes as ‘a challenging environment’, its net sales were down 27 percent and net income down 84 percent compared to the previous year. Lippert says that January 2024 sales are 13 percent ahead of the same month in 2023 primarily due to an approximate 57% increase in North American RV production, and partially offset by an approximate 44% decline in marine sales compared to January 2023. The decrease in year-over-year net sales was primarily driven by a nearly 39% decrease in North American RV wholesale shipments, decreased selling prices which are indexed to select commodities, and lower North American marine production levels, partially offset by net sales from recent acquisitions. Net sales from acquisitions completed in 2022 and 2023 contributed approximately $73.6 million in 2023. The company delivered $527 million of cash from operating activities in 2023. Commenting on these results, Jason Lippert, LCI Industries’ President and Chief Executive Officer said: “Throughout the year, our consistent execution on diversification priorities and steadfast commitment to operational discipline has supported our performance despite continued softness in the RV and marine markets.

Remarkable strength in our Aftermar-

ket business, where we continued to see robust performance, coupled with solid results and leadership in our other diversified businesses, significantly contributed to our profitability as we navigate a challenging industry environment. Our focus on operational improvement and investments in automation leave us well-positioned to drive profitable growth when production starts to normalize in 2024,”

Knaus Tabbert extends CEO Wolfgang Speck’s contract

The Supervisory Board of Knaus Tabbert AG has extended the contract of CEO Wolfgang Speck until the end of 2026 which means he will remain CEO for almost another three years. CFO Carolin Schürmann will leave the company for personal reasons on March 31, 2024. As CEO Wolfgang Speck takes over the CFO functions of Accounting & Taxes, Controlling, Costing, IT & Organization and Investor Relations; the Management Board is reduced to three members. In addition to Wolfgang Speck, this includes Head of Sales (CSO)

Gerd Adamietzki and COO Werner Vaterl, who is also responsible for the production of the wide range of motorhomes and caravans at the four locations.

16 N ews

The new Ducato and its three siblings

The Stellantis group has completely revamped its range of light commercial vehicles by simultaneously launching 12 new models. There is a strong focus on electric vehicles, with options providing a range of up to 420 km. Once again, the star of the recreational vehicles segment is the Fiat model

With the slogan ‘Six brands, one force,’ Stellantis presented a complete overhaul of its range of light commercial vehicles, launching 12 models across all segments under its brands Citroën, Fiat Professional, Opel, Peugeot, and Vauxhall. Additionally, there was a preview of the new Ram ProMaster EV, which was launched at the end of 2023. The presentation conference also emphasized the ecological transition, with the announcement of second-generation Battery Electric Vehicles (BEV) offering increased range across all models (up to 420 km). In 2024, the lineup will expand to include medium and large vans with hydrogen fuel cell technology. This unprecedented announcement in terms of scale and content underscored Stellantis’s strength in global markets: first position in Europe and Latin America, second in Africa, and third in North America. A third of the entire group’s revenue comes from the commercial vehicle market, which is already well-positioned in the electric vehicle market. In 2023, Stellantis reaffirmed its leadership in the sector, holding over 30% market

share in Europe and 45.5% in Italy. The Fiat Professional brand led sales in Italy with a 26.1% market share, driven mainly by the best-selling Ducato, achieving a 29.3% market share in its segment. In the same segment, including Peugeot Boxer, Citroën Jumper, and Opel Movano, Stellantis’s market share rose to 43.8% (+7.2%).

Fiat Ducato: the star in the recreational vehicles segment

The true star in the recreational vehicles sector is the Fiat Ducato, a model continuously produced since 1981. The flagship model of the Fiat Professional range celebrated its status as the ‘Best Camper Base 2024,’ elected by Promobil for the sixteenth consecutive time, and the ‘Best Camper Base’ voted by Auto Zeitung readers. The Ducato is a global model sold in over 80 countries worldwide and one of Fiat’s all-time best-selling models, with over 3.5 million vehicles produced in forty years. Thanks to its consistent evolution and innovations, it has become a leader in its sector, asserting its market leadership for eight

consecutive years from 2014 to 2021 and achieving continuous commercial success. On the mechanical side, the extensive range of diesel engines with the latest MultiJet generation, compliant with Euro 6E regulations, has been confirmed: a six-speed manual gearbox paired with three power levels (120, 140, 180 HP) and a new eight-speed automatic gearbox paired with 140 and 180 HP. The Heavy-Duty range with Euro 6 Step E approval is available in two power levels, 140 and 180 HP, both paired with a six-speed manual gearbox and an eightspeed automatic gearbox. Furthermore, thanks to the introduction of numerous aerodynamic improvements, the new Ducato ensures a reduction in fuel consumption and CO2 emissions of up to 9% compared to the previous generation. All this without compromising the performance of its engine, capable of delivering up to 450 Nm of torque. Regardless of the chosen engine, the new Ducato maintains its cargo capacity of up to 17 cubic meters and a payload of up to 1,500 kg.

News STELLANTIS

Words editorial staff

Technology and Design

The new Ducato introduces a comprehensive set of new Advanced Driver Assistance Systems (ADAS): Full Brake Control, Traffic Sign Recognition, Lane Departure Warning, Attention Assist, and Intelligent Speed Assist are all available as standard or optional features. The Adaptive Cruise Control with Stopand-Go function, Lane Centering, and Traffic Jam Assist, which actively maintains control of the vehicle’s trajectory considering traffic conditions, allow the new Ducato to achieve Level 2 autonomous driving. In this level, the vehicle assists the driver during acceleration, braking, and steering phases. Exterior updates have been focused on the front of the vehicle. The most significant changes involve the entire front end, which now features new bumpers, new skid plates, and an innovative front grille with a modern body-colored design aimed at improving aerodynamic efficiency. The exterior refresh is completed with updated rear lights featuring black accents and new logos.

Ample Range for the E-Ducato

This Model Year 2024 vehicle aims to meet customer needs with a multi-energy approach. Here is an electric version developed entirely in-house, boasting the best range in its category. The new E-Ducato is offered at a reduced price of 25% to make it more accessible. One of the major innovations is the new 110 kWh battery providing a range of up to 420 km in the WLTP cycle, a 30% improvement compared to the previ-

DUCATO

ous model. The new engine, capable of delivering up to 200 kW of power (270 HP) paired with 410 Nm of torque, completes the new propulsion system. The charging system is also entirely new and features two standard on-board chargers, capable of accepting up to 11 kW in alternating current or up to 150 kW in direct current for a fast battery recharge in just 55 minutes. The new E-Ducato features a particularly powerful engine and three driving modes - Eco, Normal, Power - ensuring the perfect balance between performance and range (customizable by the driver) through different acceleration profiles and maximum speeds depending on the selected driving mode. The E-coasting level can be selected using specific paddles on the steering wheel, providing the option to choose between regenerative braking and coasting mode.

“For 120 years, Fiat’s mission has been to be close to our customers, prioritizing dedicated networks and solutions,” said Olivier François, CEO of Fiat & Fiat Professional and CMO of Stellantis Global.

“As part of the Stellantis Group, we aim

120 MULTIJET3

140 MULTIJET3

to increase partnerships by leveraging a larger network, expanding beyond our leadership in Europe and South America, towards new regions like the MEA. In 2024, we will introduce a new range, including Fiat Professional vehicles Ducato, Doblò, and Scudo. These vehicles represent a new generation and offer more innovative, sustainable, and electric solutions for the businesses of the future.”

180 MULTIJET3

Version Manual Manual Automatic Manual Automatic

Displacement

Cylinders

Fuel system

Power and torque

120 hp (89 kW) at 3,500 rpm

320 nm at 1,400 rpm

Emission level Euro 6D-Final

Transmission

2.184 cc

4, in-line, industrial-derived engine

Direct electric injection Common Rail MultiJet3 with variable geometry turbocharger and intercooler

140 hp (104 kW) at 3,500 rpm

350 nm at 1,400 rpm

140 hp (104 kW) at 3,500 rpm

380 nm at 1,400 rpm

180 hp (130 kW) at 3,500 rpm

380 nm at 1,500 rpm

Euro 6 step E

6 gears + reverse in the Manual versions

8 gears + reverse in the Automatic versions

180 hp (117 kW) at 3,500 rpm

450 nm at 1,500 rpm

RV industry starts 2024 with +11%

Results for the RV Industry Association’s January 2024 survey of manufacturers found that total RV shipments ended the month with 22,674 units, an increase of 11.1% compared to the 20,405 units shipped in January 2023.

the most affordable ways to travel and we are encouraged by the excitement consumers have for the RVing lifestyle, evident by strong campground bookings for the upcoming spring travel season and solar eclipse.”

RVIA 2023 annual report

“We continue to be optimistic about the direction the industry is heading this year, and this latest shipment report aligns with the moderate increases we are expecting in 2024,” said RV Industry Association President & CEO Craig Kirby. “RVing remains one of

Towable RVs, led by conventional travel trailers, ended the month up 21.1% from last January with 19,523 shipments. Motorhomes finished the month down (-26.5%) compared to the same month last year with 3,151 units.

Flash News

The 2024 RV Dealers Convention/Expo is scheduled for November 11-15 in Paris Las Vegas, which attracts manufacturers, dealers, suppliers, and industry partners for a week of networking, educational workshops, and vendor training.

The event is presented by The RVDA, RVDA of Canada, and the Mike Molino RV Learning Center. Among its many benefits, the vendor training and workshops provide continuing education on strategies and assist RV dealership management teams to increase profitability by staying current with the latest available products, tools and services. Workshop announcements will begin in June 2024.

Park Model RVs finished January down (-44.2%) compared to the same month last year, with 305 wholesale shipments.

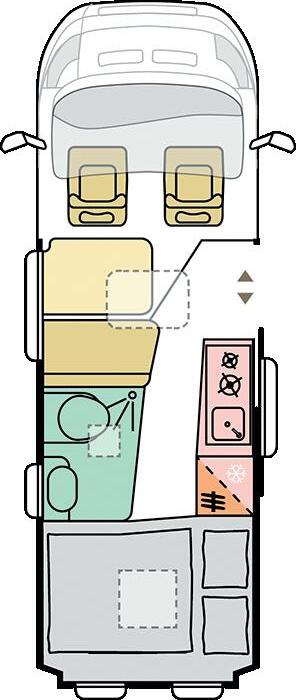

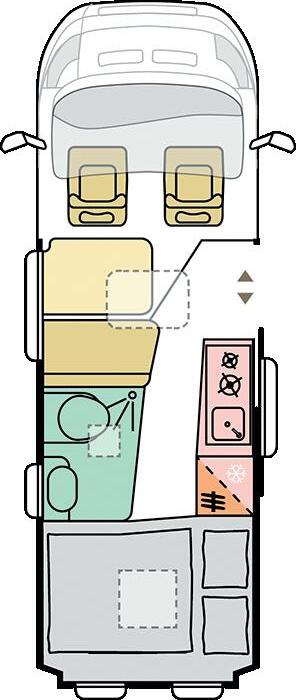

New floorplan from LTV

Leisure Travel Vans (LTV), a brand of Triple E Recreational Vehicles based in Winkler, MB, Canada, announced a new Leisure Lounge option for its Unity Corner Bed floorplan. The manufacturer of the Unity and Wonder class C models, the slide-out design converts to a dinette with an integrated table, and appointments include dual reclining chairs as well as ample storage. It also has a new 15 cu. ft. exterior compartment. “The goal was to keep everything customers love about the Corner Bed floorplan,” said Angelo Natuzzi, Lead Product Designer at Leisure Travel Vans. “We also improved comfort in the living area with ample storage, natural light, and excellent views,”

The 2023 Annual Report has been released. To view the entire document, you can click on the QR code on this page. Inside the Annual Report, you will find a retrospective of some of the high-level Association achievements and industry highlights from the past year. This includes the Association’s financials, membership and industry trends, education and standards updates, the latest from the Go RVing consumer marketing campaign, and state, federal, and international advocacy efforts.

New online tech at KOA.COM

Kampgrounds of America’s new AI-powered chatbot feature at KOA.com is designed to meet the trends of digital trip planning, customer assistance and seamless online support. The AI chatbot is accessible at KOA.com and programmed with the company’s extensive camping content, location information, FAQs. Visitors can engage in real-time conversations, and receive instant accurate, comprehensive responses to inquiries 24/7.

“This is a pathway to our mission of connecting people with the great outdoors,” said Toby O’Rourke, CEO and president of Kampgrounds of America, Inc.

Extended warranty from Pleasure-Way

Canada-based Pleasure-Way Industries brings new standard tech and extended warranty support across its line of Class B motorhomes. The UL Listed, self-heating Eco-Ion lithium battery package now supports 600-amp hours and mates to an upgraded Xantrex Freedom XC PRO 3000-Watt True Sine Wave Inverter with a 100-Amp lithium-specific battery charger. All inverter functions are con-

trolled via an enhanced 10-inch touchscreen interface, and the standard Onan generator is an alternate charging source for the lithium package. Additionally, all models are now standard with a Truma Aventa eco 120V A/C system, which can operate either from the inverter or lithium batteries. An extended, five-year, 120,700 km Mercedes-Benz basic warranty is also available and based on its original threeyear warranty.

20

News from the world NORTH AMERICA Steve Fennell

2023 manufacturing update

Flash News

Jayco is going green. Following the debut of their initial green models at 2023 Melbourne Leisurefest, Australia’s biggest RV brand Jayco takes a bold move by expanding its ‘camu’ colour to more models in the range. The green exterior colour is now exclusive for BaseStation, CrossTrack, All-Terrain, and Outback camper trailers (Swift, Lark, Wren, Eagle, Swan and Penguin). Meanwhile, Touring-spec campers will continue to feature Jayco’s signature grey scheme.

Leisure-Tec does it again. The 2024 Victorian Caravan & Camping Supershow was a great success for Leisure-Tec Australia with the launch of the new myCOOLMAN 20 and 15 Recreational Series fridges. The advantages of the two new designs are they are portable, lightweight and easy to carry, suiting picnickers, beach goers, campers and tradies. Leisure-Tec Australia keeps innovating and expanding. Earlier this year they announced the news that they added world leading Italian refrigeration manufacturer – Vitrifrigo – to their stable of caravan, motorhome, camping and 4WD premium products.

Atotal of 31,289 RVs were manufactured in Australia in 2023, up 11.6% on the previous year. This represents the strongest year of manufacturing since the 1970s. The state of Victoria Produces 93% of all Caravans & RVs and therefore grew 11.6%.

18,971 caravan units were imported into Australia in 2023, which is 7% down on the previous year. However, this represents the second highest level of imports recorded. In 2023, the average price of a camper trailer was $44k brand new, $66k for a Pop Top, $87k for a caravan and $222k for a motorhome - all in Australian dollars.

Nationally, the Australian Caravan Industry has an economic impact of $27.1 billion Australian dollars, across manufacturing, trade, retail, rental, caravan parks as well as visitor expenditure.

Caravan to a Million consumer competition

The Caravan Industry Association of Australia recently launched its latest campaign, ‘Caravan to a Million’, a consumer competition with the chance to win a million Australian dollars. This marketing campaign follows after the remarkable success of its predecessor, Road to a Million’ in 2022. While the ‘Road to a Million’ campaign predominantly targeted holiday parks and rental fleets, the ‘Caravan to a Million’ competition takes a comprehensive approach, involving the entire caravan industry,

including manufacturers and retailers. This inclusive strategy reflects the Association’s commitment to fostering growth across all sectors of the caravan industry. Participants of the ‘Caravan to a Million’ competition have multiple avenues to enter and qualify for the chance to win one million Australian dollars. Ways to enter include registering your RV and RV club, making a purchase at one of the 700 registered RV Business or purchasing tickets to a participating Caravan Show or RV event.

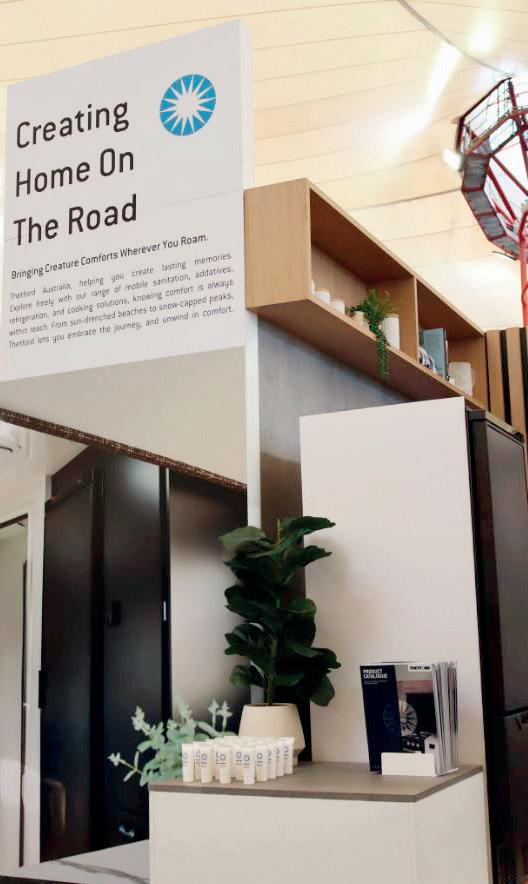

Home on the Road with Thetford

Thetford Australia shaked things up with a bold new concept for their brand new show stand at the 2024 Victorian Caravan & Camping Supershow. With ‘home on the road’ as the guiding theme, the Thetford stand was a true showstopper. From top to bottom, the theme was evident in every single detail, including the consumer giveaways. Dempsey Barnard, Marketing Coordinator at Thetford Australia: “The new Thetford Australia stand prioritises the feeling of home on the road, based on customer and end-user feedback, highlighting the significance of creature comforts. Familiar design elements from the home environment have been integrated into both the brand and the overall stand design, catering to the caravan and van life experience.” The new Thetford stand showcased a number of new products, including two new compressor fridges. Thetford is also about to launch a new hob to replace the current Topline 902 induction hob. This latest addition to the cooking range has adjustable current settings, allowing users to select from 6, 10, or 13 amps according to their specific needs.

21

Irene Viergever

News from the world AUSTRALIA

Change of management at Westfalia

Philip Kahm and Thomas Siegert form the new management team at Westfalia Mobil GmbH, taking over from Mike Reuer, who has led the traditional brand since 2011 following its takeover by the Rapido Group. He will contin-

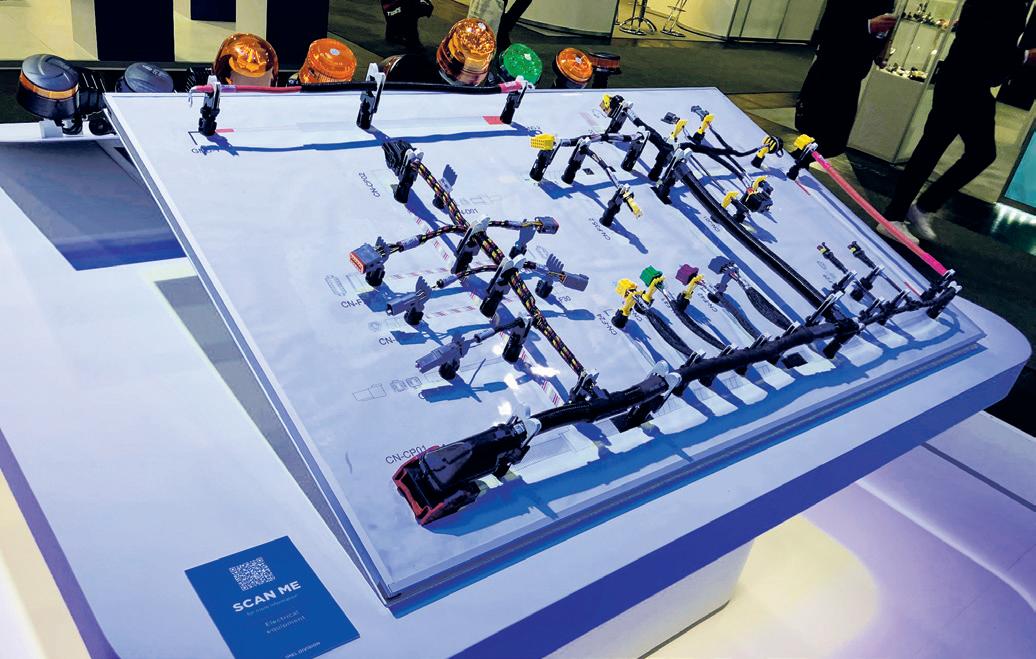

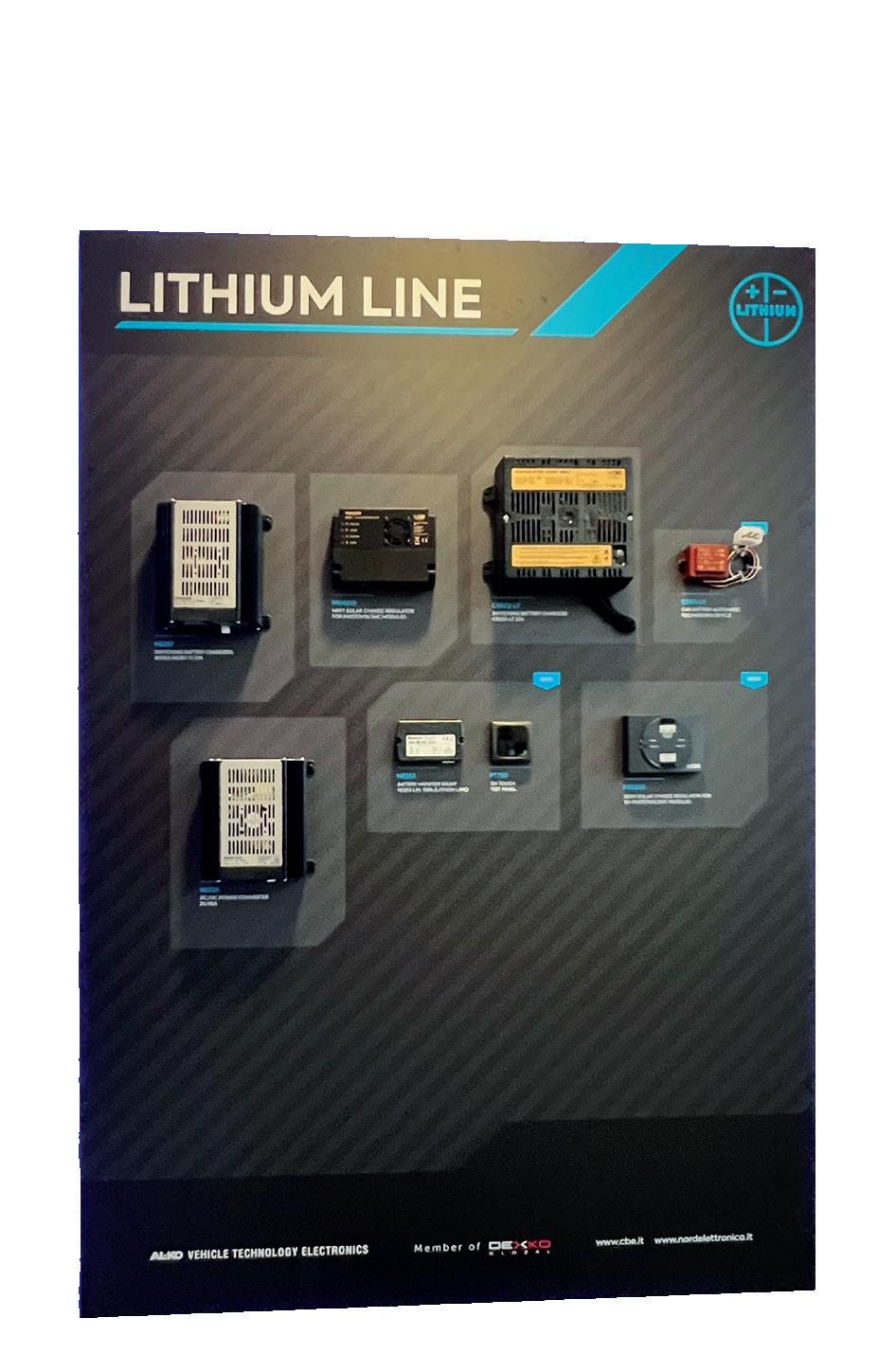

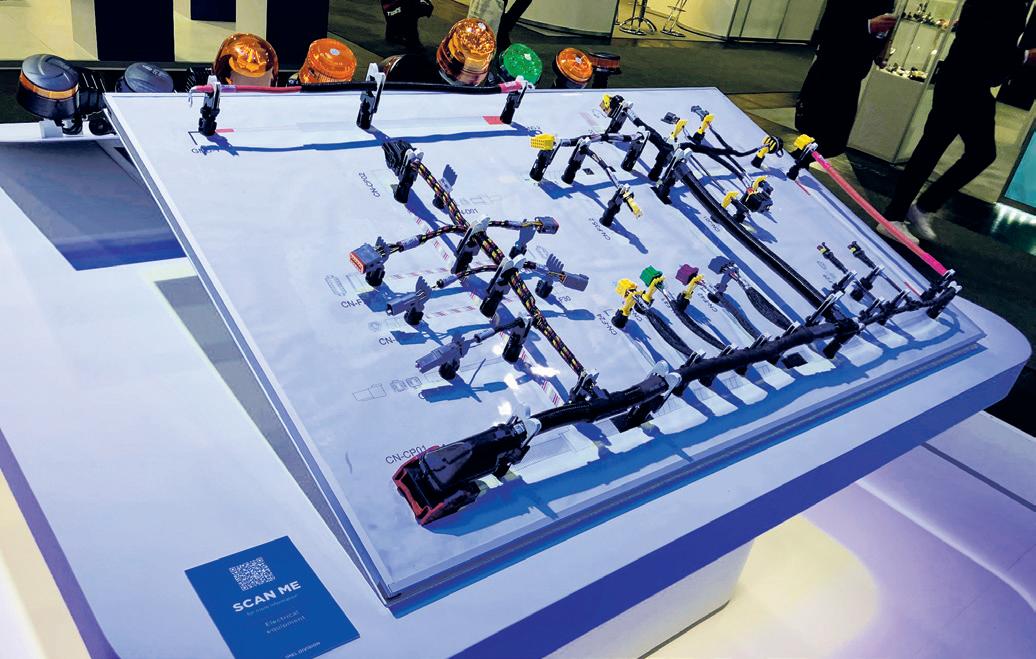

DexKo Global acquires Toptron Elektronik

DexKo Global Inc. (“DexKo”), has announced that its subsidiary, AL-KO Vehicle Technology (“AL-KO”), has completed the acquisition of Toptron Elektronik GmbH & Co. KG (“Toptron”), a company based in Germany that supplies customized onboard electronic systems and components such as control panels, power distribution devices, lighting control systems, probes and sensors. Harald Hiller, CEO and President of AL-KO, commented: “We are working intensively on integrating Toptron swiftly into our AL-KO Vehicle Technology Electronics business (‘VTE’) with its brands CBE and Nordelettronica.” Ugo Francescutti, the Managing Director at VTE, is very much looking forward “to broadening our product offering and growing our geographic coverage substantially.”

Andreas Kling, the new Toptron Managing Director, said: “Many renowned manufacturers trust Toptron’s innovation capabilities and have maintained longterm relationships with the company. Wilhelm Cramer, the former Managing Director, will remain with the business to support the transition period. So, we ensure stability in our customer relationships, which is particularly important to us.” Andreas Kling has been working with AL-KO Vehicle Technology as Chief Engineer Electronics and in various other positions in R&D. He brings a great deal of experience with the integration of companies, which he has demonstrated in recent years with the merger of CBE and Nordelettronica. Since 1995, Toptron has been supplying customized onboard electronic systems and components such as control panels, power distribution devices, lighting control systems, probes and sensors.

ue to support the company in an advisory capacity until 30 April 2024 before retiring. Philip Kahm began his career at Westfalia in 2008 in Rheda-Wiedenbrück and, after holding various positions in the company, headed up Purchasing and Project Management until he moved to the new Westfalia Mobil site in Gotha in 2017. Thomas Siegert has been with Westfalia since 2005 and, after holding positions in quality management and service, has been Head of Technical Development at the Rheda-Wiedenbrück site since 2008. He joined Westfalia Mobil in Gotha as Technical Manager in 2021 and has been Managing Director since the end of 2023.

Liqui Moly enters the RV market

Identifying growth markets and developing products for them seems to be one of Liqui Moly’s secrets to success. The Ulm-based company has now discovered the caravanning market and has launched the “Camping” series for leisure vehicles. A quick paint care product, a tent and awning impregnation, a care and glide spray, a multi-spray and the camping multi-foam cleaner are being launched. The new Liqui Moly camping programme is complemented by a wash & wax product for cleaning and sealing all exterior vehicle surfaces in a single operation and a 5W-30 refill oil for the vehicle.

Mercedes-Benz Marco Polo turns 40

The first Mercedes-Benz Marco Polo celebrated its premiere in 1984, at that time based on the “Bremer Transporter”. Since then, it has evolved - in terms of functionality, comfort and style. In the 1980s, the first Marco Polo was one of the compact campers that defined the segment. After several far-reaching facelifts and adaptation to the modern Vito and Viano base, the new V-Class Marco Polo was presented in summer 2023 and celebrates its market launch this year. It impresses with an even higher-quality look and feel in the exterior and cockpit as well as an enhanced MBUX and MBAC. And the future? The future of camping with a star is called VAN.EA. The central step into the electromobile future is the new, modular and scalable “electric-only” architecture VAN.EA, which will be introduced from 2026.

22

News from the world GERMANY Peter Hirtschulz

Philip Kahm and Thomas Siegert

Industry’s economic impact endures

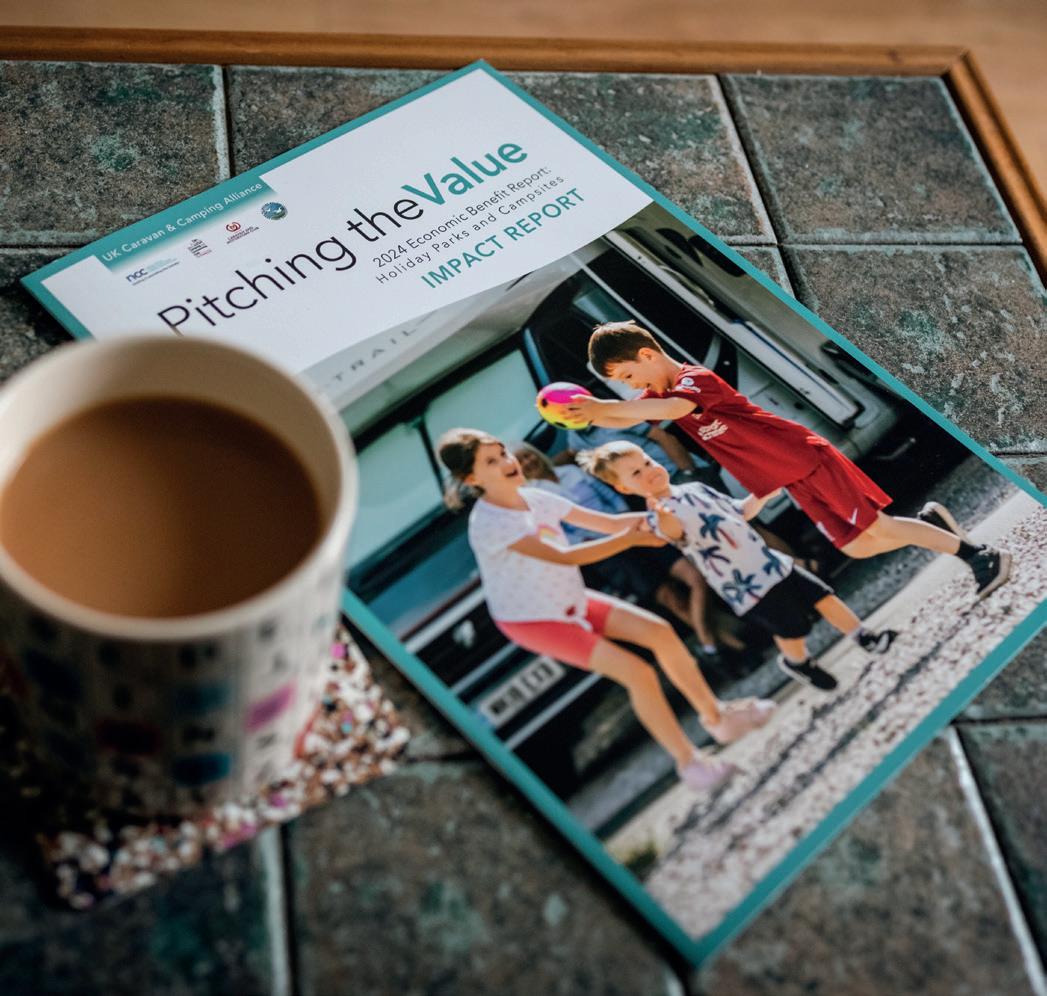

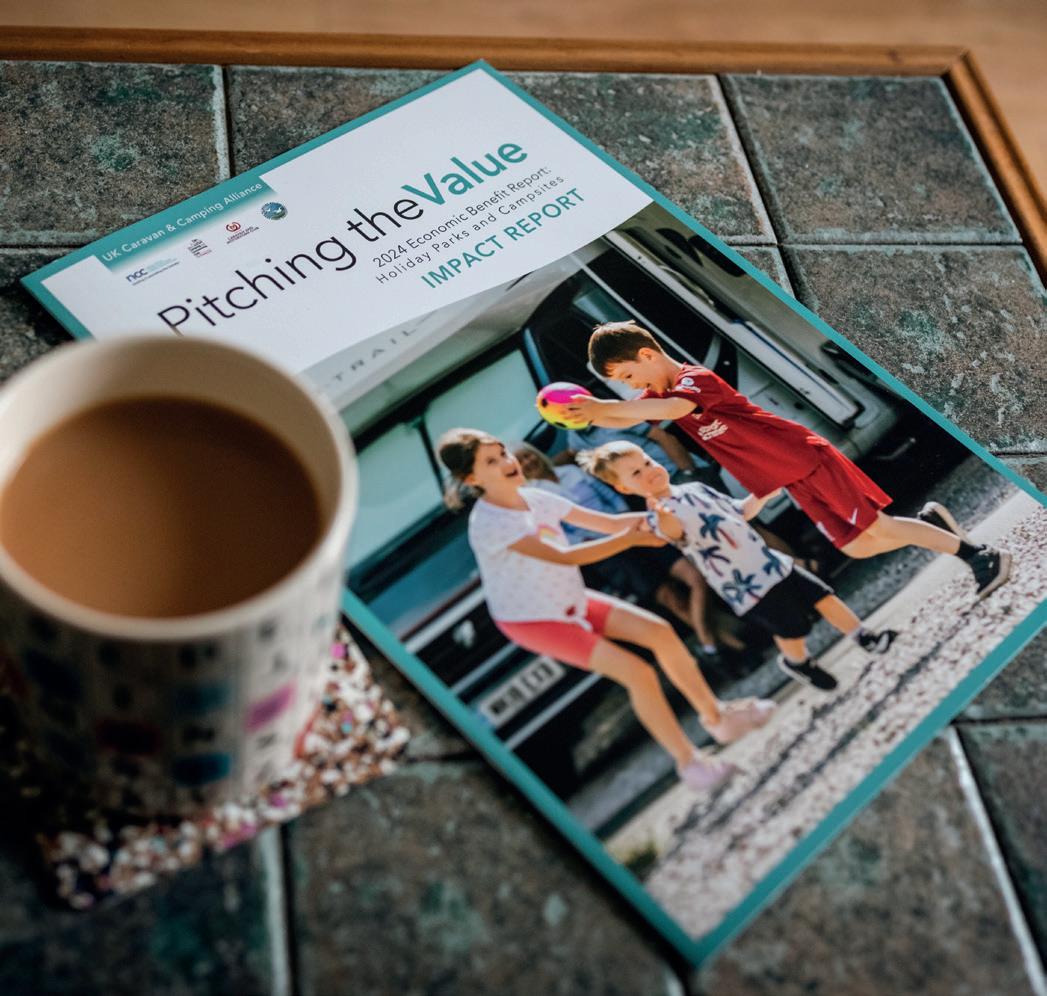

Anew study commissioned by the UK Caravan & Camping Alliance (UKCCA) has revealed that the holiday parks and campsites market is worth £7.2 billion (gross value added) to the country’s economy. The ‘Pitching the Value’ report revealed that the visitor expenditure generated by holiday parks and campsites was £12.2 billion, while the industry supports an impressive 226,745 jobs in the UK. The report also showed that visitors to holiday parks and campsites stay up to 82 per cent longer and spend 12 per cent more than the national tourism average. The average group size of UK campers is two, with only 15 per cent of groups containing children. Almost a third of those surveyed brought a pet with them, and more than half of those polled stayed at a holiday park or campsite five times or more in the last year. UKCCA spokesperson Bob Hill said: “This report evidences the value of the sector to enable it to attract investment and provide opportunities to grow, innovate and create new jobs.” - www.ukcca.org.uk

Flash News

The UK’s largest dealership for Erwin Hymer Group (EHG) motorhomes is celebrating five years in its custom-built, state-of-the-art facility in Stafford, England.

Erwin Hymer Centre Travelworld celebrated the achievement with a special five-day event for customers in February. It was attended by representatives from leading EHG brands including Hymer, Carado, Dethleffs, Laika, and Niessmann+Bischoff so that end consumers could speak directly with them and learn more in-depth information about 2024 models.

Leading caravan and motorhome brand Bailey of Bristol has promoted Cristina Dorador de los Santos to be its new Head of Marketing with immediate effect.

Cristina has been with the company for eight years, working across many of its marketing and PR campaigns, as well as content strategies – she played a significant role in campaigns such as Bailey’s Caravan in the Sky, Behind the Scenes Live Tour, and Sahara Challenge.

She will also be responsible for Bailey’s customer research programme as well as managing the entire marketing team.

Positive early signs for 2024 at UK shows

More than 400 industry exhibitors joined the UK’s Caravan, Camping & Motorhome Show in Birmingham from 13-18 February.

Many of the UK’s leading brands used the event to showcase leisure vehicles that were firsts for them in new product categories. Bailey of Bristol launched its first-ever panel van, the Endeavour, based on the Ford Transit, while Coachman showcased its first-ever Class A motorhome, the Travel Master Imperial. Diversifications such as

this display that while the industry is still relatively healthy in the UK, major players are exploring new avenues to help boost sales.

Meanwhile, 170 exhibitors were on show at the 37th annual Scottish Caravan, Motorhome and Holiday Home Show, which took place in Glasgow from 1-4 February. The show underwent a significant rebrand for its 2024 edition with a new logo and enhanced marketing activities, which helped attract thousands of campers.

Proposed licence change

The UK Government is proposing driving licence changes that could benefit those driving zero-emission vehicles (ZEVs), including electric campervans and motorhomes. Given the additional weight of batteries used in ZEVs, current UK rules allow motorists with a standard (category B) licence to drive an electric goods van with a maximum authorised mass (MAM) of 4,250kg rather than the standard entitlement of 3,500kg. Usually, driving a vehicle above this weight requires a driver to hold a category C or C1 licence, which requires additional training and cost. If approved, the new

proposals could see this flexibility extended to all vehicle types (not just goods vans), meaning electric campervans and motorhomes would be covered too. If the proposals become law, motorists will no longer have to hold a category C or C1 licence to drive a heavier electric campervan, opening up opportunities for the leisure vehicle industry. While motorhome converters and manufacturers will likely welcome this change, there are still many legal hurdles to overcome before it comes into effect.

23

world UK David Guest

News from the

News from the world FRANCE Paolo Galvani

The trend of campervans

Based on the latest statistics available by UNI-VDL in the month of January 2024, the registration of new camping-cars, including vans, saw an increase to 1,669 units from 1,545 in the previous year and from 1,400 two years ago.

Specifically, new camping-cars (excluding vans) registrations increased to 710 from 563 the previous year, while van registrations slightly decreased to 959 from 982. Used camping-car registrations decreased to 3,758 from 3,948 in the previous year. New caravan registrations were at 524, down from 590 the previous year, and used caravan registrations decreased to 2,499 from 2,598.

Cumulatively over the last 12 months, there were slight changes in the market:

• New camping-cars including vans saw a decrease to 24,049 from 24,750 the previous year, and a significant drop from 30,681 two years ago.

• Registrations of new camping-cars (excluding vans) decreased to 10,078 from 10,481 the previous year.

• Van registrations decreased slightly to 13,971 from 14,269.

• Used camping-car registrations increased to 68,273 from 66,080, showing a growing interest in the second-hand market.

• New caravan registrations saw a slight increase to 7,382 from 7,229 the previous year.

• Used caravan registrations decreased to 46,983 from 48,379.

IAn issue 138 of UNI VDL magazine, an extensive investigation delves into the popularity of vans and fourgons among diverse demographics, propelled by the allure of mobility, adventure, and comfort. Highlighting perspectives from some industry professionals the article showcases the strategic shifts companies are making to accommodate the growing interest in compact, versatile vehicles. According with the article, the van market is experiencing undeniable success, continuously gaining market share in a segment that was once underdeveloped. The appeal of these vehicles lies in their mobility, discretion, and comfort. Manufacturers like Trigano, Pilote, and Rapido, along with about twenty brands, some exclusive to this market segment (e.g., Font-Vendôme, Hanroad, Campérêve, Elios), have risen to the challenge of providing the comfort and amenities nearly equivalent to those of larger, traditional motorhomes. Pierre Terroitin, the sales manager for Campérêve in France, speaks to the enduring appeal and evolution of the van and fourgon market. Campérêve, a company with a long history in the sector, has witnessed a shift in their clientele due to the vanlife movement, which predates the Covid-19 pandemic. This movement has brought a new wave of first-time buyers to the market, drawn to the compactness and discretion of fourgons. Terroitin emphasizes that for many, the choice of a four-

tout France and the Comité de liaison du camping-car (CLC) have launched « l’Observatoire du Camping-car » aiming to provide local officials with data on motorhome tourism, which accounts for an estimated 80 million overnight stays annually. Despite its popularity, the sector often lacks visibility among tourism professionals and local authorities due to insufficient data. Managed by Atout France, the Observatory seeks to offer comprehensive insights, including visitor numbers and stay durations, to improve understanding and support for this form of tourism. Officially inaugurated at the Salon des Maires et des Collectivités Locales (SMCL) in November 2023 at the Porte de Versailles. The first detailed reports from the Observatory are expected in 2024.

gon is natural, merging the desire for a compact model with the lifestyle aspirations of vanlife enthusiasts. This demographic shift represents a broadening of the market, as traditional customers are joined by newcomers attracted by the ideals of mobility and simplicity. Antoine Guéret, the commercial and marketing director of the Pilote Group, reflects on the company’s strategic adaptation to the surging interest in fourgons. Historically focused on traditional motorhomes, the Pilote Group has seen a significant shift towards fourgons, which now account for about 30% of their production volume, a substantial increase from just 10% five to six years ago. This change aligns with broader market trends and underscores the necessity for established manufacturers to diversify their offerings. The acquisition of specialized brands and the development of the Joa Camp line, with a focus on fourgons, demonstrates Pilote’s commitment to catering to this expanding market segment. Personal anecdotes from users such as Alain Vacheron, a professional photographer, and adventurers Marie and Corentin, further illustrate the practical and lifestyle benefits that these vehicles offer. From facilitating a nomadic work lifestyle to enabling global exploration, vans and fourgons are celebrated as symbols of freedom and simplicity, appealing to a wide audience ranging from seniors to the new vanlife enthusiasts.

The new president of UNI VDL

Michel Freiche has been named the new president of the UNI VDL, the caravan and motorhome French manufacturers’ union, taking over from Pierre Rousseau, CEO of the Rapido group. At 63 years old, Freiche brings a wealth of experience to his new role, having been the General Manager of the Trigano group. His educational background includes degrees from EDHEC and certification as a chartered accountant. Since starting his career in 1988, he has largely worked within Trigano. Freiche is set to carry on the work of his predecessor, aiming to amplify the industry’s voice amidst ongoing changes.

24 Flash News

Bartek Radzimski

Bartek Radzimski

News from the world JAPAN

Celebrating 30th Anniversary of JRVA

The Japan Camping Car Show 2024, Japan’s largest camper car show, was held from February 2nd to 5th at Japan’s biggest messe, the Makuhari Messe located in Tokyo. More than 350 vehicles presented the latest trends in the industry under the theme of “Bringing the culture of campervans to Japan.” This year the Japanese RV Assocation (JRVA) is celebrating 30th anniversary of establishment of the association and this show, largest to date, confirmed that the market continues to grow and remain vibrant. Over the 4 day show, more than 46,000 visotors came to see the latet offerings from 79 manufacturers in 391 vehicles. In addition, some suppliers, campsites and other vendors participated on over 33,000m2 space. Omong the new trends, the increased presence of Fiat Ducato based offerings was seen among the domestic base vehicles like Toyota Camroad and Hi-Ace. The exhibition’s various offereings and JRVA Booth showcased the history of the past 30 years and efforts to popularize campervan culture through themes such as disaster prevention, regional revitalization, manufacturing technology, and RV parks. In addition,

Supporting earthquake victims with RVs

On 1 January 2024, at 16:10 JST a 7.5 earthquake struck nwar the Noto Peninsula of Ishikawa Prefecture, Japan. The shaking and accompanying tsunami caused widespread destruction on the Noto Peninsula & effected tens of thousands of people.

The Japanease government and it’s various disaster relef agnecies have the response procedures and countermeasure worked out in various methods, however, this time due to the test done after the 2016 earthquake in Kyushu and due to the continued lobby activities of JRVA, the response agencies came to request help from the camping industry.

Using the basica principal based on FEMA, the response agencies have implemented over 60 vehicles in various activities that have been supporting the rescue and recovery efforts in Inshikawa Prefecture. “Our hearts are with the people in the regions effected by the earthquakes and we hope that the vehicle we have provided can support a speedy recovery. We also hope that this utilization of Camping Cars for disaster relief can become a standard approach in Japan benefiting both the RV industry and various relief efforts.” said Masato Momota, JRVA Director responsible for Disaster Relief Promotion Activities.”

for the first time the “RV Park Award” was held with the aim of increasing awareness of RV parks nationwide. The award ceremony held on February 2nd awarded several RV Parks in the categories of general user category, media category, and influencer category. “With this year marking the 30th anniversary of JRVA establishement, we are very pleased to be able to organize this record breaking and successful show which will set a good precident going forward in this season.” said Mr. Kenji Araki, Chairman of the Japanease RV Association.

A red K-Car concept

ALFLEX, a coach builder which has been manufactureing Toyota Hi-Ace based luxury campers for over 25 years, this time has proposed something a bit different aimed at young lady travels. The Mia Picnica is based on the Honda N-VAN, a k-car van, which has a flexible layout and suprisingly spacious interior. It’s quite amazing how much was included in the vehicle which only has 3,395mm length, 1850mm width and 1,475mm in height. What makes this camper so great is its minimalistic yet functional interior that can fully support two adults. The sofa bed is approximately 150cm long x 140cm wide, but by folding the passenger seat, you can create a flat space on the left side of the vehicle, so even two adults traveling can sleep comfortably. Other features include a window thermo pad trim that provides privacy and insulation, a shaggy rug carpet, coordinated seat covers, as well as interior lighting, a portable power source and even external charging.

25

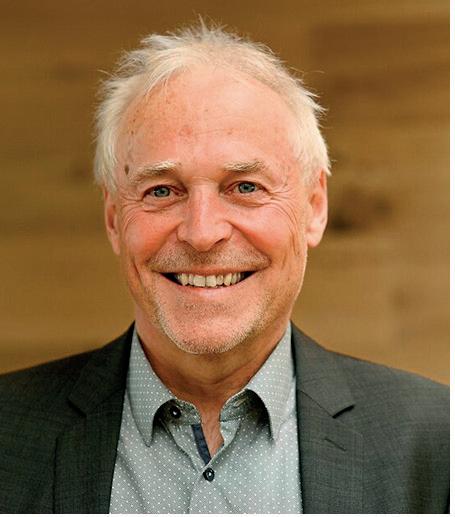

Leading a giant Group in extraordinary times: a CEO’s perspective

We interviewed the CEO of Erwin Hymer Group: his statements clearly express the intention to strengthen individual brands, while maintaining a group synergy perspective

I nterview with ALEXANDER LEOPOLD

Words Antonio Mazzucchelli photo Enrico Bona

For almost two years, Alexander Leopold has been at the helm of one of the giants in the global RV industry, the Erwin Hymer Group. The experience gained from 2015 to 2022 in leading one of Europe’s major companies, Dethleffs (Erwin Hymer Group), has allowed him to reach this top position well aware of the potential and challenges of the various brands. Here is his vision of the industry in a particular historical moment, where the market’s euphoria, the supply chain crisis, and uncertain forecasts for the future converge.

Aboutcamp BtoB − It’s been almost two years since you took on the role of CEO of Erwin Hymer Group: what assessment can be made of this initial period?

Alexander Leopold − We were able to continue our growth plan and make the Erwin Hymer Group significantly more competitive. We did this in an environment that was characterized above all by supply bottlenecks for chassis and vendor parts as well as surging prices. Our excellent contact with our sales partners and customers helped us to find viable solutions for everyone in these very difficult times. We communicated a lot internally with our brands to find the best solutions. We have been really successful in this. I see the Erwin Hymer Group and our holding company, Thor Industries, as a platform for knowledge transfer and internal services. In the area of development, for example, we support our locations with an internal development services pool that gives them the opportunity to purchase development capacities internally and deploy