Editor’s note

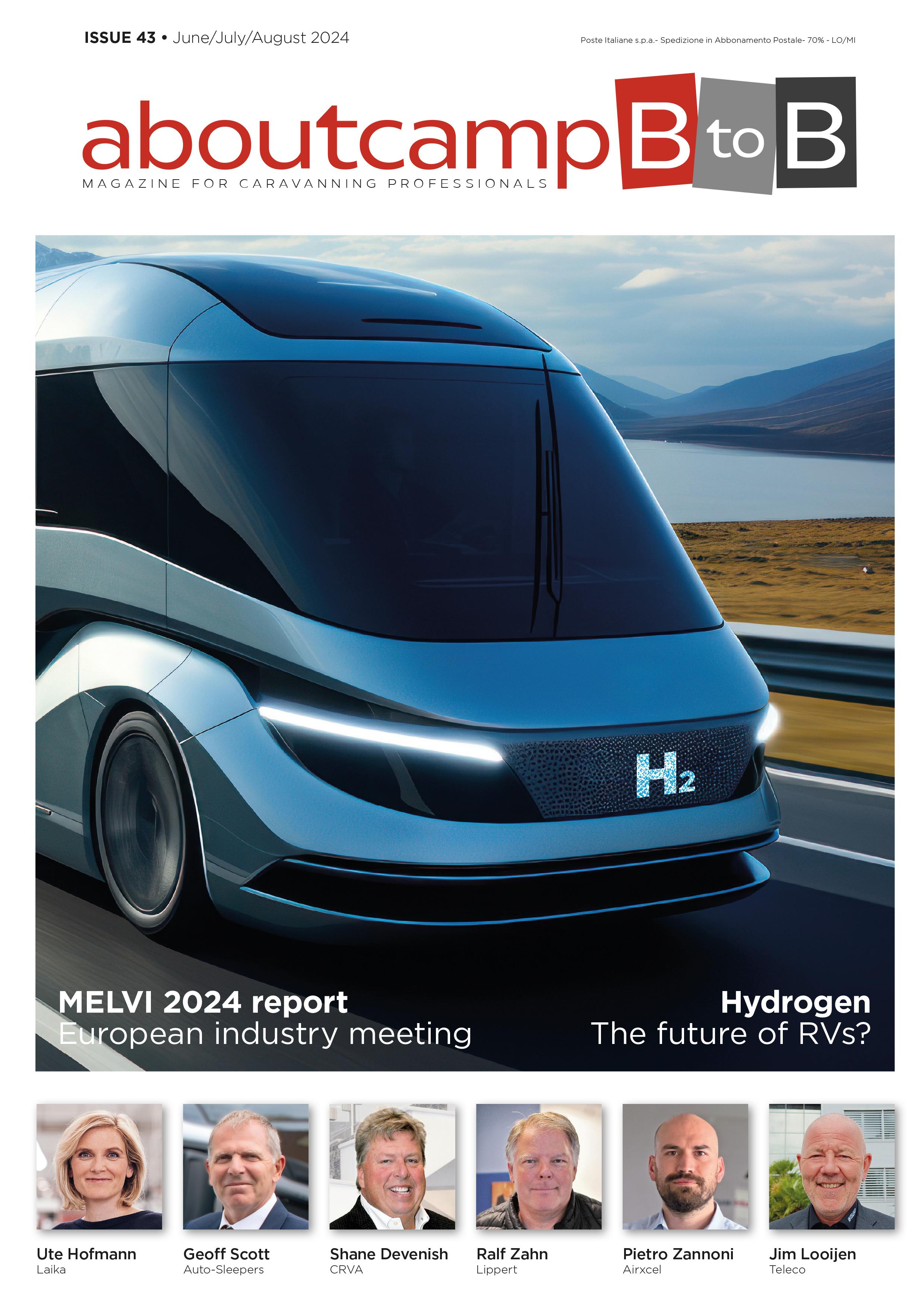

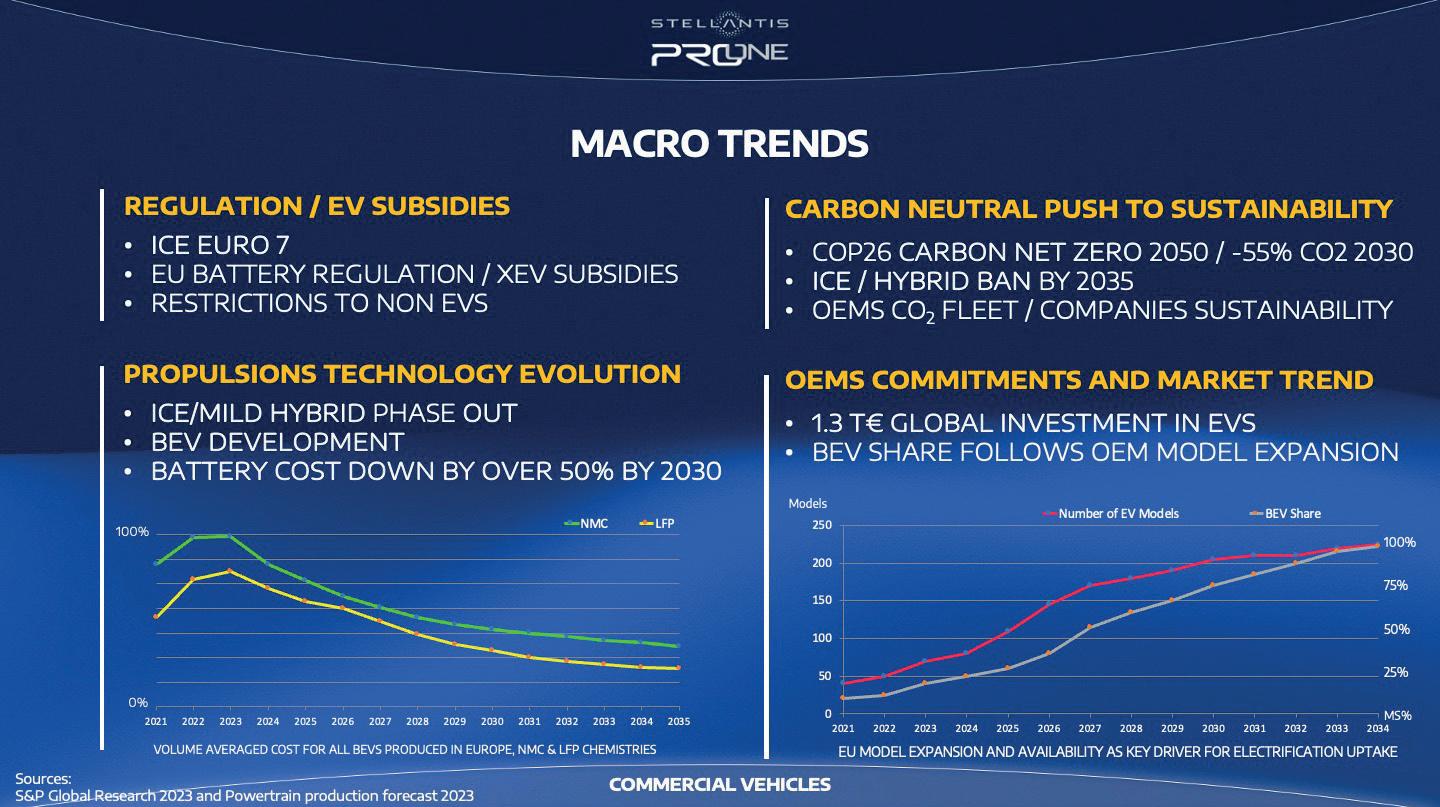

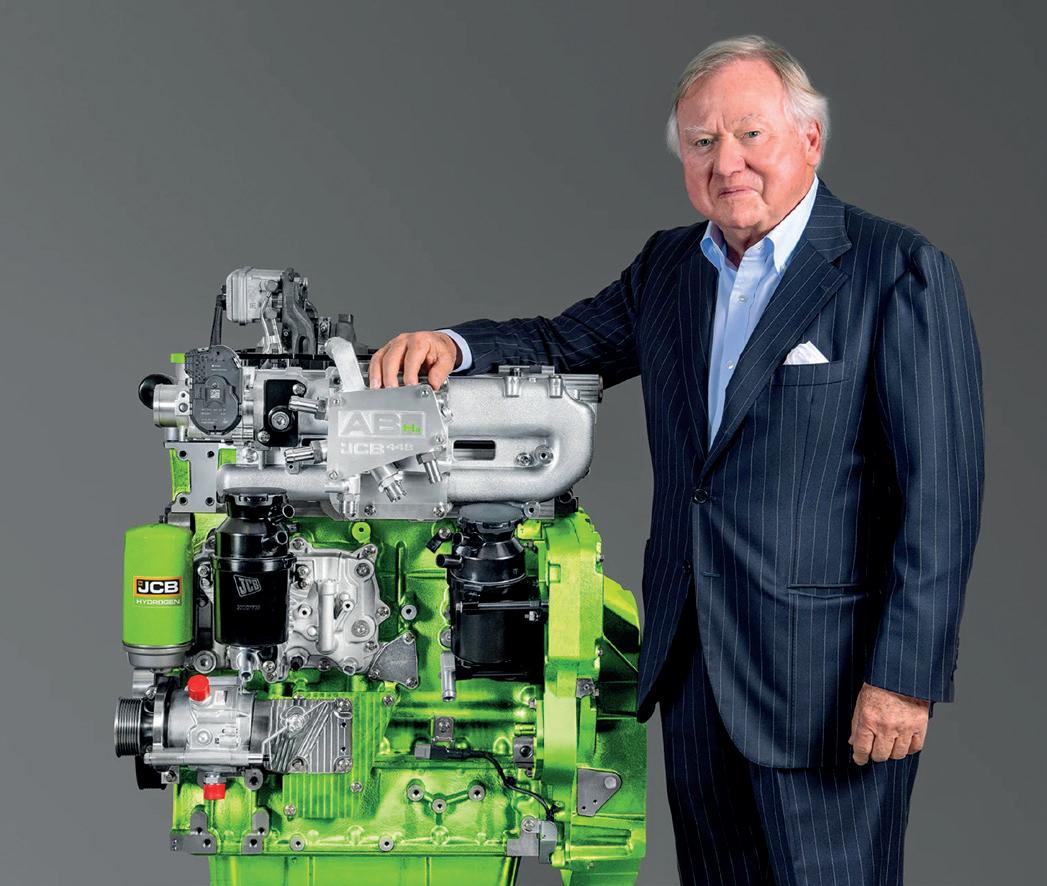

Is hydrogen the future of motorhomes? This is the question many of us are asking, and in this issue of Aboutcamp BtoB, British journalist Terry Owen helps us understand all the aspects of this technology in detail. In the journey towards zero emissions, battery electric vehicles (BEVs) are seen as the future, but they depend on lithium batteries, which have a significant environmental impact. Additionally, limited range and long charging times compared to fossil fuels hinder their adoption in campers and tow vehicles. With refueling times similar to fossil fuels and the ability to produce offgrid energy, hydrogen could be the ideal solution for the camper world. However, vehicle manufacturers are heavily focusing on electric. This was also highlighted by Luca Marengo, VP Head of Product Stellantis Pro One, Global Commercial Vehicle Business Unit, during the 29th Meeting of the European Leisure Vehicle Industry (MELVI) held in Italy in May. Electrification is fundamental for Stellantis, with the goal of achieving carbon neutrality by 2050. Hybrid

Contents

Interviews

• 36 Ute Hofmann Laika

Columns

• 52 Airxcel Investment and innovation

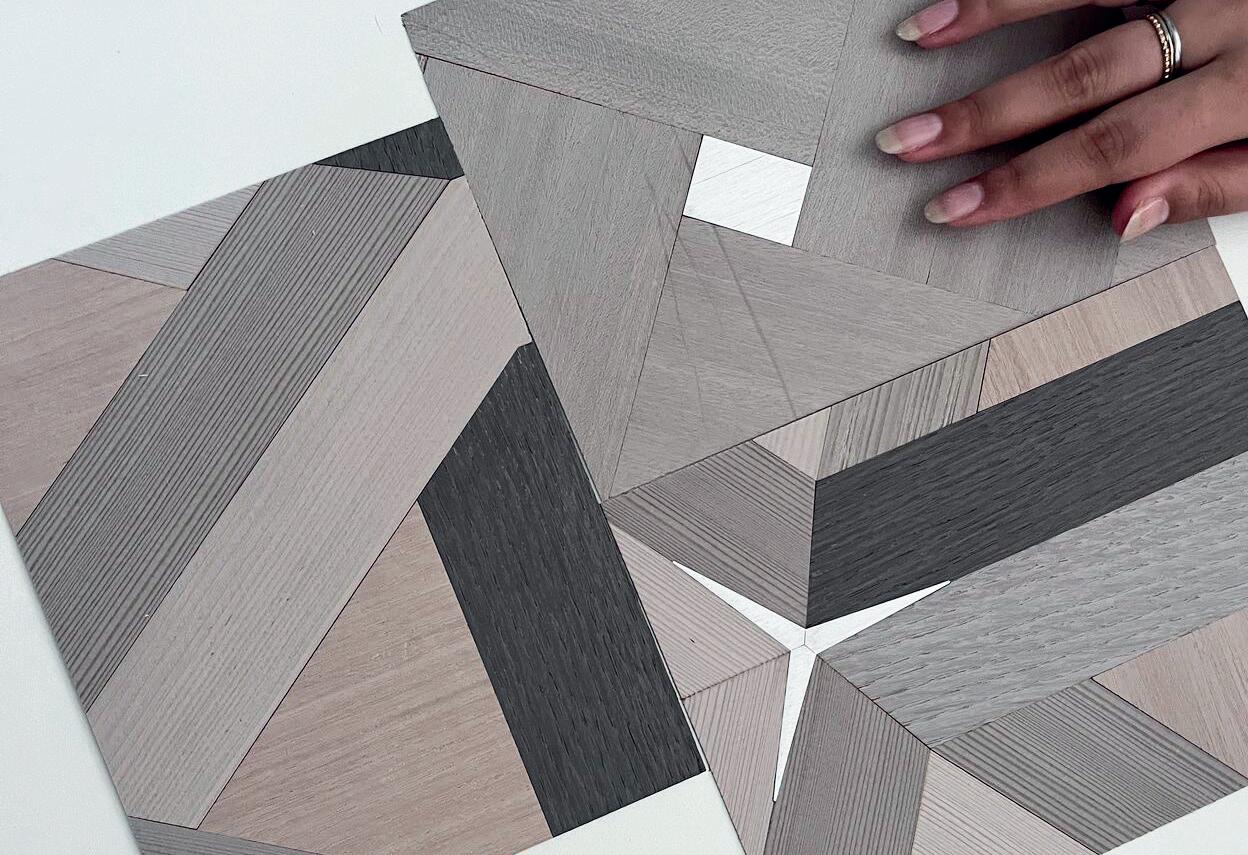

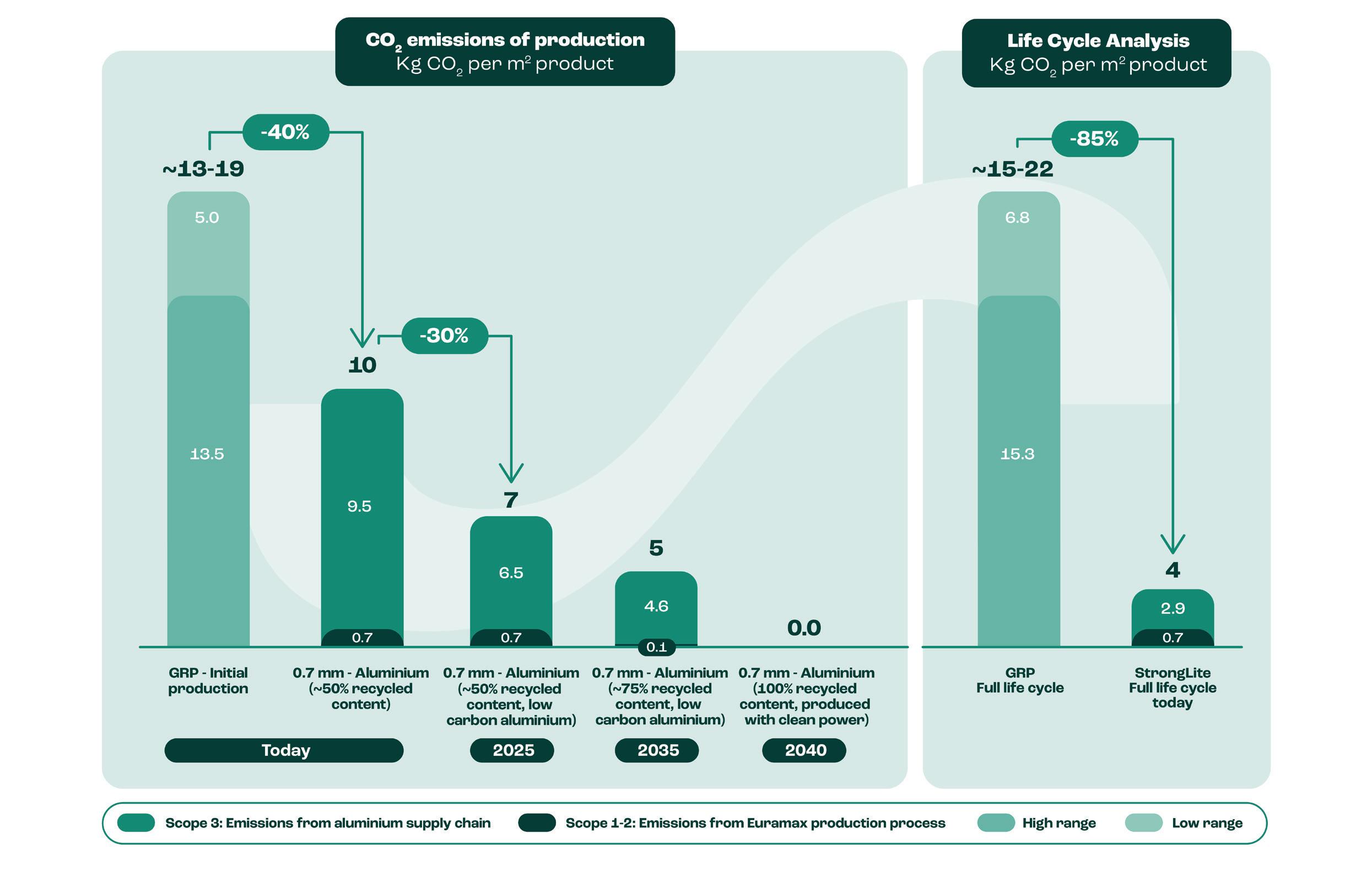

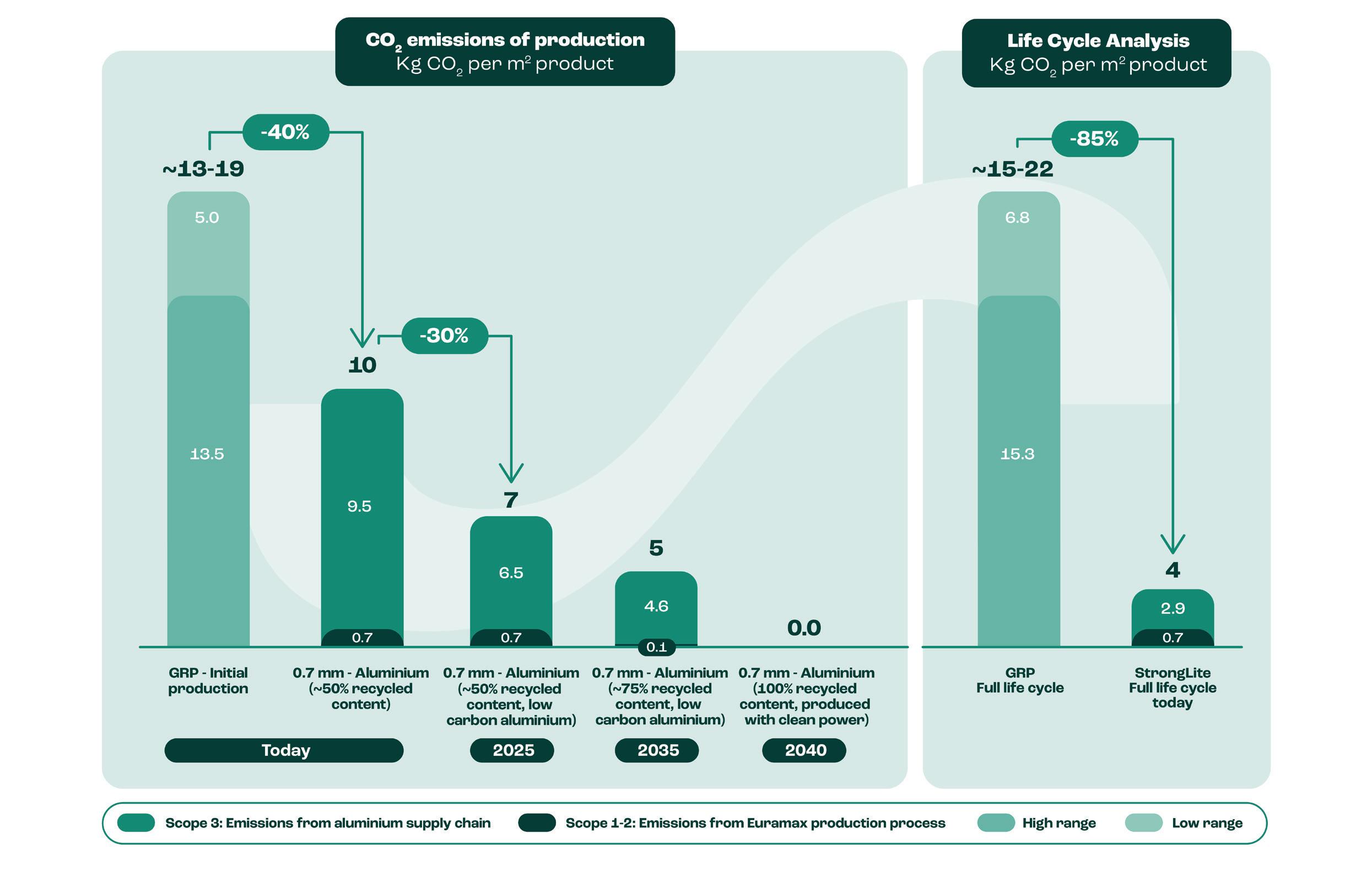

• 56 Euramax for Mobility Aluminium is ‘The Green Metal’

• 58 Filippi 1971 Beyond panels

• 60 Lippert

Long-standing reliable partner

• 64 Bartolacci Design All the forces at play

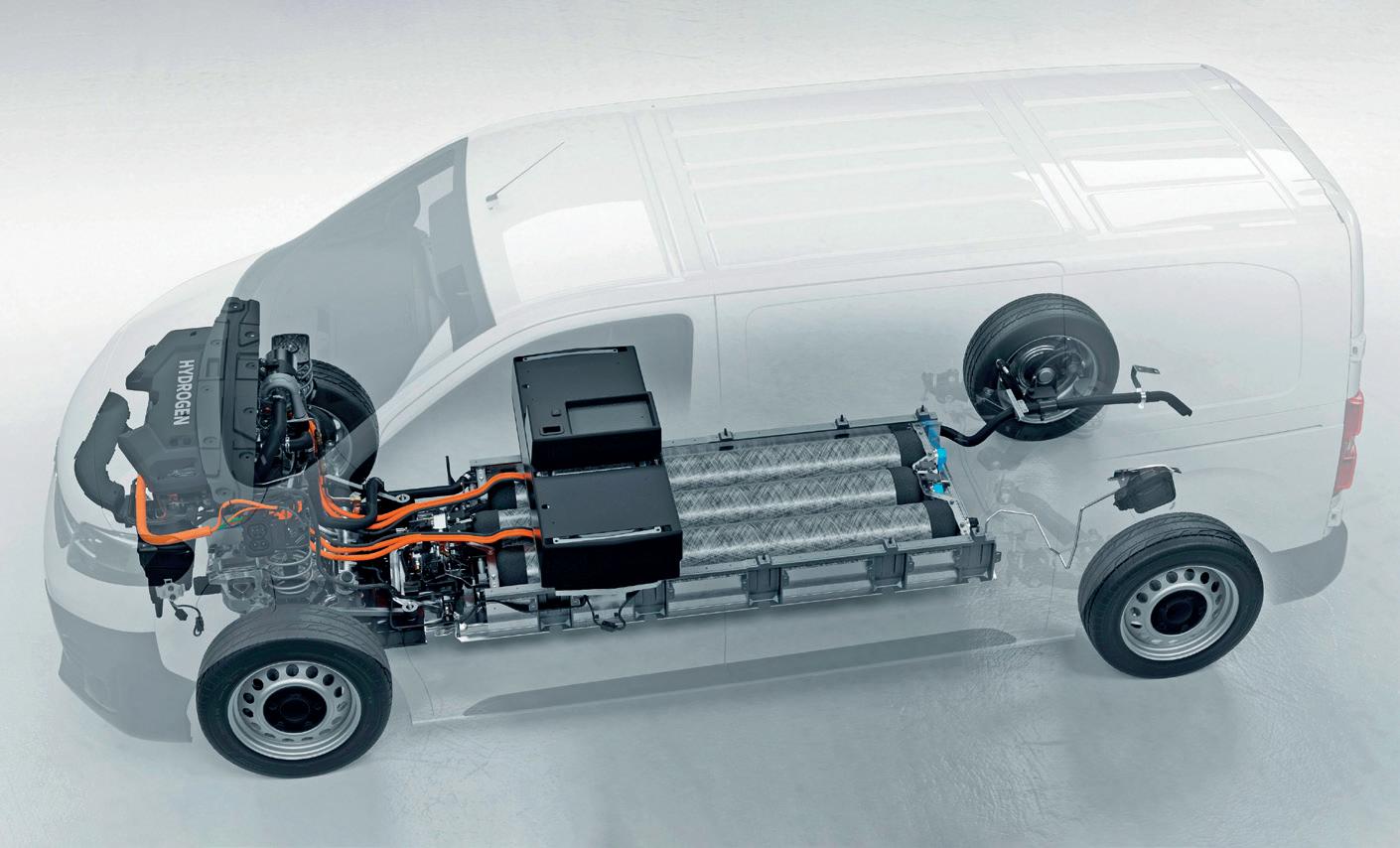

and internal combustion engine technologies will gradually be replaced by battery electric vehicles (BEVs). Marengo emphasized the importance of charging infrastructure and projected a 50% reduction in battery costs by 2030. Stellantis aims for a fully electric lineup by 2030, with continuous product updates and the introduction of zero-emission campers by 2025. However, hydrogen is also part of the group’s strategies. Stellantis’ roadmap includes the introduction of hydrogen fuel cell commercial vehicles by 2024, aiming to provide flexible and fast refueling options for long-distance travel.

Of course, this issue is not solely dedicated to these topics. As always, we have numerous interesting interviews and insights covering all relevant industry topics. We also provide a specific focus on the latest ECF meeting and the and the long-awaited publication of 2023 sales statistics in Europe by country. These data are no longer publicly available on the ECF website (at least as of today, the end of May 2024), while they can be easily found in other industry magazines, such as the journal of the French manufacturers association, UNIVDL. We hope to see them again soon on the website www.e-c-f.com, a valuable source of information for everyone in the industry.

Antonio Mazzucchelli

•

• 66 Teleco Agility and innovation

• 70 AL-KO Innovating for ideas

• 72 Vetroresina Fire-resistant laminates

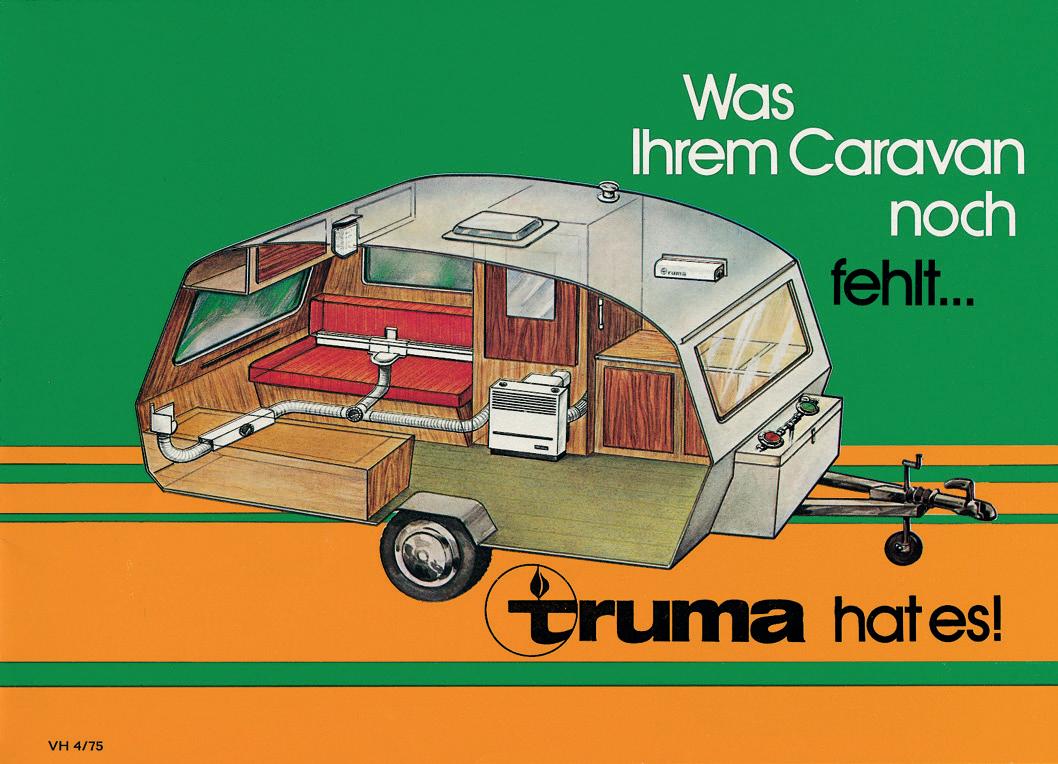

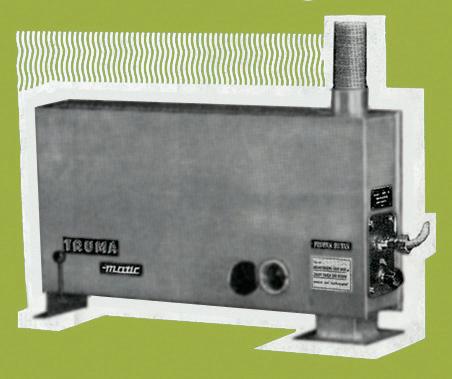

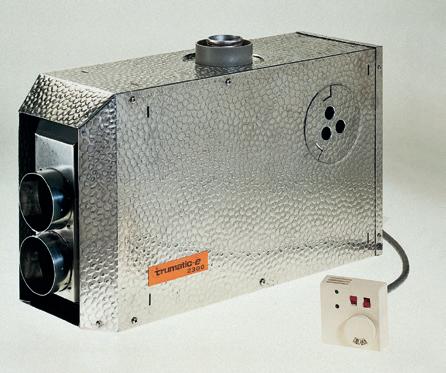

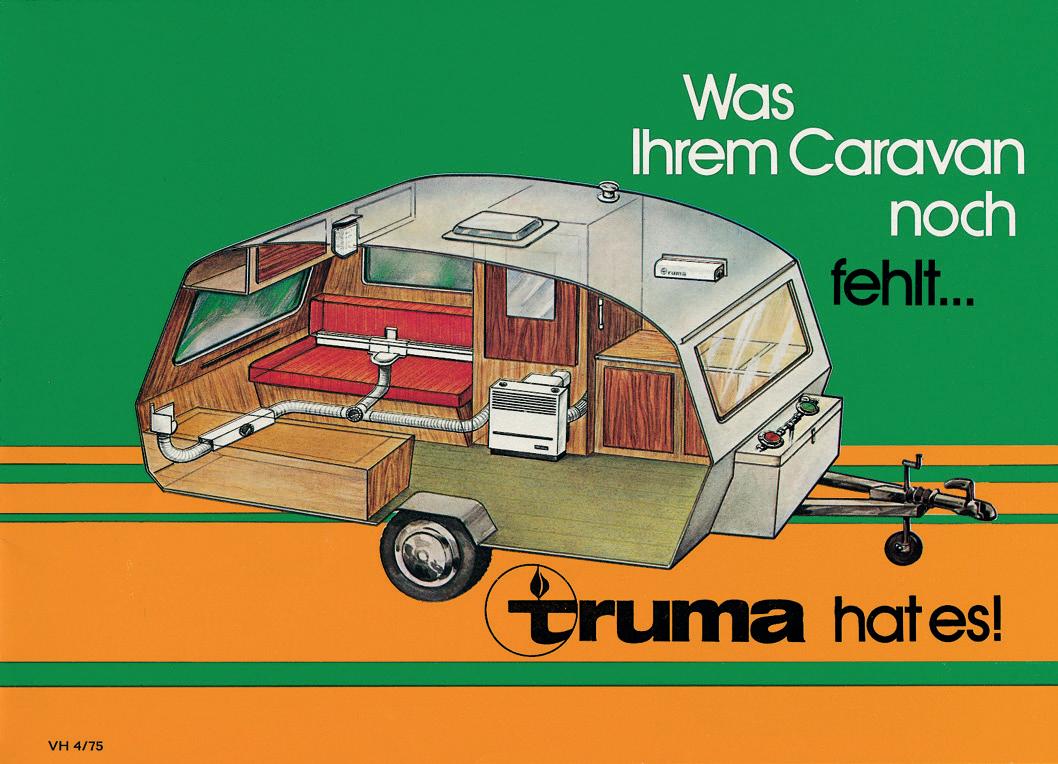

• 74 Truma Group 150 years of outdoor experience

• 76 Maller Winning team

•

Focus

• 48 Mario Bisson Politecnico di Milano

• 78 Hydrogen - part one

A new goal for camper propulsion and energy autonomy?

Reports

• 26 MELVI 2024

The European caravanning industry meets in Italy

• 82 Fit Your Camper 2024

A surprising debut for a first edition

News from the world

• 86 Updates from leading markets

3 Issue 43 JUNE/JULY/AUGUST 2024

40 Geoff Scott AutoSleepers

44 Shane Devenish CRVA

China’s All in Caravanning 2024 proves a great success

All in CARAVANING, which was held from April 19 to 21, 2024, at Beiren Etrong International Exhibition & Convention Center, Beijing, concluded successfully with 12,075 visitors over three days with an increase of over 45% compared to the last edition, among whom there are 326 overseas visitors from 41 countries and regions. Within the 27,000 square meters of indoor and outdoor exhibition space, 95 domestic and international brands were showcased. With strong support from CARAVAN SALON DÜSSELDORF, the world’s largest exhibition for motorhomes and caravans, AIC is dedicated to bringing the pinnacle of the global RV exhibition to China. For the first time, the exhibition was moved from its usual June slot to April, adapting to the evolving RV market and the growing needs of exhibitors. This strategic change paid off, with the event taking place during

Editorial

Editor in chief: Antonio Mazzucchelli direttore@aboutcamp.eu

Senior editor: Renato Antonini

Art director: Federico Cavina

more suitable weather and a prime buying season, thus attracting a larger number of visitors.

“I think that an exhibition like the AIC is the best bridge between the manufacturers and the potential customers to feel and touch it, to get an idea for the

international supporter.

“Over the past 13 years, AIC has committed to establishing an international and professional exhibition platform for the Chinese RV and camping industry. This year, AIC has been upgraded in terms of the exhibition promotion, on-site activities, and newly launched unique feature areas to better meet the local market demands for exhibitions,” said Mr. Marius Berlemann, Regional Head of Messe Düsseldorf for Asia and Managing Director of Messe Düsseldorf in China.

lifestyle. I believe this is what makes AIC important,” said Mr. Bernd Löher, President of the Caravaning Industrie Verband e.V. (CIVD), AIC’s most important

With strong support from Federal Ministry for Digital and Transport, and Federal Ministry for Economic Affairs and Climate Action from Germany, the German Pavilion has made a successful appearance at AIC. And the “Starter world of Caravaning” has become a very popular place, attracting a large number of visitors to have test-driving.

Editorial team: Paolo Galvani - Terry Owen

John Rawlings - Enrico Bona - Peter Hirtschulz

Steve Fennell - David Guest - Bartek Radzimski

Irene Viergever - Giovanni Ricciardi

Giorgio Carpi - Andrea Cattaneo

Web team: Maurizio Fontana - Gabriel Lopez

Advertising

Sales International: direzione@fuorimedia.com

Sales Italy: Giampaolo Adriano +39 338 9801370 adriano@fuorimedia.com

Web edition

Print edition

Would you like to receive the print edition of Aboutcamp BtoB? It is free of charge! Subscribe on www.aboutcampbtob.eu

Aboutcamp BtoB helps professionals in the caravan/RV and leisure industry around the world keep up to date with all the latest business news and market trends in this sector. It’s the most well informed source of B2B information in the caravan industry, with a unique global perspective and an international team of correspondents delivering daily news online at www.AboutcampBtoB.eu, a bi-monthly e-newsletter, and a high quality print magazine delivered (free) in Europe, the United States, Australia, New Zealand, South Africa, Japan, China, Korea, Argentina, Brazil, Chile. The Aboutcamp BtoB magazine is published four times a year with features including exclusive interviews with senior management from the industry, reviews of the major exhibitions around the world, and reports about the latest market trends, plus in-depth profiles of OEM suppliers who specifically manufacture components for this sector. With all the recent acquisitions, new technological developments and more and more consumers buying leisure vehicles around the world, Aboutcamp BtoB is essential reading for everyone working in any business related to the caravan industry. While so many flock to the internet, and have an inbox full of emails, Aboutcamp BtoB decided to print a paper magazine so that it gets more noticed, read, appreciated and discussed; so, we wish you happy reading!

Aboutcamp BtoB is also a website updated daily with news and information dedicated to RV builders and OEM producers. The website is supported by a professional newsletter sent monthly to the professionals in the RV sector. We also strengthened our presence on LinkedIn, where we manage the business page of the magazine but also the group “Caravanning Professional” which allows us to develop direct and informal relationships with decision-makers in the RV industry.

On our website is possible to read online the print edition of all Aboutcamp BtoB issues at: www.aboutcampbtob.eu/read-the-magazines

Fuori Media srl

Viale Campania 33 - 20133 Milan – Italy

Ph +39 0258437051 - E-mail: redazione@aboutcamp.eu

Internet: www.aboutcampbtob.eu

Registered with the Milan Court on 22 Dec. 2016 at No.310.

Subscription ROC 26927

4 N ews

Printed

at Graphicscalve SpA - Vilminore di Scalve (BG) Italy

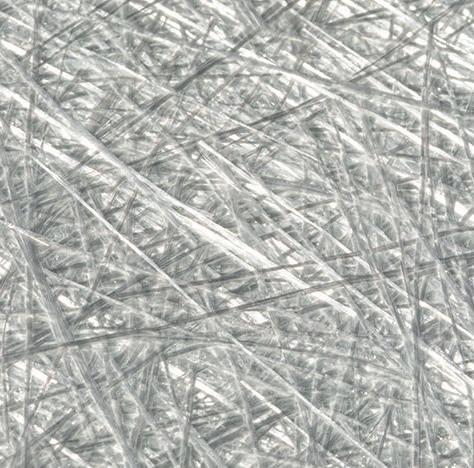

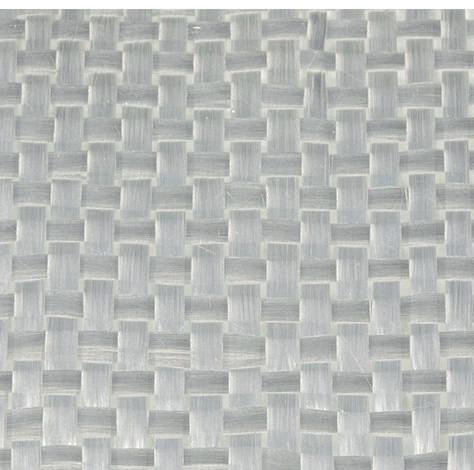

Headquarters

5

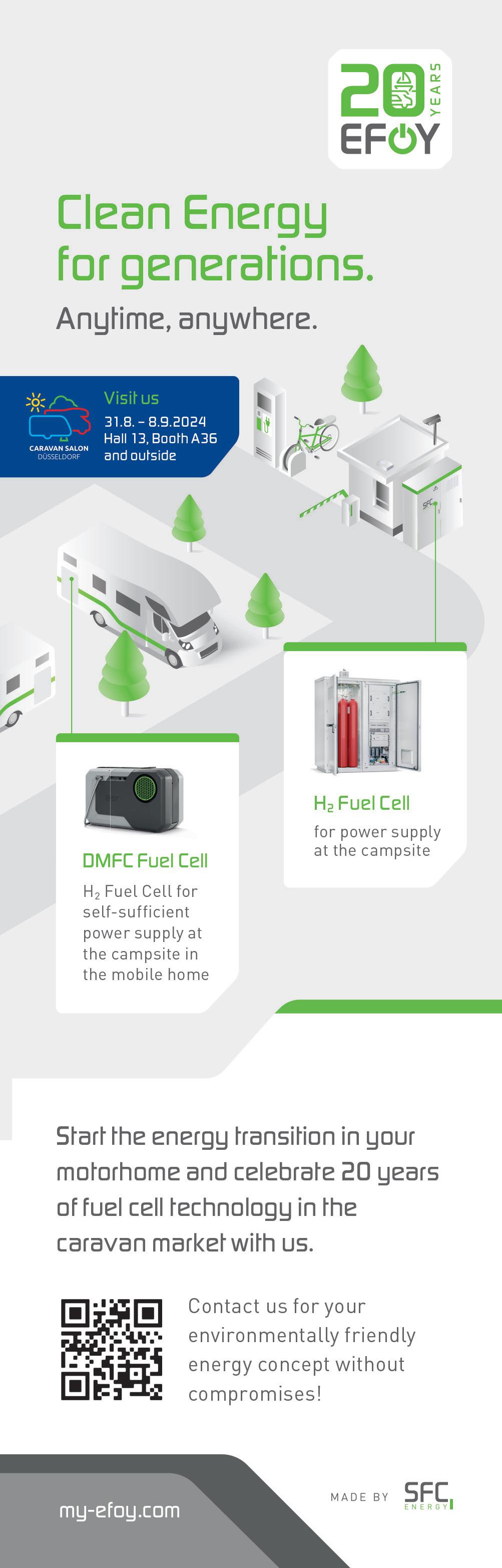

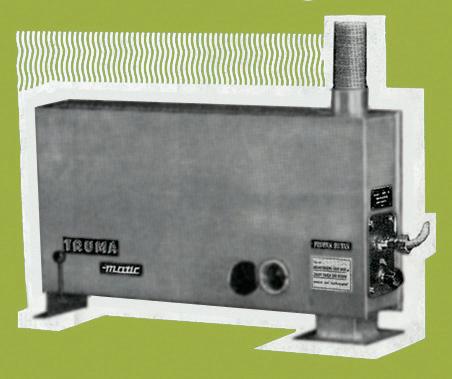

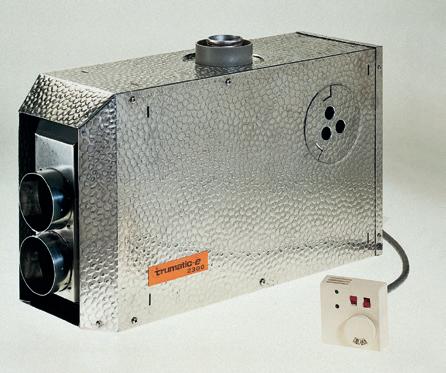

12,000 km zero-emissions caravan journey

A couple from the Netherlands have set off on a 12,000 km journey across Europe with a caravan storing hydrogen to power a fuel cell to charge their electric car to do the entire trip with zero emissions. The aim is also to prove that hydrogen could be a viable fuel for camping and caravanning, particularly for covering longer trips. The bespoke caravan is being towed by an all-electric Ford 150 Lightning pick-up truck. They have modified the car so it can be charged by a fuel cell while driving. With 28 kg of hydrogen stored in the caravan, they claim to be able to travel 1,100 km with-

out needing to refill. Their fuel cell also powers everything in the caravan, such as hot water and cooking facilities, supported by solar panels. During the road trip, they will be hosting events in each country to promote the use of hydrogen. They will be starting from the Netherlands and travel through 12 countries in 100 days to reach their destination in Istanbul, Turkey.

“Hydrogen plays an important role in reaching the targets of the Paris climate agreement for 2030. Over the last decade people always spoke about hydrogen as the fuel for the future. We want the world to know that the future has started,” say André and Els Molengraaf. “H2storage can deliver part of the solution to fulfill the climate agreement of Paris today. The fact is that we are able to store hydrogen today under high pressure, and use it as an energy carrier for the fuel cells or combustion engines,” they added.

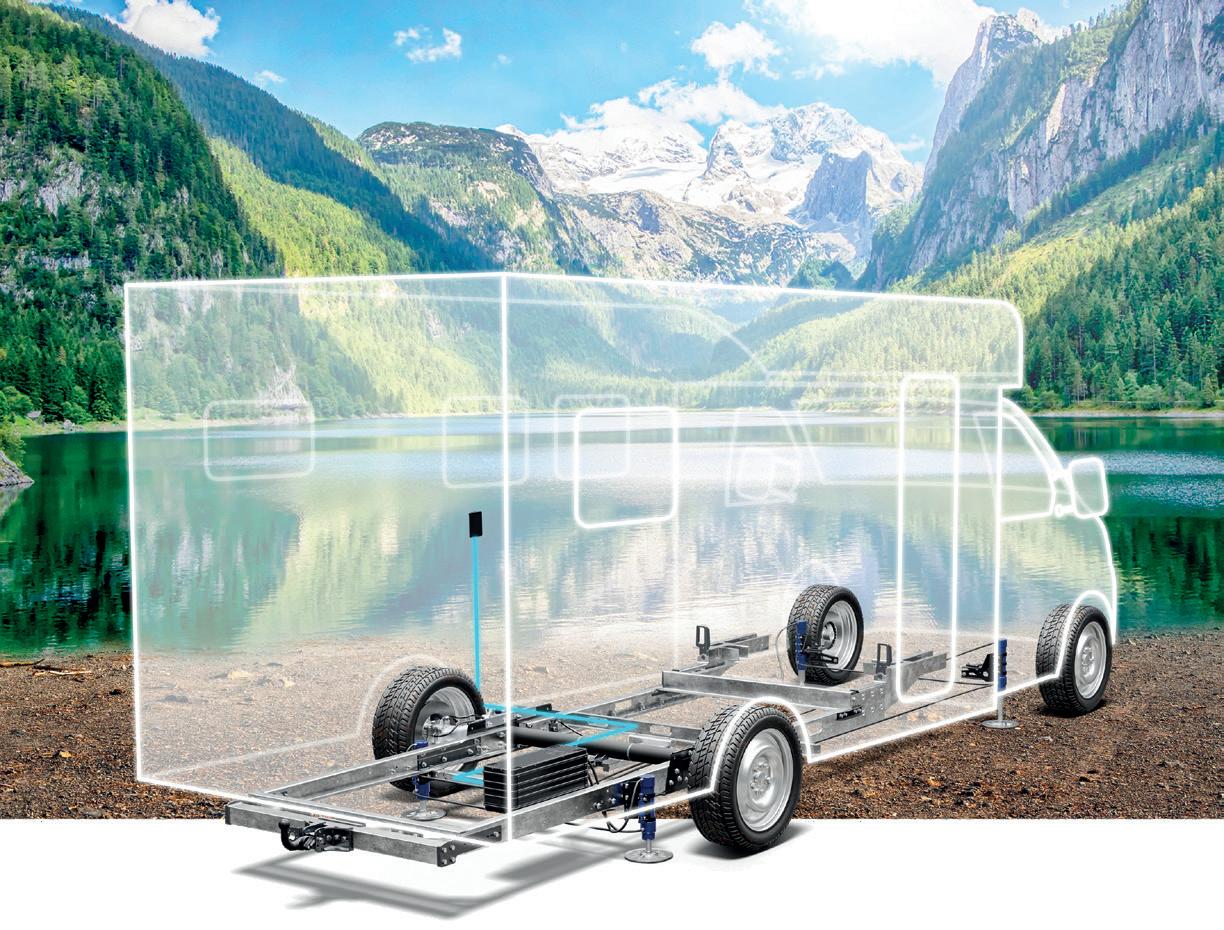

Flexis SAS teases image of its electric vans

Flexis SAS, the joint venture founded on March 22, 2024 by Renault Group and Volvo Group, is being joined by CMA CGM, through PULSE, its energy fund, which has acquired a 10% stake and confirmed its interest for a strategic investment up to €120 million by 2026. Volvo Group and Renault Group, holding each a 45% stake in Flexis SAS, plan to invest €300 million over the next three years. This coalition between the Volvo Group, Renault Group and CMA CGM Group intends to deliver the next generation of electric vans and address the expectations emerging as professional customers face increasing pressure from climate change and CO2 regulations, while e-commerce and logistics are booming. It says the European market for electrified vans is expected to grow by an average of 40% per year until 2030.Flexis SAS says it in-

tends to lead the decarbonization of transport and logistics sectors. As a coalition of three leading companies with an agile start-up approach, Flexis SAS combines the industrial expertise of world class automotive manufacturers and the know-how of the number one company for automotive logistics.

The vehicles will be built on a new fully-electric LCV skateboard platform that Flexis SAS says will offer high modularity for different body types at a competitive cost, and breakthrough on safety requirements. By adopting the new connected electronic platform, the vehicle will onboard unprecedented capabilities to monitor users’ delivery activity and business performance, reducing up to 30% the global cost of usage for logistic players. The van itself will offer a strong capacity for urban mobility, and be highly versatile for tailor made solutions with different battery capacities, as well as the first 800V architecture on the market for vehicles in this category. The vehicles will be produced in Renault Group’s Sandouville plant, expert in the LCV manufacturing, which will recruit 550 people over the next four years.

Bürstner’s Habiton micro camper wins another award

The Bürstner micro camper concept car Habiton, featuring an integrated roof tent, has won an iF Design Award in the “1.01 Automobiles / Vehicles” category. The iF Design Award is awarded by the iF International Forum Design GmbH and is considered one of the most prestigious awards in the design sector worldwide. Bürstner first revealed the Habiton micro camper concept car at the Caravan Salon in Düsseldorf last year.

Kampgrounds of America releases 2024 Camping & Outdoor Hospitality Report

Kampgrounds of America (KOA) has launched its 2024 Camping & Outdoor Hospitality Report – an annual research initiative that details North American leisure travelers’ camping and outdoor travel preferences and trends. Some key findings are that campgrounds have welcomed more than 41 million first-time camping households since the first survey was conducted in 2014 and since then there has been a 98% increase in the number of households that camp three or more times annually. More than half of campers reported they are more likely to continue camping in 2024 and beyond, a 15% increase over 2023. The 2024 report celebrates a decade of research and has been expanded to further examine the dynamic landscape of camping and outdoor hospitality. Supplemental reports include: outdoors & wellness; glamping; camping trips and travel experiences; and camping in Canada. Over the past 10 years of KOA’s research, active campers have increased by 68%, adding an additional 21.6 million households.

6

N ews

Trigano reports robust growth in first half of 2023/2024

Trigano has reported a significant increase in sales for the first half of the 2023/2024 fiscal year, with total revenues reaching €1.9 billion, marking an 18.4% rise from the previous year. This growth has been predominantly driven by a robust performance in the motorhome segment, which saw a remarkable increase of 26.4%. In the detailed financial breakdown, Trigano’s leisure vehicles, which include motorhomes and caravans, recorded sales of €1,827.5 million for the half-year, a 19.6% increase from €1,528.5 million in the previous year. This surge is attributed mainly to a significant improvement in the logistics chain and the end of shortages of rolling bases, which bolstered motorhome sales volumes by over 20%. Contrastingly, the caravan sector faced challenges, with sales plummeting by 29.4% due to rising interest rates affecting customer purchasing power. The accessories segment for leisure vehicles

also experienced a decline, dropping by 6.2%, influenced by a cautious approach from retailers adjusting to normalized wholesaler inventory levels during the winter. The leisure equipment sector painted a mixed picture. While trail-

er sales grew by 8.8%, benefiting from strong demand across all segments, particularly luggage trailers, the broader category of other leisure equipment, including camping and garden equipment, declined by 35.8%. This drop, however, is viewed as less significant due to the sea-

sonal nature of these products. Looking ahead, Trigano is optimistic about the ongoing calendar year. The company notes a positive trend in the motorhome market in Europe, particularly with firsttime buyers, and reports high attendance at fairs and regional shows. These factors are contributing to a robust spring sales period, particularly for new vehicles and traditional motorhomes. Trigano’s dealership network has successfully rebuilt inventories, positioning them well for sustained customer deliveries in the second half of the year. The company’s order books are full, indicating strong production capacity utilization for the 2023/24 season. The normalisation of logistics flows – still in progress – is resulting in a transitory increase in working capital requirement, which is enhanced by the development of Trigano’s retail business (Libertium and Marquis) and by the seasonality of the activity.

7

Lippert delivered ‘solid results’ in Q1 2024 financial report

LCI Industries, through its wholly-owned subsidiary, Lippert Components, Inc. (“Lippert”), has reported it first quarter 2024 results.

Consolidated net sales for the first quarter of 2024 were $968.0 million, a decrease of 1% from 2023 first quarter net sales of $973.3 million. Net income in the first quarter of 2024 was $36.5 million, or $1.44 per diluted share, compared to $7.3 million, or $0.29 per diluted share, in the first quarter of 2023.

The decrease in year-over-year net sales for the first quarter of 2024 was primarily driven by lower North American marine production levels and decreased selling prices which are indexed to select commodities, mostly offset by increased North American RV wholesale shipments.

“We delivered solid results in the first quarter, starting the year with healthy EBITDA generation and margin expansion supported by our strong operational focus and improved material costs. As we continue to diversify our business, strength in some of our growing markets like automotive aftermarket, housing, and our transportation businesses has consistently lifted profitability while adding a layer of durable, countercyclical revenue streams. We believe that our diversified markets will remain important drivers of Lippert’s profitable growth into the future,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer. “We are seeing signs of recovery in North American RV and expect a gradual improvement in production heading further into the year, led by towables where we typically provide the majority of our innovative RV content. Further, introductions of advanced products like our transformational ABS system are embedding us even deeper with key OEMs across our markets, creating opportunities for long-term content growth and serving as the catalyst for approximately $200 million in new business commitments for 2024.”

“We are committed to making continued operational improvements across our footprint, with a focus on creating flexible capacity while reducing costs. We continue to reduce inventory and focus on cash generation as we progress through the year. With our fortified balance sheet, we will continue investing in R&D and innovation while pursuing strategic growth opportunities and returning capital to shareholders,” continued Mr. Lippert. “Looking ahead, we are well-positioned to capture market share gains and advance our competitive position throughout 2024.”

April 2024 consolidated net sales were approximately $378 million, up 12% from April 2023, primarily due to an approximate 17% increase in North American RV production, partially offset by an approximate 33% decline in marine sales compared to April 2023.

The new Crafter is ready to go

The new Crafter will be taken to a higher level by means of an extensive software and hardware update. The cockpit in particular has been completely redesigned and now features the latest generation of infotainment systems. The fresh features include the Digital Cockpit, a multifunction steering wheel, an electronic parking brake and various assist systems. A key option is the digital voice assistant with ChatGPT integration. Pre-sales of the new Crafter start in mid-April.

The new Crafter will come with digital instruments as standard: the Digital Cockpit. A defining interior detail of the 2024 Crafter is a now 10.3-inch and optionally 12.9-inch infotainment display based on the latest modular infotainment matrix (MIB). The visually free-standing Volkswagen system has a newly developed graphical interface and self-explanatory menu navigation. The Crafter will also receive a new online voice control system for many vehicle functions. This system features ChatGPT integration and responds to natural voice commands. The handbrake and the switch for the automatic gearbox have been redesigned, as have the controls for the light functions, the buttons in the area of the centre console and all vents.

Tickets for the 63rd Caravan Salon Düsseldorf on sale

CARAVAN SALON will open its doors with a globally unique offering from 30 August (Preview Day) to 8 September 2024. The sector’s most important manufacturers will be presenting caravans, motorhomes and campervans for every taste and every destination in Düsseldorf. In addition, visitors can look forward to a huge selection of accessories, technical equipment, detachable parts, rooftop tents, mobile homes, caravanning and camping supplies, travel destinations, campsites as well as RV park pitches.

The Preview Day on Friday, 30 August, is particularly suitable for those interested in seeing and examining live the innovations of the sector right on the first day of the trade fair. The limited number of tickets ensures a relaxed tour of the exhibition halls. The exclusive atmosphere permits visitors to compare favourite models without time pressure and is especially recommended for visitors with concrete intentions to buy. The Preview Day is also ideally suited for experts, industry insiders and business visitors as a networking platform with one-on-one consulting and in-depth conversations.

8 N ews

Messe Düsseldorf appoints Marius Berlemann as new MD

Messe Düsseldorf GmbH, the venue for the annual Caravan Salon, has appointed Marius Berlemann (38) as the operative managing director. When he takes on this new role on August 1, Marius Berlemann will succeed Erhard Wienkamp (65), who will retire at the end of July 2024. As operative managing director, Marius Berlemann will take over Erhard Wienkamp’s areas and projects at the homebase Düsseldorf and worldwide. He’ll also

be responsible for the Retail and Retail Technologies portfolio (EuroShop and EuroCIS) and the Occupational Safety and Health/Glass Technologies portfolio (A+A and glasstec). He’ll also oversee the Corporate Social Responsibility department and two of Messe Düsseldorf’s three sales teams. In addition, Marius Berlemann will be responsible for the departments International Participations & Services, Special Events, which includes the German venues for the Olympic and Paralympic Games, Conference Management and International Business. Marius Berlemann has been working at Messe Düsseldorf GmbH for over 13 years. In 2011, he started his career there with a traineeship. Subsequently, he served as senior project manager of ProWein where he was already involved in the internationalization of this event and looked after key accounts. In 2013, he was

posted to Messe Düsseldorf Shanghai to organize the first ProWine China as project director. He returned to Düsseldorf in 2014, where he served as the project director of ProWein and global head of Wine & Spirits until 2019. Berlemann then returned to Messe Düsseldorf Shanghai, where as general manager he has since been responsible for 63 employees and twelve international trade shows. In addition, he added the role of managing director of Messe Düsseldorf China, which in 2023 he led to its most successful fiscal year since its founding. On top of that, Berlemann currently manages the new regional hub Messe Düsseldorf for Asia (MDfA) in Singapore, which was founded in April 2024, making him responsible for Messe Düsseldorf’s entire Asian business.

9

Winnebago announces second quarter 2024 results

Winnebago Industries, Inc. has issued its financial results for the fiscal 2024 second quarter (ended February 24, 2024) showing total revenues of $703.6 million, a decrease of 18.8% compared to $866.7 million for the comparable fiscal 2023 period, driven by lower unit sales related to market conditions and unfavorable product mix. Gross profit was $105.3 million, a decrease of 28.3% compared to $146.8 million for the fiscal 2023 period. It recorded a net loss was $12.7 million, compared to net income of $52.8 million in the prior year quarter.

“Winnebago Industries performed in line with our expectations for the quarter, navigating the effects of ongoing softness in the RV and marine markets,” said President and Chief Executive Officer Michael Happe. “As anticipated, wholesale shipments were constrained in the quarter, as dealers continued to closely manage inventory levels amid a higher inter-

est rate environment and seasonal demand trends. Despite these macroeconomic challenges, we continue to demonstrate resilient profitability and an unwavering commitment to operational discipline that is reflected in the Company’s diversified portfolio of premium brands, investments in new products and technologies, and healthy balance sheet.”

Revenues for the Towable RV segment were down compared to the prior year, primarily driven by a decline in unit volume related to market conditions and a reduction in average selling price per unit related to product mix and targeted price reductions, partially offset by lower discounts and allowances. Backlog decreased compared to the prior year due to current market conditions

and a cautious dealer network.

Revenues for the Motorhome RV segment were down from the prior year, due to a decline in unit volume related to market conditions, higher levels of discounts and allowances and unfavorable product mix, partially offset by price increases related to higher motorized chassis costs. Backlog decreased from the prior year due to current market conditions and a cautious dealer network.

10 N ews

Stellantis commercial vehicles confirms market leadership in several global markets in Q1 2024

Stellantis Pro One commercial vehicles achieved market leadership in the Middle East and Africa region for the second quarter in a row, and maintained the No. 1 position in both EU30 and South America regions. In total, it accounted for one-third of Net revenues reported by Stellantis.

The performance highlights the strength of Stellantis Pro One in global markets and puts it on track to achieve global leadership in commercial vehicles by 2027 and reach the targets outlined in the Dare Forward 2030 strategic plan.

Stellantis Pro One Middle East and Africa region market share reached 26% in the first quarter of 2024.

For EU30 BEV (battery electric vehicle) sales for the quarter, Pro One takes the top spot with 33% market share, with the Peugeot brand leading across the region.

“The Q1 2024 sales performance in commercial vehicles confirms and validates our Stellantis Pro One strategy,” said Xavier Peugeot, Stellantis Senior Vice President, Commercial Vehicles Business. “The enthusiastic welcome of our entirely new van line-up, combined with new connected services and concrete hydrogen fuel cell propulsion van offers confirm Stellantis’ position as the relevant choice for professionals.”

Indel

B achieves Q1 2024 revenue of €53.4 million

Indel B S.p.A. achieved consolidated sales revenues of €53.4 million at 31 March 2024.

Luca Bora, CEO Indel B, said: “Although there has been a drop in revenues, we are satisfied with the results we approved today. Despite a very complex and challenging market environment, which is expected to remain so throughout 2024, we have managed to contain its impact on the Group’s numbers, which once again shows resilience to the difficulties and weaknesses of certain economic cycles. The results once again confirm the validity of our strategic plans, which will continue to guide our actions. The company remains positive in the medium to long term, as per se the reference markets do not show any criticality on their fundamentals”.

11

RV shipments in USA increase 9% in April 2024

The RV Industry Association’s April 2024 survey of manufacturers found that total RV shipments ended the month with 34,197 units, an increase of 9.5% compared to the 31,216 units shipped in April 2023.

“We are encouraged by the continued incremental increases we have been seeing in RV shipments over the past six months,” said Craig Kirby, RV Industry Association President & CEO.

“In this budget conscious environment, consumers are looking for more affordable travel options for their summer trips. RVing is the choice for over 45 million Americans this summer because they can create lifelong memories with family and friends while also saving up to 60% compared to traditional air/hotel vacation.”

Towable RVs, led by conventional travel trailers, ended the month up 14.2% from last April with 30,682 shipments. Motorhomes finished the month down

(-19.4%) compared to the same month last year with 3,512 units.

To date, RVs are up 9.4% compared to the same timeframe last year with 120,138 units shipped through April.

Park Model RVs finished April down (-6.2%) compared to the same month last year, with 453 wholesale shipments.

The charts show 2023/2024 month over month total wholesale RV and Park Model shipments.

Thousands of staff take part in Lippert Volunteer Week

For the fifth year in a row, Lippert Components participated in National Volunteer Week, April 21st–27th, reaffirming its commitment to using Business as a Force for Good in the World. As Volunteer Week unfolded across the nation and around the globe, thousands of Lippert team members joined in, spearheading impactful initiatives.

12 N ews

FOR LEISURE VEHICLES

M.B. Trading is a leader supplier for RVs decorative stickers in Europe.

13 DECORATIONS

Knaus Tabbert increases turnover by 2.2% in Q1 2024

The Knaus Tabbert Group increased its revenue by 2.2% to €376.7 million in the first quarter of 2024 (previous year: €368.5 million). The Group continues to have a solid order backlog of around €621 million as at the reporting date of 31 March 2024 – measured against the revenue forecast for 2024 as a whole.

“The start to 2024 is characterised by a positive development of the leisure

vehicle market in Europe. Record figures for new registrations impressively confirm this,” comments Wolfgang Speck, CEO of Knaus Tabbert AG, on the start to the 2024 financial year. “Our order backlog as of the end of March, the product innovations planned for the 2025 model year and the launch of a new brand give us the necessary planning security and confidence for the 2024 financial year.”

In the first three months of the 2024 financial year, Knaus Tabbert achieved an increase in sales in all business segments. €327.7 million of Group sales were attributable to the premium segment (previous year: €323.1 million), while a further €49.0 million (previous year: €45.5 million) was attributable to the luxury segment. Group sales resulted mainly from the sale

Dometic sales down but EBITA margin improves

Dometic’s Q1 results for 2024 show that net sales were SEK 6,527 m (7,289), a decrease of -10%, of which -12% was organic growth. Operating profit (EBITA) before items affecting comparability was SEK 769 m (847), corresponding to a margin of 11.8% (11.6%), and operating profit (EBIT) was SEK 611 m (667), corresponding to a margin of 9.4% (9.2%). Profit for the period was SEK 273 m (334).

“Despite lower net sales,” says the CEO Juan Vargues, “the EBITA-margin before items affecting comparability for the quarter improved to 11.8 percent (11.6) supported by efficiency improvements, including the cost reduction programs completed in 2023, and continuous price management. In its first quarter as a separate segment, Mobile Cooling Solutions reported a higher margin despite lower net sales supported by sales initiatives, product innovation and cost reductions. The margin for segment Global Ventures improved to 14.2 percent (13.3) fueled by a stronger performance in subsegment Mobile Power Solutions. Segment Land Vehicles EMEA continues to show improvements compared to previous periods while segment Land Vehicles Americas EBITA margin remained under pressure. Several sales and

operational initiatives were launched in the Land Vehicles Americas segment during the quarter, and I am convinced this will accelerate our transformation journey and drive efficiencies and gradual improvements. We will also continue prioritizing margins over volumes on the competitive US market where RV industry production remains at a low level”.

“The long-term trends in the Mobile Living industry are strong, however it remains difficult to predict how the current macroeconomic situation and market conditions will impact the business in the short term. Our planning assumptions from 2023 remain largely unchanged; we anticipate the recovery in demand in the Service & Aftermarket sales channel to continue in 2024. In the Distribution sales channel we expect a continued gradual recovery coming quarters as retail inventories decline. In the OEM sales channel we foresee a continued weak demand short-term but with an improvement towards the end of the year.”

of recreational vehicles. Aftersales, which mainly comprises the spare parts business, contributed €9.9 million (previous year: €4.3 million) to sales. Based on the current business development of the Knaus Tabbert Group, the following forecasts have been made for the key performance indicators. For the 2024 financial year, we expect Group revenue to develop in a range of €1.4 billion to €1.55 billion compared to the 2023 financial year. For the remainder of the 2024 model year, which ends on 31 July 2024, Knaus Tabbert is not planning any price increases compared to the trade. In the past financial year, Knaus Tabbert delivered 4,663 motorhomes and camper vans (previous year: 4,390) and 2,925 caravans (previous year: 3,915) across the Group. A total of 7,588 units were invoiced.

REV

Group promote Gary Gunter to Vice President of REV Recreation Group

REV Group has announced the promotion of Gary Gunter to the role of Vice President/General Manager of REV Recreation Group, Inc., encompassing Fleetwood Family Class A RV brands which includes Fleetwood RV, Holiday Rambler, and American Coach and Goldshield Fiberglass.

Gary has been with the company since 2011. His first position at REV Recreation Group was Division Controller before moving to Divisio Controller – Recreation at REV Group Inc.

14 N ews

www.cta-europe.com info@cta-europe.com A leader of the European recreational vehicle components market and boasting more than 40 years of experience, CTA designs and builds innovative solutions improving safety and comfort inside the vehicle. SAFETY is our commitment, COMFORT our added value Buckle up and travel with CTA

New Ducato: 8-speed automatic transmission

FIAT Professional debuts the AT8 model, a new 8-speed automatic transmission, in the New Ducato, including its Camper variant, offering a reduction in CO2 emissions of 10 percent compared to the current automatic version. The AT8 has a more balanced, efficient, and much more controlled torque for enhanced comfort that is now defined by improved shift times, quality, and control. All these characteristics are derived from the new clutches, resulting in more efficient drivability due to the optimized torque, up to the best-in-class 450 Nm torque for a front wheel-drive large van on the 180 Multijet 4.0 engine. Another significant innovation is provided by a hydraulic accumulator, a key component in the support of transmission shifts, that manages to increase the proficiency of the output by enabling a faster response time, alongside with refinement during Engine Stop Start. The new AT8 will also be offered for the Ducato Camper, which will benefit from this significant transmission improvement. The transmission is suitable for Motorhomes up to 5-ton GVW, with an increase of over 600 kg compared to previous models and a total weight including towing of 6.5 tons. This places the New Ducato and FIAT Professional as standout choices in the market.

The anticipated CO2 reduction accompanying the launch of the AT8 was already factored into the creation process of the New Ducato, thanks to its aerodynamic enhancements.

Dexko acquires truck and trailer parts manufacturer

DexKo Global Inc. has completed the acquisition of City Spring & Axle Ltd., Pacific Spring & Axle Ltd., and Spring Service Ltd. (collectively “City Spring”), headquartered in Edmonton, Alberta, Canada through its wholly-owned subsidiary Dexter Axle Company LLC. (“Dexter”). City Spring, founded in 1956, operates out of four locations in Western Canada. “The diversity of the City Spring business was a key factor in this strategic acquisition,” states Adam Dexter, CEO, Dexter.

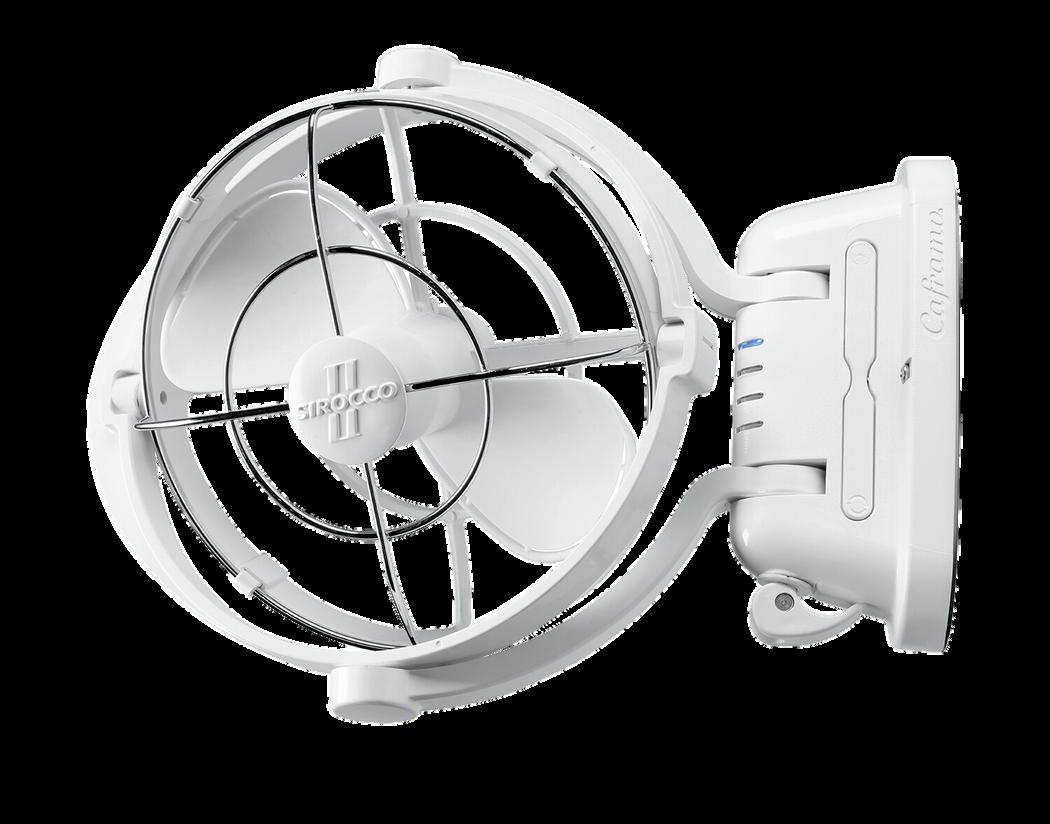

The Best Vans Have Sirocco Fans

#1 Cooling Fan for RV’s, Caravans and Motorhomes Proudly Made in Canada

N ews

seekr.caframobrands.com

www.flatlaminates.com

HIGH QUALITY GRP FOR RECREATIONAL VEHICLES. We stand right in the middle of every project realization. Close to you since 1962

Jörg Steins takes over CEO role at Purem by Eberspaecher

For health reasons, Marcus Knödler has resigned from his role as CEO of Purem by Eberspaecher. He will remain part of the Division’s management team and his CEO role will be taken over by Jörg Steins.

Jörg Steins will act as COO of the Eberspaecher Group and, as CEO, will be responsible for the business activities of all three Divisions. Jörg Steins will continue the existing strategy and the successful transformation course. The 56-year-old has been working for Eberspaecher since January 2024 and is already CEO of the Climate Control Systems and Automotive Controls Divisions.

“We are convinced that Jörg Steins will successfully take on the expanded role thanks to his many years of management and automotive expertise,” emphasizes Managing Partner

Martin Peters and adds:

“We would like to thank Marcus Knödler for the trusting cooperation over the past years, his

extraordinary commitment and his outstanding work. After a transition period, we will decide together in which management function he will return to the company.”

Marcus Knödler joined Eberspaecher in 2016 and most recently assumed sole responsibility for the Purem by Eberspaecher Division as CEO. The Division has around 35 production sites worldwide. More than 7,100 employees develop and produce exhaust aftertreatment and acoustic systems for passenger cars, commercial vehicles and off-road vehicles to ensure clean and quiet mobility.

Volkswagen prepares self-driving ID.Buzz for the commercial vehicle sector

Volkswagen is developing a self-driving ID. Buzz AD for the commercial vehicle sector and mobility and transport services in Europe and the USA. It has announced a cooperation agreement with the Israeli technology company, Mobileye Global Inc, to develop and supply software, hardware components and digital maps for the self-driving ID. Buzz AD. Volkswagen is the first vehicle manufacturer to develop an autonomous Level 4 service vehicle for large-scale production. It has already undertaken an extensive road testing pilot phase in Germany and the USA. The main part of the agreement covers delivery and use of a self-driving system (SDS) for a special version of the ID. Buzz which has been under development for autonomous driving since 2021. It corresponds to the Level 4 definition of the Society of Automotive Engineers (SAE), in which the autonomous vehicle operates self-driving in a defined area such as a city.

“Bringing autonomous shuttles on the road in large quantities requires cooperation from strong partners,” says Christian Senger, member of the Board of Management at Volkswagen Commercial Vehicles, responsible for Autonomous Driving, Mobility and Transport (ADMT): “We are developing the first fully autonomous largescale production vehicle, using Mobileye’s digital driver.”

Messe Düsseldorf ends fiscal year 2023 with record profit

Messe Düsseldorf GmbH, the venue for the annual Caravan Salon trade fair, increased its sales by 31.5% to €391.4 million (previous year: €294.9 million), while its after-tax profit rose by 10.3% to €87.3 million (previous year: €71.6 million). At the company’s Shareholders’ Meeting on May 24, 2024, the decision was made to distribute a dividend of €31.5 million.

The Messe Düsseldorf group ended the 2023 fiscal year with record sales of €422.5 million (previous year: €310.9 million), a considerable increase of more than 35.9%.

After-tax profit also increased significantly, up 56.2% to €94.6 million (previous year: €60.5 million).

A total of 73 trade shows took place in 2023, of which 27 were held in Düsseldorf, attracting 26,866 exhibitors and 1,146,874 attendees to the city. The 17 trade shows directly organized by Messe Düsseldorf had the largest share of this: Their 24,469 exhibitors demonstrated the highest level of international participation to date, at 78 percent (previous year: 75 percent). Their 1,074,870 visitors achieved the second-highest level of international participation to date, at 39 percent (previous year: 46 percent).

In order to create a foundation for growth in the Asian market, Messe Düsseldorf recently united its five Asian subsidiaries in a centrally coordinated network, the new regional hub “Messe Düsseldorf for Asia” (MDfA), which will manage the company’s Asian business out of Singapore. While customers will benefit from a range of products and services in Asia tailored to regional needs, centrally located contact persons and even stronger business platforms, Düsseldorf’s leading global trade shows will profit from an increase of exhibitors and visitors from Asia.

18

N ews

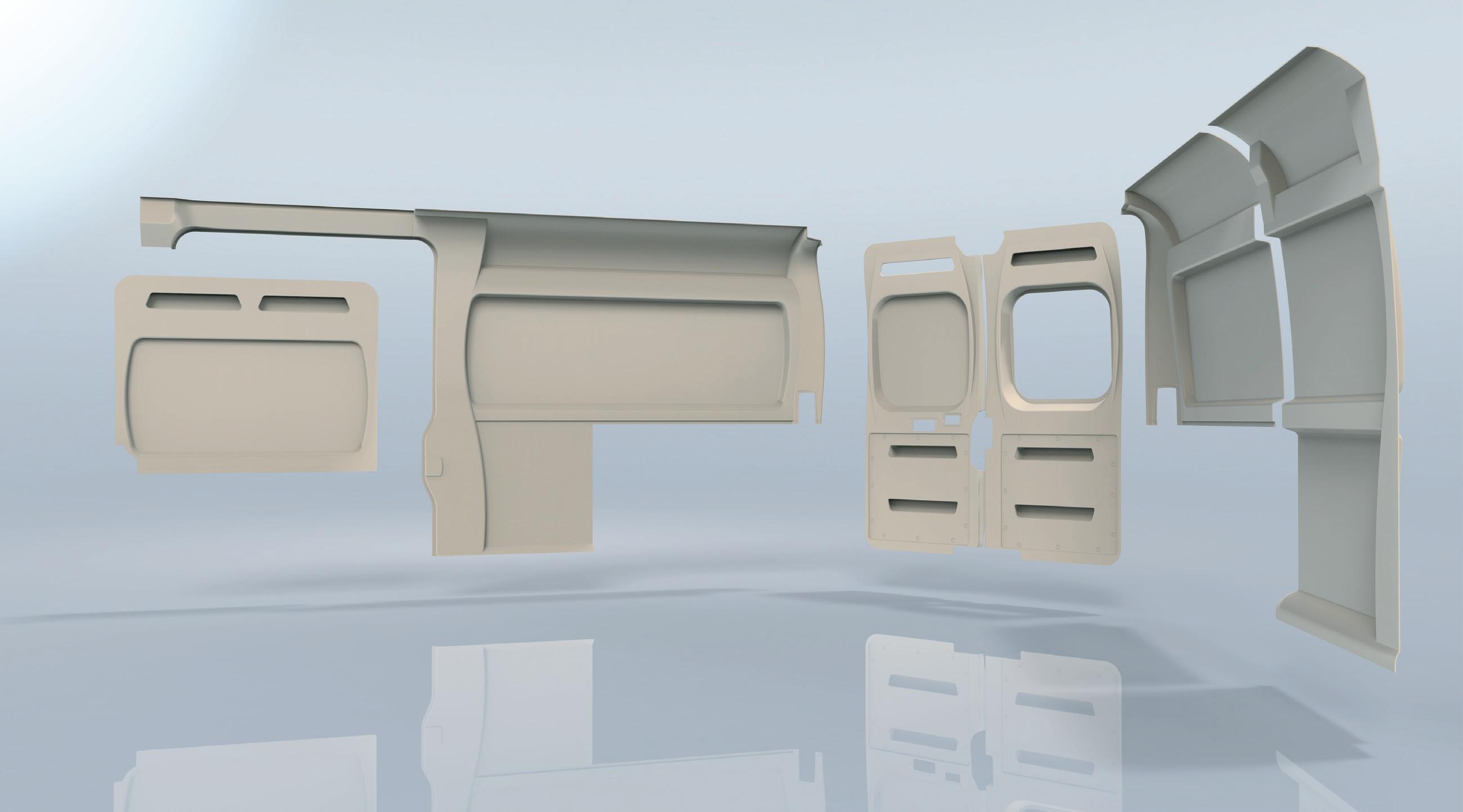

Your plan. Our project. Together by tecnoform.com tecnoform_of cial

The motorhome vacation is more sustainable compared to the “car+hotel” combination

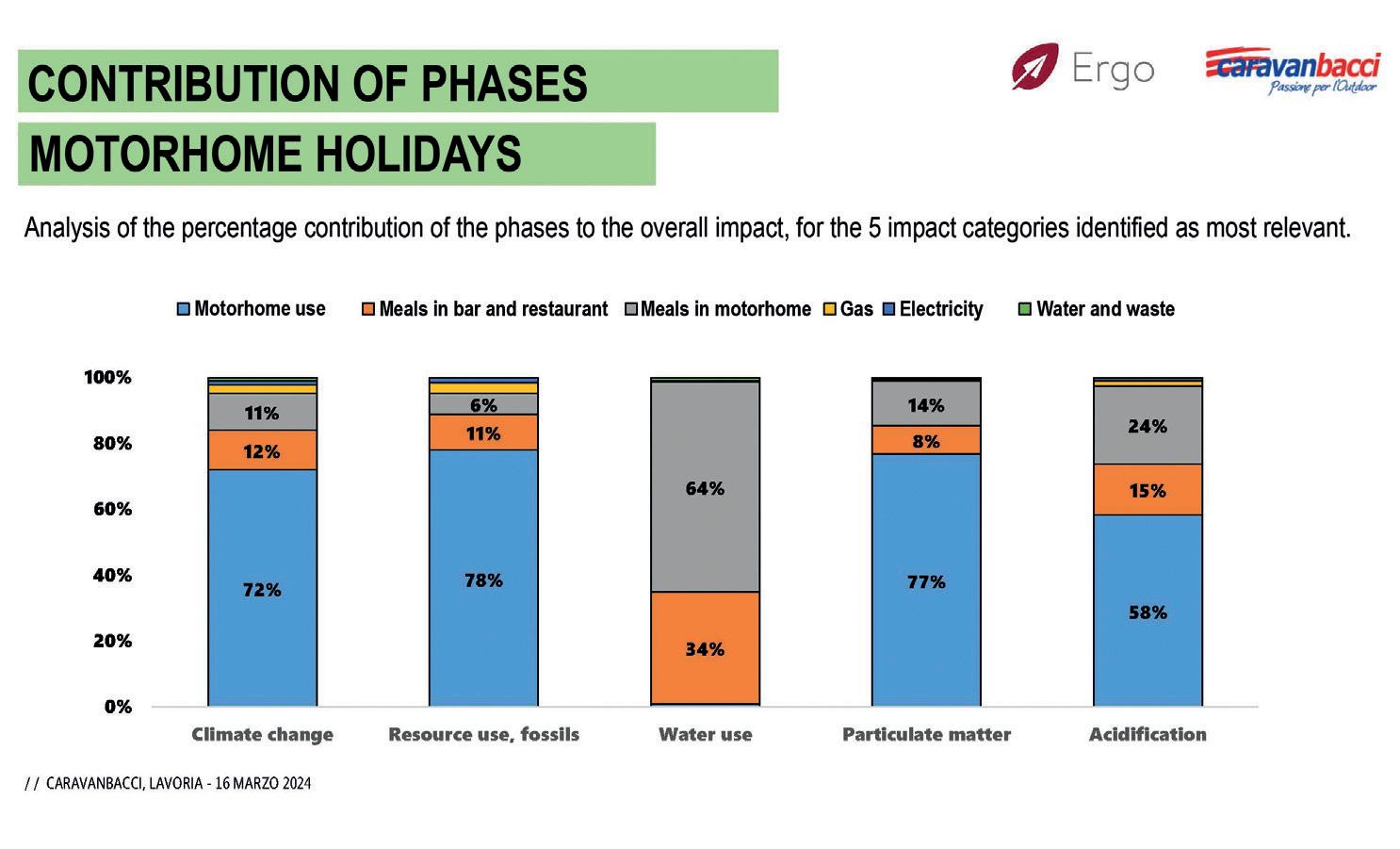

The environmental impact of motorhome vacations is always a much-debated topic. The latest research on this subject comes from Italy. The report was realized thanks to the efforts of a major Tuscan dealer: Caravanbacci, whose owner Paolo Bacci organized a conference at his facility to bring together all the relevant figures in outdoor tourism in Tuscany.

At the center of the meeting was the presentation of data from research conducted by Ergo, a spin-off of the Sant’Anna School of Advanced Studies in Pisa, in collaboration with the associations ACTItalia and UCA. Presented by Fabio Iraldo, Full Professor of Management, the research was described as “a challenge from

tionnaires would have been enough to obtain reliable results. This way, even after eliminating all questionnaires that might be unreliable, the remaining number produced a very accurate picture.

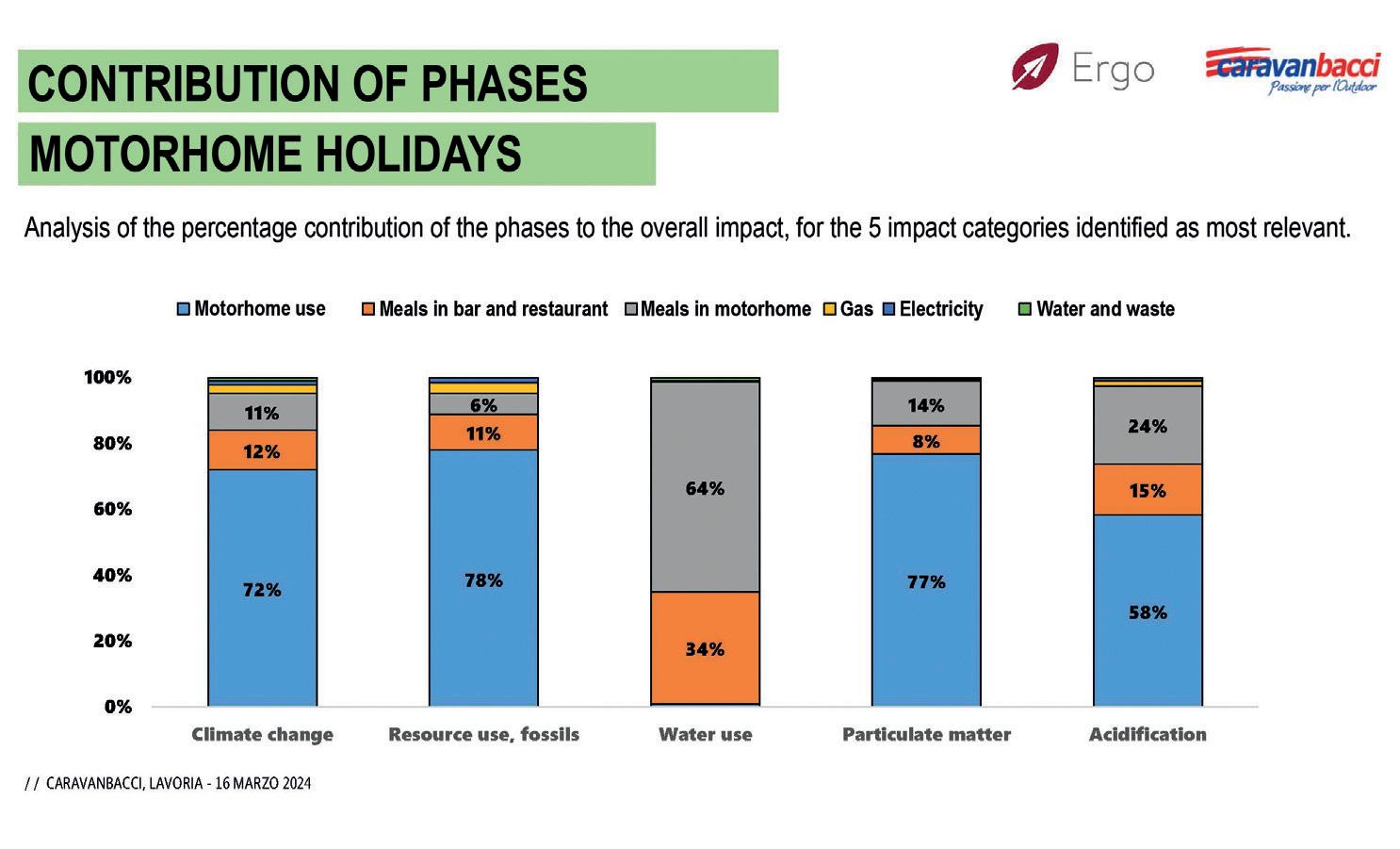

The methodology used is now consolidated and recognized, if not substantially imposed, by the European Union: the Life Cycle Assessment (LCA), which evaluates the environmental impact from a 360-degree perspective, considering everything that involves the vacation: the trip, the stay, meals, climate control, and so on. It was found that an Italian crew consists, on average, of 2.27 adults and 0.37 children, that the average distance traveled was 2,367 kilometers, with 13.7

the perspective of innovation, it was avant-garde research”. Not so much for the topic, since it is evident that the environment and tourism significantly influence each other, but for the use of “primary” data, i.e., collected directly from campers and then compared with those of more traditional vacations, and for the duration of the survey: a full nine months compared to the more traditional three.

The survey

Conducted from August 2022 to April 2023, the survey resulted in 1,958 questionnaires, studied as if they were travel logs. Given that there are 248,300 circulating vehicles in Italy, this is a statistically more than significant sample: approximately 500 ques-

nights and 9.7 meals out, 7.3 kg of gas consumed, 364.3 liters of water used, and 22.3 kWh of electricity consumed. Five main categories of environmental impact were considered: climate change (CO2 emissions), particulate emissions, acidification (indicator of potential soil and water acidification due to the release of gases), use of fossil resources, and water consumption. For each of these, the use of the motorhome, meals at bars or restaurants, meals in the motorhome, gas, electricity and water consumption, and waste production were evaluated. In the end, the use of the motorhome as such contributes the most in every category except for water consumption.

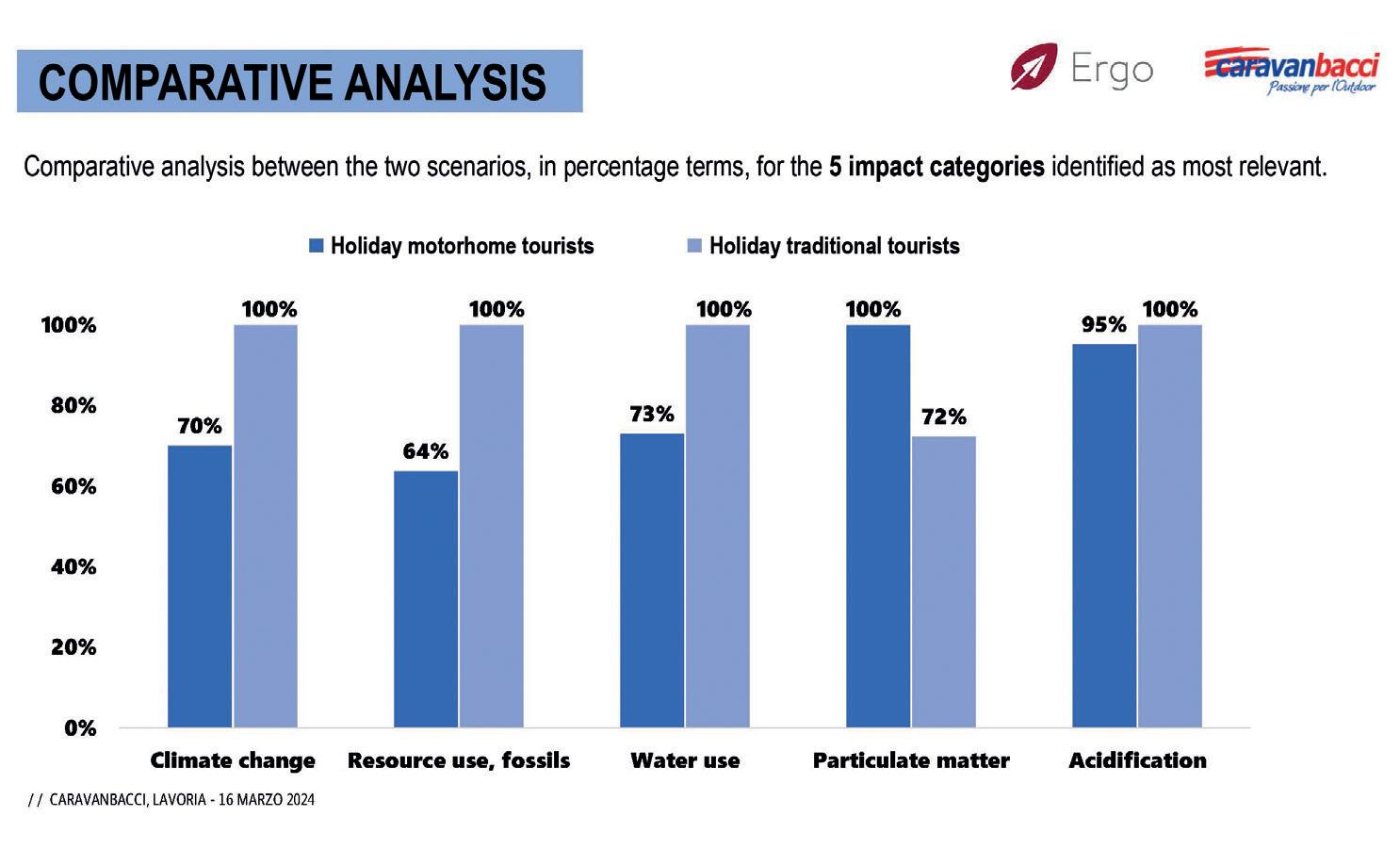

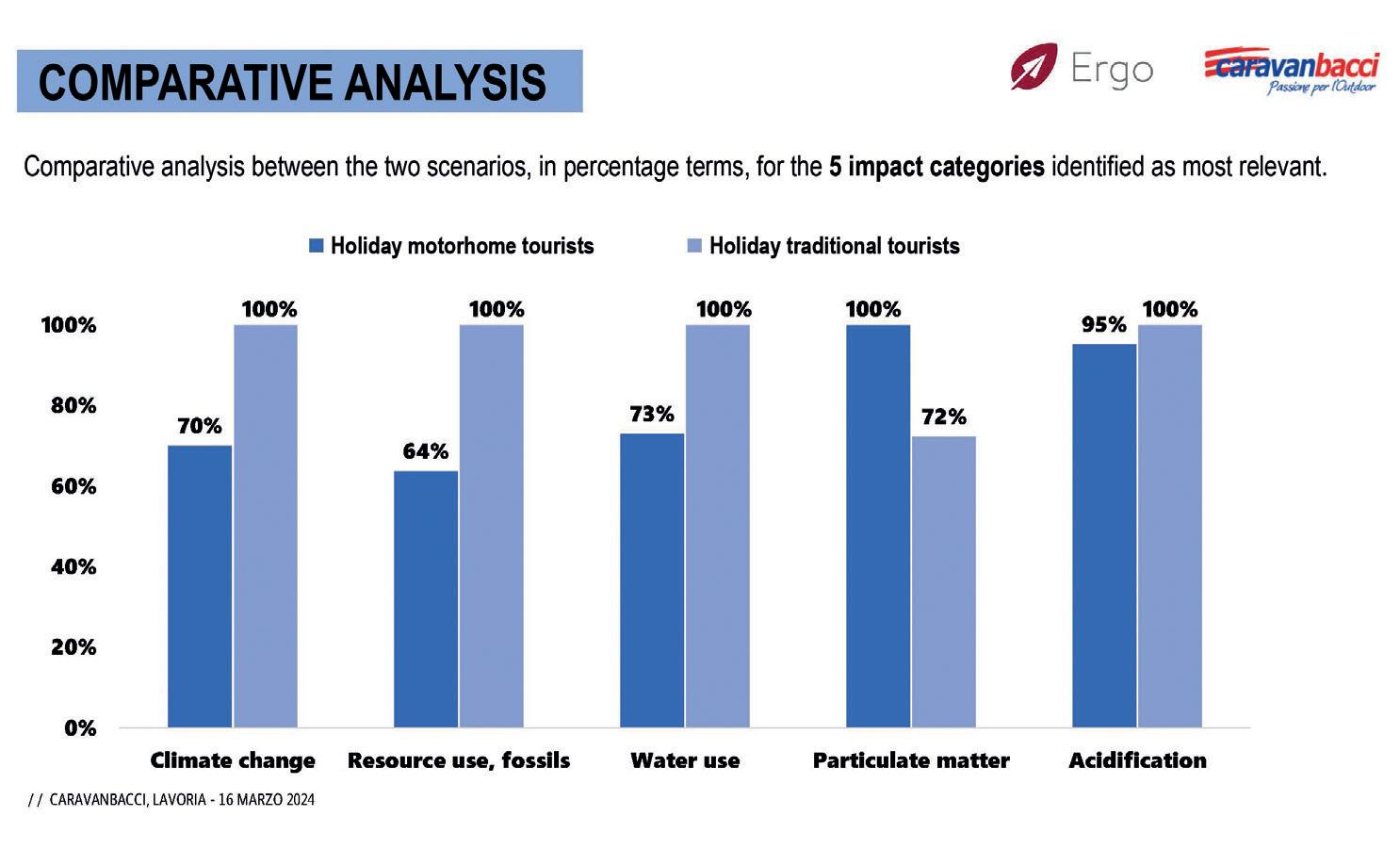

Conclusions

The most interesting data, of course, concerns the comparative results, comparing the motorhome vacation with the car + hotel formula. The conclusion is that the impact of the motorhome is much lower: compared to the “traditional” vacation, the motorhome has an impact of 64% in fossil resource use, 70% in climate change, 73% in water consumption, and 95% in acidification. The only parameter where the motorhome vacation is worse is in particulate emissions, where cars reach 72%. This confirms what could intuitively be imagined. Ergo’s research thus confirms once again that the motorhome vacation is a more environmentally sustainable choice compared to a hotel vacation with car travel.

20 N ews

21 Aluminium is On Your Side Aluminium offers a number of advantages for owners and manufacturers of recreational vehicles: - Automotive surface quality - Superb color and gloss retention - Lowest weight per square meter - Safe and healthy to work with - Fully circular material Discover what Euramax can do for you on euramaxcladding.com

on EUROPEAN MARKET

Stable market in 2023

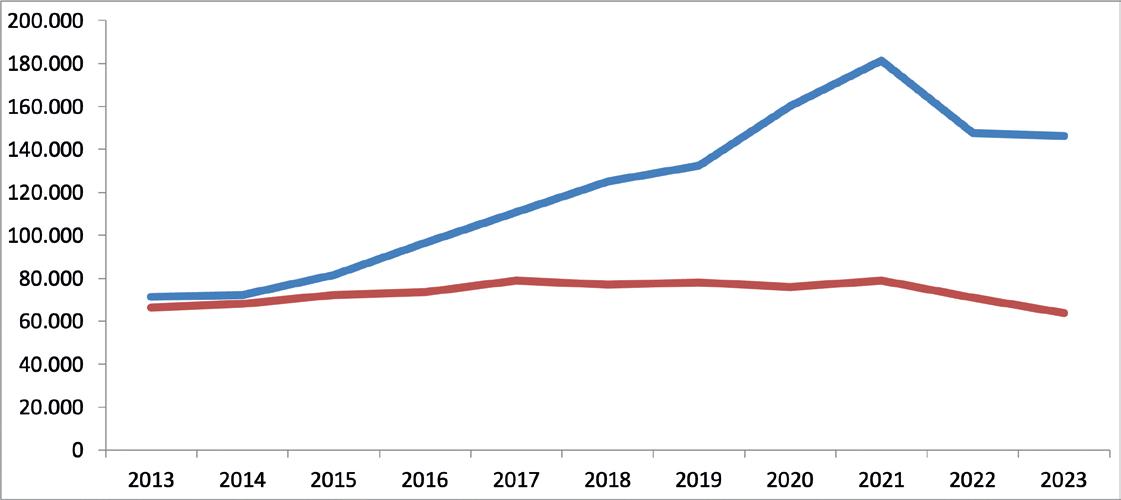

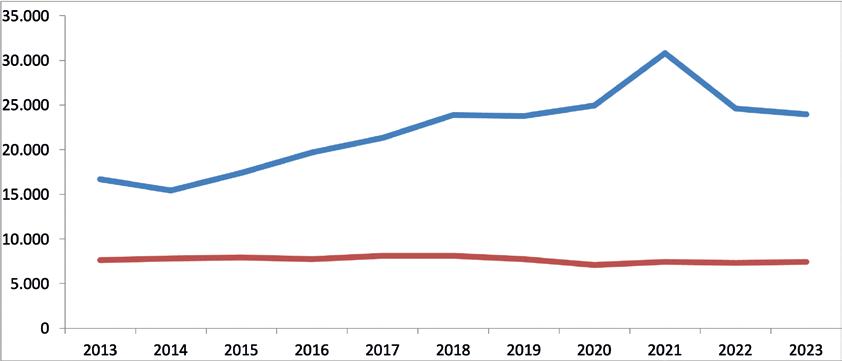

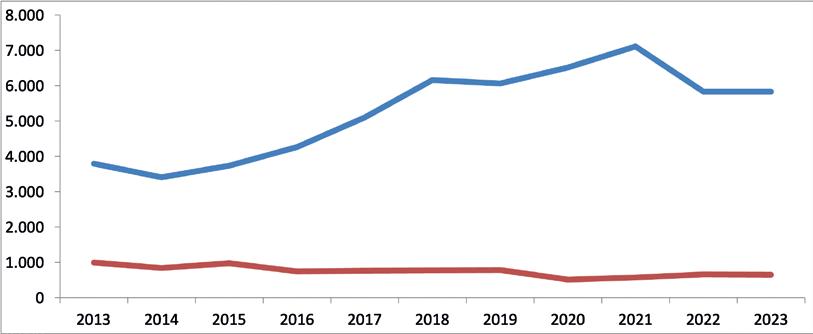

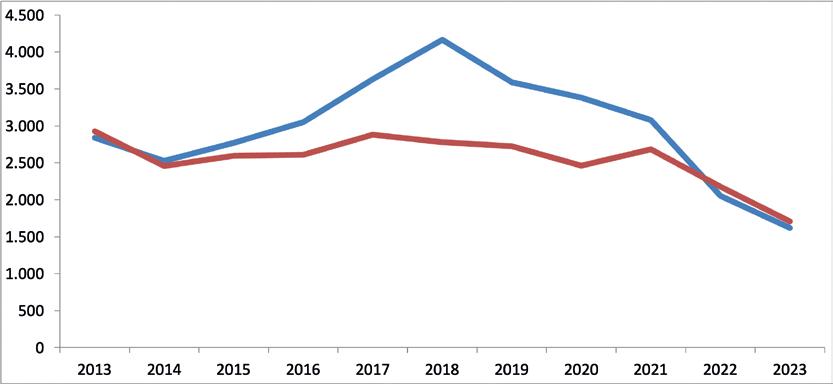

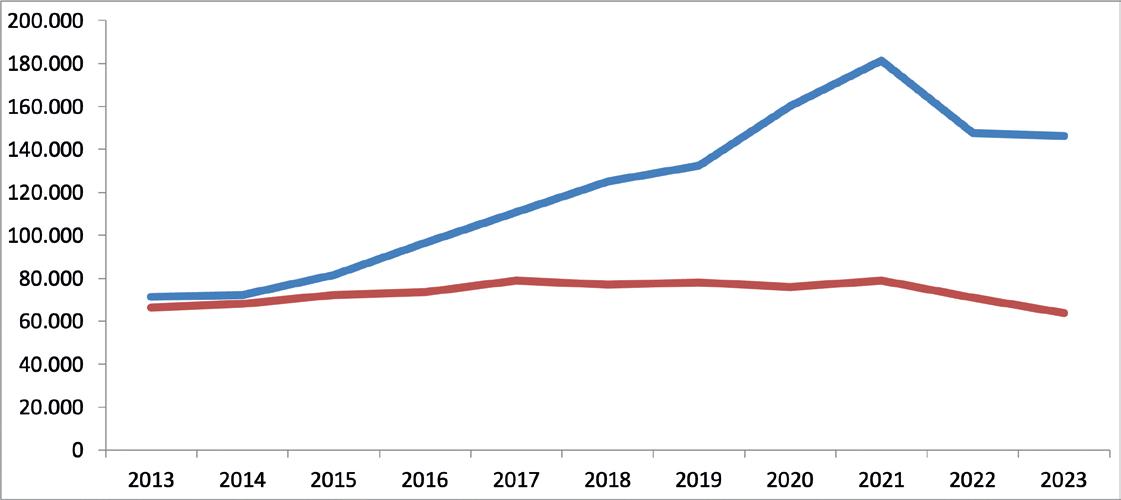

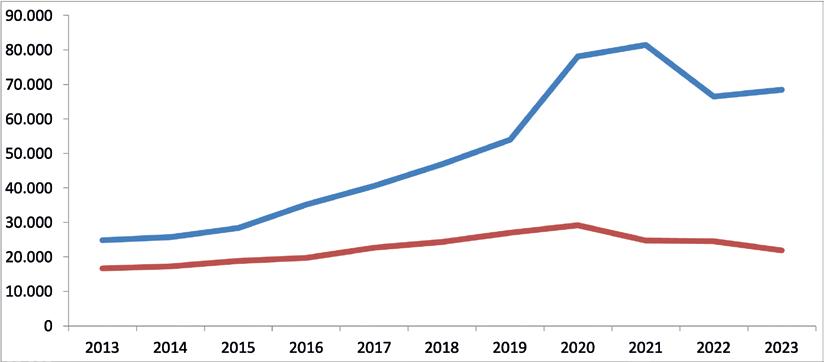

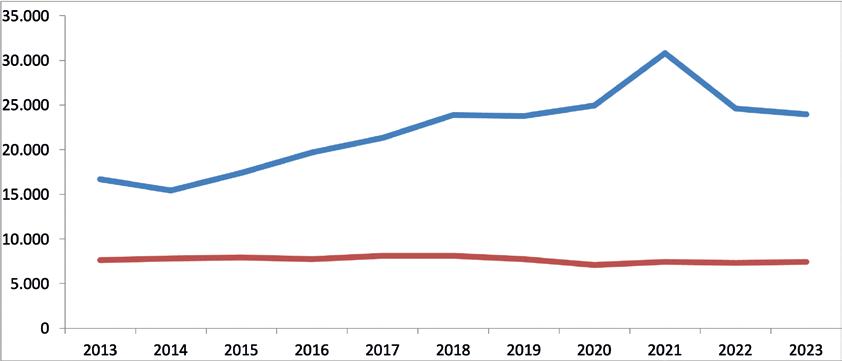

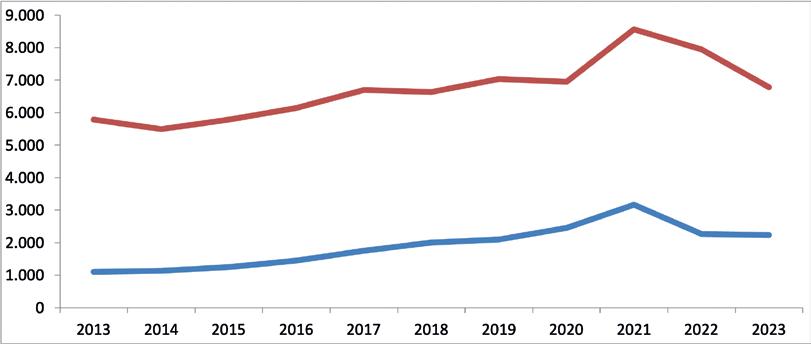

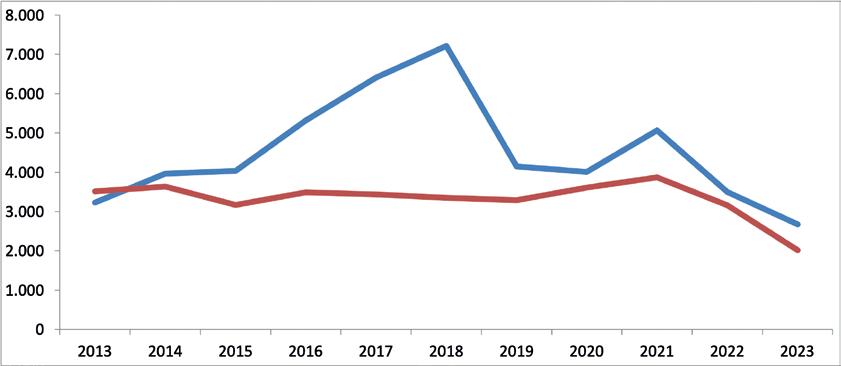

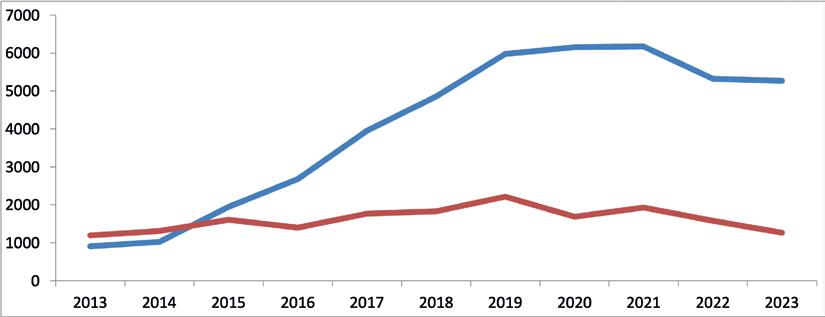

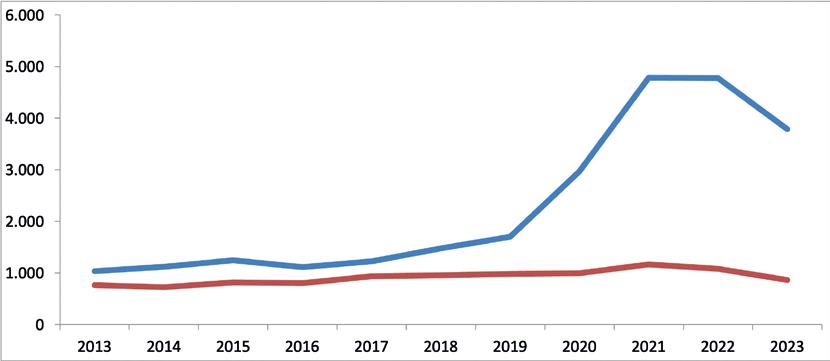

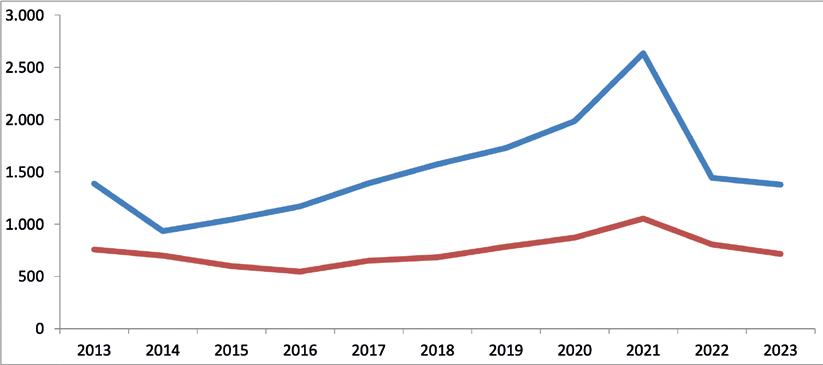

As usual, here is a summary of the statistics from the past 10 years of the main European markets for motor caravans and caravans. The year 2023 shows a stabilization of registrations compared to 2022, halting the downward trend observed since 2021

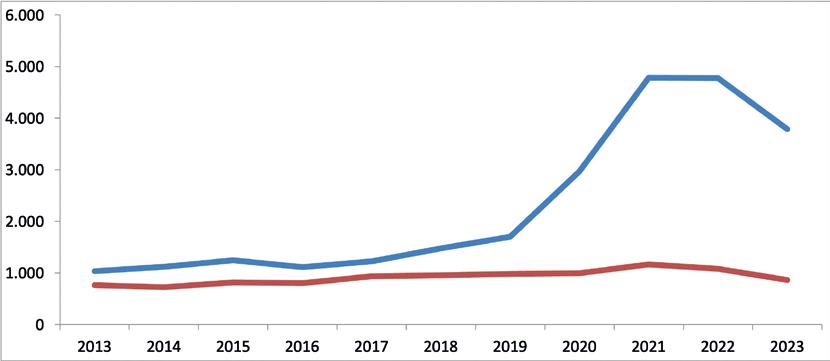

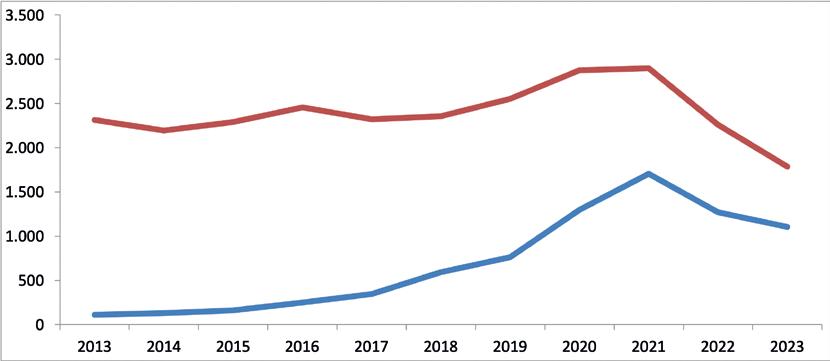

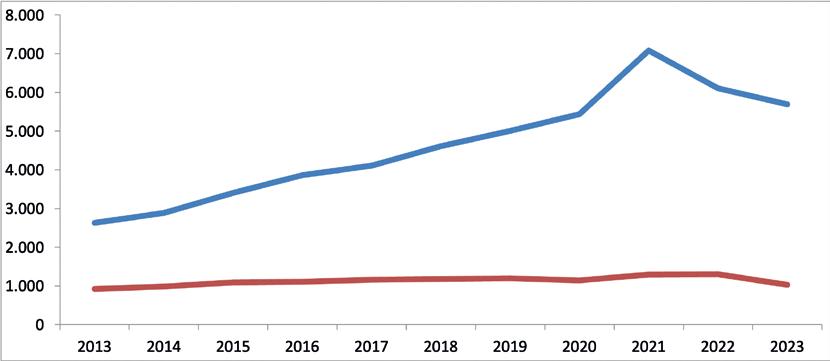

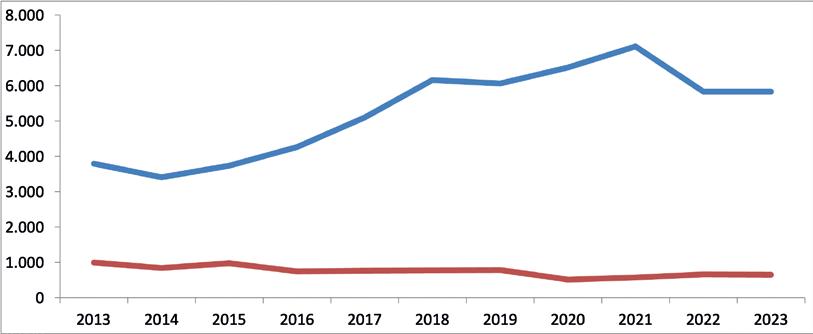

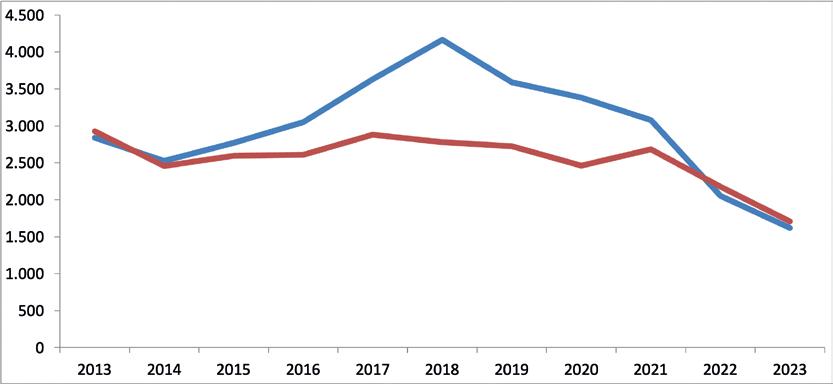

The European recreational vehicle market experienced significant changes between 2022 and 2023, with divergent trends between the caravan and motor caravan segments. Caravan registrations saw a steady decline, dropping by 10.1% between both 2021 and 2022, and 2022 and 2023. Conversely, the motor caravan segment, after a significant 18.7% decrease between 2021 and 2022, showed slight stabilization in 2023 with a minimal decline of 0.8%.

Caravan

The caravan segment has shown a constant decline over the past three years. Registrations decreased by 10.1% between 2021 and 2022, and further by 10.1% in 2023. In 2022, the

22

F ocus

Line plots are based on numerical data by ECF (European Caravan Federation) EUROPE 20132023 2023 2022 - 2023 146.339 -0,8% 63.751 -10,1%

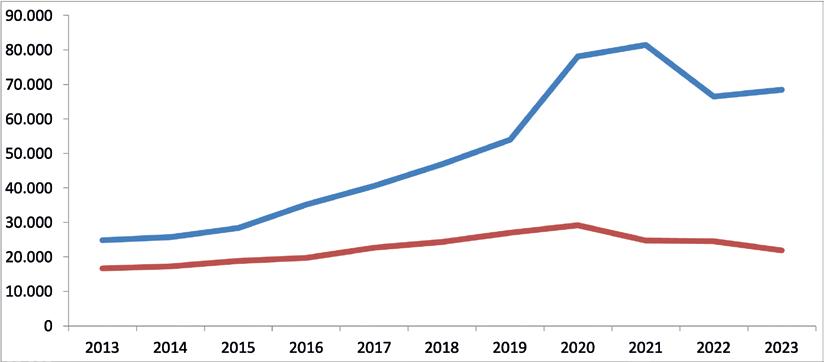

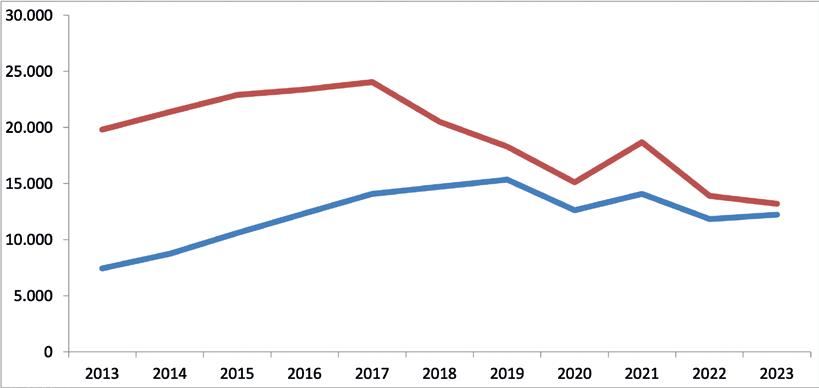

registered units in Europe totaled 70,892. This number dropped to 63,751 units in 2023. This decrease can be attributed to various factors, including possible market saturation, changing consumer preferences, and potential economic difficulties affecting customers’ purchasing power. Countries like Germany recorded a significant drop, from 24,478 caravans in 2022 to 21,896 in 2023, a decrease of 10.6%. Similarly, the United Kingdom saw a 5.0% decline, from 13,884 units to 13,193 units. In contrast, France showed slight growth of 1.6%, increasing from 7,330 to 7,448 units, indicating some stability.

Motor Caravan

The motor caravan segment displayed different dynamics compared to caravans. After a sharp 18.7% decline between 2021 and 2022, registrations only slightly

23

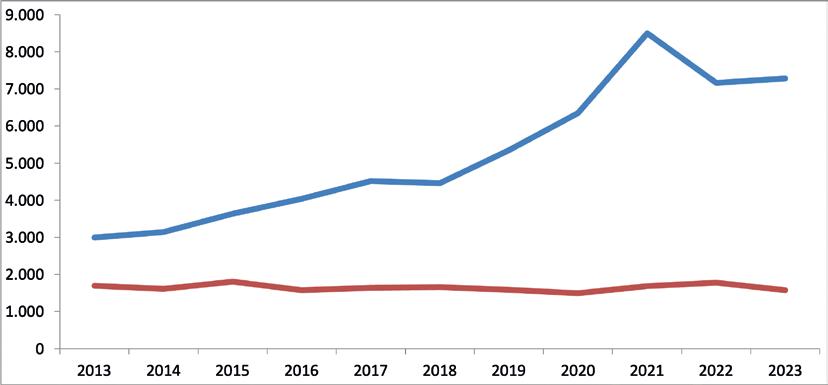

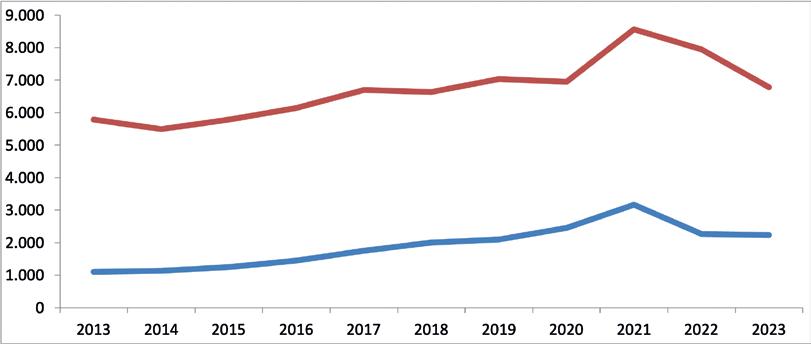

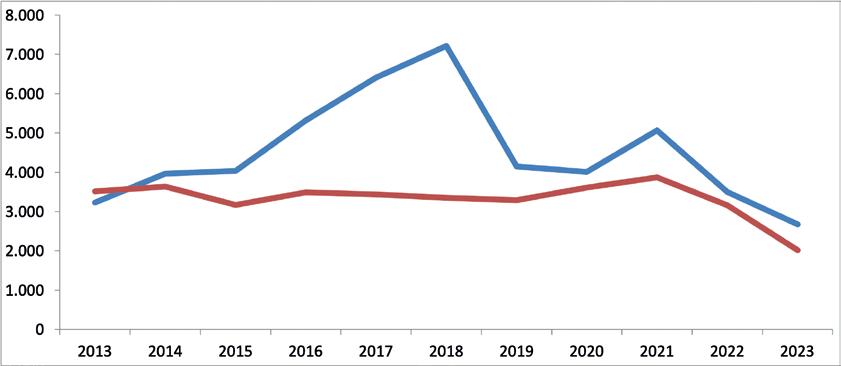

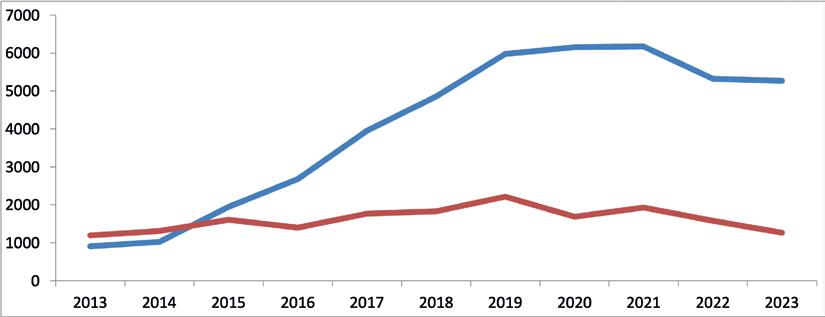

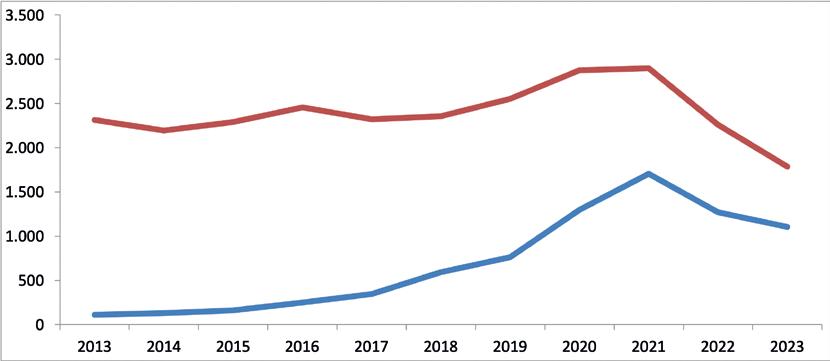

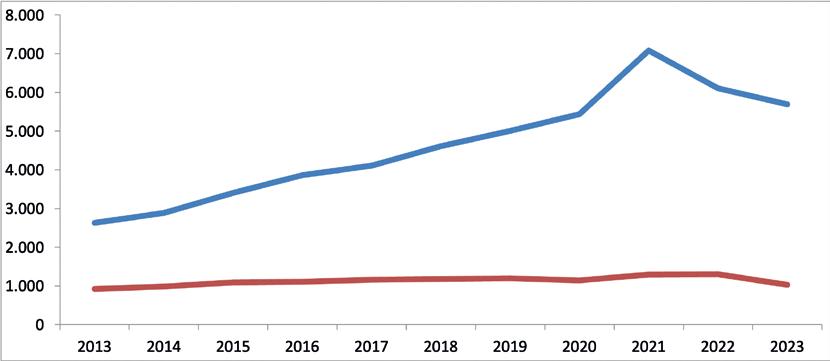

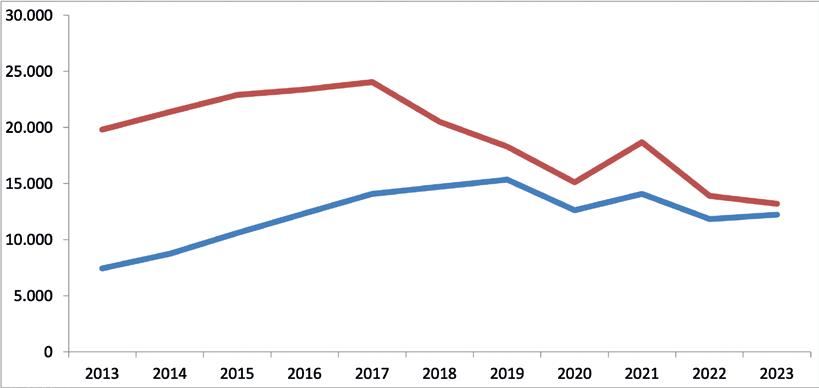

GERMANY 20132023 2023 2022 - 2023 68.469 +2,9% 21.896 -10.6% FRANCE 20132023 2023 2022 - 2023 23.936 -2,7% 7.448 +1,6% UK 20132023 2023 2022 - 2023 12.219 +3,4% 13,193 -5.0% NETHERLANDS 20132023 2023 2022 - 2023 2.230 -1,3% 6.781 -14,6% SWITZERLAND 20132023 2023 2022 - 2023 7,279 +1,6% 1.580 -11,0% SWEDEN 20132023 2023 2022 - 2023 2.676 -23.5% 2.013 -36.4%

F ocus on EUROPEAN MARKET

decreased in 2023 (-0.8%), from 147,498 units to 146,339 units. This suggests that although the market experienced a significant contraction compared to 2021, it is stabilizing, indicating a slowdown in the decline and a potential recovery. Notably, in Germany, motor caravan registrations increased by 2.9%, from 66,507 units in 2022 to 68,469 in 2023. The United Kingdom also registered a 3.4% increase, rising from 11,823 units to 12,219 units. France, however, saw a decrease of 2.7%, from 24,611 units to 23,936 units.

Countries with the worst performance

Among the countries with the poorest performance is Sweden, which suffered one of the most significant declines. In the caravan segment, Sweden registered 3,164 units in 2022, while this number dropped to 2,013 in 2023, marking a 36.4% decrease. For motor caravans, registrations fell from 3,498 units in 2022 to 2,676 units in 2023, a decrease of 23.5%. Norway also recorded significant declines: from 2,177 caravan registra-

tions in 2022 to 1,709 in 2023, a decrease of 21.5%. The motor caravan segment saw a similar drop, with registrations decreasing from 2,053 units in 2022 to 1,618 units in 2023 (-21.2%). Austria also performed poorly with a 20.1% decrease in caravan registrations (1,085 units in 2022 to 867 in 2023) and a 20.8% decrease in motor caravan registrations (4,781 units in 2022 to 3,786 in 2023).

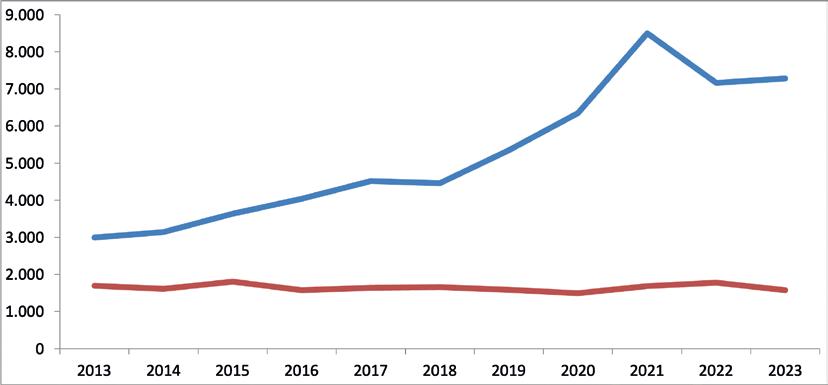

24

Line plots based on numerical data by ECF (European Caravan Federation) SPAIN 20132023 2023 2022 - 2023 5.270 -1,0% 1.266 -19,8% NORWAY 20132023 2023 2022 - 2023 1.618 -21,2% 1.709 -21,5% ITALY 20132023 2023 2022 - 2023 5.833 +0,1% 651 -1,2% BELGIUM 20132023 2023 2022 - 2023 5.693 -6,8% 1.026 -21,4% AUSTRIA 20132023 2023 2022 - 2022 3.786 -20,8% 867 -20,1% DENMARK 20132023 2023 2022 - 2023 1.103 -13,3% 1.788 -20,9% FINLAND 20132023 2023 2022 - 2023 1.376 -4,6% 715 -11,3%

Viganella Door light

The Viganella dimmable exterior lighting that is available for almost every brand of vehicle, illuminates the entrance and provides a beautiful light under the awning of the van campers. In addition, the aluminum profile has a rain gutter function that drains rainwater to the sides.

COB LED SMD LED

Our Viganella lighting is available in 2 different versions. In addition to the traditional SMD, we also have the luxury COB version available that gives your vehicle an even more luxurious look due to the even light distribution with no visible LED dots.

The right partner for manufacturers of caravans, motorhomes and specials

Art. 4300298

Now also available: Remote control with dimming function!

25

westacc.nl info@westacc.nl +31 (0)174 520178

Ford Transit

Fiat Ducato / Peugeot Boxer / Citroën Jumper

Urban (low vans)

Mercedes Sprinter / Volkswagen Crafter / Man TGE

Viganella door light

The European caravanning industry meets in Italy

Success of the MELVI 2024 Congress in Sorrento organized this year by the Italian Association of Camper Manufacturers (APC); the annual congress, promoted by the European Caravan Federation (ECF), took place in Sorrento, Italy, from March 21 to 23 and brought together over 200 participants

The organization of the Meeting of European Leisure Vehicle Industry (MELVI), which takes place annually in a different EU country, was entrusted this year to the Italian Association of Camper Manufacturers (APC). The event was attended by over 200 participants, including CEOs and general managers of manufacturing companies and component suppliers, thus representing a significant portion of the supply chain.

During the first part of the 46th Annual General Meeting (AGM), reserved for ECF members, European market data was analyzed. ECF’s general secretary, Jost Krüger, summarized the market

results, noting a 6.9% increase in registration data over the past six months compared to a year earlier: “Interest in recreational vehicles continues to be very high in Europe. In recent months, motorhome registrations have grown again, thanks to the greater availability of base chassis, surpassing pre-pandemic levels (over 210,000 recreational vehicles registered in a year, including campers and caravans). Caravans are also recovering. Caravan and camper tourism ideally embodies a more human-centered holiday, away from mass tourism.”

Interesting data on registrations by type of motorhome show that a third of the

market is represented by camper vans with toilets (slightly declining in the last two years), and another third is dominated by semi-integrated models, which in the last five years lost nearly 9 percentage points. The progressive increase in camper vans without toilets, the more compact models, is surprising, rising from just over 10% in 2019 to nearly 25% in 2023. Motorhomes hold steady (less than 10% of the market), while alcove campers, now increasingly niche, have fallen below 3%.

The 29th MELVI featured speeches from Gianguido Cerullo, CEO of TRIGANO S.p.A./TRIGANO Servizi srl; Massimiliano

26

Report MELVI 2024

Words editorial staff, photo Enrico Bona

Cusmai of Camping Sport Magenta; Stefano Bonometti of Autocaravan Bonometti; Jörg Reithmeier, President EMEA of LIPPERT Group; Luca Marengo, Head of Product at Stellantis; Antonio Erario, Head of Division “International Regulations and Norms” at the Italian Ministry of Transport; and Antonio Cellie, CEO of Fiere di Parma. Our editorial team attended the event, and in the following pages, you will find a report on the most interesting presentations.

Engineer Antonio Erario, head of the Division for International Regulations and Agreements at the Ministry of Infrastructure and Transport, presented a comprehensive overview of all the international

legislative topics addressed so far and those still under discussion. Antonio Erario then summarized Italy’s position within the European Council regarding issues related to campers, with particular reference to the proposed revision of the driving license directive, where both the Council and the European Parliament have expressed support for extending B license driving privileges to vehicles up to 4,250 kg.

At the conclusion of the event, APC President Simone Niccolai stated: “The 2024 congress for our sector marks an important moment of cohesion for the entire production and distribution chain. The challenges we face are un-

doubtedly significant, and geopolitical and macroeconomic uncertainties cannot be ignored. We can overcome these challenges by working together in the same direction. I believe that the camper sector has further growth prospects because it represents a major future trend: customized leisure time, the freedom to choose and change destinations at any time, tourism closer to nature, and the company of family, friends, and domestic pets. In short, a modern lifestyle that looks to the future.”

The economic tourism potential of campers and caravans in Europe (excluding vehicle purchase expenses) is estimated to be around 30 billion euros.

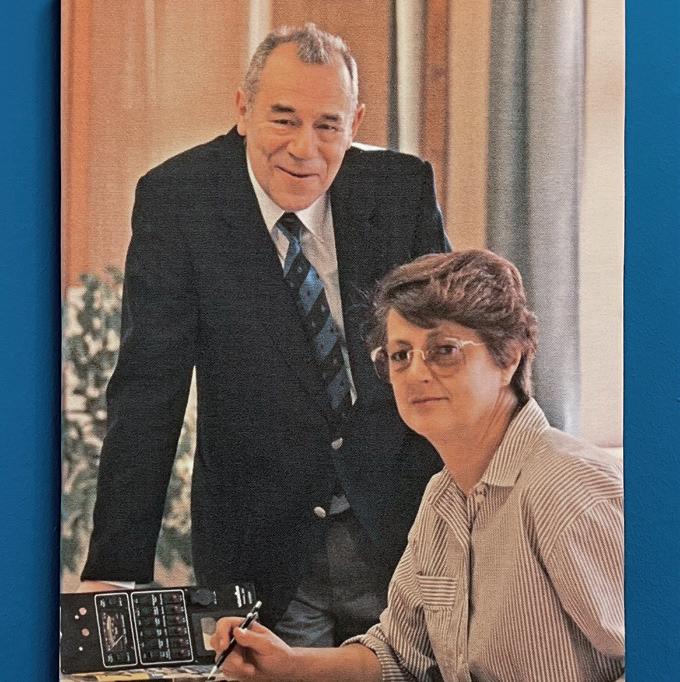

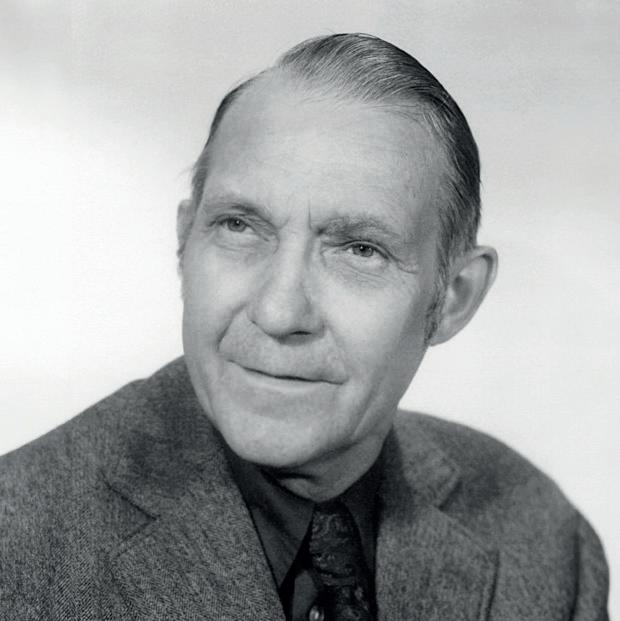

Welcome back François Feuillet and heartfelt thanks to Hermann Pfaff and Sonja Gole

During MELVI 2024, elections were held for the new president of ECF: François Feuillet, founder and owner of the Trigano Group, was unanimously appointed. Feuillet, who has intermittently served as ECF president since 1998, will lead the organization again for the next two years. On this occasion, the retirement of two iconic figures in the industry was announced, not only from

the leadership of ECF but also from the caravaning industry in general: Hermann Pfaff, who served as president of both CIVD from 2014 to 2023 and ECF from 2020 to 2024, and Sonja Gole, who was a member of the ECF council for 20 years and is retiring after over 40 years of an esteemed career at Adria Caravan, 30 of which were spent as general manager. Newly elected members to the Executive Council include Mikael Blomqvist from the Swedish industrial association HRF, Bart Decuyper, president of the Belgian association BCCMA, and Bernd Löher, president of the German manufacturers’ association CIVD. In the council election, Leo Diepemaat (Treasurer), Simone Niccolai (APC), and Anthony Trevelyan (NCC) were also confirmed for another two years in their positions.

managers

“On behalf of the entire Council, I would like to thank the members of ECF for the great trust they have placed in us. We look forward to continuing to successfully represent our industry at the European level and to face future challenges together in constructive cooperation,” declared François Feuillet. The editorial team of Aboutcamp BtoB congratulates the new president, who, with his vast experience and expertise, is undoubtedly the right person to steer the association towards new and ambitious goals. The editorial team also wishes to express deep esteem and gratitude for the departing figures, Sonja Gole and Hermann Pfaff, pillars in the European caravaning sector. Our director and our journalists, bound by years of collaboration and friendship, will feel the void left by these two icons, whose legacy will continue to influence our field for many years to come.

27

Sonja Gole

François Feuillet

The

of the Hymer Group pay tribute to Hermann Pfaff (in the center)

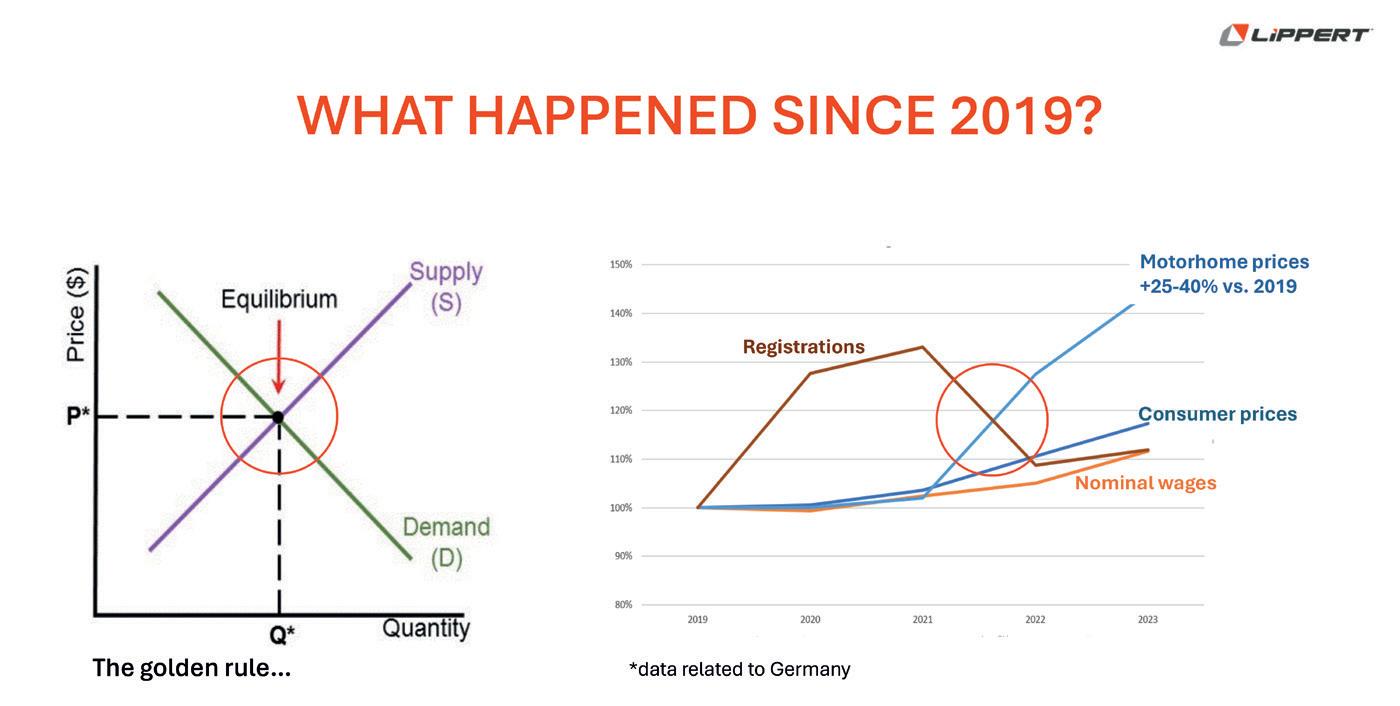

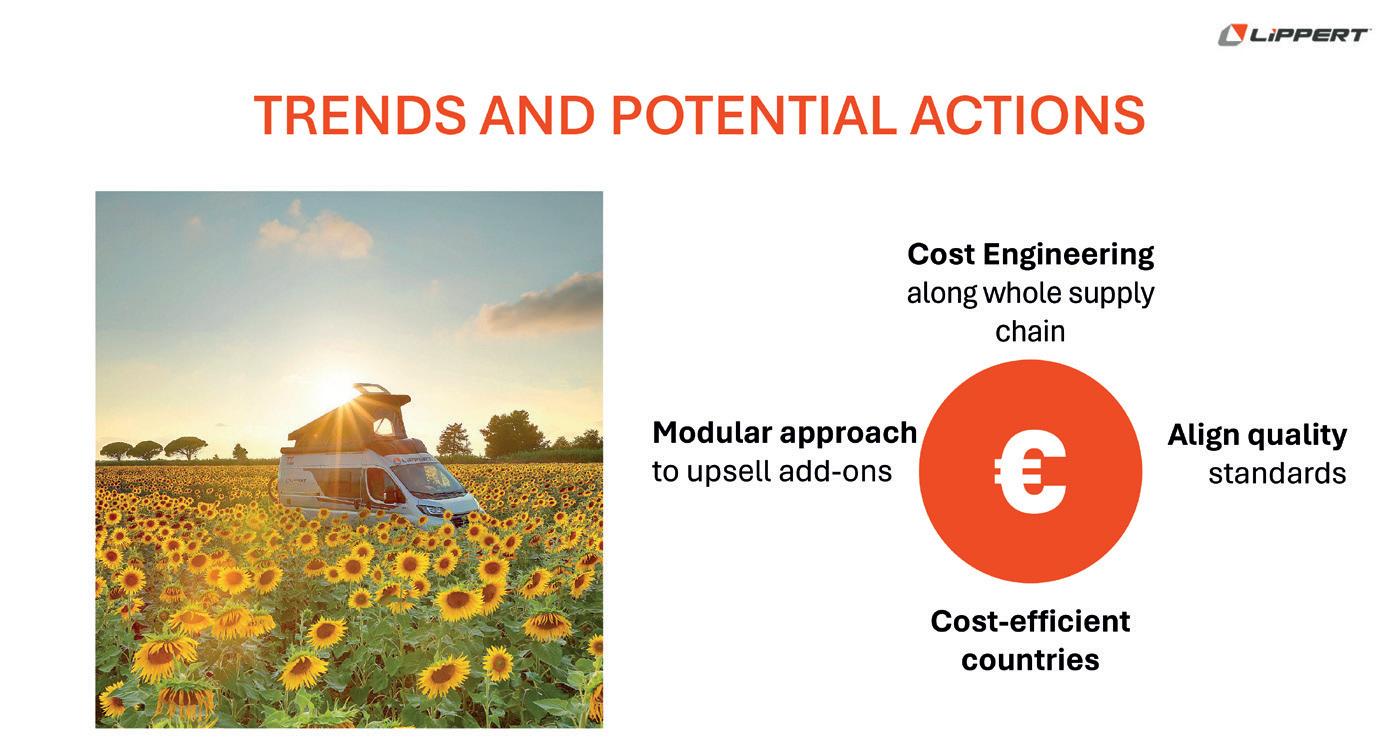

Sustainable growth through cost efficiency, quality, and modular approach

Group President EMEA at LIPPERT, Jörg Reithmeier underlined the need for the recreational vehicle industry to adapt to changing market dynamics. By focusing on cost efficiency, maintaining quality, and adopting a modular approach, the industry can find a new equilibrium that supports sustainable growth. The collaborative efforts between OEMs and suppliers will be crucial in navigating these challenges and capitalizing on the potential for renewed market expansion

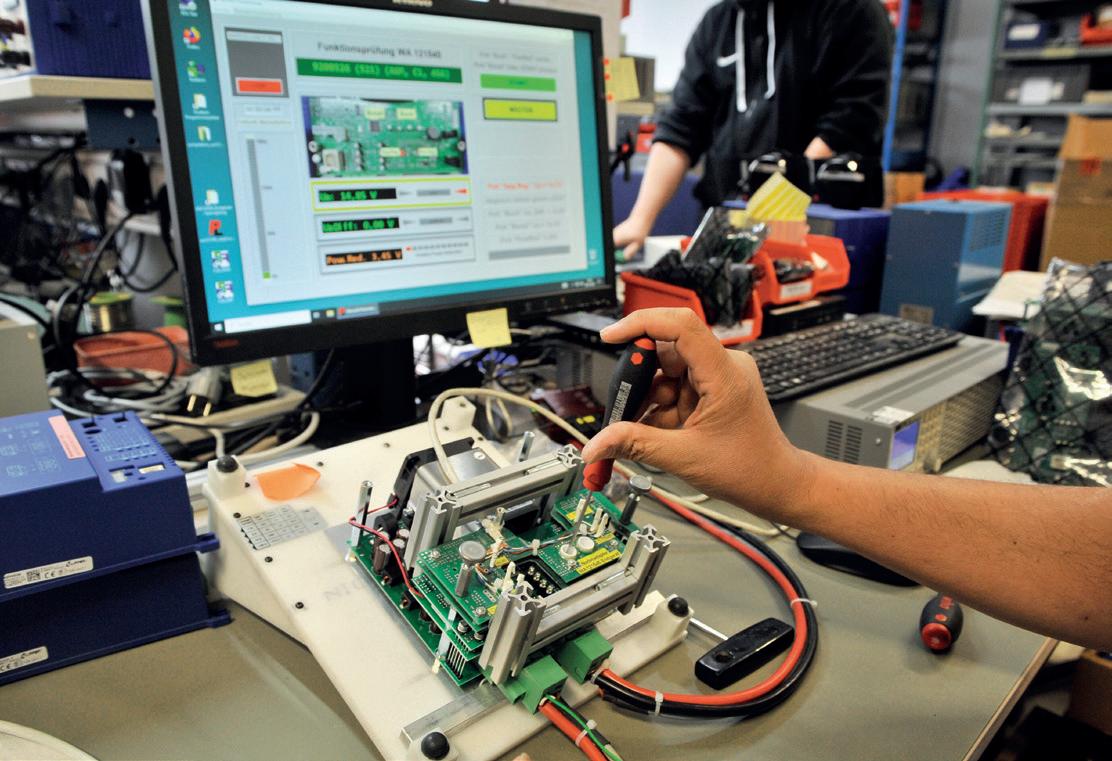

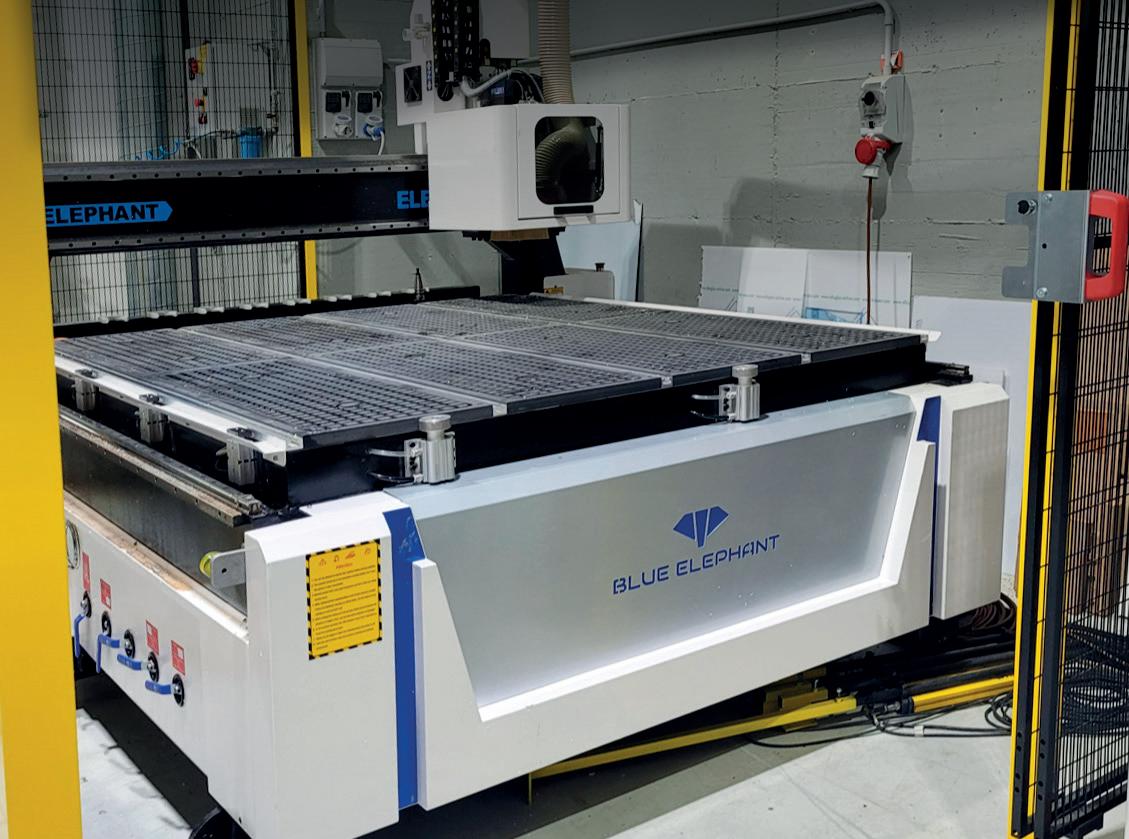

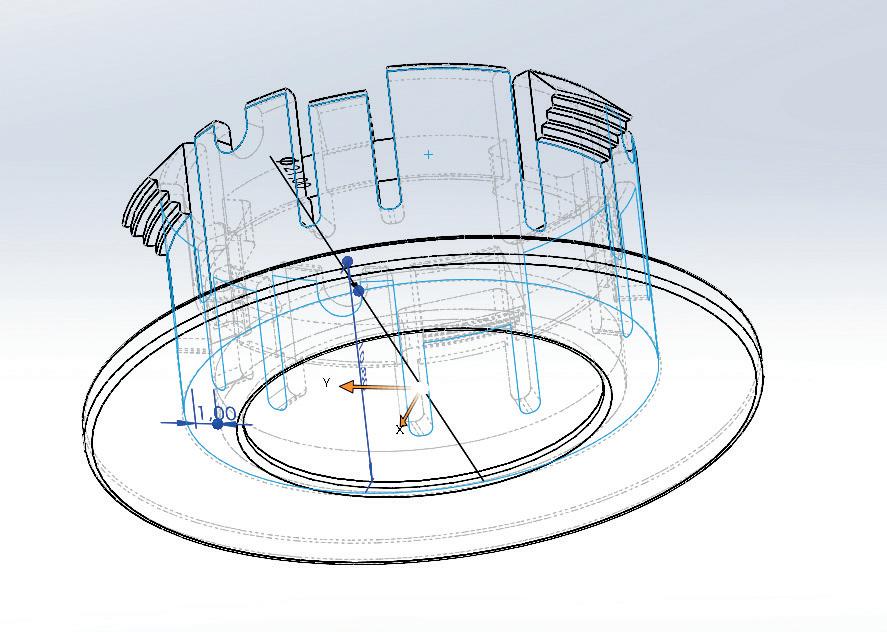

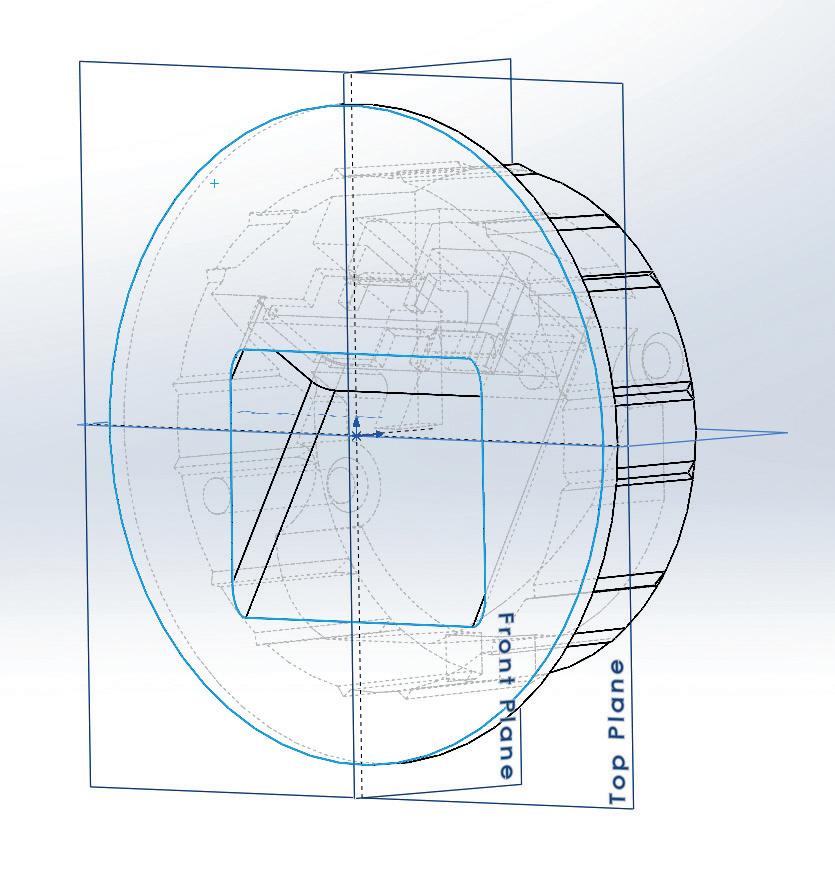

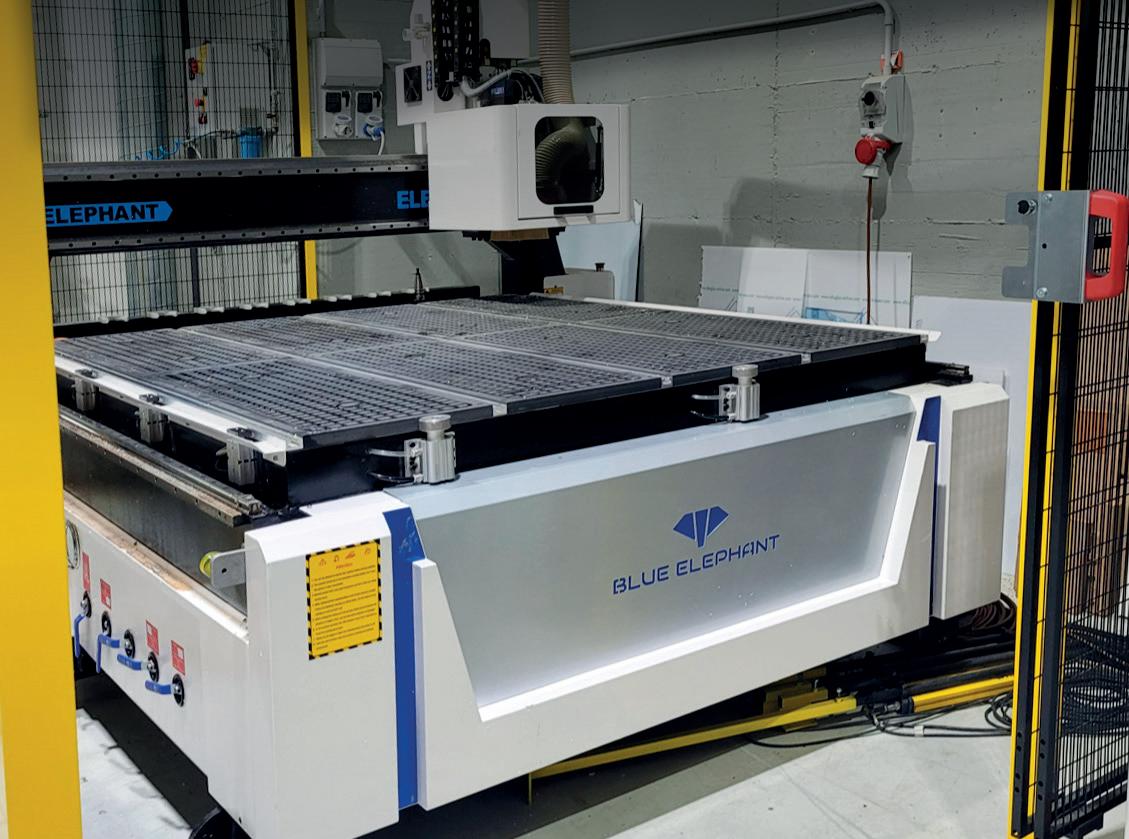

At the MELVI 2024 event, Jörg Reithmeier, Group President EMEA at LIPPERT, provided a detailed overview of Lippert’s current market dynamics and economics, as well as potential industry actions and conclusions. Founded in 1956, Lippert initially specialized in residential roofs. Under the dynamic leadership of CEO Jason Lippert, the company has significantly expanded. Last year, Lippert eclipsed $3 billion in global sales. The company

employs approximately 12,000 team members worldwide, including 1,800 in EMEA, and operates 160 plants globally, with 14 in Europe. Lippert’s portfolio includes more than 10 global brands and it is committed to social responsibility, with team members across the world contributing over 100,000 hours of volunteer work annually and raising about $4 million for charitable causes. Lippert’s European operations are spread across the UK, Ireland, Netherlands, Germany, Italy, and Tunisia. The company values its strong culture and core principles, focusing on teamwork, trust, honesty, integrity, and a positive attitude. In recent years, Lippert has grown through strategic acquisitions and positions itself as a solution provider, focusing on engineered products and smart components. This strategy includes offering complete systems, such as space on-demand systems and bike carriers, and integrating smart technologies and

28

Report MELVI 2024

energy management solutions to meet the demands of electric vehicles. In September 2023, Jörg Reithmeier was promoted to Group President EMEA. With a distinguished career in the automotive and caravanning industries spanning 27 years, Reithmeier brings a wealth of experience and expertise to his role. Before becoming a Senior Advisor to Lippert in 2019, he spent nearly a decade at the Erwin Hymer Group serving on their board of directors from 2015 to 2019. Over the past year, Reithmeier has served as Managing Director for Lippert’s Caravanning group in Europe, bringing focus and structure to Lippert’s Italian, German, and Dutch caravanning businesses.

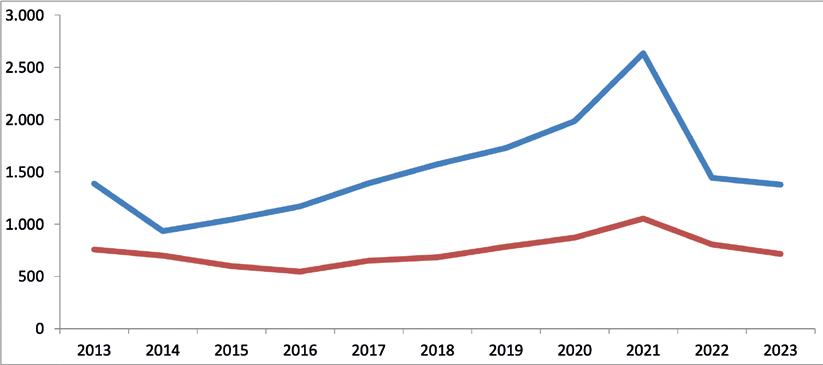

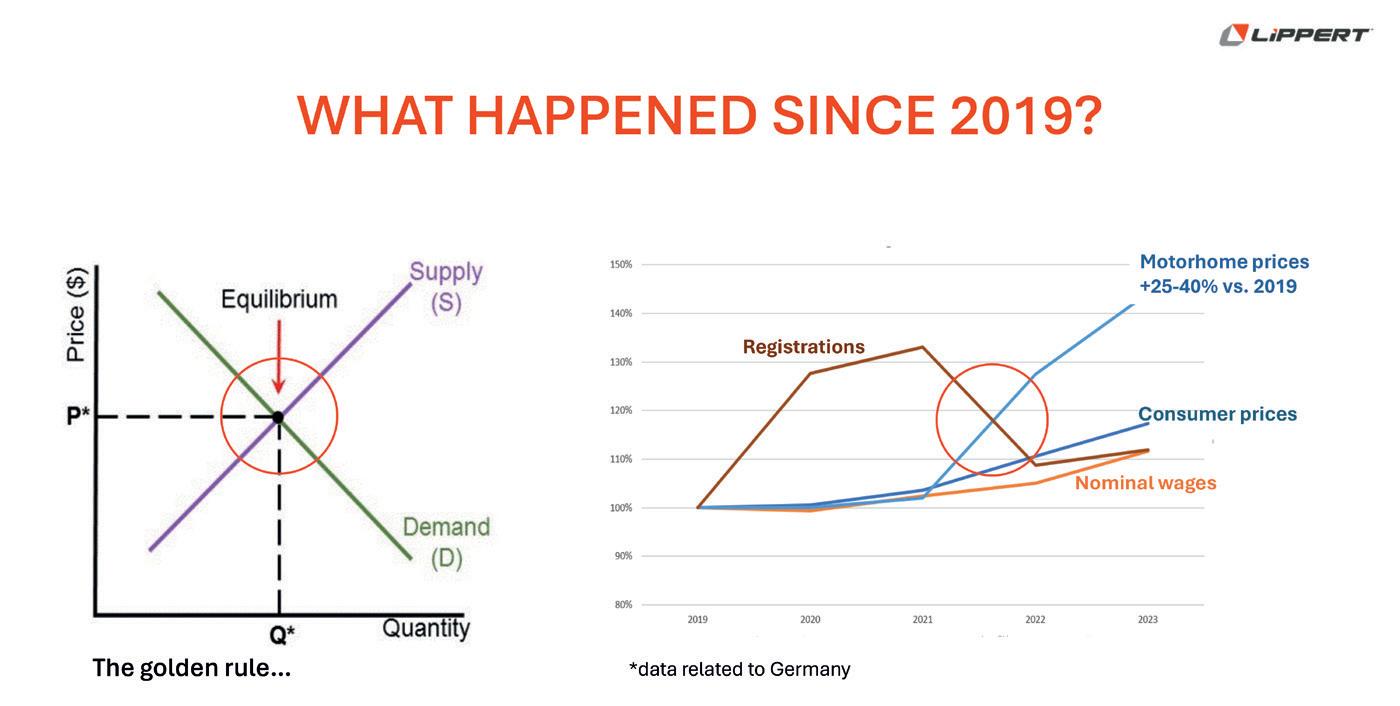

Understanding Market Dynamics

Reithmeier highlights the significant rise in prices across various industries since 2019: motorhomes (+35%), boats (+30%), cars (+20%), furniture (+18%), and motorcycles (+10%). He emphasizes that the price increase for motorhomes has far outpaced comparable products. This trend is illustrated through basic economic principles of supply and demand, showing how the equilibrium price point in the motorhome industry has shifted. During the boom years, the industry enjoyed high demand at increasing prices. However, Reithmeier suggests that the market has now moved right of the equilibrium point, where high prices have led to a drop in demand and registrations, despite sustained interest. This imbalance indicates that current prices might be too high for a significant part of the market that hence becomes unaccessible.

The Economic Landscape

Analyzing German market data from 2019 to 2023, Reithmeier points out that nominal wages increased by 12%, while consumer prices rose by 17%. This disparity has contributed to the decrease in motorhome registrations, making them unaffordable for many potential buyers. He concludes that the ideal price point for motorhomes should be 15-20% below current levels to rejuvenate the market without compromising on quality.

Improving the Supply Chain

Reithmeier stresses the importance of addressing inefficiencies within the supply chain to reduce costs without sacrificing quality. He advocates for a collaborative approach between OEMs and suppliers, focusing on cost engineering by identifying lean principles (avoid overengineering, focus on customer need and work to align expectations of customers and OEM’s with supply chain

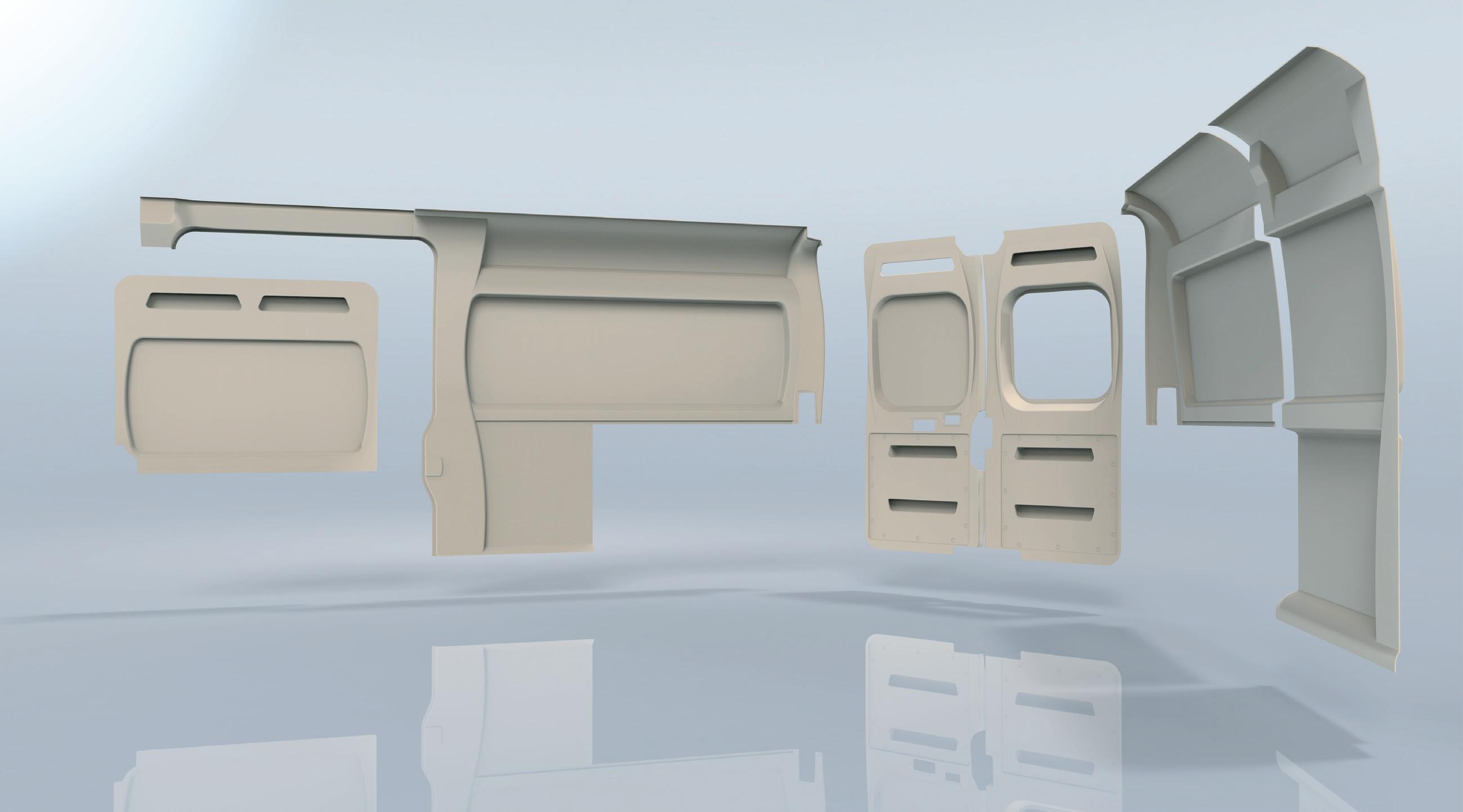

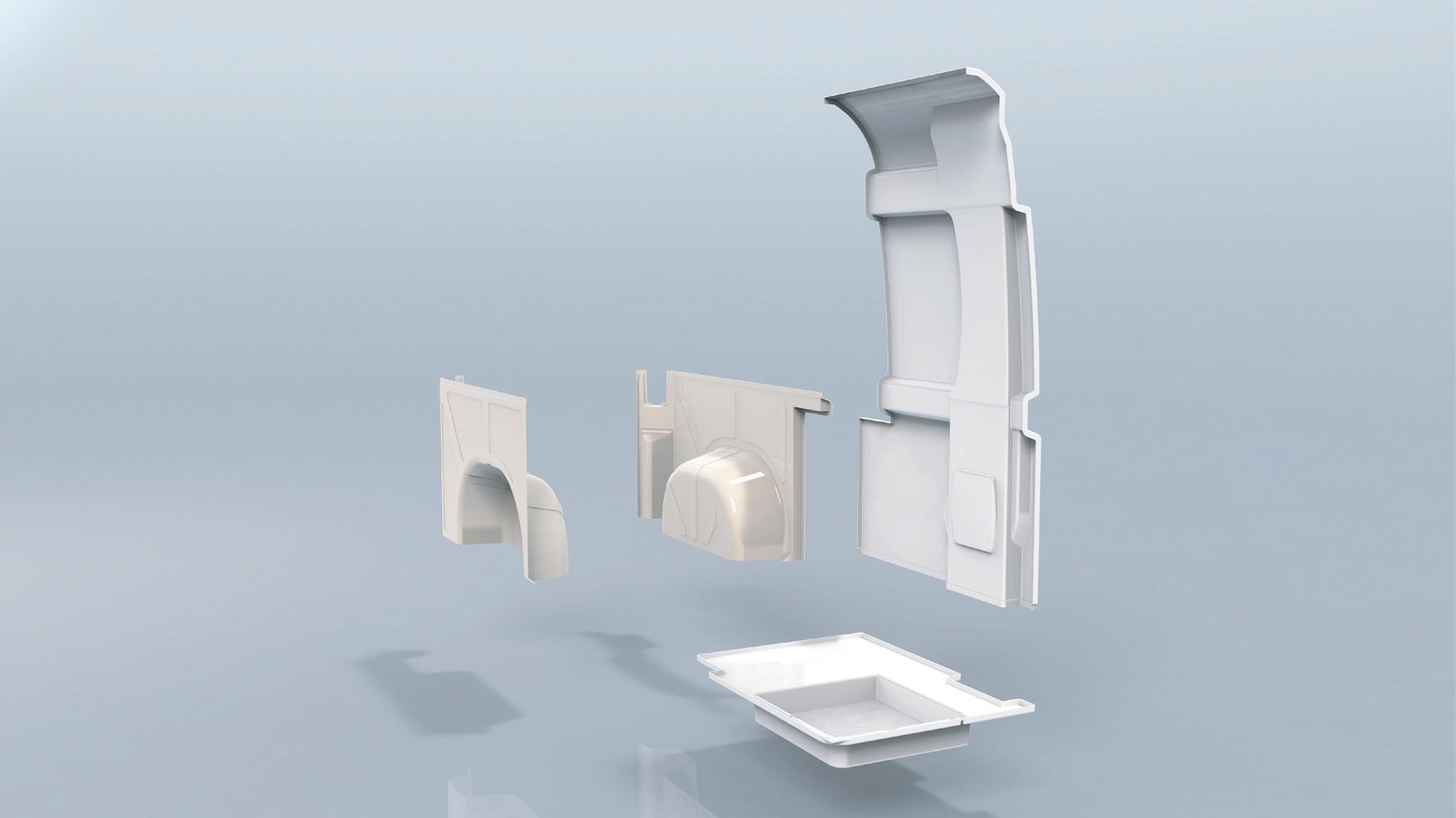

optimization potential), aligning quality standards, and utilizing cost-efficient countries. He also suggests a modular approach to vehicle manufacturing, where customers can choose and add features according to their needs, thus maintaining a competitive base price. Reithmeier provides practical examples, such as the production of garage doors, where better understanding and alignment on quality expectations could reduce costs significantly. He emphasizes that not all products require the same quality standards as premium models, and a tailored approach to quality could yield substantial savings.

Modular Approach and Upselling

A modular approach allows for upselling

at different levels of vehicle configurations. Reithmeier mentions the “Urbans” as a classical product where customers can purchase a basic model and then add modules like a fridge or cooking unit. This strategy can make high-quality recreational vehicles more accessible while allowing customers to personalize their purchases.

Potential Actions for Cost Reduction

The analysis suggests several actions, including better understanding and alignment between suppliers and OEMs, utilizing cost-efficient manufacturing in countries like Tunisia, and ensuring that quality standards match customer expectations without unnecessary over-specification.

29

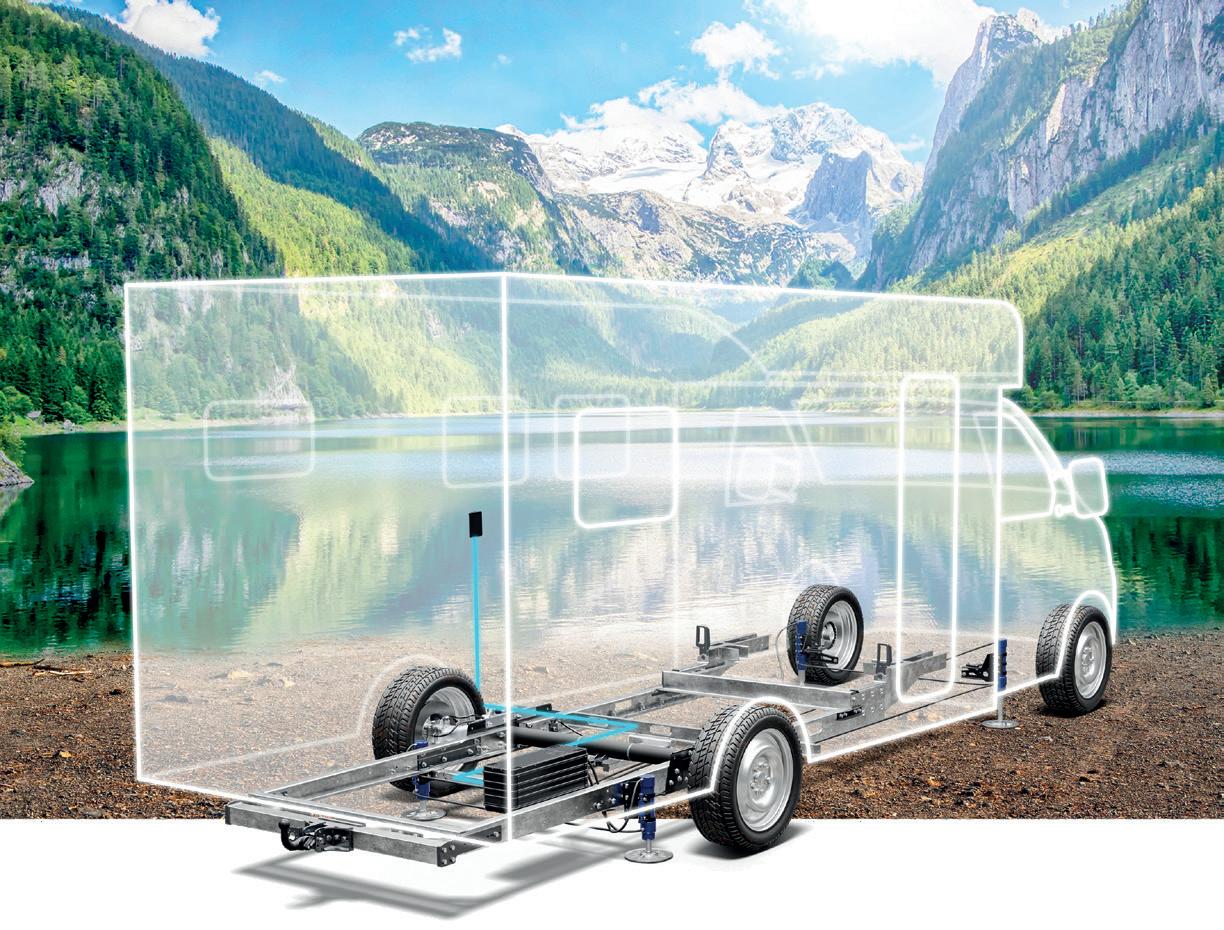

Electrification & sustainability: Stellantis’ roadmap for RVs

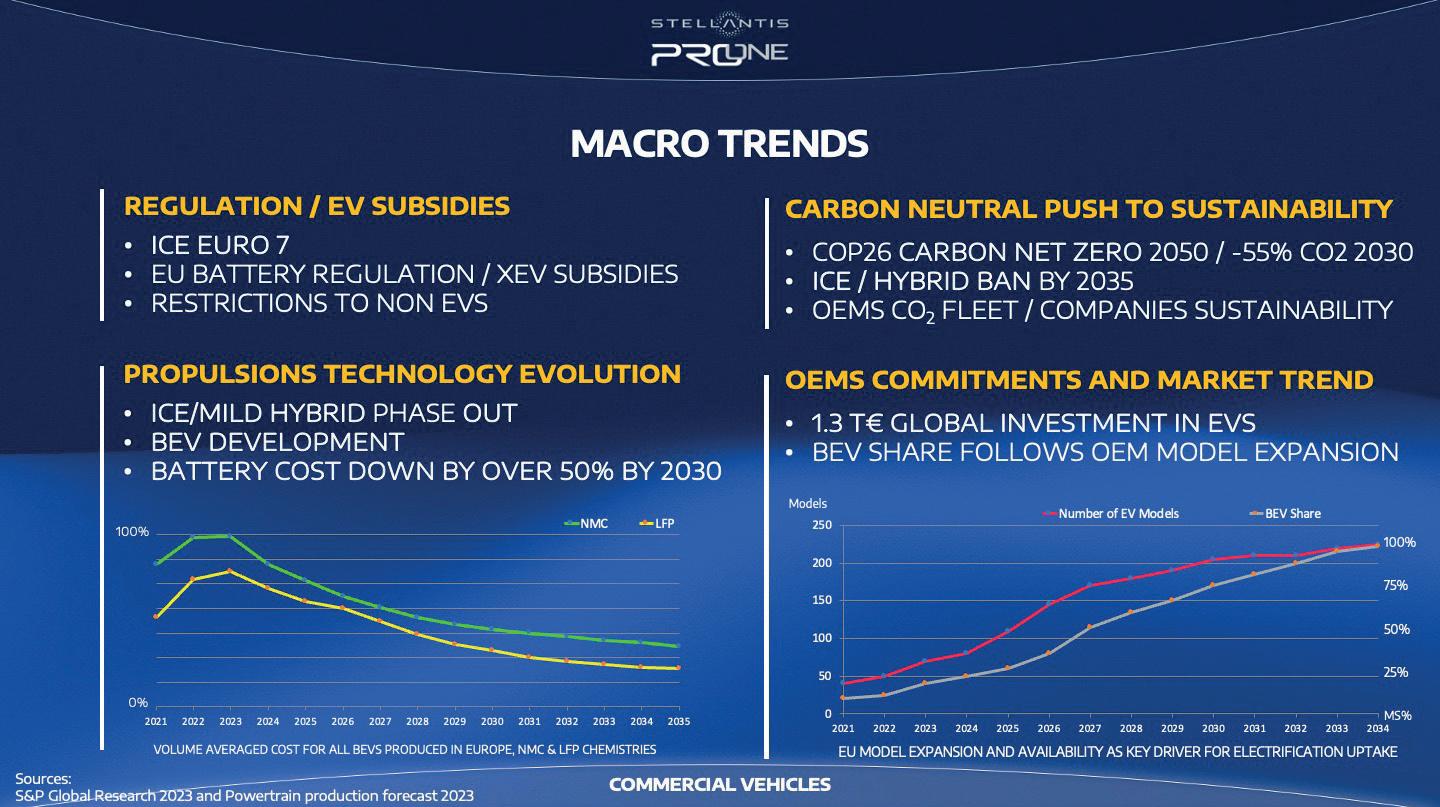

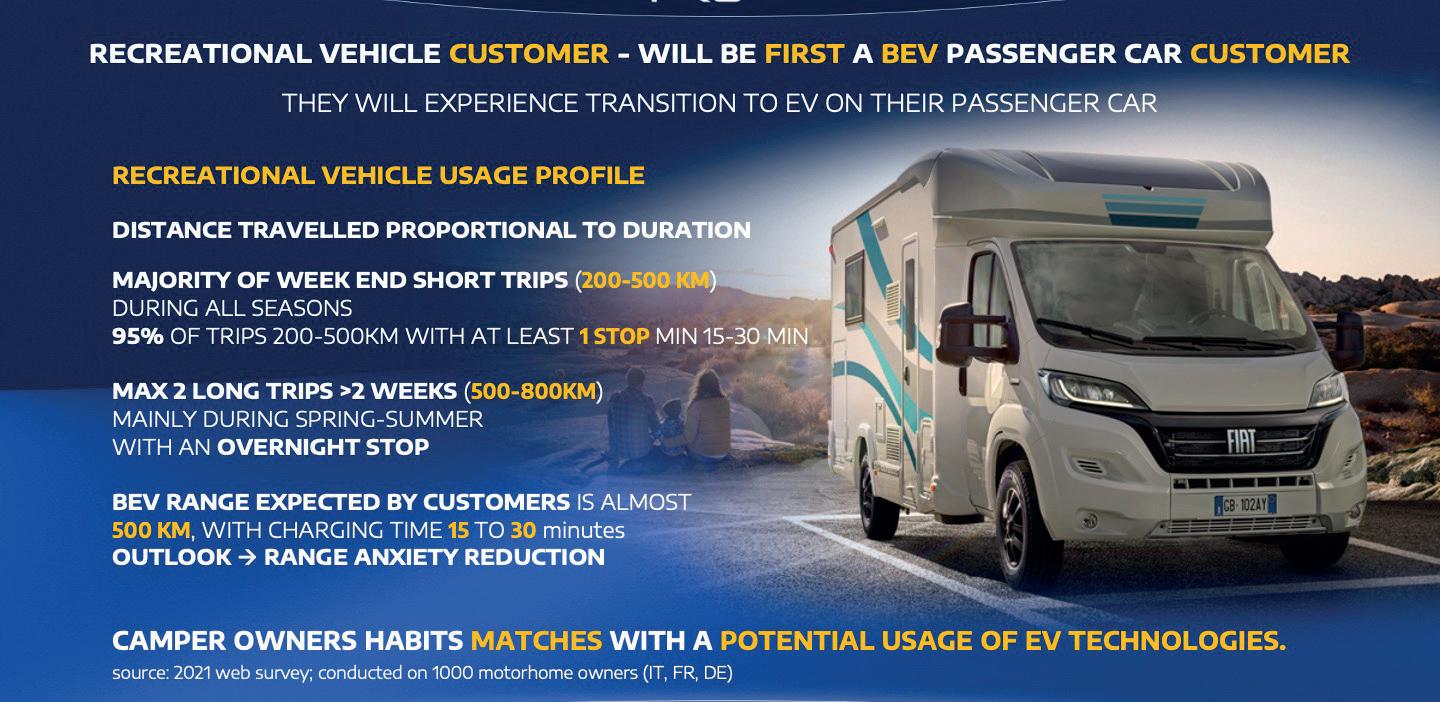

At the 29th Meeting of the European Leisure Vehicle Industry (MELVI), Luca Marengo from Stellantis outlined the company’s strategic vision for the future of electrification in the recreational vehicle sector. Highlighting the launch of Stellantis Pro One and the comprehensive 360-degree approach to commercial vehicles, he discussed industry trends, challenges, and the roadmap for integrating electric and hydrogen technologies. He emphasized Stellantis’ commitment to innovation, sustainability, and maintaining leadership in the evolving market, aiming for a fully electric lineup by 2030

Luca Marengo, VP Head of Product Stellantis Pro One, Global Commercial Vehicle Business Unit, discussed Stellantis’ strategy and the future of electrification, focusing on campers and recreational vehicles (RVs) at the 29th Meeting of the European Leisure Vehicle Industry (MELVI). With 16 years of experience in the automotive sector, beginning his career at Fiat Professional as a Pro Manager for Campers, he introduced Stellantis Pro One, officially launched in October last year, as an organization dedicated entirely to commercial vehicles. This initiative unites the six Stellantis commercial vehicle brands, Citroën, Fiat Professional, Opel, Peugeot, RAM and Vauxhall to become the preferred business partner for customers, embodying a 360-degree ap-

proach built on five pillars: Product, Zero Exhaust Emission, Customer Experience, Conversion Outfit, and Connected Services.

Current trends and challenges

Marengo highlighted that Stellantis Pro One leverages the strengths of each brand while addressing the rapid changes in the industry since 2020. Their strategy involves a comprehensive product lineup, including the 2024 range that sets the foundation for future models. Stellantis has pioneered electrification, achieving a 40% market share with their full lineup of electric vehicles launched in 2021. Customer experience remains paramount, with a focus on connectivity in sales, aftersales, and digital ecosystems. Conversion outfit remains a crucial area,

accounting for 50% of Stellantis’ sales, while connected services are increasingly essential, with all vehicles being 100% connected since March this year.

Electrification

and the future of motorized RVs

Marengo emphasized that electrification is a major focus for Stellantis. Regulations, subsidies, and environmental goals drive the rapid evolution of engine technologies, pushing towards carbon neutrality by 2050. The internal combustion engine (ICE) and mild hybrid engines will gradually phase out, making way for battery electric vehicles (BEVs) and low-emission solutions. He noted that battery costs are projected to decrease by 50% by 2030, driven by competition and technological advancements. A global investment of 1.3

30

Report MELVI 2024

trillion euros in electric vehicles by 2030 underscores the unstoppable momentum towards electrification.

The ecosystem of charging infrastructure

Marengo pointed out that a robust charging infrastructure is critical for the widespread adoption of electric vehicles. Projections indicate 24 million charging points globally by 2030, with public chargers increasing significantly. This growth aligns with substantial investments in clean energy solutions, creating a profitable ecosystem for charging stations.

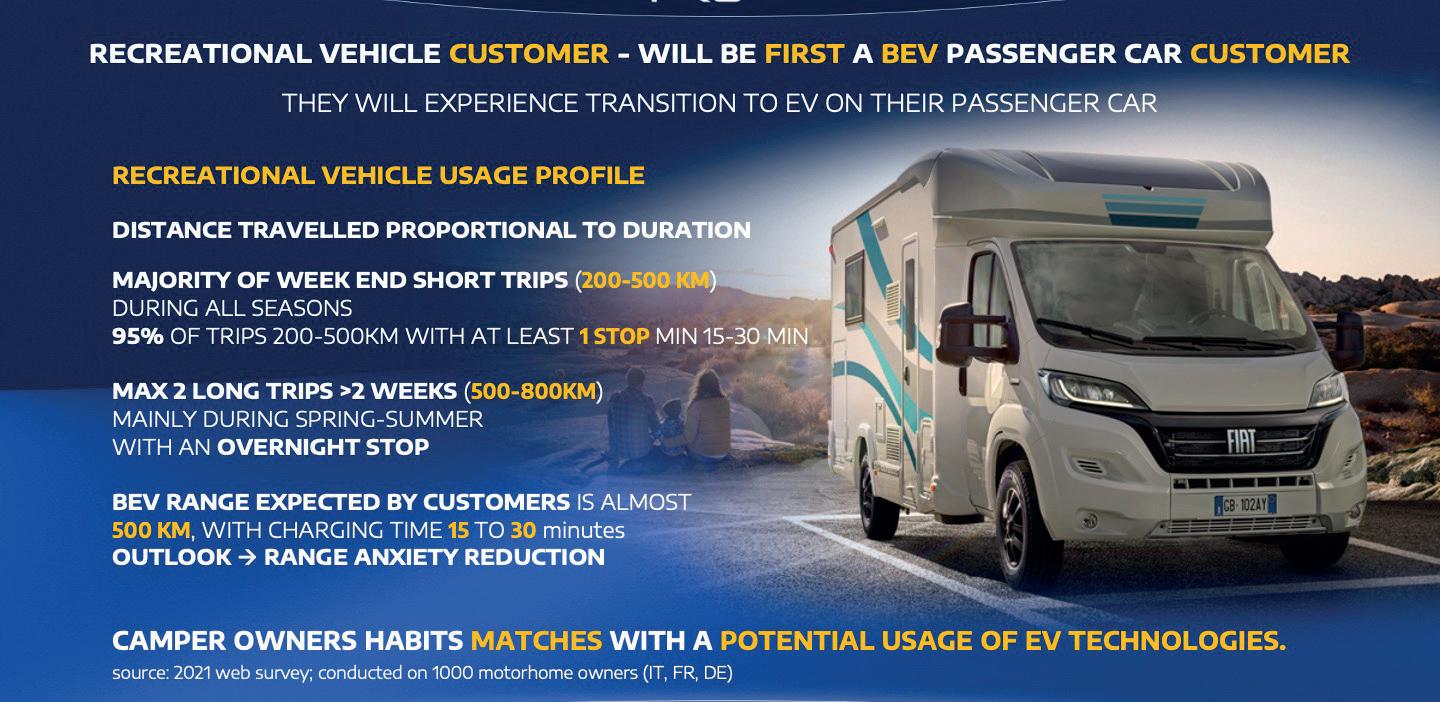

Customer trends and electric RVs

He explained that customer adoption of electric vehicles is expected to shift from early adopters to the majority by the end of decade. Improved affordability and reduced range anxiety will drive this transition. Research shows that RV owners typically travel short distances, making electric RVs feasible for most trips. However, challenges remain, including the adaptation of RV conversions to battery technology, increased vehicle mass, and the need for a tailored product lineup. Despite these hurdles, the shift to electrification in the RV sector is inevitable.

Stellantis’ Pro One strategic vision

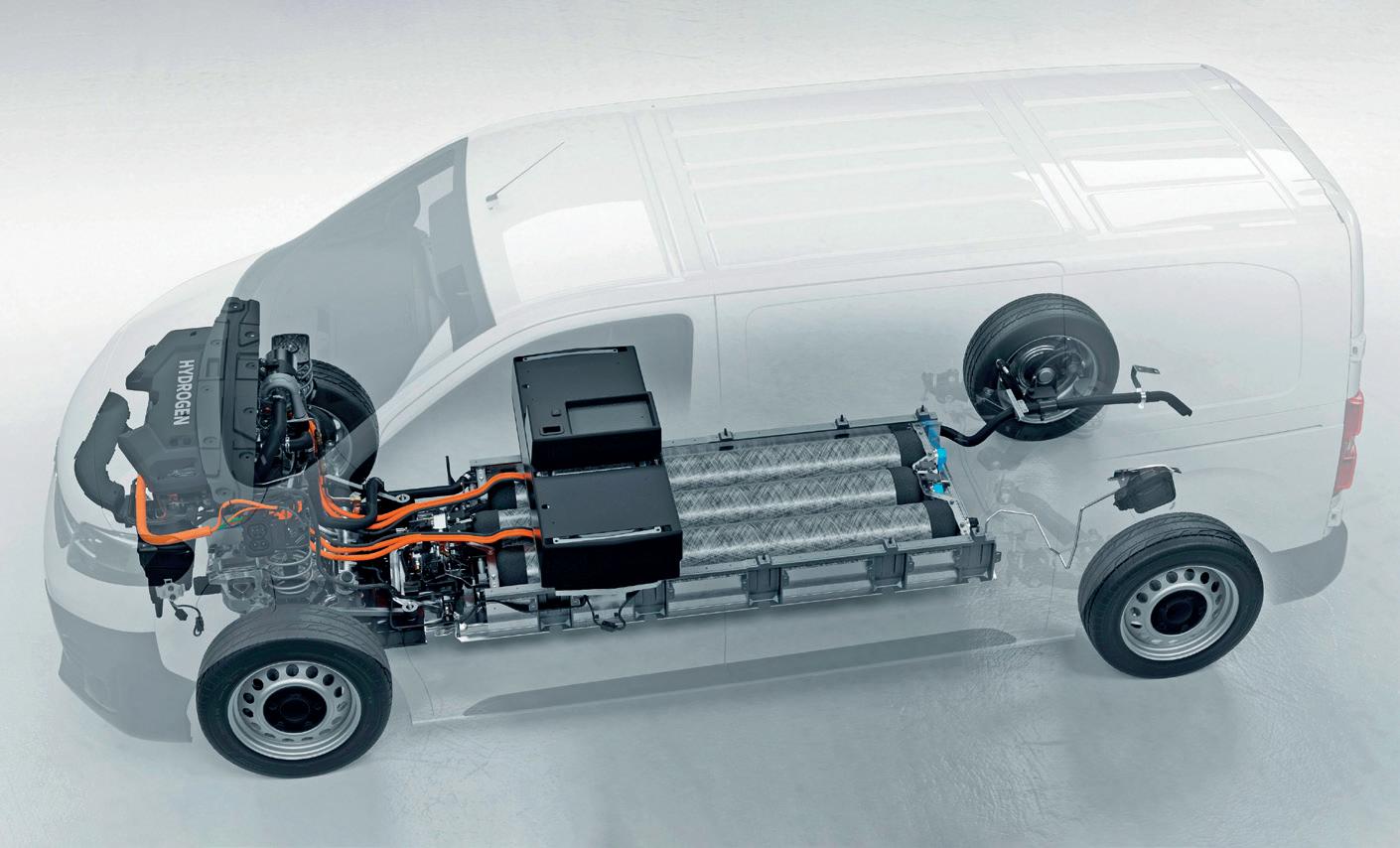

Marengo outlined Stellantis’ plans, which include a comprehensive product update in 2024 just launched, 12 renewed models in the compact, mid-size and large van segment, improving human-machine interfaces, driver assistance, and zero-exhaust emission capabilities. Their second-generation BEVs will offer record ranges, and their hydrogen strategy will provide flexible, fast-refueling options for longer distances. Stellantis continues to innovate with their diesel engines, introducing new versions that deliver durability and efficiency, particularly for the camper market. Their goal is to maintain current strengths while focusing on zero exhaust emission solutions and enhancing connectivity, safety, and conversion readiness. By 2025, Stellantis plans to introduce a dedicated

zero exhaust emission camper base, extend advanced driver assistance systems to motorhomes by 2026, and expand their EV lineup by 2027. Their target is to be 100% electric by 2030, supported by a multi-energy platform strategy that

includes both diesel and electric options. Recreational Vehicles represents a strategic asset for Stellantis Pro One, which is committed to sustain and actively support the sustainable future development of the compound.

31

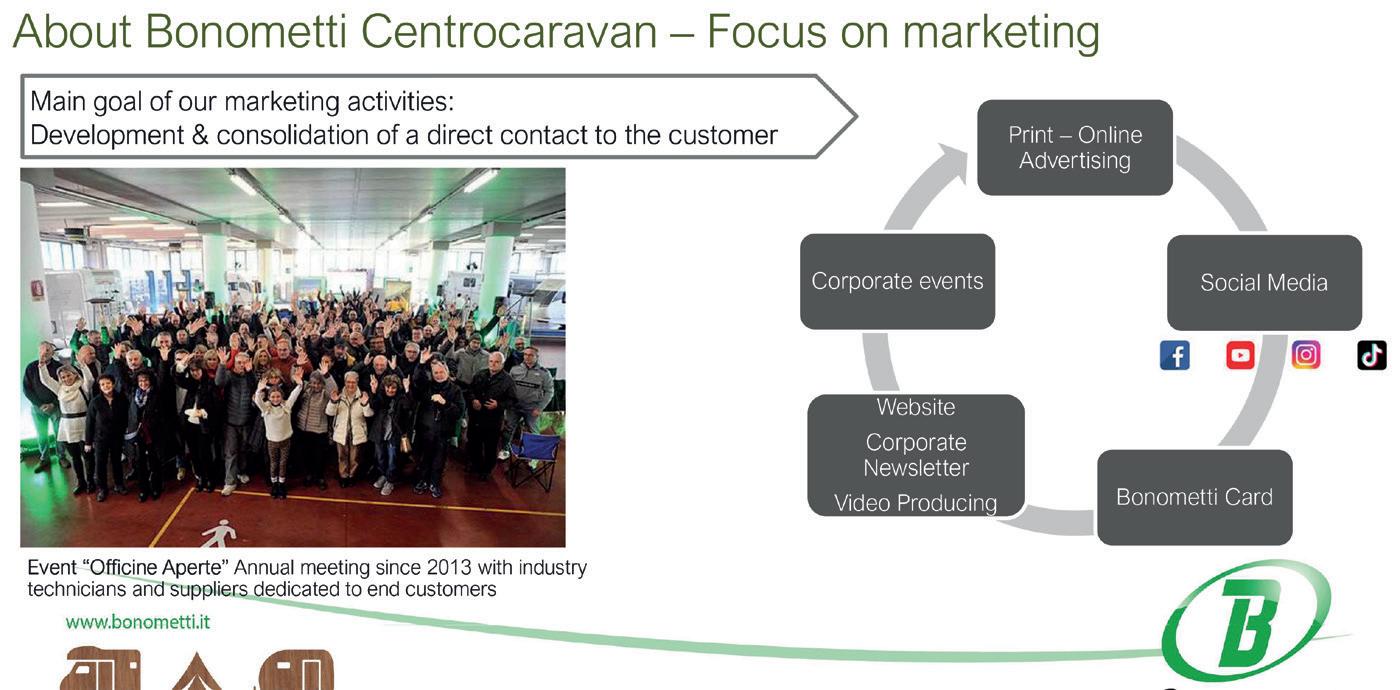

Bonometti: innovation and tradition

Stefano Bonometti, CEO of Bonometti Centrocaravan, shares the journey and vision of his company. It operates from a 27,000 square meter facility in Vicenza, Italy, showcasing over 200 new and used motorhomes and caravans from ten brands. With a strong emphasis on regional heritage Bonometti Centrocaravan leverages comprehensive marketing strategies and lean management practices to connect with customers and streamline operations

Bonometti Centrocaravan was founded by Danilo and Maria Pia Bonometti in 1966 as a dealership for cars, accessories, and tires. In 1974, a transformative event occurred when Danilo discovered a Nardi caravan during a trip to Torino. He brought it back, marking the company’s entry into the caravan market. Over the years, the business expanded to include importing caravans from Germany. In 2001, Anna Bonometti joined the company as CFO, and in 2008, the company decided to focus exclusively on recreational vehicles, ending their car dealership operations. Stefano Bonometti joined the family business in 2010, and together, they have strived to uphold their regional values and build strong partnerships, such as with the Erwin Hymer Group and Harald Striewsky Group.

Bonometti Centrocaravan today

Bonometti Centrocaravan operates from a 27,000 square meter facility, featuring a permanent exhibition of over 200 new and used vehicles, representing ten brands. The company is a distributor for the Italian market for brands like Fendt, Hobby, and Isabella. Since 2011, they have expanded their market reach to the Far East, including China and South Korea. Currently, they employ 30 individuals, half of whom boast over 20 years of experience in the industry. The company is located in Vicenza, a region rich in cultural significance. Situated between Verona and Venice, their showroom overlooks two historic castles that inspired the timeless love story of Romeo and Juliet. This connection to their heritage enhances the customer experience, inviting them to explore the rich history and beauty of the Veneto region, a UNESCO World Heritage site. Veneto is one of Italy’s wealthiest regions, with tourism being a significant contributor to its economy, generating 18 billion euros annually. Notably, Veneto hosts prominent tourist destinations like Cavallino-Treporti, Bibione, and Jesolo, attracting millions of motorhome and caravan lovers each year, particularly from Germany and Denmark. This vibrant tourism sector aligns perfectly with Bonometti Centrocaravan’s focus on outdoor and camping tourism.

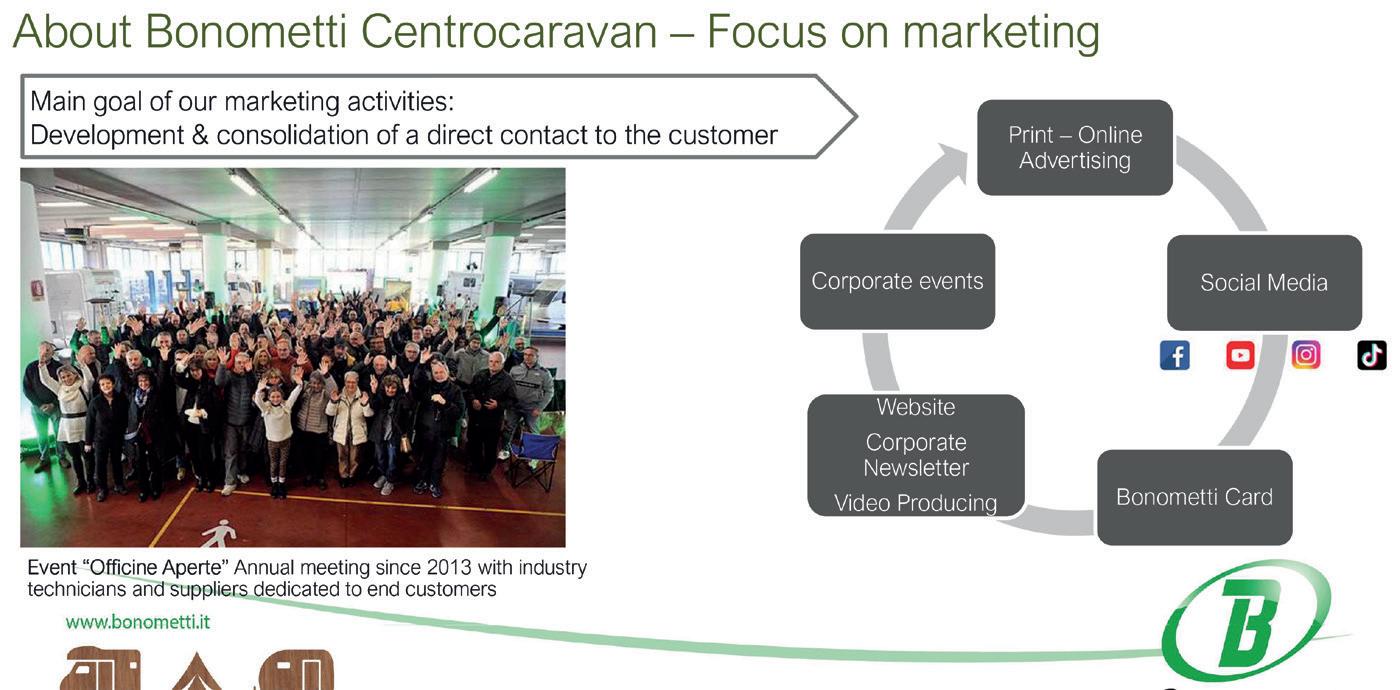

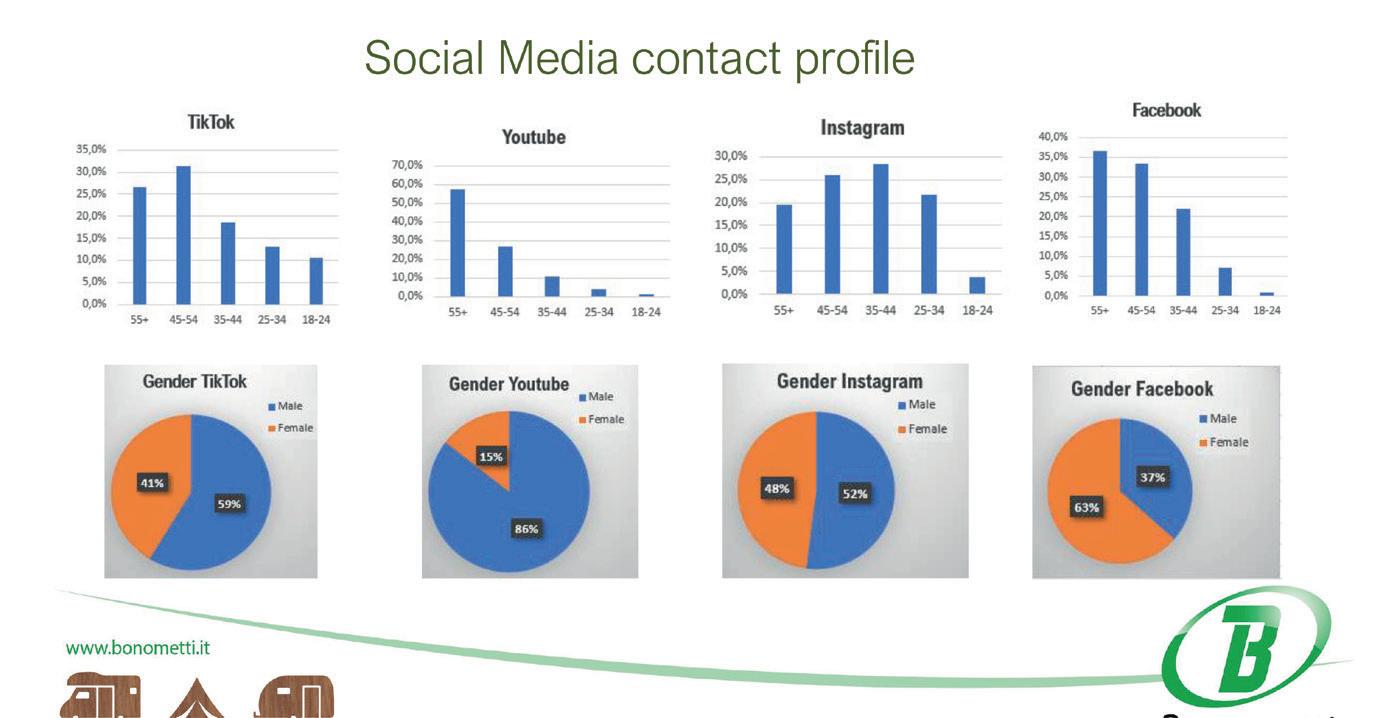

Marketing at Bonometti Centrocaravan

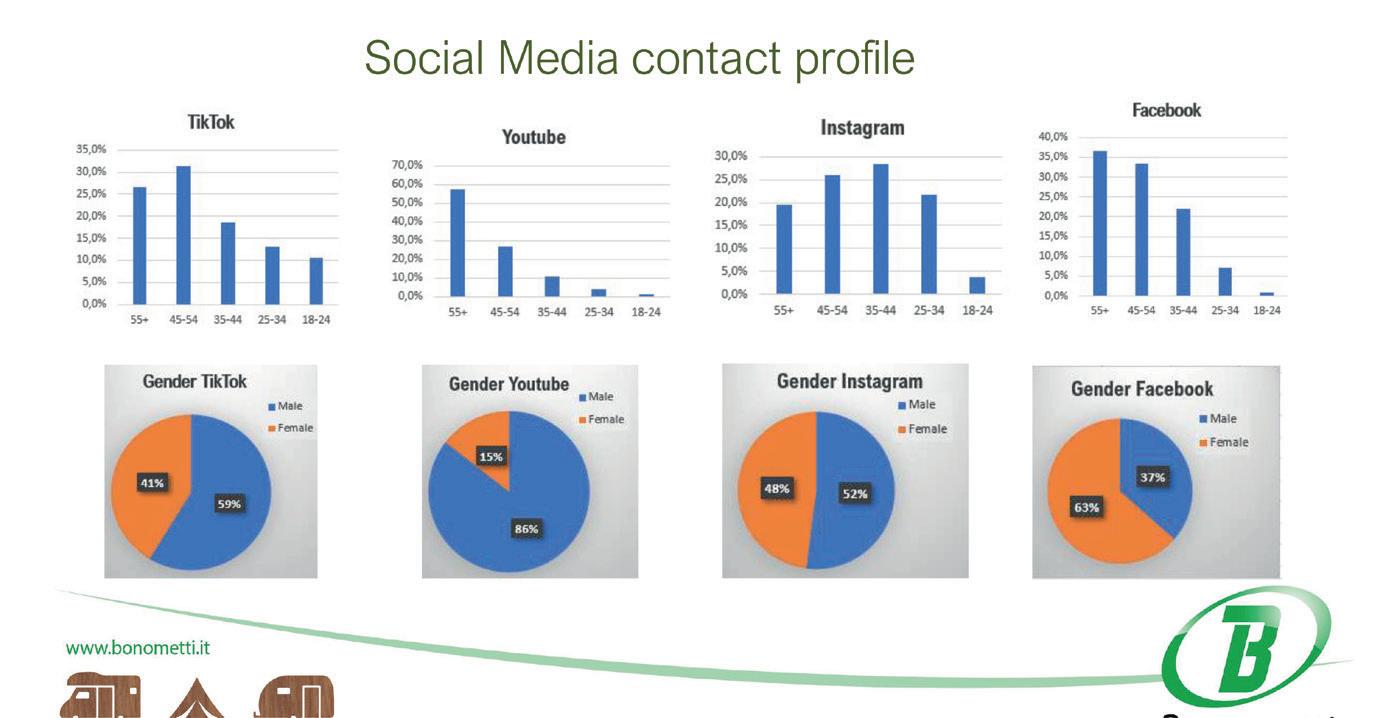

At Bonometti Centrocaravan, marketing is a cornerstone of their business strategy, aimed at developing and consolidating direct contact with customers to ensure strong and lasting relationships. To reach a wide audience, Bonometti Centrocaravan employs both tradition-

32 Report MELVI 2024

al print media and modern online platforms. This dual approach allows them to maintain a broad presence in the market and effectively communicate their offerings. Engaging with customers on social media platforms such as Facebook, YouTube, Instagram, and TikTok is also key. These platforms help them connect with a diverse audience, foster community, and build brand loyalty, providing an interactive space for direct engagement.

The Bonometti Card is a loyalty program designed to offer exclusive benefits to customers, enhancing their overall experience and encouraging repeat business by rewarding loyalty. Hosting corporate events is another crucial strategy for Bonometti Centrocaravan. These events provide opportunities for direct interaction with customers, allowing for valuable feedback and relationship strengthening.

Additionally, maintaining an informative and user-friendly website, producing a corporate newsletter, and creating engaging videos help keep customers informed and connected. This comprehensive approach to marketing ensures that Bonometti Centrocaravan remains closely connected with its customer base, continuously adapting to meet their needs and preferences. The company continuously improves its operations through the implementation of Lean Management, which began six years ago. This involves setting up business processes and improving standards. Additionally, they have implemented a Customer Relationship Management (CRM) system to better manage customer interactions.

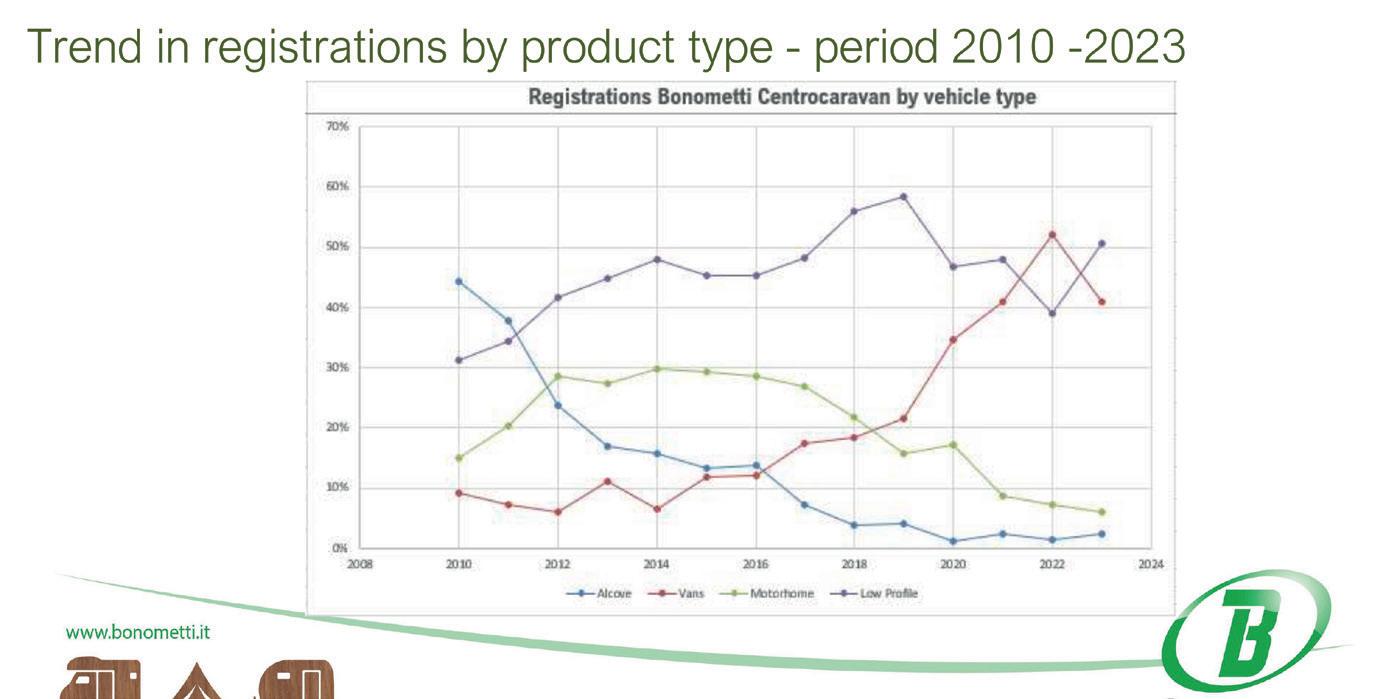

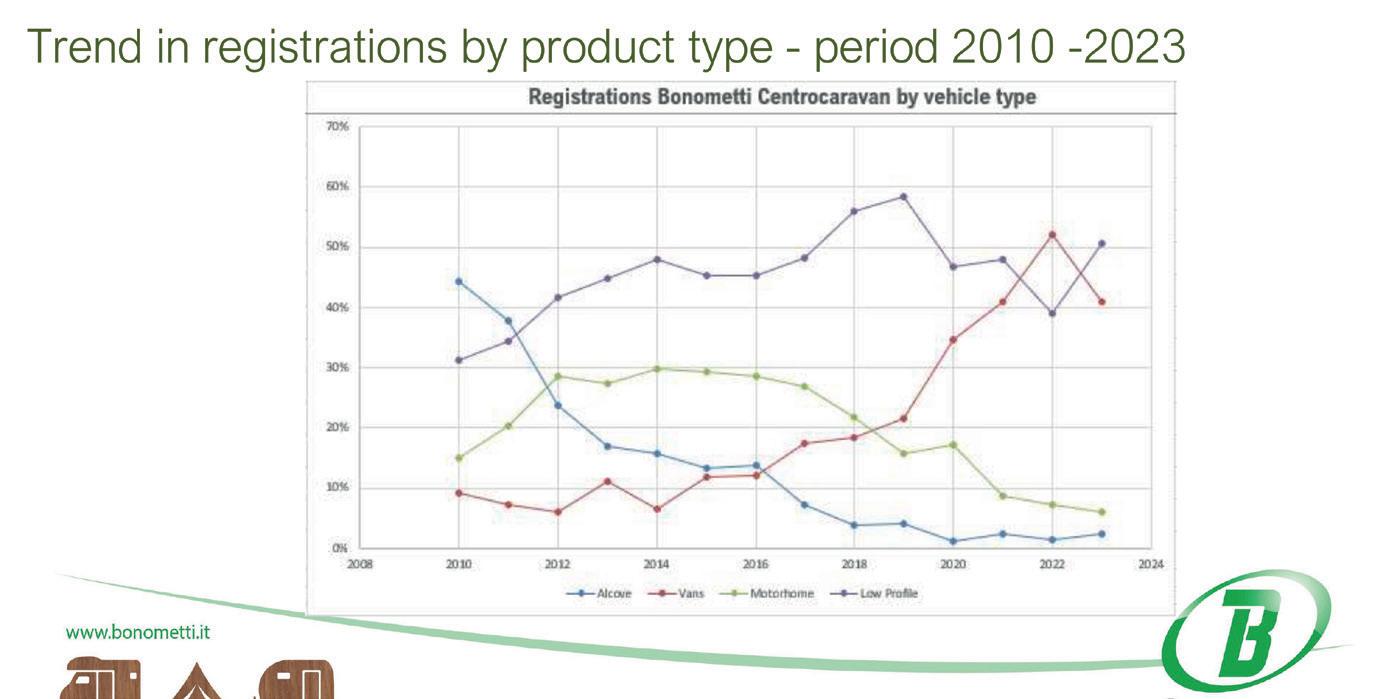

Trends and customer profiles

Bonometti Centrocaravan has observed changes in customer preferences over the years. Decline in Alcove Models: In 2011, alcove models were highly popular, accounting for 38% of sales. However, their appeal has drastically waned, plummeting to just 2% in 2023. Camper vans have experienced a substantial surge in popularity. Sales of vans increased from 7% in 2011 to 41% in 2023. Motorhomes, which made up 20% of sales in 2011, have seen a decrease in demand, dropping to 6% in 2023. This decline may be attributed to their larger size and higher costs compared to other options. Low profile models have steadily gained traction, rising from 34% in 2011 to 51% in 2023. The data highlights a significant transformation in the recreational vehicle market, with a clear shift towards more compact and versatile options like camper vans and low profile models. Stefano Bonometti provides insights also into the average ages of customers across differ-

ent categories of recreational vehicles, based on a sample of 200 customers. The average age of those purchasing new motorhomes is 62 years. Customers buying new caravans have an average age of 51 years. Those purchasing used autocaravans and caravans average 60 years old. Meanwhile, customers renting recreational vehicles have an average age of 58 years. The data indicates that the recreational vehicle market is largely driven by older adults, particularly those in their late 50s and early 60s. This demographic trend underscores the importance of catering to the preferences and needs of older customers, who are significant consumers in this sector. Bonometti Centrocaravan remains committed to

adapting to these trends and providing exceptional service to all its customers.

Looking to the future

As the market evolves, Bonometti Centrocaravan recognizes the importance of effective communication to promote this form of tourism and improve its image. They invest continuously in all communication channels aiming to reach a wider and more diversified audience. The company has been driven by heart and passion for 58 years. Stefano Bonometti, along with his sister and the whole team, remains committed to providing the best service and meeting customer needs while upholding their regional values and heritage.

33

Cusmai’s version F

Massimiliano Cusmai was invited to the 29th Meeting of the European Leisure Vehicle Industry (MELVI) to share the experience of his family business:

Camping Sport Magenta

ounded in 1965 by Giulio Cusmai in Cinisello Balsamo, just outside Milan, the company initially focused on selling tents. Over the years, the product range expanded to include caravans and motorhomes, making Camping Sport Magenta a key player in the industry.

In 1983, Michele Cusmai, the founder’s son, opened his own business in Magenta, significantly expanding operations. Starting with just four employees and an initial turnover of 0.5 million, the company has grown into a giant in the recreational vehicle sector. In 2013, another milestone was reached with the inauguration of the new headquarters, an impressive 18,000-square-meter building, leading to further increases in turnover and the number of employees.

Camping Sport Magenta today

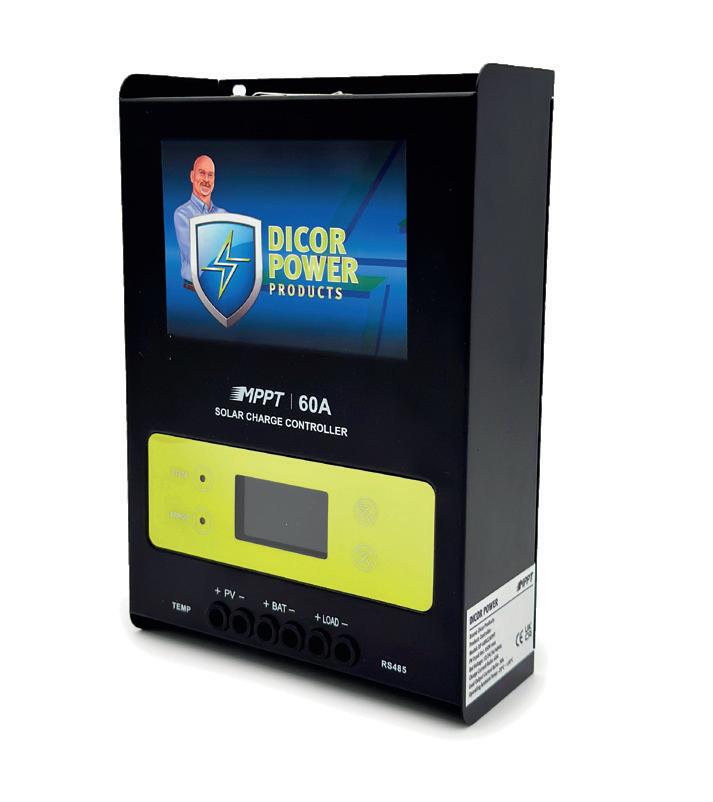

As of today, Camping Sport Magenta employs over 50 staff members, distributed across sales, administration, workshop, and warehouse departments. The owner’s family is also involved in the business: Michele’s sons Massimiliano (Showroom Manager) and Giulio (Buyer Manager), and his wife Marica (Administration). The company’s turnover has reached 43 million euros, with annual sales exceeding 600 vehicles, both new and used. Camping Sport Magenta collaborates with major brands like Trigano and Hymer, offering a wide range of vehicles and accessories for motorhomes. One of the keys to Camping Sport Magenta’s success is its ability to adapt to the needs of modern customers, especially in the accessories market, which has seen exponential growth in recent years. “The most requested accessories are no longer just simple bike racks or awnings,” says Massimiliano Cusmai, “but technologically advanced items like large Smart TVs, powerful inverters, and lithium batteries, which significantly enhance the camping experience.”

Camping Sport Magenta is not just a company that sells motorhomes and accessories; it is a true point of reference for the camper community. It is open seven days a week, with a workshop operating even on Saturdays. An extensive rest area has been created outside the facility.

A highlight of the business is its online store, which handles more than 36,000 shipments annually.

Overview of the camper market

In his speech, Massimiliano Cusmai offered insights into the current situation of the camper market, highlighting both

34

Report MELVI 2024

challenges and opportunities. The positive note, the manager said, is that since September 1, 2023, camper registrations in Italy have been increasing. However, he warned that this increase could be partially influenced by the high inventories accumulated by industry colleagues. Therefore, it is necessary to wait for further developments to confirm whether this is indeed a positive trend.

Regarding new vehicles, Massimiliano Cusmai emphasized that their high cost represents a significant barrier for many customers. The limited supply of cheaper models and the unattractive financing conditions (with interest rates of 6.95% leading to high monthly installments) make purchasing difficult for the clientele. Additionally, he highlighted an increase in the sales of new campers that doesn’t translate into returns of used vehicles, initially a positive phenomenon but problematic in the long term due to the reduced availability of used campers in the market. And the cost of used campers continues to rise, further complicating the situation. This price increase is directly linked to the rise in prices of new models.

Moving on to renting, the trend is positive, driven by new customers who, intimidated by the high prices of new motorhomes, prefer to opt for renting. Interest in this type of outdoor vacation has also grown significantly following the Covid-19 pandemic.

THE CAMPER MARKET TODAY

From 01/09/2023 the sales of new vehicles are slightly increasing due to the high number of vehicles in stock at dealerships

NEW

• Clients find it difficult to purchase due to high prices