A Finished Proiect From The Start

The DesignWood colorant* is pressure impregnated with the preservatives, giving color and protection in one step. Eliminates the need for initialstaining, saving time and money. ldeal for decks, fencing railings, steps, gazebos, playground equipment, trellis , lattice, structural framing, and every outdoor living space.

Proven Soluble Gopper Preservative

Preserve@ treated wood meets the stringent industry star of the American Wood Protection Association (AWPA), the leading authority on wood preservation science. The International Code Council's committees recognize A\ Standards directly in the model building codes (lBC and lR residential and commercial applications.

Preserve improves the durability of exterior wood for sustainable building; field-tested & proven-to-last.

Pre'Colored Treated Lumber N0w Available From select Treater: & Distributors lncluding: West Coast Wood Preser & Jones Wholesdle Lumber li | !! r Home Innovation l-J \Cg! u)F:\ CFRT r tt) RESOURCE EFFICIENCY AWPA Sbndardized For Proven Ferfonnance www,awpa.com Lmk forAWPA U1 and the Checkmark of l l

a a

* Designllood Colorant may vary sliqhtly depending on location, species of wood, aqe, grain pattern and heartwood content. dzVianCe Treated Wood Solutions . 800-421-8661

HARIIEil YOU R HOiIE

THF NATURAL CHARACTERISTICS OF A 1OO% REDWOOD SUBSTRAT[. Tl T ]NHERENT CHARACTERiSTICS PROV]DE THE OPTIMAL FEATURES TO BUILD OUR TINlSHED PRODUCT UPON, ROT, PESTS, DECAY & FIRE HAVE NOW MET THE]R MATCH, THTS VERSATILE PRODUCT tINE HAS HUNDREDS OF APPLICATIONS, AND WHEN ABLE TO USE THE SAME PRODUCT BOTH ]NTERIOR AND EXTER]OR SAY GOODBYE TO DUAL iNVENTORIES,

,

' di'q r{l- ,\\ .-'*t-='.. ----*€,: ". ri''1 ?-'tt€&$F.*;"- :lr**;J,*;, i::.+r**.* Nusru

.'at: 909,591,4841 .lt501 BRrcrrrr PnrvRno 0nrnRro, CA 97761

FTREBLOCKER@, ouR rGNrTr0N RESTSTANT Clrnn FJ Srlrre

TRrN & FAScTA LrNE; urrLrzES

CHANGE OF ADDRESS Send address label from recent issue, new address, and g{igit zip to address below.

POSTMASTER Send address chanoes to The Merchant Magazine, 4500 Campus Dr., Ste. i80, Newport Beach, Ca.92660-1872.

The Merchant Magazine (ISSN 7399723) (USPS 796560) is published monthly at 4500 Campus Dr., Ste. if80, Newport Beach, Ca.92660-1872 by Cutler Publishing, Inc. Periodicals Postage paid atNewport Beach, Ca., and additional post offices. lt is an independentlyowned publ! cation for the retail, wholesale and distribution levels ofthe lumber and building products markets in 13 weslern states,Copyright@2014 byCutler Publishing, Inc. Cover andentire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. lt reserves the dght to accept or reject any editorial oradvertising matter, and assumes no liability for materials furnished to it.

_ January2014 rne M ER G HAI|I ilas;ziner NumberT ry +E*h !H!aq'q4e96e&l:4 ^E|*b brut# ^Er*6 renh-tp.@ dbnEry ^tE*6q..hr!dr4@bhdbbtup -ra @br/l'.@* Special Features ln Every lssue 9 lNousrnv Tnrros How Drnlens AnE UsrNc Twrrrrn 1 0 Frnrunr Sronv BrwRne SuRpnrsr Snles Tnx 1 2 Pnooucr Sporucnr MnNurRcruneo SroNr VrNrrn 14 rrnsr PrnsoH WroeN Youn Sorrwnne SrnncH 16 Compnr.rv Pnonlr: Stvnsrnn 20 Mnr.rncrmtNr Trps WHe N Youn Brsr Snrrs Rrp ls ,c jenr 30 SprcrnL Focus: WrsrrnN Wooos 50 Pnoro Rrcnp: Wrsr Consr HouonY 6 Tornllv RnNoor'r 1 B Cor'rprrrrrvr lrurrrrrcnNcr 22 orsrN oN Snlrs 26 TruNxrNc Anrno 28 Movrns & Snnxrns 42 Fnr'ur-v BusrNrss 46 Nrw Pnooucrs 51 Assocrnrror Uponrr 52 tr.r Muraonrnm 52 Cussrrrro ManxnrplRcr 53 Dnrr Boox 54 lorn Frlr 54 Aovrnrsrns lruorx

Inousrny Ntws, Evrnr PHoros, & Drcrml EorrroN

u rr-orNc-PnoDUCTS.coM

Online Bnrnxrrc

B

4 I The Merchant Magazine I January 2014 Building-Products.com

I{ave Your Custorners Choose Any Color For Their Siding. Let Us Do The Rest. Cabot Factory Finish'" . Fade-Resistant, Nature Inspired Colors Saves Time and Eliminates Weather Delays Applied in Factory-Controlled Conditions . Available with S-year, 15-year or 25-Year Warranty To Learn More, visit CabotFactoryFinish.com orcall 1-8OO-US-STAIN OUR PERFoRMANcE Is LEGENDARY.*

By Alan Oakes

Letts get growing

rRSr, A Heppv New Ysen to all our readers. I hope you had a wonderful holiday with your families and are charged up for the year to come. May 2014 be profitable personally and in business.

This year certainly holds a lot of promise, as forecasts suggest the gains of the last two years will continue in2014.Indeed, at the top end of the housing starts forecasts, numbers will approach historical averages. Most businesses that have survived are already facing the challenge of how to grow again. In speaking to many owners, I know some are nervous about the thought-and for good reason. When and where to invest is a tough question.

I think that many would admit that in the yearc 2004-2007 we were all drinking the Kool-Aid and, as the market grew, we may have taken actions that our instincts told us not to. Companies entered the market and, just as quickly, exited it with no solid foundation of business. Others invested heavily, taking on debt to manage what turned out to be phantom business. Many paid a heavy price, and the industry today is a fraction of what it was only six years ago, with an awful lot of pain during the process. But the good news is that if you are reading this issue, you were one of the great survivors of our "Great Depression."

We as an industry (and this is your comment to me over the years) never learn. So the question perhaps to ask as the industry grows again is, how are we going to grow the right way? Whether large or small, we will face the challenge of growth this year.

The challenge is, if you are seeking out new business, it has to be worth the time and risk. Too often we chase new opportunities without considering whether these activities can be short- and long-term profitable, a good use of resources, worth the risk of adding new resources, or fit into the culture of our company. Perhaps the latter is what we do not take heed ofoften enough.

For any growth decision you take (developing or stocking a new product, adding staff, expanding, remodeling, rebuilding, etc.), make sure you have the funds. Monitor your cash flow intently. Nothing chases off your friendly banker like money wildly flowing in and out, as many discovered last time round. Indeed, get the bank to buy into your growth and any short-term negatives that you anticipate. Line up financing before you expand. No surprises!

Keep staffing increases to the minimum to protect cash. Staffing is normally one of our top expenses-consider outsourcing in the beginning.

Work with your suppliers, where appropriate, on scheduling, co-op marketing, training, etc.-all to get your new program off the ground as quickly as possible.

The key to any business success for the long term is to have a strategy that is focused, concentrates on profit opportunities with healthy margins, and allows you to work with customers that are profitable to the company. (Yes, you know the ones you don't want: the ones who are low-margin to start and get even lower with their constant demands). Don't waste time or resources on unprofitable business. Let those customers go elsewhere. Don't let them bleed you.

Identify the driver of your business and concentrate your energies on building that. Understand where you can gain the most. In previous columns I have suggested ranking your customers by their value to your business (by the way, that value changes every year). Pay attention to the quality of their business. Their value is not only the hard profit on products sold, but also includes the costs of servicing them. When that is done, you probably will get a better understanding of their true value.

It's the same with new customers. New business is great-in fact, the lifeblood of every company-but if you lack the skill set in your company to manage this new business, and if it does not fit in with your culture (sales or otherwise), stay clear. All business is not created equal.

Again, have a great year. I look forward to meeting you on my travels.

Alan Oakes. Publisher aioakes@aol.com

www. bu ldi n g-prod u cts. com

A publication of Cutler Publishing 4500 Campus Dr., Ste. 480, Newport Beach, CA 92660

Publisher Alan Oakes ajoakes@aol.com

Publisher Emeritus David Cutler

Director of Editorial & Production David Koenig dkoenig@building-products.com

Editor Karen Debats kdebats@building-products.com

Contributing Editors

Dwight Curran James Olsen

Carla Waldemar

Advertising Sales Manager

Chuck Casey ccasey@building-products.com

Administration Director/Secretary Marie 0akes mfpoakes@aol.com

Circulation Manager Heather Kelly hkelly@building-products.com

How to Advertise

Chuck Gasey

Phone (949) 852-1 990 Fax 949-852-0231 ccasey@building-products.com

Alan Oakes www,building-products.com

Phone (949) 852-1990 Fax 949-852-0231 ajoakes@aol.com

CLASSIFIED David Koenig

Phone (949) 852-1990 Fax 949-852-0231 dkoenig@building-products.com

How to Subscribe

SUBSCRIPTIONS Heather Kelly

Phone (949) 852-1990 Fax 949-852-0231 hkelly@building-products.com or send a check to 4500 Camous Dr.. Ste. 480, Newport Beach, CA 92660

U.S.A.: One yeat (12 issues), $22 Two years, $36 Three years, $50

FOREIGN (Per year,paidin advance in US funds):

Surface-Canada or Mexico, $48 Other countries, $60 Air rates also available, SINGLE CoPIES $4 + shipping

BACK TSSUES $5 + shipping

'']TITRGHAJIT,,O,"

6 I The Merchant Magazine I fanuary 2014 Bui lding-Products.com

WE BRING VALUE TO OUR CUSTOMERS, BOTTOM LINE. See our product catalogue online at www.silvastar.com I Lori DeWitt +1 (360) 647-2434 s'd

WHY SILVASTAR?

Excl usiuely_!!g[!b u!q!-Ey Calibnia Firc Cetlified &Appruved nttL ffiK "9" r00D Et&lRL Woodl Frodlucts Millwork that qeates distinction: ELandE LWoodProducts.com

How dealers are using Twitter

f\esetre wAILING FRoM experts on the necessity of coml-lpanies being active on Twitter to instantly communicate with customers and prospects, few LBM dealers tweet.

Of the nation's estimated 10,000 LBM retailers, the vast majority appear to have never set up a Twitter account and, among those who have, only about 30 independents send out more than two tweets a week. Next to feeling the service is not worth their time, the next primary reason for not using Twitter more is that dealers feel they don't have anything worthwhile to say. So just what are those 30 active users finding to talk about?

The Merchanr surveyed the communications of 30 indpendent lumber dealers most active on Twitter. What we discovered is that few are dreaming up long, complex posts to amaze the masses (after all, the service limits messages to 140 characters or fewer). Most are building an identity, such as:

I'he Linkcr. Linking to home improvement articles (like "How to Install Crown Moulding") may kickstart a project-and a purchase. Linking to industry news (the latest NAHB housing statistics) can also get pros thinking

about you as an expert.

I hlE|ffi6. I Abg|ErMdid:r.€P

I FlQ|.lrfur. EAt|dmffinffib.i'lM

I ffiql.dq r' i|i.-.r

I 6gntES fiFn g6FE.@lM{shfFE *'* Ms&MYdPtu

I brtffib. I hy, rtu@d.n@nrybddMsbdin Pl

I H{|trQ. E hpF.rNrFbmhnrh

+ Hqltro I AbMryffi bc6!r cntur!ebrdF... tu rcH8G|l!r'ruP^

Links can also be time-savers. It can be doubly timeconsuming to maintain presences on multiple social media platforms, so some dealers use their Twitter account primarily to link to updates on their blogs or Facebook page (which allows posts in excess of Twitter's l40-character limit).

In addition to links to its Facebook page, Parr Lumber, Hillsboro, Or., sends out several links a day to photos it's collected on its Pinterest site, highlighting glamorous projects and interesting new products.

The Conversation Starter. Ideally, tweeters want their name spread not only to their followers, but in turn to their followers' followers, so it's key to engage them and turn the monologue into a dialogue. Dealers ask what their followers' latest project is, what their dream purchase is, or what their plans are for the holidays. Peter Lumber Co., Pleasantville, N.J., and City Lumber Co., Dyer, Tn., solicit participation with a weekly trivia contest.

The Commenter. No one joining your conversation? Chime in on theirs! Dunn Lumber, Seattle, Wa., has collected more than 8,500 followers by themselves following an equal number of users and regularly commenting on their tweets and photos-and thanking anyone who mentions Dunn Lumber. The idea is to get the Dunn Lumber name out wide and often, and to be seen as a friend to the community.

The Promoter. Got something on sale? Tweet it. Ashby Lumber, Berkeley and Concord, Ca., publicizes specials on a near-daily basis. Meek's Lumber, Springfield, Mo., even tweets out downloadable coupons.

How about an upcoming contractor night or other event? Ro-Mac Lumber, Leesburg, Fl., uses Twitter to direct followers to its weekly "Around the House" radio show.

The Recruiter. About half of the 5O-plus Tweets a month by Lyman Lumber advertise the various job openings at its Wisconsin and Minnesota facilities. (With more than 250 locations, 84 Lumber has so many positions available that it maintains a separate Twitter feed, 84lumberCareers.)

Dealers on Twitter o,0oa lb

ri

What the

Survey of 30 actively tweeting independent LBM dealers, based on 967 total tweets from Nov. 1 -Dec. 2,2013 z.lsx r !ffid I Evem Promos I Nsws/Tipsr' Photo Links I shout outsr' Comments I .loos 2.5Sty. Building-Products.com fanuary 2014 r The Merchant Magazine r 9

Top 30 Are Tweeting

Are you at risk of surprise sales tax?

ll rfosr BUSINESS LEADERs are comIVlfortable discussing things like risk, ROI, and market share. They are less comfortable discussing sales tax, but it's a conversation that needs to happen.

States are getting increasingly creative about finding new revenue sources through sales tax. Businesses can easily incur "surprise" tax liabilities without realizing it. Assuming sales tax rules are the same across all your territories can be a costly mistake.

What is Nexus?

Sales tax starts with something called "nexus." Nexus is the relationship a business must have with an authority (like a state or local government) in order for that authority to collect taxes. Let's simplify that. Imagine you have a store in Nebraska: you own your building, pay employees, and complete business transactions in the state. All these things give you nexus in Nebraska, and the state will collect sales tax from your business.

Say you have a customer, Jim, who works in Iowa, but comes to Nebraska

to purchase his materials. You probably don't have nexus in Iowa just because your customer works there. But let's change the situation. Jim calls in his orders from Iowa and your employees deliver materials to his jobsites in that state. Now Iowa might argue you have nexus in their state and you owe them sales tax.

The problem businesses face lies in the words "probably" and "might." Each state has different nexus triggers. If your Nebraska store sells an item to people in two different states, you may have nexus in one but not the other. Things like buildings and equipment are almost universal triggers, but many states are starting to define nexus based on activity rather than physical presence. Sending an employee to a trade show, industry conference, or training seminar can all give you nexus in a state. You can establish nexus in Arizona if an employee spends two days of the year there. If your Nebraska store has a lot of Iowa customers like Jim, Iowa might argue you have an "economic nexus" in their state, even if all your

sales take place in Nebraska.

Delivery of Goods

Delivering purchased items is a common nexus trigger, but there are a variety of ways states approach the issue. In Georgia, the "taxable event" takes place at the ship-to location, but in Kansas, it occurs at the ship-from location. In some cases, just delivering an item may not trigger nexus, but offering a service can. (It's the difference between delivering a door, and delivering and installing a door.) The method of transportation may be a trigger as well. Are you using your own fleet, a common carrier like FedEx, or a third-party vendor? The bedding store Mattress World is an excellent cautionary tale about ignoring delivery-related sales taxes. Mattress World is located on the Oregon-Washington border. Many Washington residents would cross the border to purchase and pick up mattresses. Mattress World started offering delivery and set-up service to their Washington customers through a third-party vendor. But hiring and sending that vendor across state lines created nexus under Washington's tax code. The company didn't plan for this and ended up with a $1.7 million (plus tax) debt to the state.

Jurisdictional Boundaries

We've been discussing nexus triggers as a state-by-state issue. The truth is you can create additional nexus within the same state by crossing into new tax jurisdictions. States might define their tax jurisdictions by cities or countries, but the boundaries aren't always so clear. To further complicate the matter, some states allow jurisdictions to set their own sales tax rules. Getting business from a new area in town means you could owe a com-

By f essica Arant, DMSi

I I aF i r'q E g':,;g'g ' i rg {4 ,s ,.**af Bj $,$ i ".".. . i

10 t The Merchant Magazine I January 2014 .rBuilding-Products.com

KEEPING TMCK of differing sales tax rates within your selling area is imperative. Consider that in one area of Colorado, there aie six different tax rates'contained'within a single zip code!

plctcly new sales tax to a completely ncw uuthority. Colorudo is notorious fbr this: they have six different rates in a single zip codel

What's in a Name

Definitions arc one of the stickiest points in sales tax, in part becausc they can secm so arbitrary and abscnt of common sense. KitKats, Twizzlcrs and Whoppcrs are not "candy" undcr the Streamlir.rcd Sales Tax definition because thcy all contain f-lour. Indiana categorizcs marshmallows its "candy" (taxablc) and marshmallow crirnc as "food" (cxcrnpt). Pennsylvania does not (ux elothinr'. bul dor's trtr .'l'ur lrti.tl.r." *nien iriclude "urticl.'s m:.rdc ol' woven aninral hair or wc'rol that rcscmble s tur in appearance." (Presumably a wool sweater would be exempt. but a coat with sheepskin trirn would not.)

Calil'ornia's 20 I 3 tax on "certain lumbcr and enginecreci wood products" is a great example of deflnitionrelated chaos. Under this rule, "f-encing. railing and deckin-g" are subject ttt the tir\. but bumboo I'ene ing. pre-e()nstructed railin-q sections. and "deck packages" are exempt. Retailers spcnt countless hours determining which items in their catalclgs were taxablc. lt was a huge investment of time and

lroney for the businesses, but it needed to be done. Shortly befbre enacting this new rule. Calilbrnia announced a plan to hire 300 auditors. Businesscs are held responsible for complying with tax rules, cvcn if those rules arc ahnost impossiblc to understand.

The Take-Away

Check thc nc.rus triggers .fbr avcrv territory \'our ( ontpetlt' interuL t.t tt'ith. Don't assun're you need a building or permanent employee in a state to owe sales tax thcrc.

. Cltack lhe tax rule.; re,u,urtling clelivcrie.s .for ever r- oreu \oLr tlaliv'er Io. You mav need tcl collcct additional salcs tax from custolncrs in some arcas but not others.

Chcck the juri.srlictiottal bounclurias .frtr even stule .\'tttt do business lrr. Make sure you'rt: collecting the correct amount of salcs tax for each .jurisdiction and remitting payment to the conect authority.

. Pa)'ottetlliott to definitions uttuched to sulc.s lrr,rc.r. The distinctions between taxable and exerlpt items may seem arbitrary and silly. but the stute is going (o be very scri,rus about collecting fines and penaltics.

Sales tax is incredibly complicatcd. You need a good tetx consultant to

rnake sure you tbllow the rules in zill jurisdictions where you have nexus. But once you know what you're suPposed to do, the next step is doing it consistently.

Automating tax calculation is a -creat strategy because it v irtually eliminatcs the risk of human crror. Services like Avalara work with your ERP systern iind calculate thc appropriate late for each transaction. Your software platfbrms should bc robust. yet 1'lcxible enough to handle the inel'itable changes in salcs tax rules.

California's lumber tax impacted products so inconsistently that most POS programs couldn't apply it corrcctly. Many businesscs resorted to calculating sales titx by spreadsheet. A-eility software was one exception. It adapted to the changc casily, and users like Peterman Luntbcr. Fontana, Ca.. and S&J Lumber. Madera. Ca., were able to incorporate the tax without a problem.

You may not want to think about this topic, but it's tar better to discuss sales taxes now with your collea-tues. rather than later with an auditor.

- Je.ssittt Aruttl is conlntwtt(tti()tI (oordinator lbr DMSi Sofnrare, Otrtoltu, Ne. Rern h lrct ttt i(tt ttttl6 dttt.\i .t r'ttt.

IT'SALLABOUT TURNAROUND

FASTER SHIPPING. FASTER DELIVERY. nn ulnrurArE FAstEIwRs

To become an authorized dealer or distributor call us dir"ect at 1-888-888-3661 Shop our online catalog. Prepaid height available, orders ship same day.

Frsm the industry's deepest Stan Dr.ives to our patented Decklok advanced latenal anchor, nobody delivers quality prcducts as quickly or reliably. Now wiDh a new East Coast warehouse, over I quarber of a million dollars in inventory is waiting to ship to you even faster. Depending on your location, it could arrive as soon as tomornow

Frsm the industry's deepest Stan Dr.ives to our patented Decklok advanced latenal anchor, nobody delivers quality prcducts as quickly or reliably. Now wiDh a new East Coast warehouse, over I quarber of a million dollars in inventory is waiting to ship to you even faster. Depending on your location, it could arrive as soon as tomornow

SCRE,I-'ROEUCTS.EEM * ffi ,r, Building-Products.com lanuary 2014 I The Merchant Magazine I 1 1

The many uses of manufactured stone veneer

ll rfnNupacruRED sroNE veneer

IVlpromises to be more popular than ever in the residential building materials market this year, as its ease of installation and extreme versatility make it a perfect solution for customers looking to keep pace with today's design trends.

Whether it's a production builder seeking innovative ways to add curb appeal to a community or homeowners wishing to update their residence through a creative remodel, consumers continue to favor manufactured stone veneer because of its varied uses. And the number of applications are still growing: the product's high adaptability means it is often a natural fit for even the most innovative developments in design.

Pioneered more than 50 years ago, manufactured stone veneer is cast

from natural stone molds and then meticulously hand colored with mineral oxide pigments to give it the depth, pattern, complexity of color, and unique pattern of stone. Due to its lighter weight, it actually has many more design uses than natural stone.

Manufactured stone veneer can be adhered to most wall surfaces, since it is one-third the weight of full-rhickness stone. To comply with building codes, stone veneers cannot exceed 15 pounds per square foot, which allows for greater design flexibility.

Durability is another prime characteristic of stone veneer, which is of crucial importance to developers, builders and architects who need predictable strength, consistency and quality in their stone veneer products, ensuring materials are safe to handle and remain secure over the lons term.

Concrete mix used to make stone veneer must withstand at least 1,800 psi without damage, which ensures its durability for years of service. In fact, stone veneer products usually come with a 50-year limited warranty.

Made with Portland cement and lightweight aggregates, manufactured stone veneer is low maintenance and can tolerate a wide range of climates. Boral's Versetta Stone, for example, is rated for wind resistance of over 100 mph. This panelized stone veneer is easily installed in any climate, because its mechanical fastening system does not require heating the wall to a certain temperature during cold weather.

Residential projects of all types can benefit from the installation advantages of panelized stone veneer, as evidenced by the recent completion of a $27.9-million affordable assisted living community in Lansing, Il. The community, known as St. Anthony of Lansing, houses 125 apartment units in a three-story building on a four-acre parcel. General contractor LedCor selected panelized stone veneer for its ease of installation in cold weather. The portion of the building that involved 27,000 ft. of product applied via traditional stone masonry methods

12 r The Merchant Magazine I lanuary 2014 Bui lding-Products.com

took three months to complete and required a full wall tent and heat. In comparison, installer Residential Exteriors applied 2'/ ,OOO ft. of panelized stone veneer (along with an additional 54,000 ft. of fiber cement shake siding and trim) to the building in just three weeks, without the need for a wall tent and heat. Even with the cold weather, there were no delays.

More cost effective than natural stone and available in more than 100 colors and textures. stone veneer is increasingly popular for both exterior and interior applications. Stone veneer can be utilized in almost any manner, even as cornices, copings, wall brackets, and door surrounds. No matter where it's used, stone veneer makes good construction and design senseand even a small amount makes a large statement. Following are some of the varied applications that dealers can now target to sell stone veneer:

Fireplaces: With the wide variety of stone veneer styles available, it is easy to achieve virtually any look for fireplaces. Stone veneer fireplaces can feature anything from a traditional, rubble texture to a modern, sleek feel. They can be ornate, reminiscent of Victorian styles, given a Tuscan or

Mediterranean appearance, or simply a stone wall and floor on which a wood burner sits.

Kitchens/Bathrooms: Stone veneer islands and backsplashes can add texture and variation to kitchens, while decorative stone veneer accents can lend a rustic or natural vibe to bathrooms. A little wall cladding in stone veneer goes a long way.

Arches/Doors/Windows: An ordinary arch, door or window can be transformed into a stunning architectural feature just by adding some stone veneer accents. Using stone veneer to offset brick window accents is a growing trend, as is combining different stone veneers to give a very customized look. Keystone windows and arches are also trendy as are window and door surrounds made from carved or inset stone.

Exterior Facades: Whether used as an accent or a full wrap, stone veneer can add curb appeal to any home. Using different materials and colors can provide a three-dimensional quality, creating more interest and depth to a building. Layering also helps articulate human scale while complementing the architecture and surroundings. More earth-toned colors are being favored by architects, who are incorporating stone veneer into exterior facades as a way to complement the natural scenery around many homes.In some cases, styles that emulate the natural stone found in nearby surroundings are used, giving the illu-

sion that a piece of the landscape has been incorporated right into the home.

Outdoors: A major trend today is the use of stone veneer for outdoor fireplaces, kitchens, barbecue islands, and cabanas. Stone veneer walls can be used to add character and form to gardens and outdoor yards. Their beautiful aesthetics and extreme durability also make them a perfect option for lining driveways and property borders. A Tuscan ventacular is also popular, in which elements are completely cladded-as if the materials were "pulled off the land" and the outbuildings (such as a pool house or shed) have the same look.

Columns: With columns a preferred solution for housing heat structures in backyards, stone veneer makes for an ideal wrap because of its light weight. Stone veneer columns in a square shape are a favorite at the moment for backyards, while traditional , Tuscan-style columns are a classic choice for adding old-world charm to entranceways.

No matter what your customers' design needs and interests, stone veneer is likely to be an ideal fit, given its beautiful aesthetics, adaptability, durability and relatively low cost.

- Ed Perez is the area sales manager for Boral Stone Northern California and Northern Nevada. Based in RosweLL, Ga., Boral USA subsidiaries include Boral Bricks, Boral Roofing, Boral Stone, and Boral Material TechnoLogies. Reach him at e d.p e rez@ borsl.com.

Bui lding-Products.com fanuary 2014 r The Merchant Magazine r 13

MANUFACTURED stone veneer use is growing both indoors and out. (Photos by Boral USA)

By Cordon Birgbauer, AllS/MFP

I nd ustry-specific software isntt the only solution

('\ven rHE YEARS, I have shared \-7your pain. struggles and sleepless nights with-dare I say it?-IS (Information System) or, as it is sometimes called, IT (Information Technology). I've never liked either of those descriptions. Let's move to a much broader description: ERP, or Enterprise Resource Planning.

Why is it that we spend countless labor hours on budget meetings, integration methodologies. maintenance. inappropriate functionality, and the inflexibility to adapt to changing business needs? What frustrates me even more is that we allow this IT to rule our business lives with substandard performance, only to be assured, "Don't worry,, your software provider will have it fixed in the next enhancement release."

I contend that LBM industry-specific solutions don't have to be your only options. A SKU is a SKU is a SKU. You're telling me that the barcode on that Victoria's Secret shelf is different from the barcode on a gallon of paint at your store? I guarantee you that walking down Fifth Avenue and visiting the Ralph Lauren store or Gucci store, that they don't have the ERP struggles that our industry does.

You don't need to have exponential budgets, either. There are solutions outside our industry that offer these ancillary benefits for us to run our day-to-day operations. They are just as efficient and also effective for our internal and external customer.

Let's look at the facts. Compare the growth of our industry in terms of dealers, market share, revenue and profitability to that of Home Depot,

Lowe's and Menards.They, like most Fortune 500 up to 5000 companies, use outside ERP systems.

The experts at your local "geek shop" have probably never even heard of your system. If you search Monster or any of the other employment networks for IT or ERP jobs that relate to our industry's specific software package, you won't find a huge pool of qualified prospects.

Why is it that some co-ops use systems like SAP, but offer their dealers different ERP solutions? I guess they never read Harvard professor Michael Porter's work on value chain and the importance of transparency to the customer in order to bring value to all stakeholders. The basis of his thesis is that Enterprise Resource Planning facilitates improvement to a company's value chain, thus generating significant competitive advantage.

ERP is the integration of a busi-

ness software solution into a company's activities and strategy. The theoretical motivation behind implementing an ERP project is to increase efficiency, thereby reducing costs and increasing profitability and customer satisfaction. In addition, there should be increased efficiencies around the supply chain, consolidation of information, and an overall business improvement, which gives those who use ERP an advantage over their competitors.

According to Porter, a company's ERP project can be assessed by the level of improvement in terms of productivity and customer satisfaction. The analysis of the data presented by ROI figures will clearly show that ERP systems provide a significant benefit to the value chain, increasing competitive advantage within an industry.

Companies like SAP and Oracle have been leaders in creating value efficiently and effectively by adapting quickly to business changes for their clients.

To better compete in the 2lst Century, dealers may want to consider more than just industry-specific ERP packages. Like most owners who grew up in this business, I have sawdust in my veins. I love the independent lumber industry and want to see all of us succeed.

- The former president of LumberJack Building Centers, Algonac, Mi., where he spent 22 years, Gordon Birgbauer is now a lumber distribution consultant, as president of AIIS/MFP, Algonac. He can be reac he d at g b ir gbauer 3 @ gmail.c om.

FTRST Person

14 I The Merchant Magazine I fanuary 2014 Building-Products.com

Performance where it count5"

> 25-year limited warranty

> Reversible, smooth/textured surface

> Contains eco-friendly recycled materials

> Complements any siding and architecture

> Fiber cement for lasting performance

> Smooth, square edges for finished appearance

> Primed on six sides

> Termite and weather resistant

> Non-combustible

> No specialized tools needed at jobsite

> ISO 14001 and OHSAS 1800'l certified

Size (thickness)

that complements any siding and architecture

from long-lasting fiber cement workability that compares to wood

width* inches

Plycem Fiber Cement Exterior Trim

2" 1-314"

APly€em"' Ai.l v.r 1rr,:d Ti:r, h r:o1':rlt, 1 ;1 Fr l;r' t C r t trl trl versatility

durability

8" 7 -114" 10" 12" t-'tn'11 9-114"1 AllAvailable in 12 ft. Lengtltq_ Other widths available upon request.

Producer branches out Targets custom orders, shipping

A*t vEAR AFrER being acquired by the owners of \-fWelco Lumber, Vancouver, B.C., SilvaStar Forest Products, Bellingham, Wa., is expanding its business by introducing new products and services.

"Many companies offer one or more of the same services we do, but none offer the same unique, complete solution," says Mike Thelen, SilvaStar's chief operating officer. "Our motto is: 'Together, your product line combined with ours builds a world of possibilities."'

Here's how it works: The company produces its own fascia, trim, siding, decking, patterns and furring strips in its 100,000-sq. ft. manufacturing plant. However, with annual production capacity of 200 million bd. ft., there's also room to dry, mill and stain to customers' specifications. An additional 40,000-sq. ft. of additional covered storage keeps everything in great shape.

"Customers bring their raw material to our plant," he explains. "If it's wet, we re-dry it in our kilns. We then process their lumber to match their individual specifications."

A six-railcar spur on the 30-acre property-which is paved and fenced-simplifies delivery. "We offer a unique advantage for our rail customers, allowing them to order highly mixed cars combining material from our inventory with their custom milling and staining orders," he says.

Adding product from nearby producers isn't a problem either. "Framing lumber from nearby sawmills can be used to complete their orders," he adds. "This allows purchasing flexibility and substantial savings."

More than two-third's of SilvaStar's business is with two-step distributors, such as Boise Cascade, Boise, Id. "We currently supply l4 Boise locations from Woodinville, Wa., to Pompano Beach, F1.," says Thelen. "We also supply custom-branded products to the big boxes."

Mike Bland, general manager of Boise Cascade Building Materials Distribution in Riverside, Ca., says that Boise decided to partner with SilvaStar because "they understand that customer loyalty is all about building longterm relationships. I would rate them right at the top."

COMPANY Profile SilvaStar Forest Products

SILVASTAR'S plant produces a range of company-branded products, plus custom milling and staining to customers'specifications.

16 I The Merchant Magazine I f anuary 201 4 Building-Products.com

A SIX-CAR RAIL SPUR on the property enables mixed loads for substantial savings. (All photos courlesy of SilvaStar)

By Carla Waldemar

By Carla Waldemar

Same footpriht, but a Gi nderel la transformation

/l'-l nEc CltNe 's cor HIS dream lLfiou-.jutt ask him. He signed on a year ago as retail merchandising manager for Bloedorn Lumber, headquartered in Torrington, Wy., with 21 stores and a truss plant in four western states.

Joe Maya's crazy about his job, too. He's worked l7 years in the Worland, Wy., lumberyard he manages, which Bloedorn bought in 2000.

"I love merchandising," swears Greg, who recently masterminded the complete rehab of the Worland store Joe runs. And you couldn't pry Joe himself out of it with a forklift. "This is my hometown, where I grew up. I love working here," Joe jubilates. And after the remodel, he loves it even more: Sales are skyrocketing, and new-customer count is on the

uptick, too.

Bloedorn, launched back in l9l9 selling lumber and coal, is on track to remodel the majority of its locations, two stores at a time-some, like Worland, drastically; others with a more subtle touch. The Torrington and Buffalo locations, already completed, each shifted focus in slightly different directions-one toward the retail market, the other to the pro. No cookie cutter in the grand design: "Each storc is a little different," says Greg. So we'll look at Worland, which celebrated its grand reopening in late September.

What's the town like? Let's ask Joe, who's one of the 5900 folks who live here. First of all, "it's not a bedroom community," he laughs. "In Wyoming. every little town is out on

its own. We're the only lumberyard in town."

But they don't write off the challenges. "Very strong competition" thrives here, according to Greg, who's spotted an Ace, True Value, Big Horn, and big boxes looming down the highway. "So, we saw a need to diversify, to update things."

If you, too, are feeling that urge but hesitate to undertake a huge expansion, take note: "remodel" doesn't have to mean "expand." Worland's 10,000-sq. ft. footprint stayed the very same. And, challenging as it was, the store never closed during the top-to-bottom rehab. Customers not only took the upheaval in stride, they acted as cheerleaders, creating a buzz around town (a.k.a. free advertising) about the progress.

nce

'j

1B r The Merchant Magazine r lanuary 2O14 Building-Products.com

TOP-TO-BOTTOM remodel of Wyoming yard began on the outside, with new landscaping, signage and stylish color scheme.

"I started on the outside-I always do, where it's most visible," Greg explains. "We put in new lawn and planting, new paint (from an orangey-red color scheme to one of muted green-more stylish), added new signage. It was right on a busy highway, so people took notice.

"Before, business was 80/20, focused on pros. Contractors had their own counter, back near the office, which (unfortunately) they couldn't see from the front door. Now they can spot it, plus there's more to appeal to the walk-ins. With the recession, we knew we couldn't rely only on the building trade, so we decided this was the time for an update and a repositioning of the departments to attract the retail trade-especially those with a female appeal. Today, ladies tell us,'I like the way the store is organized. Now I can come in with my husband."' The paint department, Greg gives an example, used to be right up front. Now, it's halfway back, on the power aisle, so folks can see it easily.

Same for contractors goods. "'I never knew you had faucets,' they tell me," says Greg, "yet there'd been a 28ft. aisle of them, where the pros first came in the store. They were right in front of them." Wrong! Explains Greg, the master merchandiser, "You need a transition zone. When customers first come in, they need to get their bearings, decide where to head. They need space. So we created a foyer with tiled floor and an automatic door (used to be swinging). And"-big deal-"we've added shopping carts. They're used to grabbing carts in other stores, and it's working here. They're buying more, filling them up."

Everyone-especially the ladies-likes the new look, too. Formerly the interior was lit by fluorescent tubes hanging on chains from a vaulted ceiling. ("We were heating a lot of empty space.") Now, there's a new drop ceiling with new insulation, drywall, paint and lights. Restrooms, offices and break rooms got upgrades, too.

During the months-long transition, gondolas had to be shifted from one side of the store to the other, and products dropped in the power aisle to be sorted through-which to save and which to sell off in the $l bin. Several brand-new departments were added.

Planning was done with input of store management. "We spent a lot of time working together," Joe reports, "back and forth, exchanging ideas. Sometimes I couldn't believe the new items Greg would suggest-'Not a chance!'-but we went ahead with many of them, and they're doing very, very well."

Not by accident. Greg had done his homework, patrolling the aisles of the competition, counting the linear footage in their stores. "I did a market and site analysis, which spuned us to add whole new categories, like RV accessories (lots of tourists along the highway), Dickies work wear, and outdoor camping and cooking gear. We positioned these new features all together in an area of their own, and they've been very well-received. We plan to advertise them with circulars and with Ladies Night events."

Those ladies are thrilled with the store's brand-new cabinet displays, Greg reports. "Talk about a wow factor! Plus chandeliers and ceiling fans and new positioning of windows and doors." Speaking of wow, the floor now showcases working fireplaces and pellet stove and a brandnew outdoor kitchen in the home d6cor area, complete with grill and fridge. The lawn and garden department has tripled, including a garden tower and 17-ft.-by-35-ft. greenhouse nurturing live plants. Joe's staff of I I will expand in spring to include a nursery-products expert. A new cabinet specialist is already on board.

Bottom line: Bloedorn has become a destination store. "You don't have to run to the boxes. Now it's more in line with what the d-i-yer expects from a retailer," Greg allows. "We've incorporated items customers have been asking for, and it's greatly expanded our customer base-especially females. We'll be holding events like Powder Puff Mechanics-mowers, weed cutters-and classes in canning and food preservation."

Fine, but how about those pros? "Well, you know," Greg laughs, "when change happens, it's, 'I can't find it!' But then I hear, 'I didn't know you carried X.' They were so locked into their patterns that they never walked the other aisles."

The night before the grand reopening, the store hosted a contractors' night (wives-thrilled-were invited, too) with a catered barbecue dinner. demos and prizes. Then followed the public reopening. "That day-wouldn't you know it?-was the first big snowfall of the year. We were worried, but the store was full. Lots of new faces. and faces we hadn't seen for a lons time, coming back to us. Sales are definitely up, and (unlike the pro accounts) they're payine in cash!"

Carla Waldemar cwaldemar@comcast.net

KICKED OFF with a recent grand reopening celebration, the makeover has turned Bloedorn Lumber into a destination store.

Building-Products.com

lanuary 2014 r The Merchant Magazine r 19

So your best sales r

IIJHeN I wa,s 15, I joined a baseV V ball team, playing what would be my last year of organized ball. Because I signed up late, all the teams in my age division were full, so I agreed to play in the 16-18 league.

I've since forgotten the name of my team. but not the chaos that ensued that season. Imagine a Farrelly Brothers remake of The Bad News Bears. Most of my teammates were talented with behavioral issues. They smoked during batting practice, arrived hung over on game day, and cursed at the coach.

They were talented, though. They may have been incapable of showing up for practice or passing a drug test, but on Saturday they hit home runs and won games. I say they because I did not see a lot of playing time that season. If there was an award for effort, attendance and attitude, it would have been mine. Despite being disrespected in countless ways, my coach did the pragmatic thing and played the best players. Although I practiced tenaciously, the lion's share of playing time went to kids who were physically or mentally absent during the week. To my teenage psyche, that seemed wrong. What I realize now is that my teammates excelled in the one area that mattered most: performing on game day.

In the upper echelons of sales departments across the country, many well compensated sales professionals are resented by co-workers for thc same reasons that I resented my delinquent teammates. Do any of these water cooler rants sound familiar?

Lucky Laurie has her nerve. Someone gave her the Vanderdoody account five years ago and all she does is sit around collecting commission checks while we're working 241'l to make her look good.

Arrogant Aaron never follows up on the leads that he's supposed to. He

never fills out his call reports and always comes in late to meetings.

Lazy Louise always has her phone off. She's supposed to be working in the field, but we can never reach her before 10 a.m. She makes all her money from one account and never opens new ones.

Incompetent Ian is barely functional. Customers are calling us in the office because they can't reach him. If we weren't constantly cleaning up his messes. he'd have no accounts.

Anyone who relates to those sentiments should understand this: Laurie, Aaron, Louise and Ian all have at least one skill set that trumps their character flaws. Their flaws arc obvious. Their strengths are in areas that may not be immediately apparent. Punctuality is easy to measure. You either arrive at 7 a.m. or you're late. Earning the business of a large account is more involved. It can take a combination of timing, luck, strategy, psychology and presentation. Aniving on a prospect's doorstep three times a week at 7 a.m. shows tenacity, but it may also reveal desperation or stupidity.

Could these negative traits actually be contributing to the reps' success? Let's take a contrarian perspective.

Luck - Successful people tend to make their own luck-endearins

themselves to a new boss, becoming a widget expert just in time for the current widget expcr'l's retirenrent party. staying close by while another rep is badly botching a good account. Were things like this happening before this person's lucky break?

Even if someone is blcssed with serendipity, it rarely sustains if the person is incapable of handling it. As a sales manager, I have assigned prime accounts to reps who could not handle them. An account can be transferred, but if the client does not bond with the rep-for whatever reason-the relationship will not last. Being in the right place at the right time can help establish an account, but it takes work to sustain it. I've never encountered a situation where a client tolerates an incompetent rep for an extended period of time out of convenience. A bluechip account that churns out large commissions through no effort of the rep is the business equivalent of a Chupacabra. Urban legends abound, but I've never seen one.

Arrogance - Successful reps can come across as arrogant. It takes a certain type of person to embrace big accounts and engage in the kind of weighty deals that can significantly impact a company's bottom line. Reps open to these challenges tend to see

Commercial Forest Products

By Steve Ondich,

20 I The Merchant Magazine I lanuary 2014 Bui lding-Products.com

themselves as elite. Paperwork, meetings, non-sales-related issues, and even small accounts are beneath them. They have more important things to accomplish. Their words, actions and body language convey their mindset to everyone around them.

Certain clients are drawn to egotistical reps because it feeds into their own ego. Years ago, I was in a situation where a key account requested a new rep. The customer felt his operation was high volume but low maintenance. His rep was slow to respond, bad with paperwork, and often went MIA when problems occurred. We stood to double our business by putting someone responsive on the account. Taking the customer at his word, we reassigned the account to a junior rep who was disciplined and agreed to devote significant time to the account. The switch resulted in no new sales and the account ultimately went back to the original rep. This customer saw himself as an A-list account. What he really wanted was the time and attention of his senior level rep. Psychologically, I believe he wanted to punish the rep whose attention he sought and came to look at the new rep as a demotion in his status/value, even though it's exactly what he asked for.

Laziness - The 80/20 rule states that 8O7o of revenue comes from 2O7o of your accounts. Is it bad to focus exclusively on the 2OVo? One could make the case that it's irresponsible to do anything else. Providing a C-list account with the customer service experience of a lifetime may wann your heart, but should you do it? Reps who appear inattentive to accounts outside of their 207o circle are protecting their limited time and focusing their efforts where the results will be maximized.

Incompetence - Reps who can't seem to figure out how to complete administrative tasks are often de facto delegating. The way they approach it may not be ideal, but the intended result is achieved. With their inside support staff clamoring to send samples, generate paperwork, and provide information, the rep can focus solely on sales.

Companies rarely fire high-performing sales reps just to teach the rest of the group a lesson in etiquette. Ideally, all reps would be gracious, diplomatic, empathetic, disciplined, effective team players. If forced to select only one of those attributes, I'd pick the one that starts with "e" and doesn't end with "pathetic." The downside of harboring reps who produce well but behave shoddily is that they generate a lot of unnecessary drama and negative energy. Angry co-workers quietly rooting for someone's comeuppance don't contribute much toward optimal productivity.

If you have a star rep with behavioral issues, consider these steps:

. Don't preach about why their behavior is detrimental to office morale. Appeal to their own self-interest. People who aren't angry with you are less likely to internally sabotage your sales efforts. It would be nice if reps behaved properly because it's the right thing to do, but...

. Forget the MBA courses and executive sales programs, send the offending parties to a Dale Carnegie class (How to Win Friends and Influence People). There is a reason why these courses have been around since the early 1900s and are still wildly popular today.

Remind them that small gestures of appreciation can go a long way. Voicing a simple "Thank you" or showing up with a $7 box of doughnuts can quickly undo feelings of animosity. I've seen it happen.

. Talk frankly with your employees who are upset. If a star rep is being cut more slack than other people in the Building-Products.com

organization, it's better to acknowledge it than deny it. Coach Jimmy Johnson led the Dallas Cowboys renaissance of the 1990s. When he assumed the coaching position, the Cowboys were a pitiful organization. From 1986-1989, their win/loss record was l8-45. Johnson quickly cleal\ed house. He was unapologetically biased in his treatment of players. Former lineman Kevin Gogan explained to the los Angeles Times, "I remember once when Michael Irvin came in late to a meeting... Jimmy looked back at him and said, 'That's okay, Michael, because you're up here (holding his hand high).' With Jimmy, you've got guys up there, and guys way down." Johnson unceremoniously cut future Hall of Famers Randy White and Ed Jones. Both were about a decade removed from being "up there." Cultivating high performers should be a priority for coaches, business owners, and sales managers.

Monitor their progress on substantial new business (the reason you're putting up with their BS, right?). It's easy for reps to get in the habit of nursing one or two established accounts when those accounts are driving a lot of sales. There is a fine line between protecting your valuable time and coasting. It's important to identify when that line has been crossed. Let's say two accounts are generating $20000/month in commissions for Arrogant Aaron.

You: "Aaron, you haven't opened any new accounts lately, what's up?"

Aaron (indignantly): "I'm making $20,000/month on these two accounts and you want me to waste my time prospecting for another $200-$300? Not worth it."

You: "Agreed. You're one of a select few reps capable of finding and opening sizable accounts. I'd prefer you don't engage with the small accounts. Now that you mention it, the last account you did open was a small one. What were you thinking? You're our Reggie Jackson. Knock it out of the park or miss wildly, but don't lay down a bunt. What kind of significant new business have you been working on?"

When accounts get busy, reps should be intelligently accelerating their efforts, not coasting. In the same way poker becomes easier when you take the chip lead, adding good accounts becomes easier when you're flush with business. Counterproductive emotions like fear and desperation fade; confidence and optimism grow. It's the ideal time to cultivate better sales.

. Make them aware that by taking a self-centered approach, they're really working without a net. It's easy to tolerate boorish behavior from someone with the Midas sales touch. It almost adds to their renegade sales cowboy mystique. Eliminate their impressive sales numbers and the behavior becomes decidedly less endearing. If they hit a sales slump, their toxic behavior will certainly come back to haunt them.

Insufferable high-earning reps succeed in spite of their boorishness, not because of it. Successful reps do not need to create havoc. The best sales professionals delegate, prioritize, manage their time, and seize opportunities without alienating and offending the people around them.

o ndic h@ c o mme r c i alfo r e s tp r o duc ts .c o m. fanuary 2014 r The Merchant Magazine I 21

- Stephen Ondich is the owner of har dw o o d manufac tur e r I di s t r i b ut o r Commercial Forest Products, Fontana, Ca. Reach him at (909) 256-4583 or s

By f ames Olsen

The size of the motor

f,

nnrexo oNCE ToLD me, "If

called crazy. If you're crazy and rich, you're called eccentric." Let's just say, if they had been born rich, my parents would have been eccentric.

My mother read John Steinbeck's Grapes of Wrath about the Dust Bowl migration of millions during the Depression from Oklahoma to California looking for work. A powerful novel, the book won the National Book Award, a Pulitzer, the Nobel Prize, and drove my mother to think that it would be a good for our family to pick fruit in the summer, like migrant workers!

To my father, an easy-going dreamer and English teacher, in that order, it must have seemed like a great idea, because we spent every summer from age 5 to 14 picking fruit. School would get out on the 6th of June and on the l0th we were gone with the wind (really just an old Ford Fairlane wagon) like a band of fruit-picking gypsies for two-and-a-half months.

No baseball, golf or summer tomfoolery for the Olsen boys, no-just Grapes of Wrath.

Motor Size

I have a twin brother, David. We picked fruit together for nine summers. Cherries, apples, peaches, strawberries, plums and pears. In nine summers, I never out-picked him.

David has the focus, drive and tenacity to finish big and small jobs. He is the senior v.p. of a Fortune 500 company. He is a machine with no off switch. His motor for work is bigger than mine. We have the same DNA, but the power is dispersed differently. (I sing and dance better, but no one is paying for that.)

You may have some David Olsens working for you. Congratulations, you've won the salesman's lottery. Treat them great: they are rare.

Realistically, you probably have more James Olsen types (not Superman, just his pal, cub reporter Jimmy Olsen) working for you.

Asking a player to make a play he cannot make and then getting angry with him for not making it is bad coaching, but it happens all the time.

It happens on sales teams, too. Any time you hear yourself saying, "If only he would more, he would sell more" or "All she has to do is _ and she would sell more," stop. You are not smarter than your sales team. They know what you are telling them. (How many times

have we gone over this?) They just may not have the motor to deliver on your expectations.

Banging the Table

Many managers I work with have salespeople working for them who are 'Just good enough not to fire." They have been haranguing (managing?) these same salespeople for years. Who's lazy? The sales team or the sales manager?

A dirty little secret of sales management is that it is a pain in the neck (read: difficult) to hire and train new salespeople. So it's easier to try to get growth from the team in front of you.

Most managers have some very good salespeople who will never be great. Are they profitable? Yes, more profitable than most, but all their manager can see is what they could be doing (if only), not the great work (especially visd-vis their motor) they are doing.

Expecting A+ results from a B+ salesperson is the same as a salesperson wanting A+ results from a B+ account base! SALES GROWTH IS YOUR JOB. Banging your fist on the table and saying, "Sell more!" will not get it done.

Maximize & Grow

Set a profitability goal for all salespeople. Make it aggressive. Don't give in to mediocrity, but be realistic. Once your individual salespeople hit that number, work with them (give them RST Leadership sales training, for example) to get better, but when you get to maximization with your current team, hire more salespeople.

This strategy will work with the experienced yet underperforming salesperson who is holding your growth hostage. Like the development in a city that must grow around a hard-nosed '; non-seller, build around him.

When your team knows that you are committed to growth, that you will hire new salespeople, they will work harder for you. New blood will do what nagging never will-grow sales.

James Olsen Reality Sales Training (so3\ 544-3572

OTSEN On Sales

22 I The Merchant Magazine I January 2014

james@realitysalestraining.com .d;drs{F* Building-Products.com

PPG SEAL GRIP'MC

With more thon 80 yeors of mochine opplied cootings experience ond reseorch ond development, PPG introduces your replocement to oil-bosed primers, PPG Seo/ Grrp MC exterior ocrylic primer. ldeol for use over tonnin rich woods, PPG Seal Grip MC offers the following cootings benefits:

,/ Woier bosed, low VOC (<100 g/L)

/ Seols ond blocks tonnin stoining

/ Excellent odhesion

/ Fost drying

/ Eose of opplicotion using o voriety of opplicotion equipmenf

,/ Con be force cured

FROTUI THE IIIOSI TRUSTED NAME IN THE TACTORY FINISH INDUSTRY

PPG Architecturol Finishes, Inc. One PPG Ploce o Pittsburgh, PA 15272. 1-877-622-4277 www.ppgpro.com. www.ppgmochineoppliedcootings.com.mochoppinfo@ppg.com i? lE MAcHTN€ APPLI€D |ry rrrArrNGq PPC Seol Grip MC is o regislered lrodemork ol PPG Archilecturol Finishes, Inc

Red Bluff True Value Hardware, Red Btuff, Ca., closed Dec. 21 after 56 years, with the retirement of owners Larry and Wayne Brown.

True Value Hardware, Mercer lsland, Wa., hetd a grand re-opening Nov. 23 to show off its newly relocated store.

LOwe'S submitted revised plans for the proposed store on its 11,S-acre site in Poway, Ca,

The chain now wants to build an '111,500-sq. ft. building with attached 27,700-sq, ft, garden center instead of a 121,000-sq, ft. home center with 3'1,500-sq. ft, garden center, as approved two years earlier. Lowe's hopes to begin construction within months, in time for a grand opening at end of the year.

Home Depot plans to open eight new stores this year and repurchase approximately $5 billion of its stock, Chainwide sales were up 5,6% in 2013.

Anniversaries: Gold Beach Lumber, Gold Beach. Or.,

Stardust Non-Profit Building Supplies, phoenix, Az., won a2013 environmental award from the EPA for its creative re-use of building materials.

Echo Park Do it Center Closes

Reliable Do it Center, Echo Park (Los Angeles), Ca., closed at the end of the year, nearly six decades after its founding by owner Steve Wintner's father.

Winter, 65, had worked at the store since he was l0 and took over 25 years ago when his father passed away. He attributed the closure to big box competition and onerous city regulations. He has sold the 2.S-acre property to a Canadian-based developer, who plans to build a multi-story mix of apartments and businesses.

Plum Creek Purchases Last U.S. Forests of MeadWestvaco

Plum Creek Timber Co., Seattle, Wa., has completed the purchase of all of the U.S. timberlands of MeadWestvaco Corp., Richmond, Va.

The $1.1-billion deal includes 501,000 acres of Southeastern timberland, associated mineral and wind assets, and interests in 109,000 acres of rural and development lands in the Charleston, S.C., region.

MeadWestvaco continues to own and manage 135,000 acres of forestland in Brazll.

Kodiak Buys Denver Distributor

Kodiak Building Partners, Denver, Co., has acquired the state's largest independent drywall distributor, JonesHeartz Drywall Supply, Denver.

Prior Jones-Heartz president Greg Lyon will lead the

EE+h

24 I The Merchant Magazine I lanuary 2O14 Building-Products.com

merged drywall operations of JonesHeartz and Great West Drywall, which Kodiak bought two years ago.

RY Nets Montana Timber Sale

RY Timber, Townsend, Mt., successfully bid $1.7 million for the 789acre Palisades Timber Sale near Red Lodge, Mt.

The purchase includes 32 harvest units to net an estimated 6 million bd. ft. of timber to fuel RY's sawmills in Townsend and Livingston, Mt.

Montana Dealer Pays Tribute to Predecessors

When Triple S Building Center acquired additional land in Butte, Mt., it discovered that the property previously had been home to at least six other lumberyards since 1900.

An engineering firm hired by Triple S to conduct research on the property made the discovery looking over old fire maps of the 100-200 block of East Front Street.

While refacing the warehouse, owners David and Doug Stordahl decided to pay their respects. They installed six wooden doors with vintage lighting fixtures above to better illuminate the sidewalk below. Above each door they placed a dated plaque commemmorating a prior residentBig Blackfoot Milling, Stephenson Lumber, Monarch Lumber, Pioneer Lumber, Best Way Building Center, and United Building Center.

Two Coat Exterior Prime

0ur two-coat process starts with an atkyd seater to btock tannin migration, fottowed by a high-performance acrytic primer The resutt: RESERVE qual.ity, inside and out.

Superior Wood

Made of quatity, ctear, finger-jointed Western Red Cedar or Redwood, these products are naturatty designed for exterior use-both species are ideaI for enduring extreme weather.

Surfacing + Sizes + Lengths

RESERVE oroducts come in a wide range of sizes, lengths and finishes. Whether the project catts for 51S2E or S4S. we offer [engths ranging from 16' to 20', Pattern stock is atso avaitabte.

1"x4 - 1xI2 s/ayA, - s/ax!)

2x4 - 2x12

Boise Cascade's engineered wood products plant in White City, Or., installed a bander from Samuel Strapping Systems.

Ganfor Corp. witt invest over $30 million upgrading its Houston, B.C., sawmill.

Rhino Linings Corp.., san Diego, Ca., has acquired the assets of Expo Stucco manufacturer Expo Industries, San Diego.

Olympic Paint & Stain was honored as Lowe's 2013 lnnovation Partner of the Year.

Huttig Building Products, st. Louis, Mo., has begun trading its shares on the NASDAQ exchange under the ticker symbol "HBP."

The Finest Stock, The Best Coating

Our Siskiyou Forest Products RESERVE line is specially manufactured and treated to create the highest quality product available. Using state-of-the-art application and curing equipment, our premium Western Red Cedar and Redwood stock is made to last for many generations. We are proud to offer a beautiful, durable product that is ready for installation and final painting the moment it reaches the craftsmen.

Building-Products.com

S I S TryOU- FOREST- PRODUCTS www. siskiyouf orestprod ucts.com 800.427.8253 6275 Hwy 273. Anderson, CA 96007 January 2014 I The Merchant Magazine t 25

By Gary Vitale, President & C.e.o., North American Wholesale Lumber Association

Sizing up the supply side

Outlooks and observations for 2Oa4

p ecanolEss oF ouR pLAcE in the lumber supply I\chain-logger, mill, remanufacturer, wholesaler, retailer-the immediate future of our businesses will be determined by many forces beyond our control and several very much in our grasp.

The questions of growth and profitability will be impacted by the very small (the mountain pine beetle) and the very large (the urbanization policies of the Chinese govemment), and much in between (the ability of a young family to buy a new home, or the changing

credit policies of business lenders). With so many factors in play, what lies ahead for the lumber companies that have persevered and survived the devastating impacts of the great recession and the housing collapse?

Real recovery has been evident in recent months and there are many positive trends, and we are guardedly optimistic as we look at20l4 and beyond. What is clear is that despite generally rosy outlooks for lumber, not everyone in the industry will emerge from the recession and recovery as a winner.

There are many challenges ahead: dealing with credit issues, identifying trustworthy partners, introducing innovative products and practices, and understanding international impacts. Chief among the realities we face is the likelihood that the lumber supply cannot keep pace with growing demand.

Gonstraints on the supply side

While there are varied predictions on how much the lumber supply will tighten, there is a strong consensus among industry experts that supply will not be able to keep pace with demand increases in the U.S. and Chinabeginning this year and continuing over perhaps the next five years.

To dig deeper into this issue, I talked recently with Henry Spelter, a partner and forecaster with Forest Economic Advisors. He predicts that by 2015 or 2O16 demand will double to 1.5 billion board feet-twice the current demand-a level that will come up against major supply constraints.

The biggest constraint is the pine beetle epidemic. It is reaching its climax in British Columbia (B.C.), bur the

26 I The Merchant Magazine I lanuaty 2O14 Building-Products.com

U.S. Lumber Consumption and Forecast x000 m3

wood that has been infested is less useful and a good chunk of supply will be taken out in coming harvests. In 2013, demand was up 5Vo to lOVo, but B.C.'s harvest was the same as the previous year and its ability to respond to increasing demand is very low. This is likely to reduce B.C.'s role in the supply mix.

Mill closures due to recession are a factor. but not an enormous one, because much of their output has been replaced by more production at other mills. Still, there has been a loss of about 7 billion board feet in production capacity-about lOVo.

A third supply constraint is government policies, which are especially limiting in the U.S. Pacific Northwest. These include limitation of timber harvests from public lands, lumber trade restrictions, and log

A Special Series from North American Wholesale Lumber Association

to grow as China moves to urbanize its population. One result is likely to be higher prices for wood. If demand bumps against constraints, log prices will go up. Now about $400 per 1,000 bd. ft., the price could get to $500 or even $600 or $700. If so, alternative building products such as steel, plastic and composites will become more attractive building products.

What to do

Keep your suppliers close. Regardless of the exact levels or causes of the supply shortage, it is increasingly important for lumber wholesalers to solidify relationships with your suppliers and reach out to new possible sources before we are desperate. The competition will intensify in coming months, and those who are well positioned with suppliers will have an advantage.

Listen to the sound of the future. I invite you to join me for what will be a very important 2014 NAWLA Leadership Summit, March 30-April l, at Callaway Gardens, near Atlanta. It will be a timely gathering for all of us, as we face these challenges. Seven industry leaders have agreed to speak to us about the futureabout outlooks in various regions, U.S. and intemational developments, and navigating changes in the supply chain.

The speakers are Don Kayne, president/c.e.o. of Canfor; Marc Brinkmeyer, chairman of Idaho Forest Group; Jack Koraleski, president/c.e.o. of Union Pacific; Kimmo Jarvinen, secretary general of the European Organization of the Sawmill Industry; Jon Biotti, managing director of Charlesbank Partners; Peter Alexander, c.e.o. of BMC, and Curt Stevens, c.e.o. of Louisiana Pacific. I urge you to consider attending this Summit as we begin a new phase of lumber industry recovery. For more information, go to www.nawla.org.

export duties and restrictions.

Spelter says the high point of production, in 20042005, was 65 to 70 billion board feet a year. Today, there is 50-55 billion board feet of capacity being used of the nominal capacity of 63 billion board feet (effective or real usable capacity is less because some mills are mothballed).

Supply limitations come at a time when U.S. housing starts are trending upward and Chinese demand continues

Position yourself to compete. In this new environment, securing good deals with suppliers will become very competitive. Also, anticipate competition from engineered woods, plastics, vinyl decking and composites, which are likely to become a large part of the market. As one insider said, "We're going to have to stay alert and act decisively to get our share."

Caution: sham elbows mav nrevail.

Building-Products.com fanuary 2014 I The Merchant Magazine t 27

Mike Thelen has been named chief operating officer for Welco Lumber, Burnaby, B.C. He also continues as v.p. of sales & marketing for SilvaStar, Bellingham, Wa. Jeff Wolgemuth is now sales mgr. for SilvaStar.

Josh Clark has joined Central Valley Builders Supply, St. Helena, Ca., as director of sales & business development, managing its agriculture and contractor sales teams.

Rhonda Hunter has been promoted to senior v.p.-timberlands for Weyerhaeuser Co., Federal Way, Wa., succeeding Tom Gideon, who retires next month.

Nate Freeman is new to inside sales at Advantage Trim & Lumber, Santa Fe Springs. Ca.

Rick Re has been promoted to c.e.o. and board chairman of the Seneca Family of Companies, Eugene, Or. Todd Payne is now general mgr.

Kate Hyatt, ex-Staples, has been named v.p.-talent for ProBuild Holdings, Denver, Co. Steve Russell is new to commercial sales in Eagle,Id.

Colossal and Harmonious

The Colossal patio door system's 5'8" or 8' height option and up to 1"5' width availability allows for a visually extended living space and a panoramic view. Choose from two, three or fourpanel configurations and customize placement of fixed and sliding panels to best suit your space and home interior. Or choose the sleek, modern Harmony patio door, available with a welded sash and a frame system that's fully welded or mechanically joined. Go Colossal and bold or enjoy your view with Harmony.

Amy Monson was promoted to marketing specialist at J.M. Thomas Forest Products, Ogden, Ut.

Susan Timpe, ex-Concannon Lumber, is a new transaction specialist at Stimson Lumber, Portland, Or.

Frank Parrott, Matheus Lumber, San Marcos, Tx., has retired after 30+ years in the industry.

Frank Carroll, ex-Knaack, has been named general merchandise mgr. for Ace Hardware Corp., Oak Brook,Il.

Bruce Bunn has joined BW Creative Railings, Maple Ridge, B.C., as director of sales. Frank Girard is now senior financial mgr., and Phil Jones, controller. Kalvin Eden has been promoted to sales mgr. for BW Vista Railing Systems. Rob Schmiedel has been appointed national sales mgr. for Do it Best Corp., Fort Wayne, In. Scott Orman is national logistics mgr.

Charles W. Roady, F.H. Stoltze Land & Lumber, Columbia Falls, Mt., has been newly appointed to the Softwood Lumber Board by U.S. Agriculture Secretary Tom

Vilsack, along with Don Kayne, Canfor, Vancouver, B.C., and Danny White, T.R. Miller Mill Co., Brewton, Al. Reappointed to three more years were Francisco Figueroa, Arauco USA, Atlanta, Ga.; Aubra Anthony Jr., Anthony Forest Products, El Dorado, Ar., and Alden J. Robbins, Robbins Lumber, Searsmont, Me.

Art Burne is manning the employee cafeteria at Mungus-Fungus Forest Products, Climax, Nv., report owners Hugh Mungus and Freddy Fungus.

Plycem Buying GertainTeed Fiber Cement Business

Intent on focusing on vinyl and polymer siding, Saint-Gobain has agreed to sell its U.S .-based CertainTeed fiber cement siding business to Plycem USA.

The deal, set to close in first quarter 2014, includes plants in White City, Or.; Roaring River, N.C., and Terre Haute, In., and employs nearly 250.

Plycem and sister company Maxitile are subsidiaries of Elementia of Mexico.

5KYRENtrH Skyreach L&S Extrusions Corp. Canadian Headquarters: 55 Freshway Dr. Vaughan, ON L4K 1S1 LA Headquarters: 1814 N. Neville St. Orange, CA 92865 b--..- .': Chicago Headquarters: 4104 West Ann Lurie Place Orange, CA 92865 Tel: 1-865-903-8800 Fax: 1-866-302-8899 www.skyreachls.com 28 I The Merchant Magazine I January 2014 Building-Products.com

By Brooks Mendell, Forisk Consulting

By Brooks Mendell, Forisk Consulting

U,S. timber supplies and rising demand for softwood lumber

tTt"t UNIreo Sreres has more softI. wood trees than you can shake a stick at. Analysis bf U.S. Forest Service data indicates the South has nearly 3.5 billion tons of standing pine grade and pulpwood inventory on private, operable timberlands. That's about 140 million truckloads. Coastal Oregon and Washington, a region with 103 open softwood mills, has over 68 billion bd. ft. (over 400 million tons) of standing softwood grade inventory on privately-owned timberlands. And these numbers represent but a fraction of total U.S. forest stocks.

Forisk conducts research on the impact of local supply events (such as natural disasters) and trends (such as increased forest growth rates or plantation acreages) on timber markets to forecast timber and delivered log shipments. For the near-term, states with the most severe pine grade oversupplies show how stumpage prices become less sensitive to increases in demand in those states for which a

quantitative basis exists for significant excess inventories.

Alternately, analysis of coastal markets in the Pacific Northwest indicates less quantitative evidence for dampened log prices in a region buffeted by robust export demand.

Forest Supplies & Demand

What do we think about the potential impact of forest supplies on timber prices across the United States in the short and long-term as housing markets recover and forest harvesting increases?

In evaluating the potential for softwood grade oversupplies or constraints, Forisk uses the "removal year" metric-accessible inventory divided by removals-to identify a local market with a potential supply imbalance. The removal year estimates how many years it would take to deplete standing inventories, given a set level of removals per year. For example, if we assume one extra year's worth of standing inventory, it

would take four years of removals at 25Vo above the long-term average to deplete the backlog.

In the Pacific Northwest, estimated changes in operable inventories on private lands have been modest, with Coastal Oregon and Washington averaging l6 years of softwood grade removals on the stump on private lands alone.

The results in the Northwest change slowly for two reasons. First, the U.S. Forest Service analyzes onetenth of Oregon and Washington's forests each year. Therefore, we are continually looking at an average l0year forest. Second, Northwest markets have supplemented domestic downtime with increased export volumes, reducing the impact on net harvests. We note that the total removal years in the Northwest are higher when operating public forests are included, but we focus on private lands to better reflect harvest respons-

(Please turn to page 32)

Western Woods

state/Region Domestic Demand at capacity* 20t2|.o8 Exports Export vs Domestic CoastalOregon Coastal Washington 34,L73,248 24,658,686 733,974 4,9O0,472 2.1% 199% Totols 58,837,934 9.6% *Open sawmills 5,634,446 30 I The Merchant Magazine I lanuary 2o'14 Building-Products.com

Figure 1. Softwood Grade Demand and Exports, Oregon and Washington, green tons

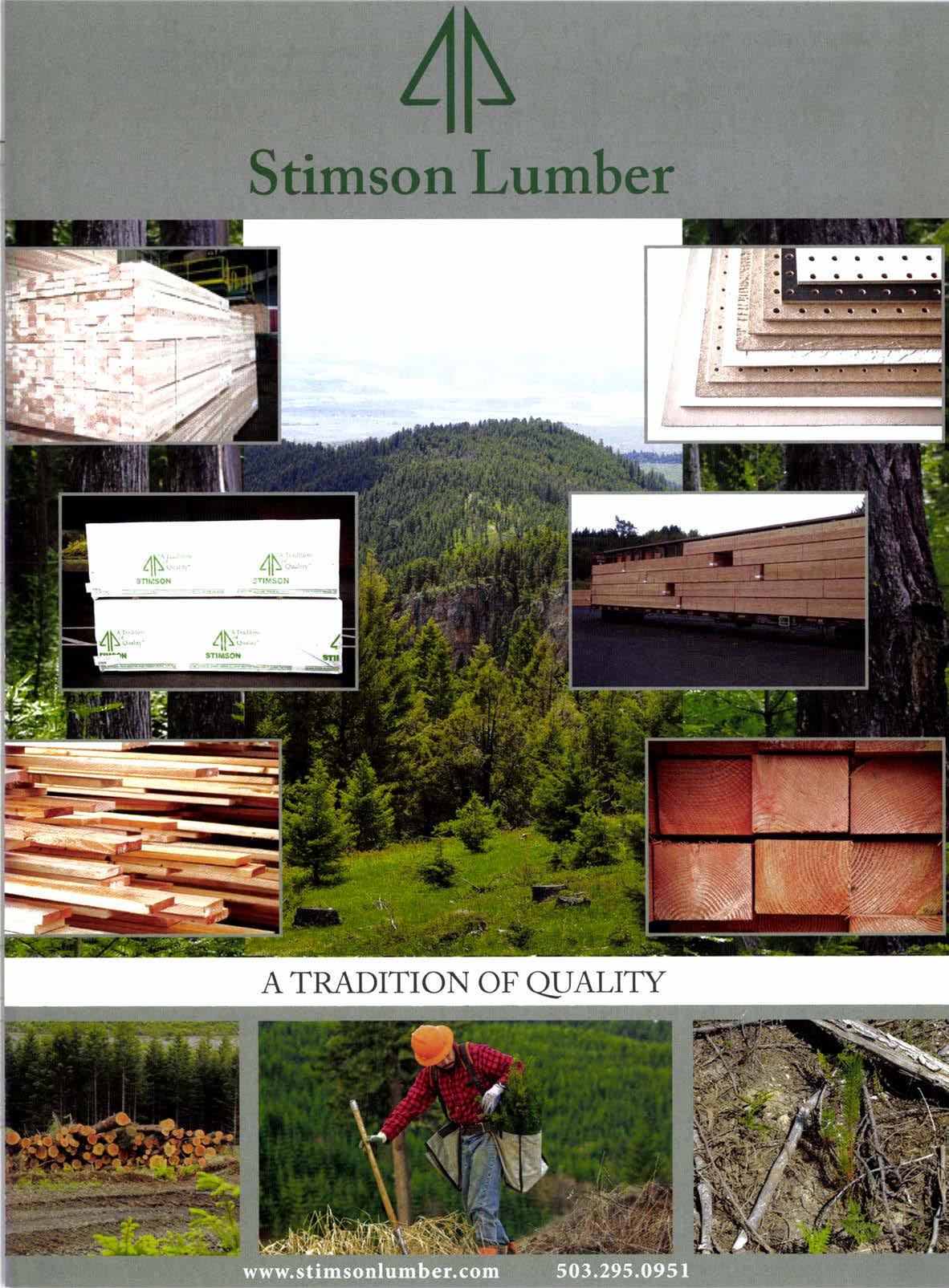

ATRADITION OFqUALITY

lJ.S. Timber Supplies

(Continued from page 30)

es to changes in market prices.