RETAIL trends trends 2022

Claudio Cocuzza Senior Partner,

Claudio Cocuzza Senior Partner,

Wewere established in 1993 and, since our foundation, we have been offering clients concrete and functional legal solutions for the pursuit of business objectives with a problem-solving approach, particularly appreciated by companies. The added value of tailor-made assistance is the result of the daily search for a balance between professional skills, interpersonal relations and specialisation.

Over the years, we have built up a vast knowledge of the retail real estate sector, handling a large number of transactions and constantly keeping abreast of the news in the markets, and their trends. This allows us to be a point of reference for many leading national and multinational companies. We are members of international lawyers associations and can count on collaborations with many law firms all over the world.

Cocuzza & Associati is an independent Italian law firm with offices in Milan and Bologna.

Retail Trends 2022

Author: Elisabetta Campana

Graphics and layout: Mariella Salvi

© 2022 COCUZZA & ASSOCIATI

All rights reserved.

Milan, May 2022

1 retail trends 2022

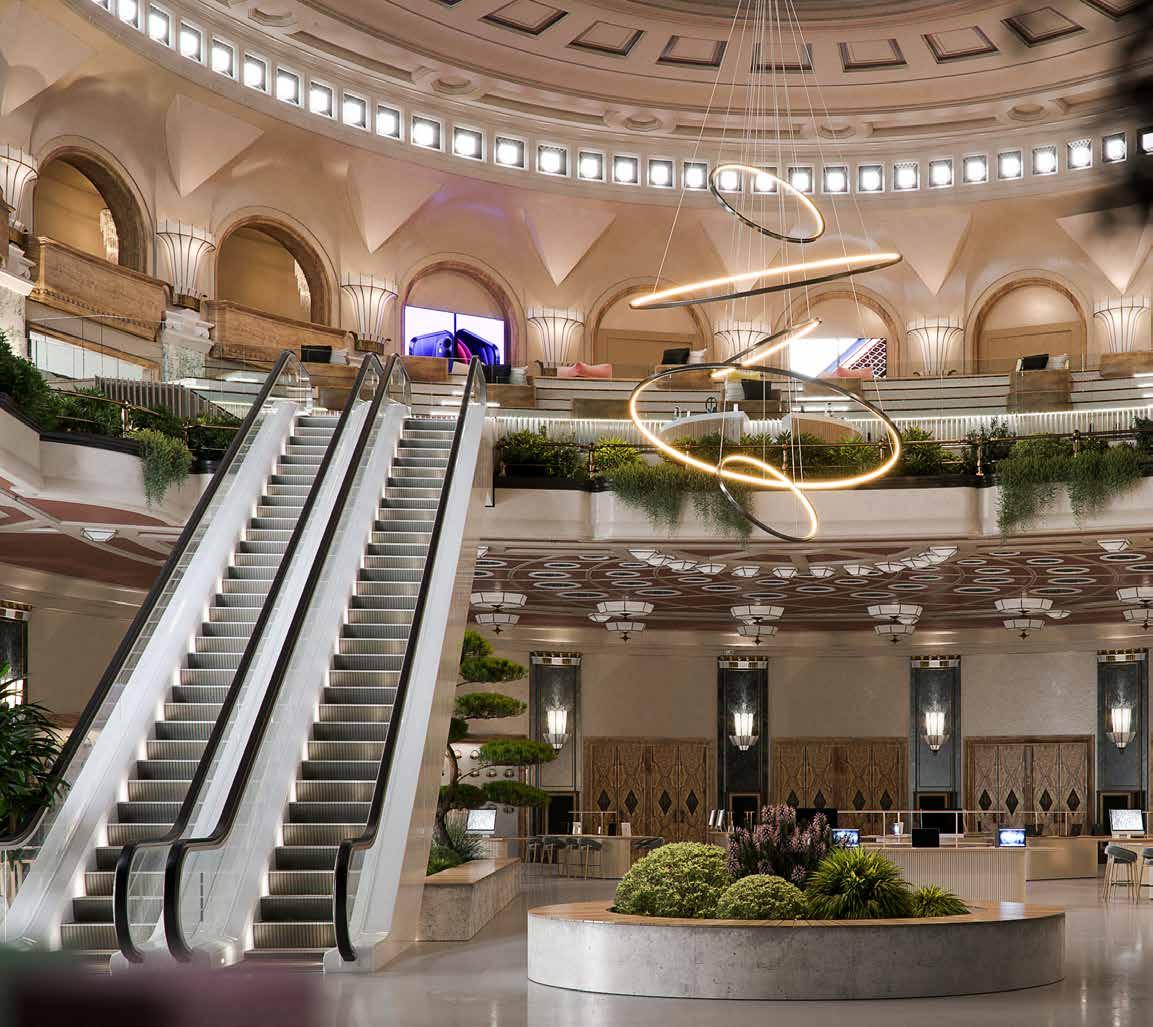

Cover photo: an image of the Odeon Cinema project in Milan

Cocuzza & Associati

Preface and acknowledgements

Many years ago, within our firm, we adopted as our motto the saying that nothing is as certain as change. And it is on this principle that we have based our way of organising our work, of dealing with cases and listening to our clients’ needs.

However, I do not believe any of us would have ever imagined the events in store for us which occurred in the past few years: circumstances that we thought were only possible in theory. And so, after Brexit, we witnessed the world come to a halt due to Covid, a shocking, dramatic event in itself but even more so for the global response and the way it monopolised the news and our lives. While we were busy counting the latest number of cases, we overlooked, among the news of the many other wars and international events that were also relegated dangerously to the background, that of the Ukraine-Russia crisis, which soon escalated into conflict. Then, there is the awareness that our way of life has already been unsustainable for quite some time, even though it is by no means clear how to stop a machine devoted to the sole watchword: ‘growth’.

All these events have touched the retail sector really deeply. Fortunately, this traditionally dynamic sector had already anticipated the trends for dealing with all this years ago: changing the role of the shop, turning to sustainability, strengthening logistics to serve customers at home. Decelerating globalisation to decrease dependence on distant countries. Promoting the reuse of goods. Real estate side: rethinking retail real estate with some imagination and reconsidering asset valuations.

These, then, are the strands of our Retail Trends, which is preparing to celebrate its tenth edition (next year) but is already ten years old (we skipped publication in 2020).

In the renewed and successful interview format – grouped under the strands mentioned above – this year we again invited many leading figures in the industry, who were kind enough to share their views with us and our audience: we would like to thank them warmly. And we cannot fail to mention the legal topics that we find ourselves dealing with most often in our professional practice.

Milan, May 2022

Alessandro Barzaghi Managing Partner of Cocuzza & Associati

2 retail trends 2022

3 retail trends 2022

Matteo Agodi Sales Manager of CO2save 42 Riccardo Bianchi Head of Valuation Advisory at JLL Italy 14 Monica Cannalire Riccardo Bianchi Founder & Managing Director of Younicorn 48 Thomas Casolo International Partner Head of Retail Italy Cushman & Wakefield 22 Michel Cohen Founder and Ceo of DentalPro 36 Alberto Da Passano Ceo of FF Design 24 Luca de Ambrosis Ortigara Founding Partner & CEO of DEA Real Estate Advisor 10 Luca Foresti Ceo of Centro Medico Santagostino 32 Alfiero Fucelli President and Alessandro Medi Managing Director of Dispensa Emilia 44 Amedeo Giustini Ceo of Prénatal Retail Group 28 Benedetto Giustiniani Head of Southern Europe Region at Generali Real Estate 12 Roberto Merlini Chief Customer Officer at laFeltrinelli 26 Maddalena Panu Head of Retail and Special Projects Director of Savills Italy 16 Christian Prazzoli CEO of Baldinini 20 Mario Resca President of Confimprese 34 Gianluca Sinisi Licence Partner Engel & Völkers Commercial Milano 38 Niccolò Suardi Head of High Street Retail at Colliers International Italy 8 Luca Zaccomer Marketing Director at Multi Corporation 46

the resPondents

4 retail trends 2022 7 SUMMARY retail assets in the Post-covid era How ratings and values vary Retailtainment, how the post-pandemic age is changing high stReet Retail ..................8 top locations in centRal aReas aRe gaining moRe and moRe impoRtance......................10 commeRcial spaces, in-depth analysis of cashflow and effoRt Rate indispensable .......12 fRom step Rent to collection loss, how valuations change ....................................14 expeRience must also be a pRioRity foR shopping centRes ........................................16 the shoP changes its skin 19 A journey through the transformation of concepts the omnichannel consumeR must be guaRanteed a custom-made expeRience .................20 the centRality of the point of sale gRows in syneRgy with the online maRket ............22 the in-stoRe expeRience Remains iRReplaceable foR communicating bRand values..........24 in the post-pandemic age, the oppoRtunity to imagine and cReate new foRmats is gRowing 26 the Retail evolution tRanslates into innovative concepts, which can also be multi-foRmat 28 the new uses of retail sPaces 31 The arrival of mixed-use services the challenge is to guaRantee a health pRoximity seRvice .......................................32 shopping habits have been Revolutionised, now Retail spaces also need to be Rethought ...34 accessibility is cRucial: in teRms of teRRitoRy, logistics and also pRice ..................36 thanks to RegeneRation inteRventions, moRe suitable and customisable spaces aRe cReated ..38 the mantra of sustainability 41 From food to clothing, the challenge is eco sustainability and eneRgy saving aRe now indispensable foR Retail too .....................42 cateRing and the enviRonment: an incReasingly close and syneRgic link ...................44 the shopping expeRience becomes moRe valuable in a sustainable context ..................46 shoppeR-fiRst Retailing is the futuRe, also fRom a sustainable peRspective ...............48 over to the lawyers 50 lease and Rent: lessons leaRned fRom the emeRgency, how to RestRuctuRe economic Relations and RedistRibute Risks ..............................50 foRce majeuRe and factum pRincipis: fRom pandemic to waR .....................................51 fRanchising: the abuse of economic dependence ..................................................52 the RefoRm of the code of civil pRoceduRe and its impact in the Retail/Real estate woRld ......................................................53 inteResting innovations fRom the consumeR code RefoRm ........................................54 the enviRonment (definitively) enteRs the constitution .........................................55

The post-pandemic scenario is opening up positively for retail, which is increasingly interacting with other sectors such as food and services, betting on experientiality, investing in the omnichannel approach, seeking sustainability and defining new tenant-landlord partnerships. Of course, the strong international political-economic instability feeds an important variable of uncertainty and concern, starting with the skyrocketing costs of energy and raw materials, an issue that must necessarily be reckoned with. But, at the time of writing, what prevails on the part of retailers and companies is the drive to design a new future and the desire to give it their best shot, overcoming the critical issues of the last 2 years. This means adopting strategies and projects that will see the threats and problems caused by the health emergency transformed into synergetic opportunities. Four areas of undisputed topicality are addressed by Retail Trends 2022, thanks to the fundamental contribution of authoritative protagonists from the sector: investors, developers, advisors, entrepreneurs and brands/retailers ranging from fashion to catering to health. Our Report starts by analysing how the values and valuations of retail assets are changing, then moves on to make a journey through the transformation of retail stores and the new uses of retail spaces, including mixed-use, and finally to the cross-cutting theme of sustainability. This year in our Report, the word most frequently used by all respondents is “experience”. And in fact, in all its multiple nuances, experience has so far become, and will increasingly become, the fil rouge of retail evolution. While it is true that the forced closures and inactivity of shops have led to a strong acceleration in online sales, it is equally undeniable that as soon as it was possible – we have all seen this – consumers quickly returned to retail stores. Because, first of all, people missed the direct relationship with the brands and stores, as well as the human contact with sales staff: elements that no chatbot and technology can reproduce online. Ensuring an immersive experience means, in a nutshell, engaging consumers with a striking location and an experiential concept, capable of arousing strong emotions such that they remember the experience with pleasure and, therefore, want to relive it. Without, of course, forgetting the essential added value given to the customer journey by the unavoidable interaction between physical and digital. With “omnichannelality” now also trespassing into the Metaverse for the retail and commercial real estate scenarios, primarily in the virtual world of Decentraland. The other word now playing a leading role in retail real estate is “partnership”. In fact, in order to tackle the enormous problem caused by the pandemic, i.e. the considerable loss of profitability of retail spaces, landlords and tenants have been obliged to work together and adopt a synergetic approach that was hardly ever adopted previously. The first meeting point was the definition of rents, with solutions such as step rent, annual discounts and turnover rent, but without affecting standard rents. If, then, we combine the innovative potentials of experience and the omnichannel with the willingness of landlords and tenants to cooperate, the challenging post-Covid period can only prove fertile and constructive for the retail sector.

Elisabetta Campana Freelance Journalist

5 retail trends 2022 introduction

▲Lenovo

in corso Matteotti, Milan

retail

assets in the Post-covid era

How ratings and values vary

Of the major legacies that the pandemic leaves to retail, a more constructive and necessary collaboration between landlord and tenant is certainly a benefit that stands out. The various forced closures, the exponential rise of e-commerce, the almost complete absence of international tourists and the consequent loss of profitability have prompted an inevitable confrontation between retailers and landlords. They were thus induced, more and more, to work in partnership and to study better concepts and solutions together. This collaboration has also been carried forward in the definition of rents: from step rents to annual discounts to cash contributions to help fit out the shop, but always keeping the standard rent intact. In some cases, a turnover rent has been introduced, based on a fixed rent plus a percentage of turnover, which in some cases can be reduced to a rent on sales alone. In general, it is also possible to adopt a flexible approach in terms of both duration and contractual rent, allowing retailers to use more flexible formulas such as pop-up stores and experiment with new formats increasingly based on experience and entertainment. Because while, inevitably, landlords are now much more careful in selecting tenants by assessing cash flow, effort rate and quality of business model, the most savvy tenants have realised that they must create a real reason for customers to return to the shop. The winning mix? Location, concept and experience. The value of a retail asset will increasingly depend on these elements.

retail trends 2022 7

at

With the post-Covid scenario, surprising new opportunities may arise for high street retail. It is not just recovery, but a real transformation of the sector, which, after the forced closures due to the pandemic, is consecrating itself as a symbol of rebirth and the beating heart of cities, thanks to its dynamic fabric of shops and restaurants. This is an unexpected change of perspective for some. True, the state of emergency gave a strong boost to e-commerce. But at the same time,

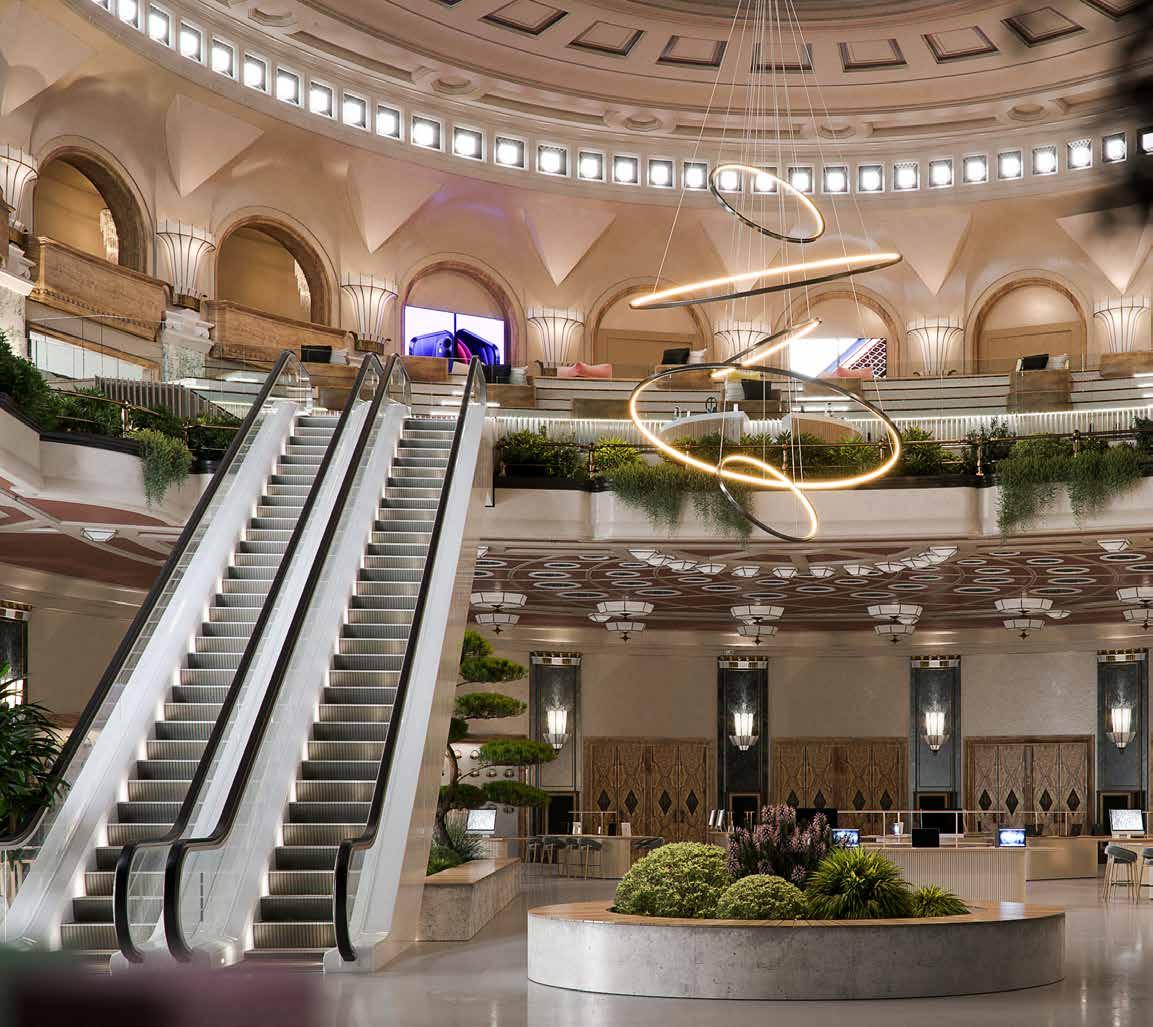

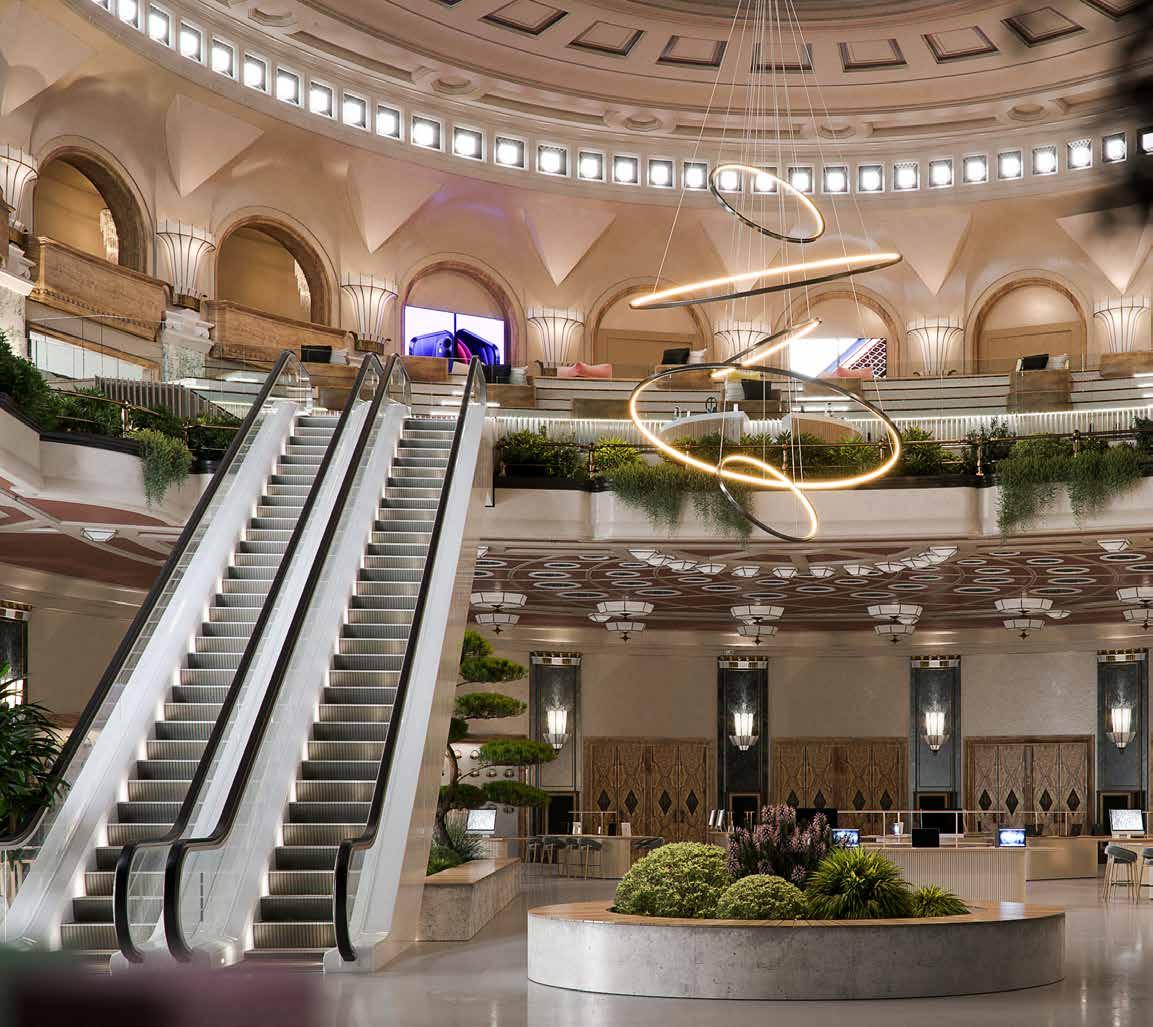

parallel to another interweaving, that between retail and entertainment: retailtainment. This term is still not used much in Italy – but it has actually been in use for some time in mature markets that tend to experiment and innovate, such as the United States – and it is one of the drivers of the new post-pandemic scenario. Just think of the Odeon Cinema project in Milan. A six thousand square metre space, just a stone’s throw from Corso Vittorio Emanuele and Piazza Duomo, which becomes a

a fundamental consumer need has emerged: the physical shop experience, which the digital retail market cannot replicate. It is wrong to think of the post-pandemic as a struggle between virtual and real. In reality, the process that has been triggered is, if anything, an increasingly strong intertwining of the two universes, online and offline. And it is precisely the phygital – physical and digital – experience that is the real added value, with the Metaverse beginning to peep out. The interweaving of virtual and real is

perfect location to offer visitors a unique shopping experience. But the intertwining does not stop there. Besides the weavings of virtual and real, retail and entertainment, another noteworthy combination has also accelerated since the pandemic: the relationship between landlord and tenant. Concepts, best solutions and even the definition of leases are now studied together. And us brokers? Our figure as advisor is definitely being considered more and more important. By the retailers, who need a professional who can go into the details of locations. And by the landlords and investors, who are increasingly demanding knowledge of operations, tenants, brand histories and, overall, the retail sphere. Finally, on the subject of investments, we are gradually seeing that trophy properties play a driving role during crises. This is demonstrated by the important

retailtainment, how the Post-Pandemic age is changing high street retail

Niccolò Suardi Head of High Street Retail

Colliers International Italy

8 retail trends 2022

«One Of the drivers Of the pOst-pandemic scenariO is retailtainment, played Out in large spaces that Offer the visitOr a unique shOpping experience»

transaction of Reale Compagnia Italiana’s real estate assets acquired by Blackstone: the heart of the operation is in fact a prominent property in via Montenapoleone. But that’s not all, in Rome we are seeing strong interest from retailers and investors for via del Corso, as well as in other key cities, such as Florence, for the high street. These are places of prestige and favourite destinations of a tourism that may be on the road to recover. Meanwhile, investors’ attitudes are changing: when they approach the high street product, they consider variables that go well beyond the brick and mortar: operations, storytelling and brand/tenant perspectives, ESG factors. Now, along with the walls, brand storytelling and performance also figure as selling points. With our role as advisor becoming more and more fundamental here as well. •

▲Rendering of Cinema Odeon, Milan

▲Rendering of Cinema Odeon, Milan

9 retail trends 2022

▼The new Fendi Casa in Piazza della Scala, Milan Colliers International Italy

Luca de Ambrosis Ortigara Founding Partner & Ceo of DEA Real Estate Advisor

toP locations in central areas are gaining more and more imPortance

The changes in the post-Covid retail landscape, compared to the pre-Covid one, are evident. The inevitable, strong development of the e-commerce channel, due to the various lockdowns, has led to an exponential evolution of the sector in terms of omnichannel retailing, further accentuating the crisis of physical retail which is now forced to adapt to the new paradigms. How? First of all, by focusing on experiential spaces capable of engaging the 5 senses, arousing multiple emotions and thus creating the wow factor, which induces the consumer to remember the experience and want to relive it. All this is evidently possible through direct contact with consumers that can only take place in

to create an unforgettable shopping experience. Clearly, to create an all-round immersive experience, the physical and digital shop must travel hand in hand to the point where the virtual world of the Metaverse is also involved. Furthermore, in order to guarantee a unique customer journey, which can start online and end offline and vice versa, technological integration and perhaps contamination with other spheres becomes indispensable. For example, not only with the restaurant or art sector, but as it has just been seen in Paris, in a new luxury flagship store, with the sphere of exclusive hospitality, even offering the opportunity to sleep in a suite within the shop. Spaces of this kind clearly go well beyond the purely commercial aspect, but fundamentally bet on the concept of experience and, indeed, of experientiality. Consequently, at the level of values and evaluations, top locations in central areas are becoming increasingly importan

«physical retail must fOcus first and fOremOst On experiential spaces in tOp lOcatiOns, which engage the 5 senses, arOuse strOng emOtiOns and thus create the wOw factOr»

physical spaces. For example, we are managing the project of the historic Odeon cinema in Milan, which will be transformed into a unique retail destination. A true showcase to the world, in the historic centre of Milan, one of the busiest, most prestigious locations in Europe. In this case the iconic environments, designed to amaze and enchant, will be enhanced with a flexible and open layout

t, and the gap with those in secondary areas, which are decidedly penalised, is widening. It is no coincidence that via Montenapoleone in Milan is increasingly expensive, just as the iconic Galleria Vittorio Emanuele is in high demand. At the same time, important renovation projects, such as that of Hines in Via Spiga or, indeed, of Odeon Milano confer further, inestimable added value. Finally,

10 retail trends 2022

the multichannel retail evolution inevitably involves all the sales channels: from online to offline, and the outlets too. Because a brand must now ensure the same kind of experience in all its touch points, regardless of where they are located. A clear example of this is the San Marino Outlet Experience, developed by a partnership comprising, in addition to us, Aedes SIIQ, Gruppo Borlet-

ti and VLG Capital. The centre – spanning about 17,000 m2 with 75 shops to which about 25,000 m2 will be added in phase 2 for a total of 130 shops – is in fact characterised by an architectural footprint of great impact. And it houses luxury and premium brands such as Prada, Dolce & Gabbana, Roberto Cavalli, Moorer, Monnalisa, Paul & Shark, The North Face and Moose Knuckles. •

11 retail trends 2022

▲San Marino Outlet Experience ►Rendering of Cinema Odeon, Milan DEA Real Estate Advisor

Benedetto Giustiniani Head of Southern Europe Region at Generali Real Estate

commercial sPaces, in-dePth analysis of cashflow and effort rate indisPensable

The difficult period experienced by the retail sector has highlighted the importance of performing an increasingly in-depth analysis of the cashflows generated by the retail spaces and the effort rate. Given the downturn in retail space turnover caused by the Covid emergency, Generali has intensified

estate, the mix of entertainment and experience undoubtedly stands out. In the physical store, the customer looks for everything that cannot be found online, so making the shopping experience engaging and personalised will play an increasingly crucial role in ensuring people continue to have a reason to visit a

its analysis of tenant quality, business sustainability, the current and future impact of e-commerce on different merchandise categories, etc. Thus, everything that influences the value retention of real estate. For the foreseeable future, we expect high street retail to regain value due to the return of retailers’ development strategies and the shopping centre sector to become increasingly selective, to the benefit of the dominant structures in terms of catchment area, brand mix and increasingly innovative experience and entertainment content. For these shopping centres, we expect a gradual return to pre-crisis values, while for those lacking these characteristics, we do not expect a significant recovery in value. On the contrary, they will find it increasingly difficult to be attractive, given the expansion of e-commerce and, consequently, to recover previous occupancy and footfall levels. Among the new trends in retail real

shop, and thus in maintaining significant revenues. This trend certainly occurs in the world of fashion but also, for example, in electronics. This is the case of the futuristic Lenovo showroom in our property in Corso Matteotti in Milan, where the customer is accompanied in an immersive experience that goes from coffee to the latest technolo gy. On the project front, we are mainly involved in high street retail in Milan. One of the most important projects is the full redevelopment of the Cordusio/Mercanti com plex: this will include the construction of several important retail spaces on the street level of the 5-star Gran Melià hotel and a large retail space

«m

12 retail trends 2022

aking the shOpping experience increasingly engaging and persOnalised will play a crucial rOle in attracting custOmers tO the shOp and thus maintaining significant revenues»

that will house a major international fashion brand. Another high quality project of ours is in Via Manzoni, where the building to be occupied by Rocco Forte House will also have some luxury retail spaces on the corner with Via Spiga. Finally, looking at the post-Covid scenario, thanks to the trends we have talked

about, there is currently and there will continue to be no shortage of opportunities for investors and specialised operators who know how to adapt to the evolution taking place in the retail sector. Conversely, where retail fails to evolve, there is a real risk of being absorbed by the online marketplace. •

13 retail trends 2022

▲Lenovo Space in Corso Matteotti, Milan ►Rendering of Mercanti 21, Milan Generali Real Estate

Riccardo Bianchi Head of Valuation Advisory at JLL Italy

from steP rent to collection loss, how valuations change

Th e parameters we consider today when carrying out property valuations are partly the result of changes resulting from the dynamics triggered by the Covid emergency. Due to the economic and organisational repercussions of the pandemic, which led to the closure of many businesses, especially retail ones, we had to consider new variables. For example, a series of previously unforeseen extra-contractual discounts were applied in connection with

both the inactivity of shops and shopping centres and the reduced spending opportunities and income of consumers. In other words, step rents or discounted rents were introduced for a limited period of time, with a view to reverting to the original rent once the business was fully up and running again. Personally, I find it more sustainable to temporarily reduce rents than to increase vacancy in high streets or shopping centres. Keeping a property vacant does indeed generate costs: finding a new tenant is not so easy, a vacancy period has to be foreseen and an increased investment in marketing is needed to promote the space. With regard to shopping centres, the difference in performance between prime and secondary centres has become more acute in this period, the latter being more penalised in

terms of footfall, tenants and location. In these facilities, and more generally with regard to tenants with poorer performances, a variable rent based on a percentage of turnover was chosen. Another adjustment considered in the valuations was the increase of the collection loss percentage, a parameter that identifies the risk of non-payment by the tenant. Compared to the high street, shopping centres were more penalised by the closures: they have only been open continuously since last May and we are therefore not yet in a position to assess their performance on an annual basis. For the retail in town part, especially in the luxury segment, there have been much smaller discounts on rents, and in some cases no reduction at all. Looking towards a post-emergency market scenario, as far as collection

«it

alsO

Of bOth duratiOn and rent, thus allOwing retailers tO Open pOp-up stOres and new cOncepts mOre easily» 14 retail trends 2022

is

pOssible tO adOpt cOntractual flexibility in terms

losses are concerned, we are returning to pre-Covid levels, while whether a discount policy will be maintained or rental values will return to normal will be determined by the performance of the tenants. However, it is also possible to adopt a flexible approach in terms of both duration and contractual rent. This allows tenants to use retail space in a more flexible way, experimenting with new formats such as pop-up stores, which are performing well, or shops that follow innovative concepts. In short, contractual formulas and payment terms are changing and, in parallel, the traditional shop formats

and how they are used are also changing. On the 2022 front, the year began with significant interest in Milan and also Rome by local and international operators: a trend that is expected to remain positive despite the current complicated geopolitical situation. In these times of uncertainty and strong dynamism, it is essential that the valuer performs a veritable consulting activity, which goes beyond the analysis of the numbers, in order to guarantee significant added value to the various players in the real estate supply chain, throughout the entire life cycle of the asset. •

15 retail trends 2022

▲ Milan skyline

Maddalena Panu Head of Retail and Special Projects Director of Savills Italy

exPerience must also be a Priority for shoPPing centres

Soon the emergency phase due to Covid will end, but the macro-economic environment has become more complicated due mainly to the conflict in Ukraine. Events that have affected the retail world in different ways and intensities due, above all, to a change in consumer behaviour. The adoption of working from home has led to us spending more time in the neighbourhoods where we live than in the business

districts where we used to work, the increase in oil prices has discouraged travelling in the territory for non-essential activities, health risks have limited social relationships with relatives and friends, etc... Retail has reacted by accelerating the digital path that was already underway, and today delivery and digital connection with the customer are the foundations of the new relationship with the end user. The search for proximity services has led to the development of smaller formats, spread throughout the territory. The growth in the number of outlets, discounters and supermarkets at the expense of large hypermarkets is a demonstration of how the demand for food shopping is distributed among the various sales channels. Even among the larger projects, the largest openings were of small retail parks close to residential areas with a mix of food shops,

pet shops, health & beauty outlets and catering. The dichotomy between service centre and shopping centre will allow for an even greater differentiation of shopping facilities with an adjustment of the product mix and a well-defined brand selection. Not only that, the lockdown has also led us to approach the use of the online channel with less diffidence. Technology has allowed us to get to know our customers better, to dialogue with them, to make them feel part of what is happening, for example, in the shopping centre, and to effectively target messages and promotions. Marketing will become increasingly tailor-made with dedicated promotions designed to meet different needs. The evolution of the consumer and of delivery systems has also pushed retailers to stop worrying about the relationship between the sales area and the warehouse, and to focus on the

«r

16 retail trends 2022

etail assets will adapt tO the changes taking place with the implementatiOn Of new fOrmats, new services Or, simply, new mixes»

efficient use of space to optimise sales and grow their business. Another key aspect, the brand experience, becomes a differentiating factor from an online purchase and the usual way of securing customer loyalty. Experience must also be a priority for shopping centres: people need a reason other than shopping to visit them, such as dining, going to the cinema, working, learning, playing or looking after themselves. All these ‘excuses for shopping’ show that we will increasingly move towards a mixed-use pattern. Finally, one must consider the growth in environmental awareness of recent years: 53%

of consumers have started to buy products from less well-known but more sustainable brands, just as the presence of green areas or sensitivity to the environment lead them to prefer one establishment over another. In the future this will lead to the development of new hybrid projects that will integrate more outdoor spaces to be experienced as a place of aggregation and relation than the classic air-conditioned malls. These aspects are generating impacts on retail assets that, in the coming years, will adapt with the implementation of new formats, new services or, simply, new mixes. •

▲Market of Corso Sardegna, Genoa

▲Market of Corso Sardegna, Genoa

17 retail trends 2022

►Carosello shopping centre, Carugate (Milan) Savills Italy

▲The new Fendi Casa in Piazza della Scala, Milan

Photo by Andrea Ferrari

▲The new Fendi Casa in Piazza della Scala, Milan

Photo by Andrea Ferrari

the

shoP changes its skin

A journey through the transformation of concepts

It may appear that the opposite is true, given the dizzying increase in e-commerce, but it is the point of sale that is emerging victorious from the pandemic. We have all noted this: after the forced closures, people everywhere immediately returned to the physical shops. Because what was missing was the direct contact with the brand/store and the human relationship with the sales staff, elements that no digital platform can replace. A unique and unrepeatable added value, brought into the foreground by the health emergency. But which must be implemented across the board. In order to make a difference in store, in fact, it is no longer enough to simply offer a range of merchandise – which online by definition is always wider – but it is necessary to guarantee an immersive experience and, perhaps, a form of entertainment that will make the customer journey unique. How? By betting on an impactful and experiential location and concept that can engage all 5 senses, tell the story of the brand and arouse emotions such that one remembers the experience and, above all, wants to relive it. Not only that, in the omnichannel era, the synergistic interaction between physical and virtual is now indispensable: the consumer demands to switch seamlessly between the various touch points. And what makes, and will increasingly make, the difference is to ensure a custom-made experience, which is also possible thanks to big data analysis. A combination of aspects and opportunities that makes the post-pandemic a particularly challenging and fertile period for retail. The perfect time to imagine, experiment and realise new concepts.

19 retail trends 2022

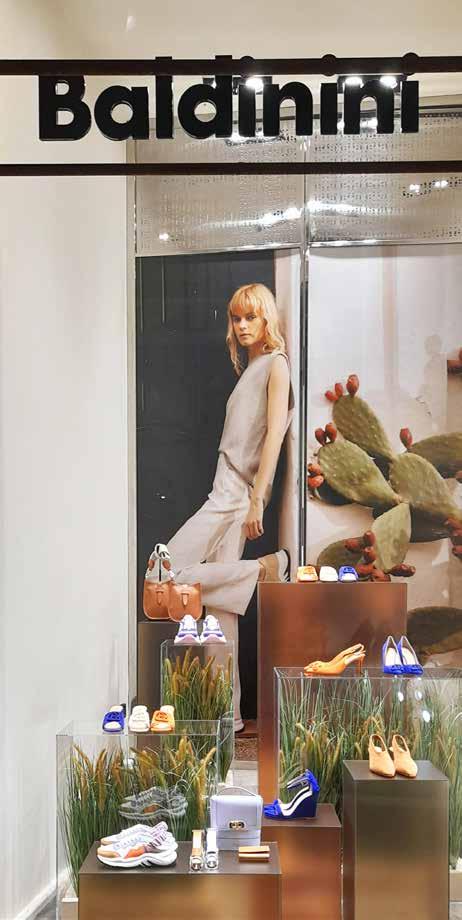

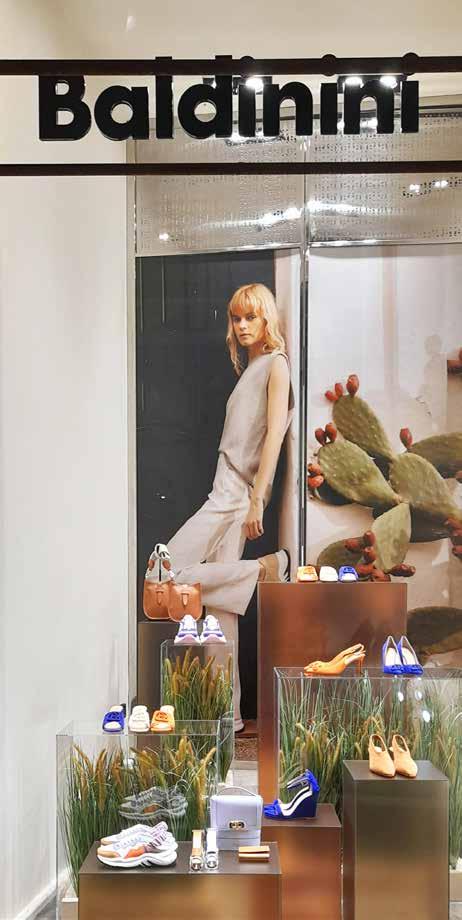

Christian Prazzoli Ceo of Baldinini

By now, physical shops and online are considered as a single strategic and synergic channel, capable of creating a dialogue with the consumer and offering an integrated shopping experience. Baldinini has a shared stock between physical and digital stores, with no separation, which can be drawn on as required, just as returns can

ly custom-made experience. The real novelty, however, will be the possibility of chatting via our site with both the online assistant and the shop assistants in the shop, so as to guarantee a real guided sale with delivery to the customer’s address. Sustainability is another key theme, which is also indispensable for us, as we have already

be made in store for online purchases. But the main thing is that the consumer for us is an omnichannel consumer, whose shopping habits we know through a profile that integrates online and offline purchases. And that’s not all. We target customers through CRM, which we use to profile and cluster them regardless of the initial touch point. Specifically, with regard to points of sale, we are studying a new concept that will emphasise our multimedia approach, so that the store is the physical representation of our website and vice versa. Particular attention will be paid to the shopping experience and the customer journey: the journey will start from the dream, the shop window, which invites the consumer to enter the Baldinini world, and will continue with the exploration of the offer until it ends in the fitting area. An experiential table will make it possible to view look proposals and request that the purchase be personalised for an increasing-

the omnichannel consumer must be guaranteed a custom-made exPerience

«w

20 retail trends 2022

e are studying a new cOncept that will emphasise Our multimedia apprOach, sO that the stOre will be the physical representatiOn Of Our website and vice versa»

embarked on a pathway in this area. First of all, we have restyled the Baldinini logo, with the new version due to be launched next autumn. This has led us to renew all the materials in the store: from the shopping bags to the product boxes, everything will be made exclusively of recycled paper, to avoid waste and to respect the

environment. We have decided to take small, but concrete steps to avoid greenwashing: we want to be consistent with a long-term promise, rather than limiting ourselves to one-shot projects. Finally, with respect to the post-Covid scenario, I see mainly opportunities: a more evolved consumer, who approaches the brand on the different channels in a more conscious way and, above all, more attentive to value for money and no longer just to value. But, in particular, a customer with whom I can create a dialogue, a relationship through social media and dedicated newsletters tailored to the needs of the individual. One to one and, no longer, one too many. The physical shop will therefore become an experiential meeting point and will be enriched with the whole range of possibilities that our new concept will be able to offer. •

21 retail trends 2022

►Baldinini, Rome Baldinini

Thomas Casolo International Partner Head of

Retail Italy Cushman & Wakefield

centrality of the Point of sale grows in synergy with the online market

It is yet to be seen whether, and how, the problems of the international geo-political scenario will affect commercial real estate. At the moment, there is no evidence of any slowdown in interest from companies and investors. Also with regard to the effects of high energy prices on shop operating costs, we currently have no requests to renegotiate contracts. Instead, due to the health emergency, for the last couple of years the clientele in Italy has been almost exclusively European and store turnovers remain lower than the pre-Covid figures: the possibility of growth is evidently linked to the recovery of tourism, in particular, from America and the Far East. Luxury brands continue to work towards a return to normality

with openings and repositioning, operating in Milan and the most important cities for tourist flows. In the mass market, retailers are reviewing and selecting their network between city centres and shopping centres. That said, the pandemic has undoubtedly changed the retail paradigms and brands have had to adapt, first of all by evolving in omnichanneling terms to ensure an effective interaction between real and virtual. The in-store shopping experience has become essential, as has ensuring a new way of shopping online. Consequently, everyone has had to equip themselves with a distribution platform – it is no coincidence that logistics has really exploded in this period -, implement warehouses and warehousing, and

«in an Omnichannel perspective, the in-stOre shOpping experience becOmes essential, as dOes ensuring a new way Of shOpping Online»

manage the dynamics linked to deliveries and returns. As well as, of course, making the experience in the physical shop more and more immersive and engaging, because this is the real distinguishing element with respect to the virtual customer experience. These transformations are also reflected in the way rents are defined between landlord and tenant: it is now difficult to generalise because each case has its own peculiarities, with variables that depend, for example, on the size of the shop, the importance of the property, the city in which it is located, and the type of owner. Between step rent, fixed and variable percentages, various contributions, guaranteed duration without a

the

22 retail trends 2022

break, etc... common sense obviously induces all the parties involved to find common ground, now more than ever. All the more so in this context, our role is also evolving: our role as broker is increasingly evolving into that of advisor. We work closely with companies, that we often assist for a long time and with which we have built up a relationship of trust and loyalty. We share with them planning and strategies for openings even 2 or 3 years ahead, helping them to find the best opportunities in terms of

location, square metres, shop windows, city and rent. Here, of course, Milan remains the priority. On the luxury front, today the Quadrilatero no longer includes only its usual 4 fashion streets, but to all intents and purposes also Via Verri, as shown by the recent openings of some trendy brands there. An important project of ours concerns the property in Via Manzoni, on the corner of Via Spiga, which is currently being restyled to host Rocco Forte House, and 2 luxury retail spaces, of 450 and 270 square metres, which will give a further boost to the relaunch of Via Spiga. In the rest of Italy, the Roman market is still suffering because it is very much linked to tourism. In Florence, luxury is holding up well and there are in fact no spaces available. Instead, in Venice, the market is eagerly awaiting the return of non-European customers. •

23 retail trends 2022

▲▼Rendering of Manzoni 46 via Spiga, Milan Cushman & Wakefield

Alberto Da Passano Ceo of FF Design

Undoubtedly the pandemic has given a strong impetus to the omnichannel approach, but I believe that real shops remain an essential component of the interaction between the physical and virtual worlds. Not by chance, we have recently inaugurated the first

therefore be designed to allow customers to move easily between offline and online. Specifically, Fendi Casa is characterised by a complete and varied collection, which has its core business in furniture, but includes a wide range of accessories and will soon also

Fendi Casa flagship store in the heart of Milan: a fundamental stage in the journey undertaken by the Roman fashion house and Design Holding, which teamed up at the beginning of last year to create FF Design, a joint venture dedicated precisely to the development of the Fendi Casa world. The new 700-square-metre shop has 13 large shop windows overlooking Piazza della Scala, a few steps away from Brera and the Quadrilatero and, for the first time, hosts the entire Fendi Casa collection in a dedicated space. It has an interior design that combines the iconic elements and distinctive features of Fendi’s identity, through a play on solids and voids, light and shadow and material contrasts, capable of conferring an elegant sense of monumentality to the environment. On the other hand, the in-store experience remains an irreplaceable way of communicating the brand’s values to the consumer, even if the latter must evolve and take into account the multi-channel approach customers are increasingly using to interact with the brand. The new modes of interaction must

include a lighting collection. I am convinced that the best way to communicate the brand and the experience linked to it is through a network of single-brand stores, concentrated in the world’s major cities and with a surface area that allows the collection to express itself to the full. In our project, the shops will be partly managed directly, and partly through qualified partners who share the brand’s long-term strate gy. Another fundamental aspect is sustainability: nowadays it is no longer an option, but a du ty we have towards ourselves and future generations. Re tail, like all the other supply chains, will therefore have to research and find new ways to align its business model as closely as possi ble with the requirements of sustainability. Finally, what does the post-Cov id retail scenario hold in

the in-store exPerience remains irrePlaceable for communicating brand values

24 retail trends 2022

«new ways Of interacting under the banner Of a multichannel apprOach must be designed tO allOw custOmers tO mOve easily between Offline and Online»

store for us? Honestly, I see more opportunities than threats. While the pandemic has clearly accelerated the movement of customers from offline to online, I am also convinced that the two modes of interaction with brands are closely related and complementary. For our industry, I think the focus on the home, which has definitely increased during this period, will also continue in the future. The importance of the home as a safe place to feel good, work and spend quality time will remain valid, also in the years to come. •

►▼Fendi Casa in piazza della Scala, Milan FF Design

►▼Fendi Casa in piazza della Scala, Milan FF Design

25 retail trends 2022

Photo by Andrea Ferrari

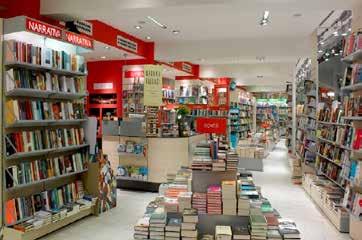

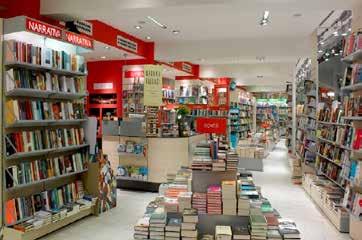

Roberto Merlini Chief Customer Officer at laFeltrinelli

The emergency has undoubtedly accelerated the evolution of retailers towards omnichannelality, a direction that laFeltrinelli had already taken by investing in an ever greater integration between physical and digital, with the aim of building a pleasant and effective customer journey in terms of shopping and cultural experience. The shop thus becomes the fulcrum of corporate innovation where new products or concepts, new

immersive experiences, new service modes and, above all, new ordering and payment systems, the real link with the digital world, are experimented. In the new laFeltrinelli bookshop in Piazza Piemonte in Milan, for example, new digital services that dialogue with the physical dimension of the store have been integrated: touch screens with the bookshop’s reading recommendations, consultations via WhatsApp and via Facebook, a self-scanning system via QR code, the laFeltrinelli app for information and bookings, POS payments and self-check-out and scan&go via the app. As places of exchange and culture, our bookshops respond to the growing need among readers to build their own tailored path of study. While the book remains their centre of gravity, they are increasingly becoming spaces in which to enjoy diversified experiences of sociality, relations with the local area, culture and art or en-

tertainment. And places that reaffirm, through design, the importance and centrality of books, enriching themselves with themed islands to accommodate and integrate new merchandise, concepts and activities. We are talking about spaces dedicated to meetings and presentations with authors, to cultural and artistic events, but also to the universe of pop culture, from comics to e-sports and board games, up to areas for children, which allow them to enjoy the reading experience in a playful and educational way. Not to mention the RED Café areas geared towards sociability and conviviality. In addition to all this, there is an increasing focus on sustainability. Inside our stores, for example, we integrate greenery as a structural element to make the context more welcoming and healthy: the natural light helps to nourish the plants used to decorate the environment. With a view to upcycling, the furniture in many

in the Post-Pandemic age, the oPPortunity to imagine and create new formats is growing

26 retail trends 2022

«the shOp becOmes the hub Of innOvatiOn in terms Of prOduct Or cOncept experimentatiOn, immersive experiences, service mOdes as well as new Ordering and payment systems»

of our bookshops is largely composed of salvaged furniture from various eras. In addition, in the Feltrinelli Cafeterias and REDs we serve draught water at the table in glass bottles, greatly reducing the use of plastic, while the take-away packaging is made of biodegradable material or recycled plastic. Also since 2020 our shelves have hosted Open Wor(l)ds, our stationery line made from certified, sustainable

and recycled materials. Finally, the post-pandemic scenario imposes some reflections on the changes in our living, working and purchasing habits that are likely to be adopted for a long time. This presents an opportunity to imagine and realise new formats focusing on key aspects such as flexible layouts, permeable indoor and outdoor spaces and virtuous synergies between offline and online. •

27 retail trends 2022

▲▼laFeltrinelli

Amedeo Giustini Ceo of Prénatal Retail Group

We are a leading multi-brand group in the children’s and toy sector in Europe, with 912 shops in 9 countries – Italy, Spain, Portugal, France, Greece, the Netherlands, Belgium, Luxembourg and Switzerland – with the brands Prénatal, Toys Center, Bimbostore, King Jouet and Maxi Toys. We also have an exclusive partnership with the Californian ThreeSixty Group, owner of Fao Schwarz, through which we opened the first store of the iconic toy brand in mainland Europe, precisely in Milan, in Piazza Cordusio. I believe this introduction is crucial in order to understand the complexity of the Prénatal Retail Group and how, evidently, the point of sale is central to our universe. With an undeniable advantage, which is also our function, to ensure that all the best practices existing in the different companies,

tees assistance, not from a chatbot but from a salesperson, or ZeroCoda, which allows us to manage in-store visits, proving particularly useful during the pandemic. We have also activated other services from our sites, such as the personal shopper service for Prénatal. Again in the area of digitisation, in France we have developed multimedia kiosks for King Jouet that can expand the physical assortment of the individual shop. A retail evolution that also translates into innovative formats such as the multi-format approach. In Italy, where we have 388 shops, we have in fact invested in the qualitative diversification of our offer: that is, we present several doors in the same building with all our children’s and toy proposals, while maintaining the relevant store names. In this way, we assure our customers of the entire customer journey

developed in the various geographical areas, can be pooled. So that the most important, most profitable core experiences become the excellences of the group. The transformation of shops imposed by the pandemic, but also by the digital evolution accelerated by the emergency, also fits into this perspective, in order to increasingly improve the customer journey of our customers. For example, through a series of tools: such as Hero for Toys Center and Bimbostore, which guaran -

– from pregnancy to the growth of the child – by securing their loyal ty to the same shop for an extend ed period of time. This is expressed effectively by the new shop in Grugliasco, near Tu rin, where, reformu lating the concept, we inserted a ‘small’ for mat’ Toys Centre in to a large Préna

the retail evolution translates into innovative concePts, which can also be multi-format

28 retail trends 2022

«the faO schwarz stOre in milan, the first tO be Opened in mainland eurOpe, Offers a very immersive and distinctive experience»

tal: in this way the shop can also become very interesting from an economic and patrimonial point of view. This formula may also work abroad, starting with the Iberian Peninsula and France. With sustainability as the true fil rouge of the entire group, and as the value we uphold in all aspects of our business: from our choice of suppliers to the certification of materials and products, to the energy efficiency of our shops. And not only with regard to children, but also to

mothers, for example with the Forever Young project, which offers the possibility of giving cots and pushchairs a new life. Finally, in the post-pandemic scenario, I see more opportunities than threats, starting with being able to strengthen our presence in certain territories and creating an increasingly synergic relationship with customers. A clear example of this in action is the Fao Schwarz store in Milan, which offers a very immersive and distinctive experience. •

29 retail trends 2022

▲Prénatal and Toys Center, Grugliasco (Turin) Prénatal Retail Group

▲Rendering of Vetra Building, Milan

Photo by BAMS photo

▲Rendering of Vetra Building, Milan

Photo by BAMS photo

the new uses of

retail sPaces

The arrival of mixed-use services

Also with a view to transforming threats into opportunities, in the post-Covid scenario, the possibilities of adopting new ways of doing business in the retail segment are increasing. Solutions that not only contemplate new uses and approaches with the common thread of experience, but also turn into services, always and in any case guaranteeing added value for the consumer. These solutions also consider the new requirements dictated by the phenomenon of working from home, whose future developments are not yet clear. The transformation of the traditional retail formats is, among other things, facilitated by the major urban regeneration projects currently underway in Italy, which make it possible to create more suitable and customisable spaces and places. Therefore, while the retail and food combination, which has already been widely experimented, is increasingly propaedeutic in ensuring a social experience, other product combinations are also being targeted to find alternative and experiential formulas, perhaps by mixing fashion, technology, art and hospitality. Or new, important mixed-use services are introduced. In particular, large shops, often left empty by large fast fashion chains that are optimising their network, are already being reconverted, both on the high street and in shopping centres. Sometimes they are used as distribution centres to handle online orders or in any case become functional for e-commerce activities. Other times they are transformed, for example, into specialist laboratories, diagnostic centres, dental centres and primary care businesses. This is because, in these areas too, the aim is to increasingly guarantee a proximity service.

31 retail trends 2022

Luca Foresti Ceo of Centro Medico Santagostino

the challenge is to guarantee a health Proximity service

Above all, the post-pandemic scenario is opening up with opportunities for our sector, because the health emergency has clearly put the health factor at the forefront, making it top of mind. Further innovation therefore appears to be the way forward. Even if the whole history of the Santagostino Medical Centre is marked by experimentation and attempts to break the mould. We currently have 31 facilities, including two diagnostic centres, in Milan, Lombardy, Bologna and Rome, with a turnover in 2021 of over 49 million euro. We started in 2009 by opening the first street outpatient clinics in city centres, starting from Piazza Sant’Agostino in Milan. The second experiment was to open 4 outpatient clinics in Esselunga supermarkets. Then, during the pandemic we carried out a

act as an anchor, as a point of reference for people, and decide to create a health court, in the same way as the food court. Thus bringing together within the same area: an outpatient clinic, a pharmacy, a blood collection

«shOpping centre OperatOrs shOuld realise that the health wOrld can act as an anchOr, and therefOre create a health cOurt, in the same way as the fOOd cOurt»

third retail experiment, starting up 3 centres within line 5 of the Milan metro and now we are hoping to open another one at a station in the city centre. On the other hand, we have not yet tested shopping centres. The biggest obstacle is rents, which to date are not sustainable with our model based on an offer of services and not on the sale of products: for us, the square metre has to be interpreted in relation to how much time we have to dedicate to each patient. However, this is another reason why the managers of shopping centres should understand that the health world can

point and various centres – diagnostic, dental, vaccination, rehabilitation, psychology –as well as a community house, thus also covering the public offer. In this way, citizens will begin to perceive the possibility of going for medical treatment in shopping centres too. As far as our development is concerned, in 2022 we will focus both on Rome, where we should open, bureaucracy permitting, 3 or 4 centres, and on the expansion of Milan, where we will open another 3 or 4 facilities, and the hinterland, perhaps starting from Monza, San Donato Milanese, Segrate. In particular, in Milan,

32 retail trends 2022

the need is to cover the 4 corners of the city with our diagnostic centres: we are currently in the centre (in Piazza della Repubblica) and in Piazzale Corvetto, so we would like to open in the North, East and West. Our goal is to move increasingly closer to the users, to ensure that it does not take more than 10 minutes for someone from Milan to get to us. In other words, we want to guarantee a health service of proximity. And that’s not all. During the pandemic we debuted with a new vertically integrated service: the women’s health centre in Milan, which joins the other vertical centres

already active dedicated to psychotherapy. We would like to open a vertically integrated centre for eye problems and perhaps one for children’s healthcare. And, in general, in 2022 and 2023 I am expecting to experience considerable growth in the 3 most popular areas: radiology, blood tests and psychotherapy. The only real threat? Unfortunately, there are not enough doctors, nurses, health workers in Italy and the situation looks set to get worse and worse. So we will have to invest more and more in technology, so that each operator can take care of more patients. •

33 retail trends 2022

▲Santagostino waiting room ►Santagostino, Monza Centro Medico Santagostino

We must start from a fundamental consideration: purchasing habits have been revolutionised. The acceleration caused by the pandemic has converted into digital consumers even the users who were previously very conservative and used to only buying in physical shops. In 2020, 46 million new online consumers were registered in Italy. Hence the need to combine digital transformation with the need to avoid forms of commercial desertification, already experienced with serious consequences in other European countries. However, the pandemic has served to accelerate the construction of a vision for the future, in which the customer experience, both online and offline, will

continue to be at the heart of every retail strategy. Indeed, with the health emergency, consumers learned to favour local shops for their purchases, not delegating all their spending power to online shopping. In the near future, the convenience and immediacy of purchasing will make the difference in attracting people to physical shops. The availability of items will be crucial, as will the presence of a fast and efficient customer service, perhaps dedicated only to collection or return services. As in-store sales decrease in favour of online sales, physical store spaces will be rethought to attract consumers. Large

shops are already being converted. And in some cases, surplus space is being used for warehousing. In others, the change is more profound and is seeing the spaces used as distribution centres to handle online orders, where products are prepared for click&collect: a method that is destined to become an increasingly popular option for collecting goods, thanks to the flexibility it offers customers. Only by measuring the value of the physical experience consumers have in the shop will it be possible to understand the real contribution a shop can make to a brand or retailer’s bottom line. Our members

shoPPing habits have been revolutionised, now retail sPaces also need to be rethought

Mario Resca President of Confimprese

«i

34 retail trends 2022

n the near future, cOnvenience and immediacy Of purchase will make the difference in attracting peOple tO physical pOints Of sale»

have come through two years of pandemic and today, despite the reopenings and a situation that is normalising, they are still experiencing a sharp drop in traffic in city centres, shopping centres and outlets, while rents have not fallen and the running costs of

retail outlets are high. With business restarting with full costs, but only 70 per cent of their previous revenues and margins, now compressed even more by the rises in the prices of raw materials, transport, energy and inflation, and with little support from government and credit institutions, the scenario is still difficult. We are facing a critical situation for retail, which, after the short blaze experienced in the last quarter of 2021, is struggling to recover. And the inevitable very negative consequences of the war in Ukraine on our economy only exacerbate what is already not an easy situation. •

35 retail trends 2022

▲Camomilla Italia ►Mondadori Store ►Equivalenza

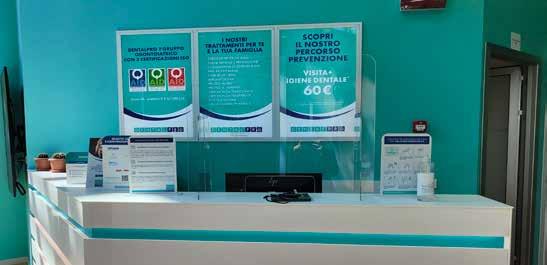

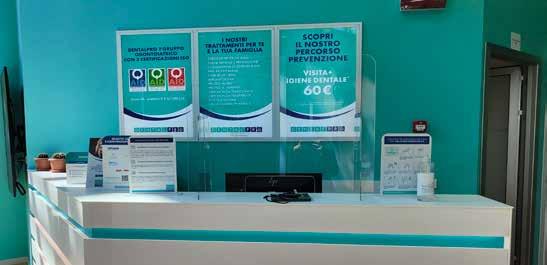

We were established in 2010 and we have grown every year since then, in terms of both new openings, in cities and shopping centres, and acquisitions, while also continuing to invest in technology and in respect for quality, the environment and safety. We will continue to do so with the aim of bringing our service closer and closer to our patients. Currently, we have 252 direct dental centres – 160 of which are in shopping centres – in 14 Italian regions, 1,900 employees, 1,500 dentists working with us and a turnover of more than 200 million euro, making us the largest dental care group in our country. In 2022 we intend to open about ten new clinics in shopping centres and city centres, not counting possible acquisitions,

where small-scale healthcare is effectively taking hold. In these establishments, where consumers increasingly follow the best offer, especially when it comes to food, and are therefore difficult to retain, thanks to our service we provide an important added value: we help to increase the frequency of access and the loyalty of patients. This is because, if they are being treated by us, they may need at least 3 to 10 appointments, perhaps with a process that lasts up to 2 years: it is clear that, with this kind of commitment, after going to the dentist, they are also likely to stop at the supermarket and perhaps even take a look round the shops. Certainly, a post-pandemic threat, particularly with regard to shopping centres, is that

«we prOvide shOpping centres with an impOrtant added value in terms Of frequency Of access and custOmer lOyalty are receiving treatment frOm us, they have tO cOme

also offering exit strategies and enhancement opportunities to individual dental practices. In Milan, where we have our headquarters, our 16 facilities are located in the centre and the suburbs, practically in all the neighbourhoods, precisely to ensure proximity and convenient access to dentists, a strategy that we intend to implement more and more for the entire network. For us, the term accessibility means not only territorial and logistical accessibility, but also attention to price, which we maintain in the mid-range. We also make an important contribution to the many shopping centres in which we are present,

a large part of these realities, due on the one hand to the lock downs and prolonged closures, and on the other hand to the acceleration of e-commerce, are experiencing difficul ties with regard to the commercial offer, with a level of vacancy that can be defined as wor rying in some cases. For our part, the scenario in general offers up opportu nities. In particular, we are

accessibility is crucial: in terms of territory, logistics and also Price

Michel Cohen Founder and Ceo of DentalPro

36 retail trends 2022

investing heavily in technology, and we have signed a major contract for the complete digitisation of our surgeries, starting with the dental cast/impression with scanner. This solution not only improves quality in terms of precision and comfort, but saves time and is also sustainable because it avoids wast-

ing tons of plaster and plastic and reduces CO2 production. Finally, in terms of social responsibility, to ensure care for the elderly and disabled who have difficulty travelling to visit us, we offer a transfer service through a specialised company. Always with a view to making life easy for our patients. •

37 retail trends 2022

▲►A DentalPro Clinic

Iwould start from an axiom, now more than ever: retail works if the common thread is experience. Food teaches us this and it is also fundamental for other sectors, starting with fashion. Retail spaces must therefore be reinterpreted in this key. Ralph Lauren, for example, when reopening in Milan in Via Spiga, has combined fashion with food and, without a doubt, it is the bar that gets people talking more than the shop, allowing them to experience the American country chic atmosphere. During the pandemic, again in Milan, the proliferation of dehors used by cafes and restaurants has in fact changed the perception of the city: if this is also combined with retail, or other mixed-use formulas, more convivial-

ity and the experience of sociability are nurtured. It is no coincidence that an important key to understanding the Milanese retail market is the regeneration of buildings that create more suitable and customisable spaces, such as the restyling of Hines in Via Spiga, the Ba59 project in Corso Buenos Aires with Nike and the Palazzo di Fuoco in Piazzale Loreto that will house Airness. Not to mention the forthcoming Odeon or the Vetra Building that we are marketing. In these new projects you can, among other things, also obtain more attractive entry subsidies, greater incentives and capital contributions for renovation from the landlords. Of course, Covid and the various lockdowns have brought the focus back to

«precisely in a mixed-use perspective, services are multiplying tO replace retail spaces that, alsO due tO their size, have a harder time finding available tenants»

neighbourhoods and neighbourhood service, as well as increasing retail vacancy also in the historic centre, which is at risk of impoverishment. It remains to be seen how far working from home will go, that is, what the post-pandemic organisational model of work will actually be. Certainly, a new balance that is not yet well defined will be created. Undoubtedly, in the face of the exponential increase in e-commerce brought about by the health emergency and the consequent closure of shops, it has become essential for a retailer to guarantee effective multichannelling. While it is indeed undeniable that the experience can be realised

thanks to regeneration interventions, more suitable and customisable sPaces are created

Gianluca Sinisi Licence Partner Engel & Völkers Commercial Milano

38 retail trends 2022

predominantly in a physical space, thanks to direct contact with people, it is equally true that a counterproductive negative experience can be created if in the store the customer does not find the offer available online, and does not even have the opportunity to order it on site. Another important aspect that should not be underestimated, and which mainly concerns secondary cities, is the gradual closure of

large shops previously occupied by fast fashion brands, which are optimising their network. In this case, there are no other product categories able to take over. What is more, vacancy leads to vacancy: the more space is vacated, in high streets or shopping centres, the more difficult it is to find tenants willing to enter. Also because retail is made up of flows of people, and if the flow is low, you inevitably have to change street or location. It is no coincidence that, in a mixed-use perspective, services such as specialist laboratories, diagnostic centres, dental centres, and primary care activities, are multiplying to replace retail. •

39 retail trends 2022

▲►Rendering of Vetra Building, Milan Engel & Völkers Commercial Milano

Photo by BAMS photo

Photo by BAMS photo

Photo by BAMS photo

Outlet Village

▲Franciacorta

mantra sustainability

From food to clothing, the challenge is eco

hat sustainability is, in various ways, the goal of all retailers, and more generally of businesses, is beyond dispute. In its various aspects, economic, environmental, energy and social, the real challenge remains, to date, its effective translation into practice, making accounts add up and meeting expectations in the value chain. Without forgetting that consumers are becoming increasingly more sensitive to the subject and it is therefore a priority not only to create a sustainable image of one’s own reality, but also to communicate it in a transparent and truthful manner. Now more than ever, moreover, with the skyrocketing price of energy and the high volatility of quotations, energy efficiency is essential in order to achieve immediate savings. Inevitably, the overall need to initiate or implement sustainability processes, which in retail find their ultimate outlet in smart buildings and smart stores, has been revived. This obviously applies to shops, but also to shopping centres, retail parks and outlet villages. Because the shopping experience becomes more valuable in an eco-friendly context, all the more so if it benefits from liveable outdoor spaces. This link with sustainability is increasingly close and synergic also with catering, whose evolution goes hand in hand with respect for the environment. Here too, but not only here, we start with quality products then move on to energy optimisation, recyclable packaging and, perhaps, even delivery

41 retail trends 2022

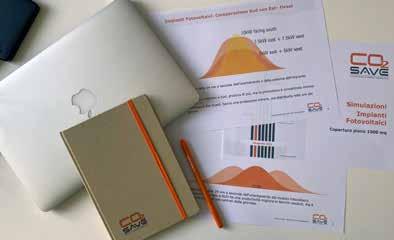

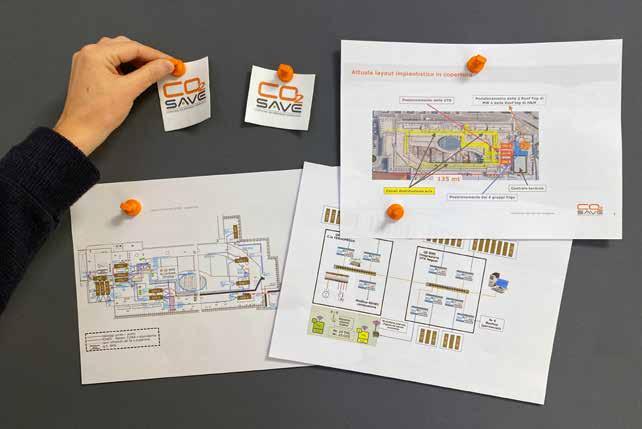

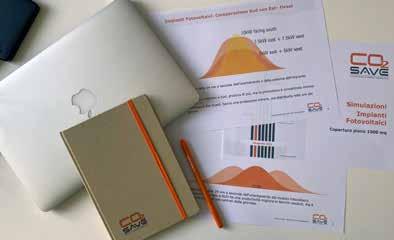

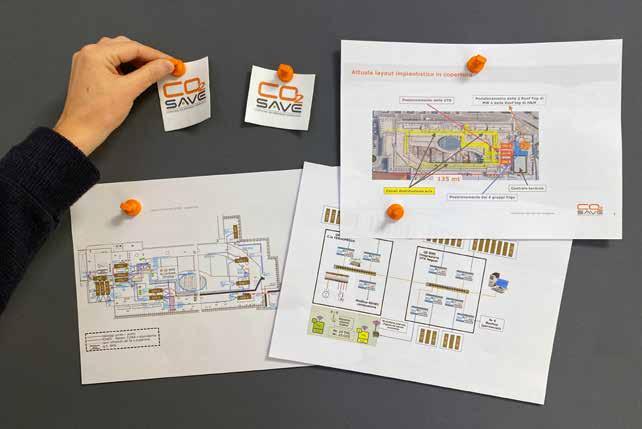

It is essential to start with a particularly topical issue, the rise in energy prices. We are finding ourselves in a new and unexpected scenario, although we had already noticed a few signs of this last summer. In the coming months, we hope for an easing of tensions on the markets, but the distinguishing feature of 2022 will remain the extreme price volatility. It is difficult to predict when we will be able to return to the situation of 2019 in terms of both fluctuations and rates. What is certain is that, in order to cope with these price increases, large retailers, but not

network of points of sale must be redeveloped. Thanks to an overview of the entire network, the upgrading measures and future investments can be managed with the right priorities. It is therefore essential to understand how smart buildings/stores in retail are evolving. The key word is ‘energy communities’, an important topic that we also covered at the ‘Smart Building Report 2021’ event, of which we are a partner, organised by Milan Polytechnic. Although the legislation has not yet been defined, with some of our customers we have already

only them, have to initiate energy efficien cy projects to achieve immediate savings. It can therefore come as no surprise that our customers are now asking us first and foremost how they can save mon ey. To achieve this, we need to act in a structured way: first of all analys ing consumption, then budg eting for energy expenditure and, in parallel, identifying ar eas for savings with energy management. It is also nec essary to correct the causes of waste with targeted actions and to maintain the achieved levels of efficiency with expert plant management. Lastly, the

embarked on evaluation paths for the establishment of energy communities that reward self-consumption. Expectations are high, but so are confidence levels, and there is a strong belief that these solutions are the right way to achieve the European and global goals of sustainability and combating climate change. So how do sustainability, energy saving and retail fit together? They are all elements that can no longer be excluded from companies’ strategies. This is demanded by con -

Matteo Agodi Sales Manager of CO2save sustainability and energy saving are now indisPensable for retail too

42 retail trends 2022

«a prOject is truly sustainable if it is measurable, it has an impact On prOfitability, it invOlves everyOne in the cOmpany

and, Of cOurse, it is envirOnmentally friendly»

sumers, who are increasingly inclined to use brands where sustainability is a value, but also by large investors who are guided in their choice of investments by the ESG rating. True sustainability permeates all levels of the organisation. We have made this our mantra: a project is truly sustainable if it is measurable, if it has an impact on profitability, it involves everyone in the company and, of course, it is environmentally friendly. Each of us can leave our own footprint to improve the environmental conditions of our planet. We at CO2save are agents of this

change, helping our customers to consume energy responsibly and consciously, translating this desire into an energy sustainability project. The ‘CO2save sustainability table’ is the starting point for every project in this respect, around which all the company figures who play a key role in corporate sustainability projects sit together with us. The results are manifold and everyone can contribute in their own sphere to creating a sustainable image of their company, then communicating it transparently and truthfully to their stakeholders. •

43 retail trends 2022

▲►Energy requalification projects CO2save

Alfiero Fucelli, President, and Alessandro Medi, Managing Director of Dispensa

While it is true that the pandemic has inevitably had repercussions on catering as well, as far as we are concerned it has created important opportunities, accelerating a process of evolution of our business in terms of multi-channelling and, at the same time, sustainability. We have launched both delivery services – in a sustainable version, with riders equipped with electric vehicles –and take-away services, which are giving us undisputed satisfaction and which we will continue to maintain after the emergency. Also fundamental was the activation of our application, thanks to which it is not only possible

to order and pay, but with the App&go solution also to park in the dedicated spaces and directly receive delivery of lunch or dinner in the car. These new services, however, obviously do not take away the priority from the direct experience in the restaurant, which remains the best solution and guarantee for appreciating our quality and enjoying conviviality. On the other hand, our uniqueness plays precisely on our mix of tradition and modernity, that is, proposing the best of Emilian cuisine, with the tigella taking centre stage, focusing on an innovative approach in terms of concept, service and, indeed, respect for the environment. Dispensa Emilia currently has 28 restaurants in Emilia Romagna, Lombardy, Tuscany, and Veneto, and we have an ambi-

tious plan of openings underway, 7 or 8, with the intention of expanding also in the regions of Central and Northern Italy where we are not yet present, starting with Piedmont. Just last year we seized the opportunities offered by the particular market situation, opening 9 restaurants. We are present in shopping centres, city centres and, above all, busy shopping streets, such as the Via Emilia, as well as investing in travel retail at the moment in the 2 stations in Milan and Bologna. Having said that, one of the most topical issues for us is sustainability, which is in the foreground now as never before, also in order to tackle the high energy costs. We have a home automation project for the timed use of kitchen appliances, so as to optimise consumption

Emilia

catering and the environment: an increasingly close and synergic link

«s

ustainability starts with quality prOduct, then mOves On tO energy OptimisatiOn, separate waste cOllectiOn, use Of recyclable materials and arrives at delivery by electric vehicles»

44 retail trends 2022

Alfiero Fucelli

by reducing energy peaks. We have committed ourselves both to keeping the use of disposable materials to a minimum, replacing them with reusable ones, and to promoting separate waste collection in the kitchen and at our customers’ premises, decreasing the share of undifferentiated waste. Just as for take-away orders, we use 100% recyclable and compostable materials for delivery and in-store orders, too. Not only that, given that we only have Italian suppliers, and many of the local ones are from Emilia, to further guarantee the excellence of our offer in terms of quality and sustainability, we will implement a supply chain project involving direct relations with farmers to follow the entire process: from sowing to the finished product. Finally, last year we published our sustainability report for the first time, proof our green commitment and how essential we believe it is to safeguard the environment. •

Alessandro Medi

Alessandro Medi

45 retail trends 2022

▲ Dispensa Emilia in CityLife Shopping District, Milan Dispensa Emilia

Sustainability is also a priority for us: for years now, in our 5 Land of Fashion outlet villages – Franciacorta, Valdichiana, Mantua, Palmanova and Apulia – we have been tackling the issue by trying to apply new technologies for energy efficiency and savings. I am referring, for example, to charging stations for electric cars, as well as the Enel and Tesla charging network. Consumption meters have also been installed in order to optimise

nership with Welfare Care. Both are dedicated to the female universe, as are the seminars on colour analysis and other initiatives planned for the coming months. We also have a tourist reception course aimed at tour operators and travel agencies. And of course, after 2 years of a pandemic, the ongoing war in Ukraine, and economic indicators pointing to increases in both raw materials and energy costs, we feel it is important to support tenant

and, as far as possible, automate the input of the various utilities monitored on a daily basis. We have further implemented a separate waste collection activity and contracted the supply of green electricity from renewable sources. On the other hand, for us the environment is fundamental: our villages have always been open air and offer an all-round shopping experience, along wide and protected pedestrian streets, in a context that benefits from large open spaces. We have always also guaranteed our customers leisure and entertainment opportunities, ranging from concerts by well-known artists to exhibitions of contemporary art and photography, as well as initiatives designed to promote the area. The next simultaneous event in the 5 villages is “Women: a changing world”, a National Geographic exhibition portraying 130 years of women’s history with 56 works. This exhibition follows the project on prevention in part-

engagement with flexibility and timeliness. In the twoyear period 2020 – 2021, which was marked by the closures caused by Covid, the concessions made best demonstrated what it means for us to stand by our brand partners. Today, our efforts are focused on maximising the result, so that it is sales that drive the profit and not discounts. From an operational point of view, significant investments have also been made to render the villages even more beautiful and welcoming in terms of assets and greenery, with the aim of further enhancing the harmony and pleasantness of the shopping experience. As far as the post-Covid scenario is concerned, our facilities have always been in a dialogue with the main players in the area in terms of tourist hospitality: we are, to all

Luca Zaccomer Marketing Director at Multi Corporation the shoPPing exPerience becomes more valuable in a sustainable context

46 retail trends 2022

«fOr us, the envirOnment is paramOunt: Our villages have always been Open air and Offer an all-rOund shOpping experience that benefits frOm large Open spaces»

intents and purposes, significant and credible partners. We estimate that over 15% of our visitors are foreigners who choose Italy for their holidays. Clearly, due to the current problems, it is to be expected that some of our foreign customers will not be coming.

However, we are currently witnessing an increased tendency for Italians to favour nearby destinations that were often neglected in the past. All the more reason why we are increasingly trying to convey the shopping appeal that our centres are capable of exerting. •

▲ Franciacorta Outlet Village

▲ Mantova Outlet Village

▲ Palmanova Outlet Village

▲ Franciacorta Outlet Village

▲ Mantova Outlet Village

▲ Palmanova Outlet Village

47 retail trends 2022

▼ Puglia Outlet Village Multi Corporation

Monica Cannalire Founder & Managing Director of Younicorn