CEO, Nash FintechX (Luxembourg)

CEO, SANZAF (South Africa)

Managing Partner, Metropolitan Law Firm (Nigeria)

Associate Dean, INCEIF University (Malaysia)

Founder, MCDGI CEO, Women on Boards (The Maldives)

Group Head, CORIS BARAK (Burkina Faso)

CEO, Ashab Consults (Nigeria)

Founder, E Tontine (Senegal)

Consultant, UNFPA (Cameroun)

28 08 18 36

CEO, Nash FIntechX - Luxembourg

Partner, Metropolitan Law Firm - Nigeria

CEO, Ashab Consults - Nigeria

04 02 04 06 17

CEO, SANZAF - South Africa

52

56

46

Founder, MCDGI – The Maldives

CEO, E Tontine - Senegal

05

Group Head, CORIS BARAK – Burkina Faso

68

Consultant, UNFPA - Cameroun

64

Associate Dean, INCEIF University -Malaysia

Women in Islamic finance: round pegs in round holes?

By Dr Aishat A. ZUBAIR

By Dr Aishat A. ZUBAIR

WiMAG: WiMAG:

WiMAG: WiMAG:

WiMAG: WiMAG:

Managerial Lessons for Women leaders

By WiMAG

By WiMAG

10

6 1 4 3 2 7 8 9 10 5

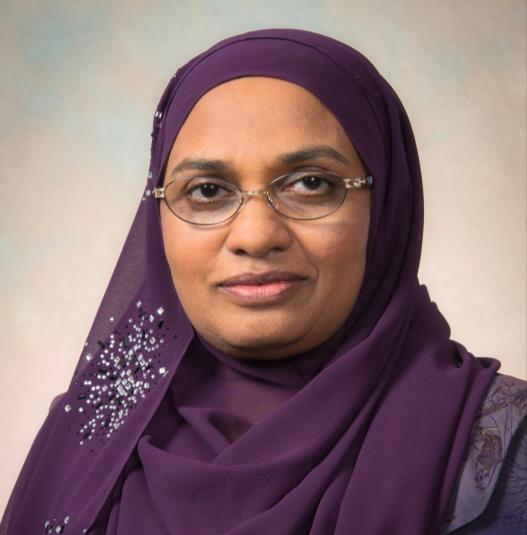

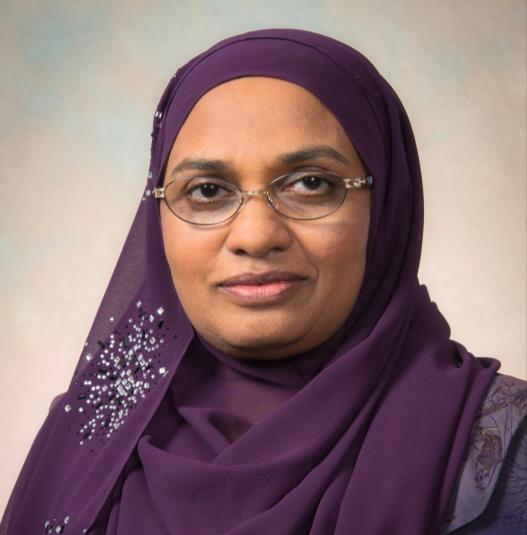

Yasmina Francke is the CEO of the South African National Zakah Fund (SANZAF), one of the largest and longest standing Zakah institutions in South Africa. She was appointed in 2018 as the first female CEO of the organisation. Before taking on this full time position, she served as a SANZAF Executive Board member for over 10 years in a voluntary capacity.

Yasmina Francke holds accreditation and qualification in Zakat Management, Islamic Finance, Social Sciences, Management and Marketing. She has over 25 years of experience in the corporate world, where she worked mostly in the Financial Services sector at a few top South African blue chip companies.

Yasmina is currently a Deputy Secretary General at the World Zakat Forum and has been a regular speaker at many international conferences, including the IFN Redmoney, BAZNAS Indonesia Winter School, as well as ILMA University In 2021, Yasmina was rated 17th amongst the 300 most influential women in Islamic Business and Finance by Cambridge IFA in their WOMANi Annual Report, followed by a recognition in 2022 by the same institution for WOMANi CEO for the Year 2022. She also achieved recognition for SANZAF, being conferred the Global Good Governance award for Capacity Building and Governance.

Yasmina FRANCKE

In South Africa, women's empowerment is a priority matter for the government and many resources have been made available to women to become financially independent. This also creates a greater awareness amongst women of the programmes they can tap into.

In the past, SANZAF was able to touch the lives of millions in need. This is because the organisation follows strict Shari'ah guidelines in ensuring that the beneficiaries' eligibility is established correctly and in a dignified manner so that both the donor and the beneficiary are protected and can fulfil their religious obligations.

My advice to the younger generation is always to seek knowledge and open yourself up for constructive criticism to grow and improve at what you do. I subscribe to the philosophy that dedication, consistency, passion and hard work DOES PAY OFF as long as you know exactly what it is, what you want to achieve and what impact you want to make, especially in the lives of others.

MetropolitanLawFirm

DCarbonX: Blockchain-based Carbon Market

Wish to acquire software to trade carbon credits and prevent greenwashing?

Salient features

▪ Interface to view all issued carbon credit/ offset certificates

▪ Primary and secondary market for trading of carbon credits

▪ Permanent digital record of issued certificates on the blockchain

▪ Primary market listing controlled by the organisation

▪ Helps to combat greenwashing

Learn more www.nashfintechx.com

Maldives Capacity Development and Governance Institute

Women on Boards

52

Fatou Kine Diop is an innovative entrepreneur who hails from Senegal. After working in e-commerce and being passionate about innovation, she decided to launch E-Tontine. Summarily, it consists of running digitally the age-long system of tontine*, which has been run mainly by and for women as a mutually beneficial financial empowerment scheme, particularly in Africa and Asia.

*In some communities, particularly in Africa and Asia, it is a customary practice whereby members periodically contribute a designated amount of money to a pool that each contributor can use in turn.

53

54

⁃ ⁃ 55

56

GROUPHEAD CORIS BARAKA

I advise resilience first and foremost because the road can be very long, but we always get there with the help of ALLAH. Furthermore, it will be necessary to show patience and persevere in the work well done…

09 MARCH 2023 09H30 - 12H30 www.eventsdexterity.com

MICRO-TAKAFUL AS A TOOL FOR PROTECTION AGAINST HEALTH-RELATED FINANCIAL RISK AND SOCIO-ECONOMIC INTEGRATION.

The case of the support project for maternal, newborn and child health (PASMNI) in Cameroon

1

F

32

PASMINI GRANT PARTICIPANTS CONTRIBUTIONS

PASMNI Grants

10% contribution to the funding awarded

MicroTakaful fund

Funding of Income Generating Activities (IGA)

Women who experienced Obstetric Fistula and VBG

Purchasing health vouchers for vulnerable pregnant women

Wakala Commission (12% of PASMNI grants)

Fund of Crédit du Sahel’s shareholders

10% contribution to the cost of the health care voucher

Vulnerable pregnant women

Creation of the MicroTakaful fund

Designation Micro-Takaful/PASMNI

Object

Targets

Area of intervention

✓ Coverage of health care costs for vulnerable pregnant women

✓ Quard hassan financing of IGAs for vulnerable women

6000 vulnerable pregnant women

300 OF & GBV women

11 Health Districts in Adamaoua, North and Far North

Nature of product Micro-Takaful through the Wakala agency model with Crédit du Sahel

Fees Members' contribution of 10% of the amount covered

• 04 ANC (prenatal consultations)

• Ultrasound,

• Childbirth,

Package of care covered

• CPON (Post-natal consultations)

• Complications related to pregnancy and childbirth + Caesarean section

• Transportation if possible

• Care for newborns and mothers for up to 42 days

Associations (poor pregnant women)

03 types of members

IGR women (OF and GBV women)

Donors (charity of non-beneficiary members)

➢ Reduced costs through grants for the purchase of health care vouchers

Benefits for members

➢ Access to IGA funding and follow-up by Crédit du Sahel

➢ Integration of pregnant women in networks of associations

-----

BANKING TECH

TAKATECH

WAQF TECH

ZAKAT TECH

HALALTECH

GREENTECH

WEALTH TECH

INCUBATION

TRAINING

MARKET INTELLIGENCE

SHARIA AUDITING

INNOVATION LAB

HACKATON & EVENTS

NETWORKING

By Dr Aishat A. ZUBAIR

By Dr Aishat A. ZUBAIR

By WiMAG

By WiMAG