By Sory TOURE

By Sory TOURE

SOUTH AFRICA

HALAL BUSINESS

THOUGHTS

FINTECH

Software Table of Contents Pages 04

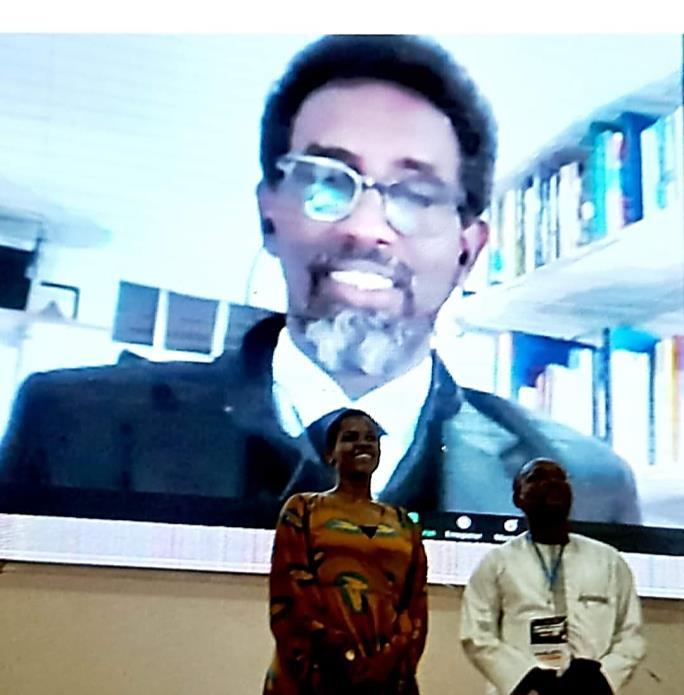

INTERVIEW Mohammed KATEEB President Middle East and Africa, Azentio

EDITORIAL

08 NEWS Updates on Islamic financein Africa and around the globe 12

Dr Ziyaad Mahomed Islamic Finance in South Africa: Time to Move Forward 22 12 18 What model of the rate of return on investments in the Islamic economy? ISLAMIC ECONOMY Dr. Adama DIEYE, Economist, Author

Lagassane OUATTARA Senior Investment Officer, IsDB The March towards the first Ivorian Sovereign Investment Vehicle

DIOUF President, Halal Sénégal Halal Certification in West Africa: Issues and Impacts on Free Trade among OIC Member Countries

Dénéba

2 IFC MAGAZINE - JULY 2022 28

Dr Ziyaad Mahomed

CEOA

80 SOCIAL FINANCE 38 Interview: Dr Umar Oseni CEO, International Islamic Liquidity Management Corporation ISLAMIC CAPITAL MARKET Some fundamental regulatory issues in Islamic finance 38 50 Analysis: Takaful Insurance as a Tool for Financial Inclusion 73 Abidjan Takaful Conference: Throwback 54ISLAMIC INSURANCE Understanding and implementing Islamic insurance 54 62 62 38 50 88 LIBRARY 89 AGENDA Interview : Ezzedine Ghlamallah 76 Dr Umar OSENI CEO, International

Liquidity Corporation (IILM) Boubkeur AJDIR 76 Ezzedine GHLAMALLAH 73 Maguette SAKHO What partnerships between Development Institutions and Zakat Funds to achieve the Sustainable Development Goals? 3 IFC MAGAZINE-JULY 2022

Islamic

Islamic finance is gaining momentum in Africa!

Dr Umar Oseni, IILM Corporation (Malaysia), asserts that "Africa stands to benefit from our drive to penetrate new markets for diversification benefits and scalability, which Africa is on our top priority list '' He is not the only one nurturing this ambition; Africa is of interest to several other financial institutions and industry players.

Africa is on the move! It is moving and growing, and so is Islamic finance Indeed, the Islamic finance industry in Africa is not yet as developed as in other parts of the world (Europe and Asia) Nonetheless, this should not overshadow the growing momentum that we have seen through numerous activities across the continent. Islamic finance is positioning itself as a viable and increasingly sought-after leverage to boost Africa's development.

Staying true to our vision of Connect Learn Impact, we bring you timely coverages on several sectors of Islamic finance in this second quarterly of IFC MAGAZINE.

In this vein, in an exclusive interview, Dr Umar Oseni, head of an international liquidity management organisation for Islamic financial institutions, talks about his experience and ambition with prospects for Africa Mr Boubkeur Ajdir's article on the Islamic capital market addresses some of the structural regulatory issues facing Islamic finance

To proceed, we are led into an eye-opening discussion on innovation and Fintech with their tremendous potential for Africa by Mr Mohammed Kateeb, President, Middle East and Africa, and Managing Director of Islamic Finance at Azentio Software, the first fully Islamic core banking provider (already present in Africa)

Dr Adama Dieye shares his expert view on the thorny issue of the rate of return on investments in the Islamic economy and the alternative to LIBOR, which has been used as a benchmark in many Islamic financial institutions Consequently, the Governor of the Central Bank of Bahrain, Mr Rasheed Mohamed Al Maraj, said on this matter at the 20th annual conference of the Shari'ah Board of AAOIFI (The Accounting and Auditing Organisation for Islamic Financial Institutions): "I believe it is time for the industry to try to address one of the strongest and most common criticisms from the public about the use of traditional benchmark rates for Islamic transaction pricing It is admittedly more complex and subtle than just using a money market reference price, but it is the right thing to do "

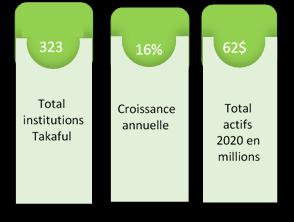

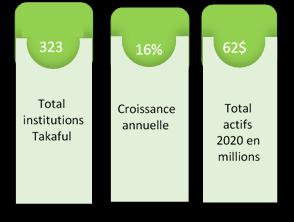

A focus on Islamic insurance will enable readers to understand this new industry that is evolving with a more inclusive value proposition that resonates with African cultures As such, Maguette Sacko sees Islamic insurance or Takaful as a vehicle for financial inclusion, which will de facto help improve the overall relatively low penetration rate of insurance Also included are the highlights of the Abidjan Takaful Conference 2022 forum entitled: Harnessing the Potential of Takaful for Economic Inclusion and Sustainable Development in Africa

The spotlight on South Africa comes from Dr Ziyaad Mahomed, who takes us down the history lane of the industry's development

Finally, this issue is packed with other articles and columns that we hope will benefit many. Given this general enthusiasm on the part of Islamic finance organisations and players, is there not a need for further actions and initiatives by all stakeholders to enhance synergy for the sustainable development of the industry?

Happy reading!

Editor-in-Chief

4 IFC MAGAZINE-JULY 2022

Editor-in-Chief sory.toure@dexterityafrica.com Managing Editor muhammed.jimoh@ dexterity-africa.com Editorial Secretaries Tenan tenan.soro@ dexterity-africa.com salomon.nouaman@ dexterity-africa.com Correction muhammed.jimoh@ dexterity-africa.com pefagneli.sanogo@ dexterity-africa.com Marketing and Sales publishing@ dexterity-africa.com Contributors Infographics yannickachille222@ gmail.com Published by Dexterity Africa Abidjan Côte d’Ivoire Contacts Tel +225 27 22 558 120 Email: publishing@dexterity-africa.com 5 IFC MAGAZINE-JULY 2022 Previous Issue

There is no doubt that Islamic social finance has the potential to achieve human development through financial inclusion and shared prosperity. In order to unlock the full potential of it, there is need to understand the challenges we face in the world in the implementation of it.

In Islamic banking, there is no black box that needs a genius to unwind it. Many of these conventional products that have been under stress lately are very complex and need special risk management tools. In Islamic banking, you will not have this kind of thing. Some of these products would not be sharia accepted.

6 IFC MAGAZINE-JULY 2022

Islamic finance can, in principle, become a factor of financial stability because risk-sharing reduces the debt ratio, and the exchanges are backed by tangible assets and therefore fully guaranteed.

All that we had borrowed up to 1985 or 1986 was around $5 billion and we have paid about $16 billion yet we are still being told that we owe about $28 billion. That $28 billion came about because of the injustice in the foreign creditors’ interest rates. If you ask me what is the worst thing in the world, I will say it is compound interest.

7 IFC MAGAZINE-JULY 2022

In her capacity as President of the National Accounting Council (CNC), Nadia Fettah Alaoui, the Moroccan Minister of Economy and Finance, has authorized, through a ministerial decree, the amendment of the accounting plan on insurance to take into account the entry of Islamic insurance (Takaful) in the market This amendment, following the introduction of Takaful, aims to support the sharp growth of the participatory finance sector in the country The amendments to the accounting plan will take effect from the date of publication of the decree of the Minister of Economy and Finance amending and supplementing the decree of the Minister of Finance and Privatization No 1493-05 of 20 October 2005 on the accounting plan for insurance

their needs for efficient care. Also, in a win-win type of partnership and through ADM, PROMISE intends to promote its actions and innovative products to a segment of the population that does not have access to conventional financing

The Islamic Microfinance Development Programme in Senegal (PROMISE) and the Municipal Development Agency (ADM) signed a partnership agreement on 15 June 2022 for five (5) years. The signing ceremony was attended by Ms Fatou Diané, Coordinator of PROMISE and Mr Cheikh Issa Sall, Director General of ADM By entering into this partnership, PROMISE's objective is to benefit from ADM's expertise and experience to be able to quickly reach vulnerable communities and identify

Organised by the Ministry of Planning and Development with the aim of mobilising the resources necessary to finance the 2021-2025 NDP (National Development Planning), the Consultative Group, which convened on 15 June 2022 at the Sofitel Hôtel Ivoire, Abidjan, brought together all the country's bilateral and multilateral financial partners Among the main actors present at this high-level gathering was the Islamic Development Bank (IsDB), which announced through its Vice-President in charge of operations, Mr Mansur Muhtar, the disbursement of USD 2 billion for the financing of the NDP It should be noted that the financing intentions gathered from the various partners were evaluated at more than francs CFA 15,000 billion against the expected francs CFA 9,335 6 billion, i e , a mobilisation rate of a little over 168%. The success of this Consultative Group is real hope for the Ivorian authorities as regards the effective mobilisation of the resources planned for the implementation of the 3rd NDP The objective of the latter is to achieve the economic and social transformation necessary to raise the country, by 2030, to the rank of upper-middle-income countries.

NEWS

The

❖ $70 billion spent on cosmetics ❖ $100 billion spent on pharmaceuticals ❖ $231bn in media expenditure ❖ $102 billion spent on tourism ❖ $295bn spent on Modest Fashion ❖ $1270 billion in food expenditure ❖ + USD 2,000 billion in total expenditure in 2021 ❖ 8.9% growth in 2021 8 IFC MAGAZINE-JULY 2022

State Global of the Islamic Economy Report in 2021 (SGIER, 2022)

The National Shipping Company of Saudi Arabia (Bahri) has announced the issuance of a Corporate Sukuk. Denominated in Saudi riyals (SAR), the value of this Sukuk, to be determined by market conditions, is estimated at SAR 3.9 billion. Launched on 16 June, the subscription period for the offer runs until 21 July 2022 Subscription to the offer is reserved explicitly for institutional investors as defined by the regulations of the Capital Market Authority (CMA) The offer has a nominal coupon value of SAR 1 million and a maturity of 7 years Al Rajhi Capital, HSBC Saudi Arabia, and SNB Capital were retained to arrange the subscription operations.

The Malaysian bank Muamalat, on Tuesday, 24 May 2022, launched its first Shari’ah-compliant digital gold investment platform allowing customers to invest in gold via mobile quickly. The application, called EasiGold, deployed in collaboration with ACE Capital Growth, aims to promote gold as a safer investment alternative for the public in the face of economic uncertainty According to Zury Rahimee Zainal Abiden, head of the retail banking division, the platform is open to the bank's customers and to people interested in investing in gold The platform is expected to attract up to 350,000 customers within 12 months. The platform also offers a real-time gold price display that allows customers to buy and sell London Bullion Market Association (LBMA) certified 999 9 purity gold at spot prices

On 23 May 2022, a Memorandum of Understanding (MoU) was signed to strengthen collaboration on the free trade zone in Azerbaijan. The signatories of this MoU are The Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of the Islamic Development Bank (IsDB) Group and the Alat Free Economic Zone Authority (AFEZA), the authority in charge of regulating investments in the Alat Free Economic Zone The agreement was signed at the ICD headquarters by Mr Ayman Sejiny, CEO of ICD, and Mr. Valeh Alasgarov, CEO of AFEZA. On the one hand, the agreement will enable ICD to meet the growing demands of companies registered with AFEZA by providing them with access to a diversified source of financing On the other hand, both parties agree to explore the possibility of organising joint activities to promote AFEZA to the member countries of the Organisation of Islamic Cooperation (OIC). The MoU will also enable both parties to collaborate and conduct joint consultations to develop specific instruments to achieve the common goals It should be noted that the ICD is a multilateral development finance institution established in November 1999 With a capital of USD 4 billion, its aim is to foster sustainable economic growth in the 55 member countries

Digital financial platform Marhaba DeFi Network (MRHB) has launched the world's first Shari'ahcompliant certification of Non-Fungible Tokens (NFTs) The initiative will bring more transparency to the process of certified companies as it gives them the ability to prove to customers the Shari'ah compliance of their business practices. This certification aims to gain acceptance over time for the use of certain crypto-currencies whose Shari'ah compliance is still a matter of controversy among scholars of Muslim business law With this new development, MRHB's intention is to make the most of the resources of the Islamic economy in crypto-currencies

ICIEC (Islamic Corporation for the Insurance of Investment and Export Credit), and IFTI (International Federation of Islamic Takaful and Insurance Companies), signed a Memorandum of Understanding (MoU) on 22 May 2022 in Saudi Arabia to boost the Takaful insurance sector.

The signing of the MoU was done in the presence of Mr Oussama Kaissi, Director General of ICIEC, and Mr Reda Amin Dahbour, President of IFTI The main objective of the agreement is to promote Takaful and to help IFTI member institutions provide the best solutions and services by building the technical capacity of the Islamic insurance workforce Established in 1994, ICIEC remains the world's only multilateral Shari'ah-compliant insurer providing a full range of insurance solutions to corporate and individual customers in all 48 member states

9 IFC MAGAZINE-JULY 2022

Islamic Finance Intelligence

THE WEEKLY

Every week, understand the dynamics of Islamic finance markets in Africa and around the world and seize new opportunities.

Français - English THE FIRST AFRICAN NEWS MAGAZINE ON ISLAMIC FINANCE News-Analysis-Surveys-Interviews Reports-Trends-Coverage-Features PROMOTE YOUR ORGANISATION OR INSTITUTION THROUGH OUR SERVICES: ADVERTISING, REPORTING, PARTNERSHIPS AND SPONSORING. THE QUARTERLY

Islamic Finance in South Africa

With

Mahomed Dr. Ziyaad

13 IFC MAGAZINE-JULY 2022

Islamic Finance in South Africa: Time to Move Forward

MILESTONES

IslamicBanking

As a country made famous for its unique landscape, significant mineral wealth, and tumultuous history of apartheid, South Africa has remained a bastion of sophisticated financial services and stringent financial regulation in Africa. Islamic finance has also gained a firm foothold in the country, serving a minority Muslim community of less than 3% of the population or 1.8 million adherents. South

IIslamic banking in South Africa was off to a shaky start, stumbling over its first effort, Jaame Limited, launched in 1980 and liquidating due to financial challenges soon after. Unfortunately, the second effort also ended in disaster, providing a unique case study for academics for decades to come (only a handful of Islamic banks have ever collapsed internationally). Islamic Bank Limited was granted banking status in 1988, failing 9 years later and leaving a trail of tears, distrust,

14 Outlook

.

(+-USD500 million) in 2021. Growth in the sector was sluggish until 2003, when First National Bank (FNB) began offering Shari'ah-compliant motor vehicle finance through Wesbank. FNB launched the first Islamic banking window in the country in 2004, followed by Islamic windows at HBZ Bank in 2005 and ABSA in 2006. Standard Bank (the largest bank in Africa) launched its South African Islamic banking offering in 2016 but was already active in Tanzania and Nigeria much earlier.

By June 2020, BASA (Banking Association of South Africa) reported that Islamic deposits stood at ZAR37 billion, up from ZAR 23 billion in December 2018; and Islamic Financing reached ZAR14.6 billion (Al Baraka contributed approximately ZAR8 billion (Islamic bank window data was not available), an increase of ZAR4 billion from 18 months earlier.

Takaful

An essential service supporting asset finance is asset cover, though conventional insurance is impermissible in Islamic law. Takafol South Africa offered the country's first Shari’ah-compliant asset protection in 2005. Since no Islamic insurance regulation exists, the company operated under the Short-Term Insurance Act through a unique Shari'ahcompliant model integrating Wakalah (agency) and Waqf (endowment). Several takaful offerings are now available in the country. The most significant recent announcement was the launching of Shari'ahcompliant medical aid by the largest medical insurance provider in the country: Discovery Health (launch expected in June 2022). By 2020, total Takaful contributions were estimated at ZAR145 million, with approximately 6,500 participants nationwide.

IslamicAssetManagement

Shari'ah-compliant asset management has also blossomed in South Africa, first introduced in 1992, then with Oasis Asset Management in 1997, and the Futuregrowth Al Baraka Equity Fund in 2003. By 2021, 25 Shari’ah-compliant domestic general equity sector funds, balanced funds, and property funds have been established. Shari'ah Compliant Unit Trusts managed over ZAR35 billion in assets in 2020.

Sukuk

The South African Sukuk market is underdeveloped, unlike its African neighbours like Nigeria and The Gambia, which have issued several sovereign and corporate issuances. However, the National Treasury did issue a USD500 million Sukuk in 2014 and Al Baraka issued the first corporate Sukuk in 2018 (ZAR200 million).

Regulation

No specific Islamic finance regulation exists in South Africa and Islamic Financial Institutions operate under conventional licenses. However, Section 24JA of the Income Tax Act No 58 of 1962 was introduced in 2010, recognising diminishing Musharaka, Mudharaba, Murabaha, and Sukuk. Other amendments to Value Added Tax (VAT) and the Transfer Duty Act (No 40 of 1949) brought relief for any double taxation arising from first sale purchases for Islamic banks. The impact facilitated better parity between conventional and Islamic banks, effectively lowering costs for customers.

Outlook

sur l'impôt sur le revenu (Income Tax Act) n° 58 de 1962 a été introduite en 2010, reconnaissant la diminution des musharaka, mudharaba, murabaha et sukuk. D'autres amendements à la taxe sur la valeur ajoutée (TVA) et à la loi sur les droits de transfert (n° 40 de 1949) ont permis d'alléger toute double imposition découlant des achats à la première vente pour les banques islamiques. Ces modifications ont permis d'améliorer la parité entre les banques conventionnelles et les banques islamiques, réduisant ainsi les coûts pour les clients.

Défis

Après plus de 30 ans de finance islamique dans le pays, des défis importants subsistent. Les produits et services ont été centrés sur les structures bancaires de base fondées sur le partenariat et la dette, les banques islamiques ayant opté pour une approche plus conservatrice de l'innovation. Le marché local a eu des difficultés à se développer, et certaines de ces difficultés ont été élaborées davantage:

proposées en Indonésie (BMT), au Soudan ou au Bangladesh n'ont pas encore pénétré le marché sud-africain.

- Le Life Takaful est un instrument populaire à l'échelle internationale, mais il n'est pas disponible en Afrique du Sud.

- Il existe peu ou pas de produits de financement personnel.

- Aucun Sukuk souverain libellé en Rand n'a été émis dans le pays, et un seul Sukuk d'entreprise a été émis, alors que des pays africains moins matures ont établi des marchés de Sukuk.

- Le renforcement des capacités est faible, ce qui se traduit par la gamme de produits limitée et restreint également l'innovation.

- Les conseils de la charia dans le pays sont dominés par une poignée d'érudits de la charia connectés depuis l'introduction, ce qui contribue potentiellement aux défis auxquels l'industrie est confrontée. La plupart des érudits qui occupent des postes dans les conseils de la charia ont peu ou pas d'expérience en finance.

- La communauté musulmane sud-africaine a une compréhension limitée de la finance islamique.

- Le développement de stratégies de durabilité axées sur la finance islamique est limité, voire inexistant.

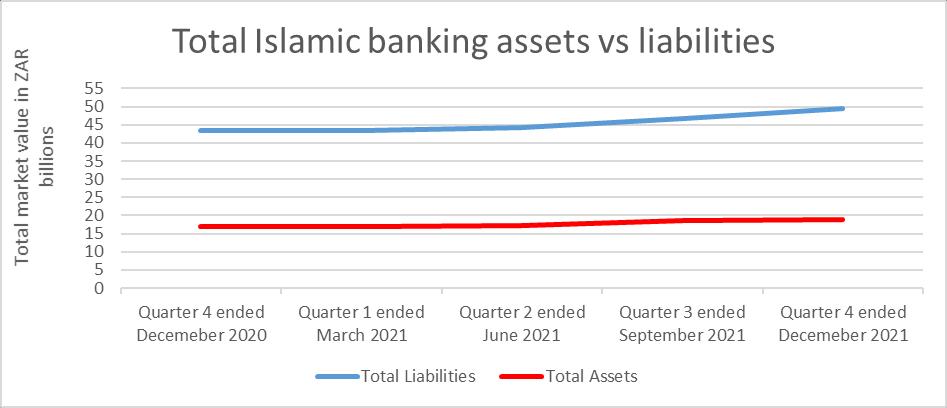

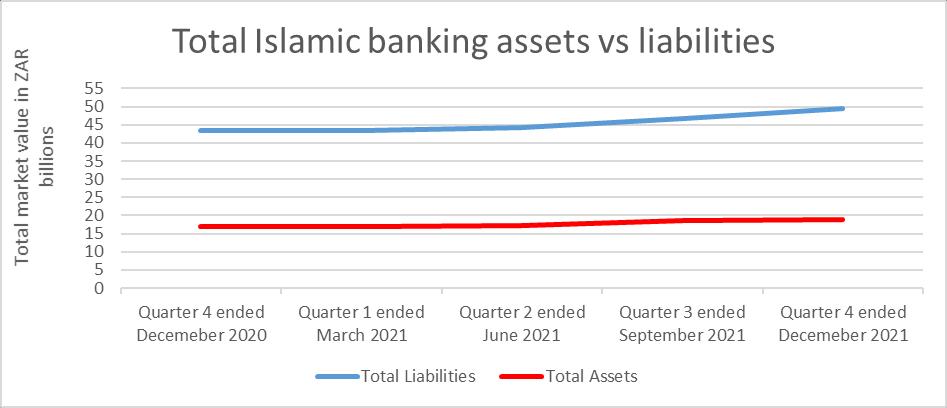

Figure 1: Total des actifs et passifs bancaires islamiques pour 2021

Source: BASA (2021)

- Les excédents de liquidités ont été particulièrement difficiles à gérer en raison du nombre limité d'instruments de trésorerie conformes à la charia. L'inadéquation entre l'actif et le passif a continué à se creuser en 2021 (voir figure 1).

- Les produits destinés aux micro et petites entreprises ont été limités, et les solutions de microfinance islamique holistiques comme celles

Allerdel'avant

Les solutions de finance islamique offrent des avantages significatifs par rapport à leurs homologues conventionnels car elles contribuent à l'édification d'une nation juste, éthique et morale. Les IFI sud-africaines ont progressé.

16 IFC MAGAZINE-JUILLET 2022 Outlook

untapped broader South and Southern African community are mostly unaware of the advantages of Islamic finance. For South Africa to move to the next stage of Islamic finance development, significant introspection is required. This begins with Islamic corporate value intent based on the Maqasidic approach (Islamic legal objectives), firmly rooted in socioeconomic empowerment, promoting an entrepreneurial mindset, and building a sustainable and responsible industry. With external exposure, practitioners may recalibrate and expand the sector, whilst Shariah Boards must diversify and develop through international capacity. Existing regulation

requires substantial revision if Islamic finance is to grow, broadening the product dispensations, removing barriers to Sukuk issuance, and assuring tax certainty. Providing an enabling environment for Islamic fintech solutions may be significantly advantageous as established IFIs may reach an untapped market through fintech incubation and collaboration. The South African Islamic finance sector has made significant strides since it stumbled in the 80s and 90s and has supported a minority Muslim community effectively in the past. It is time to move forward.

17 IFC MAGAZINE-JULY 2022

Outlook

Halal Certification in West Africa: Issues and Impacts on Free Trade among OIC Member Countries

The problem

The trade of Halal products has entered a phase of unprecedented growth in recent years. It has recorded a growth of 25% with a portfolio of more than US$3.6 trillion, with one-third of this amount coming from Halal food products, and forecasts of more than 40% growth in the next five years.

In a context where multilateralism is stalling, the rush toward regional and bilateral trade agreements is increasing. Especially since the unconditional supporters of multilateral agreements, the United States and Japan, have abandoned their initial reluctance. As a result, a new era of economic partnership agreements has opened up.

Today, it must be acknowledged that the Organisation of Islamic Cooperation (OIC) member states are not left behind. Their regional economic integration is again on the agenda

agenda through implementing the Protocol on the Preferential Tariff Scheme (PRETAS) for the Trade Preferential System (TPS) among the OIC member countries. The TPS is an appropriate way to achieve the free trade area project to open a new era in trade cooperation among Islamic countries, particularly in sub-Saharan Africa.

The Halal production industry is probably one of the most dynamic in the world. The partnerships with

From a niche market to a mainstream market, halal is going global

18 IFC MAGAZINE-JULY 2022

African Muslim countries are often more dependent on interstate affinities in bilateral cooperation and assistance rather than the private sector's economic opportunism based on the strengths of a sustainable business relationship. Yet the African continent offers resources in terms of human capital, inputs, raw materials, and development opportunities that could form the basis of a new attractiveness for several other countries of the Organisation of Islamic Cooperation (OIC).

Challenges

SMEs play an essential role in all economies as they drive growth,

generate employment, generate employment and raise living standards. As far as women are concerned, they can achieve economic empowerment if their SMEs receive support. It is estimated that 500 million new jobs will be created by 2030. A significant proportion of these jobs will be in the Organisation of Islamic Cooperation (OIC) member countries, where 60% of the population is under 30 years of age. Supporting SMEs/SMIs in West Africa by taking on the responsibility for standardisation and certification could be an excellent vector for growth.

While many market sectors are experiencing increased saturation and competition, the halal sector in West Africa, as elsewhere in the world, is evolving. The sector brings about new opportunities and rules and gives agile and enterprising SMEs the chance to connect with this new market.

19 IFC MAGAZINE-JULY 2022

It is estimated that 500 million new jobs will be created by 2030. A significant proportion of these jobs will be in the Organisation of Islamic Cooperation (OIC) member countries.

However, the halal sector poses its own challenges that newcomers may encounter: different ways of interpreting religious rules, different standards, and constantly changing regulatory frameworks. By shedding light on these issues, West African countries (a market of about 250 million consumers) will be able to implement a sub-regional strategy on halal business to accompany the actors and raise the level of trade within the OIC countries.

Opportunity and Impact

The adherence level of the governments of the OIC member countries in West Africa and their understanding of the halal sector as well as institutional capacity building within the halal sector is a crucial factor for success.

The primary role of a Trade and Investment Assistance Institution (TII) such as the Islamic Centre for the Development of Trade is to promote and facilitate trade, finding ways to connect businesses with potential buyers. Trade exhibitions like the World Halal Summit are well-established and proven venues. Similarly, halal food and beverage fairs have become a significant player in the industry over the past decade. Initiatives that help companies from the same country to come together to exhibit their products in a joint stand are helpful. However, the benefits of these gatherings can be maximised

The choice of standards that a manufacturer decides to adopt and the certifying body to issue the certificate of conformity must be carefully considered, especially when exporting to West Africa.

West African manufacturers who are serious about successfully entering the market need to

keep abreast of discussions and decisions taken at national, regional, and international levels regarding halal compliance and quality. Exporters do not want to find themselves, as in the past, with whole containers ready to be shipped but whose goods are no longer considered halal by the authorities of the importing country.

Priority and favourable areas for halal business entrepreneurship in West Africa

Agribusiness and the tourism economy have been identified as essential growth sectors for halal business in relation to the economic development policies of WAEMU and ECOWAS countries.

Perspectives

• Anchoring the dynamism and innovation of SMEs/SMIs in West Africa in the growth policies of OIC countries as well as in their current priorities in terms of job creation among youth and women;

• Harmonising the halal standard in West Africa and creating national, sub-regional, and intra-Umma strategic alliances to penetrate large markets and be competitive;

• Establishing a sub-regional strategy on Halal business and an Observatory of the Halal market's evolution in West Africa.

20 IFC MAGAZINE-JULY 2022

Islamic

Economics

By

DIEYE

What model of the rate of return on investments in the Islamic economy?

The announcement made in July 2017 by the Director-General of the UK's Financial Conduct Authority (FCA) that the market needs to abandon LIBOR as an interest rate benchmark by the end of the year has reignited the issue of determining benchmark rates for economic and financial transactions in the Islamic economy. The announcement by the Financial Conduct Authority was accompanied by proposals to replace LIBOR with what was termed "backwards-looking overnight riskfree rates" (i.e. the Secured Overnight Financing Rate (SOFR) for USD transactions and the Sterling Overnight Index Average (SONIA) for GBP transactions). Generally speaking, the approach raises essential practical and methodological issues, to which must be added, for Islamic finance institutions, the Sharia issues involved in determining a risk-free rate. Indeed, IBORs (Interbank Offered Rates) are "forward" rates, which means that the rates are fixed and publicly available at the beginning of each calculation period. In contrast, RFRs are overnight rates, and - at this stage - the market consensus is that a forward rate can only be produced on a "backwardslooking" basis, meaning that an RFR would be determined based on historical data at the end of each calculation period. This would result in uncertainty about the price of a transaction, which according to Sharia rules, must be determined when a

service is agreed upon, or an actual transaction occurs.

In this context, it appears that it is time for the Islamic financial system to abandon conventional reference rates and instead establish an alternative reference rate consistent with Shariah principles.

From a broader perspective of the Islamic macroeconomic framework, due to the prohibition of fixed and predetermined income (such as interest rates), the determination of a rate of return that compensates the owners of public or private assets (or even both) has created a central issue that has quickly captured the attention of Islamic economic scholars and practitioners. The issue goes beyond the financial sphere to include aspects of macroeconomic policy design. In this regard, Askari et al. (2014) show that an increase in the rate of return on investment would lead to an increase in investment spending, which would result in an increase in aggregate demand and, consequently, desired output levels. The availability of this indicator makes it possible to incorporate medium- and long-term economic growth considerations into the technical work through the specification and estimation of a longterm relationship that positively links gross domestic product (GDP) to the rate of return on investment in the real sector of the economy (Dieye, 2020). Among these pioneering works is the work of Khan and Mirakhor (1989).

They established that the rate of return on financial assets is determined by the rate of return on the real sector of the economy that serves as a benchmark for investment decisions. Several approaches have been widely discussed at the macro and sectoral levels, ranging from simple ratios to more complex market indices. One method suggested by Haque and Mirakkor (1999) would be to estimate the overall rate of return based on the market index return on capital in well-developed financial markets.

However, for many other developing countries, financial markets are not sufficiently developed and do not allow the use

IFC MAGAZINE-JULY 2022 24

Islamic Economics

From a broader perspective of the Islamic macroeconomic framework, due to the prohibition of fixed and predetermined income (such as interest rates), the determination of a rate of return that compensates the owners of public or private assets (or even both) has created a central issue that has quickly captured the attention of Islamic economic scholars and practitioners.

of this method. In practice, these limitations have motivated the use of an alternative (Bai Chong-En et al. 2006) to estimate a rate of return on capital as a proxy for the rate of return on investment in the real sector (Dieye, 2020).

Recent literature has suggested using indicators referring to the economic growth rate, the producer price index, the bank profit rate, and even the Zakat collection rate.

Undoubtedly, much more theoretical analysis and empirical validation will be needed.

IFC MAGAZINE-JULY 2022 25

Islamic Economics

Lagassane Ouattara

Senior Investment Officer Islamic Development Bank

The March towards the first Ivorian Sovereign Investment Vehicle

Stage 2 : Mobilisation of Resources

The conceptual foundations of the first Ivorian sovereign fund were laid in a previous article This fund will position itself as the operational leverage of the State's policy to acquire stakes in the private sector. In this article, we propose analysing the possible financing channels that will enable the fund to be endowed with significant financial resources commensurate with its ambitions

The financing of the strategic fund will have to be based on resources from various sources outside the state budget. The aim is to use under-exploited funds that do not fit into the traditional budget financing channels to make them yield a profit through profitable investments. In this regard, the different types of resources to target are the following:

recently set up, will undoubtedly play a fundamental role in centralising these resources, part of which could be allocated to the sovereign wealth fund. The fund managers will be saddled with the responsibility to make them grow. Collaboration can be envisaged in which the CDC centralises the reserves of the various social security funds and the regulated deposits to transfer them to the sovereign fund for profitable investments.

In short, the State of Côte d'Ivoire has several non-budgetary financing channels to endow its future sovereign fund with the resources necessary for its proper functioning

•

Mining

and oil revenues: The revenues collected by the State within the framework of the mining and oil codes are a potentially substantial source of financing for the sovereign wealth fund; in exchange for the awarding of mining permits, the State benefits from a 10% share in the capital of each operating company. In the oil sector, this share varies according to the terms and conditions of each contract. In addition, operators are required to pay, where applicable, taxes on additional profits (superprofit).

• Coffee and cocoa marketing royalties : Part of the royalties paid by coffee and cocoa exporters to the State (excluding the Single Exit Duty, which is an essential component of the state budget) can also be used to finance the Sovereign Wealth Fund effectively.

• Reserves of social security funds and regulated deposits: This category includes, among others, the reserves of pension funds (CNPS, CGRAE, among others), the sums received by judicial administrators and judicial representatives, as well as the accounts of third parties deposited with notaries. The Caisse des Dépôts et Consignation (CDC), which was

• Initial lump sum contribution from the government of Côte d'Ivoire: Although the Strategic Fund does not envisage using direct resources from the government budget to finance its investments, a lump sum contribution from the government will be necessary at the start of activities to cover the operating costs of the first few years (fitting out of offices, logistics, office supplies and equipment, payroll, to mention but a few).

Lagassane Ouattara works at the Islamic Development Bank as a Senior Investment Officer He is involved in private sector financing operations in the institution's member countries, which are spread over various continents, including Africa, the Middle East, Central Asia, Latin America, etc In addition to his professional activities, Lagassane regularly produces thoughts on economic and financial subjects, which are published in renowned magazines such as Jeune Afrique and Tycoon

26 IFC MAGAZINE-JULY 2022

Interview

Mohammed Kateeb 29 IFC MAGAZINE-JULY 2022

30 IFC MAGAZINE-JULY 2022

MohammedKateebisanestablishedleader,knownforbeingresults-driven, dynamicandhighlyentrepreneurial.Hehasadiverseexperiencein buildingbusinesses,teamsandidentifyingandcapitalizingonmarket opportunitiesforover30yearsintheUSA,UKandtheMiddleEast.Heiscurrently leadingtheregionalstrategy,commercialoperations,productandbusiness growthforAzentioSoftwareacrossMEA,advancingitspositionasaninnovative industryleader.BeforejoiningAzentio,KateebwastheGroupChairman&CEOof PathSolutions,focusedongrowingthecompany'stop-linegrowthtowininthe complexmarketplace.Previously,Kateebhasspent11yearsasanexecutivewith Microsoft.Heisalsoknownasakeycontributortotheregion's Telecommunication,MediaandInformationTechnologyindustry.Kateebwas recentlyselectedasaco-chairoftheGeneralCouncilforIslamicBanksand FinancialInstitutions(CIBAFI)InnovationandTechnologyWorkingGroup(ITWG) fortheyear2021-2022.TheITWGispartoftheapprovedCIBAFI'sStrategicPlan 2019-2022whoseobjectiveistoconductvariousinitiativeswiththeaimof strengtheningtheadoptionoffinancialtechnologieswithintheIslamicfinancial servicesindustry.Currently,heistheBoardDirectorofiPORTALandFaster Community.HealsoservedasamemberoftheBoardofTrusteesofIsDBI,an affiliateoftheIslamicDevelopmentBankGroup(IsDB)thatfocuseson developingatechnology-enabledIslamicfinancialservicessectorleveraging state-of-the-arttechnologytomainstreamIslamiceconomicsandfinance knowledge.Kateebwaspresentedwiththe'Fintech LeaderofTheYearAward'at FintechLeadershipPrize2021andthe'FinancialServicesTechnologyLeadership Award'attheMEAFinanceBankingTechnologyAwards2021.Apartfrom receivingthe'IslamicFintechLeaderoftheYearAward'ofFINTECHPRIZEin2020, hewasalsoselected'BankingTechnologyPersonalityoftheYear'attheBanktech Award2021and'BestTechnologyExecutiveoftheYearforFinancialServices'at theMEAFinanceAwards2020.Winnerofthe‘2018GIFAAdvocacyAward(Islamic FinancialTechnology)',Kateebwaschosenthesameyearamongthe'Leadersof IslamicEconomyinEastAfrica',andin2017hewasgrantedtheprestigious 'LeadershipAwardinInformationTechnologies&Media'byISFIN,namedfive timesamongthe'Top50MostInfluentialLeadersWhoMaketheIslamicEconomy' inISLAMICA500.Kateebisalsotherecipientof'FinanceMonthly–CEOAward 2018',andrecognized'GamechangeroftheYear(IslamicFintech)'inACQ5Global Awards2021,2019&2018,honoredbyIFFSAwiththe‘2016HonoraryLeadership Award',namedamongthe'Top10CEOsinEnterpriseSoftware'inthe2016/17CEO InsightGlobalAwards,inadditiontobeingselectedtwicein2018&2017'Best IslamicFinanceTechnologyCEOoftheYearEMEA'byGlobalBanking&Finance Review,aswellas'IslamicFinanceTechnologyCEOoftheYear2015'byBusiness Worldwidemagazine.Kateebisalsoaregularspeakerandhaskeynotedatmany internationalconferencesonthesubjectofITtrendsintheglobalfinancial servicesindustry,andisanactivememberoftheIslamicfinancecommunity. Furtherinfoisavailablehere:https://www.linkedin.com/in/mohammedkateeb/

31 IFC MAGAZINE-JULY 2022

It is our pleasure to interview one of the most important leaders in the emerging world of fintech, particularly in the Islamic financial services sector, Mohammed Kateeb, President, Middle East & Africa and Global Head of Islamic Banking at Azentio Software.

Mr. Kateeb, when it comes to Islamic banking and fintech, the industry is undoubtedly gaining momentum but facing unique challenges. As an expert, tell us your strategies to successfully sail through them.

Thank you for this opportunity. The last couple of years have rocked the financial world with an explosion of technological innovation mainly due to the pandemic which forced an unprecedented level of channel switching to address changes in customer behavior and expectations. At the heart of all these changes, financial technology or fintech which has pushed traditional financial institutions to keep up with the digital revolution and prioritize the needs of their customers.

As you know, the Islamic banking industry is heavily burdened with regulations and restrictions. Many Islamic banks in this part of the world still have a long way to go to be on par with conventional banks due to regulatory limitations and concerns. Nonetheless, we have seen some Islamic banks being true pioneers in relation to how they utilize these evolving technologies to meet customers demands like never before.

With more Islamic financial institutions adopting the new technologies, they too can see similar success and growth to what has been experienced by their counterparts. The outlook seems very favourable, given the strategic intents of various governments in the region to either transforming to Islamic fintech hubs or sustaining their position as Islamic financial hubs.

Azentio Software has a proven track record helping Islamic banks with their digital transformation. We empower the Islamic finance community with flexible and innovative Sharia-compliant software products that are specifically designed to improve customer experiences to compete in the digital age.

We are now in the post-pandemic era going through unprecedented and profound changes. How can digital trends in Islamic finance be effectively utilized to overcome the economic damage caused by the pandemic?

Several studies showed that Islamic finance is not only capable of weathering the economic consequences of the pandemic but it also has the potential to emerge as a successful alternative financial system. It can challenge the conventional banking system dominance. The current pandemic has provided another opportunity for Islamic finance to prove its potential and shine. The digital disruption is prompting Islamic banks to accelerate their digital strategy - though each at its own pace - with a vision to create a resilient and competitive sector.

THE CURRENT PANDEMIC HAS PROVIDED ANOTHER OPPORTUNITY FOR ISLAMIC FINANCE TO PROVE ITS POTENTIAL AND SHINE.

As one of the industry veterans, what does it take to understand banking customers today?

Financial institutions worldwide are using the wide array of advanced research and scientific tools available today to give them a big competitive advantage in generating insights that lead to new organic growth. Consumer Behavioral Science plays a key role in understanding customers' behavior, lifestyle, and preferences. The classic general segmentations that

32 IFC MAGAZINE-JULY 2022

the banks have utilized over the years will not be good enough to keep their customers satisfied. Banks need to collect a tremendous amount of data about their customers through various channels, analyze this data, recognize patterns of behaviour, and use it strategically to deliver products and services that suit their needs. Their main objective is to understand how they can drive growth by meeting customers' individual needs. Getting to this level of understanding about what customers really want from their banks requires the ability to understand what motivates them and how they make decisions deeply. Banks that identify those needs are best suited for attracting new customers, which, in turn, leads to new growth opportunities.

Whether Islamic finance is a catalyst for inclusive growth and sustainable development is not as straightforward as one may hope. While the inherent features of Islamic finance confer several advantages, the full potential of a complete Islamic economy has yet to be realized.

For Islamic finance to reach there requires significant improvements in awareness level, capacity building, standardization, risk management practices, regulatory oversight, tax treatment, and insolvency frameworks.

Can Islamic finance spur inclusive growth and sustainable development?

THE CLASSIC GENERAL SEGMENTATIONS THAT THE BANKS HAVE UTILIZED OVER THE YEARS WILL NOT BE GOOD ENOUGH TO KEEP THEIR CUSTOMERS SATISFIED.

33 IFC MAGAZINE-JULY 2022

Azentio recently deployed a BI solution at a Kenya-based bank. What is the relation between business intelligence and decision-making?

Right, Gulf African Bank in Kenya (GAB) went live with Azentio's Business Intelligence solution. This implementation will provide the bank with a cutting-edge solution that utilizes analysis techniques, ratios, formulas and computation procedures to measure and monitor the GAB's online performance and profitability in real-time. The ultimate goal of this project is to drive better business decisions that enable the bank to increase revenue, improve operational efficiency and gain competitive advantages over local and regional banks. When our customers implement our Intelligence platform, the objective is directly related to the importance of using the data strategically internally to enhance the efficiency of the bank's operations and externally to deliver superior products and services to GAB customers. It is important that every decision in the bank is based on data with the objective of becoming a datadriven organization.

What is Azentio's vision for advancing Islamic banking in Africa?

Africa's fast-growing population and markets present ample opportunities for us in an environment of slowing global growth. It is one of our key focus markets. We have the market knowledge and the skills to serve our African clients. Leveraging Islamic fintech and innovative digital technologies can provide a comparative advantage, especially for expanding outreach to the unbanked/remote communities and reducing the cost of financial intermediation.

THE ULTIMATE GOAL OF THIS PROJECT IS TO DRIVE BETTER BUSINESS DECISIONS THAT ENABLE THE BANK TO INCREASE REVENUE, IMPROVE OPERATIONAL EFFICIENCY AND GAIN COMPETITIVE ADVANTAGES OVER LOCAL AND REGIONAL BANKS.

34 IFC MAGAZINE-JULY 2022

Muhammed JIMOH, IFC MAGAZINE

ADVERT COVERAGE ANNOUNCEMENT

Islamic Capital Markets

Dr. UMAR OSENI

International Islamic Liquidity Management Corporation (Malaysia)

Our interest in Africa remains strong, and we are already in talks with multilateral institutions such as the African Development Bank (AfDB) in a collaborative effort to see how we can support the African market.

39 IFC MAGAZINE-JULY 2022

The International Islamic Liquidity Management Corporation (IILM) is an international organisation established by central banks and a multilateral organisation to address liquidity management challenges faced by Islamic financial institutions globally by developing and offering highly rated Shari’ah-compliant liquidity instruments.

The IILM has a diverse membership, comprising central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Turkey, the United Arab Emirates, and the Islamic Corporation for the Development of Private Sector (ICD). The IILM aims to foster regional and international cooperation and build robust liquidity management infrastructure at national, regional, and international levels by offering US dollar short-term Sukuk in the market on a regular basis. The IILM Sukuk is a highly rated Shari’ah-compliant money market instrument supported by sovereign linked and supranational assets, which is offered to suit the varying liquidity needs of Islamic financial institutions. The IILM issuance programme is rated A-1 by Standard and Poor’s (S&P) and is distributed and tradable globally via a multi-jurisdictional network of primary dealers. To date, the IILM has issued over USD 78 billion of Sukuk.

Since 2018 you have been heading IILM moving from acting CEO to CEO of an important organisation such as IILM. What does it mean to you? What lessons of leadership should we learn from this outstanding trajectory?

Alhamdulillah, I give thanks to Almighty Allah for his bounties. Indeed, it is an honour to continue to serve as CEO of such a great international organisation, and it has been an exciting journey and experience. Leading the IILM, where you have Central Banks as the shareholders, requires leading with the highest level of

ethics and professionalism. I am proud of my team and fervently appreciate the guidance from the IILM Board; they have been the backbone of the success since I assumed the position of Acting CEO and subsequently the CEO. I lead with a simple approach of making the office title less important while laying more emphasis on results. This strategy has been effective as everyone feels a sense of belonging and is ready to give their best, which has been instrumental in all the milestones achieved thus far. We work not in silos but as a TEAM (Together Everyone Achieves More). And together, we have achieved important milestones, such as increasing the IILM Sukuk outstanding in the market to an all-time high of USD 3.51 billion in 2020 from USD 1.96 billion earlier. This allowed us to address investors’ needs by regularly offering various tenors and improving the liquidity in the secondary market. And this was achieved during an unprecedented time when the COVID-19 pandemic hit the world.

The Covid-19 pandemic has impacted economic activities and created a new normal. What are some of the challenges faced IILM during the pandemic, and what mechanisms were used by IILM to curb the impact of Covid-19? Did it impact your vision and long-term strategies in addressing the market challenges?

Undoubtedly, the COVID-19 pandemic had a major impact on the global economy, but the monetary authorities stood firm to support their economies and markets. The IILM was no exception, as we are part of the financial ecosystem and had our share of the challenges. At the height of the pandemic in April 2020, there was a liquidity squeeze in the global financial market and the IILM incurred a high cost of issuance to address investors' demand.

Oil prices also crashed to one of the lowest of all time, affecting the income streams of GCC countries and, by

What is IILM, its purpose and its objective?

40 IFC MAGAZINE-JULY 2022

Meet the Leader

Dr. Umar A. Oseni is the Chief Executive Officer and the General Counsel of the International Islamic Liquidity Management Corporation (IILM). Prior to this, he was the Acting Chief Executive Officer and Executive Director (Legal and Compliance) and has served as a member of IILM’s senior executive and management team since 2016.

Dr. Umar A. Oseni was also a visiting post-doctoral fellow at the Islamic Legal Studies Program of the Harvard Law School, Harvard University. Apart from being a Harvard-certified negotiator and dispute resolution expert in commercial law, he also has significant and diverse experience in Sukuk structuring, Islamic finance law, and compliance matters.

Dr. Umar A. Oseni has consulted for numerous bodies in the areas of law and regulation of Islamic finance. With a good blend of both significant academic and industrywide experience in Islamic finance, Umar has completed strategic consultancy works for some United Nations agencies such as the International Organization for Migration (IOM), COMCEC of the Organization of Islamic Cooperation (OIC), Islamic Development Bank (IsDB) Group and other government and governmentlinked agencies.

Dr. Umar A. Oseni is a member of the Canadian Bar Association as well as the Nigerian Bar Association. In addition, he previously served as an Associate Professor of Law and Regulation of Islamic Finance at the International Islamic University Malaysia.

As part of his thought leadership role, Dr. Umar A. Oseni has published widely in refereed journals and has also authored authoritative books on Islamic finance and law.

He co-authored the first Textbook on Islamic Finance titled: Introduction to Islamic Banking and Finance: Principles and Practice (United Kingdom: Pearson Education Limited, 2013). He is also a co-author of IFSA 2013: Commentaries on Islamic Banking and Finance, and Alternative Dispute Resolution in Islam (Kuala Lumpur: IIUM Press, 2013). He co-edited Islamic Finance and Development (Cambridge, Massachusetts: ILSP, Harvard Law School, 2014) and Emerging Issues in Islamic Finance Law and Practice in Malaysia, (United Kingdom: Emerald Publishing, 2019. He is also a contributing editor of Fintech in Islamic Finance: Theory and Practice (UK: Taylor and Francis, Routledge, 2019), a pioneering authoritative book on the dynamics of financial technology in Islamic finance.

41 IFC MAGAZINE-JULY 2022

extension, creating opportunities to support jurisdictions in need of funding. The IILM, like every other organisation, also faced operational challenges due to lockdowns, ensuring the safety of employees and the new normal of working virtually. The organisation adapted operationally, re-strategised and overcame these challenges head-on. 2020 turned out to be one of the best years in the history of IILM. The IILM navigated the storm by strategically issuing to the market short-term Sukuk to support Islamic financial institutions in managing their liquidity needs. Most importantly, the IILM Sukuk served as a safehaven asset for investors seeking safety at the height of the pandemic. We also engaged in funding sovereigns to help them support their economies during the pandemic, thereby increasing our program size to USD 4 billion and an outstanding issuance size of USD 3.51 billion. The pandemic did not affect the long-term vision of the IILM; rather, it presented us with new challenges and opportunities given the new normal that we have incorporated into our vision as an adaptable and dynamic institution.

Considering that every jurisdiction has its own Shari'ah regulations and other Shari'ah requirements, how does IILM deal with this issue since they are involved in cross-board liquidity management? Do you think standardisation could be a potential solution?

No doubt that standardisation is key in accelerating the development of any programme or framework as it ensures wider market acceptance, transparency, and confidence, among others; that is why notable institutions and professions strive for it. The IILM recognises these benefits and continues to engage with Shari’ah scholars and stakeholders through Shari’ah roundtables and collaborative events with the Islamic Financial Services Board (IFSB) on how to entrench uniformity in standards, especially regarding the HQLA treatment of the IILM Sukuk and the need for a global Islamic Repo benchmark rate, which we believe would help further deepen the IILM

42 IFC MAGAZINE-JULY 2022

programme and the Islamic financial services industry as a whole. As a cross-border liquidity instrument, the IILM's short-term Sukuk has fared well, gained acceptance, and continues expanding its investors base in different regions. This is because it meets most of the requirements needed by the different standards in different regions, such as asset pool definition of Sukuk, risk management framework, Shari'ah Board, and fatwa, etc. For the IILM Sukuk to be widely accepted in terms of Shari'ah compliance, we aim at the highest tangibility ratio in structuring the Sukuk. At the moment, our asset portfolio is ~80% tangible, which is above the minimum 51% required by AAOIFI. Nevertheless, more can be achieved with regard to standardisation. Undoubtedly, it will unlock growth opportunities in the Islamic finance space and help boost the outreach of the IILM Sukuk programme

Today, the question of integrating ESG in the Sukuk structuring is being debated in many Islamic finance ecosystems, and many voices are calling for revamping the model to meet the maqassid of Sharia. How do you think the Islamic capital market could achieve these goals?

The relevance and growth of environmental, social and governance (ESG) principles in investment have attracted the attention of the global business community, especially with the current climate change concerns. There is a great synergy between Shariah and ESG principles, especially with regard to its ethical values and social considerations, which are in line with the original value proposition of Islamic economic theory and maqasid as-Shari’ah. The idea of expanding the concept of ESG integration to capture the maqasid as-Shari'ah is essential because it incorporates the broader ESG values and principles

recognised by the socially responsible investing (SRI) industry, which is effective in addressing the socio-economic challenges of society. To upscale the adoption of the ESG consideration in line with maqassid al-Shari’ah, the Islamic capital market must undertake a more dynamic and proactive approach such as encouraging financial institutions to integrate ESG goals into their business models and policy formation, incentivise complying entities, providing platforms and infrastructure for ESG related products, promote standardisation and reporting frameworks, effective regulation, and regulatory incentives. We have seen significant developments in this space in some advanced jurisdictions, such as Malaysia, where it introduced the Sustainable and Responsible Investment (SRI) Sukuk Framework. Therefore, one could easily say that there is some sort of convergence between ESG principles and the principles underpinning the Islamic Capital Market.

What role could IILM play in tackling these challenges? Is ESG Sukuk relevant from a liquidity management perspective?

The ESG challenge is a concern for all and within the financial ecosystem. As issuers of short-term Sukuk, the IILM could explore issuing ESG-related Sukuk in the future as the market develops. Also, we are open to long-term funding of sovereigns and GREs that are passionate about green projects and social financing within the ESG space. Liquidity is relevant to most financial institutions, especially Banks, and short-term ESG Sukuk would be relevant for institutions that are ESG-driven to invest in liquid instruments that are also ESG-compliant. By doing so, they can fulfil their ESG mandates without compromising liquidity. There is indeed a market for ESG short-term Sukuk, given the growing popularity of green Sukuk and the likes.

43 IFC MAGAZINE-JULY 2022

Islamic finance is making waves in Africa. New regulatory frameworks in many jurisdictions. But among the challenges faced by Islamic banks is liquidity. Is IILM tapping into this market? What is your relationship with African Islamic Finance Ecosystem?

Africa remains an important investment destination hub for investors due to its potential growth, colossal market base and diversification benefits. Islamic finance, as rightly mentioned, is beginning to penetrate the African market, which is long overdue given the numerous expected benefits and high level of financial exclusion on the continent.

However, like in other parts of the world, liquidity management remains a challenge, especially for Islamic financial institutions where instruments are scarce, hence the need for an institution such as the IILM.

We have yet to fully tap the African markets as we have been more concentrated in the GCC region and Asia, given the depth of Islamic finance in those regions. However, the Central Bank of Nigeria and Bank of Mauritius are founding members of the IILM. Currently, collaborative efforts are ongoing to deepen the IILM market in Nigeria by onboarding financial institutions to subscribe to the IILM’s short-term Sukuk. We also have investors from other African countries, and we plan to continue to expand our African investor base in the near future.

What do you think African countries should do to be more attractive to investors like IILM?

It is critical for Africa to deepen the finance infrastructure and platform solutions in which financial products can be implemented and upscale their creditworthiness to attract capital globally. There is also the need to sustain the drive for awareness in the Islamic finance space and support establishing more robust Islamic financial institutions on the continent that can compete globally, roll out innovative Islamic products and deepen the market. Government, Shari’ah scholars and other stakeholders all have a role to play in developing the financial industry to be competitive globally and attract the best of investors, given the vast market potential.

What are the projections of IILM since they are planning to expand, and how would Africa benefit from this? Would you consider signing MoUs with African financial bodies?

The IILM plans to sustain its upward trajectory in providing cross-border liquidity solutions globally as the only dollar-denominated short-term Sukuk issuer. The vision is to be more innovative, penetrate more markets, serve as the global benchmark for Islamic liquidity management solutions and be adaptable in this ever-changing environment. Africa stands to benefit from our drive to penetrate new markets for diversification benefits and scalability, which Africa is on our top priority list. These developments would give them access to funding for sovereigns and liquidity solutions for their financial institutions. Our interest in Africa remains strong, and we are already in talks with multilateral institutions such as the African Development Bank (AfDB) in a collaborative effort to see how we can support the African market.

We know you are also involved in many strategic topics regarding the development of the Islamic finance industry, like Islamic Fintech. How do you see Islamic fintech as an opportunity for the industry?

Every leader in the financial ecosystem needs to have an eye on the tech space if you wish to continue to be in business. In this era of exponential growth in technology, adaptability and being alert are the ingredients for success. There are a lot of opportunities in the fintech space, and Islamic

44 IFC MAGAZINE-JULY 2022

finance needs to position itself strategically to make the best out of it.

Every aspect of our lives is being digitalised, such as digital currencies, blockchains, NFTs, etc. These are the realities of the future, and a lot of opportunities lie within them and Islamic finance should not be left behind. Undoubtedly, Islamic Fintech will define the success of the Islamic finance industry in the future, and there is an urgent need to develop the Fintech space. As part of my humble efforts, I led a global team of experts to produce one of the pioneering authoritative books on Fintech in Islamic Finance. This is part of the thought leadership some of us try to offer the global Islamic financial services industry.

How could the African Islamic finance ecosystem leverage Fintech to boost its leadership/appeal in the global finance industry?

By being there, proactive and not just reactive. Knowledge is power; we need to begin investing in the future and creating leaders who can evolve and keep up with the time. You need to be ready to accept change and move swiftly. The Islamic Finance space is still at its infancy stage, with so many products yet to be developed to meet the demand of investors, and the fintech space is the ideal place to make it happen. To be reckoned with globally, the African Islamic finance ecosystem could leverage technology, which has helped break barriers and allowed for a more global market. However, this can only be achieved by concerted efforts from industry leaders, considerable investments in Fintech, capacity building and innovative solutions.

Are there any further plans by the IILM to expand its programme offering?

The IILM has thrived to fulfil its mandate of providing liquidity management instruments to the market. In 2021, the IILM supplied an excess of USD 14.12 billion across 36 Sukuk, the highest volume since its inception. It became a frequent and stable issuer, constantly offering for the first time 3 different tenors monthly, namely 1-month,

3-month and 6-month Sukuk. This accounted for 27% of the total global USD Sukuk issuances in 2021 and positioned the IILM as one of the top USD Sukuk issuers. The secondary market volume increased to USD 1.4 billion, representing circa 10% of the total issuance.

Moving forward, the IILM will focus on developing its issuance programme with new features as well as addressing the demand for more high-quality liquidity assets (HQLA) and longer tenors depending on market conditions. The IILM looks forward to attracting new investors, particularly in Africa, to diversify its investor base, thus enhancing its liquidity for its Sukuk on the secondary market.

Sory TOURE, IFC MAGAZINE

Sory TOURE, IFC MAGAZINE

45 IFC MAGAZINE-JULY 2022

SOME

BOOKS AUTHORED BY Dr. OSENI

46 IFC MAGAZINE-JULY 2022

CERTIFICATE PRACTICE OF ISLAMIC CAPITAL MARKETS DEVELOP COMPETENCIES IN ISLAMIC CAPITAL MARKETS PRODUCTS AND SEIZE NEW OPPORTUNIES For more information training@dexterity-africa.com +225 07 57 707 012 +225 27 22 558 120 SUKUK AND STOCKS SHARI’AH/ESG SCREENING INVESTMENTS FUNDS PRIVATE EQUITY FINANCIAL MODELLING CROWDFUNDING FINTECH Malaysia Bahrain With virtual professional immersion ONLINE Nigeria Senegal

IFC MAGAZINE-JULY 2022 48 Ṣ ū Ṣ ū Ṣ ū Ṣ ū Ṣ ū Ṣ ū Ṣ ū Ṣ ū

AN ANALYSISBY

Boubkeur

AJDIR

SOME FUNDAMENTAL REGULATORY ISSUES IN ISLAMIC FINANCE

Boubkeur AJDIR

Considering the regulatory approach to implementing an Islamic finance market in a jurisdiction is crucial. The laws governing the financial sector in non-Muslim countries contain some regulatory aspects that can potentially hinder Islamic finance.

We will review here two issues that bother the most on structuring and which concern the Islamic capital market, Sukuk, and some collective management tools: (i) the integration in texts or the integration of texts and (ii) the particular case of Sukuk and securitisation and (iii) the Shari'ah compliance benchmark. We will have the opportunity to address other issues in future articles to be published.

From this point of view, the examples closest to West Africa, namely Morocco and Tunisia, are radically different: while Tunisia has put in place specific texts on Sukuk, Morocco has chosen to integrate these instruments into the regulatory framework of securitisation

Both approaches have advantages and disadvantages.

Regarding the integration into the existing texts:

- Advantages: consistency between the Islamic and conventional products;

- Disadvantages: risk of forcing certain concepts that do not correspond to conventional finance.

Regarding the establishment of ad hoc texts :

- Advantages: better readability and consistency of the Islamic product;

I. Designated texts vs amendments to existing texts

When looking at regulatory approaches at the international level, one will notice there is no specific regulation for the "Islamic financial market" but rather for "Islamic financial products". Though, there are few exceptions. These products are usually regulated within a general framework of savings protection and market integrity. The objectives of the market authorities do not differ whether they are dealing with conventional or Islamic financial products. Concerning the products themselves, the question is whether it is appropriate to amend the existing texts governing the products and investment vehicles already in force (Undertakings for Collective Investment, Securitisation Mutual Funds, Repurchase Agreements, etc.), or whether it is appropriate to create an ad hoc text for each of these instruments.

- Difficulties: risk of being seen as a radically different product from the equivalent in conventional finance (e.g. an Islamic REPO may be seen as totally different from a conventional REPO).

II. Sukuk Issuance Through Securitisation and Without Securitisation

In the absence of a legal instrument comparable to the Anglo-Saxon trust, the issuance of Sukuk relies substantially on the technique of securitisation and/or assetbacked securities. [These so-called "assetbased" structures, which do not provide a right of co-ownership but rather a right to the income from the assets, give rise to divergent opinions among Muslim legal scholars].

IFC MAGAZINE-JULY 2022 51

However, the use of regulated securitisation vehicles is not an obligation imposed by the principles and rules of Islamic finance. For example, a joint venture company could issue Sukuk. These transactions can therefore be structured in different ways, depending on the needs of the issuers, the underlying assets available, and the investors' risk aversion. This structuring can be done while relying on ad hoc legal structures. Sukuk issuance without a securitisation mechanism is all the more important for governments that need to rely on a less cumbersome, less tedious, and less costly procedure. A sovereign Sukuk issuance should not be more complex to carry out than a conventional bond issuance. This is also applicable to private issuances as long as the interests and rights of investors are adequately protected. It is then relevant to study the use of SPVs rather than securitisation vehicles.

of Islamic financial products with Muslim business law. At the same time, they must put in place a framework to reconcile compliance with domestic law and compliance with Islamic law. To be possible, they must at least assess Muslim legal scholars' ability to provide opinions or advice to financial institutions. To this end, they need to define an institutional anchor for Shari’ah compliance and governance based on or inspired by international standards such as the IFSB and AAOIFI. The civil society context of West Africa does not allow for automatic and simplistic duplication of the approaches adopted in South Asian or GCC countries. Consequently, it is necessary to set up a "Shari’ah Reference System" that is specific to these countries, which makes it possible to integrate local legal specificities and take into account the socio-cultural, socioeconomic, and religious dynamics within the WAEMU zone.

III. The Need to Define a Normative Benchmark for Shari'ah Compliance

West African jurisdictions evolve in a secular context. This situation makes us consider that their authorities have neither the competence nor the legitimacy to pronounce themselves on the conformity

IFC MAGAZINE-JULY 2022 52

Boubkeur AJDIR, Partner, Director of IFAAS groupe in francophone countries

Audit Shariah d´un portefeuille d’actifs islamiques d'une valeur de 3 milliards de dollars

Des clientssur 5 continents

+ de 20 autorités (banques centrales, ministères) nous ont déjà fait confiance

Des projets et des missions dans plus de 40 pays

Près de 150 produits financiers islamiques dans diverses juridictions

Plusieurs milliers de professionnels ont déjà suivi nos formations

40 150

3 20

5 + 3000

Understanding and implementing Takaful

ver the past 30 years, the Islamic financial services industry has expanded rapidly in many parts of the world. According to the 2021 Refinitiv report, there are 1595 Islamic financial institutions in the world. In a context of perpetual crisis, the need to refer to ethical values is becoming increasingly important. The attractiveness of socially responsible investments has been strengthened, and Islamic finance is becoming more and more a reliable alternative to conventional finance. The Islamic insurance sector, or Takaful, has been one of the most successful since the arrival of the first such insurer in 1979 in Sudan. Islamic insurance or Takaful is etymologically a way of organising solidarity within the community (Ummah) of believers, designed in accordance with Islamic ethics and implemented through legal mechanisms that are consistent with Islamic law (Shari'ah).

Takaful is a system of insurance in which members contribute to a mutual fund to support each other in the event of a loss. The purpose of Takaful is to cooperate, live in harmony within the community and protect each other against the hazards of life. Takaful policyholders regularly contribute on a monetary basis which is supervised and managed by a Takaful management company. Conventional insurance penetration remains very low in Africa. It accounts for 60190 billion USD of life and non-life premiums in 2020, i.e. 0.95% of the world premium (Atlas Magazine N°189, March 2022).

MICROTAKAFUL TAKAFUL GENERAL TAKAFUL FAMILY

IFC MAGAZINE-JULY 2022 54

O

South Africa alone accounts for 67 5% of the continent's premiums, i e 1% of its GDP, far from the 5% observed in Asia (Atlas Magazine, February 2021). Insurers have been slow to adapt their products and services to the realities of the African continent These are, for the most part, identical to the products and services offered in industrialised countries, i e long and complex contracts distributed through expensive networks of agents and brokers which only reach the urban elite. Given the inability of the traditional insurance market to meet the insurance needs of all social classes, Islamic insurance, based on ethical principles, is positioning itself as a viable alternative

I- FOUNDATIONS

A- Principle and Model of Takaful a- Principle

Takaful insurance is fundamentally different from conventional insurance in that premiums are considered 'contributions' to a common fund established to spread the risk of an adverse event affecting a member of the group Takaful is an agreement of mutual aid and solidarity between members of a community in the event of loss or damage suffered by one of them. It is a global concept that can be translated into that of mutual guarantee or compensation between members of a group who are both insurers and insured It advocates the fair sharing of risks and benefits, a form of associative finance

Takaful insurance is, therefore, a mutual guarantee based on the principles of Islamic finance, which are :

- Risk sharing between the parties to the contract;

- Materiality: all transactions must have a "material purpose", directly or indirectly linked to the actual economic transaction;

- Non-exploitation: financial transactions must never result in the exploitation of one of the contracting parties;

- The prohibition of financing "haram" or illicit activities related to the production of alcoholic beverages, pork, pornography, and gambling.

The only investments allowed by religious law are those whose remuneration is the result of a sharing of the fate between investors and beneficiaries

Takaful implies:

- Separation of policyholders' funds from those of shareholders;

- Commitment to distribute financial profits to policyholders;

- The establishment of a Sharia Supervisory Board, which supervises insurance operations and monitors their compliance with Shari'ah law

b-Takaful: products and models

. The products

There are two types of Takaful products: General Takaful (nonlife insurance) and Family Takaful (life insurance). General Takaful, which offers short-term protection, generally for a period of one year, includes property insurance, liability insurance and personal injury insurance These are: motor, fire, marine, miscellaneous accident Takaful, Et Cetera.

Concerning the Family Takaful, it offers a combination of protection and long-term savings, covering a period of more than one year It includes personal insurance, with the exception of personal injury insurance These include Takaful for death, credit, education, health, Et Cetera

IFC MAGAZINE-JULY2022 55

Within the Takaful regime, there are several operational models that Takaful companies around the world have adopted Takaful with small numbers of participants operates as cooperatives and relies on Tabarru' (donation in Arabic) The contribution given by the promoters to the establishment of the Takaful is considered a Qard Hassan, i.e. a free loan, and that of the participants (policyholders) a donation (Tabarru') to the mutual guarantee fund.

Takaful companies operating as commercial companies may be managed according to some existing contracts in Islamic finance The separation is upheld between the mutual fund of the insured and the fund set up by the promoters The most commonly used models are the Mudaraba (partnership) model, the Wakalah (agent contract) model, and the hybrid model.

➢ Mudarabah model

General Takaful

PARTICIPANTS

1 Participants pay takaful contributions which form a takaful pool

2 The fund is invested in Shari'ah-compliant assets

3 Any profits generated by the investments are shared between the participants and the Takaful operator on the basis of a pre-agreed profit-sharing ratio.

4. At the end of the year, the surplus (after deducting claims, retakaful contributions, reserves and management fees) is distributed to participants In a modified Mudarabah model, the surplus is shared between the participants and the Takaful operator

➢ Mudarabah Model • Takaful Family

1) Participants pay takaful contributions which form a common takaful fund

2 The Takaful fund is divided into accounts: the participants' investment account (also called the participants' savings account) and the participants' special account (also called the participants' risk account). The latter is based on the Tabarru’ concept. The fund distribution ratio is agreed upon in advance between the participants and the Takaful operator

3 The funds in both accounts are invested in Shari'ah-compliant assets, such as Islamic government instruments, Islamic private debt and equity, as well as Islamic fixed assets and fixed deposit accounts

4. Any profits generated by the investments are shared between the participants and the Takaful operator on the basis of a pre-agreed profit-sharing ratio

5 The amount in the participants' investment account is paid to the participants at the maturity of the Takaful scheme or to the beneficiary in the event of the death of the policyholder

6 The amount in the participants' special account is used to pay participants' claims, retakaful contributions, provisions and management fees.

7. At the end of the year, the surplus is distributed to the participants. In a modified Mudarabah model, the surplus is shared between the participants and the Takaful operator

IFC MAGAZINE-JULY 2022 56

•

Models

•