Synergy and internalization: the trump cards of large-scale distribution

Decathlon: PLs… our ‘passion’

I.c.e.f or: Environmentally friendly detergents

2/2023

Private Label Magazine

36 Markets PL cleansers: affordability, quality and sustainability

42 QBerg observatory QBerg analyzes the Personal Hygiene market in the Web FMCG distribution channel. What emerges?

PLMagazine Quarterly

of Distribuzione Moderna

a media outlet registered with the Court of Milan Registration No. 52 of 30 January 2007

Editor-in-chief

Armando Brescia

Editorial director

Maria Teresa Manuelli

Translation Jcs - Language Services info@jcslanguage.it

Scientific Committee

Stefano Ghetti, Managing Partner Expertise on Field/partner IPLC Italy

Gianmaria Marzoli, Retail Solutions Vice President IRI Italia

Alberto Miraglia, General Manager Retail Institute Italy

Paolo Palomba, Managing Partner Expertise on Field/partner IPLC Italy

Emanuele Plata, Co-Founder, Past President, Board Advisor PLEF

Contributing Authors

Federica Bartoli, Stefania Colasuono, Maria Teresa Giannini, Fabio Massi, Fabrizio Pavone, Luca Salomone

Creative Director Silvia Ballarin

Editor Edizioni DM Srl - Via A. Costa 2 20131 Milano

P. Iva 08954140961

Contact Phone 02/20480344

redazionedm@edizionidm.it

Advertising Sales office: commerciale@edizionidm.it

Tel: 02/20480344

There is no guarantee that we will publish the original versions or any part of submissions (texts, articles, news, images, data, charts, research, etc.) sent by authors outside the Editorial Board. Submissions may, however, be published in a revised form for editorial reasons. It should also be noted that sending a submission constitutes an automatic authorisation by Edizioni DM Srl to publish it free of charge in all its publications.

4 16 32 29 24 36 3 Editorial PLs, collaboration beyond the product 4 Cover story Synergy and internalization: the trump cards of large-scale distribution 16 Interview with distribution Decathlon: PLs... our ‘passion’ 20 The private label scenario Private label: emerging trends to consider in 2023 24 PLM Awards The best PL business partners 29 Companies in the field Discount stores focus on wine: an MD case study 32 Interview with the company I.c.e.for S.p.a.: Environmentally friendly detergents

SUMMARY - PLM

supplement

magazine,

Excellence Wins.

Our private label has earned another significant recognition in the industry.

The European Private Label Awards 2023 has affirmed our branded products’ market leadership and value. A panel of experts acknowledged the taste and quality of our 11 Paralleli, Sapori&Idee Conad, and Verso Natura Conad product lines. These products have already gained a strong reputation in Italy, where millions of customers enjoy them every day.

PLs, collaboration beyond THE PRODUCT

Maria Teresa Manuelli Editorial director

This issue of PLM is dedicated to all the excellent collaborations established over the years between brands and important players working in the food and non-food industry, standing out for their innovation and service provided. This was not only to improve the quality of products and supplies, but also to promote development and progress. The campaigns carried out by Coop Italia to close the gender gap and support Iranian women, Carrefour’s campaign promoting local products, food education and food waste elimination, and VéGé’s support for sport associations, are just a few examples of different initiatives that share one common ambition: making the environment and society brands work in a better place. However, today, PL goes even beyond simple campaigns and mere consumer’s education/awareness, offering its own practical solutions to the lack of welfare and services, which range from opening health centers in supermarkets, to establishing agreements with insurance and oil companies. If we look at other countries, where the evolution of PLs started before, the advanced stages of such a phenomenon, towards which also our brands are going, are clearly visible. For instance, Tesco - the first British distribution center since 1929 - in 1974, in collaboration with Esso, started distributing its own PL fuel. Not to mention that, since 1997, thanks to a joint-venture with the Royal Bank of Scotland, it has been providing a wide range of financial services that go from traditional bank services (bank account, credit cards, loans, mortgages, prepaid cards), to insurance options (house, car, travel). In addition to that, in 2003 Tesco decided to extend its PL to telephony (landline, mobile phone, Internet connection) and health on various fronts, like ‘Pharmacy’, which includes, ‘Repeat Prescription Collection’ and ‘Health Check’ services, and ‘Tesco Diets’. Therefore, the direction to take by shifting from the conventional commodity sectors of commercial distribution is almost limitless, and private label is now not only a distributor’s development strategy, but also a quite convenient means for consumers.

EDITORIAL - PLM

3

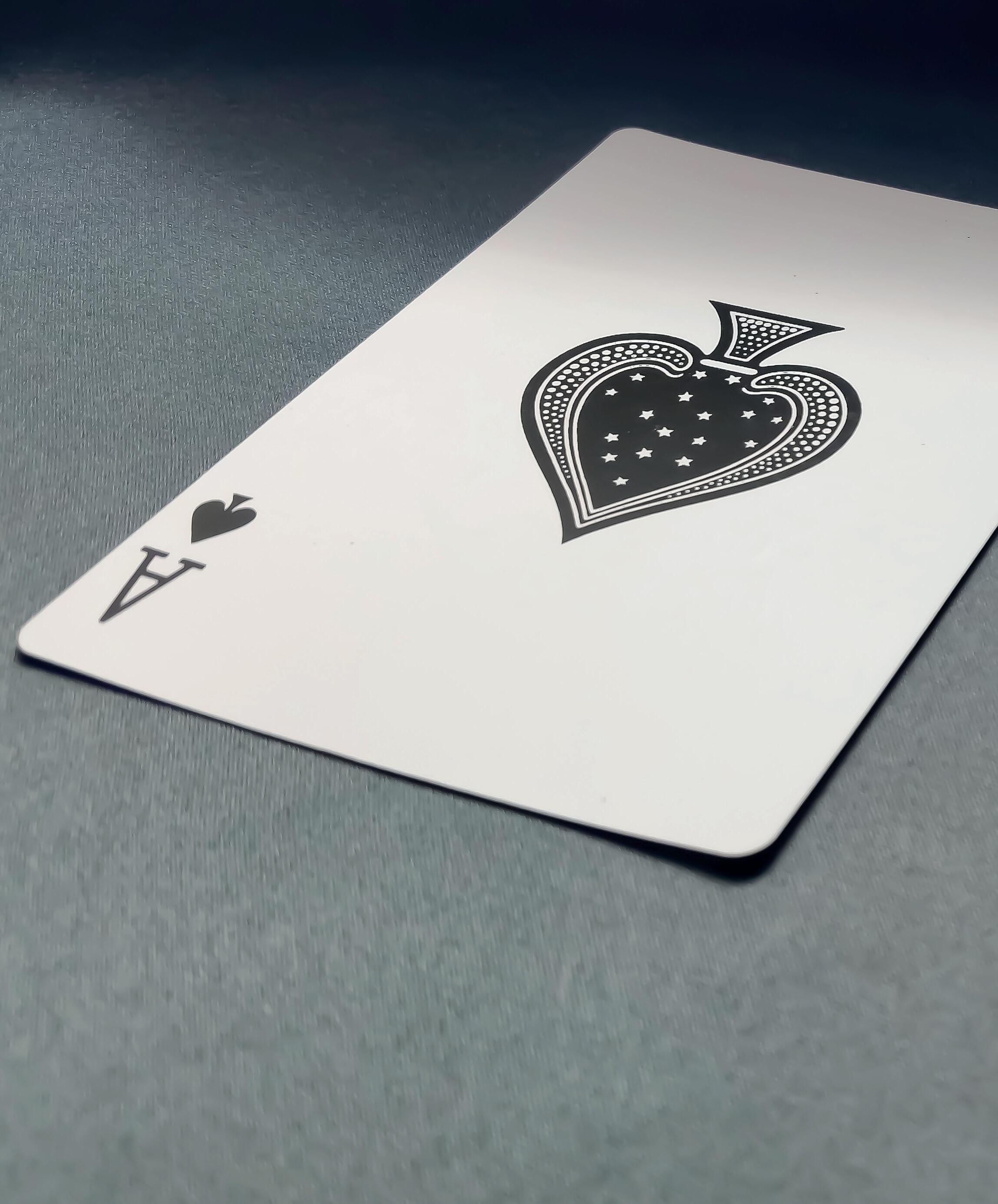

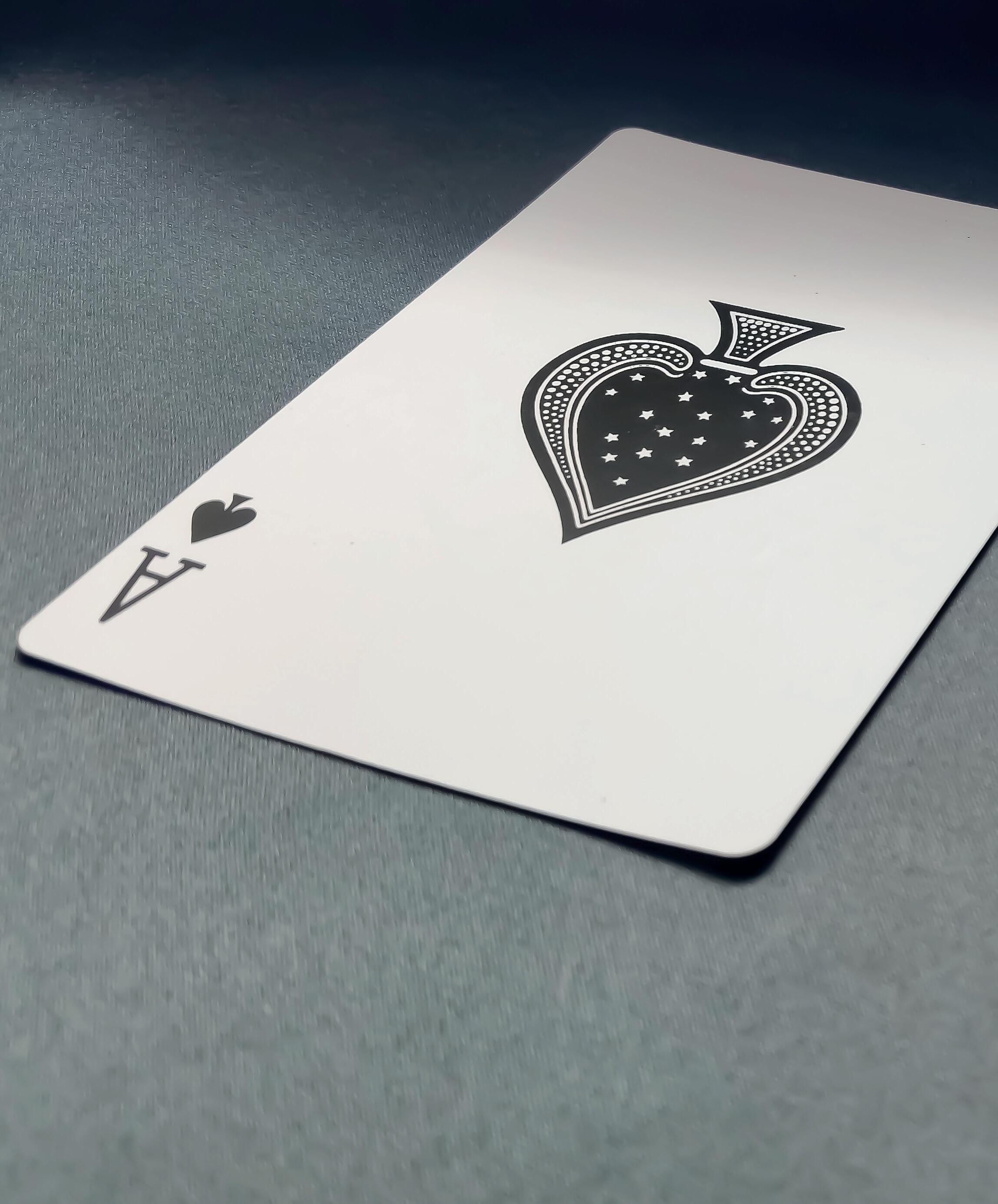

Synergy and internalization: the

trump cards of large-scale distribution

Best performing chains and first-class collaborations

In the race towards innovation, given the chance, PL businesses bet on the internalization of production processes to attract even more customers and meet their need for traceability and safety. However, some brands may want, or need, to walk a different path and foster excellent collaborations with companies - known for their reliability and social commitment - that combine business and ethics, craftsmanship and mass consumption.

4

PLM - COVER STORY

LARGE-SCALE DISTRIBUTION AND CONSUMERS: HUNGER (FOR NEW NEEDS) SHARPENS YOUR WITS

In the first months of 2022, the private-label turnover in Italy amounted to 9.6 billion euros overall, 9.5% more compared to September 2021. This was revealed by the position paper ‘Marca del distributore e consumatore nella società che cambia’ (PL and consumers in a changing society) by Forum Ambrosetti, in collaboration with Ipsos and Adm, presented at Marca 2023 exhibition. Like any other human phenomenon related to economic and social-cultural choices, there may be different reasons behind data. And the ability of large-scale distribution to identify and anticipate the new needs of consumers in terms of ‘supply characteristics and complexity’ is one of those. According to the paper, consumer needs fall within 4 macro categories, namely food experience, services, free time, and wellness. Indeed, today more than 500 points of sales in Modern Distribution provide services such as OTC pharmacies, optical stores, perfume stores, cafés, pet stores and gas stations. The agri-food sector, specifically ‘extended agrifood supply chains’, is the hard core of PL. As a matter of fact, private labels in this segment have grown about 3.7 times more than the brand food industry. Therefore, the behind-the-scenes story of quality products, as well as new formulas (e.g. food courts, cafés, bakeries and pasta factories), translates into ‘new initiatives‘’ for pos, i.e. supermarkets and hypermarkets.

€ 9.6 billion (+9.5% compared to September 2021 = overall private label turnover.

5

COVER STORY - PLM

BREAD AND BAKED PRODUCTS IN LARGE-SCALE DISTRIBUTION: SNAPSHOT OF A SHIFT

With 250 traditional types estimated, Italy is the land of bread par excellence, specifically of artisan bread, which reached 84.1% in 2021. Despite the leading role of bakeries and small shops, bread and baked products recorded a significant increase in large-scale distribution (currently 43.5%). Discounters have made a leap forward after widening their bake-off supply as a result of the loss of purchasing power due to the Covid-19 pandemic and the crisis hitting the years 2022-23. It’s the case of Penny, Lidl, which currently supply 50 different types of sweet and salty baked products in all (croissants, muffins, doughnuts, pizzas and focaccia bread, traditional bread), and Aldi, where 85% of the bread supplied is PL.

IPER-LA GRANDE i: RESTAURANTS AND INTERNALIZATION OF BAKERIES AND PASTA FACTORIES

Iper-la grande “i” is among those that have walked both paths, starting with a great classic, its bread and pastry production. “Everything is processed right before the eyes of our customers, from raw materials to finished products,” pointed out Marilena De Leonibus, Bakery and Pastry Coordinator at Iper-La Grande i. Our thought goes to pastry, pizza, and chocolate laboratories in Iper pos. As for tomato-based products, such as meat, Arrabbiata and Amatriciana sauce, lasagna and eggplant parmesan, Mutti is the brand standing out. Also fresh pasta is produced in-house, from dough to the filling. “Our leading reference is braised beef ravioli, which are also available with vegetable or cheese filling. We’re always trying to add new products to our supply” claimed Giuseppe Calogero and Cristian Adelghi, Food and Distribution Coordinators at Iper-la grande “i”. The company had already expanded beyond the food sector in 2016 entering the beverage industry with its BellaFresca brand. “It’s an ambitious project that’s been consolidating our positioning as manufacturers to this day.”

6

PLM - COVER STORY

According to recent research carried out by Deloitte titled ‘Foodservice market monitor’, the food service market will be driven by full-service restaurants, with a +9.3% estimated growth between 2021 and 2026, as a result of the greatest importance of casual dining. It should be no surprise that also Iper-la grande “I” tried to revolutionize the idea of ‘aisles’ in its points of sales by creating actual restaurants, each with its own concept. In the last 11 years, 8 restaurants have been opened, four of which in difficult times, between 2020-2021. From Musi Lunghi, the first one, opened in Iper Lonato in June 2012, to Macelér, opened in Iper Seriate on February 2, 2023. As for the menu of La Corte di Maestoso, which opened in Monza on December 5, 2019, “We decided to include a product imported by one of our suppliers, Giraudi, which is the American Black Angus meat from Creekstone Farms. There, animals’ breeding is hormone-free in compliance with directives safeguarding animal well-being”, explained Stefano Arzillo and Salvatore Biondo, Food service Coordinators . “Macelér’s menu is instead characterized by Carnitalia ’s selected meat, the purchasing platform of Finiper Group, whose leading products are the Irish T-bone steak and the heifer sliced steak”.

7 COVER STORY - PLM

about 3.7 times more = private label growth compared to the branded food industry.

SELEX: A TRULY ‘EXCELLENT’ COLLABORATION

Last year, Si con te (Cedi Marche), a supermarket chain owned by Selex Group, started a collaboration with Frolla, a small all-Italian cookie factory in Osimo, the brainchild of two young men, an aspiring pastry chef and a social worker. Thanks to their dedication and commitment, Frolla is now a true business employing young disabled people. The products of this lab-company have been included and displayed in the Group's stores among the excellences of the area. And the great thing is that they’ve become an excellence themselves, as, in November 2021, Frolla was awarded with the ‘European Citizen’s Prize’ by the European Parliament.

8

PLM - COVER STORY

ESSELUNGA: THE CONCEPT OF ELISENDA BAKERIES AND CUCINA ESSELUNGA

The undisputed protagonist of this collaboration is undoubtedly Esselunga. Their brand Elisenda was designed to add that something extra in customers’ everyday shopping, that only high quality pastry products can boast. Created in 2016 from the meeting between the brand and the 3 Micheline-starred restaurant ‘Da Vittorio’, today Elisenda is present in over 100 Esselunga points of sales. In collaboration with the Cerea Brothers, Enrico “Chicco” and Roberto, who also contribute to the management of the pastry lab in Pioltello (Milano), the recipes, are conceived by experts trained in the Cerea brothers’ restaurant in Brusaporto (Bergamo) on a daily basis. New products have recently been added to the assortment, such as

9 COVER STORY - PLM

Over 500=large-scale distribution points of sales with OTC pharmacies, optical stores, perfume stores, cafès, restaurants, pet stores and gas stations.

the Colomba Easter cake, available in the classic or chocolate version, and the Venezianina, a soft, buttery pastry product with a Madagascar Bourbon vanilla aroma, topped with an almond glaze and granulated sugar. Something new was also introduced in the range of Elisenda’s flagship product, macarons. A new flavor, hazelnut, is now available alongside vanilla, chocolate, pistachio, strawberry and lemon. However, the Lombard brand hasn’t just started excellent collaborations. As a matter of fact, it has also consolidated its role in Spadari street- better known as ‘la via del gusto’. Here, Elisenda is now challenging the appeal of the historic Peck delicatessen, which has been displaying its products in this district of taste since the early 1900s. In the Le eccellenze di Esselunga (Esselunga’s excellencies) store, the brand Cucina Esselunga (Esselunga’s Kitchen) made its debut in December 2022, alongside different local specialties.

11 COVER STORY - PLM

We don’t sell beer here, we have you taste it

Including a # to encourage people to taste the beer (#daassaggiare), this slogan was used to launch the BellaFresca beer by Iper-la grande ‘i’ in 2016. This unpasteurized and non-micro filtered beer is produced in Arese (Milano) and in the Stores in Seriate (Milano) and Monza. It’s supplied in Iper points of sales as draft beer and is currently available in 4 different flavors ranging from 4.3 to 5.9 ABV: Blanche, an opalescent, spicy and slightly sour beer, Golden, light-colored and easy-todrink ApA, copper-colored and not too foamy, and Bock, ruby-colored with a sweet aroma of roasted and caramelized malt.

ALDI: PEDON ORGANIC LEGUMES AND MONTI TRENTINI DOP ASIAGO CHEESE

Recently, Aldi has dethroned ‘the big four’ of large-scale distribution in terms of affordability. In fact, it’s the most affordable discounter in Italy (based on data by Altroconsumo in 2022), where a 4-person family can save up to 3,350 euros yearly, compared to 8,550 euros spent on average (Istat data). However, affordability alone isn’t enough to meet customers’ expectations. As a matter of fact, 37.5% of customers expect an ever more premium PL for the future, and discounters are no exception. For this reason, at Aldi’s, the lentils, spelt, chickpeas and barley of ‘Natura Felice’ line, 100% Italian and organic, come from the fields and silos of Pedon. This family-run business located in Colceresa (Vicenza), was founded in 1984 by three brothers, Remo, Sergio, and Franco and has been cultivating legumes, cereals and seeds for over thirty years now. The Dop Asiago cheese of the ‘Gourmet’ line is also produced in the province of Vicenza, by Casearia Monti Trentini, a company based in Enego. Casearia Monti Trentini has over 100 years’ experience in cheese making, and uses 100% Italian milk from cows bred in the Venetian plateau. First cut in in pieces of 300 grams each, the cheese is then vacuum packaged.

12

PLM - COVER STORY

Large-scale distribution in extended agrifood supply chains

‘Extended agrifood supply chains’ are one of the ‘4 As¹’ (automobile, clothing, agrifood, and furniture) of the Made in Italy industry, as well as the most significant in terms of figures with 124.9 billion of added value in 2021 and over 3 million and 300 thousand employees. In this sector, large-scale distribution is either involved simply as a retailer or all-round with private labels, when, at the end of its ‘journey’, a product is given a brand label or distribution group. Private labels comprise about 50 economic sub-sectors. In all, large-scale distribution supports 1500 companies working in production and related intermediate stages. 92% of them are Italian, 61.5% of which are SMEs. Large businesses, however, don’t disdain the idea of becoming copackers (38.5%).

LIDL: THE PRIVATE LABEL TOMATO SAUCE FOSTERING INCLUSIVENESS

Produced with controlled and quality raw materials, PL lines, or even single PL products in discounters,represent a great opportunity for partners to foster valuable projects and even solidarity projects. In fact, PL products in discounters make up for 80% of the assortment. A case in point is Lidl Italia with its ‘Italiamo’ tomato sauce. The product is produced using 100% Italian tomatoes thanks to the work of Coldiretti farmers, and it’s part of ‘Fdai’ products (Firmato dagli agricoltori italiani - Produced by Italian farmers). For each bottle purchased from March 20 to 2, April 2023, sold at 1.19 euros, the German discounter donates 20 cents to PizzAut, the Italian chain of pizzerias and non-profit organization, which employs people with autism. At the end of the initiative, Lidl will double the proceeds and donate them to this non-profit organization. And when it comes to social inclusivity, there’s no better place than a pizzeria and its pizza, the symbol of conviviality par excellence, whose main ingredient is nothing more than tomato.

13

COVER STORY - PLM

¹ The 4 As of the Made-in- Italy industry comprise the driving economic sectors in Italy, that is, alimentare, abbigliamento, arredamento, automobile.

CARREFOUR: A CITY VEGETABLE GARDEN BY POTAGER CITY

Last but not the least, a European example: Carrefour . In its birthplace, France, it started collaborating with quality producers, a winning move on the chessboard of competition. In its first two Potager City (a vegetable garden in town) points of sales in Paris, opened in early March in Rue de Tolbiac and Rue de Seine, 170 food references are currently available, alongside a fruit and vegetable assortment. The references

were created in collaboration with Omie & Cie , a B-Corp-certified food brand committed to fighting climate change. About 40 different wine references, selected in collaboration with Le Petit Ballon , and self-service fresh products, such as cheese, dairy and cold cuts, for a total of 230 items, complete the supply. Addition to the physical stores,fruit and vegetables can be ordered on its e-commerce platform and then collected in store.

IN CONCLUSION

Ipsos statistical surveys show that the relative majority of Italians (47%) choose where to shop based on proximity to their house or workplace. However, for large-scale distribution labels one principle still applies: they can’t rest on their laurels, but should rather face the future with minor, yet frequent, innovative ideas. By doing so, they won’t be considered outdated or, worse, unalterable. l

+9.3% until 2026=full-service restaurant growth estimated by Deloitte due to the growing importance of ‘casual dining’.

COVER STORY - PLM 15

Maria Teresa Giannini, Professional Journalist specialized in Large-scale Distribution.

THERE'S ERIC GOUSSEN, SALES MANAGER AT DECATHLON ITALIA , TO TALK WITH PL MAGAZINE.

16 PLM - INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW

Decathlon: PLs... our “passion”

When we think of PLs we, usually, think of food. But it’s not always like this. In fact, more than 80% of the turnover of the multinational producer of sport products is PL.

IRegarding figures, the king of the sports world had, as of April 2022, 1,746 stores in 60 countries for a net turnover, in 2021, of 13.8 billion euros, of which 1.7 was due to Italy. In Italy, there are almost 150 stores and 8 thousand employees.

Also in PLs, or rather, ‘Passion Brand’, the group leads the way, as Eric Goussen, Sales Manager at Decathlon Italia , tells us.

How much do your Pls affect your sales, in Italy and in the world, right now?

Tribord (sail, ed.) and Quechua are the first Passion brands for Decathlon, which came to be in 1996. Their design office is close to their sport sites, so that they are able to take advantage of convenient tests and exchanges with users. Over the years, we added more exclusive brands and now, their turnover accounts for over 80% of the total turnover.

What is the main criterion for the development of your products?

Since 1996, when we created our first exclusive brands, we have made a lot of progress. In 2006, we introduced eco-design to our production processes. For a brand, this is an important step towards sustainability and, in this, it helps to go faster. Our objective is clear: reaching eco-friendly production for 100% of our products by 2026.

INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW - PLM

17

The Internet is very important for you. On this channel, are your own PLs or other brands doing better?

Decathlon.it website is now a vessel for both our own and others’ products: in fact, it’s also a marketplace and, so, it can also offer all the references of other collections. So, it’s clear that the Passion brand percentage on the web it’s not predominant.

Let’s quantify the supply...

Today, our design and planning center develops items for more than 80 sports. Considering the total turnover of Decathlon brands, our best-selling products are in the categories of cycling, hiking and fitness.

The Sports world has always been innovative, especially in the past few years, when gyms were closed because of the Covid-19 pandemic. Which products did you favor and do you think you still prefer launches of new products and lines?

No matter the circumstances and the recent past, I have to say that, for Decathlon, innovation is the criterion that informs product design and the challenge, in providing new sportive solutions to our clients, is constant. Our team is motivated to use new materials and new technologies and to always give a new look to our products, and as I said before, to move towards environmentally sustainable manufacturing techniques. For this reason, at Decathlon we have 850 product engineers and 300 designers, which in more than 10 centers have recorded, over the years, more than 9 thousand patents.

2021 net global turnover (billions euros)

Total Pos (April 2022) 1,746 Operating

60 Italian Pos 146 60 Total ‘Passion Brands’ 2021 Italian Turnover (billion euros) 1.7 Passion Brands / Turnover >80% Total suppliers in Italy 100

13.8

countries

18 PLM - INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW

DECATHLON’S KEY FIGURES

Source: company data

Decathlon is a multinational company. What are the exclusive products you import from other national supply chains?

And what do you export?

In Italy, we develop for the group several industrial processes, which allow us to produce their relevant items. In particular, in the cycling, metal processing, textile, footwear, plastic, optic, foams and component industries. Furthermore, Italy now accommodates the design for 4 sports. Bicycle production, then, reflects one of the excellencies of our industrial department: metal and cycling are certainly among these. In Particular, we develop steel frames, wheels and bikes for children.

What is the average duration of the contracts with the suppliers?

Decathlon assigns the production of its sport products to a world-wide supplier panel, organized according to industrial processes. The company wants to establish long-term relationships based on trust. This is carried out on a daily basis by the Decathlon production department teams, which guarantee respect for the Decathlon ‘Code of Conduct’ and carry out audit procedures. In Italy, we collaborate with about 100 suppliers, 2 of which are partners. The producers are supervised, through training or support, to facilitate, among other things, learning and the adoption of our solid code of ethics and safety.

And do we narrow it down to ‘the most loyal’?

Quoting our 2021 Extra-finance Sustainability Report, I can say there’s a shortlist of 50 suppliers that fully share our entrepreneurial perspective and produce 34.7% of the total company production. Plus, in 2021, Decathlon United widened its group of subcontractors with 5 new third-party partners. Those you call ‘the most loyal’ are large, strategic suppliers, with whom Decathlon established their relationship according to the increase of sustainable performances. Others, which represent less than 20% of the production of the group, can be valid collaborators, especially for local supplies. l

19

INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW - PLM

Luca Salomone Professional Journalist specialized in Consumer Goods, Distribution, Shopping Centres and Finance.

Private label: emerging trends to consider in 2023

by Claudia Scorza

An increase in consumer awareness and shifts in the marketplace have witnessed the average buyer become more mindful of how they spend their money and engage with brands.

PLM - THE PRIVATE LABEL SCENARIO 20 -

The proliferation of PL products in large-scale distribution shows no signs of slowing in 2023. An increase in consumer awareness and shifts in the marketplace have witnessed the average buyer become more mindful of how they spend their money and engage with brands. A US study conducted in December revealed that roughly 60% of shoppers believe that PL products are as good as national brands when it comes to quality, innovation, sustainability, and trust. According to IRI, a quarter of shoppers feel that distributor brands still hold these characteristics more than national brands, which shows a significant shift in opinion compared to previous performance periods. The same can also be said when considering sales. For example, private sales in Italy reached an all-time high of 12.8 billion euros in 2022, an increase of 9.4% on a yearly basis. Similar trends were reported in Britain, Spain, Germany, and the Netherlands. Considering this, ESM (European Supermarket Magazine) examined eight private label trends to watch out for in 2023.

CONSUMERS ARE BECOMING ‘AGNOSTIC’

A 2022 study by Daymon revealed that retailers must update their private-label innovation strategies or risk falling behind competitors in an increasingly complex and changing environment. When facing today's challenges, consumers are becoming ‘agnostic,’ and supermarkets should aim to create a groundbreaking business model when it comes to private labelling, rather than taking a blanket approach.

21 THE PRIVATE LABEL SCENARIO - PLM

PRICING STRATEGY UNDERWAY

In early 2023, Walmart began marketing its private label products to shoppers as lower-cost alternatives to traditional suppliers, warning major packaged goods manufacturers that their price increases would no longer be acceptable. As a result, supermarkets must strike a balance between premium quality and competitive prices.

THE IMPORTANCE OF FINDING A NICHE

See a problem and find a solution. Though it may sound simple, many supermarkets make the mistake of launching products into a market that is already saturated. Unfulfilled needs create unfulfilled demands.

PRIVATE LABEL ALLIED TO FIGHT INFLATION

During previous financially challenging periods, such as the 2008 recession and the years that followed, private label sales increased dramatically. The Private Label Manufacturers Association (PLMA) claims that one of the key reasons for the rising figures in private label penetration in the United States in 2022 was that store brands were embraced by American shoppers as a "reliable ally" against the persistent inflation and other personal financial difficulties. Interestingly, shoppers across the country reported a high level of satisfaction with the branded products they purchased for the first time in some categories, adding that they would continue to purchase them.

PL PURCHASES WILL CONTINUE

Despite inflation, recession fears, supply chain prob lems, and geopolitical unrest, consumers have been able to continue to buy high-quality food and non-food products by adapting to making smarter purchases, as PLMA recently reported. We have every reason to believe that this beneficial dynamic will persist in 2023.

PRICE WAR

There are indications that once the current spell of high inflation ends, FMCG brand suppliers are likely to engage in extensive discount campaigns, which could affect PL performance. IRI has been suggesting that a price war is increasingly likely in 2023, as inflation levels normalize, and brands seek to win back market share.

22 PLM - THE PRIVATE LABEL SCENARIO

ARE PRIVATE LABEL PRICES THE LOWEST?

According to Ananda Roy, SVP Global, strategic growth insights at IRI , PLs have generally been offering buyers the lowest prices. "However, these figures are not sustainable, and inflation has caused more significant price increases for PLs than well-known brands. This has not diminished demand levels, especially in chilled, fresh, ambient temperature, and frozen food categories, as well as in home and personal care categories."

QUALITY WILL DECIDE

The trajectory that the private label market takes will depend on a customer consensus: not only that store brands offer great value in a challenging economy, but that their quality exceeds that of mainstream market brands. Trying times will push consumers toward private label products, however, quality will determine whether they remain in that particular segment. l

PL product prices rise in Portugal

A typical basket of private label products in Portugal has seen a 32% increase over the past year, while a similar basket of manufacturer-branded products has seena 13 percent increase. Despite the price growth, consumers continue to prefer PLs, according to a study by Deco Proteste . During the period from 1st January to 31st December 2022, the Portuguese consumer association monitored the price of 60 products on a daily basis. These products included 30 mid-range brand products, along with the same number of manufacturer-brand references, on the online stores of five supermarkets: Auchan, Continente, Intermarché, Minipreço and Pingo Doce. Over the course of 2022, the average price of most products rose well above the rate of inflation, while 23 of the 30 private label items witnessed relatively more significant price increases than their manufacturer-branded counterparts. According to Deco Proteste, in certain categories, the savings that shoppers made by purchasing private labels versus manufacturer's products were significant. For example, those who opted for the PL fusillo pasta shape at the beginning of 2022 saved an average of 48% compared to the manufacturer's brand equivalent, a difference that dropped to only 22% on 31st December. This is because the price of the manufacturer's brand decreased by 4% (from €1.32 to €1.27), while the price of the PL product increased by 44%, from €0.69 to €0.99.

23

THE PRIVATE LABEL SCENARIO - PLM

business partners The best PL

The ceremony promoted by the PLM digital magazine and created by Edizioni DM to award the best Italian businesses supplying private label products took place on April 18. 140 businesses present, 24 awards, and 8 winners

The first edition of the PLM Awards , by PLM digital magazine and Edizioni DM , saw the participation of 140 businesses . The ceremony was conceived to give recognition to those Italian businesses supplying PL products and that stand out for their characteristics ideal for retailers. The businesses were selected based on objective criteria, such as production excellence and reliability. Out of the 74 businesses that were shortlisted for the final stage of the PLM Awards, 24 were awarded, three for each category. Finally, 8 businesses outdid in their respective category, winning the first prize .

The event was also an opportunity to take part in a Roundtable discussion around co-packers and Italian business providing PL products, with:

24

PLM - AWARDS WINNERS TABLE 1ST PLACE 2ND PLACE 3RD PLACE CONVENIENCE STORE PEDON MENZ&GASSER DE MATTEIS AGROALIMENTARE BEVERAGES ALMAS FRUTTAGEL SIMFED FRESH RAVIOLIFICIO LO SCOIATTOLO FELSINEO EURIAL FREDDO SAMMONTANA EMILIA FOODS SURGITAL HOME CARE I.C.E. FOR SACI INDUSTRIE RAYS PERSONAL CARE ESSITY ITALY MIL MIL 76 ROLLY BRUSH PET CARE CELMAX ITALIA RINALDO FRANCO MUGUE OTHER NON-FOOD PRODUCTS CONTITAL I.M.I. TAM TAM

• Alessia Bonifazi - Head of Communication & CSR at Lidl Italia

• Alessandra Businaro - The Optimist

• Giovanni D’Alessandro - Channel Executive Director at Basko

• Francesca Morgante - Sr Manager Europe at Rspo

• Paolo Palomba - Managing Partner Expertise on fieldIPLC ITALIA Partner

• Elisa Rota - Business Development Leader Italy at Sealed Air

PLM AND EDIZIONI DM’S IDEA TO REWARD CO PACKERS

Unlike other similar initiatives related to large-scale distribution and mass consumption, the award is given to businesses and not products. « This award is for businesses, specifically PL product suppliers, which the industry lacked», pointed out PL Magazine editorial staff. «And this lack was unjustified , given the growing importance of private labels in national and European retailer supply. Hence, the idea of launching this new contest. We wanted to reward the work of thousands of SMEs that work with the main distribution groups in the market and follow selection criteria that are even more stringent than the ones of the brand industry».

THE STAGES OF THE PLM AWARDS

The PLM Awards started in late January with a first stage of applications sent by different businesses, and came to a close at the beginning of March 2023: from score assessment, to the first selection carried out by PLM editorial staff and IPLC Italy Board up to the short list assessment by a judging panel of Italian and foreign buyers. Then, the final stages of the contest were marked by the selection of the winners, and the award ceremony of April 18.

‘BEST COPACKER PROFILE’ PLM AWARDS PARTNERS

The award ceremony organized by PL Magazine and Edizioni DM was sponsored by MarcabyBolognafiere, the reference Italian event for PLs. The initiative was also supported by IPLC Italy, a consultancy firm specialized in private label, and Sealed Air (leading company in food packaging), Rspo - Roundtable on Sustainable Palm Oil and The Optimist (design, communication, digital and event planning agency).l

For further information, please visit the website www.plmawards.it.

25 AWARDS - PLM

Award-winning companies The top finishers

CONVENIENCE STORE CATEGORY PEDON

✪ Italian family business that has ventured all over the world. It selects and processes grains, legumes, and seeds. Founded in the 1980s, the company has managed to innovate while sticking to its principles, such as a curious attitude towards what is new, a promise to grow in a healthy and sustainable way, and an enterprising spirit.

https://www.pedon.it/en/

BEVERAGE CATEGORY ALMAS

✪ Conceived to make the best plant-based products at the most competitive prices. The company meets customers' needs by optimizing costs and combining innovation with environmental respect. For all its customized plant-based products, the company relies on on-site production processes.

https://www.almasitalia.it

FRESH CATEGORY RAVIOLIFICIO LO SCOIATTOLO

✪ Scoiattolo is an Italian family history that began 30 years ago around the table. It is the evolving tradition of Fresh Pasta, now in its third generation, filled with passion, courage and creativity in the kitchen.

https://www.scoiattolopastafresca.it

COLD CATEGORY SAMMONTANA

✪ A story that for more than 70 years has been fascinating all Italians; a story made of tradition, quality and experience, but also of innovation, modernity, desire to grow and achieve ever new goals. Today a leader in the industrial bulk ice cream market.

26 PLM - AWARDS

https://www.sammontana.it

PERSONAL CARE CATEGORY ESSITY ITALY

✪ Its mission is to sustainably develop, produce, market, and sell value-added products and services in hygiene and health. Devoted to improving well-being through excellence in hygiene and health solutions, it strives to create long-term value for its customers, consumers, employees, shareholders and society at large.

Private Label Division https://www.essity.it/

PET CARE CATEGORY CELMAX ITALIA

✪ Celmax Italia was founded in 2007 by the will of three companies, already established in Europe, with the aim of developing the business lines of Pet Care, Personal Care and Baby Care also in the Italian market. Experience, diversified assortment, and impeccable service in PL have made it a point of reference for large-scale and specialized distribution.

https://www.celmaxitalia.it/en/

HOME CARE CATEGORY I.C.E.FOR

✪ Ecological Chemical Industry. A company that, for more than 40 years, has specialized in the production of high-quality detergents, cleansers, emulsions, waxes and sanitizers intended for hygiene in both professional and domestic settings. Particularly committed to sustainability, the company produces under its own brand name and for third parties.

https://www.icefor.com

OTHER NON-FOOD PRODUCTS CONTITAL

✪ A leading food packaging company, It is one of Europe's leading suppliers of aluminum containers. Its production facility is equipped with over 450 different molds with a fully automated packaging system. The goal is to create strategic partnerships with customers along the entire supply chain.

https://www.contital.com/en/

27 AWARDS - PLM

Discount store focus on wine: an MD case study

Last January, the brand presented its Enotrium line, a local ‘family’ of selected wines to make high quality choices accessible in the world of wine as well.

If you say ‘discounter’, you immediately think of PLs, which represent the pillar of this channel, even in wine. At the heart of the brand’s proposal, there’s the desire of “giving the client the confidence to buy a high quality, value-for-money product.” The MD discount chain, which designed an important private label wine project, is no exception. Giuseppe Cantone, Sales manager at MD, had already announced, in October 2021, during a workshop held by Vinitaly of Verona, that the wine department would have been the protagonist of a fine market development: “The consumer should choose to go shopping in MD for wines as well,” he had explained.

So, last January, the brand presented its wine line Enotrium , a ‘family’ of local wines selected by MD to make the choice of high quality products also accessible for wine. In fact, the local grape variety, cultivated and spread in its area of origin, reflects a strong relationship with the territory, its traditions, and inhabitants.

On Monday 3rd April 2023, at the traditional round table of Vinitaly on wine and Modern Distribution organized by Veronafiere Marco Usai, Wine Specialist at MD, confirmed the preliminary results of the actual ‘revolution’, in which, over the last two years, the MD wine section has been in-

COMPANIES IN THE FIELD - PLM 29

volved. “The negative effects of the complex situation recorded in 2022 has affected the shopping habits of consumers, with negative repercussions also for wine. Nevertheless, MD continues to record great performances in the wine industry, confirming its effective strategic choice: diversification of the supply to make its wine section, not a secondary element, but an important pillar of the discounter world, which contributes to increase loyalty and attract new clients.”

An attainable objective also thanks to a precise strategy applied to wines: give the client the confidence to buy a high quality, value-for-money product. This quality is confirmed not just by continued research on premium and current products, but also by a strict Protocol of chemical-physical and organoleptic analysis, which results in hundreds of controls over the presented wines.

“Welcoming the migration of clients coming from supermarkets also means being responsive and ready to follow new trends. In line with the context of the market, in fact, MD recorded great results in the dry sparkling wines and Igt rosé wines segments, showing its capability to adapt to new market dynamics and to meet consumers’ needs once more” Usai concluded. l

Enotrium Labels

• Albana Romagna Docg

• Corvina Verona Igt

• Frappato Terre Siciliane Igt

• Lucido Terre Siciliane Igt

• Malbo Emilia Igp

• Spergola Emilia Igp

• Susumaniello Salento Igt

• Zibibbo Terre Siciliane Igt

Coming soon:

Cococciola Brut Terre di Chieti Igt

Coda di Volpe Sannio Doc

Greco nero Calabria Igt

Pallagrello bianco Campania Igt

Pallagrello nero Campania Igt

31 COMPANIES IN THE FIELD - PLM

IT’S NOW DANIELA ANTONIUZZI, AT I.C.E.FOR VICE PRESIDENT, TO TALK WITH PL MAGAZINE .

32 PLM - FROM THE POINT OF VIEW OF THE INDUSTRY

I.c.e.for : environmentally friendly detergents

Initially established for the business sector, before specializing in toll manufacturing for various industries and offering tailor-made products, the company has developed a focus on sustainability

by Maria Teresa Giannini

Founded over 45 years ago, I.c.e.for is a family company that produces professional detergents, as well as detergents for home use. They have 30 employees, and their 2021 turnover was 8.5 million euros (source: registroaziende.it). I.c.e.for is located in Magenta’s Ticino Park, which prompted the company to develop a particular passion for environmental protection, which was solidified in 1985, upon the creation of their ‘Ecological Formula’ manifesto. I.c.e.for's goal has always been to research groundbreaking formulations for its products, using raw, plant-based materials that guarantee maximum biodegradability and minimum environmental impact.

Daniela Antoniuzzi,

vice president of the company, tells us about it.

How was last year for your company?

2022 was positive overall, but, as with all companies, we have had trouble sourcing raw materials over the past few months. In spite of this, we have never let our customers go without our products; we avoided systematically passing on any price increases to them, while also keeping raw material and electricity costs as low as possible.

How much of your overall turnover and sales is generated by your private label products?

75% of our overall production comes from third-party branded products and the remaining 25% comes from I.c.e.for branded products. We have developed a strategy around PL to match our excellence in R&D and production with excellence in the supply chain. A good number of products in the I.c.e.for lines are customizable, particularly our household cleaners and disinfectants.

What sort of market is the detergent market? Is it more vulnerable to certain variables such as rising costs of raw materials and inflation than other markets? Rising household bills and record-high inflation are certainly affecting consumption. People are cautious in their spending and plan their purchases carefully. At the same time, there has been considerable growth in attention to the sustainability of products, as well as corporate transparency.

33

FROM THE POINT OF VIEW OF THE INDUSTRY - PLM

Do you have a presence in overseas markets? Where do you mainly direct your export business?

We have recently formed partnerships with some companies located in Eastern Europe, but our business is still mainly directed towards the Italian market.

Which brands do you work with?

Domestically, we serve the main large-scale distribution brands, but we also work with specialized stores.

What are the benefits that you offer as a PL manufacturer?

I.c.e.for was initially established for the professional field, but as time has gone on, we have begun to specialize in toll manufacturing for a variety of sectors, and can offer custom-made products. Thanks to our research and development team, we are now able to offer our customers concentrated formulas, ingredients that are both renewable and sustainably sourced, recycled primary packaging, FSC-certified secondary packaging, as well as tertiary packaging also made of recycled material. In addition, we can guarantee the production of medical surgical aids, as we are a licensed manufacturer. Over the years, we have gained some of the most significant certifications, such as the ISO 14001 (for environmental high performance), as well as the IFS (a global certification for products manufactured under a third-party brand). Companies that are interested in producing their own brands through us can also claim labels such as ‘EcoBioControl and EcoBioVegan - products not tested on animals or animal-based’. "Second Life Plastic - 100% certified recycled plastic," "EU Ecolabel - certified ecological quality on a European level"; "A.I.S.E. Charter for Sustainable Cleaning"; "Nickel, Chromium, Cobalt tested," in other words, products tested for metal allergies.

34 PLM - FROM THE POINT OF VIEW OF THE INDUSTRY

Active for 45 years in Magenta

8.58 million euro tournover

30 employees

75% third-party branded production

25% I.c.e.for branded production

What are your most in-demand products?

Our various lines of green detergent (both our own brand and customer-branded products) are in high demand, as are the aforementioned PMC products, which consist of highly specialized cleaners and specific household products, such as descaling agents for irons and coffee machines, induction hob cleaners, window and blind cleaners, and glass and fireplace cleaners.

How can a detergent manufacturer get the certification “Legambiente Recommended Product?"

At a few conferences in the 1980s, the President met the new Legambiente association and immediately shared the idea of sustainability with them. This encounter created a bond of great truth and respect. In the years that followed, we strengthened this partnership and have always supported them in protecting the environment, so much so that today I.c.e.for is the only company in Italy to have multiple lines that carry the exclusive "Legambiente Recommended Product" logo. This title was given to us following a careful analysis by the environmental association’s technical-scientific committee, which assessed the environmental friendliness of our products, not from a chemical perspective, but rather more comprehensively, taking into account factors such as production cycle, packaging, and formula.

Businesses like I.c.e.for are in the spotlight for two reasons: they produce detergents and use packaging made from polymers. What steps are you taking to make your business more eco-friendly?

I.c.e.for has always firmly believed that sustainability is no fleeting concept, so much so that it was already listed 10 years ago in the "Golden Book on Corporate Social Responsibility'' for the DADO project, which is an environmentally friendly container for detergents designed in collaboration with the Iuav University of Venice. This project was already cutting-edge several years ago due to its 100% recycled plastic material; it reduced the environmental impact of transportation through palletizing, which is a means of optimizing occupied space on vehicles, and it contained a waste-reducing concentrate that benefited the environment. In 2023, we cemented our position as a sustainable company through the ISO 14067 Certification (Carbon Footprint Management). Additionally, a continued team effort made it possible to quantify this footprint with the equivalent CO2 weight corresponding to 1kg of product in its packaging. Once again, this reveals the importance our company policy attaches to environmental impact and will be a new benefit to our customers.l

35 FROM THE POINT OF VIEW OF THE INDUSTRY - PLM

PL cleansers : affordability, quality and sustainability

Sales growth has been slowing down, but labels are still keeping a high focus on sustainability and specialization.

The high need for household hygiene and cleaning of the months of the Covid-19 emergency last year is now suffering a setback. Based on data by Osservatorio Assocasa, in collaboration with NielsenIQ, in the year ending August 2022, the growth rate of the household cleanser market didn’t exceed 1.2%. Sanitizers (+14.3%) and laundry aids (+2.3%) are among the best-performing segments, whereas cleansers and washing machine cleaners have recorded a less significant increase (+0.1% and +1.1% respectively). In terms of distribution channels, an overall downward trend was recorded, which was offset by the outstanding performances of drugstores (+4.8%) and discounts (+7.7%). The increase in the price of raw materials and energy costs has favored mainly large-scale distribution brands, which, besides being affordable, also ensure quality performances and more sustainability.

36

PLM - MARKETS

37 MARKETS - PLM

*

Put at your service 40 years of experience and commitment: deeds, not words

A MARKET INFLUENCED BY THE INCREASE IN PRICES

“Overall, PL cleanser sales trends have been very positive - commented Carrefour - and, specifically, a significant growth has been recorded in the dishware and fabric segment. Throughout the year 2022, consumers consolidated this trend. We’ll continue betting on these two categories this year adding new products to the fabric softener supply, where the market has now shifted towards larger sizes.” Also in Iper La grande points of sales this section recorded a positive trend in 2022, both in terms of volume and value. “Actually, it was more of a value rather than a volume growth - specified Antonio Matarrese and Rosa Tufano, Private Label Cleanser Segment Buyer and Shopper Analyst and Cleanser Category Manager at Iper La grande i . This resulted from the price increase for the final consumer due to the higher inflation rate recorded since the first half of the year. In terms of trends, the increase in PL product incidence on expenditures is significant. This shows that households struggling due to the sharp rise in prices, in order to limit spending, in addition to cutting volumes are buying products belonging to lower price ranges. And this trend has been recorded in all segments.”

39 MARKETS - PLM

The positive trends recorded by Iper La grande i products in 2022 were mainly due to the increase in value rather than in volume.

BALANCE BETWEEN PRODUCT QUALITY AND PRICE POSITIONING

For Moroni Amato Group,the supply of PLs to the main brands of large-scale distribution has always been a relevant factor. For this reason, over the years, significant investments have been made to provide a complete service with industry analysis, ad-hoc formulas, graphic study and adaptation, and logistics service. “In view of the experience and knowledge of the market we operate in - explained Tomas Beggio, Sales Director at Moroni Amato - our role is often that of consultants for our clients’ projects. In 2022, PL accounted for slightly more than half of our total turnover, while our brands accounted for the remaining part. In the Italian distribution industry, our main collaborations with PLs have historically been with major drugstore specialized labels and discounters. On the one hand, it is also true that our supply has always had the approval of consumers due to product quality and correct price positioning, which has contributed to such growth. Last year and for 2023 we’ve built new partnerships, and we’re currently developing projects for important large-scale brands, which will be launched and available on our shelves before summer.”

BEST VALUE FOR MONEY LEADING CONSUMPTIONS

Fabrizio Mancinelli, No Food and Pet Food Product Manager at Despar Italia , confirms that affordability is among the purchase drivers for PL cleansers: “Last year, our private label cleanser section recorded an increase by 25.6% in value and 6.7% in volume, despite the high inflation rate, which is affecting everyone. The dishwasher segment recorded the most interesting performance in terms of increase in revenue (+27%) and volume (+8.6%). Customers have acknowledged a better value for money in PL compared to market leaders, which, in several cases, have changed their formula and reduced the product quantity. The trend for the new year doesn’t seem to differ from the previous one. Consumers have notably appreciated the new air fresheners under our label in our supply. Conversely, a significant decrease in sanitizing products has been recorded, after a surge in sales during the Covid-19 pandemic.”

PLM - MARKETS 40

In 2022, the Despar cleanser segment recorded an increase by 25.6% in value and 6.7% in volume.

ECO-FRIENDLY ASSORTMENTS ON THE RISE

Sustainability is one of the main strategic goals of Despar Italia. The company has implemented policies aimed to reduce their environmental impact and foster a more sustainable development model also for the products under their brand. “We’re moving in this direction also for the whole household cleanser production chain - added Fabrizio Mancinelli - for which we’re working on a new portfolio of more sustainable and competitive products. Hence, the use of raw materials of natural origin whenever possible, sustainable packaging made of 30%-100% recycled plastic, which are equally effective in terms of reference benchmarks and ensure the right performance. The main categories involved in this transformation are degreasers, limescale removers, liquid and spray glass, and all-purpose cleansers with new allergen-free scents” .l

MARKETS - PLM 41

Fabio Massi, Journalist specialized in Retail and Mass market issues.

QBerg analyzes the Personal Hygiene market in the Web FMCG distribution channel. What emerges?

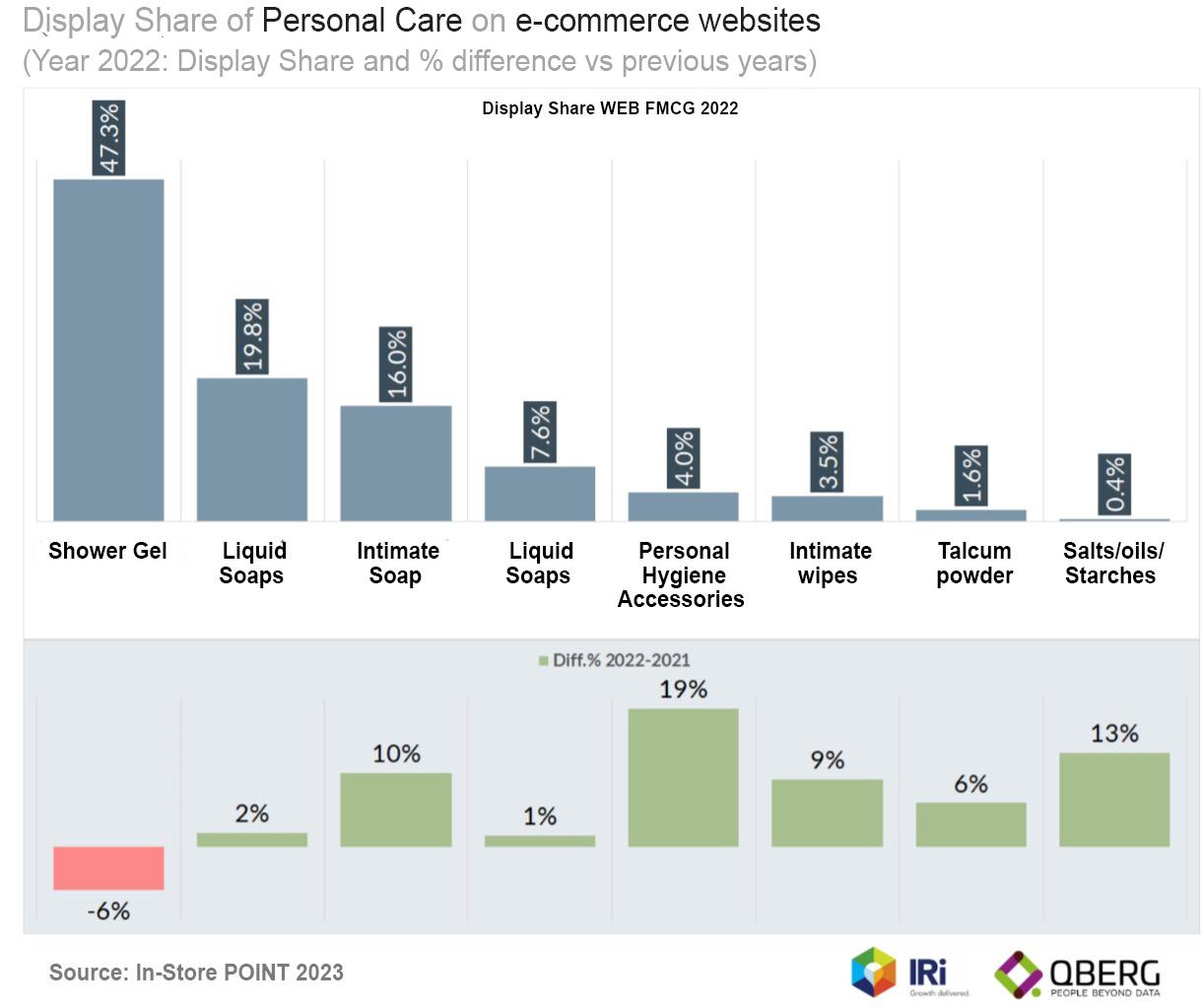

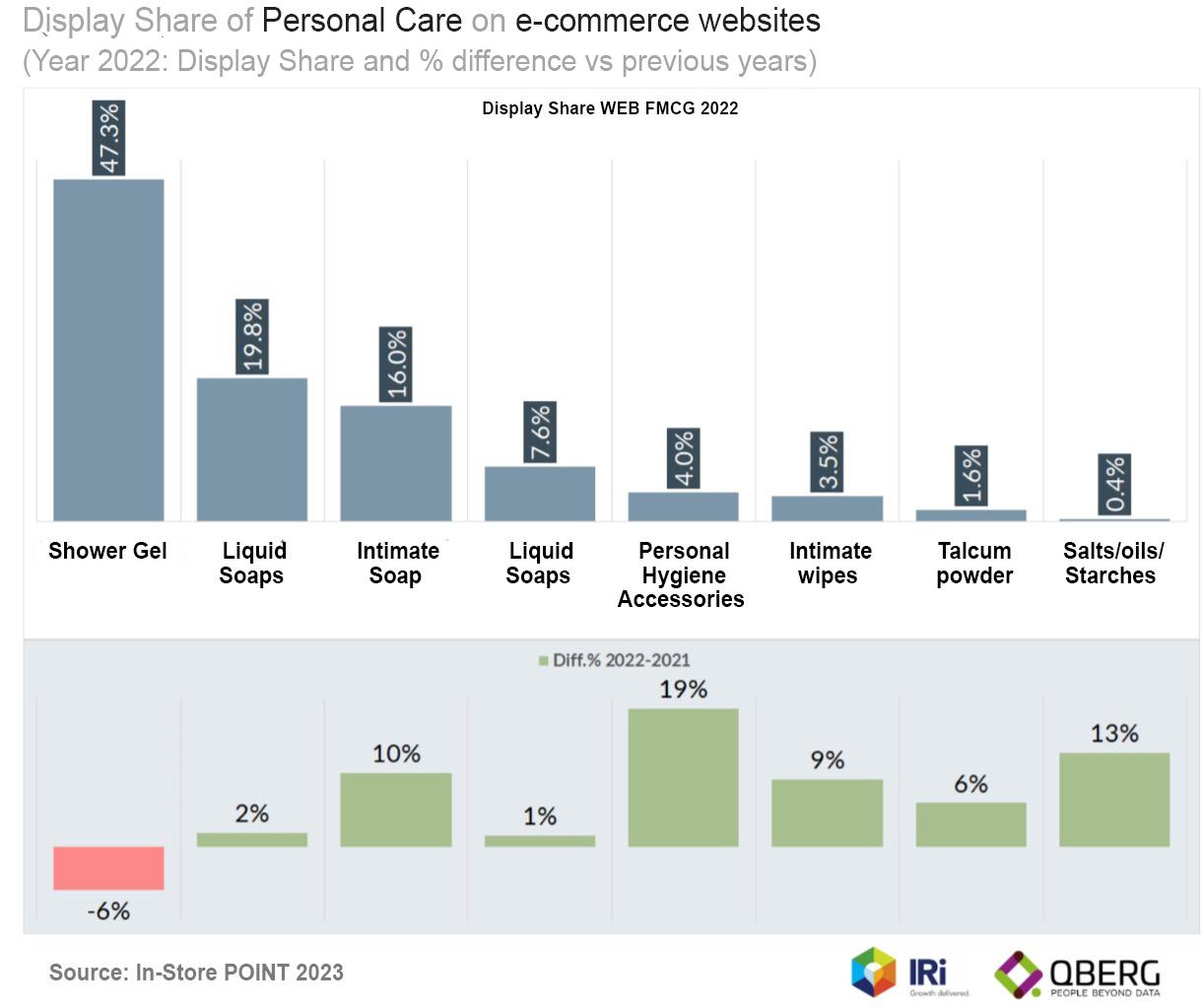

QBerg, Italian Research Institute, leader in price intelligence and multichannel strategy-analysis services (flyers, physical stores, e-commerce and newsletters), analyzed the supply trend of the Personal Hygiene Market (Shower Gel, Liquid Soap, Intimate Skin Care, Intimate wipes, talcum powder, Salts/Oils/Starches) in the web channel in 2022. The used parameters were: Display Share, TOP5 Producers and PL Display Share and Average Price.

42

PLM - QBERG OBSERVATORY

Undoubtedly, in 2022, the highest Visibility share (Display Share in technical terms) on the FMCG Websites was offered to Shower Gel products (47.3%), followed by Liquid Soaps at 19.8% and by Intimate Soap (16.0%) . Then, from all the other segments, starting from 7.6% of solid Soaps , up to 0.4% of Salts/Oils/Starches .

Comparing these to 2021 figures, the visual loss of Shower Gel products (-6%) is clear in 2022, while all the other segments increased their presence, in particular Personal Hygiene Accessories,Intimate Soap, Intimate wipes and Salts/oils/starches (about +10%).

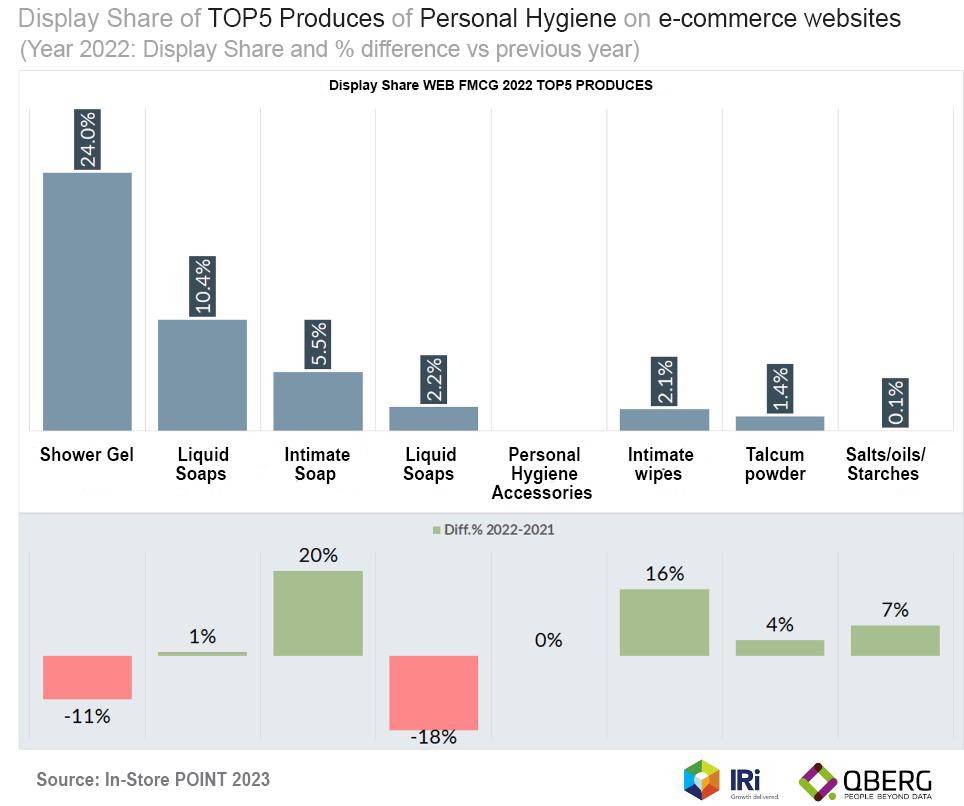

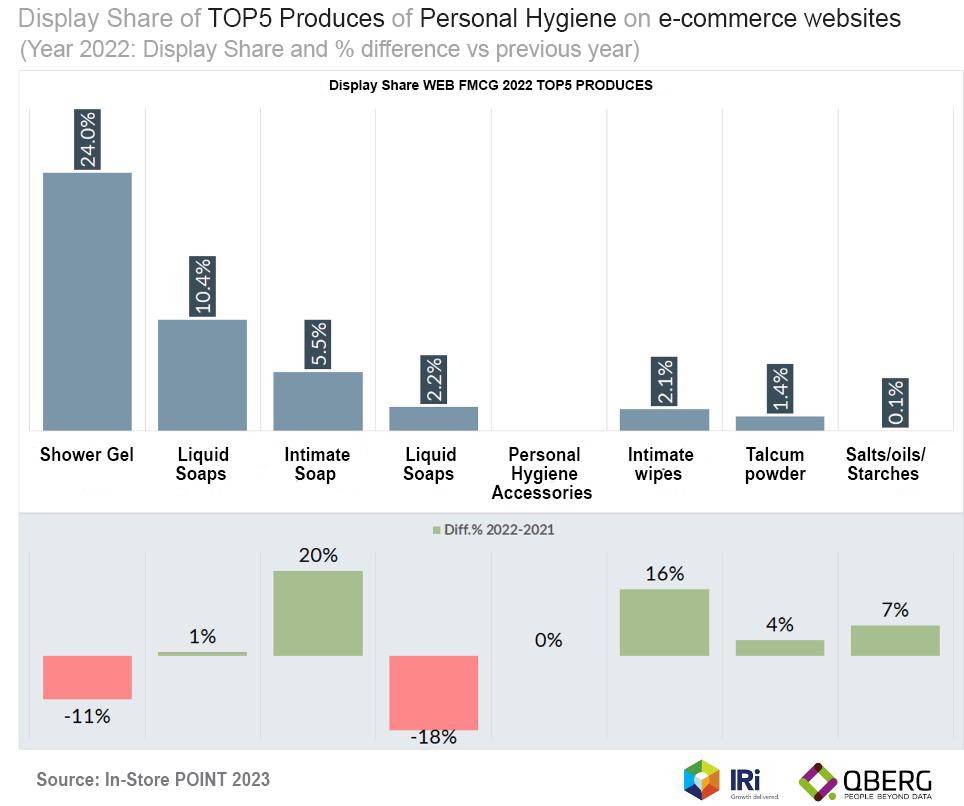

The TOP5 Producers (Bolton Group, Colgate Palmolive, Paglieri, Sodalis Group, Unilever) have the relative majority on the total of the products on the FMCG Websites. However, in 2022 we outlined:

● A reduction of the presence in some important segments, such as Shower Gel, which in 2022 recorded 24% (-11% compared to 2021) and Solid Soaps, which in 2022 decreased by 2.2% and 18% compared to 2021.

● An increase in Intimate Hygiene product presence, such as Detergents and Wipes (20% and 16%, respectively)

● The supply of liquid soaps remains unchanged and Talcum Powder and Salts/Oils/ Starches see a moderate increase (4% and 7%, respectively).

43 QBERG OBSERVATORY - PLM

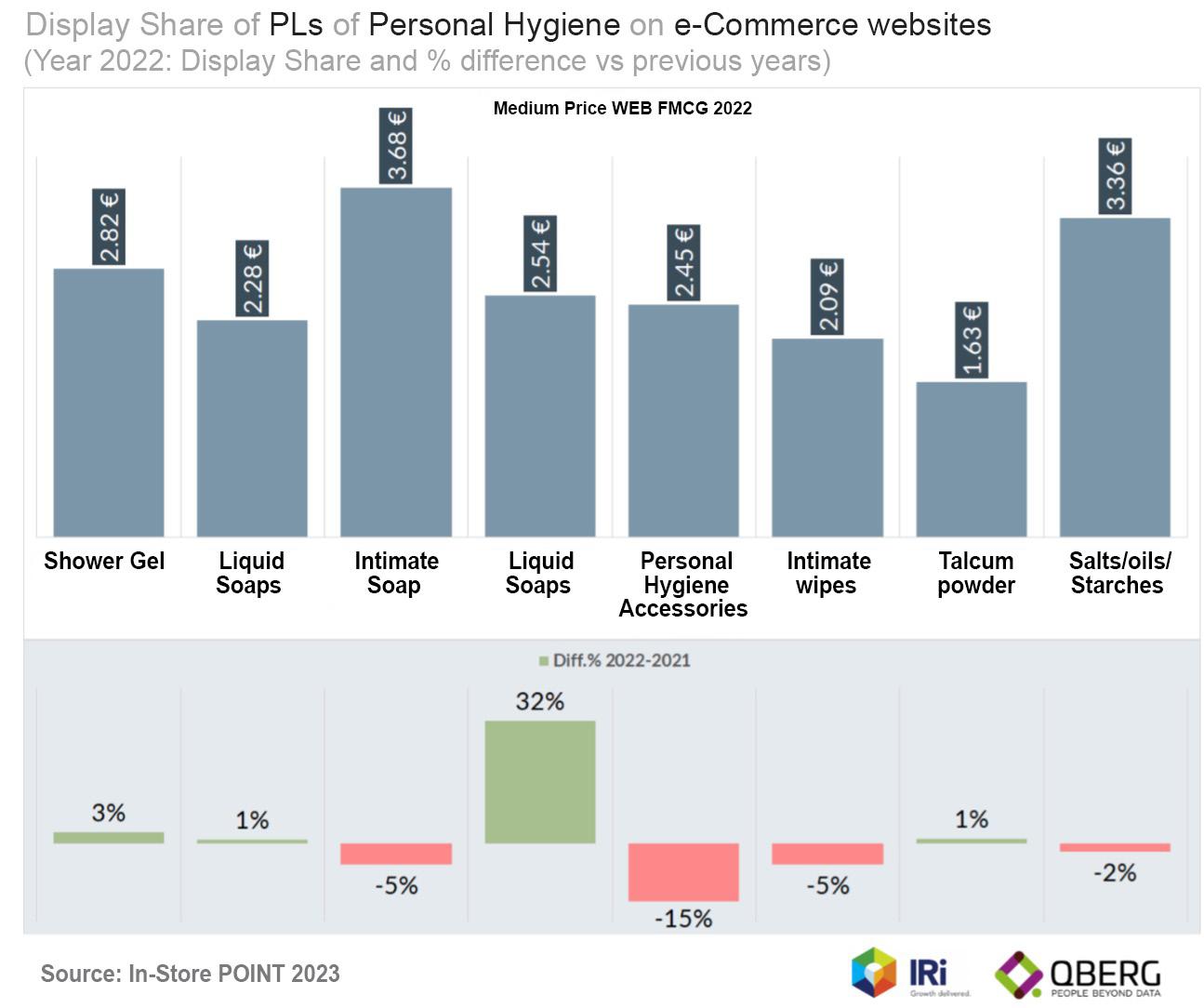

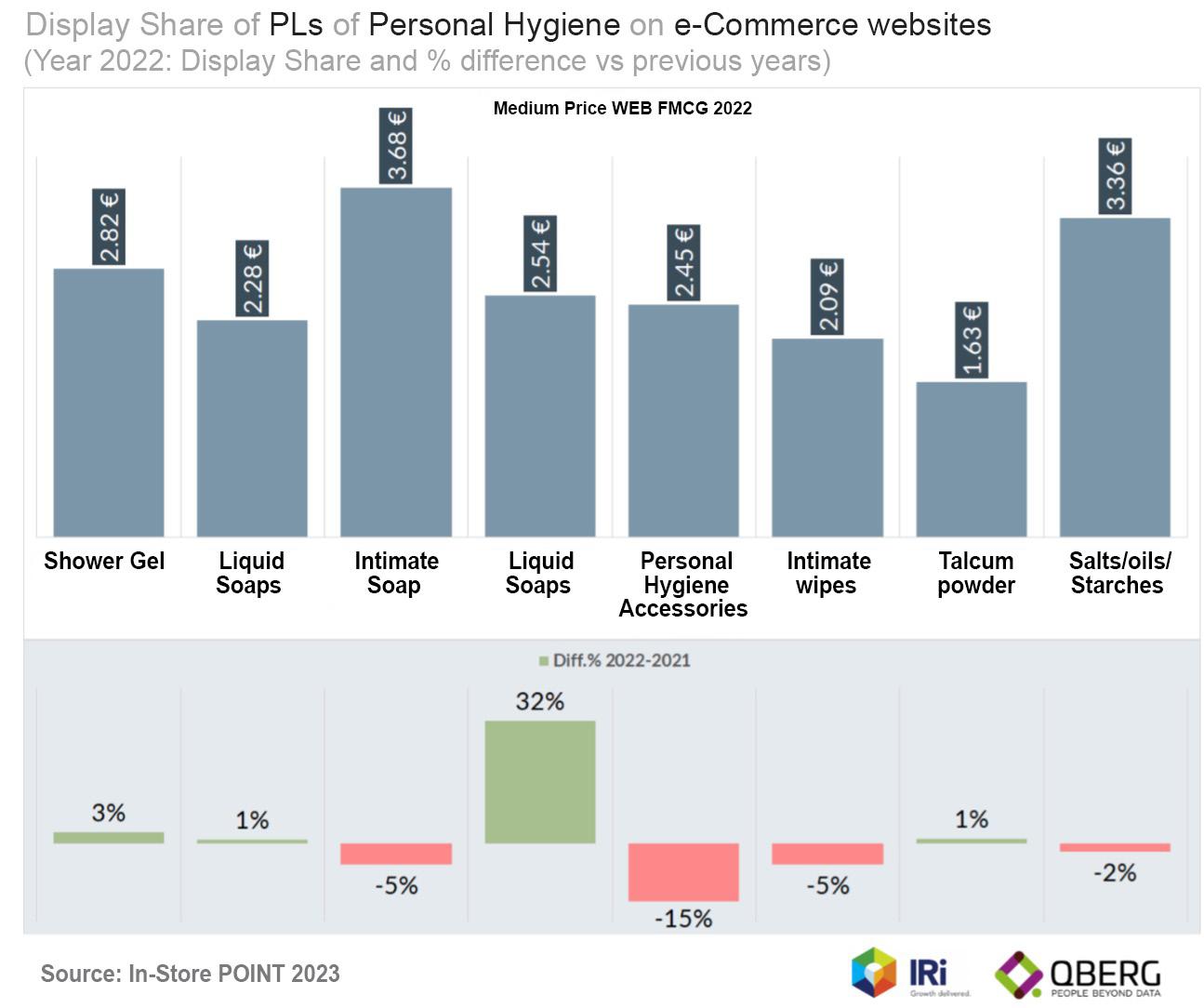

PLs , already a distinct minority in the visibility spectrum of Personal Hygiene products, reduced quite noticeably their Display Share in 2022 compared to 2021 on our FMCG websites.

The main decrease is recorded for Solid Soaps (-30%), for Shower-Gel (between 6% and 15%), Personal Hygiene Accessories , Intimate wipes . The visibility decrease is minor for Liquid Soaps (-6% vs 2021), which in 2022 was 2.4 of visible product total.

PLM - QBERG OBSERVATORY

44

In 2022, average prices of Personal Hygiene products on websites were unvaried compared to 2021 . However, there were interesting fluctuations among the segments:

● On a positive note, large fluctuations for Solid Soaps, whose average price was €2.54 in 2022 (+32% compared to the previous year). On a negative note, the Personal Hygiene Accessories trend decreased to €2.45 (-15% compared to 2021);

● Slight negative fluctuations for Intimate hygiene products: both detergents and wipes decreased in price by 5%, ending up costing€3.86 and €2.09, respectively.

● Average prices in 2022 for Shower gel, Liquid Soaps, Talcum powder and Salts/Oils/Starches were quite steady compared to 2021. l

Fabrizio Pavone Marketing Manager and Business Development of QBergg

45

QBERG OBSERVATORY - PLM