The great infatuation

The parable of e-commerce and the role of PLs

Iper, all-round private label

Marenchino: growth in volume and recognition beyond Piedmont’s valleys

The parable of e-commerce and the role of PLs

Iper, all-round private label

Marenchino: growth in volume and recognition beyond Piedmont’s valleys

Our private label has earned another significant recognition in the industry.

The European Private Label Awards 2023 has affirmed our branded products’ market leadership and value. A panel of experts acknowledged the taste and quality of our 11 Paralleli, Sapori&Idee Conad, and Verso Natura Conad product lines. These products have already gained a strong reputation in Italy, where millions of customers enjoy them every day.

8

PLMagazine Quarterly supplement of Distribuzione Moderna magazine, a media outlet registered with the Court of Milan Registration No. 52 of 30 January 2007

Editor-in-chief Armando Brescia

Editorial director Maria Teresa Manuelli

Translation Jcs - Language Services info@jcslanguage.it

There

25

Carrefour opens the Terre D'Italia flagship store in Milan

Penny Italia: first retailer with a private label from vertical farming

36 Interviews for the industry Marenchino: growth in volume and recognition beyond Piedmont’s valleys

40 Markets

PL local food specialties continue to grow

Scientific Committee

Stefano Ghetti, Managing Partner Expertise on Field/partner IPLC Italy

Gianmaria Marzoli, Retail Solutions Vice President Circana Italy

Alberto Miraglia, General Manager Retail Institute Italy

Paolo Palomba, Managing Partner Expertise on Field/partner IPLC Italy

Emanuele Plata, Co-Founder, Past President, Board Advisor PLEF

Contributing Authors Federica Bartoli, Stefania Colasuono, Maria Teresa Giannini, Fabio Massi, Fabrizio Pavone, Luca Salomone

Creative Director Silvia Ballarin

Editor Edizioni DM Srl - Via A. Costa 2 20131 Milano P. Iva 08954140961

Contact Phone 02/20480344

redazionedm@edizionidm.it

Advertising Sales office: commerciale@edizionidm.it

Tel: 02/20480344

is no guarantee that we will publish the original versions or any part of submissions (texts, articles, news, images, data, charts, research, etc.) sent by authors outside the Editorial Board. Submissions may, however, be published in a revised form for editorial reasons. It should also be noted that sending a submission constitutes an automatic authorisation by Edizioni DM Srl to publish it free of charge in all its publications.

The record growth of PLs continues, setting a new sales record, in the first six months of 2023, unbroken for more than 18 months now.

And the gap between private PLs- now surging- and industrial brands - still weighed down by production and logistics costs - becomes clear when it comes to two key values.

According to data by Circana in the six-month period ended June 18, PL value growth outdistanced industrial brands by as much as three percentage points: +8.2% vs. +5.1%. Even in volume, the former is essentially stable (-0.5%) with -3.4% for the latter, a gap that analysts expect to widen.

The second is numerical, as most consumers consider them even better than or equal to industrial offerings. And in Italy? Here, the PL share actually reached 30% in December 2022. So, brands decide to do without industrial brands and fill entire stores with their own brands or outdoing in innovation and previously ‘forbidden’ areas.

This is a trend that has been going on for a few years now, but that is now significantly accelerating. Following in the footsteps of Coop with ‘FiorFiore’ line, Esselunga with Elisenda pastries, Conad with Sapori&Dintorni, Unes with Il ViaggiatorGoloso, and Carrefour's Terre d'Italia project, dedicated to typical Italian products, is the latest launch of the week. With the first line dedicated to salads grown in aeroponics in a special vertical farm, Penny Italia is, instead, the most daring brand. But PL’s reach is not limited to FMCGs: since last year, Conad has been pushing pharmaceuticals with its ConCura format, a sort of ‘health hub’ that integrates parapharmacy, opticians and first-rate analytical services. Competition is in the air now. And it is not over prices.

According to Ananda Roy, Svp of Circana, 2022 was the year of overtaking, in the six major European economies. The first overtake is conceptual: PLs are increasingly being perceived as brands and are no longer seen as pauperistic. The second overtake is numeric, since the majority of consumers consider PLs even better or equal to industrial products. As a matter of fact, in Italy the Llc share almost reached 30%.

Today, PLs account for 38% of large-scale distribution sales in Europe, for a total value of 229 million euros. Despite a higher price increase, compared to those of brand products, in proportion, they continue to record, in the fourth quarter, an increase in shares and significant peaks in almost all the major Llc categories. Circana well explains this in the new edition of Fmcg demand signals, a semestral report that involved the six major European economies (France, Italy, Germany, Spain, the UK and the Netherlands), analyzing more than 230 categories, for more than 2,000 good segments and more than 10 million Ean codes. The report underlines a positive variation of PLs in all the six major European markets, with the highest penetration in Spain (47%) and Germany (41%) and the lowest in the United Kingdom (37%), where consumers continue to be loyal to Industrial brands.

As far as Italy is concerned, PL incidence is high, much more than most Italian distributors state: an average of 29% for 24 billion euro of sales, with double-digit increase rates. Ananda Roy, global Svp, Strategic growth insights of Circana, comments: “PLs have come a long way compared to 40 years ago, when they first arrived on the shelves. The distributors’ investments supporting the development of these products are bringing significant results. Today these references are perceived as better, or even the best, compared to many other brand products they compete with. Consumers consider PLs as innovative. This is the reason why they're not the cheap alternative motivated by price anymore.” The report also shows that the most loyal PL customers account as the most loyal brand customers. Actually, PL consumers overtake brand ones: 60% of the interviewers affirm that PL are innovative, of high quality, sustainable and as good as other industrial brands; 25% of them consider PLs even the best ones. 21% of consumers are undecided and buy both types, however they affirm that, today, PLs are better than industrial brands.

Moreover, buyers choose to buy PLs mainly in the food category and, since inflation especially affected this segment, PLs show a higher penetration in cold segments and ambient-temperature products. Regarding non-food goods, on the other hand, PLs are mainly present in house-care and, in particular, in detergents and sanitizing products. Alcoholic beverage and some children food categories recorded only a partial increase in PLs. For these categories, consumers were more loyal to their favorite brands. Distributors are introducing innovative goods, such as non-alcoholic beers, or high-quality artisan products, made of local ingredients. And again: a large majority of consumers, as said before, consider PLs as innovative and this results in significant growth rates. Finally, PL customers look for the right balance between price (78% actively look for low prices) and quality: 72% pay attention to product labels and 63% check the declarations on the packaging.l

Our journey to meet all the protagonists of the PLM Awards continues, the awards that our online magazine PLM and Edizioni DM designed to reward the Italian PL companies that best represent the ideal characteristics for the retailers. These companies are selected according to objective criteria of production excellency and reliability. We will now introduce you to the companies that ranked second.

✪ It’s the major Italian producer of jam: reliable and consistent quality, carefully selected raw materials and over 80 years of experience in the field. Plus, with 3 in-house labs, cutting-edge production plants and a team of experts dedicated to Research&Development, it’s the perfect partner to guarantee a significant added-value to PL products.

https://www.menz-gasser.it/private-label/

✪ It’s a co-operative Society specialized in industrial transformation of fresh fruit and vegetable, cereals, and legumes in finished products, for retail, food service, door to door and food industry operators. Its model completes and enhances all the phases of the supply chain, from field to distribution, to ensure the final consumer food with the same intact properties of the fresh product, ensuring quality, authenticity and safety.

https://www.fruttagel.it/

✪ Felsineo has been synonymous with high quality mortadella for four generations. Mortadella is a noble coldcut, born in Bologna a few centuries ago. And Felsina is the original name of Bologna. The company’s name derives from it, and it reveals its strong relationship with the city. For Felsineo, mortadella is not only a simple product, but a system of values: food culture, tradition, integrity through quality, well being and enjoying life through food and what it represents.

https://www.felsineo.com/

✪ Its history dates back to 2013, across “Via Emilia”, the old Roman street that today represents the beating heart of the most authentic artisan food production in Italy. It’s the ideal partner for medium and large distribution, as well as for premium brands that want to develop a high-quality and innovative line of PL products. With more than 450 references distributed in more than 21 countries, it well shows its wide possibilities of partnerships.

https://www.emiliafoods.com/

✪ Very well-known in its industry, with more than 40 years of experience, the company has constantly continued to develop and grow and now is a reliable and renowned company. During its activity, it has always stuck to the value of quality, which has become key for its success over the years.

https://milmil.it/

✪ Born in 1956, the society took its name from its founder who, first with the indispensable help of his wife and life-partner Lina, and then with his sons, Dan and Claudio, developed the company until reaching its current extraordinary presence on the pet market. The company is now present both in Italy and abroad, with the production and distribution of dog, cat, rodents, birds, reptiles, tortoises and fish goods.

https://www.recordit.com/

✪ IMI Spa is a public limited company with an Italian heart and a lean and flexible structure, which make it the ideal partner for the PL market, in which it operates in Italy and abroad. The quality of its products, the technicians’ expertise, the personnel’s passion together with the organizational system brought the company to international level, where it became a leader among the disposable tableware production companies.

✪ It operates in the professional home cleaning industry and it’s one of the major international players in the PL channel. Constant growth, competitiveness and quality are the elements that have always distinguished it on the market, since its establishment in 1925. Able to provide a rapid response in every project step, it provides clients with tailored solutions that encourages its PL development to give consumers an immediate perception of the high-quality of the product.

https://www.saci.it/

http://www.imimonouso.it/

The growth recorded since before the Covid-19 pandemic is undisputed. However, it is much less likely that it will continue throughout 2023, now that the emergency phase is over. Here are the solutions and strategies (proposed) by retailers.

Once upon a time, in a country called Italy, people had to live with the burden of a health emergency for two years. Online commerce became a collective mantra, so much so that websites, online services, and delivery companies started to blossom like flowers when the spring sun hits. Yet, they were decimated, or downsized, with the arrival of the “new normal” in winter. If it were narrated with the same ease of a fairy tale, this would probably be the story of the rise and downturn of e-commerce. On this channel, which still remained until 2019, a lot of fmcg retailers (small retailers and large brands) announced their will to support private labels from 2020 onwards. Yet, are these products actually enhanced with targeted actions or do they indirectly benefit from general ones?

The growth that has been recorded since before the Covid-19 pandemic is undisputed. However, it is much less likely that it will continue throughout 2023, now that the emergency phase is over. If we had to answer “which format best adapts to change” in the grocery industry, we would say that e-commerce has decreased from 23.1% in 2021 to 10.5% in 2022. As for fresh produce (a slight increase of +1.1% but a decrease of -5.4% on the channel), frozen food (down -0.1% on an annual basis, and -6.6% on the channel) and beverages (a decrease of -4.8% and -7.8% on the channel) the drops (recorded) carry their weight and these categories are traditionally referred to as “fief” of private labels. On the whole, the latter is up 6.7% online (source Iri). “Data on fresh produce proves that during the Covid-19 pandemic in Italy, people got “drunk” on e-commerce and delivery services, which are now settling at lower levels, as can be seen by the withdrawal of Uber Eats and Sezamo” commented Alberto Miraglia, General Director of Retail Institute of Milan.

According to a study carried out by Netcomm - a consortium promoting the development of e-commerce and the digital evolution of businesses - in collaboration with NIQ, in the brand industry+private label total, e-commerce rose from 1,472 million euros in volume in 2020 ,to 1,818.4 million euros in 2021 and 2,008.5 million euros in 2022 (in the first 52 weeks). Its marginal growth rose from 7.5% in 2021 to 10.5% in 2022.

A Netcomm report published in February 2023 (based on data of the 3rd quarter 2022) shows that online purchases were 10.7 million, 2.3 million more than in the period before the Covide-19 pandemic. Their share accounted for 8% of the total, 2% more than in the pre-pandemic period. Finally, market penetration amounted to 42%, 8% more compared to 2019 and previous years.

According to retailers, the way online shopping is used can still be improved: based on in-house and customer surveys carried out by Md, some work is needed to have a better seo positioning on search engines, as well as to make the website faster and more functional for the customers, and, finally, to analyze the online behavior of customers (also of “long-time” ones) so as to design customized promotions and advertising. Furthermore, the purchase of product bundles instead of a single product. According to Coop Alleanza 3.0, the shopping experience should be faster and more catchy, which may be achieved with the use of artificial intelligence.

Being a marketplace working closely with major players in large-scale distribution, Everli claims that in the last five years, private labels have been a strategic asset for most brands. “Regardless of the individual specific promotional strategy, this choice proved to be successful in each industry, from food to clothing and general platforms - stated Alessandro Angelini, Everli Coo and Cfo - About 40% of users got used to buying online and about 50% affirmed to be more inclined to continue doing so. For the most part, this segment includes upper-middle income consumers between 25 and 44 years of age, mostly young couples or couples with young children (source: GroupM Research & Insight). In the last year, in particular, the high inflation rate caused 42% of consumers to cut down on superfluous purchases, 33% to choose discounted products, 27% to take more advantage of fidelity programs and giving more preference to commercial products. In the Q1 area (north-east) this preference increased by 4 % in 2023 compared to 2022.”

“Grocery shopping in Italy is still a pleasant moment to share with one’s trusted seller, as well as a creative one. Italians do without only due to force majeure, rather than systematically - explained Alberto Miraglia. - Retailers know it, which is why they create an environment using spaces and colors that can make customers feel at ease.” A pioneering example in this sense comes from the French chain Gran Frais, which has been present in Italy for six years under the brand Banco Fresco and in Milan since 8 June 2023 with a new format, Fresh, a burst of colors in structures that remind consumers of local markets, where customers usually look for human contact (especially in the meat department) and suggestions. Their e-commerce portal is colorful too, from their leaflets to each category section, as done by “Il Viaggiator Goloso”, Unes private label.

Based on the Coop Alleanza 3.0 experience, private labels record a much higher online share compared to physical stores. “When online, people aren’t distracted by speculation and offshelf displays typical of POS. We also tend to give more visibility to private label products to build customer loyalty, also in terms of service - affirmed Gian Maria Gentile, Director at Digital, company 100% owned by Coop Alleanza. The increase in the percentage of Coop products was also steady in 2022 and is inversely proportional to promotional pressure, which has progressively decreased since the Covid-19 pandemic. The e-commerce share has become stable, as expected, reaching lower levels compared to 2020-21, although more significant compared to 2019. However, we’re convinced that even if e-commerce isn’t recording 3% of the turnover generated in the territories we are present today, within 3-5 years it could reach 5% and will perfectly integrate into the classic channel. When we talk about online purchase, we refer to a wider range of services. Some are already being provided, such as the purchase collection available in 10 refrigerated lockers installed in January 2023, others will be activated in the future, such as the “click & collect desk” for smaller points of sales and the “drive” service for those having a parking lot. We’re starting to work on a joint visibility with EasyCoop, the online purchase service we launched in Rome in 2016, which also serves 10 municipalities close to Rome, Emilia-Romagna, and the major cities in Veneto”. Easycoop can be used on the official website or smartphone app (once logged in) and offers a range of 13 thousand products, 3 thousand of which are of the fresh produce segment, such as fruit, vegetables, meat, fish and dairy products. Italy as a whole, however, isn’t

just the nort-eastern part of the country, for better or for worse. Although the Q1 area is still a “digital land”, the South of Italy, the Q4 area, has recorded a double-digit growth in its turnover (+30.8%). “This piece of data on the South of Italy is undoubtedly significant, yet aligned with the low figures previously recorded. In other words, it’d have been hard to perform worse than this.”

“E-commerce is more popular in metropolitan cities and investments in this channel at a national level are still very significant. However, in the regions we are present, which are Marche, Abruzzo, Molise, Apulia and Basilicata, there’s a minimum use of this channel, also because it has received little attention by consumers - stated Antonio Di Fernando, Conad Adriatico CEO and General Manager. Generally, in Italy people are used to seeing products first-hand, which is particularly evident in these regions. On the other hand, there’s a growing interest in

cross-channel digital service, which is why we’d rather refer to it as “digitalization”: advertising and information on promotions, for example, are even more prevalent online.”

E-commerce users, according to Alberto Miraglia, Retail Institute, are already loyal customers who know the assortment well and search for it on the Internet as it’s faster. They’re also generally wealthier, considering the delivery costs. “Also for these reasons discounts have fewer advantages in investing in online services. In fact, they have a lower unit price for each product and also spend less on their shopping compared to supermarkets.” However, some cases contradict this trend, especially beyond Italy’s borders, in Europe

According to Everli, the shift from industrial brands to private labels is not temporary but a real trend, which has been consolidated over the years. “On our platform, at the turn of the year 2021-2022, due to uncertainty and the first effects of inflation, an increase by 2% was recorded, which further rose at the turn of the year 2022-2023 due to the persistence of these two elements” - stated Angelini.

A few months ago in Germany, Aldi Süd introduced a delivery service for foodstuffs purchasable online. A test is currently being carried out in the city of Mülheim (Rheinland), where the company has its headquarters, and the surrounding areas. Over 1,300 items (over ¾ from the Aldi assortment) will be available online, among which dried, refrigerated and frozen foodstuffs can be found. The prices will be equivalent to those in stores and deliveries will be made from a fully automated warehouse by electric vans. It is quite a surprising piece of news, as German hard discounts have always refrained from entering the

According to Coop Alleanza 3.0, the top ten of online orders includes service products and commodities, such as water, tinned tuna, eggs and zucchini. Customers understood that it is better to order heavier products online. Additionally, frozen food is performing well for obvious reasons related to the cold chain. As for non-food groceries (detergents, personal care, etc.), incidences are aligned with the physical channel: the competition from category killers is stronger compared to food categories and they are also starting to approach the web.

world of online sales due to concerns that they would affect traditional stores. Rumor has it, Aldi may be planning to provide a "click & collect" service in the future, which would allow consumers to shop online and collect orders in store at a later date. Lidl has opened its seventh marketplace in France. It was not a profitable choice, as for the Neckarsulm based company the countries beyond the Alps are the oldest and strongest markets, with a market share around 8% and a turnover of 15 billion euros. The company aims to double its original 1,000 units within 2-3 months and reach 5 thousands by next year. The product assortment does not include foods; it instead ranges from sports items to clothing, from children’s items to gardening tools, from household products to DIY.

“A market that is growing significantly in the northern and central countries is that of bowls and ready-to-cook meals - noted Alberto Miraglia. The British chain Tesco , for instance, sells “easy family” boxes online at 25 pounds. They contain ingredients to make five dinners for four people, together with recipes that use almost exclusively private label products. Since June 2022, the Dutch brand Albert Heijn, of Delhaize group, has been delivering fresh ready-to-eat meals to its customers.” With this new service, the reseller, which is already the second e-commerce player in the Netherlands, the meals are regularly delivered to customers’ homes by a delivery man on a set day: the service focuses on the concept of access to healthy food, especially for the elderly (in the Netherlands the average age of the customers is increasing significantly). There are signs of how some discounts have been contributing to their first steps in online shopping in Italy as well.

“Online customers are more demanding than ever and the Covid-19 pandemic has only sped up behavioral changes that had already been taking place”, admitted Patrizio Podini, Md founder. With its web store, especially once the pandemic was over, the brand changed its approach and started investing in ad hoc advertising campaigns to promote its own private label lines. Together with delivery, the “Click & Collect” service is also available, meaning that food and non-food products can be or-

dered online, purchased with a click or paid at a physical checkout and finally collected for free at the chosen point of sale. “In the two years hit by the Covid-19 emergency, we recorded a +19.4% increase in online orders of private label products. However, it’s clear that besides this type of service, there should also be a solid omnichannel strategy able to combine the online and the physical channel” stated Podini.

E-commerce in fmgc (brand industry+private labels) in January 2023

10.7 milllion (+2.3 million compared to the pre-coronavirus period) - Italian online purchasers in absolute numbers

8% of total (+2% compared to the pre-coronavirus period) percentage of Italian online purchasers

42% (+8% of years <2019) market penetration of this channel behind the UK and France

6.7% private label market share percentage (in its various industries and segments) in the online channel

6.8% - E-commerce purchase frequence second to last, only Portugal performed worst

3.5% e-commerce market share, behind the UK and France

10.5% e-commerce value in the total grocery, -12.6% from 2021

The online channel has little impact when it comes to groceries. Purchases are 90%-95% in stores and those online are often part of the total shopping. Therefore, by overlooking the online channel, retailers would miss much more than the simple percentage of consumers not buying in stores. There is no pure “e-commerce customer”, as there is an interdependence between the two channels. Therefore, the focus should not be on how e-commerce and physical shopping are competing for the title, but rather on how complementary they are. l

Journalist Giannini,

Maria Teresa

Professional

specialized in Large-scale Distribution.

Giannini,

Maria Teresa

Professional

specialized in Large-scale Distribution.

The PLs of the Finiper Group chain stand out for their varied supply, which, starting from mainstream, unusually boasts also a great range of products in their non-food supply. The production process in the points of sale is the flagship of many grocery stores and tasty recipes.

Iper La grande i , a chain of great surfaces funded by Marco Brunelli and part of Finiper Canova Group (with a turnover of over 3 billion) today has 21 hypermarkets and a superstore in North Italy, an area covered extensively.

Those are locomotives of many other shopping centers, such as Il Centro in Arese, Piazza Portello in Milan, Il Globo in Busnago (Monza Brianza), Oriocenter in Orio al Serio (Bergamo), Il leone in Lonato del Garda (Brescia), Il Fiordaliso in Rozzano (Milan)...

The brand made its food and non-food PL products one of its own flagships. We talked about it with Alessandro Mutti , shopper analyst and category manager, Samanta Brasiello and Simona Ometti , both PL buyers, and Ivano Cuozzo , traditional fresh purchase manager.

How have the trends of your PLs been during these years? There was a great boom during the Covid-19 pandemic...

A.M. : Actually, during the Covid-19 pandemic, we didn’t record a positive trend. Rather, 2022 was much more important, with a positive, double-digit closure of the year.

How many lines do you have?

A.M. : We have 15 PL lines, both food and non-food, and they range from mainstream, to specialties, fresh produce, textiles, diy...

What products are really fundamental? In other words, let’s talk of your best sellers.. but also of innovation and launches.

S.B. and S.O .: In fresh and mini-marts segments, the most important PLs are dairy products, from mozzarella cheese to yogurt, while for the frozen segment, natural fish is the product group that displays the best results. In sweet baked goods, the most interesting segment is cookies, thanks to their value for money. In the fish segment, tuna is growing, strong of a commercial strategy that includes major visibility for the product. As far as innovation is concerned, we’re working on several projects, both in ready-toeat dishes, and fresh frozen products and, transversally, also on fresh and canned food, free-from and protein products, with the aim of meeting our consumers’ needs, as well as current trends.

Premium lines have always been among your best sellers, particularly regarding food and wine specialties. How’s this line for you?

A.M. : We’ve monitored this line of products for years with the Il Viaggiator Goloso brand. We recorded great results both for fresh and canned products.

Inflation has also affected PLs. In your case, which strategies have you adopted to slow down eventual price-increase?

S.B. and S.O. : 2022 was a difficult period, which also affected the first months of 2023, significantly increasing prices, because of requests of increases, due not only to the energy crisis and transportation costs, but also to the lack of raw materials. In this

IPER

IPER PIÙ

PATTO QUALITÀ IPER

GRANDI VIGNE

iNATURALE BIO

AMARSI E PIACERSI

MAREVIVO

CÀ

GROCERY

GROCERY

SELECTED FRESH FOOD

ORGANIC WINES WITH DENOMINATION

ORGANIC AND NATURAL

VEGETARIAN AND BALANCED NUTRITION

FISH

FURNITURE

DANILO TREVIGLIANI MEN AND WOMEN TEXTILES

BICONTATTO

WORKTIME

XERIS

STATIONERY

GARDENING, DIY, CAR ACCESSORIES

BIKING

iNATURALE ECO GREEN CLEANSING

BUONGIORNO FRESCHEZZA IV RANGE

VIAGGIATOR GOLOSO FOOD SPECIALTIES

scenario, PLs were able to control the increases of large-scale distribution, raising its market share with its own product development and innovation and with new packaging solutions. We can confirm that, for Iper, the strategy has been self-determined. Our PL is a reassuring choice for families, able to reduce the impact of the rising costs of living, thanks to its particular value for money, consequently keeping its volumes.

I.C. : Iper La grande i has always had the whole production system as its main pillar. It is no coincidence that one of our slogans says: “Made in front of you”. In all our POS there are real open bakery and pastry kitchens, where all our products are made, such as the 30 different types of bread, croissants, cakes of all types, chocolates, pastries and much more. It’s also important to mention all the dishes in our deli counter, such as fresh pasta (present in some of our POS). Moreover, in all our butcher counters, it is possible to find different ready-to-eat meal references, made by Iper. Finally, in three POS, we make ice-cream and in two of them, beer, BellaFresca, available in four variants: Golden, Blanche, Apa and Bock. l

In the following pages, we present the first part of the articulated IPLC research, presented in Shenzhen during the latest edition of Marca China on 7 and 8 June. The study analyzes the innovation of branded products and the related 2023 trends.

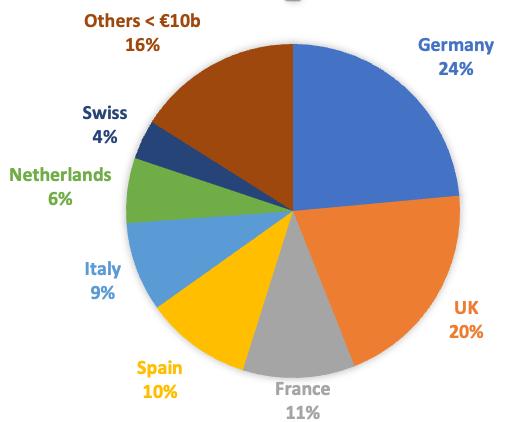

Why is private label so strong in Europe?

▸ The consolidation of the retail market has led to the emergence of more focused manufacturers.

▸ Shopper acceptation: consumers fully trust private label.

▸ Increased competition: Private label is used to build shopper loyalty to the store

▸ Private label is an extraordinary opportunity for thousands of companies to enter or expand into new markets at competitive costs and quickly

▸ There is a direct correlation between private label share and the degree of retailer concentration.

▸ Retail consolidation has led to strong competition.

▸ Private label offers retailer the opportunity to launch unique initiatives and to compete with brands and other retailers.

▸ Retailers challenge their suppliers to drive innovation.

The 5 most relevant countries : Germany, UK, France; Spain and Italy are the 85%

Source: IPLC Italy elaboration on various sources: IGD, Kantar, NielsenIQ, Circana, 2023

ITALY - Value Market Shares of Private Brands in the main categories.

Consumer Packaged Goods

Food and Beverage

Home Care

Health Beauty Care

The annual report of the organization promoting the development of agricultural supply chains that respect human rights captures the growth of certified private labels, despite the consumption crisis. This can especially be seen with ingredients.

The Fairtrade Italia social report displays a substantial hold in the consumption of Fairtrade products. Fairtrade Italia is the organization that promotes the development of agricultural supply chains that respect human rights in Italy. According to the publication, in 2022 Italians spent more than 580 million euros on products containing at least one certified ingredient. The use of cocoa continues to grow, and last year 9,756,051 kg were consumed - a 9% increase. Bananas remain the leading product in terms of volume, albeit with a slight decrease (-3%) due to declines in organic sales. Regarding percentages, the most significant increase was seen in the non-food category: cotton (+78% for 713,000 kilograms) and cut roses (+37 percent for 9 million stems sold). From both we expect a positive performance in 2023 as well.

Large-scale distribution is the most important channel, and PLs have the spotlight: certified references in Conad, Selex, Carrefour, Despar, Pam, Lidl, In's Mercato and Aldi PLs are about 2,400. Products with the traditional Fairtrade Mark on a black background account for roughly two-thirds of sales in Italy. The growth of Fairtrade Sourced Ingredient Mark with a white background (FSI) is also confirmed because of the increase in volumes it has generated, particularly on cocoa, as well as because of the ease of use of the raw material it allows.

580 million Euros spent in 2022 by Italians in products with at least one certified ingredient.

2.400 Fairtrade-certified references in PL products

In fact, through the FSI model, cocoa is present in many recipes such as breakfast cereals, snacks, ice cream, cookies, and in a wide range of products for Valentine's Day, Easter, and Christmas.

F or example, in 2021, Coop (the first Italian retailer to develop a Fairtrade-branded PL line) offered a Gianduia chocolate and a white chocolate egg with salted almond granola for Easter, as well as two leavened products: a dark chocolate and coconut lamb and a chocolate and dove.

In IN'S Mercato stores, Fairtrade-certified products including chocolates, extra dark pralines, and the extra dark Easter egg could also be found on the shelf. Lidl stores featured PL products such as soft nougats and baskets of chocolates, and chocolate bars made from Fairtrade cocoa. Meanwhile, Aldi offered a huge range including eggs, lambs, and other chocolate figures.

Thanks to product sales in Italy, benefits for farming and worker organizations in Asia, Africa, and Latin America, which received 3.8 million euros in

Cotton: +78%

Cut roses: +37%

Fairtrade Premium , also grew. Together with the Stable Minimum Price, the Premium is a key component of the Fairtrade model. Practically speaking, it is an extra sum that organizations receive to implement initiatives of collective interest, which are decided through a democratic process. The Premium can be used for the technical and productive improvement of agricultural enterprises, such as the purchase of fertilizer or other agricultural products and machinery. It can also be used to build classrooms and school facilities, health clinics, etc. "Fairtrade, while remaining faithful to its values," says Thomas Zulian, sales manager of Fairtrade Italia , "continues to adapt to respond in an increasingly effective and simple way to the sustainability needs of people who go shopping, as well as companies. Even in 2022, while in a complex economic and geopolitical context, the path of strengthening the presence of Fairtrade-certified products in the PL of the many partner brands continued, thanks to the inclusion of dozens of new products. This success encourages us to make further progress on our path to growth, focusing on the protection of human rights and the environment with more sustainable business practices that know how to generate real and measurable change." l

A new format to discover and savor the Italian excellence and live an all-round experience: from purchase to tasting.

Carrefour Italia has opened its Terre D'Italia flagship store in Milan, in Piazza De Angeli, consolidating its presence in the capital of Lombardy with a completely new store experience. In fact, the new flagship store offers a range of regional products and wines under the Terre D'Italia brand, designed for one of the Milanese's favorite moments of the day: the Italian happy hour, aperitivo.

An all-time first for Carrefour Italia, as it is a brand new format, a place to live an all-round Italian experience, made of wine tastings and happy hour menus, as well as small portions

for lunch by Terre d’Italia. In addition to the shopping experience, boasting a wide range of products and a wine selection of more than 400 labels, Carrefour is now aiming at a new way of consumption: the opportunity to take part in weekly events at its salespoint, in collaboration with selected wine cellars.

In fact, the space includes an outdoor area with 30 seats to enjoy taglieri (cold cuts and cheese), taralli and Italian wines. The 50-square-meter indoor space also boasts an important section dedicated to the wine bar, with 15 varieties of wines by the glass. Customers will have the chance to choose, among the many bottles on display, the one to drink during their happy hour. In the months leading up to the opening of the flagship store, Carrefour provided training sessions also concerning the quality and characteristics of the products sold in the new store. In fact, employees were given the opportunity to visit wine and cheese suppliers in order to be well acquainted with the entire assortment, also through dedicated tastings.

The on-the-job training carried out within the cafes in Carrefour stores was noteworthy as well. In this way, they could better understand what’s behind their supply, and even conceive a new cocktail during a team-building activity: the De Angeli (with gin, bitters, grapefruit juice, lime, agave, mint). This cocktail, which is the combination of ingredients that represent the character of each person in the team, can now be enjoyed right inside the new Terre D'Italia flagship store.

Located in one of Milan’s fastest-growing areas, the Terre d'Italia flagship store gives you the chance to sip a glass of wine while savoring traditional Italian specialties, such as 24-month Dop Parma ham and cow's milk Dop Gioia del Colle mozzarella.

While the selection of food products is designed to accompany wine tastings during your happy hour; risottos and other dishes are also served during lunch hours. l

Innovation and sustainability are confirmed as growth assets for the retailer even in product development.

These days, Penny Italia, a food discounter of Rewe Group, has launched the ‘Pianetiamo’ line dedicated to vertical farming. Aeroponic technology is the new frontier in terms of sustainable agriculture; a suspended, above-ground, vertical cultivation that safeguards and respects the resources of our planet. In particular, the production uses 95% less water, zero pesticides, reduced soil use, in a certainly short, all-Italian supply chain. Moreover, from an organoleptic point of view, these salads are unique in taste compared to the IV range standard.

As for its launch, ‘Pianetiamo’ includes three salad references: lettuce and two mixes, ‘Balsamica’ and ‘Piccantina’, under the ‘Natura è’ brand, recently relaunched in terms of quality and design, and representing Penny's sustainable supply in fresh produce.These products are made from integrated agriculture relying on cultivation systems that respect biodiversity and techniques aimed at minimizing the use of chemicals.

«With #VIVIAMOSOSTENIBLE, - Monica Dimaggio, Penny's Manager for Private Label and Sustainability, confirms - we started our responsible journey towards people and the environment. The theme of production with zero waste and minimal resource consumption is central for us. With ‘Pianetiamo’ we can bring our customers a fresh product of excellent quality, resulting from innovation and responsible technology. Penny is proudly the first and only PL in vertical farming.» l

IT’S NOW STEFANO ZILIOTTI, SALES AND MARKETING DIRECTOR AT MARENCHINO, TO TALK WITH PL MAGAZINE.

Since 2018, its three different productions have gathered under the same family name Cisalpino, Perla and Caseificio Reale. And now, its aim is to become more popular among the general public as a Dop Piedmontese cheese and other regional dairy product specialties.

by Maria Teresa Giannini

by Maria Teresa Giannini

At the foothill of the Alpin valleys and among the flourishing curves of the Marenchino Langhe, over the last 70 years, the Piedmontese Cheese Company, with 4 plants in Savigliano (Cuneo, Piedmont) has become famous over all the territory, with important acquisitions that have enabled it to increase its production capacity and become visible in italy and abroad, becoming a real Group. Established in the 50s, at the end of 2017 it finished a significant restyling and in January 2018 the Marenchino Brand unites under the same Family Name the three different productions: Cisalpino, Perla and Caseifico Reale. In 2012, the Group ended the fiscal year with roughly 25 million euro turnover and about 3,300 tons of production. Today, it aims to become popular also in the general public as Dop Piedmontese Cheese specialist, as well as a brand specializing in regional dairy, as Stefano Ziliotti, Sales and Marketing Director at Marenchino, tells us.

The Group confirmed its business with the existing clients, increasing also the weighted distribution, by generating new clients and an increase in volume and value compared to 2021. At the same time, 2022 was a unique year in recent history, because we witnessed both a price increase and a shortage of raw material price: these two phenomena drove the consumption trends on the market in a significant way.

About 40% of our production is dedicated to PLs and they are all produced in our plants, with no exceptions

As PL Producers, what’s your large-scale distribution share and how are you organized: more in supermarkets or in smaller retailers and discounters?

Our channelization is divided in about 80% in large-scale distribution (50% of which is Discounters) and 20% in Food Service. Thanks to our clients’ trust, we collaborate with the most important Italian chains.

How important is the e-commerce channel instead?

At the moment, e-commerce is 5% of our turnover and in particular our PL production reaches 7%. We’re developing new strategies dedicated to promotional and tailored storytelling activities for those products to meet an increasing product culture and promote new consumption opportunities.

What are the brands you provided in Italy and which ones are for a foreign market?

In Italy, we mainly collaborate with large-scale distribution and discounters, both in mini-marts and service counters.

In which areas of Italy are the different products mainly appreciated and bought?

The core of our consumption in Italy is in the North-East and North-West. We’re investing in product culture and consumption opportunities to support central and southern areas of Italy.

In which countries, besides Italy, can a consumer find your products on the shelf?

Abroad, in France, the UK, Scandinavian Countries, Hungry, Poland and the USA.

Your assortment currently boasts 5 Dop products: what are they and what are the characteristics of this supply chain?

Our story is a family history of love for cheese. We work following a short supply chain for all types of milk - cow, sheep, and goat, receiving, every day, contributions of the breeders of the area. Currently the 5 Dop that the Group boasts in its assortment are the Toma Piemontese, Bra Tenerem Bra Duro, Raschera and Murazzano, plus different specialties of soft cheese made with sheep, goat, and cow milk: tasty, soft and melting cheese.

The rules and regulations of the Dop are stricter than any other production: so, how did you manage the production in your plants?

At Savigliano, where everything started, we now have the seasoning and packaging center and the logistic hub, while the Dop products are produced in Murazzano. The Racconigi and Saluzzo plants, on the other hand, are dedicated to fresh and blue cheese production and seasoned cheese respectively. For the latter, we have Toma Piemontese, Soft Bra cheese, Hard Bra Cheese, Raschera, National Fontal, Goat Fontal, Seasoned goat cheese, Seasoned Pecorino, bovine seasoned cheese.

What did the Covid-19 pandemic represent for your company, in terms of market share, product demand and success? And what about 2022, the first year after the pandemic, how was it compared to 2020 and 2021?

The two years of the pandemic changed the consumers’ purchasing and consumption habits, creating two main trends: online and take away growth and sustainable and local awareness of consumers’ habits.

How is the consumer behaving, in your opinion, towards your products, with an increasing double-digit inflation for the cost of the shopping cart?

The period we’re living in is bringing a peculiar feeling from the social and economical point of view, in which we’re facing a rationalization of consumptions and resulting change of consumption occasions. People experienced a significant downturn in their purchasing power, however, on the other hand, they’re more attentive to traditions, localism, high quality of products and sustainability: these will be the key pillars on which Gruppo Marenchino will continue to invest in the future.

Regarding sustainability, what is the commitment of the company on that, especially concerning packaging?

The respect towards the environment, the eco-friendly packaging and animal welfare are among the commitments that we, as Gruppo Marenchino, consider as strategic priorities, since they’re increasingly appreciated by consumers. We constantly invest in the research and development of materials that are more and more “green” and convenient. We have several types of packaging and sizes, from flowback Bdf packaging to fixed and variable weight Skindarfresh, to provide a better service, by guaranteeing a fresh product and supporting new consumption occasions. Currently, we offer recyclable packaging for our mini-markets and service counter products, but the objective is to provide plastic-free packaging, by 2025, for all our product supply.l

Over the past few years, sales of Dop and Igp products have increased more than the agri-food total, also thanks to PLs of large-scale distribution brands, whose assortments are increasingly varied and appreciated by consumers.

Local and regional food specialties continue to fill the shopping cart of Italians and, according to the data of the the latest Ismea-Qualitavita report, large-scale distribution pos are confirmed to be one of the healthier channels of the supply of Dop and Igp products, and their turnover largely exceeds 5 billion euros. In recent years, the sales of Igp specialties products, such as cheese, meat-based products, fruit and vegetables, wines, bakery, and pastry specialties increased even more compared to the agri-food total. These assortments, in fact, are increasingly wider and appreciated by consumers, thanks also to the contribution of PLs in the large-scale distribution brands. It is no coincidence that during the International trade show Plma in Amsterdam last May, Italy was the most awarded country with more than 15 awards in as many products. This underlined some important values such as sustainability in productions and affordability also linked to high quantities.

Valle Fiorita receives 60% of its own turnover thanks to some of the most important Italian and European PLs. "This allows us to have a high company reputation - explains Francesco Galizia, Export Manager of the company - a guarantee of reliability and quality not just for our current clients of the large-scale distribution, but also of both Italian and international, and new and potential clients. Salentine Puccia and Pizza dough are among our most requested products by our national and international PLs. In fact, the 100% Italian origin of the raw materials is appreciated, as is the exclusive use of our daily home-made sourdough, the clean label of products with high quality, but few and simple ingredients."

A journey through the numerous, traditional flavours that make up the extraordinary Italian food scene: ALDI’s line Regione che Vai, which includes, protects and promotes the D.O.P. and I.G.P. products of our territory, taking us from the warm Mediterranean sun to the suggestive peaks of the Alps and thus letting us discover the authentic corners of Italy through each of its products. From the starters to the desserts, this line offers the taste of many different territories, which come together to create new recipes and pave the way for new taste paths.

We can start from the Alps, with the ‘Lagorai’ Cheese, in the Trentino-Alto Adige Region: with a melting, very sweet paste, produced with mountain pasture milk and traditional methods, the ‘Lagorai’ Cheese is an excellence that stems from a careful protection of the mountain heritage, favouring the preservation, care and maintenance of the forests and the alpine landscape to the benefit of the environmental balance.

Moving down the peninsula, we find many gastronomic specialities, including the pitted Taggiasca Olives, which are ideal to snack on during an aperitif, to enrich salads or fish dishes or to create a delicious Ligurian-style sauce. www.aldi.it

When you think about sauce, you automatically think about one of the food specialities of Regione che Vai: Spaghetti di Gragnano I.G.P., produced with special bronze dies that guarantee high quality, the ideal star for memorable first courses.

With our ‘Terra di Bari’ D.O.P. Extra Virgin Olive Oil, your dish will taste even more delicious, as it is obtained from at least 80% of the Coratina cultivar, which is produced, harvested and pressed in the area of the relevant D.O.P. regulations. With its intensely fruity aroma and spicy, bitter aftertaste, this oil will perfectly accompany and enrich every dish. Used as a raw condiment, it will add flavour to all of your dishes!

For PL regional food specialties, brands can count on their historical producers, an expression of excellency of a specific territory. “The PL world has been the core of our business until 2002 - explains Emidio Mansi, Global Marketing Director and Sales Manager Italia of Pastificio Lucio Garofalo - so even if today it is about 15% of our volumes, we always try to seize its opportunities. Igp Gragnano pasta, with a great competitive convenience in practicality and prices, is the added-value we can offer to Italian and international distributors. This is surely the most requested type.”

For almost 15 years, the high-range Premium brand embodies the Despar food excellence and territorial specialties. “The premium line, that soon will mark 600 products and that in some period of the year is enriched with some Special edition in the cold cuts, cheese and pastry segments, - says Massimo Riezzo, Purchasing Manager of Despar Italia - has currently reached a 15.5% share on the total of our PL products. Although inflation has affected the market, in May 2023, the Premium line increased by 3% in volume with peaks of 18% in fresh and ultra-fresh sections, where we are investing a lot in building a relationship of trust with our client, by training personnel to transmit the added value of our Premium Despar products. These results come from our product development team’s hard work, which is valued by the client and also by the international market, as the Plma trade show displays. On this occasion, our brand ranked first in the ‘appetizer’ category with Sicilian Caponata and three other PL products - frozen fish, ice-cream and a pet food - were on the podium in their categories.”

Perfect combination of territory-taste-goodness-nature

What better name to define her as “An Italian out of the choir”

The Manzetta project was born from our philosophy, to give value to what nature offers us, Abruzzo, our land, “Strong and gentle”: so many words have never been so true.

The excellent raw material coming from young crossbreeds BORN, RAISED AND PROCESSED IN ABRUZZO, PASTURED FOR AT LEAST 6 MONTHS, and under ANIMAL WELL-BEING REGIME, our Manzetta is rustic, attentive to the environment, it feeds on local cereals which contain the taste of our land, close to the sea and the hills

A project sensitive to environmental sustainability but also to economic and social sustainability, in fact all the players in the 0 km supply chain receive the right value.

The figurative symbols of our Manzetta are the Gran Sasso mountain and our Serafino Volpi, the one who takes care of the growth of our garments with love and passion under the guidance of expert collaborators.

There is a true story, a true story behind our project, we like to represent it because it makes us proud of our choices, in a period in which the consumer listens, gets informed and chooses. Our Manzetta prides itself on being “suitably lean and suitably fat” as well as tender, tasty, healthy and respectful of the environment in which it was born and raised.

Our Manzetta D’Abruzzo burger is born from the careful processing of our bone half-carcasses, the recipe but above all the care in choosing the cuts, denervated and always fresh, make it a unique product.

Aldi Italia PL share, for the first time in Italy in 2018

For Aldi, a German brand in Italy for the first time in 2018, private labels comprise 85% of their assortment. “It’s undoubtedly a significant share - says the national buying services of Aldi Italia section - that we want to confirm every year with the quality of our products. These represent the Italian excellence of which we’re proud promoters also thanks to the support of those that we define ‘guardians of taste’, i.e. our suppliers. In particular, we have developed some PLs that best represent our relationship with the territory. Among this, there’s Regione che vai, a complete range, from starter to dessert, which brings to tables the taste of many different territories through Igp and Dop products, made by following old traditions, by meeting quality, and by paying the right attention in the raw material choice. One of the most favored products of the line by our clients is definitely our Pistacho spreadable Cream, which was among the winners of the European Private Label Awards in the ‘Ambient Grocery’ and ‘Taste Excellence Award’ category.”

Beppino Occelli has been offering personal creations and interpretation of the traditional products for more than 50 years. These are the results of its profound and limitless love for its land, where he was born: Langhe and Alps. “PL represents a strategic asset for our future development plans - explains Beppino Occelli, founder of the homonymous dairy company - and one of our priority is to widen our supply of cheese dedicated to this market segment - which in the last few years recorded an increase in demand for premium references. Today, we make PL both for large-scale distribution and traditional stores that focus on the certified quality of our products, such as Bianco di Lango, Truffle Bianco di Langa, Toma Monte Regale, Robiola di Langa and Castelmagno Dop.”

Marenchino is a story of family and love for cheeses, this story starts in the Fifties in the Province of Cuneo, in a generous land between the pristine pastures at the foot of the Alps and the lush curves of the Langhe.

Starting from the historic factories in Savigliano, over time the company has established itself throughout the Piedmont area, making important acquisitions that have brought the Marenchino Group to visibility on a national scale while maintaining the same values as always: Tradition,Localism and Quality

Today, Marenchino Group includes Cisalpino and Perla companies, which have stood out for representing the Piedmontese dairy specialties in Italy and in the world.

The production of our cheeses is done in the traditional way, as it once was, the maturing is slow, still done by hand, shape after shape, rigorously respecting the cheese and its organoleptic characteristics.

Currently the Group has 5 PDO Cheeses in its range, of its own production: Toma Piemontese, Bra Tenero, Bra Duro, Raschera, Murazzano and a few of soft paste specialties made with goat, sheep and cow milk: a creamy combination of three milks pasteurized to obtainunique cheeses, a real treasure with an irresistible taste and a soft and melting consistency. Among these Tomini, Robiole, fresh and aged Goat and Sheep cheeses, Fontal and Cheeses refined and flavored with

natural ingredients. The Group offers different types of packaging and formats, from flowpack packaging to BDF up to Skindarfresh both at fixed weight and at variable weight in order to guarantee a better service that guarantees product freshness and lower environmental impact, creating and developing new opportunities and consumer attitudes.

Marenchino Group continuously invests in the research and development of increasingly sustainable materials that are “green” and functional in their use.

Our supply chain is entirely local, aiming at enhancing localism and its traditions

Lettere dall’Italia is the PL product line dedicated to the food excellencies that characterize different Italian regions. “Lettere dall’Italia largely occupies fresh and ultra-fresh segments - MD say - and it grows in volume more than 30% year on year. Among the specialties most appreciated by our clients are Dop Black Asiago cheese, Igp Bresaola punta d’anca of Valtellina, Igp Piadina romagnola, Salentine Puccia, stone-baked with 100% Italian wheat. The line is constantly growing, thanks to the research and development work that goes beyond the known denomination, gathers together products that best represent the Italian know-how, for their traditions, and simply following the raw material processing. The latest news is, for example, pesto sauce with genovese Dop basil, Sycilian pistachio granola cones and products that, distinguished on their packaging by a mark, come form controlled and certified farms, such as the 100% Italian microfiltered milk.”

Pietro Poltronieri, PL Line Manager of Crai , pays constant attention, from the consumers to regional products: “We recorded almost 30 points more increase of the Piacere Italiani line, which is focused on regional specialties. Our main new project is La Rosa dei gusti, a real brand of excellent products of our Group developed to provide a unique and special taste experience, thanks to the careful planning of the recipes and maniacal care in the choice of ingredients. It targets consumers who are sensitive to the value of intrinsic quality and curious about new food trends. It consists of more than 300 products and is characterized by having very clear virtues underlying the development of each reference: recipe design, authenticity of flavors, affordability, sustainability, and distinctiveness. During 2023, we are rolling out the line throughout the network, and consumer evidence is very good." l

Fabio Massi Journalist specialized in Retail and Mass market issues.

Fresh and ultra-fresh largely occupy the segment, the PL Lettere dall’Italia line grows +30% in volume year on year.