• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Plasterer

• Chinese Medicine

• Chiropractor

• Creative Director

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• Digital Media

• Electrical Operations

• Electrician

• Finance Bookeeper

• Financial Planner

• Fitness Trainer

• Flooring

• Pilates

• Garage Doors

• General Insurance

• Health & Wellness Coach

• Homeopathy

• Lactation Consultant

• Lawn Care

• Lawyer

• Life Coach

• Loans

• Marketing

• Massage Therapist

• Meditation/Yoga

• Mortgage Broker

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• Personal Trainer

• Photographer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• Solicitor

• Travel Agent

• Website Developer

• Wedding Planner

anningham The We are looking for business owners who like to join the Find Manningham Network Group and Community Paper. FOUNDER | ACCOUNTANT LEGAL WARREN STRYBOSCH DEAN BOSMAN

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design • Attorney- Family

• Auctions- Real Estate

CLUB SPONSORS Looking for 8 clubs to join. GENERAL INSURANCE MORTGAGE BROKER VIDEO PRODUCTION FACILITATOR NFP MARKETING & STAFFING Find Manningham Network Members waiting for other people to join. CRAIG ANDERSON REECE DROSCHER ALLISON GROOT ERRYN LANGLEY JODIE MOORE COLUMNIST CONTRIBUTORS Cricket Clubs Basketball Club Football Clubs Golf Clubs Bowls Club Netball Club Soccer Club Tennis Clubs ETHAN STRYBOSCH DIGITAL MAKETING LACTATION CONSULTANT JOANNA STRYBOSCH

About the Find Manningham

By Warren Strybosch

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support, The Find Manningham Team.

anningham The

EDITORIAL ENQUIRES:

Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

OUR NEWSPAPER

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

ALL THINGS MANNINGHAM

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

ACKNOWLEDGEMENT

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

DISCLAIMER

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

ADVERTISING RATES (INCLUDE GST)

NEXT ISSUE

2 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

Manningham

Sizes: Rates:

Double Page Spread (408 x 276mm) $1650

Full Page (198 x 276mm) $1100

Half Page Landscape (198 x 138mm) $715

Half Page Portrait (95 x 276mm) $715 • Third Page (189 x 90mm) $550 • Quarter Page (97 x 137mm) $440 • Business Card Size (93 x 65mm) $275 • Ads Smaller than (85 x 55mm) and Below $121 We can create your ad for you. Prices start at $77 for the very first hour and $22 for each hour thereafter. • Design Services

Next Issue of the Find

will be published on Monday April 11, 2023. Advertising and Editorial copy closes Friday March 31, 2023. Available

•

•

•

•

GENERAL INSURANCE

By Craig Anderson

In the last few days, you may have become aware that Optus has disclosed that a cyber-attack against them has resulted in a hacker accessing the personal details of many of their customers. Details accessed may include name, date of birth, email, phone number, address, and ID numbers such as drivers license or passport numbers. If this can happen to a multi-million dollar global communications giant with a full time IT department, then it can happen to you.

This news should send a shiver down the spine of all small and medium enterprises as well, because similar data breaches experienced by small businesses put up to half of them out of business within 12 months. Reputational damage and associated lack of trust is certainly a revenue killer, even if the horrendous cost of rectifying a breach isn’t enough to bankrupt the business first. Fines and penalties will sometimes be a problem too, and there are potential EU General Data Protection Regulation fines, which may apply within Australia if the affected

Cyber Insurance

party is from an EU country.

So what might a Cyber Policy typically cover?

a. Business interruption financial loss due to a network security failure or attack, human errors, or programming errors

b. Cost of data loss and restoration including decontamination and recovery of files and hardware

c. Emergency incident response and investigation costs, supported by an insurer appointed contractor

d. Delay, disruption, and acceleration costs from business interruption event that stems from a cyber-related issue

e. Crisis communications with clients and reputational damage mitigation expenses

f. Civil Liability costs arising from failure to maintain confidentiality of data

g. Civil Liability arising from unauthorised use of your network

h. Computer/data network, or data extortion / blackmail (where insurable. Paying this may be illegal under certain circumstances)

i. Online media civil liability

j. Regulatory investigations expenses

As diligent as you may be at managing your clients’ data, system intrusions can still happen. Given that cyber-crime profits have eclipsed the global drug trade in turnover, I would say it’s a pretty fair assumption that the SME sector will take a beating sooner rather than later. Talk to your broker about Cyber Insurance today, and protect yourself and your clients against extensive losses. For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Craig Anderson GENERAL INSURANCE

Small Business Insurance Brokers

0418 300 096

3 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 3 MARCH 2023 | FIND MANNINGHAM

Is Your Low Fixed Rate About To Expire? What Can You Do To Minimise The Financial Impact?

MORTGAGE BROKERING

By Reece Droscher

In the current interest rate and inflationary climate Mortgage Brokers are spending a lot of time engaged with their existing clients, discussing what will happen when the current fixed rate on their Home Loan expires. When rates were at their lowest a lot of borrowers, quite smartly, took advantage of this and locked in their rate for anywhere between 1 and 5 years. Most took a fixed rate of 2-3 years at rates as low as 1.79%. As all good things must come to an end, these rates will be coming up to their expiry dates over the next few months, and some borrowers could see their mortgage rates increase by almost 5% when their fixed rate expires.

If you are in this situation there is one important thing you should do to plan for this eventuality and to try and mitigate, as much as possible, the inevitable impact on your cashflow that you will be about to experience.

TALK TO A MORTGAGE BROKER AND REVIEW YOUR LOAN

It is vitally important to get a real understanding of your options, and

discussing your situation with a mortgage broker will be the best course of action to ensuring you get the best deal and minimise the financial impact of a significant increase in your interest rate. We can talk to your current lender to see what they can offer as an incentive to remain with them or see what else is available in the market that may be a better option.

There are a number of lenders offering cash-back incentives to attract new business, some up to $4,000 depending on the loan amount and other factors. They may also be negotiable on the interest rate to ensure they win your business. Your mortgage broker is in the perfect position to help with these negotiations by presenting a case to the lenders, then seeing who is offering the most suitable deal.

Mortgage Brokers can also negotiate with your current lender if you provide them permission to do so. I have personally re-negotiated rates for new clients who were placed on the standard variable rate once their fixed rate expired, and their existing Bank discounted their rate by almost 1.5% to ensure they retained the business. It costs Banks more money to attract a new client than to keep their existing customers, so they are being a lot more aggressive using their business

retention teams to offer existing clients better deals.

It is also important to note that a mortgage broker is required to act in the best interest of their client, which is not a requirement of the Banks or other lenders. When you engage a broker to review your loan we are required to provide our clients with the most suitable option to meet their needs, even if the best option is for the client to remain with their current lender and the broker receives no remuneration by recommending this option. This ensures that you are receiving the best advice available at the time of the review.

Every client’s requirements are different, and dealing with a Mortgage Broker will provide you with a much wider range of options than just dealing with your current lender. At SHL Finance we are helping our clients save thousands by reviewing their loans and ensuring they are getting the best deal to meet their needs.

Please call Reece Droscher on 0478 021 757 to arrange a review. www.shlfinance.com.au

4 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

5 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 5 MARCH 2023 | FIND MANNINGHAM

INFLUENTIAL FINANCIAL ADVISER IN AUSTRALIA 2021 & 2022 WARREN

founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50. Find Accountant | Find Wealth | Find Retirement | Find Insurance | Find Aged Care Services | Find Foundation | Find Network

on winning the Holistic Adviser of the Year again at the IFA Excellence Awards 2022.

Adviser Warren Strybosch

TOP 50 MOST

STRYBOSCH The

Find Group

CONGRATULATIONS!

Financial

by

@findfoundation/videos

hosted

Ben Nash

ACCOUNTANT

By Warren Strybosch

New ATO rules you need to understand if you wish to claim a tax deduction at the end of this financial year.

Even before COVID hit, many people were working from home, and it was costing the ATO a lot of money. During COVID the amount of work from home (WFH) deductions that were claimed, increased dramatically.

During COVID, the ATO was generous enough to offer a shortcut method to calculate the WFH deductions. You simply added up all of your hours working from home and multiplied it by 80 cents per hour.

Unfortunately, a lot of individuals who submitted their own tax returns got it wrong or over claimed the amount they were entitled too.

The shortcut method was supposed to include your phone and internet use and the depreciation of items purchased for your home office. However, it seems some people claimed the hours as well as claiming phone, internet and office equipment. Even some tax agents and accountants were getting it wrong.

As such, the ATO has tightened up on WFH claims for 2023 and made it an arduous process for those wishing to claim the WFH expenses from 1st March 2023.

The first thing the ATO did was get rid of the COVID shortcut method and will only allow two methods to calculate WFH: the fixed rate method or the actual costs method.

In the past, most people would simply opt for the fixed rate method because it was less onerous to keep records but that is all about to change. The ATO is now applying a rigorous approach to record keeping where WFH expenses are involved including under the fixed rate method.

The fixed rate deduction will be 67 cents per hour but those who now work from home must keep a diary of all the hours they work from home. The ATO will not an estimate based over several weeks. No, the ATO wants you to record every single hour you work from home under the fixed rate method.

The ATO stated that taxpayers should

Are you Working from Home?

keep records “as they occur” as “timesheets, rosters, logs of time spent accessing employer or business systems, or a diary for the full year”.

Not only will taxpayers need to keep a detailed record throughout the whole financial year of the hours they have worked from home, but they must also keep a copy o their utility bills, phone, internet, stationary and computer consumables e.g. paper and ink for the printer.

It is believed that if a taxpayer is audited in the future, they will have to justify that their working from home costs were incurred. The ATO wants to see an increase in costs to justify the claim being made.

The fixed rate method will still allow a separate claim to be made for depreciation of computers and office furniture, which was not allowed under the fixed rate method during COVID. Other items like repairs, cleaning and maintenance can also be claimed separately.

Those claiming 67c an hour will also need to keep bills for costs included in the fixed rate, which covers electricity, gas, phone, the internet, stationery and computer consumables. The threshold cost for depreciation of an asset remains at $300.

What has changed is that those working from home do not now need to have a dedicated home office to claim WFH expenses, which was a requirement in past years. The ATO believes this will be a boon for taxpayers.

However, Assistant Commissioner Tim

Loh warned that taxpayers “carrying out minimal tasks, such as occasionally checking emails or taking calls” were ineligible to claim because “you must be working from home to fulfil your employment duties”. So, if you are doing work from home but it was not a requirement by your employer to do so or there was no arrangement in place to carry out those work duties from home, then you will be ineligible to claim future WFH expenses.

Mr Loh said the ATO would accept a representative record of hours worked from home for the period 1 July 2022 to 28 February 2023, but after that “taxpayers will need to record the total number of hours they work from home”. “And remember, you can’t claim for things like coffee, tea, milk and other general household items, even if your employer may provide these kinds of things for you at work.”

What does this mean for tax agents and accountants who prepare tax returns? It is likely the tax agent or accountant will be asking the client to verify their WFH expenses. This will initial cause friction between the taxpayer and their accountant/tax agent, but as the saying goes, ‘don’t shoot the messenger’. We encourage everyone to work with their accountants/tax agents where further information has been requested of the taxpayer to substantiate their WFH claims.

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

6 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

NATUROPATH

By Kathryn Messenger

Traditionally in many cultures menopause was celebrated as freedom from childbearing and a sign of wisdom. Sadly in our culture many women struggle with the loss of youth, it can be good to be reminded to enjoy this stage of life and look for some positives.

The average age for menopause is 51, and by definition is 12 months with no period. Perimenopause is the transition stage and usually occurs from age 45 to 55. Changes occur due to changes to main female hormones: oestrogen and progesterone. Oestrogen is the ‘strong’ hormone, it has a role in strengthening bones with calcium, and during perimenopause the levels fluctuate. Progesterone is the ‘calming’ hormone, it relaxes the nervous system, and in perimenopause the levels drop. During the reproductive years, these hormones generally create balance and after menopause, even though much less of each of these hormones are produced, they are also in balance. It’s unbalanced ratio in perimenopause that causes the symptoms of increased anxiety, unstable mood, changes to the menstrual cycle, and hot flushes.

PMS

Premenstrual syndrome (PMS) is often due to a drop in oestrogen and often women who had PMS previously can find symptoms to be worse or last longer in perimenopause. But there’s something easy that can make a big difference: phytoestrogens. This is a group of foods that are chemically similar to the hormone oestrogen and when consumed help to modulate oestrogen levels. Phytoestrogens are found in soy products, linseed, as well as other seeds and legumes, eating these foods can help to offset the fluctuating oestrogen levels.

Stress

Often the first sign of perimenopause is higher stress levels due to the loss of progesterone. Rather than try to fight the hormonal changes, find activities that you can do each week that you find relaxing or fun. Magnesium is a great nutrient for calming the nervous system: magnesium citrate or magnesium glycinate are the best forms.

Short cycle

The early stages of perimenopause can

An Easier Transition Into Menopause

also be characterised with a shorter menstrual cycle and very heavy periods, be sure to have your iron levels checked if this is the case, as low iron can lead to exhaustion. There are herbal medicines that do well at regulating the cycle, and a naturopath or herbalist can help with this.

Hot flushes

Hot flushes occur due to the fluctuating oestrogen levels and can be somewhat regulated with phytoestrogens. Sage is a great herb for hot flushes with excessive sweating, and whilst it can be consumed as a tea (chilled), capsules may be more convenient. Homeopathic Amyl nit can be taken with each hot flush to reduce the severity, especially in severe cases such as waking to saturated sheets from sweat, or being unable to regulated body temperature afterwards.

Osteoporosis

After menopause, due to the reduced oestrogen levels, women are at higher risk of osteoporosis. Adequate consumption of calcium in foods such as dairy, soy, tinned fish with bones, nuts and seeds are important in the diet. Vitamin D is required to move the calcium into bones, so time should be spent outside each week as this vitamin is made by your skin, but not long enough for sunburn. Weightbearing exercise increases bone density and 30 minutes of exercise is day is recommended.

There is so much that can be done naturally to support the transition to menopause.

Whole Naturopathy can help provide you with natural products to help ease the transition into menopause.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

7 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 7 MARCH 2023 | FIND MANNINGHAM

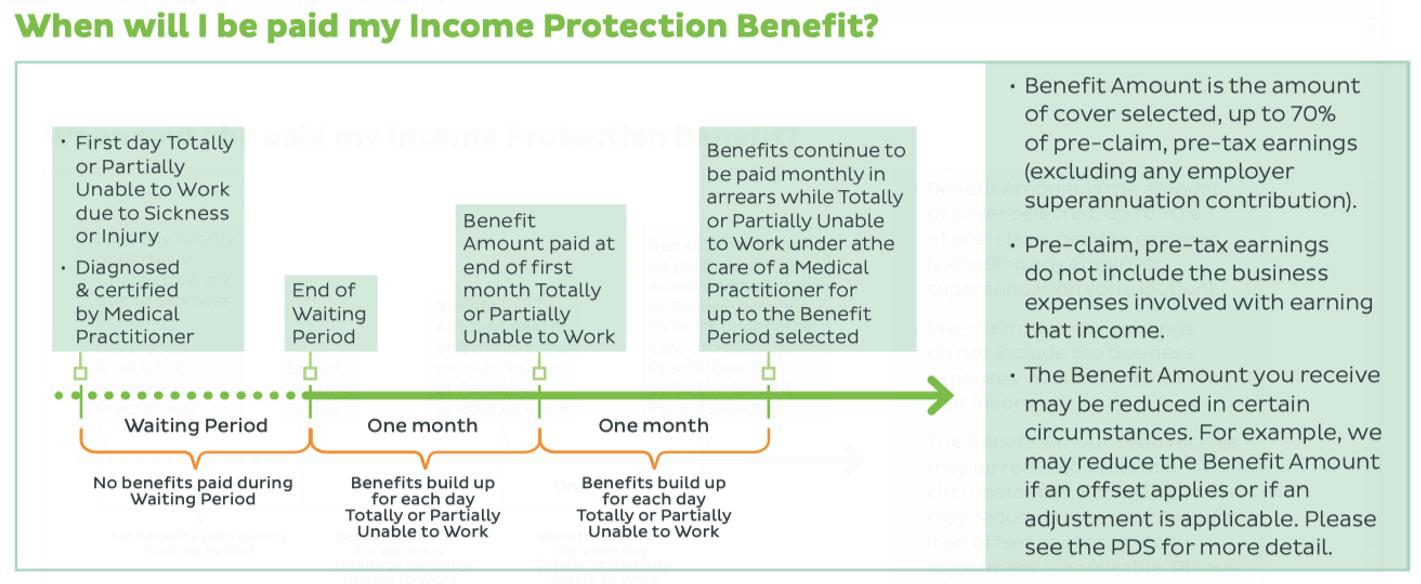

Income Protection: Considerations before Cancellation

FINANCIAL PLANNER

By Erryn Langley

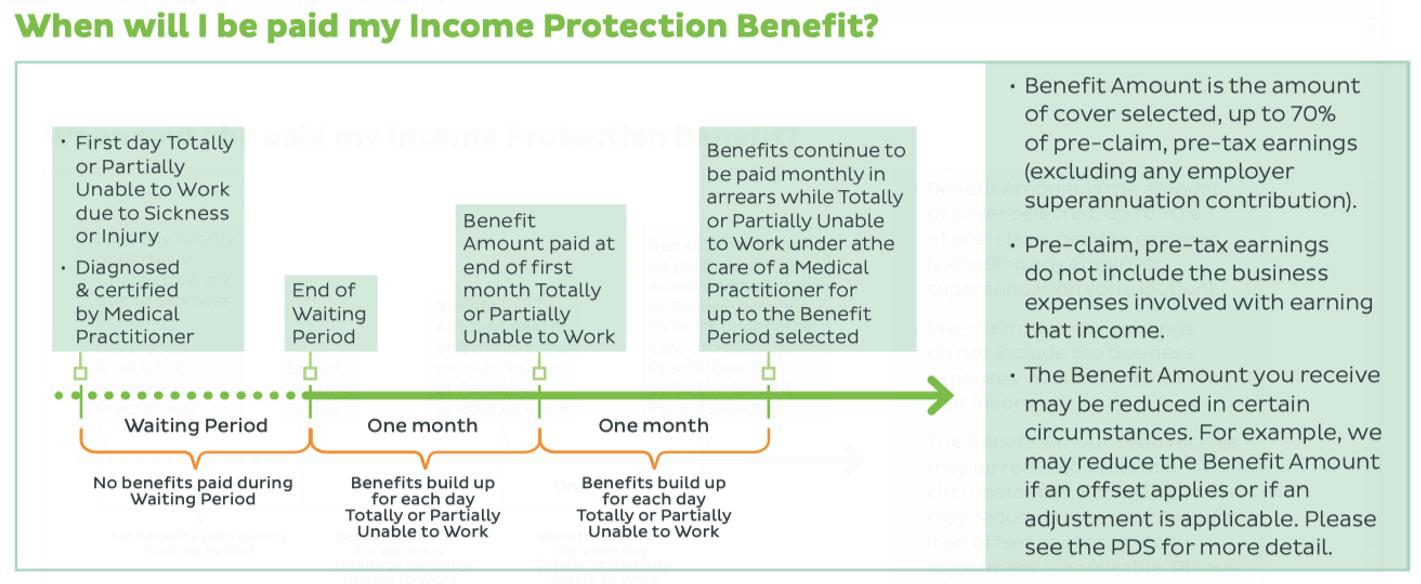

Insurance is designed to protect clients in those specific instances in which an event occurs.

There are various of insurances (summarised in Figure 1) available and is fundamental for you to understand the key differences between each. A good advisor will help guide you through the process of choosing the right type and amount of cover that you need.

The discussion will usually include:

• Understanding the client’s current situation and why they may require personal insurance;

• Work out what the client’s needs are by asking a series of questions;

• Identifying any issues that may arise and steps that need to be taken e.g., pre-existing medical conditions;

• The costs associated with having insurances in place. It is not always about how much more it will cost but sometimes finding ways to save on premiums;

• Provide quotes and agreeing on what to take up/hold and/or what to scope out; and

• Implementing the insurances which includes underwriting and disclosures.

Note: Various insurance product providers may have different names for their products, for example, trauma cover may also be known as crisis recovery or critical illness insurance.

As of 1 October 2021, the Australian Prudential Regulation Authority (APRA) mandated the change in income protection (IP) products for “life companies to better manage riskier product features by:

• ensuring DII [disability income insurance] benefits do not exceed the policyholder’s income at the time of claim, and ceasing the sale of Agreed Value policies;

• avoiding offering DII policies with fixed terms and conditions of more than five years; and

• ensuring effective controls are in place to manage the risks associated with longer benefit periods. (APRA 2019).”

Note: The terms disability income insurance (DII) and individual disability income insurance (IDII) have the same meaning. Both terms will be referred to as IP going forward.

It is important to understand the key differences that now apply to income protection and more importantly, if you decide to cancel and replace your current IP policy, what benefits you might lose.

A. Agreed vs Indemnity

In the past you could choose between an agreed and indemnity. Now you can only be provided with an indemnity style policy. Most Agreed policies would ask you to prove your earnings at time of application whereas an indemnity policy would ask you to proof your earnings at time of claim. The big difference was that if you had an agreed policy, it would likely pay you the agreed amount regardless of what you were earning at the time of claim. This meant, you could have been earning less for several years prior to the claim being submitted and still be entitled to the amount you insured yourself for. Whereas, with indemnity, you get paid based on what you earned up to 12 months prior to the claim was submitted. Obviously, an agreed policy is more beneficial to have and keep compared to an indemnity type policy. APHRA decided to remove the ability for insurers to offer an agreed policy because it was costing the insurance industry way too much money in claims.

B. Benefit Amount

For those who have older IP policies, you would likely be entitled to receive 75% of your income at claim time. However, new policies only allow you to insurer up to 70% of your income. If you have a new policy that has a benefit period longer than 5 years, then the income may reduce down to 60% after the first 2 years. Some insurers will allow you to maintain the 70% but other terms and conditions will apply. Anyone wanting to take out a policy with a benefit period greater than 5 years must make sure they understand these changes that occur after the 2 year period when on claim.

C. Own vs Any Occupation Definition

Source: TAL 2022

What are the key benefits that might be lost if you replace your IP policy?

Before I can mention benefit periods, I need to explain the difference between an ‘Any’ occupation and ‘Own’ occupation definition. For the most part, you would want to have an ‘Own’ occupation IP policy. This meant that if you could not do your ‘own’ job because of injury and/or illness, you would be paid at claim time, subject to waiting periods. However, APHRA have decided that an ‘Own’ occupation definition is too generous and have now restricted the use of an ‘Own’ occupation definition to a maximum of 5-year benefit period. Going forward, if a young person wants a benefit period greater than 5 years e.g., up to age 65 or 70, they will only be allowed an ‘Own’ occupation for the first 2 years and then the policy reverts to an ‘Any’ occupation definition. As a financial planner, this new change

8 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

Figure 1: Types of personal insurance

in definition for those wanting a benefit period longer than 5 years is disconcerting. It means that the insurer could potentially force you to return to work after the 2 years or you lose your payments. This new change in definitions has not been tested yet and we await the outcome when the first client has no choice but to return to work.

Note: For those who choose benefit periods of 5 years or less will continue to have an ’own’ occupation definition.

One insurers definition of disability are as follows:

During the waiting period

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of your regular occupation at full capacity for the duration of the waiting period; and

• you are not working in any capacity for 14 days out of the first 19 consecutive days of the waiting period.

For the first 30 months following the date of disability.

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of your regular occupation at full capacity; and

• your monthly earnings are less than 80% of your pre-disability earnings; and

• within your regular occupation you are unable to work the lesser of:

• 38 hours or more per week

• the number of hours you regularly worked prior to disability.

(Source: www.clearview.com.au)

D. Benefit Periods

After 30 months from the date of disability

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of any suited occupation at full capacity; and

• you monthly earnings are less than 80% of your pre-disability earnings; and

• within any suited occupation you are unable to work the lesser of:

• 38 hours or more per week

• the number of hours you regularly worked prior to disability.

One of the most difficult changes to understand is the new benefit periods that have come into effect. For those who choose a 2 year or 5-year benefit period, not a lot has changed. For those who wish to have a benefit period longer than 5 years, each insurer has a different way of assessing the amount you will receive after the 2- or 2.5-year mark when on claim as well as the change in definitions (already discussed above). Most insurers will not continue to pay up to 70% of the benefit amount after the 2-year claim benefit period has been reached. Often it will drop down to 60% of the insured amount. APHRA believes this will encourage more people to try and return to work faster than if they were to continue to be paid the 75% amount offered on old IP policies.

E. Waiting Periods

Most insurers have reduced the number of waiting periods on offer with many only going up to 13 weeks, with the most common waiting period being 8 weeks or 3 months. Before you can receive any benefits once a claim has been submitted, you must have completed your waiting period.

For instance, if you are director of a company that produces a profit, your profit may be offset against your IP benefit amount whilst on claim.

Income protection insurance is a must have for all those who are currently working and especially if they do not have enough assets or other sources of income to supplement their current earnings should an event occur which results in them not being able to work.

It is surprising how many people have no income protection in place or have simply accepted the default insurances provided by their superannuation funds. Having some insurance is ‘good’ but we want to make sure you have moved to ‘better’ or ‘best’ cover.

Personal insurance is a necessary evil in that it costs money to hold on to it and you hope you never have to use it, but when you do need to use it, you are very thankful you have it in place.

We encourage everyone to speak to a financial planner about personal insurances. If you don’t have a financial planner than reach out to Find Insurance (www.findinsurance.com.au) and book a meeting with them or call 1300 88 38 30

Erryn Langley

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

(Source: tal.com.au)

F. Offsets

Most insurers will apply ‘offsets’ to benefits. Some will include sick leave and annual leave as an offset, but some do not. Others will offset ‘other payments’ and ‘earnings.’

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

9 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 9 MARCH 2023 | FIND MANNINGHAM

Preparing for Breastfeeding Success

LACTATION CONSULTANT

By Dr. Joanna Strybosch

By Dr. Joanna Strybosch

It is said that preparation is the key to success but how do you best prepare for breastfeeding? For something you have never experienced before? For learning a new skill that you cannot practice ahead of time? And how do set yourself up for success when there are so many potential roadblocks and variables, which you cannot predict?

Breastfeeding is a learned skill, that improves with practice and is empowered by knowledge. Many of today’s new mums do not have the benefit of having observed other women work through the learning process of early breastfeeding and seen how common issues can be resolved. In our society today, most women who give birth will have never held a newborn baby before, never changed a nappy or burped a baby. Never bathed or dressed a baby, settled a baby to sleep or seen a baby breastfeed up close and personal.

What we know from the data is that many women run into difficulties with breastfeeding in the early weeks. In Australia most women want to try breastfeeding. Approximately 92% of mothers start out breastfeeding after birth, however by 6 months of age, the number of women exclusively breastfeeding has reduced to just 14%. Many mums report that early breastfeeding is much harder than they had expected. What are the factors that seperate those that go on to long term breastfeeding success and those that don’t?

Breastfeeding takes both practice and perseverance. Research clearly tells us is that women who report higher rates of self-efficacy have better breastfeeding outcomes, both in terms of initiation and duration. In other words, women who feel confident about their ability to face challenges with determination and who have a wider plan to overcome obstacles, are more likely to breastfeed and to stick at it for longer. They are prepared to work hard and are open to testing different ideas and suggestions as needed. And if things don’t work out, they are more likely to blame external circumstances rather than blame themselves.

Learning a new skill is not always easy, but approaching the task with positive

expectation, rather than fear and selfdoubt, is really important. So, in preparing to breastfeed, mums will benefit firstly by having a realistic and positive attitude towards it and a mindset to trust their body and to work at it, even if things don’t turn out as easy as she expected. In order to feel positive and empowered, women need to be informed and they need appropriate support from those around them.

Mothers want to be informed about what to expect. Attending breastfeeding education classes through the Australian Breastfeeding Association (available online) is an excellent way to gain information and knowledge. Classes both educate and empower mothers. They teach her important skills such as how to identify her baby’s feeding cues, how to latch and position her baby at the breast and how to know if her baby is getting enough milk. Learning as much as she can before the arrival of her baby will help her confidence.

Getting in touch with an International Board Certified Lactation Consultant (IBCLC) is another great way to get informed. Even before the birth of her baby, it’s a good idea to make contact with her local lactation consultant so that she can build a connection and know exactly where to turn once her baby arrives. After her baby is born, she will benefit from having the sort of personalised, one-on-one, hands-on help that a lactation consultant can provide.

Mothers also need appropriate support, and lots of it. This can come from many sources; her health care professionals, her partner, her own mother and friends as well as her wider family, co-workers and society at large. Reading, discussing and asking questions will allow the expectant mother time to think about what it might be like, how she may respond to the challenges of breastfeeding and what sort of emotional and practical support she would prefer. She needs to be able to ask questions and to receive reassurance. In particular, mothers want their health care professionals to have good breastfeeding knowledge, to have an “authentic presence”, to listen well, to give positive reflection to their emotions and to provide practical suggestions and advice.

Being informed, supported and connected with a skilled lactation consultant can be invaluable in getting mum and baby off to the best possible start and avoiding many of the pitfalls that are common in the early months and set them up for long term breastfeeding success.

Dr. Joanna Strybosch

Dr. Joanna Strybosch

10 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

Dip Paeds LACTATION CONSULTANT

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad

www.childrensosteopathiccentre.com

The Rich get Poorer under Albanese’s new super laws

By Warren Strybosch

It had to happen. With record spending under Labor, and Australia’s debt continuing to skyrocket, Labor has been under pressure to find ways to either curb spending or find new ways to increase revenue. Given Labor is not known for having a good fiscal policy and would rather give away money to the masses, they have sought to raise revenue instead.

They did not have to look to far. With total superannuation assets worth $3.3 trillion at the end of the September 2022 quarter (https://www.superannuation. asn.au/), there is a massive amount of money at the governments fingertips ready for the taking. Obviously, they cannot simply take the funds, but they can sure as hell tax it. This is exactly what they have decided to do.

The Prime Minister, on the 27th of July, announced that from 1st July 2025, anyone with superannuation balances over $3 million, will be taxed at 30 cents

in the dollar. That is a whopping 100% increase in taxes for those with large super balances.

The change will take place after the next federal election. Labor is hoping that by taxing the rich it will be resonant with the less fortunate. After all, who really cares about the big end of town? Ironically, more and more people in the future are going to find themselves with likely super balances above 3 million dollars. In the next 10 to 15 years, we are going to see the largest movement in intergenerational wealth that the world has ever seen and a lot of that transfer of wealth will be likely placed into superannuation…well, it was going to be.

For those who have worked hard and made their fortunes, they will be forking the bill for those who have not once again. Again, who cares, right?

Mr Albanese said the reform would “strengthen the system by making it more sustainable”.

“The savings that are made from this tax breaks will contribute $900 million to the bottom line of the forward estimates and some $2 billion when it is operating over the full year period,” he said.

We are not sure how these changes will ‘strengthen the system by making it more sustainable’?

Isn’t the amount of superannuation assets growing year by year? I think he means that this will make it more sustainable for them to keep spending money like it grows on trees by taking it from others.

Will this win votes with the average Aussie punter? Likely it will as we are known for our tall poppy syndrome in Australia. We are all on about given the battler a go but don’t get too high or we will try and pull you down.

In short, super is getting taxed again and this is likely to lead to more scepticism about using super in the future.

11 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 11 MARCH 2023 | FIND MANNINGHAM

Turning into our senses is an important way to disconnect from the fast pace of modern life.

NATURE

By Kayte Kitchen

This is the fifth of five publications where we have been running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position. For this breathing exercise, we will follow a pattern of 4 counts in, holding for 7 and then exhaling for 8.

Follow this pattern, allow it to take all of your focus and to help you unwind. Repeat for a few minutes.

Allow your breathing to find its natural rhythm once more.

For the next 5 mins we are going to practise tuning into all of our senses while we do a slow walk. You may only move a few metres within the 5 mins, the point of the exercise being to tune in to your senses of sight, smell, hearing and feeling as you go. Draw your attention to the details, get in close to nature, take time to experience the full experience of each moment.

You are trying to slow down your senses, slow down your experience. Try not to allow distractions to come into your mind, be fully present to the experience. If you do get distracted, don’t stop, just

tune back in and continue.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

KayteKitchen

isthefounderofAdmirariNatureTherapywhoprovidenatureexperiencesfor schools, business and individuals. For more information visit admirari.com.au

Neurodiversity Celebration Week: 13 -19 March 2023

Neurodiversity Celebration Week is a worldwide initiative that challenges stereotypes and misconceptions about neurological differences. Together, let’s change the narrative to understand, accept, and celebrate neurodiversity!

We're excited to present a week of great events at Croydon & Realm Libraries during Neurodiversity Celebration Week. Events include:

• Social morning for adults with Different Journeys (Croydon)

• Growing in to Autism with author Prof Sandra Thom-Jones (Croydon)

• Different Journeys information session (Croydon)

• Gently Gently Storytimes (Croydon & Realm)

• Games afternoon for children & teens with Different Journeys (Realm)

12 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

View program & book your place

Through The Eyes Of The Camera

VIDEO PRODUCTION

By Allison Groot

When we watch a video we are usually there for the subject matter - whether its to learn, be informed, upskill or just to have a good laugh but what we don’t realise is that there has been (in most cases) a lot of thought and concepting has gone into how everything looks down to how clean the background is.

These subtle things delve deep into our psyche and create unconscious decisions for us. Our mind fills in the gaps with language and visual cues. Great marketing and design can embed feelings and emotions towards colours, scenes and imagery. The same can be said about a good background.

Let’s talk about cameras for a second. They are all around us at the supermarket, in security cameras, in our computers, laptops, and phones. We are constantly recording our lives and workplaces on them and our cameras see everything. From the coffee table with tissues on it to the top of our neighbours head as they walk past the window…they capture it all.

But have you ever stopped to think about what the camera is seeing in your background?

If you are regularly doing posts and making videos then you should be considering the locations of where you are filming, what you are talking about and how you want your customers to see you.

A messy background can be distracting, and annoying, it puts customers off your products and subconsciously delivers a message of disorganisation, forgetfulness and a preconceived idea that you aren’t connected to your products and the quality is not great.

Making some changes and creating a clean, uncluttered background helps to provide a clear focal point for the viewer to see you and your products. It shows that you love what you do and take pride in the products, that the quality is exceptional and that you are great at what you do.

I know you are asking how can a clean and tidy background create all that. It is simple, we buy with our eyes. Sure our products or services are amazing and yes people will still buy them but there is something to be said about clean lines, pops of colour and an inviting scene to showcase your products.

So remember when filming your social media videos.. the camera see’s everything!

Yes Today Media - Quick Tips:

Before you do any filming at home or in the office, have a tidy-up. Tidy shelves, desks, wipe down benches, put out the rubbish, put those boxes away that you have been meaning to move for ages. Add some brand colours, use a pull-up banner or even products could be your backdrop. Be very deliberate in your choices.

For more information or quick tips contact Yes Today Media

13 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 13 MARCH 2023 | FIND MANNINGHAM Allison Groot Creative Director Yes Today Media 0403 899 697 hello@yestodaymedia.com.au yestodaymedia.com.au

Manningham

Cracking the Code for Gender quality this International Women’s Day

In the lead up to International Women’s Day (IWD), Manningham Mayor, Councillor Deirdre Diamante says we need more than rousing campaigns, inspirational hashtags and rational argument to close the gender diversity gap in science, technology, engineering and maths (STEM).

As a business owner, co-founder of the TechDiversity Awards, mother and a mayor, Cr Diamante, knows a thing or two about this year’s IWD theme, Cracking the Code: Innovation for a gender equal future.

IWD will be held internationally on Wednesday 8 March and the theme was selected by UN Women Australia, to recognise the important role of women in STEM fields.

“Too often, women and girls feel that they are not welcome in STEM because of the discrimination they face and the barriers to entry,” the Mayor said, adding that according to the World Economic Forum’s Global Gender Gap Report 2021, another generation of women will have to wait for gender parity.

“As the impact of the COVID-19 pandemic continues to be felt, closing the global gender gap has increased by a generation from 99.5 years to 135.6 years. This is a sobering thought.”

“Across the globe, women have lost ground in accessing the same opportunities that are open to men, and they are far more limited in their ability to fulfil their social and economic potential.”

Cr Diamante said this is especially true in the tech industry,

which also offers the largest and broadest skills and jobs opportunities for the future.

“Only 23 per cent of employees in the Australian tech sector are women and this is down from 35 per cent in the 1980s… meanwhile, Australia has a critical shortage of tech, data sciences, cyber security and digital skills, amongst others.

“We need committed leaders that lead by example and personally oversee a workplace culture that enshrines equality, respect and inclusiveness across their organisations,” Cr Diamante said.

Manningham will celebrate IWD with a morning tea at the Manningham Function Centre organised with guidance from the Manningham Gender Equality & LGBTIQA+ Advisory Committee, which includes a diverse range of residents and local organisations.

This year’s event will have a strong focus on intergenerational collaboration, with young and young-at-heart encouraged to mix and share ideas.

The morning tea will feature a keynote speech from Ally Watson OAM, who is the founder of Code Like a Girl, a social enterprise aimed at giving women and girls the skills to enter the technology industry. The event will also include a panel discussion about this year’s theme.

The morning tea is historically a very popular event, limited tickets are available at: manningham.vic.gov.au/events/iwd

For other ideas on how to get involved visit: unwomen.org.au/ get-involved/international-womens-day/events/

Manningham Mayor, Councillor Deirdre Diamante and attendees at last year’s International Women’s Day event, which had the theme #BreakTheBias

Council News

Community Consultation now open on Draft Pricing Policy for use of Council Active Open Space

Manningham Council is dedicated to providing accessible and affordable active open space for the community. In line with its Active for Life Recreation Strategy 2010-25 (2019 Review), Council is reviewing its current Seasonal Sports Pricing Policy to better align with the needs of the community.

The review provided recommendations on the fees and charges for use of Council’s active open space. The draft policy developed aims to recoup 35% of maintenance costs for turf sports fields and netball courts at the Manningham Templestowe Leisure Centre through fees and charges, with this figure lower for satellite netball courts. Under the draft policy a nominal rate is applied to leased facilities where clubs are responsible for maintenance. The draft policy also aims to ensure it remains equitable and accessible to all.

To support community groups, the proposed policy includes fee concessions for eligible community groups. It is proposed that around 80% of groups in Manningham will see minimal or no impact on their fees, with 50% of groups expected to receive a fee reduction. Fee decreases are proposed to be

applied immediately, whilst groups that may see a fee increase would have this fee applied over a 3-year period. Further assistance will also be available through payment plans as required.

Community Consultation Now Open

Manningham Council is inviting community feedback on the draft policy from March 1 to 29, 2023. Feedback can be provided through an online survey or at an in-person workshop on March 15, 2023 at Mullum Mullum Stadium. The purpose of this consultation period is to gather community feedback and shape the policy in a way that is accessible and equitable for all.

Manningham Council is committed to providing accessible and affordable active open space for the community and the proposed draft policy reflects this commitment.

Join the community consultation period and share your feedback on the draft policy. Visit yoursay.manningham.vic. gov.au/pricing-policy-active-open-space

Manningham’s Reconciliation Action Plan (RAP) 2023 – 25 now endorsed

Manningham Council’s Reconciliation Action Plan 2023-25 (RAP) was officially endorsed at the February Council meeting. This is an important step in ensuring we continue to plan and create opportunities for First Nations peoples and support a culturally safe and thriving city.

Reconciliation Action Plans enable organisations to sustainably and strategically take meaningful action to advance reconciliation. Our new RAP has been endorsed by Reconciliation Australia and will build relationships, respect and opportunities to advance reconciliation across Manningham.

Manningham Mayor, Deirdre Diamante said the new RAP is the most recent milestone in a journey that began in 1997.

“It was developed in partnership with Wurundjeri Woi-wurrung Corporation and local First Nations peoples. We thank them for their contribution and generosity in helping us to produce this document. We also thank the Reconciliation Action Plan Working Group who guided its development.”

The Mayor said Manningham is committed to being an inclusive and connected community.

“We proudly acknowledge the Wurundjeri Woi-wurrung people as the Traditional Owners of the land and waterways known as Manningham and are respectful of the Victorian First Nations

communities. We recognise and respect the deep and continuous connection the Wurundjeri Woi-wurrung people have for the land Manningham Council operates on.”

“We recognise that although there is still much work to be done, local government has a key role to play in the achievement of reconciliation.”

It is our hope that this RAP supports us to:

• Create meaningful relationships

• Recognise and support First Nations self-determination and cultural rights

• Build understanding of our shared history

• Celebrate, recognise and respect First Nations cultural heritages

• Educate our community on First Nations culture and history and provide them with an opportunity to take an active part in the process of reconciliation.

Our RAP will be officially launch on Saturday 18 March, at the Yaluk Langa (‘River’s Edge’ in Woi-wurrung language) Indigenous garden at Heide, in Bulleen as part of a community day exploring Wurundjeri’s deep connection to land the continuation of a tree scaring project.

• Read our Innovate Reconciliation Action Plan 2023 - 25

• Find out more about the Yaluk Langa Community Day

15 MARCH 2023 | FIND MANNINGHAM

March 2023

Commonwealth Government changes prompt Manningham to consider future of in-home aged care services

The Commonwealth Government is making significant changes to aged care services and developing a new in-home aged care program. The Government currently funds Council’s inhome aged care services under a contract arrangement.

These changes mean Manningham Council, like the majority of Victorian councils, is looking at whether it can continue delivering in-home aged care services. It will make a final decision on this issue in mid-2023.

To participate in the new Government program, Council would need to work across a large geographic region and offer a more comprehensive range of services (e.g., allied health, inhome palliative care and physiotherapy) than we currently provide.

“We understand we would not be offered a contract within this new program,” Manningham Mayor Cr Deirdre Diamante said. Over 50 councils have already decided to transition out of the aged care system, and in these cases, the Commonwealth Government has appointed other specialist providers to deliver services.

Cr Diamante said she wanted to reassure residents that if Council cannot continue to offer in-home aged care services, the Government will ensure our older clients still receive the services they need.

“The Commonwealth Government would appoint a range of new providers to deliver services in the Manningham area. Residents would have access to these other providers who would offer a broader range of services at similar cost. Council would be committed to supporting existing clients to connect to these new providers and making the transition as smooth as possible.”

“Council is considering this issue very carefully and thoughtfully. We need to look at what is best for our community in the long term. We are not looking at ‘outsourcing’ our in-home aged care services – the contract model is changing, and we have to respond to it.”

“Most importantly, there are no immediate changes to Council’s current in-home aged care services of domestic help, personal care, respite care, Meals on Wheels and social support.”

“If the final decision is to change in-home aged care services, this would happen towards the end of 2023.

”Cr Diamante said Council continues to be committed to the safety and wellbeing of its older residents.“

Even if we can no longer provide in-home aged care services, we would continue to offer other services that support healthy and positive ageing, like community transport and social connection activities.”

“Council would also continue to take an active role in ensuring our community receives high-quality aged care services and will strongly advocate for the needs of vulnerable community members.”

Cr Diamante said Council is also consulting with staff on the potential change.

“We would like to acknowledge our Aged and Disability Support Services staff and the valuable work they do with the older adults in our community.”

16 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

Get ready: Food Organics Garden Organics (FOGO) starts this July

Set to be delivered during April and May, the FOGO starter kits include a kitchen caddy, a roll of certified compostable liners and an information pack to help Manningham households get started with FOGO.

Manningham Mayor, Cr Deirdre Diamante, said the FOGO starter kits include everything you need to get going with the Food Organics Garden Organics service.

“The FOGO kitchen caddy and the compostable liners have been designed to help you collect and carry food waste from your kitchen out to your green lid FOGO bin.

“You won’t need a new green lid bin – from July your existing green lid garden bin will become your green lid FOGO bin and it will be collected weekly instead of fortnightly.

“You will be able to place all food waste into your green lid bin, including fruit and vegetable scraps, bread, pasta, rice, meat, bones, dairy, seafood, loose tea leaves and coffee grounds.

“We know many in Manningham are keen composters, FOGO can complement your home composting and is great for items that usually aren’t usually suitable for home compost systems, like citrus, meat, bones and dairy products,” Cr Diamante said.

FOGO is about reducing the amount of waste that is being sent to landfill and its impact on our environment. In landfill, food waste creates methane, a greenhouse gas that contributes to climate change.

Manningham’s new Food Organics Garden Organics (FOGO) service starts in July and every household with a Council residential waste service will soon receive a FOGO starter kit.

Once FOGO starts for Manningham households, food waste will go into your existing green lid bin along with garden waste for it to be recycled into compost.

Voucher

“Going FOGO in Manningham is one of the simplest ways we can all reduce our emissions and divert up to 20,000 tonnes of food waste from landfill each year – while instead creating compost that will be used in gardens and farms across Victoria,” Cr Diamante said.

For more information about Manningham’s Food Organics Garden Organics (FOGO) service, visit manningham.vic.gov. au/FOGO

program aims to cut the cost of kids’ sports

The Get Active Victoria voucher program aims to help eligible families and their children get active in sports and recreation by reimbursing the cost of membership and registration fees.

Up to 100,000 vouchers are available to support eligible kids by providing up to $200 towards these costs which often provide a barrier to entry.

This initiative is part of Get Active Victoria’s efforts to inspire all Victorians – regardless of age, ability or location – to move more, every day.

To find out more about the voucher program and how you can apply, visit Get Active Victoria.

17 MARCH 2023 | FIND MANNINGHAM www.findmanningham.com.au 17 MARCH 2023 | FIND MANNINGHAM

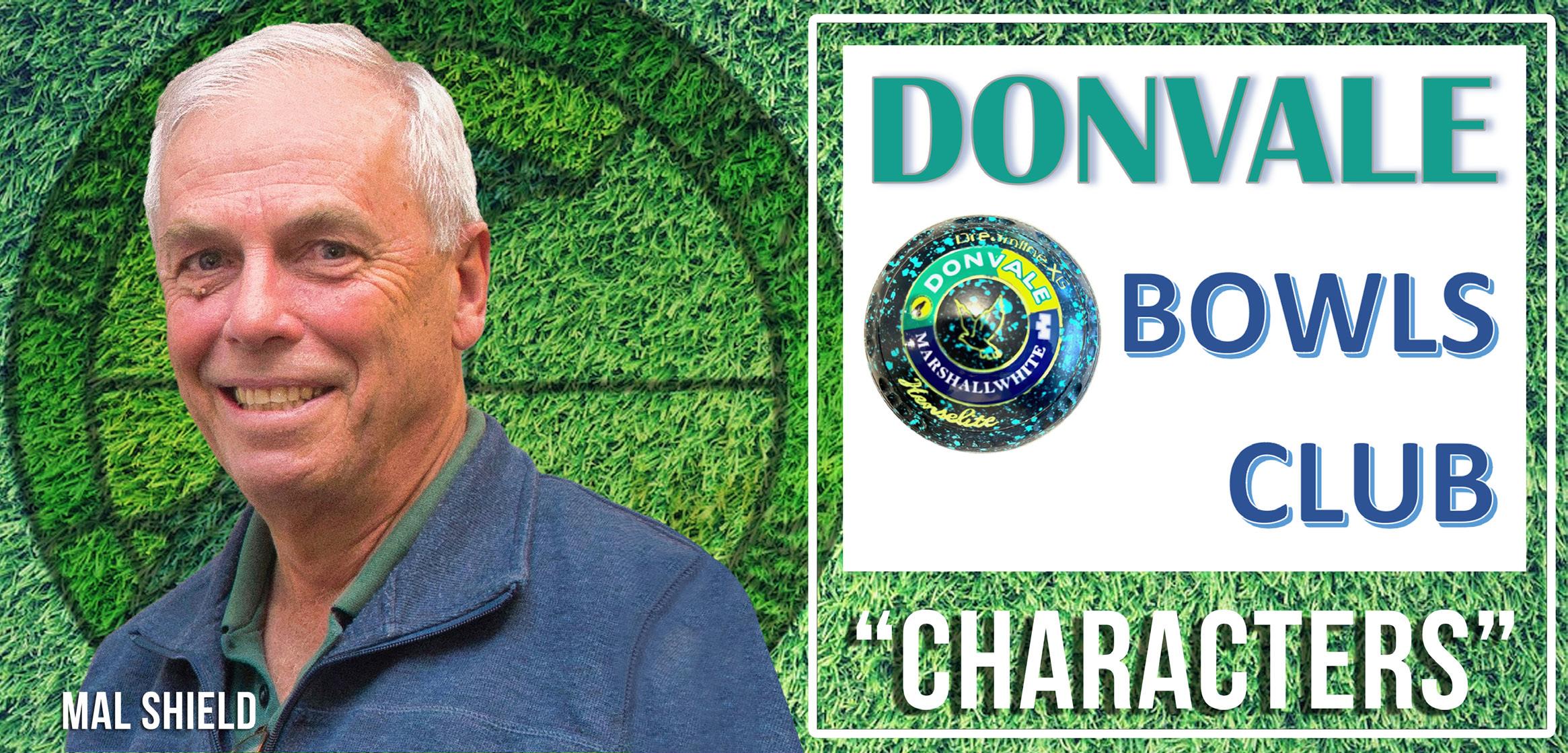

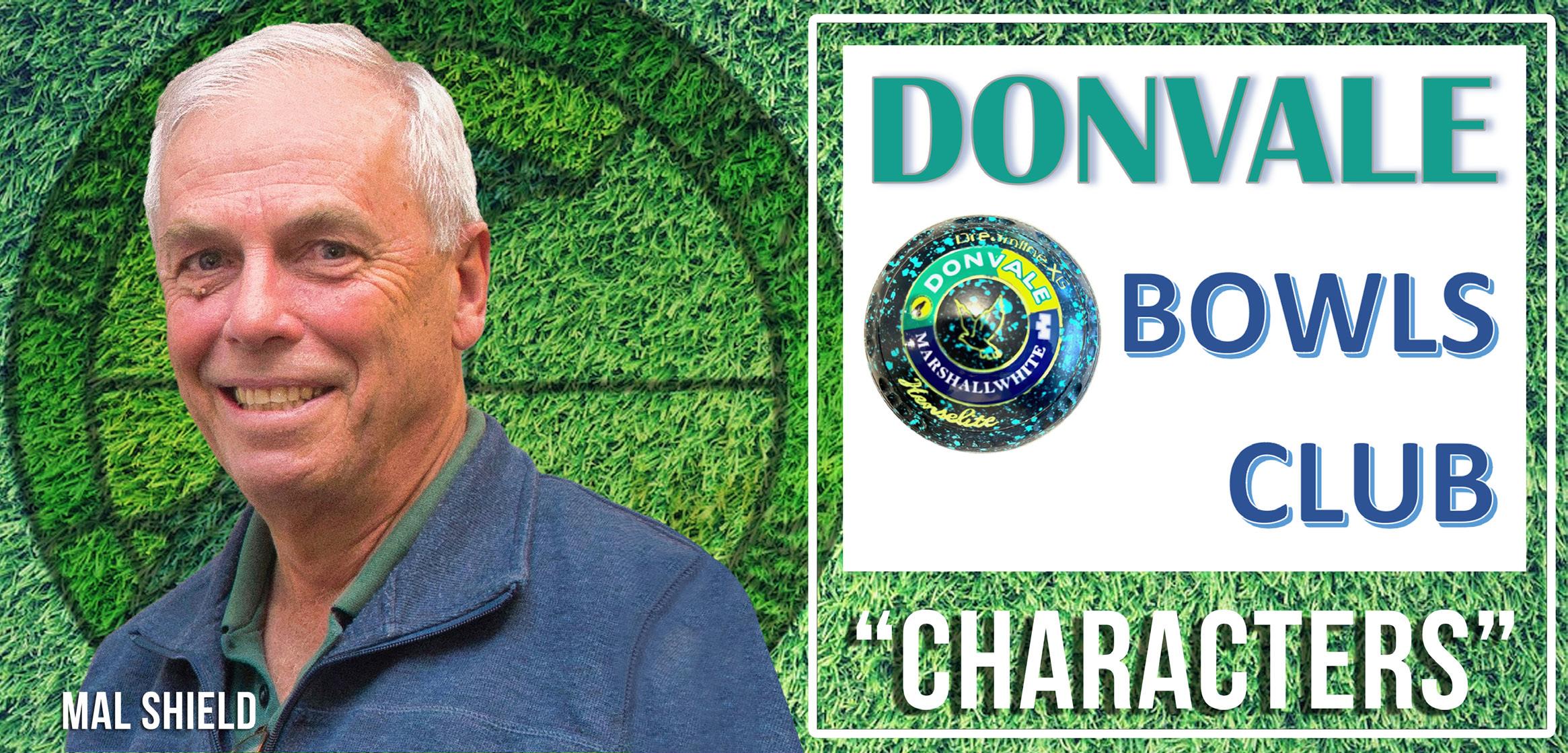

Donvale Bowls Club is indeed indebted and beholden to many of our beloved characters which define and distinguish it.

One such character at Donvale is Mal Shield (Pictured)

A brief insight into Malcolm’s working life, his involvement at Donvale Bowls Club, and the successful experiences it provided.

Born in Melbourne in 1953.

Completed his Primary/ Secondary and Technical school education.

Enrolled at RMIT qualifying as an engineer.

During these formative years he became active in Heidelberg Rotaract becoming treasurer for the club and the Rotaract district.

It was during this period he met Jan Allan, a Canadian exchange student with the Heidelberg Rotary a 19-year-old exchange student. The Rotarians requesting the Rotaract club to include her in their activities.

The timing was perfect, known as a man of discerning taste and as luck would have it, between girlfriends, he volunteered to accept her.

Life takes romantic twists, Jan supposably swept off her feet by this persistent and suave suitor, they later married.

His working career commenced as an engineer at Siddons Industries in Heidelberg an institution, famous for the quality Sidchrome spanners and work tools.

Promotion was swift!

Following on his role as an engineer took him to the Australian

Papermakers in Fairfield, later transferring to their Maryvale mill in Gippsland as assistant power engineer.

Next move to their Botany mill in Sydney, becoming the powerhouse and wastepaper engineer.

His ongoing journey with the company taking him back to the Fairfield Plant as South Mill Manager.

The APM had now been renamed Amcor, Mal was immediately promoted to Mill General Manager.

His final executive role Managing Director PMP print Australia. After constantly involved in large national roles, and the long hours it entailed he decided to start his own business doing management consulting work, sitting on boards, mergers, and acquisitions for medium sized companies, at one time travelling to Indonesia 13 times in a year.

In 2020 his workload and Covid, influencing him to retire. His interests are fishing, cycling, caravanning, travelling, Probus and family.

They have 3 children Kristy 39, Steven 39, and Michael 29. 4 grandchildren, 2 boys and 2 girls ranging in age from 8 to 11. The two oldest living in Melbourne, the youngest in Brisbane.

In 2014 he commenced bowling at Donvale Bowls Club initially attracted and enjoying 2 years of twilight bowls.

He is now well entrenched and extremely proud to be a member of such a welcoming and hardworking fun group of people.

Mal and Jan have made a substantial and immeasurable contribution to our club, the partnership, their readiness to contribute, volunteer, and be involved.

How fortunate we are they chose Donvale as their next chapter.

18 FIND MANNINGHAM |MARCH 2023 www.findmanningham.com.au

SPORTS

MARCH 2023 EDITION

By Dr. Joanna Strybosch

By Dr. Joanna Strybosch

Dr. Joanna Strybosch

Dr. Joanna Strybosch