BREXIT

New import controls and ‘lost’ exports

Why they could be Spain’s next seafood speciality

Arctic charr Sapphire Springs gears up for growth

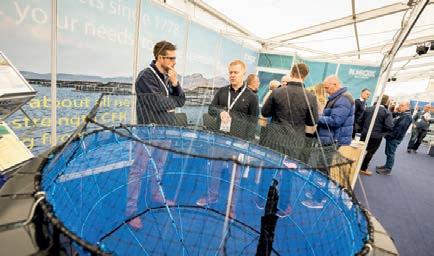

Aviemore Aquaculture UK show preview

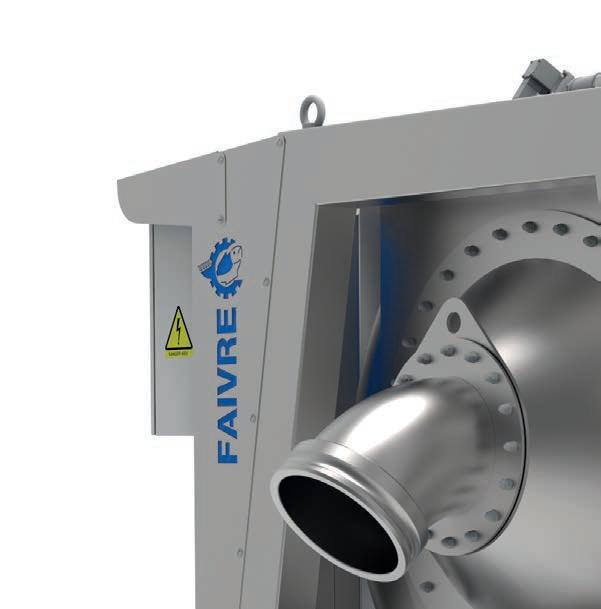

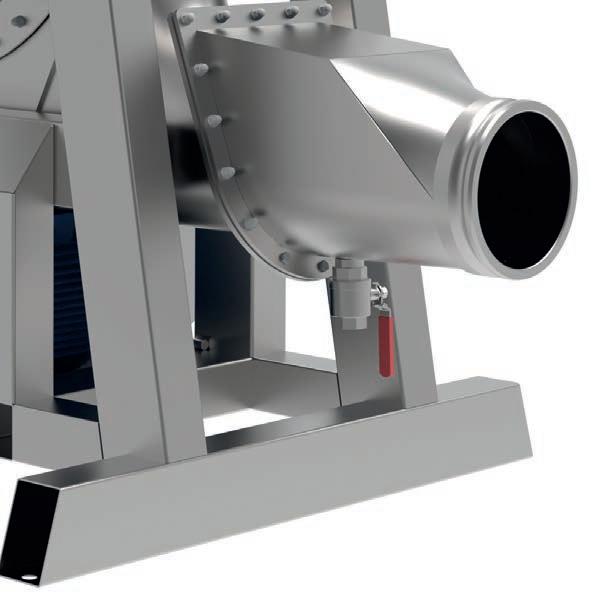

Pescamotion 50 (10‘‘), high speed loading and transfer Fish Pump

Meet us booth # A 11

High quality fish farming equipment

Designer & Manufacturer since 1958

High quality fish farming equipment

Designer & Manufacturer since 1958

MORE than four years after the UK officially left the European Union, the implications of Brexit continue to reverberate through the economy.

The slogan that helped to sway voters in favour of leaving was “take back control.” In practice, however, that appears to have been adopted by the UK’s European neighbours more readily than by the UK itself. For the seafood trade, it has meant a huge growth in paperwork and inspection protocols when exporting to EU countries, while up until now, the UK has been reluctant to impose such controls for products going the other way.

That all changes this month, however, as Sandy Neil reports in this issue. Physical border inspections are being introduced and it is still unclear how much of an impact that will have on incoming seafood from the EU and countries such as Norway. What is apparent is that the UK industry, while it is not keen on red tape in either direction, wants to see a level playing field operating in this marketplace.

Salmon Scotland argues that the loss in potential trade with the EU, for Scottish salmon alone, is worth £100m annually. Tavish Scott, the industry body’s Chief Executive, explains why in his Fish Farmer column.

Also in this issue, we meet a businessman from Spain who is looking to raise Europe’s first commercially farmed sea cucumbers. While sea cucumbers may not be a fixture on European restaurant menus, they are highly prized by Chinese consumers and their increasing rarity as a wild catch commodity should make them a premium export product.

We also profile Canadian Arctic charr producer Sapphire Springs and explain why Norway’s rule against the export of poorer quality salmon is being contested by processors in the EU.

This month’s issue also features California’s fledgling seaweed industry and a project in Tasmania, funded by salmon farmers, that aims to save an endangered skate.

Meanwhile, we are also previewing Aquaculture UK, the country’s biggest event for the industry, which takes place in Aviemore next month. We hope to see you there!

Best wishes

Robert Outram

SCOTLAND’S fish farmers have succeeded in their bid to strengthen the rules over what is allowed to be called Scottish salmon .

The overnment has agreed to amend the protected geographical indication for Scottish farmed salmon to Scottish salmon . This means that any product described in this way will have to meet strict criteria. status initially part of the single mar et can apply to a wide range of food and drin products. n the case of Scottish farmed salmon this not only covered its geographical origin but also the production process and uality controls involved.

The Scottish salmon industry through Salmon Scotland as ed for the change to prevent unscrupulous traders from passing a product off as Scottish salmon even if for example it had only been processed in Scotland or if it failed to meet the same environmental and food safety standards as the genuine product.

From now on any product described as Scottish salmon must meet the same rules as Scottish farmed salmon .

The labelling decision by the epartment for nvironment Food

and ural ffairs efra means that farm raised salmon from Scotland will now have greater post rexit protection Salmon Scotland said to prevent the ris of food fraud through imports of inferior salmon products which could misleadingly be sold as Scottish salmon .

The new geographical designation will be the coastal region of mainland Scotland estern sles r ney and Shetland sles .

The overnment said that no admissible reasoned statement of opposition had been received. ny appeal against the decision would have to be presented by pril. The update replaces a previous for Scottish

farmed salmon given that wild Scottish salmon is no longer available for sale in supermar ets following decades of population decline.

Salmon Scotland stressed that it remains a re uirement of all seafood products on sale in the to list the production method on pac aging. The change of name does not affect this statutory re uirement so pac aging will continue to ma e clear that salmon is farm raised.

Tavish Scott hief xecutive of Salmon

Scotland said Farm raised Scottish salmon is a globally recognised brand and rightly considered the best in the world so it is vital that we ta e steps to protect our premium product from food fraud. hen consumers tal about Scottish salmon’ they are tal ing about farm raised tlantic salmon from Scotland and this change ma es that clear while boosting legal protection post rexit.

Scotland’s salmon farmers wor hard to rear their fish and this recognition by efra is testament to the commitment of all those in remote communities who continue to meet the growing demand for Scottish salmon at home and abroad.

BAKKAFROST says its Scottish arm is on a steady but positive road to recovery, despite the latest trading update, which shows a year-on-year fall in production for this year’s first quarter.

The Scotland division has reported a harvest of 7,300 tonnes for the January to March period. This compares to 8,100 tonnes a year earlier, when all of that total came from Scotland North.

Scotland South, which produced nothing 12 months ago, turned in 3,300 tonnes this time, while Scotland North produced 4,000 tonnes.

The Faroe Islands total was 14,300 tonnes, up from 11,000 tonnes last year.

Feed sales in Q1 2024 were 27,000 tonnes, up from 22,300 tonnes in Q1 last year,

Bakkafrost said Havsbrún sourced 136,900 tonnes of raw materials during the recent quarter.

Bakkafrost said in its annual report for 2023 that prospects for this year are bright, with increased biomass and larger fish in the water in both the Faroe Islands and Scotland, indicating robust biological health. It added: “Our strategic initiative, ‘One Company’, aimed at integrating our Scottish and Faroese operations, continues to progress effectively.

“In 2023, we streamlined processes and restructured the organisation to enhance efficiency, which included a workforce reduction of 75 employees in Scotland, in addition to the earlier mentioned layoffs in the Faroe Islands due to adjustments in value-added processing in response to tax changes.”

The report said Bakkafrost stood in an advantageous position with an increased biomass comprising a high share of large-sized fish (of which there is a shortage) of almost exclusively superior quality.

The full Q1 report, including financial information, will be published on 6 May.

50 years of selection, innovation and precision led us here. Solid genetic foundation. High quality. All year round.

Our portfolio of products includes high-performing salmon genetics for sustainable salmon farming.

Benchmark salmon ova are the result of long-term breeding programs and intensive innovation, using the latest genomic technologies to develop traits adapted to face the challenges of net-pen and landbased farming conditions.

With land-based broodstock facilities, we can deliver high-quality, biosecure salmon ova all year round.

We are fully dedicated in supporting our customers in Scotland and Ireland to maximizing the potential of our genetics.

Learn more about our products at bmkgenetics.com

SCOTTISH-based marine support services business Underwater Contracting (UCO), already owner of the world’s largest fleet of Saab Seaeye Falcon ROVs, has added to its pool through the purchase of five new machines. The deal gives UCO a total of 38 Falcon systems.

The company, based in Aberdeen in northeast Scotland, said it has expanded its fleet in response to major new multi-year contract wins across all sectors, which will see it provide a range of services in Europe, North America and the Middle East.

VOLUNTEERS from Scottish salmon farms cleared away more than 23 tonnes of litter from Highlands and Islands beaches last year, as part of efforts to keep the areas they live and work clean. Data compiled from last year’s efforts has been published by industry body Salmon Scotland.

Salmon farmers take part in regular beach cleans throughout the year to ensure beaches and coastlines are free from litter and aquaculture debris. While some of the beach litter was related to aquaculture, the vast majority was not and had either been washed up on the shore or left behind by visitors.

THE impact of data, automation and cutting-edge tech on aquaculture will be among the key themes at the Blue Food Innovation Summit, taking place in London on 21 and 22 May. More than 350 leaders will be

joining from across the globe to forge partnerships and discuss solutions for a biodiverse, stronger and more sustainable blue economy. To find out more or to register, visit www.bluefoodinnovation.com

60-year salmon study helps to

THE most detailed long-term study ever carried out of Atlantic salmon in a Scottish river valley has yielded valuable insights, say researchers at the University of Aberdeen.

The data covers six decades’ worth of data on salmon populations and river conditions in Girnock Burn, Royal Deeside.

Atlantic salmon have long een identified as a threatened species because they need marine and freshwater habitats during their complex life cycle, and both are being affected by climate change.

To gain a greater understanding of this life c cle, fish traps were installed in 1966 in the Girnock Burn in Royal Deeside, between the royal estates of Birkhall and Balmoral, within the Cairngorms National Park.

Now, a research paper led by the University of Aberdeen, has highlighted the insights from long-term monitoring at the site.

Scottish Government and the Leibniz Institute of Freshwater Ecology and Inland Fisheries in Germany is the most detailed long-term study of an Atlantic salmon population in the world.

The study, which has been summarised and published in the journal Hydrological Processes, has revealed quantitative changes in the return rates, distribution, size, growth and age of salmon.

Professor Chris Soulsby of the University of Aberdeen has been involved in the Girnock study for more than 30 years. He said the strong dataset they have been able to capture over six decades provides vital science that can support salmon restoration efforts in Scotland, adding: “This is an internationally important salmon research site and, unusually, it has been accompanied by a wide range of related environmental research, which helps understand why salmon numbers have declined as a result of climate change, which mainly contributes to poor marine survival but also affects freshwater habitats.”

The Girnock, draining mountains and moorland, became of interest to scientists when it was identified as ha ing an important population of spring salmon fish that spend more than one year at sea and return to freshwater early in the year, coinciding with the start of the fishing season.

The work carried out there as a partnership between the University of Aberdeen, the Marine Directorate of

Six decades of ecohydrological research connecting landscapes and riverscapes in the Girnock Burn, Scotland: Atlantic salmon population and habitat dynamics in a changing world (C Soulsby, IA Malcolm, D Tetzlaff) Hydrological Processes, published March 2024.

HOPES for an effective vaccine against sea lice have been boosted with the news of a grant that is helping research into a further stage.

Partners from the University of Stirling’s Institute of Aquaculture, AQUATRECK Animal Health SL and oredun Scientific ha e een awarded almost £50,000 from the Sustainable Aquaculture Innovation Centre, after the initial proof-of-concept phase, which concluded last year, showed promising findings.

The latest stage involves assessing the impact of the novel vaccine technology against adult lice, building on the first part of the research, which looked at larval stages and identified a gut protein required for protection.

The team is using advanced recombinant expression technology for injection vaccination, a technique that involves implanting cells with a DNA vector that contains the required template for a desired protein and then culturing the cells so that they transcribe and translate the protein.

If successful, the technology could be scaled up to make mass antigens available, to

later be applied via salmon feeds as an oral vaccine.The formula has been developed to trigger an immune response and create elevated antibody levels in the bloodstream of fish, helping to impair sea lice development and reproductive capacity following sea lice feeding on the fish. he accine could also reduce the number of parasite offspring.

Dr Sean Monaghan, lead researcher and lecturer at University of Stirling’s Institute of Aquaculture, said: “Finding a vaccine-based solution for treating sea lice would be a huge development for the aquaculture sector globally... we are hoping that this second stage of the project will demonstrate the efficac of the vaccine for protecting Atlantic salmon against adult lice and help to uild the scientific evidence base.”

MOWI’S long-time Director of Communications for Scotland, Ireland and Canada, Ian Roberts, is set to join the ranks of ex-Mowi alumni this summer.

The company said that Mowi and Roberts reached mutual agreement to end the position with effect from 1 August 2024.

Roberts (pictured, taking part in Mowi’s Salmon Wagon community initiative) has been with Mowi since 1993, with a number of positions held in salmon production and communications spanning his 31-year career.

He said: “I’ve thoroughly enjoyed the various career opportunities that the company has entrusted to me.

“From leading the salmon aquaculture partnership with the Kitasoo Xai’xais First Nation in British Columbia during the first half of my career, to directing communications in Canada and Scotland over the past 15 years and having the opportunity to work with fabulously smart and caring people, it has all been rewarding for me personally.”

Ben Hadfield, Mowi’s COO Farming (Scotland, Ireland the Faroes and Canada East), said: “Ian’s leadership and confident presence in communications has been a strong asset for Mowi and for the wider salmon farming sector. His confident, passionate approach alongside strong respect from communities where salmon is produced has led to trust and a greater understanding of our business. I wish Ian all the best in his future endeavours and hope that he will remain closely involved in the aquaculture sector in some capacity.”

THE gap between salaries for male and female employees at salmon producer Scottish Sea Farms widened as a result of its acquisition of Grieg’s Shetland assets – but the latest figures show that the company has regained its position on gender parity and closed the pay gap further in several areas.

UK legislation requires that large companies report on their gender pay gap. Last year, the figures showed that the acquisition of Grieg Seafood Shetland, which meant an additional 146 men and 40 women joined the team, had led to a wider gap.

However, the company’s 2023 gender pay gap reporting confirms that Scottish Sea Farms has not only returned to its pre-acquisition position but also made slight advances, aided by ongoing work to benchmark and align pay grades across the integrated team.

Advances achieved include:

• a 3.8% reduction in women’s mean hourly pay gap;

• a 5.4% reduction in women’s median hourly pay gap;

• 1.2% more women in the top pay quartile; and

• 28.6% more women receiving bonus pay.

Fiona McCann (pictured), Head of HR at Scottish Sea Farms, said: “The key takeaway from the latest reporting, as our mean average hourly pay shows, is that female colleagues are paid on a par with their male counterparts – or, as with this snapshot, slightly more.

“What we can’t ignore, however, is that salmon farming was seen as a primarily male

career for many years. As such, we have significantly more men on the team than women, some 82% to 18% in 2023, impacting other measures.

“So while there remains no difference in median bonus pay – in other words, the middleearning male and female received the same bonus – the simple fact men outnumber women in each pay quartile, including those in which bigger bonuses are often paid, contributed to our mean bonus pay gap widening in 2023.”

The single best way to close this and other gender-related pay gaps, says McCann, is to attract and retain more women into the company and sector.

“Our priority has been and always will be to hire the best candidate for the job. We’ve made real progress, with 109 women on our team currently in roles ranging from freshwater technician and fish vet to environmental scientist and supply chain coordinator – but we’d like to see many more.”

BREXIT has cost Scotland up to £100m each year in “lost” salmon exports, according to the industry body, Salmon Scotland.That’s what the organisation’s Chief Executive, Tavish Scott, told MSPs in the Scottish Parliament last month.

He was addressing MSPs on the Constitution, Europe, External Affairs and Culture Committee as part of their inquiry into the EU-UK Trade and Cooperation Agreement – which is up for review after the general election.

Scottish salmon is the UK’s largest food export, but farming companies have faced increased red tape and costs triggered by the departure from the EU in January 2020.

In 2019, there were more than 53,000 tonnes of Scottish salmon exported to the bloc, with the figure falling to 44,000 tonnes in 2023.

Export values to the EU were only down 3% to £356m because strong global demand drove up prices, but if the sector had maintained volumes at 2019 levels, then sales would have been above £430m.

That means there has

been a net “loss” of around £75m or up to £100m had the sector grown at the rate previously expected.

The Brexit impact has been mitigated by huge growth in other markets, particularly Asia and the US.

Overall international sales in 2023 were up from £578m to £581m (up 0.5%), including a 7% increase to the US and 22% to Asia.

However, with salmon increasingly popular in traditionally smaller European markets such as the Netherlands and Spain, smoother trade flow and new markets would open up the possibility of further economic growth – generating greater investment in the Scottish economy and more highskilled Scottish jobs, Salmon Scotland says.

The estimated Brexit impact of lost sales does not include the direct £3m-a-year cost to farming companies in terms of extra administrative costs because of the lack of an e-certification scheme.

See also the Salmon Scotland column on page 30 and more on import controls on page 42.

SCOTTISH Sea Farms has taken delivery of the first batch of “green” (unfertilised) eggs at the new £2m incubation unit at the company’s Barcaldine Hatchery.

The move is part of a strategy aimed at making the company’s operations more self-reliant in terms of ova supply and less dependent on imported eggs.

This batch, which were fertilised on-site in a first for the company, are doing well so far, according to Scottish Sea Farms’ Head of Freshwater Rory Conn.

He said: “The incubation unit is designed to receive eggs immediately post-stripping, giving us greater control in the earliest days of the production cycle.

“We trialled two smaller test batches in Q4 2023 ahead of receiving our first full intake of around three million green eggs either side of Christmas.

“These were fertilised on arrival at the new unit.”

Scottish Sea Farms conducted a series of assessments, from evaluating the success of the fertilisation process within the first 24 hours to checking embryonic development around the 60-day stage.

When the eggs reach the eyed ova stage, they will go through a further quality check to ensure only the viable ones are transferred to incubation trays in the hatcheries.

Conn said: “From the results to date, we know already that the quality of water in the green egg unit has mitigated a number of the issues we had been seeing with our intakes of eyed ova.”

The eggs stay in the incubation unit, which is adjacent to the main Barcaldine Hatchery, for six weeks to five months, depending on requirements, before being moved to one of Scottish Sea Farms’ three hatcheries: Barcaldine itself, Knock on the Isle of Mull or Girlsta in Shetland.

The new facility enables the eggs to be incubated for longer, at lower temperatures, during the most fragile stages of development.

“We have taken the temperature down to below 2°C which, research suggests, results in better outcomes for fish health later on, particularly cardiac health,” said Conn.

He added: “By incubating the eggs over a longer period, we can meet our year-round demand for eyed ova, ensuring security of supply.

“From this initial batch alone, we will be able to put close to 600,000 smolts into one of our marine farms at the required time – around late August next year.

“Without the green egg unit, it simply wouldn’t have been possible to produce smolts from Scottish-sourced ova at this time of year.”

The new unit benefits, Scottish Sea Farms said, from the same purity of water and state-of-the-art recirculating aquaculture system technology as the company’s neighbouring Barcaldine Hatchery.

THE Scottish Government is calling for innovative ideas to help transform the country’s blue economy – with £14m in grant funding on offer this year.

Applications are invited for grants from the Marine Fund Scotland, which is now in its fourth year.

Addressing the Fisheries Management Scotland conference on 28 March, Cabinet Secretary for Rural Affairs, Land Reform and Islands Mairi Gougeon confirmed that m will e made available through the fund in 2024 to 2025 to help deliver Scotland’s Blue Economy Vision, which sets out plans to transform the way the marine environment is used and how Scotland’s

blue resources are managed.

The funding is available to a wide range of eligible individuals, businesses, organisations and communities to deliver projects that contribute to an innovative and sustainable marine economy, support coastal communities and contribute to Scotland’s net zero ambitions.

Last year, a total of 91 projects were awarded funding, with grants ranging from under £1,000 up to £1.6m. These projects included the modernising of seafood processing facilities to reduce energy consumption and improve efficienc har our impro ements such as community clean-ups and marine litter pre ention impro ements to safety training and on-board safety for sea fishers trials of new technolog to protect farmed fish against sea lice and ell fish and marine research and innovation to protect Scotland’s iconic wild salmon.

Gougeon said: “The Marine Fund Scotland supports a wide range of exciting and innovative projects delivering on our Blue Economy Vision.

Congratulations to those organisations and individuals who have already made successful applications – it’s fantastic to see that Scottish Government funding is playing an important role in helping our marine industries to e ol e and flourish. I am looking forward to seeing the types of projects that apply for funding in this fourth year of the fund.

“However, while the fund is critical in delivering on one of our three core government missions – opportunity: building a fair, green and growing econom we no longer ha e sufficient funding to support longer-term investment.

“Marine funding in Scotland continues to be short-changed by the UK Government so, as well as ensuring the full allocation for the Marine Fund Scotland is maintained in future years, we will keep pressing the UK Government to uphold their commitment to replace lost EU funding in full, so that we can continue supporting innovative projects in our marine sectors and coastal communities in the future.”

ANTI-salmon farming activist Don Staniford has lost his appeal against a Sheriff Court order barring him from Mowi’s farm sites in Scotland

Staniford has for many years used covertly filmed video and photography of fish farming sites to back up his argument that finfish aquaculture is damaging to the environment and to the fish being farmed. His typical approach has been to row to the farms by kayak at dawn before staff arrive on site.

Mowi Scotland had sought an interdict under Scottish law to prevent Staniford from trespassing on 47 named farms and their equipment or approaching within 15m of

those sites. In October last year, this was granted by Sheriff Andrew Berry at the sheriffdom of North Strathclyde at Oban. The Sheriff Appeal Court rejected Staniford’s grounds for appeal on 14 March, ruling that the test for interdict had been correctly applied, observing: “An award of perpetual interdict does not require harm to be established. Interdict is available to prevent unlawful conduct. The pursuer has a right of ownership in the structure of the marine farms, extending to the whole of the structure. It is entitled, as of right, to prevent the defender entering upon or interfering with the structures.”

A NEW study aims to use tagged lobsters to help assess the positive impact of offshore shellfish a uaculture on marine ecology.

Scientists mussel farmers and fishers on the Devon and Dorset coast have started the tagging work that will help them assess the impact of offshore a uaculture on the general health of the ocean.

The Ropes to Reefs project – funded through the Fisheries Industry Science Partnership scheme, part of the government’s UK Seafood Fund is loo ing to assess the wider benefits of the ’s first large scale offshore mussel farm located in yme ay.

It is being led by scientists at the University of Plymouth working with a range of partners,

including producers such as ffshore Shellfish Ltd, Scallop Ranch Ltd, Biome Algae Ltd, as well as various local and national fishing and conservation organisations.

Work has begun to tag lobsters living in and around the mussel farm.

This means the project team can gain a better appreciation of their movements and the habitats they favour.

This will be followed up over the coming months with the tagging of thornback ray, blac bream and thic lipped mullet giving researchers a clearer picture of the mussel farm’s impacts on various species that are critically important to the region’s fishing industry.

The Ropes to Reef project builds on more than a decade of research at the university, funded by ffshore Shellfish td.

NORWAY’S amazing threeyear record of seafood export growth has finally stopped at least for the time being.

Figures from the Norwegian Seafood ouncil show a fall in the value of sales including salmon both for last month and over the first uarter of 2024.

Norway exported NOK . bn almost bn worth of seafood between January and arch a decrease of N . bn or less compared to the same period last year.

three months of the year.

Seafood ouncil hristian Chramer said: “Thanks to a weak Norwegian rone and high prices there was growth in the export value in anuary and February. n arch however the currency effect decreased while at the same time there has been a drop in volume for a number of species in the first

The result was a decrease in the value of seafood exports in the first uarter.

Fisheries and Oceans Minister ecilie yrseth added Three consecutive years of export records clearly show that Norwegian seafood is in demand around the world.

lthough we are now seeing a slight decline there must be no doubt that the seafood industry is doing well.

t is still one of our largest and most important export industries.

The value of salmon exports during the first three months fell by to N . bn bn . The first uarter volume was down by to tonnes.

The arch salmon figure was N . bn m down by on the same month last year and down by in volume.

Seafood ouncil analyst aul T andahl said The fall in value for salmon is primarily due to reduced production and lower slaughter volume.

The reason is among other things lower sea temperatures compared to the same period last year. ncreased export of fillets at the expense of whole fish also contributes to the drop in volume.

A ROW is brewing over plans for a new post-smolt facility in the north of Norway – which will involve blowing up two small islands to make space for the construction.

The company behind the project is Gaia Salmon, which plans to produce between 8,000 and 10,000 tonnes of post-smolts weighing up to 800 grams annually, once the building is operational.

The site is at the Ross Islands at Træna in Nordland, where there are more than 477 tiny islands.

Gaia Salmon says the area involved covers about 12 to 14 football pitches in area.

The plan is creating no little controversy and has attracted a number of protests although the overall view from the local community is fairly positive, because the project would create many jobs for local people.

However, various national and regional conservation groups are calling for the project to be shelved.

Frode Solbakken of the Nature Conservation Association in Nordland told the broadcaster NRK:“We cannot blow up large parts of our coastal nature because we wantto get rid of

salmon lice on the farmed salmon.”

The local Labour party mayor Trond Vegar Sletten and the Træna municipality, however,are positive about the plans because it will provide up to 50 jobs, leading to more people settling in the area and building new homes. But the mayor admits it was not an easy decision to make.

He told national broadcaster NRK: “After all, we want to be a viable society. We who live here have faith in the future. But then we also have to be able to make these tough decisions on a sound basis.”

He also stressed the importance of Gaia taking steps to ensure that as many of the jobs as possible are actually taken up by local people.

Gaia Salmon general manager Erik Hernes told NRK that the company respected there were different opinions about the plan. He said: “ We are concerned with safeguarding and developing natural diversity at the same time as we develop industry and the local community.

“We collect all sludge in the plant and reuse this for energy for use in the plant.”

In that way, the company hopes to significantly reduce emissions at sea, while at the same time reducing its CO2 footprint by more than 30%. Gaia also says the facility will be a world leader in energy efficiency.

Below: aia Salmon facility

Pioneering a better future

Celebrating 50 years of pioneering plastic pen production

akvagroup.com

FORMER Mowi CEO Alf-Helge Aarskog looks set to join the board of Faroes salmon producer Bakkafrost. The notice for Bakkafrost’s annual general meeting, which is due to take place on 30 April, includes his name on the list of directors submitted for election. Apart from Aarskog, all the others are existing board members up for re-election, including Chairman Rúni Hansen. Aarskog left Mowi

in November 2019 after 10 years with the salmon giant.

A NEW name in the aquaculture industry has made its debut on the Oslo Stock Market. The Torghatten Aqua group, an investment business specialising in aquaculture and aquaculture training, will become the ninth-largest company among some 40 businesses on the Norwegian over the counter (NOTC) list of the Oslo Børs. Øyvind Løvdahl, CEO of Torghatten Aqua, said: “Listing on NOTC was a promise we made to the shareholders when we raised capital via Folkeinvest (a platform for buying shares in unlisted companies) last year.”

KRILL harvesting company Aker

BioMarine has won this year’s nnovation Norway and sfin export award. The company was able to convince the jury that it is possible to achieve success through a “targeted, sustainable and innovative strategy”. The award was announced at last

month’s xport onference held by nnovation Norway and sfin the Norwegian government’s export finance agency at the MUNCH Museum in Oslo. Krill is used as both fish and animal feed. In addition, there is a growing consumer market that sources high-quality proteins from krill.

CERMAQ has become the latest large Norwegian salmon company to be hit by a major biological issue.

The company has been forced to cull fish with wounds in six cages at its facility near Hammerfest. The fish weigh around g on average.

Earlier, the Lerøy Seafood Group reported almost half a million young salmon deaths at its Sjøtroll facility in western Norway.

Cermaq said it has taken the action due to a demanding fish health situation, which appears to have developed over time.

The company has been in engaged in a lengthy period of contact with the Norwegian Food Safety Authority. Cermaq has now decided to remove, stun and euthanise the fish concerned.

Cermaq Regional Director Gunnar Gudmundsson said: “This has been a desperate situation, where we have seen increased mortality in these cages since the beginning of January this year, as a result of ellyfish and a period

of stormy weather, which has subsequently led to a bacterial wound infection.”

He added: “We have had a close dialogue with the Norwegian Food Safety Authority and implemented measures to improve the situation, with increased withdrawal of wea ened and dead fish.

“Despite measures, the situation has not changed and considering the time of year and low sea temperatures, we fear a further deterioration.”

He stressed it was necessary to take such action for the sake of fish welfare.

THE Icelandic Food Agency, MAST, has renewed the operating licence of Arctic Sea Farm, a subsidiary of Arctic Fish, at two key sites. The decision allows for up to 7,800 tonnes of salmon.

The sites are at Patreksfjörður and Tálknafjörður in the Westfjords region of the country.

Arctic Fish, which is majority owned by Mowi, is one of Iceland’s largest salmon farming companies with total licences for up to 29,800 tonnes.

There was some opposition to the plan and MAST has said that individuals and organisations can appeal its decision to the Environmental and Natural Resources Appeals Committee. The appeal deadline is one month from the publication of the notice going out.

Arctic Fish had a difficult year operationally in 2023, following a large escape into Patreksfjörður, which led to MAST requesting an official inquiry.

Local police were called in to investigate the incident but later

decided to take no further action. The company later apologised for the incident, stating it had been working day and night to establish what happened.

Despite the escape problems

Arctic Fish, enjoyed a fairly good year financially, producing an operational EBIT of £2.7m. The company said the financial and biological performance improved somewhat after a challenging third quarter when the escapes took place.

The fourth quarter harvest volume was 2,529 tonnes gutted weight in the fourth quarter, exceeding the guidance volumes.

Harvest volumes for the full year of 11,878 tonnes reached an alltime high for Arctic Fish.

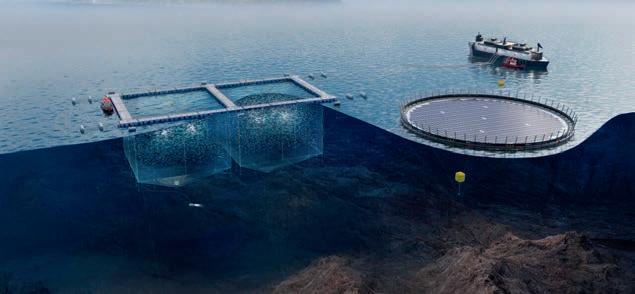

PLANS for a fish farming superyacht, the Ocean Ark, have moved a step closer to reality, with an agreement between assurance and risk management provider DNV and the developers, aimed at securing registration as a French vessel.

The Ocean Ark, a patented advanced self-cleaning trimaran superstructure incorporating fish pens into its design, was developed by Ocean Sovereign according to Marpol, Solas and International Maritime Organization regulations.

The 170m-long vessel is projected to have a biomass capacity of up to 4,000 tonnes. As a mobile platform, its developers believe it will be better able to avoid algal blooms, marine heatwaves and storms.

As part of the collaboration deal, DNV will support Ocean Sovereign with business-critical challenges and innovations, designed to prevent fish escape and reduce the risk of technical failure in operation by delivering:

• classification of the floating structure/vessel and marine systems;

• certification of mooring/ dynamic positioning system;

• certification of aquaculture nets and systems; and

• assessment operation and integrity controls during the design lifetime.

The Ocean Ark is designed to operate in high-energy offshore waters, drifting with the natural current and natural fish shoals. It is designed to ensure sufficient safety for the environment, fish and crew.

Ocean Sovereign said: “The mobile nature of Ocean Ark will help to ensure the health and

welfare of the fish and ensure that the fish are kept in their natural habitat.”

Cross-industry know-how DNV is an independent assurance and risk management provider, operating in more than 100 countries. Its roles include certifying products, verifying claims, creating new assurance models and optimising and decarbonising supply chains.

“Offshore fish production is based on a combination of two well-known concepts: fish farming and offshore technology. Therefore, a cross-industry approach and know-how is needed,” explains Ocean Sovereign General Manager, Zeyd Fassi Fehri. “At Ocean Sovereign, we are happy to join forces with DNV and benefit from their knowledge gained through decades of experience in these two fields that will allow us to safely deploy the vessels. We believe that DNV’s extensive experience in offshore and fish farming will help us to play a key role in the deployment of our vessels under French registration.”

In addition to its high-quality standards and being Europe’s largest market for salmon, France has one of the largest maritime exclusive economic zones.

“As well as sustainability and fish welfare, the inclusion of local communities is embedded into every Ocean Sovereign project. The deployment of the Ocean Ark offers many synergies and growth opportunities for the existing local aquaculture and fishing sector,” said Zeyd Fassi Fehri.

“To seize these opportunities, agreements have been reached with French aquaculture and fishing stakeholders and will be released shortly.”

THE CEO of Norwegian landbased fish farmer Gigante Salmon has left the company after a warning that construction costs for the completion of its site at Rødøy are now expected to be more than 50% higher than the previous estimate.

The news that CEO Helge EW Albertsen has had his contract terminated broke in March. Albertsen will continue to serve as an adviser to the company, while non-executive board member Kjell Lorentsen has been appointed as interim CEO. Lorentsen was formerly CEO before the appointment of Albertsen in 2021. The company said: “The work to recruit a new CEO to the company has been initiated.” Company shares dropped 20% on the

Oslo Stock Exchange after the news. The latest projected cost increase is approximately NOK 350m (around £26m), taking the total investment needed to complete the facility to around NOK 995m (£73m).

The forecast increase is mainly due to longer construction time, including costs for rigging and operation.

The company’s board, in a stock market statement, said the figures are still subject to control, quality assurance and dialogue with suppliers.

The statement went on: “The cost increase will require new capital to the company. This work has been initiated. The plan is that the cost increase will be covered through a combination of equity and debt financing.”

NORWEGIAN super striker Erling Haaland is to become an ambassador for the country’s seafood industry.

The prolific anchester ity forward has signed a deal with the Norwegian Seafood ouncil. He will appear in commercials, promotional posters and digital ads worldwide as part of the collaboration. The deal will last for two-and-a-half years and came into effect on aster onday.

Haaland said: “Seafood has been part of my upbringing and my diet growing up. Norwegian seafood, which I consider to be the best in the world, still has a natural place in my life.

“The Norwegian Seafood ouncil does an important ob of inspiring and building knowledge about tasty and healthy seafood globally and at home in Norway” Haaland, who was actually born in Leeds when his father was involved with the Yorkshire club, has become a footballing sensation since oining anchester ity from the German club Borussia

Dortmund in July 2022. He scored goals in his first season with anchester ity.

hristian hramer of Norway’s Seafood ouncil has called the signing a great deal for Norway’s seafood industry.

He said: “Haaland is recognised as one of the world’s best footballers and is a gigantic profile with unrivalled global visibility.

“The match with Norwegian seafood, which is in demand, bought and en oyed all over the globe, is obvious. Being able to combine two of Norway’s best exports and strongest brands fills us with enormous pride. A separate deal has also been struck with Norway’s two national soccer teams, women’s and men’s.

NORWEGIAN regulators have called a temporary halt to further cod farming applications, particularly those at new locations.

The sector has been growing so fast that the Norwegian Food Safety Authority (Mattilsynet) wants time for everyone to draw breath and examine any biological or related implications. Whether growth resumes will depend on an assessment of the risks to wild cod.

The authority told Fish Farmer: “There has been a temporary delay in the processing of applications for the establishment of localities for cod farming.

“The reason for this is based on the increasing number of applications for cod farming [over] the last years and the lack of knowledge about the risk of the spread of infection between farmed cod facilities and between farmed cod and wild cod populations.

“The Norwegian Institute of Marine Research’s (IMR) risk report from 2022 points out that an increase in biomass linked to already given permits for cod farming will entail a risk of negative impact on populations of wild cod along the coast.

“In recent meetings with the IMR, it was again stressed that there is still a lack of knowledge concerning the spread of diseases, but the IMR has now started several projects to give more concise answers and advice to clarify these emerging aspects.”

The authority pointed out that there had been a significant increase in the number of given cod permits since 2022.

Some of the approved locations had not yet started for various reasons, but it was important to point out that if all the permits had become operational, the risk of infection would probably be higher by now.

It added: “The Norwegian Food Safety Authority will, until the IMR can give us more detailed advice, use precautionary principles as a basis for processing applications for establishment of cod farming.

“In addition, the Food Safety Authority wants to have a dialogue with the Ministry of Trade, Industry and Fisheries, and based on this dialogue, we will get further information on how applications will be handled in the future.

“Therefore, we cannot give a date for when the processing of the applications will start again but we will wor to get clarifications in place as quickly as possible.”

RESISTANCE is growing against a plan to build a huge land-based salmon facility at a former mountain mining site in Norway.

The project, which will trade as World Heritage Salmon, is being opposed by a number of environmental groups, however. The latest to come out against it this week is the national archive organisation, Riksantikvaren.

The company behind the proposed farm is Hofseth, which is planning to use the site on the Sunnylvsfjorden, an abandoned olivine mine, for a flow-through facility producing up to 100,000 tonnes of salmon per year. It would be one of the largest of its type in the world.

It will comprise 15 tunnels housing the fish tanks, utilising flow-through technology, and would benefit from its own smolt facility nearby.

The site, in Møre and Romsdal county, is not far from the Geirangerfjord World Heritage site, northeast of Bergen, designated as an area of exceptional national beauty by the UN agency UNESCO. Riksantikvaren told the broadcaster NRK that it fears discharges into the fjord from the land farm would threaten the natural balance of the area.

Its spokeswoman, the antiquarian Hanna Geiran, said: “The world heritage status hangs particularly high and only the most valuable places in the world are entered on the list.”

She also maintained the release of nitrogen into the fjord would be damaging.

Norway has committed to comply UNESCO’s regulations and Geiran said that it is the Riksantikvaren’s responsibility to see to it that we take care of these values.

She also fears for marine life in the fjord, geological values and consequences for world cultural values, if the farming facility is built.

Hofseth believes that its project will be environmentally friendly and will not have any effect on the area. The county’s planning authority has approved the plan and the Norwegian Directorate of Fisheries has also determined that it will not have an adverse impact on the environment.

FISH farmer iddenf ord has become the first salmon company in the Faroe Islands to achieve the maximum Best Aquaculture Practices (BAP) four star designation following the certification of its freshwater hatchery, Fútaklettur. is a third party certification programme developed by the Global Seafood Alliance S an international not for profit trade association headquartered in the United States, dedicated to advancing environmentally and socially responsible seafood practices through education, advocacy and third-party assurances. s feed is sourced from certified mills operated by Skretting and Havsbrún, Hiddenfjord now has the maximum BAP star designation and use of the four-star logo. The freshwater facility at Fútaklettur was the last link in the chain.

Óli Hansen, Sales Director at Hiddenfjord, said: “In our interactions with business partners, the BAP accreditation emerges as a marker of excellence, epitomising our dedication to premium salmon production,” said “Attaining our fourth star is not merely an accomplishment but a testament to our relentless pursuit of premium quality and sustainability. We look forward to sharing its implications with our customers, ensuring they benefit from our commitment to sustainable salmon farming.”

“It’s been an impressive journey for

Hiddenfjord to certify their whole production chain,” said Iain Shone, Director of Market Development for Europe at GSA. “They committed to four star from the outset and put a huge amount of work into this project. I know the whole team is really proud of their achievement. Well done!”

Hiddenfjord is a family-owned business with an emphasis on high-quality and sustainable fishing practices with roots dating bac to . The Faroese company is the first salmon producer in the world to stop all distribution by air freight, reducing its CO2 emissions for overseas transportation by 94%.

FEWER escaped salmon are getting into Norwegian rivers, according to the latest annual survey.

OURO, the aquaculture industry’s association for dealing with escaped farmed fish, says that fewer of these salmon migrated up the rivers in 2023 than in previous years.

It adds: “This is positive because fewer escaped fish in waterways before spawning reduces the impact on wild salmon.”

OURO saidthe national monitoring programme was assessed in some 195 watercourses.

Of these, OURO selected 38 rivers for fishing. Fishing of escaped farmed salmon was carried out in 20 of these rivers.

The rivers were selected on the basis of historical features of escaped salmon in the watercourse, vulnerability and proportion of escaped fish in 2021, or based on a decision that it may be appropriate to follow the development in the watercourse over time.

In 17 of the investigated rivers, no escaped salmon were observed during the autumn of 2023.

Due to heavy rainfall, high water flow and poor visibility, however, it was difficult to calculate the proportion of escaped fish in the spawning stock in some rivers in western Norway.

In addition to fishing in rivers, OURO has contributed to the collection of escaped fish with fish traps in Trøndelag.

The results from the removal of escaped farmed fish in rivers and seas for the autumn of 2023 show that a total of 226 escaped farmed fish were removed.

For 30 of the 31 rivers in which calculations of the number of escaped fish had been made, the proportion of escaped farmed salmon after harvesting was below 4%.

“Since the start of OURO in 2015, there have not been as few escaped farmed salmon recorded in the rivers as in 2023,” said chairwoman Ingrid Lundamo.

NORWEGIANS are becoming increasingly negative about salmon farming, according to new polling.

The survey was carried out by Norwegian broadcaster NRK public radio and follows a series of reports about large salmon death numbers from various biological issues.

But the industry organisation Seafood Norway believes that views would be different if there were more positive reports about the industry.

NRK said the attitude of Norwegians towards farmed salmon had changed a great deal recently. Some 37% of

those questioned said they were more negative about farmed salmon than before.

Most of those who have changed their minds, which included many older people this time, said that ethical and environmental factors had become the main drivers.

The industry organisation Seafood Norway believes that attitudes would change if there was more positive news about the industry in the general media. People tend to react based on how things are reported, it says.

And Trond Blindheim, an associate professor at the University of Kristiania, told NRK that the farming companies need to get their act together.They had a tough task ahead of them and they needed to restore the industry’s good reputation.

Seafood Norway said it took people’s concerns seriously.

NORWAY is preparing to impose a production tax on foreignowned aquaculture businesses, it has emerged.

The tax, which will also affect employees, will apply to those companies which farm offshore in Norwegian waters on the continental shelf.

Finance Minister Trygve Slagsvold Vedum has submitted his proposals for public and parliamentary consultation.

Vedum said: “We want to ensure that the community gets a rightful share of foreign companies’ value creation in Norwegian areas and therefore make some necessary tax measures to ensure national control.”

•

•

•

Vedum said his plans will, for the moment, apply to those companies which farm offshore.

Vedum has set a deadline of 17 June for comments and he wants the new tax to start next year.

The minister said the country was preparing for growth in offshore fish farming activity on the Norwegian continental shelf.

“We want to ensure that the community gets a rightful share of foreign companies’ value creation in Norwegian areas,” he added.

One of the main criticisms when he unveiled the ground rent tax (also known as the salmon tax) on Norwegian aquaculture businesses, over two years ago, was that it only fell on domestic businesses, while overseas-owned businesses and their executives were exempt.

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost. Contact

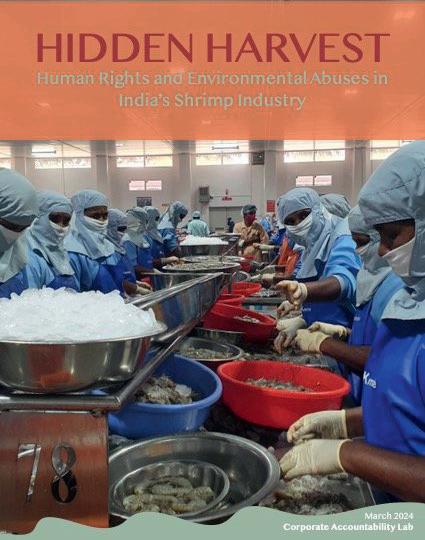

INDIA’S extensive shrimp farming industry has been accused, in a new report, of large-scale human rights violations and unacceptable employment practices.

The report has been published by the international human and labour rights organisation, Corporate Accountability Lab (CAL), which carried out a three-year investigation into India’s multi-billion dollar shrimp aquaculture industry.

The CAL report, Hidden Harvest, says: “Over the past decade, India has emerged as the United States’ leading source of shrimp, the most consumed seafood in the country.

“However, this success is marred by a production process that relies on forced labour, dangerous and abusive working conditions, and environmental destruction to meet demands for ever-lower prices.

“While countries such as Thailand, China and Bangladesh have faced criticism for similar abuses, India, which supplies almost 40% of US shrimp imports, has remained under the radar with little public scrutiny – until now.”

The CAL investigation found that the Indian shrimp workforce is primarily composed of workers from Dalit, Adivasi and fisher communities many of whom are internal migrants and from regions with few employment options.

Migrant workers are particularly vulnerable to exploitation, the report says, because they are far from home, may lack social networks and often have few other job opportunities.Through recruiters, companies prey on the vulnerability of those needing work. Recruitment loans tie workers to jobs, keeping them in debt bondage. Most workers in the Indian shrimp industry lack contracts with their employers, resulting in job insecurity and the absence of a formal connection to companies.

CAL says: “These hidden, informal

THE giant Chilean fishing and aquaculture group Camanchaca saw its profits fall last year.

The company has blamed higher costs and weak demand for salmon, particularly during the second quarter of 2023.

The group earnings came out around 5% higher at almost US $762m (£607m), of which US $353.9m (£282m) was from salmon.

The salmon division suffered with smaller Atlantic salmon volumes and lower prices of farmed

species. There was also an increase in feed costs and health incidents.

Camanchaca was one of the founders of Chile’s aquaculture industry. Its main aquaculture production is centred around Atlantic and Coho salmon and rainbow trout.

The fishing division turned in a strong performance, although higher fuel prices took some of the shine off its performance.

Atlantic and coho salmon prices were down. There was also a sharp increase in production costs due to various health issues. The industry also faced higher feed costs. The company’s EBITDA was around 27% down on 2022 at US $90m.

workers are at high risk for forced labour – especially those whose housing is tied to their employment, a common practice across the supply chain.Workers report an exploitative relationship with employers and feeling trapped in abusive jobs with few alternative means to earn a living. Child labour is also prevalent, with young teenage girls working in processing facilities to help support their families.”

Chicago-based CAL says its report challenges the current narrative and issues an urgent call to action. As demand for shrimp continues to grow, so must the pressure on companies and governments to identify and remedy the sector’s pervasive forced labour, abusive conditions and environmental harms, the report argues.

It calls on American retailers and wholesalers to push for changes in the Indian shrimp sector and to promote the implementation of agreements between companies and independent worker organisations.

CAL also says the US and Indian governments should vigorously enforce laws meant to prohibit labour and environmental abuses, reducing the ability of companies to ignore accountability.

COOKE Seafood has abandoned plans to win back leases at its two Washington state trout farms in the US, blaming delays by the state’s administration, which it says make the case futile.

In November 2022, Department of Natural Resources head Hilary Franz ordered that leases for the farms, the last remaining net-pen aquaculture operations in the state, should not be renewed.

The company’s Superior Court motion had sought a reinstatement of Cooke’s leases at the Rich Passage and ope sland steelhead trout fish farms in uget Sound. Since the injunction was issued against DNR in January 2023, Cooke said it has endeavoured without success to obtain public records from DNR that it believes are needed to allow for a fair appeal hearing. Cooke’s statement said: “Based on the number of records that DNR claims are responsive to Cooke’s request, at the rate DNR has produced records to date, it would take another six to seven years for all responsive records to be produced by DNR, which is an untenable and inconceivable situation.”

Above: Hope Island steelhead farmProbably the most sustainable antifouling product for pen nets

► Powerful waterbased antifouling that offers excellent protection against fouling

► Safe for the fish and for the environment

► Protects against UV radiation

► Controlled leaking of the active ingredient

► Free from PFAS chemicals

► Free from microplastics

Slalåmveien 1, NO-1410 Kolbotn, Norway Ph.: +47 66 80 82 15 - post@netkem.no

When excellence in aquaculture is required you can rely on the services from MEST

We are part of the build and fabric of the Faroese salmon industry, constructing and maintaining the farming vessels, facilities and equipment.

We are proud to have supported world class salmon farming in the North Atlantic.

When world class is the demand - You can count on MEST.

Feed from Scotland helped Cooke produce t e st o anic a e sal on in ile

COOKE Aquaculture’s feed mill in Scotland has been playing a key role in helping to produce the company’s first organic salmon in Chile.The organic salmon now being harvested by Cooke Chile is that country’s first organic farm raised Atlantic salmon. Organic salmon will initially be equivalent to 25% of Cooke’s total salmon production in Chile. Organic feed

is not yet available in Chile, so the company provides feed from its affiliated feed mill in nvergordon Scotland, to aid in organic production.

To qualify for organic status, all feed ingredients used during production must also be organic, and fish oil and fishmeal used in the feed must come only from certified sustainable fisheries.

AQUACULTURE tech group

AKVA has entered into a partnership deal, which could help transform the hilean fish farming industry’s power setup. The deal is with two Norwegian companies: Inseanergy, which specialises in turnkey solutions for floating solar power systems

and Kverneland Energi.

The initiative aims at precision farming with minimal emissions, incorporating advanced hybrid battery systems, solar power plants, software and control systems tailored to meet the challenging demands of sustainable aquaculture.

POSEIDON Ocean Systems, the Canadian company behind the Trident sea cage system, has completed a US $20.75m

LAND-based salmon farmer AquaBounty Technologies has reported a year-on-year revenue increase of 23% for the last quarter of 2023, but the period also saw losses growing. AquaBounty has developed a genetically modified strain of salmon.

For Q4, the company recorded revenue of US $553,000 (£440,000) in product revenue, with US $451,000 (£359,000) for the same period in 2022. Net loss in the fourth uarter was up significantly at US $8.42m (£6.7m) compared with US $6.07m (£4.83m) in the fourth quarter of 2022.

For the year ended 31 December 2023, however, product revenue totalled US $2.47m, (£1.97m), a year-on-year decrease of 21% as compared with US $3.14m (£2.5m) in 2022. For the year ended 31 December 2023, net loss increased to US $27.56m (£21.92m), compared with US $22.16m (£17.63) in 2022.

Sylvia Wulf, Board Chair and Chief xecutive fficer of ua ounty explained that the revenue drop was largely down to an interruption

in production at the company’s Albany, Indiana, site early last year. AquaBounty’s business model depends on gearing to full-scale production at its site in Pioneer, Ohio.With faltering production in Indiana and a pause in construction in Ohio, the company has been burning through its cash reserves. As at 31 December 2023, AquaBounty held US $9.2m (£7.32m) in cash and cash equivalents, compared with US $102.6m (£81.61m) 12 months before.

Wulf said: “We announced in February 2024 that we had made the decision to sell our Indiana farm operation... additionally, we engaged Berenson & Company as our investment bank to advise on debt financing secured by our unencumbered assets.”

A-LIST Hollywood actor Leonardo DiCaprio has become the latest celebrity to come out against open net pen fish farming in ritish Columbia – but his stance has sparked a backlash from those indigenous groups who are backing the industry.

The star has criticised the Canadian government for extending the licences of salmon farming companies for up to six years to give them more time to adjust.

(£16.3m) capital-raising exercise. The Series B funding round was led by Ecosystem Integrity Fund and joined by InBC Investment Corp, along with additional investment support from one of Poseidon’s existing shareholders, Export Development Canada.

Poseidon said the funds raised will expand the company’s manufacturing capacity and support growth.

The Oscar-winning actor posted his criticism on Instagram, accusing Ottawa of breaking its promise. He said people should oin the fight against any extension and accused the Canadian government of breaking its promise to end net-pen farming by 2025.

But people in British Columbia are split on the issue, especially among First Nation groups.The Kitasoo Xai’Xais Nation issued a statement condemning DiCaprio’s

comments, saying: “Decisions about our territories should not be made or influenced by external parties, be it the Government of Canada, privileged self-serving CEOs or Hollywood actors… we, the Kitasoo Xai’Xais Nation, are salmon farmers and we will not be governed by external influences who have excluded Coastal First Nations from writing their own narratives and determining their own futures.”

Their criticism is stinging for i aprio whose latest film Killers of the Flower Moon, deals with the plight of indigenous people in the USA.

TRIDENT Seafoods has completed the sale of three key processing plants in Alaska as part of the company’s restructuring exercise, with multiple parties interested in a fourth site. The company announced in December 2023 that it was seeking buyers for the four plants as part of a comprehensive, strategic restructuring initiative.

The sell-off involves Trident’s Alaskan seasonal plants in Petersburg, Ketchikan and False Pass.

interested buyers for its fourth plant in Kodiak. As the largest and most complex plant, with year-round operations supporting multiple species, the complexity of the operations makes this a lengthier due diligence process.

The sale of the plants is underpinned by a desire to secure buyers who share the company’s values, Trident stressed.

“We have been intentional about finding buyers who will take great care of the fleet and employees who will integrate themselves into the communities,” said Joe Bundrant, CEO of Trident Seafoods.

closing as quickly as possible,” said Welbourn. “We are keenly aware of the upcoming salmon season and we are confident that the buyers, with Trident’s support, will be able to communicate with the fleet, employees and tenders in the coming weeks.”

Following the Ketchikan deal, Cora Campbell, President and CEO of Silver Bay Seafoods, said: “We are excited to add this facility to the Silver Bay family and appreciate Trident’s focus on finding the best solution for the community, employees, and fleet. We look forward to operating the Ketchikan facility, along with our other southeast facilities in Sitka and Craig, for the 2024 salmon season.”

Silver Bay Seafoods has been confirmed as the buyer for Ketchikan and EC Phillips & Son, an established family company, has agreed terms for the acquisition of the plant at Petersburg. The buyer for the False Pass plant has not yet been named.

Trident is speaking with multiple

Jeff Welbourn, Senior Vice President of Alaska Operations, said last month: “These are relatively simple, straightforward transactions and we’re simplifying the deals to facilitate

“Trident is committed to Alaska for the long term and finding the best solutions for these plants is important. We care deeply about the fishermen and communities. Their success is our success,” said Bundrant. “Consolidating our operations allows us to focus reinvestments and ensure we’re able to contribute positively to the Alaska seafood sector for many years to come.”

“We are excited to add this facility to the Silver Bay family ”

GRIEG Seafood is answering the call to process more salmon in Norway with a new processing facility near the capital, Oslo.

The NOK 130m (£10m) centre (impression shown here) will be close to Gardermoen, Oslo’s main airport. The development is part of the company’s strategy to increase value creation and process more of its own fish.

Erik Holvik, Grieg’s Chief Commercial Officer, said: “Grieg Seafood aims to take one step closer to the customer and the market.

“With this tailor-made facility, we will make high-quality products from our fish with the most modern equipment available. In addition, we will be able to cut significant amounts of CO2 emissions from the transportation of our products to the world.”

The company said it plans to establish the processing factory in a new and energy-efficient facility at the airport. It will have an annual processing capacity of 10,000 to 12,000

tonnes (HOG equivalent), with an option of increasing the capacity to 20,000 tonnes if needed at a later stage. The project will create up to 60 new jobs.

The location makes it possible to process Grieg Seafood’s salmon from its northern region, Finnmark, as well as its southern region in Norway, Rogaland. It is optimally placed, Grieg said, for smooth logistics to the markets by truck, boat, train or air freight.

Grieg plans to start processing its fish in the new facility during the summer of 2025.

Holvik added: “So far, we have worked with external partners to process some of our fish. We will continue these partnerships. With the new processing facility, we see opportunities for additional partnerships with salmon farmers and customers. It will be an exciting journey.”

Grieg plans to process 25% of its global production volume by 2026.

SCOTTISH Sea Farms’ newly upgraded processing facility in Lerwick now boasts a high-tech data hub that allows managers to see what is happening on the facility floor at a glance.

Dubbed “Mission Control” by the IT and digital team behind the installation, the hub occupies a large space upstairs, with banks of screens showing everything from production throughputs to water consumption to energy usage.

“I wanted an immediate overview, with data that’s relevant, accurate and demonstrates how well the facility is running,” said Head of Processing Operations at Scottish Sea Farms, Donald Buchanan. “Instead of having monthly meetings to review performance against targets, we have dynamic reports and constant monitoring.”

The data hub has been made possible by the in-house expertise of the IT department and, in particular, Shetland-based David Lipcsey and Krystian Lis.

Physically linking the facility hardware to the database involved interfacing equipment such as the Baader gutting machines, Ace Aquatec electric stunner, the robots in the packing area and the utility meters with computer devices called programmable logic controllers (PLCs).

Lis explained: “It’s a matter of taking a signal from the machine, connecting the wires and fitting it into the PLC. The technology drives improvement by analysing the machinery’s performance, with even subtle changes detectable and potential problems addressed before they happen.

“With the Baader, for example, we measure how many fish go in, how many go out, how long the machine is running and how many stops it has on a given day. From this data we can see whether the machine is above or below the target efficiency.”

Although the new system is still a work in progress, it has already made a difference, according to Buchanan.

He said: “We’re getting faster all the time. When we opened the facility, we were processing 15 tonnes an hour, which equates to roughly 100 tonnes per day. Now we’re processing close to 24 tonnes an hour, with our next target being 30 tonnes an hour.”

Key to the project’s success is the “incredibly talented” IT team, Buchanan added.

He said: “If we didn’t have Krystian and David we wouldn’t have been able to do this because it would cost too much money buying an off-theshelf system and I wouldn’t have got what I wanted.”

SEAFOOD Expo Global/Seafood Processing

Global, the largest and most diverse seafood trade event in the world, has announced that its t edi�on i be t e ar est in its istor As o ear Apri t e e po ta in p ace rom to Apri at ira de arce ona ran ia is set to occup net s uare meters o e ibit space a increase o er its pre ious edi�on The event will once again provide an interna�ona p a orm or oba industr supp iers and bu ers to meet in person and conduct business e edi�on i e come more t an e ibi�n companies rom countries and i a e countr and re iona pa i ions e countries suc as A erbai an ra i and ote oire or oast and ne re iona pa i ions rom ra i France, Republic of Korea, Japan and Oman, a e con rmed t eir a endance or t e e ent Amon t e current e ibi�n companies companies i be e ibi�n or t e rst �me in at east t o edi�ons man or t e rst �me e er

“With the expansion into hall one, the event rein orces its posi�on as t e ar est in person

global seafood trade event and enables us to reac a broader ran e o interna�ona sea ood pro essiona s rom across t e supp c ain who are eager to showcase and discuss their atest ad ancements said W nter ourmont ice resident o Sea ood at i ersi ed ommunica�ons or t e t edi�on o t e e ent e e strate ica created ne spaces to en ance a endees e perience on site aci itate meanin u con ersa�ons and pro ide a uni ue p a orm or t e industr to or e ne business partners ips and re a�ons ips ira de arce ona enera ana er onstan Serrallonga commented: “Seafood Expo Global and arce ona a e ormed a success u partners ip it a reat uture e e ent came ere t ree ears a o to ro and it is a read brea in records as t e oba ub or t e sea ood industr ira s eaders ip as a benc mar ins�tu�on or interna�ona e ents a on it its inno a� e and premium enue and a e comin cit suc as arce ona pro ides t e idea en ironment burs�n it opportuni�es or an e ent suc as t is Seafood Expo Global features suppliers from around the world, who will showcase their atest inno a�ons in sea ood: res ro en canned a ue added processed and pac a ed n Sea ood rocessin oba e er aspect of seafood processing and services for t e sea ood industr inc udin pac a in materia and mac iner e uipment and supp ies or re ri era�on and ree in primar and secondar processin e uipment iene contro and sanita�on ua it assurance ser ices a uacu ture e uipment transporta�on co d stora e traceabi it so u�ons and more i be represented in a s one and t ree

NORWAY’S ban on the export of lower-grade production fish constitutes a barrier to free and fair trade, the European Commission has concluded.

Under Norwegian Regulation No. 844 on fish and fish products quality, Norwegian farmed salmon is sorted and marketed in three quality categories: superior, ordinary and production. Salmon is placed in the lowest quality category (production) when the fish has wounds, malformations, treatment errors or similar minor defects. Salmon qualified under this quality category is prohibited by Norwegian law from being exported before these defects are corrected at Norwegian processing plants. In recent months, the proportion of salmon exported as fillets rather than whole fish has grown, thanks to a high level of winter sores and other wounds.

The ban on exporting these fish to be filleted elsewhere suits Norway’s processing sector but has been challenged by Norwegian producers including Mowi and by trade associations in the Netherlands and Denmark, who believe that the opportunity to buy cheaper fish for processing is being denied to them.

The argument could end up as an intergovernmental row if the European Commission sticks to its position.

• See the article on page 46 – “Can you fillet?” – for more.

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports

IHAVE recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional produce on the world stage. In a busy programme, I joined innovative Scottish companies at a major trade fair, made site visits to learn from Chilean aquaculture businesses and undertook intergovernmental engagements with major aquaculture nations.

With more than 22,000 visitors, Aquasur is the largest aquaculture trade fair in the southern hemisphere and it was great to meet some of the Scottish businesses exhibiting. We know from research following Aqua Nor last year the value that these trade events can bring, with three-quarters of companies who joined us in the Scottish Pavilion in Norway expecting to see an increase in turnover after attending the event and most feeling optimistic about new business, customers or markets. I am keen to see what opportunities come from this visit for our innovative Scottish businesses in the valuable Chilean market.

I was pleased to meet directly with my ministerial counterparts, Norwegian State Secretary to Minister of Fisheries and Ocean Policy Even Sagebakken and Undersecretary for Fisheries and Aquaculture Julio Salas Gutiérrez from our hosts Chile. As well as one-to-one engagements, they joined me and representatives from Brazil and Denmark on a panel discussing how innovation can help make the aquaculture sector more sustainable. A highlight was agreeing with Undersecretary Gutiérrez that Scotland and Chile will work towards a Memorandum of Understanding (MoU) on aquaculture. Technical work will soon be underway, with a view to signing a formal agreement by the end of the year. This follows on from an MoU signed with Chile

at COP26 in Glasgow in 2021 on the sustainable management of peatlands and wetlands. Seeing the progress already made in that area in just a few years was an encouraging and fascinating part of my itinerary, and a reminder of how determined action can lead to change and a more sustainable future.

Forging strong relationships with other leading fish farming nations is key to learning and sharing expertise. It also enhances Scotland’s standing on the world stage as an exporter of aquaculture products and services, and as a destination for inward investment.

Being on the ground in Chile also allowed me to see innovation in the sector first hand. This included salmon producers Lago Sofia, who are developing the nation’s first commercial aquaponics farm (using aquaculture water supply to grow plants without soil), and Ventisqueros, who have established Chile’s first salmon farm powered by 100% renewable energy.

I also visited a wellboat utilising new technology developed by Salmo Clinic, which removes medicine residues from water used in treatments before it is released back into the environment.

In Santiago, I was able to hear how

Forging strong relationships with other leading fish farming nations is key to learning and sharing expertise

From the top: Site visit to ago Sofia salmon farm Mairi Gougeon and en Sagebakken or egian State Secretar to Minister of Fisheries and cean Polic Mairi Gougeon mee�ng ulio Gu� rrez ndersecretar for Fisheries and A uaculture, hile

Chilean salmon farmers are being supported by a consultancy to improve their engagement with coastal communities. It’s fascinating to see how these local challenges have direct relevance and resonance for Scottish producers. I hope we’ll be able to bring some of that learning back to Scotland.

I’m pleased to say that we don’t have to wait too long to revisit some of these new connections. Lago Sofia will attend Aquaculture UK in Aviemore this May to explore investment opportunities in Scotland in a visit funded by the Blue Bridge programme, alongside a broader delegation of Chilean aquaculture technology companies.

I’m delighted to be giving Aquaculture UK’s opening keynote. I’ll be talking about our Vision for Sustainable Aquaculture, collaborative actions to streamline aquaculture consenting and how we can work together to face shared challenges.

Aquaculture and its supply chain are worth over £1.8bn to the Scottish economy. The learning and connection from the Chilean visit will be invaluable in the Scottish Government’s continued ambition to grow the sector’s sustainability, diversity, innovation and economic prosperity.

Mairi Gougeon is Cabinet Secretary for Rural Affairs, Land Reform and Islands in the Scottish Government.

Predator Exclusion Nets

Anti Foul Coatings

Ropes - Large Stock All Sizes

Floats, Buoys, Cushion Buoys

Chain & Chain Weights

Tarpaulins

QUALITY NETS FOR FISH FARMING

Tel: 01253 874891

Tel: 01253 874891

e-mail: john@borisnet.co.uk

e-mail: john@borisnets.co.uk

web: www.borisnet.co.uk

web: www.borisnets.co.uk

Salmon Scotland Chief

Executive Tavish

Scott says the coming general election is an opportunity to reset the UK’s relationship with the EU and smooth the vital flow of trade

THE Brexit debate that so dominated our politics not so long ago has taken something of a backseat in the past couple of years.

But many challenges created by the UK’s departure from the European Union remain.

This year is a general election year and the party which forms the next UK Government will have an opportunity to review the EUUK Trade and Co-operation Agreement which now governs our relationship with Europe.