Welcome to the August issue of Fish Farmer. This month, we finally got to report on the Scottish Government’s Vision for Aquaculture, which had originally been expected by the end of last year.

The Vision sets out the Scottish Government’s aspirations for the aquaculture sector – finfish, shellfish and seaweed – and explains the thinking which will underpin its policies. It is a broadly positive document, stressing the importance of aquaculture to Scotland’s economy and to its rural and island communities, and welcoming developments such as offshore farming and investment in local sources to supply fish ova, shellfish spat and seaweed seed.

The paper has been welcomed by the industry. Anyone expecting a plan or a programme, however, might be a little disappointed. There is no overall target for growth, whether in terms of output, economic contribution or jobs, or any specific commitment as regards what government is prepared to encourage growth. The Vision is best seen as an explanation of the thinking that will underpin future policy.

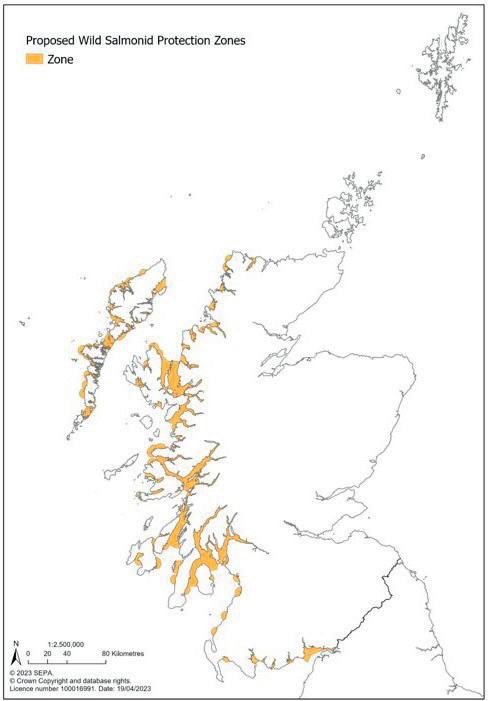

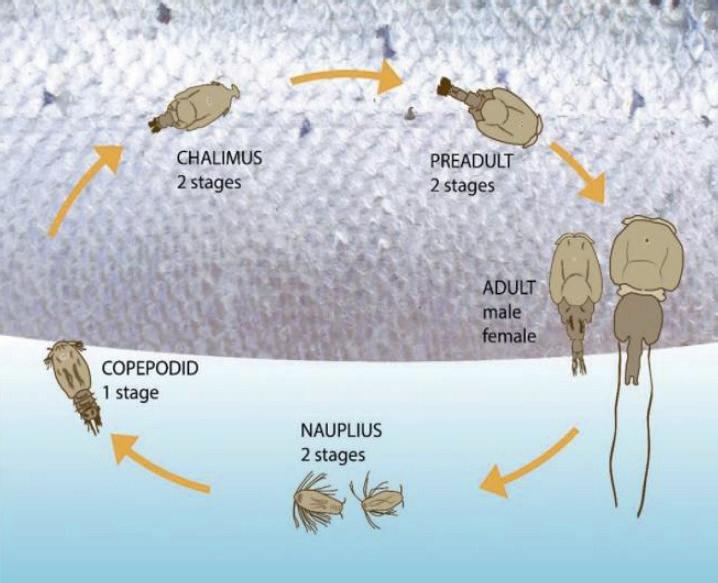

Meanwhile, elsewhere in this issue we look at the way in which Scotland’s salmon farmers are using cleaner fish as a natural ally to help control sea lice numbers. And with the consultation deadline fast approaching, there’s an explanation of how the proposed Wild Salmon Protection Zones – intended to ensure that lice on fish farms do not pose an unacceptable threat to migrating wild salmon – will work.

Sandy Neil reports on the Invest in the West campaign, which is focusing on the need for better housing and infrastructure for the islands and along Scotland’s west coast.

We also talk to Donna Fordyce, Chief Executive at industry body Seafood Scotland, about her organisation’s role in helping spread the word about this important sector.

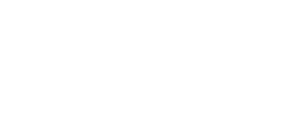

Elsewhere in the magazine you can find a preview of the Aquaculture Europe conference in Vienna this September; Nicki Holmyard’s report on the debate over nonnative oysters on the British coast; and find out why Nick Joy, perhaps surprisingly, wants us to be fair to politicians.

Best wishes

Robert OutramMeet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston jjohnston@fishfarmermagazine.com

Publisher: Alister Benne�

@fishfarmermagazine

@fishfarmermag

www.fishfarmermagazine.com

Fish Farmer Volume 46, number 08 Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901 Email: editor@fishfarmermagazine.com

Head office: Special Publica�ons, Fe�es Park, 496 Ferry Road, Edinburgh EH5 2DL

Subscriptions

Subscrip�ons address: Fish Farmer magazine subscrip�ons, Warners Group Publica�ons plc, The Mal�ngs, West Street, Bourne, Lincolnshire PE10 9PH Tel: +44(0)177 839 2014

UK subscrip�ons: £75 a year

ROW subscrip�ons: £95 a year including postage all air mail

• Its environmental impact is within acceptable limits, with continual progress to minimise that impact through innovation, research and development.

• The aquaculture sector collaborates with other stakeholders to protect and restore biodiversity in the freshwater and marine environment.

• High standards for farmed animal health and welfare are a priority, maintaining Scotland’s high health status and declared freedom from listed fish and shellfish diseases.

• Development happens in the right places, underpinned by an effective and efficient regulatory framework informed by the best available science and evidence.

THE Scottish Government has set out its long-awaited Vision for Sustainable Aquaculture, setting out environmental, economic and social aims for the sector.

The document, which had been expected at the end of last year, was launched by Mairi Gougeon, Cabinet Secretary for Rural Affairs, Land Reform and Islands at Kames Fish Farming’s site at Loch Melfort, Argyll on 20 July.

In her foreword, Mairi Gougeon states: “Aquaculture has a crucial role to play in contributing to our food security and meeting our commitment to becoming a Good Food Nation, producing healthy, nutritious food, with a greenhouse gas emissions profile that is lower than many other farmed sources of animal protein, for people in Scotland and around the world.”

She notes that the Scottish aquaculture sector and its supply chain supported an estimated 11,700 jobs in the Scottish economy and generated £885m GVA (gross value added) in 2018.

The Vision sets out aspirations for the aquaculture sector and a blueprint for where it should be by 2045 – but without stating any targets for growth, or on for the sector’s economic contribution should be by that date. It explicitly links the objectives for aquaculture to the Blue Economy Vision published last year.

• The Vision for Aquaculture also states that the following should be true of the Scottish industry by 2045:

• Its produce makes a significant contribution to Scotland’s reputation for premium food and drink.

• Our communities are supported through the provision of highly skilled employment opportunities, access to healthy local foods and other lasting benefits.

The document refers to a number of initiatives already announced and underway, including the review of the consenting process being carried out by the Consenting Task group following the Griggs report; delivering on the Scottish Government’s commitments made to the Salmon Interactions Working Group; and revising the echnical Standard for Scottish Finfish Aquaculture, with a view to achieving zero escapes.

The Vision commits to “streamlining” the marine and freshwater planning and consenting system, improving spatial planning tools and ensuring an “efficient, effective and transparent” system “…with alignment between all regulatory processes”.

It also says the Scottish Government will encourage exploring the potential for offshore development, within three

and 12 nautical miles. It will also encourage the “redevelopment of farms where there is no planned production into alternative forms of aquaculture, other marine sector development, or returning the farm site to the wild.”

The Vision commits government, among other things, to improving port and harbour infrastructure; improving housing stock in rural and island areas; ensuring access to high-speed broadband; attracting inward investment; identifying new market opportunities; promoting organic aquaculture; improving water quality in shellfish producing areas; improving productivity for shellfish; and introducing a Code of Good Practice for seaweed production.

It also talks about building resilience by increasing the domestic supply of fish ova, shellfish spat and seaweed seed, and exploring opportunities to diversify the species farmed in Scotland.

In her foreword, Mairi Gougeon says: “Aquaculture depends on Scotland’s natural capital and the communities within which the sector operates. It must operate within environmental limits, to ensure that our waters are clean and safe, supporting healthy and diverse flora and fauna. As we respond to the twin crises of climate change and nature loss, we envisage a sector that leads the world through the responsible and sustainable ways in which it operates, delivering significant and lasting socio-economic benefits for Scotland and for the communities that host aquaculture businesses.”

The document makes it clear that the

industry will need to show that it can help to preserve and enhance biodiversity and the marine environment, as well as benefiting local communities and the wider economy.

It also pledges “protecting and improving the ability of communities to meaningfully contribute to aquaculture planning and consenting”, an objective which may lead to tension with the aim of streamlining the consent process.

Welcoming the document, Tavish Scott, chief executive of Salmon Scotland, said: “We welcome this vision which puts salmon farming at the heart of the country’s economic growth plans, helping Scotland’s journey to net zero and supporting healthy diets.

“The blue economy has the potential to both increase food security at home and feed the

growing global population.

“Scotland is uniquely placed to lead the way in the drive for the sustainable use of the oceans and seas, while conserving our shared environment for future generations.

“Like all sectors, we face challenges from issues ranging from climate change to Brexit to rampant inflation, but by working together with government we can continue to grow a low carbon, highly nutritious food that sustains thousands of jobs and ensures our rural communities can thrive.”

Following her visit to Loch Melfort, Mairi Gougeon said: “I was delighted to visit Kames Scotland and to learn more about its focus on the future and sustainability. It was interesting to learn about Kames’ Future50 programme and their planned investment into their business, community and local environment. We have many examples in Scotland of what aquaculture brings to Scotland’s economy now, and can do in the future – Kames Scotland shows the role Scottish, family owned businesses can play.”

Andrew Cannon, MD of Kames, commented: “We hope this vision document triggers action, further than just words, within the industry. We are proud to be a Scottish owned, awardwinning family company, but we need support to keep the innovation and diversity that SMEs like us bring to the table alive, alongside economic growth. The vision supports this view, and we look forward to seeing the action to come and more innovation and diversity in Aquaculture.”

EDINBURGH-based fleet management company Gofor has been appointed to manage Mowi Scotland’s transition to a combined electric and plug-in hybrid electric vehicle fleet.

Mowi said it intends for all its company cars to be zero-emission or hybrid by 2025, and will include vans and pick-ups in this transition, as and when suitable vehicles become available.

The salmon producer has already begun its change to electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) and is now undertaking the installation of workplace charging at its sites. Originally deploying 7kw charge points, Mowi is now looking to introduce more rapid charging to its business as it seeks to meet the evolving demands of its low carbon fleet.

Gofor has provided a range of fleet management support materials to assist Mowi during its decarbonisation process. These include strategic insight on the move to electric, creating an EV/PHEV fleet policy and driver guidance which highlights benefit in kind (BIK) savings.

The first fully electric vehicles – Citroen e-Spacetourers – have already been delivered, alongside a new dual-branded MG4 Electric. The people carriers were selected as ideal vehicles to transport staff

to and from work across two key highland routes.

Allan Macdonald, Area Manager for Mowi, explained: “In addition to the clear environmental benefits from this move, thanks to the electric people carriers, it is now easier to transport staff to and from their place of work which will also help with recruitment in the future.”

Mowi now has e-vehicle charging points at its head office in Fort William as well as the salmon hatcheries at Lochailort and Invermoriston, and the plan is to expand these charging points at the company’s many business

locations across the Highlands and Islands. Graham Lesslie, Managing Director of Gofor commented: “We’ve taken a highly proactive approach to ensure that the switch to electric and hybrid is as smooth as possible for Mowi. The Gofor team set up test drives to get employees comfortable with EVs and we also facilitated workplace charge point installation to make running the vehicles really easy.

“Our customer success team will support Mowi in the future with both vehicles and chargers as they transition to a reduced carbon fleet.”

SHETLAND salmon farmers oined forces to support the all Ships’ return to erwick last month. ndustry body Salmon

Scotland and local fish farming companies, ooke Aquaculture

Scotland, and Scottish Sea Farms, sponsored the four-day event as ost ort Associates. he event marks the third time the Tall Ships fleet has been hosted in

erwick after visits in and .

Sailing vessels moored in erwick harbour as part of a route including Aberdeen, artlepool, the utch city of Den Helder, and Fredrikstad in orway. he festivities involved thousands of people, and hundreds of young sailors on nearly 40 tall ships.

THE first stage of a study to see whether hemp seed could be a viable source of protein for salmon feed has proved successful, researchers say. Now the trials are entering a second stage to find out how salmon perform in the long term when fed on the ingredient.

Rare Earth Global, the company behind the initiative and growers of industrial hemp for a range of sustainable products, has received more than £260,000 in funding from the UK Seafood Innovation Fund (SIF) for a full-scale research and development project which will include a two-month feed assessment.

A feasibility study conducted last year set out to explore how hemp seeds could be integrated into the diets of farmed salmon in Scotland.The team tested two types of hemp meal against a range of factors such as digestibility, fish growth, and the effect on gut health, finding that the ingredient had a comparable nutritional profile with soy and fishmeal.

The next stage of testing involves monitoring how fish perform over the long term when fed hemp seed protein as part of their diet, with the company also supported by the Sustainable Aquaculture Innovation Centre (SAIC) and the University of Stirling’s Institute of Aquaculture. Mowi, the global producer of Atlantic salmon, will support the formulation and production of the feed, while farmers in Angus and Aberdeenshire will grow the crops.

MOWI executives Scott olan (pictured) and iotr Kapinos have been appointed as directors on the board of

Wester Ross Fisheries. Nolan is Sales and Operations Director ( , reland, Faroes celand) with Mowi and Kapinos is Finance Director with Mowi Scotland. Mowi Scotland acquired Wester oss in une last year, but the company still trades as Wester Ross Salmon. David obinson, who was one of those involved in the management buy-out of Wester oss in , is no longer a director of the company.

ELEANOR Lawrie, who became Mowi Scotland s first female deckhand last year, has been appointed as skipper. She originally joined the company as a farm technician but then oined the crew of workboat the Ailsa Craig. Lawrie was named as the ising Star for at the Aquaculture Awards in Inverness last month.

The research team is aiming to understand the viability of hemp meal protein for commercial inclusion and to discover whether an optimum composition can be identified that delivers the best nutritional results for salmon, as well as testing secondary ingredients used as part of the feed. Another element of the project will cover sustainability, identifying methods for hemp farmers, feed companies and seafood producers to measure the carbon footprint of the entire process.

Suneet Shivaprasad, director and co-founder of Rare Earth Global, said: “The first feasibility trial returned positive results for the viability of hemp seed protein as a core aquaculture feed ingredient, and we are now testing whether it could be included on a commercial scale. Further research will enable us to look at a range of other factors over a longer time period, with the aim of demonstrating that this novel protein can be a success.

“Locally grown, plant-based ingredients are already more environmentally friendly than any imported soy or fishmeal but our zero waste approach to growing it also ensures that every part of the hemp plant is used for maximum value. In this case, the seeds will be used as a protein source for aquaculture, while the stalks will be used for sustainable construction materials, bioplastics and bioenergy feedstocks.”

Up to two tonnes of hemp seed can be produced per hectare of the crop, and Rare Earth Global is working with a range of farming cooperatives and family run farms – including farmers in Scotland, Yorkshire, Lincolnshire and Hertfordshire – to develop the supply of the raw material throughout the UK.

Last summer, the UK Government published its Hemp-30 roadmap – a 10-year strategy to make industrial hemp a major UK crop. It is estimated to add around £700m to the economy and sequester or displace one million tonnes of carbon dioxide each year.

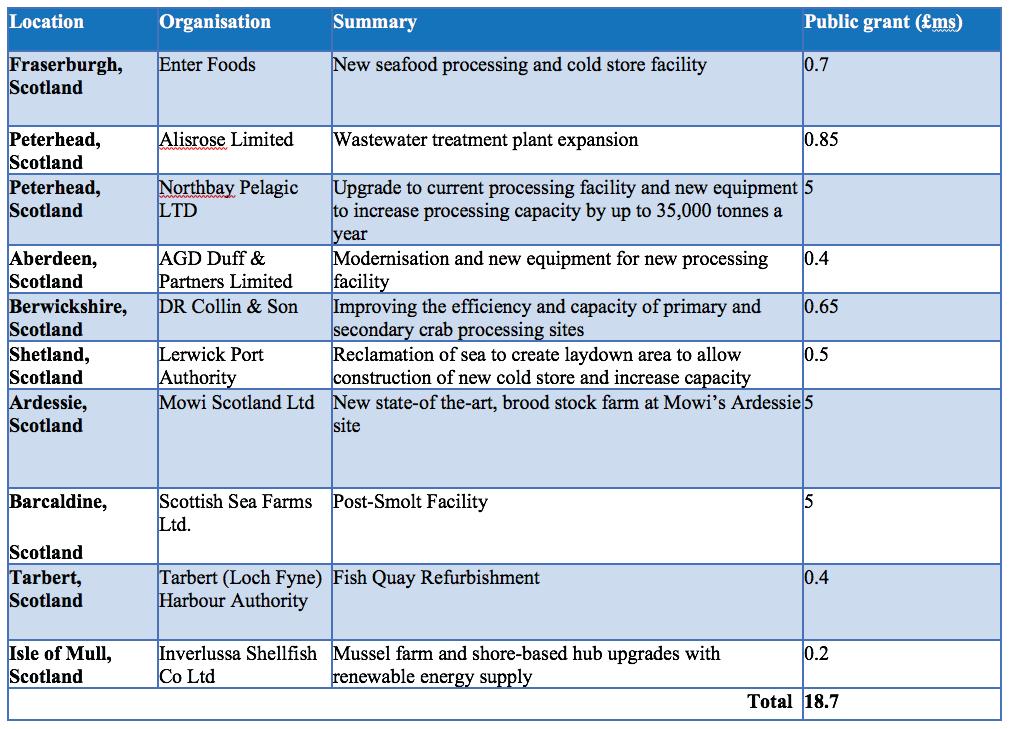

nverlussa Shellfish is an award-winning mussel producer operating in och Spelve on the sle of Mull. he grant funding of , will enable the company to upgrade its mussel farm and shore-based hub, with a renewable energy supply.

ther funded pro ects include upgrades to seafood processing facilities in Aberdeen, eterhead, Fraserburgh, arbert, Berwickshire and erwick in the Shetland slands.

Seafood Fund pro ects uly

A total of . m has been granted for research pro ects covering scallop, nephrops (langoustine) and ling fisheries. A total of , in match funding from alternative private or public contributions is supporting these pro ects.

Funding has also been made available for the catching sector across the to replace or modernise fishing vessel engines to reduce emissions, improve reliability and enable new technologies to be tested. he scope for the Fleet Modernisation ound is being extended to include all commercial vessels.

UK Government Minister for Scotland John amont said: m delighted that almost m in Seafood Fund investment is being shared across Scottish pro ects. he fund is a crucial part of our commitment to help level up coastal communities and deliver the Prime Minister’s priorities of growing the economy and creating better-paid obs and opportunity right across the country.

We are supporting fishing communities across the so they benefit from better infrastructure, new obs and investment in skills to ensure they have a long-term and sustainable future.

MOWI’S planned broodstock project at Ardessie, the Scottish Sea Farms post-smolt facility at Barcaldine and mussel farmer nverlussa Shellfish are among the recipients of the latest round of overnment funding for the Scottish fishing and aquaculture sectors, through the Seafood Fund.

A total of . m is being awarded to pro ects across Scotland through the Infrastructure Scheme to improve capability at ports, harbours, processing and aquaculture facilities. n addition, . m is being allocated to four Scottish pro ects through the Fisheries Industry Science Partnerships (FISP) scheme to provide vital research that will inform fisheries management.

ver m in match funding from alternative private or public contributions is supporting these pro ects.

The Ardessie project is intended to secure a supply of salmon eggs for Mowi in Scotland. Based on the shores of Little Loch Broom, oss-shire in north west Scotland, the new facility will replace an existing hatchery building. When complete, Mowi said, it will offer eight to direct new obs and supply chain opportunities to the local region. he grant is worth m.

Scottish Sea Farms receives a grant of m for its post-smolt site at Barcaldine which is being planned as an extension to the company’s existing hatchery there. he new building will be placed between the hatchery and the shoreline, enabling easy transfer of the smolt to wellboats. he new facility will enable Scottish Sea Farms to grow the smolts to a larger si e before transfer to sea pens, improving their chances of thriving at sea.

SALMON producer Bakkafrost Scotland has taken delivery of a new 24-metre workboat from Macduff Shipyards.

The vessel has been named Turas a ‘Bhradain, meaning “the salmon’s journey” in Gaelic.An internal competition was launched to name the new workboat, and the winner was six year old Chloe Macdonald, from the Isle of Lewis.

Bakkafrost Scotland commissioned the £2.6m vessel from the Macduff Shipyards in Aberdeenshire, and it is the first of two bespoke vessels being built by the yard for the business.

Turas a 'Bhradain, will operate across Bakkafrost Scotland’s sites on the West Coast and Hebrides and has been delivered following a year-long construction period.

From mid-July, the new vessel will be operating alongside Bakkafrost Scotland’s

wellboats the Ronja Star and Ronja Fisk, playing a key role in fish health by preparing the pens for the wellboat to carry out freshwater treatments.

Ronja Star joined the Bakkafrost Scotland eet in November 2022, and has been specifically built to handle fish with care, while increasing biosecurity in line with Bakkafrost Scotland’s sustainability strategy, which will see an increase in

the use of freshwater treatments across all its marine sites on the West Coast of Scotland.

Ian Laister, managing director at Bakkafrost Scotland said: “By commissioning the Turas a ‘Bhradain and the second workboat from Macduff Shipyards we have been in a position to support approximately 2 0 jobs at the yard, which will hopefully help the business to continue investing in young people, where they are typically hiring 10-12 apprentices annually.

“Bakkafrost Scotland are committed to investing in an environmentally sensitive manner and in local communities by actively awarding contracts where possible to local businesses.This deal is important to us and integral to our plan for responsible growth.”

MOWI has announced a 2023 second quarter EBIT or operating profit of €300m (£256m), with its Scotland division showing a much improved harvest and financial performance.

The operating profit was €20m (around £17m) lower than last year, but this is in line with industry expectations.

The world’s largest producer of Atlantic salmon harvested 107,500 tonnes during the April to June period against 103,000 tonnes in the same quarter last year.

The harvest volumes were made up as follows (Q2 2022 figures in brackets):

• Farming Norway 61,500 tonnes (60,000 tonnes);

• Farming Scotland 18,000 tonnes (13,000 tonnes);

• Farming Chile 14,000 tonnes (14,500 tonnes);

• Farming Canada 9,500 tonnes (10,500 tonnes);

• Farming Ireland 1,500 tonnes (3,500 tonnes);

• Farming Faroes 3,000 tonnes (1,500 tonnes);

• Farming Iceland (Arctic Fish) 100 tonnes (2022 comparison figure not applicable as group was not part of Mowi at the time).

All harvest volumes are provided in gutted weight equivalents (GWE).

The total operational EBIT per kg through the value chain was broadly as follows (Q2 2022 figures in brackets) :

• Norway €3.35 (€3.95)

• Scotland €2.30 (€1.60

• Chile €1.80 (€1.05)

• Canada €1.30 (€3 )

• Ireland €1.40(€2.80)

• Faroes €4.60 (€5.80).

The operational EBIT in consumer products was more than double on last year at €37m (£31.6m).The operational EBITDA for feed was €10m (£8.5m), €4m (£3.4m) up on last year.

Mow said thereported financial net interest-bearing debt (NIBD) for the group was approximately

€1,665m (£1,423m) at the end of the quarter (excluding IFRS 16 effects), of which €90m (£77m) involved in Arctic Fish, acquired at the end of last year.

The complete Q2 2023 report will be released on 23 August.

THE government has published a new contingency aquatic animal disease outbreak plan for England and Wales, to ensure the UK retains its high health status in this area.

The plan outlines how Defra (the Department for Environment, Food & Rural Affairs) and the Welsh Government, along with its operational partners, respond to outbreaks of aquatic diseases.

They say disease outbreaks such as viral haemorrhagic septicaemia (VHS) and infectious haematopoietic necrosis (IHN), can cause

aquatic animals to suffer, disrupt trade, damage businesses and the environment, and cost the taxpayer significant sums of money.

The UK currently has high aquatic animal health status and is free from the most serious aquatic animal diseases. There is a shared responsibility between government and industry, the paper says, to ensure that if disease occurs, it is diagnosed earlyand eradicated.

Aquatic animals generally relates to creatures that live predominantly in different water forms, such as seas, oceans, rivers, lakes, ponds, etc. xamples of aquatic animals include fish, ellyfish, sharks, whales, octopus, barnacles, crabs, dolphins, eels, rays, mussels, and so on.

The plan provides for a swift, effective and co-ordinated response to control and eradicate disease, which supports the path to regaining disease-free status, and restoring international trade.

hief eterinary fficer hristine Middlemiss said:“ am proud of the UK’s high aquatic animal health status, and we are committed to maintaining this internationally recognised footing.

“ he plan published today sets out clear steps for industry and government to respond quickly to aquatic disease outbreaks, ensuring the UK remains a world-leading food and farming nation.”

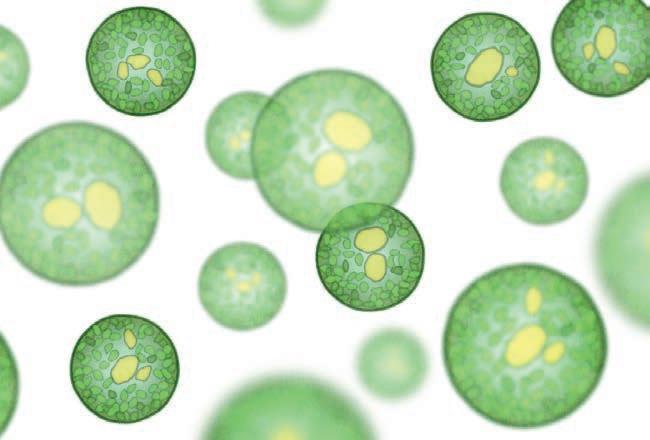

RESEARCHERS are studying the potential for lab-grown algae as a viable alternative protein source for aquafeed and other uses.

Experts in animal nutrition from Biosimetrics and Abrimar, both based in Edinburgh, Scotland, are working alongside researchers at the Scottish Association of Marine Science (SAMS) to explore the optimum conditions required for growing algae as a novel feed ingredient.The project is funded by the Industrial Biotechnology Innovation Centre (IBioIC), which hopes it could help to unlock new Scottish supply chains for natural and sustainable feeds.

Previous studies have demonstrated the potential of algae as a high-quality, nutritious alternative to imported soy and fishmeal protein.The cost and complexity of scaling up to mass production, however, has meant the process has not yet been developed further. For this project, species were specifically selected for their commercial viability, to minimise potential waste and maximise value.

The consortium has devised a new strategy where multiple sectors will use different components of the algae crop for different purposes.While some elements of algae would go into fish and livestock feeds, other co-products – which may previously have been deemed waste – could be used as pigments for a range of food and drink or consumer

products.

The researchers have tested a range of organisms supplied by the Culture Collection of Algae and Protozoa (CCAP) – Europe’s largest collection of living strains from freshwater and marine environments – to determine which species could unlock the greatest feed value for monogastric animals, fish and humans by measuring their speed of growth, protein yield and digestibility.

Algae has a similar nutritional profile to soy, eggs, fishmeal and other commonly used protein sources. However, algae can be grown locally, while the UK imports around 3.5 million tonnes of soybean equivalents per year mostly from South America, much of which is used for animal feed and aquafeed.

Dr Virgilio Ambriz-Vilchis, head of technical services at BioSimetrics, said: “Different species of algae have already shown huge potential in terms of the nutritional benefits for aquaculture and agriculture. However, transferring the process from the lab to fullscale production is not as straightforward as it may seem. As well as the technical hurdles, we also need to optimise the process so that it makes sense economically.

“Algae is a high volume and comparatively low-value product, so we have evaluated 10 separate species and different growing conditions to see which achieves the best results. "

A team of island athletes supported by Bakkafrost Scotland returned home in July from the NatWest International Island Games XIX in Guernsey with a good haul of medals.

The Western Isles Island Games Association (WIIGA) squad had an “incredible week” winning four silver medals in the Mountain Bike Crit, Mountain Bike X-Country, Men’s Half Marathon, and Women’s Football competitions, as well as a bronze in the Women’s Half Marathon Team event.

Norrie MacDonald, WIIGA chair, said: “The team has had another incredible experience, and they are an immensely proud group of top athletes representing the Western Isles.

“We had another amazing experience and apart from the terrific achievements in winning the medals, there were many personal bests from our young athletics and swimming squad and lots of other success stories throughout the team.”

The team of 92 athletes plus management, coaches and medical team, flew out from Stornoway on Friday 7 July to take part in the biennial multi sports event.

WIIGA competed in nine sports: athletics, swimming, shooting, cycling, badminton, men’s and women’s football, men’s and women’s golf, indoor bowls and archery.

Ian Laister, managing director of Bakkafrost Scotland, said: “We are proud to support the squad and were especially proud of Bakkafrost Scotland’s own Donald Macinness who competed in the shooting category, travelled home and was then back at work first thing on the next morning!

”Events like this help the team build their experience of competing at the highest level and we look forward to the team going from strength to strength at the next island gathering.”

THE orwegian land based fish farmer Andf ord Salmon has announced the successful completion of its first harvest of Atlantic salmon at its new facility in valnes in the north of the country.

he company said the harvest yielded strong results with an industry leading survival rate of . and superior share of . .

he total biomass of Atlantic salmon reached tonnes translating to approximately metric tonnes ( ), with an average weight of approximately . kilograms per fish.

An exit-count in con unction with transfer of fish from the pool shows that approximately , salmon were released in the pool one year ago.

Martin amussen (pictured) said: “We are elated to achieve such a remarkable survival rate, especially after transportation to slaughter.

“ he fact that . of the fish survived underscores that the fish has had excellent living conditions in the pool.

e added: “As a consequence of this, we have harvested fish that may not have survived in other fish farming facilities. his has a negative impact on the average weight and superior share, which is still at an impressive level. owever, a high survival rate is

obviously the most valuable from a financial perspective.

A company statement said the harvested fish displayed a diverse range of weights, from - kg up tokg. f particular note, approximately of the fish fell into the - kg category, achieving an average price of approximately ( ) per kg. Additionally, around of the fish weighed between - kg, realising an average price of approximately ( ) per kg.

amussen continued: “ he high-quality attributes of our salmon have not gone unnoticed by our customers, who have provided very positive feedback, especially on the

colour of the fish.

“ his reiterates the conceptual advantages of Andf ord Salmon’s salmon farming method. ur main goal for the first batch of fish was to reach the right’ buyers, not to maximise the average price.

“ ven so, we have seen buyers coming back after the first shipment wanting to pay extra for the next delivery. his has made us even more confident that we will be able to achieve a healthy premium on our product in the future, he concluded. ast month Andf ord Salmon secured loans worth around m and boosted its balance sheet with a share issue totalling some m.

SALMON exports held up well during July with China emerging as one of the strongest growth markets, says the Norwegian Seafood Council in its latest monthly export report.

Norway’s salmon farmers sold 95,620 tonnes of fish worth NOK 9.6bn (£736m) last month, a 13% increase in value and a one per cent increase in volume on July 2022.

Once again Poland and Denmark – two countries with large salmon processing sectors – and France were the largest markets.

But China had the largest increase in value, with exports up by NOK 230m (£17.6m) or 90%, compared to July last year.

Andreas Thorud, the Seafood Council’s China envoy said it was the strongest July growth so far, but pointed out that July last year was affected by Covid-19 closures.

He said demand was demand was

particularly strong not only from restaurants but also from the grocery and e-commerce sectors which were now emerging as important sales channels.

“We also see an exciting tendency for more and more Norwegian salmon to be found in grocery stores outside the big cities,” he added.

Farmed trout sales grew by 14% in volume terms during July to 5,845 tonnes while the value rose by one per cent to NOK 527m (£40.5m) with,

surprisingly, war-ravaged Ukraine one of the largest growth markets. Thailand and the US were the other main markets.

Ukraine had the largest increase in value at NOK 42m (£3.2m) or 188 % while the volume at 890 tonnes was 178% higher than a year ago.

Total Norwegian seafood exports last month were worth NOK 12.4 bn (£953m), 8% higher than a year ago. So far this year Norway has sold fish of all types worth NOK 94.4bn (£7.26bn) to countries around the world.

Seafood Council CEO Christian Chramer said the rise was larger due to a weak kroner, although the currency had strengthened somewhat last month.

The UK continued to be one of the strongest markets for exports of frozen cod, buying 1,300 tonnes of the popular whitefish, 6% more than 12 months ago.

SAMHERJI, the Icelandic seafood group planning to build a large land farm near the capital Reykjavik has said its “phased” approach should address any concerns that the project might pose a threat to water supplies in the area.

Iceland’s national planning agency last month expressed concerns about the impact of the development on water resources around Reykjanes in the south west of the country.

The agency called for the £260m facility to be built in stages so the effects on water supply can be assessed after each phase is completed. The ultimate harvest target is 40,000 tonnes of Atlantic salmon.

Samherji has now issued a statement saying it already plans to do that, with the first stage producing 10,000 tonnes, the second 20,000 tonnes and 40,000 tonnes after the third and final phase.

It says: “Sea extraction will also be phased, but in a fully built station. The company plans to use a maximum of 30,000 l/s [litres per second] of ground sea, about 50 l/s of freshwater and about 3,200 l/s of warm seawater from Reykjanesvirkjun… it is worth stressing that all other water that will be used for the fish farm is salty seawater that will be pumped from the coastal ridge below Eldisgarð.The Planning Agency believes that the most significant environmental impact concerns groundwater and geological formations.

“The institute’s assessment of possible environmental impacts is comparable to the results of the Samherji fish farm’s environmental assessment report.

“The opinion acknowledges the importance of the phasing of the Edisgarð development, as proposed by Samherji Fish Farm, in order to ensure the most accurate information about the environmental impact at any given time.”

Jón Kjartan Jónsson, manager of Samherji Fish Farms, says that work on the assessment plan and the environmental assessment report took three years, and they tried to answer the comments of the public and commenters in a clear and decisive manner.

Jónsson said: “The environmental assessment report also states the proposed countermeasures to minimize the environmental impact of the project. The environmental assessment and approved plan are important milestones for us to build a new and complete onshore power plant at Reykjanes.

He added: “The opinion is positive and it is also a pleasure to receive praise from the authorities for a thorough and well-prepared report.

“We are aiming for the production of salmon, where sea pumping will be a key factor, and it is a self-evident requirement that we raise the impact of sea fishing on the environment as we propose.

“The only way to map the impact with more precision than we have already done is to responsibly monitor the impact of sea pumping, which is the main reason why the project will be phased.”

He also said that uncertainty has been eliminated through monitoring, stressing that the company had taken great pride and put in a lot of hard work in its entire preparation for the project.

• Fish Cage Nets

– Nylon & HDPE

• Predator Solutions

• Net Service Plant

• Treatment Tarpaulins

• Lice Skirts

• Supplier of LiFT-UP

• Wrasse Hides

TWO privately owned Norwegian fish farming companies, Wilsgård Fish Farming and Arnøy Laks, have each announced positive financial results for 2022.

In both cases revenues and profits were much higher with Wilsgård achieving a company record and more than doubling its turnover from NOK 320 million in 2021 £24m) to almost NOK 757m (£56m) last year.

High salmon prices last year also helped boost the two companies.

The company appears to have recovered from a serious infectious salmon anaemia outbreak in 2021, which badly dented profits.

the time although it has since grown considerably. Then, it had just two employees. The workforce has since grown to around 60 with more than 120 working for the now wider and larger group.

Meanwhile, the Troms based farming company Arnøy Laks, also around 40 years old, saw its turnover rise by around 40% from NOK 292m (£22m) in 2021 to NOK 364m (£27m) last year. The pre-tax profit was NOK 85.7m (£6m) against NOK 60.9m (£4.4m) in 2021.

The company said there was still a great deal of unused potential in the business, adding that negatives issues such as the war in Ukraine and biological challenges continued to provide uncertainties.

It is also building its own fish processing facilities which will include a new filleting line.

THE salmon “winter wound” problem is becoming a challenging issue that requires special attention, the employer organisation Seafood Norway has said.

CEO Geir Ove Ystmark said Seafood Norway plans to strengthen co-operation with the relevant professional authorities.

Winter wounds or sores affect salmon skin and, as the name suggests, are most prevalent in the colder months. Seafood Norway believes that much of the problem can be linked to the handling of salmon lice and the increasing use of treatment methods. Preventive measures have therefore been implemented to reduce the need for handling the fish, including of these is the use of laser technology to kill lice.

Seen in isolation, wound challenges are a big problem, he says. Primarily this is because it causes suffering in the fish, but also financially due to the loss of fish and the downgrading of slaughter.

Seafood Norway says it has long prioritised the development of a system for internal control to safeguard fish welfare in aquaculture. Systematics is the key to understanding causal relationships, the organisation maintains, uncovering adverse developments and taking measures in time.

Ystmark argued that another important reason for the increase is that the old vaccines do not work well enough. New vaccines will be introduced continuously. Several vaccines are under development, but there is a need to speed up the process of approval. Strategic use of bacteriophages, probiotics and special feed are further contributors to reducing risk.

Karoline Skaar Amthor, veterinarian and head of health and environment at Seafood Norway, said: “Like other biological challenges, it is about understanding causal relationships and managing risks.

“To do this, you have to work systematically. Although trends and similarities are seen in ulcer outbreaks, there is also variation when it comes to underlying or contributing factors.

“It is not the case that ‘wounds are wounds’. Follow-up of each individual case represents an important contribution to increased knowledge”, she added.

The 2022 operating EBIT or profit was NOK 320m (£23m) against just under NOK 6m (£447,000) in 2021.

Based in Senja, Norway, the group was established in 1983 by Vidkun and Fridtjof Wilsgård with just a single fish licence at

NORWEGIAN cod farmer

Statt Torsk has been hit by high mortalities and production issues this summer.

The company has said the problems are likely to cost it up to NOK 12 million (£920,000). It has suffered a high level of mortalities at its Stokkeneset location in the north of the country, which occurred during June and July, as temporary.

Statt Torsk said in a close of trading press release to the Oslo Stock Exchange that the economic cost of the Stokkeneset mortalities was likely to be NOK 4.5m (around £346,000). The cost of the reduced production at its Rekvika site near Tromso is expected to be up to NOK 7.5 million (£578,000).

The company is expecting its harvest at Rekvika to be around 280 tonnes short of target.

The cause of the mortalities has

been identified, and “appropriate measures” have been taken”, Statt Torsk said, although the company has so far not revealed exactly what the problem is.

A year ago, Statt Torsk announced it had won a new contract worth around £6m.

In February this year the company said it was scaling down harvest plans to focus on contract deliveries rather than the spot market. It makes regular deliveries to a pilot customer in Spain.

Cod farming in Norway is still small compared to salmon farming, but it is on the increase.

Private salmon companies are also doing wellAbove: Geir Ove Ystmark Top left: Wilsgård Fish Farm Above: Arnøy Laks workers

NORDIC Halibut said it achieved an average sale price of NOK 155 (£11.50) per kilo during the second quarter of this year, representing a year-on-year increase of 7% and considerably higher than that for wild-caught halibut.

In an operational update last month, the company reported that it is witnessing a growing willingness to pay and acceptance for farmed halibut in key export markets.

It added: “As awareness of the outstanding qualities and attributes of farmed halibut products continues to rise, the price differential against wild halibut products also continues to widen. “

The average export sales price for Nordic Halibut’s products during the quarter reached NOK 171 per kilo (£12.60), marking a 13% year-on-year increase, while the average export sales price for wild halibut from Norway stood at NOK 109 (£8) per kilo , resulting in a price differential of 57%.

Nordic said: “The established price level indicates strong potential for higher prices for farmed halibut. Ongoing assessments of long-term strategic considerations will determine the allocation of biomass held at sea between periods, aiming to create a strong market presence and achieve optimized prices and revenue.

“Notably, larger-sized halibut, particularly those sold at 7-9 kg and 9 kg plus, are yielding higher sales prices.”

Nordic said that consequently, its strategic commercial focus in the upcoming periods will prioritise achieving favourable prices and establishing a strong market presence.

In line with the strategic harvest plan for 2023, the company reduced its Q2 harvest volume to ensure optimal utilisation of biomass in the second half of this year.

During the April to June period Nordic harvested 151 tonnes (135 tonnes in head-on-gutted (HOG) weight), with an average harvest weight of 5.2 kg (4.7 kg HOG – head on gutted).

Total revenue for the quarter amounted to NOK 21m (£1 . m). This year it plans to release one million fish into the sea, equivalent to the growth phase one production target of 5,000 tonnes (4,500 tonnes HOG) to be harvested within 2026.

ARCTIC Fish of Iceland has agreed a major refinancing package to help its sustainability goals and prepare the way for major expansion in the estfjords region.

The Mowi-owned business has signed a three year agreement for an ISK 2 bn (£1 6m) refinancing with a syndicated loan from N , anske ank, Nordea and Rabobank.There is also a possibility of increasing the facility as the business continues to grow.

A plan to build a land-based salmon farm in the French fishing port of Boulogne has run into opposition from environmental groups and many locals.

In typical French style, there have been angry demonstrations from placard-carrying opponents.

A public inquiry into the project, which could decide its future, has just ended with the outcome expected within a few months. But Local Ocean, the company behind the plan remains confident, saying it hopes to begin construction this year and will label its salmon “Made in Boulogne”.

If approved, it would be the second time a RAS facility has been mooted for for the Channel port. Pure Salmon had proposed constructing a farm in Boulogne, with an intended annual production of 10,000 tonnes, but last year switched its preferred site to Verdon-sur-Mer on the Gironde estuary in south east France.

In some respects the Local Ocean project is similar to the RAS (recirculating aquaculture system) salmon farm planned for Grimsby – another traditional fishing port that has seen better days. The big difference is that the Grimsby farm has stronger local support.

Among the issues raised by French environmentalists were risks from the high flow of waste water in the Ro-Ro (roll-on, roll-off) basin through which much of the port’s crossChannel traffic passes, as well as the danger that the farm’s waste could cause the spread of green and brown algae.

Local Ocean said it is in Boulogne for the long haul, arguing that it is the perfect location from a social and environmental standpoint.

“The farm will be seamlessly integrated with the commercial fishing hub and Boulogne is just a few hours from major markets like Paris and London,” the company added.

“We are a collection of experienced aquaculture professionals, researchers, educators and entrepreneurs who are passionate about changing the way we raise, harvest, purchase and consume salmon.

“Our team has over a century of combined experience and has pushed innovation in RAS from its humble beginnings”.

Local Ocean was founded by Werner Forster, now the CEO and Alain Treuer, who is the company president.

Neil Shiran risson, Arctic Fish’s financial director, said: “ e are very pleased with the funding, which will support the company’s future focus.”

Arctic Fish said it has been developing a sustainability strategy and is working on its implementation, in accordance with international standards.

The loan is linked to the company’s sustainability goals and success in that area. Neil Shiran says this it will have a positive effect on interest rates for the future and provide great motivation for the continued good works that the company intends to support.

The banks responsible for the refinancing

will be kept informed about the success of the company’s sustainability goals.

Arctic Fish is a rapidly growing salmon farming company with operations in the estfjords region of Iceland. It owns and operates its own onshore fry farm, which is one of the most advanced in the world when it comes to water reuse and the use of clean energy sources.

The company employs more than 100 people but that figure is expected to increase by 20 before the end of the year Mowi acquired Arctic Fish from SalMar at the end of last year.

GRIEG Seafood saw its operating costs soar by up to 50% year-on-year in Norway and by more than 40% in Canada, it has reported in its 2023 second quarter trading update.

The full impact of these higher costs on profits will not become apparent until the full second quarter results are published later this month.

However, the better news is that in Norway at least costs appear to have steadied and are marginally down on the previous quarter.There was no harvest in British Columbia, Canada during that period, but costs are around two dollars

per kilo lower than during Q4 last year.

Year-on-year costs are up in all three active regions, but the variations are quite marked. In Rogaland the increase is around 25%, but in Finnmark, further along the coast, they have risen by around 50% during the past 12 months.

Salmon farming is even more expensive on the other side of the Atlantic. Costs increased year on year by 44%, but the NOK equivalent was 89.11 – more than NOK 30 per kg than in Norway.

Grieg harvested 22,600 tonnes during the April to June period, which was 1,000 tonnes

lower than the same period a year ago.

It was made up of (Q2 2022 figures in brackets): ogaland , tonnes ( , tonnes), Finnmark 5,600 tonnes (9,800 tonnes) and British olumbia , tonnes ( , tonnes).

However, it is the rise in production costs which may come as a surprise to observers outside the company.

The average cost per kg are as follows ( figures in brackets) ogaland . ( . ); Finnmark . ( . ) and British olumbia A . ( A . ).

The full Q2 report is due out on 25 August.

NORWAY is facing the costly prospect of more infectious salmon anaemia (ISA) cases, it has emerged this week.

The latest suspected outbreak is at a location in Vestland county, where Lerøy Seafood has a farm.

Lerøy informed the Food Safety Authority (FSA) following a PCR analysis carried out on samples of fish by Pharmaq Analytiq.

The FSA said follow-up tests would be carried out to confirm the suspicions. In the meantime restrictions were imposed on movement of fish and personnel, to prevent any further spread of the disease.

Meanwhile, ISA was also confirmed at a site in Heim municipality in Trondelag

county where Salmar Oppdrett and Norsk Sjømat Oppdrett have farms. A culling operation followed.

The Food Safety Authority was first informed of suspicions on 7 uly following samples taken from a number of fish and ISA was subsequently confirmed.

These latest incidents follow a high number of ISA outbreaks in Norway in une, with the estland and Rogaland regions the main areas to be hit.

Most suspected cases turn out to be positive, because fish farm managers and testing companies know from past experience whether the fish are diseased or not.

Grieg Seafood was one of the “big

five” companies forced to slaughter thousands of fish last month following confirmation of an outbreak. While ISA does not affect humans and infected fish are safe to eat, there are restrictions on exports of fish from affected areas to certain countries.

BAKKAFROST shares plunged by 15% in a single day on the Oslo Stock Exchange last month, following a second quarter profit warning from the company.

Some estimates put the loss in share value at more than five million Norwegian kroner – or at least £380,000. Bakkafrost has a

current market value of NOK 32bn (£2.4bn).

The shock came on 16 July when the Faroese salmon farmer announced its EBIT or operating profit for the April to June period would be DKK 353m (£40.7m) due to lower slaughter volumes in the Faroe Islands and higher costs in dealing with mortality issues in Scotland.

Some industry insiders had expected an operating profit around 560m Danish kroner (£64m) for the quarter – the company’s share price is reckoned in NOK but its

THE Kingfish Company has reported a 1 increase in second quarter sales for its farmed Dutch yellowtail. Sales were up year on year during the quarter to .6m (£ . m) while revenues per kilo increased by 1 to 1 . 0 (£12. 0).The total volume sold was 377 tonnes.

Kingfish CE incent Erenst said: “ e reached important milestones in the past few months, financially as well as operationally: we have started operations of the hase 2 grow-out systems and celebrated record production at our facility in Kats Kingfish eeland .

“ e have also secured additional financing which will provide full funding until we reach positive cash ow. ur priorities now are to finalize construction of hase 2, continue to improve operational performance, and increase sales volumes to reach profitability.”

The total standing biomass increased by more than 2 to 12 tonnes with an all-time high net growth of around 1 tons in une alone, and 12 tonnes net growth in the quarter.

This, said Kingfish, shows the excellent performance of its systems as well as the faster growth of the third generation of fish.

The company’s management said they remain positive about the outlook for the company. ith financing secured for completion of hase 2 and the path to profitability, Kingfish could now focus fully

financial results are given in Danish kroner.

Bakkafrost has adjusted the slaughter volume for the year in the Faroes to 63,000 tonnes while Scotland remains on target at 30,000 tonnes.

Hitherto, it was Scotland that posed problems for the business, but those concerns have now been overtaken by the main farming platforms in the Faroe Islands.

There were indications of problems when the company published its Q2 trading update at the start of the month, predicting a 16,000 tonne

harvest against 19,100 tonnes in the previous (winter) quarter.

Whatever the cause, investors reacted strongly with shares falling heavily.

At first the share price was down by around 9%, but as analysts began to look more closely at the company’s problems it fell further to 15%, before recovering a little.

Some believe that Bakkafrost’s profit for the entire year may be up to 20% lower this year compared with earlier expectations, although more optimistic observers think it could be around 10% down.

on growing the business and optimising operations. The statement added: “The group capacity will more than double after the new extension of the farm in eeland is fully commissioned, enabling us to meet the growing demand for high-quality yellowtail kingfish. “The company expects to benefit from the scaling effect and further improvement in operations and productivity, to become profitable and cash positive. here the current focus is on completion of the eeland project, management continues to develop expansion plans in the US and Europe.”

aquaculture to operating this barramundi farm.”

Tassal will have a head start by leveraging excellent existing relationships with retailers across Australia to reinforce the reputation of West Australian barramundi as a premium product. MPA currently produces around 1,600 tonnes of barramundi annually in Australia.

THE Tasmanian salmon farmer Tassal has bought a troubled Western Australia barramundi farmer, saving dozens of jobs in the process.

Tassal, now part of the global Cooke aquaculture and seafood group, said last night that it has taken over MPA Fish Farms Pty Ltd and MPA Marketing Pty Ltd, which operates Western Australia’s only ocean based barramundi farm.

The Cone Bay based company, previously part of the Singapore-based Barramundi Group, entered voluntary administration in May, threatening the jobs of its 50 strong workforce.

Tassal is Australia’s largest vertically integrated seafood growing, processing

and marketing business, employing nearly 2,000 people. It said it was delighted to add barramundi to its growing list of products.

Tassal Managing Director and CEO Mark Ryan said he looked forward to adding Australian ocean-farmed barramundi to the business.

“Tassal has turned around both the salmon and prawn industries in Australia before and has the skills and capabilities to apply the same learnings and intellectual capital to do this for the MPA companies and the wider barramundi industry in Australia,” he said.

“We are excited to bring world-class engineering, technology, innovative equipment, and 36 years’ experience in

“Once operations are consolidated, we will look at growth opportunities. This is a huge win for Northern WA, and a win for local jobs and investment. At Tassal we work in regionalareas across the country and are committed to working closely with traditional owners and the local community,” Ryan said.

Tassal said it believes in sustainably produced food, through responsibly harnessing the nation’s precious water resources and playing its part in ensuring a prosperous, healthy planet for future generations.

In a deal completed in November last year, Tassal is now part of Cooke Inc, one of the largest global aquaculture and seafood family of companies, producing salmon, sea bass, shrimp/prawns, and harvesting several wild fisheries species. The group includes Cooke Aquaculture Scotland.

Tassal-branded barramundi is due to hit the market in November, the start of the Australian summer.

THE giant Japanese trading group Mitsui is investing a further 78.5 billion Yen (£43m) in a major RAS trout farming project.

It means that Mitsui now has a majority 50.4% stake in the trout producer known as FRD Japan.

The new plant will be sited at Futtsu-shi, Chiba, around 25 miles east of Tokyo.

Large Japanese corporations have been investing heavily in seafood in recent years in Europe, including the UK, and in Asia.

The announcement on Monday said: “FRD farms and sells rainbow trout raised in its proprietary land-based Closed Recirculating Aquaculture System (“Closed-RAS”).

“FRD’s strength comes from the combination of its (1) water treatment technology for achieving a high water circulation rate using bacteria without the need to draw natural seawater and (2) aquaculture operations backed by extensive operational experience of Closed-RAS.

It added: “Making the most of this strength, it aims to facilitate development of the land-based aquaculture

industry, which has thus far faced commercial feasibility issues. FRD aspires to develop series of largescale plants, starting with this planned commercial plant, with a focus on Asia, including Japan.”

Since Mitsui’s equity participation in FRD six years ago, it has been supporting FRD’s research and development activities.

FRD’s pilot plants at Saitama-shi, Saitama and Kisarazushi, in Chiba, have been in operation since 2018. The pilot facilities have farmed more than 20 generations of fish to date, demonstrating stable production of rainbow trout by maintaining what the company calls “ideal water quality for fish growth”.

Based on this work, FRD is now constructing a commercial scale plant.

Mitsui says that against a background of a growing global population and rising living standards, the demand for marine products was increasing year by year which meant the importance of aquaculture was increasing.

Liberal Party since 2015.

It is too early to tell if she will follow Joyce Murray’s policy of ending open pen farming in British Columbia. Murray had been at odds with much of Canada’s aquaculture industry. Her appointment has been welcomed by the BC Salmon Farmers Association.

Trudeau axed seven senior ministers and several more junior ministers in a dramatic attempt to regain flagging popularity.

The BC Salmon Farmers Association said it looked forward to discussing the importance of the salmon farming sector with the new minister.

Minister Lebouthillier, along with our members and the First Nations whose territories we operate in, to learn more about the sector and the role of salmon farming in supporting poverty reduction, economic growth and sustainable food production in BC.”

Farm-raised salmon is BC’s largest aquaculture export and, before 2020, created over CA $1.6 billion in economic activity annually for the province.

JOYCE Murray, Canada’s controversial Minister of Fisheries and Oceans, has lost her job in a major reshuffle by Prime Minister Justin Trudeau.

Murray had announced, prior to the reshuffle, that she would not be seeking re-election.

She is replaced by Diane Lebouthillier, who has been an MP with the governing

“We understand Minister Lebouthillier is from a fishing community,” said Brian Kingzett, the association’s executive director.

“We appreciate the appointment of a Minister that understands the opportunities and challenges of resource-based communities, especially in relation to the federal salmon farming Transition Plan.”

He added: “We are ready to meet with

The salmon farming sector says it supports the federal government’s visions and goals by providing thousands of jobs and rural economic opportunities which support healthy and thriving communities, families and poverty reduction.

They are also committed to meeting the challenge of continued innovation through ongoing transition of the sector to achieve higher standards of environmental responsibility while further reducing potential impacts on wild salmon populations.

ECONOMIC and climate factors are set to make the second half of this year “the most challenging” period for global aquaculture since the peak of the pandemic in 2020, according to analysts at Dutch financial giant Rabobank.

Rabobank’s latest report, Global Aquaculture Update 2H 2023: Between a Rock and a Hard Place, warns that worldwide demand for

seafood is softening, while feed costs are expected to stay high.

The report says that salmon prices have largely corrected to more normal levels but remain high compared to historical levels. The slump in shrimp demand may even get worse in 2H 2023 as Chinese demand softens. And due to high fish meal and fish oil prices, aqua feed prices will not experience the correction that had been expected given lower soymeal prices. El Niño, a cyclical ocean current along the Pacific coast of South America that affects weather worldwide, has created conditions leading to the cancellation of the first fishing season in Peru. This, Rabobank says, is creating an acute fish meal and fish oil shortage Aquafeed prices will be supported due to

this scarcity of fish meal and oil, the report concludes.

On the demand side, Rabobank says, soft demand driven by inflation in the US and Europe is continuing, with salmon appearing relatively better placed than shrimp. Chinese demand is not recovering from the pandemic as fast as expected, resulting in low protein prices and high inventories. Fish meal and fish oil demand seem robust for now, but high prices will force rationing and substitution for many producers.

On the supply side, Rabobank expects that salmon supply will return to growth after nearly two years of contraction in Q3. The Asian shrimp industry, meanwhile, is facing a challenging period of record low prices due to oversupply caused by Ecuadorian growth.

US land-based salmon farmer AquaBounty Technologies saw second quarter revenue fall by more than a quarter year on year, despite increasing its output.

The company has reported revenue of $788,000 (£616,000) for Q2 2023, compared with $1.1m (£860,000) for the same period last year. Net loss in the second quarter of 2023 was $6.5m (£4.7m) million, as compared to $5.5m (£4.3m) in the second quarter of 2022.

Cash and cash equivalents and restricted cash have also fallen, with $43.8m (£34.2m) recorded as of June 30, 2023, compared to $102.6m (£80.2m) as of December 31, 2022.

AquaBounty aims to be the first business to produce genetically-modified ( M) salmon at scale. Its AquAdvantage salmon combine Atlantic salmon with elements of other salmon species.

The company has blamed falling salmon prices for the fall in revenue, but its losses are also down to delays in the construction of its

planned major site in Ohio.

Sylvia Wulf, Board Chair and Chief xecutive fficer of AquaBounty, said: “Our second quarter results were impacted by a significant decline in market prices for Atlantic salmon, despite the fact that our Indiana farm had its highest quarterly output to date.

“ he demand for our fish continues to exceed our supply and we continue to identify opportunities to increase our production to meet this demand.”

She added: “We announced in early June that the company was pausing the construction of our farm in Pioneer, Ohio due to a substantial increase in its estimated cost of completion. The company is currently evaluating both the cost estimate and our options for moving forward, including alternative financing solutions

FISHERIES and aquaculture giant Thai Union has produced its Sustainability Report for 2022, examining the progress achieved during the year while also detailing new ambitious goals under SeaChange 2030, the Company’s refreshed sustainability strategy. The report provides an in-depth look at how Thai Union, one of the world’s leading seafood producers and one of the largest producers of shelf-stable tuna products, continued to drive positive change across its own operations and the global seafood industry during 2022.

During 2022,Thai Union delivered several significant achievements, the report says, including:

• Beginning the full implementation of the Employer

Pays Principle to ensure that no worker pays for a job.

• Submitted short-term and long-term climate change targets to the Science Based Targets Initiative.

• Entered a partnership with Sustainable Fisheries Partnership to improve transparency across Thai Union’s supply chains.

• onducted the first at-sea audit to assess working conditions and crew welfare on longline vessels.

• ublished the company’s first Task Force on Climate-related Financial Disclosures (TCFD) report.

• Reduced greenhouse gases for Scope 1 & 2 by 7 percent in absolute terms in 2022 compared to 2021.

• Increased the percentage of tuna

to bring the project to completion. We previously announced our entry into a contractual commitment with a new construction firm who is assisting us in evaluating construction costs and who would lead construction of the facility going forward.”

Wulf also said that progress continues on the expansion of AquaBounty’s broodstock and egg production facility on Prince Edward Island; and that the company continues “to explore new business development opportunities which leverage our core strengths, and which could be applied to new species, including conventional salmon and other finfish, and new geographical territories worldwide”.

purchased from vessels equipped with electronic monitoring and/or human observers from 71% in 2021 to 79%.

“Thai Union is a company with great ambition, and our global sustainability strategy is an integral part of our goal to become the world’s most trusted seafood leader,” said Thiraphong Chansiri, CEO of Thai Union Group. He added: “To achieve that goal, we must continue to be an industry leader, and this report demonstrates how Thai Union has continued to develop and implement initiatives and programs that deliver the positive change that will help transform the seafood industry. We recognize that there continue to be enormous challenges, but we

have the ambition to tackle them, as evidenced by our new SeaChange 2030 strategy,”

THE largest fish transport shipever built in Chile, the world’s second largest salmon farming country, has set sail for the first time.

The atagon 1 is also the largest fish carrier in both North and Latin America.

Manufactured by the ASENA national shipyard in aldivia, it measures 7 . 0 metres longoverall, a width of 17.20 metres, and reaches up to 26.6 metres in height. The management of the operation says this was vital so that the ship could pass under a tilting structure of the Caucau bridge on the way out.

Heinz ierce, general manager of ASENA , highlighted the importance of the ship going out into the open sea.

He said: “ ith the atagon

I setting sail, we are giving a concrete signal that this Live Fish Carrier, built entirely in Chile, establishes us as a country as a benchmark and at the forefront of the shipbuilding industry and maritime solutions in general at an international level.

He added: “Undoubtedly, its navigation under the Caucau ridge implies that we can address different challenges, which is why we are proud to promote Chilean engineering and be a contribution as one of the most relevant shipyards on the acific Coast and the Caribbean.”

es s Grand n, head of Ship Inspection of the General

irectorate of the Maritime Territory and Merchant Marine of Chile indicated that although the vessel will operate in national waters, from the city of uerto Montt to the south, “it could transit to another country”.

Ricardo Contreras, the ASENA project engineer, highlighted the technical details of the atagon I with its innovative system for loading and unloading live fish, oxygenation of the species, and water treatment systems in the sectors in the ship operational regions.

He said: “This vessel has a large cargo capacity of up to 00 tons of live fish, representing an advantage for the salmon industry, with fewer trips between a farm and harvest centres.

“The atagon I also has a C 2 treatment system and U reactors to eliminate infections that the fish might have when getting into the vessel. In this way, clean water is returned to the sea, making this ship more environmentally friendly.”

Contreras explained that the vessel also has a particular method of “dry” loading and unloading live fish in thatafter collecting the fish from the cages in the sea, it separates them from the water and enters them into a hold-pond that contains seawater in ideal conditions to receive them and keep them in good condition during transport.

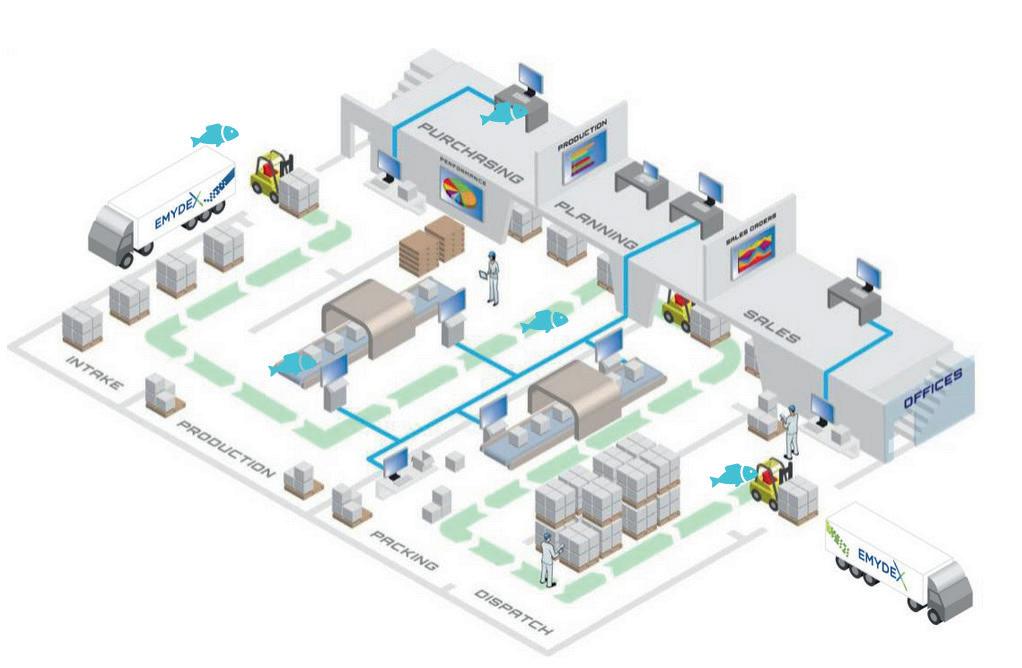

FOOD processing machinery and solutions specialist BAADER has acquired a majority stake in EMYDEX Technology. EMYDEX is an international leader in the provision of scalable Manufacturing Execution System (MES) software for the food processing sector.

In a joint statement, the two parties said: “Combining the strengths of both companies will mean enhanced digital capabilities for BAADER and accelerated growth and market reach for EMYDEX.”

EMYDEX was founded in 2004 in Ireland and has since expanded into a global concern, marketing a scalable MES software solution that addresses the challenges of process management in the food industry. Now, its toptier solution is integrated in food processing facilities across Canada, New Zealand, Australia and South Africa.

BAADER Global SE, headquartered in Lübeck, Germany, develops innovative and holistic solutions for food processing at all stages. With 30 subsidiaries in Europe, the USA, China, South America, Africa and Asia, BAADER employs 1,600 people in more than 100 countries.

David McMahon and James Grennan of EMYDEX, CEO and CTO respectively, will continue as shareholders and will retain their executive roles.

Petra Baader, CEO of BAADER Global SE, says: “This significant step promises to enhance our portfolio offerings. As a crucial strategic pillar for the BAADER Group, digitalisation will be significantly strengthened through this acquisition, promising increased value for our customers in the future. The impressive track record of EMYDEX and its reputation within the food industry make it an ideal fit for BAADER.”

McMahon says: “As demand for EMYDEX’s solutions continued to grow – particularly from large-scale global customers with multiple plants – we

knew we needed to fund the growth opportunity. BAADER, with its similar culture and ethos, as well as the access it provides to new markets, was the ideal partner to help bring EMYDEX on the next stage of its journey. We’re very excited to work with the BAADER team to realise our collective plans for growth and innovation over the coming years.”

SALMON and salmon-based products have made a strong showing in the shortlist for the Scotland Food & Drink Excellence Awards 2023.

St James Smokehouse’s smoked salmon pure royal fillet, Belhaven Smokehouse’s Belhaven cured cold smoked salmon and Bakkafrost Scotland’s native Hebridean

Scottish salmon are all in the running in the Fish & Seafood Products Category.

They’ll be up against Campbells Prime Meat (Orkney hand-dived scallops) and the WeeCOOK Fishwife Pie.

Belhaven Smokehouse’s charcoal smoked salmon and Salar Smokehouse’s flaky smoked salmon are also shortlisted for Artisan Product of the Year. The judging panel is made up of decisionmaking buyers, influencers and chefs from across the food and drink sector.

The winners in all categories will be announced at a gala dinner at the Edinburgh International Conference Centre on Thursday 7 September, hosted by Fred Sirieix, star of Channel 4’s First Dates reality TV series.

To see the complete shortlist for the 2023 awards, visit excellenceawards.foodanddrink. scot/2023-shortlist

“ We knew we needed to fund the growth opportunity ”Below: EMYDEX technology Bottom: Petra Baader Left: Smoked salmon dish

NORWEGIAN exporter Coast Seafood has reported a 14% increase in its turnover to NOK 6.4bn (£475m) for last year.

In January this year, it bought the Danish company Vega Salmon for an undisclosed sum and it is reported that part or all of Vega’s performance has been included in the accounts.

Vega Salmon produces around 25,000 tonnes of salmon a year and has an annual turnover equivalent to around £150m. The company sells fresh and frozen salmon, cold and hot smoked, and marinated salmon as well as value-added products and salmon off-cuts.

At the time of the acquisition, Coast Seafood CEO Sverre Søraa said: “With Vega as part of the Coast family, we will be well positioned to increase sales of processed salmon to the global market.”

With locations in at least three Norwegian centres, Coast exports fish to more than 400 mainly small and medium customers, and 80 different markets around the world. These include around 50 fish farmers. Its products include a wide variety of fish including salmon, trout, cod, haddock and pelagic species such as mackerel.

Operational profit or EBIT increased by almost 23% to NOK 111.8m (£8.6m). The operating margin was also higher.

Søraa also said the higher sales were making the company more cost effective, adding that the industry was changing, which will eventually lead to further acquisitions.

interaction between small- and medium-sized businesses would become even more necessary, and Coast would continue to contribute with creative and innovative marketing for these businesses, Coast’s statement added.

pumping system, a bespoke modification meaning there’s a seamless transition from water to ice, resulting in safer and more humane processing of fish, safer staff and greater efficiency across the harvest.

Ace Aquatec’s stunner technology was installed with the help of Australian distributor Fresh by Design.

in so many respects. We want to lead the way in fish welfare in a commercial setting and this has helped us to be at the forefront of highwelfare production of this iconic Australian fish.”

AN Australian Murray cod farmer has transformed its slaughter process with a humane stunner from technology business Ace Aquatec.

Aquna Sustainable Murray Cod, based in New South Wales, installed a trailer-mounted in-water stunner in a bid to reduce fish stress.

Despite its name, Murray cod (Maccullochella peelii) is a freshwater, river-dwelling fish and no relation of the Atlantic cod. Aquna Sustainable Murray Cod supplies premium, pond-grown fish, which has increased in popularity in recent years, situated in a remote and challenging landscape.

Aquna was looking for a solution that enabled them to harvest these unique fish in a more efficient and ethical manner, and opted for Ace Aquatec’s in-water stunning technology.

The in-water nature of Ace Aquatec’s humane stunner solution no longer requires Aquna to use percussion stunning techniques, which can be stressful for fish and the staff who handle them. The bespoke solution also means that live fish are no longer transported over long distances, which was stressful to fish and required the use of large vehicles. The trailermounted stunner is integrated to Aquna’s

Mat Ryan, Managing Director of Aquna Sustainable Murray Cod, said: “Our sites are spread across 200km so the tailored solution offered by Ace Aquatec has allowed us to integrate with a mobile trailer to harvest on site at a time that works for us, which has made a huge difference to us in terms of welfare and fish quality, not to mention the vast reduction in on-road transport and consequent environmental impact.

“Aquna Sustainable Murray Cod has big growth plans, but only if this is done in a high-welfare, high-quality way, which the installation of the stunner allows us to do

Aquna said that the introduction of the new stunner had also made production more efficient. The company aims to scale up to producing 10,000 tonnes annually by 2030. It has already produced 4,000 to 5,000 tonnes this year.

Tara McGregor-Woodhams, CSMO of Ace Aquatec, said: “Mat and the team at Aquna Sustainable Murray Cod have shown strong leadership in the way Australian fisheries approach high-welfare fish production, enhancing their quality and welfare-first promise to their customers.”

Above left: Mat Ryan

Below: The Aquna farm

The

By Dr Martin Jaffa

By Dr Martin Jaffa

Now that the Scottish Government has abandoned its current attempt to impose HPMAs (highly protected marine areas), or at least has gone away to reconsider a more appropriate policy, perhaps other planned measures should be given similar consideration.

The obvious choice is the proposed sea lice risk framework which the Scottish Government has decided is the best option for the regulation of the salmon farming industry whilst protecting wild salmon and sea trout along Scotland’s west coast. However, as with HPMAs what the Scottish Government thinks and the reality are two very different things. The Scottish Government policy has been formed following many years of whingeing and whining by salmon anglers who have mistakenly blamed the decline of wild salmon stocks on the arrival of salmon farming. Their unfounded claims are based on some limited circumstantial evidence, supported by some very selective theoretical science.