F ish F armer

OCTOPUS

Is this the next farmed species?

INNOVATION

The Blue Food and SAIC summits

Feed

Aquafeed case studies

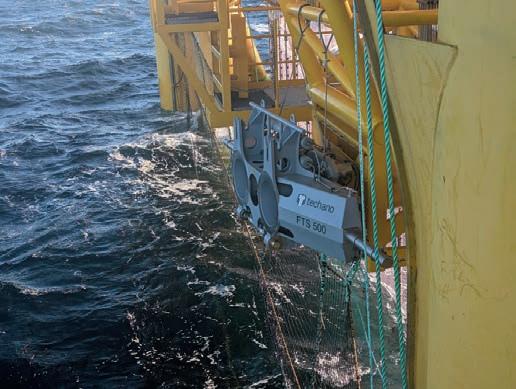

Subsea technology

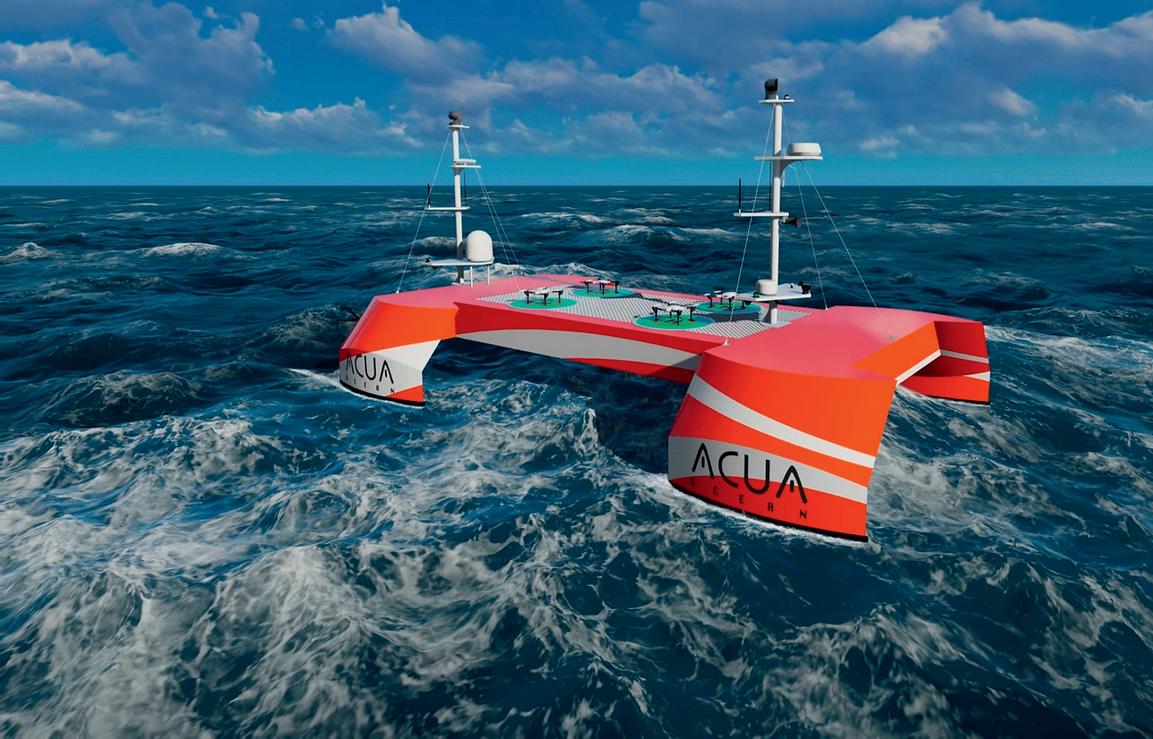

Rise of the robots

Is this the next farmed species?

The Blue Food and SAIC summits

Aquafeed case studies

Rise of the robots

Bring confidence to your net cleaning job, with the most reliable pump on the market.

NLB’s high-pressure water jet pumps are proven reliable for offshore and onshore net cleaning. Engineered specifically for the aquaculture market, they withstand the harsh conditions of open seas, foul weather, and salt corrosion, all while delivering the same performance and durability NLB has been recognized for since 1971. Our units also offer a compatible interface with the industry’s leading head cleaning systems.

NLB will go the extra mile to make the switch easy for you. Contact us today to discuss your options!

evidence-based regulatory approach to protect young salmon as they leave rivers and begin their journey to feeding grounds in the north Atlantic.

The Scottish Government’s Wild Salmon Strategy, published earlier this year, aims to build resilience and transform the fortunes of wild Atlantic salmon through coordinated action to manage pressures in rivers and coastal waters, including the effects of climate change, barriers in rivers to migration, diffuse pollution, fish diseases and sea lice from fish farms.

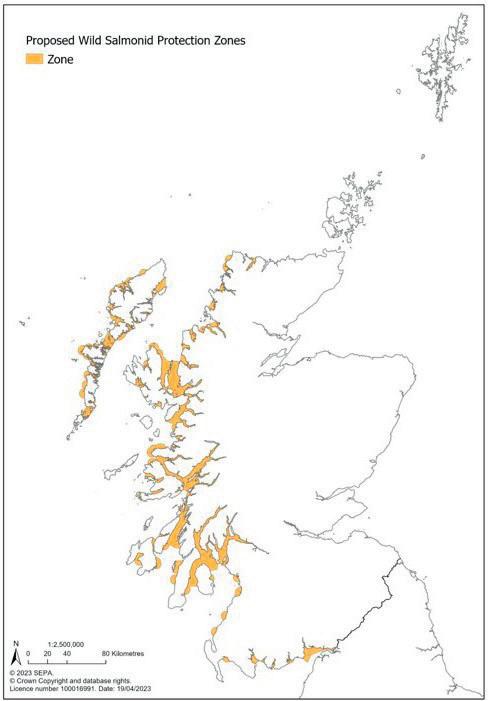

THE Scottish Environment Protection Agency (SEPA) has published more information on the zones where it believes sea lice pose the highest risk to migrating wild Atlantic salmon.

SEPA is consulting on the latest stage of its sea lice control measures, setting out a network of wild salmon protection zones in migration bottlenecks in coastal waters on the West Coast and Western Isles, such as sea lochs and sounds.

The Agency says the proposed zones would not be no-go areas for fish farms, but farmers operating within them all proposals for new finfish farms or increases in fish numbers at existing farms that could affect protection zones will be subject to risk assessment and appropriate permit conditions.

Farms in the areas identified could also be subject to tighter controls regarding sea lice monitoring, with stricter thresholds than in other areas.

Peter Pollard, Head of Ecology at SEPA, said: “The science is clear that Scotland’s wild Atlantic salmon populations have seriously declined over the last few decades and are now at crisis point. Safeguarding the future of Scotland’s ‘king of fish’ requires coordinated action and a broad range of interests working together to manage all the pressures they face in rivers and coastal waters, from climate change to migration barriers and sea lice.

“As Scotland’s environmental watchdog, SEPA’s new responsibilities on managing the risk to wild salmon and sea trout from sea lice offer an opportunity for a fresh, proportionate and evidencebased approach to working together on the shared challenge.

“Our modelling of wild salmon protection zones, built on international best practice, uses cutting edge science to triage risk and specifically builds in opportunities for additional modelling, monitoring, engagement and adaption. It does not lock in or out development in any area. What it might mean is farms in higher risk areas implementing tighter but achievable levels of sea lice control, with the sector having a good track record in innovating and adapting.”

SEPA said the second consultation, which follows an initial 2021 consultation and engagement with a range of stakeholders, outlines a proportionate,

Peter Pollard added: “We’ve worked hard to date to listen to a broad and often diverse range of views on the future regulatory landscape to support wild salmon. We understand views can be polarised and we’ll continue to listen during this further consultation, which we’re extending to ensure we hear directly from all those who share an interest in the framework and the future of wild Atlantic salmon.”

A series of workshops will be hosted with stakeholders during June, July and August 2023.

Detailed proposals for a risk-based, spatial framework for managing interaction between sea lice from marine finfish farm developments and wild salmonids in Scotland is available to view online. The consultation closes on 15 September.

INDUSTRY body Salmon

Scotland has welcomed a report which is calling for a major reform of skills training in Scotland.

The report, Independent Review of the Skills Delivery Landscape, was commissioned by the Scottish Government and led by James Withers, former Chief Executive of Scotland Food and Drink. It makes 15 recommendations to help reach targets for economic transformation, including:

• the creation of a new single funding and delivery body, bringing together functions from Skills Development Scotland (SDS), the Scottish Funding Council (SFC) and, possibly, the Student Awards Agency Scotland (SAAS);

• giving the enterprise agencies a clear remit for supporting businesses, with workforce planning as an embedded and integrated part of business development and planning;

• ensuring there is a clear remit for the new qualifications body – the

successor to the SQA - in overseeing development and accreditation of all publicly funded post-school qualifications;

• moving responsibility for national skills planning to the Scottish Government;

• reform of SDS to create a new body with a singular focus on careers advice and education.

Tavish Scott, Chief Executive of Salmon Scotland, said: “The salmon sector, Scotland’s leading food export,

welcomes this well-argued case for change on skills businesses need.

“Our sector is responsible for creating thousands of high-paid, skilled, and rewarding jobs right across the country.

“We want to help the next generation of young people and are a leading provider of modern apprenticeships and other training opportunities.

“But the current approach does not work as effectively as it should.

“We hope the Government will embrace the recommendations, take the views of business and growth sectors such as ours, and move to implementation.”

Graeme Dey, Minister for Further and Higher Education in the Scottish Government, thanked James Withers and said: “I am supportive of the broad direction of travel James Withers identifies but will take a little time to consider fully the detail of the recommendations and the practicalities of implementing them.”

MATILDA Lomas has been promoted to the post of Veterinary Practice & Cleanerfish Manager at Bakkafrost Scotland. She was previously Biology & Cleanerfish Co-ordinator with the company.

Lomas joined the company in 2014. She is also a member of the Advisory Board of Women in Scottish Aquaculture (WiSA) and a Membership Engagement and Communications Lead Volunteer with Girlguiding Scotland.

AQUACULTURE support business Gael Gorce Group has promoted Craig Graham to the newly created role of Customer Service Director. He brings more than a decade of experience working with the company, and will lead the delivery of a major strategic commitment to establish a sector-leading standard of service and support for Gael Force’s aquaculture customers.

He said: "We have always taken pride in offering what we hope is considered a high level of customer service and fast response times. The challenge to ourselves is to elevate that level even further."

INDUSTRY body Seafood Scotland has appointed Jeni Adamson as Industry Engagement Manager. She joins Seafood Scotland after six years working for land-based and environmental skills body sector Lantra.

Jeni will support Seafood Scotland in strengthening

relationships with key stakeholders across the entire supply chain of Scottish seafood, including the organisation and planning of the Responsible Seafood Summit which will be held in St Andrews in October 2024.

CLEANTECH fund Earth Capital Limited has backed aquaculture technology business Ace Aquatec, joining Aqua-Spark and Chroma Ventures as an investor in the company.

The sum invested has not been disclosed. Ace Aquatec said it would use the injection of capital to grow its current portfolio of products and markets.

As part of the deal, Bradley Jones, Senior Investment Manager with Earth Capital, is joining the Ace Aquatec board.

Wider changes to the board see Chris van der Kuyl CBE appointed Chair and Nina Santi joining the board as a non-exec director. Chris van der Kuyl is Principal of existing investor, Chroma Ventures and Nina Santi is also a senior advisor at INAQ AS, a business strategy advisory firm specialising in the seafood industry.

Earth Capital’s Bradley Jones said: “We are excited to be partnering with Ace Aquatec, a key player in the aquaculture industry, on the next stage of its development journey. Championing sustainable practices and setting high welfare standards paves the way to ensuring that seafood farming becomes one of the biggest opportunities to responsibly feed a growing population. Sustainable farming aligns perfectly with Earth Capital Limited's mission to advance technology within the energy, food, and water sectors while driving towards a net-zero future."

Nathan Pyne-Carter, CEO of Ace Aquatec, said: "Earth Capital Limited shares our outlook and passions – namely, the critical importance of technology to drive sustainable food production. Together we can tackle one of the world’s most pressing issues by providing sustainable and responsible protein for a growing world population. The team’s support and expertise will help us scale the business and take another huge step forward in the development of high-welfare products for the global seafood industry. We are also excited to welcome Bradley Jones to our board, whose deep knowledge and strategic insights will be invaluable in guiding our future growth."

The Dundee-based supplier of global aquaculture solutions has raised over £10m since its series A investment with Aqua-Spark and Chroma Ventures. Ace Aquatec has already shown strong growth in key markets including the UK, Europe, Canada, South America, and South East Asia and will use part of this additional capital to expand its presence and distributor networks in these markets. It will also provide a recruitment boost, with 10 jobs expected to be created including Engineering, Software and Sales support roles in Dundee and Chile.

The investment will also enable the acceleration of the firm’s development in innovative aquaculture technology solutions, including its Biomass Camera which has recently started production following successful trials. This underwater camera is designed to detect and quantify fish biomass automatically. It uses machine learning and artificial intelligence (AI) to produce accurate, real-time data on a range of fish species populations and distributions.

TRIBUTES have been paid to Neil Manchester, Managing Director at Kames Fish Farming, who passed away suddenly last month.

Manchester, who was 59, was appointed as Managing Director-designate at the trout farming buisness as from August 2021, and succeeded the company’s founder Stuart Cannon as Managing Director in February 2022, when Cannon took up the role of Chairman.

In an announcement on LinkedIn the company said: “Neil Manchester died very suddenly at his home on Sunday. Our hearts go out to his wife and two children, we offer them all our thoughts and condolences at such a difficult time.

“It is a huge shock to everyone at Kames, as we’re sure it is to all of you who have known and worked with Neil. He was a much-loved leader, colleague and friend, who has added so much to our business.

“He has driven Kames forward in strategy, communication, team empowerment, marketing nous and industry expertise over the past two years, helping us to thrive and shaping our future. Most of all he had an absolute passion for our values, our

community and our staff. We will carry on his vision and honour his great investment and commitment to us all.”

Neil Manchester brought more than 35 years’ experience in aquaculture, having started out at the company in 1985, before moving to Landcatch in 1998 and then Hendrix Genetics in 2011. As Managing Director of Aquaculture at Hendrix Genetics he was instrumental in developing the business as a global leading player in the aquaculture breeding sector. He was well-liked in the industry, and former colleagues and associates have already offered their own condolences.

Tavish Scott, Chief Executive of Salmon Scotland, said: “He was a bundle of ideas, common sense and humour. A real person of the seafood family.”

Keith Drynan Managing Director, Aquagen Scotland, described Neil Manchester as: “A gentleman who will be sadly missed in the industry.”

Chris Wallard, CMO and COO of Xelect said: “He was, we all agree, ‘one of the best ones’… we will miss him, and I will always remember him as one of the legends of our industry.”

See Obituary, page 17.

SCOTTISH salmon producer Mowi has denied it wants to gag a campaigner by banning him from its fish farms, in a civil case heard at Oban Sheriff Court on 1 June.

Mowi Scotland Ltd is pursuing an interdict to prevent environmental activist Don Staniford coming within 15 metres of its fish farms.

Acting for the defender, Don Staniford, advocate Simon Crabb called for the "ridiculously extravagant" action to be dismissed.

"Mr Staniford is a journalist and carries out watchdog functions," he said. "A picture tells a thousand words. Images do not lie.

"His source material informs mass media and welfare complaints.

"There is a necessity. There is a public interest. There is a genuinely held belief, which gives him right to investigate what he believes is unlawful practices.

"Mr Staniford is trying to expose unlawful conduct. He is there to protect the fish.

"It is not the case that journalists say 'okay we will leave it up to the authorities', especially with a vulnerable population. Wildlife do not have a voice.

"They require someone like Don Staniford to do that lawfully, which the law in Scotland allows him to do.

"The defender's ability to inform the public depends on his access to the waters where the salmon farms are located.

"His lawful authority comes from his right to navigate the public waters and do any act that is incidental to that.

"Mowi have employed an excessive restriction on the freedom of navigation.

"Any presence has been passive and temporary. He does not attend in large

numbers. He attends with journalists.

"Potentially we could have kayakers and yachters being told by Mowi to stay off the water and keep the cameras away.

"The pursuer in this case seeks to protect itself from reputational damage."

Mr Crabb said installing cameras on the pens "would put the issue to bed".

Acting for the pursuer, Mowi Scotland Ltd, Jonathan Barne KC said: "My learned friend is throwing everything at the court in the hope something sticks."

He summed up Mowi's argument: "We own the stuff and people should not be able to come onto it.

"We have eight individual incidents of where the defender has tethered his boat to the pursuer's equipment and boarded." Mr Staniford, he said, had also deployed a camera underwater.

"If there was a yacht in the Firth of Forth, he would be entitled to tether his boat to the yacht and board the yacht. That simply cannot be right.

"The public has a right of navigation to sea lochs and rivers. It gives them a right from A to B. It does not give them the

right to every inch.

"There is no evidence an interdict would prevent the defender from navigating from A to B.

"Issues of proportionality or necessity do not arise, as there is a trespass, and may be a reasonable apprehension of trespass.

"We have a highly regulated industry," Mr Barne said. "There is a voluntary code, managed by Marine Scotland, where operators publish monthly mortality rates.

"Having a camera affixed to some pens is going to be far less useful than the information that is already available.

"It is not for the pursuer to modify and pay for equipment in order to satisfy the defender's curiosity.

"The pursuer is attempting to keep the defender off the equipment and a 15 metre allowance so there is not damage to himself or the equipment.

"The working environments can be potentially hazardous," he said. "To have third parties gaining access, with safety protocols, is simply not acceptable.

"We are not seeking orders against the public. The public at large have not on numerous occasions boarded the equipment of the pursuer.

"We are not trying to gag what is said by Mr Staniford. That is not the reason for this, and it is certainly not accepted."

In reply, Mr Crabb concluded: "He said Mowi's intention is not to gag Mr Staniford. Whether they intend it or not, that is the outcome."

Thanking the advocates, Sheriff Andrew Berry said: "I am going to reserve my decision so I can reflect on what I am told and submit a decision in writing."

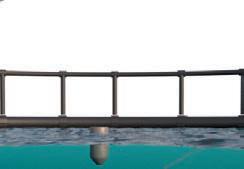

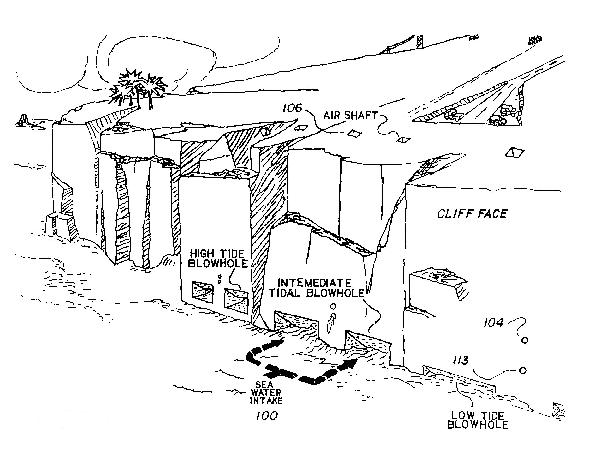

Gael Force Group has named its partners in a project aimed at developing a ground-breaking semi-closed containment solution for fish farmers.

Gael Force’s SeaQureFarm is a semi-closed cage structure which aims to keep fish safe from pathogens and predators, and allow for the collection of waste, while at sea.

The Scottish-based company will be working with Cunningham Covers, a Northern Irish manufacturer specialising in protective covers and containment, and with Italy’s Serge Ferrari, a global leader in flexible composite materials.

The SeaQureWell, an integral element in the SeaQureFarm, is an arrangement

where seawater is pumped and pushed into a floating enclosed “well” with its floating collar at the sea surface.The collar supports the Well and its pumping arrangements which lifts deeper coastal water into the well, creating an in-well temperature profile that is warmer in the winter and cooler in the summer.

The SeaQureWell will be constructed of engineered high-quality composite membrane material, cut, and welded to form the “Well”, with structural flotation at the surface and a rigid sub-surface service and support structure. It aims to provide and maintain a secure controlled environment to safeguard healthy growing fish against external environmental threats

to the fish from sea lice, gill amoeba, jellyfish and algae bloom as well as protect against sea mammal predation.

Additionally, faecal depositions along with any uneaten food will be captured in the “Well” for on-site recovery.

Cunningham Covers produces and supplies a range of specialised cover products for aerospace, offshore, and aquaculture applications, including freshwater treatment bags, fresh-water storage bags, lice skirts, and other custom products.

Gael Force Group Managing Director, Stewart Graham, commented: “By announcing this next major step forward in the development of SeaQureFarm, we continue to demonstrate our commitment to the continual improvement of a greener, carbon-friendly way to sustainably produce a healthy, nutritious food protein. "

SALMON farmer Mowi is consulting with the local community on plans to switch the former Dawnfresh trout farm sites on Loch Etive to growing post-smolt salmon.

Mowi acquired Dawnfresh Farming Ltd in February this year, after Dawnfresh was placed into the hands of administrators in 2022. The Dawnfresh farming operations include three hatcheries, three freshwater sites and four seawater sites. Mowi Scotland currently operates the Dawnfresh Farming company as a separate business.

The Dawnfresh sites in the brackish waters of Loch Etive, have been used for raising rainbow trout. Now Mowi – which is exclusively a salmon producer – proposes to use them to grow smolts to a larger size before they are transferred to sea cages.

Mowi said: “The proposed post-smolt programme will realise a number of benefits

for the salmon as well as Loch Etive and the surrounding environment”.

Typically, smolts are moved directly from freshwater hatcheries and lochs to seawater sites at a size of about 130 grams, where they are grown for 18-24 months before harvest. With post-smolt salmon, they are moved to sea when they are larger and more robust at a size of up to 1.0 kg. This reduces the on-growing time at offshore sea sites to 12 months, avoiding a second summer of warm temperatures and resulting algae blooms –as well as micro-jellyfish – that can create significant health challenges for large salmon. The lower salinity in Loch Etive also means a lower sea lice population.

Mowi said that the move to post-smolt production will mean that fallow periods can be synchronised throughout the whole loch system, which will also help to keep sea lice

numbers down.

Mowi has also announced the appointment of Clara McGhee as Area Manager of Dawnfresh operations. Previously Farm Manager at Mowi’s 3500 tonne salmon farm at the Isle of Muck, she holds an undergraduate degree in Sustainable Development and a Masters in Sustainable Aquaculture from Stirling University.

THE Aquaculture Stewardship Council has logged record growth in ASC certification in the UK, with the number of certified farm sites doubling since February 2022.

Forty farm sites are now ASC certified in the UK, including finfish and shellfish producers. A further 18 farms are in the initial audit stage with a view to being certified by the end of 2023.

From January 2022 to January 2023, 16 more companies became ASC Chain of Custody holders – up from 88 at the start of the period. As of March 2023, there are 139 UK Chain of Custody holders.

Lorraine Gallagher, ASC UK and Ireland Market Development Manager, said: “We are delighted

to see such an increase in the number of farms and companies in the UK joining the ASC programme or becoming ASC Chain of Custody holders. We know that market demand is driving this increase and we expect even more farms and companies to take up this opportunity over 2023 and beyond”.

The ASC standards for aquaculture industry include requirements covering the potential impacts of the farms on the environment, workers, animal health and the surrounding communities.

Bakkafrost Scotland recently achieved ASC certification for four salmon farms in Scotland in 2023.

Ian Laister, Managing Director

at Bakkafrost Scotland, said: “ASC develops and manages some of the strictest quality standards in the industry, increasingly sought after by customers. includes requirements covering aspects such as water quality, responsible sourcing of feed, animal health, fair working conditions and maintaining positive relationships in our communities in which we live and work.

“Bakkafrost Scotland is very much aligned to this level of quality control and inspection and happy to be working with the ASC team to develop the scheme across our business in Scotland.”

In the UK alone, demand for ASC labelled consumer products rose by 62% in 2022.The UK is trending above the global average annual increase of 14%.

THE proposed new RAS salmon farm in Grimsby, on England’s North Sea coast, will be one of the most technically advanced of its type, the company behind the project said yesterday.

Neil Jamieson, director and founder of Aquacultured Seafood told Fish Farmer that there would be extensive use of artificial intelligence (AI) in its operation. The company is engaging the Israeli company AquaMaof to handle the RAS (recirculating aquaculture system) technology.

Aquacultured Seafood was in Grimsby yesterday to outline its plan, meet local residents living near the site and attempt to allay any fears they may have.

The event was held at the Grimsby Fishing Heritage Centre, the town’s award winning museum depicting the history of the fishing industry.

Up to about 50 people are thought to have shown up for the consultation which turned out to be a friendly encounter, although there were one or two “stop salmon farming” placards outside the building.

Canadian born Jamieson said the company spent three years looking at potential sites around the UK and visiting other RAS farms abroad.

It will be the UK’s first major salmon farm outside Scotland and the first to use RAS technology for grow-out production. Jamieson said he believed RAS to be the way forward and was now being adopted across the world

Why Grimsby? “Because of its access to fresh water and because of ABP’s (Associated British Ports) belief in using renewable energy,” he said to Fish Farmer.

“We were also enthused by the history of Grimsby and the fact that it has excellent support services in refrigeration, logistics and other important matters.”

He also thanked Young’s Seafood, which has its main production sites close to the site, for its “great support”.

The £75m project will create around 100 full-time jobs plus many others from

businesses supplying support services.

He said the expected timeline to the first harvest was broadly three to four years. A formal planning application will be submitted in the next few weeks and (if approved) this will be followed by six months to finalise the plans, 18 months for construction and a final 18 months to the first harvest.

Aquacultured Seafood’s market will be in the UK, Jamieson said: “We will be producing 5,000 tonnes of salmon a year against total UK consumption of 160,000 tonnes, which is really a drop in the ocean.”

Describing it as a game changer for the town’s seafood sector, another director, Mike Berthet, assured members of public attending the meeting that there will be practically no noise and no smells from the site and waste products would leave in sealed containers.

Peter Dalton, co-founder and director of the Grimsby Seafood Village project told Fish Farmer he thought the facility will be “absolutely brilliant” for the town’s economy, adding: “Some of the arguments being used by opponents were the same as those being used against us when we wanted to build our seafood business park.”

ON 31 May, the Norwegian Parliament voted in favour of the government’s controversial new “ground rent” tax, which will be levied on much of the country’s salmon industry.

The decision on the new tax – also known as the “salmon tax” – came after a lengthy and often fractious five hour debate in the Storting, as the Parliament is known. The vote was passed by 93 to 76 votes – a majority of just 17.

Even though the rate has been cut from the original budget proposal of 40% down to 35% and finally 25%, it effectively doubles the previous tax burden on the coastal salmon and trout farming companies when combined with existing taxes. Landbased salmon farms and small coastal farms are exempt.

Billions of kroner were wiped off the value of salmon company shares on the Oslo Stock Exchange immediately following the vote.

The outcome represents victory for Prime Minister Jonas Gahr Støre’s Labour-Centre party coalition, which has faced a barrage of criticism from the industry, opposition parties and business commentators since the plan was first announced in the national budget last September.

Right up until the last it looked as if the vote might be won on a majority of one after a late decision

by the Liberals – and the single seat Patient Focus party – to back the government.

Patient Focus was formed two years ago to promote the building of a new hospital in the Finnmark town of Alta. It won one of Finnmark’s five parliamentary seats through Norway’s proportional representation voting system.

The government won additional support when the far left Red (“Rodt”) party’s decided to back the 25% rate, even though it had wanted a far larger tax take from salmon companies. Rodt has nine sitting members in the Storting.

Other measures voted through at the same time included increased funding for coastal salmon farming communities, stronger environmental controls and an increase in the wealth tax valuation discount from 50% to 75% (which mostly affects privately owned salmon businesses).

Just days afterwards, salmon producer Mowi said that it had dramatically cut back on investment worth at least NOK 5bn (£367m), citing the new tax as the reason.

The company broke the news to the newspaper and media outlet

vg.no, saying it planned to call a halt to significant investment in its post-smolt strategy in Norway.

Mowi CEO Ivan Vindheim told vg.no that the company would stop the building of seven facilities along the entire coast.

So far Mowi has reacted more strongly against the tax than most of the other large salmon farmers, but they too look likely to go down the same path on future investment.

Vindheim said: “Unfortunately, it [the new tax] has consequences for the supplier industry.

“The Storting majority has imposed a tax on us that amounts to more than double, on top of the tax we already pay.

“This means that our funds for investments decrease accordingly. So we have to adapt our plans based on the increased cost picture.”

Meanwhile, Conservative party leader Erna Solberg, who is widely tipped to return to power in 2025, has said that if re-elected, she would cut the tax rate to 15% and then study other systems including the Faroese model. The latter is regarded by in the industry as fairer, because it takes market prices and production costs into account.

SEVERAL leading Icelandic salmon farmers have come together to form a new industry group.

The 10 initial members include some of the biggest names in the business such as SalMar owned Arnarlax and Mowi’s Arctic Fish, Samherji and Benchmark Genetics

Iceland.

Called the Iceland Aquaculture and Oceans Forum or IAOF, its aim is to support the sustainable growth of the country’s rapidly expanding aquaculture sector.

IAOF says it will be a non profit organisation acting as a platform for the for international cooperation and dissemination of knowledge about marine aquaculture, both at sea and on land.

It will also talk about the challenges related to climate change and exploitation, and other features of fundamental importance for the sustainable development of the marine aquaculture sector in Iceland.

It also plans to use its experience and knowledge to establish partnerships with leading international institutions, research institutions, NGOs, universities, associations, clusters, companies and other stakeholders who can help understand and find solutions to the many challenges facing the sector today.

The new organisation said it plans to “participate in the work of creating new meeting places for ocean-related and land-based aquaculture farming themes and the global aquaculture industry”.

It also intends to generate knowledge about global ocean and land aquaculture, targeting various governments, business and international organisations.

Some of this will be done by meeting with the media and institutions to enhance the understanding of the industry.

The group’s first chairman is Kjartan Olafsson (pictured) who is also chairman of Arnarlax.

SALMON farmers in the Faroe Islands are facing sizeable increases in their tax bill, it emerged yesterday.

The Faroes’ largest fish farmer, Bakkafrost, has revealed that the Faroese parliament has finally approved a new law which will see some rates double at the top end. Details of the scheme became public earlier this year.

Bakkafrost said: “A total of nine different tax rates can be applied, dependent on the difference between the monthly FishPool Index prices and the average production cost for the Faroese salmon industry.

“The average production costs will be assessed twice a year.The applicable tax rate range from 0.5% to 20.0%.

As previously reported, the proposal consists of nine tax rates which range from 0.5% to 20%, calculated around the relationship between the “FishPool” price index and production costs.

At the highest level, the rate will be 20% if the FishPool price exceeds the equivalent of NOK 119 per kilo (£9.29)

which is the price Norwegian buyers were paying for the best quality fish last week.

Bakkafrost said in its first quarter report last month that when the rates became known it would revise its investment plan accordingly.

The Norwegian government which is forcing a new ground rent tax on its salmon farmer has rejected calls to switch to a Faroesstyle model.

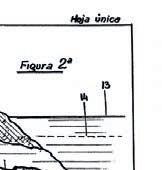

The formula by which the tax will be calculated is shown below:

INTERNATIONAL investment group

Goldman Sachs Asset Management has bought the wellboat and aquaculture support business Frøy, it was announced earlier this month.

The news ends considerable industry speculation about this highly successful business, which was part of the NTS group acquired by the salmon farming giant SalMar last year.

However, Frøy did not fit with SalMar’s core business of salmon farming and a sale was always on the cards.

The announcement said the acquisition is at a price of NOK 76.50 (around £5.30) per share, and entails a total consideration for all the shares in Frøy of approximately NOK 6.6 billion (£482m).

It means Goldman Sachs is paying a total of NOK 4.8 billion (£350.8m) for SalMar’s shares in Frøy.

Tavis Cannell, Global Co-Head of Infrastructure within Goldman Sachs Asset Management said: “We are excited to be able to invest in Frøy, as one of the leading companies providing missioncritical transportation and support infrastructure to the aquaculture industry.

“Wellboats and service vessels are vital to enabling best-in-class farming practices and Frøy is at the forefront of driving sustainability. We look forward to partnering with Frøy and its management team, employees and long-standing customers in supporting long-term growth and value creation.”

SalMar CEO Frode Arntsen said: “We are pleased to have successfully completed the strategic review in Frøy

announced earlier this year.

“Following a constructive process and after reaching a final agreement we believe we have found the best solution, not only for the SalMar group, but for all shareholders in Frøy.

He added: “Following a successful process with many highly reputable interested parties involved, we have found a buyer for the shares in Frøy who we believe is a good fit and will be a strong partner for Frøy in the future.”

Frøy said: “We are pleased that Goldman Sachs Asset Management is becoming a strategic partner to us to further strengthen Frøy as a leading integrated provider of aqua services to fish farmers.

“By leveraging Goldman Sachs’ capital, expertise and network, Frøy will be well positioned to develop the business with the intention to continue the sustainable growth of the Company. The team is excited for the next phase of developing the Frøy group.”

The deal is expected to be completed by the end of the summer.

AQUACULTURE biotech group Benchmark saw its revenues for the six months to 31 March 2023 go up, year on year, by 25% to £98.9m.

The period, the first half of the group’s current financial year, also saw a 39% increase in adjusted EBITDA to £22.1m (H1 FY22: £15.9m). Benchmark’s financial accounting pre-tax loss was cut to £1.9m (H1 2022: loss of 5.1m. The figures are unaudited.

For the second quarter of Benchmark’s 2023 financial year, the company recorded revenues up 13% to £44.4m and adjusted EBITDA up 32% to £11.1m (Q2 FY22: £8.4m).

Benchmark’s Genetics arm recorded H1 FY23 Revenues at £34.5m, up 30%. This was driven by higher salmon sales from Norway and Iceland, the company said, with 181m salmon eggs sold (H1 FY22: 134m). Benchmark noted “continued commercial progress” in Chile with new customer wins and an endorsement from the Chilean regulator conferring “disease free compartment status”, which will enable the company to export salmon eggs from Chile.

The Advanced Nutrition business turned in a strong performance with revenues at £45.3m (up 8%) despite “soft” shrimp markets, while Health, benefiting from the commercial rollout of the combined Ectosan and CleanTreat lice treatment, recorded revenues of £19.1m, an increase of 78% year on year.

The company said the group was set to meet market expectations for 2023.

Meanwhile Lene Stokka, Catrine Smørås, and Ruben Helmersen Johansen have joined Benchmark’s commercial team for salmon. The change, a combination of promotions and position restructuring, is part of a planned strategic initiative to further strengthen the company’s customer support, following Kate Furhovden Stenerud assuming the role of Commercial Director for salmon at Benchmark on 1 May.

Lene Stokka and Catrine Smørås have been working as Fish Health Specialists in the technical department at Benchmark Animal Health since 2021, while Ruben Helmersen Johansen has been employed as a trainee in the marketing team since August last year and has now been given a permanent position as a Sales and Technical Associate.

A further decline in the value of the krone was the major contributor to another increase in the value of the country’s seafood exports last month, according to the Norwegian Seafood C ouncil.

T he seafood export total for May 2023 was NOK 13.1bn (almost £1bn), a rise of 7% or NOK 816m (£60m) on May last year.

One pound sterling will buy around NOK 13.6 today compared with around NOK 12 a year ago. Farmed salmon accounts for 70% of the country’s overall seafood exports.

Seafood C ouncil CEO C hristian C hramer said that, as happened in April, there was another significant currency effect last month: “ T he weak Norwegian krone alone contributed to an increase in value of around NOK 1.5 billion last month.”

“Without this currency development, there would have been a decline in export value. T he market situation has now become more demanding,” he added.

C hramer said that measured in euros, the export value fell by 8% in May, while measured in dollars it fell by 5%, compared to

May last year.

“T he re-opening after the corona pandemic and a subsequent high inflation all over the world have contributed to raising global food prices in the past year.

“Together with the weak Norwegian krone, this has resulted in a strong increase in the value of seafood exports.”

So far this year, NOK 67.5 bn (almost £5bn) worth of seafood has been exported, a growth of NOK 9.9bn (£722m).

Seafood C ouncil analyst Paul T. Aandahl said: “In the most important market for Norwegian salmon, the EU, we see that the growth trend has reversed.

“An example of this is fresh whole salmon to the EU. T here, the export volume fell by 6% in May, to 44,874 tonnes, while the price measured in euros fell by 4%.”

Norway exported 82,148 tonnes of salmon worth NOK 9.6bn (£701m), a value rise of 14% on a year ago. T he volume was down by 2%. Poland, Denmark and the U S remain the main markets.

ICELANDIC salmon producer

Ice Fish Farm was unable to slaughter any fish during the first quarter of this year and is unlikely to produce a harvest during the current quarter, the company has reported.

Ice Fish Farm says the problem is due to lower winter temperatures and high mortality resulting from biological issues. Slaughter will start again during the first quarter which begins in July.

The high mortality rate is mainly down winter wounds and the disease parvicapsulose, caused by the Parvicapsula parasite, the company said.

Ice Fish Farm’s first quarter turnover was NOK 37.4m (£2.79m) compared with NOK 155m (£11.5m) over the same period in 2022.

This fall led in turn to a small loss (NOK 0.3m or £24k) in contrast with a profit of 12.9m (almost £1m at last year’s exchange rate) 12 months ago.

On a more positive note, Ice Fish Farm said the plan for smolt production this year continues, with improved robustness.

The report says: “Quality control implementation have been activated and all sites have been evaluated by a third party.

“The focus is on improving

conditions for the fish on land and utilizing our production capacity. This will improve our production on land and at sea. Robust smolt performs better in the sea and we see clear difference on FCR and Growth.

“Smolt release in 2023 is estimated to be around 5,5m at average size about 300 grams. This is lower than we estimated before, due to higher mortality and culling of smolt than expected.”

The report also says the company is on track for reaching the planned 6,000 tonnes harvest volume in 2023.

It states: “At the end of the Q1 2023, we had about 5.6 million fish in the sea of the generation 2022 and total biomass of 6,179 tonnes.

“Generation 2022 is now spread over two fjords into two production zones and four sites. All the cages have been updated with stronger nets and improved setup. All sites are fed from centralized feeding centre.”

Norwegian-owned Måsøval Eiendom and the Icelandic fishing company Ísfélag Vestmannaeyja recently entered into a strategic partnership with Ice Fish Farm.

A separate holding company, Austur, has since been created to manage the joint ownership.

BAKKAFROST has set bullish harvest targets for its Faroese and Scottish farms over the next three to five years.

By 2026 the plan is for production of 95,000 tonnes in the Faroe Islands and 45,000 tonnes in Scotland.

But in 2028 that should increase to 110,000 tonnes in the Faroe Islands and 55,000 tonnes in Scotland. That would represent an 82% increase on the combined harvest figure for last year, which was 90,600 tonnes.

The plans were outlined at the company’s Capital Markets Day, held for the first time in Inverness, Scotland.

Ian Laister, managing director and Dave Cockerill, biology director of Bakkafrost Scotland respectively, outlined the situation in the UK’s 37 active sites.

Shareholders were told that survivability and harvest weights in Scotland were improving significantly thanks to various company measures. Gill health had presented the main problem.

But there had also been issues with PD (Pancreas Disease) and CMS (Cardiomyopathy Syndrome).

Gill health was now 45% lower than the industry average while lice was being maintained at the lowest recorded level.

The event was told that Bakkafrost’s increased water treatment capacity had been a major factor in improving gill health, but it did not remove all risks.

However, since the final quarter of last year the company has reported new capabilities for the “efficient and gentle” treatment of gill health and sea lice, helped by two year-round farming service vessels.

The company’s “large smolt” strategy – allowing smolts more time to grow before releasing them into sea cages – is expected to help address biological problems. Reducing the time at sea to around 12 months is expected to lead to reduced risk exposure and lower mortality rates, shareholders heard.

Bakkafrost’s stated priority for growth in Scotland over the next five years is to stabilise and ensure profitability, achieve best practice husbandry and strategic investment, growth through larger smolt and increased capacity and site development.

The two directors said Bakkafrost Scotland has a large scope for growth and for higher turnover by using larger smolt, along with further site development.

The overall strategic objective for Scotland, they added, is to build a healthy business around higher average harvest weights, better survival rates and a shorter cycle accompanied by production growth, higher prices achieved in the market and lower costs.

UK-based aquaculture software business Aquanetix is moving to Greece, following its acquisition by Innovasea.

The cloud-based farm management software developed by Aquanetix is in use at more than 200 farms in 31 countries, helping to grow more than 30 species of fish and shrimp.

The US-based aquaculture tech group Innovasea announced yesterday that it had acquired Aquanetix, and that the UK company’s operations would be relocating to Corinth, Greece.

COD farming company Norcod has set out a long term business strategy for sustained major growth.

The Norwegian-based business said in its annual report that it is experiencing increased demand for year-round stable deliveries of fresh cod.

It announced that it is targeting a near sevenfold increase in its annual harvest by 2027.

“The global market demands stable deliveries of fresh cod, and for the first time, high quality farmed cod has been produced on a larger scale and delivered to the market. With wild fish stock under pressure and fishing quotas for cod being cut,” the report says.

CEO Christian Riber told investors: “We have strategically positioned our production facilities in the natural cold-water habitat along the coast of Central and Northern Norway, where we will establish new farm locations in the coming years to execute our long-term business plan.

“We have set a target of approximately 25,900 tonnes (whole fish equivalent ) annual harvest in 2027.

“The global market demands stable deliveries of fresh cod, especially with wild fish stocks under pressure and fishing quotas for cod being reduced.

“As a leading producer of farmed cod, Norcod aims to fill this gap in the market and provide high-quality and fresh cod throughout the year.”

CEO Riber said Norcod’s commitment to the entire value chain, from production to market, ensured stability and control in every segment, setting the stage for solid industrial growth in the years ahead.

“We are proud to have assembled a team of experienced aquaculture professionals who bring their expertise from the salmon farming industry to our cod farming operations.

“Additionally, we have seen a rise in interest and have established apprenticeships for students in aquaculture education, further contributing to talent development in the industry.”

Norcod’s core business area lay in the sea-phase of the cod farming value chain, where the fish grow from 0.1 to 3.5-4 kg in its commercial marine production sites.

Aquanetix co-founder Diogo Thomaz and his team will be relocating to the new HQ, and the company aims to hire more staff there.

Thomaz said: “We’re thrilled to become part of the Innovasea family and add our farm management software to its strong portfolio of egg-to-harvest aquaculture solutions.This is a wonderful opportunity for us to make additional investment into our business to enhance our existing tools and better serve our customers.”

Terms of the deal, which closed earlier this year, were not disclosed.

The company was founded in 2015 and

in 2020 it opened a full service office in Puerto Varas, Chile.

Innovasea CEO David Kelly said: “Acquiring a company of Aquanetix’s calibre presents an exciting opportunity for us. By adding its powerful farm management capabilities to our suite of real-time aquaculture intelligence solutions, we’ll be rounding out our precision aquaculture platform and further helping our customers make data-driven decisions to improve operations, run more efficiently and sustainably and become more profitable.”

He added that Innovasea’s footprint in Greece will help it execute on its growth strategy in key markets like the Mediterranean and Middle East while better serving existing customers in those areas. The group already has offices in the US, Canada, Norway and Australia.

AN outbreak of infectious salmon anaemia (ISA) is suspected at a Mowi-owned site in Norway, the country’s Food Safety Authority has said.

The location is at Kvinnherad municipality in the Vestland region.

Mowi first suspected it had a problem over a week ago and immediately notified the authority before sending it samples for analysis.

A number of ISA outbreaks have been reported along the Norwegian coast in recent months and this location is only a few miles from another site where ISA is also suspected.

ISA is an expensive problem for fish farmers because all the fish in infected cages are usually destroyed whatever their size or age.

The Food Safety Authority has warned that everyone

who travels to the area on fish farming business must take special care to avoid any further spread of the disease.

The Authority said Mowi first suspected a problem on 31 May. It confirmed the company’s suspicions following the testing of samples, which were then sent to the Veterinary Institute for confirmation.

In addition to tough travel restrictions, the Food Safety Authority said: “Localities with proven ISA must slaughter or destroy the salmon, and clean and disinfect the facility before it is left fallow for a minimum of three months.”

It adds that suspicion or detection of ISA means that salmon from the farm cannot be exported to Australia, China and New Zealand. Australia also bans imports from locations within 10 km of confirmed or suspected ISA outbreaks.

ISA does not present a health problem for humans.

Neil first came to Kames as a student in 1985. When he finished his course at Harper Adams university, he returned to work for us and stayed for over 10 years. He took to the aquaculture world immediately; he was fizzing with enthusiasm and incredibly hardworking. He became our hatchery manager and was part of many pioneering projects such as developing the pressure vessel for triploidising eggs. He excelled at getting things done and always being planned and conscientious. He took to life in Argyll like a duck to water, becoming Chairman of the Community Council, organising popular Hogmanay parties in the village hall, and loving the country sports, particularly fishing and shooting. He stood out for his drive to achieve, exuberant company, and natural enjoyment in the life he had chosen.

Neil then left to forge an ambitious career in aquaculture by working at Landcatch in 1998 and then becoming Managing Director of Aquaculture at Hendrix Genetics in 2011, where he was instrumental in developing the business as a global leading player in the aquaculture breeding sector. He travelled all over the world, to Chile, Hawaii, Malaysia and more, seeing some amazing sites and achieving many successes, as well as gaining great regard in the industry and of course creating friendships wherever he went –as clearly seen by the overwhelming tributes that have poured in since the sad news of his death.

I had kept in touch with Neil over the decades and felt sure he was a natural choice to replace me as MD when I retired to the Chairman position in 2021. Neil was delighted to return to Kames and Argyll, and his impact on the company has been tremendous. He fully understood Kames’ values and he was passionate about driving Stuart’s family

ethos and the business forward, whilst understanding that a company of Kames’ size needed to become more structured and corporate.

Neil’s management and communication skills have allowed us to execute a forward-thinking vision for Kames. He has helped to drive our innovative brood stock programme with his genetics expertise, as well as a “Future50” initiative, cementing the values of quality, sustainability and community that Kames was built on with more transparency and long-term strategy. Leading, championing and empowering our teams particularly motivated Neil, and it is a devastating blow to our staff to lose such a passionate, encouraging man, with his gently teasing sense of humour. However, the strength and responsibility he has instilled in his teams will remain, and he has given us real confidence in our route forward.

On a wider industry level, Neil was renowned for being enthusiastic, collaborative and helpful to everyone doing good things in the aquaculture sphere. He knew how much the industry had to offer – on both a personal and global impact level, and he loved communicating that.

The move back to the West Coast also marked a change of pace for Neil. He had clearly thought about what he wanted from life, about what was important – and was living it. He relished spending more time with his beloved wife and two children as together they immersed themselves back in the outdoor Argyll lifestyle.

It is to them that we offer our greatest sympathy, and hope that they can glean some comfort in the great and farreaching impact that Neil had, and in the truly exceptional man that he was.

Stuart Cannon is Chairman of Kames Fish Farming. Left: Neil Manchester Above: The Aquaculture UK Awards winners 2022It is a devastating blow to our staff to lose such a passionate, encouraging man

growth will target 9,000 metric tons of biomass with goals to diversify species and expand into seaweed cultivation.

Gunnar Bracelly, Petros’ founder and President, said: “We are fortunate to have a strong partner in Innovasea, an industry leader in open ocean farming with proven experience with warm water species such as Red Snapper.

“Being able to rely on Innovasea’s full-service capabilities enables our team to focus on implementing the bold vision of diversifying the Aruban economy and becoming the catalyst for an aquaculture revolution throughout the Caribbean region.”

AQUACULTURE technology business

Innovasea has helped to secure government approval for the first ocean-based fish farm in the Caribbean resort island of Aruba.

The farm, which initially has permission for a biomass of 3,000 tonnes, will be located eight kilometres off the coast of Aruba, and will make use of Innovasea’s submersible SeaStation cage design. The farm will be operated by Petros Aquaculture.

The farm will raise northern red snapper, a high value species with strong demand in the US, but which has a limited and seasonal supply that comes entirely from the fishing industry.

Built over three phases, the farm aims to produce fish in a sustainable, secure and traceable manner. Once complete, it will feature 16 SeaStations and a land-based hatchery and employ close to 100 local team members. Future

Aruba, part of the Kingdom of the Netherlands, is a popular cruise ship destination. The design of the SeaStation cages means they will be submerged most of the time, when they will not be visible to tourists.

“We’re thrilled to be partnering with Petros to create Aruba’s first ocean-based fish farm,” said Langley Gace, Innovasea’s senior vice president of business development. “This is an important project for the country and the region and we’re confident that our open ocean expertise and our proven egg-to-harvest approach to fish farming will help ensure its success.”

A leading businesswomen in Surrey, a town on the coast of British Columbia, has expressed her concern over threats to force more salmon farm closures in the province.

Anita Huberman, President & CEO of the Surrey Board of Trade, was responding to reports that Joyce Murray, Canada’s Minister of Fisheries and Oceans, intends to propose additional closures of salmon farms as part of her salmon farming transition plan for British Columbia.

Surrey is the hub of salmon farming in the Vancouver area, and is home to numerous operations in salmon feed milling, fish processing, trucking, packaging, and the provision of goods and services.

Huberman said the community is already experiencing negative impacts due to the already 40 per cent reduction in salmon farming production since 2020.

She added: “We have seen the impacts the closures have had on our businesses in Surrey. Last year Mowi Canada West permanently closed their fish processing plant, which resulted in the loss of 80 direct jobs locally, and this isn’t the only example. There still has been no government action to support these workers.”

Any further closures of salmon farms will mean the removal of the entire salmon farming sector in BC, she said, not only impacting producing companies but many local businesses

in the supply chain on Vancouver Island and the Lower Mainland.

An earlier report prepared by RIAS Inc., an independent economics firm, estimated that salmon farming companies directly contribute CAN $46m in GDP and 344 full-time jobs in Surrey area, and indirectly around CAN $122m and 1,189 jobs are at risk.

Brian Kingzett, Executive Director of the BC Salmon Farmers Association, said: “We are calling on the federal government to bring a more rational approach to the transition plan and include other Ministers in providing leadership to developing a reasonable path forward.”

THE sale of Barramundi Group’s Australian fish farming business has fallen through because the prospective buyer was unable to raise sufficient capital, Barramundi has reported. In a stock exchange announcement made on 24 May, Barramundi said its Australian operations, managed under Marine Produce Australia Pty Ltd (MPA) had been placed into administration with a view to a complete “reconstruction” of the company.

The statement said: “Rob Kirman and Rob Brauer of McGrathNicol were appointed as Voluntary Administrators of MPA and its two subsidiaries, MPA Fish Farms Pty Ltd and MPA Marketing Pty Ltd (“MPA Group”) on 24 May 2023, by its directors pursuant to Section 436A of the Corporations Act 2001

(‘Act’).

“The Administrators are currently making an assessment of the MPA Group’s position with a view to undertaking a restructure or recapitalisation of the MPA Group in line with the objectives of the Voluntary Administration provisions of the Act. The Administrators, with the support from the MPA Group’s management,

intend to continue to operate the MPA Group on a ‘business as usual’ basis while exploring options for a sale and/or recapitalisation of the MPA Group.”

MPS will continue to trade while in administration, and Barramundi’s Singapore- and Brunei-based operations are not affected by the move. Last year it was announced that Barramundi was in talks

with Wild Ocean Australia over the sale of MPA, but it seems that Wild Ocean was unable to find sufficient finance for the acquisition. Barramundi had ambitious plans for expansion in Western Australia, but the project required more capital than the company was able to raise.

a detailed review of its strategic options, including evaluating a smaller scope or size for the farm.”

LAND based salmon farmer AquaBounty Technologies has “paused” work on its planned facility in Ohio, citing cost inflation.The US company has not specified when work will resume, and has left open the question of whether the project might go ahead at a smaller scale.

AquaBounty is the first company to produce genetically-modified (GM) salmon at commercial scale.Their fish combine the DNA of Atlantic salmon with other salmonid species in order to achieve faster growth, and are grown in RAS (recirculating aquaculture systems) farms.

Ground was broken at the new site in the township of Pioneer, Ohio in April this year.The farm was planned for a production capacity of 10,000 tonnes.

In a stock exchange announcement on Friday, AquaBounty’s CEO Sylvia Wulf said: “During the past three years, AquaBounty has been working with its design and construction partners to manage through and mitigate the increasing costs

that were exacerbated by historic inflation levels to complete construction of its Pioneer, Ohio farm. As cost estimates provided by our initial design/construction firm continued to increase, we engaged a second construction firm in January of this year to review the current cost estimates and to rebid the remaining construction elements in order to finalize the project’s Guaranteed Maximum Price (“GMP”), which was integral to completing our municipal bond financing.

“Despite the value engineering and cost reduction efforts we undertook, the GMP estimate that we received came in at a price that is significantly above our previously disclosed estimate of $375m - $395m [£302m - £319m]. Given this information, we cannot finance the project through a municipal bond placement without a significant increase in the Company’s equity contribution. As a result, the Company has put an immediate pause on further construction of the site while the management team undertakes

She added that AquaBounty has been working closely with the Village of Pioneer on the water and wastewater lines for the Ohio farm and the Village has approved the creation of a public utility, which will own and operate the water and wastewater lines required for the farm’s operation. AquaBounty is currently waiting for the issuance of the Right of Way (“ROW”) permit from Williams County. Wulf said Aquabounty appreciated the support and collaboration from the State of Ohio,Williams County Economic Development Corporation and the Village of Pioneer.

Wulf concluded: “We believe in this project and its importance to the Company’s growth strategy. Our focus now is on bringing it to completion in a manner that is prudent for the Company and our shareholders. In the meantime, we intend to continue to supply our customer base with salmon from our Indiana farm, while using that facility to improve our operational practices and to test new technologies in preparation for the Ohio farm start up. Progress also continues at our PEI farms to expand the production of non-transgenic eggs and fry and on our R&D work focused on improvements in our broodstock and the improvements in the overall health and well-being of our fish. I look forward to providing further updates on our review process over the coming months as we strive to create sustainable value for our shareholders.”

growing more seafood at home. This legislation would establish comprehensive standards for offshore aquaculture, helping US producers meet the growing demand for fresh, locally-sourced seafood.”

Senator Schatz said:“Hawai‘i’s diverse aquaculture produced over $80m [£64m] of finfish, shellfish, and algae in 2019. At the same time, the movement to restore native Hawaiian fishponds such as those at He‘eia and Maunalua continues to develop momentum. This bipartisan bill would increase federal support for both.”

The AQUAA Act would establish National Standards for offshore aquaculture and clarify a regulatory system for the farming of fish in the US exclusive economic zone (EEZ). The bill would also establish a research and technology grant program to fund innovative research and extension services focused on improving and advancing sustainable domestic aquaculture.

The introduction of companion legislation in the US House of Representatives is expected soon.

TWO US senators have reintroduced legislation that aims to provide the regulatory framework needed to increase American offshore aquaculture production.

The bipartisan bill, the Advancing the Quality and Understanding of American Aquaculture (AQUAA) Act, sets out to increase production of sustainable seafood offshore in US federal waters and create economic opportunities for American communities coast-to-coast.

The bill has been introduced by Senators Roger Wicker (Republican, Mississippi) and Brian Schatz (Democrat-Hawaii).

Senator Wicker said: “The aquaculture industry is growing rapidly, but the lack of a national permitting system for federal waters has held back development and prevented American producers from

Drue Banta Winters, Campaign Manager of lobby group Stronger America Through Seafood (SATS), commented: “Now is the time for Congress to act to support the expansion of American aquaculture offshore. As one of the most environmentally friendly forms of protein production, aquaculture will ensure American food security by increasing our supply of healthful and affordable seafood sustainably.

“Communities across America would benefit, creating new job opportunities for American workers throughout the US supply chain, including for fish farmers, feed producers and manufacturers, and seafood processors, as well as for American famers of crops that can be used in fish feed, such as corn, soybeans, peas and more.”

THE Tasmanian government has drawn up a long term plan for the state’s salmon farming industry.

A key aim of the strategy is to restore declining public trust in the sector. Primary Industries Minister Jo Palmer admitted that support for salmon farming had declined and said: “This is an industry that desperately wants the Tasmanian people’s approval.”

But she also said the number of critics who wanted the industry closed down was small, but very noisy.

The Tasmanian government, she added, was committed to a thriving industry – one that was economically successful and environmentally responsible.

The Tasmanian Salmon Industry Plan 2023 sets out aims and actions in four core priority areas:

• Sustainable industry;

• Healthy ecosystems;

• Prosperous communities; and

• Contemporary governance.

The document promises a revamped regulatory system and “improved” penalties for companies breaching the regulations. It also says that for proposed new farms, “the Government will support planning proposals in areas that are further away from land, in higher

energy, more exposed and deeper water.”

Jo Palmer said, launching the plan: “Tasmania is surrounded by temperate oceans, with highly valued wild fisheries and exceptional opportunities for diverse forms of aquaculture.

Over the past 40 years the Tasmanian salmon industry has emerged as a leader in innovation and producing premium seafood.

“We are well placed to build on our natural advantages, to provide more sustainably sourced seafood while protecting our unique marine ecosystems.

Salmon is Tasmania’s largest primary industry and has become Australia’s most valuable aquaculture sector.”

The Minister said Tasmania will produce a plan to feed the state, wider Australia and other parts of the world, This would be supported, she said, by world class research and development, and new forms of partnerships such as participation in the Blue Economy Cooperative Research Centre.

She pledged to continue to support businesses large and small, with an extensive consultation process among the local community.

Tasmania is Australia’s main salmon producing region, but most of the major companies have fallen under foreign ownership over the past two years.

Critics of the industry said the plan contained very little detail, accusing the government of a “cynical public relations exercise”.

COOKE Aquaculture has once again picked up a platinum honour at the “Canada’s Best Managed Companies” awards event.

The aquaculture division is part of the wider Cooke Seafood group and includes extensive salmon farming interests in Orkney and Shetland.

It is the 18th consecutive time that Cooke has collected this award.

CEO Glenn Cooke said: “We are dedicated to maintaining our Best Managed Platinum Club designation each year.

“Our people are our most important assets, and I am personally so proud of the care and commitment they bring to their jobs each day.

He added: “It is important that we continue to provide for our communities and cultivate our oceans with care and it means a lot to be

recognised nationally for this, along with our overall business performance.”

Canada’s Best Managed Companies remains one of the country’s leading business awards programmes.

Each year, hundreds of entrepreneurial companies compete for this designation in a rigorous and independent evaluation process. Applicants are evaluated by an independent panel of judges with representation from programme sponsors and special guests.

Cooke Seafood has been busy on the acquisition trail over the past year, having taken over the Tasmanian salmon company Tassal, Europe’s largest shrimp and prawn processor, Morubel NV and the large US seafood distributor Slade Gorton.

THE global market for salmon and other seafood could be changing, with increasing demand in Asia, the latest data from the Norwegian Seafood Council suggests.

The Council’s CEO Christian Chramer said in his latest monthly report that while Europe clearly remains the largest single market for Norway’s seafood, there were signs of a shift in demand to other parts of the world.

Europe takes 68% of Norway’s seafood overall exports, Asia 21% and North America 9%.

But Chramer added: “We are seeing a shift in total Norwegian

seafood exports from Europe to overseas markets such as Asia and North America. In May, we have never had a lower European value share [comparing May year on year] than this year.”

Seafood analyst Paul T. Aandahl added: “China had the greatest value growth in May, with an increase in value of NOK 218m (£16m) or 83% on the same period last year.”

The Council also reports demand for salmon in China rising, ending at 3,297 tonnes, 86% up on a year ago.

But as the Council’s China Director Andreas Thorud points out, May 2022 was affected by a full shutdown in Shanghai and a great deal of uncertainty in the market due to Covid uncertainty in China at the time.

“Since the turn of the year, the re-opening in China has created a strong demand for salmon that has persisted,” Thorud added.

SOFINA Foods has appointed one of the food industry’s highest profile figures as the new chief executive for its European division which includes Young’s, the UK’s largest seafood company.

He is Ash Amirahmadi (pictured) currently managing director of Arla UK, which means he switches from the problems of the dairy industry to the challenges of buying cod, haddock and salmon.

He takes over in August from Michael Latifi, who stepped in as CEO for Sofina Foods Europe in 2021 when the Canadian parent bought Young’s and other operations in the Eight Fifty Food Group.

Latifi remains the founder, chairman and chief executive officer of Sofina Foods Inc in Canada.

Amirahmadi is regarded as a leading figure in the UK food sector and was awarded the OBE earlier this year.

Born in Iran, he came to the UK as a youngster to escape the impact of the Iran-Iraq war.

After graduating, he began his career with Unilever and spent time in various businesses before joining Arla in 2004.

Sofina Foods Europe, a subsidiary of

Sofina Foods Inc., is one of Europe’s leading manufacturers of processed protein products for both retail and foodservice customers via its Karro, Young’s Seafood and Greenland Seafood subsidiaries and has operations across the UK, Ireland, France and Germany.

Latifi said: “We are delighted to welcome Ash to the Sofina family. I am confident that Ash’s deep experience and reputation within the grocery and farming sectors will help us deliver ongoing success across our European operations and demonstrate our continued commitment to quality and innovation.

“Ash joins us at an important time for the industry. He will help Sofina Foods Europe lead the way in developing a

more sustainable supply chain, capable of producing great-tasting, affordable and high-quality products for consumers and greatly contribute to our vision.”

Amirahmadi added: “I am delighted to be joining Sofina Foods and relishing the opportunity to work with Michael Latifi and the Sofina Foods Europe team to build on their significant progress in transforming the business towards category leadership.

“Sofina Foods has a track record of working in partnership with its customers and suppliers, developing sustainable and resilient supply chains, investing in its people, adding value to categories, and long-term commitment to social responsibility across multiple stakeholders.”

SALMON producer Mowi is to cut an unspecified number of jobs at its secondary processing plant in County Donegal, Ireland.

The company said it has been talking to staff at the facility, which is sited on a peninsula in the far north of the country.

Mowi has been carrying out a streamlining review of jobs across its global set-up, announcing earlier this year that around 430 jobs were likely to go worldwide.

Despite record profits last year, the company is understood to want a 12% reduction in its workforce worldwide, saving around £20m to help combat soaring cost inflation.

This is expected to be carried out by streamlining the business, introducing more automation and renegotiating contracts with suppliers.

A company spokesman told the Irish press: “It is with great regret that Mowi Ireland has begun a programme of consultation with staff regarding a reduction in employment numbers.

“Following a global review, a decision has been reached to streamline a number of processing plants which are under capacity.

“This will result in secondary fish processing ceasing in Ireland by October 2023 leading to a number of redundancies at the company’s Rinmore base in Fanad, Donegal.”

A consultation process has commenced with a view towards redeploying staff elsewhere within the company in Donegal.

“The consultation exercise will be used to establish if staff, who currently work in secondary production, can be deployed elsewhere within the company’s Donegal headquarters.”

Mowi said it could not put a figure on the number of jobs likely to go until the consultation process has been completed.

“Ash joins us at an important time for the industry ”

“A decision has been reached to streamline a number of processing plants which are under capacity ”Above: The Mowi office in Donegal

UK-based Direct Seafoods has launced an apprenticeship scheme for new and experienced fishmongers. The bespoke course, developed in partnership with Crosby Training, aims to further enhance the skills and knowledge of wholesale fishmongers to take their career development to the next level.

The course covers food safety, health and safety, picking and packing and knife skills. Each of these modules, over a 12 month course, contributes to the qualification of a Level Two Diploma upon completion of an assessment, with each module tailored to the apprentice’s level of ability.

So far the business has taken on several apprentices across three of its UK sites. The Direct Seafoods group includes Bidfresh, which has 12 fishmonger brands around the UK.

Neil Poxon, Operational Support Manager at Bidfresh commented: “I’m delighted that Direct Seafoods is utilising this great initiative. It’s something I’m thrilled to be able to offer our current and future employees and am incredibly passionate in seeing it succeed.

“This fresh approach to recruitment will help us not only in achieving our ambitious growth plans but also providing sustainable, progressive careers for those involved in the scheme moving forward, helping us to retain and develop the fantastic talent we have within our business.”

SEAFOOD producer and processor

Grupo Profand has reported increased sales for 2022, but it saw profitability cut thanks to its decision not to pass on rising costs to customers.

Profand, based in Vigo, is one of Spain’s largest seafood companies and has operations in 10 countries, ranging from processing to catch fishing and aquaculture.

For 2022, Profand reported revenue up to €929m (£798m), up 15% on revenue for 2021; but the companay also said that earnings before interest depreciation and

tax (EBITDA) were down 19%. The company is privately held and the figure for EBITDA was not made public.

The company said that profits had been hit by costs, including high fuel and electricity prices, freight charges and staff costs.

Profand has been on an acquisition spree over the past few years, buying up US firm Stavis Seafoods in 2018; processor and seafood distributor Caladera, and Seafreeze in 2019; and in 2021, Greek aquaculture business Kefalonia Fisheries.

RAW material inflation, especially for salmon, has had an impact on Iceland Seafood International’s first quarter results.

But the company adds, in its report for Q1, that there are signs of a more balanced external environment on the horizon.

ISI reported a 23% increase in sales from a year to €123.1m (£107m), along with a slightly lower net margin of €9.8m (£8.52m) leading to a net loss of €2.2m (£1.9m) against €0.8m (£695,000) in Q1 2022.

The Q1 report said the quarter was marked by prices increases in key import factors, mainly salmon, which is important in its Spanish and Irish businesses.

The report said: “Steep price increases in salmon negatively impacted sales volume in the quarter. Price increases offset the impact of lower volume, leading to a slight growth in sales in Euro terms.

“These increases in salmon prices caused similar challenges as in the same period last year, as it takes time to push cost increases through to customers.

“Based on current forward prices, the price of salmon peaked in March this

year, compared to the beginning of May 2022. The outlook for the remainder of the year is good, as salmon prices are expected to come down and stabilise.”

The group said seafood prices are still high and have increased more than prices of other animal protein.

“This has decreased demand, reflected in lower volumes. After strong sales in S-Europe in March, demand fell in April.

“The outlook for the coming tourism season in Spain is good, which should positively impact demand. Salmon prices have stabilised after a sharp increase in Q1 23 and are expected to ease further in the coming months.”

ISI put the sale of its Grimsby production site on hold late last year after it failed to find a suitable buyer. The loss from that operation was €2.3m (£2m) which was in line with budget.

The company added: “Significant steps have been taken towards improved operation in the period, in line with what was previously communicated. “ The process of recovering inflationary costs had come through as planned, production efficiencies and the installation of new equipment.

But “a negative market trend” where volume has declined through significant consumer price increases had a significant negative impact on sales.

“It needs to be seen if these impacts are temporary or long-term, but this will delay the point where IS UK will reach a positive cash flow,” ISI said.

Speaking to the Herald newspaper about the Scottish Government’s plan for Highly Protected Marine Areas (HPMAs), the Net Zero Minister, Mairi McAllan said that she firmly believes that you don’t impose policies on the communities. You work hand in hand with them to make them work, she argued, and that’s the only way to do it sustainably.