2 minute read

Day After Trump Elected

Day After Trump Elected (11/09/2016)

The 2016 election of Donald Trump was another surprise that shocked the global financial world. However, market agents’ forces again quickly took advantage of trading opportunities and restored any misalignment.

Advertisement

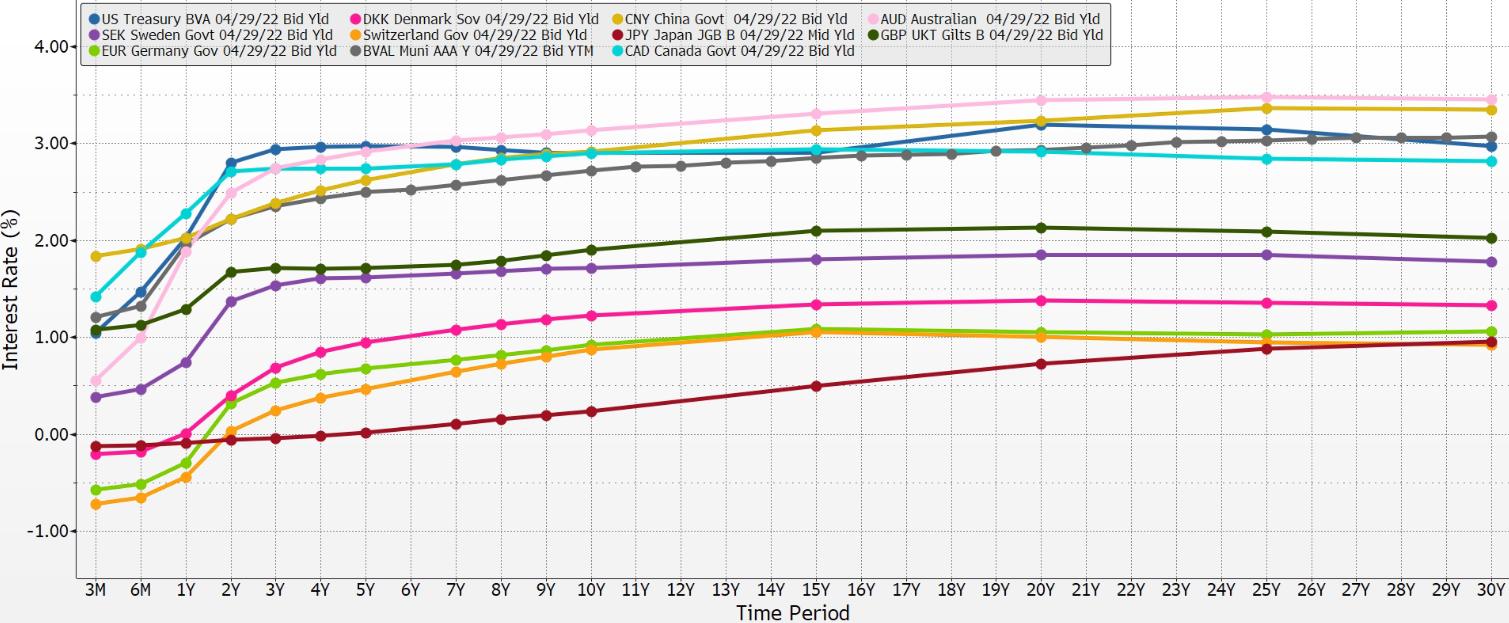

At this point, five currencies are now trading below zero. Nearly all longer-term bonds are below 3%. The parallel term structure using the twospread analysis is intact. The bunching continues.

Day After Trump Elected (11/09/2016)

Sweden Lows (11/17/2017)

Here’s the extreme in market-based pricing and policy responses to a central bank. The actual policy-driven interest rate in Sweden has fallen below a negative 1%. Yield curves worldwide are now very parallel in shape. Market agents have been using this swaps technique for years and are very good at it. The largest G-SIB banks are facilitators, and the fee income from accommodating these market agents is a considerable sum. We can examine the notes on the financial reporting statements of those banks to see the amounts of derivative notional exposures. With a time lag for data accumulation, we can see the growing outstanding balance of derivatives from the reporting of the Bank for International Settlements (BIS).

Readers can see that we have incorporated the AAA U.S. municipal bond curve into this slide set. At this point the muni bond curve is very much influenced by these forces that are driven by multinational jurisdictions. American investors tend to ignore foreign forces’ influence on the setting of municipal bond prices in the United States. That’s a mistake. A large component of global bond investors realize that sovereign debt of American states and some local governments offers nearly the same credit quality as some international sovereign debt. In a few cases the American state’s credit rating is higher than the foreign country’s rating.

Those foreign investors also watch the spread between taxable Treasury yields and tax-free yields of very-high-credit-quality munis. They know that when tax-free yields are higher than taxable yields are, it is only a matter of time before the market will adjust. Thus the “crossover buyer” is a serious player in the American municipal bond markets. We see that buyer become active when tax-free yields are higher than taxable yields are, as they are at time of the writing of this pamphlet.

The graphics depict this relationship, and that is why we have added munis to the series. It is very hard to find public evidence of the use of crosscurrency interest rate swaps in transactions affecting municipal bonds. We know of anecdotes. We know they are used. The collection of data on this subject of the influence of the crossover bond buyer merits a future research project.

Sweden Lows (11/17/2017)