1 minute read

After Omicron, Biden Budget’s Failure

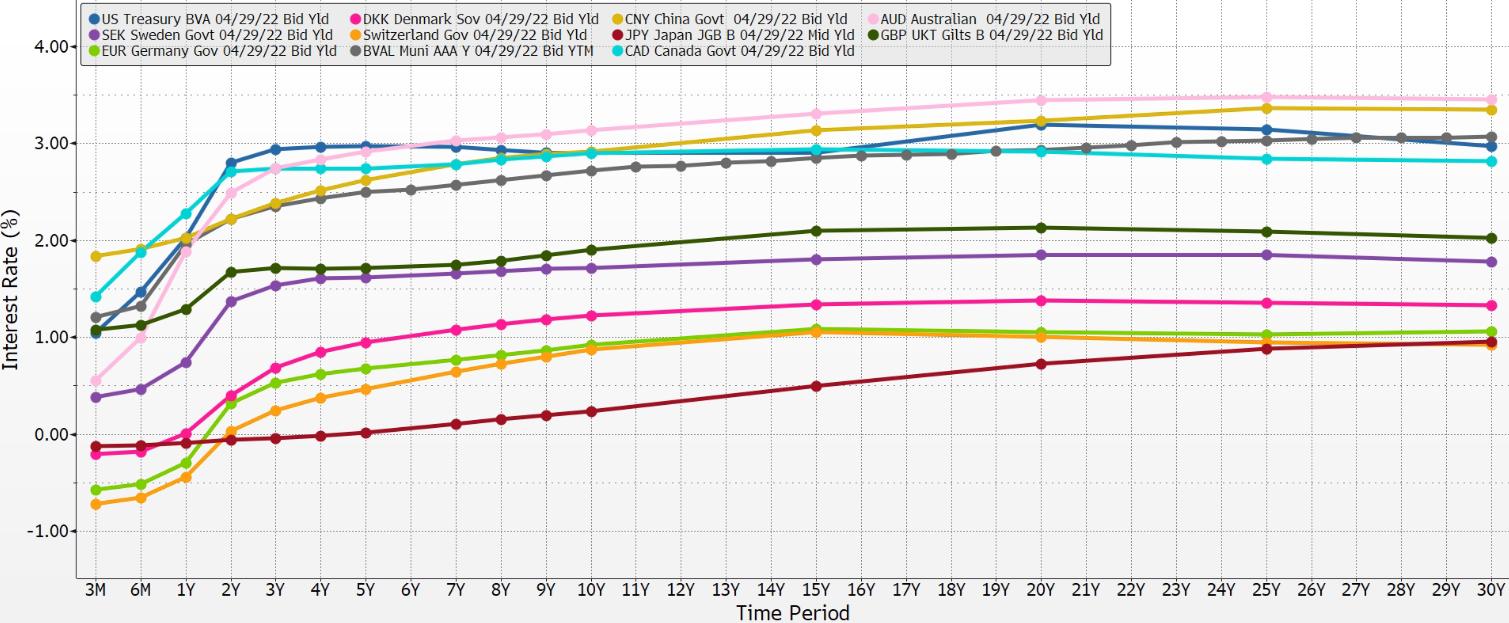

Yield curves are steepening in January 2022, and the spread measures show how dramatically things are changing. The currency markets reflect the volatility. Meanwhile, the use of swaps continues and has a dampening effect. Estimates of total notional derivatives in this mode are now in the $700 trillion range.

Advertisement

Notice that bunching in the short term continues unabated. Why? The rolling one-month and three-month currency side of the swaps mechanism keeps these anchors in place. At the same time, the longer side of the spread comparisons is steepening. Curve structures remain nearly parallel. No one knows that the Russian invasion of Ukraine lies only a month in the future. There is no evidence of anticipatory pricing in these currency markets.