1 minute read

Two Days After First U.S. Case of COVID-19

The Covid shock was extraordinary in so many ways. It triggered a worldwide recession. Markets reacted violently. All financial markets faced turmoil.

Advertisement

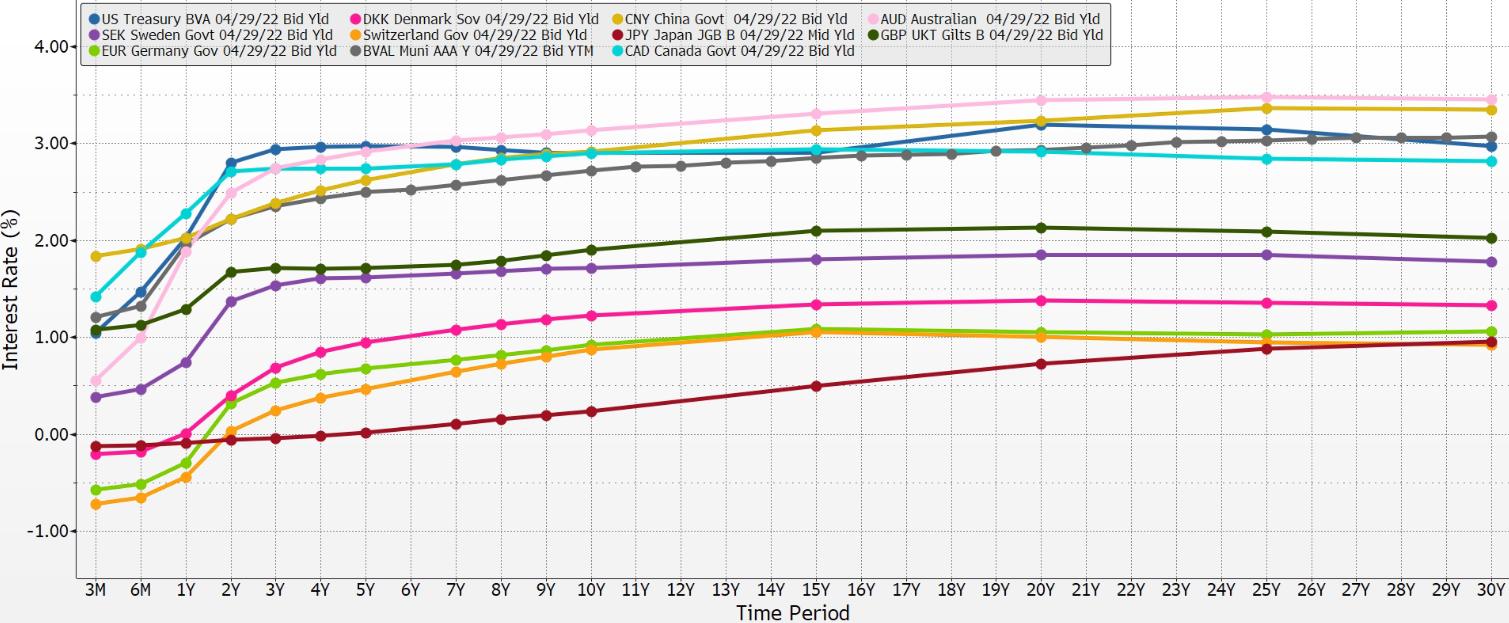

In the global sovereign debt markets of the major countries, Covid caused the bunching to tighten. Market agents had many years of practicing using derivatives for the adjustment process. Note how all yield curves are very nearly parallel except for China’s. Notice how tight the U.S. Treasury–muni spread is. Also notice how the Canadian spread comparison has become completely flat. As Switzerland was in the early part of the series, Canada is now the outlier. Market forces will quickly take advantage of this shock, as will be depicted in the next few slides.