1 minute read

After April 1st Employment Report

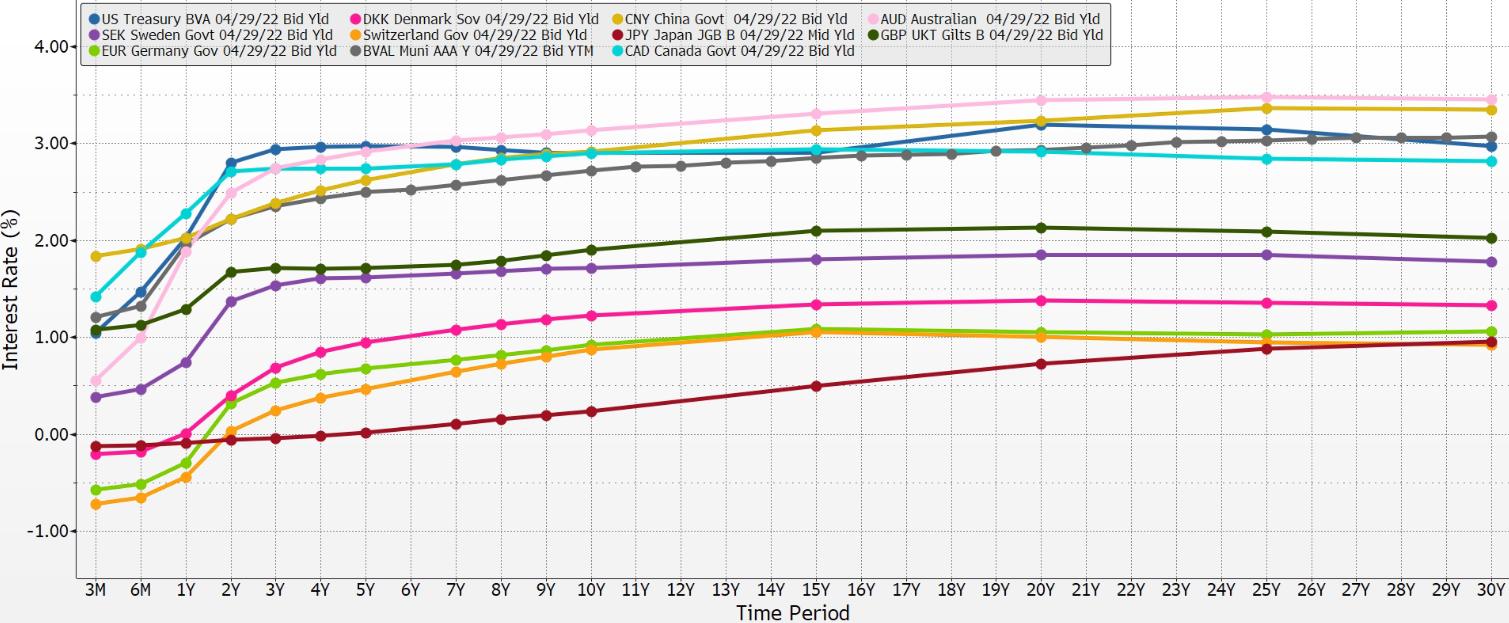

In April 2022, yield curve parallels persist. Bunching in the short-term is very tight. Bunching in the longer term is unwinding slowly as the longerterm spread is widening. Inflation is now at the top of every political and central banking agenda. The Russian invasion of Ukraine looks like a longer-term event. War risks are consequently rising. The Covid surge in China is having an enormous shock effect on world supply chains. Geopolitics has triggered worldwide commodity price shocks. Aggregate demand curves and supply curves have both shifted.

Advertisement

Given these headlines without understanding the nature of the yield curves, their slopes, and their parallel term structures, would we expect the curves to be so aligned and parallel? Would we ever expect them to show the bunching that we see in the graphics? We suspect that the answer is no.

The only major central bank that is not in motion for change is Japan. And it’s Japanese currency volatility that is revealed, as one would expect. Remember, the short end of the swaps technique anchors the currency in the rolling one-month and three-month currency exchange trading arena. The longer-maturity side of the swaps is matched in terms of maturity of loan and project. That hasn’t changed.

We will now look at the last set of slides and then the tables, which will capture the statistical measures used for assessing trading opportunities and risks.