1 minute read

After Lagarde, German Yield Spike & U.S. CPI Spike

Things have clearly changed by February. The European Central Bank is trying to be in two places at once: raising interest rates sometime in the future to fight developing inflation risk and not raising interest rates now because of worries about financial stability. Early warning signs about Putin’s invasion of Ukraine are still being ignored by market agents but are worrisome to military planners and geopolitical risk analysts. Market agents simply don’t believe Putin is engaged in anything more than a fearmongering military exercise.

Advertisement

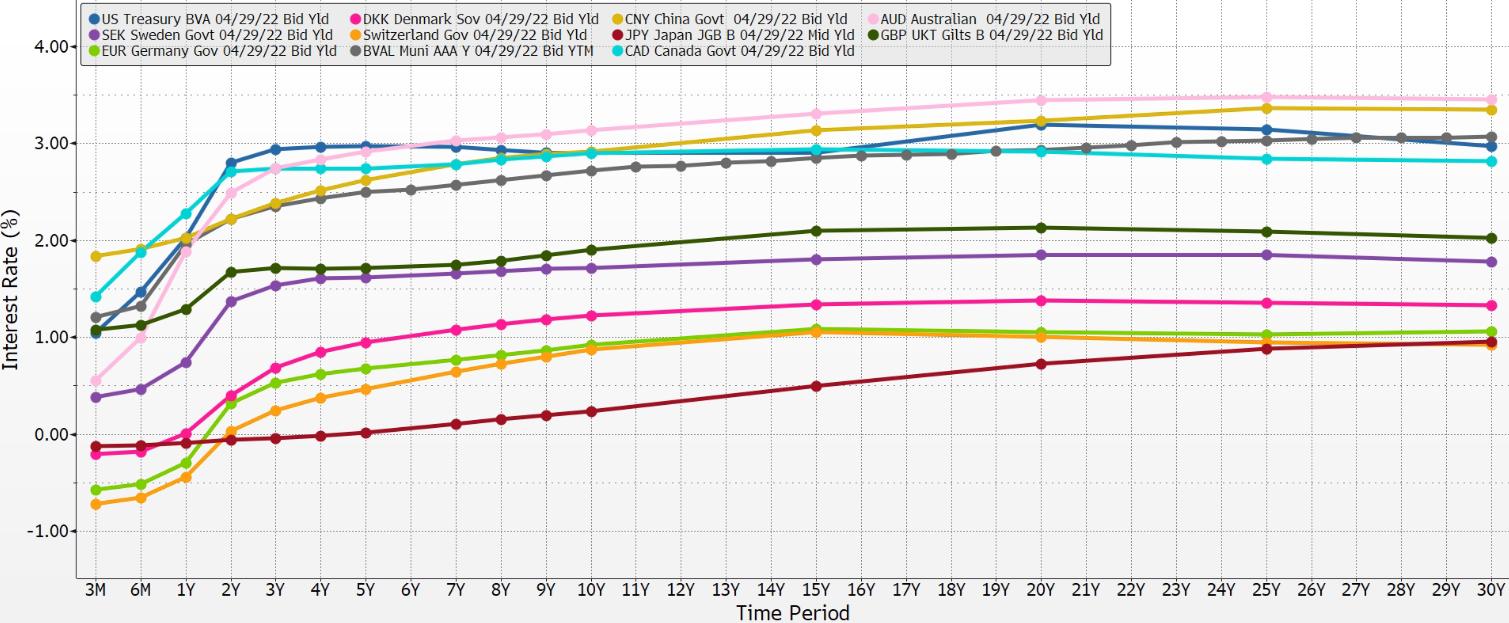

Meanwhile, Covid fatigue seems to have returned to many countries but is fully reversed in others. China and others in Asia, such as South Korea, now face rising Covid cases and the spread of the newer variants. Fewer short-term interest rates are below zero. Yield curves remain parallel, but the shape to a more upward slope is developing in most of them. The very short period of one month to two years is steepening rapidly, and market agents are discounting a rise in policymakers’ shorter-term interest rate targets. The longer and intermediate ends of yield curves are also steepening, but less dramatically. Note how the spread measures capture the differentials. Using these various spreads, arbitrage possibilities continue for market agents. The process of continuous rolling of the currency side is ongoing.